Inflation and Reinforced Concrete Materials: An Investigation of Economic and Environmental Effects

Abstract

1. Introduction and Theoretical Background

- (1)

- First, the majority of the studies of Table A1, including Oghenekevwe et al. [14]; Adegbembo and Adeniyi [15]; Kalu et al. [16]; Oladipo and Olukayode [17]; Bediako et al. [18]; Oba [19]; Mohamed and Mahmoud [20]; and Dilip and Jesna [21] utilized Pearson correlation test or the regression analysis to examine the relationship between the inflation rate and building material prices. This is a critical flaw in these works, indicating that their findings are totally inaccurate. The reason is completely intelligible, as the inflation–material prices nexus is often nonlinear; accordingly, it cannot be analyzed based on Pearson correlation test or the regression analysis. It can, however, be scrutinized by utilizing Spearman correlation test [3,4].

- (2)

- Second, the other works of Table A1, comprising Musarat et al. [3], Musarat et al. [22], and Musarat et al. [23] determined the correlation between the inflation rate and building material prices using Spearman correlation test. Further, they studied the materials with the highest consumption rates in any construction market, i.e., steel reinforcement, ordinary Portland cement, sand, and gravel. However, none of these works focused on showing how the cost of the main associated construction item of these materials, namely Reinforced Concrete (RC), can be affected by inflation. This is a critical knowledge gap because RC is the most used and expensive building material worldwide, represents a considerable percentage of the project cost, and possesses severe implications on deviating the project budget [24,25].

- (3)

- Third, despite the pioneering role of Musarat et al. [23] in terms of examining the relationship between inflation and CO2 emissions of construction materials, their conclusion is controversial. Musarat et al. [23] were able to collect data on inflation and construction material prices. However, they were unable to gather data on CO2 emissions of building materials for being analyzed with inflation. Alternatively, they deemed the value of the executed works instead of the construction materials’ CO2 emissions in order to be explored against the inflation rate. Drawing on this methodology, Musarat et al. [23] reached that reducing inflation reduces building material prices, pushing the end-users to grab the opportunity of buying construction materials at lower prices; accordingly, more construction works are executed. In the same vein, implementing more construction works needs additional production of construction materials, increasing CO2 emissions. This indirect and inverse relationship between inflation and CO2 emissions implies that if governments play their roles to control inflation in their countries, the CO2 emissions of building materials will be increased. This is a controversial result and cannot be generalized without examining the inflation–construction material CO2 emissions relationship directly, as will be addressed in the current study.

2. Contextual Background

- (1)

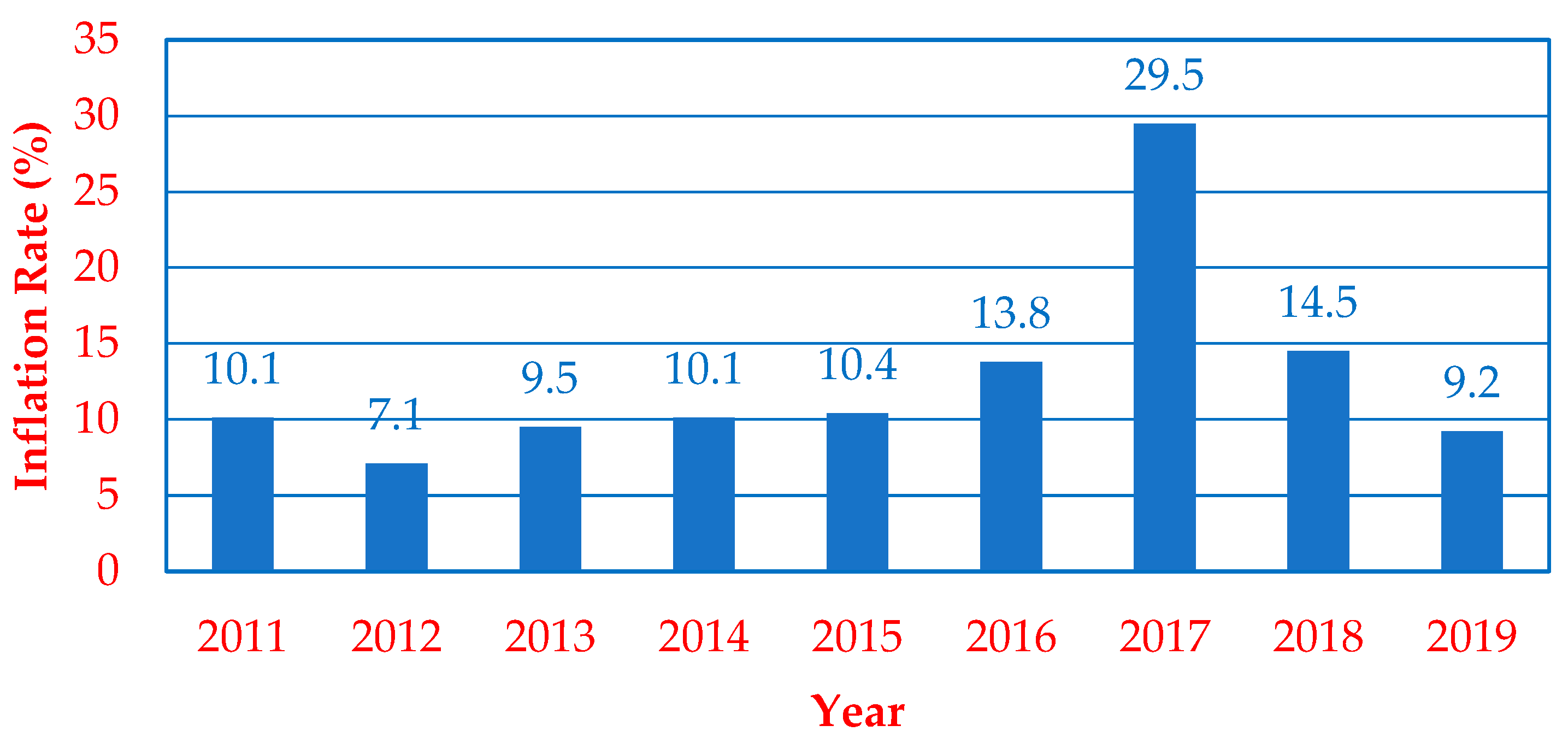

- First, from 2011 to 2019, Egypt experienced severe economic and political instabilities, comprising (a) the January 2011 Egyptian revolution; (b) the June 2013 Egyptian revolution; and (c) the November 2016 Egyptian government devaluation of the Egyptian pound (LE) [4]. Certainly, whatever the reforms taken by the Egyptian government during this period, the inflation lesion has appeared and impacted the prices of the materials used in all sectors. For instance, the Central Agency for Public Mobilization and Statistics (CAPMAS)—Egypt’s official statistical agency—declared that the price of hollow cement bricks/1000 bricks increased by 211.864% from 2011 to 2019 [26]. Such sharp increases can reveal how construction material prices can be affected by macroeconomic variables, particularly when they result from unstable economic and political conditions.

- (2)

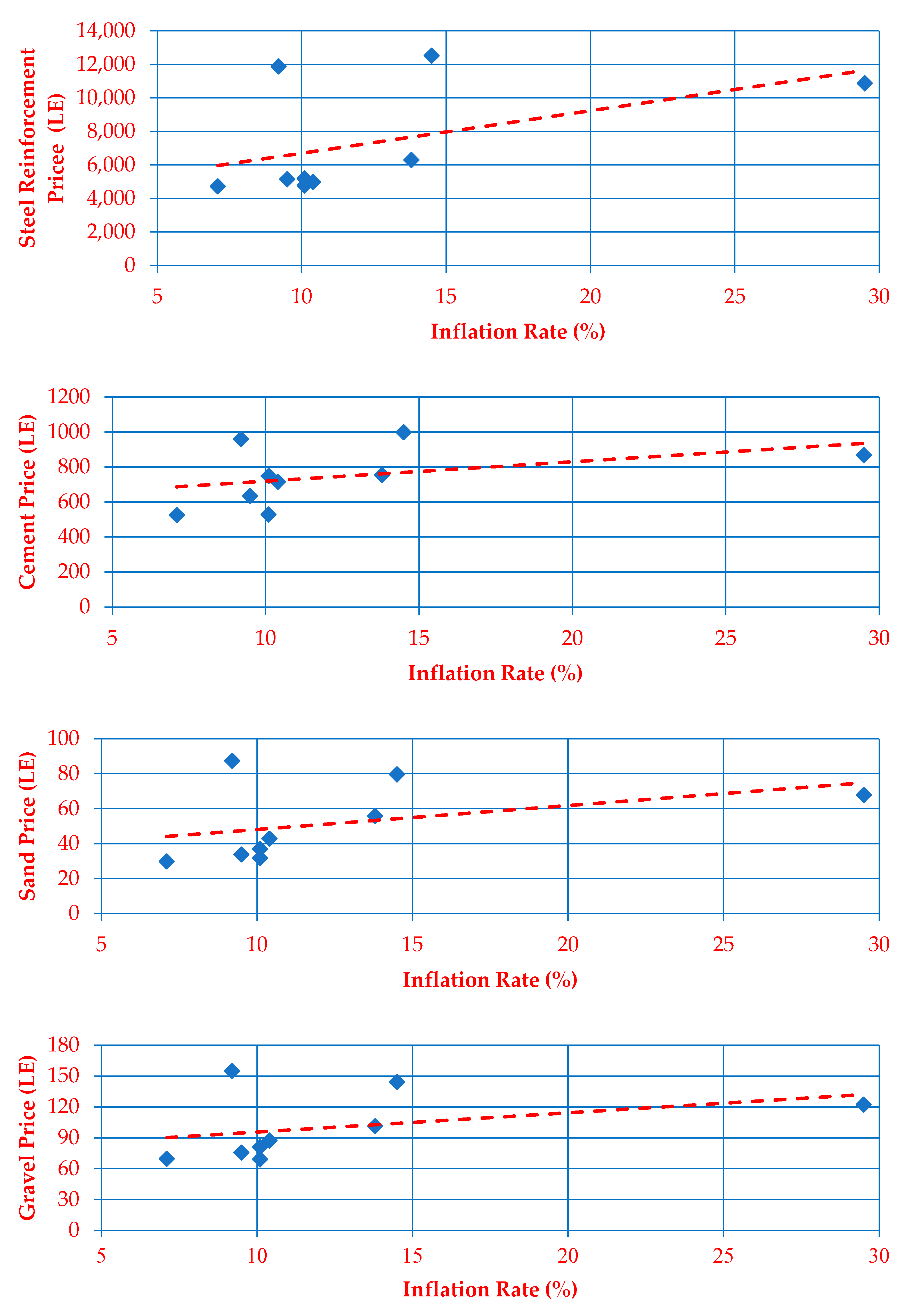

- Second, concerning RC—the wide utilized building material in the Middle East and Egypt, without exception [24]—Hassanein and Khalil [27] reported that RC materials, specifically steel reinforcement and cement, represent 43.98% and 32.29%, respectively, of the construction costs of the Egyptian RC buildings. More importantly, the statistical data of CAPMAS [26] highlighted that steel reinforcement, ordinary Portland cement, sand, and gravel—the major components of RC in Egypt—witnessed severe increases in their prices from 2011 to 2019. In 2011, the average prices of steel reinforcement/ton, ordinary Portland cement/ton, sand/m3, and gravel/m3 were 4778.25 LE, 528.7 LE, 31.83 LE, and 69.15 LE, respectively. Yet, in 2019, the average prices of these materials were 11,892.56 LE, 960 LE, 87.5 LE, and 155 LE. Of course, these sharp movements in the prices of these materials have been affected by inflation during this period. Additionally, the implications of these increases lead to significant changes in the cost of their construction item, i.e., RC. Hence, by collecting the data associated with this period, encompassing inflation rates, RC material prices, and RC cost, this study can define the inflation–RC material prices nexus and the inflation–RC cost relationship. Fortunately, CAPMAS [26] and CAPMAS [28] in Egypt collect credible statistics on such data, providing reliable answers to the first three questions of the present work.

- (3)

- Third, focusing on the fourth question of the current paper, CAPMAS [29] has significant statistics concerning the annual consumed quantities of RC materials in Egypt. However, from the data of CAPMAS [29], only the consumed quantities of steel reinforcement will be relied upon. The reason behind this consideration will be demonstrated later in Section 3. Subsequently, by multiplying the annual consumed quantities of steel reinforcement by the corresponding rate of CO2 emissions per unit, using the data of a report relevant to Egypt’s construction industry (i.e., [30]), the annual CO2 emissions of steel reinforcement can be defined. This output, in turn, along with the annual inflation rates of CAPMAS [28], provides the author with trustworthily data to directly investigate the pattern of the inflation–building material CO2 emissions relationship.

- (4)

- Fourth, the reason for studying this time period of Egypt’s construction sector, specifically from 2011 to 2019, is ascribed to the availability of data, particularly those related to the consumed quantities of RC materials. Although this adds a limitation to the present work in terms of the novelty of data, the above-mentioned justifications illustrate that the findings of the current research will be based on reliable data. This enhances the precision of the derived conclusions for providing the scholarly based-knowledge with more accurate implications concerning the economic and environmental consequences of inflation on construction material prices and their associated CO2 emissions, respectively.

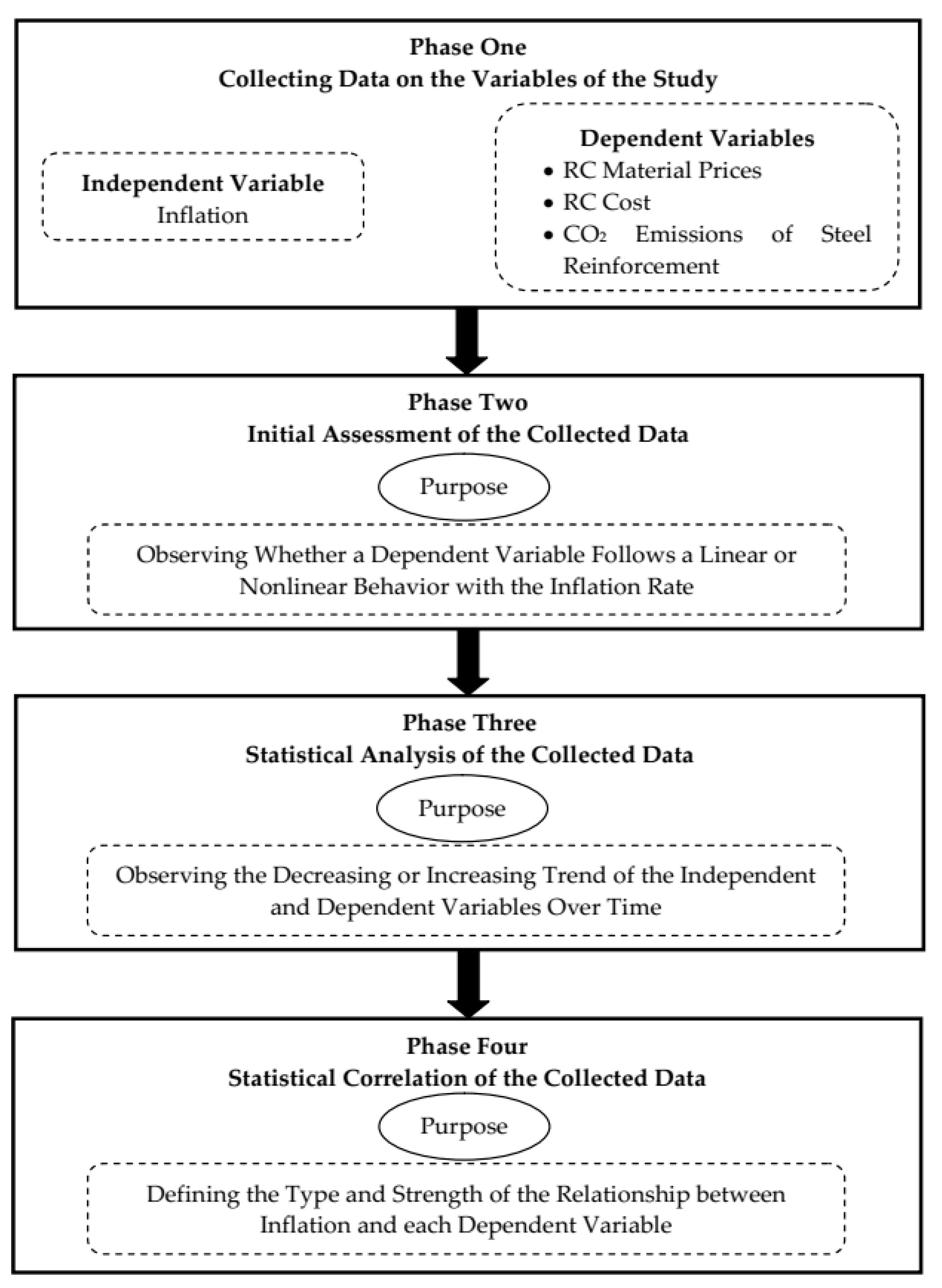

3. Research Methodology

3.1. Data Collection

- (1)

- (2)

- RC material prices: CAPMAS [26] has been utilized to specify the prices of RC materials, comprising steel reinforcement, ordinary Portland cement, sand, and gravel. It is worth mentioning that building material prices in CAPMAS [26] are monthly prices. Therefore, the monthly prices per year with respect to each RC material have been averaged to determine its annual price. The column of “average prices of RC materials” in Table 1 presents the average annual prices of steel reinforcement/ton, ordinary Portland cement/ton, sand/m3, and gravel/m3.

- (3)

- RC cost: According to Marzouk and Amin [6], in Egypt’s construction sector, the RC cost from materials is 51%. Yet, the other percentage (i.e., 49%) is pertinent to the costs of site overhead, equipment, and labor. Focusing on RC cost from materials, Marzouk and Amin [6] defined the percentages of 40%, 9%, and 2% for determining the RC cost from steel reinforcement, cement, and sand and gravel, respectively. Hence, by multiplying these percentages in the annual prices of their corresponding materials, as Equation (1) demonstrates, the annual RC cost can be specified. The column of “RC cost” in Table 1 illustrates the annual RC cost from 2011 to 2019.

- (4)

- CO2 emissions: Although CAPMAS [29] has the annually consumed quantities of RC materials, its data can be relied upon to get the annual consumed quantities of steel reinforcement only. This stems from two facts. First, the utilized quantities of sand and gravel are aggregated and presented together. Second, the used quantities of cement in CAPMAS [29] may represent many types of cement, such as ordinary Portland cement, Sulphate resistant cement, and white cement. These types of cement have many applications in the construction sector, comprising the works of plain concrete, RC, and finishing. Hence, the data of CAPMAS [29] are accurate to get the annually consumed quantities of steel reinforcement only. Although this adds a limitation to the present paper, it is important to build the results on reliable data. In accordance with Enterprise [30], the CO2 emissions of steel reinforcement/ton are 1890 kg. Enterprise [30] has been adopted as a reference because its scope is relevant to Egypt’s construction industry. By multiplying this rate in the annual consumed quantities of steel reinforcement, using the data of CAPMAS [29], this study can present the annual CO2 emissions of steel reinforcement, as the column of “CO2 emissions” in Table 1 includes.

3.2. Initial Assessment of the Data

3.3. Statistical Analysis of the Data: Annual Percentage of Deviation

3.4. Statistical Correlation of the Data: Spearman Correlation Test

4. Analysis and Discussion

4.1. Behavior of the Data

4.2. Annual Percentage of Deviation

4.3. Spearman Correlation

- (1)

- First, it urges governments to work in leaps and bounds for improving their economic conditions. This is a vital strategy for making their macroeconomic environments more stable. This contributes significantly to controlling the impacts of inflation on their construction sectors [35].

- (2)

- Second, it asks the officials in the construction community to shorten the duration of their projects, mainly when they are implemented in countries with high inflation rates [36,37]. Musarat et al. [3] illustrated the importance of this suggestion that inflation poses fewer effects on overrunning the costs of the short-term projects than the projects having a lengthy duration.

- (3)

- Third, as explained by Musarat et al. [3], this paper highly recommends that in the case of the long-term projects, the prices of building materials must be forecasted relying upon the past inflation rates for being considered in the preliminary Bill of Quantities to avert cost overrun.

5. Limitations and Upcoming Research Directions

- (1)

- First, CAPMAS [29] does not have reliable data concerning the consumed quantities of ordinary Portland cement, sand, and gravel for being multiplied by their rates of CO2 emissions to determine their inflation–CO2 emissions relationships. As a result, the study was able to specify the inflation–CO2 emissions nexus with respect to steel reinforcement only. Despite the impact of this challenge, the realized investigation led to correct the implications of Musarat et al. [23] that overcoming inflation can reduce building material prices; nevertheless, it increases CO2 emissions. However, this paper advises the analysts in their future works to exert more efforts to examine the uninvestigated correlations in order to grasp the whole picture of the inflation–RC material CO2 emissions nexus.

- (2)

- Second, the findings of this paper have been explored from data related to a developing country, i.e., Egypt. Hence, the presented outputs are limited to developing economies which have the same economic characteristics as Egypt in terms of causing the decreasing or increasing behavior and intensity of inflation and material prices over time.

- (3)

- Third, it was difficult to compare the outputs of this research with those of prior studies concerning the inflation–material prices relationship. The reasons are that while the findings of most of the previous works (e.g., [21]) are based on imprecise methodologies, other results (e.g., [3]) are associated with different economic and political conditions from Egypt’s circumstances.

- (4)

- Finally, the comprehensive methodology of the present paper can be utilized in various countries and applied on the materials relevant to other activities of the construction industry, such as mechanical and architectural works. Such studies are priceless to scrutinize the construction materials-specific differences in terms of their prices, costs, and CO2 emissions owing to the influences of the inflation rate, whether in similar or dissimilar contexts. Consequently, a better understanding can be realized to overcome the economic and environmental implications of inflation on the sustainable development of the construction sectors and their nations.

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Study | Study Scope | Investigated Materials | Analyzing Tools |

|---|---|---|---|

| [14] |

| Cement, steel reinforcement, coarse aggregate, fine aggregate, sandcrete blocks, long-span aluminum roofing sheets, and paints. |

|

| [15] |

| Not mentioned. |

|

| [16] |

| Cement, steel reinforcement, wire mesh, gravel, granite, sand, laterite, blocks, hardwood, and paints. |

|

| [17] |

| Cement, sand, aggregate, sandcrete blocks, steel reinforcement, asbestos, roofing sheets, nails, timber, ceiling board, electrical cables, paints, sanitary fitting, flooring tiles, sliding windows, and glass. |

|

| [18] |

| Cement. |

|

| [19] |

| Cement. |

|

| [20] |

| Steel reinforcement, cement, sand, bricks, and aggregate. |

|

| [3] |

| Cement; aggregate; sand; steel reinforcement; ready mix concrete; bricks; roofing; walls and floor tiles; ceiling board; plumping; sanitary fitting; paints; steel and metal sections; plywood; timber; glass; and ironmongery. |

|

| [22] |

| Cement, steel, crushed aggregate, sand, and bricks. |

|

| [23] |

| Sand; cement; steel reinforcement; bricks; aggregate; roofing; ceiling board; walls and floor tiles; ironmongery; plumping; timber; sanitary fitting; ready concrete mix; paints; plywood; glass; and steel and metal sections. |

|

| [21] |

| Cement and steel. |

|

References

- Musarat, M.A.; Alaloul, W.S.; Liew, M.S. Impact of inflation rate on construction projects budget: A review. Ain Shams Eng. J. 2021, 12, 407–414. [Google Scholar] [CrossRef]

- Firouzi, A.; Yang, W.; Li, C.Q. Prediction of total cost of construction project with dependent cost items. J. Constr. Eng. Manag. 2016, 142, 04016072. [Google Scholar] [CrossRef]

- Musarat, M.A.; Alaloul, W.S.; Liew, M.S.; Maqsoom, A.; Qureshi, A.H. Investigating the impact of inflation on building materials prices in construction industry. J. Build. Eng. 2020, 32, 101485. [Google Scholar] [CrossRef]

- Shiha, A.; Dorra, E.M.; Nassar, K. Neural networks model for prediction of construction material prices in Egypt using macroeconomic indicators. J. Constr. Eng. Manag. 2020, 146, 04020010. [Google Scholar] [CrossRef]

- Kar, S.; Jha, K.N. Assessing criticality of construction materials for prioritizing their procurement using ANP-TOPSIS. Int. J. Constr. Manag. 2022, 22, 1852–1862. [Google Scholar] [CrossRef]

- Marzouk, M.; Amin, A. Predicting construction materials prices using fuzzy logic and neural networks. J. Constr. Eng. Manag. 2013, 139, 1190–1198. [Google Scholar] [CrossRef]

- El-Kholy, A.M. Predicting cost overrun in construction projects. Int. J. Constr. Eng. Manag. 2015, 4, 95–105. [Google Scholar]

- Balali, A.; Moehler, R.C.; Valipour, A. Ranking cost overrun factors in the mega hospital construction projects using Delphi-SWARA method: An Iranian case study. Int. J. Constr. Manag. 2022, 22, 2577–2585. [Google Scholar] [CrossRef]

- Chukwudi, U.; Chigozie, G.; Chukwujekwu, A.; Hadiza, A. The correlation between foreign exchange rates and prices of building materials in Nigeria, 2011–2017. Int. J. Bus. Manag. 2017, 5, 94–100. [Google Scholar]

- Abdulhaqq, M.O.; Abdulsamad, M.A. Correlation between petroleum pump price volatility and selected building materials prices of construction projects in Nigeria, 2011–2020. Int. J. Bus. Manag. 2021, 9, 42–51. [Google Scholar] [CrossRef]

- Faghih, S.A.M.; Kashani, H. Forecasting construction material prices using vector error correction model. J. Constr. Eng. Manag. 2018, 144, 04018075. [Google Scholar] [CrossRef]

- Mir, M.; Kabir, H.D.; Nasirzadeh, F.; Khosravi, A. Neural network-based interval forecasting of construction material prices. J. Build. Eng. 2021, 39, 102288. [Google Scholar] [CrossRef]

- Oladipo, F.O.; Oni, O.J. Review of selected macroeconomic factors impacting building material prices in developing countries–A case of Nigeria. Ethiop. J. Environment. Stud. Manag. 2012, 5, 131–137. [Google Scholar] [CrossRef]

- Oghenekevwe, O.; Olusola, O.; Chukwudi, U.S. An assessment of the impact of inflation on construction material prices in Nigeria. PM World J. 2014, III, 1–22. [Google Scholar]

- Adegbembo, T.F.; Adeniyi, O. Evaluating the Effect of Macroeconomic Indicators on Building Materials Prices. In Proceedings of the Nigerian Institute of Quantity Surveyors: 2nd Research Conference–ReCon2, Abuja, Nigeria, 1–3 September 2015. [Google Scholar]

- Kalu, J.U.; Gyang, Z.Z.; Aliagha, G.U.; Alias, B.; Joachim, O.I. Monetary policy and its price stabilization effects on the prices of building materials. Mediterran. J. Soc. Sci. 2015, 6, 171–177. [Google Scholar] [CrossRef]

- Oladipo; Olukayode, F. An assessment of the relationship between macro-economic indicators and prices of building materials in Nigerian construction industry. Int. J. Sci. Bas. Appl. Res. 2015, 24, 112–123. [Google Scholar]

- Bediako, M.; Amankwah, E.O.; Abodor, C.D. The impact of macroeconomic indicators of cement prices in Ghana. J. Sci. Res. Rep. 2016, 9, 1–6. [Google Scholar] [CrossRef]

- Oba, K.M. A multiple linear regression model to predict the price of cement in Nigeria. Int. J. Econo. Manag. Eng. 2019, 13, 1482–1487. [Google Scholar]

- Mohamed, E.B.; Mahmoud, S.Y. An assessment of the impact of inflation on the prices of selected construction materials in Sudan. Int. J. Multidiscipli. Res. Publica. 2020, 2, 41–44. [Google Scholar]

- Dilip, D.K.; Jesna, N.M. Macroeconomic indicators as potential predictors of construction material prices. Sustainabil. Agr. Food Environment. Res. 2022, 10, 1–9. [Google Scholar]

- Musarat, M.A.; Alaloul, W.S.; Qureshi, A.H.; Altaf, M. Inflation Rate and Construction Materials Prices: Relationship Investigation. In Proceedings of the International Conference on Decision Aid Sciences and Application, Sakheer, Bahrain, 8–9 November 2020. [Google Scholar]

- Musarat, M.A.; Alaloul, W.S.; Liew, M.S.; Maqsoom, A.; Qureshi, A.H. The effect of inflation rate on CO2 emission: A framework for Malaysian construction industry. Sustainability 2021, 13, 1562. [Google Scholar] [CrossRef]

- Bassioni, H.A.; Elmasry, M.I.; Ragheb, A.M.; Youssef, A.A. Time Series Analysis for the Prediction of RC Material Components Prices in Egypt. In Proceedings of the 28th Annual ARCOM Conference; Association of Researchers in Construction Management, Edinburg, UK, 3–5 September 2012. [Google Scholar]

- Marey, H.; Kozma, G.; Szabó, G. Effects of using green concrete materials on the CO2 emissions of the residential building sector in Egypt. Sustainability 2022, 14, 3592. [Google Scholar] [CrossRef]

- CAPMAS (Central Agency for Public Mobilization and Statistics). Monthly Bulletin of Average Retail Prices of Major Important Building Materials; Central Agency for Public Mobilization and Statistics: Cairo, Egypt, 2023. [Google Scholar]

- Hassanein, A.A.; Khalil, B.N. Developing general indicator cost indices for the Egyptian construction industry. J. Finan. Manag. Prop. Constr. 2006, 11, 181–194. [Google Scholar] [CrossRef]

- CAPMAS (Central Agency for Public Mobilization and Statistics). Urban’s Annual Inflation Rate of the Republic. 2023. Available online: https://www.capmas.gov.eg/Pages/IndicatorsPage.aspx?ind_id=2517 (accessed on 3 February 2023).

- CAPMAS (Central Agency for Public Mobilization and Statistics). Annual Bulletin of Construction & Building Statistics for Private Sector Companies; Central Agency for Public Mobilization and Statistics: Cairo, Egypt, 2023. [Google Scholar]

- Enterprise. Just How Bad is Construction Material Pollution in Egypt? Enterprise Ventures LLC: Cairo, Egypt, 2021. [Google Scholar]

- Alaloul, W.S.; Musarat, M.A.; Liew, M.S.; Qureshi, A.H.; Maqsoom, A. Investigating the impact of inflation on labour wages in construction industry of Malaysia. Ain Shams Eng. J. 2021, 12, 1575–1582. [Google Scholar] [CrossRef]

- Musarat, M.A.; Alaloul, W.S.; Liew, M.S. Inflation rate and labours’ wages in construction projects: Economic relation investigation. Eng. Constr. Archit. Manag. 2022, 29, 2461–2494. [Google Scholar] [CrossRef]

- Xiao, C.; Ye, J.; Esteves, R.M.; Rong, C. Using Spearman’s correlation coefficients for exploratory data analysis on big dataset. Concurr. Computat. Pract. Exper. 2016, 28, 3866–3878. [Google Scholar] [CrossRef]

- El-Dash, K.; Abdel Monem, M. Potential Risks in Civil Infrastructure Projects in Egypt. In Proceedings of the VIII International Congress on Project Engineering-III IPMA-ICEC International Expert Seminar, Bilbao, Spain, 6–8 October 2004. [Google Scholar]

- Cheung, E.; Chan, A.; Kajewski, S. Factors contributing to successful public private partnership projects: Comparing Hong Kong with Australia and the United Kingdom. J Facili. Manag. 2012, 10, 45–58. [Google Scholar] [CrossRef]

- Tiong, R. CSFs in competitive tendering and negotitaion model for BOT projects. J. Constr. Eng. Maanag. 1996, 122, 205–211. [Google Scholar] [CrossRef]

- Zhang, X. Concessionaire selection: Methods and criteria. J. Constr. Eng. Maanag. 2004, 130, 235–244. [Google Scholar] [CrossRef]

- IEA (Industrial Energy Accelerator). Case study: Al Ezz Dekheila Steel company: Implementation of Energy Management System (EnMS) to Decrease Energy Consumption. 2023. Available online: https://www.industrialenergyaccelerator.org/egypt/case-study-al-ezz-dekheila-steel-company/ (accessed on 3 March 2023).

- Hamza, A.S. Assessment of Carbon Dioxide Emission and Its Impact on High-Rise Mixed-Use Buildings in Egypt. Master’s Thesis, American University in Cairo, Cairo, Egypt, 2021. [Google Scholar]

- Colangelo, F.; Petrillo, A.; Farina, I. Comparative environmental evaluation of recycled aggregates from construction and demolition wastes in Italy. SCi. Tot. Environ. 2021, 798, 149250. [Google Scholar] [CrossRef]

- Petrillo, A.; Colangelo, F.; Farina, I.; Travaglioni, M.; Salzano, C.; Cioffi, R. Multi-criteria analysis for Life Cycle Assessment and Life Cycle Costing of lightweight artificial aggregates from industrial waste by double-step cold bonding palletization. J. Clean. Product. 2022, 351, 131395. [Google Scholar] [CrossRef]

- Tang, Y.; Lee, Y.; Amran, M.; Fediuk, R.; Vatin, N.; Kueh, A.; Lee, Y. Artificial neural network-forecasted compression strength of alkaline-activated alag concretes. Sustainability 2022, 14, 5214. [Google Scholar] [CrossRef]

- Demissew, A.; Fufa, F.; Assefa, S. Partial replecemnt of cement by coffee husk ash for C-25 concrete production. J. Civ. Eng. Sci. Tech. 2019, 10, 12–21. [Google Scholar] [CrossRef]

- Hafez, H.; Kurda, R.; Al-Ayish, N.; Garcia-Segura, T.; Cheung, W.; Nagaratnam, B. A whole life cycle performance-based ECOnomic and ECOlogical assessment framework (ECO2) for concrete sustainability. J. Clean. Product. 2021, 292, 126060. [Google Scholar] [CrossRef]

- Akbarnezhad, A.; Ong, K.; Chandra, L. Economic and environmental assessment of deconstruction strategies using building information modeling. Automat. Constr. 2014, 37, 131–144. [Google Scholar] [CrossRef]

| Year | Average Prices of RC Materials | RC Cost (LE) | CO2 Emissions | |||

|---|---|---|---|---|---|---|

| Steel Reinforcement (LE/Ton) | Cement (LE/Ton) | Sand (LE/M3) | Gravel (LE/M3) | Steel Reinforcement (Ton CO2) | ||

| 2011 | 4788.25 | 528.7 | 31.836 | 69.162 | 1964.903 | 560,190.33 |

| 2012 | 4727.75 | 525.8 | 29.972 | 69.617 | 1940.414 | 418,406.31 |

| 2013 | 5145.833 | 635.1 | 33.864 | 75.671 | 2117.683 | 306,639.27 |

| 2014 | 5200.083 | 749.717 | 36.939 | 80.879 | 2149.864 | 481,997.25 |

| 2015 | 4995.048 | 717.25 | 42.909 | 87.493 | 2065.18 | 882,507.15 |

| 2016 | 6300.827 | 754.683 | 55.862 | 101.502 | 2591.399 | 1,080,053.73 |

| 2017 | 10,879.79 | 868.85 | 67.967 | 122.315 | 4433.918 | 13,247,822.7 |

| 2018 | 12,525.67 | 999.833 | 79.667 | 144.45 | 5104.734 | 2,146,123.35 |

| 2019 | 11,892.86 | 960 | 87.5 | 155 | 4848.392 | 2,219,213.43 |

| Year | Inflation | Average Prices of RC Materials | RC Cost | CO2 Emissions | |||

|---|---|---|---|---|---|---|---|

| Steel Reinforcement | Cement | Sand | Gravel | Steel Reinforcement | |||

| 2011–2012 | −29.703 | −1.263 | −0.548 | −5.855 | 0.657 | −1.246 | −25.301 |

| 2012–2013 | 33.803 | 8.843 | 20.787 | 12.987 | 8.696 | 9.135 | −26.712 |

| 2013–2014 | 6.316 | 1.054 | 18.047 | 9.080 | 6.883 | 1.520 | 57.187 |

| 2014–2015 | 2.970 | −3.943 | −4.330 | 16.162 | 8.178 | −3.939 | 83.094 |

| 2015–2016 | 32.692 | 26.141 | 5.219 | 30.188 | 16.012 | 25.480 | 22.385 |

| 2016–2017 | 113.768 | 72.672 | 15.128 | 21.668 | 20.504 | 71.101 | 1126.589 |

| 2017–2018 | −50.847 | 15.128 | 15.075 | 17.214 | 18.097 | 15.129 | −83.800 |

| 2018–2019 | −36.552 | −5.052 | −3.984 | 9.833 | 7.303 | −5.021 | 3.406 |

| Average | 9.056 | 14.197 | 8.174 | 13.909 | 10.791 | 14.020 | 144.605 |

| Dependent Variable | Spearman Correlation Coefficient (RS) | Type of the Relationship with the Inflation Rate | Strength of the Relationship with the Inflation Rate |

|---|---|---|---|

| Price of Steel Reinforcement | +0.571 | Direct relationship | Moderate relationship |

| Price of Cement | +0.548 | Direct relationship | Moderate relationship |

| Price of Sand | +0.357 | Direct relationship | Weak relationship |

| Price of Gravel | +0.357 | Direct relationship | Weak relationship |

| RC Cost | +0.571 | Direct relationship | Moderate relationship |

| CO2 Emissions of Steel Reinforcement | +0.524 | Direct relationship | Moderate relationship |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Akal, A.Y. Inflation and Reinforced Concrete Materials: An Investigation of Economic and Environmental Effects. Sustainability 2023, 15, 7687. https://doi.org/10.3390/su15097687

Akal AY. Inflation and Reinforced Concrete Materials: An Investigation of Economic and Environmental Effects. Sustainability. 2023; 15(9):7687. https://doi.org/10.3390/su15097687

Chicago/Turabian StyleAkal, Ahmed Yousry. 2023. "Inflation and Reinforced Concrete Materials: An Investigation of Economic and Environmental Effects" Sustainability 15, no. 9: 7687. https://doi.org/10.3390/su15097687

APA StyleAkal, A. Y. (2023). Inflation and Reinforced Concrete Materials: An Investigation of Economic and Environmental Effects. Sustainability, 15(9), 7687. https://doi.org/10.3390/su15097687