1. Introduction

As sustainable development has become a global consensus, China is taking steps to promote its sustainable economic development by transformation of its economic development and strategic restructuring of its economy [

1]. The integration of culture and tourism is one of its key policies to achieve this goal. Culture, as the core of China’s strategy of building a strong cultural nation, plays a role in enhancing national confidence and serving society. Tourism, as an important way to meet people’s aspirations for a better life, has a comprehensive driving function for boosting the economy and stabilizing society, but at the same time it has brought over-consumption of resources and damage to the ecological environment. Integrating culture and creativity into tourist attraction, tourism publicity and tourism brands can accelerate the upgrading of the tourism industry and transform the traditional model of relying on resource consumption into a new one of low energy consumption and high income, achieving a harmonious unity between the cultural and tourism industry and the ecological environment, thereby contributing to the sustainable development of the ecological environment and the economy [

2,

3]. In 2009, the Ministry of Culture and the National Tourism Administration issued the

Guiding Opinions on Promoting the Integrated Development of Culture and Tourism, which clearly made a series of strategic arrangements to promote the coordinated development and in-depth integration of culture and tourism [

4]. In 2018, the Ministry of Culture and Tourism of the People’s Republic of China was officially established. It is obvious that the convergence of the culture industry and tourism industry has become an inevitable trend in China.

Meanwhile, as the head of the cultural tourism industry, culture and tourism listed companies are an organizational form that combines the cultural and tourism industry with finance after reaching a certain level of development. They are an important carrier and support for cultural and tourism integration, functioning as the barometer of the cultural tourism industry and the indicator of regional cultural tourism economy, and their quantity and quality directly affect regional cultural and tourism revenue and even the national economy [

5]. Through their spatial distribution, we can get a glimpse of the balance of the cultural and tourism industry and the coordination of regional economies. Their spatial evolution mechanism can provide reference for improving the cultural and tourism economy in the right way, exploring and innovating the mode and path of cultural and tourism integration according to local conditions, thereby promoting sustainable economic development.

With the deepening of cultural and tourism integration and the expansion of the cultural and tourism industry, academia has been paying increasing attention to the driving force of the industry—culture and tourism listed companies. At present, research on culture and tourism listed companies mainly focuses on three aspects. The first aspect is enterprise performance evaluation. Ma et al. [

6] believe that the economic performance of listed companies in the scenic area category is significantly different in both the time and space dimensions. Liu et al. [

7] found that the operating efficiency of listed companies in the cultural and tourism industry has a significant positive impact on their profitability. Zhu [

8] and Ma [

9] et al. constructed a performance evaluation system for listed companies in the cultural and tourism industry, which can provide an important reference for stakeholders to evaluate enterprises and make decisions. The second aspect is business diversification. The diversified M&A of China’s tourism listed companies is mainly driven by factors such as industry market opportunities, state-owned holdings and political affiliation [

10]. Dou et al. [

11] found that it is rather common for media listed companies, which belong to cultural listed companies, to carry out diversified operations, and the overall diversity in the cultural industry is significantly higher than that of other industries; and listed companies should choose suitable diversification types according to their own industrial attributes to avoid blind unrelated diversification. Pang et al. [

12] found that corporate social networks can reduce the incentive for tourism listed companies to internalize external resources with diversification by reducing transaction costs. Personal social networks can help the management to obtain information about new products and new markets to improve the diversification ability of tourism listed companies. The final aspect is enterprise management. Du et al. [

13] constructed an empirical model of the interaction between the governance system and performance of tourism listed companies, confirmed the positive correlation between the two and provided effective guidance and countermeasures for tourism listed companies to build a sustainable governance mechanism. Han et al. [

14] proved that, for listed cultural and creative enterprises, high-quality internal management can notably inhibit financial fraud. Additionally, improving the internal control systems can promote the healthy and long-term development of cultural and creative industries. However, it is rare for researchers to study culture and tourism listed companies from a geographical perspective. Although, some studies conducted from a geographical perspective on other research objects rooted in the cultural and tourism industry provide inspiration and reference for the ideas and research methods in this paper. Yuan et al. [

15] used the nearest neighbor index, the standard deviation ellipse (SDE) and kernel density estimation to describe the spatial patterns of cultural resources within the Yellow River National Cultural Park, and used the Geodetector tool to study the influence of physical geography and social and human factors on the spatial distribution pattern of cultural resources. Kuang et al. [

16] analyzed the spatial distribution and clustering characteristics of 407 national intangible cultural heritages in Central China by using the geographic concentration index and kernel density, and then explored natural and social environmental influencing factors and their interaction on ICH spatial distribution using the Geodetector. Luo et al. [

17] took 585 theme parks in the Chinese mainland as the research objects, using the nearest neighbor index, kernel density and SDE to analyze the development stage characteristics, spatiotemporal differentiation and diffusion of the theme parks, and multiple factor regression analysis methods were used to explore the influencing factors. As mentioned, most of the current research related to culture and tourism companies has focused on the performance and management of the enterprises. Little attention has been paid to the study of their geographic characteristics, and the literature introducing the complete developing process of culture and tourism listed companies since the emergence of China’s cultural and tourism industry is also rare.

Consequently, this paper takes China’s culture and tourism listed companies as research subjects, collecting the panel data from 1992 to 2021, and firstly analyzes the time-series evolution characteristics to introduce the complete developing process of cultural and tourism companies. Then, GIS analysis methods are used to explore the spatial distribution characteristics over a long time scale to understand the spatial evolution of culture and tourism listed companies. Indicators from the four dimensions of “cultural and tourism development”, “economic conditions”, “public services” and “political support” are selected as conditional variables, and the Geodetector is used to explore the influencing factors of spatial distribution of culture and tourism listed companies to determine which factors and their interaction play a core role in it.

The aim of this paper is to introduce the complete growing process of culture and tourism companies since the emergence of the cultural and tourism industry, reveal the spatial distribution characteristics of the culture and tourism companies over the past 30 years with the help of GIS spatial analysis methods, and explore the spatial influencing mechanism of the spatial evolution based on single-factor analysis and two-factor interaction analysis using the Geodetector.

The contributions of this study paper are mainly two aspects. From the theorical aspect, this study fills the research gap in studying culture and tourism listed companies from a geographical perspective, thereby enriching and deepening the research system of enterprise geography and tourism geography. From the practical aspect, first, this study clarifies the complete growth process of culture and tourism companies since the very beginning of the industry to help visualize the industry characteristics and predict future trends. Second, this study reveals the spatial layout evolution of culture and tourism companies to help grasp the past and current quality levels of cultural and tourism integration and development in different regions of China accurately, and identify backward regions of the high-quality and sustainable development of the cultural and tourism industry. In addition, by clarifying which factors and their interactions play a central role in the layout of culture and tourism companies, this study helps to optimize the spatial structure of the cultural and tourism industry according to local conditions.

4. Analysis of Driving Factors

In order to analyze the numerous factors affecting the spatial distribution of culture and tourism listed companies in China, according to the relevant literature, combined with the characteristics of listed companies, this paper constructed four dimensions of indicators, namely, “cultural and tourism development”, “economic conditions”, “public services” and “political support”. The following indicators were selected: the number of scenic spots of grade 3A and above (X1); the quality score of scenic spots (X2) (10 points for 5A, 6 points for 4A and 4 points for 3A; the total score is obtained using the formula “score of single scenic spot × number of scenic spots = total score of scenic spot quality”, to represent the development level of cultural tourism [

6] (the number of tourists and tourism revenue were not selected, firstly because the reliability of the data is questionable, and secondly because there is endogeneity between the two and the quantity and quality of scenic spots)); GDP (X3); the ranking of urban openness (X4); the number of financial industry employees (X5), which represents economic conditions [

30,

31]; the number of star-rated hotels (X6); telecom business income (X7); airport passenger throughput (X8), representing public services [

32]; land price of commercial services (X9); and local financial expenditure (X10), representing policy support [

33,

34], with a total of 10 factors (

Table 2). Then, the natural breakpoint method in ArcGIS was used to divide the 10 continuous independent variables into five categories and obtain discrete type values. After that, single-factor detection and interactive-factor detection were carried out using Geodetector.

4.1. Single-Factor Detection

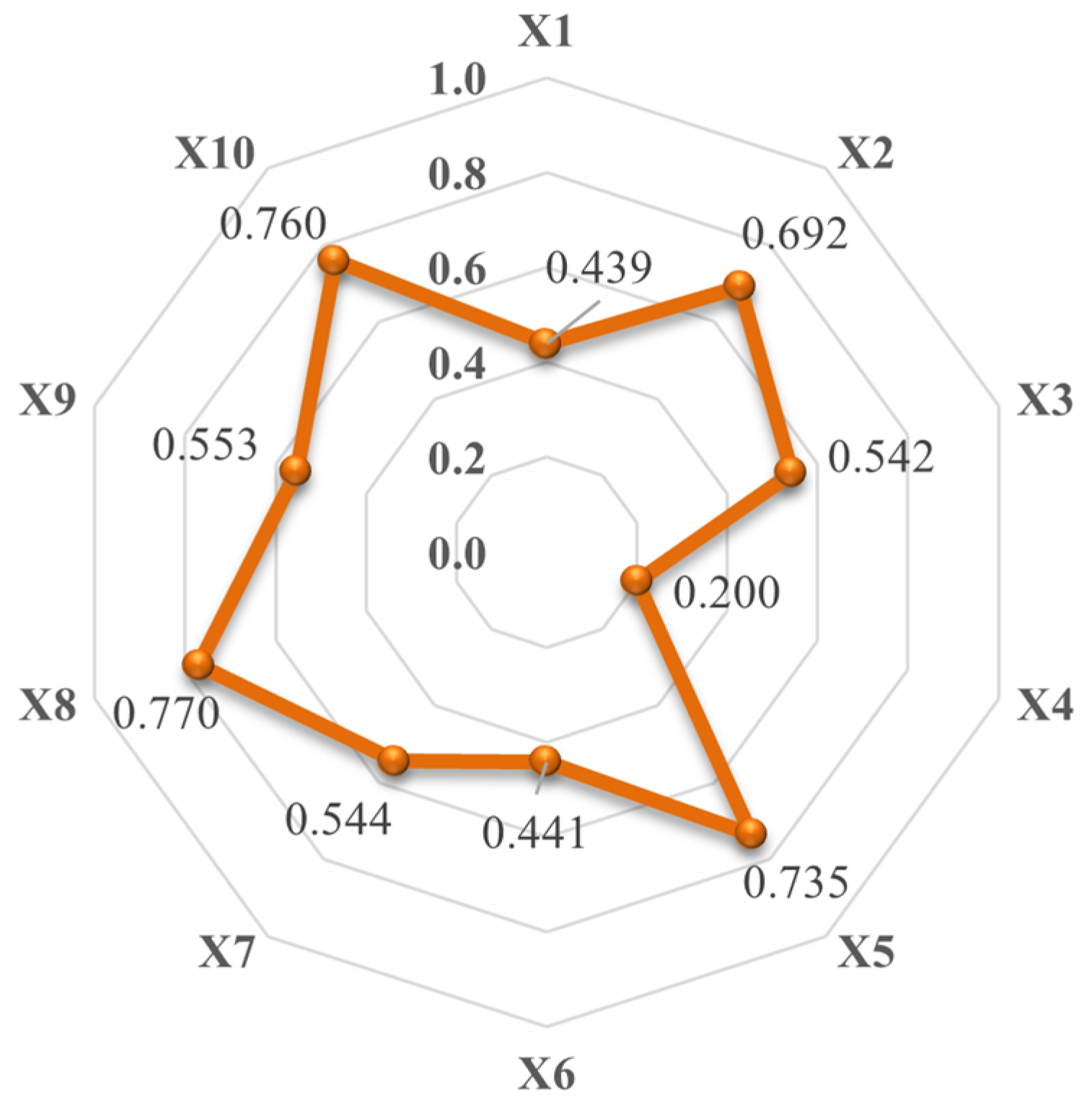

As shown in

Figure 5, in the order of explanatory power, the Q value of each factor was as follows: airport passenger throughput (0.770) > local financial expenditure (0.760) > number of financial industry employees (0.735) > scenic spot quality score (0.692) > commercial land price (0.553) > telecom business revenue (0.544) > GDP (0.542) > number of star-rated hotels (0.441) > number of scenic spots of 3A and above (0.439) > ranking of urban openness (0.200).

- (1)

Cultural Tourism Development

The quality score of scenic spots had an explanatory power of 0.692 for the spatial distribution of culture and tourism listed companies in China, and 0.439 for the number of scenic spots of 3A and above. The development of cultural tourism enterprises is strongly related to the quality of local tourist attractions. Scenic spots with excellent resources can more easily attract tourists, stimulate the supply of cultural products while boosting consumption, and promote the development of the cultural tourism industry chain. The rich types and large number of high-level scenic spots mean that there is sufficient space and various choices for tourists. As a corporate force rooted in the cultural tourism industry, culture and tourism listed companies are more likely to have their locations in cities and regions with a high abundance of tourism resources.

- (2)

Economic Location

The explanatory power of the number of financial industry employees reached as high as 0.735, ranking third, indicating that the regional financial environment is very important for the spatial distribution of culture and tourism listed companies in China. Cities such as Beijing, Shanghai and Shenzhen, with some of the highest numbers of culture and tourism listed companies, also have the highest number of financial industry employees. Culture and tourism listed companies need a good financing environment and adequate financial services, meaning that cities and regions with a developed financial industry are more likely to attract them. The factor explanatory power of GDP was 0.542, showing that regional economic growth has a certain boosting effect. Only cities with a strong economy can easily produce economies-of-scale effects to attract culture and tourism listed companies in China [

35]. The urban openness ranking had a relatively small impact on culture and tourism listed companies in China, with an explanatory power of only 0.200.

- (3)

Public Service

The explanatory powers of airport passenger throughput, telecom business income and the number of star-rated hotels were 0.770, 0.544 and 0.441, respectively. The control of transportation services over the distribution of culture and tourism listed companies in China ranked first: on the one hand, the large-scale movement of tourists from the source to the destination depends on good transportation agencies; on the other hand, listed companies have a large number of demands for national and international conferences, and the high-frequency flow of personnel requires cities to be equipped with high-level transportation facilities, such as airports, meaning that convenient transportation services are the primary impact factor. The level of communication development also had some influence, especially in the period of COVID-19, where online conferences were particularly necessary. The impact of accommodation services, on the one hand, lies in the tourists’ sense of experience, and high-quality accommodation conditions attract “repeat visitors”; on the other hand, it decides the experience of employees or customers on business trips. Considering the treatment of personnel, culture and tourism listed companies tend to choose cities with relatively many star-rated hotels to settle in.

- (4)

Policy Support

The explanatory power of local fiscal expenditure ranked second, reaching 0.760. The regions with a strong government financial strength are in a position to allocate additional corporate working capital and corporate renovation funds, and have a more adequate budget for the protection and development of their culture and heritage. The explanatory power of the commercial land price level was 0.553. In Beijing, Shenzhen, Shanghai and other cities where the commercial land price level is relatively high, the distribution of culture and tourism listed companies is also relatively dense. It is clear that culture and tourism listed companies are willing to bear the higher land rent costs in places where the infrastructure is complete and the office environment is comfortable.

4.2. Interactive Factor Detection

The results show that the influence of factor integration is greater than that of a single factor (

Table 3), and all of the top three factors are combinations of the scenic spot quality score (X2) and other factors, namely, X2 ∩ X8 (0.961), X2 ∩ X7 (0.937) and X2 ∩ X3 (0.924), which shows that the interaction between the quality of urban tourist attractions and the level of transport services, communication development and economic development has a dominant control on the spatial distribution pattern of culture and tourism listed companies in China. This also proves that, for culture and tourism listed companies, strong tourism resource endowment is an extremely critical factor in increasing their distribution in a city or region. The influence of X3 ∩ X7 is the smallest, with 0.582. In addition to the nonlinear enhancement of X1 ∩ X4 and X4 ∩ X6, the remaining interactions of influencing factors show a two-factor enhancement, which shows that, in the process of forming the spatial differentiation pattern of culture and tourism listed companies in China, each driving factor does not independently have an influence, but plays a synergistic role together with other factors. This reflects the complexity of the driving factors and formation mechanism of the spatial differentiation of culture and tourism listed companies in China.

5. Discussion

From the perspective of geography, this paper extracts the data for culture and tourism listed companies in China from 1992 to 2021, takes prefecture-level cities and above as statistical units, reveals the spatiotemporal evolution characteristics over the past 30 years with the help of GIS spatial analysis, and explores the factors and their interactions affecting culture and tourism listed companies by means of single-factor analysis and two-factor interaction analysis using the Geodetector.

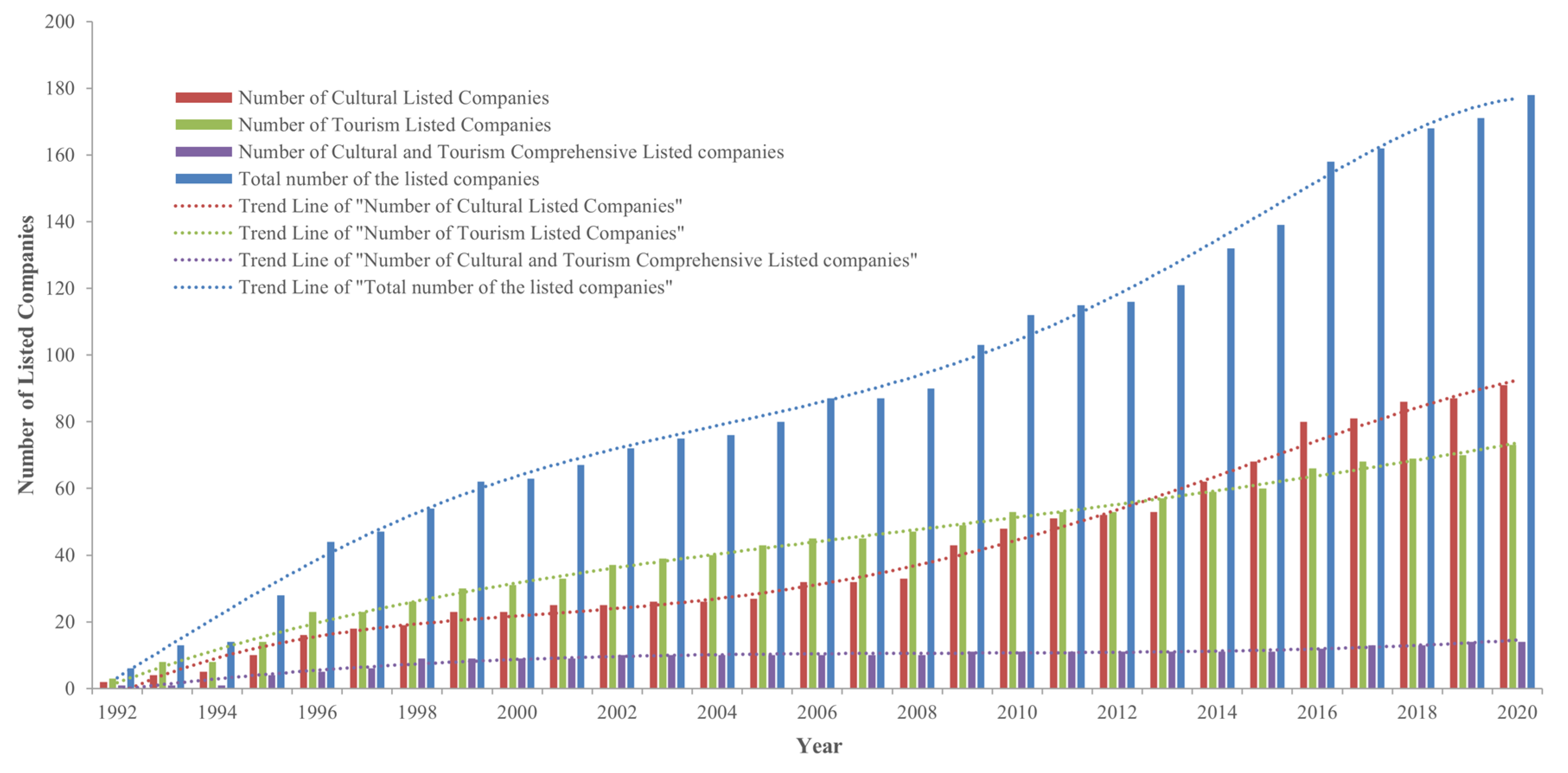

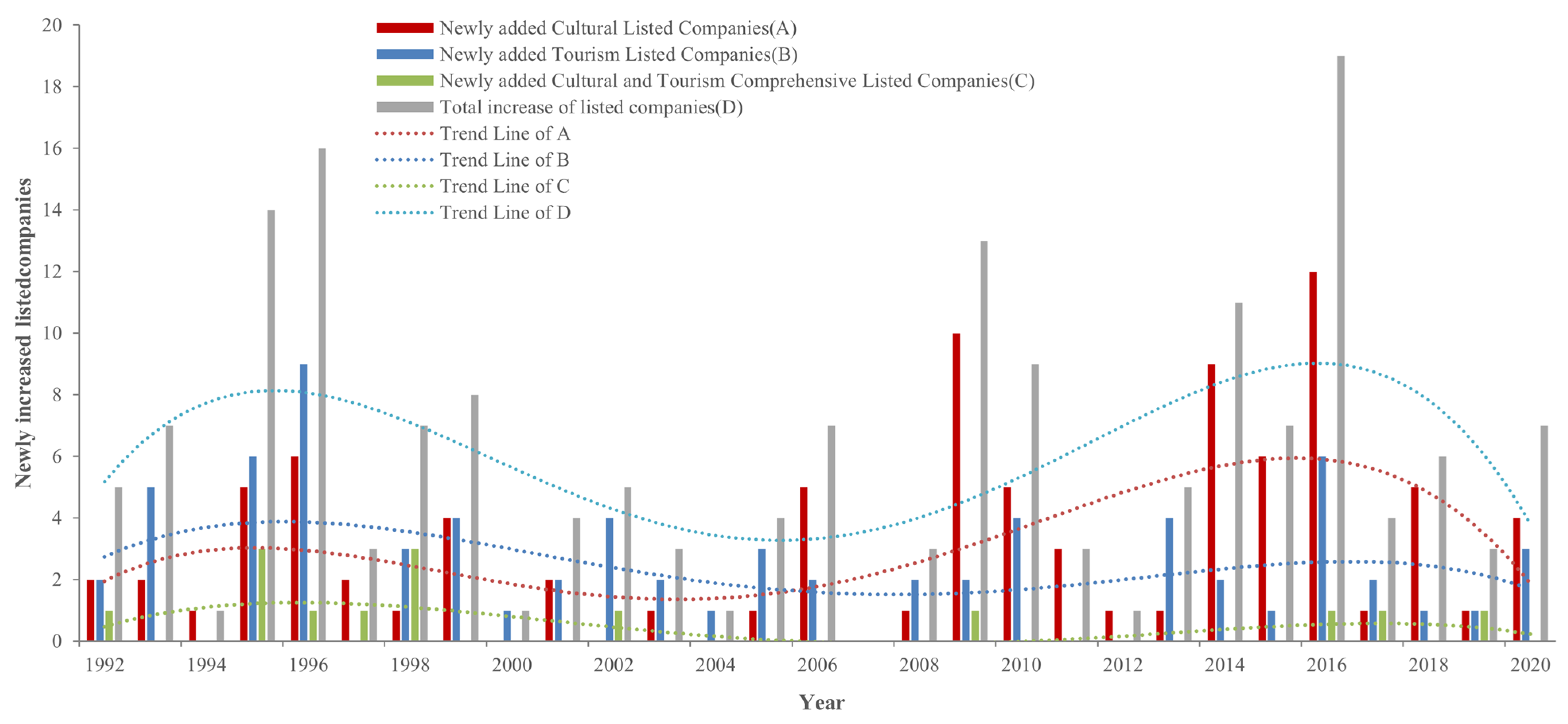

Our study found that, since China’s reform and opening up, the culture and tourism companies had been poised for springing up, and the three categories of them (cultural category, tourism category and comprehensive cultural and tourism category) showed a basically consistent trend, which according to the “peak and valley” of the curve and the change consistency could be divided into three periods, namely, the embryonic (1978–1992), the exploration (1992–2006) and the growth (2007–2021). The developing trend was found to be closely related to the relevant national cultural and tourism policies, and external economic and financial background.

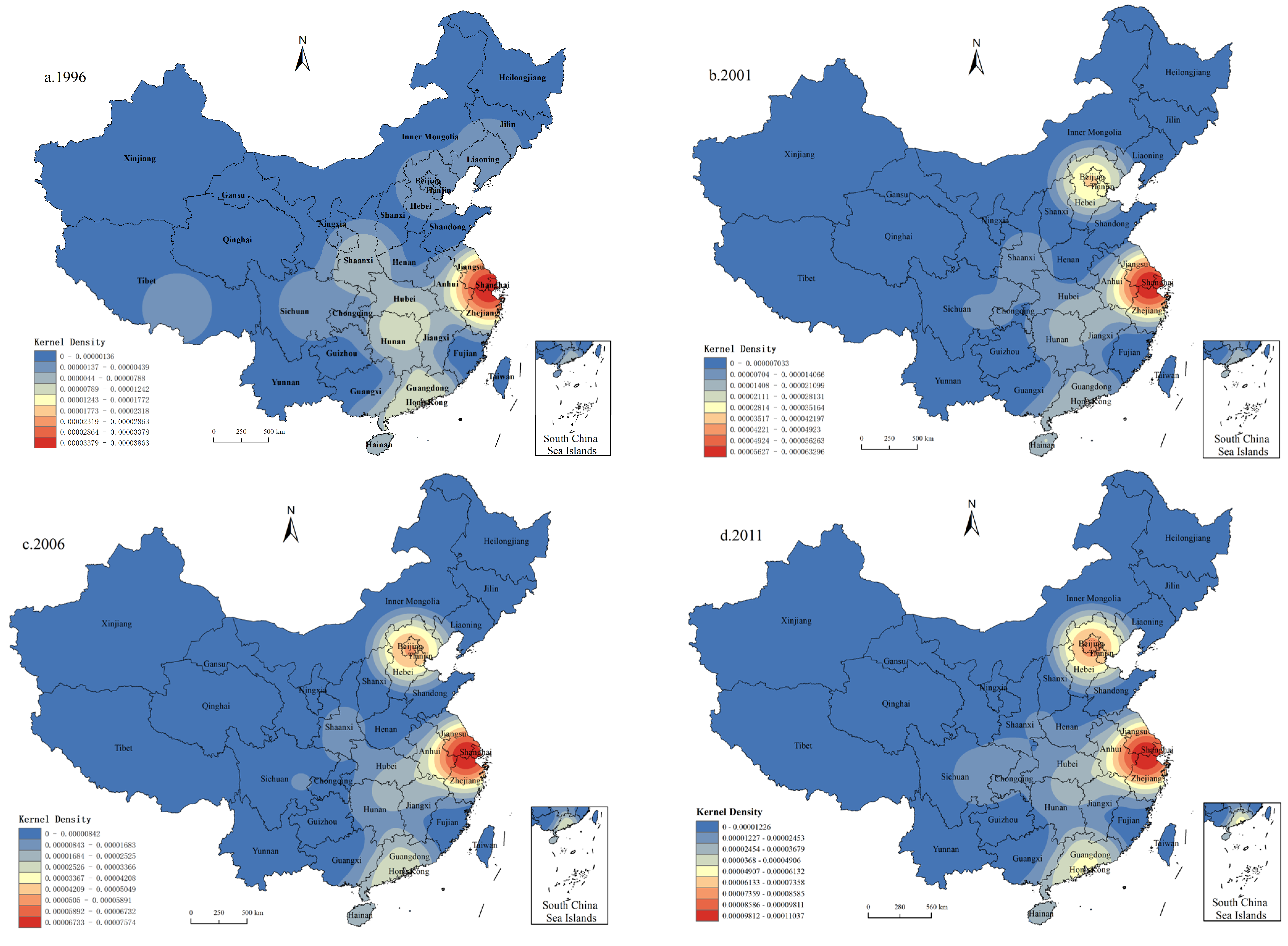

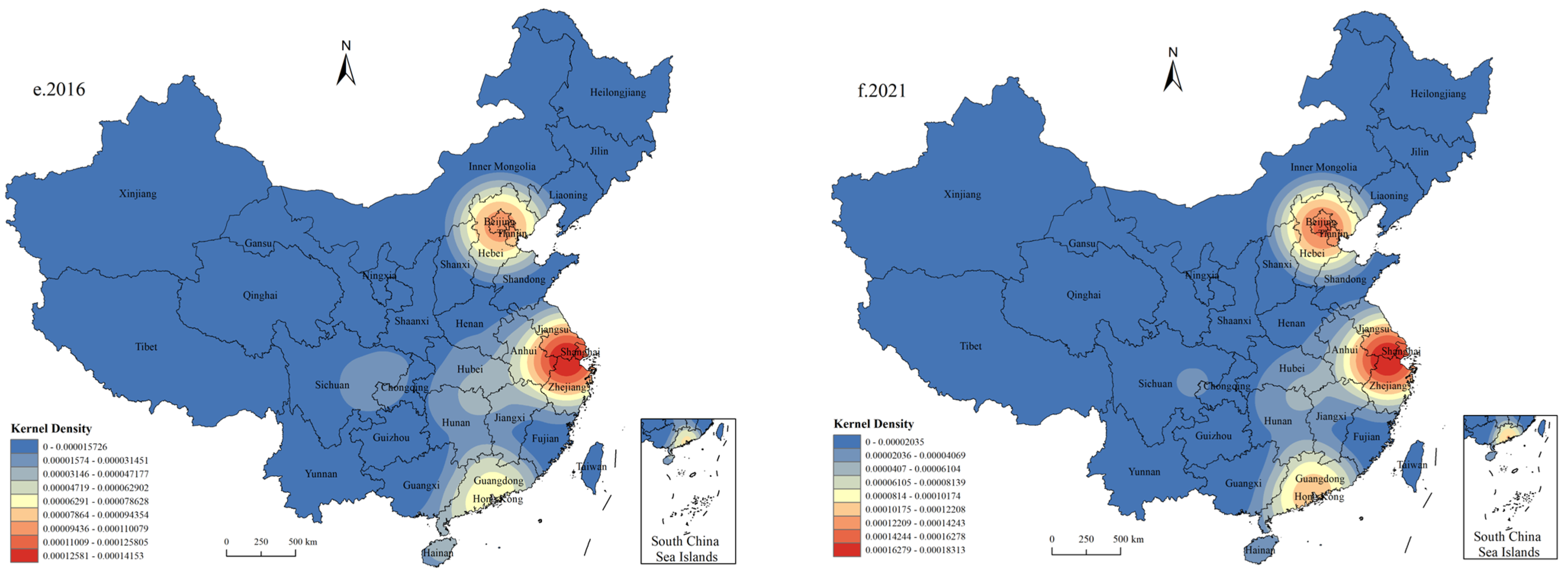

In the past 30 years, the overall spatial layout of culture and tourism listed companies in China showed a spatial evolution pattern of transforming from “single core” to “one core and multiple stars”, gradually stabilizing to a “three cores” with the B–T–H, the PRD and the Yangtze River Delta being the “cores”. This is in line with the research on the headquarters of the Chinese listed companies conducted by Zhong [

31] and Pan [

36], according to which the spatial aggregation of the Chinese listed companies are located in the same three most developed regions in China, which indicates that the Chinese culture and tourism industry is not yet developed enough to bring into full play the high-quality tourism resources of regions where the economy and transportation are underdeveloped, failing to break away from the inherent distribution pattern of listed companies. The reason could be found in Liu’s [

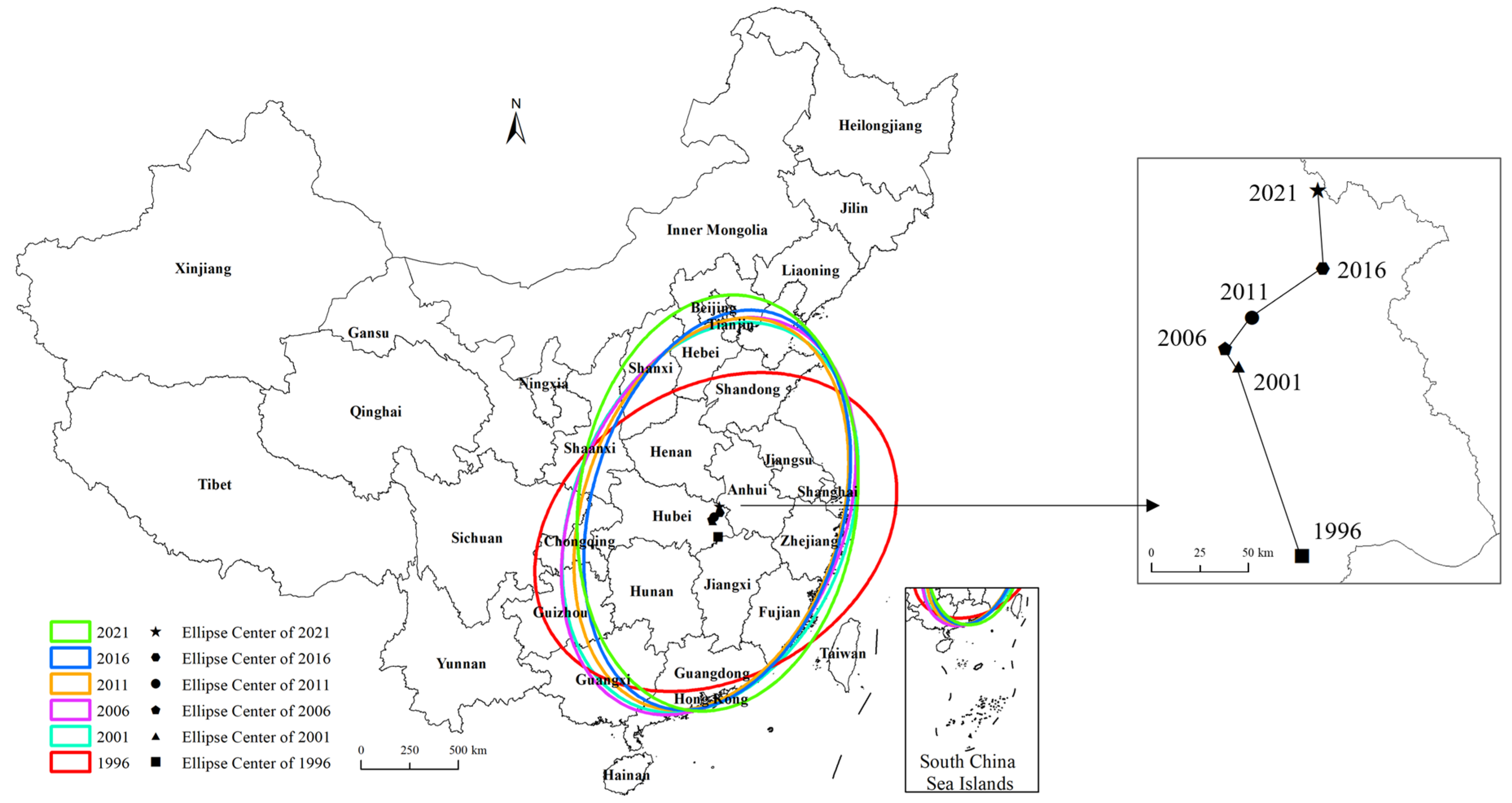

7] research, which pointed out that many cultural and tourism listed companies have shown below average profitability, with a shortage of cultural boutique projects, and are generally in a state of investment saturation, excessive investment and insufficient output, causing the low driving capacity for regional economy. The standard deviation ellipse shifted from southeast to the northwest over time and showed a pattern of “expansion–contraction–expansion”, and the center of gravity moved from south to north along a “Z”-shaped track. Compared with the findings of Meng [

37] and Zhong [

31] that Chinese listed companies are gradually evolving from the central and western part to the eastern metropolises and the center of gravity of listed companies is gradually shifting to the southeast, the results of this paper are quite the opposite, indicating that, although the culture and tourism companies are concentrated in the prosperous areas, they do show a diffusion trend to the regions undeveloped but with great tourism resources.

Cultural and tourism development, economic conditions, public services and political support had explanatory power in the spatial distribution of culture and tourism listed companies in China. In terms of single factors, the level of transportation services, the financial strength of the government and the control of the financial environment ranked as the top three. However, the interaction of various influencing factors had a far greater impact on the spatial distribution of culture and tourism listed companies than one single factor. The leading interactive factors were the quality of scenic spots and transportation services, the quality of scenic spots and the level of communication development, and the quality of scenic spots and the level of economic development, indicating that tourism resource endowment has a strong impact on the formation of the distribution pattern of culture and tourism listed companies. Combined with the results of single-factor detection, it can be seen that, if a region has only high-quality cultural and tourism resources, the positive impact to the spatial distribution of cultural and tourism listed companies cannot be maximized. Only when the great quality of regional tourism resources and relatively universal influencing factors such as traffic reachability, technology level and capital play a positive role at the same time, can the concentration of cultural and tourism listed companies be determined. This is in line with Kuang’s [

16] research on central China’s intangible cultural heritage and Yuan’s [

15] research on cultural resources in the Yellow River National Cultural Park in China, both of which focused on the objects rooted in the cultural and tourism industry. According to their study, the interaction impact of one key factor combined with some others is also greater than that of the single factors, indicating that the spatial distribution of objects rooted in the cultural and tourism industry results from multi-factor coupling, and the effects of all driving factors need to be comprehensively considered. The main type of interactions between those factors was two-factor enhancement, also reflecting the complex characteristics of the formation mechanism of the spatial differentiation of culture and tourism listed companies in China.

6. Conclusions

Culture and tourism listed companies not only have a close relationship with the development of the cultural tourism industry, but also, as large enterprises, have important significance in promoting local economic development and optimizing the image of cities and regions [

36]. This paper provides guidance for the reasonable layout of cultural and tourism enterprises by studying the space–time evolution patterns and influencing factors of culture and tourism listed companies. Culture and tourism listed companies mainly converge to the three major urban clusters in the east, while the distribution density in the central and western regions is relatively low. In addition, the distribution balance of culture and tourism listed companies in China needs to be improved and the spatial structure needs to be optimized. Regarding the influencing factors of layout of culture and tourism listed companies, the interactions between the quality of tourist attractions and the level of transport services, communication development and economic development have dominant controls on the spatial distribution pattern.

6.1. Implications

Based on the above findings, in response to the strategies of “Western Development” and “Central Rise”, this study proposes recommendations for the promotion of the balanced development of culture and tourism companies, and an increase in revenue of the cultural and tourism industry from the perspective of high-quality development. First, given that the growth of culture and tourism listed companies is closely related to policy changes, strong policy support should be provided to the cultural and tourism industry. There is a need to give full play to the guiding role of government planning and the leading role of culture and tourism companies, to accelerate the upgrading of the cultural and tourism industry, thereby achieving the continuous transformation of tourism resource advantages into market advantages and industrial advantages. In addition, to the backward regions, financial payments transfer should be implemented, to balance the regional financial capacity, thereby enhancing the enterprise support and transformation capacity of governments in the regions with limited distribution of culture and tourism listed companies.

Second, given the significant differences in the distribution of culture and tourism listed companies between the southeast and northwest regions, each region should make construction plans according to local conditions. The eastern regions should be encouraged to make full use of their advantages of economic location, public services and policy bias to enhance the radiation effect and drive the cultural and tourism economy of the surrounding areas, to change the distribution of culture and tourism listed companies from agglomeration to diffusion and improve the rationality of coverage. The western region should improve the equipment of star-rated hotels, airports and communication information services, thereby provide tourists with a better experience; moreover, the production of excellent film and television works would also bring good publicity and attraction effects to the local scenic spots.

Lastly, given that the quality of tourism resources plays a crucial role in the distribution of cultural and tourism listed companies, each region should attach importance to the protection and development of cultural and tourism resources. The eastern region can leverage its economic and technological advantages to create a digital cultural tourism format, such as building regional smart cultural tourism public service platforms, speeding up the distribution of digital tourism consulting service centers, and encouraging cultural and tourism listed companies to accelerate digital transformation. Those measures will help to foster new scenes of digital cultural tourism and push the cultural tourism industry into a new stage. The western region can revitalize rural tourism and pastoral tourism by amplifying agricultural and rural characteristics; at the same time, while developing and utilizing the natural landscape, the local culture, which could be unique and profound, is supposed to be explored as well to create a local cultural and tourism brand and maximize the value of cultural tourism resources.

6.2. Limitations and Further Research

This study also has some limitations. (1) This study discussed the Chinese culture and tourism listed companies as point elements when analyzing the spatial pattern, without collecting and analyzing the relevant attribute data of culture and tourism listed companies, such as the corporate culture, business performance and corporate image [

38]. (2) This study only picked the culture and tourism listed companies whose offices are located in the Chinese Mainland, and it did not explore the listed companies working in Hong Kong, Macao and Taiwan, which will have a certain impact on the evolution of the overall spatial layout. In addition, small- and medium-sized enterprises in the cultural and tourism industry were not considered either, which may have an impact on the discussion of spatial balance in the cultural and tourism industry. In addition, this study did not analyze and compare the spatial evolution and impact mechanisms of different types of cultural and tourism listed companies. (3) At the end of 2022, the Chinese government ended the implementation of the isolation policy on COVID-19, setting off a wave of retaliatory tourism around China, and providing more relaxed conditions for artistic works, film and television works, which may cause subversive changes in the cultural and tourism industry. Therefore, follow-up studies may need to conduct further in-depth research from the following angles. First, build links to more attribute data and discuss the spatial differentiation in the performance, management mode and marketing characteristics of culture and tourism listed companies, to analyze the cultural and tourism industry more deeply and specifically. Second, conduct a larger sample collection to discuss the spatial differentiation and type differences of small- and medium-sized cultural and tourism enterprises or all enterprises in this industry. Last, in view of the changes in China’s cultural and tourism industry before and after COVID-19, discuss the increase and decrease in the number of cultural and tourism enterprises in different regions and the difference in profits.