An Explorative Study of Resilience Influence on Business Performance of Korean Manufacturing Venture Enterprise

Abstract

1. Introduction

- (1)

- What resilience factors impact and how do they impact business performance?

- (2)

- Does resilience influence financial performance and non-financial performance differently or similarly?

2. Literature Review and Hypotheses Setting

2.1. Resilience Concept

2.2. Resilience and Business Performance

2.3. Korean Manufacturing Venture Enterprise

2.4. Hypotheses Setting

3. Methodology

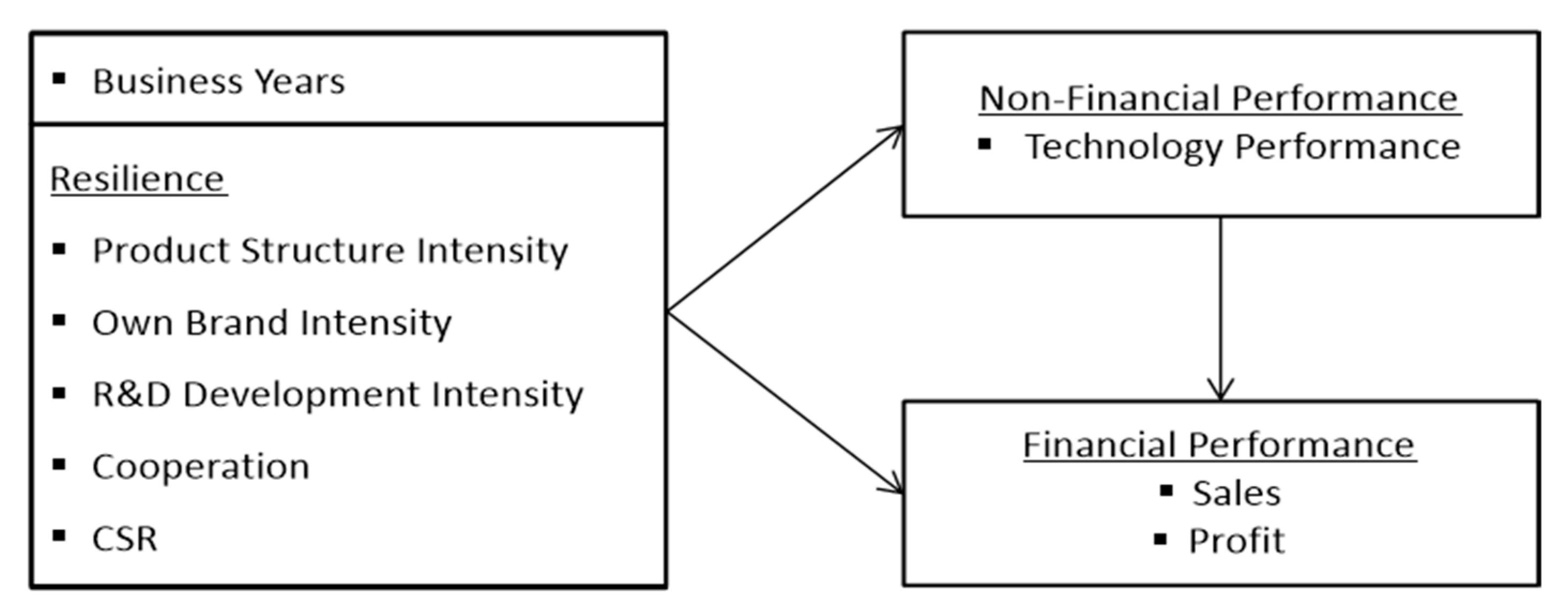

3.1. Research Model

3.2. Research Measurement

3.3. Data

4. Empirical Findings

5. Discussion and Conclusions

5.1. Managerial Implication

5.2. Theoretical Implications

5.3. Study Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Craig, N.; DeHoratius, N.; Raman, A. The impact of supplier inventory service level on retailer demand in the supply chain for functional apparel items. Bus. Sch. Technol. Oper. Manag. Unit Work. Pap. 2014, 11, 034. [Google Scholar]

- De Angelis, R.; Howard, M.; Miemczyk, J. Supply chain management and the circular economy: Towards the circular supply chain. Prod. Plan. Control 2018, 29, 425–437. [Google Scholar] [CrossRef]

- Farooque, M.; Zhang, A.; Thurer, M.; Qu, T.; Huisingh, D. Circular supply chain management: A definition and structured literature review. Clean. Prod. 2019, 228, 882–900. [Google Scholar] [CrossRef]

- Kang, Y.; Cho, B. Effects of knowledge management activities on financial performance: Focusing on the mediating effects of enterprise-level resilience. Knowl. Manag. Res. 2021, 22, 139–154. [Google Scholar]

- Kim, D.; Yun, J.; Kim, K.; Lee, S. A comparative study of the robustness and resilience of retail areas in Seoul, Korea before and after the COVID-19 Outbreak, using big data. Sustainability 2021, 13, 3302. [Google Scholar] [CrossRef]

- Bianchini, M.; Kwon, I. Enhancing SME’s Resilience through Digitalization: The Case of Korea; OECD SME and Entrepreneurship Papers; OECD: Paris, France, 2021. [Google Scholar]

- Yu, S.; Kim, D. Changes in regional economic resilience after the 2008 global economic crisis: The case of Korea. Sustainability 2021, 13, 11392. [Google Scholar] [CrossRef]

- Weng, X. Towards business resilience against business crisis in China, Japan, and South Korea by stage model comparative case study on Sanlu, Toyota, and Samsung. J. Jpn. Soc. Bus. Ethics Study 2021, 28, 209–224. [Google Scholar]

- Staw, B.M.; Sandelands, L.E.; Dutton, J.E. Threat Rigidity Effects in Organizational Behavior: A Multilevel Analysis. Adm. Sci. Q. 1981, 26, 501–524. [Google Scholar] [CrossRef]

- Meyer, A.D. Adapting to Environmental Jolts. Adm. Sci. Q. 1982, 27, 515–537. [Google Scholar] [CrossRef]

- Sutcliffe, K.M.; Vogus, T.J. Organizing for Resilience. In Positive Oranizational Scholarship: Fundations of a New Discipline; Cam-eron, K.S., Dutton, J.E., Quinn, R.E., Eds.; Berrett-Koehler: San Franciso, CA, USA, 2003. [Google Scholar]

- Vogus, T.J.; Sutcliffe, K.M. Organizational Resilience: Towards a Theory and Research Agenda. In Proceedings of the 2007 IEEE International Conference on Systems, Man and Cybernetics, Montreal, QC, Canada, 7–10 October 2007. [Google Scholar]

- Beuren, I.M.; Santos, V.; Theiss, V. Organizational Resilience, Job Satisfaction and Busin essperformance. Int. J. Product. Perform. Manag. 2022, 71, 2262–2279. [Google Scholar] [CrossRef]

- Luthans, F.; Avey, J.B.; Avolio, B.J.; Peterson, S.J. The Development and Resulting Performance Impact of Positive Psycholog-ical Capital. Hum. Resour. Dev. Q. 2010, 21, 41–67. [Google Scholar] [CrossRef]

- Shin, J.; Taylor, M.S.; Seo, M.G. Resources for Change: The Relationships of Organizational Inducements and Psychological Resilience to Employees’ Attitudes and Behaviors Toward Organizational Change. Acad. Manag. J. 2012, 55, 727–748. [Google Scholar] [CrossRef]

- Ayala, J.-C.; Manzano, G. The resilience of the entrepreneur. Influence on the success of the business. A longitudinal analysis. J. Econ. Psychol. 2014, 42, 126–135. [Google Scholar] [CrossRef]

- Klein, R.J.T.; Nicholls, R.J.; Thomalla, F. Resilience to Natural Hazards: How Useful is This Concept? Glob. Environ. Change 2003, 5, 35–45. [Google Scholar] [CrossRef]

- Manyena, S.B. The Concept of Resilience Revisited. Disasters 2006, 30, 433–450. [Google Scholar] [CrossRef] [PubMed]

- Linnenluecke, M.K. Resilience in Business and Management Research: A Review of Influential Publications and a Research Agenda. Int. J. Manag. Rev. 2017, 19, 4–30. [Google Scholar] [CrossRef]

- Kim, B.; Kim, B.-G. An explorative study of the Korean venture companies: Do CSR and companies competitiveness improve non-financial and financial performance? Sustainability 2021, 13, 13106. [Google Scholar] [CrossRef]

- Kang, M.; Stephens, A.R. Supply chain resilience and operational performance aid COVID-19 supply chain interruptions: Evi-dence from South Korean manufacturers. Uncertain Supply Chain. Manag. 2022, 10, 383–398. [Google Scholar] [CrossRef]

- Howells, R. 4 Ways to Create a More Resilient Supply Chain. Forbes. Available online: https://www.forbes.com/sites/sap/2022/03/21/4-ways-to-create-a-more-resilient-supply-chain/ (accessed on 21 March 2023).

- Pettit, T.F.; Fiksel, J.; Croxton, K.L. Ensuring supply chain resilience: Development of a conceptual framework. J. Bus. Logist. 2010, 31, 1–21. [Google Scholar] [CrossRef]

- Bruneau, M.; Chang, S.E.; Eguchi, R.T.; Lee, G.C.; O’Rourke, T.D.; Reinhorn, A.M.; Von Winterfeldt, D. A framework to quan-titatively assess and enhance the seismic resilience of communities. Earthq. Spectra 2003, 19, 733–752. [Google Scholar] [CrossRef]

- Reggiani, A. Network resilience for transport security: Some methodological considerations. Transp. Policy 2013, 28, 63–68. [Google Scholar] [CrossRef]

- Ponomarove, S.Y.; Holcomb, M.C. Understanding the concept of supply chain resilience. Int. J. Logist. Manag. 2009, 20, 124–143. [Google Scholar] [CrossRef]

- Day, J.M. Fostering emergent resilience: The complex adaptive supply network of disaster relief. Int. J. Prod. Res. 2014, 52, 1970–1988. [Google Scholar] [CrossRef]

- Rice, J.B.; Caniato, F. Building a secure and resilience supply network. Supply Chain. Manag. Rev. 2003, 7, 22–30. [Google Scholar]

- Brandon-Jones, E.; Squire, B.; Autry, C.W.; Petersen, K.J. A contingent resource-based perspective of supply chain resilience and robustness. J. Supply Chain. Manag. 2014, 50, 55–73. [Google Scholar] [CrossRef]

- Sheffi, Y. The Resilient Enterprise: Overcoming Vulnerability for Competitive Advantage; The MIT Press: Cambridge, MA, USA, 2005. [Google Scholar]

- Fisher, R.E.; Bassett, G.W.; Buehring, W.A.; Collins, M.J.; Eaton, L.K. Constructing a Resilience Index for the Enhanced Critical In-frastructure Protection Program; Argonne National Laborator: Argonne, IL, USA, 2010.

- Singh, C.S.; Soni, G.; Badhotiya, G.K. Performance indicators for supply chain resilience: Review and conceptual framework. J. Ind. Eng. Int. 2019, 15, 5105–5117. [Google Scholar] [CrossRef]

- Khan, K.A.; Pilania, R.K. Strategic sourcing for supply chain agility and firms’ performance: A study of Indian manufacturing sector. Manag. Decis. 2008, 46, 1508–1530. [Google Scholar] [CrossRef]

- Betts, T.; Tadisina, S.K. Supply chain agility, collaboration, and performance: How do they relate. In Proceedings of the 20th Annual Conference of the Production and Operations Management Society, Orlando, FL, USA, 1–4 May 2009. [Google Scholar]

- Yauch, C.A. Measuring agility as a performance outcome. J. Manuf. Technol. Manag. 2011, 22, 384–404. [Google Scholar] [CrossRef]

- Carvalho, H.; Azevedo, S.G.; Cruz-Machado, V. Supply chain management resilience: A theory building approach. Int. J. Supply Chain. Oper. Resil. 2014, 1, 3–27. [Google Scholar] [CrossRef]

- Yusuf, Y.Y.; Gunasekaran, A.; Musa, A.; Dauda MEl-Berishy, N.M.; Cang, S. A relational study of supply chain agility, competi-tiveness and business performance in the oil and gas industry. Int. J. Prod. Econ. 2014, 147, 531–543. [Google Scholar] [CrossRef]

- Yang, T. The impact of resumption of former top executives on stock prices: An event study approach. J. Bus. Econ. Manag. 2013, 14, 292–302. [Google Scholar] [CrossRef]

- Wieland, A.; Wallenburg, C.M. The influence of relational competencies on supply chain resilience: A relational view. Int. J. Phys. Distrib. Logist. Manag. 2013, 43, 300–320. [Google Scholar] [CrossRef]

- Elleuch, H.; Dafaoui, E.; El Mhamedi, A.; Chabchoub, H. A quality function deployment approach for production resilience improvement in supply chain: Case of agrifood industry. IFAC-PapersOnLine 2016, 49, 125–130. [Google Scholar] [CrossRef]

- Ivanov, D.; Sokolove, B.; Solovyeva, I.; Dolgui, A.; Jie, F. Ripple effect in the time-critical food supply chains and recovery poli-cies. IFAC-PapersOnLine 2015, 48, 1682–1687. [Google Scholar] [CrossRef]

- Li, X.; Wu, Q.; Holsapple, C.W.; Goldsby, T. An empirical examination of firm financial performance along dimensions of sup-ply chain resilience. Manag. Res. Rev. 2017, 40, 254–269. [Google Scholar] [CrossRef]

- Hemant, J.; Rajesh, R.; Daultani, Y. Causal Modelling of the Enablers of CPFR for Building Resilience in Manufacturing Supply Chains. RAIRO Oper. Res. 2022, 56, 2139–2158. [Google Scholar] [CrossRef]

- Pine, B.J. Mass Customization: The New Frontier in Business Competition; Harvard Business Press: Boston, MA, USA, 1999; pp. 21–24. [Google Scholar]

- Jiao, J.; Tseng, M.M. A methodology of developing product family architecture for mass customization. J. Intell. Manuf. 1999, 10, 3–20. [Google Scholar] [CrossRef]

- MacDuffie, J.P.; Sethuraman, K.; Fisher, M.L. Product variety and manufacturing performance: Evidence from the internation-al automotive assembly plant study. Manag. Sci. 1996, 42, 350–369. [Google Scholar] [CrossRef]

- El Maraghy, H.; Schuh, G.; ElMaraghy, W.; Piller, F.; Schönsleben, P.; Tseng, M.; Bernard, A. Product variety management. CIRP Ann.-Manuf. Technol. 2013, 62, 629–652. [Google Scholar] [CrossRef]

- Robertson, D.; Ulrich, K. Planning for product platforms. Sloan Manag. Rev. 1998, 39, 19–31. [Google Scholar]

- Simpson, T.W.; Siddique, Z.; Jiao, R.J. Product Platform and Product Family Design: Methods and Applications; Springer Science & Business Media: New York, NY, USA, 2006; pp. 1–15. [Google Scholar]

- Aaker, D.A. Building Strong Brands; Simon & Schuster: New York, NY, USA, 2002. [Google Scholar]

- Kim, K.H.; Jeon, B.J.; Jung, H.S.; Lu, W.; Jones, J. Effective employment brand equity through sustainable competitive ad-vantage, marketing strategy, and corporate image. J. Bus. Res. 2011, 64, 1207–1211. [Google Scholar] [CrossRef]

- Aaker, D.A.; Joachimsthaler, E. The lure of global branding. Harv. Bus. Rev. 1999, 77, 137–144. [Google Scholar]

- He, Z.; Wintoki, M.B. The cost of innovation: R&D and high cash holdings in U.S. firms. J. Corp. Financ. 2016, 41, 280–303. [Google Scholar]

- Brockoff, K.K.; Medcof, J.W. Cooperation, Participation, Planning and Performance in Internationally Dispersed Research and Development Units. Adm. Sci. Assoc. Can.-Annu. Conf. 1999, 20, 1–9. [Google Scholar]

- Yam, R.C.M.; Lo, W.; Tang, E.P.Y.; Lau, A.K.W. Analysis of Sources of Innovation, Technological Innovation capabilities, and Performance: An Empirical Study of Hong Kong Manufacturing Industries. Res. Policy 2011, 40, 391–402. [Google Scholar] [CrossRef]

- Ince, H.; Imamoglu, S.Z.; Turkcan, H. The Effect of Technological Innovation competencies and Absorptive Capacity on Firm Innovativeness: A Conceptual Framework. Soc. Behav. Sci. 2016, 235, 764–770. [Google Scholar] [CrossRef]

- Tubbs, M. The Relationship Between R&D and Company Performance. Res.-Technol. Manag. 2007, 50, 23–30. [Google Scholar]

- Tsao, S.M.; Lin, C.H.; Chen, V.Y. Family Ownership As a Moderator Between R&D Investments and CEO Compensation. J. Bus. Res. 2015, 68, 599–606. [Google Scholar]

- Neves, A.; Teixeira, A.A.; Silva, S.T. Exports-R&D Investment Complementarity and Economic Performance of Firms Located in Portugal. Investig. Económica 2016, 75, 125–156. [Google Scholar]

- Deng, Y.; Parajuli, P.B. Return of Investment and Profitability Analysis of Bio-Fuels Production Using a Modeling Approach. Inf. Process. Agric. 2016, 3, 92–98. [Google Scholar] [CrossRef]

- Dzhumashev, R.; Mishra, V.; Smyth, R. Exporting, R&D Investment and Firm Survival in the Indian IT Sector. J. Asian Econ. 2016, 42, 1–19. [Google Scholar]

- Bočková, N.; Meluzín, T. Electronics Industry: R&D Investments as Possible Factors of Firms Competitiveness. Soc. Behav. Sci. 2016, 220, 51–61. [Google Scholar]

- Brettel, M.; Heinemann, F.; Engelen, A.; Neubauer, S. Cross-Functional Integration of R&D, Marketing, and Manufacturing in Radical and Incremental Product Innovations and Its Effects on Project Effectiveness and Efficiency. J. Prod. Innov. Manag. 2011, 28, 251–269. [Google Scholar]

- Lang, T.M.; Lin, S.H.; Vy, T.N.T. Mediate Effect of Technology Innovation competencies Investment capability and Firm Per-formance in Vietnam. Procedia-Soc. Behav. Sci. 2012, 40, 817–829. [Google Scholar] [CrossRef]

- Mitchell, V.W. Consumer Perceived Risk: Conceptualisations and Models. Eur. J. Mark. 1999, 33, 163–195. [Google Scholar] [CrossRef]

- Rickne, A. Connectivity and Performance of Science-Based Firms. Small Bus. Econ. 2006, 26, 393–407. [Google Scholar] [CrossRef]

- Watson, J. Modeling the Relationship between Networking and Firm Performance. J. Bus. Ventur. 2007, 22, 852–874. [Google Scholar] [CrossRef]

- Coleman, J.S. Social Capital in the Creation of Human Capital. Am. J. Sociol. 1988, 94, 95–120. [Google Scholar] [CrossRef]

- Lechner, C.; Dowling, M.; Welpe, I. Firm Networks and Firm Development: The Role of the Relational Mix. J. Bus. Ventur. 2006, 21, 514–540. [Google Scholar] [CrossRef]

- Jian, Z.; Wang, C. The Impacts of Network Competence, Knowledge Sharing on Service Innovation Performance: Moderating Role of Relationship Quality. J. Ind. Eng. Manag. 2013, 6, 569–576. [Google Scholar]

- Walter, A.; Auer, M.; Ritter, T. The Impact of Network competencies and Entrepreneurial Orientation on University Spin-Off Performance. J. Bus. Ventur. 2006, 21, 541–567. [Google Scholar] [CrossRef]

- Acquaah, M. Social Networking Relationships, Firm-Specific Managerial Experience and Firm Performance in a Transition Economy: A Comparative Analysis of Family Owned and Nonfamily Firms. Strateg. Manag. J. 2012, 33, 1215–1228. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Capitalism, Socialism and Democracy; Unwin: London, UK, 1942. [Google Scholar]

- Tether, B.S. Who cooperates for innovation, and why: An empirical analysis. Res. Policy 2002, 31, 947–967. [Google Scholar] [CrossRef]

- Monjon, S.; Waelbroeck, P. Assessing spillovers from universities to firms: Evidence from French firm-level data. Int. J. Ind. Organ. 2003, 21, 1255–1270. [Google Scholar] [CrossRef]

- Deeds, D.L.; Rothaermel, F.T. Honeymoons and liabilities: The relationship between age and performance in research and development alliances. J. Prod. Innov. Manag. 2003, 20, 468–485. [Google Scholar] [CrossRef]

- Hoffmann, W.H. Strategies for managing a portfolio of alliances. Strateg. Manag. J. 2007, 28, 827–856. [Google Scholar] [CrossRef]

- Bowen, H.R. Social Responsibilities of the Businessman; Harper & Row: Manhattan, NY, USA, 1953. [Google Scholar]

- ISO 26000 2009; Risk Management: Principles and Guidelines. International Organization for Standardization: Geneva, Switzerland, 2009.

- Brown, T.J.; Dacin, P.A. The Company and the Product: Corporate Associations and Consumer Product Responses. J. Mark. 1997, 6, 68–84. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economic. Acad. Manag. Rev. 1995, 77, 470–478. [Google Scholar] [CrossRef]

- Cegarra-Navarro, J.G.; Revertea, C.; Gómez-Meleroa, E.; Wensley, A.K.P. Linking Social and Economic responsibilities with Financial Performance: The Role of Innovation. Eur. Manag. J. 2016, 34, 530–539. [Google Scholar] [CrossRef]

- Choi, J.S.; Kwak, Y.M.; Choe, C.W. Corporate Social Responsibility and Corporate Financial Performance: Evidence from Korea. Aust. J. Manag. 2010, 35, 291–311. [Google Scholar] [CrossRef]

- Galbreath, J.; Charles, D.; Oczkowski, E. The Drivers of Climate Change Innovations, Evidence from the Australian Wine In-dustry. J. Bus. Ethics 2016, 135, 217–231. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, A.; Waddock, S. Corporate Responsibility and Financial Performance: The Role of Intangible Resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Venture Business Precision Survey 2020 from the Ministry of SMEs and Start-Ups. Available online: https://www.data.go.kr/data/3043469/fileData.do (accessed on 22 April 2022).

- Lee, H.; Kim, R. Comparative Analysis of Age Effect, Period Effect, and Cohort Effect through Time Series Data Analysis—Focus on Changes in Consumer Perception of Corporate Social Responsibility. J. Con. Stud. 2021, 32, 49–73. [Google Scholar] [CrossRef]

- Kim, B.; Kim, B.-G. Intangible cost influence on business performance of wholesale and retail brokerage in Korea: Focusng on HRM, Marketing and CSR. J. Distrib. Sci. 2022, 20, 119–127. [Google Scholar]

- Ali Abbasi, G.; Abdul Rahim, N.F.; Wu, H.; Iranmanesh, M.; Keong, B.N.C. Determinants of SME’s social media marketing adoption: Competitive industry as a moderator. Sage Open 2022, 12, 21582440211067220. [Google Scholar] [CrossRef]

- Jessin, T.A.; Rajeev, A.; Rajesh, R. Supplier Selection Framework to Evade Pseudo-Resilience and to achieve Sustainability in Supply Chains. Int. J. Emerg. Mark. 2022. ahead-of-print. [Google Scholar] [CrossRef]

| Type of Variables | Items | ||

|---|---|---|---|

| Dependent variable (Business Performance) | Non-financial Performance (Mediator) | Technology Performance | The number of applicated and registered patents (patent rights, utility model rights, design rights, trademark rights, etc.) |

| Financial Performance | Sales | Total sales of a company (1 Mil.) | |

| Profit | Net profit of a company (1 Mil.) | ||

| Independent variable (Resilience) | Product Structure Intensity (Productivity) | The number of main focused product (Choose: 1—one main product, 2—two to three main products, 3—more than 4 main products) | |

| Own Brand Intensity (Productivity) | The number of own brands (ranged: 0~50) | ||

| R&D Development Intensity (Agility) | The structure and level of technology development (choose: 1—no affiliated research institute, relevant department, and R&D personnel, 2—no affiliated research institute and relevant department but have R&D personnel, 3—no affiliated research institute but has a relevant department, 4—have an affiliated research institute, 5—have affiliated research institute and overseas local R&D center) | ||

| Cooperation (Connectivity) | The number of organization types that the company cooperates with (ranged: 0~4) (choose all relevant cooperating partner types: university(industry-university), research institute(government-funded, specialized, etc.), SME and venture company, mid-sized company, big-sized company, a foreign company, etc.) | ||

| CSR (Sustainability) | The number of CSR types that the company participates in (ranged: 0~3) (choose all relevant CSR types: donation, talent donation, creating shared value, community service, sponsorship, etc.) | ||

| Control variable | Business Years | The years of business operation (Choose: 1—under 3 years after establishment, 2—4~10 years, 3—11~20 years, 4—Over 21 years) | |

| (N = 667) | Frequency | % | |

|---|---|---|---|

| Business Year | under 3 years | 34 | 5.1 |

| 4~10 years | 213 | 31.9 | |

| 11~20 years | 288 | 43.2 | |

| over 21 years | 132 | 19.8 | |

| Product Structure Intensity | 1 main product | 77 | 11.5 |

| 2~3 main product | 238 | 35.7 | |

| more than 4 main products | 352 | 52.8 | |

| Own Brand Intensity | No Brand | 353 | 52.9 |

| Have Own Brand | 314 | 47.1 | |

| Mean: 1.859, Middle: 0, S.D.: 5.210, Mini: 0, Max: 50.0 | |||

| R&D Development Intensity | No affiliated research institute, relevant department, and R&D personnel | 54 | 8.1 |

| No affiliated research institute and relevant department but have R&D personnel | 29 | 4.3 | |

| No affiliated research institute but has a relevant department | 55 | 8.2 | |

| Have an affiliated research institute | 527 | 79.0 | |

| Have affiliated research institute and overseas local R&D center | 2 | 0.3 | |

| Cooperation | No Cooperation | 436 | 65.4 |

| There is Cooperation | 231 | 34.6 | |

| Mean: 0.492, Middle: 0, S.D.: 0.774, Mini: 0, Max: 4.0 | |||

| CSR | No CSR | 442 | 66.3 |

| Participate CSR | 225 | 33.7 | |

| Mean: 0.384, Middle: 0, S.D.: 0.577, Mini: 0, Max: 3 | |||

| Technology Performance | Mean: 20.459, Middle: 9.0, S.D.: 34.830, Mini: 0, Max: 241 | ||

| Sales | Mean: 22,998.889, Middle: 9691.0, S.D.: 34,761.149, Mini: 1.0, Max: 348,824.0 | ||

| Profit | Mean: 953.045, Middle: 200.0, S.D.: 5479.593, Mini: −38,889.0, Max: 64,364.0 | ||

| Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2.78 | 0.82 | 1 | |||||||

| 2 | 2.41 | 0.69 | 0.073 | 1 | ||||||

| 3 | 1.86 | 5.21 | 0.159 ** | 0.115 ** | 1 | |||||

| 4 | 4.38 | 1.28 | 0.230 ** | 0.082 * | 0.108 ** | 1 | ||||

| 5 | 0.49 | 0.77 | 0.074 | 0.157 ** | 0.171 ** | 0.232 ** | 1 | |||

| 6 | 0.38 | 0.58 | 0.147 ** | 0.043 | 0.048 | 0.141 ** | 0.098 * | 1 | ||

| 7 | 22,998.89 | 34,761.15 | 0.246 ** | 0.052 | 0.155 ** | 0.181 ** | 0.077 * | 0.206 ** | 1 | |

| 8 | 953.05 | 5479.59 | 0.042 | −0.034 | 0.061 | 0.090 * | −0.045 | 0.128 ** | 0.531 ** | 1 |

| Β(t) | Technology Performance | Financial Performance | VIF | H | |

|---|---|---|---|---|---|

| Sales | Profit | ||||

| Business Years | 0.221 *** (6.163) | 0.181 *** (4.718) | 0.003 (0.064) | 1.093 | |

| Product Structure Intensity | 0.087 * (2.503) | 0.011 (0.286) | −0.041 (−1.052) | 1.038 | H1: Partial |

| Own Brand Intensity | 0.226 *** (6.384) | 0.105 ** (2.782) | 0.064 (1.629) | 1.062 | H2: Partial |

| R&D Development Intensity | 0.074* (2.037) | 0.104 ** (2.679) | 0.088 * (2.173) | 1.123 | H3: Supported |

| Cooperation | 0.165 *** (4.565) | 0.004 (0.097) | −0.082 * (−2.039) | 1.104 | H4: Rejected |

| CSR | 0.082 * (2.331) | 0.159 *** (4.253) | 0.122 ** (3.118) | H5: Supported | |

| Ad.R2 | 0.215 | 0.105 | 0.024 | ||

| F | 31.489 *** | 14.023 *** | 3.712 *** | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, B.; Kim, B.-G. An Explorative Study of Resilience Influence on Business Performance of Korean Manufacturing Venture Enterprise. Sustainability 2023, 15, 7218. https://doi.org/10.3390/su15097218

Kim B, Kim B-G. An Explorative Study of Resilience Influence on Business Performance of Korean Manufacturing Venture Enterprise. Sustainability. 2023; 15(9):7218. https://doi.org/10.3390/su15097218

Chicago/Turabian StyleKim, Boine, and Byoung-Goo Kim. 2023. "An Explorative Study of Resilience Influence on Business Performance of Korean Manufacturing Venture Enterprise" Sustainability 15, no. 9: 7218. https://doi.org/10.3390/su15097218

APA StyleKim, B., & Kim, B.-G. (2023). An Explorative Study of Resilience Influence on Business Performance of Korean Manufacturing Venture Enterprise. Sustainability, 15(9), 7218. https://doi.org/10.3390/su15097218