An Evaluation of ASEAN Renewable Energy Path to Carbon Neutrality

Abstract

1. Introduction

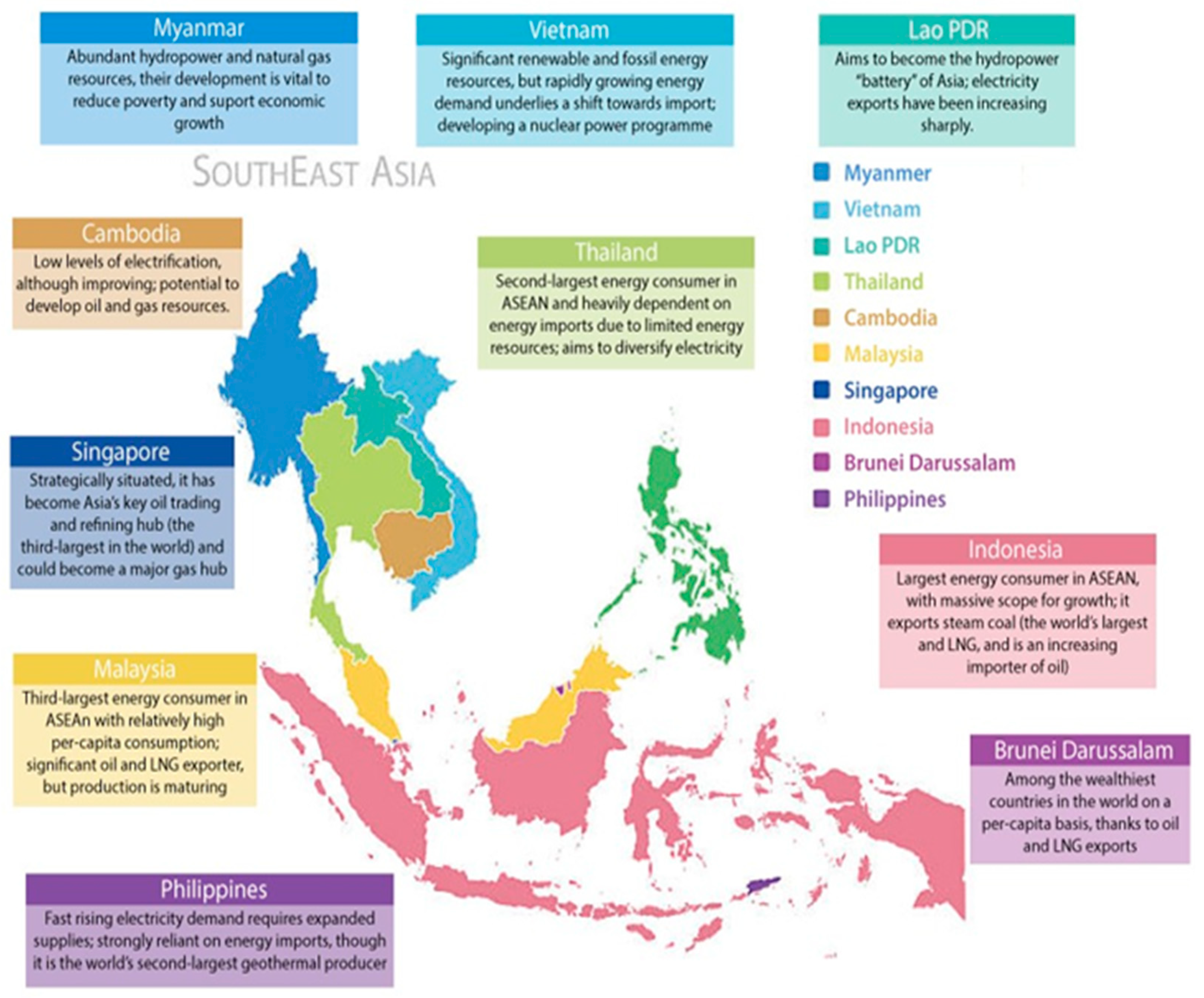

2. Renewable Energy Potential and Installed Capacity in the ASEAN

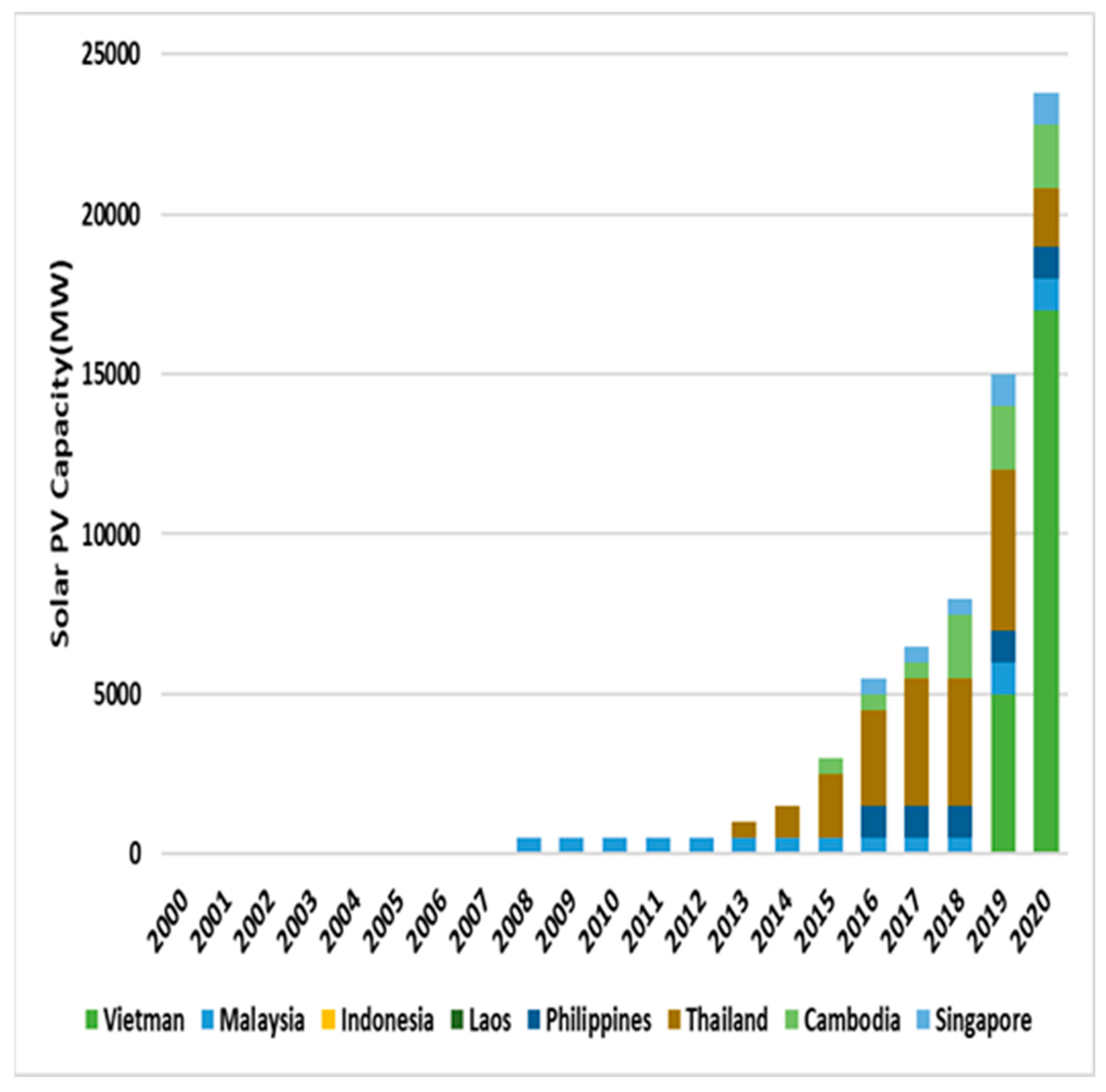

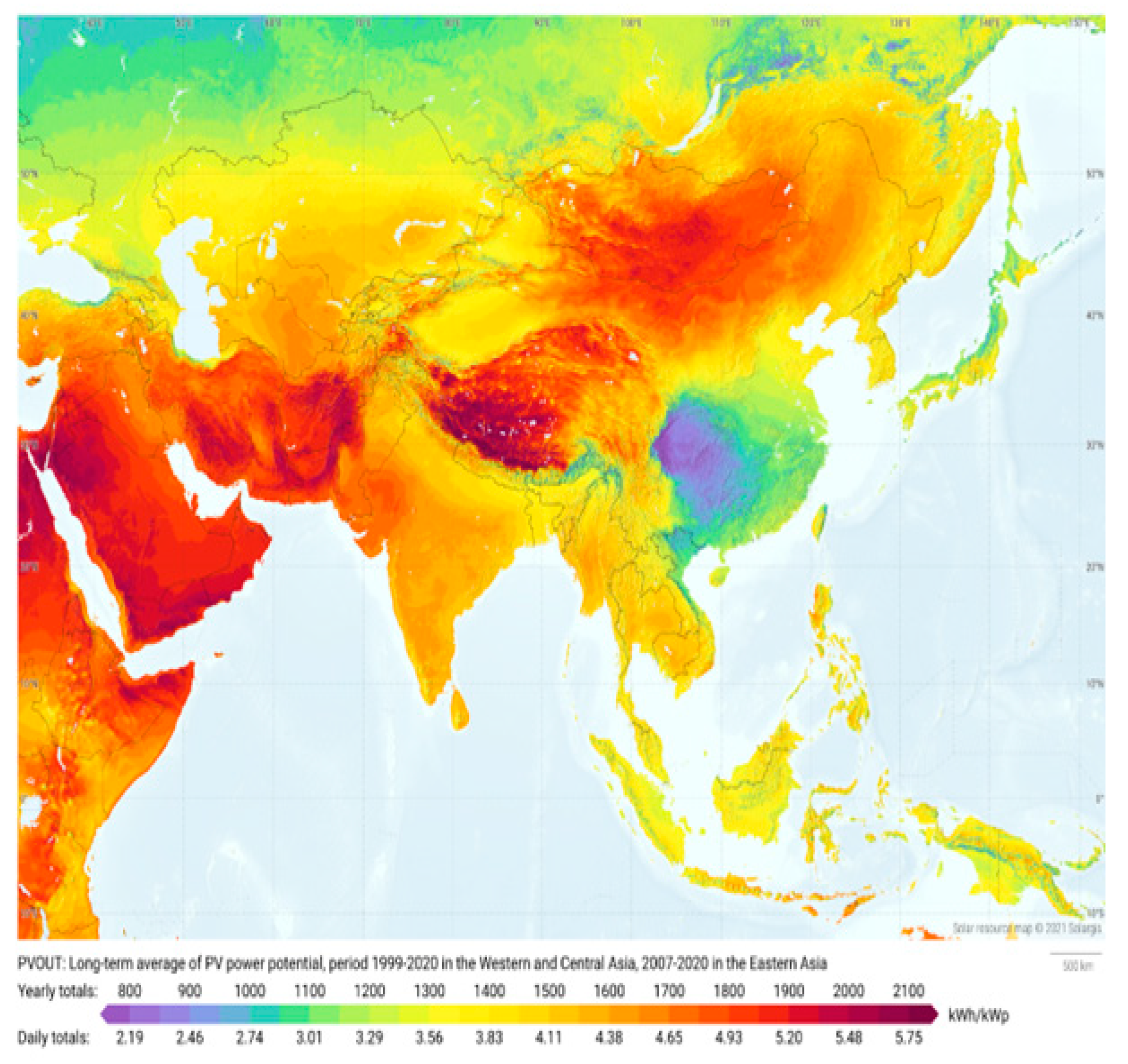

2.1. Solar PV

2.2. Wind Energy

2.3. Hydropower

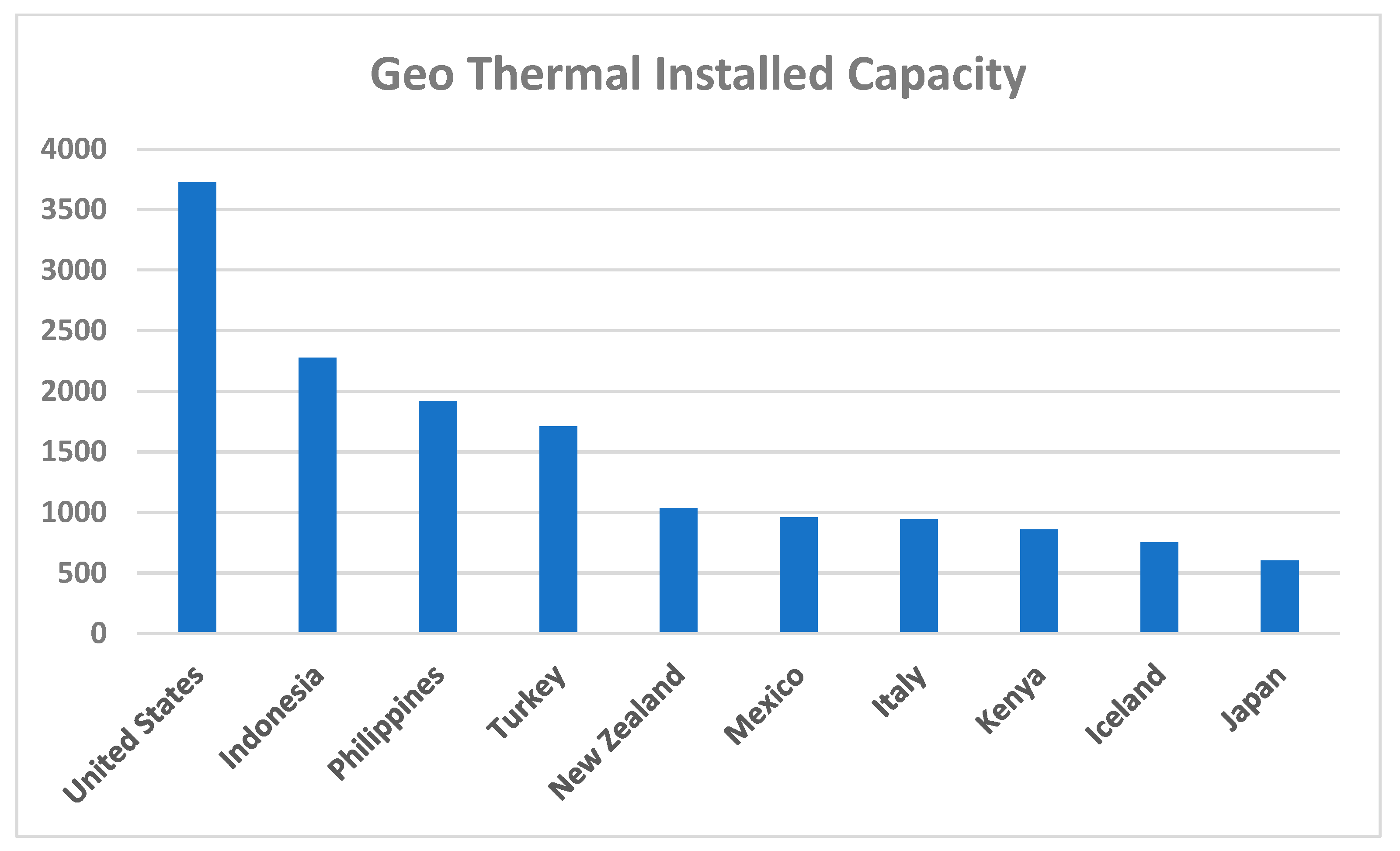

2.4. Geothermal

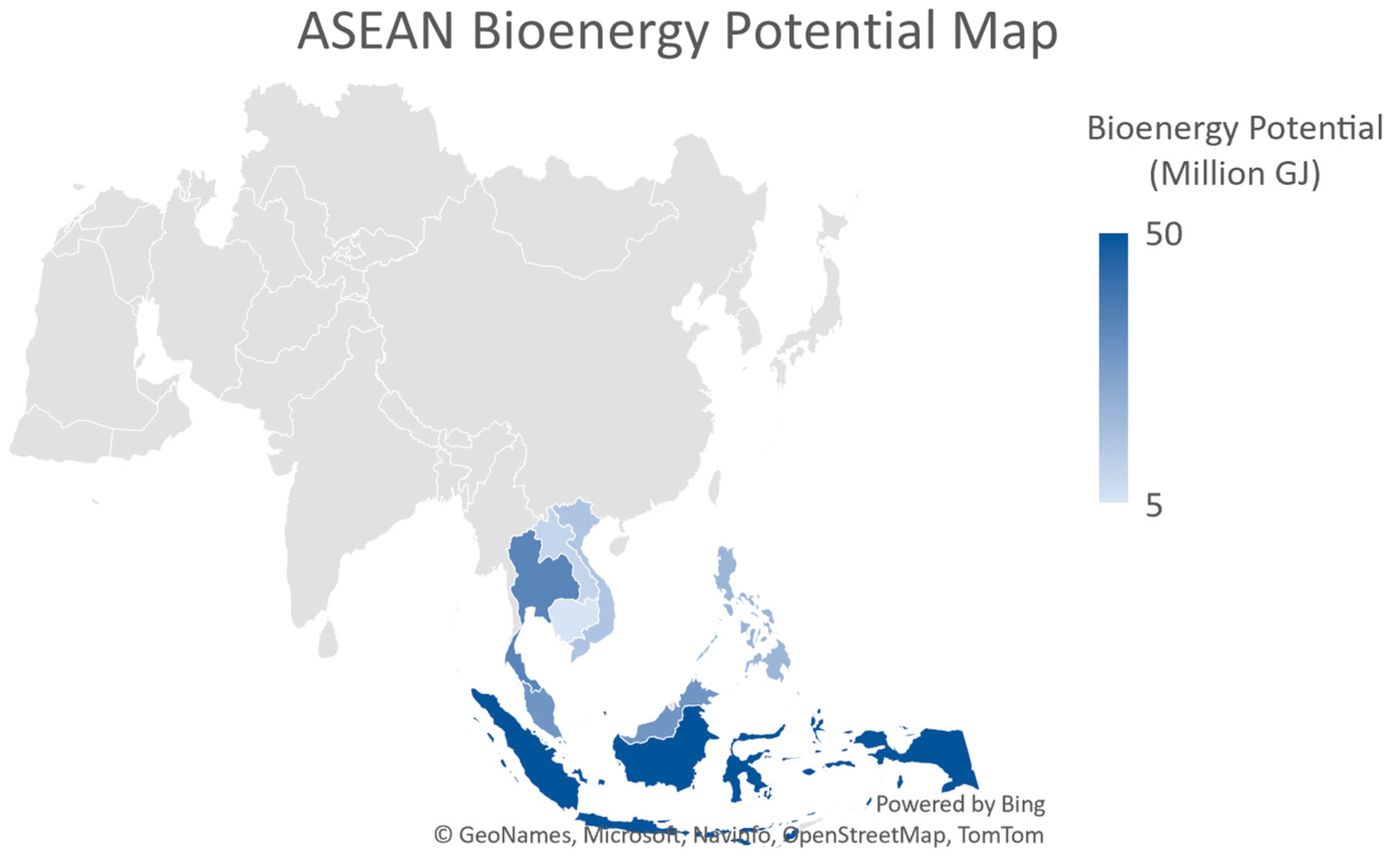

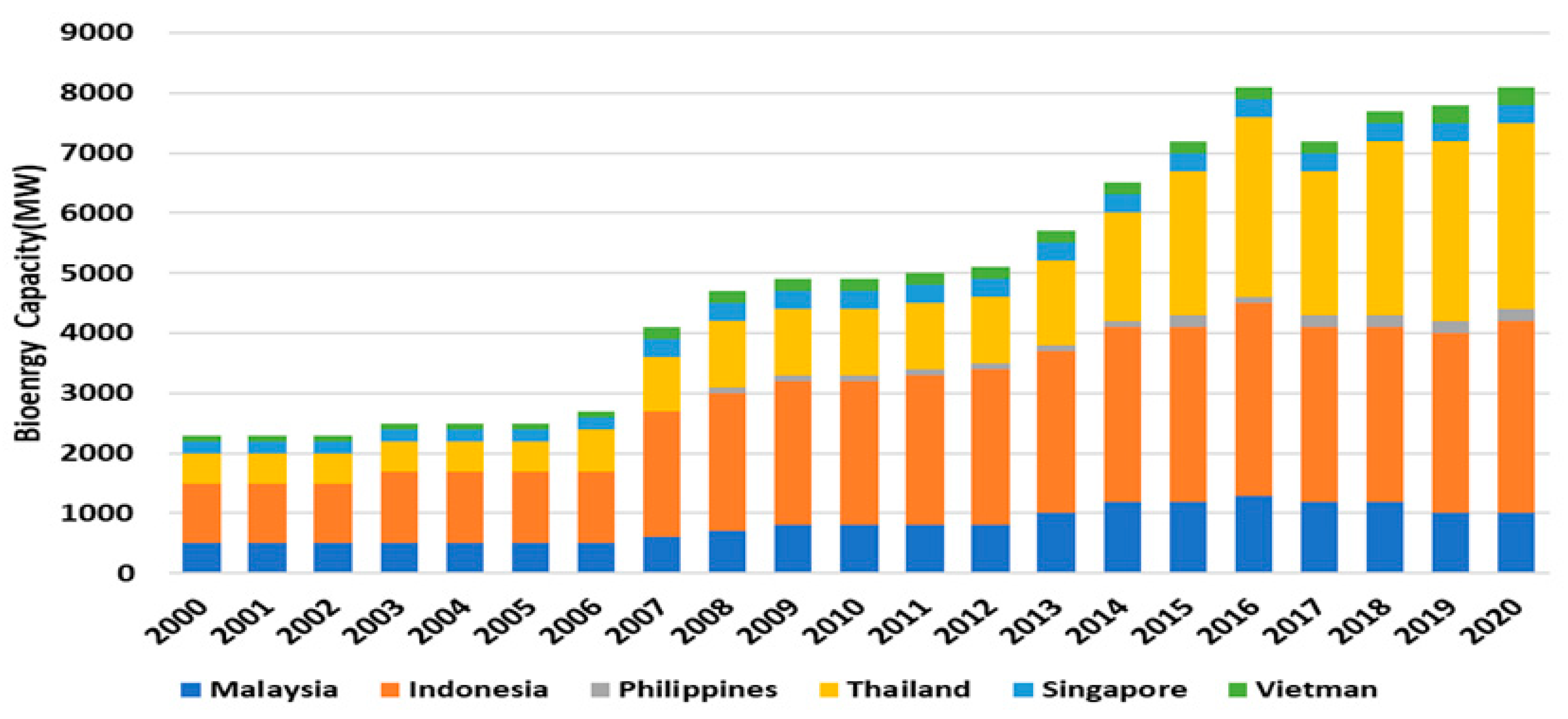

2.5. Bioenergy

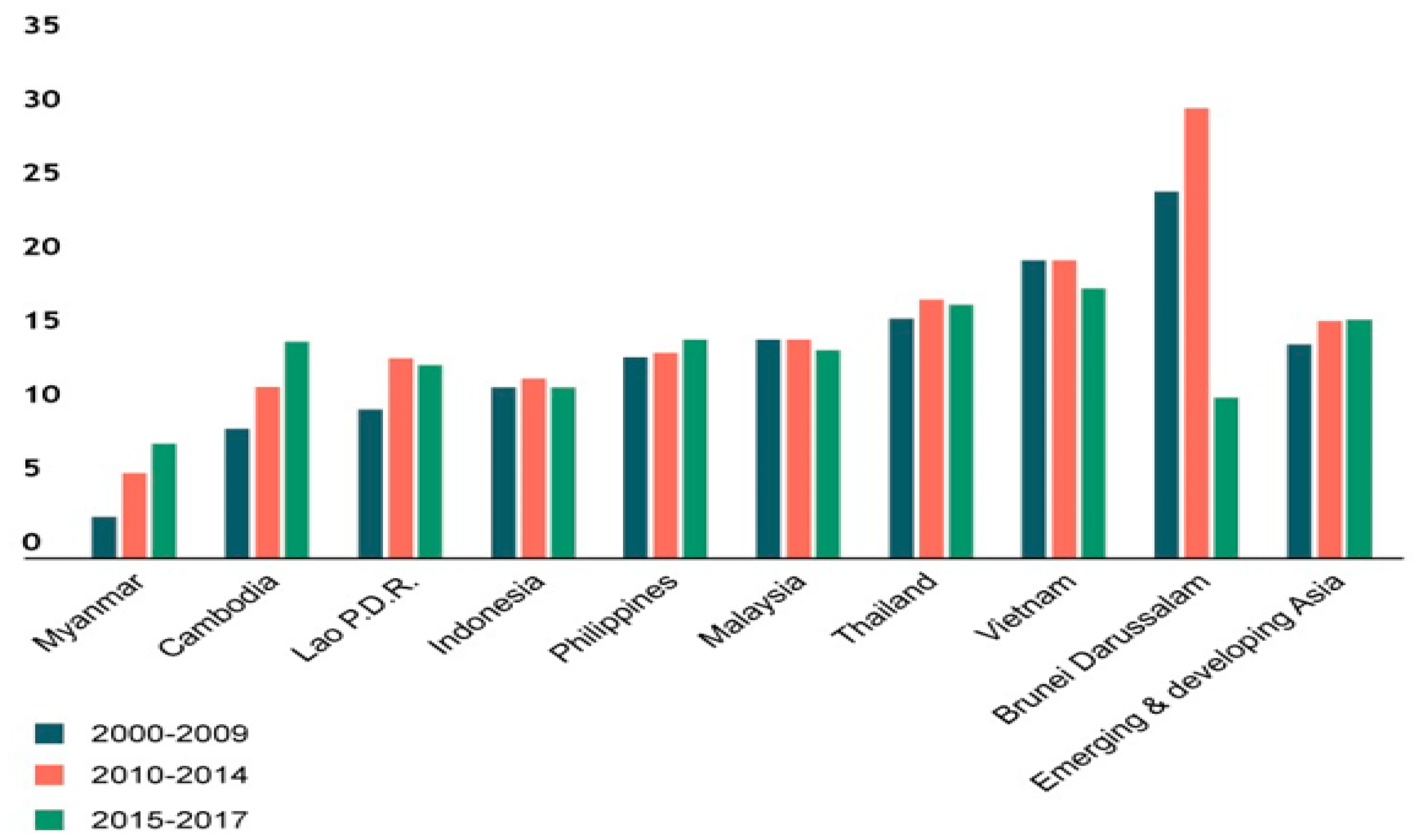

3. Factors Influencing the Growth of Renewable Energy in ASEAN Countries

3.1. Project Funding

3.2. Public Investment

3.3. Environmental Taxes

3.4. Risks, Challenges, and Solution to Green Investment

3.5. Current Market Failure

3.6. Public Awareness

4. Energy Framework of ASEAN Countries

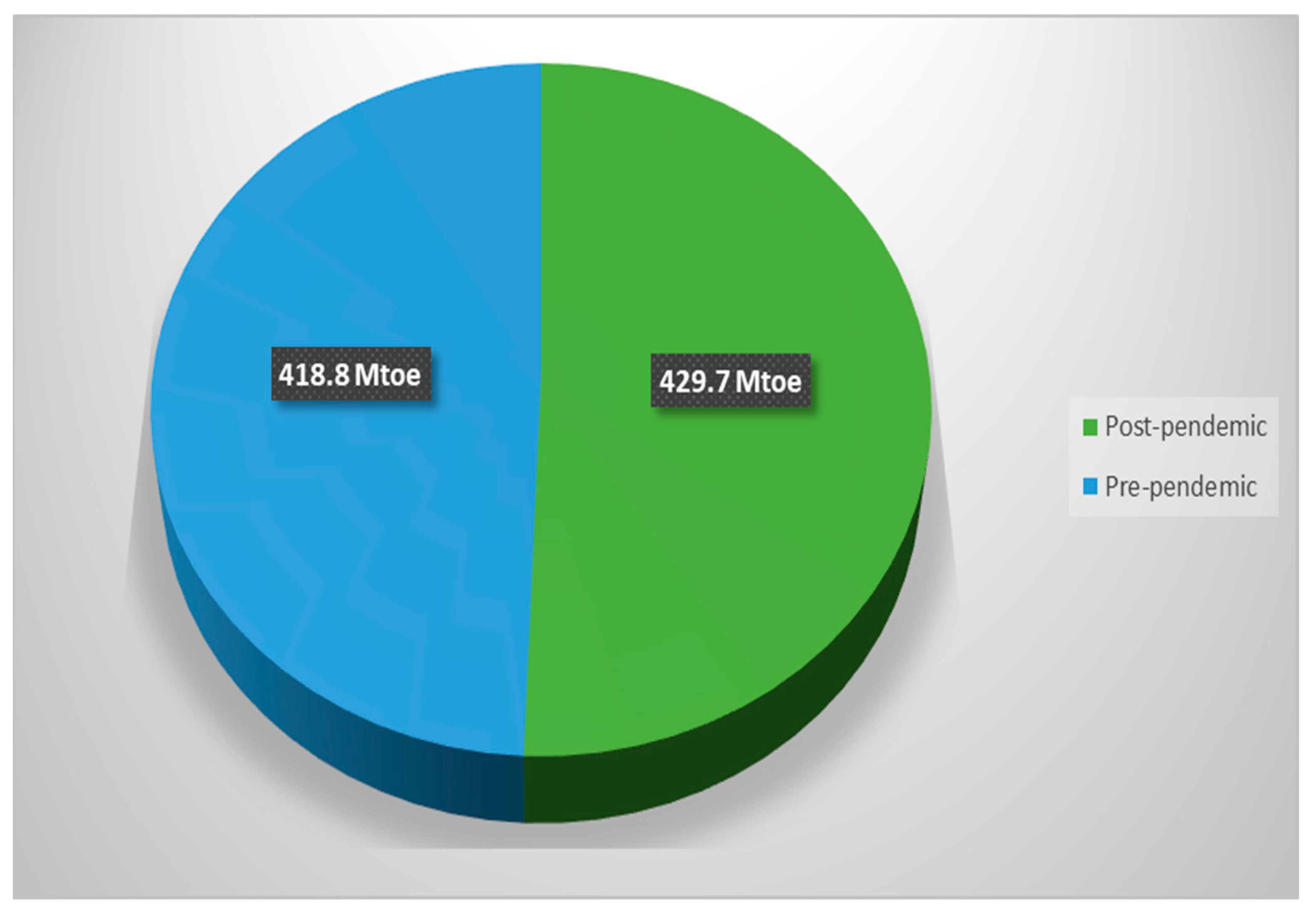

4.1. Post COVID-19 Recovery

4.2. The Pandemic Impact on the Energy Sector: Current Sector

4.3. Before and after COP26

4.4. Global Coal to Clean Power: ASEAN Perspective

- -

- Rapid development of clean power as well as significant increases in energy efficiency measures.

- -

- Scaling up the technologies and policies needed to transition away from coal in the 2030s for major economies and 2040s globally.

- -

- Ceasing issuance of permits and direct government support for the construction of new unabated coal-fired power plants.

- -

- Strengthening efforts to provide robust technical and financial frameworks and social support to make a just and inclusive transition away from coal.

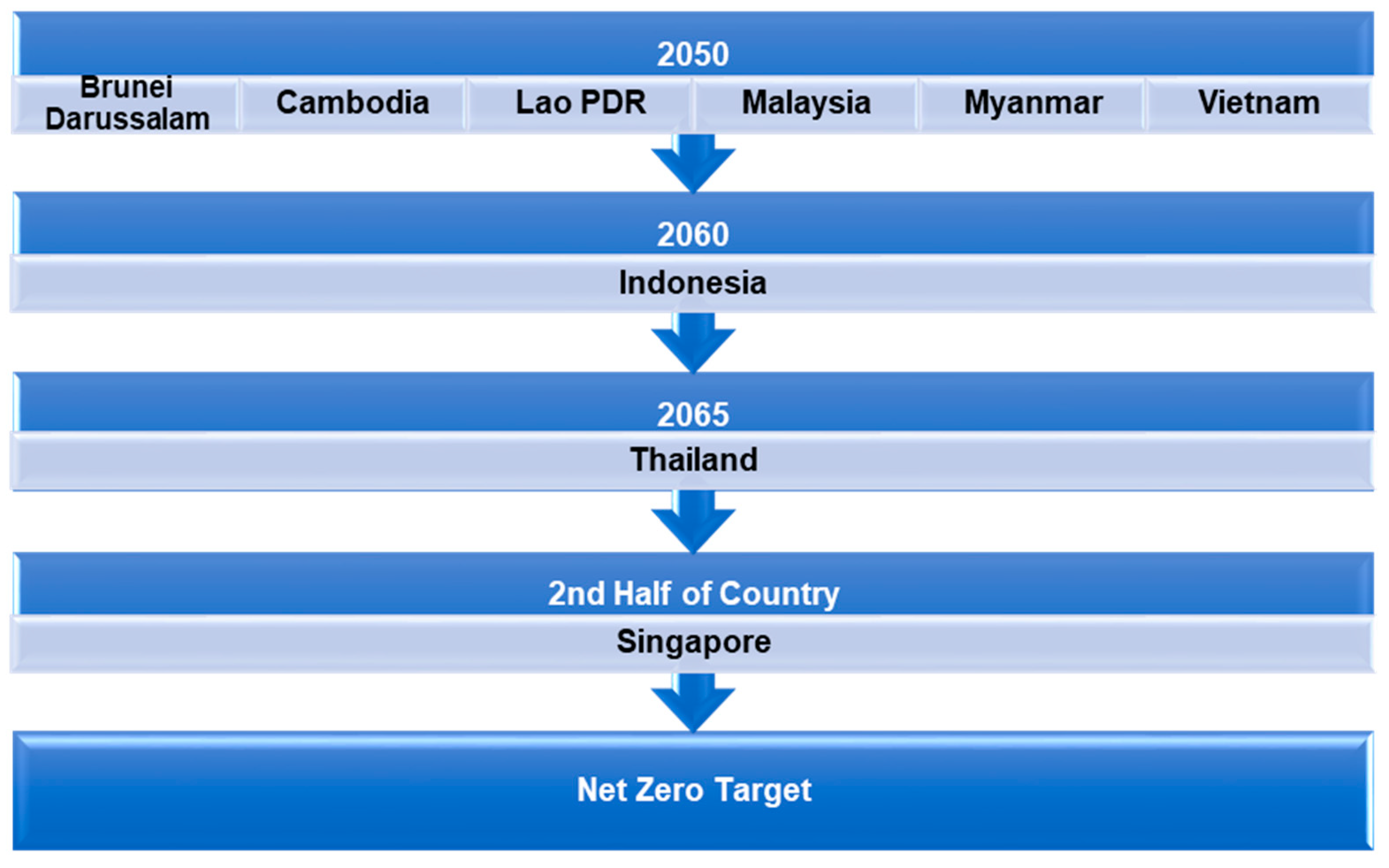

4.5. Beyond NDCS: The AMS’ Long-Term Strategies

4.6. Accelerating toward Energy Transition

4.7. Long-Awaited Rules and the Largest Free Trade Pact in History

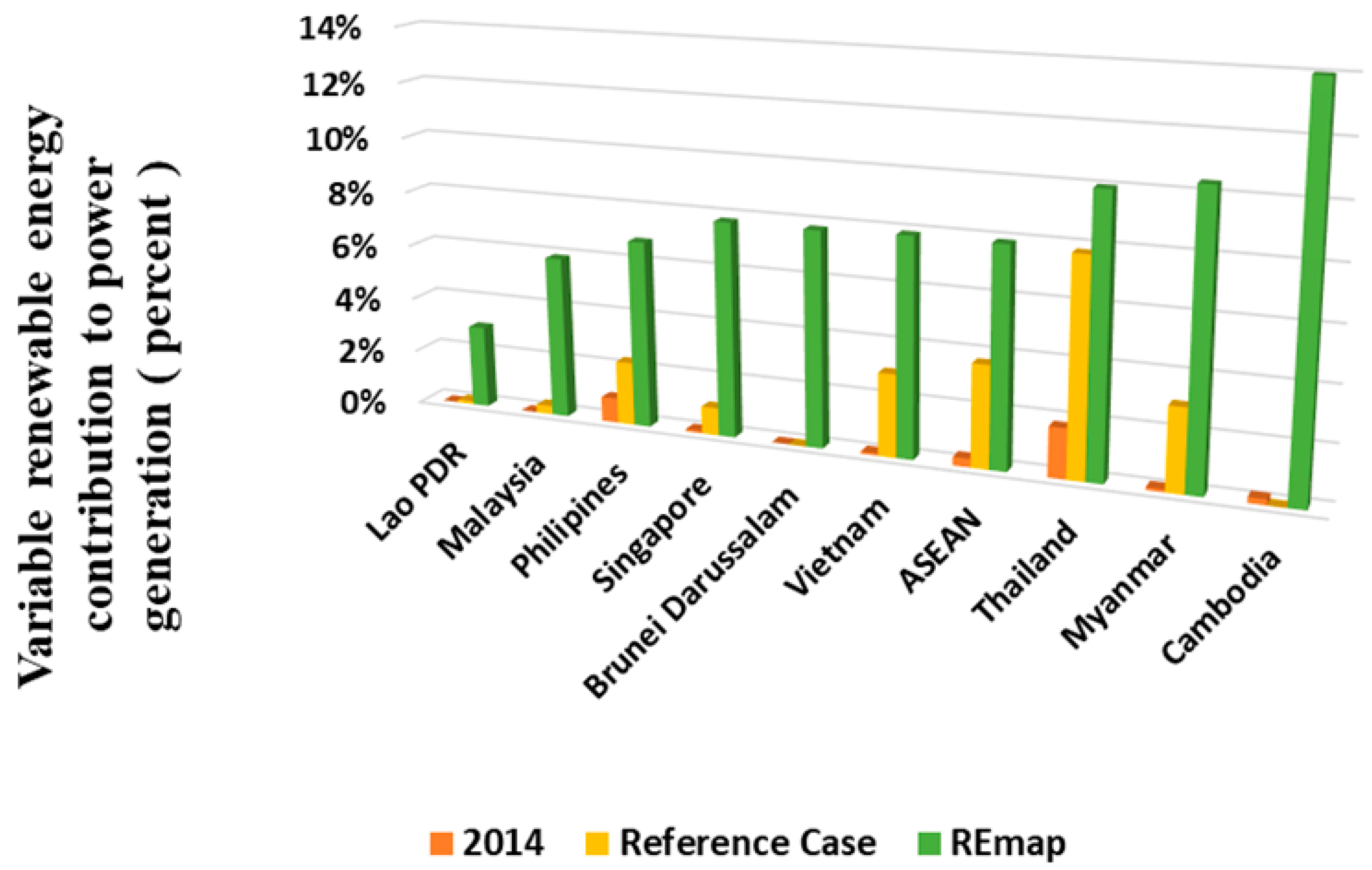

5. Comparing the Growth of Renewable Energy in ASEAN

5.1. Contribution of Each Nation to Raising RE through Various Methods

5.2. Renewable Energy in ASEAN Countries

6. ASEAN Energy Market and Energy Security

6.1. Energy Security

6.2. Issues Regarding Energy Security in ASEAN

- Environmental concerns have led to opposition to fossil fuels for power generation;

- The need to diversify the fuels used in power generation;

- Nuclear energy is still far off, although detailed plans could be released soon.

- Encourage enterprise and institute collaborations on energy planning;

- Involve consumers in energy efficiency;

- Ensure that the gas supply is stable;

- Making green fuel mandatory in the transportation sector.

- Energy demand is a term that refers to energy intensity (energy consumption per unit of GDP), energy consumption per person, and similar concepts (it also takes into account one primary energy resource and one country-dependent sector—in Thailand, oil, and transportation);

- The reserve-to-production ratio and resource estimation demonstrate the availability of energy supply resources (RPR);

- The non-carbon intensive fuel portfolio (NCFP) and emissions are used to illustrate how energy use affects the environment;

- Factors affecting the energy market include imports, energy import dependency, geopolitical market concentration risk, market liquidity, geopolitical energy security, and the oil vulnerability index (OVI);

- Oil expenditure per GDP and total energy cost per GDP is also included in the statistics on energy prices and expenditures.

7. COVID-19 Pandemic Actions to Support the Further Growth of the Solar Industry

- Vietnam set goals to generate 4% of its electricity from renewable sources by 2020 and 10% by 2030, and the country has made progress towards these targets. In 2020, Vietnam has added 2 GW of new renewable energy (RE) capacity, mostly from solar [90].

- Philippines has been making progress on its target of generating 35% of its electricity from renewable sources by 2030. In 2020, Philippines added around 1 GW of new RE capacity, mostly from solar and wind [91].

- Indonesia: The pandemic and resulting economic downturn led to a decrease in demand for energy and a decline in investment in RE projects [92].

- Malaysia: The economic downturn caused by the pandemic led to a decrease in investment in renewable energy projects [93].

- Thailand: The pandemic led to a slowdown in the country’s RE sector, with delays in construction and implementation of projects [94].

8. Conclusions

8.1. Recommendations

- (a)

- Adequately funding private and public universities for research in RE technologies such as solar, wind, hydro, geothermal, and biomass.

- (b)

- Adopting a holistic approach to energy policy that considers emissions from all sectors and reduces overall emissions through policies such as carbon pricing, emissions trading, and regulations.

- (c)

- Offering comprehensive training programs for self-employment and startup support.

- (d)

- Maximizing the potential of RE sources through alternative production capacities, such as Myanmar’s hydropower.

- (e)

- Monitoring climate change and CO2 emissions regularly through a separate policy or framework.

- (f)

- Focusing on reducing transportation pollution and CO2 emissions.

- (g)

- Reducing plastic usage and promoting eco-friendly alternatives.

- (h)

- The development process must prioritize long-term benefits and cost management for maximum impact.

8.2. Future Goals

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| Abbreviation | Meaning |

| RE | Renewable Energy |

| GHG | Greenhouse Gas |

| FDI | Foreign Direct Investment |

| IAE | International Energy Agency |

| NDCS | Nationally Determined Contributions |

| AMS | ASEAN member states |

| UNFCCC | United Nations Framework Convention on Climate Change |

| PDP | Provisional Detention Regulation |

References

- Pacudan, R. Feed-in tariff vs. incentivized self-consumption: Options for residential solar PV policy in Brunei Darussalam. Renew. Energy 2018, 122, 362–374. [Google Scholar] [CrossRef]

- Lu, Y.; Khan, Z.A.; Alvarez-Alvarado, M.S.; Zhang, Y.; Huang, Z.; Imran, M. A critical review of sustainable energy policies for the promotion of renewable energy sources. Sustainability 2020, 12, 5078. [Google Scholar] [CrossRef]

- Fahim, K.E.; Farabi, S.M.; Farhan, S.S.; Esha, I.J.; Muhtadi, T. Overview of Maximum Power Point Tracking Techniques for PV System. In Proceedings of the E3S Web of Conferences, Eskisehir, Turkey, 22–24 September 2021; EDP Sciences: Les Ulis, France, 2021; Volume 242, p. 01004. [Google Scholar]

- Khan, T.M.A.; Rahman, S.; Afgani, M.K.; Fahim, K.E. Solar Car; BRAC University: Dhaka, Bangladesh, 2014. [Google Scholar]

- Baviera, A.; Maramis, L. Building ASEAN Community: Political–Security and Socio-Cultural Reflections; Economic Research Institute for ASEAN and East Asia: Jakarta, Indonesia, 2017. [Google Scholar]

- Abdullah, I.; Warviyan, D.; Safrina, R.; Rosalia, S.; Tirta, A.; Demoral, A.; Bilqis, A. COVID-19 and the Energy Sector Development in ASEAN Countries: Assessing the Role of Fiscal Measures for Green Recovery Trajectory. In Proceedings of the IOP Conference Series: Earth and Environmental Science, Bogor, Indonesia, 14 September 2021; p. 012010. [Google Scholar]

- Gnanasagaran, A.J.T.A.P. Renewable Energy Cooperation in ASEAN. 2019. Available online: https://theaseanpost.com/article/renewable-energy-cooperation-asean (accessed on 1 January 2023).

- ASEAN Centre for Energy. Renewable Energy in ASEAN: Status, Challenges, and Opportunities. 2019. Available online: https://www.aseanenergy.org/wp-content/uploads/2019/07/RE-in-ASEAN-Report_Final_v2.0.pdf (accessed on 27 March 2023).

- Shuai, J.; Chen, C.F.; Cheng, J.; Leng, Z.; Wang, Z. Are China’s solar PV products competitive in the context of the Belt and Road Initiative? Energy Policy 2018, 120, 559–568. [Google Scholar] [CrossRef]

- Lau, H.C.; Zhang, K.; Bokka, H.K.; Ramakrishna, S. A Review of the Status of Fossil and Renewable Energies in Southeast Asia and Its Implications on the Decarbonization of ASEAN. Energies 2022, 15, 2152. [Google Scholar] [CrossRef]

- Mamat, R.; Sani, M.S.; Khoerunnisa, F.; Kadarohman, A. Target and demand for renewable energy across 10 ASEAN countries by 2040. Electr. J. 2019, 32, 106670. [Google Scholar]

- Ismail, M.I.; Yunus, N.A.; Kaassim, A.Z.M.; Hashim, H. Pathways and challenges of solar thermal utilisation in the industry: ASEAN and Malaysia scenarios. Sustain. Energy Technol. Assess. 2022, 52, 102046. [Google Scholar] [CrossRef]

- Atlas, G.S. 2022. Available online: https://globalsolaratlas.info/download/south-asia (accessed on 30 January 2023).

- Kanchana, K.; McLellan, B.C.; Unesaki, H. Energy Dependence with an Asian Twist? Examining International Energy Relations in Southeast Asia. Energy 2016, 21, 123–140. [Google Scholar] [CrossRef]

- Pandey, A.; Kalidasan, B.; Reji Kumar, R.; Rahman, S.; Tyagi, V.; Said, Z.; Salam, P.A.; Juanico, D.E.; Ahamed, J.U.; Sharma, K. Solar Energy Utilization Techniques, Policies, Potentials, Progresses, Challenges and Recommendations in ASEAN Countries. Sustainability 2022, 14, 11193. [Google Scholar] [CrossRef]

- Hasan, M.H.; Mahlia, T.M.I.; Nur, H. A review on energy scenario and sustainable energy in Indonesia. Renew. Sustain. Energy Rev. 2012, 16, 2316–2328. [Google Scholar] [CrossRef]

- Avci, A.C.; Kaygusuz, O.; Kaygusuz, K. Geothermal energy for sustainable development. J. Eng. Res. Appl. Sci. 2020, 9, 1414–1426. [Google Scholar]

- ASEAN Centre for Energy. ASEAN Centre for Energy. Available online: https://aseanenergy.org/ (accessed on 30 January 2023).

- Dehghani Madvar, M.; Aslani, A.; Ahmadi, M.H.; Karbalaie Ghomi, N.S. Current status and future forecasting of biofuels technology development. Int. J. Energy Res. 2019, 43, 1142–1160. [Google Scholar] [CrossRef]

- IEA Bioenergy ExCo. IEA Bioenergy Countries’ Report—Update 2021: Implementation of Bioenergy in the IEA Bioenergy Member Countries. November 2021. Available online: https://www.ieabioenergy.com/wp-content/uploads/2021/11/CountriesReport2021_final.pdf (accessed on 2 March 2023).

- Tun, M.M.; Juchelkova, D.; Win, M.M.; Thu, A.M.; Puchor, T. Biomass energy: An overview of biomass sources, energy potential, and management in Southeast Asian countries. Resources 2019, 8, 81. [Google Scholar] [CrossRef]

- Li, Q.; Cherian, J.; Shabbir, M.S.; Sial, M.S.; Li, J.; Mester, I.; Badulescu, A. Exploring the relationship between renewable energy sources and economic growth. The case of SAARC countries. Energies 2021, 14, 520. [Google Scholar] [CrossRef]

- Mehta, K.; Ehrenwirth, M.; Trinkl, C.; Zörner, W.; Greenough, R. The energy situation in Central Asia: A comprehensive energy review focusing on rural areas. Energies 2021, 14, 2805. [Google Scholar] [CrossRef]

- Nepal, R.; Phoumin, H.; Khatri, A. Green technological development and deployment in the association of southeast Asian economies (ASEAN)—At crossroads or roundabout? Sustainability 2021, 13, 758. [Google Scholar] [CrossRef]

- Said, R.; Bhatti, M.I.; Hunjra, A.I. Toward Understanding Renewable Energy and Sustainable Development in Developing and Developed Economies: A Review. Energies 2022, 15, 5349. [Google Scholar] [CrossRef]

- Haseeb, M.; Kot, S.; Hussain, H.I.; Jermsittiparsert, K. Impact of economic growth, environmental pollution, and energy consumption on health expenditure and R&D expenditure of ASEAN countries. Energies 2019, 12, 3598. [Google Scholar]

- Crijns-Graus, W.; Wild, P.; Amineh, M.P.; Hu, J.; Yue, H. International Comparison of Research and Investments in New Renewable Electricity Technologies: A Focus on the European Union and China. Energies 2022, 15, 6383. [Google Scholar] [CrossRef]

- Zaman, K.A.U.; Sarker, T. Public finance and fiscal instruments for sustainable development. De Gruyter Handb. Sustain. Dev. Financ. 2022, 153. [Google Scholar] [CrossRef]

- Shahzad, U. Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environ. Sci. Pollut. Res. 2020, 27, 24848–24862. [Google Scholar] [CrossRef]

- Afshan, S.; Yaqoob, T. The potency of eco-innovation, natural resource and financial development on ecological footprint: A quantile-ARDL-based evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 50675–50685. [Google Scholar] [CrossRef] [PubMed]

- Liu, X.; Chen, S. Has environmental regulation facilitated the green transformation of the marine industry? Mar. Policy 2022, 144, 105238. [Google Scholar] [CrossRef]

- Hieu, V.M. Influence of green investment, environmental tax and sustainable environment: Evidence from ASEAN countries. Int. J. Energy Econ. Policy 2022, 12, 227–235. [Google Scholar] [CrossRef]

- Tseng, S.; Appraising Singapore’s Carbon Tax through the Lens of Sustainability; NUS Law Working Paper No. 2022/002 and NUS Asia-Pacific Centre for Environment Law Working Paper 22/01. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4005891 (accessed on 2 March 2023).

- Taghizadeh-Hesary, F.; Yoshino, N. Sustainable solutions for green financing and investment in renewable energy projects. Energies 2020, 13, 788. [Google Scholar] [CrossRef]

- ASEAN. ASEAN Investment Report 2020–2021. 2021. Available online: https://asean.org/wp-content/uploads/2021/09/AIR-2020-2021.pdf (accessed on 8 January 2022).

- Marquardt, J.; Delina, L.L. Reimagining energy futures: Contributions from community sustainable energy transitions in Thailand and the Philippines. Energy Res. Soc. Sci. 2019, 49, 91–102. [Google Scholar] [CrossRef]

- Kılıç, U.; Kekezoğlu, B. A review of solar photovoltaic incentives and Policy: Selected countries and Turkey. Ain Shams Eng. J. 2022, 13, 101669. [Google Scholar] [CrossRef]

- Mika, K.; Minna, M.; Noora, V.; Jyrki, L.; Jari, K.O.; Anna, A.; Eliyan, C.; Dany, V.; Maarit, K. Situation analysis of energy use and consumption in Cambodia: Household access to energy. Environ. Dev. Sustain. 2021, 23, 18631–18655. [Google Scholar] [CrossRef]

- Qaqaya, H. Sustainability of ASEAN integration, competition policy, and the challenges of COVID-19. J. Antitrust Enforc. 2020, 8, 305–308. [Google Scholar] [CrossRef]

- Fayaz, H.; Khan, S.A.; Saleel, C.A.; Shaik, S.; Yusuf, A.A.; Veza, I.; Fattah, I.; Rawi, N.F.M.; Asyraf, M.; Alarifi, I.M. Developments in Nanoparticles Enhanced Biofuels and Solar Energy in Malaysian Perspective: A Review of State of the Art. J. Nanomater. 2022, 2022, 8091576. [Google Scholar] [CrossRef]

- Qazi, A.; Bhowmik, C.; Hussain, F.; Yang, S.; Naseem, U.; Adebayo, A.A.; Gumaei, A.; Al-Rakhami, M. Analyzing the public opinion as a guide for renewable-energy status in Malaysia: A case study. IEEE Trans. Eng. Manag. 2021, 70, 371–385. [Google Scholar] [CrossRef]

- Phoumin, H.; Kimura, F.; Arima, J. ASEAN’s energy transition towards cleaner energy system: Energy modelling scenarios and policy implications. Sustainability 2021, 13, 2819. [Google Scholar] [CrossRef]

- Barnes, M.; Bauer, L.; Edelberg, W. 11 Facts on the Economic Recovery from the COVID-19 Pandemic. 2021. Available online: https://www.hamiltonproject.org/assets/files/COVID_Facts.pdf (accessed on 2 March 2023).

- Nathaniel, S.; Khan, S.A. The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. J. Clean. Prod. 2020, 272, 122709. [Google Scholar] [CrossRef]

- BP. bp Statistical Review of World Energy. 2022. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf (accessed on 30 January 2023).

- NUS. Resilience of Renewable Energy in Asia Pacific to the COVID-19 Pandemic. 2022. Available online: https://www.kas.de/documents/265079/265128/Resilience+of+Renewable+Energy+in+Asia+Pacific+to+the+COVID-19+Pandemic.pdf/c13b1882-d2f9-e8d4-fd14-41c4b249d6a7?version=1.1&t=1615453667153 (accessed on 9 January 2023).

- Sadiq, M.; Hsu, C.-C.; Zhang, Y.; Chien, F. COVID-19 fear and volatility index movements: Empirical insights from ASEAN stock markets. Environ. Sci. Pollut. Res. 2021, 28, 67167–67184. [Google Scholar] [CrossRef] [PubMed]

- Phoumin, H.; Kimura, F.; Arima, J. ASEAN Energy Landscape and Emissions: The Modelling Scenarios and Policy Implications. In Energy Sustainability and Climate Change in ASEAN; Springer: Berlin/Heidelberg, Germany, 2021; pp. 111–146. [Google Scholar]

- Cai, Y.; Qin, Z. Review and Medium-and Long-Term Prospect of Global Oil Demand. In Annual Report on China’s Petroleum, Gas and New Energy Industry (2021); Springer: Berlin/Heidelberg, Germany, 2022; pp. 115–128. [Google Scholar]

- Hill, A.C. The Fight for Climate after COVID-19; Oxford University Press: Oxford, UK, 2021. [Google Scholar]

- Wiltshire, A.; Bernie, D.; Gohar, L.; Lowe, J.; Mathison, C.; Smith, C. Post COP26: Does the 1.5 °C climate target remain alive? Weather 2022, 77, 412–417. [Google Scholar] [CrossRef]

- Krittasudthacheewa, C. Development and Climate Change in the Mekong Region: Case Studies; 2019; ISBN: 978-967-2165-63-7. Available online: https://www.preventionweb.net/publication/development-and-climate-change-mekong-region-case-studies. (accessed on 2 March 2023).

- Nguyena, M.A.; Helgenbergerb, S.; Suryadic, B. Maximizing the Co-Benefits of Climate Action by Enhancing the NDCs of Vietnam and other ASEAN Member States. Target 2020, 11, 9. [Google Scholar]

- van Asselt, H.; Green, F. COP26 and the dynamics of anti-fossil fuel norms. In Wiley Interdisciplinary Reviews: Climate Change; Wiley: New York, NY, USA, 2022; p. e816. [Google Scholar]

- Seah, S.; Energy Transitions in ASEAN COP26 Policy Report. Newcastle University. 2021. Available online: eprints.ncl.ac.uk/file_store/production/278635/05BA9894-7D52-4579-A66B-51A03C85A881.pdf (accessed on 2 March 2023).

- Luo, J.; Ali, S.A.; Aziz, B.; Aljarba, A.; Akeel, H.; Hanif, I. Impact of natural resource rents and economic growth on environmental degradation in the context of COP-26: Evidence from low-income, middle-income, and high-income Asian countries. Resour. Policy 2023, 80, 103269. [Google Scholar] [CrossRef]

- Johnstone, I. Governance of the Energy Transition in the ASEAN: Current Status and Future Potential. 2022. Available online: papers.ssrn.com/sol3/papers.cfm?abstract_id=4291916 (accessed on 2 March 2023).

- Noch, N.A.; Wijayanti, P. Potensi Reduksi Gas Rumah Kaca di TPA Kawatuna melalui Proyek Pemulihan Gas Metana: Reduction of Greenhouse Gases in Kawatuna Landfill through Methane Gas Recovery Project. J. Teknol. Lingkung. 2022, 23, 100–109. [Google Scholar] [CrossRef]

- Handayani, K.; Anugrah, P.; Goembira, F.; Overland, I.; Suryadi, B.; Swandaru, A. Moving beyond the NDCs: ASEAN pathways to a net-zero emissions power sector in 2050. Appl. Energy 2022, 311, 118580. [Google Scholar] [CrossRef]

- Yeon, S.; Centrality and Community: ASEAN in the Regional Comprehensive Economic Partnership. ERIA. 2022. Available online: www.eria.org/uploads/media/discussion-papers/FY22/Centrality-and-Community-ASEAN-in-the-Regional-Comprehensive.pdf (accessed on 2 March 2023).

- Renewables & Sustainable Finance on Acceleration Mode. 2020. Available online: https://www.maybank.com/mibg/files/2022/05_ESG_Renewables_and_Sustainable_Finance_on_Acceleration_Mode.pdf (accessed on 9 January 2022).

- Jiang, H.; Gao, Y.; Xu, P.; Li, J. Study of future power interconnection scheme in ASEAN. Glob. Energy Interconnect. 2019, 2, 549–559. [Google Scholar] [CrossRef]

- Vakulchuk, R.; Overland, I.; Suryadi, B. ASEAN’s energy transition: How to attract more investment in renewable energy. Energy Ecol. Environ. 2022, 8, 1–16. [Google Scholar]

- Al Hakim, R.R.; Ariyanto, E.; Arief, Y.Z.; Sungkowo, A.; Trikolas, T. Preliminary Study of Juridical Aspects of Renewable Energy Draft Law In Indonesia: An Academic Perspectives. ADLIYA J. Huk. Dan Kemanus. 2022, 16, 59–72. [Google Scholar]

- Junlakarn, S.; Kittner, N.; Tongsopit, S.; Saelim, S.J.R.; Reviews, S. A cross-country comparison of compensation mechanisms for distributed photovoltaics in the Philippines, Thailand, and Vietnam. Renew. Sustain. Energy Rev. 2021, 145, 110820. [Google Scholar] [CrossRef]

- Abbass, K.; Qasim, M.Z.; Song, H.; Murshed, M.; Mahmood, H.; Younis, I. A review of the global climate change impacts, adaptation, and sustainable mitigation measures. Environ. Sci. Pollut. Res. 2022, 29, 42539–42559. [Google Scholar] [CrossRef]

- Vaka, M.; Walvekar, R.; Rasheed, A.K.; Khalid, M. A review on Malaysia’s solar energy pathway towards carbon-neutral Malaysia beyond COVID’19 pandemic. J. Clean. Prod. 2020, 273, 122834. [Google Scholar] [CrossRef]

- Taqwa, A. Higher Education Role in Supporting Indonesian Government Policy in Developing Renewable Energy. J. Phys. Conf. Ser. 2019, 1167, 012010. [Google Scholar] [CrossRef]

- Alzahrani, A.; Ramu, S.K.; Devarajan, G.; Vairavasundaram, I.; Vairavasundaram, S. A review on hydrogen-based hybrid microgrid system: Topologies for hydrogen energy storage, integration, and energy management with solar and wind energy. Energies 2022, 15, 7979. [Google Scholar] [CrossRef]

- Huang, Y.W.; Kittner, N.; Kammen, D.M. ASEAN grid flexibility: Preparedness for grid integration of renewable energy. Energy Policy 2019, 128, 711–726. [Google Scholar] [CrossRef]

- Nguyen, D.T.T. Air Quality-Related Health and Environmental Trade-off of Electrification: Evidence from Vietnam. Richard A. Harrison Symposium. May 2021. Available online: lux.lawrence.edu/harrison/8/ (accessed on 2 March 2023).

- Anbumozhi, V.; Phoumin, H.; Kimura, S.; Purwanto, A.; Lutfiana, D. Fostering Energy Market Synergies in the Mekong Subregion and ASEAN’. In Subregional Development Strategy in ASEAN after COVID-19: Inclusiveness and Sustainability in the Mekong Subregion (Mekong 2030); Kimura, F., Ed.; ERIA: Jakarta, Indonesia, 2020; pp. BP139–BP160. [Google Scholar]

- ASEANPOST. 5 Energy Companies to Look out for in ASEAN. Available online: https://theaseanpost.com/article/5-energy-companies-look-out-asean (accessed on 9 January 2023).

- Cravioto, J.; Ohgaki, H.; Che, H.S.; Tan, C.; Kobayashi, S.; Toe, H.; Long, B.; Oudaya, E.; Rahim, N.A.; Farzeneh, H.J. The effects of rural electrification on quality of life: A southeast Asian perspective. Energies 2020, 13, 2410. [Google Scholar] [CrossRef]

- Phoumin, H.; Kimura, F. The impacts of energy insecurity on household welfare in Cambodia: Empirical evidence and policy implications. Econ. Model. 2019, 82, 35–41. [Google Scholar] [CrossRef]

- Yulianto, B.; Maarif, S.; Wijaya, C.; Hardjomidjojo, H. Energy security scenario based on renewable resources: A case study of East Sumba, East Nusa Tenggara, Indonesia. BISNIS BIROKRASI J. Ilmu Adm. Dan Organ. 2019, 26, 2. [Google Scholar] [CrossRef]

- Sobok, S. The Impacts of Fossil Fuel Subsidy Reform on the Uptake of Sustainable Energy in the ASEAN Region: A Case Study of Indonesia; Murdoch University: Murdoch, Australia, 2020. [Google Scholar]

- Ly, K.; Metternicht, G.; Marshall, L. Transboundary river basins: Scenarios of hydropower development and operation under extreme climate conditions. Sci. Total Environ. 2022, 803, 149828. [Google Scholar] [CrossRef]

- Gasser, P. A review on energy security indices to compare country performances. Energy Policy 2020, 139, 111339. [Google Scholar] [CrossRef]

- Shadman, S.; Chin, C.; Sakundarini, N.; Yap, E. Quantifying the impact of energy shortage on Malaysia’s energy security using a system dynamics approach. In Recent Trends in Manufacturing and Materials Towards Industry 4.0; Springer: Berlin/Heidelberg, Germany, 2021; pp. 143–154. [Google Scholar]

- Ralph, N.; Hancock, L. Energy security, transnational politics, and renewable electricity exports in Australia and Southeast Asia. Energy Res. Soc. Sci. 2019, 49, 233–240. [Google Scholar] [CrossRef]

- Traivivatana, S.; Wangjiraniran, W. Thailand Integrated Energy Blueprint (TIEB): One step towards sustainable energy sector. Energy Procedia 2019, 157, 492–497. [Google Scholar] [CrossRef]

- Parmar, H.; Siddhpura, M.; Siddhpura, A. A Sustainability Case Study of a Biomass Power Plant Using Empty Fruit Bunch in Malaysia; EIT Australia: West Perth, WA, Australia, 2010. [Google Scholar]

- Sanusi, N.A.; Moosin, A.F.; Kusairi, S. Economics; Business. Neural network analysis in forecasting the Malaysian GDP. J. Asian Financ. Econ. Bus. 2020, 7, 109–114. [Google Scholar] [CrossRef]

- La Viña, A.G.; Gamboa, J.R. Making space for just transition in climate change legal instruments: Philippine Nationally Determined Contributions from Paris to Glasgow, and beyond. Asia Pac. J. Environ. Law 2022, 25, 77–99. [Google Scholar]

- Mamat, R.; Sani, M.S.M.; Sudhakar, K.J. Renewable energy in Southeast Asia: Policies and recommendations. Sci. Total Environ. 2019, 670, 1095–1102. [Google Scholar]

- Zulkarnaen, W.; Erfiansyah, E.; Syahril, N.N.A.; Leonandri, D.G. Comparative Study of Tax Policy Related to COVID-19 in ASEAN Countries. Int. J. TEST Eng. Manag. 2020, 83, 6519–6528. [Google Scholar]

- Eroğlu, H.; Erdem, C.Ü. Solar energy sector under the influence of COVID-19 pandemic: A critical review. J. Energy Syst. 2021, 5, 244–251. [Google Scholar] [CrossRef]

- DeWit, A. Climate ‘Code Red’ at COP26 and the Diversification of Decarbonization Narratives. 2022. Volume 75, pp. 1–45. Available online: rikkyo.repo.nii.ac.jp/?action=pages_view_main&active_action=repository_view_main_item_detail&item_id=21416&item_no=1&page_id=13&block_id=49 (accessed on 2 March 2023).

- Vietnam Briefing. Renewables in Vietnam: Current Opportunities and Future Outlook—Vietnam Briefing News. Vietnam Briefing News 2019. Available online: www.vietnam-briefing.com/news/vietnams-push-for-renewable-energy.html/ (accessed on 2 March 2023).

- Arantegui, R.L.; Jäger-Waldau, A. Photovoltaics and wind status in the European Union after the Paris Agreement. Renew. Sustain. Energy Rev. 2018, 81 Pt 2, 2460–2471. [Google Scholar] [CrossRef]

- Meliana, M.; Kesuma, H.; Enjelina, D.; Rijanto, A.; Saraswati, D.S. Is cash flow growth helping stock performance during the COVID-19 outbreak? Evidence from Indonesia. Invest. Manag. Financ. Innov. 2022, 19, 247–261. [Google Scholar] [CrossRef]

- Xia, Y.; Jiang, Q.; Yang, C.; Wang, S. Belt and Road Initiative Promote Green Development of Countries and Regions along Belt & Road. Bull. Chin. Acad. Sci. 2020, 35, 602–608. (In Chinese) [Google Scholar]

- Mouritz, F. Implications of the COVID-19 Pandemic on China's Belt and Road Initiative. Connections 2020, 19, 115–124. [Google Scholar] [CrossRef]

| Country | Hydroelectric Power | Geothermal Power | Biomass Power | Solar Power | Wind Power |

|---|---|---|---|---|---|

| Indonesia | 40% | 15% | 10% | - | - |

| Thailand | 30% | - | 20% | 10% | - |

| Philippines | 40% | 30% | - | 10% | - |

| Vietnam | 60% | - | 20% | - | 10% |

| Malaysia | 50% | - | 20% | 10% | - |

| Singapore | - | - | 10% | 50% | 20% |

| Myanmar | 90% | - | 5% | 5% | - |

| Laos | 90% | - | 5% | 5% | - |

| Cambodia | 80% | - | 10% | 10% | - |

| Brunei | 90% | - | 5% | 5% | - |

| Indonesia | Malaysia | Philippines | Singapore | Thailand | |

|---|---|---|---|---|---|

| Conditional Target | 29% less GHG emissions by 2030 compared to BAU. | By 2030, the economy’s carbon intensity (as a percentage of GDP) will be reduced by 45%. | 2.71% less greenhouse gas emission by 2030 compared to BAU. | Peak emission at 65 Mt e to 2030 to achieve 36% energy intensity reduction from 2005 levels. | GHG emissions will be reduced by 20% by 2030 compared to baseline. |

| UnconditionalTarget | By 2030, GHG emissions will be reduced by 41% compared to BAU. | N/A | GHG emissions will be reduced by 72.29% by 2030 compared to BAU. | N/A | 20% cut in GHG emissions from baseline levels by 2030. |

| Sectors | Energy IPPU LULUCF Waste Energy IPPU | Energy IPPU LULUCF Waste Energy IPPU | Energy Transport Agriculture Waste | Energy IPPU LULUCF Waste Agriculture | Energy Transport IPPU Agriculture LULUCF Waste |

| GHG Coverage |

|

|

|

|

|

| Time Frame | 2020–2030 | 2021–2030 | 2020–2030 | 2021–2030 | 2021–2030 |

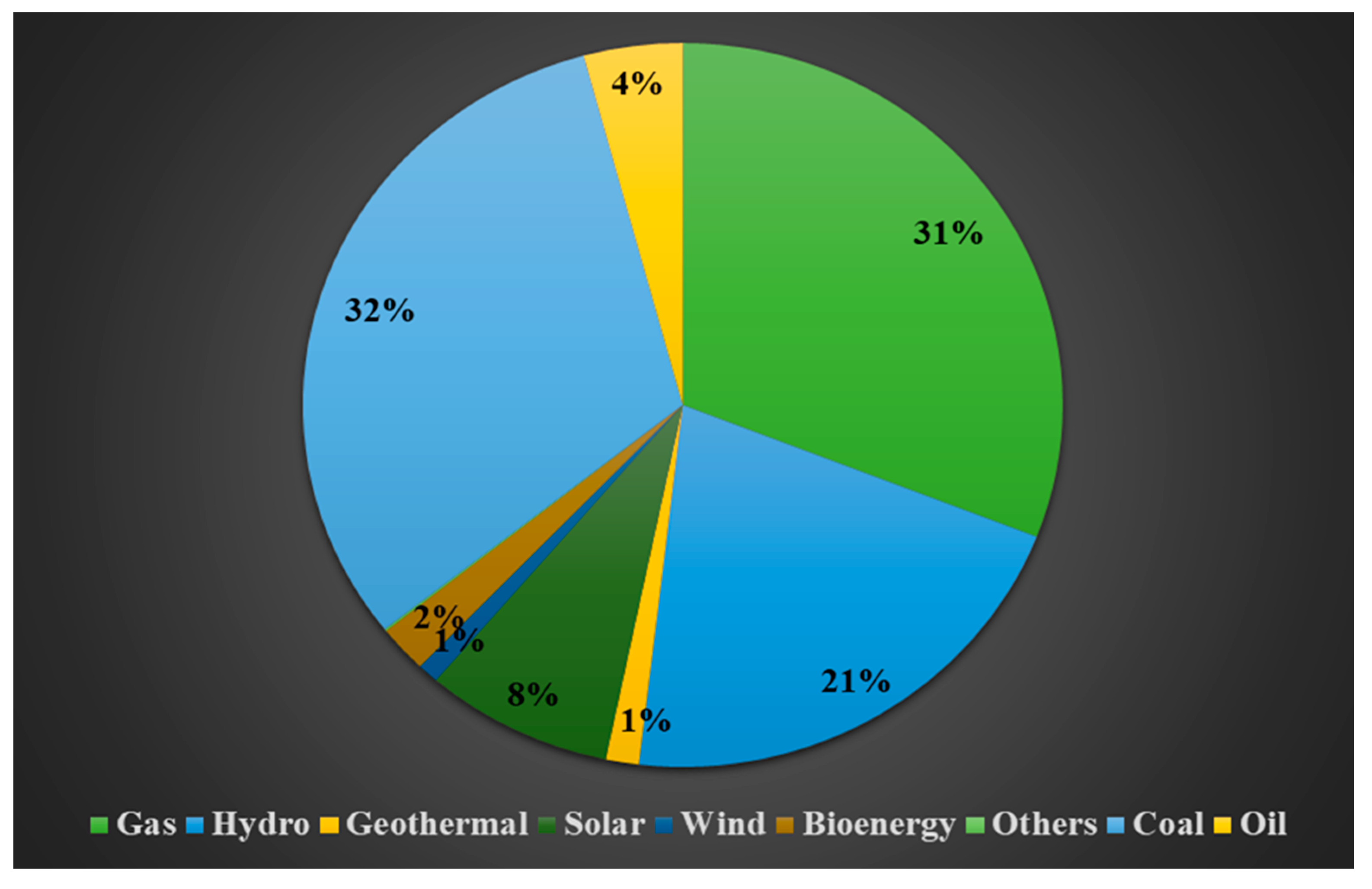

| Coal | Oil | Gas | Hydro | Geothermal | Solar | Wind | Bioenergy | Others | Total |

|---|---|---|---|---|---|---|---|---|---|

| 89,451 | 11,925 | 88,234 | 59,451 | 4058.7 | 22,942 | 2665 | 5969 | 393 | 285,089 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fahim, K.E.; De Silva, L.C.; Hussain, F.; Shezan, S.A.; Yassin, H. An Evaluation of ASEAN Renewable Energy Path to Carbon Neutrality. Sustainability 2023, 15, 6961. https://doi.org/10.3390/su15086961

Fahim KE, De Silva LC, Hussain F, Shezan SA, Yassin H. An Evaluation of ASEAN Renewable Energy Path to Carbon Neutrality. Sustainability. 2023; 15(8):6961. https://doi.org/10.3390/su15086961

Chicago/Turabian StyleFahim, Khairul Eahsun, Liyanage C. De Silva, Fayaz Hussain, Sk. A. Shezan, and Hayati Yassin. 2023. "An Evaluation of ASEAN Renewable Energy Path to Carbon Neutrality" Sustainability 15, no. 8: 6961. https://doi.org/10.3390/su15086961

APA StyleFahim, K. E., De Silva, L. C., Hussain, F., Shezan, S. A., & Yassin, H. (2023). An Evaluation of ASEAN Renewable Energy Path to Carbon Neutrality. Sustainability, 15(8), 6961. https://doi.org/10.3390/su15086961