The Eligibility of Green Bonds as Safe Haven Assets: A Systematic Review

Abstract

1. Introduction

- How did the literature on green bonds’ interaction with other assets evolve?

- What are the prominent data frequencies and methodologies used in the literature of green bonds’ relationship with other markets?

- How are green bonds used in cross-market interactions?

- What are the implications of the research outcomes and the future trends?

2. Materials and Methods

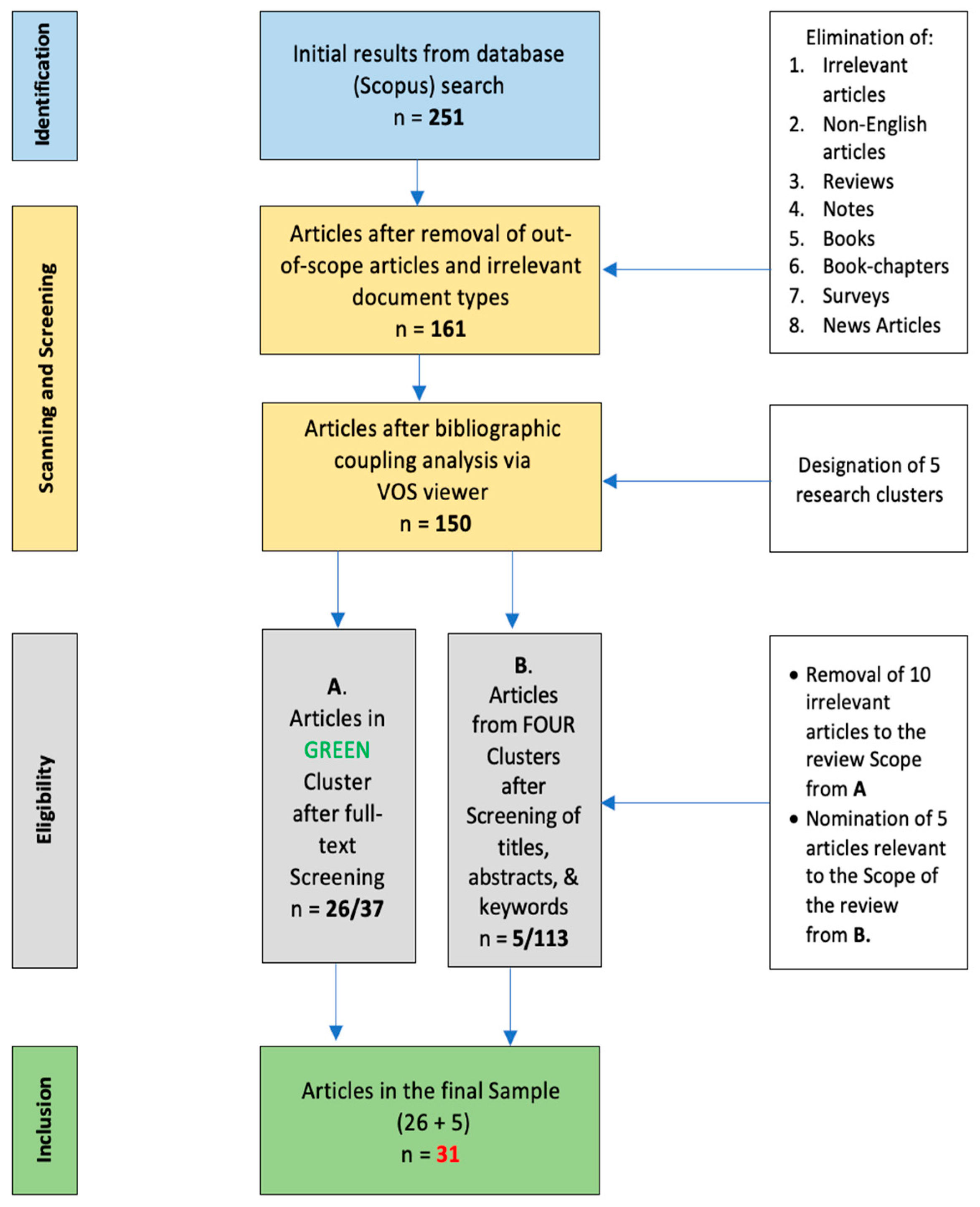

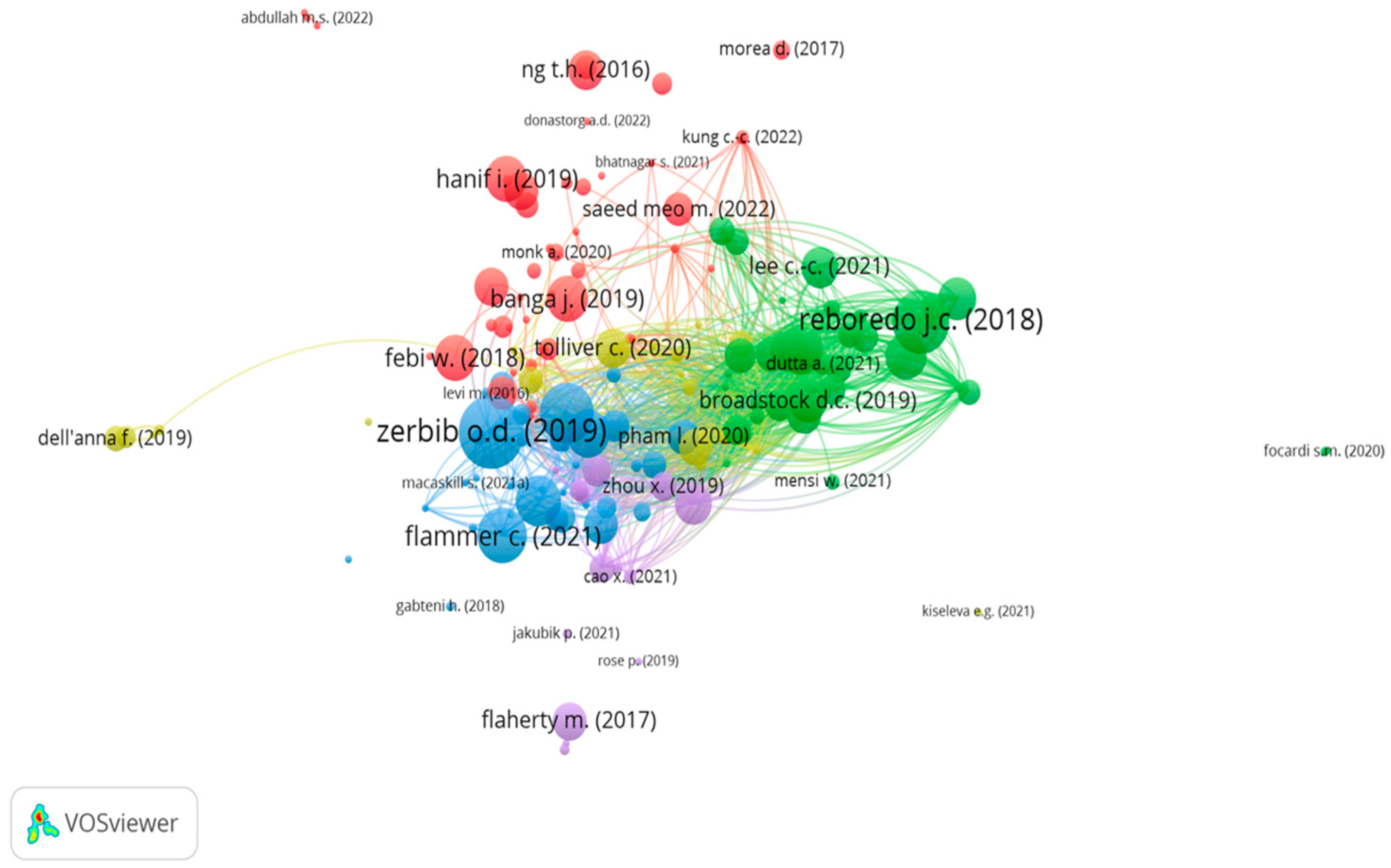

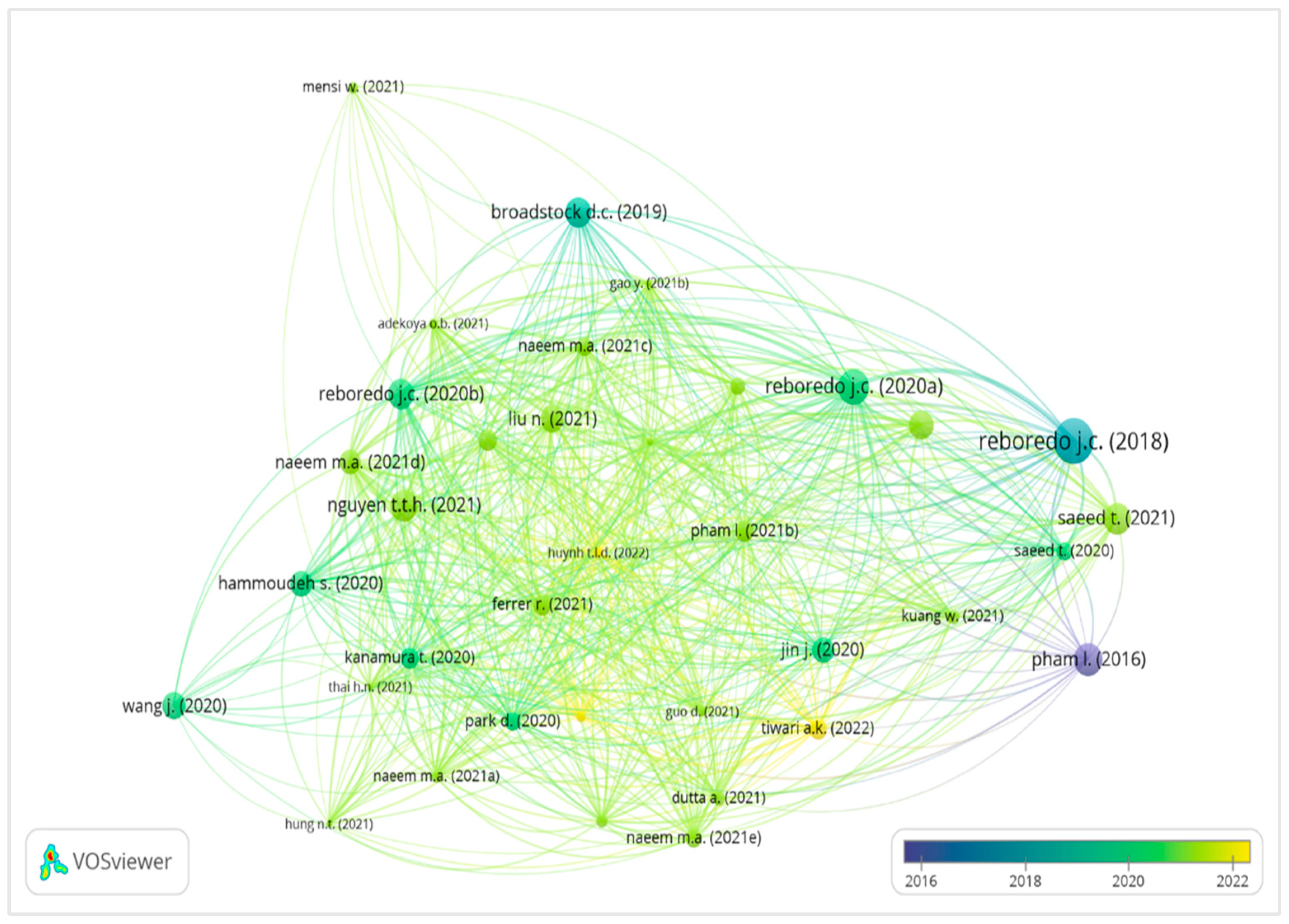

2.1. Sample Selection

2.2. Inclusion Criteria

3. Results and Discussion

3.1. Background

3.1.1. Green Bonds and the Green Bonds Market

3.1.2. Safe Haven, Hedge and Diversifier

3.1.3. Financial Contagion and Spillover

3.2. Evolution of Research in Green Bonds’ Connectedness with Other Markets

3.3. Data Frequencies

3.4. Methodologies

3.4.1. The GARCH Family Models

3.4.2. Cross-Quantilogram

3.4.3. The Spillover Indexes

3.4.4. The Wavelet

3.4.5. The Copula Approaches

3.4.6. Granger Causality

3.4.7. VAR Models and Other Models

3.5. Green Bonds as a Diversifier, Hedge, and Safe-Haven Asset

3.5.1. The Financial Markets

Conventional Bonds

Stocks

3.5.2. The Energy Markets

Energy Market

Crude Oil

3.5.3. Precious Metals

3.5.4. Renewable and Clean Energy Assets

3.5.5. The Commodity Market

3.5.6. Bitcoin, Forex, and Money Markets

3.5.7. Global and Macroeconomic Factors

4. Future Research Trends

- The nascent research field of green bonds’ connectedness with other asset classes, coupled with the dearth of publications in the respective scope, led to the emergence of mixed and contradictory results of green bonds’ interaction with other markets. In fact, we are yet to reach a consensus on the types of correlations between green bonds with most of the investigated markets. Mixed results can be found in green bonds’ relationship with conventional bonds [20,43,45,46,47,48], renewable equities and clean energy stocks [4,36,39,41], energy stocks [5,21,23,24], and money markets [4,31,43]. The contradictions in research findings can be attributed to the differences in the applied methodologies, the specified sample, and the employed control variables, as well as the factorization of crises in the overall models (such as the COVID-19 pandemic), among others. Future research can extend the sample period to comprehensively analyze cross-market relationships under different market conditions using robust methodologies which account for various aspects of market relationships to generate robust results.

- The vast majority of studies included in the sample under study focused on specific geographical regions, such as the US, Europe, and China. Given the evolving green bonds market coupled with an ease of green bond data access, extending this line of research to incorporate studies on green bonds from various regions (developed countries, emerging economies, etc.) will offer a holistic overview of green bonds’ cross-market relationships across multiple regions accounting for various regional determinant factors and can be a step forward towards promoting a consensus in green bonds’ hedging and safe-haven properties.

- Generally, the focus of the studies on green bonds’ market connectedness has been on traditional financial markets, commodity markets, and energy markets. With the evolving landscape of crypto-assets’ innovation and regulations, understanding green bonds connectedness to novel markets is vital to reduce the variance of investments portfolios. Furthermore, the use of crypto-currencies for speculative purposes is apparent in the literature [88,89,90]. Hence, a combination of green bonds with crypto-currencies in the same portfolio can facilitate testing short–medium- and long-term diversifying, hedging, and safe-haven properties between the two markets.

- Our study demonstrated the dominance of high-frequency (daily) data in about 90% of the research papers in our sample. While high-frequency data are efficient in short-term cross-market interdependence analyses and forecasting, the long-term nature of green projects suggests the appropriateness of using low-frequency data (such as weekly or monthly) or mixed data for long-term investment decision making. This step will attract a wide range of investors in green investments and is a better fit to forecast long-term relationships between green bonds and other markets.

- The severity of the novel COVID-19 pandemic has crippled the foundations of financial systems and markets worldwide. Green investments are no exception, nor are they immune to the negative impact of the COVID-19 pandemic, as demonstrated in this review. The aftermath of the crisis led to high volatilities in green bond prices and spillovers from other markets, which shows the significant predictive power of the COVID-19 pandemic on asset prices and market relationships. This is a perfect example of the influence of global and macroeconomic factors on cross-market interactions. However, only a handful of studies in our sample factored global and macroeconomic factors into their models. Future studies may consider integrating factors such as the COVID-19 pandemic recovery, the development of COVID-19 vaccines, and other macroeconomic determinants, among others. Similarly, future studies can explore the channels of markets interdependence and correlations (idiosyncratic or systematic or external) to generate robust results.

- The research papers under study use the data of corporate green bonds. Green bonds issued by sovereign and supranatural organizations are yet to be analyzed in cross-market studies despite their data’s availability. The use of such data can pave the way to tap new research dimensions, such as testing how green bonds can be used by corporations, financial institutions, and even central banks for risk management and portfolio optimization and diversification. For instance, future research can evaluate the eligibility of sovereign green bonds to serve as a High-Quality Liquid Asset (HQLA) to meet Basel III regulations using sophisticated econometric methodologies, such as copula models [36], quantile time–frequency models [39], and Markov-switching dependence models [91].

5. Conclusions

6. Policy Recommendations

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abduh, M. The Impact of Crisis and Macroeconomic Variables towards Islamic Banking Deposits. Am. J. Appl. Sci. 2011, 8, 1378–1383. [Google Scholar] [CrossRef]

- Farooq, M.; Zaheer, S. Are Islamic Banks More Resilient During Financial Panics? Pacific Econ. Rev. 2015, 20, 101–124. [Google Scholar] [CrossRef]

- Pham, L. Frequency connectedness and cross-quantile dependence between green bond and green equity markets. Energy Econ. 2021, 98, 105257. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; Soriano, P. Are green bonds a different asset class? Evidence from time-frequency connectedness analysis. J. Clean. Prod. 2021, 292, 125988. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Aikins Abakah, E.J.; Gabauer, D.; Dwumfour, R.A. Dynamic spillover effects among green bond, renewable energy stocks and carbon markets during COVID-19 pandemic: Implications for hedging and investments strategies. Glob. Financ. J. 2022, 51, 100692. [Google Scholar] [CrossRef]

- Littell, J.H.; Corcoran, J.; Pillai, V. Systematic Reviews and Meta-Analysis; Oxford University Press: New York, NY, USA, 2008; ISBN 9780199864959. [Google Scholar]

- Stechemesser, K.; Guenther, E. Carbon accounting: A systematic literature review. J. Clean. Prod. 2012, 36, 17–38. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Randhawa, K.; Wilden, R.; Hohberger, J. A Bibliometric Review of Open Innovation: Setting a Research Agenda. J. Prod. Innov. Manag. 2016, 33, 750–772. [Google Scholar] [CrossRef]

- Tamilmani, K.; Rana, N.P.; Prakasam, N.; Dwivedi, Y.K. The battle of Brain vs. Heart: A literature review and meta-analysis of “hedonic motivation” use in UTAUT2. Int. J. Inf. Manage. 2019, 46, 222–235. [Google Scholar] [CrossRef]

- Rosado-Serrano, A.; Paul, J.; Dikova, D. International franchising: A literature review and research agenda. J. Bus. Res. 2018, 85, 238–257. [Google Scholar] [CrossRef]

- Paul, J.; Benito, G.R.G. A review of research on outward foreign direct investment from emerging countries, including China: What do we know, how do we know and where should we be heading? Asia Pac. Bus. Rev. 2017, 24, 90–115. [Google Scholar] [CrossRef]

- López-Illescas, C.; de Moya-Anegón, F.; Moed, H.F. Coverage and citation impact of oncological journals in the Web of Science and Scopus. J. Informetr. 2008, 2, 304–316. [Google Scholar] [CrossRef]

- Archambault, É.; Campbell, D.; Gingras, Y.; Larivière, V. Comparing bibliometric statistics obtained from the Web of Science and Scopus. J. Am. Soc. Inf. Sci. Technol. 2009, 60, 1320–1326. [Google Scholar] [CrossRef]

- Kessler, M.M. Bibliographic coupling between scientific papers. Am. Doc. 1963, 14, 10–25. [Google Scholar] [CrossRef]

- Gao, Y.; Li, Y.; Wang, Y. The dynamic interaction between investor attention and green security market: An empirical study based on Baidu index. China Financ. Rev. Int. 2023, 13, 79–101. [Google Scholar] [CrossRef]

- Yousaf, I.; Suleman, M.T.; Demirer, R. Green investments: A luxury good or a financial necessity? Energy Econ. 2022, 105, 105745. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is gold a safe haven? International evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Huynh, T.L.D. When ‘green’ challenges ‘prime’: Empirical evidence from government bond markets. J. Sustain. Financ. Invest. 2022, 12, 375–388. [Google Scholar] [CrossRef]

- Guo, D.; Zhou, P. Green bonds as hedging assets before and after COVID: A comparative study between the US and China. Energy Econ. 2021, 104, 105696. [Google Scholar] [CrossRef]

- Naeem, M.A.; Bouri, E.; Costa, M.D.; Naifar, N.; Shahzad, S.J.H. Energy markets and green bonds: A tail dependence analysis with time-varying optimal copulas and portfolio implications. Resour. Policy 2021, 74, 102418. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Noor, M.H. Climate bond, stock, gold, and oil markets: Dynamic correlations and hedging analyses during the COVID-19 outbreak. Resour. Policy 2021, 74, 102265. [Google Scholar] [CrossRef]

- Pham, L.; Nguyen, C.P. Asymmetric tail dependence between green bonds and other asset classes. Glob. Financ. J. 2021, 50, 100669. [Google Scholar] [CrossRef]

- Naeem, M.A.; Nguyen, T.T.H.; Nepal, R.; Ngo, Q.T.; Taghizadeh–Hesary, F. Asymmetric relationship between green bonds and commodities: Evidence from extreme quantile approach. Financ. Res. Lett. 2021, 43, 101983. [Google Scholar] [CrossRef]

- Naeem, M.A.; Adekoya, O.B.; Oliyide, J.A. Asymmetric spillovers between green bonds and commodities. J. Clean. Prod. 2021, 314, 128100. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Baruník, J.; Křehlík, T. Measuring the frequency dynamics of financial connectedness and systemic risk. J. Financ. Econom. 2018, 16, 271–296. [Google Scholar] [CrossRef]

- Ul Haq, I.; Chupradit, S.; Huo, C. Do green bonds act as a hedge or a safe haven against economic policy uncertainty? Evidence from the usa and china. Int. J. Financ. Stud. 2021, 9, 40. [Google Scholar] [CrossRef]

- Hung, N.T. Nexus between green bonds, financial, and environmental indicators. Econ. Bus. Lett. 2021, 10, 191–199. [Google Scholar] [CrossRef]

- Kocaarslan, B. How does the reserve currency (US dollar) affect the diversification capacity of green bond investments? J. Clean. Prod. 2021, 307, 127275. [Google Scholar] [CrossRef]

- Gao, Y.; Li, Y.; Wang, Y. Risk spillover and network connectedness analysis of China’s green bond and financial markets: Evidence from financial events of 2015–2020. North Am. J. Econ. Financ. 2021, 57, 101386. [Google Scholar] [CrossRef]

- Kuang, W. Are clean energy assets a safe haven for international equity markets? J. Clean. Prod. 2021, 302, 127006. [Google Scholar] [CrossRef]

- Naeem, M.A.; Farid, S.; Ferrer, R.; Shahzad, S.J.H. Comparative efficiency of green and conventional bonds pre- and during COVID-19: An asymmetric multifractal detrended fluctuation analysis. Energy Policy 2021, 153, 112285. [Google Scholar] [CrossRef]

- Nguyen, T.T.H.; Naeem, M.A.; Balli, F.; Balli, H.O.; Vo, X.V. Time-frequency comovement among green bonds, stocks, commodities, clean energy, and conventional bonds. Financ. Res. Lett. 2021, 40, 101739. [Google Scholar] [CrossRef]

- Saeed, T.; Bouri, E.; Alsulami, H. Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Econ. 2021, 96, 105017. [Google Scholar] [CrossRef]

- Liu, N.; Liu, C.; Da, B.; Zhang, T.; Guan, F. Dependence and risk spillovers between green bonds and clean energy markets. J. Clean. Prod. 2021, 279, 123595. [Google Scholar] [CrossRef]

- Naeem, M.A.; Raza Rabbani, M.; Karim, S.; Billah, S.M. Religion vs ethics: Hedge and safe haven properties of Sukuk and green bonds for stock markets pre- and during COVID-19. Int. J. Islam. Middle East. Financ. Manag. 2021, 16, 234–252. [Google Scholar] [CrossRef]

- Ratner, M.; Chiu, C.C. Hedging stock sector risk with credit default swaps. Int. Rev. Financ. Anal. 2013, 30, 18–25. [Google Scholar] [CrossRef]

- Thai, H.N. Quantile dependence between green bonds, stocks, bitcoin, commodities and clean energy. Econ. Comput. Econ. Cybern. Stud. Res. 2021, 55, 71–86. [Google Scholar] [CrossRef]

- Lee, C.C.C.; Lee, C.C.C.; Li, Y.Y. Oil price shocks, geopolitical risks, and green bond market dynamics. N. Am. J. Econ. Financ. 2021, 55, 101309. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Ajmi, A.N.; Mokni, K. Relationship between green bonds and financial and environmental variables: A novel time-varying causality. Energy Econ. 2020, 92, 104941. [Google Scholar] [CrossRef]

- Saeed, T.; Bouri, E.; Vo, X.V. Hedging strategies of green assets against dirty energy assets. Energies 2020, 13, 3141. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. Price connectedness between green bond and financial markets. Econ. Model. 2020, 88, 25–38. [Google Scholar] [CrossRef]

- Park, D.; Park, J.; Ryu, D. Volatility spillovers between equity and green bond markets. Sustainability 2020, 12, 3722. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A.; Aiube, F.A.L. Network connectedness of green bonds and asset classes. Energy Econ. 2020, 86, 104629. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Cheng, L.T.W. Time-varying relation between black and green bond price benchmarks: Macroeconomic determinants for the first decade. Financ. Res. Lett. 2019, 29, 17–22. [Google Scholar] [CrossRef]

- Reboredo, J.C. Green bond and financial markets: Co-movement, diversification and price spillover effects. Energy Econ. 2018, 74, 38–50. [Google Scholar] [CrossRef]

- Pham, L. Is it risky to go green? A volatility analysis of the green bond market. J. Sustain. Financ. Invest. 2016, 6, 263–291. [Google Scholar] [CrossRef]

- Jelemensky, J. Green Bonds. In Mobilising the Debt Capital Markets for a Low-Carbon Transition; Springer Gabler: Wiesbaden, Germany, 2015. [Google Scholar] [CrossRef]

- Aassouli, D.; Asutay, M.; Mohieldin, M.; Nwokike, T.C.; Chiara Nwokike, T.; Nwokike, T.C. Green Sukuk, Energy Poverty, and Climate Change: A Roadmap for Sub-Saharan Africa, In Policy Research Working Paper; OECD Policy Perspectives: Paris, France, 2018; Volume 44. [Google Scholar] [CrossRef]

- Sartzetakis, E.S. Green bonds as an instrument to finance low carbon transition. Econ. Chang. Restruct. 2021, 54, 755–779. [Google Scholar] [CrossRef]

- Gianfrate, G.; Peri, M. The green advantage: Exploring the convenience of issuing green bonds. J. Clean. Prod. 2019, 219, 127–135. [Google Scholar] [CrossRef]

- Tuhkanen, H.; Vulturius, G. Are green bonds funding the transition? Investigating the link between companies’ climate targets and green debt financing. J. Sustain. Financ. Investig. 2020, 12, 1194–1216. [Google Scholar] [CrossRef]

- Hachenberg, B.; Schiereck, D. Are green bonds priced differently from conventional bonds? J. Asset Manag. 2018, 19, 371–383. [Google Scholar] [CrossRef]

- International Finance Corporation, World Bank Group. Riding the Green Wave: Emerging Market Green Bonds. 2022. Available online: www.amundi.com (accessed on 1 January 2023).

- Baur, D.G.; Lucey, B.M. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financ. Rev. 2010, 45, 217–229. [Google Scholar] [CrossRef]

- Beckmann, J.; Berger, T.; Czudaj, R. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Econ. Model. 2015, 48, 16–24. [Google Scholar] [CrossRef]

- Bouri, E.; Molnár, P.; Azzi, G.; Roubaud, D.; Hagfors, L.I. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Financ. Res. Lett. 2017, 20, 192–198. [Google Scholar] [CrossRef]

- Nguyen, Q.N.; Bedoui, R.; Majdoub, N.; Guesmi, K.; Chevallier, J. Hedging and safe-haven characteristics of Gold against currencies: An investigation based on multivariate dynamic copula theory. Resour. Policy 2020, 68, 101766. [Google Scholar] [CrossRef]

- Forbes, K.J.; Rigobon, R. No Contagion, Only Interdependence: Measuring Stock Market Comovements. J. Financ. 2002, 57, 2223–2261. [Google Scholar] [CrossRef]

- Rigobon, R. Contagion, spillover and interdependence. Economía 2019, 19, 69–100. [Google Scholar] [CrossRef]

- Fleming, J.; Kirby, C.; Ostdiek, B. Information and volatility linkages in the stock, bond, and money markets. J. Financ. Econ. 1998, 49, 111–137. [Google Scholar] [CrossRef]

- Agénor, P.R.; Pereira da Silva, L.A. Financial spillovers, spillbacks, and the scope for international macroprudential policy coordination. Int. Econ. Econ. Policy 2022, 19, 79–127. [Google Scholar] [CrossRef]

- Kaminsky, G.L.; Reinhart, C.M.; Végh, C.A. The Unholy Trinity of Financial Contagion. J. Econ. Perspect. 2003, 17, 51–74. [Google Scholar] [CrossRef]

- Jin, J.; Han, L.; Wu, L.; Zeng, H. The hedging effect of green bonds on carbon market risk. Int. Rev. Financ. Anal. 2020, 71, 101509. [Google Scholar] [CrossRef]

- Shi, S.; Phillips, P.C.B.; Hurn, S. Change Detection and the Causal Impact of the Yield Curve. J. Time Ser. Anal. 2018, 39, 966–987. [Google Scholar] [CrossRef]

- Zhou, B. High-Frequency Data and Volatility in Foreign-Exchange Rates. J. Bus. Econ. Stat. 1996, 14, 45–52. [Google Scholar] [CrossRef]

- Chin, W.C.; Lee, M.C. High-frequency volatility combine forecast evaluations: An empirical study for DAX. J. Financ. Data Sci. 2017, 3, 1–12. [Google Scholar] [CrossRef]

- Li, S.; Tsang, E.P.K.; O’Hara, J. Measuring relative volatility in high-frequency data under the directional change approach. Intell. Syst. Account. Financ. Manag. 2022, 29, 86–102. [Google Scholar] [CrossRef]

- Andersen, T.G.; Bollerslev, T.; Diebold, F.X.; Labys, P. Modeling and Forecasting Realized Volatility. SSRN Electron. J. 2005, 71, 579–625. [Google Scholar] [CrossRef]

- Rafique, A.; Zulfikar Ali Bhutto, S. Comparing the persistency of different frequencies of stock returns volatility in an emerging market: A case study of Pakistan. Int. J. Manag. Bus. Stud. 2019, 10, 59. [Google Scholar]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Fama, E. The Behavior of Stock-Market Prices on JSTOR. J. Bus. 1965, 38, 34–105. [Google Scholar] [CrossRef]

- Xu, Y. DCC-HEAVY: A Multivariate GARCH Model with Realized Measures of Variance and Correlation. Cardiff, UK, E2019/5. 2019. Available online: http://econpapers.repec.org/paper/cdfwpaper/ (accessed on 1 January 2023).

- Kebalo, L. What DCC-GARCH Model Tell Us about the Effect of the Gold Price’s Volatility on South African Exchange Rate? MPRA Pap., 2014. Available online: https://ideas.repec.org/p/pra/mprapa/72584.html (accessed on 26 December 2022).

- Moore, T.; Wang, P. Dynamic linkage between real exchange rates and stock prices: Evidence from developed and emerging Asian markets. Int. Rev. Econ. Financ. 2014, 29, 1–11. [Google Scholar] [CrossRef]

- Glosten, L.R.; Jagannathan, R.; Runkle, D.E.; Breen, W.; Hansen, L.; Hess, P.; Hsieh, D.; Judson, R.; Kocher-Lakota, N.; Mcdonald, R.; et al. On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. J. Financ. 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Cappiello, L.; Engle, R.F.; Sheppard, K. Asymmetric Dynamics in the Correlations of Global Equity and Bond Returns. J. Financ. Econom. 2006, 4, 537–572. [Google Scholar] [CrossRef]

- Mittnik, S.; Paolella, M.S.; Rachev, S.T.; Mittnik, S.; Paolella, M.S.; Rachev, S.T. Diagnosing and Treating the Fat Tails in Financial Returns Data. Available online: https://econpapers.repec.org/RePEc:eee:empfin:v:7:y:2000:i:3-4:p:389-416 (accessed on 26 December 2022).

- Ibragimov, R.; Walden, J. Value at risk and efficiency under dependence and heavy-tailedness: Models with common shocks. Ann. Financ. 2011, 7, 285–318. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Gallegati, M.; Gallegati, M.; Ramsey, J.B.; Semmler, W. Does Productivity Affect Unemployment? A Time-Frequency Analysis for the US. Dyn. Model. Econom. Econ. Financ. 2014, 20, 23–46. [Google Scholar] [CrossRef]

- Cherubini, U.; Luciano, E.; Vecchiato, W. Copula Methods in Finance; John Wiley & Sons Ltd.: West Sussex, UK, 2004; ISBN 9780470863442. [Google Scholar]

- Baum, C.F.; Hurn, S.; Otero, J. The dynamics of U.S. industrial production: A time-varying Granger causality perspective. Econom. Stat. 2021; in press. [Google Scholar] [CrossRef]

- Mensi, W.; Lee, Y.J.; Al-Yahyaee, K.H.; Sensoy, A.; Yoon, S.M. Intraday downward/upward multifractality and long memory in Bitcoin and Ethereum markets: An asymmetric multifractal detrended fluctuation analysis. Financ. Res. Lett. 2019, 31, 19–25. [Google Scholar] [CrossRef]

- Mensi, W.; Sensoy, A.; Vo, X.V.; Kang, S.H. Impact of COVID-19 outbreak on asymmetric multifractality of gold and oil prices. Resour. Policy 2020, 69, 101829. [Google Scholar] [CrossRef]

- Matkovskyy, R.; Jalan, A. From financial markets to Bitcoin markets: A fresh look at the contagion effect. Financ. Res. Lett. 2019, 31, 93–97. [Google Scholar] [CrossRef]

- Paule-Vianez, J.; Prado-Román, C.; Gómez-Martínez, R. Economic policy uncertainty and Bitcoin. Is Bitcoin a safe-haven asset? Eur. J. Manag. Bus. Econ. 2020, 29, 347–363. [Google Scholar] [CrossRef]

- Mariana, C.D.; Ekaputra, I.A.; Husodo, Z.A. Are Bitcoin and Ethereum safe-havens for stocks during the COVID-19 pandemic? Financ. Res. Lett. 2021, 38, 101798. [Google Scholar] [CrossRef] [PubMed]

- Tiwari, A.K.; Abakah, E.J.A.; Le, T.L.; Leyva-de la Hiz, D.I. Markov-switching dependence between artificial intelligence and carbon price: The role of policy uncertainty in the era of the 4th industrial revolution and the effect of COVID-19 pandemic. Technol. Forecast. Soc. Chang. 2021, 163, 120434. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, 71. [Google Scholar] [CrossRef] [PubMed]

| No | Author and Year | Title | Freq | Scope | Method | Variables | Findings |

|---|---|---|---|---|---|---|---|

| 1 | Tiwari et al. (2022) [5] | Dynamic spillover effects among GB, renewable energy stocks and carbon markets during COVID-19 pandemic: Implications for hedging and investments strategies | Daily | 4 January 2015–22 September 2020 | TVP-VAR | GB, CO2 emissions, and renewable energy stocks | GB significantly reduced investment risks when combined with any assets (bilaterally) but do not hedge other assets |

| 2 | Yousaf et al. (2022) [17] | Green investments: A luxury good or a financial necessity? | Daily | 31 August 2012–20 November 2020 | (DCC)-GARCH Baur and McDermott (2010) [18] | GB, clean energy stocks, gold, indexes (World sustainability, North American sustainability, Eurozone sustainability, the emerging market sustainability, S&P global sukuk, and Dow Jones Islamic) | Clean energy investments and GB have the potential to serve as a safe haven against stock market downturns amid COVID-19 |

| 3 | Huynh (2022) [19] | When ‘green’ challenges ‘prime’: empirical evidence from government bond markets | Monthly | December 2008–November 2019 | Copulas tail dependence and transfer entropy | GB and triple-A government bonds of 10 countries | GB are not ideal portfolio diversifier during financial turmoil |

| 4 | Guo and Zhou (2021) [20] | GBs as hedging assets before and after COVID: A comparative study between the US and China | Daily | August 2014–August 2021 | Copula approach based on the TGARCH | GB, equity, conventional bond, forex, and energy (oil) markets in US and China | Hedging effect of GB is weaker in extreme times but effective in normal times |

| 5 | Naeem, Bouri, et al. (2021) [21] | Energy markets and GBs: A tail dependence analysis with time-varying optimal copulas and portfolio implications | Daily | December 2008–June 2020 | Time-varying optimal copula (TVOC) model | GB, oil, natural gas, coal, gasoline, and heating oil | GB are efficient in hedging against most energy assets (coal) |

| 6 | Dutta et al. (2021) [22] | Climate bond analyses, stock, gold, and oil markets: Dynamic correlations and hedging during the COVID-19 outbreak | Daily | 1 March 2017–30 June 2020 | VAR-ADCC-GARCH | Climate bonds, S&P 500 index, crude oil, and gold | Climate bonds cannot be an effective hedging asset the COVID-19 pandemic in contrast to normal times |

| 7 | Pham and Nguyen (2021) [23] | Asymmetric tail dependence between GBs and other asset classes | Daily | 12 October 2014–12 February 2021 | Cross-quantilogram | GB, Treasury bond market, energy market, stock market, and corporate bond market | GB are strategic diversifiers for energy markets across all market conditions and for conventional bonds in normal times. |

| 8 | Naeem, Nguyen, et al. (2021) [24] | Asymmetric relationship between GBs and commodities: Evidence from extreme quantile approach | Daily | 1 December 2008–31 December 2020 | Cross-quantilogram | Energy assets, metals, and agricultural assets | GB are effective diversifiers against natural gas, agricultural commodities, and some industrial metals but not precious metals. |

| 9 | Naeem, Adekoya, et al. (2021) [25] | Asymmetric spillovers between GBs and commodities | Daily | 1 December 2008–31 December 2020 | Diebold and Yilmaz (2014) [26] and Barunik and Krehlik (2018) [27] | GB, gold, silver, crude oil, natural gas, wheat, and corn | GB can hedge against risks from precious and agricultural assets and against crude oil in the short term |

| 10 | Ul Haq et al. (2021) [28] | Do GBs act as a hedge or a safe haven against economic policy uncertainty? Evidence from the USA and China | Daily | 11 March 2014–29 September 2020 | DCC-MGARCH | Economic policy uncertainty, GB, clean energy stocks, and global rare earth elements | GB were a strong hedge against China and UK EPU but did not hedge against US EPU and lost safe-haven ability during COVID-19 |

| 11 | Hung (2021) [29] | Nexus between GBs, financial, and environmental indicators | Daily | January 2013–March 2019 | (MPN) Network nonlinear Granger causality and transfer entropy | GB and clean energy, price of CO2 emission allowances, Bitcoin, and the S&P 500 stock market | GB provide shelter to price oscillations in stock, Bitcoin, clean energy, and price of CO2 emission allowances |

| 12 | Kocaarslan (2021) [30] | How does the reserve currency (US dollar) affect the diversification capacity of GB investments? | Daily | 1 August 2014–19 October 2019 | DCC-GARCH and ARDL. | S&P GB, S&P US Aggregate Bond, S&P 500, and S&P GSCI Energy | GB have diversification capacity for investors in energy and stock markets in bad times |

| 13 | Gao et al. (2021a) [31] | Risk spillover and network connectedness analysis of China’s GB and financial markets: Evidence from financial events of 2015–2020 | Daily | 8 April 2015–8 April 2020 | DCC-GJRGARCH model | GB, stock market, conventional bond market, forex market, commodities market, and monetary markets | GB are not ideal for hedging risks in the forex and monetary markets |

| 14 | Kuang (2021) [32] | Are clean energy assets a safe haven for international equity markets? | Daily | 9 July 2012–18 December 2020 | Standard deviation, maximum drawdown, (VaR), and (CVaR). | GB, clean energy assets, equities, and dirty assets. | GB are efficient risk diversifiers for dirty energy stocks. |

| 15 | Pham (2021) [3] | Frequency connectedness and cross-quantile dependence between GB and green equity markets | Daily | August 2014–August 2020 | Cross-quantilogram | GB, green equities, and energy and financial markets (corporate bonds and stocks) | GB are a diversifier against clean equity in normal conditions and diminish in extreme conditions |

| 16 | Naeem, Farid, et al. (2021) [33] | Comparative efficiency of green and conventional bonds pre- and during COVID-19: An asymmetric multifractal detrended fluctuation analysis | Daily | 3 November 2014–3 September 2020 | Asymmetric multifractal detrended fluctuation analysis (A-MF-DFA) | S&P, Solactive, and Bloomberg Barclays MSCI GB indexes The S&P Global Developed Aggregate Ex-Collateralized Bond, Solactive Global Developed Government Bond TR EU, and Bloomberg Barclays Global Aggregate Total Return Indexes | GB are an effective diversifier for traditional assets in extreme market turmoil periods |

| 17 | Nguyen et al. (2021) [34] | Time-frequency comovement among GBs, stocks, commodities, clean energy, and conventional bonds | Daily | December 2008–December 2019 | Wavelet correlation | S&P GB Index, S&P 500 Composite Index, S&P GSCI Commodity Index, S&P Clean Energy Index, Barclays Bloomberg Global Treasury Index. | GB are a strategic diversifier against volatilities from stocks and commodities in the short term and at a lower degree in the long run. |

| 18 | Ferrer et al. (2021) [4] | Are GBs a different asset class? Evidence from time-frequency connectedness analysis | Daily | 14 October 2014–19 December 2019 | Barunik and Krehlik (2018) [27] | GB, renewable market, corporate bond, treasury, stock, currency markets, and oil | GB are not a different class and do not offer diversification benefits in the short term |

| 19 | Saeed et al. (2021) [35] | Extreme return connectedness and its determinants between clean/green and dirty energy investments | Daily | 3 January 2012–29 November 2019 | Quantile VAR model | GB, oil, energy ETFs, and clean energy stock | GB offer diversification benefits against dirty assets |

| 20 | Liu et al. (2021) [36] | Dependence and risk spillovers between GBs and clean energy markets | Daily | 5 July 2011–24 February 2020 | Marginal and copula models (CoVaR) and delta CoVaR. | GB, solar, wind, renewable energy, and clean technology index, and 3 clean energy indexes | Long positions in GB cannot hedge long positions in clean energy assets and vice versa |

| 21 | Naeem, Raza, et al. (2021) [37] | Religion vs ethics: hedge and safe haven properties of sukuk and GBs for stock markets pre- and during COVID-19 | NA | 2020–2021 | DCC-GARCH Ratner and Chiu (2013) model [38] | GB, sukuk, and stock markets | GB exhibit safe-haven and diversification benefits for low-risk investors in economic distress spells |

| 22 | Thai (2021) [39] | Quantile dependence between GBs, stocks, bitcoin, commodities and clean energy | Daily | April 2013 –December 2019 | Quantile regression and quantile Granger causality | GB, stocks, Bitcoin, commodities, and clean energy | GB offer shelter to price oscillations in the stock, bitcoin, and commodity markets |

| 23 | Lee et al. (2021) [40] | Oil price shocks, geopolitical risks, and GB market dynamics | Monthly | December 2013–January 2019 | Quantile-based methods Granger causality in quantile tests | Brent crude oil prices, MSCI GB index, and geopolitical risk index | GB hedge against oil price shocks in bearish market conditions and are a diversifier in bullish markets |

| 24 | Hammoudeh et al. (2020) [41] | Relationship between GBs and financial and environmental variables: A novel time-varying causality | Daily | 30 July 2014–10 February 2020 | Time-varying Granger causality test | GB, US conventional bonds, WilderHill clean energy index, and CO2 emission allowances | GB are a diversifier in a commercial and sovereign bonds portfolio |

| 25 | Saeed et al. (2020) [42] | Hedging strategies of green assets against dirty energy assets | Daily | 3 January 2012–29 November 2019 | DCC-GARCH and dynamic optimal hedge ratios | GB, clean energy stocks, energy ETFs, and crude oil | Hedge effectiveness of clean energy stocks against dirty energy assets is superior to GB |

| 26 | Reboredo and Ugolini 2020 [43] | Price connectedness between GB and financial markets | Daily | 14 October 2014–25 June 2019 | Structural vector autoregressive (VAR) model | GB Index, high-yield corporate debt market, USD currency market, global stock market, and energy commodity market | GB hedge against portfolio risks and minimize downside risks from stocks, energy assets, and high-yield corporate debt but are impacted by changes in the USD and Treasury bonds |

| 27 | Park et al. (2020) [44] | Volatility spillovers between equity and GB markets | NA | January 2010–January 2020 | ADCC-GARCH, BEKK, and DCC-GARCH models | GB and equity market (S&P 500) | Evidence of insignificant volatility spillovers between GB and equity |

| 28 | Reboredo et al. (2020) [45] | Network connectedness of GBs and asset classes | Daily | 12 October 2014–20 December 2018 | Wavelet VAR models Granger causality | GB Index, Treasury, corporate, and high-yield corporate debt market, USD currency market, global stock market, and energy commodity market | GB are effective for portfolio hedging and risk diversification over different investment horizons for stocks, high-yield corporate bonds, and energy stocks |

| 29 | Broadstock and Cheng (2019) [46] | Time-varying relation between black and GB price benchmarks: Macroeconomic determinants for the first decade | Daily | 28 October 2008–31 July 2018 | (DCC) with dynamic model averaging methods. | GB, black bonds, daily economic activity, US financial market index returns, VIX, EPU, NEWS, and oil | Connectedness between green and black bonds is sensitive to changes in selected variables |

| 30 | Reboredo (2018) [47] | GB and financial markets: Co-movement, diversification and price spillover effects | Daily | 14 October 2014–31 August 2017 | Time-varying copulas models, conditional diversification benefit measure, and (VaR) | GB, fixed income, and stock and energy markets | GB have sizeable diversification benefits for stock and energy markets but not for corporate and treasury bond markets |

| 31 | Pham (2016) [48] | Is it risky to go green? A volatility analysis of the GB market | Daily | 30 April 2010–29 April 2015 | Multivariate GARCH framework | S&P GB, S&P Green Project Bond, and S&P US Aggregate Bond | A strong correlation between the two markets’ limiting diversifications opportunities |

| Market | Instrument | Findings |

|---|---|---|

| Financial markets | Stocks | Safe haven and hedge |

| Conventional bonds | Not safe haven or hedge | |

| Energy market | Natural gas | Diversifier |

| Dirty energy stocks | Safe haven in market stress | |

| CO2 emission allowance | Hedge | |

| Crude oil | Diversifier and hedge | |

| Precious metals | Gold | Mixed results (hedge and not hedge) |

| Industrial metals | Diversifier | |

| Global rare earth elements | Diversifier | |

| Clean energy | Clean energy assets | Mixed results (diversifier, hedge, and no benefits) |

| Commodity market | Soft commodities | Hedge |

| Commodity market | Mixed results (hedge and not hedge) | |

| Bitcoin | Hedge | |

| Forex | Hedge and safe haven in COVID-19 and diversifier | |

| Money market | Mixed results (diversifier and no benefits) | |

| Global and macroeconomic factors | Economic policy uncertainty | Influences the intensity of markets relations |

| Green bonds market sentiment | Influences the intensity of markets relations | |

| Daily economic activity | Influences the intensity of markets relations | |

| OVX | Influences the intensity of markets relations | |

| VIX | Influences the intensity of markets relations |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khamis, M.; Aassouli, D. The Eligibility of Green Bonds as Safe Haven Assets: A Systematic Review. Sustainability 2023, 15, 6841. https://doi.org/10.3390/su15086841

Khamis M, Aassouli D. The Eligibility of Green Bonds as Safe Haven Assets: A Systematic Review. Sustainability. 2023; 15(8):6841. https://doi.org/10.3390/su15086841

Chicago/Turabian StyleKhamis, Munir, and Dalal Aassouli. 2023. "The Eligibility of Green Bonds as Safe Haven Assets: A Systematic Review" Sustainability 15, no. 8: 6841. https://doi.org/10.3390/su15086841

APA StyleKhamis, M., & Aassouli, D. (2023). The Eligibility of Green Bonds as Safe Haven Assets: A Systematic Review. Sustainability, 15(8), 6841. https://doi.org/10.3390/su15086841