The Adoption of Robo-Advisory among Millennials in the 21st Century: Trust, Usability and Knowledge Perception

Abstract

1. Introduction

2. Literature Review

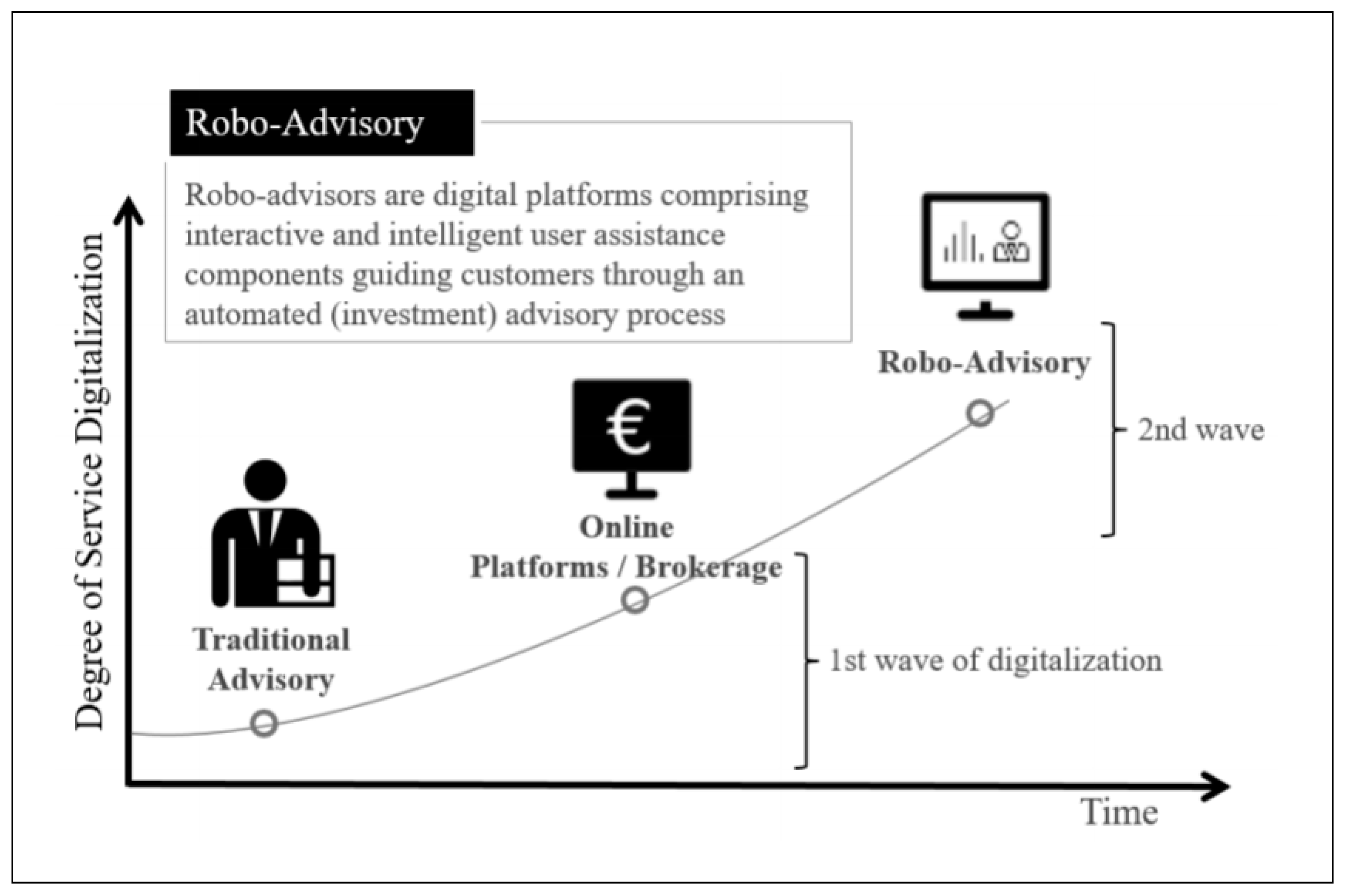

2.1. Related Research on Robo-Advisory

2.2. Artificial Intelligence in Service

2.3. Adoption Intention towards Robo-Advisors

2.4. Impact of COVID-19 on Young Tech-Savvy Investors

3. Research Method

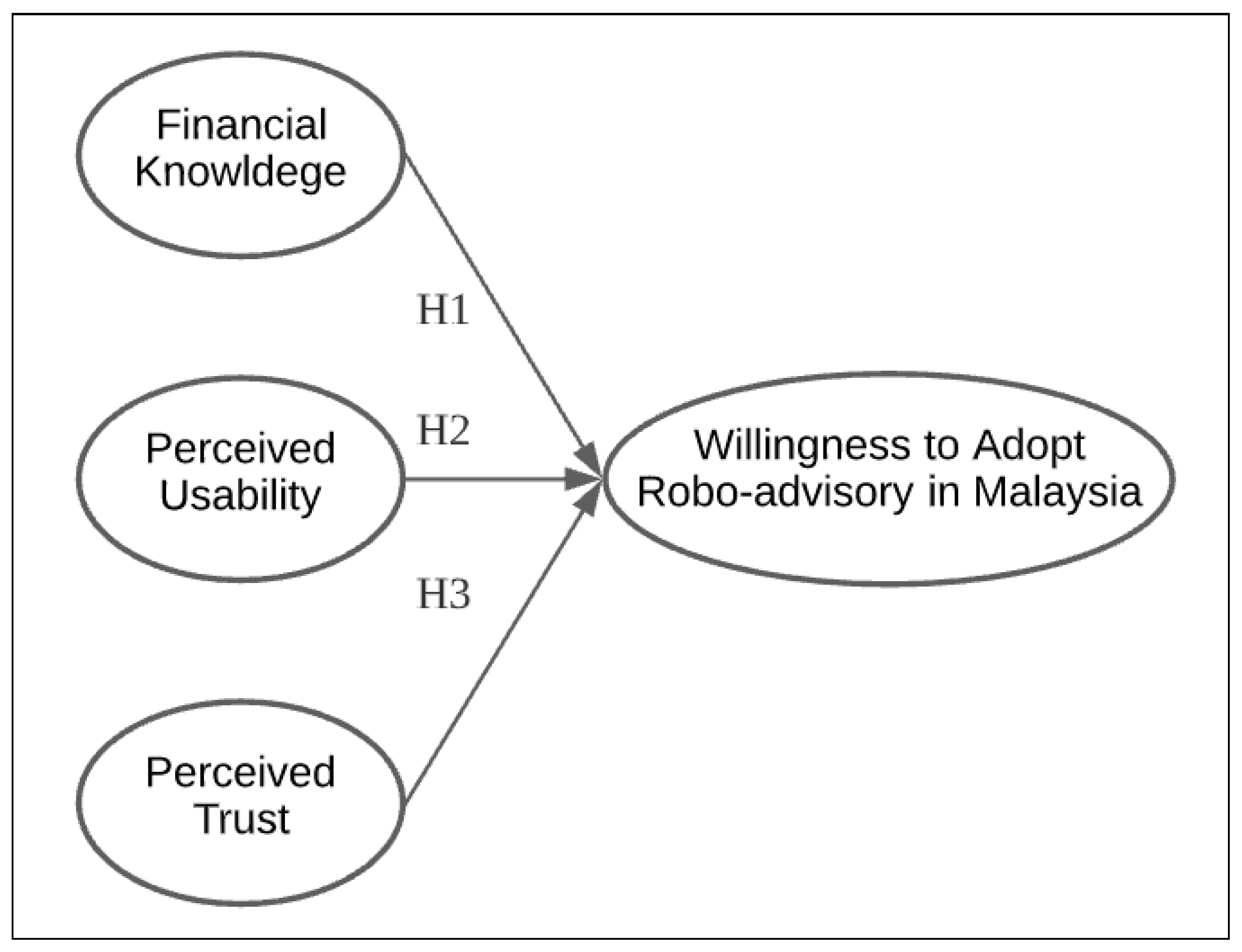

3.1. Framework and Hypothesis

3.1.1. Financial Knowledge

3.1.2. Perceived Usability

3.1.3. Perceived Trust

3.2. Research Design

4. Data Analysis and Findings

4.1. Descriptive Analysis

4.2. Pearson’s Correlation Analysis

4.3. Regression Analysis

5. Discussion

6. Recommendations

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Seiler, V.; Fanenbruck, K.M. Acceptance of digital investment solutions: The case of robo advisory in Germany. Res. Int. Bus. Financ. 2021, 58, 101490. [Google Scholar] [CrossRef]

- Junger, M. and Mietzner. M. Banking goes digital: The adoption of FinTech services by German households. Financ. Res. Lett. 2020, 34, 101260. [Google Scholar] [CrossRef]

- Sironi, P. FinTech Innovation: From Robo-Advisors to Goal Based Investing and Gamification; John Wiley & Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Frankenfield, J. Retrieved from What Is a Robo-Advisor? 28 March 2020. Available online: https://www.investopedia.com/terms/r/roboadvisor-roboadviser.asp (accessed on 20 August 2022).

- Statista. Statistical Portal, Robo Advisors. 2017. Available online: https://www.statista.com/outlook/337/100/robo-advisors/worldwide#marketStudy (accessed on 20 August 2022).

- BI Intelligence. The Robo-Advising Report: Market Forecasts, Keygrowth Drivers, and How Automated Asset Management Will Change the Advisory Industry. 2017. Available online: https://www.businessinsider.com.au/the-robo-advising-report-market-forecasts-key-growth-drivers-and-how-automated-asset-management-will-change-the-advisory-industry-2016-6 (accessed on 20 August 2022).

- Barron’s. Robo-Advisor Account Sign-Ups Surge Amid Pandemic, April 2020. Available online: https://www.barrons.com/articles/robo-advisor-account-sign-ups-surge-amid-pandemic-51585757592 (accessed on 20 August 2022).

- Northey, G.; Hunter, V.; Mulcahy, R.; Choong, K.; Mehmet, M. Man vs machine: How artificial intelligence in banking influences consumer belief in financial advice. Int. J. Bank Mark. 2022, 40, 1182–1199. [Google Scholar] [CrossRef]

- Faradynawati, I.A.A.; Söderberg, I.-L. Sustainable investment preferences among robo-advisor clients. Sustainability 2022, 14, 12636. [Google Scholar] [CrossRef]

- Gan, L.Y.; Khan, M.T.L.; Liew, T.W. Understanding consumer’s adoption of finanical robo-advisors at the outbreak of the COVID-19 crisis in Malaysia. Financ. Plan. Rev. 2021, 4, e1127. [Google Scholar] [CrossRef]

- Zheng, K.W.; Cheong, J.H.; Jafarian, M. Intention to adopt robo-advisors among Malaysian retail investors:Using an extended version of TAM Model. In Proceedings of the International Conference on Emerging Technologies and Intelligent Systems. ICETIS 2021, Al Buraimi, Oman, 25–26 June 2021; El Emran, M., Al-Sharafi, M.A., Al-Kabi, M.N., Shaalan, K., Eds.; Lecture Notes in Networks and Systems. Springer: Cham, Switzerland, 2022; Volume 299, pp. 624–634. [Google Scholar] [CrossRef]

- BNM. Strategic Thrust 2: Elevate the Financial Well-Being of Households and Businesses in Financial Sector Blueprint 2022–2026. 2022. Available online: https://www.bnm.gov.my/documents/20124/5915429/fsb3_en_s2.pdf (accessed on 20 August 2022).

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the FinTech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2017, 35, 220–265. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.-A.; Siering, M. Digital finance and FinTech: Current research and future research directions. J. Bus. Econ. 2018, 87, 537–580. [Google Scholar] [CrossRef]

- Belanche, D.; Casaló, L.V.; Flavián, C. Artificial Intelligence in FinTech: Understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. 2019, 119, 1411–1430. [Google Scholar] [CrossRef]

- Risi, D.; Paetzold, F.; Kellers, A. Wealthy private investors and socially responsible investing: The influence of reference groups. Sustainability 2021, 13, 12931. [Google Scholar] [CrossRef]

- Thakor, A.V. Fintech and banking: What do we know? J. Financ. Intermediation 2020, 41, 100833. [Google Scholar] [CrossRef]

- Brenner, L.; Meyll, T. Robo-advisors: A substitute for human financial advice? J. Behav. Exp. Financ. 2020, 25, 100275. [Google Scholar] [CrossRef]

- Fisch, J.E.; Labouré, M.; Turner, J.A. The emergence of the robo-advisor. In The Disruptive Impact of FinTech on Retirement Systems; OECD Publishing: Paris, France, 2019; pp. 13–32. [Google Scholar]

- Lopez, C.J.; Babcic, S.; De La Ossa, A. Advice goes virtual: How new digital investment services are changing the wealth management landscape. J. Financ. Perspect. 2015, 3, 71–87. [Google Scholar]

- Woodyard, A.; Grable, J.E. Financial risk tolerance and additional factors that affect risk taking in everyday money matters. J. Financ. Couns. Planning 2018, 29, 3–15. [Google Scholar] [CrossRef]

- Meyll, T.; Walter, A. Tapping and waving to debt: Mobile payments and credit card behavior. Financ. Res. Lett. 2019, 28, 381–387. [Google Scholar] [CrossRef]

- Yakoboski, P.J.; Lusardi, A.; Hasler, A. Millennial Financial Literacy and Fin-Tech Use: Who Knows What in the Digital Era. New Insights from the 2018 P-Fin Index; Teachers Insurance and Annuity Association of America, Global Financial Literacy Excellence Center (GFLEC), TIAA Institute: Washington, DC, USA, 2018. [Google Scholar]

- Akram, U.; Khan, I.; Akram, S.; Ahmad, A.; Muhammad, S. Impact of digitalization on customers’ well-being in the pandemic period: Challenges and opportunities for the retail industry. Int. J. Environ. Res. Public Health 2021, 18, 7533. [Google Scholar] [CrossRef]

- Digalaki, E. The Impact of Artificial Intelligence in a Banking Sector & How AI Is Being Used on 2022. Business Insider. 3 February 2022. Available online: https://www.businessinsider.com/ai-in-banking-report (accessed on 20 August 2022).

- Phaneuf, A. Artificial Intelligence in Financial Services: Applications and Benefits of AI in Finance. 2022. Available online: https://www.businessinsider.com/ai-in-finance (accessed on 20 August 2022).

- Flavián, C.; Pérez-Rueda, A.; Belanche, D.; Casaló, L. Intention to use analytical artificial intelligence (AI) in services—The effect of technology readiness and awareness. J. Serv. Manag. 2022, 33, 293–320. [Google Scholar] [CrossRef]

- Caron, M.S. The transformative effect of AI on the banking industry. Bank. Financ. Law Rev. 2019, 34, 169–214. [Google Scholar]

- Huang, M.H.; Rust, R.T. Engaged to a robot? The role of AI in service. J. Serv. Res. 2021, 24, 30–41. [Google Scholar] [CrossRef]

- Goldstein, I.; Jiang, W.; Karolyi, G.A. To FinTech and beyond. Rev. Financ. Stud. 2019, 32, 1647–1661. [Google Scholar] [CrossRef]

- Jung, D.; Dorner, V.; Glaser, F.; Morana, S. Robo-Advisory: Digitalization and Automation of Financial Advisory. Bus. Inf. Syst. Eng. 2018, 60, 81–86. [Google Scholar] [CrossRef]

- Nicoletti, B. The Future of FinTech: Integrating Finance and Technology in Financial Services; Palgrave Studies in Financial Services Technology; Springer: Cham, Switzerland, 2017. [Google Scholar]

- Jung, D.; Glaser, F.; Köpplin, W. Robo-Advisory: Opportunities and Risks for the Future of Financial Advisory: Recent Findings and Practical Cases. In Advances in Consulting Research; Springer: Cham, Switzerland, 2019; pp. 405–427. [Google Scholar]

- Zhang, L.; Pentina, I.; Fan, Y. Who do you choose? Comparing perceptions of human vs robo-advisor in the context of financial services. J. Serv. Mark. 2021, 35, 634–646. [Google Scholar] [CrossRef]

- Faloon, M.; Scherer, B. Individualization of Robo-Advice. J. Wealth Manag. 2017, 20, 30–36. [Google Scholar] [CrossRef]

- Heinrich, P.; Schwabe, G. Facilitating Informed Decision-Making in Financial Service Encounters. Bus. Inf. Syst. Eng. 2018, 60, 317–329. [Google Scholar] [CrossRef]

- Jung, D.; Dorner, V.; Weinhardt, C.; Pusmaz, H. Designing a robo-advisor for risk-averse, low-budget consumers. Electron. Mark. 2017, 28, 367–380. [Google Scholar] [CrossRef]

- Schweitzer, V. Only 20% of Affluent Millennials are Using Robo-Advisors, October 2019. Available online: https://www.investopedia.com/study-affluent-millennials-are-warming-up-to-robo-advisors-4770577 (accessed on 20 August 2022).

- Iacurci, G. Young Investors Are Going Digital. Financial Advisors Need to Adapt with Them, October 2020. Available online: https://www.cnbc.com/2020/10/14/millennials-gen-z-want-robo-advisors-and-digital-financial-advice.html (accessed on 20 August 2022).

- Tan, V. COVID-19 Lockdown Stimulates Malaysia’s Retail Investor Boom, July 2020. Available online: https://www.channelnewsasia.com/news/asia/malaysia-covid-19-lockdown-retail-investor-boom-share-trading-12894640 (accessed on 20 August 2022).

- Phoon, K.; Koh, F. Robo-Advisors and Wealth Management. J. Altern. Invest. 2018, 20, 79–94. [Google Scholar] [CrossRef]

- Fülöp, M.T.; Magdas, N. Opportunities and challenges in the accounting profession based on the digitalization process. Eur. J. Account. Financ. Bus. 2022, 10, 38–45. [Google Scholar]

- Fülöp, M.T.; Topor, D.A.; Ionescu, C.A.; Capiusneanu, S.; Breaz, T.O.; Stanescu, S.G. Fintech accounting and Industry 4.0: Futureproofing or threats to the accounting profession? J. Bus. Econ. Manag. 2022, 23, 997–1015. [Google Scholar] [CrossRef]

- Stavrova, E. Financial Literacy and Investment Behavior—Relationships and Dependencies. 2014. Available online: https://tinyurl.com/b9ymu7nr (accessed on 20 August 2022).

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory and evidence. J. Econ. Lit. Am. Econ. Assoc. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed]

- Cedrell, L.; Issa, N. The Adoption of Robo-Advisory in the Swedish Financial Technology Market: Analyzing the Consumer Perspective; KTH Royal Institute of Technology: Stockholm, Sweden, 2018. [Google Scholar]

- Ostrom, A.; Fotheringham, D.; Bitner, M. Customer acceptance of AI in service encounters: Understanding antecedents and consequences. In Handbook of Servoce Scoemce; Springer: Cham, Switzerland, 2019; Volume II, pp. 77–103. [Google Scholar]

- Bock, D.E.; Wolter, J.S.; Ferrell, O.C. Artificial intelligence: Disrupting what we know about services. J. Serv. Mark. 2020, 34, 317–334. [Google Scholar] [CrossRef]

- Milani, A. The Role of Risk and Trust in the Adoption of Robo-Advisory in Italy: An Extension of the Unified Theory of Acceptance and Use of Technology; PricewaterhouseCoopers Advisory SpA: Milan, Italy, 2019. [Google Scholar]

- Chong, T.-P.; Keng-Soon, W.C.; Yip, Y.-S.; Chan, P.-Y.; Hong-Leong, J.T.; Ng, S.-S. An Adoption of Fintech Service in Malaysia. South East Asia J. Contemp. Bus. Econ. Law 2019, 18, 134–147. [Google Scholar]

- Howcroft, B.; Hamilton, R.; Hewer, P. Consumer attitude and the usage and adoption of Home-based Banking in the United Kingdom. Int. J. Bank Mark. 2002, 20, 111–121. [Google Scholar] [CrossRef]

- Lavrakas, P.J. Non-Probability Sampling. In Encyclopedia of Survey Research Methods; Lavrakas, P.J., Ed.; SAGE Publications: Thousand Oaks, CA, USA, 2008; pp. 517–519. [Google Scholar]

- Stratton, S. Population research: Convenience sampling strategies. Prehospital Disaster Med. 2021, 36, 373–374. [Google Scholar] [CrossRef]

- Etikan, I.; Bala, K. Sampling and sampling methods. Biom. Biostat. Int. J. 2017, 5, 215–217. [Google Scholar] [CrossRef]

- Bryman, A. Social Research Methods; Oxford University Press: Oxford, UK, 2016. [Google Scholar]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Ringle, C.M.; Sarstedt, M.; Mitchell, R.; Gudergan, S.P. Partial least squares structural equation modeling in HRM research. Int. J. Hum. Resour. Manag. 2018, 31, 1617–1643. [Google Scholar] [CrossRef]

- Memon, M.A.; Ting, H.; Cheah, J.; Thurasamy, R.; Chuah, F.; Cham, T.H. Sample Size for Survey Research: Review and Recommendations. J. Appl. Struct. Equ. Model. 2020, 4, 1–20. [Google Scholar] [CrossRef]

- Babakus, E.; Mangold, W.G. Adapting the SERVQUAL scale to hospital services: An empirical investigation. Health Serv. Res. 1992, 26, 767–786. [Google Scholar]

- Sachdev, S.B.; Verma, H.V. Evaluation of supplier development initiatives—A case study. J. Purch. Supply Manag. 2004, 10, 207–215. [Google Scholar]

- Leung, S.-O. A Comparison of Psycho-metric Properties and Normality in 4-, 5-, 6-, and 11-Point Likert Scales. J. Soc. Serv. Res. 2011, 37, 412–421. [Google Scholar] [CrossRef]

- Hohenberger, C.; Lee, C.; Coughlin, J.F. Acceptance of robo-advisors: Effects of financial experience, affective reactions, and self-enhancement motives. Financ. Plan. Rev. 2019, 34, 12–22. [Google Scholar] [CrossRef]

- Robb, C.A. The effect of perceived discrimination on financial well-being. J. Financ. Ther. 2012, 3, 50–63. [Google Scholar]

- David, D.B.; Sade, O. Robo-Advisor Adoption, Willingness to Pay, and Trust-An Experimental Investigation. 2018. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3361710 (accessed on 20 August 2022).

- Beketov, M.; Lehmann, K.; Wittke, M. Robo Advisors: Quantitative methods inside the robots. J. Asset Manag. 2018, 19, 363–370. [Google Scholar] [CrossRef]

- Lay, A.; Furnham, A. A New Money Attitudes Questionnaire. Eur. J. Psychol. Assess. 2018, 35, 1–10. [Google Scholar] [CrossRef]

- Financial Education Network (FEN). Malaysia National Strategy for Financial Literacy 2019–2023; Financial Education Network: Kuala Lumpur, Malaysia, 2019. [Google Scholar]

| Variables | Sources |

|---|---|

| Financial Knowledge (FK) | [45,63,64] |

| Perceived Usability (PU) | [15] |

| Perceived Trust (PT) | [49,65] |

| Willingness to Adopt (WA) | [66] |

| Frequency | Percent | ||

|---|---|---|---|

| Gender | Female | 42 | 48.8 |

| Male | 44 | 51.2 | |

| Total | 86 | 100.0 | |

| Education | High school | 19 | 22.1 |

| Bachelor degree | 44 | 51.2 | |

| Master degree | 12 | 14.0 | |

| Ph.D./Professional Certification | 11 | 12.8 | |

| Total | 86 | 100.0 | |

| Employment | Employed full-time | 53 | 61.6 |

| Employed part-time | 11 | 12.8 | |

| Self-employed | 13 | 15.1 | |

| Not employed | 9 | 10.5 | |

| Total | 86 | 100.0 | |

| Monthly Income | Below MYR 3000 | 6 | 7.0 |

| MYR 3000–MYR 5000 | 39 | 45.3 | |

| MYR 5001–MYR 10,000 | 25 | 29.1 | |

| MYR 10,001–MYR 15,000 | 14 | 16.3 | |

| Above 15,000 | 2 | 2.3 | |

| Total | 86 | 100.0 | |

| Prior Experience | No | 27 | 31.4 |

| Yes | 59 | 68.6 | |

| Total | 86 | 100.0 | |

| Mean | Std. Deviation | ||

|---|---|---|---|

| FK1 | I understood the concept of robo-advisors. | 3.91 | 0.777 |

| FK2 | I understood my financial goal when investing with robo-advisors. | 4.02 | 0.881 |

| FK3 | I understood my risk tolerance for investing with robo-advisors. | 3.94 | 0.886 |

| FK4 | I am able to keep close track of my money affairs using robo-advisors. | 3.58 | 0.913 |

| FK5 | I believe robo-advisors make investing easier. | 3.98 | 0.767 |

| OVERALL | 3.886 | 0.8448 | |

| PU1 | I would find robo-advisors useful in managing investments. | 3.84 | 0.824 |

| PU2 | I believe robo-advisors would improve my performance in managing investments. | 3.80 | 0.823 |

| PU3 | I believe robo-advisors would improve my productivity in managing investments. | 3.76 | 0.839 |

| PU4 | I believe robo-advisors would enhance my effectiveness in managing investments. | 3.77 | 0.850 |

| PU5 | The advice offered to me is relevant based on my risk tolerance and goals. | 3.92 | 0.770 |

| OVERALL | 3.818 | 0.8212 | |

| PT1 | I feel comfortable relying on the advice offered to me. | 3.64 | 0.944 |

| PT2 | The advice offered to me has nothing to gain by being dishonest with me. | 4.06 | 0.845 |

| PT3 | The advice offered to me has nothing but the client’s interest. | 4.06 | 0.845 |

| PT4 | I feel safer that there is an advisor that is making this financial decision with me. | 3.86 | 0.948 |

| PT5 | I believe robo-advisory services can be trusted. | 3.88 | 0.773 |

| OVERALL | 3.900 | 0.871 | |

| WA1 | I could imagine using a robo-advisor as a means of financial management. | 3.81 | 0.805 |

| WA2 | I am willing to invest with a robo-advisor. | 3.80 | 0.931 |

| WA3 | I could imagine using a robo-advisor instead of a human financial advisor. | 3.76 | 0.894 |

| WA4 | I am confident to use robo-advisor to reach my financial goal. | 3.64 | 0.932 |

| WA5 | I would recommend friends and family to try robo-advisors. | 3.77 | 0.863 |

| OVERALL | 3.756 | 0.885 | |

| FK | PU | PT | WA | |

|---|---|---|---|---|

| FK | 1 | 0.815 ** | 0.818 ** | 0.837 ** |

| PU | 0.815 ** | 1 | 0.848 ** | 0.894 ** |

| PT | 0.818 ** | 0.848 ** | 1 | 0.858 ** |

| WA | 0.837 ** | 0.894 ** | 0.858 ** | 1 |

| Variables | Standardised Coefficients | Statistical Significance Level |

|---|---|---|

| Financial Knowledge | 0.227 | 0.006 |

| Perceived Usability | 0.492 | 0.000 |

| Perceived Trust | 0.255 | 0.005 |

| F | 42.84 | 0.000 |

| R2 | 0.849 | |

| Adjusted R2 | 0.844 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yi, T.Z.; Rom, N.A.M.; Hassan, N.M.; Samsurijan, M.S.; Ebekozien, A. The Adoption of Robo-Advisory among Millennials in the 21st Century: Trust, Usability and Knowledge Perception. Sustainability 2023, 15, 6016. https://doi.org/10.3390/su15076016

Yi TZ, Rom NAM, Hassan NM, Samsurijan MS, Ebekozien A. The Adoption of Robo-Advisory among Millennials in the 21st Century: Trust, Usability and Knowledge Perception. Sustainability. 2023; 15(7):6016. https://doi.org/10.3390/su15076016

Chicago/Turabian StyleYi, Tan Zi, Noor Ashikin Mohd Rom, Nurbani Md. Hassan, Mohamad Shaharudin Samsurijan, and Andrew Ebekozien. 2023. "The Adoption of Robo-Advisory among Millennials in the 21st Century: Trust, Usability and Knowledge Perception" Sustainability 15, no. 7: 6016. https://doi.org/10.3390/su15076016

APA StyleYi, T. Z., Rom, N. A. M., Hassan, N. M., Samsurijan, M. S., & Ebekozien, A. (2023). The Adoption of Robo-Advisory among Millennials in the 21st Century: Trust, Usability and Knowledge Perception. Sustainability, 15(7), 6016. https://doi.org/10.3390/su15076016