1. Introduction

In an in-depth study of the supply chain, supply chain members of SMEs often face difficulties in financing. The main reason for this is that most SMEs are not transparent in their business activities, information data is difficult to obtain and the asset status of enterprises is difficult to grasp. For this reason, supply chain finance is gradually becoming an effective solution to the problem [

1,

2,

3,

4]. Through trade credit [

5,

6], factoring [

7,

8] and other financing tools [

9], financing services are provided to suppliers who lack capital to meet their production operations. In traditional supply chain finance, the credit and accounts receivable of core enterprises are used as backing to finance SMEs from financial institutions, but SMEs at the end of the supply chain are affected by credit transmission [

10,

11,

12]. Blockchain, a distributed ledger technology for digital transformation, has tamper-proofness, decentralization, smart contracts and consensus mechanisms, making it widely used in supply chain management [

13,

14,

15,

16]. For example, large retailer Walmart has established the VeChain platform through blockchain computing, which is jointly managed by Walmart China, Vickers, PricewaterhouseCoopers (PwC), Inner Mongolia Kerchin Cattle Company and the China Chain Store Association, overseeing the entire supply chain transportation and food supply process through blockchain, and covering 23 product lines and 100 different categories of products. Based on the case of Walmart, a large retailer, it is difficult to effectively transfer the credit of core enterprises in traditional supply chains to the end of the supply chain due to the varying lengths of the supply chains involved. Ref. [

14] study shows that blockchain can effectively transfer the credit of core enterprises to the end of the supply chain and help SMEs to finance; however, the cost threshold of introducing blockchain is not considered and [

1,

11] shows that order-to-factoring financing is effective in relieving the financing pressure of SMEs. However, little research has been conducted on the supply chain finance of order-to-factoring with blockchain technology.

With the continuous development of global economic integration process, “cooperation” has become the theme of today’s society [

17,

18]. Among them, the solution of the Shapley value of the cooperative game is a single-valued solution, which is applicable to the profit distribution of supply chain members. However, the analysis of the cooperative game for supply chain finance of order-to-factoring in the context of blockchain has not been studied by experts. In view of the above analysis, this paper considers the retailer as the core firm, financially constrained SMEs as super suppliers, and the retailer providing cross-level guarantees to its suppliers in the practical context of the retailer Walmart providing guarantees to its suppliers. The Stackelberg primary-secondary game approach [

1,

19,

20,

21,

22] is used to study the optimal pricing strategy and revenue allocation mechanism of a three-tier supply chain finance consisting of suppliers, manufacturers and retailers, with a view to provide theoretical support for the coordinated and stable development of supply chain finance. Firstly, decentralized game models of supply chain finance without and with blockchain technology, as well as partial insider alliances and grand alliance game models with all insider participation under blockchain technology, are constructed, respectively; secondly, the Shapley value of the cooperative game is used to further investigate the coordination mechanism of revenue allocation in blockchain supply chain finance. The main research questions are as follows.

(1) What is the cost threshold for supply chain members to introduce blockchain, and the impact of introducing blockchain on the decision making of supply chain members?

(2) Can the cooperative game generate revenue for supply chain members and can the Pareto optimization be achieved by using Shapley values for revenue allocation?

Therefore, the academic contributions of this paper are as follows: (1) the adoption of an order-to-factor financing instrument in which the retailer directly provides a cross-grade guarantee to the supplier not only reflects the fact that the supplier can effectively use the retailer’s credit rating for financing and reduce financing costs, but also develops an effective mechanism for cooperation between the retailer and the supplier; (2) the mechanism of blockchain technology’s influence on wholesale price, retail price and order quantity in three-level SCF is explored, and the coordination mechanism of profit distribution among SCF members is studied by the cooperative game method, which provides a theoretical basis for the application of blockchain technology in SCF. This paper provides a coordination mechanism for the cooperation of blockchain SCF members from the perspective of profit allocation, which is conducive to the adoption of blockchain technology in SCF, promoting the development of cross-level guarantee business and solving the financing problem of SMEs.

The rest of this paper is organized as follows:

Section 2 is a review of the literature related to this paper, expressing the differences between this paper and the existing literature.

Section 3 is a description of the model process involved in this paper and the assumptions on which the paper is based,

Section 4 develops a non-cooperative game model without the introduction of blockchain to derive the optimal decisions of supply chain members,

Section 5 investigates the non-cooperative and cooperative game models for the introduction of blockchain by supply chain finance members and investigates the profit allocation coordination mechanism using Shapley’s values.

Section 6 compares and analyses the optimal decisions in

Section 4 and

Section 5 to derive the cost thresholds for introducing blockchain and the impact on decisions before and after the introduction of blockchain.

Section 7 conducts a numerical analysis to verify the conclusions drawn in this paper,

Section 8 discusses the conclusions of this paper and validates them with the existing research literature to show the reasonableness of the results, and

Section 9 summarizes the conclusions, limitations and future research directions of this paper.

2. Literature Review

The literature related to the study of this paper includes factoring finance in SCF, blockchain supply chain and blockchain SCF. The following literature review will be conducted from these three aspects.

Factoring financing is one of the main financing modes of SCF. Factor is the capital provider in the whole process of supply chain factoring, and it applies efficient financial services to bring benefits to SMEs in need of capital by reviewing the credit status of upstream and downstream enterprises and core enterprises, and granting credit to them [

23,

24,

25]. Factoring is more suitable for SME financing in SCF, and upstream SMEs are provided with credit guarantees by downstream core enterprises for reverse factoring. Chen and Yu found that reverse factoring can increase the overall supply chain revenue [

7]. Wu et al. showed that reverse factoring can result in greater benefits for suppliers and retailers than bank payments [

8]. Kouvelis and Xu analyzed a supply chain game model based on forward and reverse factoring and concluded that a rational design of factoring can increase retailers’ profits and that retailers are biased towards reverse factoring [

10]. Yan et al. developed a two-level Stackelberg game model to investigate the equilibrium strategies of each member when an upstream supplier provides credit guarantees to the retailer to obtain financing from bank [

5]. Yu and Ma showed that the order-to-factoring model for secondary supply chains improves the overall supply chain performance in the context of the order-to-factoring financing scheme introduced by Walmart and ICBC [

11].

Blockchain is a distributed ledger technology, and the blockchain technology is widely used in supply chain management [

26]. Scholars have studied the supply chain management based on blockchain technology [

27,

28,

29,

30,

31], including the cost [

32], robustness [

33] and risk [

9,

34,

35] of blockchain technology and individual preference under the cost uncertainty of supply chain members. Choi studied fashion apparel supply chain financing and established a bargaining game model to analyze the blockchain implementation conditions and the optimal decision of supply chain participants in terms of both profit and risk [

15]. Choi and Luo developed the Stackelberg game model for environmental sustainability, analyzed the sufficient conditions for blockchain to improve social welfare and compared the robustness of equilibrium results under decentralized versus centralized decision making [

22]. Choi et al. explored the application of the blockchain technology in an information disclosure of leasing service-based supply chains, and gave the optimal information disclosure strategy for firms and its conditions [

27]. Fan et al. studied the optimal pricing strategy for a three-level supply chain with and without blockchain adoption, and discussed the conditions for the supply chain adoption of blockchain technology and supply chain coordination [

28]. Pun et al. studied the market conditions for manufacturers to adopt blockchain technology to combat counterfeit products, analyzed the implementation of blockchain technology for the case of customer privacy fears, and analyzed the incentive effect of government subsidies on manufacturers’ adoption of blockchain technology [

13]. All of these research studies use the Stackelberg game approach to study the supply chain pricing problem.

Blockchain technology facilitates the development of SCF [

2,

12,

16,

36,

37,

38]. Li et al. outlined the role of blockchain in SCF: blockchain technology can transmit the credit of core companies to the end of the supply chain, smart contracts can guarantee the execution of contracts, blockchain can provide data security and digital assets can track the flow of assets [

4]. Chod et al. further argued that blockchain technology can enhance the authenticity and transparency of information verification of inventory, logistics and capital flow in the supply chain, sending signals to investors about the company’s operational capabilities, which in turn helps high-quality enterprises to obtain financing concessions at a lower signal cost [

39]. Du et al. constructed a new SCF platform using the blockchain technology to manage the whole process, which solved the distrust problem among supply chain participants and improved the efficiency of capital flow and information flow [

2]. Deng and Li considered a game analysis of the secondary supply chain factoring financing process based on blockchain technology [

40]. Liu et al. studied a three-level supply chain consisting of a capital-sufficient producer, a capital-constrained distributor, and a capital-constrained retailer, and obtained the optimal wholesale price, distribution price and order quantity of supply chain members using the Stackelberg game approach [

14]. In summary, the studies on blockchain SCF have mainly focused on secondary SCF, and there is a lack of research on tertiary SCF with blockchain technology, and the studies mainly use the Stackelberg game model to analyze the optimal wholesale price, retail price and members’ revenue. However, blockchain technology provides a guarantee for the cooperation of SCF members and improves the total supply chain revenue.

In summary, the studies on blockchain SCF have mainly focused on secondary SCF, and there is a lack of research on tertiary SCF with blockchain technology, and the studies mainly use the Stackelberg game model to analyze the optimal wholesale price, retail price and members’ revenue. However, blockchain technology provides a guarantee for the cooperation of SCF members and improves the total supply chain revenue. Therefore, profit sharing after the cooperation of supply chain members is a key issue for the stable development of SCF. At present, there is no research on the profit-sharing mechanism of SCF members’ cooperation under blockchain technology. The conventional SCF coordination mechanism mainly studies the secondary supply chain with a revenue-sharing model. For example, Cao and Yu constructed a supply chain revenue-sharing model consisting of manufacturers and capital-constrained retailers and found that capital-constrained retailers could earn more profits than capital-rich retailers [

6]. Tan and Yang analyzed the different financing options faced by retailers under credit constraints and the optimal order lot size and revenue-sharing mechanism when achieving supply chain coordination under different options [

19].

However, for the coordination problem of three-level SCF, the increase in supply chain members increases the revenue-sharing coefficient, which makes it difficult to determine the optimal sharing coefficient. Therefore, the existing revenue-sharing model of the second-level supply chain is no longer applicable, and a new revenue-sharing mechanism needs to be proposed. Zhou et al. argued that blockchain technology makes it a cooperative game among power suppliers, and the Shapley value of the cooperative game is used to analyze the revenue-sharing problem of the power supplier [

17]. Meanwhile, some scholars have also used the cooperative game approach to study the supply chain revenue allocation problem [

20,

21,

37,

41,

42].

Based on the above investigation, blockchain technology, tertiary SCF, cooperative gaming and the Shapely value profit distribution have not been studied. In order to fill the gap, we study the Shapley value cooperative game research on three-level SCF under blockchain according to

Table 1. In this paper, firstly, we develop a cooperative game model for SCF based on blockchain, which analyzes the cost threshold for introducing blockchain, and investigates the impact of blockchain costs on the wholesale price, retail price and revenue of supply chain members from a quantitative perspective. Further, the cooperative game of Shapley value is used to reasonably allocate the revenue of supply chain member alliances under blockchain.

3. Model Description and Assumptions

A three-level supply chain consisting of a supplier, a manufacturer and a retailer is considered, where the supplier is a SME subject to financial constraints, the manufacturer produces the product, and the retailer is the core business that sells the product. The basic assumptions in this paper are as follows.

- (1)

Assume that the market stochastic demand function is , where the random number denotes the number of potential consumers in the market, and the consumer valuation of the product is the random variable , which is the probability density function of , and follows a [0–1] uniform distribution. As society progresses, consumers are increasingly concerned about the comprehensiveness of product information and the authenticity of the information, thus, is the extent of the retailer’s efforts in collecting product information, while () is the degree of consumer trust in the authenticity of the product information provided by the retailer; the larger it is the higher the level of trust. Consumer demand for a product is proportional to and , and inversely proportional to . When the price of the product is lower and the information of the product is more real and comprehensive, the sales volume of the product is higher. In this paper, we use superscript and to denote the supply chain finance model without blockchain and the supply chain finance model with blockchain, respectively. Under the supply chain finance model without blockchain, consumers have doubts about the authenticity of product information, i.e., , so the stochastic demand function ; under the adoption of blockchain technology, consumers have higher trust in the authenticity of product information, i.e., , then ;

- (2)

The initial capital of the supplier is 0;

- (3)

The supplier’s proceeds are sufficient to pay the principal and interest of the bank loan and the factoring fee;

- (4)

There is no risk of default and no bankruptcy of the financing member;

- (5)

The order quantity is assumed to be equal to the market demand;

- (6)

Considering the complexity of the model and for better comparative analysis, it is assumed that the ordering information among the supplier, manufacturer, retailer and bank is completely symmetric.

The symbolic descriptions in the text are shown in

Table 2.

For comparative analysis, the decentralized decision models of supply chains without and with blockchain technology are constructed below to compare the optimal wholesale price, retail price and revenue of supply chains under the two models, as well as the profit distribution mechanism of supply chain members after adopting blockchain technology.

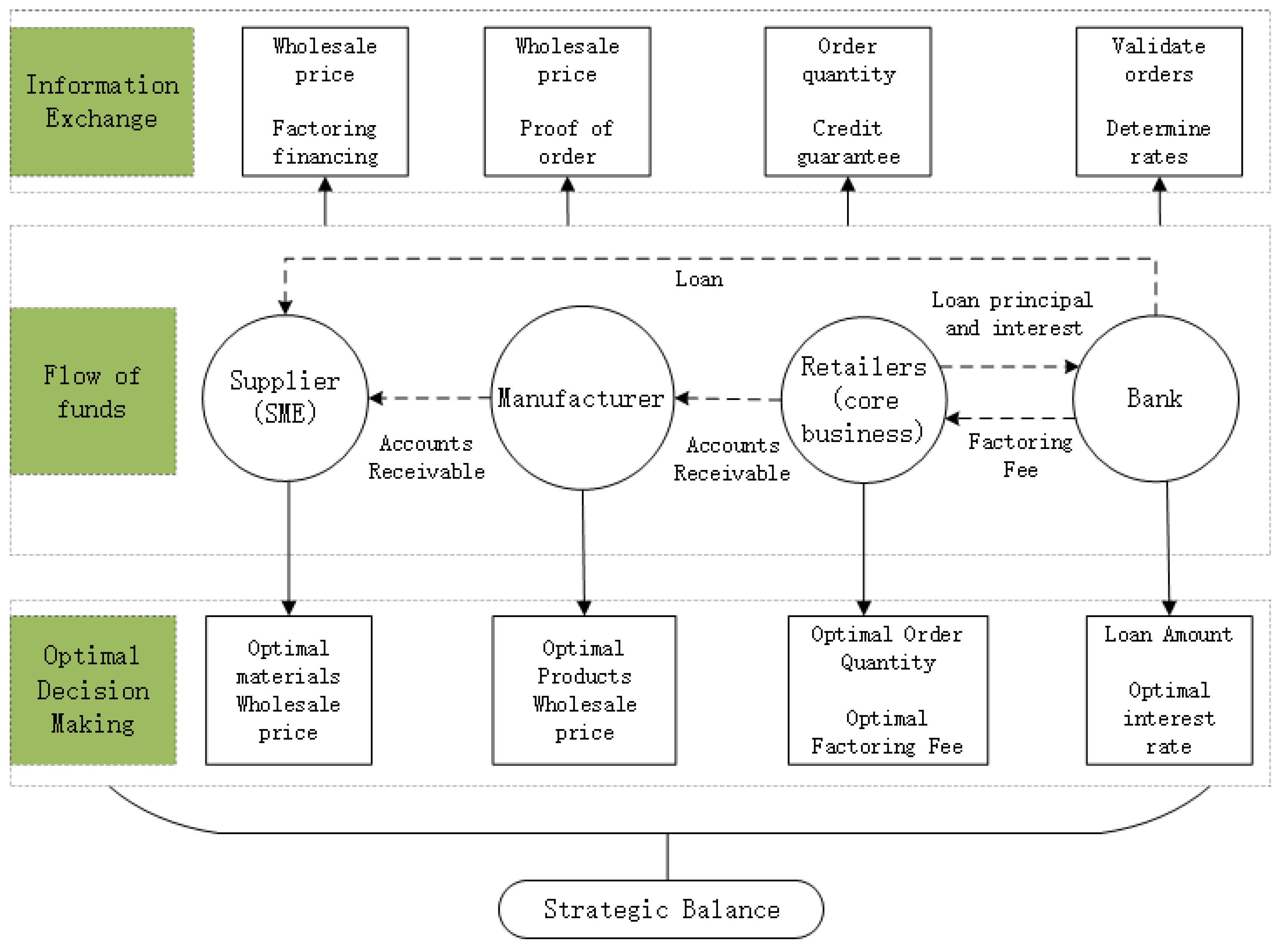

4. Decentralized Game Model for SCF without Blockchain Technology

In the decentralized decision making of the supply chain without blockchain technology, the two-level Stackelberg game process with the supplier as the dominant player and the manufacturer and the retailer as the followers is described as follows, as model

N. In the supply chain without blockchain, since the credit rating of the retailer cannot be effectively transmitted to the supplier, the supplier needs not only the guarantee of the retailer to obtain bank loans, but also the manufacturer’s orders of support, thus incurring the cost of information verification. Without loss of generality, assume that the supplier (

), manufacturer (

) and retailer (

) each have a cost of

for information validation based on the market demand function

, where

is the unit validation cost. First, the supplier determines the wholesale price

of raw materials based on the production cost

. Second, the manufacturer determines the wholesale price

of the product based on the wholesale price

of raw materials and the cost

of the product, and charges the order validation cost

. Finally, the retailer determines the retail price

of the product and the order quantity

based on the wholesale price

, and provides a loan guarantee to the supplier based on the product order information provided by the manufacturer, with a factoring rate

of return and a factoring fee

. The supplier obtains the order and applies for a loan from the bank at an interest rate of

. The retailer sells the product, recovers the funds, repays the loan principal and interest to the bank, and the bank passes the factoring fee to the retailer. This process is shown in

Figure 1.

Based on the above description and model assumptions, the revenue function of supply chain members without blockchain technology are as follows.

Supplier payoff functions

Manufacturer payoff function

Substituting the expected demand function as

into Equations (1)–(3), the expected revenue functions of the supplier, manufacturer and retailer can be derived as:

According to the inverse solution method of the Stackelberg game, the optimal solution of the model can be obtained.

The optimal expected returns for the supplier, manufacturer and retailer without blockchain technology can be obtained as follows.

The optimal expected total revenue of the supply chain system can be obtained by adding up the optimal expected total revenue of the three members of the supply chain as

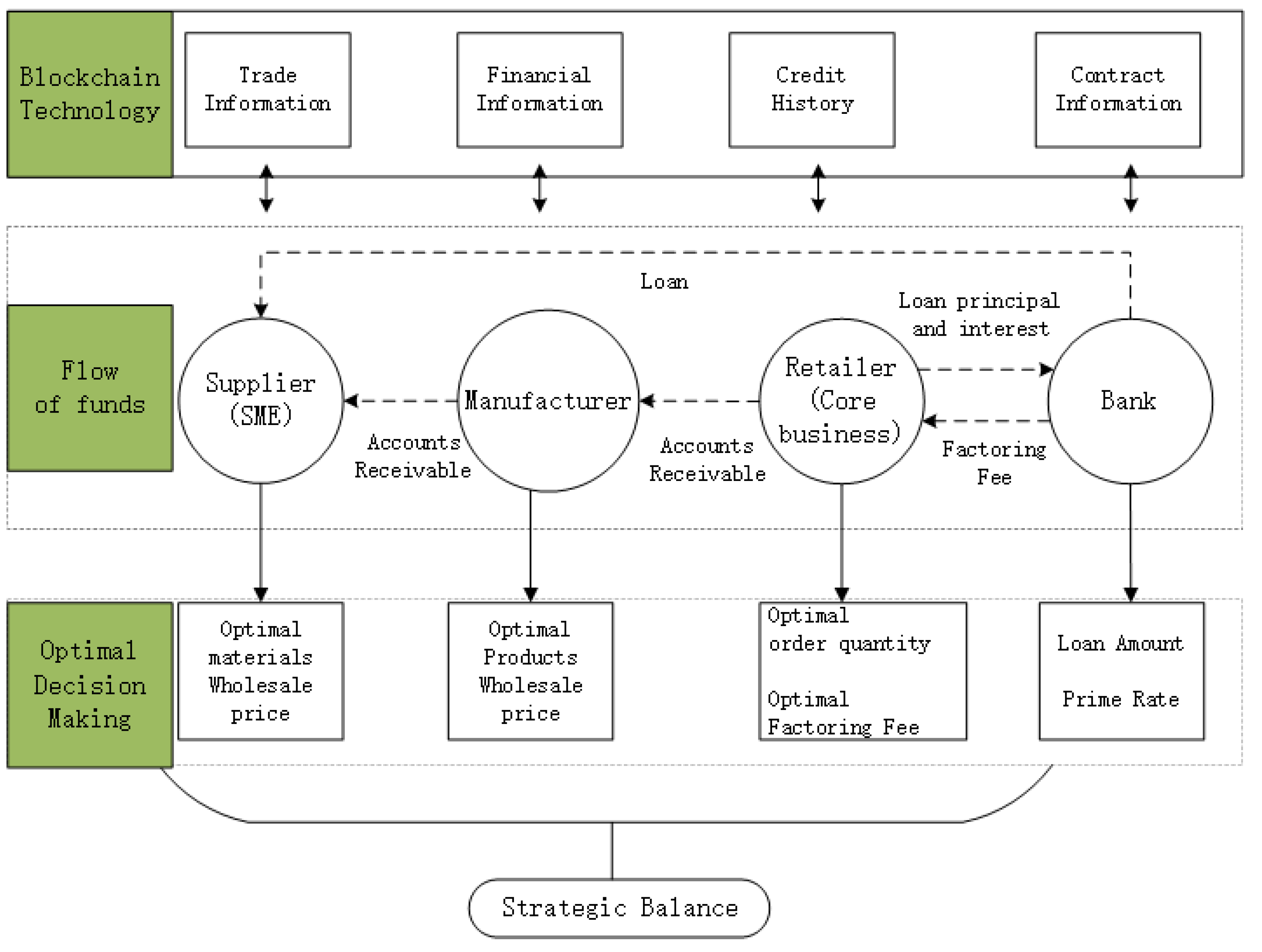

5. Cooperative Game Model Using Blockchain Technology

Blockchain has the features of decentralization, openness and transparency, and cannot be tampered with at will, which makes the supply chain members get information in a more timely, convenient and accurate manner, and each transaction is recorded through blockchain, and the information on the chain can only be added and found, but cannot be deleted or modified. Therefore, blockchain technology effectively improves the trust among supply chain members and forms effective cooperation. Retailers can obtain their order status directly on the blockchain without the need for manufacturers to provide proof of orders, thus realizing cross-level guarantees, reducing suppliers’ financing costs and improving financing efficiency. When the supplier submits loan applications to banks, banks improve the efficiency of reviewing and issuing loans based on the suppliers’ own credit records, transaction records and credit ratings transmitted by retailers. The process of SCF under the adoption of blockchain technology is shown in

Figure 2.

By applying blockchain technology to the supply chain, the retailer’s credit can be effectively transferred to the supplier at the end of the supply chain, as the retailer does not need the manufacturer to provide proof of order for the supplier, and can obtain the order information directly from the blockchain to provide a guarantee for the supplier, with a guarantee return rate of , and the supplier factoring investment cost of . At the same time, supply chain members can access and verify information from all parties on the blockchain, saving the cost of information review . However, the adoption of blockchain technology requires consideration of its investment cost, which is an important factor influencing members’ decisions, assuming that the unit input cost of blockchain technology is . Blockchain technology is beneficial to cooperation among supply chain members, so that different member federations can be formed, and the following is to find the benefits of each federated supply chain member separately.

5.1. Supply Chain Decentralized Game Model

In the decentralized game model, the members of the supply chain all make decisions with the objective of maximizing their own interests. Based on the model description and basic assumptions, the revenue functions of the supplier, manufacturer and retailer under the adoption of blockchain technology are given as:

Again, using the inverse solution method, the expected demand function is substituted into Equations (11)–(13), and the expected revenue functions of supplier, manufacturer and retailer are given as:

The specific solution process is similar to that in

Section 3 and will not be repeated here. The optimal wholesale price of the supplier’s raw material, the optimal wholesale price of the manufacturer’s product, the optimal retail price of the retailer’s product and the order quantity are calculated as:

Substituting the above Equations (17)–(19) into Equations (14)–(16), the optimal expected revenue of the supplier, manufacturer and retailer, and the total expected revenue of the supply chain for decentralized decision making under blockchain technology, are as follows:

5.2. Supply Chain Alliance Game Model

Under blockchain technology, a supply chain alliance means that some or all members of the supply chain reach cooperation, and the members of the alliance do not make decisions with the goal of maximizing their own interests, but make optimal decisions with the goal of maximizing the benefits of the alliance. The partners will write the binding terms into the smart contract, and the cooperation is bound and automatically executed through the smart contract. In the following financing, trading and profit distribution process, the cooperative members will follow the regulations of the smart contract, which effectively ensures the capital flow of the cooperative partners in the supply chain and reduces the risk of the cooperative partners executing the contract. In this model, firstly, the supplier and the manufacturer are considered to form an alliance; secondly, the manufacturer and retailer are considered to form an alliance, and suppliers and retailers are not considered to reach an alliance due to cross-level alliances and the lack of manufacturers for product packaging; and finally, all members of the SCF are considered to cooperate in a grand alliance.

5.2.1. Supplier and Manufacturer Alliance Game Model

When a supplier and a manufacturer reach an alliance, the alliance is at the leading level of the supply chain and the retailer is at the following level of the supply chain; the alliance between the supplier and the manufacturer and the retailer constitutes a Stackelberg game.

The payoff function of the supplier-manufacturer alliance:

The revenue function of the retailer:

Further, by substituting the expected demand function into Equations (21) and (22), the expected revenue functions of the supplier and manufacturer alliance, and retailer, respectively, are:

Using the inverse solution method, the optimal wholesale price of the alliance, the optimal retail price of the retailer and the optimal demand are obtained as:

Thus, the optimal expected revenue of the supplier and manufacturer alliance, the retailer and the supply chain, respectively, can be obtained as:

5.2.2. Manufacturer-Retailer Alliance Game Model

Similarly, when a manufacturer and a retailer form an alliance, the alliance is at the following level of the supply chain and the supplier is at the leading level of the supply chain; the alliance between the supplier, the manufacturer and the retailer constitute the Stackelberg game.

The supplier’s revenue function is:

The payoff function of the manufacturer-retailer alliance is:

Further, by

putting into Equations (28) and (29), the expected payoff functions of the supplier, manufacturer–retailer coalition, respectively, are:

Using the inverse solution method, the detailed solution process is similar to

Section 5.2.1 and will not be repeated. According to the computation, we can obtain:

Substituting Equations (32)–(34) into Equations (30) and (31), the optimal revenue function of supplier, manufacturer and retailer alliance and supply chain are obtained as:

5.2.3. Supplier, Manufacturer and Retailer Alliance Game Model

Considering the supplier, manufacturer and retailer as a whole, the collective decision with the objective of maximizing the overall revenue of the supply chain forms a grand coalition game with the revenue function:

Substituting

into Equation (35), the expected revenue function of the grand coalition can be obtained as:

Using the inverse solution method, the first-order partial derivative and the second-order partial derivative of Equation (36) with respect are:

Therefore, the expected return function of the grand coalition

is a concave function and there exists an optimal solution. According to the first-order optimality condition, let

, the optimal retail price and demand of the retailer can be obtained as:

Substituting Equation (37) into Equation (36), the optimal total revenue of the supply chain is obtained as:

5.2.4. Benefit Distribution Mechanism

After the alliance between the supplier, manufacturer and retailer is formed, how do we allocate the revenue so that the supply chain members are willing to cooperate? A fair and reasonable revenue distribution mechanism is the guarantee for supply chain members to be willing to cooperate. In fact, the revenue distribution of supply chain members’ cooperation based on blockchain technology is a kind of cooperative game problem. In this section, the Shapley value method of a cooperative game is used to analyze the revenue distribution mechanism of supply chain members.

Suppose

denote a cooperative game, where

denotes the set of insiders consisting of the supplier, manufacturer and retailer. The coalition

is

,

,

,

,

,

and

.

denotes an eigenfunction defined on

and satisfying

. Let

, the eigenvalues of different coalitions as shown in

Table 3, where the supplier and retailer cannot form a coalition, i.e., it is zero [

28].

The revenue-sharing mechanism must ensure that the revenue of each member is not lower than its individual contribution. Shapley value is an important single-valued solution to the cooperative game, which solves the allocation problem among the supply chain members based on the contributions of the participating members. When the characteristic function satisfies super additivity, the Shapley value is a better allocation that satisfies individual rationality and collective effectiveness. We can prove that the eigenfunctions in

Table 3 satisfy super-additivity.

Proposition 1. The characteristic function satisfies super additivity.

Proof. From

Table 3, we know that

,

, so

. Similarly, from

,

, it is known that

, and because

,

, then we have

. The proof is over. ◻

According to the literature [

43], the Shapley value is calculated as follows:

where

,

is the number of participants in the subset

,

is the weighting factor, and

,

is the number of all coalitions in the set

in which the player

participates,

denotes the alliance

divided by the gain of the participant

, and

is the value of the change in the alliance

gain before and after the participant’s participation

, the marginal contribution value. From the above formula of the Shapley value and

Table 3, the Shapley value of the supplier is derived, as shown in

Table 4.

Summing the last row in

Table 4 gives the value of the supplier’s profit distribution as:

Similarly, the value of profit sharing for manufacturer and retailer can be obtained as:

From the Shapley value, the vector of allocation coefficients of the supplier, the manufacturer and the retailer regarding the total supply chain revenue can be obtained as .

Proposition 2. The Shapley value of the supply chain satisfies individual rationality and collective validity, i.e., , , , and .

Proof. According to , , it is known that . Similarly, from , , we can obtain , and according to , , it is known that . In summary, it can be proved that individual rationality holds.

Since , and , it follows that , the collective validity holds. ◻

The Shapley value distribution is more conducive to the collaborative development of supply chain members and the win-win situation of the enterprise, which not only improves the profit of supply chain members but also contributes to the sustainable and healthy development of SCF. The profit distribution coordination mechanism can be written into the smart contract to provide a certain theoretical basis and methods for SCF managers to solve the profit distribution of supply chain members after the introduction of blockchain technology.

6. Model Comparison and Analysis

Based on the above various types of game models, this section firstly analyzes the benefits of adopting blockchain technology when the supply chain members are not aligned with the conditions for adopting blockchain, and then further analyzes the relationship between the retail price, order quantity and total supply chain benefits of the supply chain under different alliance scenarios when blockchain technology is adopted. The proof of these propositions are shown in

Appendix A.

Proposition 3. If the supply chain members are not aligned, when , the benefits of the supply chain members that adopt blockchain technology are greater than the benefits of the supply chain members that do not adopt blockchain technology, i.e., , , and hold.

The blockchain technology cost is an important influencing factor for supply chain members to decide whether to adopt the technology or not, by analyzing the impact of blockchain technology cost on the revenue of the supplier, manufacturer and retailer. When , the benefits of each supply chain member that adopts blockchain technology outperform the benefits of supply chain members that do not adopt blockchain technology. This indicates that the greater cost of investing in blockchain affects the returns of supply chain members and is detrimental to supply chain development.

Proposition 4. If the supply chain members are not aligned, when , the order quantity of the supply chain with and without blockchain technology satisfies .

Proposition 4 showed that under certain conditions, the order quantity of the retailer with blockchain technology is higher than that without blockchain technology, which can increase the order quantity of products and improve the supply chain efficiency.

Proposition 5. If supply chain members are not aligned, when , the retail price of SCF with and without blockchain technology satisfies .

Proposition 5 showed that the retail price with blockchain technology is higher than the retail price without blockchain technology when the cost of adopting blockchain is greater than the cost of reviewing information without adopting blockchain, in the case of non-union of supply chain members. Therefore, as the cost of blockchain increases, the retail price increases.

Proposition 6. When , the retail price and order quantity of supply chain members with blockchain technology under different alliances satisfy , .

From Proposition 6, it is cleared that the larger the alliance formed by supply chain members using blockchain technology, the lower the retail price and the higher the order quantity for retailers. The lower the retail price, the more beneficial to consumers, and the higher the order quantity of the supply chain, indicating that the utilization of the supply chain is higher and more conducive to the development of SCF.

Proposition 7. The total revenue of the supply chain using blockchain technology satisfies .

From Proposition 7, it is clear that the greater the degree of insider alliance under the adoption of blockchain technology, the more the supply chain members make decisions with the goal of maximizing the system revenue, thus making the supply chain system more profitable and conducive to the better development of the supply chain system.

Proposition 8. When , the effect of the retailer’s information gathering effort on order quantity and retail price is as follows.

- (1)

; .

- (2)

; .

Proposition 8 showed that (1) with or without blockchain technology, the order quantity and retail price of the retailer increase as the retailer’s effort in information collection increases, and the order quantity and retail price of the retailer increases faster with the adoption of the blockchain technology. (2) Comparing the effects of retailers’ information collection efforts on order quantity and retail price of different alliances with blockchain technology, it can be concluded that the order quantity and retail price of the retailer increase with the increase in retailers’ information collection efforts regardless of the alliance method; the larger the alliance, the more the effect of retailers’ information collection efforts has on order quantity as it gradually increases and the effect on retail price gradually. The larger the alliance, the greater the impact of the retailer’s information gathering effort on order quantity and the decreasing impact on retail price.

7. Numerical Analysis

Based on the theoretical analysis, numerical calculations were carried out by MATLAB software to verify the impact of retailer information collection efforts on blockchain costs and total supply chain revenue, as well as the impact of blockchain technology on retail prices and order quantities, respectively. The specific parameters are assigned as shown in

Table 5 [

1,

14,

15].

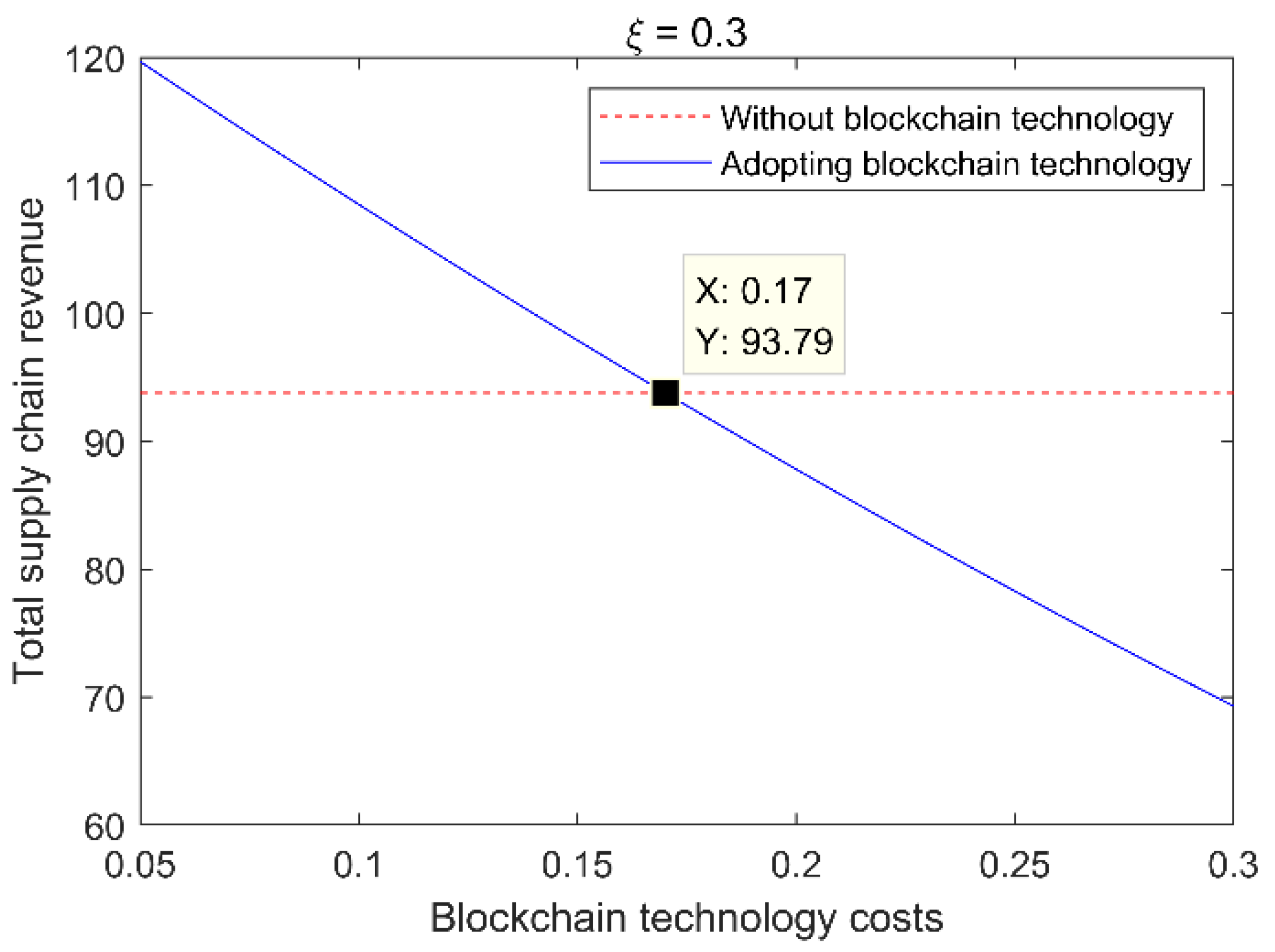

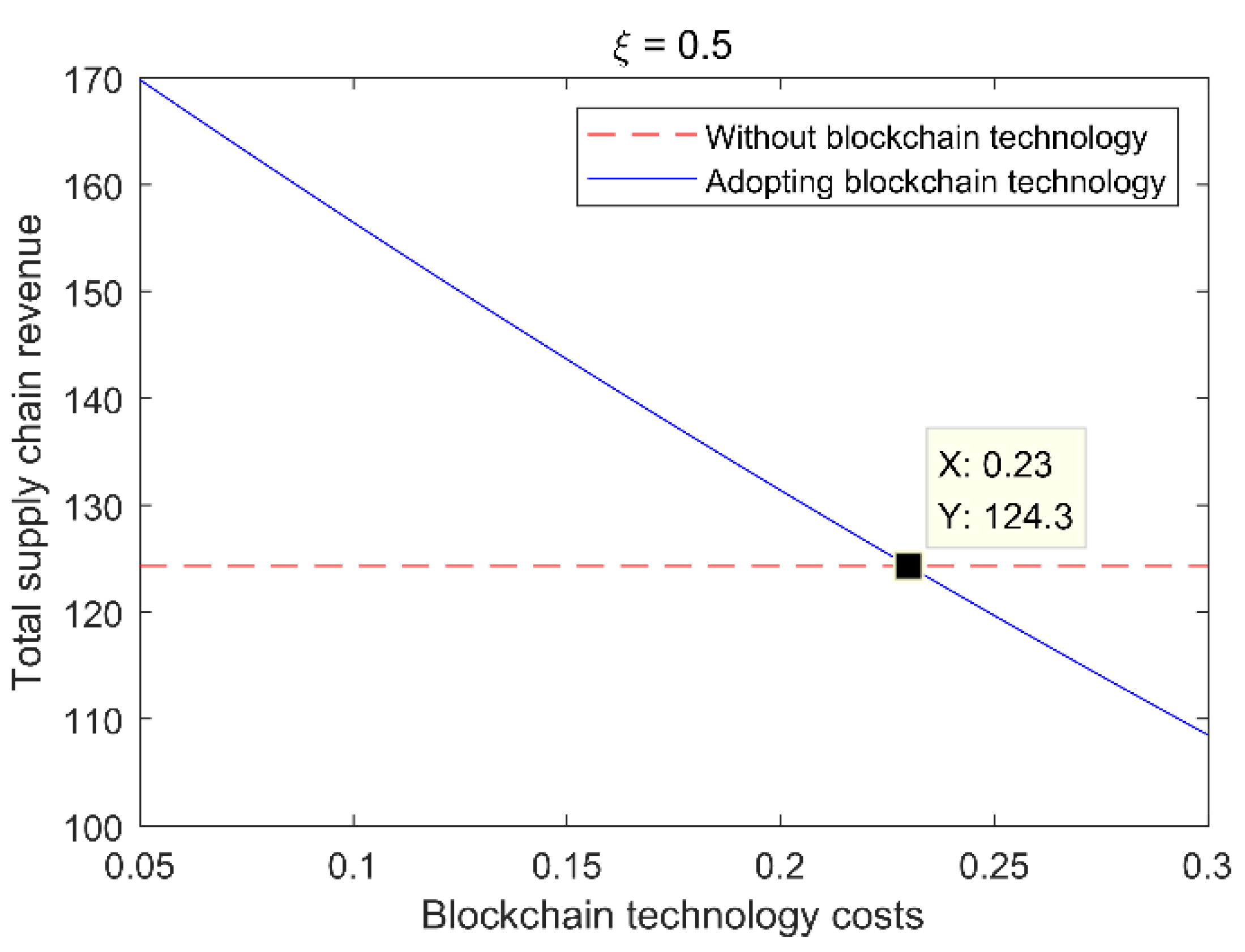

7.1. Impact of Retailer Information Collection Effort on Blockchain Cost

First of all, the relationship between the adoption of blockchain technology and the retailer’s effort to collect information is verified.

Figure 3 and

Figure 4 are based on Proposition 3. From

Figure 3, we know that if the supply chain members are not federated when the retailer’s effort to collect information

and in the case where the cost of blockchain satisfies

, the total revenue of the supply chain with blockchain technology is higher than the total revenue of the supply chain without blockchain technology. When

, the total benefit of the supply chain without blockchain technology is higher than the total benefit of the supply chain system with blockchain technology. The supply chain members consider their own interests and will refuse to adopt blockchain technology. It means that when the blockchain cost meets certain conditions, the adoption of blockchain technology can improve the benefits of the supply chain members.

is called the blockchain cost threshold for the adoption of blockchain technology. From

Figure 4, it can be seen that the total benefit of the supply chain adopting blockchain technology is higher than the total benefit of the supply chain without blockchain technology if

when the cost of blockchain satisfies

.

In addition,

other values are taken as shown in

Table 6. From

Table 6, it can be concluded that the greater the retailer’s effort in product information collection, the greater the blockchain cost threshold.

7.2. Impact of Blockchain Cost on Retail Price, Order Quantity and Total Supply Chain Revenue

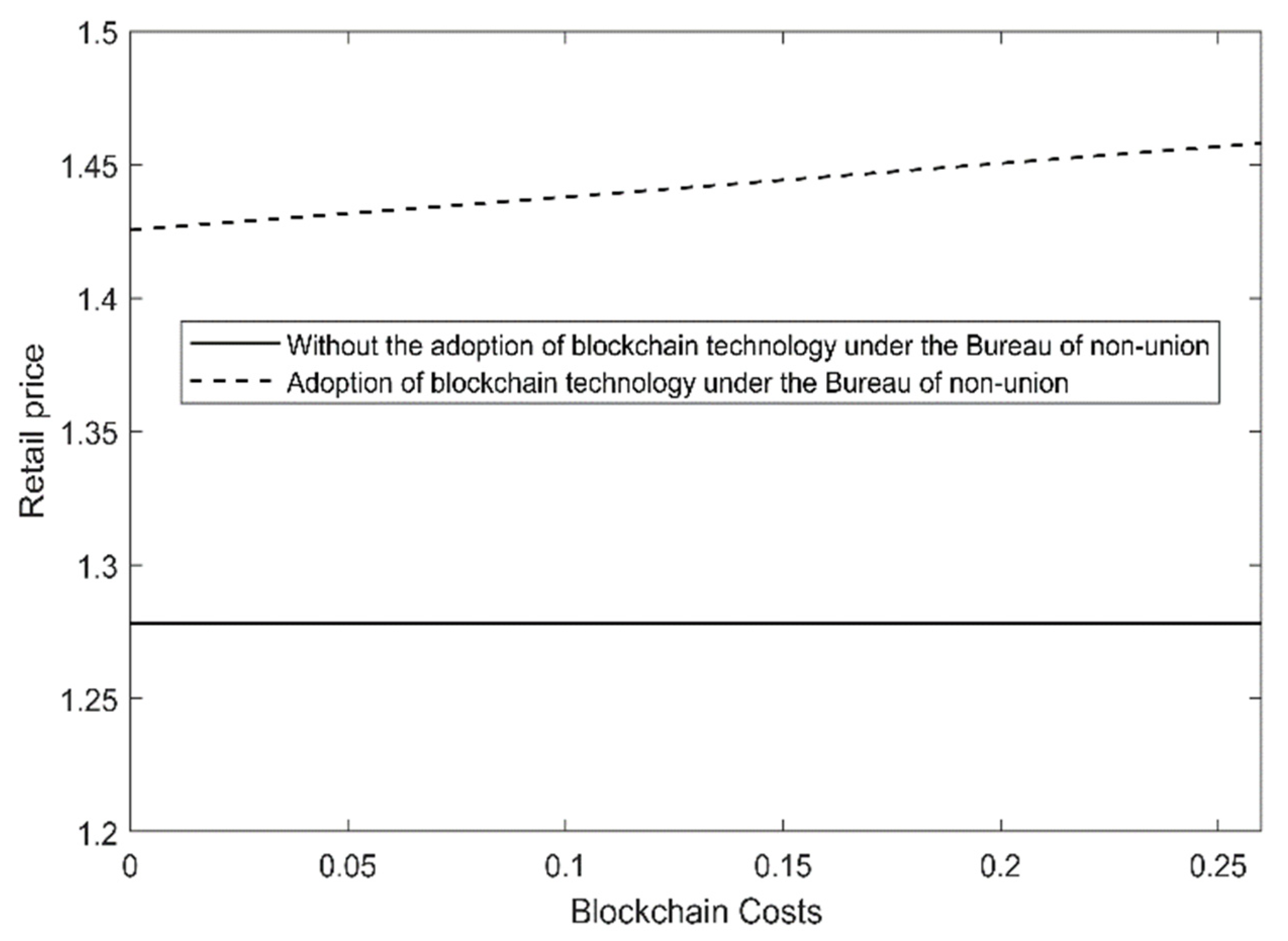

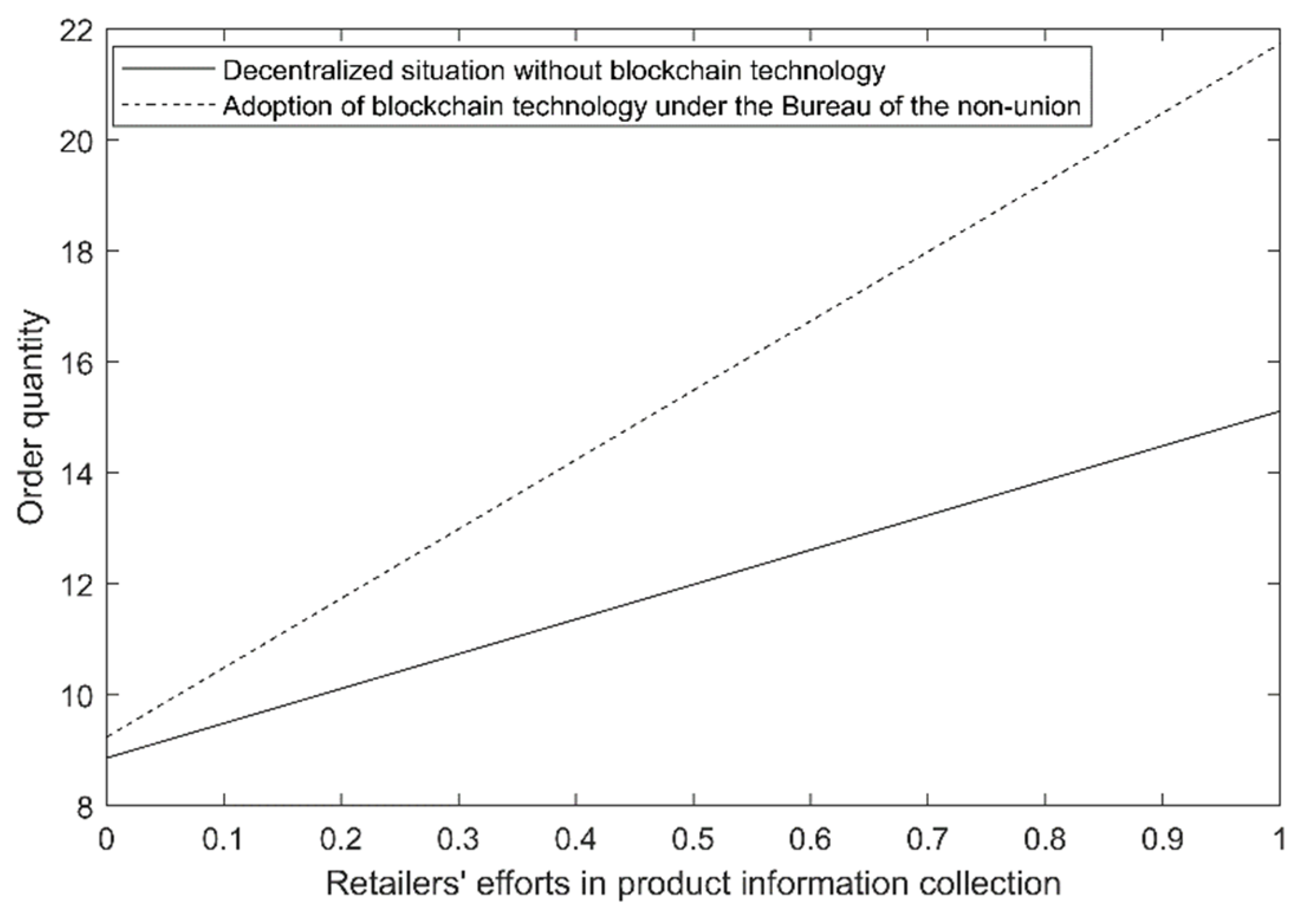

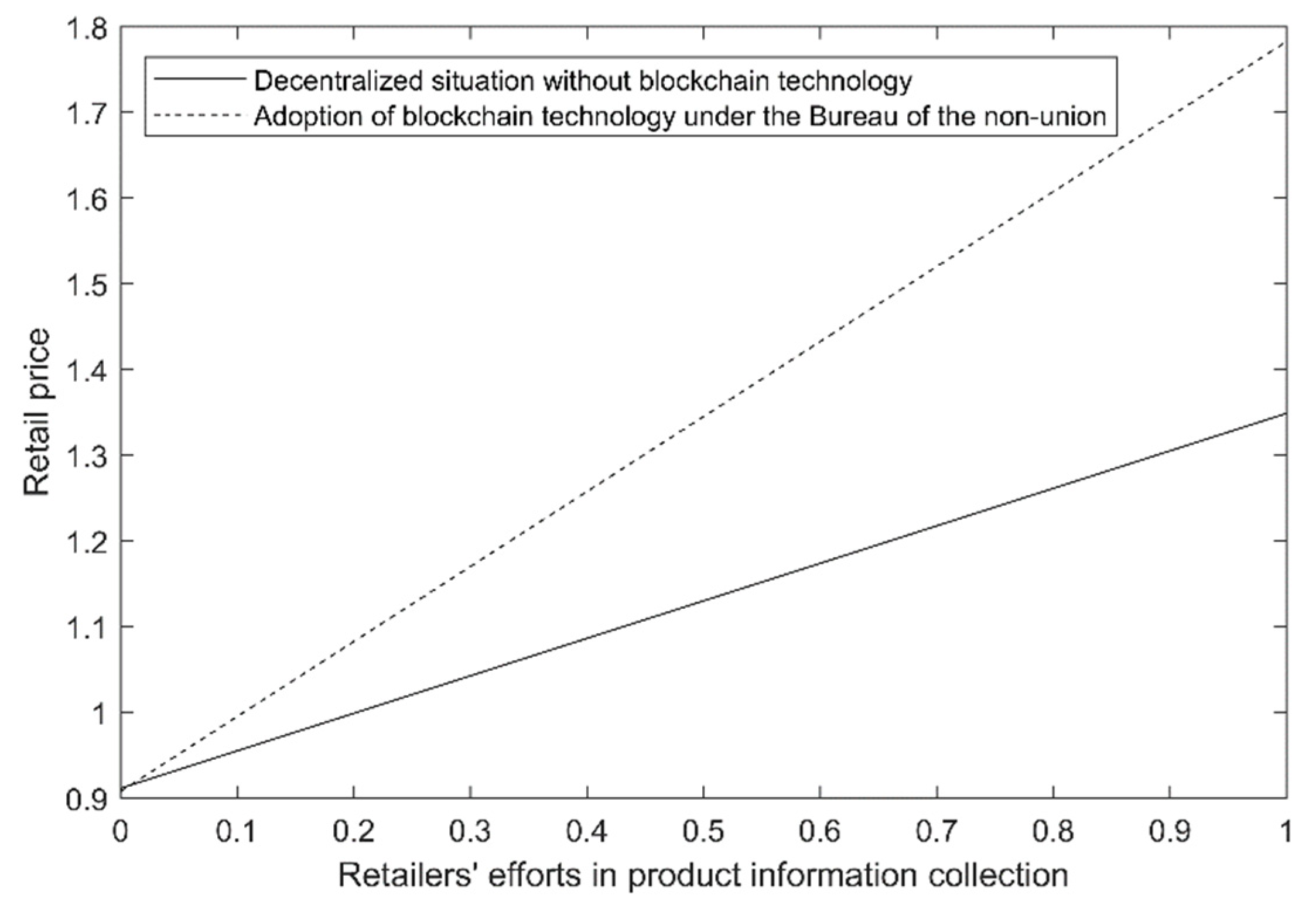

This subsection verifies the relationship between retail price and order quantity of retailers without blockchain technology and with decentralized decision making using blockchain technology. Based on Propositions 4 and 5,

Figure 5 and

Figure 6 can be plotted.

As shown in

Figure 5 and

Figure 6, the retail price and order quantity of supply chain members are higher with blockchain technology than without blockchain technology. Although the adoption of blockchain technology increases the retail price of the retailer, the consumer can get more and more realistic product information, which makes the consumer’s rights and interests more protected and thus increases the order quantity. Considering the overall development of the supply chain, the adoption of blockchain technology increases the order quantity of the supply chain, which will be beneficial to the sustainable and healthy development of the supply chain. That is, the conclusions of Propositions 4 and 5 are verified.

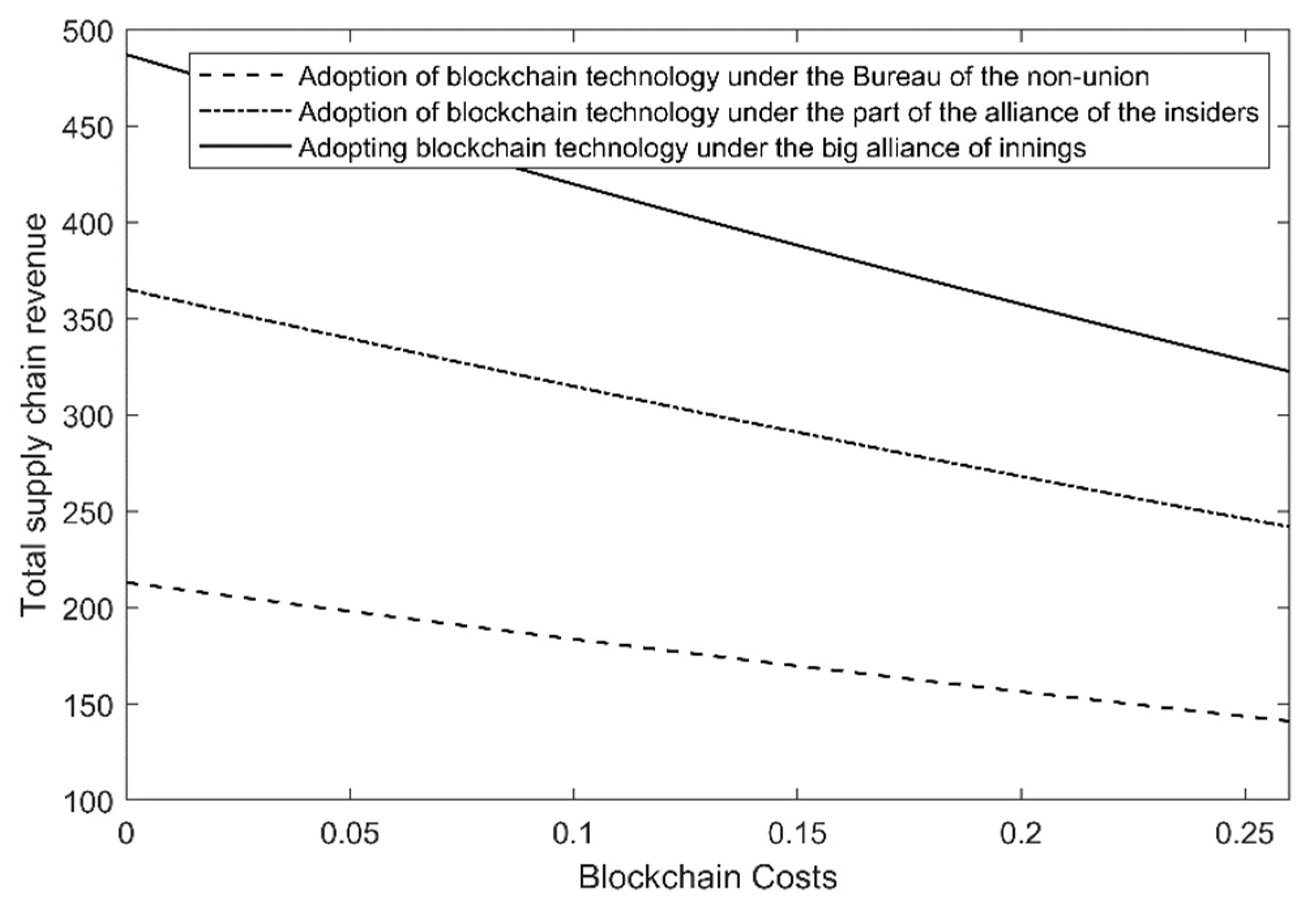

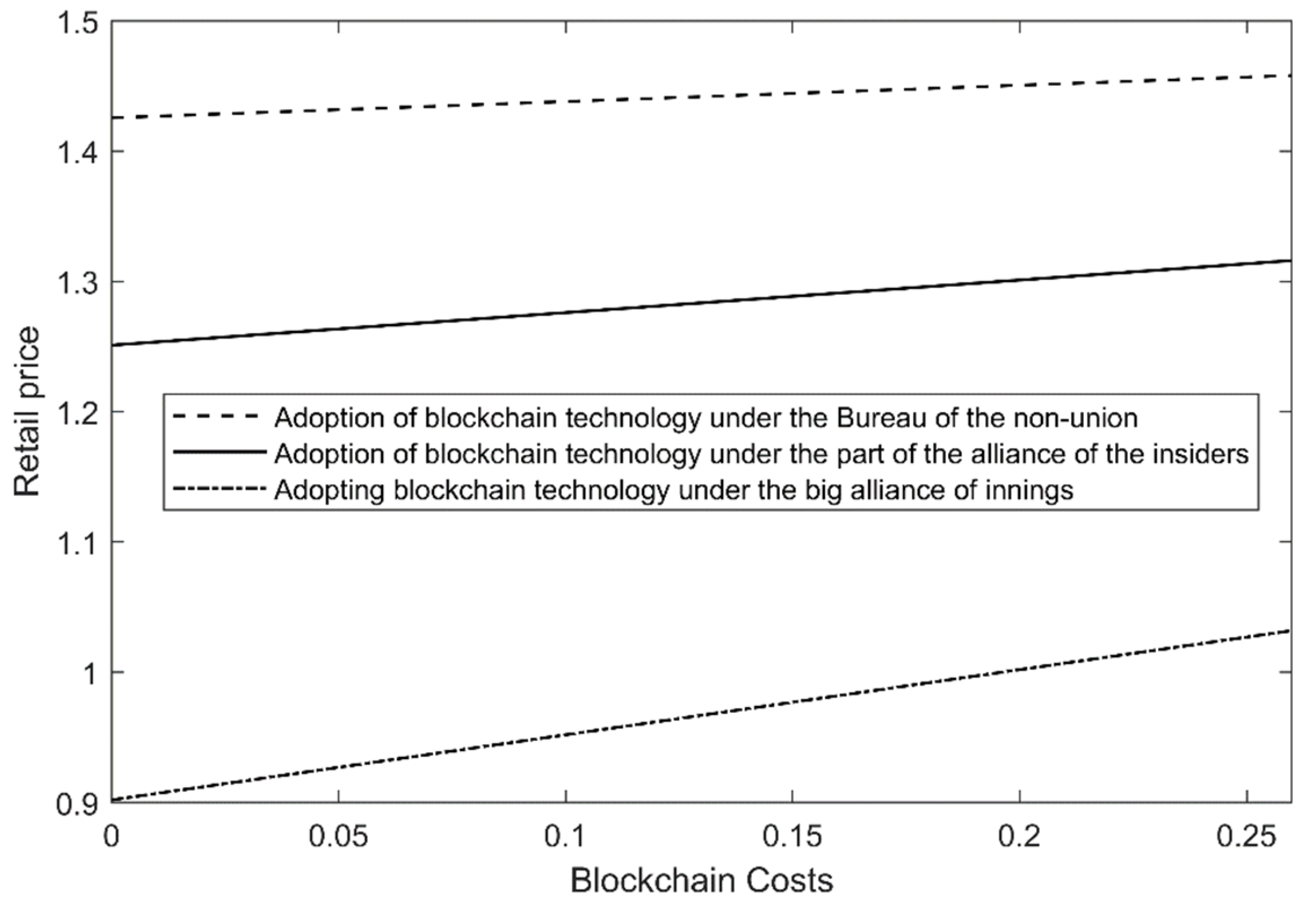

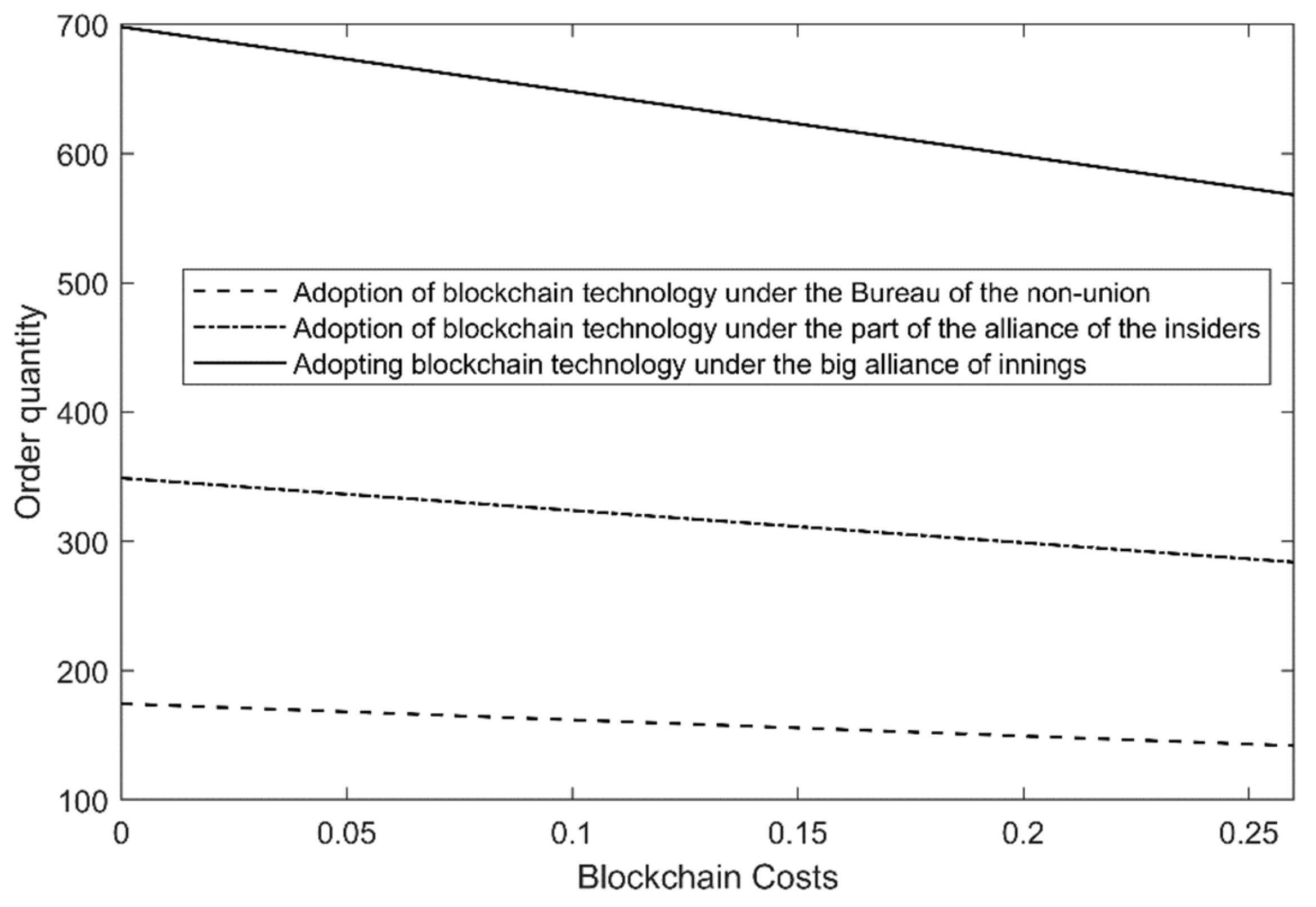

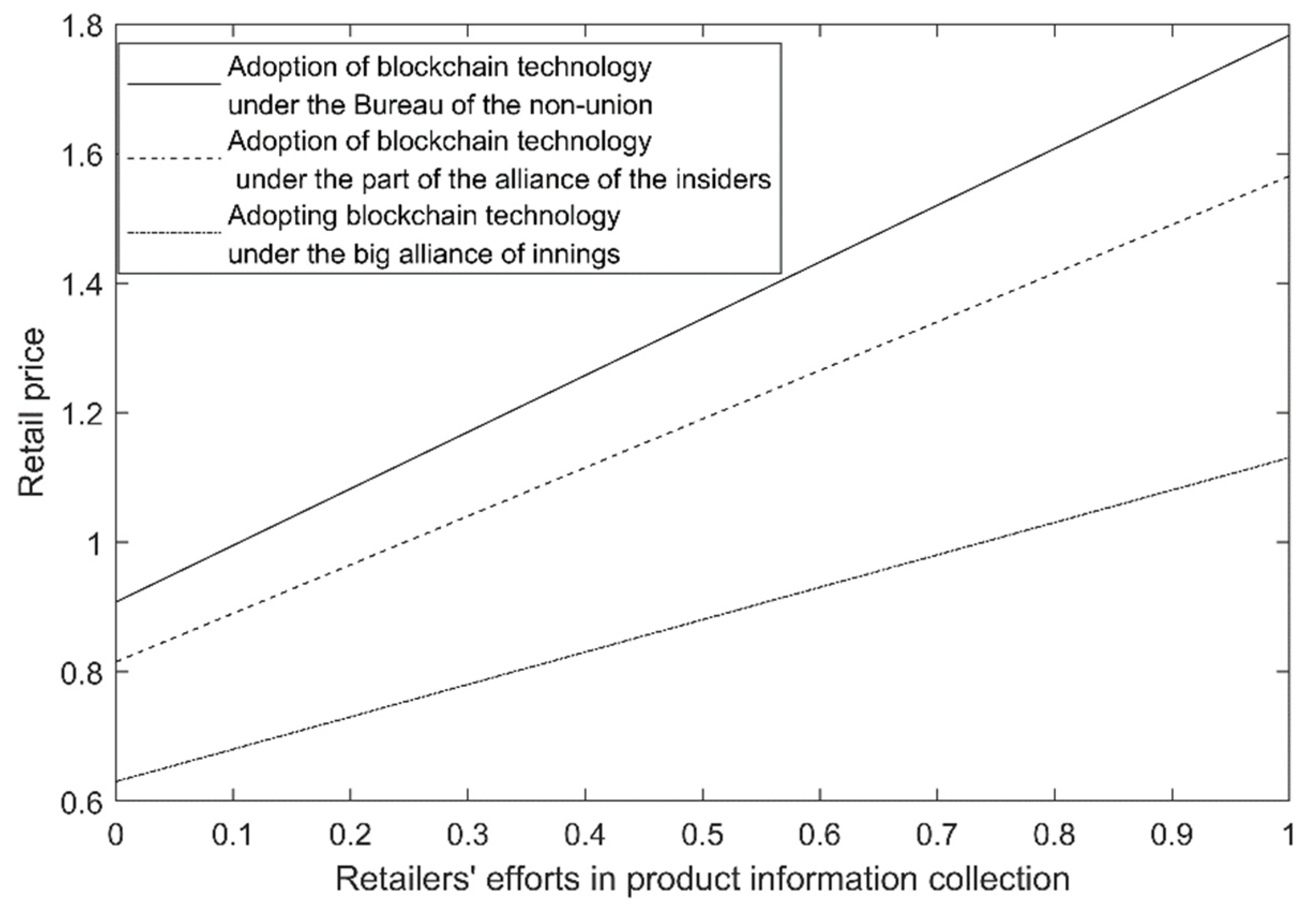

Further, it is verified that the relationship between blockchain cost and total supply chain revenue, order quantity and retail price of the retailer when the supply chain members are in different alliances. Based on Propositions 6 and 7, assume that the retailers’ efforts to collect product information

,

Figure 7,

Figure 8 and

Figure 9.

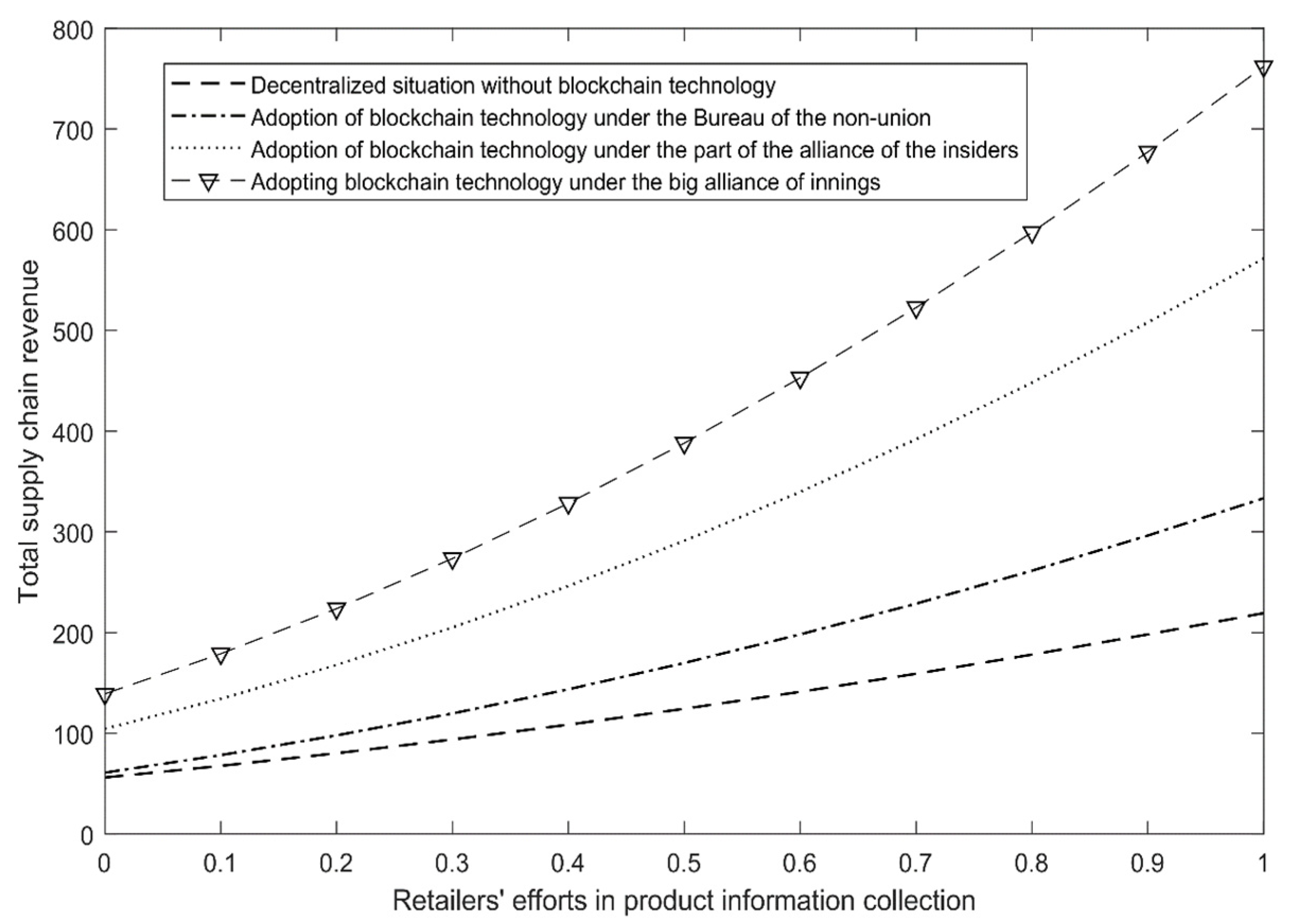

From

Figure 7, it can be concluded that as the blockchain cost increases, the total benefit of the supply chain decreases, regardless of whether the supply chain members cooperate or not. In addition, the greater the degree of the alliance of the insiders, the greater the total benefit of the supply chain. That is, the conclusion of Proposition 7 is verified.

From

Figure 8 and

Figure 9, it can be seen that as the blockchain cost increases, the retail price of retailers increases, which will affect consumer rights and lead to a decrease in order quantity, indicating that the retail price is positively related to the blockchain cost and the order quantity is negatively related to the blockchain cost. In addition, the larger the alliance formed by supply chain members, the lower the retail price of retailers and the higher the order quantity. It indicates that cooperation facilitates the increase in total supply chain revenue, which verifies the conclusion of Proposition 6.

7.3. Effect of Retailer’s Information Collection Effort on Retail Price, Order Quantity and Total Supply Chain Revenue

This subsection verifies the impact of retailers’ information collection effort on retail price, order quantity and total supply chain revenue in different game models, thus verifying the conclusion of Proposition 8. Firstly, we verify the effect of retailers’ information gathering effort on retail price and order quantity of retailers without and with blockchain technology under decentralized decision making.

From

Figure 10 and

Figure 11, it can be seen that with or without blockchain technology, as the retailer’s effort in information collection increases, it leads to an increase in order quantity and retail price. The impact is greater for the supply chain members that adopt blockchain technology. The retail price of the retailer increases with the adoption of blockchain technology, but the consumer has access to more and more realistic information about the product, which leads to greater protection of the consumer’s rights and thus increases the order quantity.

From

Figure 12, we can see that regardless of the alliance method, the order quantity and retail price of retailers increase with the increase in retailers’ information collection efforts, and the influence of retailers’ information collection efforts on order quantity and retail price increases with the increase in alliance degree. The greater the degree of an alliance, the greater the retailer’s information collection effort, and from the consumer’s perspective, the safer and more secure products are available to the consumer, and the consumer’s rights are better protected.

Further, the relationship between the degree of the retailer’s effort in collecting product information and the total supply chain revenue are discussed. From

Figure 13 below, we can find that regardless of whether blockchain technology is adopted or not, and whether supply chain members cooperate or not, the total supply chain revenue gradually increases with the increase in retailers’ efforts in information collection. That is, the more effort retailers put into collecting product information, the more it helps supply chain members’ revenue increase, which is beneficial to the better operation and development of SCF.

7.4. Study Sample

This paper introduces a case study of blockchain on JD’s supply chain finance to justify the results and to validate the existing findings. The data involved are all from the publicly available data on JD’s website.

According to the official website of JD Cloud, the annualized interest rate of a “Jingbao Bei” product is 9–14.5%, the daily interest rate of a “Jing Xiao Loan” product is between 0.033–0.066%, and the daily interest rate of other supply chain finance products is also around 0.04%. The daily interest rates for the rest of the supply chain finance products are also around 0.04%, and the interest rates for loans vary among MSMEs with different credit ratings, which greatly reduces the financing costs for MSMEs compared to traditional supply chain finance services.

Compared with traditional supply chain finance, JD’s “Blockchain + Supply Chain Finance” business can better understand the trade background of suppliers, so that the financing business can cover more levels of suppliers, and combine with diversified financing modes to effectively reduce the financing threshold of small- and medium-sized enterprises. In traditional supply chain finance, less than 15% of enterprises in the supply chain can obtain financing, while in JD’s “Blockchain + Supply Chain Finance”, except for suppliers with real operational problems, nearly 90% of enterprises can obtain corresponding loan services. In the “Blockchain + Supply Chain Finance” of JD, except for suppliers with real business problems, nearly 90% of the enterprises can obtain corresponding loan services, which can help the rapid development of SMEs to the maximum extent.

Figure 14 shows the amount of financing and the number of customers of JD’s supply chain finance in recent years, both of which are increasing year by year.

According to JD.com’s annual report, during the outbreak of COVID-19 in the first half of 2020, the “Growth Support Plan for SMEs” launched by JD.com provided financial support to nearly 210,000 SMEs that resumed production and work, saving them about CNY 350 million in procurement funds. According to the forecast to make reasonable arrangements, the reduction of costs, the rational use of resources and an increase in profit income will create greater revenue, as shown in

Table 7.

Based on the research case of blockchain + JD supply chain finance, it is then verified that the introduction of blockchain in this paper not only promotes the effective transfer of the credit of core enterprises and effectively reduces the financing cost of SMEs, but also creates greater value for supply chain members and enables the core enterprises to develop more.

8. Discussion

With the in-depth study of blockchain technology and SCF, the drawbacks of traditional supply chain finance have become more and more obvious, and the financial difficulties and poor credit of SMEs have gradually become the pain points of the industry, but the characteristics of blockchain technology itself can better compensate for the outstanding problems in traditional SCF. Modelling, comparative analysis and numerical simulations have enabled the research team to highlight some new implications in theory and practice. Firstly, we found that the adoption of blockchain technology by supply chain members can increase the revenue of supply chain members and the total revenue of the system when the blockchain costs are met, finding studies [

14] that are consistent and provide the required empirical evidence. Secondly, as suggested by [

44], blockchain is capable of spreading value across all nodes of the chain. As the cost of blockchain increases, it has an impact on the decisions of supply chain members. Thirdly, as the theme of the times is developing [

17,

18] win-win cooperation for sustainable supply chain development and collaborative distribution to create greater benefits. The following sub-sections aim to relate the results of the above discussion to some theoretical implications, in order to provide a better understanding of the topic and to open up new avenues of research.

- (1)

The adoption of blockchain technology by supply chain members can increase the revenue of supply chain members and the total revenue of the system, provided that the blockchain costs are met; the greater the retailer’s efforts in product information collection, the greater the range of blockchain costs that allow the supply chain to adopt blockchain technology to increase revenue, and the greater the probability that supply chain members will adopt blockchain technology to increase revenue. As defined by [

14,

27,

45], transaction cost theory and economic theory predict that every human action has a cost. This brings to mind the concepts of choice, sacrifice and missed opportunities. As mentioned above, one of the roles of blockchain seems to be concerned with developing the concepts of networking and collaboration. That said, the adoption of blockchain technology reduces the cost of financing for SMEs and increases the benefits for supply chain members, and SCF members are more willing to adopt blockchain technology in supply chain financing, which facilitates better SCF operations and growth.

- (2)

As the cost of blockchain increases, the total revenue of the supply chain finance system gradually decreases, with a subsequent increase in retail price and a subsequent decrease in order volume. As studied by [

2,

22,

46], the change in cost is bound to affect the decision making of supply chain members Therefore, in order to make the supply chain finance system continue to develop smoothly, the government should introduce relevant policies to give financial support to certain supply chain members who adopt blockchain technology, so as to reduce the input of supply chain members on blockchain cost and thus improve the revenue of the supply chain system.

- (3)

Cooperation has become the theme of development in today’s era, and so have supply chain members. As the study concluded, the benefits obtained by SCF members after cooperation are higher than the optimal benefits of supply chain members under decentralized decision making. Thus, the distribution of value in the supply chain allows for increased economy and additional economic value. However, as suggested by [

18,

21,

47], this additional value makes the cooperation of supply chain members and the further diffusion of blockchain possible. A blockchain-based Shapley value profit sharing model is proposed to provide some basis for Walmart’s decision making.

9. Conclusions, Limitations and Further Research

With the in-depth study of blockchain technology and SCF, the drawbacks of traditional SCF have become more and more obvious, and the financial difficulties and poor credit of SMEs have gradually become the pain points of the industry, but the characteristics of blockchain technology itself can better compensate for the outstanding problems of traditional SCF. This study aims to develop a coupling on supply chain finance and blockchain. A three-tier supply chain of suppliers, manufacturers and retailers is considered, where the retailers are core firms with good credit, the manufacturers neither have the ability to help SMEs grow nor need the help of core firms, the suppliers are cash-strapped SMEs and the retailers provide cross-level guarantees for the suppliers. Firstly, we examine the conditions for the adoption of blockchain technology in comparison to supply chains without it; secondly, blockchain facilitates the cooperation of supply chain finance members. Further, the distribution of benefits among the cooperating supply chain members is considered as a cooperative game problem, and the coordination mechanism for the distribution of benefits among supply chain members is investigated using Shapley values.

As reported in the previous section, research developments have enabled us to identify a number of theoretical and practical implications. From a theoretical perspective, we show the impact of blockchain technology on the decision making of supply chain members. In particular, blockchain has facilitated new streams of research based on transaction cost theory, co-participation and co-creation theory, stakeholder engagement and social innovation entrepreneurship. Interestingly, the numerical analysis also highlights how blockchain contributes to the transaction cost theory and the benefits of cooperation for supply chain members, which are well represented here. In conclusion, this research can provide managers, CEOs and future entrepreneurs with some basis for decision making to adopt blockchain in their business processes, enabling them to increase their competitive advantage while pursuing sustainable development goals.

Our study, as with all studies, has several limitations. Firstly, the impact of the introduction of blockchain technology on supply chain members was only analyzed from a benefits perspective, laying the groundwork for further risk analysis to follow; secondly, future literature reviews could examine the impact of aspects such as risk assessment and the level of information disclosure by supply chain members on supply chain finance under blockchain technology when introducing blockchain technology. Finally, further research should quantitatively assess whether blockchain can deliver economic, environmental and corporate social value by monitoring specific indicators.

In view of the limitations of the above description, future research directions can be carried out in the following aspects: in terms of model, the initial capital is taken into account, and the change of bankruptcy threshold before and after the introduction of blockchain is compared and analyzed; in terms of method, a robust optimization method is adopted to obtain a more stable decision-making scheme to help SMEs develop rapidly; in terms of allocation and a coordination mechanism, multi-faceted considerations are made instead of only considering the benefits, e.g., cost-sharing, etc.