Development of a Long-Term Repair Allowance Estimation Model for Apartments Based on Multiple Regression Analysis in Korea

Abstract

1. Introduction

2. Theoretical Analysis of the LTRA for Apartments

2.1. Necessity and Problems of the LTRA

2.2. Previous Studies Related to LTRA Estimation Models

3. Definition of LTRA Estimation Model and Development Process

3.1. Data Collection and Descriptive Statistics Analysis

3.2. Correlation Analysis

3.3. LTRA Estimation Model Development and Selection Process

3.3.1. Dependent Variable Transformation

3.3.2. Dummy Variable Transformation

3.3.3. Multiple Regression Model Development

3.3.4. Outlier Identification and Removal

- Standard residual: The standard residual is the residual () in the error term, standardized so as not to be affected by the unit and calculated using Equation (5). Because performance data are highly likely to be outliers when the standard residual is outside the range ±3, the performance data with standard residuals outside the range ±3 were regarded as outliers [32] and removed before developing the multiple regression model.

- Cook’s distance: Cook’s distance is a method for finding data that significantly affect the slope or intercept of the regression line. Because performance data are highly likely to be outliers when Cook’s distance is outside the range ±2 [38], the performance data with Cook’s distance outside the range ±2 were removed before developing the multiple regression model.

- DfFit Standardized: DfFit Standardized is a measure that shows the influence of performance data in a regression analysis. Because performance data are highly likely to be outliers if their DfFit Standardized is outside the range ±2 [38], the performance data with DfFit Standardized outside the range ±2 were removed before developing the multiple regression model.

3.3.5. Independent Variable Selection and Removal

3.3.6. Multiple Regression Model Test

- Regression model test (F test): The F test was used to analyze whether the regression model, that is, the coefficient of determination (), was statistically significant. The null hypothesis of the F test is that “the coefficient of determination of the population is zero (H0: = 0).” If this is rejected, the coefficient of determination of the population can be regarded as non-zero.

- Error term independence test (autocorrelation): The Durbin–Watson test was used to test the independence of the error term. This test results in a value for the correlation (autocorrelation) between error terms, and Durbin–Watson coefficients always have a value in the range 0–4. As this value approaches 2, autocorrelation can be neglected. Therefore, when the Durbin–Watson coefficient had a range of 1.7 ≤ d ≤ 2.3, it was judged that autocorrelation could be neglected [39].

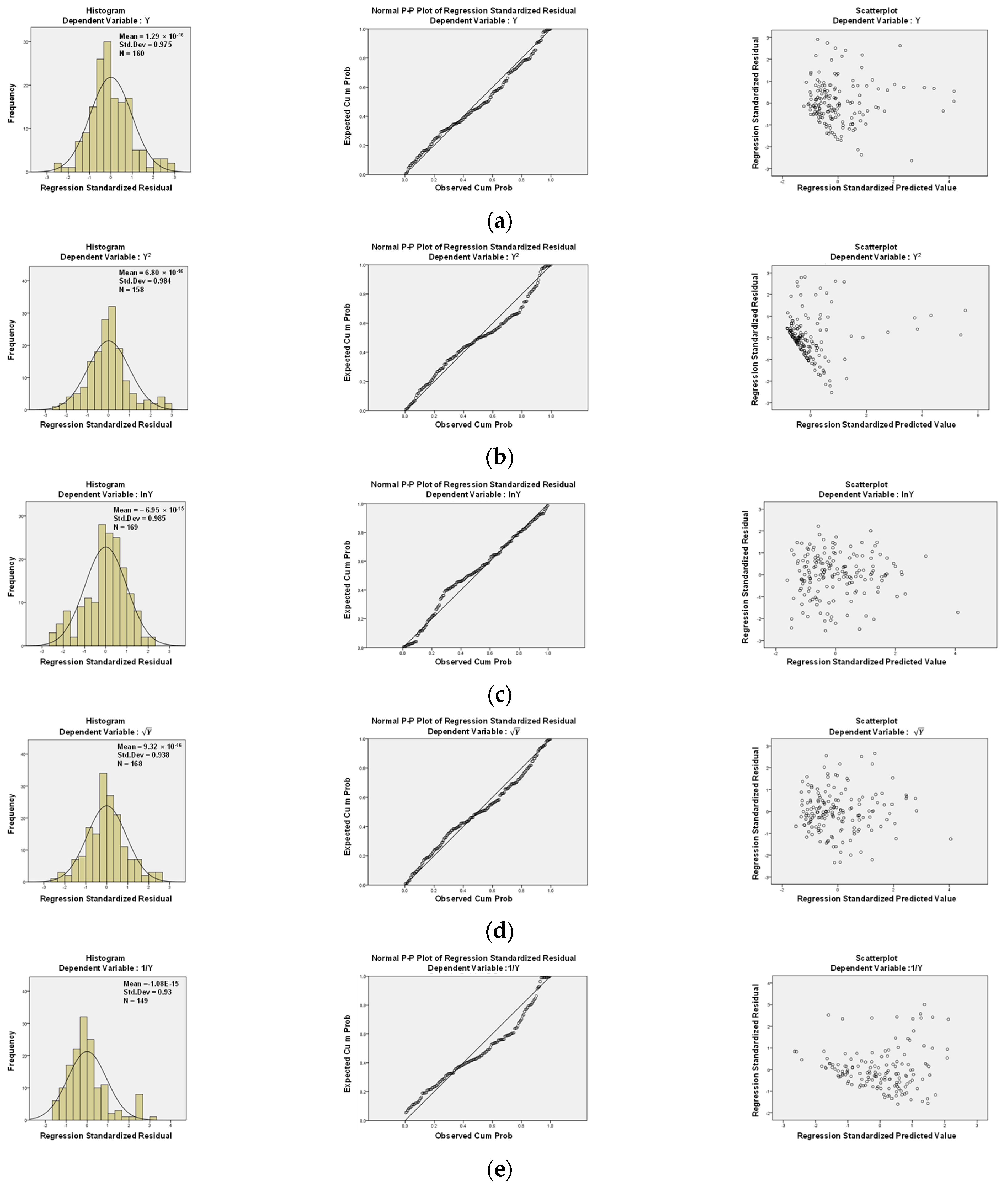

- Model linearity, error term normality, and equivalence test: Residual analyses were conducted to test the linearity of the regression model and the normality and equivalence of the error term. The following three analyses were conducted: (1) a histogram analysis of the regression standardized residual, (2) normal P-P plot analysis of the regression standardized residual, and (3) scatter plot analysis of the standard residual and standard prediction values.

3.3.7. Final Model Selection and Performance Evaluation

4. Development of LTRA Estimation Models and Performance Evaluation

4.1. Development of LTRA Estimation Models for Apartments

4.2. Selection of an LTRA Estimation Model for Apartments and a Performance Evaluation

4.3. Analysis of the Difference between the Total LTRA of the Current Estimation Method and the Developed Model

5. Conclusions

- (1)

- Thirteen factors that consider the apartment scale, degree of deterioration, degree of management, equipment scale, apartment type, and method were selected as factors that influence the LTRA estimation model. A total of 212 LTRA performance data points were collected. Based on the results of the descriptive statistics and correlation analysis of the collected data, a total of seven processes were defined for the LTRA estimation model development and selection process.

- (2)

- Among developed LTRA estimation models, the dependent variable (Y) with the highest modified coefficient of determination () of 0.653 was selected as the final model. RMSE and MAPE of the final selected model were found to be USD 144,587.38 and 25.6%, respectively. To consider the time value, an equation capable of estimating the total LTRA for apartments over 40 years was derived.

- (3)

- When the mean difference between the total LTRA estimated with the developed estimation model and that estimated with the rate estimation method utilized in Korea was analyzed, the p-values of the Welch test and post hoc (Games–Howell) were found to be less than 0.05, indicating that the mean difference is significant. Therefore, it is concluded that there is a difference between the total LTRA to be used and the LTRA to be accumulated.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Area | Construction Type | Repair Method | Repair Cycle (Year) | |

|---|---|---|---|---|

| Building exteriors | Roof | Mortar finish | Front repair | 10 |

| Polymer membrane waterproofing | Front repair | 15 | ||

| Polymer sheet waterproofing | Front repair | 20 | ||

| Metal tile jointing | Partial repair | 5 | ||

| Front replacement | 20 | |||

| Twinkle on the asphalt | Partial repair | 5 | ||

| Front replacement | 20 | |||

| Exterior | Sticking stones | Partial repair | 25 | |

| Water-based paint | Full paint | 5 | ||

| External window, door | Entrance door (automatic door) | Front replacement | 15 | |

| Building interiors | Ceiling | Water-based paint | Full paint | 5 |

| Oil paint | Full paint | 5 | ||

| Paint with synthetic resin | Full paint | 5 | ||

| An inner wall | Water-based paint | Full paint | 5 | |

| Oil paint | Full paint | 5 | ||

| Paint with synthetic resin | Full paint | 5 | ||

| Floor | Underground parking lot (floor) | Partial repair | 5 | |

| Front replacement | 15 | |||

| Stairs | Stair Nonslip | Front replacement | 20 | |

| Oil paint | Full paint | 5 | ||

| Electricity/firefighting/elevator/intelligent/home network equipment | Reserve power (self-generation) | Generator | Partial repair | 10 |

| Front replacement | 30 | |||

| Switchboard | Partial replacement | 10 | ||

| Front replacement | 20 | |||

| Substation facility | Transformer | Front replacement | 25 | |

| Incoming panel | Front replacement | 20 | ||

| Switchboard | Front replacement | 20 | ||

| Automatic fire detection system | Detector | Front replacement | 20 | |

| Receiver | Front replacement | 20 | ||

| Fire extinguishing equipment | Fire pump | Front replacement | 20 | |

| Sprinkler head | Front replacement | 25 | ||

| Fire water pipe (steel pipe) | Front replacement | 25 | ||

| Elevators and lifts | Mechanical device | Front replacement | 15 | |

| Wire rope, sheave (puller) | Front replacement | 5 | ||

| Control panel | Front replacement | 15 | ||

| Governor | Front replacement | 15 | ||

| Door operating equipment | Front replacement | 15 | ||

| Lightning protection and outdoor lighting | Lightning protection system | Front replacement | 25 | |

| Security light | Front replacement | 25 | ||

| Communication and broadcasting facilities | Amps and speakers | Front replacement | 15 | |

| Broadcast reception facility | Front replacement | 15 | ||

| Boiler room and machine room | Power board | Front replacement | 20 | |

| Security and crime prevention facilities | Monitoring panel (monitor type) | Front replacement | 5 | |

| Recording device | Front replacement | 5 | ||

| Image information processing device and intrusion detection facility | Front replacement | 5 | ||

| Intelligent/home network equipment | Home network device | Front replacement | 10 | |

| Complex common system equipment | Front replacement | 20 | ||

| Water supply/gas/ drainage/ ventilation equipment | Water supply equipment | Water pump | Front replacement | 10 |

| High water tank (STS, synthetic resin) | Front replacement | 25 | ||

| Water supply pipe (steel pipe) | Front replacement | 15 | ||

| Gas equipment | Pipe | Front replacement | 20 | |

| Valve | Front replacement | 10 | ||

| Drainage equipment | Pump | Front replacement | 10 | |

| Drain pipe (steel pipe) | Front replacement | 15 | ||

| Sewage pipe (cast iron) | Front replacement | 30 | ||

| Sewage pipe (PVC) | Front replacement | 25 | ||

| Ventilation equipment | Ventilation fan | Front replacement | 10 | |

| Outdoor/auxiliary/welfare facilities | Asphalt pavement | Partial repair | 10 | |

| Front replacement | 15 | |||

| Fence | Front replacement | 20 | ||

| Children’s play facilities | Partial repair | 5 | ||

| Front replacement | 15 | |||

| Sidewalk block | Partial repair | 5 | ||

| Front replacement | 15 | |||

| Septic tank | Partial repair | 5 | ||

| Drains and manholes | Partial repair | 10 | ||

| Roof entrance/underground parking lot access road | Front replacement | 15 | ||

| Bicycle storage | Front replacement | 10 | ||

| Parking breaker | Front replacement | 10 | ||

| Landscaping facilities | Front replacement | 15 | ||

| Information sign | Front replacement | 5 | ||

Appendix B

| Variable | Mean | Median | Minimum | Maximum | Standard Deviation | Coefficient of Variation |

|---|---|---|---|---|---|---|

| Long-term repair allowance used (USD) | 395,857 | 270,458.2 | 10,133 | 3,453,670.9 | 440,554 | 111.29% |

| Total floor area | 69,300.9 | 59,444.7 | 14,313.9 | 241,486.2 | 41,214.2 | 59.47% |

| Number of households | 766.2 | 650 | 300 | 2544 | 404.4 | 52.77% |

| Years of use | 16.2 | 15 | 2 | 38 | 6.7 | 40.94% |

| Common management expenses | 38,023.33 | 31,876.67 | 7309.1 | 139,311.8 | 23,067.58 | 60.67% |

| Number of administrators | 18.7 | 15 | 3 | 73 | 12.6 | 67.47% |

| Energy use cost | 44,237.5 | 32,530 | 0 | 210,025.8 | 38,886 | 87.90% |

| Number of closed-circuit televisions (CCTVs) | 88.2 | 75 | 0 | 368 | 63.8 | 72.38% |

| Number of elevators | 15.8 | 15 | 0 | 64 | 11.9 | 75.25% |

| Variable | Mean | Median | Minimum | Maximum | Standard Deviation | Coefficient of Variation |

|---|---|---|---|---|---|---|

| Long-term Repair allowance used (USD) | 432,729.3 | 399,283.8 | 76,615.2 | 1,043,927.6 | 228,451 | 52.79% |

| Total floor area | 79,831.7 | 76,440 | 18,143 | 194,380.7 | 40,144.2 | 50.29% |

| Number of households | 901.7 | 810 | 321 | 1835 | 375.6 | 41.65% |

| Years of use | 15.4 | 15 | 5 | 28 | 6.1 | 39.56% |

| Common management expenses | 43,827.50 | 44,689.17 | 10,607.40 | 113,333.33 | 20,400.75 | 46.55% |

| Number of administrators | 21.5 | 19 | 5 | 54 | 10.6 | 49.62% |

| Energy use cost | 50,205 | 41,005 | 107.67 | 155,000 | 37,223.75 | 74.14% |

| Number of closed-circuit televisions (CCTVs) | 114.5 | 109 | 10 | 344 | 69 | 60.27% |

| Number of elevators | 18.5 | 19 | 0 | 47 | 12.3 | 66.67% |

Appendix C

| Model | Unstandardized Coefficients | Standardized Coefficients | t | p-Value | Collinearity Statistics | |||

|---|---|---|---|---|---|---|---|---|

| B | Std. Error | Tolerance | VIF | |||||

| Constant | 5.65 × 104 | 1.07 × 108 | 0.635 | 0.526 | ||||

| Number of administrators | 1.69 × 104 | 2.65 × 106 | 0.755 | 7.655 | 0.000 | 0.224 | 4.459 | |

| Years of use | 1.20 × 104 | 2.99 × 106 | 0.294 | 4.815 | 0.000 | 0.584 | 1.713 | |

| RC types | −2.90 × 105 | 8.03 × 107 | −0.233 | −4.338 | 0.000 | 0.755 | 1.325 | |

| S types | −4.49 × 105 | 1.58 × 108 | −0.184 | −3.398 | 0.001 | 0.747 | 1.339 | |

| Number of elevators | 8.10 × 103 | 2.02 × 106 | 0.358 | 4.802 | 0.000 | 0.392 | 2.552 | |

| Total floor area | −2.07 | 8.44 × 102 | −0.31 | −2.936 | 0.004 | 0.196 | 5.112 | |

| Booster method | 7.57 × 104 | 3.36 × 107 | 0.139 | 2.707 | 0.008 | 0.827 | 1.209 | |

| Corridor types | 8.75 × 104 | 4.21 × 107 | 0.127 | 2.492 | 0.014 | 0.836 | 1.197 | |

| Constant | −2.24 × 1014 | 7.77 × 1013 | −2.879 | 0.005 | ||||

| Number of administrators | 3.49 × 1013 | 2.12 × 1012 | 1.192 | 16.477 | 0 | 0.256 | 3.907 | |

| Total floor area | −3.95 × 109 | 6.48 × 108 | −0.459 | −6.094 | 0 | 0.236 | 4.236 | |

| Years of use | 1.18 × 1013 | 2.31 × 1012 | 0.225 | 5.111 | 0 | 0.692 | 1.445 | |

| SRC types | −1.86 × 1014 | 5.87 × 1013 | −0.116 | −3.167 | 0.002 | 0.996 | 1.004 | |

| Booster method | 9.05 × 1013 | 2.80 × 1013 | 0.128 | 3.226 | 0.002 | 0.847 | 1.181 | |

| Constant | 1.47 × 10−2 | 0.241 | 73.246 | 0.000 | ||||

| Number of households | 8.33 × 10−7 | 0 | 0.251 | 2.95 | 0.004 | 0.453 | 2.205 | |

| Corridor types | 6.18 × 10−4 | 0.141 | 0.319 | 5.248 | 0.000 | 0.885 | 1.13 | |

| Number of elevators | 2.83 × 10−5 | 0.008 | 0.42 | 4.545 | 0.000 | 0.385 | 2.601 | |

| Years of use | 3.08 × 10−5 | 0.011 | 0.251 | 3.26 | 0.001 | 0.552 | 1.812 | |

| Booster method | 2.13 × 10−4 | 0.12 | 0.131 | 2.13 | 0.035 | 0.867 | 1.154 | |

| Constant | 0.766 | 2078.79 | 0.442 | 0.659 | ||||

| Number of households | 5.89 × 10−3 | 1.768 | 0.327 | 3.997 | 0.000 | 0.47 | 2.13 | |

| Corridor types | 5.11 | 1241.097 | 0.291 | 4.942 | 0.000 | 0.903 | 1.107 | |

| Number of elevators | 0.229 | 65.091 | 0.381 | 4.216 | 0.000 | 0.383 | 2.609 | |

| Years of use | 0.285 | 96.909 | 0.266 | 3.526 | 0.001 | 0.552 | 1.811 | |

| Booster method | 2.27 | 1028.953 | 0.158 | 2.642 | 0.009 | 0.875 | 1.143 | |

| Constant | 5.36 × 10−12 | 3.80 × 10−10 | 16.926 | 0.000 | ||||

| Number of households | −1.26 × 10−15 | 5.32 × 10−13 | −0.24 | −2.831 | 0.005 | 0.602 | 1.661 | |

| Corridor types | −1.60 × 10−12 | 4.30 × 10−10 | −0.313 | −4.466 | 0.000 | 0.876 | 1.141 | |

| Number of elevators | −6.73 × 10−14 | 1.84 × 10−11 | −0.375 | −4.381 | 0.000 | 0.588 | 1.699 | |

Appendix D

| Case | Total LTRA for 40 Years (USD) | ||

|---|---|---|---|

| Rate (1) | Rate (2) | Estimation Model (3) | |

| 1 | 1306.91 | 7885.34 | 2548.51 |

| 2 | 2210.62 | 15,862.17 | 4833.25 |

| 3 | 2688.90 | 19,293.99 | 7145.53 |

| 4 | 1737.03 | 8337.76 | 3427.81 |

| 5 | 2055.99 | 12,404.96 | 4840.72 |

| 6 | 1204.14 | 5779.86 | 3191.68 |

| 7 | 3500.38 | 25,116.72 | 11,210.21 |

| 8 | 2363.65 | 16,960.19 | 6924.06 |

| 9 | 1856.19 | 8909.69 | 5101.10 |

| 10 | 2083.42 | 14,949.42 | 5657.78 |

| 11 | 1427.07 | 9400.84 | 5397.54 |

| 12 | 521.03 | 3738.58 | 1208.25 |

| 13 | 1811.02 | 8692.90 | 3858.35 |

| 14 | 712.90 | 5115.39 | 2967.11 |

| 15 | 1471.70 | 10,560.05 | 6112.27 |

| 16 | 1039.51 | 7458.94 | 3994.58 |

| 17 | 1823.92 | 11,004.74 | 5060.47 |

| 18 | 2636.03 | 17,364.83 | 5842.65 |

| 19 | 1905.94 | 11,499.64 | 5181.28 |

| 20 | 3413.98 | 16,387.11 | 5487.17 |

| 21 | 2335.54 | 16,758.52 | 9031.01 |

| 22 | 1540.06 | 10,145.16 | 4589.86 |

| 23 | 4051.63 | 19,447.83 | 5163.75 |

| 24 | 995.86 | 7145.74 | 4440.96 |

| 25 | 2768.06 | 16,701.32 | 7475.09 |

| 26 | 785.95 | 5639.50 | 2831.12 |

| 27 | 2014.47 | 14,454.68 | 9594.42 |

| 28 | 1855.94 | 8908.50 | 4855.34 |

| 29 | 1766.68 | 12,676.65 | 4067.16 |

| 30 | 1275.83 | 9154.62 | 2797.89 |

| 31 | 496.88 | 3565.35 | 3036.39 |

| 32 | 404.63 | 2903.36 | 1651.62 |

| 33 | 2704.66 | 11,358.93 | 3911.88 |

| 34 | 4916.53 | 20,648.25 | 6393.10 |

| 35 | 2993.10 | 12,570.28 | 4293.38 |

| 36 | 1569.90 | 10,341.71 | 4947.08 |

| 37 | 2051.90 | 14,723.26 | 5132.03 |

| 38 | 540.17 | 3875.97 | 1858.47 |

| 39 | 1248.66 | 8959.66 | 5148.07 |

| 40 | 2383.19 | 17,100.42 | 5183.47 |

| 41 | 874.82 | 6277.23 | 4448.79 |

References

- Ruparathna, R.; Hewage, K.; Sadiq, R. Multi-Period Maintenance Planning for Public Buildings: A Risk Based Approach for Climate Conscious Operation. J. Clean. Prod. 2018, 170, 1338–1353. [Google Scholar] [CrossRef]

- Van Winden, C.; Dekker, R. Rationalisation of Building Maintenance by Markov Decision Models: A Pilot Case Study. J. Oper. Res. Soc. 1998, 49, 928–935. [Google Scholar] [CrossRef]

- Chan, D.W.M. Sustainable Building Maintenance for Safer and Healthier Cities: Effective Strategies for Implementing the Mandatory Building Inspection Scheme (MBIS) in Hong Kong. J. Build. Eng. 2019, 24, 100737. [Google Scholar] [CrossRef]

- Chanter, B.; Swallow, P. Building Maintenance Management, 2nd ed.; Blackwell Publishing Inc.: Malden, MA, USA, 2008. [Google Scholar]

- Seeley, I.H. Building Maintenance, 2nd ed.; PALGRAVE: New York, NY, USA, 1987; ISBN 978-1-349-18925-0. [Google Scholar]

- MOLIT Building Status Statistics. Available online: http://www.molit.go.kr/USR/NEWS/m_71/dtl.jsp?id=95085286 (accessed on 20 February 2023).

- Arditi, D.; Nawakorawit, M. Issues in building maintenance: Property managers’ perspective. J. Archit. Eng. 1999, 5, 117–132. [Google Scholar] [CrossRef]

- Silva, A.; de Brito, J. Do We Need a Buildings’ Inspection, Diagnosis and Service Life Prediction Software? J. Build. Eng. 2019, 22, 335–348. [Google Scholar] [CrossRef]

- Ali, A.S.; Kamaruzzaman, S.N.; Sulaiman, R.; Cheong Peng, Y. Factors Affecting Housing Maintenance Cost in Malaysia. J. Facil. Manag. 2010, 8, 285–298. [Google Scholar] [CrossRef]

- Wordsworth, P.; Lee, R. Lee’s Building Maintenance Management, 4th ed.; Blackwell Science: London, UK, 2001; ISBN 978-0-632-05362-9. [Google Scholar]

- Kim, S.H.; Song, S.H. A Maintenance Cost Forecast According to Deterioration of Public Rental Housing. Seoul City Res. 2012, 13, 133–146. [Google Scholar]

- Park, S.Y. Implications of the Mansion Management System in Japan. KHousing 2014, 9, 20–26. [Google Scholar]

- Kang, H.J.; Gye, S.J.; Kim, K.S.; Im, J.B.; Lee, K.H.; Choi, D.K.; Choi, D.S. Multi-Family Housing Management Theory; Shinjeong: Seoul, Republic of Korea, 2003; ISBN 9788989858577. [Google Scholar]

- Ha, S.; Kim, J.; Eun, N.S.; Kim, S.; Kim, J.; Kim, S.; Lee, K.H.; Lee, H.; Kim, S.; HAN, Y.H.; et al. A New Paradigm of Apartment Management; Parkyoungsa: Seoul, Republic of Korea, 2017; ISBN 9791130303871. [Google Scholar]

- Enforcement Decree of the Multi-Family Housing Management Act. Available online: https://www.law.go.kr/LSW/lsInfoP.do?lsiSeq=245879#0000 (accessed on 19 February 2023).

- Enforcement Decree of the Special Act on Public Housing. Available online: https://www.law.go.kr/법령/공공주택특별법시행령 (accessed on 20 February 2023).

- Kim, S.H. Underestimation of Long-Term Repair Provisions. Master’s Thesis, Hanyang Cyber University, Seoul, Republic of Korea, 2020. [Google Scholar]

- Kim, M.S. A Study on the Acquisition Rate Calculated Rent Apartment Special Repairs Allowance. Master’s Thesis, Sungkyunkwan University, Seoul, Republic of Korea, 2016. [Google Scholar]

- Kim, J.H. Research on the Status of Long-Term Repair and Maintenance & Management Cost of Permanently Leased Apartment Housing. Master’s Thesis, Seoul National University of Science and Technology, Seoul, Republic of Korea, 2011. [Google Scholar]

- Lee, S.-J.; Ju, K.-S.; Cho, G.-H.; Lee, H.K.; Lee, J.-S.; Hwang, J.C.; Woo, J.J. A Study on Efficient Management and Operation Plan of Long-Term Cost in Apartment Houses; Korea Land & Housing Research Institute: Daejeon, Republic of Korea, 2021. [Google Scholar]

- Korea’s Apartment Information System (K-Apt). Available online: http://www.k-apt.go.kr/ (accessed on 15 February 2023).

- Koo, S.; Kim, J.; Jun, I.; Kim, Y.; Yoon, Y.; Hyun, C. Estimation and Adjustment Model Considering Time Value of Money for Long-Term Maintenance Cost of Apartment House. Korea Inst. Constr. Eng. Manag. 2017, 18, 12–21. [Google Scholar]

- Lee, H.J.; Kim, S.; Kim, D.-H.; Cho, H. Forecast of Repair and Maintenance Costs for Public Rental Housing. J. Korea Inst. Build. Constr. 2018, 18, 621–631. [Google Scholar]

- Yoon, D. Forecasting Long-Term Maintenance Costs for the Apartment Housing by Monte-Carlo Simulation. Master’s Thesis, Kyungpook National University, Daegu, Republic of Korea, 2015. [Google Scholar]

- Park, M.; Kwon, N.; Lee, J.; Lee, S.; Ahn, Y. Probabilistic Maintenance Cost Analysis for Aged Multi-Family Housing. Sustainability 2019, 11, 1843. [Google Scholar] [CrossRef]

- Kim, S.; Lee, S.; Han Ahn, Y. Evaluating Housing Maintenance Costs with Loss-Distribution Approach in South Korean Apartment Housing. J. Manag. Eng. 2019, 35, 04018062. [Google Scholar] [CrossRef]

- Kwon, N.; Song, K.; Ahn, Y.; Park, M.; Jang, Y. Maintenance Cost Prediction for Aging Residential Buildings Based on Case-Based Reasoning and Genetic Algorithm. J. Build. Eng. 2020, 28, 101006. [Google Scholar] [CrossRef]

- Lee, K.H.; Chae, C.U. Repair Accumulation Cost for the Long-Term Repair Plan in Multifamily Housing Using the Forecasting Model of the Repair Cost. Korea Inst. Ecol. Archit. Environ. 2016, 16, 137–143. [Google Scholar]

- Multi-Family Housing Management Act. Available online: https://www.law.go.kr/법령/공동주택관리법 (accessed on 20 February 2023).

- Muyingo, H.G. Analysis of Factors Influencing Reported Housing Maintenance Costs in Sweden’s Public and Private Rental Sectors. Int. J. Strateg. Prop. Manag. 2017, 21, 284–295. [Google Scholar] [CrossRef]

- Kyu, K.H.; Han, C.H. An Empirical Analysis of the Effect of Variables on Maintenance Expenses of Public Rental Housing. Korea Inst. Constr. Eng. Manag. 2006, 7, 185–192. [Google Scholar]

- Lee, K.-H.; Yoo, U.-S.; Chae, C.-U. A Study on the Forecasting Model of the Required Cost for the Long-Term Repair Plan in Apartment Housings. Korea Inst. Ecol. Archit. Evironment 2011, 11, 63–68. [Google Scholar]

- Lee, J.I. An Analysis of the Influence Factors on the Gap between Standard Unit Price and Actual Saving Unit Price of Long-Term Repair Reserve. Master’s Thesis, Seoul National University, Seoul, Republic of Korea, 2019. [Google Scholar]

- Park, C.S.; Kim, H.K.; Ro, S.H. A Study on the Relationship between Management Fee and Long-Term Repair Reserve for Apartment Housing. Hous. Stud. Rev. 2016, 24, 71–93. [Google Scholar]

- Phil-Eze, P.O. Variability of Soil Properties Related to Vegetation Cover in a Tropical Rainforest Landscape. J. Geogr. Reg. Plan. 2010, 3, 177–184. [Google Scholar]

- Bollen, K.A.; Arminger, G. Observational Residuals in Factor Analysis and Structural Equation Models. Sociol Methodol 1991, 21, 235. [Google Scholar] [CrossRef]

- Heeyeon, L.; No, S. Advanced Statistical -Theory and Practice-; Moonwoosa: Gyeonggi, Republic of Korea, 2013; ISBN 9791195103409. [Google Scholar]

- Alan, L.; Ross, I.; Chris, T. Advanced Statistical Modelling; Citeseer: Princeton, NJ, USA, 2012. [Google Scholar]

- Durbin, J.; Watson, G.S. Testing for Serial Correlation in Least Squares Regression: I. Biometrika 1950, 37, 409–428. [Google Scholar] [PubMed]

| Author | Building Type | Dependent Variable | Methodology | Intervening Factor |

|---|---|---|---|---|

| Koo et al. (2017) [22] | Apartments | Total long-term repairs allowance | LCC | Time |

| Lee et al. (2018) [23] | Rental house | Total long-term repairs allowance | LCC | Time |

| Yoon (2015) [24] | Apartments | Total long-term repairs allowance | MCS | Time |

| Kim et al. (2019) [26] | Apartments | Distribution of long-term repairs allowance | LDA | - |

| Park et al. (2019) [25] | Apartments | Total long-term repairs allowance | MCS | - |

| Kim and Song (2012) [11] | Rental housings | Maintenance cost for 10 years | Multiple regression | Total floor area Number of households Completion year Number of buildings Number of floors |

| Lee and Chae (2016) [28] | Apartments | Total long-term repairs allowance | Multiple regression | Total floor area for management Number of households |

| Muyingo (2017) [30] | Rental house | Maintenance cost for 1 year | Multiple regression | Type of ownership category Ratio of aged housing Rent revenue Total space under management |

| Kwon et al. (2020) [27] | Apartments | Long-term repairs allowance of MEP for 1 year | CBR, GA | Building coverage ratio Floor area ratio Number of buildings Number of floors Number of households Parking lots Area for management Completion year |

| Influencing Factor | Data Scale | Definition |

|---|---|---|

| Total floor area | Continuous () | Sum of the floor areas of a building. |

| Number of households | Discrete | Number of households in which people reside in a particular building. |

| Years of use | Discrete (year) | Number of years that have passed since the apartments were completed. |

| Common management expenses | Continuous (USD/month) | Expenses charged to householders for the management of the apartments, excluding LTRA. |

| Number of administrators | Discrete | Total number of management personnel for the apartments. |

| Energy use cost | Continuous (USD/month) | Sum of shared and exclusive costs for the heating, hot water, gas, electricity, and water used by householders. |

| Number of closed-circuit televisions (CCTVs) | Discrete | Number of security and crime prevention cameras in the apartment complex. |

| Number of elevators | Discrete | Number of lifting devices that transport people or cargo in the vertical direction. |

| Housing structure type | Nominal | Four housing structure types were defined in this study: (1) reinforced concrete (RC), (2) steel (S), (3) steel reinforced (SRC), and (4) others. |

| Housing corridor type | Nominal | Three housing corridor types were defined in this study: (1) staircase, (2) corridor, and (3) blended (staircase and corridor). |

| Housing management method | Nominal | Housing management methods in this study were divided into (1) management on commission and (2) self-management. |

| Housing water supply method | Nominal | Four housing water supply methods were defined in this study: (1) direct connection to the public water supply, (2) water supply by elevated tanks, (3) booster, and (4) others. |

| Housing heating method | Nominal | Three housing heating methods were defined in this study: (1) individual, (2) central, and (3) district. |

| Variable | Mean | Median | Minimum | Maximum | Standard Deviation | Coefficient of Variation |

|---|---|---|---|---|---|---|

| Long-term repair allowance used (USD) | 402,988.0 | 297,780.8 | 10,133.0 | 3,453,670.9 | 408,020.7 | 101.25% |

| Total floor area | 71,337.5 | 62,801.8 | 14,313.9 | 241,486.2 | 41,127.1 | 57.65% |

| Number of households | 792.4 | 706.0 | 300.0 | 2544.0 | 401.7 | 50.69% |

| Years of use | 16.1 | 15 | 2 | 38 | 6.54 | 40.67% |

| Common management expenses | 39,146.1 | 34,220.4 | 7309.1 | 139,311.8 | 22,647.2 | 57.85% |

| Number of administrators | 19.2 | 17 | 3 | 73 | 12.3 | 63.88% |

| Energy use cost | 45,391.5 | 34,240.7 | 0 | 210,025.8 | 38,555.9 | 84.94% |

| Number of closed-circuit televisions (CCTVs) | 93.25 | 81.5 | 0 | 368 | 65.52 | 70.26% |

| Number of elevators | 16.31 | 16 | 0 | 64 | 11.99 | 73.49% |

| Variable | Long-Term Repair Allowance Used | Total Floor Area | Number of Households | Years of Use | Common Management Expenses | Number of Administrators | Energy Use Cost | Number of CCTVs | Number of Elevators |

|---|---|---|---|---|---|---|---|---|---|

| Long-term repair allowance used | 1 | 0.431 ** | 0.599 ** | 0.181 ** | 0.537 ** | 0.511 ** | 0.419 ** | 0.232 ** | 0.341 ** |

| Total floor area | 0.431 ** | 1 | 0.865 ** | −0.266 ** | 0.881 ** | 0.837 ** | 0.874 ** | 0.797 ** | 0.719 ** |

| Number of households | 0.599 ** | 0.865 ** | 1 | 0.086 | 0.905 ** | 0.889 ** | 0.774 ** | 0.569 ** | 0.596 ** |

| Years of use | 0.181 ** | −0.266 ** | 0.086 | 1 | −0.074 | −0.030 | −0.145 * | −0.479 ** | −0.446 ** |

| Common management expenses | 0.537 ** | 0.881 ** | 0.905 ** | −0.074 | 1 | 0.956 ** | 0.873 ** | 0.622 ** | 0.642 ** |

| Number of administrators | 0.511 ** | 0.837 ** | 0.889 ** | −0.030 | 0.956 ** | 1 | 0.838 ** | 0.539 ** | 0.578 ** |

| Energy use cost | 0.419 ** | 0.874 ** | 0.774 ** | −0.145 * | 0.873 ** | 0.838 ** | 1 | 0.623 ** | 0.568 ** |

| Number of CCTVs | 0.232 ** | 0.797 ** | 0.569 ** | −0.479 ** | 0.622 ** | 0.539 ** | 0.623 ** | 1 | 0.705 ** |

| Number of elevators | 0.341 ** | 0.719 ** | 0.596 ** | −0.446 ** | 0.642 ** | 0.578 ** | 0.568 ** | 0.705 ** | 1 |

| Model | R | R2 | Ra2 | Durbin–Watson | F | p-Value |

|---|---|---|---|---|---|---|

| 0.819 | 0.671 | 0.653 | 1.984 | 38.45 | 0.000 | |

| 0.892 | 0.796 | 0.790 | 2.048 | 118.84 | 0.000 | |

| 0.682 | 0.466 | 0.449 | 1.872 | 28.405 | 0.000 | |

| 0.701 | 0.492 | 0.476 | 1.858 | 31.336 | 0.000 | |

| 0.612 | 0.374 | 0.361 | 1.834 | 28.902 | 0.000 |

| Model | Total LTRA for 40 Years (USD) | ||||

|---|---|---|---|---|---|

| Rate (1) | Rate (2) | Estimation Model (3) | (1)/(3) | (2)/(3) | |

| Average | 1,886,458 | 11,465,368 | 4,898,566 | 2.94 | 0.46 |

| Minimum | 404,626 | 2,903,361 | 1,208,248 | 1.27 | 0.27 |

| Maximum | 4,916,532 | 25,116,718 | 11,210,211 | 6.11 | 0.85 |

| Welch Statistics | df1 | df2 | p-Value |

|---|---|---|---|

| 93.719 | 2 | 64,427 | 0.000 |

| Category | Group 1 | Group 2 | Mean Difference between the Groups | Standard Error | p-Value |

|---|---|---|---|---|---|

| Games–Howell | Rate (1) | Rate (2) | −9,578,909.20 | 837,368.33 | 0.000 |

| Estimation model (3) | −3,012,107.50 | 352,701.67 | 0.000 | ||

| Rate (2) | Rate (1) | 9,578,909.17 | 837,368.33 | 0.000 | |

| Estimation model (3) | 6,566,801.67 | 882,239.17 | 0.000 | ||

| Estimation model (3) | Rate (1) | 3,012,107.50 | 352,701.67 | 0.000 | |

| Rate (2) | −6,566,801.7 | 882,239.17 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.-S.; Kim, Y.S. Development of a Long-Term Repair Allowance Estimation Model for Apartments Based on Multiple Regression Analysis in Korea. Sustainability 2023, 15, 4357. https://doi.org/10.3390/su15054357

Kim J-S, Kim YS. Development of a Long-Term Repair Allowance Estimation Model for Apartments Based on Multiple Regression Analysis in Korea. Sustainability. 2023; 15(5):4357. https://doi.org/10.3390/su15054357

Chicago/Turabian StyleKim, Jun-Sang, and Young Suk Kim. 2023. "Development of a Long-Term Repair Allowance Estimation Model for Apartments Based on Multiple Regression Analysis in Korea" Sustainability 15, no. 5: 4357. https://doi.org/10.3390/su15054357

APA StyleKim, J.-S., & Kim, Y. S. (2023). Development of a Long-Term Repair Allowance Estimation Model for Apartments Based on Multiple Regression Analysis in Korea. Sustainability, 15(5), 4357. https://doi.org/10.3390/su15054357