How and When Does Big Data Analytics Capability Boost Innovation Performance?

Abstract

1. Introduction

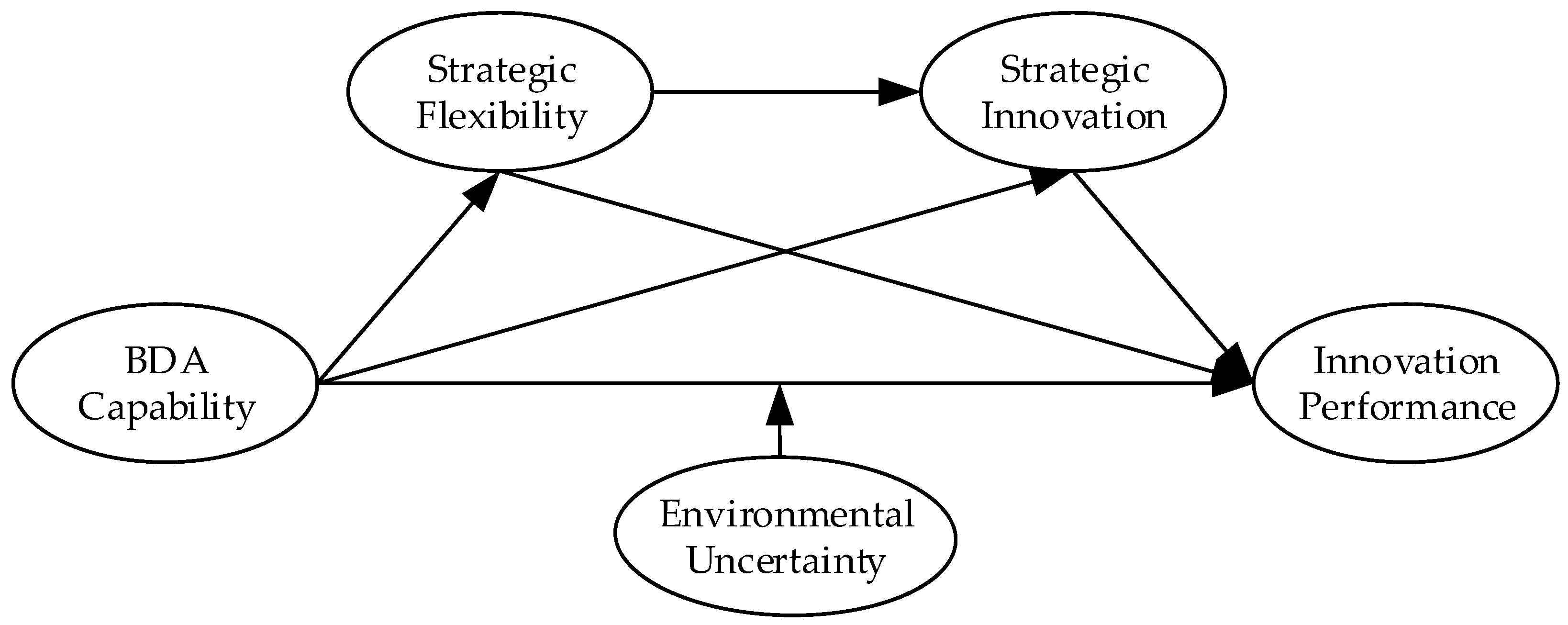

2. Literature Review and Hypothesis Development

2.1. Resource-Based Theory (RBT)

2.2. BDAC Based on RBT

2.3. BDAC, Strategic Flexibility and Innovation Performance

2.3.1. BDAC and Innovation Performance

2.3.2. BDAC and Strategic Flexibility

2.3.3. Strategic Flexibility and Innovation Performance

2.4. BDAC, Strategic Innovation and Innovation Performance

2.4.1. BDAC and Strategic Innovation

2.4.2. Strategic Innovation and Innovation Performance

2.5. Strategic Flexibility and STRATEGIC Innovation

2.6. The Moderating Effect of Environmental Uncertainty

3. Methodology

3.1. Sample

3.2. Measures

3.3. Statistical Procedure

4. Results

4.1. Correlation Analysis

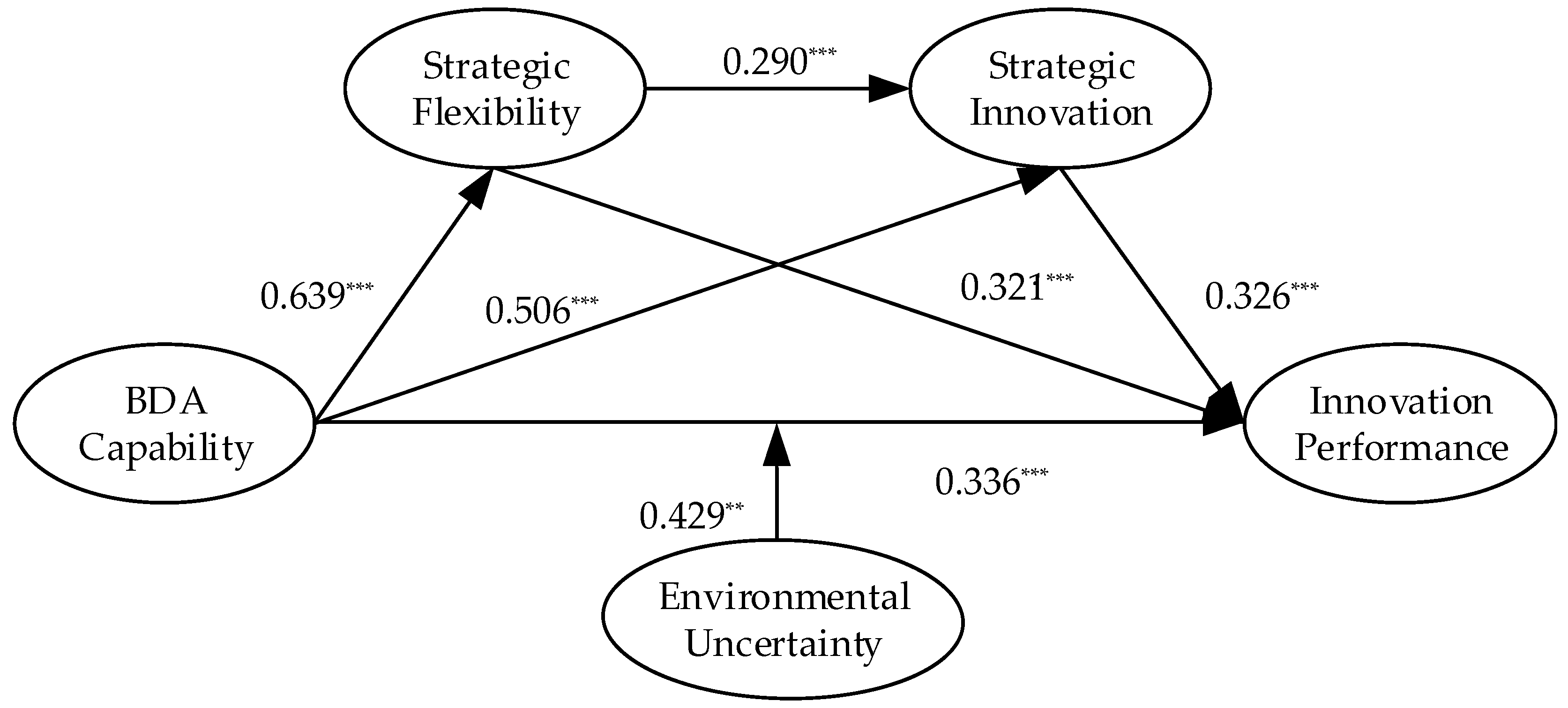

4.2. Hypothesis Testing

5. Discussion

5.1. Discussion of the Empirical Results

5.2. Theoretical Contributions

5.3. Managerial Implications

5.4. Limitations and Future Research Directions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Constructs | Items |

| BDA infrastructure flexibility | BDA Connectivity (α = 0.842) Compared with the competitors in your industry, your firm owns more advanced analytics systems. The branch offices of your company are closely connected to the central office of your firm for sharing analytics insights. Open system network mechanisms are used in your firm to support analytics connectivity. Apparent communications bottlenecks do not exist within your firm when sharing analytics insights. |

| BDA Compatibility (α = 0.860) The software applications in your firm can be easily applied on multiple analytics platforms. The user interfaces in your company offer transparent access to all platforms and applications. Your firm can seamlessly share analytics-driven information internally, regardless of location. The multiple analytics interfaces or entry points are provided in your firm for external end-users. | |

| BDA Modularity (α = 0.865) Your firm widely utilizes reusable software modules in the new system development. Object-oriented technologies are available for end users to create their own applications. Object-oriented tools are available for analytics personnel to shorten the development time of new applications. The applications in your firm can be adapted to fulfill various requirements when carrying out analysis tasks. | |

| BDA management capabilities | BDA Planning (α = 0.840) Your firm constantly seeks innovative opportunities for the strategic utilization of BDA. Your firm introduces and develops numerous plans for the strategic use of BDA. Your firm executes BDA planning processes in systematic ways. Your firm adjusts BDA plans frequently according to the changing environment. |

| BDA Investment (α = 0.880) When your firm makes BDA investment decisions, it always considers and forecasts the effects they will have on employee productivity. When your firm makes BDA investment decisions, it usually thinks about and projects how much these actions can support end users in making quicker decisions. When your firm makes BDA investment decisions, it always considers and estimates whether it will consolidate or eliminate some jobs. When your firm makes BDA investment decisions, it usually considers and forecasts the cost of training end-users. When your firm makes BDA investment decisions, it always thinks about and forecasts the time that managers may spend overseeing the change. | |

| BDA Coordination (α = 0.862) The business analysts and line people in your firm meet regularly to discuss significant firm issues in both formal and informal ways. The business analysts and line people from various departments of your firm regularly attend cross-functional meetings. The business analysts and line people in your firm harmoniously coordinate their efforts with each other. The business analysts and line people regularly share various information to ensure that decision-makers and operators have access to all necessary and available know-how. | |

| BDA Control (α = 0.892) The responsibility for BDA development in your firm is clearly allocated. The BDA department in your firm is clear about the criteria of their performance. Compared with rivals, your firm is better at connecting parties (i.e., communicating and information sharing) within the business processes. Compared with rivals, your firm is better at controlling costs within business processes. Compared with rivals, your firm is better at introducing complex analytical methods into business processes. Compared with rivals, your firm is better at introducing detailed information into business processes. | |

| BDA personnel expertise | BDA Technical knowledge (α = 0.865) The analytics personnel at your firm are quite capable in terms of programming skills. The analytics personnel at your firm are quite capable in terms of managing project life cycles. The analytics personnel at your firm are quite capable in the areas of data management and maintenance. The analytics personnel at your firm are quite capable in the area of distributed computing. The analytics personnel at your firm are quite capable in data analytics decision systems. |

| BDA Technological management knowledge (α = 0.832) The analytics personnel at your firm are quite capable of understanding technological trends. The analytics personnel at your firm are quite capable of learning new technologies. The analytics personnel at your firm are quite capable of understanding the critical factors for the success of the firm. The analytics personnel at your firm are quite capable of understanding the role of business analytics as a means, not an end. | |

| BDA Business knowledge (α = 0.861) The analytics personnel at your firm have a good understanding of your firm’s policies and plans. The analytics personnel at your firm are quite capable of dealing with business problems and thinking of appropriate solutions. The analytics personnel at your firm understand your business functions at a high level. The analytics personnel at your firm understand your business environment at a high level. | |

| BDA Relational knowledge (α = 0.857) The analytics personnel at your firm are quite capable in terms of managing projects. The analytics personnel at your firm are quite capable in terms of executing work in a collective environment. The analytics personnel at your firm are quite capable in terms of teaching others. The analytics personnel at your firm are quite capable of keeping close relationships with your firm’s customers. | |

| Resource flexibility | Resource flexibility (α = 0.843) The difficulty in switching the utilization of core resources to another way within your firm is quite low. The time to switch the utilization of core resources to another way within your firm is quite short. The cost to switch the utilization of core resources to another way within your firm is quite low. The extent that the same resources are alternatively used in developing, producing, and selling different products within your firm is quite high. |

| Coordination flexibility | Coordination flexibility (α = 0.885) Your firm can reach a high degree of consensus in the utilization of resources in different departments. Your firm can reach a high sharing degree in the utilization of resources in different departments. Your firm can discover some new resources or combinations of resources inside the firm. Your firm can discover some new resources or combinations of resources outside the firm. Your firm enhances agility by fostering capabilities. Your firm enhances adaptability by fostering capabilities. |

| Strategic innovation | Strategic innovation (α = 0.848) Your firm has a unique business model. Your firm’s strategy is different from others in the industry. Your firm strives to have an unusual strategy. Your firm’s competitive strategy has great potential value. |

| Technology uncertainty | Technology uncertainty (α = 0.847) The degree of technological change within your industry is great. The availability of technology is higher in your enterprise. The speed of technology updates in your industry is very fast. Technological innovation has great influence on product development at your firm. |

| Market uncertainty | Market uncertainty (α = 0.893) Customer needs and product preferences change quickly. The customers’ demand for new products is high. New customers have high demand for our products. New customers are constantly entering the market. The product demand from new and old customers is completely different. |

| Innovation performance | Innovation performance (α = 0.866) Compared with your rivals, your firm usually launches new products or services earlier. Compared with your rivals, your firm’s products usually have more advanced technologies. Compared with your rivals, the market responses to your firm’s new products are better. Compared with your rivals, the development speed of products in your firm is faster. Compared with your rivals, the input-output rate of new products in your firm is higher. |

References

- Wang, Y.; Yan, F.; Jia, F.; Chen, L. Building supply chain resilience through ambidexterity: An information processing perspective. Int. J. Logist. Res. Appl. 2021. early access. [Google Scholar] [CrossRef]

- Kawasaki, T.; Wakashima, H.; Shibasaki, R. The use of e-commerce and the COVID-19 outbreak: A panel data analysis in Japan. Transp. Policy 2022, 115, 88–100. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Khan, Z.; Wood, G.; Knight, G. COVID-19 and digitalization: The great acceleration. J. Bus. Res. 2021, 136, 602–611. [Google Scholar] [CrossRef]

- Côrte-Real, N.; Oliveira, T.; Ruivo, P. Assessing business value of big data analytics in European firms. J. Bus. Res. 2017, 70, 379–390. [Google Scholar] [CrossRef]

- Côrte-Real, N.; Ruivo, P.; Oliveira, T. Leveraging internet of things and big data analytics initiatives in European and American firms: Is data quality a way to extract business value? Inf. Manag. 2019, 57, 103141. [Google Scholar] [CrossRef]

- Akter, S.; Wamba, S.F.; Gunasekaran, A.; Dubey, R.; Childe, S.J. How to improve firm performance using big data analytics capability and business strategy alignment? Int. J. Prod. Econ. 2016, 182, 113–131. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Calic, G. Assessing the impact of big data on firm innovation performance: Big data is not always better data. J. Bus. Res. 2020, 108, 147–162. [Google Scholar] [CrossRef]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. Big data analytics capabilities and innovation: The mediating role of dynamic capabilities and moderating effect of the environment. Br. J. Manag. 2019, 30, 272–298. [Google Scholar] [CrossRef]

- ZareRavasan, A. Boosting innovation performance through big data analytics: An empirical investigation on the role of firm agility. J. Inf. Sci. 2021, 1–16. [Google Scholar] [CrossRef]

- Wamba, S.F.; Akter, S.; Edwards, A.; Chopin, G.; Gnanzou, D. How ‘big data’ can make big impact: Findings from a systematic review and a longitudinal case study. Int. J. Prod. Econ. 2015, 165, 234–246. [Google Scholar] [CrossRef]

- Calantone, R.J.; Cavusgil, S.T.; Zhao, Y. Learning orientation, firm innovation capability, and firm performance. Ind. Mark. Manag. 2002, 31, 515–524. [Google Scholar] [CrossRef]

- Gobble, M.M. Big data: The next big thing in innovation. Res. Technol. Manag. 2013, 56, 64–66. [Google Scholar] [CrossRef]

- Manyika, J.; Chui, M.; Brown, B.; Bughin, J.; Dobbs, R.; Charles, R.; Byers, A.H. Big Data: The Next Frontier for Innovation, Competition, and Productivity; McKinsey Global Institute: New York, NY, USA, 2011. [Google Scholar]

- Lehrer, C.; Wieneke, A.; Vom Brocke, J.; Jung, R.; Seidel, S. How big data analytics enables service innovation: Materiality, affordance, and the individualization of service. J. Manag. Inf. Syst. 2018, 35, 424–460. [Google Scholar] [CrossRef]

- Pelliere, L.R.; Cunha, C.D. Impacts of big data analytics and absorptive capacity on sustainable supply chain innovation: A conceptual framework. Logforum 2018, 14, 151–161. [Google Scholar]

- Sultana, S.; Akter, S.; Kyriazis, E.; Wamba, S.F. Architecting and developing big data-driven innovation (DDI) in the digital economy. J. Glob. Inf. Manag. 2021, 29, 165–187. [Google Scholar] [CrossRef]

- Hao, S.B.; Zhang, H.L.; Song, M. Big data, big data analytics capability, and sustainable innovation performance. Sustainability 2019, 11, 7145. [Google Scholar] [CrossRef]

- Niebel, T.; Rasel, F.; Viete, S. BIG data-BIG gains? Understanding the link between big data analytics and innovation. Econ. Innov. New Techol. 2019, 28, 296–316. [Google Scholar] [CrossRef]

- Minatogawa, V.L.F.; Franco, M.M.V.; Rampasso, I.S.; Anholon, R.; Quadros, R.; Batocchio, A. Operationalizing business model innovation through big data analytics for sustainable organizations. Sustainability 2019, 12, 277. [Google Scholar] [CrossRef]

- De Luca, L.M.; Herhausen, D.; Troilo, G.; Rossi, A. How and when do big data investments pay off? the role of marketing affordances and service innovation. J. Acad. Mark. Sci. 2020, 49, 790–810. [Google Scholar] [CrossRef]

- Xiao, X.; Tian, Q.; Mao, H. How the Interaction of Big data analytics capabilities and digital platform capabilities affects service innovation: A dynamic capability view. IEEE Access 2020, 8, 18778–18796. [Google Scholar] [CrossRef]

- Olabode, O.E.; Boso, N.; Hultman, M.; Leonidou, C.N. Big data analytics capability and market performance: The roles of disruptive business models and competitive intensity. J. Bus. Res. 2022, 139, 1218–1230. [Google Scholar] [CrossRef]

- Alonso, A.D.; Bressan, A. A resource-based view of the firm and micro and small Italian wine firms. Int. J. Wine Bus. Res. 2017, 28, 349–368. [Google Scholar] [CrossRef]

- Brink, T. Orchestration of dynamic capabilities for competitive advantage. Int. J. Energy Sect. Manag. 2019, 13, 960–976. [Google Scholar] [CrossRef]

- Sen, S.; Savitskie, K.; Mahto, R.V.; Kumar, S.; Khanin, D. Strategic flexibility in small firms. J. Strateg. Mark. 2022. early access. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Wu, F. Technological capability, strategic flexibility, and product innovation. Strateg. Manag. J. 2010, 31, 547–561. [Google Scholar] [CrossRef]

- Rialti, R.; Marzi, G.; Caputo, A.; Mayah, K.A. Achieving strategic flexibility in the era of big data: The importance of knowledge management and ambidexterity. Manag. Decis. 2020, 58, 1585–1600. [Google Scholar] [CrossRef]

- Xiao, H.; Yang, Z.; Hu, Y. Influencing mechanism of strategic flexibility on corporate performance: The mediating role of business model innovation. Asia Pac. Bus. Rev. 2021, 27, 470–492. [Google Scholar] [CrossRef]

- Miroshnychenko, I.; Strobl, A.; Matzler, K.; Massis, A.D.; Woodside, A.G. Absorptive capacity, strategic flexibility, and business model innovation: Empirical evidence from Italian SMEs. J. Bus. Res. 2021, 130, 670–682. [Google Scholar] [CrossRef]

- Li, M.L.; Hsu, C.H.C. Customer participation in services and employee innovative behavior: The mediating role of interpersonal trust. Int. J. Contemp. Hosp. Manag. 2018, 30, 2112–2131. [Google Scholar] [CrossRef]

- Schlegelmilch, B.B.; Diamantopoulos, A.; Kreuz, P. Strategic innovation: The construct, its drivers and its strategic outcomes. J. Strateg. Mark. 2003, 11, 117–132. [Google Scholar] [CrossRef]

- Herhausen, D.; Morgan, R.E.; Brozovi, D.; Volberda, H.W. Re-examining strategic flexibility: A meta-analysis of its antecedents, consequences and contingencies. Br. J. Manag. 2021, 32, 435–455. [Google Scholar] [CrossRef]

- Sun, Y.; Li, L.; Chen, Y.; Kataev, M.Y. An Empirical Study on Innovation Ecosystem, Technological Trajectory Transition, and Innovation Performance. J. Glob. Inf. Manag. 2021, 29, 148–171. [Google Scholar] [CrossRef]

- Wamba, S.F.; Gunasekaran, A.; Akter, S.; Ren, J.F.; Dubey, R.; Childe, S.J. Big data analytics and firm performance: Effects of dynamic capabilities. J. Bus. Res. 2017, 70, 356–365. [Google Scholar] [CrossRef]

- Drnevich, P.L.; Kriauciunas, A.P. Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance. Strateg. Manag. J. 2011, 32, 254–279. [Google Scholar] [CrossRef]

- Forcadell, F.; Ubeda, F.; Zuniga-Vicente, J. Initial resource heterogeneity differences between family and non-family firms: Implications for resource acquisition and resource generation. Long Range Plan. 2018, 51, 693–719. [Google Scholar] [CrossRef]

- Barney, J.B.; Hesterly, W.S. Strategic Management and Competitive Advantage: Concepts and Cases, 1st ed.; Pearson Hall: New Jersey, NJ, USA, 2012.

- Mishra, D.; Luo, Z.W.; Hazen, B.; Hassini, E.; Foropon, C. Organizational capabilities that enable big data and predictive analytics diffusion and organizational performance A resource-based perspective. Manag. Decis. 2019, 57, 1734–1755. [Google Scholar] [CrossRef]

- Davenport, T.H. Competing on analytics. Harv. Bus. Rev. 2006, 84, 98–107. [Google Scholar]

- Loebbecke, C.; Picot, A. Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J. Strateg. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Ciampi, F.; Marzi, G.; Demi, S.; Faraoni, M. The big data-business strategy interconnection: A grand challenge for knowledge management. A review and future perspectives. J. Knowl. Manag. 2020, 24, 1157–1176. [Google Scholar] [CrossRef]

- Erevelles, S.; Fukawa, N.; Swayne, L. Big Data consumer analytics and the transformation of marketing. J. Bus. Res. 2016, 69, 897–904. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Q.; Xie, J. Online social interactions: A natural experiment on word of mouth versus observational learning. J. Mark. Res. 2011, 48, 238–254. [Google Scholar] [CrossRef]

- Johnson, J.S.; Friend, S.B.; Lee, H.S. Big Data facilitation, utilization, and monetization: Exploring the 3Vs in a new product development process. J. Prod. Innov. Manag. 2017, 34, 640–658. [Google Scholar] [CrossRef]

- Ynet.cn, Tesla’s R&D and Data Dual Driven Innovation in China. Available online: https://t.ynet.cn/baijia/31643718.html (accessed on 7 May 2021).

- Ferraris, A.; Mazzoleni, A.; Devalle, A.; Couturier, J. Big data analytics capabilities and knowledge management: Impact on firm performance. Manag. Decis. 2018, 57, 1923–1936. [Google Scholar] [CrossRef]

- Muhammad, A.; Yu, C.K.; Qadir, A.; Ahmed, W.; Yousuf, Z.; Fan, G. Big data analytics capability as a major antecedent of firm innovation performance. Int. J. Entrep. Innov. 2022, 23, 268–279. [Google Scholar] [CrossRef]

- Akhtar, M.; Sushil, S. Strategic performance management system in uncertain business environment: An empirical study of the Indian oil industry. Bus. Process. Manag. J. 2018, 24, 923–942. [Google Scholar] [CrossRef]

- Su, Z.; Xie, E.; Li, Y. Organizational slack and firm performance during institutional transitions. Asia Pac. J. Manag. 2009, 26, 75–91. [Google Scholar] [CrossRef]

- Ashrafi, A.; Zare, R.A. How market orientation contributes to innovation and market performance: The roles of business analytics and flexible IT infrastructure. J. Bus. Ind. Mark. 2018, 33, 970–983. [Google Scholar] [CrossRef]

- Chen, H.; Chiang, R.H.; Storey, V.C. Business intelligence and analytics: From big data to big impact. MIS Q. 2012, 36, 1165–1188. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J. Big data analytics capability in supply chain agility: The moderating effect of organizational flexibility. Manag. Decis. 2018, 57, 2092–2112. [Google Scholar] [CrossRef]

- Yi, Y.Q.; Gu, M.; Wei, Z.L. Bottom-up learning, strategic flexibility and strategic change. J. Organ. Chang. Manag. 2017, 30, 161–183. [Google Scholar] [CrossRef]

- Matalamaki, M.J.; Joensuu-Salo, S. Digitalization and strategic flexibility—A recipe for business growth. J. Small Bus. Enterp. D 2021, 29, 380–401. [Google Scholar] [CrossRef]

- Li, W.; Wang, F. Digital innovation, strategic flexibility and enterprise intelligent transformation: Considering the moderating effect of environmental complexity. Stud. Sci. Sci. 2022, 1–16, early access. [Google Scholar] [CrossRef]

- Pereira, V.; Budhwar, P.; Temouri, Y.; Malik, A.; Tarba, S. Investigating investments in agility strategies in overcoming the global financial crisis—The case of Indian IT/BPO offshoring firms. J. Int. Manag. 2021, 27, 100738. [Google Scholar] [CrossRef]

- Brozovic, D. Strategic flexibility: A review of the literature. Int. J. Manag. Rev. 2018, 20, 3–31. [Google Scholar] [CrossRef]

- Kekale, T.; De Weerd-Nederhof, P.; Visscher, K.; Bos, G. Achieving sustained innovation performance through strategic flexibility of new product development. Int. J. Innov. Learn. 2010, 7, 377–393. [Google Scholar] [CrossRef]

- Cingöz, A.; Akdoğan, A.A. Strategic flexibility, environmental dynamism, and innovation performance: An empirical study. Procedia Soc. Behav. Sci. 2013, 99, 582–589. [Google Scholar] [CrossRef]

- Cheah, S.; Wang, S. Big data-driven business model innovation by traditional industries in the Chinese economy. J. Chin. Econ. Foreign Trade 2017, 10, 229–251. [Google Scholar] [CrossRef]

- Paiola, M.; Gebauer, H. Internet of things technologies, digital servitization and business model innovation in B to B manufacturing firms. Ind. Mark. Manag. 2020, 89, 245–264. [Google Scholar] [CrossRef]

- Wang, B.; Zhang, Q.; Cui, X. Research on the configuration of business model innovation of Internet Service Enterprises: Based on strategy and resource perspective. Manag. J. 2022, 35, 119–135. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2009, 43, 172–194. [Google Scholar] [CrossRef]

- Carrillo-Carrillo, F.; Alcalde-Heras, H. Modes of innovation in an emerging economy: A firm-level analysis from Mexico. Innov. Organ. Manag. 2020, 22, 334–352. [Google Scholar] [CrossRef]

- Merono-Cerdan, A.L.; Lopez-Nicolas, C.; Molina-Castillo, F.J. Risk aversion, innovation and performance in family firms. Econ. Innov. New Technol. 2018, 27, 189–203. [Google Scholar] [CrossRef]

- Tavassoli, S.; Bengtsson, L. The role of business model innovation for product innovation performance. Int. J. Innov. Manag. 2018, 22, 1850061. [Google Scholar] [CrossRef]

- Gronum, S.; Steen, J.; Verreynne, M.L. Business model design and innovation: Unlocking the performance benefits of innovation. Aust. J. Manag. 2016, 41, 585–605. [Google Scholar] [CrossRef]

- Majid, A.; Yasir, M.; Yousaf, Z. Network capability and strategic performance in SMEs: The role of strategic flexibility and organizational ambidexterity. Eurasian Bus. Rev. 2021, 11, 587–610. [Google Scholar] [CrossRef]

- Han, C.; Gao, S. A chain multiple mediation model linking strategic, management, and technological innovations to firm competitiveness. Rev. Bras. Gestão Negócios 2020, 21, 879–905. [Google Scholar] [CrossRef]

- Clauss, T.; Abebe, M.; Tangpong, C.; Hock, M. Strategic agility, business model innovation, and firm performance: An empirical investigation. IEEE Trans. Eng. Manag. 2019, 99, 767–784. [Google Scholar] [CrossRef]

- Chen, J.Y.; Wang, X.C.; Shen, W.; Tan, Y.Y.; Matac, L.M.; Samad, S. Environmental Uncertainty, Environmental Regulation and Enterprises’ Green Technological Innovation. Int. J. Environ. Res. Public Health 2022, 19, 9781. [Google Scholar] [CrossRef]

- Rashidi, M. The pricing of information asymmetry based on environmental uncertainty and accounting conservatism. Int. J. Product. Perform. Manag. 2022, 71, 3121–3137. [Google Scholar] [CrossRef]

- Wilden, R.; Gudergan, S.P. The impact of dynamic capabilities on operational marketing and technological capabilities: Investigating the role of environmental turbulence. J. Acad. Mark. Sci. 2015, 43, 181–199. [Google Scholar] [CrossRef]

- Yang, R.J.; Yu, L.; Zhao, Y.J.; Yu, H.X.; Xu, G.P.; Wu, Y.T.; Liu, Z.K. Big data analytics for financial Market volatility forecast based on support vector machine. Int. J. Inf. Manag. 2019, 50, 452–462. [Google Scholar] [CrossRef]

- Li, Y.; Li, P.P.; Wang, H.F.; Ma, Y.C. How do resource structuring and strategic flexibility interact to shape radical innovation? J. Prod. Innov. Manag. 2017, 34, 471–491. [Google Scholar] [CrossRef]

- Chen, J.Y.; Reilly, R.R.; Lynn, G.S. The impacts of speed-to-market on new product success: The moderating effects of uncertainty. IEEE Trans. Eng. Manag. 2005, 52, 199–212. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach, 1st ed.; Guilford Press: New York, NY, USA, 2013. [Google Scholar]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage Publications: London, UK, 2016. [Google Scholar]

- Gujarati, D.N.; Porter, D.C.; Gunasekar, S. Basic Econometrics, 5th ed.; Tata McGraw-Hill Education: Alapakkam Porur, India, 2013. [Google Scholar]

- Xu, G.; Tian, M. An empirical study on the impact of big data system implementation on enterprise performance. Sci. Technol. Prog. Countermeas. 2017, 34, 98–105. [Google Scholar]

| Control Variable | n | % | |

|---|---|---|---|

| Gender | Male | 205 | 48.7 |

| Female | 216 | 51.3 | |

| Age | 18–30 years | 45 | 10.7 |

| 31–35 years | 39 | 9.3 | |

| 36–40 years | 254 | 60.3 | |

| 41–45 years | 42 | 10.0 | |

| 46 years or older | 41 | 9.7 | |

| Education | Junior qualifications | 39 | 9.3 |

| Secondary qualifications | 50 | 11.9 | |

| Junior college | 250 | 59.4 | |

| Bachelor | 37 | 8.8 | |

| Master’s or above | 45 | 10.7 | |

| Job position level | Junior | 64 | 15.2 |

| Intermediate | 74 | 17.6 | |

| Senior | 283 | 67.2 | |

| Firm tenure | Less than 5 years | 83 | 19.7 |

| 5–9 years | 55 | 13.1 | |

| More than 10 years | 283 | 67.2 | |

| Number of employees in the firm (Firm size) | Less than 10 | 50 | 11.9 |

| 10–99 | 44 | 10.5 | |

| 100–999 | 263 | 62.5 | |

| More than 1000 | 64 | 15.2 | |

| Constructs | Items | Loadings | CR | AVE | Constructs | Items | Loadings | CR | AVE |

|---|---|---|---|---|---|---|---|---|---|

| BDA Connectivity (BDACN) | BDACN1 | 0.933 | 0.590 | 0.850 | BDA Business Knowledge (BDABK) | BDABK1 | 0.906 | 0.620 | 0.866 |

| BDACN2 | 0.688 | BDABK2 | 0.724 | ||||||

| BDACN3 | 0.711 | BDABK3 | 0.767 | ||||||

| BDACN4 | 0.714 | BDABK4 | 0.739 | ||||||

| BDA Compatibility (BDACM) | BDACM1 | 0.887 | 0.618 | 0.865 | BDA Relational Knowledge (BDARK) | BDARK1 | 0.930 | 0.617 | 0.864 |

| BDACM2 | 0.753 | BDARK2 | 0.728 | ||||||

| BDACM3 | 0.748 | BDARK3 | 0.732 | ||||||

| BDACM4 | 0.746 | BDARK4 | 0.733 | ||||||

| BDA Modularity (BDAMD) | BDAMD1 | 0.920 | 0.633 | 0.872 | Resource Flexibility (RF) | RF1 | 0.912 | 0.587 | 0.849 |

| BDAMD2 | 0.744 | RF2 | 0.731 | ||||||

| BDAMD3 | 0.782 | RF3 | 0.715 | ||||||

| BDAMD4 | 0.720 | RF4 | 0.686 | ||||||

| BDA Planning (BDAPL) | BDAPL1 | 0.935 | 0.591 | 0.850 | Coordination Flexibility (CF) | CF1 | 0.932 | 0.568 | 0.886 |

| BDAPL2 | 0.694 | CF2 | 0.700 | ||||||

| BDAPL3 | 0.752 | CF3 | 0.734 | ||||||

| BDAPL4 | 0.665 | CF4 | 0.706 | ||||||

| BDA Investment (BDAIN) | BDAIN1 | 0.917 | 0.608 | 0.885 | CF5 | 0.721 | |||

| BDAIN2 | 0.743 | CF6 | 0.701 | ||||||

| BDAIN3 | 0.741 | Strategic Innovation (SI) | SI1 | 0.951 | 0.597 | 0.853 | |||

| BDAIN4 | 0.728 | SI2 | 0.715 | ||||||

| BDAIN5 | 0.753 | SI3 | 0.693 | ||||||

| BDA Coordination (BDACO) | BDACO1 | 0.938 | 0.626 | 0.869 | SI4 | 0.702 | |||

| BDACO2 | 0.724 | Technology Uncertainty (TU) | TU1 | 0.927 | 0.595 | 0.853 | |||

| BDACO3 | 0.737 | TU2 | 0.729 | ||||||

| BDACO4 | 0.747 | TU3 | 0.696 | ||||||

| BDA Control (BDACT) | BDACT1 | 0.940 | 0.589 | 0.895 | TU4 | 0.710 | |||

| BDACT2 | 0.742 | Marketing Uncertainty (MU) | MU1 | 0.948 | 0.633 | 0.895 | |||

| BDACT3 | 0.744 | MU2 | 0.736 | ||||||

| BDACT4 | 0.707 | MU3 | 0.728 | ||||||

| BDACT5 | 0.728 | MU4 | 0.765 | ||||||

| BDACT6 | 0.717 | MU5 | 0.781 | ||||||

| BDA Technical Knowledge (BDATK) | BDATK1 | 0.924 | 0.575 | 0.870 | Innovation Performance (IP) | IP1 | 0.929 | 0.572 | 0.868 |

| BDATK2 | 0.670 | IP2 | 0.706 | ||||||

| BDATK3 | 0.721 | IP3 | 0.721 | ||||||

| BDATK4 | 0.702 | IP4 | 0.690 | ||||||

| BDATK5 | 0.750 | IP5 | 0.709 | ||||||

| BDA Technological Management Knowledge (BDATM) | BDATM1 | 0.942 | 0.577 | 0.842 | |||||

| BDATM2 | 0.663 | ||||||||

| BDATM3 | 0.711 | ||||||||

| BDATM4 | 0.689 |

| Variables | Mean | SD | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|---|

| BDAC | 2.954 | 0.475 | 0.789 | ||||

| Strategic Flexibility | 3.034 | 0.738 | 0.417 *** | 0.759 | |||

| Strategic Innovation | 3.028 | 0.969 | 0.341 *** | 0.323 *** | 0.773 | ||

| Environmental Uncertainty | 3.014 | 0.756 | 0.427 *** | 0.385 *** | 0.299 *** | 0.785 | |

| Innovation Performance | 2.980 | 0.885 | 0.416 *** | 0.459 *** | 0.508 *** | 0.355 *** | 0.756 |

| Coefficient | SE | t Value | p Value | LLCI (95%) | ULCI (95%) | |

|---|---|---|---|---|---|---|

| Dependent variable: Innovation performance (R2 = 0.289, F = 20.985) | ||||||

| BDAC | 0.766 | 0.082 | 9.293 | 0.000 | 0.604 | 0.928 |

| Mediation of Strategic Flexibility | ||||||

| Dependent variable: Strategic flexibility (R2 = 0.198, F = 14.548) | ||||||

| BDAC | 0.639 | 0.069 | 9.312 | 0.000 | 0.504 | 0.773 |

| Dependent variable: Innovation performance (R2 = 0.289, F = 20.985) | ||||||

| BDAC | 0.501 | 0.085 | 5.878 | 0.000 | 0.333 | 0.668 |

| Strategic flexibility | 0.416 | 0.056 | 7.477 | 0.000 | 0.306 | 0.525 |

| Mediation of Strategic Innovation | ||||||

| Dependent variable: Strategic innovation (R2 = 0.127, F = 8.604) | ||||||

| BDAC | 0.692 | 0.094 | 7.364 | 0.000 | 0.507 | 0.876 |

| Dependent variable: Innovation performance (R2 = 0.341, F = 26.617) | ||||||

| BDAC | 0.506 | 0.079 | 6.380 | 0.000 | 0.350 | 0.662 |

| Strategic innovation | 0.376 | 0.039 | 9.615 | 0.000 | 0.299 | 0.453 |

| Serial Multiple Mediation of Strategic Flexibility and Strategic Innovation | ||||||

| Dependent variable: Strategic flexibility (R2 = 0.198; F = 14.548) | ||||||

| BDAC | 0.639 | 0.069 | 9.312 | 0.000 | 0.504 | 0.773 |

| Dependent variable: Strategic innovation (R2 = 0.166; F = 10.280) | ||||||

| BDAC | 0.506 | 0.101 | 5.010 | 0.000 | 0.308 | 0.705 |

| Strategic flexibility | 0.290 | 0.066 | 4.397 | 0.000 | 0.160 | 0.420 |

| Dependent variable: Innovation performance (R2 = 0.396; F = 29.902) | ||||||

| BDAC | 0.336 | 0.081 | 4.142 | 0.000 | 0.176 | 0.495 |

| Strategic flexibility | 0.321 | 0.053 | 6.114 | 0.000 | 0.218 | 0.424 |

| Strategic innovation | 0.326 | 0.038 | 8.509 | 0.000 | 0.251 | 0.402 |

| Effect | Coefficient | SE | LLCI (95%) | ULCI (95%) |

|---|---|---|---|---|

| Total Effect | 0.766 | 0.082 | 0.604 | 0.928 |

| Total Direct Effect | 0.336 | 0.081 | 0.176 | 0.495 |

| Total Indirect Effect | 0.431 | 0.043 | 0.348 | 0.516 |

| Indirect 1: BDAC → Strategic flexibility → Innovation performance | 0.205 | 0.034 | 0.143 | 0.272 |

| Indirect 2: BDAC → Strategic flexibility → Strategic innovation → Innovation performance | 0.165 | 0.032 | 0.105 | 0.231 |

| Indirect 3: BDAC → Strategic innovation → Innovation performance | 0.060 | 0.017 | 0.030 | 0.098 |

| Coefficient | SE | t Value | p Value | LLCI (95%) | ULCI (95%) | |

|---|---|---|---|---|---|---|

| Moderation of Environmental Uncertainty | ||||||

| Dependent Variable: Innovation performance (R2 = 0.253; F = 15.435) | ||||||

| BDAC | 0.475 | 0.393 | −4.814 | 0.001 | 0.111 | 2.568 |

| Environmental uncertainty | 0.113 | 0.322 | −2.173 | 0.000 | 0.038 | 1.073 |

| BDAC × Environmental uncertainty | 0.429 | 0.122 | 3.510 | 0.001 | 0.189 | 0.669 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, H.; Yuan, S. How and When Does Big Data Analytics Capability Boost Innovation Performance? Sustainability 2023, 15, 4036. https://doi.org/10.3390/su15054036

Zhang H, Yuan S. How and When Does Big Data Analytics Capability Boost Innovation Performance? Sustainability. 2023; 15(5):4036. https://doi.org/10.3390/su15054036

Chicago/Turabian StyleZhang, Hua, and Shaofeng Yuan. 2023. "How and When Does Big Data Analytics Capability Boost Innovation Performance?" Sustainability 15, no. 5: 4036. https://doi.org/10.3390/su15054036

APA StyleZhang, H., & Yuan, S. (2023). How and When Does Big Data Analytics Capability Boost Innovation Performance? Sustainability, 15(5), 4036. https://doi.org/10.3390/su15054036

_Li.png)