2.2. Theoretical Analyses and Research Hypotheses

The first assessment factor, the ESER effect, includes indicators such as carbon emissions, energy consumption per unit of GDP, and the main pollutant discharge amount. Carbon emissions, needless to say, and energy consumption per unit of GDP directly link with carbon emissions. The decrease in this indicator can effectively reduce carbon emissions. If carbon emissions or the actual amount of energy consumption per unit of GDP are lower than the target ones, they will affect the assessment results of demonstration cities. Under the supervision of the assessment, demonstration cities positively achieve the target aims, which also leads to a reduction in carbon emissions. So, this article proposes the hypothesis:

H1: Green transfers play a role in reducing carbon emissions.

The second assessment factor, the completion of green projects, means that the actual investment completion of typical green projects is declared by demonstration cities themselves. Green projects that are declared mainly contain six aspects: low-carbon-industry development, traffic cleaning, green urban construction, service intensification, the quantification of main pollutants, and scaling up renewable energy utilization. These green projects can realize carbon emission reduction by increasing urban green areas and improving energy efficiency.

Especially on the one hand, green transfers can reduce carbon emissions by increasing the urban green area. Green urban construction includes green buildings, urban green land, and park and wetland construction, which can add vegetation coverage, increase carbon sinks and contribute to carbon emission reduction [

28,

29,

30]. For example, Deyang City carried out the landform restoration and vegetation transplantation for ecological function degradation sites, built three new wetland parks, 1536 km of greenway, and added 760 hectares of green area during the demonstration periods. Additionally, Liaocheng City carried out the Zhougonghe Wetland Project, which included the construction of a subsurface flow wetland, surface flow wetland, and river corridor wetland. At the same time, Tongchuan City implemented the greening of urban construction. All of these projects could increase urban green areas, parks, and wetlands, which can achieve direct carbon fixation by isolating and storing carbon dioxide in the atmosphere through plant photosynthesis, providing a direct way for cities to increase sinks [

31]. By enhancing the carbon sink function of urban green areas, the purpose of accomplishing the carbon and oxygen balance in the city or alleviating the carbon sink pressure of forest land outside the city is conducive to the sustainable renewal of urban green area inventory, reducing the impact of the increase in carbon dioxide concentration on human production and life, and playing an important role in achieving the goal of carbon emission reductions. Therefore, this article proposes the following hypothesis:

H2: Green transfers reduce carbon emissions by increasing urban green area.

On the other hand, green transfers reduce carbon emissions by improving energy efficiency. Energy consumption is one of the main sources of carbon emissions [

32]. Additionally, improving energy efficiency is an essential way to reduce carbon emissions. For example, low-carbon-industry development means that enterprises are supported to apply for advanced energy-saving and environmental protection equipment and eliminate under-developed production capacity. The entry threshold is raised for industries with high energy consumption and high emissions and the energy consumption quota for major energy-consuming products. Because carrying out investment projects based on the internalization of environmental costs has positive externalities, which is helpful for the whole environment, but has little benefit for the enterprises themselves, even having a negative effect on their profitability [

33]. ESER transfers can not only subsidize enterprises to replace energy-saving equipment, but can also attract social capital to invest in the energy saving and environmental protection industry, which provides sufficient financing channels for enterprises to increase cash flow. Then, enterprises can introduce advanced and environmentally friendly production equipment and technology, produce green products and develop a circular economy with relatively small risks. This contributes to carbon emission reduction. Additionally, traffic cleaning means promoting energy-saving and new energy vehicles and developing public transport systems. ESER transfers provide automobile enterprises and consumers fiscal subsidies, which encourage people to purchase energy-saving and new energy vehicles. It can also strengthen the construction of public transport. Energy-saving and new energy vehicles can directly promote energy efficiency and mitigate carbon emissions [

34]. Additionally, a perfect public transport system improves the willingness of people to travel by public transport. As it is convenient to travel by public transport, the opportunity to drive private cars will be reduced, which is conducive to energy saving and emission reduction. Scaling up renewable energy utilization can also improve energy efficiency. Because in the process of the delivery of basic energy services, extraction, conversion, transportation, transmission, and terminal use generate potential losses. The opportunity to improve the energy efficiency of the whole system exists at every link. First of all, renewable energy, such as wind energy, solar energy, and hydropower, which do not need fuel, will naturally improve efficiency because there is no need for heat conversion. Secondly, the deployment of distributed renewable energy will increase the proportion of renewable energy, and the other primary energy required to provide the same level of energy services will be reduced accordingly, thus minimizing the environmental and economic costs of the entire system and improving energy efficiency [

35]. All in all, these green projects supported by ESER transfers can improve energy efficiency, and eliminate under-developed production capacity, which reduces carbon emissions [

36,

37]. Therefore, this article proposes the following hypothesis:

H3: Green transfers reduce carbon emissions by improving energy efficiency.

The third assessment factor is a long-term mechanism construction which contains building local energy saving, an environmental protection market, and carbon emission trading mechanisms in demonstration cities. As shown by a large number of studies, carbon emission trading schemes can improve carbon productivity [

38,

39,

40] and reduce carbon emissions [

10,

11,

12,

13]. Moreover, once the carbon emission trading market is established with the support of transfer payment funds, it can be used for a long time and plays a sustainable role in carbon emission reduction, which means that the carbon reduction effect of ESER transfers is long-term effectively. Therefore, this article proposes the following hypothesis:

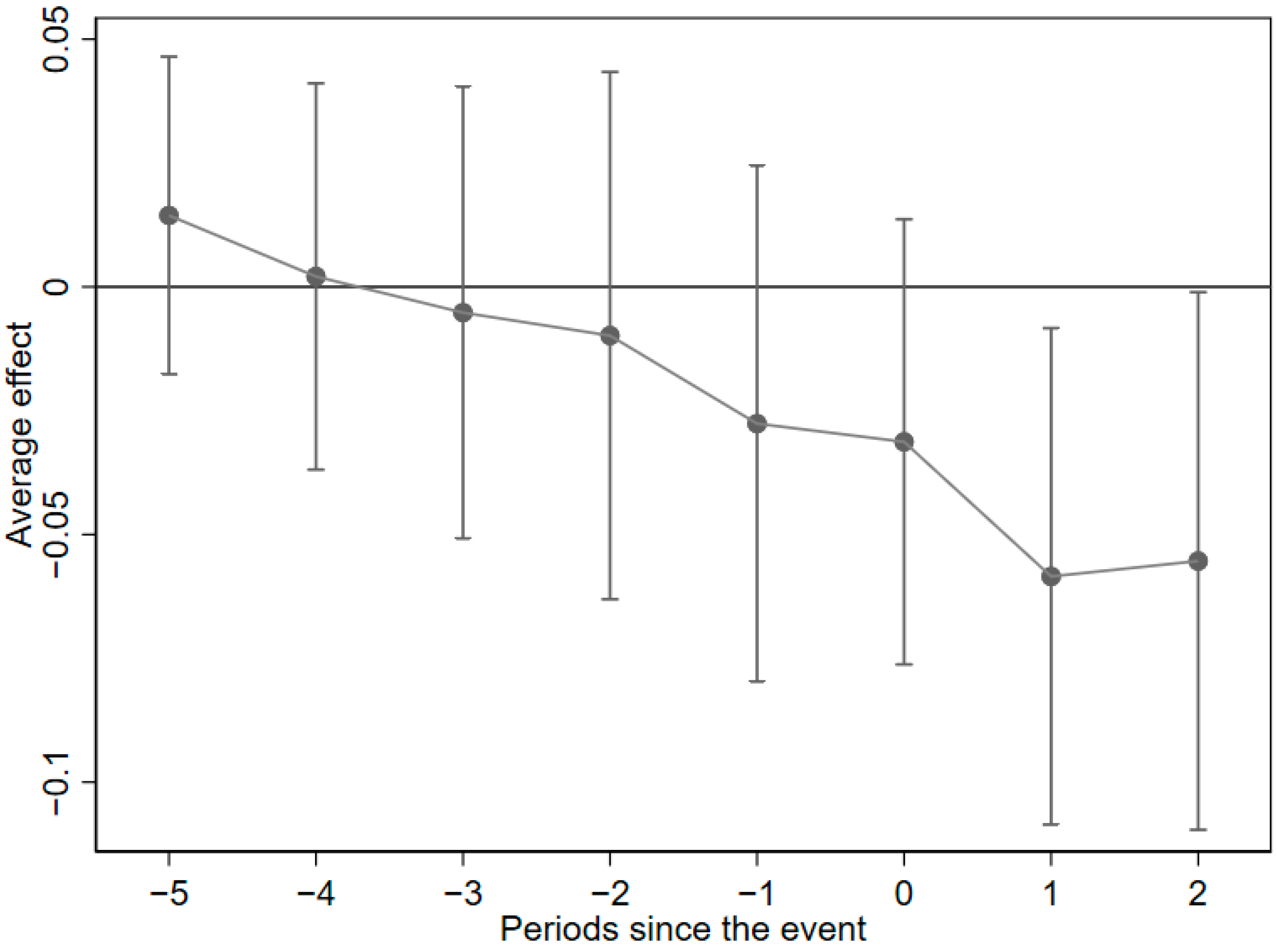

H4: Carbon reduction effect of green transfers is sustainable even after the demonstration periods.

While receiving ESER transfers from the central government, provincial and municipal governments also provide counterpart funds for the construction of green projects in demonstration cities. Take the first batch of demonstration cities as an example. In 2012 alone, the central government allocated 4 billion yuan of ESER transfers to eight of the first batch of demonstration cities, and the provincial government, where the eight demonstration cities were located, also allocated more than 20 billion yuan of counterpart funds. Demonstration cities integrated funds from different sources and made comprehensive utilization of them. For example, as a subordinate county-level city of Deyang City, Mianzhu City coordinated ESER funds at the central, provincial, and municipal levels and cooperated with Deyang to promote the implementation of 24 industrial low-carbon projects, which avoided the “fragmentation” of the use of funds and gave full play to the combined forces of various ESER transfers. Generally speaking, the more ESER transfer payment funds were received from the central government, the more counterpart funds will be provided by the provincial government. For example, some of the demonstration cities that belong to Class I will not only receive more ESER transfer payment funds from the central government each year but also have more corresponding provincial and municipal counterpart funds. Additionally, more green and low-carbon projects need to be built in such cities. What’s more, governments of demonstration cities are also encouraged to make ESER transfers play the leverage role, take advantage of local financial markets, and use ESER transfers to leverage social capital to participate in green and low-carbon construction. For example, Deyang City innovated the mode of capital investment, attracted the participation of social capital, and deeply explored the application of the public-private partnership (PPP) model in the typical ESER demonstration projects. From 2015 to 2016, Deyang City made the central ESER transfers of 39.05 million yuan and played the leverage role, leveraging the social investment of 2.879 billion yuan in typical demonstration projects, achieving a driving effect of 1:73.73.

Therefore, on the one hand, the more ESER transfer payment funds at the central, provincial, and municipal levels that are received, the greener projects need to be built, and the stronger the carbon reduction effect is. On the other hand, the more social funds are guided by green transfer payment funds to invest in green, low-carbon projects, the better the effect of ESER demonstration cities’ construction is. The number of social funds that cities can attract to invest in green projects is related to the financial development level of the cities. Green transfer payments can drive more social funds in demonstration cities with better financial development levels. The more funds are invested in green project construction, the better the carbon reduction effect is. So this article proposes hypotheses H5 and H6.

H5: Demonstration cities receiving more green transfer payment funds have greater effect of carbon reduction.

H6: Demonstration cities with higher level of financial development have greater effect of carbon reduction.