1. Introduction

One of the primary mandates of any government is to achieve sustainable economic growth, which is associated with a reduction in unemployment, improvement in the standard of living and progress in the human development index. To accelerate the growth rate at a sustainable level, governments adapt different policies, including fiscal and monetary policies. Sometimes, the national budget can be in deficit, implying that the expenditure exceeds the revenue at the time when government must emphasize some adverse economic conditions, including recession, high unemployment rates, pandemics, and natural phenomena [

1]. In the case of a deficit budget, the government borrows money either from the domestic economy or abroad, with a different type of interest system and duration [

2]. The effectiveness of budget deficit is contrasting in the different schools of thought (Keynesian vs. Classical) and the empirical literature. Since no study can generalize the effectiveness of budget deficit in explaining long-term growth, we believe that the role of the budget deficit can be conditional on other factors. Precisely, the pattern and sustainable threshold of fiscal expenditure diverge significantly over welfare and non-welfare states. Therefore, we are motivated to re-scrutinize the effectiveness of budget deficit on economic growth by clubbing our sample countries into welfare vs. non-welfare.

We are further motivated by several strands of propositions to conduct this study. First, the effectiveness of budget deficit in promoting economic growth has been a long debate in theoretical and empirical studies [

3,

4]. The Keynesian school of economics considers the budget deficit as one of the significant macroeconomic tools that can drive economic growth by increasing net government spending, investment, and consumption [

5,

6]. On the other hand, Classical and Neoclassical followers criticize the viewpoints of Keynesian economics. They argue that the budget deficit might be helpful in the short term, but in the long term, it creates a huge debt burden, high inflation and crowd-out in the private sector [

7,

8]. Meanwhile, New Keynesians believe that a budget deficit promotes full employment and better wages that stimulate demand, enabling the government to collect significant amounts of revenue from spurring the economy [

9,

10,

11]. Hence, theoretically, the effectiveness of budget deficit on economic growth is still debated and deserves more attention in a revisitation of the issue.

Second, empirical studies on the effectiveness of budget deficit in economic growth are also in a dilemma. Dweck et al. [

12] state that the budget deficit causes high-interest rates and high inflation, which have long-term negative economic repercussions due to limited investment and a shaky domestic debt market. Asandului et al. [

13] similarly find that budget deficit reduces private investment due to its crowd-out effect, which limits fund supply from the banking sector to private investors. A number of studies have also come up with similar findings [

14]. Contrarily, another group of studies argues that budget deficit encourages macroeconomic components that curb the economic downturn through its multiplier effects [

15]. Ahuja and Pandit [

16] similarly state that the budget deficit boosts the demand side of the economy by increasing capital formation, employment, and wage levels, which stimulate the macroeconomic environment. Therefore, the existing literature maintains conflicting positions about the effectiveness of budget deficit on sustainable economic growth, which motivates us to revisit the issue with robust methods.

Third, much of the literature argues that the effectiveness of budget deficit is conditional on factors including quality of governance. A number of experts state that QOG is one of the key factors for the economic growth disparity between the countries [

17,

18,

19,

20]. Studies also argue that QOG removes the distortions from the growth process and ensures the better use of public funds, such as the budget deficit, to spur the whole economy. Recent studies also find similar results regarding the effectiveness of QOG on the nexus between budget deficit and economic growth [

3,

21,

22]. Another group of studies argues that the effectiveness of QOG is diverse in different countries, and poor QOG often promotes growth, whereas strict rules and restrictions on QOG push the economy towards growth stagnation in many developed countries [

23,

24]. According to the studies, strong QOG frequently creates barriers to the use of public funds, such as the budget deficit, through complex fund governance. Therefore, the role of QOG in economic growth, as well as in the nexus between budget deficit and economic growth, is still debated.

Fourth, prior studies highlight disproportionate economic growth patterns across welfare and non-welfare countries due to the disparity in QOG [

4]. However, in some studies, welfare and non-welfare countries are discussed, considering the level of Subsidies and Other Transfers (SOT) to the citizen, the level of Institutional Quality (IQ), and the position of the Human Development Index (HDI) of the country [

25,

26,

27,

28]. Studies argue that the group of nations that emerged as welfare countries are those in which the government is primarily responsible for safeguarding and advancing its citizens’ economic and social well-being. On the other hand, another group of nations, known as non-welfare countries, have made considerably fewer efforts to ensure the economic and social well-being of their population, along with possessing low IQ and a poor HDI rank [

28]. Additionally, a strong or weak IQ indicates the best or worst use of SOT funds, and the HDI position confirms the output of the SOT and IQ in determining the Welfare and Non-Welfare Countries. Although the welfare and non-welfare groups are highly related to economic growth factors, the existing literature largely ignores explaining the growth–deficit relationship in these two groups of countries.

The study discovers a number of gaps in prior studies that need to be filled. First, few studies investigate the moderating role of QOG in the deficit–growth relationship. Second, earlier research primarily considers the European Union, emerging economies, African countries, Asian countries, and developed and developing countries as samples, while ignoring welfare and non-welfare countries in order to investigate the issue. Third, the existing literature employs a variety of static and linear approaches, as well as conventional Quantile Regression, which has a number of drawbacks, including biased estimation and the incapacity to offer information about scale and location. Given the specific shortcomings, the goal of this study is to add new knowledge to the body of literature on the subject.

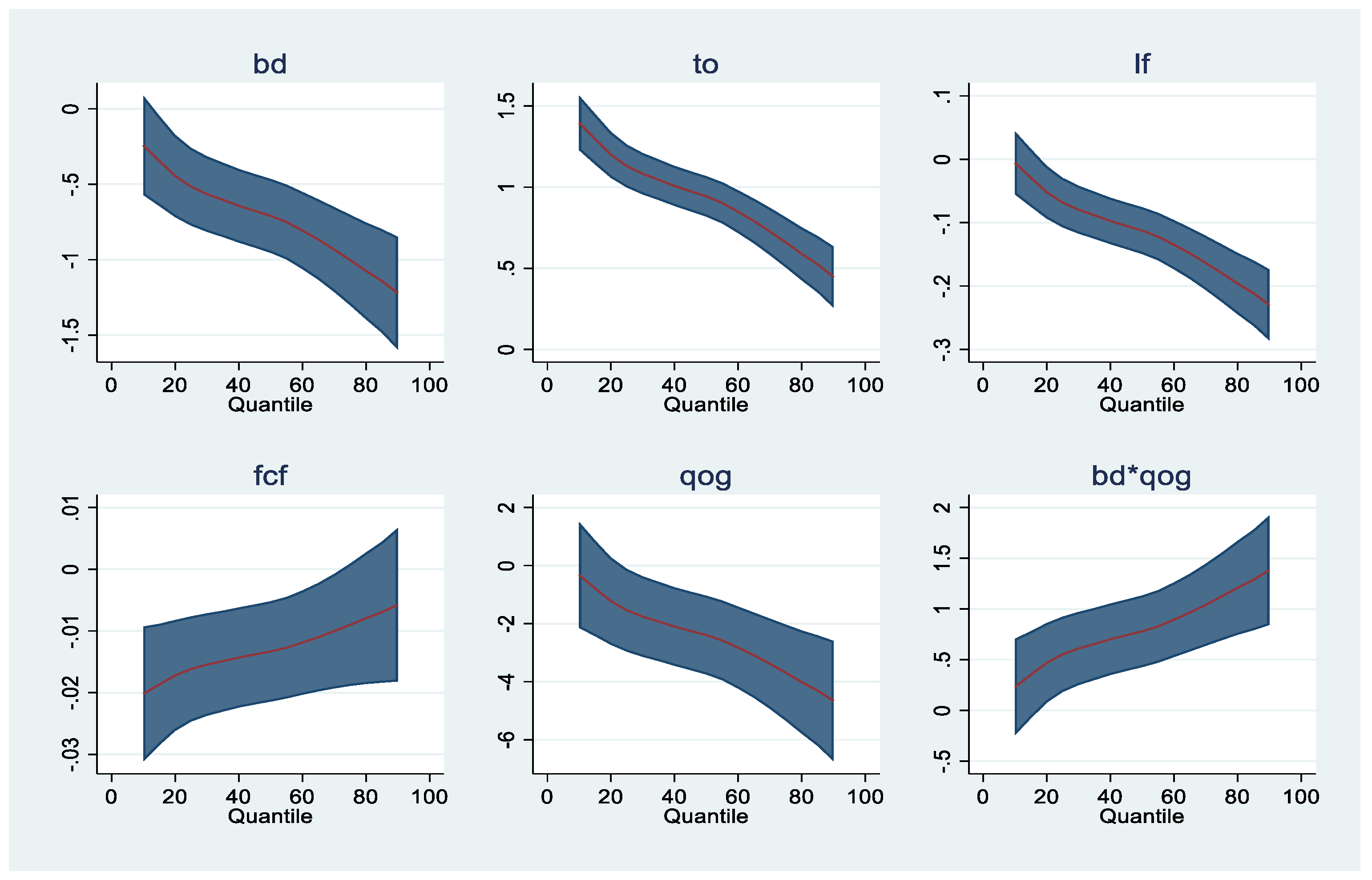

We contribute to the existing growth literature in several ways. First, to the best of our knowledge, our study is the first attempt to measure the impact of budget deficit on economic growth in the context of welfare and non-welfare countries. As the level of QOG fluctuates between welfare and non-welfare countries, our study investigates both its direct and moderating impact on economic growth in the samples. Second, we apply a newly developed econometric model, namely Quantile via Moment, that considers the quantile in both scale and location due to highly heterogeneous panel data. The Quantile via Moment approach is robust in the presence of an abnormality in the data, cross-sectional heterogeneity, and potential endogeneity issues. Moreover, this approach allows us to measure the impact of the budget deficit and QOG on economic growth in different quantiles. Third, our empirical investigation shows that the budget deficit promotes sustainable economic growth in the overall samples. Interestingly the results indicate that the QOG overall supports growth and the deficit–growth nexus for all samples; however, a QOG that is too strong slows down the growth wheel as well.

The next sections of the study are as follows: the following section reviews the relevant literature.

Section 3 explains the data, sample setting and methodology.

Section 4 discusses the results. Finally,

Section 5 contains conclusions and policy implications.

2. Literature Review

Many internal and external factors, such as economic depression, recession, or other crises, can cause an economy to experience a rapid economic crisis. Governments typically inject more money into the economy through the budget deficit as an expansionary fiscal policy to alleviate the crisis. This method was used as a macroeconomic approach to boost the economy during the 1929 Great Depression, the 1997 Japanese economic crisis, the 2007–2008 global financial crisis, and most recently, the COVID-19 economic downturn [

29,

30]. During these crises, governments intervened in the economy and upturned public expenditure through a bailout policy, lowering interest rates, and decreasing taxes to stimulate vulnerable sectors and augment aggregate demand [

30,

31].

Anecdotal evidence argues that government intervention through the budget deficit plays a significant role in managing the financial crisis and upholding economic growth in different countries [

9]. However, the effectiveness of budget deficit on economic growth is still inconclusive in different settings, according to numerous studies. Hence, we review several study clusters on the issue throughout the section, along with different theoretical aspects, methodologies, and sample settings, and recommend a newly designed robust econometric model that can yield robust results.

The effectiveness of the budget deficit on economic growth is still debated from the different points of view of macroeconomic theories. The New Keynesian macroeconomic theory has led to cyclical budget deficits in the majority of countries in recent years [

9,

18]. As the budget deficit increases, other government expenses also increase at the state level, i.e., capital expenditure, development expenditure, welfare expenditure and interest payments. However, in some countries, capital and development expenditure has decreased compared to aggregate social-welfare expenditure, which slows down the growth rate [

32]. However, the New Classical theorists argue that the budget deficit may have some impacts on economic growth during the crisis period but barely has any positive impact in the long run [

33,

34]. Moreover, some countries adopt the budget deficit tool in order to implement the politically promised mega projects, to improve living standards, and to achieve sustainable economic growth, and many of them frequently fail to generate the expected growth due to an overemphasis on eye-catching megaprojects to win elections [

35].

A group of studies argues that budget deficit is a key macroeconomic mechanism for stabilizing economic performance through heavy investment, increasing employment rates, and augmenting aggregate demand [

36,

37]. From a sceptic perspective, proponents argue that the budget deficit usually has minimal effects, but when the budget deficit utilizes properly, that spurs economic growth. Espinosa et al. [

38] and Rickman and Wang [

39] similarly report that if the deficit fund is used in productive sectors, such as developing infrastructure, physical capital, and human capital, it can promote economic growth. Nyasha and Odhiambo [

40] and Devarajan et al. [

41] investigate a similar issue in European countries and demonstrate that raising the share of current spending has favourable and statistically significant growth impacts. Mawejje and Odhiambo [

42] and Sedighi et al. [

43], by employing the ARDL bound testing approach, reveal inconsistent evidence in several developing or non-welfare African countries, finding that raising government spending through budget deficits encourages economic growth in the short and long term.

Some other studies find that the budget deficit has ambiguous impacts on economic growth. Similarly, Yang & Usman [

44] and Mohsin et al. [

45] find that the relationship between budget deficit and economic growth is as complex and ambiguous in welfare and non-welfare countries due to dissimilar responses. Additionally, if the budget deficit is financed through heavy borrowing and high tax, it may create distortion in the credit market and banking sector; consequently, private investment may be squeezed out due to the lack of funds, which could inhibit economic growth [

46,

47]. A number of other studies also find an asymmetric effect of budget deficit on economic growth [

12,

48]. Hence, the effectiveness of budget deficit is still conflicting in empirical studies.

The QOG encourages governance accountability, transparency, efficiency, and other qualities that make it possible to manage resources effectively for sustainable economic progress [

17,

19]. Lopez et al. [

22] similarly argue that QOG upholds a growth-promoting economic environment and removes obstacles from the growth process. On the other hand, Salawu et al. [

49] and Albalate and Bel [

50] state that QOG is not the only factor to motivate economic growth; even sometimes, strong QOG slows down economic activities. Moreover, poor QOG facilitates economic growth in many developing countries [

51]. In addition, some studies claim that QOG plays a sensitive role in managing budget deficit funds and impacts economic growth [

52]. The contrasting findings in the previous studies could be due to model specification, sample setting or biased causal effect relations, and so on, which motivate us to re-examine the issue. in addition, previous studies have mostly failed to provide an estimation that considers scale and location effects; they were also unable to estimate budget deficit effects in different economic conditions where the newly developed Quantile via Moment technique can offer robust estimations considering these issues. However,

Table 1 provides the recent picture on the budget deficit, QOG and economic growth relationship using conventional quantile regression, as well as Quantile via Moment.

Table 1 demonstrates the budget deficit and economic growth relationship in different sample settings, in order to examine the economic growth the recent studies mostly apply the MMQR method. In addition, some of the studies examine the budget deficit and economic growth relationship using conventional Quantile Regression, which is unable to provide information about scale and location [

45,

53,

54]. The method also has data smoothing issues, computing, and mathematical limitations [

59]. Other studies employ the new MMQR, or the method of moment approach, in examining the impacts of the oil sector, renewable energy use and environmental issues on economic growth [

55,

56,

57]. These studies mostly ignore examining the impacts of budget deficit and QOG on economic growth. Additionally, the method of moment, or MMQR, is able to produce less biased estimations in different quantiles considering the scale and location; the method also overcomes the criticism of conventional Quantile Regression as. Therefore, the current study deploys this method to close the methodological gap in the literature on budget deficit, QOG and economic growth issues.

Moreover, a number of the prior studies employ linear models, while we deploy the robust Quantile via Moment technique, developed by Machado and Silva [

60], in order to examine the impact of the budget deficit and QOG on the conditional distribution of economic growth. This also differs from the conditional mean regressions carried out by prior studies. To the best of our knowledge, this paper is one of the first to examine the deficit–growth dynamics, and to incorporate QOG into an examination of welfare and non-welfare countries employing this method.

5. Conclusions and Policy Implication

In order to improve the macroeconomic environment, welfare and non-welfare countries have frequently adopted budget deficits for decades. Because the effect of budget deficit on economic growth is debatable, we re-examine the issue while considering the role of QOG. Our analyses demonstrate that budget deficit benefits welfare countries, while hurting non-welfare countries in achieving sustainable economic growth. Existing studies claim that strong and poor fiscal management, and the presence of corruption, are the major factors that influence the disproportionate growth between welfare and non-welfare countries [

22,

81]. Additionally, both welfare and non-welfare countries grease up their economies quite effectively with the presence of QOG. A number of studies, including a study by Chu et al. [

68], agree that strong governance removes barriers from the growth function and promotes economic growth. The result of this study also reveals that strict regulations and governance norms frequently enhance growth for non-welfare countries in most quantiles and occasionally inhibit growth for welfare countries; these findings are also parallel with Chu et al. [

68] and Oliskevych et al. [

69]. Finally, our research displays that the QOG plays a critical role in the relationship between economic growth and the budget deficit, and the study also indicates that the QOG promotes growth sustainability in both welfare and non-welfare countries.

Based on the results, we provide several policy implications. First, investigations show that budget deficit is positive for the sustainable economic growth of welfare countries, while being detrimental to non-welfare countries. Anecdotal evidence shows that the budget deficit encouraged the economy to escape the financial crisis in 2007−2009 and even during the COVID-19 pandemic for high-income welfare countries, according to Briceño and Perote [

82]. On the other hand, an over-reliance on budget deficit has also invited macroeconomic crises for Greece and, most recently, Sri Lanka. Hence, policymakers should consider the feasibility of the budget deficit before adopting it for their country. Second, QOG has highly growth-enhancing impacts on welfare and non-welfare countries. Therefore, both groups of countries should prioritize keeping a strong level of QOG for sustainable economic growth. However, the coefficients for the moderating role of QOG in the deficit–growth nexus show that QOG demotivates growth activities in welfare countries, whereas it supports economic growth in non-welfare countries. Therefore, welfare countries should consider the negative effects of overly stringent QOG norms and regulations when developing governance policies because their level of QOG is already in a strong position. At the same time, the policymakers of non-welfare countries should improve and maintain a stable QOG to promote a sustainable economy using the budget deficit tool. The overall results suggest that the effectiveness of budget deficits in welfare and non-welfare countries varies, followed by the magnitude of QOG.

This study examines the effectiveness of the budget deficit in welfare and non-welfare countries. While the COVID-19 outbreak fosters the budget deficit once again, some countries are adopting an expansionary fiscal policy to mitigate the adversity of the ongoing pandemic in the economy.

However, the current study was unable to incorporate the global context. Hence, future studies can focus on the topic, looking at the short- and long-term implications of the pandemic-era budget deficit on economic growth, extending beyond the context of welfare and non-welfare countries. In addition, the current study was unable to assess the impact of various aspects of QOG on growth independently. Therefore, future research may investigate the issue using separate components of QOG in difficult samples, in order to provide additional insights into the growth–deficit nexus.