Coordination Analysis of the Recycling and Remanufacturing Closed-Loop Supply Chain Considering Consumers’ Low Carbon Preference and Government Subsidy

Abstract

1. Introduction

- When there are conflicts between sales channels and recovery channels, how do the manufacturer and the retailer set wholesale prices, retail prices and recycling prices in the CLSC, and in addition, what is the difference between the total recycling amount and total profit of CLSC, and the level of CER efforts of the manufacturer, under decentralized and centralized decision-making models?

- What is the correlation between consumers’ low carbon preference coefficient and government CER subsidy coefficient, and the level of manufacturer CER? What is the impact on a manufacturer’s and retailer’s pricing decisions?

- Can the “CER cost sharing + revenue sharing” contract improve the profits of various interested parties and total profit of the supply chain, as well as the level of the manufacturer’s CER? What is the best way to set contract parameters?

2. Literature Review

2.1. CLSC under the Background of the Goals of Carbon Peaking and Carbon Neutrality

2.2. CLSC Considering Consumers’ Low Carbon Preference

2.3. CLSC Considering Government Subsidy

3. Model Description and Assumptions

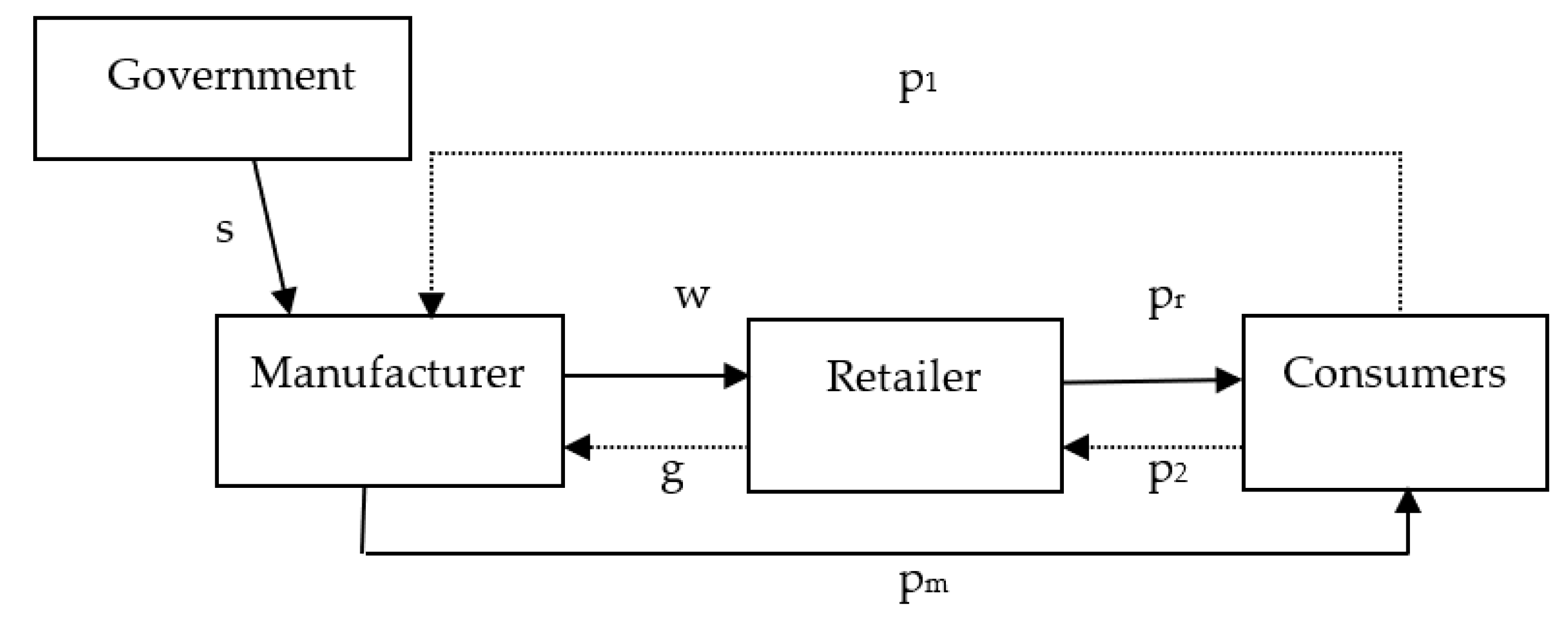

3.1. Description of the Problem and Symbolic Meaning

3.2. Assumptions

4. Model Decisions

4.1. Decentralized Decision-Making Model (Model D)

4.2. Centralized Decision-Making Model (Model C)

4.3. Analysis of Equilibrium Results of Different Decision-Making Models

4.3.1. The Influence of Each Parameter on the Equilibrium Result

4.3.2. Comparative Analysis of Equilibrium Results of Different Decision-Making Models

5. Coordination of the Recycling and Remanufacturing CLSC

6. Numerical Examples

6.1. Comparative Analysis of Centralized or Decentralized Decision-Making

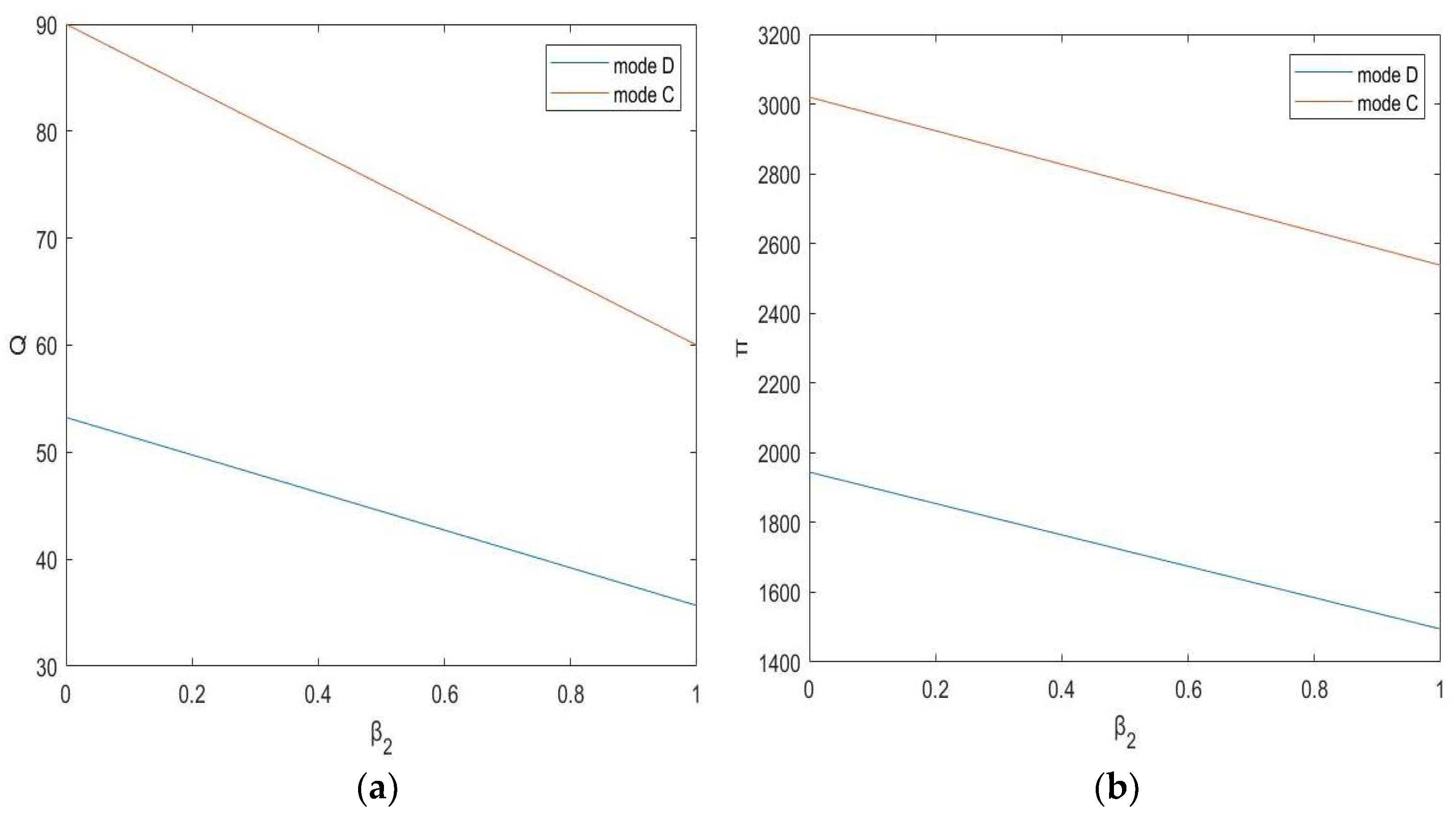

6.2. Sensitivity Analysis of System Parameters

6.2.1. Analysis of the Influence of Recycling Channel Competition Coefficient

6.2.2. Analysis of the Influence of Consumers’ Low Carbon Preference Coefficient

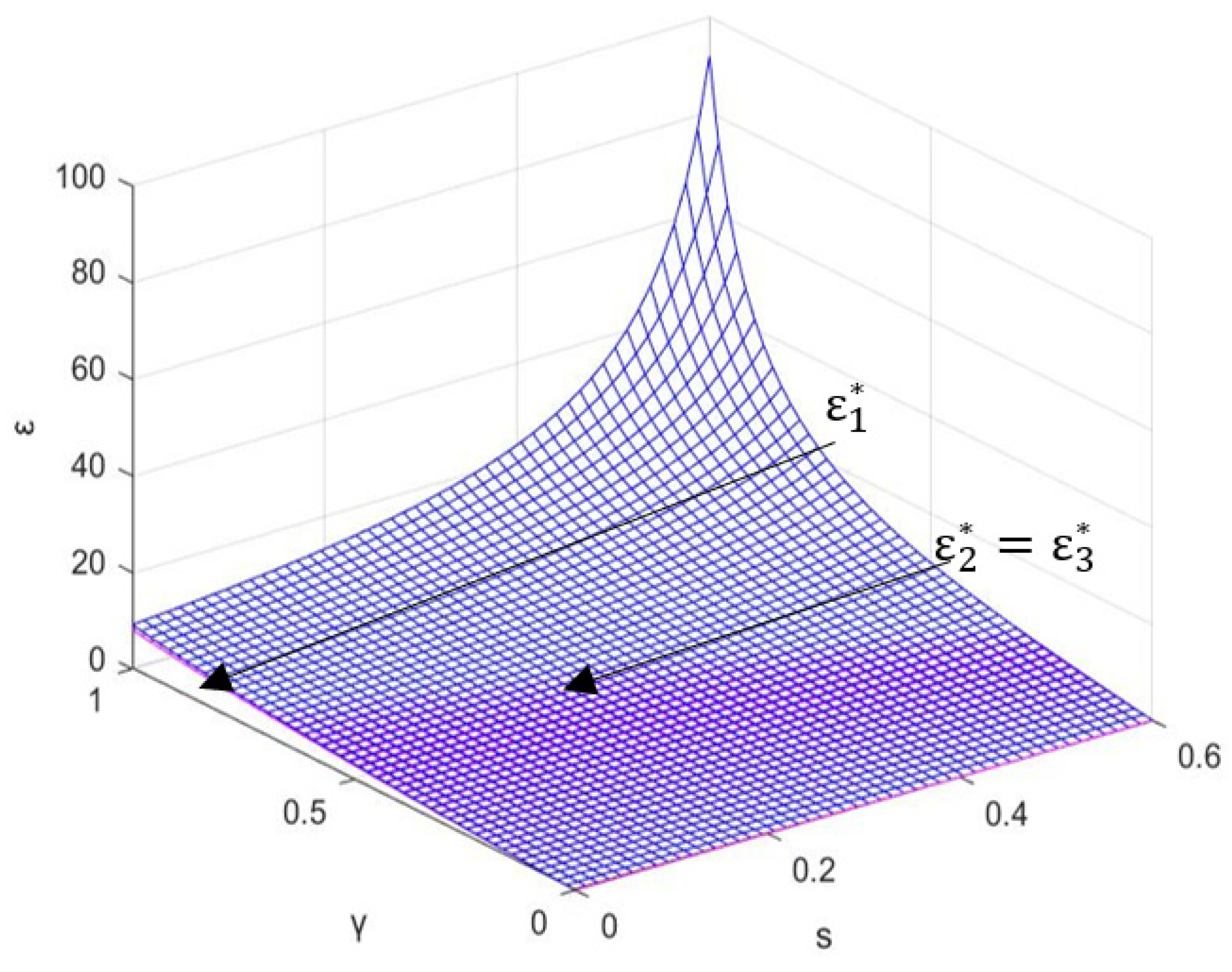

6.2.3. Analysis of the Influence of Government CER Subsidy Coefficient

6.2.4. Analysis of the Common Influence of ³ and S on CLSC

6.3. Analysis of the Results of ContractCoordination

7. Conclusions

- (1)

- In the recycling and remanufacturing CLSC, the total supply chain recycling amount, total profit, and manufacturer’s CER effort level under the centralized decision-making model are higher than those under the decentralized decision-making model. The competition between recycling channels will reduce the total recycling amount, and the total profit of the supply chain is negatively related to the recycling channel competition coefficient.

- (2)

- The price set by the manufacturer and retailer under the centralized decision-making model is lower than that under the decentralized model, which encourages consumers’ purchasing intention and correspondingly expands market demand. In addition, the manufacturer’s CER effort level and his direct selling price, the retailer’s retail price, and the total profit of the supply chain are all positively related to consumers’ low carbon preference coefficient and government CER subsidy coefficient. Under the decentralized decision-making model, however, the retailer sets a higher price and the continuous increase in retail price will eventually damage the overall profit of the supply chain.

- (3)

- The cost-and-benefit-sharing contract can coordinate CLSC. The parameters of the contract in some circumstances can mitigate the competition between recycling channels and hence increase the total recycling amount of the supply chain, the profit of each involved party and that of the entire supply chain, as well as the CER effort level of the manufacturer, which consequently leads to the Pareto improvement of CLSC.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Entezaminia, A.; Gharbi, A.; Ouhimmou, M. Environmental hedging point policies for collaborative unreliable manufacturing systems with variant emitting level technologies. Clean. Prod. 2020, 250, 119539. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, W.; Liu, B. Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. Clean. Prod. 2017, 140, 1118–1128. [Google Scholar] [CrossRef]

- Yi, Y.; Li, J. The effect of governmental policies of carbon taxes and energy-saving subsidies on enterprise decisions in a two-echelon supply chain. Clean. Prod. 2018, 181, 675–691. [Google Scholar]

- Luo, M. To fully launch new march on constructing beautiful China by pursuing green, low-carbon and circular development. Environ. Prot. 2021, 49, 9–11. [Google Scholar]

- Fogarty, J.; Sagerer, S. Exploration externalities and government subsidies: The return to government. Resour. Policy 2016, 47, 78–86. [Google Scholar] [CrossRef]

- Jauhari, W.A.; Adam, P.; Rosyidi, C.N. A closed-loop supply chain model with rework, waste disposal, and carbon emissions. Oper. Res. Perspect. 2020, 7, 100155. [Google Scholar] [CrossRef]

- Giri, B.C.; Mondal, C.; Maiti, T. Analyzing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. Clean. Prod. 2018, 190, 822–837. [Google Scholar] [CrossRef]

- Cheng, H.Y.; Meng, L.J.; Hu, Y.Q.; Huang, Z.Q. A Research on Remanufacturing Authorization Model of Closed Loop Supply Chain Based on Consumer Heterogeneous Demand. Ind. Eng. J. 2021, 24, 140–149. [Google Scholar]

- Zhou, Y.; Xiong, Y.; Jin, M.Y. Less is more: Consumer education in a closed-loop supply chain with remanufacturing. Omega 2021, 101, 102259. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Gan, W.H.; Han, L.; Su, L.; Zhong, R. Closed-loop supply chain pricing and coordination considering WTP under carbon trading policy. Ecol. Econ. 2019, 35, 67–74. [Google Scholar]

- Zheng, Q.; Kadeer, A.R. Study on dynamic game model and complexity of different low-carbon strategies under carbon tax mechanism. Oper. Res. Manag. 2022, 31, 55–60. [Google Scholar]

- Qi, Q.; Wang, J.; Bai, Q. Pricing decision of a two-echelon supply chain with one supplier and two retailers under a carbon cap regulation. Clean. Prod. 2017, 151, 286–302. [Google Scholar] [CrossRef]

- Yang, Y.X.; Guan, Q.; Zhang, B.Y.; Meng, L.J.; Yu, Y.N. Equilibrium analysis of closed-loop supply chain network under carbon tax policy. China Manag. Sci. 2022, 30, 185–195. [Google Scholar]

- Liu, X.; Yang, Y.X. Multi-objective optimization of sustainable closed-loop supply chain network. Comput. Eng. Appl. 2022, 5, 1–10. [Google Scholar]

- Zhang, J.F.; Cao, X.Y. Research on Production Decision and Coordination of Closed-loop Supply Chain under Carbon Quota Policy. Soft Sci. 2018, 32, 44–49. [Google Scholar]

- Li, H.; Wang, C.X.; Xu, L. Decision-making of carbon emission reduction and low-carbon promotion in closed-loop supply chain under different competitive structures. Control Theory Appl. 2019, 36, 1776–1790. [Google Scholar]

- Shi, C.D.; Yan, X.X.; Wu, M.X.; Xing, E.F.; Zhang, H.T. Research on low-carbon emission reduction from the perspective of remanufacturing closed-loop supply chain. Sci. Technol. Manag. Res. 2018, 38, 244–250. [Google Scholar]

- Li, H.; Wang, C.X.; Shang, M.; Ou, W.; Qin, W. Cooperative decision in a closed-loop supply chain considering carbon emission reduction and low-carbon promotion. Environ. Prog. Sustain. Energy 2019, 38, 143–153. [Google Scholar] [CrossRef]

- Yang, J.Y.; Yuan, Y.H.; Li, Y. Research on carbon emission reduction and pricing strategy of closed-loop supply chain considering uncertain recycling quality. Ecol. Econ. 2020, 36, 38–44+98. [Google Scholar]

- Zhang, L.R.; Yang, Z.F.; Cheng, C.Q. Choice of emission reduction strategy in closed-loop supply chain under carbon quota trading policy. Ind. Eng. Eng. Manag. 2022, 36, 172–180. [Google Scholar]

- Wang, Y.C.; Feng, G.Z.; Wang, N.M. Analysis of manufacturers-led low-carbon supply chain emission reduction strategy. Bus. Econ. Res. 2017, 12, 72–75. [Google Scholar]

- Ji, T.; Xu, X.; Yan, X. The production decisions and cap setting with wholesale price and revenue sharing contracts under cap-and-trade regulation. Int. J. Prod. Res. 2020, 58, 128–147. [Google Scholar] [CrossRef]

- Sun, J.Y.; Yang, L.; Yao, F.M. Recovery and Patent Authorization Strategy for Closed-loop Supply Chain Considering Low Carbon Preference and Carbon Emission Reduction. Oper. Res. Manag. Sci. 2022, 31, 120–127. [Google Scholar]

- Xing, G.J.; Li, Y.Y. Research on production decision of competitive closed-loop supply chain considering consumers’ green preference. Ind. Eng. 2020, 23, 22–29. [Google Scholar]

- Coskun, S.; Ozgur, L.; Polat, O.; Gungor, A. A model proposal for green supply chain network design based on consumer segmentation. Clean. Prod. 2016, 110, 149–157. [Google Scholar] [CrossRef]

- Wu, D.; Yang, Y.X. Study on differential game model of supply chain emission reduction considering consumers’ low-carbon preference. China Manag. Sci. 2021, 29, 126–137. [Google Scholar]

- Yang, L.; Ji, J.; Wang, M. The manufacturer’s joint decisions of channel selections and carbon emission reductions under the cap-and-trade regulation. Clean. Prod. 2018, 193, 506–523. [Google Scholar] [CrossRef]

- Zhang, F.; Li, N.; Da, Q.L.; Wang, W.B. Research on low-carbon emission reduction of multi-demand closed-loop supply chain based on two subsidy policies. China Manag. Sci. 2022, 5, 1–11. [Google Scholar]

- Cao, X.G.; Wang, X.J.; Wen, H. Managing new and remanufactured productions with remanufacturing degree under patent protection. Kybernetes 2019, 49, 707–731. [Google Scholar] [CrossRef]

- Guo, J.Q.; He, L.; Gen, M. Optimal strategies for the closed-loop supply chain with the consideration of supply disruption and subsidy policy. Comput. Ind. Eng. 2019, 128, 886–893. [Google Scholar] [CrossRef]

- Jena, S.K.; Sarmah, S.P.; Padhi, S.S. Impact of government incentive on price competition of closed-loop supply chain system. Inf. Syst. Oper. Res. 2018, 56, 192–224. [Google Scholar] [CrossRef]

- Guo, S.D.; Jing, Y.Q.; Li, Q. Research on the optimal decision of remanufacturing closed-loop supply chain considering government subsidies and different recycling channels. Ind. Eng. 2022, 25, 19–27. [Google Scholar]

- Zhang, X.M.; Li, Q.W.; Qi, G.H. Decision-making of a dual-channel closed-loop supply chain in the context government policy: A dynamic game theory. Discret. Dyn. Nat. Society 2020, 2313698. [Google Scholar] [CrossRef]

- Wang, W.B.; Ding, J.F.; Da, Q.L. Cost sharing-profit sharing contract of closed-loop supply chain under reward and punishment mechanism. Control Decis. 2019, 34, 843–850. [Google Scholar]

- Li, J.; Du, W.H.; Yang, F.M.; Hua, G.W. The carbon subsidy analysis in remanufacturing closed-loop supply chain. Sustainability 2014, 6, 3861–3877. [Google Scholar] [CrossRef]

- Yang, Y.X.; Xu, X. A differential game model for CLSC participants under carbon emission permits. Comput. Ind. Eng. 2019, 135, 1077–1090. [Google Scholar] [CrossRef]

- Shang, C.Y.; Guan, Z.M.; Mi, L.Y. Analysis of government subsidy strategy in green supply chain considering dual consumption preference. Syst. Eng. 2020, 38, 93–102. [Google Scholar]

- Heydari, J.; Govindan, K.; Jafari, A. Reverse and closed-loop supply chain coordination by government role. Transp. Res. Part D Transp. Environ. 2017, 52, 379–398. [Google Scholar] [CrossRef]

- Shu, T.; Huang, C.F. Trade-old-for-remanufactured closed-loop supply chain with carbon tax and government subsidies. Sustainability 2018, 10, 3935. [Google Scholar] [CrossRef]

- Xu, J.; Cheng, F.X.; Liu, J.L. Equilibrium Decision of Closed-loop Supply Chain Network Considering Consumers’ Low-carbon Preference under Government Subsidy. Sci. Technol. Manag. Res. 2019, 39, 266–274. [Google Scholar]

- He, L.H.; Chen, L.Y. The incentive effects of different government subsidy policies on green buildings. Renew. Sustain. Energy Rev. 2021, 135, 110123. [Google Scholar] [CrossRef]

- Mi, Y.; Bo, H. Subsidy policies under the coexistence of “trade old for new” and “trade old for remanufactured” programs. J. Ind. Technol. Econ. 2021, 40, 102–109. [Google Scholar]

- Gurnani, H.; Erkoc, M. Supply contracts in manufacturer-retailer interactions with manufacturer quality and retailer induced demand. Nav. Res. Logist. 2010, 55, 200–217. [Google Scholar] [CrossRef]

- Li, H.; Wang, C.X. Closed-loop supply chain decision of multi-channel recycling under government subsidy. Pract. Underst. Math. 2017, 47, 48–57. [Google Scholar]

- Ha, A.Y.; Tong, S.; Zhang, H. Sharing demand information in competing supply chains with production diseconomies. Math. Oper. Res. 2011, 57, 566–581. [Google Scholar] [CrossRef]

- Zhou, Y.J.; Bao, M.J.; Chen, X.H. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Li, X.; Li, Y.J. A non-cooperative game on the acquisition pricing of multiple remanufacturers. J. Manag. Eng. 2012, 26, 72–76. [Google Scholar]

- Zhang, Y.H.; Wang, Y. The impact of government incentive on the two competing supply chains under the perspective of corporation social responsibility: A case study of photo voltaic of photo voltaic industry. Clean. Prod. 2017, 154, 102–113. [Google Scholar] [CrossRef]

- Chen, J.H.; Mei, J.X.; Cao, Q.Q. Decision-making of hybrid recycling channels selection for closed-loop supply chain with dominant retailer. Comput. Integr. Manuf. Syst. 2021, 27, 954–964. [Google Scholar]

| Parameters | Definitions |

|---|---|

| Capacity of the market | |

| Unit cost of manufacturing new products with brand-new parts | |

| Unit cost of remanufacturing the recycled waste products to produce new products | |

| Unit wholesale price of the manufacturer | |

| Manufacturer’s online market proportion coefficient | |

| Sensitivity coefficient of demand price | |

| Cross price elasticity coefficient | |

| Direct selling price of products sold in manufacturer’s direct selling channel | |

| Retail price of products sold in retailer’s retail channel | |

| The level of manufacturer’s CER effort | |

| Unit initial carbon emissions of new products | |

| Consumer’s low carbon preference coefficient (referring to consumers’ willingness to buy remanufactured products) | |

| Influence coefficient of the level of manufacturer’s CER effort on CER cost | |

| Government CER subsidy coefficient | |

| Transfer payments made by the manufacturer to the retailer | |

| Unit recycling price paid by the manufacturer to consumers | |

| Unit recycling price paid by the retailer to consumers | |

| Sensitivity coefficient of consumers to recycling price | |

| Recycling channel competition coefficient | |

| Demand of direct selling channel | |

| Demand of retail channel | |

| Total market demand | |

| Manufacturer’s recycling amount | |

| Retailer’s recycling amount | |

| Total recycling amount under CLSC | |

| Manufacturer’s profit | |

| Retailer’s profit | |

| Total profit under CLSC |

| Model | w | pm | pr | p1 | p2 | g | ɛ | Q | Π |

|---|---|---|---|---|---|---|---|---|---|

| Model D | 65.608 | 73.197 | 80.938 | 15 | 10 | 15 | 3.440 | 50 | 2393.786 |

| Model C | / | 73.339 | 76.197 | 15 | 15 | / | 7.560 | 60 | 2721.332 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Y.; Wang, Z.; Liu, Y.; Mou, Z. Coordination Analysis of the Recycling and Remanufacturing Closed-Loop Supply Chain Considering Consumers’ Low Carbon Preference and Government Subsidy. Sustainability 2023, 15, 2167. https://doi.org/10.3390/su15032167

Chen Y, Wang Z, Liu Y, Mou Z. Coordination Analysis of the Recycling and Remanufacturing Closed-Loop Supply Chain Considering Consumers’ Low Carbon Preference and Government Subsidy. Sustainability. 2023; 15(3):2167. https://doi.org/10.3390/su15032167

Chicago/Turabian StyleChen, Yan, Zhuying Wang, Yan Liu, and Zongchao Mou. 2023. "Coordination Analysis of the Recycling and Remanufacturing Closed-Loop Supply Chain Considering Consumers’ Low Carbon Preference and Government Subsidy" Sustainability 15, no. 3: 2167. https://doi.org/10.3390/su15032167

APA StyleChen, Y., Wang, Z., Liu, Y., & Mou, Z. (2023). Coordination Analysis of the Recycling and Remanufacturing Closed-Loop Supply Chain Considering Consumers’ Low Carbon Preference and Government Subsidy. Sustainability, 15(3), 2167. https://doi.org/10.3390/su15032167