Long-Term Leases vs. One-Off Purchases: Game Analysis on Battery Swapping Mode Considering Cascade Utilization and Power Structure

Abstract

1. Introduction

2. Literature Review

2.1. The Operational Strategy of BSM

2.2. The Cascade Utilization of Battery

2.3. The Power Structure and Game Theory in the EV Supply Chain

2.4. The Impact of the Supply Chain System on Environmental Issues and Customer Satisfaction

2.5. Summary

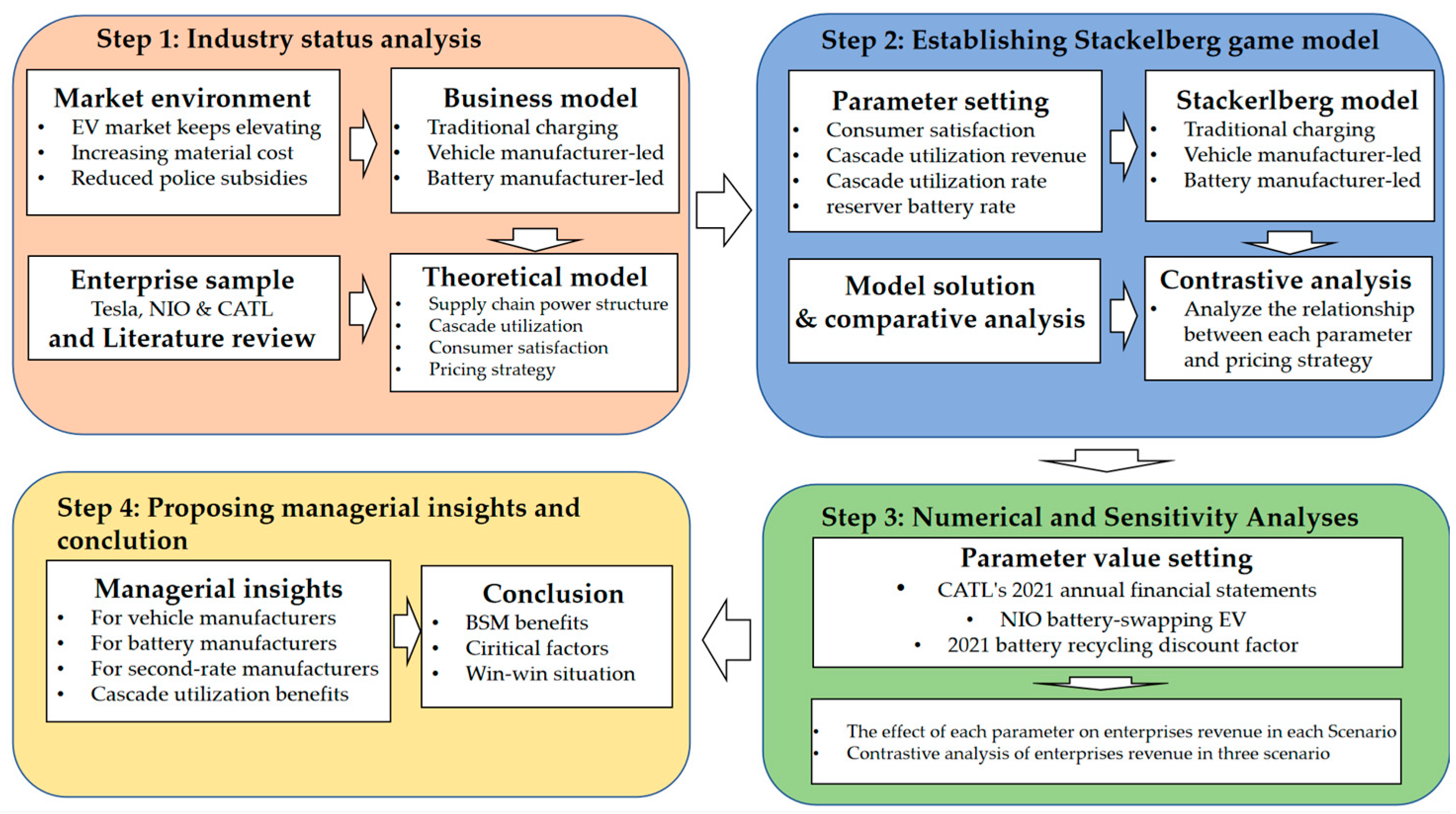

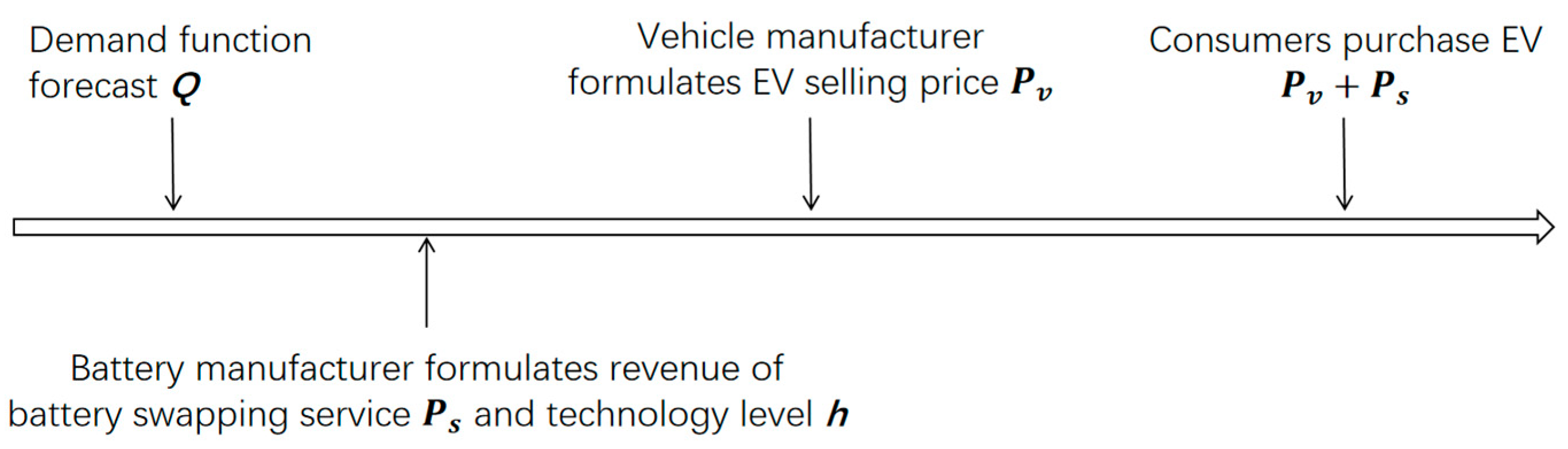

3. Model Formulation and Analysis

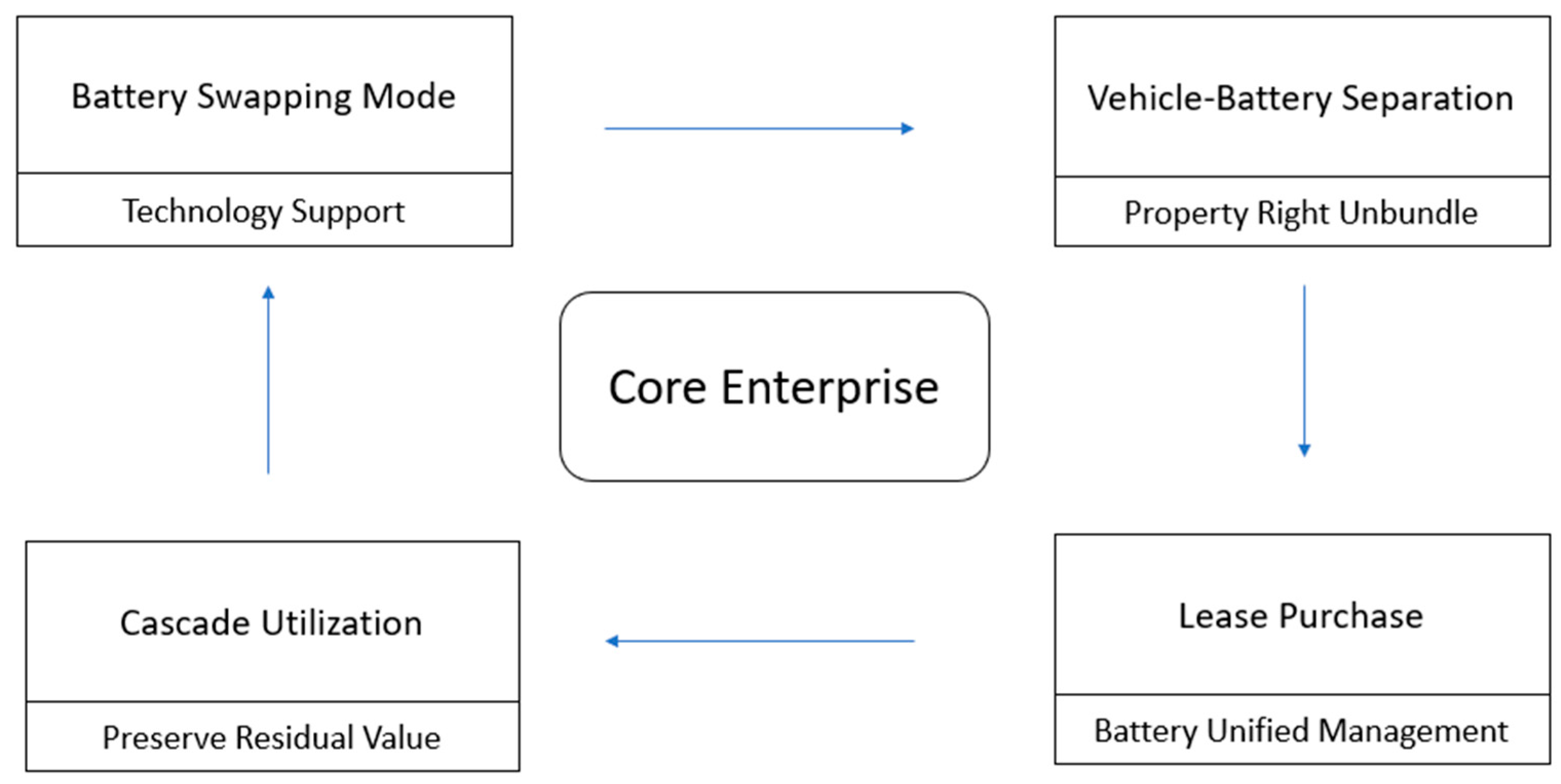

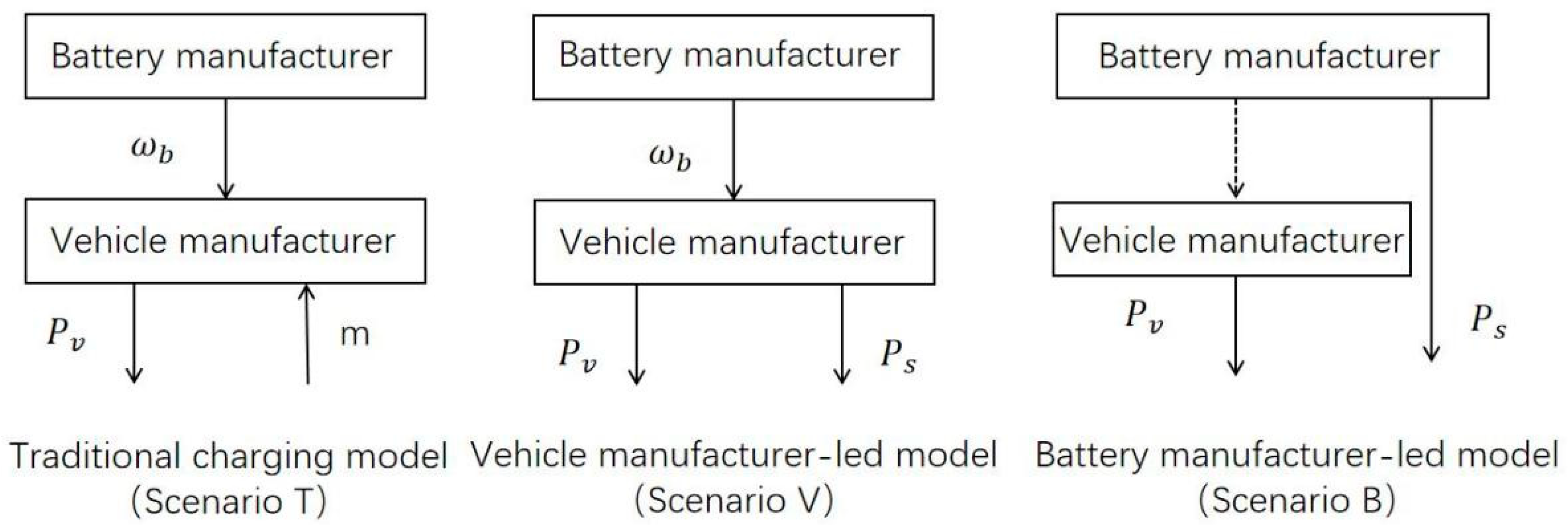

3.1. Background Description

3.2. Basic Assumption

3.3. Demand Function Construction

3.4. Nomenclature

4. Stackelberg Game Model Analysis

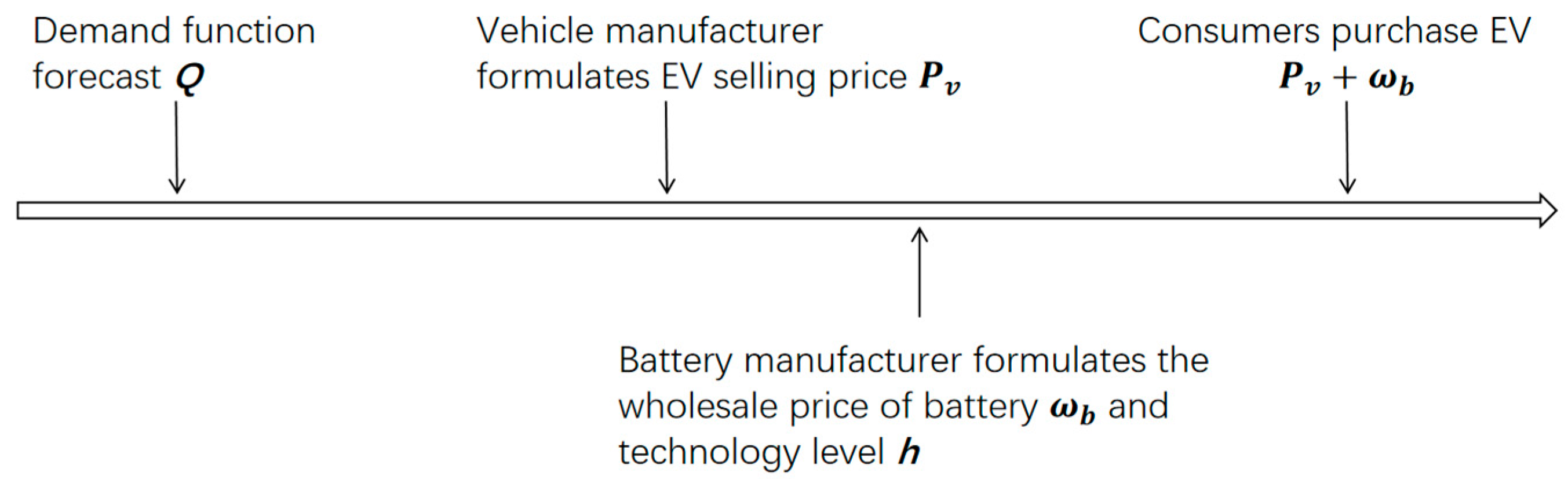

4.1. Scenario T

4.2. Analysis of BSM Supply Chain

4.2.1. Scenario V

4.2.2. Scenario B

5. Numerical and Sensitivity Analyses

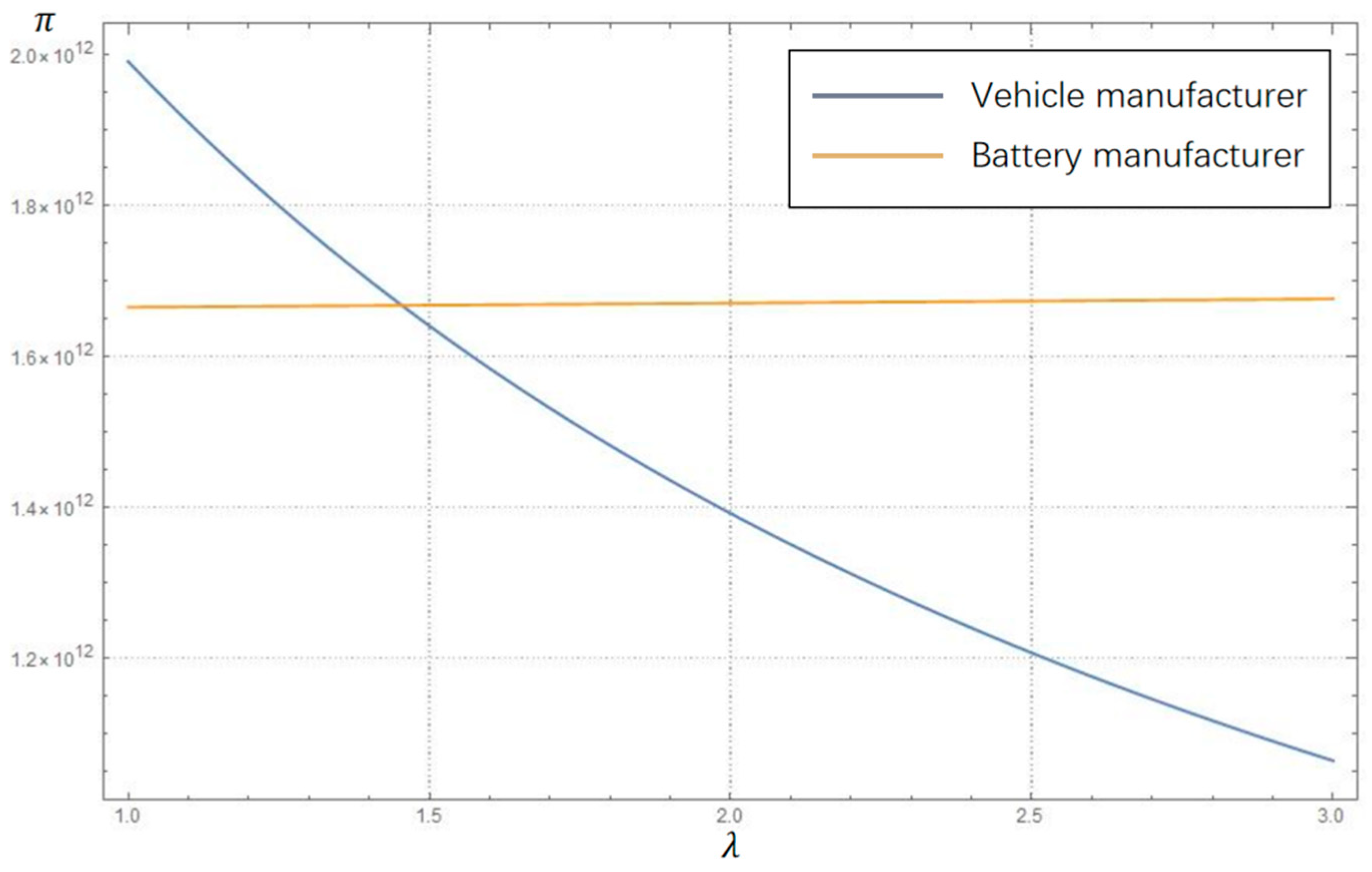

5.1. The Effect of the Pricing Strategy on Enterprise Revenue in Scenario V

5.2. The Effect of the Reserve Battery Quantity on Enterprises’ Revenue

5.3. The Effect of Cascade Utilization Ratio on Recycling Revenue

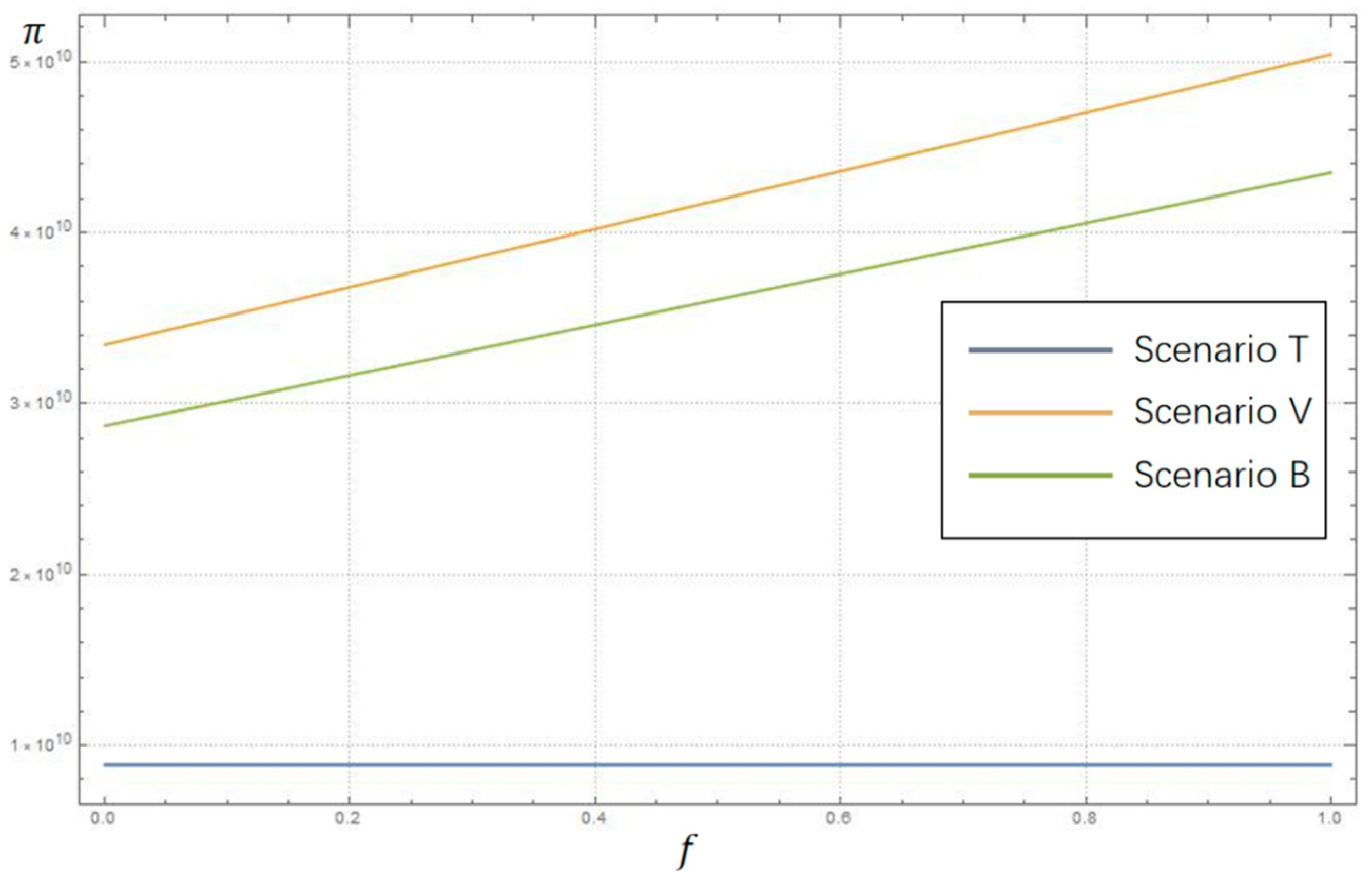

5.4. The Effect of Elastic Coefficient on Enterprises Revenue

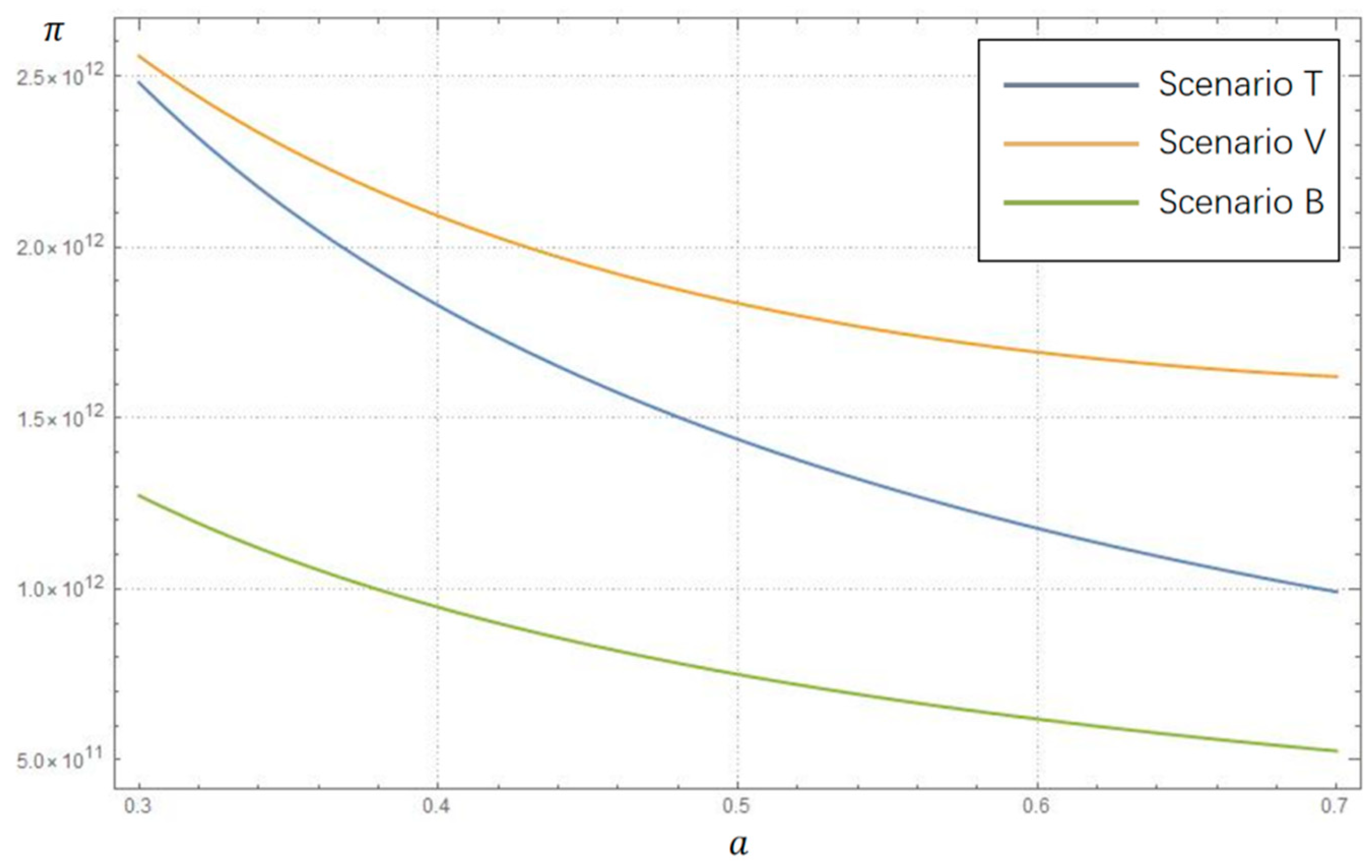

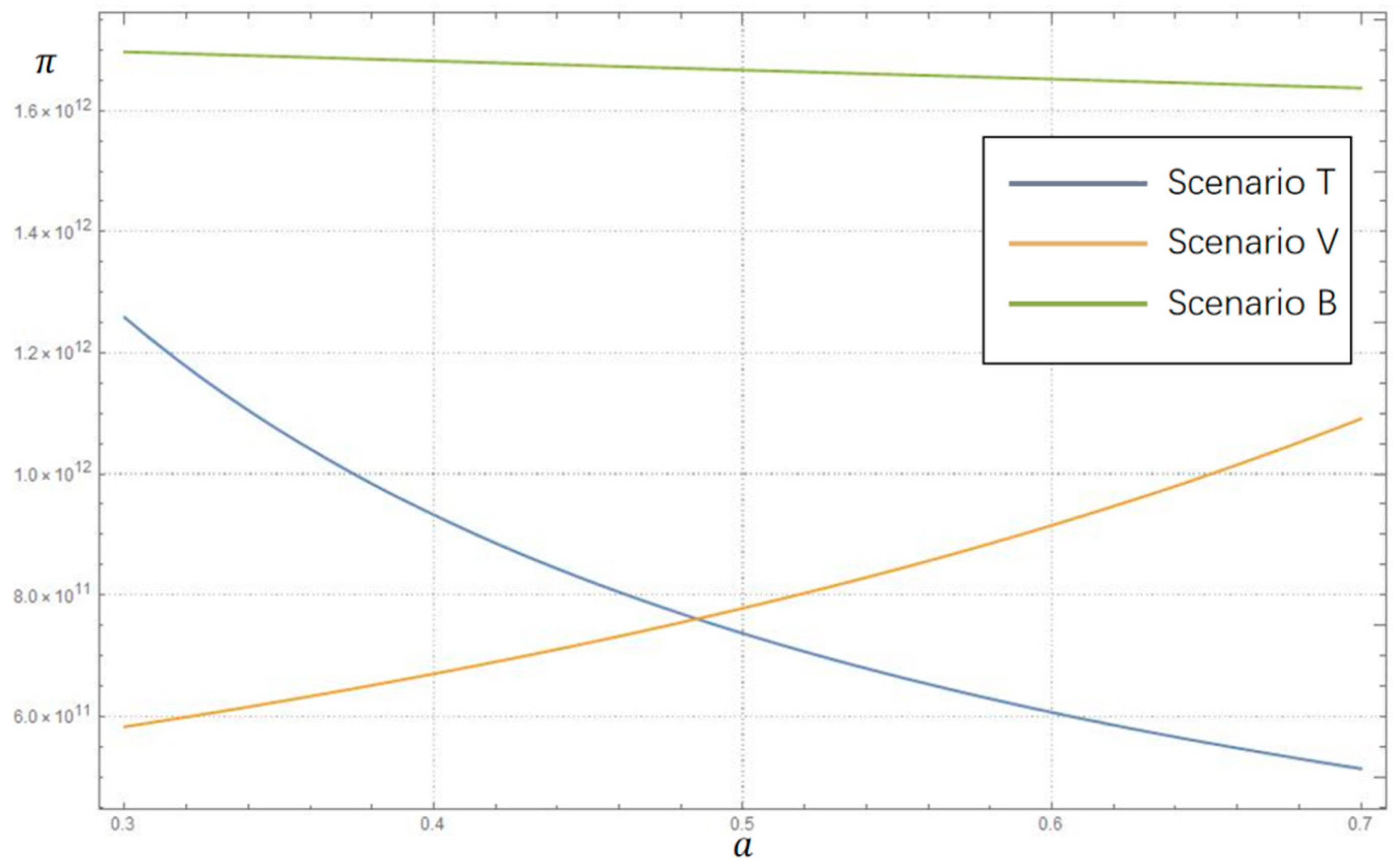

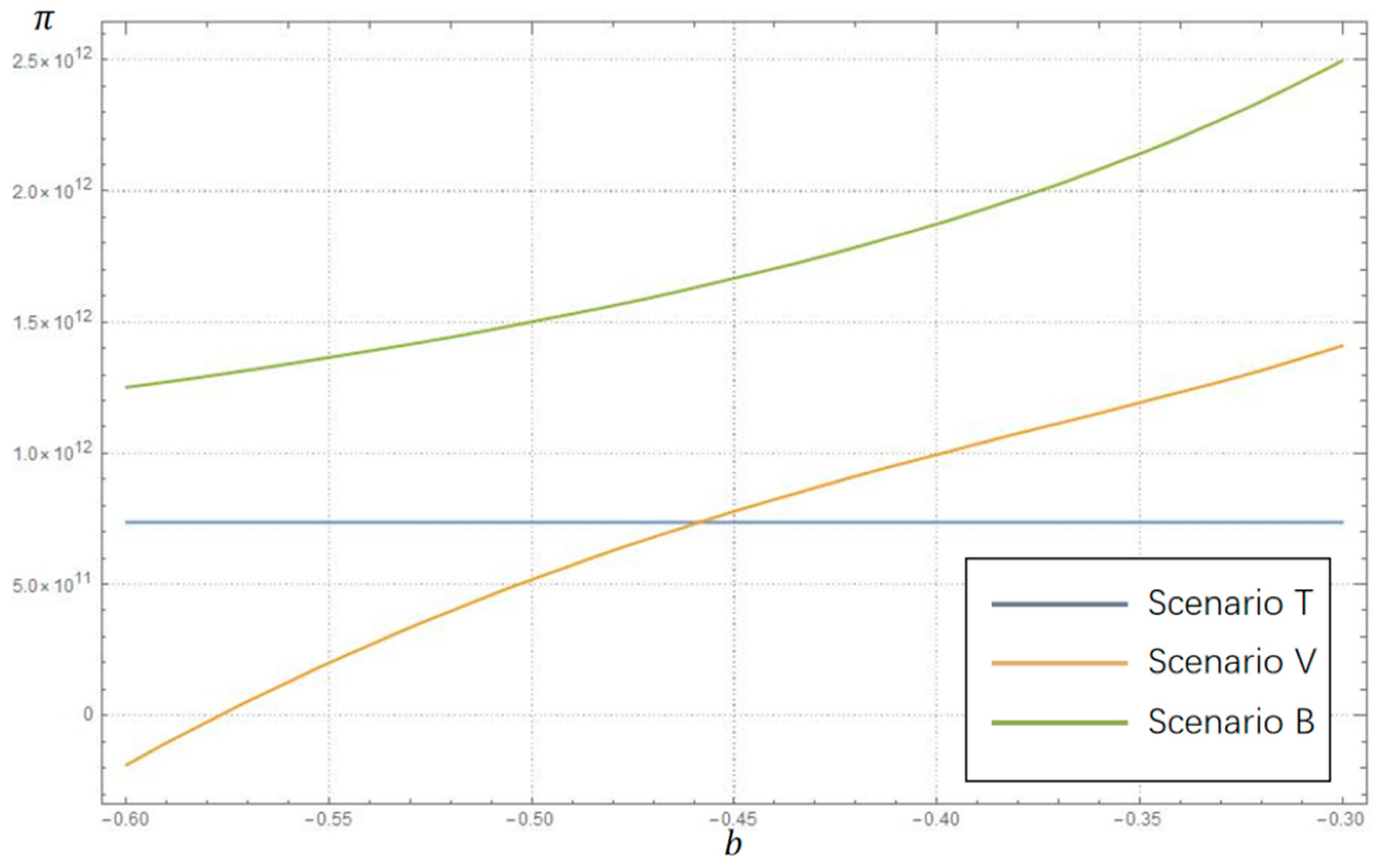

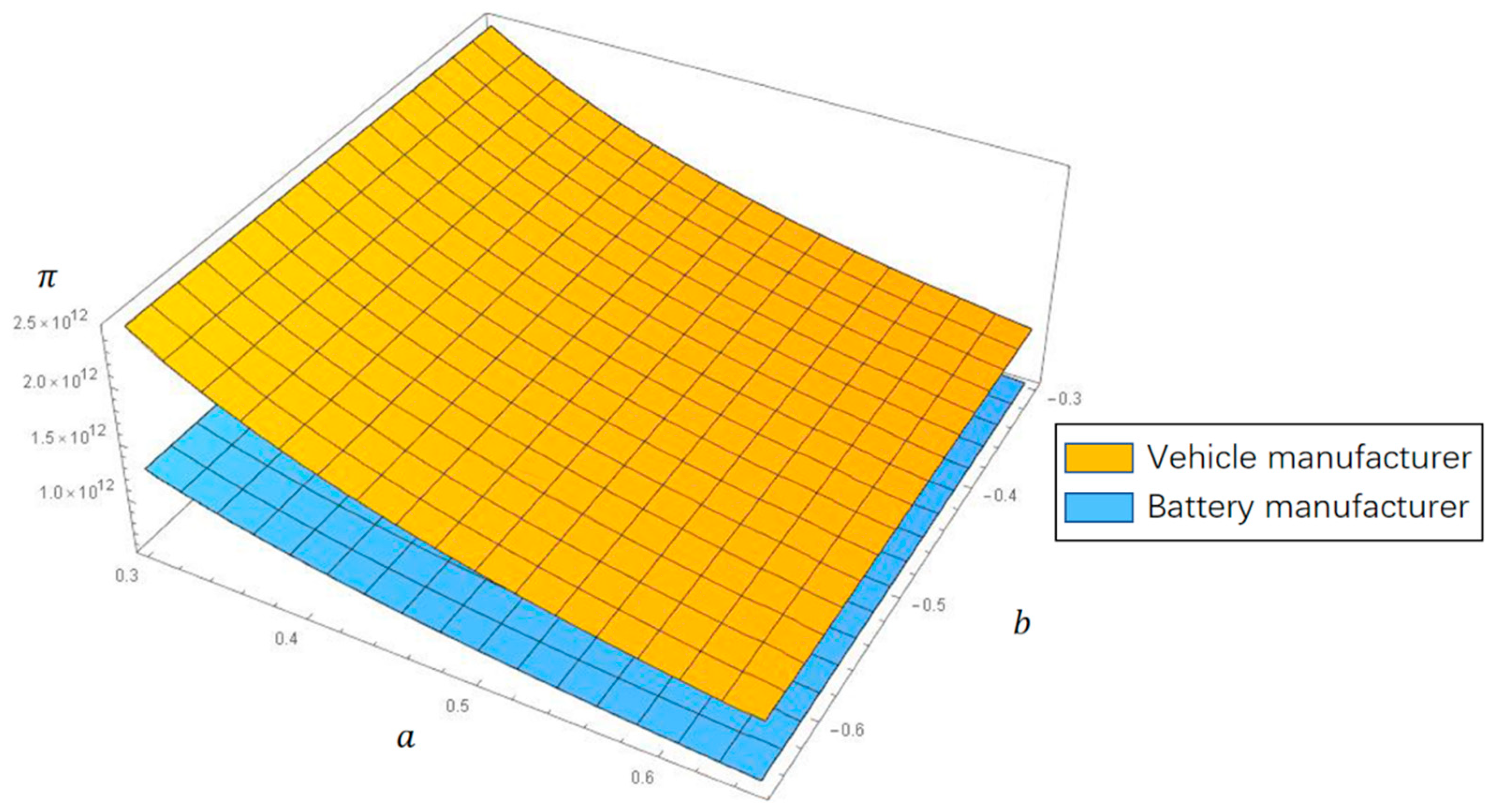

5.5. Contrastive Analyses of Variables in Differential Power Structures

5.6. Analyses of Enterprises’ Revenue in Differential Power Structures

6. Managerial Insights

6.1. For VMs Extending the Industry Chain, the Advantages of Battery Swapping Service Outweigh the Disadvantages

6.2. The Opportunity of Business Transformation and New Profit Growth Is Feasible for BMs by Entering the BSS Market

6.3. The Escalating Environment and Increased Competition Brought by BSM Forces Second-Rate Manufactures to Cooperate in Depth

6.4. In All Scenarios, Cascade Utilization, as an Important Component and a Valuable Source of Profit, Should Be Given Strong Consideration

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

References

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef] [PubMed]

- Ehsani, M.; Singh, K.V.; Bansal, H.O.; Mehrjardi, R.T. State of the art and trends in electric and hybrid electric vehicles. Proc. IEEE 2021, 109, 967–984. [Google Scholar] [CrossRef]

- Lin, X.; Sovacool, B.K. Inter-niche competition on ice? Socio-technical drivers, benefits and barriers of the electric vehicle transition in Iceland. Environ. Innov. Soc. Transit. 2020, 35, 1–20. [Google Scholar] [CrossRef]

- Irle, R. Global EV Sales for 2021. Available online: https://www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes (accessed on 12 September 2022).

- Department Ⅰ of Equipment Manufacturing Industry. China Leads the World in New Energy Vehicle Development in 2021, and the Construction of a Strong Automotive Nation Takes Solid Steps Forward. 2022. Available online: https://www.miit.gov.cn/jgsj/zbys/qcgy/art/2022/art_8d564ef9d3a845cf9c34b481e2d24955.html (accessed on 12 September 2022).

- Kong, D.; Xia, Q.; Xue, Y.; Zhao, X. Effects of multi policies on electric vehicle diffusion under subsidy policy abolishment in China: A multi-actor perspective. Appl. Energy 2020, 266, 114887. [Google Scholar] [CrossRef]

- Yang, S.; Li, R.; Li, J. “Separation of Vehicle and Battery” of Private Electric Vehicles and Customer Delivered Value: Based on the Attempt of 2 Chinese EV Companies. Sustainability 2020, 12, 2042. [Google Scholar] [CrossRef]

- Yang, S.; Yao, J.; Kang, T.; Zhu, X. Dynamic operation model of the battery swapping station for EV (electric vehicle) in electricity market. Energy 2014, 65, 544–549. [Google Scholar] [CrossRef]

- Zhang, T.; Chen, X.; Yu, Z.; Zhu, X.; Shi, D. A Monte Carlo simulation approach to evaluate service capacities of EV charging and battery swapping stations. IEEE Trans. Ind. Inform. 2018, 14, 3914–3923. [Google Scholar] [CrossRef]

- Zhan, W.; Wang, Z.; Zhang, L.; Liu, P.; Cui, D.; Dorrell, D.G. A review of siting, sizing, optimal scheduling, and cost-benefit analysis for battery swapping stations. Energy 2022, 258, 124723. [Google Scholar] [CrossRef]

- Shao, S.; Guo, S.; Qiu, X. A mobile battery swapping service for electric vehicles based on a battery swapping van. Energies 2017, 10, 1667. [Google Scholar] [CrossRef]

- de Rubens, G.Z.; Noel, L.; Kester, J.; Sovacool, B.K. The market case for electric mobility: Investigating electric vehicle business models for mass adoption. Energy 2020, 194, 116841. [Google Scholar] [CrossRef]

- Noel, L.; Sovacool, B.K. Why Did Better Place Fail?: Range anxiety, interpretive flexibility, and electric vehicle promotion in Denmark and Israel. Energy Policy 2016, 94, 377–386. [Google Scholar] [CrossRef]

- Huang, Y.; Qian, L.; Soopramanien, D.; Tyfield, D. Buy, lease, or share? Consumer preferences for innovative business models in the market for electric vehicles. Technol. Forecast. Soc. Chang. 2021, 166, 120639. [Google Scholar] [CrossRef]

- Deng, J.; Bae, C.; Denlinger, A.; Miller, T. Electric vehicles batteries: Requirements and challenges. Joule 2020, 4, 511–515. [Google Scholar] [CrossRef]

- Mahoor, M.; Hosseini, Z.S.; Khodaei, A. Least-cost operation of a battery swapping station with random customer requests. Energy 2019, 172, 913–921. [Google Scholar] [CrossRef]

- Rao, R.; Zhang, X.; Xie, J.; Ju, L. Optimizing electric vehicle users’ charging behavior in battery swapping mode. Appl. Energy 2015, 155, 547–559.2. [Google Scholar] [CrossRef]

- Wu, H. A survey of battery swapping stations for electric vehicles: Operation modes and decision scenarios. IEEE Trans. Intell. Transp. Syst. 2021, 23, 10163–10185. [Google Scholar] [CrossRef]

- Liang, Y.; Zhang, X. Battery swap pricing and charging strategy for electric taxis in China. Energy 2018, 147, 561–577. [Google Scholar] [CrossRef]

- Liang, Y.; Cai, H.; Zou, G. Configuration and system operation for battery swapping stations in Beijing. Energy 2021, 214, 118883. [Google Scholar] [CrossRef]

- Kane, M. SNE Research: Global xEV Battery Market Exceeded 296 GWh in 2021. Available online: https://insideevs.com/news/568640/global-battery-market-2021/ (accessed on 12 September 2022).

- Pagliaro, M.; Meneguzzo, F. Lithium battery reusing and recycling: A circular economy insight. Heliyon 2019, 5, e01866. [Google Scholar] [CrossRef]

- Bobba, S.; Mathieux, F.; Blengini, G.A. How will second-use of batteries affect stocks and flows in the EU? A model for traction Li-ion batteries. Resour. Conserv. Recycl. 2019, 145, 279–291. [Google Scholar] [CrossRef]

- Gu, X.; Ieromonachou, P.; Zhou, L.; Tseng, M.L. Developing pricing strategy to optimise total profits in an electric vehicle battery closed loop supply chain. J. Clean. Prod. 2018, 203, 376–385. [Google Scholar] [CrossRef]

- Wang, L.; Wang, X.; Yang, W. Optimal design of electric vehicle battery recycling network–From the perspective of electric vehicle manufacturers. Appl. Energy 2020, 275, 115328. [Google Scholar] [CrossRef]

- Zhang, Q.; Tang, Y.; Bunn, D.; Li, H.; Li, Y. Comparative evaluation and policy analysis for recycling retired EV batteries with different collection modes. Appl. Energy 2021, 303, 117614. [Google Scholar] [CrossRef]

- Tang, Y.; Zhang, Q.; Li, Y.; Wang, G.; Li, Y. Recycling mechanisms and policy suggestions for spent electric vehicles’ power battery-A case of Beijing. J. Clean. Prod. 2018, 186, 388–406. [Google Scholar] [CrossRef]

- Haberl, H.; Geissler, S. Cascade utilization of biomass: Strategies for a more efficient use of a scarce resource. Ecol. Eng. 2000, 16, 111–121. [Google Scholar] [CrossRef]

- Sirkin, T.; ten Houten, M. The cascade chain: A theory and tool for achieving resource sustainability with applications for product design. Resour. Conserv. Recycl. 1994, 10, 213–276. [Google Scholar] [CrossRef]

- Richa, K.; Babbitt, C.W.; Nenadic, N.G.; Gaustad, G. Environmental trade-offs across cascading lithium-ion battery life cycles. Int. J. Life Cycle Assess. 2017, 22, 66–81. [Google Scholar] [CrossRef]

- Xu, Z.; Wang, J.; Lund, P.D.; Fan, Q.; Dong, T.; Liang, Y.; Hong, J. A novel clustering algorithm for grouping and cascade utilization of retired Li-ion batteries. J. Energy Storage 2020, 29, 101303. [Google Scholar] [CrossRef]

- Zhang, H.; Zhu, K.; Hang, Z.; Zhou, D.; Zhou, Y.; Xu, Z. Waste battery-to-reutilization decisions under government subsidies: An evolutionary game approach. Energy 2022, 259, 124835. [Google Scholar] [CrossRef]

- Abdel-Monem, M.; Hegazy, O.; Omar, N.; Trad, K.; Van den Bossche, P.; Van Mierlo, E.F. Lithium-ion batteries: Comprehensive technical analysis of second-life batteries for smart grid applications. In Proceedings of the 2017 19th European Conference on Power Electronics and Applications (EPE’17 ECCE Europe), Warsaw, Poland, 11–14 September 2017; IEEE: New York, NY, USA, 2017; p. P-1. [Google Scholar]

- Fragiacomo, P.; Piraino, F.; Genovese, M.; Corigliano, O.; De Lorenzo, G. Strategic Overview on Fuel Cell-Based Systems for Mobility and Electrolytic Cells for Hydrogen Production. Procedia Comput. Sci. 2022, 200, 1254–1263. [Google Scholar] [CrossRef]

- Tolj, I.; Lototskyy, M.V.; Davids, M.W.; Pasupathi, S.; Swart, G.; Pollet, B.G. Fuel cell-battery hybrid powered light electric vehicle (golf cart): Influence of fuel cell on the driving performance. Int. J. Hydrogen Energy 2013, 38, 10630–10639. [Google Scholar] [CrossRef]

- Yu, P.; Li, M.; Wang, Y.; Chen, Z. Fuel cell hybrid electric vehicles: A review of topologies and energy management strategies. World Electr. Veh. J. 2022, 13, 172. [Google Scholar] [CrossRef]

- Fan, Z.P.; Huang, S.; Wang, X. The vertical cooperation and pricing strategies of electric vehicle supply chain under brand competition. Comput. Ind. Eng. 2021, 152, 106968. [Google Scholar] [CrossRef]

- Zhu, M.; Liu, Z.; Li, J.; Zhu, S.X. Electric vehicle battery capacity allocation and recycling with downstream competition. Eur. J. Oper. Res. 2020, 283, 365–379. [Google Scholar] [CrossRef]

- Ma, J.; Hou, Y.; Yang, W.; Tian, Y. A time-based pricing game in a competitive vehicle market regarding the intervention of carbon emission reduction. Energy Policy 2020, 142, 111440. [Google Scholar] [CrossRef]

- Kwon, Y.; Son, S.; Jang, K. User satisfaction with battery electric vehicles in South Korea. Transp. Res. Part D Transp. Environ. 2020, 82, 102306. [Google Scholar] [CrossRef]

- Benzidia, S.; Luca, R.M.; Boiko, S. Disruptive innovation, business models, and encroachment strategies: Buyer’s perspective on electric and hybrid vehicle technology. Technol. Forecast. Soc. Chang. 2021, 165, 120520. [Google Scholar] [CrossRef]

- Gu, H.; Liu, Z.; Qing, Q. Optimal electric vehicle production strategy under subsidy and battery recycling. Energy Policy 2017, 109, 579–589. [Google Scholar] [CrossRef]

- Ashok, B.; Kannan, C.; Usman, K.M.; Vignesh, R.; Deepak, C.; Ramesh, R.; Narendhra, T.M.V.; Kavitha, C. Transition to Electric Mobility in India: Barriers Exploration and Pathways to Powertrain Shift through MCDM Approach. J. Inst. Eng. Ser. C 2022, 103, 1251–1277. [Google Scholar] [CrossRef]

- Chidambaram, K.; Ashok, B.; Vignesh, R.; Deepak, C.; Ramesh, R.; Narendhra, T.M.; Usman, K.M.; Kavitha, C. Critical analysis on the implementation barriers and consumer perception toward future electric mobility. Proc. Inst. Mech. Eng. Part D J. Automob. Eng. 2022. [Google Scholar] [CrossRef]

- Hu, S.; Chen, P.; Xin, F.; Xie, C. Exploring the effect of battery capacity on electric vehicle sharing programs using a simulation approach. Transp. Res. Part D Transp. Environ. 2019, 77, 164–177. [Google Scholar] [CrossRef]

- China Institute for Studies in Energy Policy. CATL and GEELY Enter the Market One after Another, Who Can Pass the “Ultimate Test” of the Battery Swapping Model? Available online: https://cicep.xmu.edu.cn/info/1011/3680.htm (accessed on 12 September 2022).

- Wanitschke, A.; Hoffmann, S. Are battery electric vehicles the future? An uncertainty comparison with hydrogen and combustion engines. Environ. Innov. Soc. Transit. 2020, 35, 509–523. [Google Scholar] [CrossRef]

- Lane, B.W.; Dumortier, J.; Carley, S.; Siddiki, S.; Clark-Sutton, K.; Graham, J.D. All plug-in electric vehicles are not the same: Predictors of preference for a plug-in hybrid versus a battery-electric vehicle. Transp. Res. Part D Transp. Environ. 2018, 65, 1–13. [Google Scholar] [CrossRef]

- Gil Moltó, M.J.; Georgantzis, N.; Orts, V. Cooperative R&D with endogenous technology differentiation. J. Econ. Manag. Strategy 2005, 14, 461–476. [Google Scholar]

- Contemporary Amperex Technology, Co., Limited. 2021. Annual Report. Available online: https://www.catl.com/uploads/1/file/public/202204/20220426184645_v8k07d2sih.pdf (accessed on 12 September 2022).

- Lin, P.; Gao, W. In-Depth Analysis of the Lithium Battery Recycling Industry: Destinations, Players and “Mobile Mines”. Available online: https://auto.gasgoo.com/news/202208/1I70309204C501.shtml (accessed on 12 September 2022).

- Lih, W.C.; Yen, J.H.; Shieh, F.H.; Liao, Y.M. Second use of retired lithium-ion battery packs from electric vehicles: Technological challenges, cost analysis and optimal business model. In Proceedings of the 2012 International Symposium on Computer, Consumer and Control, Taichung, Taiwan, 4–6 June 2012; IEEE: New York, NY, USA, 2012; pp. 381–384. [Google Scholar]

- Yuzawa, K.; Bhandari, N.; Delaney, M.; Galliers, G.; Fang, F.; Muthiah, C.; Lee, G.; Cai, A.; Zhang, J.; Kim, K.R.; et al. Electric Vehicles: What’s Next VII: Confronting Greenflation. 2022. Available online: https://www.goldmansachs.com/insights/pages/electric-vehicles-whats-next-vii-confronting-greenflation.html (accessed on 12 September 2022).

- Wedbush Securities. How Electric Vehicles Are Reshaping the Automotive Industry. Available online: https://www.wedbush.com/how-electric-vehicles-are-reshaping-the-automotive-industry/ (accessed on 12 September 2022).

- Vigna, M.D.; Stavrinou, Z.; Ji, C.; Zhai, C.; Chen, T.; Zhang, J.; Yang, S.; Bhandari, N.; Cai, A.; Fang, F.; et al. Carbonomics China Net Zero: The Clean Tech Revolution. Available online: https://www.goldmansachs.com/worldwide/greater-china/insights/carbonomics-china-net-zero.html (accessed on 12 September 2022).

| Symbol | Symbol Definition |

|---|---|

| Q | demand for EV in the market |

| potential market size | |

| a | elastic coefficient to the price of one-off transaction |

| b | cross-price elastic coefficient to the price of battery lease (b < 0) |

| unit cost of producing a body of the vehicle | |

| unit cost of producing a new battery with the raw materials | |

| unit cost of operating the battery in the swapping station | |

| technology research and development cos coefficient in each scenario ) | |

| consumers’ sensitivity for the technology of battery and replenishment | |

| the revenue of battery disassemble recycling | |

| the revenue of battery cascade utilization ) | |

| f | the ratio of the decommission batteries recycled with cascade utilization ( < 1) |

| the ratio of the actual battery quantity needed to the demand for EV in the market ( > 1) | |

| m | unit recycle price for decommissioned battery from the consumer |

| k | the ratio of the life-cycle BSS revenue to the battery wholesale price (k > 1) |

| the profit of vehicle manufacturer | |

| the profit of battery manufacturer | |

| unit price of an electric vehicle body without the battery | |

| unit revenue of battery swapping service during the whole life cycle | |

| unit wholesale price of the battery from the battery manufacturer | |

| h | the technology level of battery and energy replenishment |

| Scenario T | Scenario V * | Scenario B | |

|---|---|---|---|

| / | |||

| / | |||

| Symbol | Symbol Definition | Value Setting |

|---|---|---|

| potential market size | 2,500,000 | |

| a | elastic coefficient to the price of one-off transaction | 0.5 |

| b | cross-price elastic coefficient to the price of battery lease (b < 0) | −0.45 |

| unit cost of producing a body of the vehicle | 110,000 | |

| unit cost of producing a new battery with the raw materials | 50,000 | |

| unit cost of operating the battery in the swapping station | 100 | |

| technology research and development cost coefficient in Scenario T | 100 | |

| technology research and development cost coefficient in Scenario V | 160 | |

| technology research and development cost coefficient in Scenario B | 140 | |

| consumers’ sensitivity for the technology of battery and replenishment | 0.3 | |

| the revenue of battery disassemble recycling | 40,000 | |

| the revenue of battery cascade utilization | 60,000 | |

| f | the ratio of the decommissioned batteries recycled with cascade utilization | 0.95 |

| the ratio of the actual battery quantity needed to the demand for EVs in the market | 1.2 | |

| m | unit recycle price for decommission battery from the consumer | 25,000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, G.; Wang, T. Long-Term Leases vs. One-Off Purchases: Game Analysis on Battery Swapping Mode Considering Cascade Utilization and Power Structure. Sustainability 2022, 14, 16957. https://doi.org/10.3390/su142416957

Li G, Wang T. Long-Term Leases vs. One-Off Purchases: Game Analysis on Battery Swapping Mode Considering Cascade Utilization and Power Structure. Sustainability. 2022; 14(24):16957. https://doi.org/10.3390/su142416957

Chicago/Turabian StyleLi, Guohao, and Tao Wang. 2022. "Long-Term Leases vs. One-Off Purchases: Game Analysis on Battery Swapping Mode Considering Cascade Utilization and Power Structure" Sustainability 14, no. 24: 16957. https://doi.org/10.3390/su142416957

APA StyleLi, G., & Wang, T. (2022). Long-Term Leases vs. One-Off Purchases: Game Analysis on Battery Swapping Mode Considering Cascade Utilization and Power Structure. Sustainability, 14(24), 16957. https://doi.org/10.3390/su142416957