1. Introduction

Safety management for coal mining processes is regarded as a necessary means to reduce coal mine accidents and improve coal mine safety. Due to the massive market demand for coal and the harshness of the underground coal-mining environment, safety accidents during the coal mining process are common worldwide. Coal mining safety management is highly valued by coal-producing countries such as China [

1,

2], the United States [

3,

4,

5], Spain [

6], Australia [

7], India [

8], Turkey [

9], and so on.

With improvements in the level of process safety management and the closure of coal mines with poor mining conditions, the safety situation of coal mines has substantially improved [

10,

11,

12]. Poor geological environments, outdated mining equipment, and a lack or failure of safety management during the coal mining process are notable reasons for the large number of coal mine accidents. Hence, coal mine safety management needs to be improved [

13].

More efforts are still needed to strengthen the safety management of the coal mining process. The excessive pursuit of coal production while neglecting safety management is one of the main reasons why coal mine production still experiences multiple accidents and incurs multiple casualties. However, excessive pursuit of safety may inhibit the development of the coal industry, especially in times of energy stress. In other words, blindly chasing coal production or safety may not be the optimal strategy for a large developing country with a high energy demand such as China [

14]. Therefore, seeking a compromise between coal mine productivity and safety is the purpose of coal mine safety management [

15].

Designing an effective management and incentive mechanism for the safe production of coal is crucial for reducing accidents in coal mines and ensuring economic development [

16]. The safe productivity of a coal mine involves multiple participants such as coal mine enterprises and coal mine managers [

17]. Different participants have different interests and concerns in coal production, which poses challenges to coal production and safety management [

18,

19,

20,

21,

22]. For example, coal mining enterprises care about the total output of coal mines, including coal production and coal mine safety, whereas coal mine managers only care about their own income. Under decentralized decision making, coal mine managers proceed from their own interests and make decisions that affect coal mine productivity and safety; these decisions may be detrimental to coal mine enterprises and the entire coal mining process. Therefore, coal mine managers must be guided and encouraged to make decisions that are beneficial to coal mining enterprises to increase both the overall output level of production and the safety of the coal mining process.

In the process of coal mining, the coal mine enterprise and manager form a principal–agent relationship and play a game. The coal mine enterprise is the principal, and the coal mine manager, who is the agent, is entrusted to conduct coal mine production and safety management. The coal mine enterprise provides the coal mine manager with payments based on an incentive contract which incentivizes them to make optimal efforts in production and the safety management of the coal mine. Therefore, an effective incentive contract becomes a core component of managing coal mine safety. Due to the different interests of coal mine enterprises and managers, and the existence of asymmetric information Resende and Hurley [

23], difficulties and challenges are encountered in designing an effective incentive contract for the safety of coal mine production.

Systemic analysis of safety management in coal mining processes, which is based on game theory from the perspective of interest conflict, is an effective means to manage coal mine production and safety [

24,

25]. Chen et al. (2014) [

26] investigated rent-seeking activities in the safety management of the Chinese coal industry using a model comprising dynamic games with incomplete information. Furthermore, Chen et al. (2016) [

27] simulated the impact of rent-seeking from each level of the management department on coal mine productivity in different scenarios. Chen et al. (2015) [

25] constructed a game model to analyze how the attributes of the safety output and bounded authority of safety supervision act on the safety output. The authors argued that the government should establish a public supervision system and introduce innovative methods for safety supervision.

The evolution of coal mine safety systems has also attracted the attention of scholars [

28]. Liu and Xiao et al. (2015) [

29] noticed that a periodic fluctuation appears in coal mines and other fields of government safety supervision, and provided a theoretical explanation. Liu and Li et al. (2015) [

30] used evolutionary game theory to describe the interactions between the stakeholders in China’s coal mining safety inspection system. Furthermore, Liu and Li et al. (2019) [

31] explored the use of evolutionary game theory to describe the long-term dynamic process of a multiplayer game of coal mine safety regulation under the conditions of bounded rationality. You et al. (2020) [

32] used evolutionary game theory to describe the interactions between the stakeholders in China’s coal enterprises internal safety inspection system. They found that increasing the static reward and punishment intensity quickly reduces the unsafe behavior ratio, but increases the fluctuation in the game. Liu et al. (2020) [

33] constructed a tripartite evolutionary game model among the state administration of work safety, local regulatory departments of work safety, and mining enterprises. They argued that the possibility of rent-seeking can be reduced by raising the rent-seeking cost.

Safety incentives can be effectively used to improve people’s safety awareness and prevent people from performing unsafe behaviors [

34]. Safety incentives have been proven effective in many process management areas, such as oil mining [

35,

36], manufacturing [

37,

38], construction [

39,

40], transportation [

41], food [

42], and vaccines [

43].

Designing an effective incentive mechanism to encourage agents to improve their level of safety efforts is an effective means for improving production safety [

44]. Ma and Zhao (2018) [

45] analyzed the interaction between the government’s safety regulation efforts and a company’s safety efforts, based on a case in China. Winkler et al. (2019) [

46] presented a game theory model that captures the decision processes of a manager and an employee with regard to the reporting of a near-miss event for reducing the likelihood of a future accident. The authors considered that a manager decides on an incentive (penalty) to motivate an employee to report, whereas each employee decides on the resource level that they invest in reporting. Osmundsen et al. (2006) [

35] considered how financial incentives in contracts can impact a contractor’s focus on safety, and confirmed the relationship between an oil company and a drilling contractor. Osmundsen et al. (2008) [

47] found that the lack of effective safety incentives is problematic, as enhanced incentives for other performance dimensions that are easier to monitor may lead to safety being less prioritized. Therefore, safety indicators must be reflected in the design of incentive contracts. Sund and Hausken (2012) [

36] compared a fixed price contract with an incentive-based contract in the oil and gas industry; they found both the operator and the service provider preferred the incentive-based contract. Differing from the above, this study incorporates the trade-off between productivity and safety into the incentive contracts used in coal mine production.

The information asymmetry between the principal and agent creates difficulties for the design of the incentive mechanism. Resende and Hurley (2012) [

23] studied traceability incentives for food safety by considering a principal that cannot observe agents’ food safety efforts. They found that high precision can act as a substitute for highly intensive contingent payments, as government regulation based on mandatory traceability with sanctions may not necessarily lead to safer food. Sund and Hausken (2012) [

36] argued that uncertainty often exists in interorganizational relationships, and information was often asymmetric between the principal and agent. However, the authors did not explicitly model the incomplete information in oil and gas contracts. Huang et al. (2019) [

48] considered two types of asymmetric information between the principal and agent, namely adverse selection and moral hazard, and designed four types of contracts to manage the risk of outsourced logistics. Aiming at the moral hazard and adverse selection between the coal mining enterprise and manager, we designed the corresponding incentive contracts for safety management of coal mining process.

In response to the requirement for safety management of coal mines, we used game theory to design safety production incentive contracts to improve the safety of coal mine production. We specifically considered the following questions. First, how do coal mine enterprises design incentive contracts under moral hazard and adverse selection? Second, how do moral hazard and adverse selection affect incentive contracts for the safety of coal mine production? Finally, what are the managers’ production and safety efforts under different contracts?

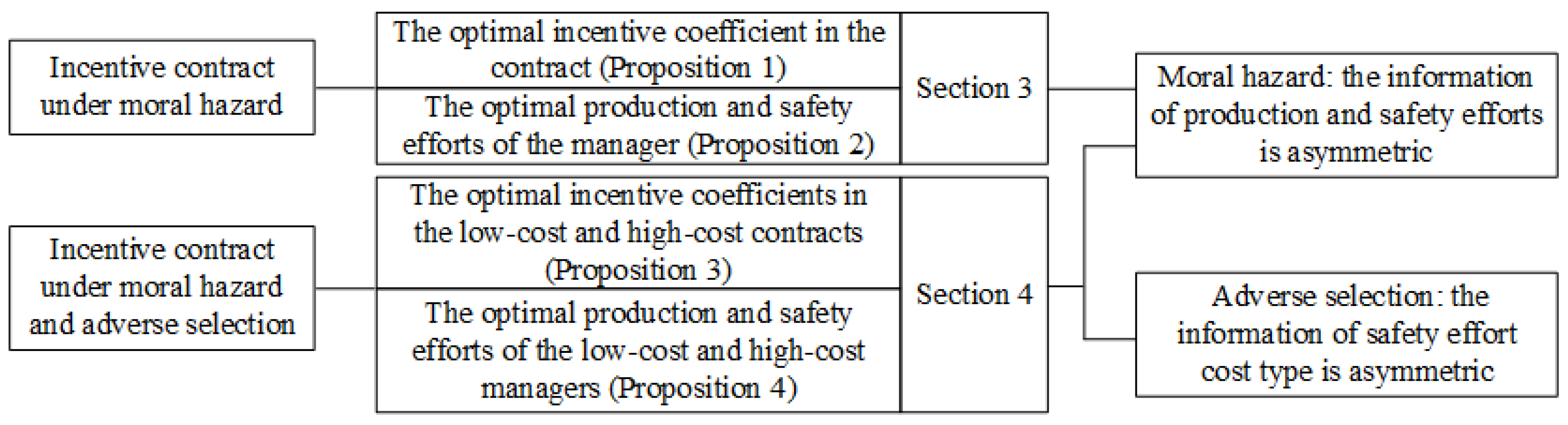

We provide two main contributions to the existing literature. First, by jointly considering the production and safety efforts of the coal mine manager, we designed incentive contracts for safety of coal mine production from the coal mine enterprise perspective to improve the safety of coal mines. Second, for two types of asymmetric information, that is, the coal mine manager’s effort level information and cost-type information, we designed a two-part linear tariff contract and a menu of contracts. The position of this study is shown in

Table 1.

The remainder of this paper is organized as follows:

Section 2 describes the problem and describes models and symbols.

Section 3 outlines the incentive contract under moral hazard, and analyzes the optimal results of production and safety efforts.

Section 4 describes the design of a menu of contracts under moral hazard and adverse selection, and compares the effects of the two types of asymmetric information. In

Section 5, we numerically compare the optimal contract results.

Section 6 presents our conclusions and future study directions.

2. Problem Description and Assumptions

The two players in coal production are the enterprise or the owner of the coal mine and the manager or the actual organizer of the coal production. Thus, the enterprise (principal) and the manager (agent) constitute a typical principal–agent relationship. As the agent, the manager is entrusted by the enterprise to perform the production and safety tasks for the mine, and is expected to ensure high production and safety. The final coal output is determined by the manager’s production efforts as well as by safety efforts and random factors. Coal mine safety issues due to insufficient managerial safety efforts can even interrupt the coal mine production process, thereby reducing coal production.

The manager’s production and safety efforts are denoted by and , respectively. These efforts can be measured by safety investments. For example, an increase in the manager’s safety efforts can be achieved by adding safety personnel, purchasing safety equipment, and improving safety performance. The manager specifically knows their production and safety efforts, which they determine themselves. However, due to costs and the actual production environment of the coal mine, neither the manager’s production effort nor their safety effort can be monitored in real time by the enterprise. Thus, the enterprise can only estimate production and safety efforts through the actual output results of the mine. However, many random factors affect and interfere with the output results of mine production and safety, such as complex geological conditions and production uncertainty. These random factors create difficulties for the enterprise to truly grasp the manager’s production and safety efforts.

Safety measures can be well-documented and visible. Then, the safety effort of the manager can be identified. However, we argue that safety efforts may still be not fully known to the coal mine enterprise. The coal mine enterprise and the manager may not have a contract on safety effort, although both of them may observe safety effort. At that time, the safety effort is completely determined by the manager, and the coal mine enterprise is not involved. Therefore, said safety effort is uncertain from the perspective of the coal mine enterprise. The reasons for noncontractual safety efforts are as follows: safety effort is difficult to measure and verify for a third party such as a court; additionally, both the enterprise and the manager cannot identify every possible contingency in advance.

The enterprise can only pay the manager based on the actual output of the coal mine. Considering the unobservability and cost of the efforts, the manager will have low motivation to execute both production and safety tasks; therefore, a moral hazard problem exists. Moral hazard refers to the agent’s laziness caused by the principal’s inability to directly observe the agent’s actions [

48]. The information on the manager’s production and safety efforts is asymmetric between the manager and the enterprise; this is considered the first information asymmetry in this study. The moral hazard caused by the first information asymmetry lowers the production and safety levels of coal mines. In turn, enterprise profits decrease. Therefore, the enterprise must design an effective contract to motivate the managers to exert effort in both production and safety tasks.

A certain level of effort in the production and safety tasks of a manager requires a certain cost, which is measured in money, i.e., the cost of effort. The manager’s cost of effort can be recorded as , where and denote the cost coefficients of the production and safety efforts, respectively. The cost function of the production and safety efforts is convex and increases with and . For the tractability of the model, and without loss of generality, we assume that the costs of the production and safety efforts are independent.

Assuming that the scale return is constant, we define the output function of the production and safety efforts as the extended Cobb–Douglas production function , which is the revenue function of the enterprise under certain production and safety efforts of the manager. The condition reflects the comprehensive technical level that can transform the efforts of the manager into outputs, including the management level, labor quality, and the introduction of advanced technology. and denote the relative importance levels of the production and safety efforts, respectively, satisfying , and . Random interference is denoted by and , which represents the influence of other factors on the mine revenue and reflects the uncertainty of the external environment. Without loss of generality, is considered to have a lower bound, which ensures that the production function is never negative.

Notably, the revenue of the enterprise, defined here as an extended Cobb–Douglas function, is completely different from the output of coal from the coal mine. The revenue of an enterprise depends not only on the actual output of coal in coal mines, but also on the safety status of the coal mine. The revenue function of an enterprise needs to be maximized with optimal production and safety efforts. As such, and cannot replace each other. and in this study have widely different physical characteristics, which can be explained by the following two aspects. First, the output of safety effort is different from the output of the production effort. For example, enterprise revenue may include rewards or punishments from the government regulator. When the safety conditions of coal mines are improved by the manager’s safety efforts, the enterprise may receive safety performance rewards from the government. When the safety conditions of coal mines become poor, the enterprise may incur administrative penalties. In particular, when accidents occur due to poor safety levels in coal mines, the enterprise also needs to bear the losses of coal mine accidents. Second, the manager’s production and safety efforts jointly determine the coal output and coal mine safety level. For example, when the coal mine manager’s safety efforts are appropriate and the its safety level is high, the coal mine can continue to safely produce coal and achieve excellent output. When the coal mine manager’s safety efforts are inadequate and the safety level of the coal mine is low, coal production may be interrupted due to near-miss events or accidents, which eventually lead to a low coal output. In addition, excessive pursuit of output reduces the safety level of the coal mine.

The Cobb–Douglas production function has been used several times to define the coal mine production function, utility function [

49], and so on. Sider (1983) [

50] used an extended Cobb–Douglas production model that incorporates work-related accidents as a joint output to analyze job safety and productivity in underground coal mining. The safety efforts of the coal mine manager are demonstrated by many aspects, including formulating strict safety management rules [

10], performing high-quality safety inspections [

32], and organizing safety training to improve miners’ safety awareness [

51]. These safety efforts are related to the production efforts of the manager and affect the actual total coal production [

52]. The production efforts of the manager can be expressed by investments of capital into purchasing additional mining equipment and hiring miners, which is easy to understand. The manager’s production and safety efforts are often demonstrated in the form of labor and capital input, which is consistent with the definition of the Cobb–Douglas function. For example, the Cobb–Douglas function was used to represent the interaction between coal production and safety management by introducing the labor growth rate and safety input [

12]. Pendharkar et al. (2008) [

53] used the Cobb–Douglas function to express software development effort. In our opinion, the use of the Cobb–Douglas function in this study is similar to that in the above studies. Therefore, we thought it appropriate to express the interaction between safety and production efforts with the Cobb–Douglas function.

The existence of the weights of production and safety efforts and reflect the decision-maker’s trade-off between the coal output and safety level of the coal mine, that is, whether to pay more attention to the coal output or the safety level. Changes in the weights of the efforts directly affect the manager’s investment level in production and safety efforts. An enterprise’s excessive emphasis on coal output leads to the coal mine manager reducing safety effort, and vice versa. In this study, based on the principal–agent framework, we designed optimal incentive contracts for coal mine enterprises, and production and safety strategies for coal mine managers using the Cobb–Douglas utility function to achieve a trade-off between production and safety in the enterprise’s expected profit.

The enterprise pays the manager for their production and safety efforts, according to the actual output of production and safety efforts

. A two-part linear tariff contract is used by the enterprise to motivate the manager to devote effort to both production and safety tasks, that is,

. Specifically, the payment the manager receives from the contract is

, where

is the fixed payment and

is the incentive or sharing coefficient. Following the basic framework of principal–agent theory, we assume that the enterprise (principal) is risk-neutral, whereas the manager (agent) is risk-averse and has an Arrow–Pratt absolute risk aversion degree. The manager’s reserve utility is

, which means that only when the manager’s utility obtained from the contract is not less than

will the manager accept the contract and exert effort in production and safety according to the level desired by the enterprise. All notations are listed in

Table 2.

The risk attitude setting of decision makers can be explained as follows. The coal enterprise cares about risks and expects the coal manager to invest in production and safety efforts to reduce risks. However, the purpose of the enterprise caring about risk is not the risk itself, but maximizing its expected utility; the enterprise hopes to achieve this by encouraging the manager to use the optimal combination of production and safety efforts. According to the assumptions of this study, the manager’s production and safety efforts cannot be determined or observed by the enterprise. Therefore, the enterprise can only see the output of the coal mine. In coal mine production, managers need to directly invest in both production and safety efforts; random factors interfere with the results of these efforts, and an output risk exists. Therefore, as a rational economic human, the coal mine manager is risk averse. In contrast, the coal mine enterprise pays the manager based on the output results when coal production is finished, and the enterprise no longer needs to invest in the coal production process. Therefore, the coal mine enterprise, as the principal, can be considered to be risk neutral.

The cost coefficients of the manager’s production and safety efforts may or may not be information that is common between the manager and enterprise. When the enterprise can accurately grasp the information of the cost coefficients, only the effort level of the manager is asymmetric information in the contract design problem. In this study, we termed this contract scenario “incentive contract under moral hazard”. However, the enterprise may be unable to accurately know the cost coefficients of production and safety efforts. Subsequently, the cost coefficients are the private information of the manager; this indicates an adverse selection problem. This constitutes the second information asymmetry between the manager and enterprise; we term this contract scenario “incentive contract under moral hazard and adverse selection”.

The owner of coal mine is often a large coal enterprise that owns multiple coal mines. The main business of the owner is the marketing of coal, and a manager is often entrusted with managing the specific operation of a coal mine. As the situation in which the owner of coal mine is also the manager is rare in the coal industry, we did not consider the centralized decision-making scenario in which the coal mining enterprise and the manager form a community of interests. In

Section 3 and

Section 4, we describe the issues of contract design in these two scenarios, respectively. In addition, we assumed that other information on decisions is common knowledge to both parties. The contract scenarios considered in this study are summarized in

Figure 1.

3. Incentive Contract under Moral

Hazard

Here, we assumed that the cost coefficients of the manager are common knowledge. Therefore, the enterprise accurately knows the coefficient information. Considering the moral hazard problem, the enterprise must design an incentive contract to motivate the manager to make effective production and safety efforts which are not directly observed by the enterprise.

According to the contract payment and the cost of production and safety efforts, the manager’s risk income is

Because the manager is risk averse, the aforementioned risk benefit to the manager can be replaced by their deterministic equivalent gain, which is expressed as

where

is the risk cost of the manager.

Because the enterprise is risk neutral, it maximizes its expected profit, that is,

In the design of the incentive contract under the existence of moral hazard, the enterprise and manager maximize their expected profit and deterministic equivalent gain, respectively. That is, the incentive contract is produced through distributed decision making. The goal of the enterprise is mainly achieved by determining the parameters in the incentive contract in consideration of the manager, which must be considered as a constraint. The input of production and safety efforts must be optimal for the manager (moral hazard); that is, the incentive compatibility constraint (IC) should be satisfied. Additionally, the deterministic equivalent gain obtained by the manager from the incentive contract should not be lower than their reservation utility ; that is, the individual rationality constraint (IR) should be satisfied.

Therefore, the optimization model of the enterprise can be expressed as

By solving the model, we can obtain the optimal incentive coefficient for the contract, which is shown in Proposition 1. The proofs of all formal results are presented in the

Appendix A.

Proposition 1. When the effort level is asymmetric information, the optimal incentive coefficient in the contract is , decreasing in for and increasing in for .

We provide discussion and management insights on Proposition 1 in the following paragraphs. Proposition 1 provides the optimal incentive coefficient in the contract under moral hazard, where depends on , , , , A, , and .

We observe that decreases with for in Proposition 1; otherwise, it increases with . Note that and are the cost coefficients of the production and safety efforts, respectively; therefore, denotes the weight of the cost coefficient of production efforts in a certain sense. As denotes the relative importance level of the production effort on the output of the coal mine, reveals that the contribution of the production effort to the cost is higher than its contribution to the output. Subsequently, an excessive incentive for the manager is harmful to the system composed of the enterprise and manager. Therefore, the enterprise gradually reduces the incentive coefficient as increases. Conversely, the contribution of the production effort to the cost is lower than its contribution to the output when . Subsequently, the system output increases with . Thus, the enterprise sets a large incentive coefficient to motivate the manager to work hard. As and have a completely symmetric position with , we argue that the influence of on is similar to the influence of on ; we do not provide details here.

We observe that decreases with and in Proposition 1. As the cost coefficient of production and safety efforts increases, the enterprise reduces the incentive for the manager. Providing an excessive incentive for production or safety effort at a high cost is not appropriate. Proposition 1 also indicates that increases in A. This is intuitive; increasing the incentive when the output scale of the coal mine increases is profitable for the enterprise.

We also see that decreases with in Proposition 1. Note that when the manager is risk neutral, that is, , then . This means that the enterprise makes the manager bear all the risk of coal mine output through the contract. However, for a risk-averse manager, the enterprise reduces the incentive coefficient in the contract. Subsequently, the enterprise must bear part of the mine’s output risk, which increases with the manager’s risk-aversion coefficient. Proposition 1 also indicates that decreases with . Knowing the risk aversion of the manager, the enterprise must reduce the incentive when the randomness of the mine output increases.

By substituting of Proposition 1 into the expressions of and , which can be found in the proof of Proposition 1, we obtain the following proposition:

Proposition 2. When the effort level is asymmetric information, the optimal production and safety efforts of the manager are , increasing with if and , respectively. is larger than when ; otherwise, is smaller than .

We see that the manager’s production and safety efforts are completely symmetric with and . The impact of on is similar to the impact of on . Additionally, the impact of on and on are exactly opposite. In the following, we mainly analyze the impact of on the optimal production effort and the optimal safety effort .

We observe that when in Proposition 2. This reveals that the optimal production effort increases with the relative importance level of the production effort, whereas the production effort is larger than the safety effort. When the production effort is more profitable than the safety effort, a larger relative importance level of the production effort means a larger optimal production effort. At this time, the increase in production effort is beneficial to the system. Conversely, while . That is, the optimal production effort is smaller than the optimal safety effort at this time. When the relative importance level of the safety effort is larger than that of the production effort, the manager must increase the safety effort. However, the effect of on is not monotonic at this time.

We observe that both production and safety efforts decrease with and in Proposition 2. As the cost coefficients of the efforts increase, the manager reduces both efforts. We also see that both production and safety efforts decrease with and . The higher the manager’s risk aversion, the weaker the production and safety efforts. The higher the randomness of the output, the weaker the production and safety efforts. In a random yield environment, the manager tends to reduce their production and safety efforts. For decreasing with A, we observe that both the optimal production effort and safety effort increase with the increasing output scale of the coal mine A. The manager can reasonably increase their efforts when the scale of coal mine output increases.

We also see that the manager exerting more effort for production or safety tasks is conditional in Proposition 2. The optimal production effort is higher than the optimal safety effort, whereas the former is more economical than the latter. Exerting more effort on high-output projects (production or safety) is more profitable than on low-output projects (safety or production).

4. Incentive Contract under Moral

Hazard and Adverse Selection

Here, we assumed that the safety effort cost coefficient of the manager is private information, and the production and safety efforts are not directly observed by the enterprise. Thus, both the effort level and cost type of the manager are asymmetric information to the enterprise. Different from moral hazard, adverse selection is another typical problem in principal–agent theory and is considered the second information asymmetry between the enterprise and the manager. We thus designed a menu of contracts under double information asymmetry.

Consider the case wherein the manager is more aware of the safety situation than the enterprise. The cost coefficient of the safety effort is assumed to be private information, and the cost coefficient of the production effort is assumed to remain public knowledge between the manager and enterprise. The enterprise cannot accurately know . It only knows that the manager belongs to the high-effort cost type with a probability p, and low-cost with a probability ; then, .

To identify the manager’s true safety-effort cost type [

54], the enterprise designs a high-cost contract

, and a low-cost contract

for the high-cost and low-cost managers, respectively. High-cost and low-cost contracts constitute a menu of contracts. That is, the enterprise provides a menu of contracts to the manager. Based on the revelation principle [

54], the manager selects the corresponding contract according to their safety-effort cost type: a high-cost manager selects the high-cost contract and the low-cost manager selects the low-cost contract.

Based on these assumptions, when the high-cost contract is chosen, the deterministic equivalent gain of the high-cost manager is

If the high-cost manager chooses the low-cost contract, the deterministic equivalent gain is

When the low-cost contract is chosen, the deterministic equivalent gain of the low-cost manager is

If the low-cost manager chooses the high-cost contract, the deterministic equivalent gain is

Therefore, the enterprise determines the incentive coefficients in the menu of contracts by solving the following model:

Equation (

11) is the enterprise’s expected profit, which is an expectation with regard to to the cost type of the safety effort. Constraints (12) and (13) are the individual rationality constraints of the high-cost and low-cost managers, respectively. Constraints (14) and (15) are the incentive compatibility constraints of the high-cost and low-cost managers, respectively. Constraints (16) and (17) cause the manager to choose the right type of contract.

By solving the model, we obtain the optimal incentive coefficients in the menu of contracts, as expressed by Proposition 3.

Proposition 3. When the effort level and cost type are asymmetric information, the optimal incentive coefficients for the low-cost and high-cost contracts are and , respectively.

From Proposition 3, we observe that the optimal incentive coefficient in the low-cost contract is the same as that in the incentive contract under moral hazard, which can be found in Proposition 1. The enterprise provides the same level of incentive to the low-cost manager regardless of whether the information on the cost type of safety effort is symmetric or asymmetric. Compared with the incentive coefficient in the contract under moral hazard, the incentive coefficient in the high-cost contract is reduced when . Furthermore, the incentive coefficient increases with the probability that the manager belongs to the high-effort cost type, that is, p. The optimal incentive coefficient in a high-cost contract is the same as that in the contract under moral hazard while . At this time, the enterprise accurately knows that the manager belongs to the high-effort cost type. The incentive coefficient tends to 0 when p tends to 0. At this point, the enterprise knows with a very small probability that the manager belongs to the high-effort cost type. Therefore, the enterprise provides the manager with a very low incentive level.

We observe that both and decrease with and and increase with A in Proposition 3. These trends are the same as those in Proposition 1. We observe that decreases with and , decreases with for , and increases with for , which can be obtained from Proposition 1. In addition, decreases with and . However, we observe that increases with . The increase in the cost coefficient of the low-cost manager causes the enterprise to increase the incentive coefficient of the high-cost contract. Particularly, no difference exists between the incentive coefficient in the high-cost contract and that in the contract under moral hazard when . At this time, the manager has only one cost type, which they know accurately. For , we conclude that increases with for .

The equilibrium results of the production and safety efforts of the manager are given by Proposition 4.

Proposition 4. When both the effort level and cost type are asymmetric information, the optimal production and safety efforts of the low-cost and high-cost managers are , , , and , where . The information rent paid by the enterprise to the low-cost manager is .

This shows that the production and safety efforts of the low-cost manager are consistent with those in the incentive contract under moral hazard. The inputs of the low-cost manager in the two aspects are indistinguishable. The low-cost contract produces the incentive for the low-cost manager. With a decrease in , the efforts of the high-cost manager in both production and safety tasks are reduced compared with those in the contract under moral hazard. Because the production and safety efforts are reduced, the motivation of the high-cost manager becomes low. Thus, the high-cost contract fails to motivate the manager. Due to the asymmetry of the cost type information of the safety efforts, the enterprise has an information disadvantage and must pay information rent to the manager.

Compared with the scenario of incentive contract under moral hazard, the coal mine enterprise needs to pay for information rent (cost) under the scenario with an incentive contract under moral hazard and adverse selection. The two forms of information rent depend on the type of safety-effort cost of the manager. When the manager belongs to the low-effort cost type, the safety effort under the low-cost contract is the same as that in the contract under moral hazard. At that time, the outputs of the coal mine in the low-cost contract and that in the contract under moral hazard are the same. The manager now receives a larger reward than the reserve utility (low bound), which is obtained by the manager from the contract under moral hazard. Therefore, the utility of the enterprise in the low-cost contract is reduced. Because of information asymmetry, the enterprise pays more to the low-cost manager, which reduces their utility. When the manager belongs to the high-effort cost type, the safety effort under the high-cost contract is lower than that in the contract under moral hazard. At that time, the output of the coal mine in the low-cost contract is reduced. The manager can still obtain the reserve utility (low bound), which is the same as the manager’s utility in the contract under moral hazard. Therefore, the utility of the enterprise in the high-cost contract is reduced. To summarize, when the cost-type information of the manager’s safety effort is asymmetric, the coal mine enterprise needs to pay information rent (cost).

Note that the reductions in the production and safety efforts are in equal proportion. This means that the asymmetric information of the cost type of safety effort has a similar impact on both production and safety efforts. The reason for this phenomenon is the enterprise’s use of only an incentive coefficient to stimulate the manager’s efforts in both production and safety tasks. Therefore, no separate incentive is used for production and safety efforts.

Under the menu of contracts, high-cost and low-cost managers choose high-cost and low-cost contracts, respectively. Therefore, the menu of contracts achieves both the identification of the safety effort cost-type of the manager and the manager’s “truth-telling”. However, the enterprise must pay information rent because of the asymmetry of the information on the cost type of safety effort.

5. Numerical Analysis

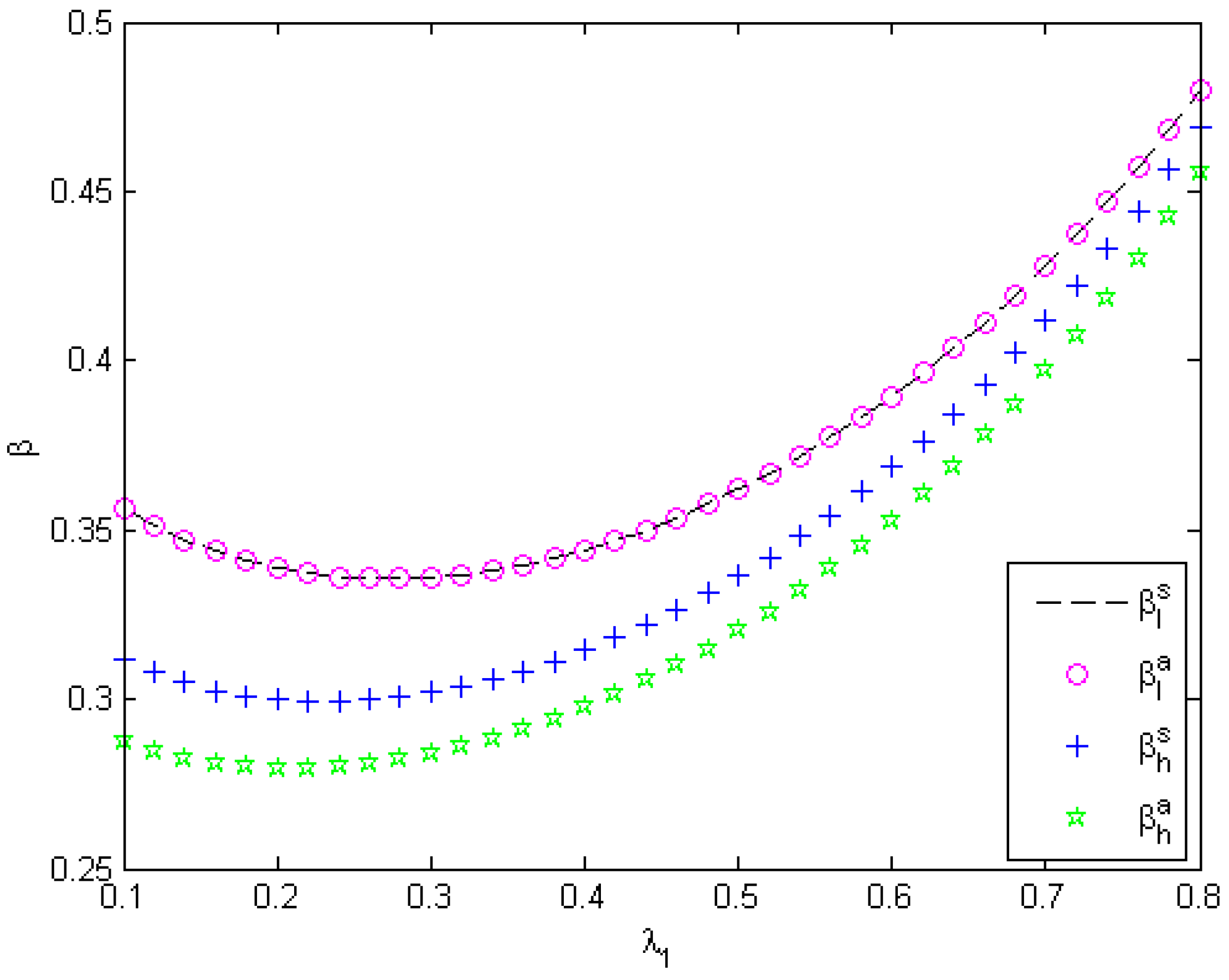

We used numerical experiments to study the effect of the system parameters on the optimal contract results. The basic parameters were set as follows:

,

,

, and

. As the marginal cost of the safety effort is not lower than the marginal cost of the production effort, that is,

, we set

,

, and

. Letting

, we investigated the impact of

on the incentive coefficient

under different contract scenarios, and the results are shown in

Figure 2. Superscript

s denotes the incentive contract under moral hazard, and the superscript

a denotes incentive contract under moral hazard and adverse selection. The subscripts

l and

h denote the low-cost and high-cost manager, respectively.

We found that the incentive coefficient

initially decreases with

and subsequently increases with

, regardless of the contract scenarios in

Figure 2. Note that

denotes the relative importance level of production efforts, and we predicted that a moderate value of

would cause the enterprise to reduce the incentive coefficient.

Figure 2 also shows that the incentive coefficient in the high-cost contract is the lowest when the information on the manager’s cost type is asymmetric to the enterprise. At this time, the enterprise benefits from reducing the incentive. When the manager belongs to the low-effort cost type, the incentive coefficients are the same. We also observed that

is the same when the manager belongs to the low-effort cost type, regardless of the cost-type information status.

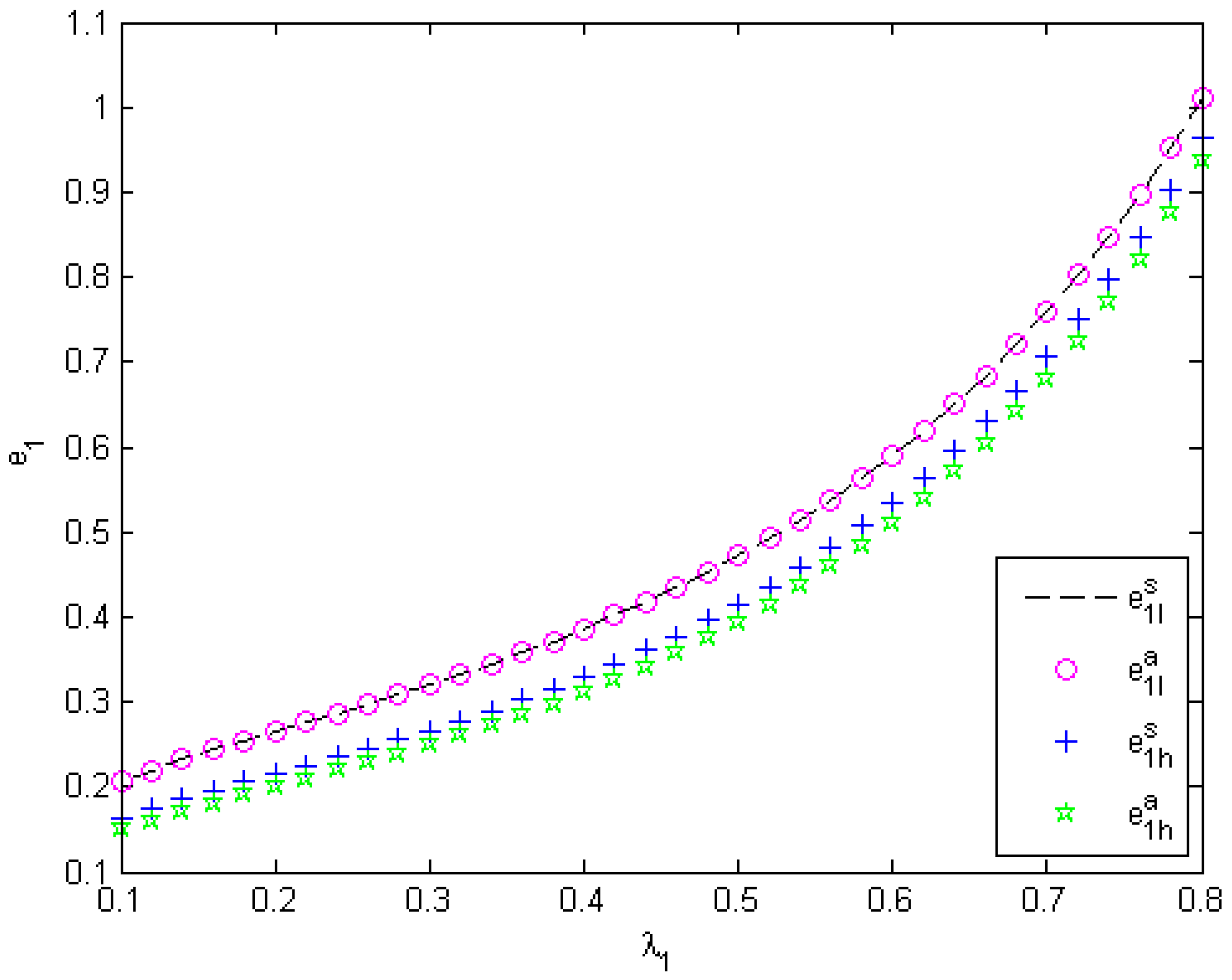

Figure 3 depicts the influence of

on the manager’s production efforts. We see that the production efforts of the manager in different contract scenarios increase with

. The larger the relative importance level of the production, the more effort the manager exerts in the production task, which is intuitive. The high-cost manager in the high-cost contract exerts a lower production effort than the one in the contract under moral hazard. The information asymmetry on the cost type causes the manager to reduce their production effort. The low-cost manager exerts the same production effort in the two scenarios. We also observed that the smaller the cost coefficient of safety effort, the larger the production effort of the manager.

Figure 4 shows the influence of

on the manager’s safety effort. The figure shows that the safety effort initially decreases and subsequently increases as

increases, regardless of the contract scenarios or information status. When the relative importance level of production is small, the manager can rationally reduce their safety effort when

increases. The reason for this is the increase in the production effort at this time. Subsequently, the safety effort reaches a minimum when

increases to a certain value. Thereafter, the manager must increase their safety effort because it is profitable. When the information on the cost type of safety effort is asymmetric, the high-cost manager reduces their safety effort. The information asymmetry on the cost type causes the manager to reduce their safety effort. When the manager belongs to the low-effort cost type, the safety efforts in the two scenarios are the same.

Figure 4 also shows that the smaller the cost coefficient of the safety effort, the stronger the safety effort of the manager. Comprehensively examining

Figure 3 and

Figure 4, the influence of

on the safety effort is larger than that of

on the production effort.

Figure 5 shows the influence of

on the fixed payment

, which reflects a nonmonotonic trend. Generally, with the increase in

, the fixed payment initially decreases and then increases. However, the trends in different contract scenarios are not uniform. We see that the low-cost manager who accepts the low-cost contract when the information on cost type is asymmetric always obtains the largest fixed payment, which is understandable. When the manager belongs to the low-effort cost type, the incentive coefficient in the contract under moral hazard is the same as that in the contract under moral hazard and adverse selection, as shown in

Figure 4. Therefore, the enterprise must increase the fixed payment to induce the manager to choose a low-cost contract. When the information on the cost type of safety effort is symmetric, the fixed payment received by the high-cost manager is initially lower and then higher than the fixed payment received by the low-cost manager. When the value of

is small, the fixed payment in the high-cost contract is always the lowest. When the value of

is sufficiently large, the fixed payment in the low-cost contract reaches its minimum.

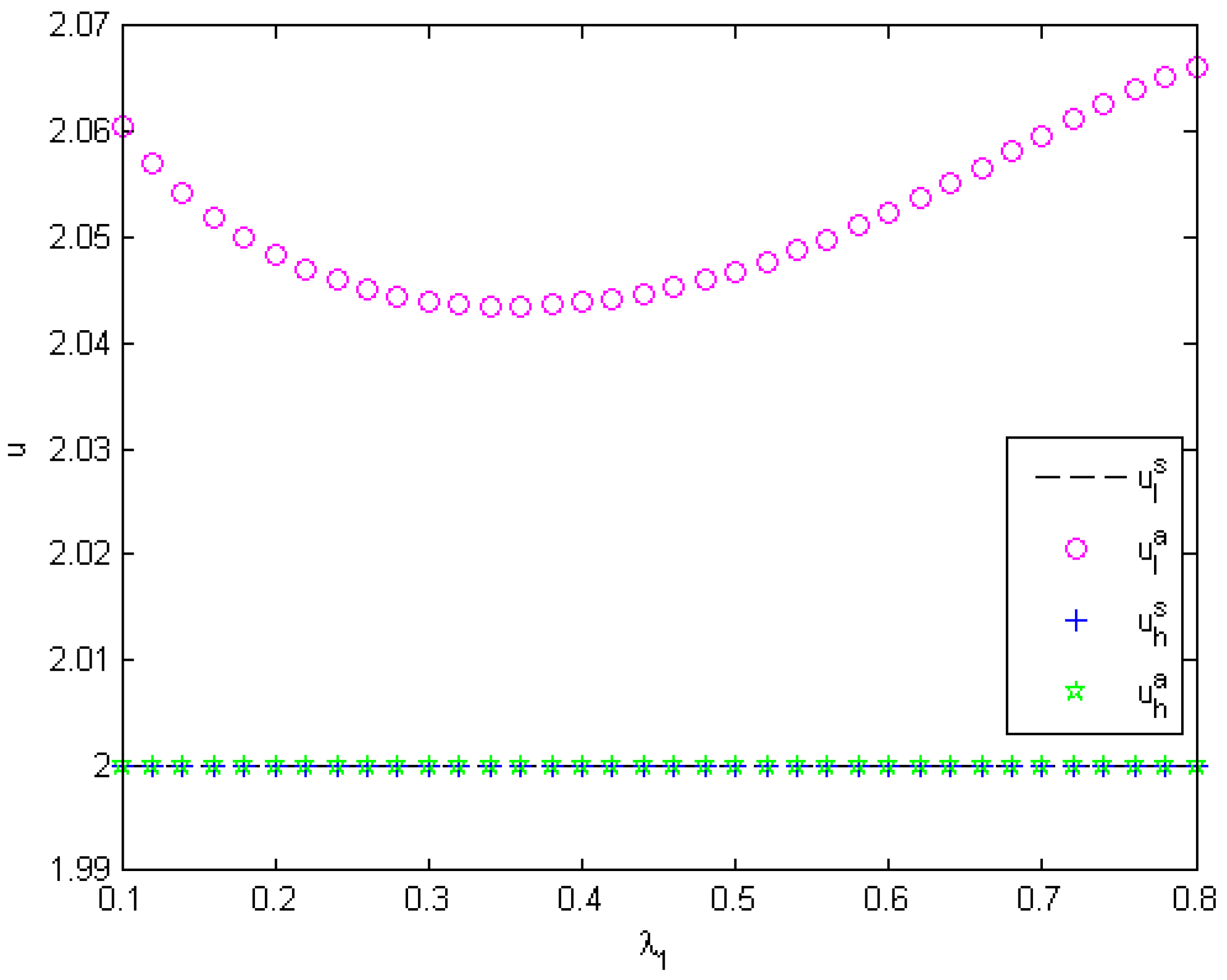

Figure 6 shows the influence of

on the expected utility of the manager. The manager only obtaining reservation utility from the contract under moral hazard is logical, as shown in the theoretical results. When the information of the cost type of safety effort is asymmetric, the high-cost manager still obtains only the reservation utility from the high-cost contract, whereas the low-cost manager can obtain positive information rent from the low-cost contract. The information rent initially decreases and then increases as

increases. The impact of

on the information rent is similar to that of

on the safety effort, as shown in

Figure 4.

Figure 7 shows the influence of

on the enterprise’s expected profit, which initially decreases and then increases with

, regardless of the contract scenario. When

attains a certain value in the middle, the enterprise obtains the lowest expected profit. The enterprise benefits from the manager belonging to the low-effort cost type. The smaller the cost coefficient of the safety effort, the larger the enterprise’s expected profit. Owing to the information rent paid by the enterprise to the manager, the expected profit obtained by the enterprise is reduced when the information on the cost type of safety effort is asymmetric. When the manager belongs to the low-effort cost type, the enterprise can obtain the largest expected profit from the contract under moral hazard. However, we found no apparent difference between the enterprise’s expected profit under the two contract scenarios.

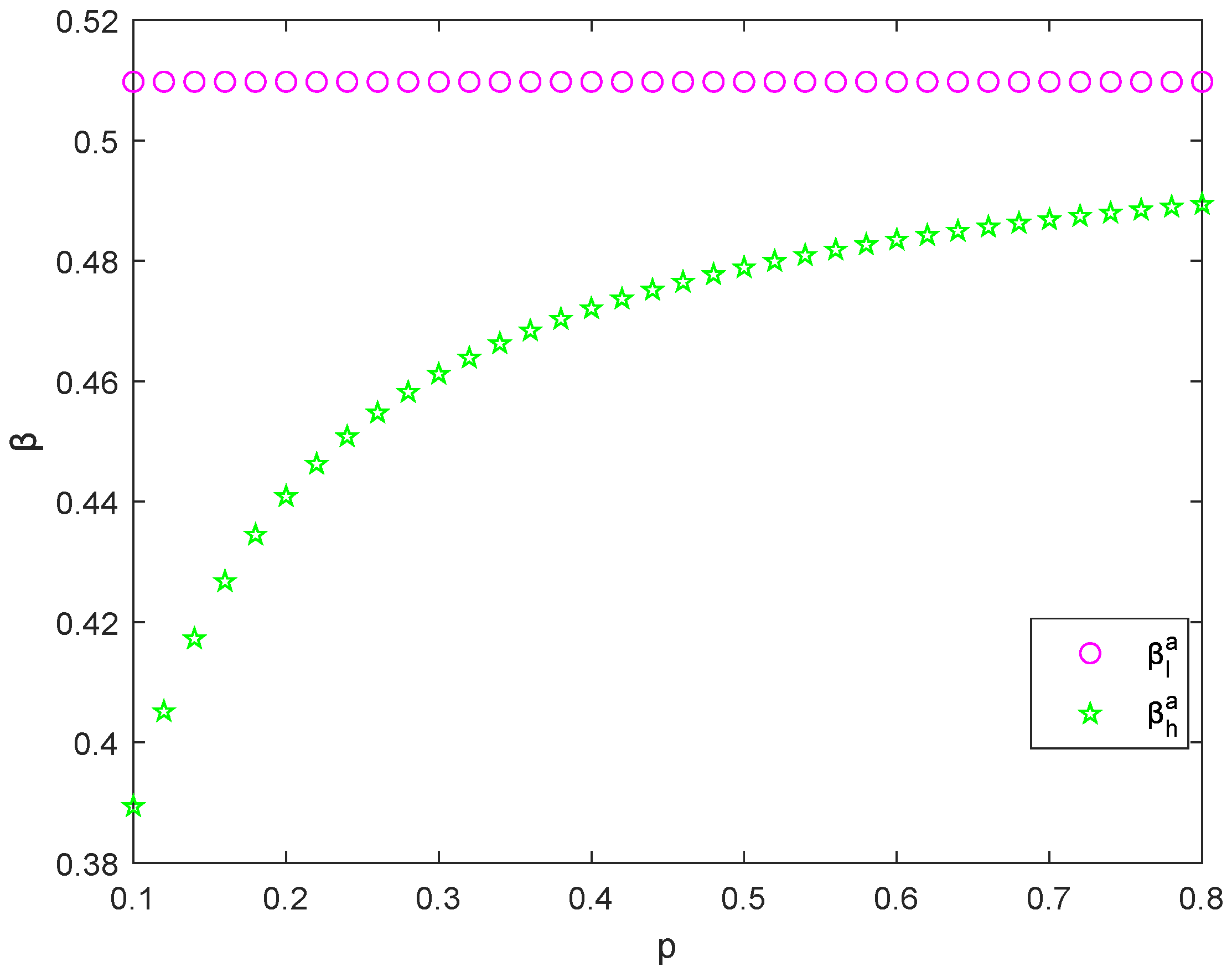

Next, we investigated the effect of the probability of the manager belonging to the high-cost type on the incentive coefficient of the contract and the manager’s efforts. Let

. The results are shown in

Figure 8 and

Figure 9.

Figure 8 shows that the incentive coefficient in the high-cost contract increases with probability

p. The higher the probability the manager is a high-cost type, the higher the incentive level given by the enterprise to the manager. Nevertheless, the incentive level for high-cost managers is always lower than that for low-cost managers. This is because providing more incentive for low-cost manager is beneficial. We also found that the incentive coefficient in the low-cost contract does not depend on the probability

p. The coal mine enterprise always provides a constant incentive level for low-cost managers, which is the same as that in the contract under moral hazard.

Figure 9 shows that both the production and safety efforts in the high-cost contract increase with the probability

p. The greater the probability of the manager is a high-cost type, the higher the manager’s production and safety efforts. Considering the degree of efforts depends on the incentive level of the contract, this observation is easy to understand. We also can see that the manager’s efforts in the low-cost contract do not depend on the probability

p. The production effort or safety effort made by the low-cost manager is always consistent with that in the contract under moral hazard.

Figure 9 also shows that the low-cost manager always inputs more than the high-cost manager in both production and safety efforts.

6. Concluding Remarks

The coal mine enterprise and manager are the two main participants in coal production. As the principal, the enterprise entrusts the manager with the actual coal production. In the process of coal mine production, the two main tasks are production and safety. The production and safety tasks jointly determine the final output of the coal mine. To maximize mine output, the manager must exert effort in terms of both production and safety tasks. Both production and safety require effort cost from the manager. The enterprise cannot observe the manager’s production and safety efforts in real time, but can only estimate these efforts through the final mine output. Due to the randomness of mine output, the motivation of the manager tends to be low; that is, the manager desires to reduce production and safety efforts. Therefore, a moral hazard problem must be considered. At the same time, due to the differences in individual characteristics of coal mines, the cost coefficients of managers’ efforts are different. Subsequently, managers can be categorized into different types of costs. We assumed that the cost type of the safety effort is the private information of the manager and cannot be accurately grasped by the enterprise. Therefore, a problem of adverse selection exists in the design of incentive contracts for coal production.

We analyzed the design of incentive contracts for coal production under moral hazard and adverse selection. We designed incentive contracts under moral hazard and a menu of contracts under moral hazard and adverse selection. We established the corresponding mathematical models of the system and obtained the optimal theoretical results, such as the incentive coefficients in the contracts and the manager’s production and safety efforts, by solving the models. In addition, we analyzed the influence of the system’s parameters. Based on the results of numerical analysis, we studied the effects of system’s parameters on the incentive coefficient, production effort, safety effort, fixed payment and expected utility of managers, and on the enterprise’s expected profit. The results indicated that the optimal incentive coefficient in the incentive contract under moral hazard and adverse selection is the same as that under the incentive contract under moral hazard when the manager belongs to the low-effort cost type. However, the high-cost manager receives a lower incentive coefficient from the incentive contract under moral hazard and adverse selection than from the incentive contract under moral hazard. Compared with the optimal production and safety efforts in the incentive contract under moral hazard, the optimal efforts in the incentive contract under moral hazard and adverse selection are reduced when the manager is high cost. In the incentive contract under moral hazard and adverse selection, the high-cost manager still only obtains the reserved utility, whereas the low-cost manager can obtain an expected utility that is larger than the reserved utility. That is, the low-cost manager obtains positive information rent. Considering the decline in the efforts and the increase in expected utility of the manager, the decline in the enterprise’s expected profit in the contract under moral hazard and adverse selection is logical.

Due to the problem of adverse selection, the manager reduces production and safety efforts, which in turn leads to reductions in the output of the coal mine and the enterprise’s expected profit. To address the problem of asymmetric information, the profit coordination mechanism for coal production can be further studied in the future, based on revenue-sharing and cost-sharing contracts.