The Effects of ESG Management on Business Performance: The Case of Incheon International Airport

Abstract

1. Introduction

2. Theoretical Background

2.1. ESG (Environment, Social, Governance)

2.2. Trust

2.3. Reputation

2.4. Business Performance

3. Methodology

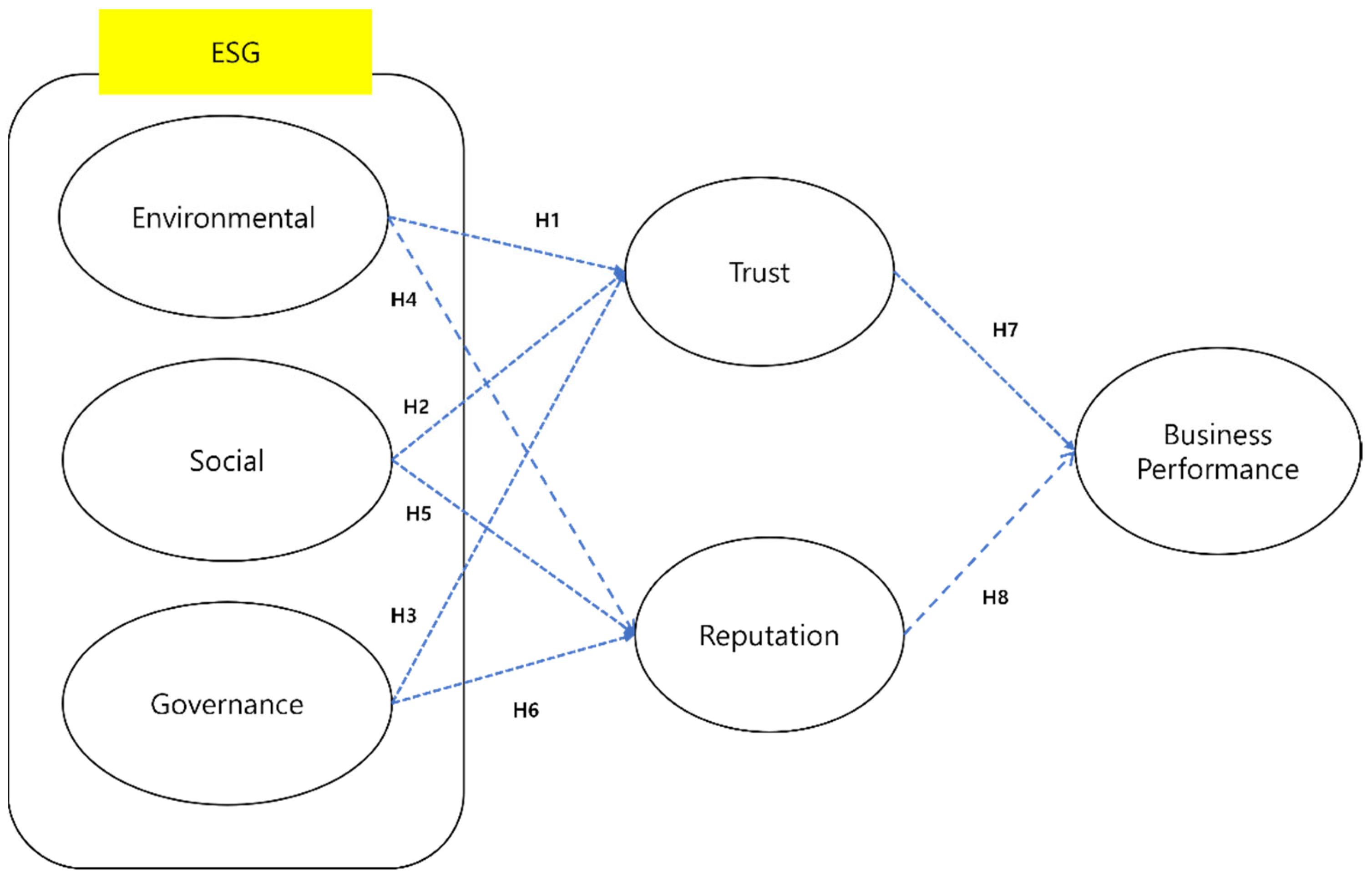

| Hypothesis 1 (H1) | The environment has a positive effect on trust |

| Hypothesis 2 (H2) | The environment has a positive effect on the reputation |

| Hypothesis 3 (H3) | Social has a positive effect on trust |

| Hypothesis 4 (H4) | Social has a positive effect on reputation |

| Hypothesis 5 (H5) | Governance has a positive effect on trust |

| Hypothesis 6 (H6) | Governance has a positive effect on reputation |

| Hypothesis 7 (H7) | Trust has a positive effect on business performance |

| Hypothesis 8 (H8) | Reputation has a positive effect on business performance |

| Construct | Item | Related Studies |

|---|---|---|

| Environment | Incheon International Airport uses eco-friendly renewable energy (LED lighting, solar light, etc.) for energy consumption efficiency. | [30,130] |

| Incheon International Airport uses eco-friendly transportation (Hydrogen, Electric Bus, Charging Station, etc.) | ||

| Incheon International Airport manages and recycles household waste. | ||

| Social | Incheon International Airport plays a positive role in the community. | [30,130] |

| Incheon International Airport contributes to the development of the community and airport industry. | ||

| Incheon International Airport supports the creation of various jobs, such as fostering local talent and youth jobs. | ||

| Governance | Incheon International Airport establishes and operates a trusted governance structure for professional management. | [131,132] |

| Incheon International Airport transparently discloses information about airport operations to the public. | ||

| Incheon International Airport establishes a clean and transparent ethical management system. | ||

| Reputation | Incheon International Airport has a very good reputation. | [30,71,133,134] |

| Incheon International Airport is well known to people. | ||

| Incheon International Airport is a world-class airport. | ||

| Incheon International Airport has a good reputation compared to other airports. | ||

| Trust | I think Incheon International Airport makes various efforts to build trust with the users. | [53,56,135,136] |

| I think Incheon International Airport responds immediately to requests for the convenience of users. | ||

| I think Incheon International Airport is a trusted airport by the public. | ||

| Business Performance | Incheon International Airport strives to have high airport competitiveness. | [137,138] |

| Incheon International Airport tries new changes before competing with airports. | ||

| Incheon International Airport grows faster than competing airports. |

| Division | Frequency | Percentage | |

|---|---|---|---|

| Gender | Male | 175 | 54.2 |

| Female | 148 | 45.8% | |

| Age | Less than 20 | 4 | 1.2% |

| 21~30 | 93 | 28.8% | |

| 31~40 | 72 | 22.3% | |

| 41~50 | 80 | 24.8% | |

| 51~60 | 64 | 19.8% | |

| Over 60 | 10 | 3.1% | |

| Education | High School (Graduated) | 39 | 12.1% |

| College (Graduated) | 39 | 12.1% | |

| University (Graduated) | 192 | 59.4% | |

| Masteral/Doctoral (Graduated) | 53 | 16.4% | |

| Occupation | Student | 62 | 19.2% |

| Practitioner/Researcher | 56 | 17.3% | |

| Sales/Services | 43 | 13.3% | |

| Office Worker | 71 | 22.0% | |

| Governmental Official | 29 | 9.0% | |

| Freelancer | 19 | 5.9% | |

| House Wife | 13 | 4.0% | |

| Others | 30 | 9.3% | |

| Purpose | Travel | 255 | 78.9% |

| Business/Work | 48 | 14.9% | |

| VFR (Visiting friends and relatives) | 7 | 2.2% | |

| Study Abroad | 6 | 1.9% | |

| Others | 7 | 2.2% | |

4. Empirical Analysis

4.1. Descriptive Analysis Results

4.2. Descriptive Analysis Results of SEM

5. Discussion

6. Conclusions and Implication

6.1. Academic Implication

6.2. Managerial Implication

6.3. Limitation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ortas, E.; Álvarez, I.; Garayar, A. The Environmental, Social, Governance, and Financial Performance Effects on Companies that Adopt the United Nations Global Compact. Sustainability 2015, 7, 1932–1956. [Google Scholar] [CrossRef]

- Kim, S.; Yoon, A. Analyzing active fund managers’ commitment to ESG: Evidence from the United Nations Principles for Responsible Investment. Manag. Sci. 2023, 69, 741–758. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Cini, A.C.; Ricci, C. CSR as a Driver where ESG Performance will Ultimately Matter. Symphonya Emerg. Issues Manag. 2018, 68–75. [Google Scholar] [CrossRef]

- Pollman, E. The Making and Meaning of ESG; Research Paper; University of Pennsylvania Institute for Law and Economics: Philadelphia, PA, USA, 2022; pp. 1–53. [Google Scholar]

- Hazen, T.L. Social Issues in the Spotlight: The Increasing Need to Improve Publicly-Held Companies’ CSR and ESG Disclosures. Univ. Pa. J. Bus. Law 2020, 23, 740. [Google Scholar]

- Taylor, J.; Vithayathil, J.; Yim, D. Are corporate social responsibility (CSR) initiatives such as sustainable development and environmental policies value enhancing or window dressing? Corp. Soc. Responsib. Environ. Manag. 2018, 25, 971–980. [Google Scholar] [CrossRef]

- Murè, P.; Spallone, M.; Mango, F.; Marzioni, S.; Bittucci, L. ESG and reputation: The case of sanctioned Italian banks. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 265–277. [Google Scholar] [CrossRef]

- Litvinenko, V.; Bowbriсk, I.; Naumov, I.; Zaitseva, Z. Global guidelines and requirements for professional competencies of natural resource extraction engineers: Implications for ESG principles and sustainable development goals. J. Clean. Prod. 2022, 338, 130530. [Google Scholar] [CrossRef]

- Assaf, A.G.; Gillen, D. Measuring the joint impact of governance form and economic regulation on airport efficiency. Eur. J. Oper. Res. 2012, 220, 187–198. [Google Scholar] [CrossRef]

- Park, J.W.; Kim, K.-W.; Seo, H.-J.; Shin, H.-W. The privatization of Korea’s Incheon international airport. J. Air Transp. Manag. 2011, 17, 233–236. [Google Scholar] [CrossRef]

- Marques, R.C.; Brochado, A. Airport regulation in Europe: Is there need for a European Observatory? Transp. Policy 2008, 15, 163–172. [Google Scholar] [CrossRef]

- Gillen, D.; Lall, A. Airport performance measurement: Data envelope analysis and frontier production functions. Transp. Res. E 1997, 33, 261–274. [Google Scholar] [CrossRef]

- Pels, E.; Nijkamp, P.; Rietveld, P. Relative efficiency of European airports. Transp. Policy 2001, 8, 183–192. [Google Scholar] [CrossRef]

- Bannard, D.Y. ESG and airports: The benefits and risks of ESG reporting for US airports. J. Airpt. Manag. 2023, 17, 248–265. [Google Scholar]

- Marques, R.C.; Simões, P. Measuring the influence of congestion on efficiency in worldwide airports. J. Air Transp. Manag. 2010, 16, 334–336. [Google Scholar] [CrossRef]

- Özcan, İ.Ç. Determinants of environmental, social, and governance disclosure performance of publicly traded airports. Int. J. Transp. Econ. 2019, 46, 77–92. [Google Scholar]

- Dimitriou, D.J. Climate Change Implications in Aviation and Tourism Market Equilibrium. In Climate Change Adaptation, Resilience and Hazards; Springer: Cham, Switzerland, 2016; pp. 409–424. [Google Scholar]

- Graham, A. Managing Airports: An International Perspective; Taylor & Francis: Abingdon, UK, 2023. [Google Scholar]

- Hartmann, S.P. The Impact of ESG Scores on the Firm Value-Evidence from the Airline Industry. 2022. [Google Scholar]

- Tettamanzi, P.; Venturini, G.; Murgolo, M. Sustainability and financial accounting: A critical review on the ESG dynamics. Environ. Sci. Pollut. Res. 2022, 29, 16758–16761. [Google Scholar] [CrossRef] [PubMed]

- Cantino, V.; Devalle, A.; Fiandrino, S. ESG sustainability and financial capital structure: Where they stand nowadays. Int. J. Bus. Soc. Sci. 2017, 8, 116–126. [Google Scholar]

- Lozano, R. A holistic perspective on corporate sustainability drivers. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 32–44. [Google Scholar] [CrossRef]

- Gillan, S.; Hartzell, J.C.; Koch, A.; Starks, L.T. Firms’ Environmental, Social and Governance (ESG) Choices, Performance and Managerial Motivation; Department of Finance, The University of Texas at Austin: Austin, TX, USA, 2010; Volume 10. [Google Scholar]

- Drempetic, S.; Klein, C.; Zwergel, B. The influence of firm size on the ESG score: Corporate sustainability ratings under review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 2021, 168, 315–334. [Google Scholar] [CrossRef]

- Humphrey, J.E.; Lee, D.D.; Shen, Y. The independent effects of environmental, social and governance initiatives on the performance of UK firms. Aust. J. Manag. 2012, 37, 135–151. [Google Scholar] [CrossRef]

- Alareeni, B.A.; Hamdan, A. ESG impact on performance of US S&P 500-listed firms. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1409–1428. [Google Scholar]

- Rezaee, Z. Business sustainability research: A theoretical and integrated perspective. J. Account. Lit. 2016, 36, 48–64. [Google Scholar] [CrossRef]

- Tripopsakul, S.; Puriwat, W. Understanding the Impact of ESG on Brand Trust and Customer Engagement. J. Hum. Earth Future 2022, 3, 430–440. [Google Scholar] [CrossRef]

- Kim, K.; Kim, Y. Study of the Improvement plans of related to Environmental Factors (E) of ESG—Focused on Information Disclosure and Tax Regulations. Environ. Law Policy 2021, 27, 55–91. [Google Scholar] [CrossRef]

- Hannan, S.; Sutherland, C. Mega-projects and sustainability in Durban, South Africa: Convergent or divergent agendas? Habitat Int. 2015, 45, 205–212. [Google Scholar] [CrossRef]

- Bohne, R.A.; Klakegg, O.J.; Lædre, O. Evaluating sustainability of building projects in urban planning. Procedia Econ. Financ. 2015, 21, 306–312. [Google Scholar] [CrossRef]

- Fröch, G. Sustainability issues in the valuation process of project developments. Energy Build. 2015, 100, 2–9. [Google Scholar] [CrossRef]

- Chang, A.S.; Tsai, C.Y. Sustainable design indicators: Roadway project as an example. Ecol. Indic. 2015, 53, 137–143. [Google Scholar] [CrossRef]

- Ganesan, Y.; Hwa, Y.W.; Jaaffar, A.H.; Hashim, F. Corporate governance and sustainability reporting practices: The moderating role of internal audit function. Glob. Bus. Manag. Res. 2017, 9, 159–179. [Google Scholar]

- Shavit, T.; Adam, A.M. A preliminary exploration of the effects of rational factors and behavioral biases on the managerial choice to invest in corporate responsibility. Manag. Decis. Econ. 2011, 32, 205–213. [Google Scholar] [CrossRef]

- Baldarelli, M.-G.; Gigli, S. Exploring the drivers of corporate reputation integrated with a corporate responsibility perspective: Some reflections in theory and in praxis. J. Manag. Gov. 2014, 18, 589–613. [Google Scholar] [CrossRef]

- Handayani, M. The effect of ESG performance on economic performance in the high profile industry in Indonesia. J. Int. Bus. Econ. 2019, 7, 112–121. [Google Scholar]

- Leiblein, M.J.; Reuer, J.J.; Dalsace, F. Do make or buy decisions matter? The influence of organizational governance on technological performance. Strateg. Manag. J. 2002, 23, 817–833. [Google Scholar]

- Nicolau, J.L. Corporate social responsibility: Worth-creating ctivities. Ann. Tour. Res. 2008, 35, 990–1006. [Google Scholar] [CrossRef][Green Version]

- Park, S.-Y.; Lee, S. Financial rewards for social responsibility: A mixed picture for restaurant companies. Cornell Hosp. Q. 2009, 50, 168–179. [Google Scholar] [CrossRef]

- Lee, S.; Seo, K.; Sharma, A. Corporate social responsibility and firm performance in the airline industry: The moderating role of oil prices. Tour. Manag. 2013, 38, 20–30. [Google Scholar] [CrossRef]

- Inoue, Y.; Lee, S. Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag. 2011, 32, 790–804. [Google Scholar] [CrossRef]

- Liu, L.; Nemoto, N. Environmental, social and governance (ESG) evaluation and organizational attractiveness to prospective employees: Evidence from Japan. J. Account. Financ. 2021, 21, 14–29. [Google Scholar]

- Yang, A.S.; Baasandorj, S. Exploring CSR and financial performance of full-service and low-cost air carriers. Financ. Res. Lett. 2017, 23, 291–299. [Google Scholar] [CrossRef]

- Lee, S.; Park, S.-Y. Financial impacts of socially responsible activities on airline companies. J. Hosp. Tour. Res. 2010, 34, 185–203. [Google Scholar] [CrossRef]

- Cowper-Smith, A.; De Grosbois, D. The adoption of corporate social responsibility practices in the airline industry. J. Sustain. Tour. 2011, 19, 59–77. [Google Scholar] [CrossRef]

- Seo, K.; Moon, J.; Lee, S. Synergy of corporate social responsibility and service quality for airlines: The moderating role of carrier type. J. Air Transp. Manag. 2015, 47, 126–134. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Hsu, J.-L. Corporate social responsibility programs choice and costs assessment in the airline industry—A hybrid model. J. Air Transp. Manag. 2008, 14, 188–196. [Google Scholar] [CrossRef]

- Arayssi, M.; Jizi, M.I. Does corporate governance spillover firm performance? A study of valuation of MENA companies. Soc. Responsib. J. 2018, 15, 597–620. [Google Scholar]

- Lee, S.; Park, J.-W.; Chung, S. The Effects of Corporate Social Responsibility on Corporate Reputation: The Case of Incheon International Airport. Sustainability 2022, 14, 10930. [Google Scholar] [CrossRef]

- Muflih, M. The link between corporate social responsibility and customer loyalty: Empirical evidence from the Islamic banking industry. J. Retail. Consum. Serv. 2021, 61, 102558. [Google Scholar] [CrossRef]

- Suhartanto, D. Predicting behavioural intention toward Islamic bank: A multi-group analysis approach. J. Islam. Mark. 2019, 10, 1091–1103. [Google Scholar] [CrossRef]

- Pavlou, P.A.; Fygenson, M. Understanding and predicting electronic commerce adoption: An extension of the theory of planned behavior. MIS Q. 2006, 30, 115–143. [Google Scholar] [CrossRef]

- Park, E.; Kim, K.J.; Kwon, S.J. Corporate social responsibility as a determinant of consumer loyalty: An examination of ethical standard, satisfaction, and trust. J. Bus. Res. 2017, 76, 8–13. [Google Scholar] [CrossRef]

- Pandey, M.M. Evaluating the service quality of airports in Thailand using fuzzy multi-criteria decision making method. J. Air Transp. Manag. 2016, 57, 241–249. [Google Scholar] [CrossRef]

- Sethi, S.P.; Martell, T.F.; Demir, M. Building corporate reputation through corporate social responsibility (CSR) reports: The case of extractive industries. Corp. Reput. Rev. 2016, 19, 219–243. [Google Scholar] [CrossRef]

- Martínez-Navalón, J.G.; Gelashvili, V.; Saura, J.R. The impact of environmental social media publications on user satisfaction with and trust in tourism businesses. Int. J. Environ. Res. Public Health 2020, 17, 5417. [Google Scholar] [CrossRef]

- Park, J.; Lee, H.; Kim, C. Corporate social responsibilities, consumer trust and corporate reputation: South Korean consumers’ perspectives. J. Bus. Res. 2014, 67, 295–302. [Google Scholar] [CrossRef]

- Verburg, R.M.; Nienaber, A.-M.; Searle, R.H.; Weibel, A.; Den Hartog, D.N.; Rupp, D.E. The role of organizational control systems in employees’ organizational trust and performance outcomes. Group Organ. Manag. 2018, 43, 179–206. [Google Scholar] [CrossRef]

- Hausman, A. Variations in relationship strength and its impact on performance and satisfaction in business relationships. J. Bus. Ind. Mark. 2001, 16, 600–616. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.-S. Trust, control, and risk in strategic alliances: An integrated framework. Organ. Stud. 2001, 22, 251–283. [Google Scholar] [CrossRef]

- Park, E.; Kim, K.J. What drives “customer loyalty”? The role of corporate social responsibility. Sustain. Dev. 2019, 27, 304–311. [Google Scholar]

- Bellini, E.; Piroli, G.; Pennacchio, L. Collaborative know-how and trust in university–industry collaborations: Empirical evidence from ICT firms. J. Technol. Transf. 2019, 44, 1939–1963. [Google Scholar] [CrossRef]

- Zhang, M.; Zhao, X.; Lyles, M. Effects of absorptive capacity, trust and information systems on product innovation. Int. J. Oper. Prod. Manag. 2018, 38, 493–512. [Google Scholar] [CrossRef]

- Nyaga, G.N.; Whipple, J.M.; Lynch, D.F. Examining supply chain relationships: Do buyer and supplier perspectives on collaborative relationships differ? J. Oper. Manag. 2010, 28, 101–114. [Google Scholar] [CrossRef]

- Gunday, G.; Ulusoy, G.; Kilic, K.; Alpkan, L. Effects of innovation types on firm performance. Int. J. Prod. Econ. 2011, 133, 662–676. [Google Scholar] [CrossRef]

- Jaramillo, F.; Valenzuela, L. Building Customer Trust and Loyalty: Does Salesperson Empathy Matter? In Marketing Challenges in a Turbulent Business Environment: Proceedings of the 2014 Academy of Marketing Science (AMS) World Marketing Congress, Lima, Peru, 5–8 August 2014; Springer: Cham, Switzerland, 2016; pp. 611–612. [Google Scholar]

- Swan, J.E.; Trawick, I.F.; Silva, D.W. How industrial salespeople gain customer trust. Ind. Mark. Manag. 1985, 14, 203–211. [Google Scholar] [CrossRef]

- Carmeli, A.; Tishler, A. Perceived organizational reputation and organizational performance: An empirical investigation of industrial enterprises. Corp. Reput. Rev. 2005, 8, 13–30. [Google Scholar] [CrossRef]

- Agmeka, F.; Wathoni, R.N.; Santoso, A.S. The influence of discount framing towards brand reputation and brand image on purchase intention and actual behaviour in e-commerce. Procedia Comput. Sci. 2019, 161, 851–858. [Google Scholar] [CrossRef]

- Foroudi, P. Influence of brand signature, brand awareness, brand attitude, brand reputation on hotel industry’s brand performance. Int. J. Hosp. Manag. 2019, 76, 271–285. [Google Scholar] [CrossRef]

- Loureiro, S.M.C. The role of the rural tourism experience economy in place attachment and behavioral intentions. Int. J. Hosp. Manag. 2014, 40, 1–9. [Google Scholar] [CrossRef]

- Capozzi, L. Corporate reputation: Our role in sustaining and building a valuable asset. J. Advert. Res. 2005, 45, 290–293. [Google Scholar] [CrossRef]

- Del-Castillo-Feito, C.; Blanco-González, A.; González-Vázquez, E. The relationship between image and reputation in the Spanish public university. Eur. Res. Manag. Bus. Econ. 2019, 25, 87–92. [Google Scholar] [CrossRef]

- Gray, E.R.; Balmer, J.M. Managing corporate image and corporate reputation. Long Range Plan. 1998, 31, 695–702. [Google Scholar] [CrossRef]

- Irfan, A.; Rasli, A.; Sulaiman, Z.; Sami, A.; Liaquat, H.; Qureshi, M.I. Student’s perceived university image is an antecedent of university reputation. Int. J. Psychosoc. Rehabil. 2020, 24, 650–663. [Google Scholar] [CrossRef]

- Dowling, G. Creating Corporate Reputations: Identity, Image and Performance: Identity, Image and Performance; OUP Oxford: Oxford, UK, 2000. [Google Scholar]

- Hillenbrand, C.; Money, K. Corporate responsibility and corporate reputation: Two separate concepts or two sides of the same coin? Corp. Reput. Rev. 2007, 10, 261–277. [Google Scholar] [CrossRef]

- Deephouse, D. The term ‘Reputation Management’: Users, uses and the trademark tradeoff corporate reputation: An eight-country analysis. Corp. Reput. Rev. 2002, 5, 9–18. [Google Scholar] [CrossRef]

- Vidaver-Cohen, D. Reputation beyond the rankings: A conceptual framework for business school research. Corp. Reput. Rev. 2007, 10, 278–304. [Google Scholar] [CrossRef]

- Rindova, V.P.; Williamson, I.O.; Petkova, A.P.; Sever, J.M. Being good or being known: An empirical examination of the dimensions, antecedents, and consequences of organizational reputation. Acad. Manag. J. 2005, 48, 1033–1049. [Google Scholar] [CrossRef]

- Decker, S.; Sale, C. An Analysis of Corporate Social Responsibility, Trust and Reputation in the Banking Profession. In Professionals’ Perspectives of Corporate Social Responsibility; Springer: Berlin/Heidelberg, Germany, 2010; pp. 135–156. [Google Scholar]

- Gatzert, N. The impact of corporate reputation and reputation damaging events on financial performance: Empirical evidence from the literature. Eur. Manag. J. 2015, 33, 485–499. [Google Scholar] [CrossRef]

- Kotha, S.; Rajgopal, S.; Rindova, V. Reputation building and performance: An empirical analysis of the top-50 pure internet firms. Eur. Manag. J. 2001, 19, 571–586. [Google Scholar] [CrossRef]

- Quintana-García, C.; Benavides-Chicón, C.G.; Marchante-Lara, M. Does a green supply chain improve corporate reputation? Empirical evidence from European manufacturing sectors. Ind. Mark. Manag. 2021, 92, 344–353. [Google Scholar]

- Fombrun, C.J. List of lists: A compilation of international corporate reputation ratings. Corp. Reput. Rev. 2007, 10, 144–153. [Google Scholar] [CrossRef]

- Boyd, B.K.; Bergh, D.D.; Ketchen, D.J., Jr. Reconsidering the reputation—Performance relationship: A resource-based view. J. Manag. 2010, 36, 588–609. [Google Scholar] [CrossRef]

- Fliess, S.; Volkers, M. Trapped in a service encounter: Exploring customer lock-in and its effect on well-being and coping responses during service encounters. J. Serv. Manag. 2020, 31, 79–114. [Google Scholar] [CrossRef]

- Nikbin, D.; Ismail, I.; Marimuthu, M.; Younis Abu-Jarad, I. The impact of firm reputation on customers’ responses to service failure: The role of failure attributions. Bus. Strategy Ser. 2011, 12, 19–29. [Google Scholar] [CrossRef]

- Wattanacharoensil, W.; Schuckert, M.; Graham, A. An airport experience framework from a tourism perspective. Transp. Rev. 2016, 36, 318–340. [Google Scholar] [CrossRef]

- Moon, H.; Yoon, H.J.; Han, H. Role of airport physical environments in the satisfaction generation process: Mediating the impact of traveller emotion. Asia Pac. J. Tour. Res. 2016, 21, 193–211. [Google Scholar] [CrossRef]

- Veasna, S.; Wu, W.-Y.; Huang, C.-H. The impact of destination source credibility on destination satisfaction: The mediating effects of destination attachment and destination image. Tour. Manag. 2013, 36, 511–526. [Google Scholar] [CrossRef]

- García, J.B.D.; Puente, E.D.Q. The complex link of city reputation and city performance. Results for fsQCA analysis. J. Bus. Res. 2016, 69, 2830–2839. [Google Scholar]

- Carmeli, A.; Tishler, A. The relationships between intangible organizational elements and organizational performance. Strateg. Manag. J. 2004, 25, 1257–1278. [Google Scholar] [CrossRef]

- Wæraas, A.; Byrkjeflot, H. Public sector organizations and reputation management: Five problems. Int. Public Manag. J. 2012, 15, 186–206. [Google Scholar] [CrossRef]

- Aqueveque, C.; Ravasi, D. Corporate reputation, affect, and trustworthiness: An explanation for the reputation-performance relationship. In Proceedings of the 10th Annual Corporate Reputation Institute Conference, New York, NY, USA, 2006. [Google Scholar]

- Peteraf, M.A. The cornerstones of competitive advantage: A resource-based view. Strateg. Manag. J. 1993, 14, 179–191. [Google Scholar] [CrossRef]

- Wu, H.-C.; Cheng, C.-C.; Ai, C.-H. A study of experiential quality, experiential value, trust, corporate reputation, experiential satisfaction and behavioral intentions for cruise tourists: The case of Hong Kong. Tour. Manag. 2018, 66, 200–220. [Google Scholar] [CrossRef]

- Ding, X.; Lu, Q.; Li, L.; Sarkar, A.; Li, H. Evaluating the Impact of Institutional Performance and Government Trust on Farmers’ Subjective Well-Being: A Case of Urban–Rural Welfare Gap Perception and Family Economic Status in Shaanxi, Sichuan and Anhui, China. Int. J. Environ. Res. Public Health 2022, 20, 710. [Google Scholar] [CrossRef] [PubMed]

- Xu, G.; Sarkar, A.; Qian, L. Does organizational participation affect farmers’ behavior in adopting the joint mechanism of pest and disease control? A study of Meixian County, Shaanxi Province. Pest Manag. Sci. 2021, 77, 1428–1443. [Google Scholar] [PubMed]

- Fama, E.F.; French, K.R. Size and book-to-market factors in earnings and returns. J. Financ. 1995, 50, 131–155. [Google Scholar]

- Bini, M.; Penman, S. Companies with Market Value below Book Value Are More Common in Europe than in the US: Evidence, Explanations, and Implications; Report; KPMG: Amstelveen, The Netherlands, 2013. [Google Scholar]

- Aluchna, M.; Roszkowska-Menkes, M.; Kamiński, B. From talk to action: The effects of the non-financial reporting directive on ESG performance. Meditari Account. Res. 2022, 31, 1–25. [Google Scholar] [CrossRef]

- Chelli, M.; Durocher, S.; Richard, J. France’s new economic regulations: Insights from institutional legitimacy theory. Account. Audit. Account. J. 2014, 27, 283–316. [Google Scholar] [CrossRef]

- Fontana, S.; D’Amico, E.; Coluccia, D.; Solimene, S. Does environmental performance affect companies’ environmental disclosure? Meas. Bus. Excell. 2015, 19, 42–57. [Google Scholar] [CrossRef]

- Frost, G.R. The introduction of mandatory environmental reporting guidelines: Australian evidence. Abacus 2007, 43, 190–216. [Google Scholar] [CrossRef]

- Da Silva Monteiro, S.M.; Aibar Guzmán, B. The influence of the Portuguese environmental accounting standard on the environmental disclosures in the annual reports of large companies operating in Portugal: A first view (2002–2004). Manag. Environ. Qual. Int. J. 2010, 21, 414–435. [Google Scholar] [CrossRef]

- Fatima, A.; Abdullah, N.; Sulaiman, M. Environmental disclosure quality: Examining the impact of the stock exchange of Malaysia’s listing requirements. Soc. Responsib. J. 2015, 11, 904–922. [Google Scholar] [CrossRef]

- Riley, R.A., Jr.; Pearson, T.A.; Trompeter, G. The value relevance of non-financial performance variables and accounting information: The case of the airline industry. J. Account. Public Policy 2003, 22, 231–254. [Google Scholar] [CrossRef]

- Wallman, S.M. The future of accounting and financial reporting part II: The colorized approach. Account. Horiz. 1996, 10, 138. [Google Scholar]

- Wallman, S.M. The future of accounting and disclosure in an evolving world: The need for dramatic change. Account. Horiz. 1995, 9, 81–91. [Google Scholar]

- Forsyth, P. Environmental and financial sustainability of air transport: Are they incompatible? J. Air Transp. Manag. 2011, 17, 27–32. [Google Scholar] [CrossRef]

- Bogićević, J.; Domanović, V.; Krstić, B. The role of financial and non-financial performance indicators in enterprise sustainability evaluation. Ekonomika 2016, 62, 1–13. [Google Scholar] [CrossRef]

- Wang, Y.; Bhanugopan, R.; Lockhart, P. Examining the quantitative determinants of organizational performance: Evidence from China. Meas. Bus. Excell. 2015, 19, 23–41. [Google Scholar] [CrossRef]

- Muthuveloo, R.; Shanmugam, N.; Teoh, A.P. The impact of tacit knowledge management on organizational performance: Evidence from Malaysia. Asia Pac. Manag. Rev. 2017, 22, 192–201. [Google Scholar] [CrossRef]

- Lyon, T.P.; Maxwell, J.W. Greenwash: Corporate environmental disclosure under threat of audit. J. Econ. Manag. Strategy 2011, 20, 3–41. [Google Scholar] [CrossRef]

- Hess, D. The transparency trap: Non-financial disclosure and the responsibility of business to respect human rights. Am. Bus. Law J. 2019, 56, 5–53. [Google Scholar] [CrossRef]

- Hassan, O.A.; Romilly, P. Relations between corporate economic performance, environmental disclosure and greenhouse gas emissions: New insights. Bus. Strategy Environ. 2018, 27, 893–909. [Google Scholar] [CrossRef]

- Mahoney, L.S.; Thorne, L.; Cecil, L.; LaGore, W. A research note on standalone corporate social responsibility reports: Signaling or greenwashing? Crit. Perspect. Account. 2013, 24, 350–359. [Google Scholar] [CrossRef]

- Gond, J.-P.; Herrbach, O. Social reporting as an organisational learning tool? A theoretical framework. J. Bus. Ethics 2006, 65, 359–371. [Google Scholar] [CrossRef]

- Lozano, R.; Nummert, B.; Ceulemans, K. Elucidating the relationship between sustainability reporting and organisational change management for sustainability. J. Clean. Prod. 2016, 125, 168–188. [Google Scholar] [CrossRef]

- Herzig, C.; Schaltegger, S. Corporate Sustainability Reporting. In Sustainability Communication: Interdisciplinary Perspectives and Theoretical Foundation; Springer: Dordrecht, The Netherlands, 2011; pp. 151–169. [Google Scholar]

- Hill, J. Environmental, Social, and Governance (ESG) Investing: A Balanced Analysis of the Theory and Practice of a Sustainable Portfolio; Academic Press: Cambridge, MA, USA, 2020. [Google Scholar]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Lourenço, I.C.; Branco, M.C.; Curto, J.D.; Eugénio, T. How does the market value corporate sustainability performance? J. Bus. Ethics 2012, 108, 417–428. [Google Scholar] [CrossRef]

- Gorondutse, A.H.; Ahmad, A.; Nasidi, M. Corporate reputation on performance of Banking Industries in Nigeria: Using PLS-SEM tool of analysis. Bus. Ethics 2014, 6, 71–79. [Google Scholar]

- Oláh, J.; Hidayat, Y.A.; Dacko-Pikiewicz, Z.; Hasan, M.; Popp, J. Inter-organizational trust on financial performance: Proposing innovation as a mediating variable to sustain in a disruptive era. Sustainability 2021, 13, 9947. [Google Scholar] [CrossRef]

- Ahmad, N.; Mahmood, A.; Ariza-Montes, A.; Han, H.; Hernández-Perlines, F.; Araya-Castillo, L.; Scholz, M. Sustainable businesses speak to the heart of consumers: Looking at sustainability with a marketing lens to reap banking consumers’ loyalty. Sustainability 2021, 13, 3828. [Google Scholar] [CrossRef]

- Ul Musawir, A.; Serra, C.E.M.; Zwikael, O.; Ali, I. Project governance, benefit management, and project success: Towards a framework for supporting organizational strategy implementation. Int. J. Proj. Manag. 2017, 35, 1658–1672. [Google Scholar] [CrossRef]

- Del-Castillo-Feito, C.; Blanco-González, A.; Delgado-Alemany, R. The relationship between image, legitimacy, and reputation as a sustainable strategy: Students’ versus professors’ perceptions in the higher education sector. Sustainability 2020, 12, 1189. [Google Scholar] [CrossRef]

- Nguyen, N.T.T.; Nguyen, N.P.; Hoai, T.T. Ethical leadership, corporate social responsibility, firm reputation, and firm performance: A serial mediation model. Heliyon 2021, 7, e06809. [Google Scholar] [CrossRef]

- Martos-Pedrero, A.; Cortés-García, F.J.; Jiménez-Castillo, D. The relationship between social responsibility and business performance: An analysis of the agri-food sector of southeast Spain. Sustainability 2019, 11, 6390. [Google Scholar] [CrossRef]

- Song, H.; Ruan, W.; Park, Y. Effects of service quality, corporate image, and customer trust on the corporate reputation of airlines. Sustainability 2019, 11, 3302. [Google Scholar] [CrossRef]

- Mercadé Melé, P.; Molina Gómez, J.; Sousa, M.J. Influence of sustainability practices and green image on the re-visit intention of small and medium-size towns. Sustainability 2020, 12, 930. [Google Scholar] [CrossRef]

- Kong, Y.; Javed, F.; Sultan, J.; Hanif, M.S.; Khan, N. EMA implementation and corporate environmental firm performance: A comparison of institutional pressures and environmental uncertainty. Sustainability 2022, 14, 5662. [Google Scholar] [CrossRef]

- Gimeno-Arias, F.; Santos-Jaén, J.M.; Palacios-Manzano, M.; Garza-Sánchez, H.H. Using PLS-SEM to analyze the effect of CSR on corporate performance: The mediating role of human resources management and customer satisfaction. An empirical study in the Spanish food and beverage manufacturing sector. Mathematics 2021, 9, 2973. [Google Scholar]

- Chang, L.-Y.; Hung, S.-C. Adoption and loyalty toward low cost carriers: The case of Taipei–Singapore passengers. Transp. Res. Part E Logist. Transp. Rev. 2013, 50, 29–36. [Google Scholar] [CrossRef]

- Mandhachitara, R.; Poolthong, Y. A model of customer loyalty and corporate social responsibility. J. Serv. Mark. 2011, 25, 122–133. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Tam, C.M.; Zeng, S.; Deng, Z. Identifying elements of poor construction safety management in China. Saf. Sci. 2004, 42, 569–586. [Google Scholar] [CrossRef]

- Bae, J.-H.; Park, J.-W. Research into individual factors affecting safety within airport subsidiaries. Sustainability 2021, 13, 5219. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM) An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Rahman, I.A.; Al-Emad, N. Structural relationship of leadership qualities with worker’s issues for Saudi Arabia’s construction industry. Proc. MATEC Web Conf. 2018, 250, 05002. [Google Scholar] [CrossRef]

- Hair, J., Jr.; Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2021. [Google Scholar]

- Henseler, J. Bridging design and behavioral research with variance-based structural equation modeling. J. Advert. 2017, 46, 178–192. [Google Scholar] [CrossRef]

- Hair, J.; Hair, J.F., Jr.; Sarstedt, M.; Ringle, C.M.; Gudergan, S.P. Advanced Issues in Partial Least Squares Structural Equation Modeling; Sage Publications: Thousand Oaks, CA, USA, 2023. [Google Scholar]

- Cachón-Rodríguez, G.; Prado-Román, C.; Blanco-Gonzalez, A. Efectos de la imagen universitaria sobre la identificación y la lealtad:¿ existen diferencias significativas entre estudiantes y egresados. Rev. Espac. 2020, 41, 1015. [Google Scholar]

- Cachón Rodríguez, G.; Prado Román, C. The identification-loyalty relationship in a university context of crisis: The moderating role of students and graduates. Tec Empres. 2020, 16, 39–50. [Google Scholar] [CrossRef]

- Schermelleh-Engel, K.; Moosbrugger, H.; Müller, H. Evaluating the fit of structural equation models: Tests of significance and descriptive goodness-of-fit measures. Methods Psychol. Res. Online 2003, 8, 23–74. [Google Scholar]

- Hair, J.F.; Gabriel, M.; Patel, V. AMOS covariance-based structural equation modeling (CB-SEM): Guidelines on its application as a marketing research tool. Braz. J. Mark. 2014, 13, 44–55. [Google Scholar]

- Ryu, Y.K.; Park, J.-W. Investigating the effect of experience in an airport on pleasure, satisfaction, and airport image: A case study on incheon international airport. Sustainability 2019, 11, 4616. [Google Scholar] [CrossRef]

- Chung, S.; Park, J.-W.; Lee, S. The influence of CSR on airline loyalty through the mediations of passenger satisfaction, airline brand, and airline trust: Korean market focused. Sustainability 2022, 14, 4548. [Google Scholar] [CrossRef]

- Pineiro-Chousa, J.; Vizcaíno-González, M.; López-Cabarcos, M.Á.; Romero-Castro, N. Managing reputational risk through environmental management and reporting: An options theory approach. Sustainability 2017, 9, 376. [Google Scholar] [CrossRef]

- Abbas, J. HEISQUAL: A modern approach to measure service quality in higher education institutions. Stud. Educ. Eval. 2020, 67, 100933. [Google Scholar] [CrossRef]

- Rosamartina, S.; Giustina, S.; Angeloantonio, R. Digital reputation and firm performance: The moderating role of firm orientation towards sustainable development goals (SDGs). J. Bus. Res. 2022, 152, 315–325. [Google Scholar] [CrossRef]

- Maaloul, A.; Zéghal, D.; Ben Amar, W.; Mansour, S. The effect of environmental, social, and governance (ESG) performance and disclosure on cost of debt: The mediating effect of corporate reputation. Corp. Reput. Rev. 2023, 26, 1–18. [Google Scholar] [CrossRef]

- Aroul, R.R.; Sabherwal, S.; Villupuram, S.V. ESG, operational efficiency and operational performance: Evidence from Real Estate Investment Trusts. Manag. Financ. 2022, 48, 1206–1220. [Google Scholar] [CrossRef]

- Amiraslani, H.; Lins, K.V.; Servaes, H.; Tamayo, A. Trust, social capital, and the bond market benefits of ESG performance. Rev. Account. Stud. 2023, 28, 421–462. [Google Scholar] [CrossRef]

- Miranda, B.; Delgado, C.; Branco, M.C. Board Characteristics, Social Trust and ESG Performance in the European Banking Sector. J. Risk Financ. Manag. 2023, 16, 244. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

| Construct | Measurement Variable | SRC | SMC | AVE | C.R a | C.R b | CA c |

|---|---|---|---|---|---|---|---|

| Environment | Environment1 | 0.624 | 0.381 | 0.452 | 0.711 | - | 0.709 |

| Environment2 | 0.709 | 0.505 | 9.658 | ||||

| Environment3 | 0.68 | 0.469 | 9.395 | ||||

| Social | Social1 | 0.685 | 0.467 | 0.435 | 0.697 | - | 0.773 |

| Social2 | 0.657 | 0.432 | 16.576 | ||||

| Social3 | 0.636 | 0.405 | 10.363 | ||||

| Governance | Governance1 | 0.663 | 0.533 | 0.677 | 0.862 | - | 0.827 |

| Governance2 | 0.842 | 0.778 | 12.695 | ||||

| Governance3 | 0.887 | 0.718 | 13.032 | ||||

| Trust | Trust1 | 0.746 | 0.548 | 0.590 | 0.810 | - | 0.852 |

| Trust2 | 0.698 | 0.443 | 15.337 | ||||

| Trust3 | 0.899 | 0.777 | 16.618 | ||||

| Reputation | Reputation1 | 0.834 | 0.743 | 0.810 | 0.898 | - | 0.887 |

| Reputation2 | 0.761 | 0.641 | 14.216 | ||||

| Reputation3 | 0.845 | 0.667 | 18.103 | ||||

| Reputation4 | 0.85 | 0.703 | 18.253 | ||||

| Business Performance | BP1 | 0.875 | 0.765 | 0.862 | 0.833 | - | 0.865 |

| BP2 | 0.754 | 0.57 | 16.168 | ||||

| BP3 | 0.737 | 0.542 | 15.597 |

| Division | Result | Good Fit | Acceptable Fit | Source | |

|---|---|---|---|---|---|

| Absolute fit index | CMIN/DF | 2.91 | 0 2 | 3 | [152] |

| RMR | 0.33 | 0 | |||

| GFI | 0.882 | ||||

| AGFI | 0.826 | ||||

| RMSEA | 0.77 | ||||

| Incremental fit index | NFI | 0.912 | |||

| CFI | 0.939 | ||||

| Variable | A | B | C | D | E | F |

|---|---|---|---|---|---|---|

| Environment | 1 | |||||

| Social | 0.802 | 1 | ||||

| Governance | 0.796 | 0.747 | 1 | |||

| Trust | 0.677 | 0.850 | 0.66 | 1 | ||

| Reputation | 0.496 | 0.864 | 0.505 | 0.846 | 1 | |

| Business Performance | 0.647 | 0.774 | 0.623 | 0.977 | 0.831 | 1 |

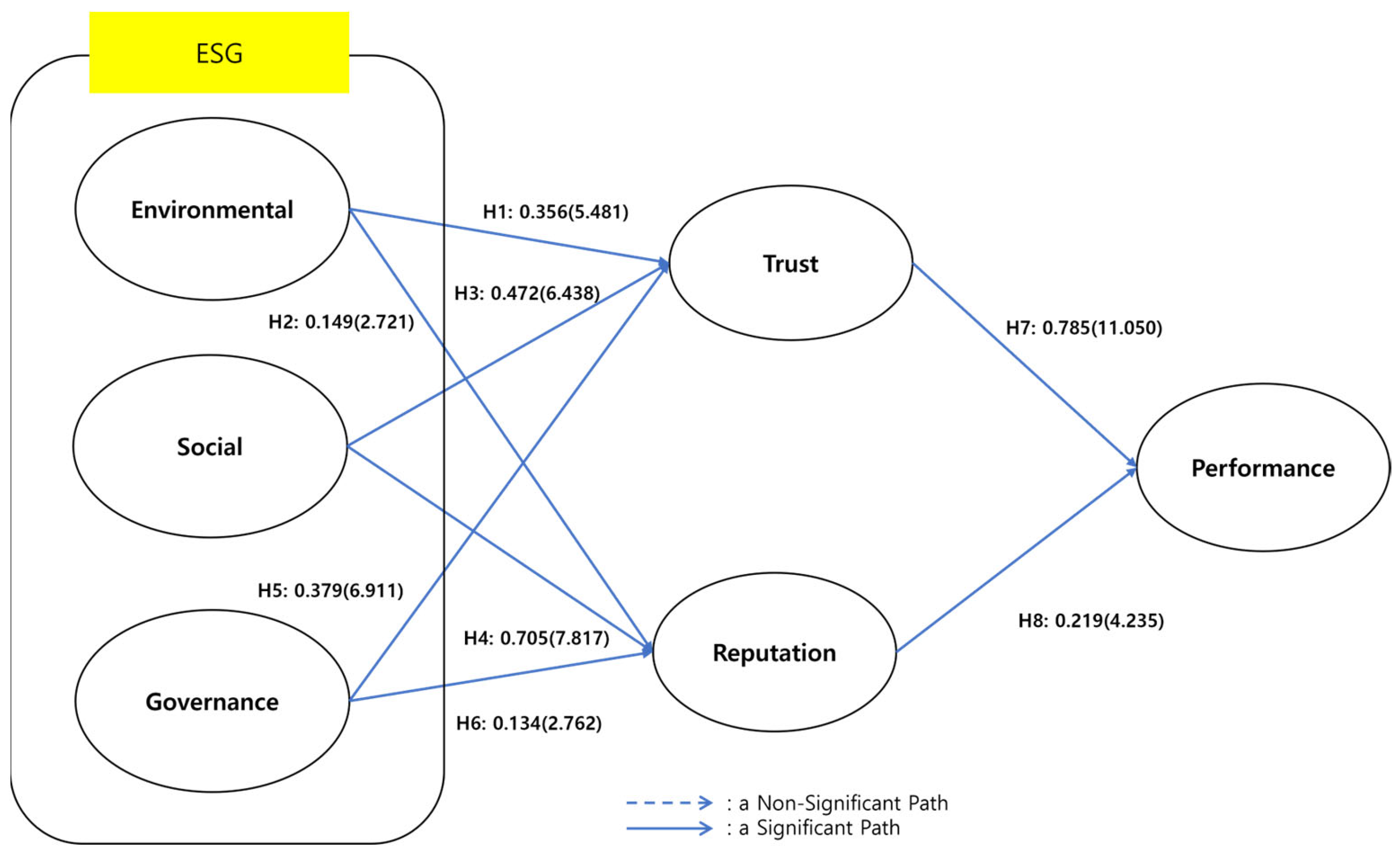

| Path | SRC a | C.R | p-Value | Decision | |

|---|---|---|---|---|---|

| H1 | Environment → Trust | 0.356 | 5.481 | *** | Supported |

| H2 | Environment → Reputation | 0.149 | 2.721 | 0.007 (**) | Supported |

| H3 | Social → Trust | 0.472 | 6.438 | *** | Supported |

| H4 | Social → Reputation | 0.705 | 7.817 | *** | Supported |

| H5 | Governance → Trust | 0.379 | 6.911 | *** | Supported |

| H6 | Governance → Reputation | 0.134 | 2.762 | 0.006 (**) | Supported |

| H7 | Trust → Business Performance | 0.785 | 11.050 | *** | Supported |

| H8 | Reputation → Business Performance | 0.219 | 4.235 | *** | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, S.; Park, J.-W.; Choi, D. The Effects of ESG Management on Business Performance: The Case of Incheon International Airport. Sustainability 2023, 15, 16831. https://doi.org/10.3390/su152416831

Lee S, Park J-W, Choi D. The Effects of ESG Management on Business Performance: The Case of Incheon International Airport. Sustainability. 2023; 15(24):16831. https://doi.org/10.3390/su152416831

Chicago/Turabian StyleLee, SangRyeong, Jin-Woo Park, and DongRyeol Choi. 2023. "The Effects of ESG Management on Business Performance: The Case of Incheon International Airport" Sustainability 15, no. 24: 16831. https://doi.org/10.3390/su152416831

APA StyleLee, S., Park, J.-W., & Choi, D. (2023). The Effects of ESG Management on Business Performance: The Case of Incheon International Airport. Sustainability, 15(24), 16831. https://doi.org/10.3390/su152416831