Blockchain-Powered Incentive System for JIT Arrival Operations and Decarbonization in Maritime Shipping

Abstract

:1. Introduction

2. Literature Review

2.1. Blockchain in Decarbonization Efforts

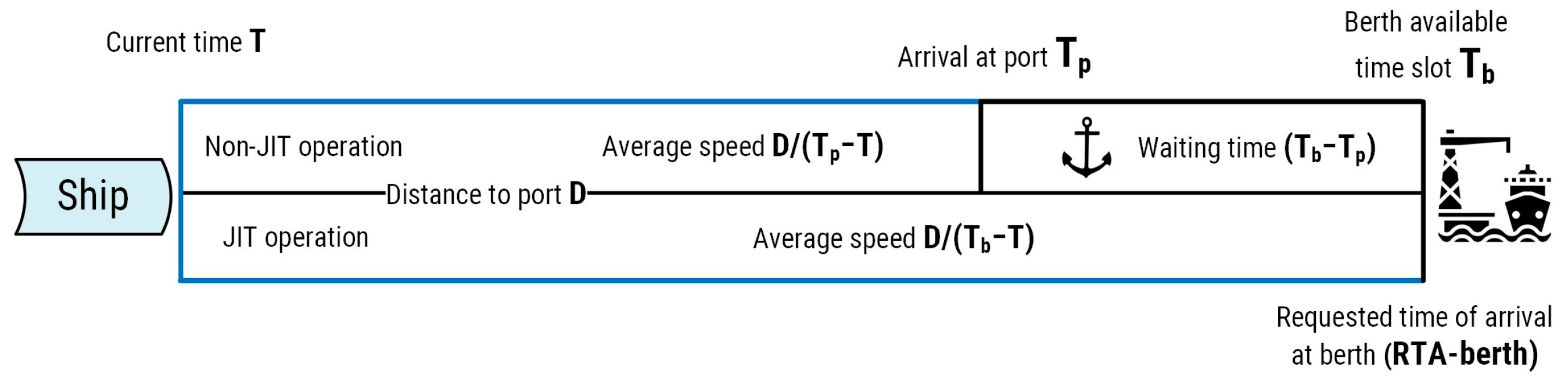

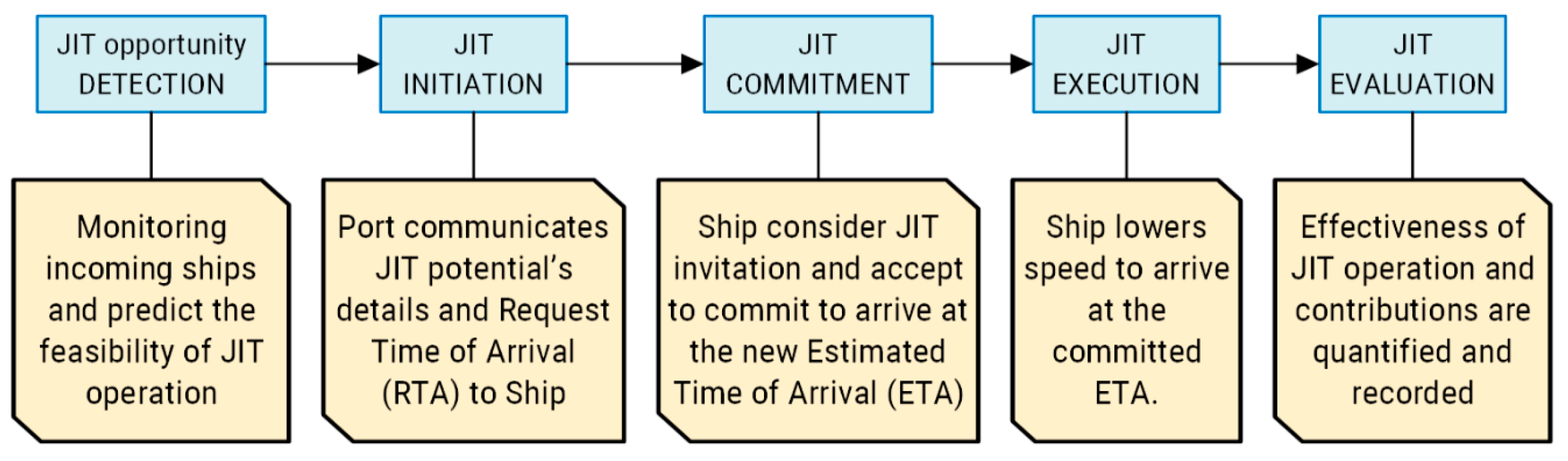

2.2. Port-Ship Coordination and Just-in-Time Arrival of Ships

2.3. Blockchain Applications in Maritime Logistics

2.4. Key Innovations and Contributions

- Immutable and tamper-free storage for critical data records (i.e., JIT and emission performance) that brings in transparency and immutability.

- Incentive distributor of built-in tokens for recognition of collaborative efforts.

- Backbone digitalized network linking with other services, such as port operation optimization, carbon accounting, and emission trading platform.

- The details on technological design approaches and architecture paradigms associated with port operation practices are elaborated with rationale.

- Incentive rewarding models for JIT and decarbonization are proposed.

- A working prototype system is implemented on Solana blockchain, demonstrating the system’s feasibility and key features.

3. Fundamental Concepts and Infrastructure Elements

3.1. JIT Framework and Coordination Plan

3.2. Crypto-Economic Considerations

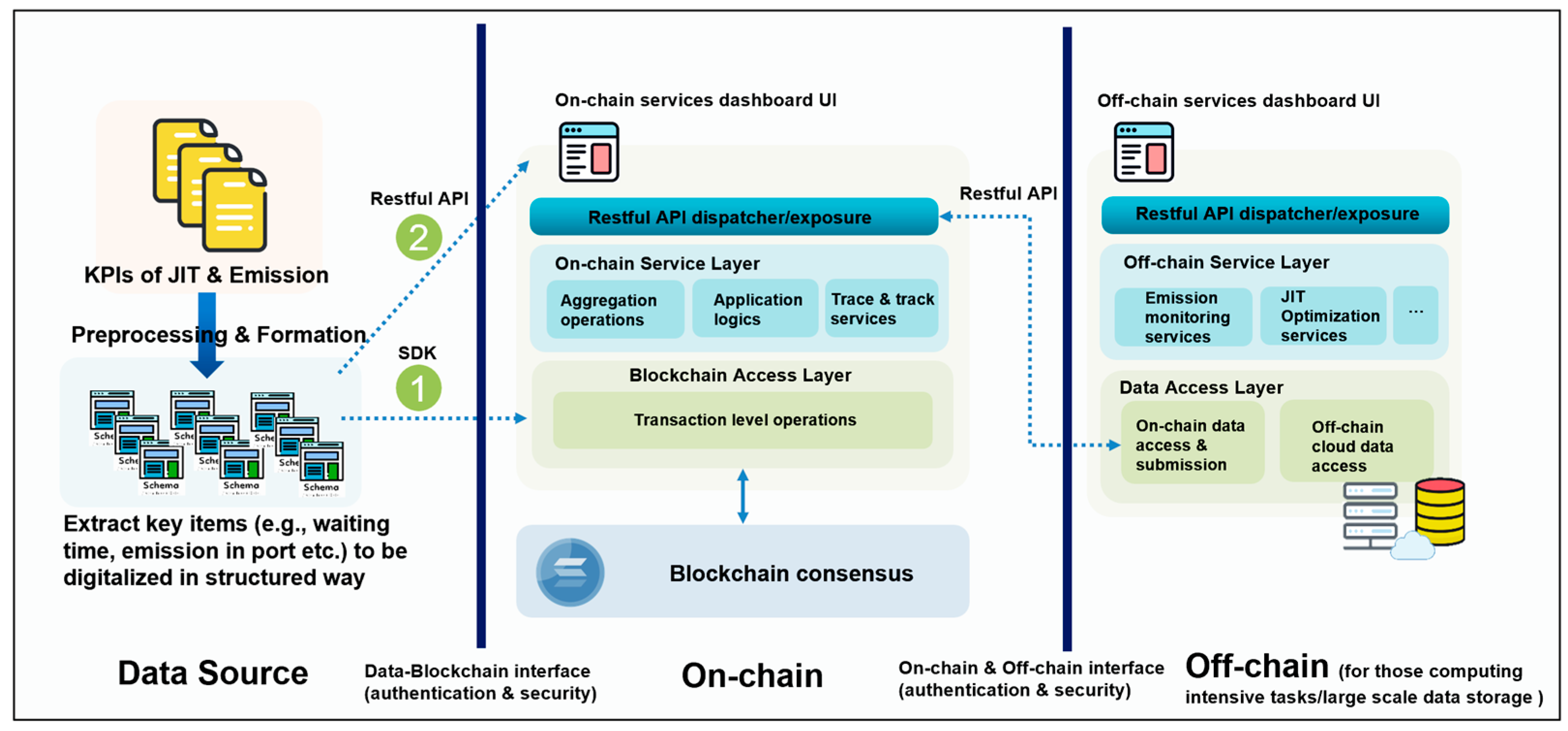

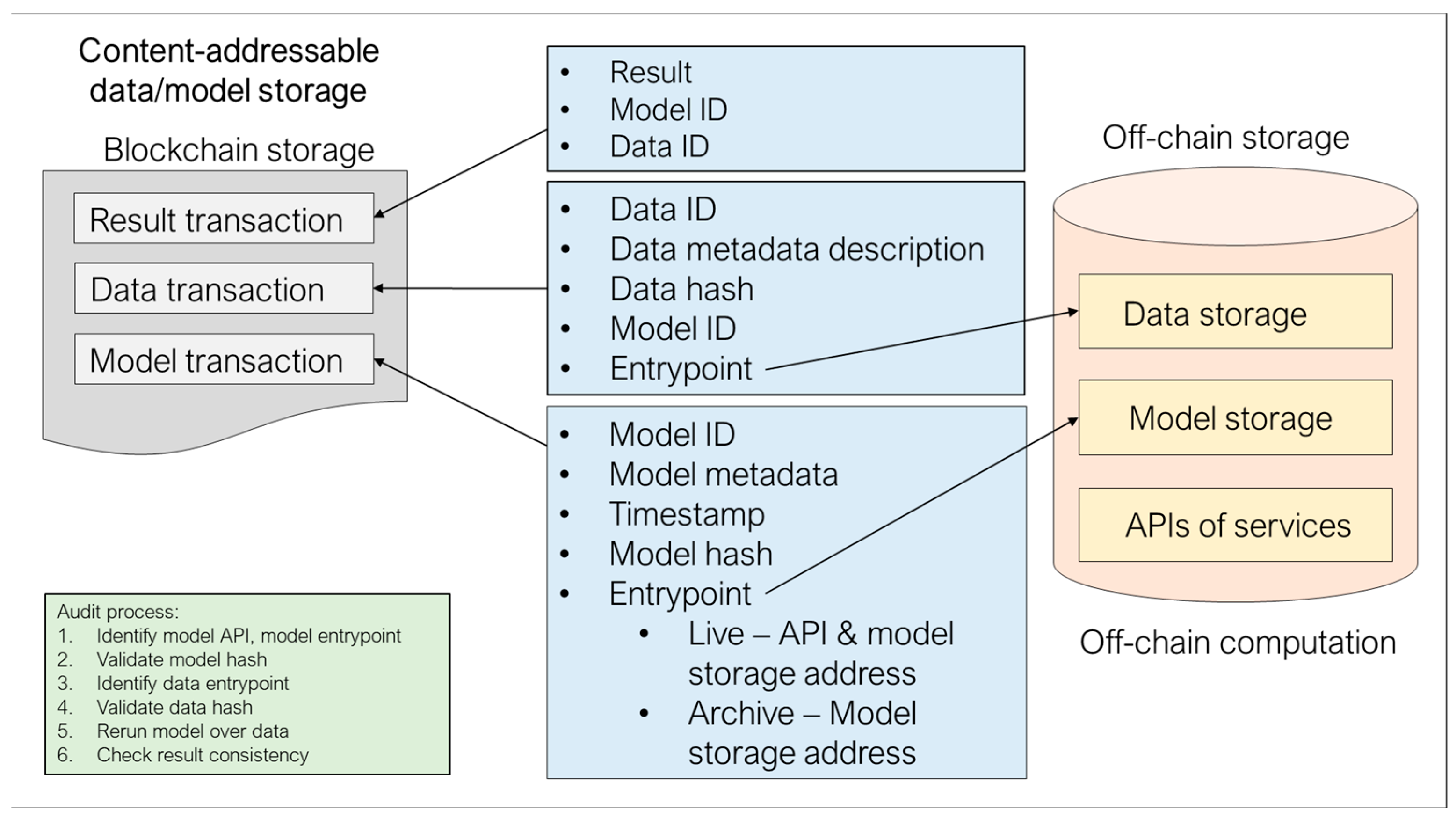

3.3. System Design and Architecture of the Blockchain-Based Incentive Solution

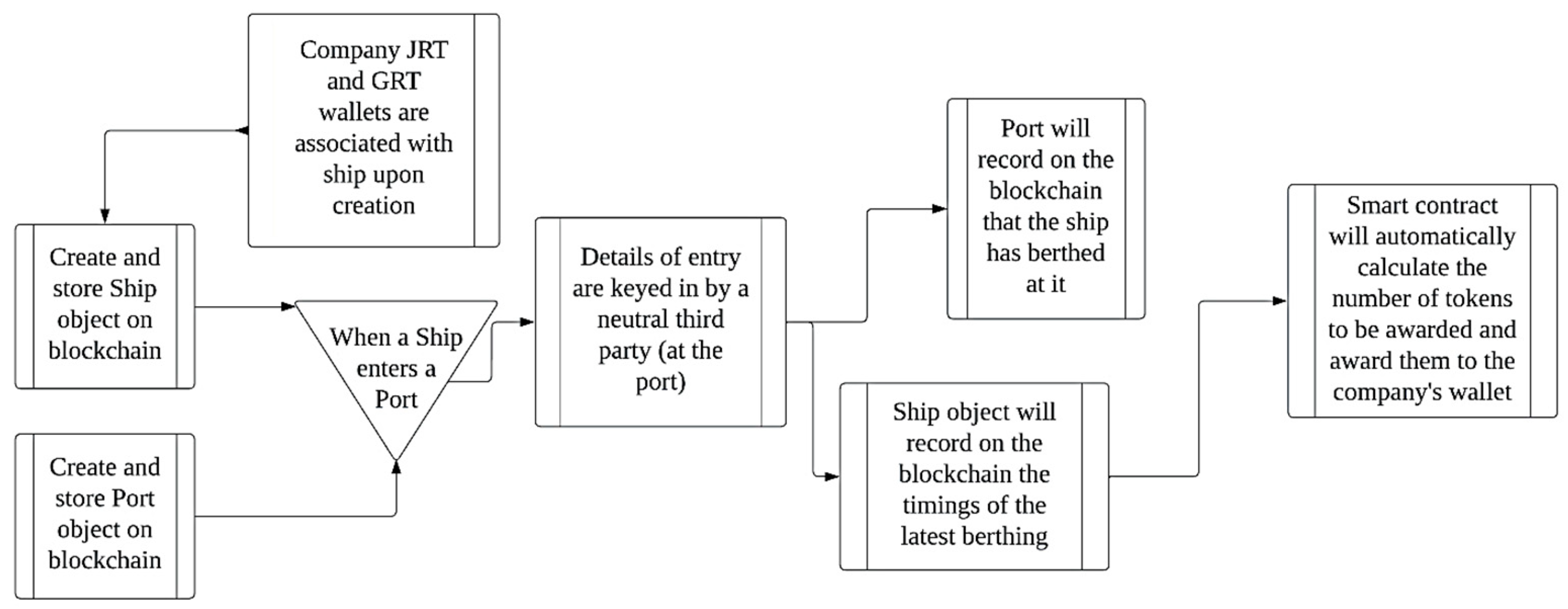

4. Proof-of-Concept (POC) Prototype System Implementation

4.1. The Relevant Entities

4.2. Transaction Security and Wallet Ownership

4.3. Remote Procedure Calls and Functions

4.4. Software Testing and the Implemented User Interface (UI)

5. Decarbonization Potential and Challenges for Continuous Developments

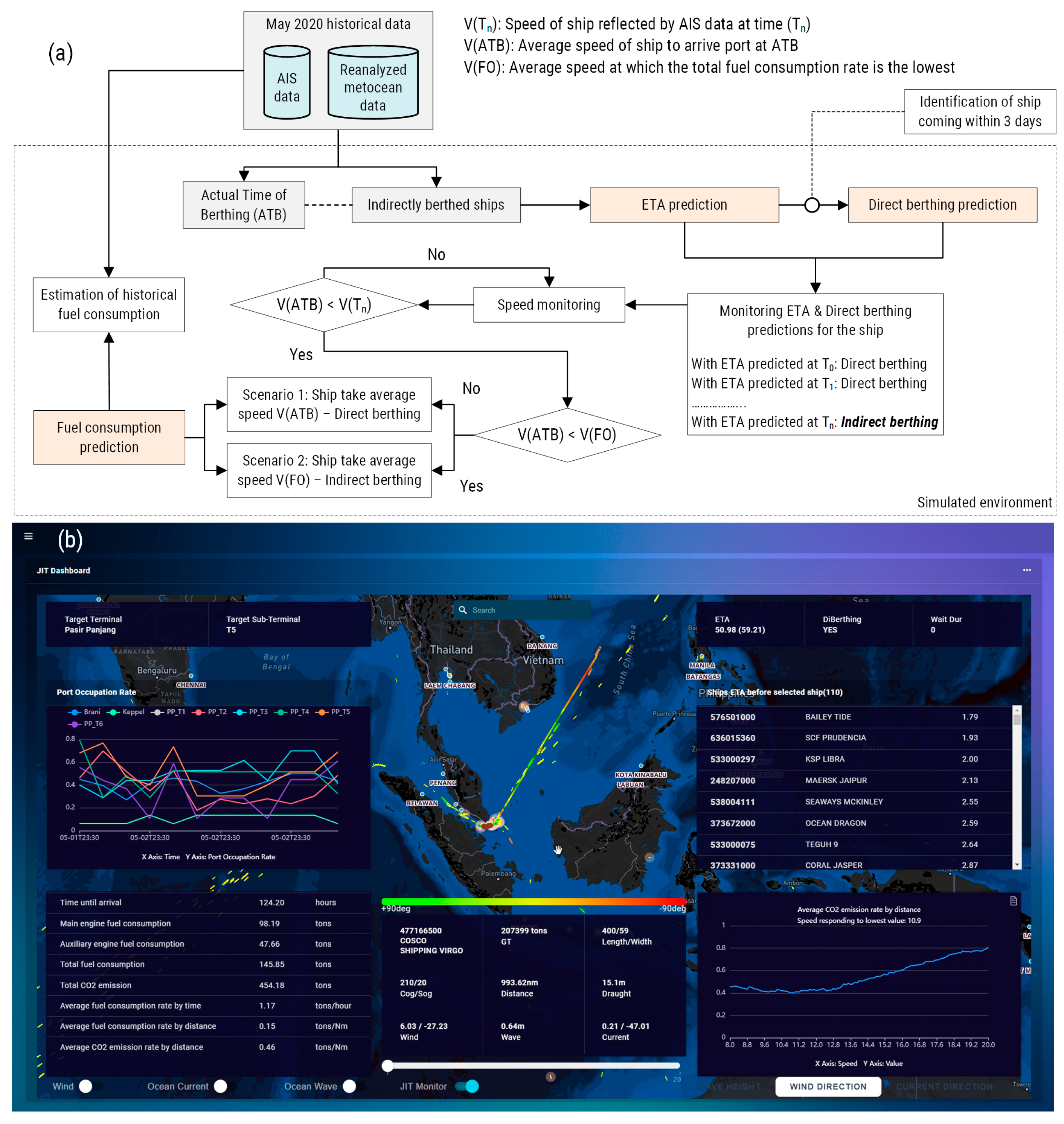

5.1. Decarbonization Potential Experiment

5.2. Challenges for Continuous Improvements

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Arjona Aroca, J.; Giménez Maldonado, J.A.; Ferrús Clari, G.; Alonso i García, N.; Calabria, L.; Lara, J. Enabling a green just-in-time navigation through stakeholder collaboration. Eur. Transp. Res. Rev. 2020, 12, 22. [Google Scholar] [CrossRef]

- MarineTraffic. Just In Time Arrival: Emissions Reduction Potential in Global Container Shipping; International Maritime Organization: London, UK, 2022. [Google Scholar]

- GloMEEP. Just In Time Arrival Guide: Barriers and Potential Solutions; GloMEEP Project Coordination Unit, International Maritime Organization: London, UK, 2020. [Google Scholar]

- Mallouppas, G.; Yfantis, E.A. Decarbonization in Shipping Industry: A Review of Research, Technology Development, and Innovation Proposals. J. Mar. Sci. Eng. 2021, 9, 415. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Nguyen, S.; Chen, P.S.-L.; Du, Y. Blockchain adoption in container shipping: An empirical study on barriers, approaches, and recommendations. Mar. Policy 2023, 155, 105724. [Google Scholar] [CrossRef]

- Balci, G.; Surucu-Balci, E. Blockchain adoption in the maritime supply chain: Examining barriers and salient stakeholders in containerized international trade. Transp. Res. Part E Logist. Transp. Rev. 2021, 156, 102539. [Google Scholar] [CrossRef]

- Carlan, V.; Coppens, F.; Sys, C.; Vanelslander, T.; Van Gastel, G. Blockchain technology as key contributor to the integration of maritime supply chain? In Maritime Supply Chains; Vanelslander, T., Sys, C., Eds.; Elsevier: Amsterdam, The Netherlands, 2020; pp. 229–259. [Google Scholar]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2018, 57, 2117–2135. [Google Scholar] [CrossRef]

- Pournader, M.; Shi, Y.; Seuring, S.; Koh, S.C.L. Blockchain applications in supply chains, transport and logistics: A systematic review of the literature. Int. J. Prod. Res. 2019, 58, 2063–2081. [Google Scholar] [CrossRef]

- WEF. Building Block(chain)s for a Better Planet; World Economic Forum: Geneva, Switzerland, 2018. [Google Scholar]

- Zhao, N.; Zhang, H.; Yang, X.; Yan, J.; You, F. Emerging information and communication technologies for smart energy systems and renewable transition. Adv. Appl. Energy 2023, 9, 100125. [Google Scholar] [CrossRef]

- Zhu, X.; Zhang, X.; Gong, P.; Li, Y. A review of distributed energy system optimization for building decarbonization. J. Build. Eng. 2023, 73, 106735. [Google Scholar] [CrossRef]

- Zhang, D.; Chen, X.H.; Lau, C.K.M.; Xu, B. Implications of cryptocurrency energy usage on climate change. Technol. Forecast. Soc. Chang. 2023, 187, 122219. [Google Scholar] [CrossRef]

- Carter, N. How Much Energy Does Bitcoin Actually Consume? Available online: https://hbr.org/2021/05/how-much-energy-does-bitcoin-actually-consume (accessed on 4 August 2023).

- WEF. Cryptocurrencies: A Guide to Getting Started; Global Future Council on Cryptocurrencies. World Economic Forum: Cologny, Switzerland, 2021. [Google Scholar]

- UNCTAD. Harnessing Blockchain for Sustainable Development: Prospects and Challenges; United Nations Conference on Trade and Development: Geneva, Switzerland, 2021. [Google Scholar]

- Munim, Z.H.; Duru, O.; Hirata, E. Rise, Fall, and Recovery of Blockchains in the Maritime Technology Space. J. Mar. Sci. Eng. 2021, 9, 266. [Google Scholar] [CrossRef]

- IMO. Fourth IMO GHG Study 2020; International Maritime Organization: London, UK, 2021. [Google Scholar]

- Wang, H.; Nguyen, S. Prioritizing mechanism of low carbon shipping measures using a combination of FQFD and FTOPSIS. Marit. Policy Manag. 2016, 44, 187–207. [Google Scholar] [CrossRef]

- Mylonopoulos, F.; Polinder, H.; Coraddu, A. A Comprehensive Review of Modeling and Optimization Methods for Ship Energy Systems. IEEE Access 2023, 11, 32697–32707. [Google Scholar] [CrossRef]

- Rehmatulla, N.; Calleya, J.; Smith, T. The implementation of technical energy efficiency and CO2 emission reduction measures in shipping. Ocean Eng. 2017, 139, 184–197. [Google Scholar] [CrossRef]

- IMarEST. Reduction of GHG Emissions from Ships: Marginal Abatement Costs and Cost-Effectiveness of Energy-Efficiency Measures; International Maritime Organization: London, UK, 2010. [Google Scholar]

- Nguyen, S. A multi-aspect framework to support the decision-making process of low carbon emission solutions. WMU J. Marit. Aff. 2018, 18, 165–195. [Google Scholar] [CrossRef]

- Qi, X.T.; Song, D.P. Minimizing fuel emissions by optimizing vessel schedules in liner shipping with uncertain port times. Transp. Res. E-Log. 2012, 48, 863–880. [Google Scholar] [CrossRef]

- Wang, S.A.; Meng, Q. Sailing speed optimization for container ships in a liner shipping network. Transp. Res. E-Log. 2012, 48, 701–714. [Google Scholar] [CrossRef]

- Mansouri, S.A.; Lee, H.; Aluko, O. Multi-objective decision support to enhance environmental sustainability in maritime shipping: A review and future directions. Transp. Res. E-Log. 2015, 78, 3–18. [Google Scholar] [CrossRef]

- Yan, R.; Wang, S.; Psaraftis, H.N. Data analytics for fuel consumption management in maritime transportation: Status and perspectives. Transp. Res. Part E Logist. Transp. Rev. 2021, 155, 102489. [Google Scholar] [CrossRef]

- UNCTAD. Review of Maritime Transport; United Nations Publications: New York, NY, USA, 2022. [Google Scholar]

- Cariou, P.; Lindstad, E.; Jia, H. The impact of an EU maritime emissions trading system on oil trades. Transp. Res. Part D Transp. Environ. 2021, 99, 102992. [Google Scholar] [CrossRef]

- Wang, S.; Zhen, L.; Psaraftis, H.N.; Yan, R. Implications of the EU’s Inclusion of Maritime Transport in the Emissions Trading System for Shipping Companies. Engineering 2021, 7, 554–557. [Google Scholar] [CrossRef]

- Gilbert, P.; Bows, A. Exploring the scope for complementary sub-global policy to mitigate CO2 from shipping. Energy Policy 2012, 50, 613–622. [Google Scholar] [CrossRef]

- Smith, T.W.P.; Jalkanen, J.P.; Anderson, B.A.; Corbett, J.J.; Faber, J.; Hanayama, S.; O’Keeffe, E.; Parker, S.; Johansson, L.; Aldous, L.; et al. Third IMO GHG Study 2014; International Maritime Organization (IMO): London, UK, 2014. [Google Scholar]

- Nguyen, S. Development of an MCDM framework to facilitate low carbon shipping technology application. Asian J. Shipp. Logist. 2018, 34, 317–327. [Google Scholar] [CrossRef]

- Buhaug, Ø.; Corbett, J.; Endresen, Ø.; Eyring, V.; Faber, J.; Hanayama, S.; Lee, D. Second IMO GHG Study; International Maritime Organization (IMO): London, UK, 2009. [Google Scholar]

- Rehmatulla, N.; Smith, T. Barriers to energy efficient and low carbon shipping. Ocean Eng. 2015, 110, 102–112. [Google Scholar] [CrossRef]

- Senss, A.; Canbulat, O.; Uzun, D.; Gunbeyaz, S.A.; Turan, O. Just in time vessel arrival system for dry bulk carriers. J. Shipp. Trade 2023, 8, 12. [Google Scholar] [CrossRef]

- Li, X.; Du, Y.; Chen, Y.; Nguyen, S.; Zhang, W.; Schönborn, A.; Sun, Z. Data fusion and machine learning for ship fuel efficiency modeling: Part I—Voyage report data and meteorological data. Commun. Transp. Res. 2022, 2, 100074. [Google Scholar] [CrossRef]

- Meng, Q.; Du, Y.; Wang, Y. Shipping log data based container ship fuel efficiency modeling. Transp. Res. Part B Methodol. 2016, 83, 207–229. [Google Scholar] [CrossRef]

- Veenstra, A.W.; Harmelink, R.L.A. Process mining ship arrivals in port: The case of the Port of Antwerp. Marit. Econ. Logist 2022, 24, 584–601. [Google Scholar] [CrossRef]

- Green, E.H.; Carr, E.W.; Winebreak, J.J.; Corbett, J.J. Blockchain Technology and Maritime Shipping: A Primer; U.S. Maritime Administration: Washington, DC, USA, 2020. [Google Scholar]

- WEF. Redesigning Trust: Blockchain Deployment Toolkit; World Economic Forum: Cologny, Switzerland, 2020. [Google Scholar]

- Copigneaux, B.; Vlasov, N.; Bani, E.; Nikolay, T.; Lämmel, P.; Fuenfzig, M.; Snoeijenbos, S.; Flickenschild, M.; Piantoni, M.; Frazzani, S. Blockchain for Supply Chains and International Trade; Scientific Foresight Unit, European Parliament: Brussels, Belgium, 2020. [Google Scholar]

- Wong, S.; Yeung, J.K.-W.; Lau, Y.-Y.; Kawasaki, T. A Case Study of How Maersk Adopts Cloud-Based Blockchain Integrated with Machine Learning for Sustainable Practices. Sustainability 2023, 15, 7305. [Google Scholar] [CrossRef]

- Yang, T.; Cui, Z.; Alshehri, A.H.; Wang, M.; Gao, K.; Yu, K. Distributed Maritime Transport Communication System With Reliability and Safety Based on Blockchain and Edge Computing. IEEE Trans. Intell. Transp. Syst. 2022, 24, 2296–2306. [Google Scholar] [CrossRef]

- Tsiulin, S.; Reinau, K.H.; Hilmola, O.-P.; Goryaev, N.; Karam, A. Blockchain-based applications in shipping and port management: A literature review towards defining key conceptual frameworks. Rev. Int. Bus. Strategy 2020, 30, 201–224. [Google Scholar] [CrossRef]

- Pu, S.; Lam, J.S.L. Blockchain adoptions in the maritime industry: A conceptual framework. Marit. Policy Manag. 2020, 48, 777–794. [Google Scholar] [CrossRef]

- Ahmad, R.W.; Hasan, H.; Jayaraman, R.; Salah, K.; Omar, M. Blockchain applications and architectures for port operations and logistics management. Res. Transp. Bus. Manag. 2021, 41, 100620. [Google Scholar] [CrossRef]

- Irannezhad, E.; Faroqi, H. Addressing some of bill of lading issues using the Internet of Things and blockchain technologies: A digitalized conceptual framework. Marit. Policy Manag. 2021, 50, 428–446. [Google Scholar] [CrossRef]

- Lu, B.; Lu, H.; Wang, H. Design and value analysis of the blockchain-based port logistics financial platform. Marit. Policy Manag. 2023, 1–25. [Google Scholar] [CrossRef]

- Li, X.; Zhou, Y.; Yuen, K.F. Blockchain implementation in the maritime industry: Critical success factors and strategy formulation. Marit. Policy Manag. 2022, 1–19. [Google Scholar] [CrossRef]

- Falcone, E.C.; Steelman, Z.R.; Aloysius, J.A. Understanding Managers’ Reactions to Blockchain Technologies in the Supply Chain: The Reliable and Unbiased Software Agent. J. Bus. Logist. 2021, 42, 25–45. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Saberi, S.; Sarkis, J. Blockchain technology and the sustainable supply chain: Theoretically exploring adoption barriers. Int. J. Prod. Econ. 2021, 231, 107831. [Google Scholar] [CrossRef]

- Yang, C.-S.; Lin, M.S.-M. The impact of digitalization and digital logistics platform adoption on organizational performance in maritime logistics of taiwan. Marit. Policy Manag. 2023, 1–18. [Google Scholar] [CrossRef]

- Dutta, P.; Choi, T.M.; Somani, S.; Butala, R. Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transp. Res. Part E Logist. Transp. Rev. 2020, 142, 1–33. [Google Scholar] [CrossRef]

- Yang, C.-S. Maritime shipping digitalization: Blockchain-based technology applications, future improvements, and intention to use. Transp. Res. Part E Logist. Transp. Rev. 2019, 131, 108–117. [Google Scholar] [CrossRef]

- Venturini, G.; Iris, Ç.; Kontovas, C.A.; Larsen, A. The multi-port berth allocation problem with speed optimization and emission considerations. Transp. Res. Part D Transp. Environ. 2017, 54, 142–159. [Google Scholar] [CrossRef]

- CargoX. CargoX Platform for Blockchain Document Transfer is #builtonEthereum #poweredbyPolygon. Available online: https://cargox.io/press-releases/cargox-platform-blockchain-document-transfer-builtonethereum-poweredbypolygon/ (accessed on 20 December 2021).

- Zhang, P.; Wang, Y.; Aujla, G.S.; Jindal, A.; Al-Otaibi, Y.D. A Blockchain-Based Authentication Scheme and Secure Architecture for IoT-Enabled Maritime Transportation Systems. IEEE Trans. Intell. Transp. Syst. 2022, 24, 2322–2331. [Google Scholar] [CrossRef]

- Orji, I.J.; Kusi-Sarpong, S.; Huang, S.; Vazquez-Brust, D. Evaluating the factors that influence blockchain adoption in the freight logistics industry. Transp. Res. Part E Logist. Transp. Rev. 2020, 141, 102025. [Google Scholar] [CrossRef]

- Xiao, Z.; Li, Z.; Yang, Y.; Chen, P.; Liu, R.W.; Jing, W.; Pyrloh, Y.; Sotthiwat, E.; Goh, R.S.M. Blockchain and IoT for Insurance: A Case Study and Cyberinfrastructure Solution on Fine-Grained Transportation Insurance. IEEE Trans. Computat. Soc. Syst. 2020, 7, 1409–1422. [Google Scholar] [CrossRef]

- Dominioni, G. Towards an equitable transition in the decarbonization of international maritime transport: Exemptions or carbon revenues? Mar. Policy 2023, 154, 105669. [Google Scholar] [CrossRef]

- Dolgui, A.; Ivanov, D.; Potryasaev, S.; Sokolov, B.; Ivanova, M.; Werner, F. Blockchain-oriented dynamic modelling of smart contract design and execution in the supply chain. Int. J. Prod. Res. 2019, 58, 2184–2199. [Google Scholar] [CrossRef]

| Shipping Companies | Port Operator | |

|---|---|---|

| Service market position | - Port and terminal service user | - Port and terminal service provider - Port authority/Data exchange platform owner |

| JIT and decarbonization benefits and motivations | - Lower fuel cost - Reputational recognition as more efficient and greener | - Lower port density—port congestion reduction - Better port safety situation - Better port service and management - Assure global and regional goals for emission reduction and meet legislative requirements |

| JIT contributions | - Operationally ready for JIT arrival - Follow JIT requests to implement slow-steaming | - Berthing slot prediction and assurance - Supportive services assurance |

| Decarbonization contributions | - Less fuel consumption—Less emission - Reduction of emissions in coastal areas | - Drive sustainable port development - Reduce the impact of ship emissions on coastal and urban area - Reduce overall emissions while providing a better level of port service |

| Platform Role/End User | Operational Functions | On-Chain/Off-Chain Data Storage and Computation |

|---|---|---|

| Shipping Companies |

|

|

| Port |

|

|

| Entity | Attribute | Description |

|---|---|---|

| Ship | Company_id | Unique company identifier |

| Ship_id | Unique ship identifier (MMSI/IMO) | |

| berth_time | Actual berthing time of the ships | |

| intial_berth_time | The timing ship was going to berth before the slow speeding request | |

| expected_berth_time | The timing of the ship was requested to berth | |

| emission | The amount of greenhouse gasses emitted by the ship | |

| wallet_id | Unique wallet ID (unique to each company) to be used in transactions of GRTs | |

| Slowspeed_reward | The amount of GRTs awarded to the ship | |

| Port | port_id | Unique port identifier |

| ship_count | An integer showing the number of ships currently berthed at the port | |

| wallet_id | Unique wallet ID (unique to each port) | |

| ships_berthed | A vector containing the MMSIs of the ships currently berthed at port |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, S.; Leman, A.; Xiao, Z.; Fu, X.; Zhang, X.; Wei, X.; Zhang, W.; Li, N.; Zhang, W.; Qin, Z. Blockchain-Powered Incentive System for JIT Arrival Operations and Decarbonization in Maritime Shipping. Sustainability 2023, 15, 15686. https://doi.org/10.3390/su152215686

Nguyen S, Leman A, Xiao Z, Fu X, Zhang X, Wei X, Zhang W, Li N, Zhang W, Qin Z. Blockchain-Powered Incentive System for JIT Arrival Operations and Decarbonization in Maritime Shipping. Sustainability. 2023; 15(22):15686. https://doi.org/10.3390/su152215686

Chicago/Turabian StyleNguyen, Son, Aengus Leman, Zhe Xiao, Xiuju Fu, Xiaocai Zhang, Xiaoyang Wei, Wanbing Zhang, Ning Li, Wei Zhang, and Zheng Qin. 2023. "Blockchain-Powered Incentive System for JIT Arrival Operations and Decarbonization in Maritime Shipping" Sustainability 15, no. 22: 15686. https://doi.org/10.3390/su152215686

APA StyleNguyen, S., Leman, A., Xiao, Z., Fu, X., Zhang, X., Wei, X., Zhang, W., Li, N., Zhang, W., & Qin, Z. (2023). Blockchain-Powered Incentive System for JIT Arrival Operations and Decarbonization in Maritime Shipping. Sustainability, 15(22), 15686. https://doi.org/10.3390/su152215686