1. Introduction

In 2019, the EU Commission announced its intention to reduce net greenhouse gas (GHG) emissions by at least 55% by 2030 compared to 1990 [

1]. It is considered undisputed that sustainable corporate action is a necessary prerequisite for achieving such ambitious climate targets. To assess a firm’s climate performance, stakeholders can use sustainability reporting information, which is now prepared and published by many firms either voluntarily or due to regulatory requirements [

2,

3,

4]. In addition to overarching sets of rules, such as the standards of the Global Reporting Initiative (GRI) or the German Sustainability Code (DNK), the Greenhouse Gas Protocol (GHG Protocol) [

5] is highly relevant with regard to the identification and reporting of GHG emissions [

6,

7]. The GHG Protocol was already considered as the predominating framework for firms’ GHG reporting in the last decade [

8,

9]. Most recently, the European Parliament passed a new sustainability reporting directive [

10]. The European Sustainability Reporting Standards that will have to be applied under this directive also refer to the GHG Protocol in terms of GHG emissions reporting [

11]. Similarly, the newly founded International Sustainability Standards Board (ISSB) announced required application of the GHG Protocol under its standards [

12]. Accordingly, these decisions highlight the current relevance of the GHG Protocol and thus the importance of a closer examination of the current practice related to GHG reporting.

Apart from other frameworks, the GHG Protocol claims to contribute to cross-firm comparability of GHG emissions reported by firms [

13]. However, calculating the total emissions required for reporting purposes is not trivial, because they include not only the emissions caused by the reporting firm itself, but also those caused by other legal entities in which it holds an interest and/or over which it can exercise a controlling influence. Consequently, a concept to define the organizational boundaries of the reporting entity in order to consolidate the emissions within these boundaries is required [

14]. In terms of such consolidation approaches, the GHG Protocol allows firms to choose between the control approach or the equity share approach to define the emissions to be reported.

The amount of GHG emissions reported can vary substantially depending on the approach chosen and the individual firm’s shareholding structure. This is due to the fact that the equity share approach links the GHG emissions to be reported to the amount of the participation rights, while the control approach is primarily based on the influence that the reporting firm can exert on the investee. Furthermore, the control approach opens up additional latitude, as it can be applied in two variants. Such room for maneuver conflicts with the information function of sustainability reporting, as it considerably restricts stakeholders’ ability to compare the climate performance of different firms [

15]. However, demands for a modification of the GHG Protocol should be preceded by empirical studies on the application relevance of the approaches allowed under the GHG Protocol. The existing GHG reporting literature mainly focuses on issues such as firms’ disclosure and related effects [

16,

17,

18,

19,

20,

21], stakeholders’ role [

22,

23], firms’ performance and value [

24,

25,

26,

27,

28], as well as comparability [

29,

30,

31,

32]. However, empirical results on firms’ use of the consolidation approaches allowed under the GHG Protocol are underrepresented in research to date. There is only one study that analyzes this issue, which is, however, limited in that it exclusively uses data from European firms from 2019 [

33]. As a result, there is a strong need to provide a broader empirical basis in this regard. Therefore, this study’s first research question is:

RQ1. Which consolidation approach for reporting GHG emissions do firms use and how has the choice between the approaches allowed under the GHG Protocol developed over time?

Against this background, this study examines the relevance of the GHG Protocol’s consolidation approaches for the period 2009 to 2019, using a dataset of 3830 firms from 67 countries. This broad data basis allows critical discussion of the implications for the future direction of the GHG Protocol and emissions reporting in general. In this context, the current reporting practices are examined in light of societal and political goals.

Notwithstanding the relevance of this study’s results, more research is needed in our view to provide further evidence on the suitability of the GHG Protocol for achieving sustainability goals in order to improve current GHG reporting. Hence, to stimulate such research, the second research question is:

RQ2. What are promising future research avenues that can help advance the reporting of GHG emissions?

To answer this research question, the study develops clearly articulated directions that future researchers can build on to engage in this research area and improve the current state of emissions reporting research. As a result, this study contributes to the literature by initiating a discussion on current GHG reporting. Since many political sustainability goals are connected to using the GHG Protocol, a critical evaluation of the Protocol’s suitability for supporting the achievement of these goals is necessary. Moreover, by providing relevant insights grounded in empirical data from firms around the world, this study is the first that uses a large sample of firms globally to inform researchers and practitioners about the consolidation approaches applied. Finally, the open research agenda lays the foundations for further research in this area that enhances the current state of knowledge to further inform and continue the discussion.

The paper proceeds as follows.

Section 2 provides essential information to explain the foundations of the GHG Protocol.

Section 3 provides a brief overview of previous research dealing with GHG reporting in general and the GHG Protocol in particular.

Section 4 outlines the method used to answer our research question, including the data. In

Section 5, the results relating to firms’ use of the different consolidation approaches are presented.

Section 6 discusses the results and articulates implications especially for standard setters, policy makers, and users of reporting information.

Section 7 provides further implications for researchers by developing an open research agenda. Finally,

Section 8 summarizes the main findings and provides some concluding remarks.

2. GHG Protocol Foundations

The GHG Protocol is jointly published by the World Business Council for Sustainable Development (WBCSD) and the World Resources Institute (WRI). This private standard setter is thus built on the collaboration of firms organized under the WBCSD and a non-profit organization, the WRI [

34,

35]. The Protocol’s key objective is to provide standardized information on emitted GHGs for both internal management processes and external reporting purposes on the basis of a principle-oriented set of rules [

5]. The amount of GHG emissions to be reported by an entity is determined based on two measurement and reporting decisions: the scope of emissions and the organizational boundaries [

36,

37].

Figure 1 provides an overview of these two aspects’ roles in GHG reporting.

The GHG Protocol distinguishes three “scopes” of emissions that can be attributed to a firm. Scope 1 exclusively includes a firm’s direct emissions, i.e., emissions of sources owned or controlled by the firm. Indirect emissions that result from the production of electricity that is purchased by the firm are captured by Scope 2. However, these first two scopes only account for parts of the value chain as they summarize the emissions that directly result from firms’ operations [

38]. Under the GHG Protocol, these two scopes are required for reporting, but each unit of emissions should not be reported by two or more firms in the same scope. Scope 3 measures other indirect emissions that result from any activities along the value chain, but reporting such emissions is not mandatory [

5].

On the other hand, the emissions by a firm’s equity investments that are attributed to the firm need to be defined [

39]. This allocation of emissions is based on the selected consolidation approach, which determines a firm’s organizational boundaries in terms of reporting [

40,

41]. Under the GHG Protocol, the equity share approach and the control approach are allowed. With the equity share approach, the emissions of a firm’s investments are attributed to the firm according to its share of equity in the investee, regardless of the influence that is associated with these shares [

42].

Using the control approach, a firm (generally) reports 100% of the emissions of investees which it controls. Accordingly, this approach is similar to consolidation concepts in financial reporting, e.g., under the International Financial Reporting Standards (IFRS) [

43]. The control criterion is divided into two separate types: financial and operational control. The financial control criterion is met if a firm “has the ability to direct the financial and operating policies” [

5] (p. 17) of its investment. Thus, financial control is generally given if the reporting firm holds the majority of voting rights in a (subsidiary) firm. In this case, the emissions of the firm concerned are to be included in full, irrespective of the actual shareholding. If the firm exercises financial control jointly with another firm, for example, in the case of a joint venture, the GHG emissions are to be determined based on the equity share approach. Operational control, on the other hand, is given if a firm directly or indirectly (through other subsidiaries) “has the full authority to implement its operating policies” [

5] (p. 17). Hence, under the operational control approach GHG emissions are recognized entirely or not at all, and in case of a joint venture, where no partner has control, no partner reports GHG emissions from this joint venture. However, if a partner firm of the joint venture has the sole decision-making authority to introduce and implement business processes, 100% of the GHGs of the joint venture are attributed to this firm. Possible double counting as a result of different exercise of voting rights appears unavoidable but is not considered problematic by the GHG Protocol if the chosen approach is adequately disclosed.

In summary, firms can choose between three approaches: equity share, financial control, and operational control. In this context, the GHG Protocol provides a list of criteria that could be relevant for firms’ decision on a suitable consolidation approach. These include, e.g., firms’ actual responsibility for GHG emissions, governmental aspects, and completeness of reporting [

5].

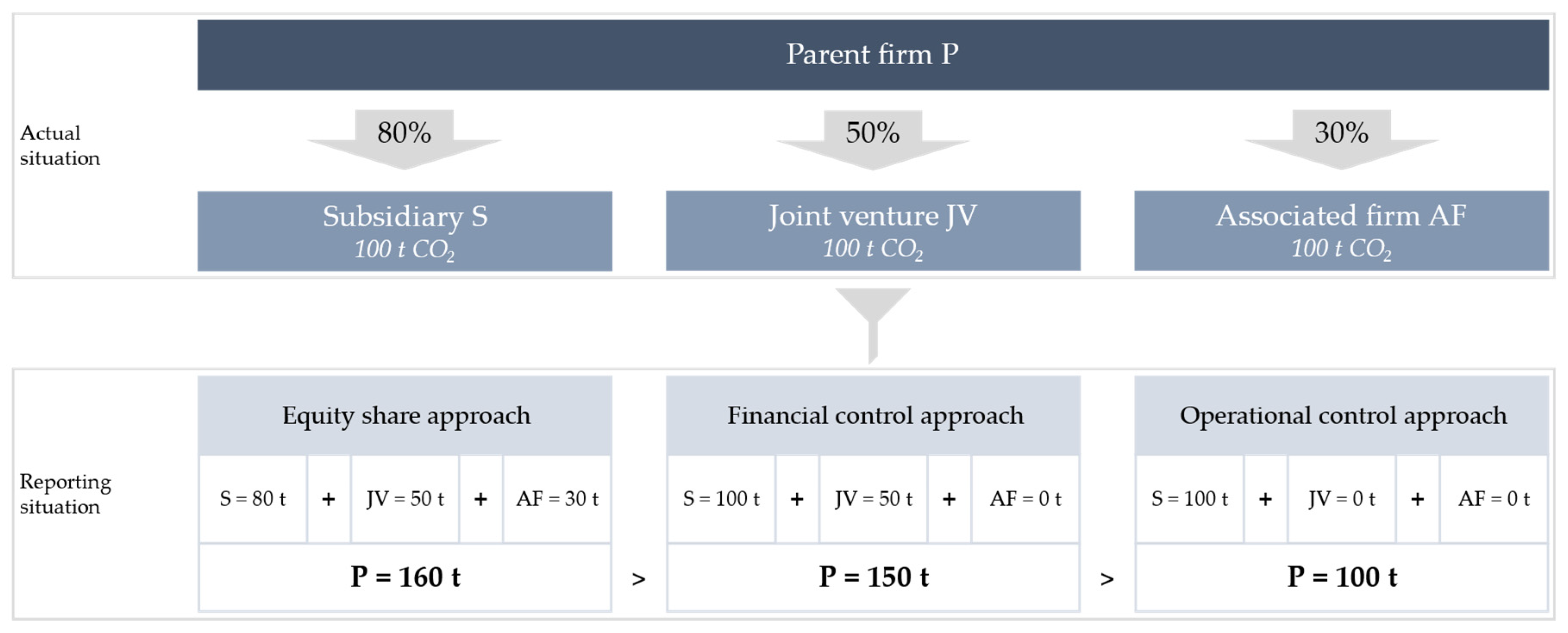

Figure 2 illustrates the effects of the respective approaches with regard to the total emissions to be reported. The example illustrates the significance of the selected consolidation approach for the reporting of GHG emissions, even against the background of significantly more complex group structures.

As the example clearly shows, the operational control approach leads to the lowest reported emissions. Although this is just one example, compared to the financial control approach, unincorporated joint ventures are the only case where the operational control leads to higher reported emissions [

5]. On the other hand, the equity share approach has the highest impact on the parent firm’s reported emissions in this example. In this context, the example clearly shows that, due to the lack of control, the GHG emissions of associated firms in which the parent firm holds an interest are only included in climate reporting in the case of the equity share approach. Considering various possible constellations of group structures, the equity share approach will lead to the highest reported emissions when a firm has many associated firms, non-controlled joint ventures, and/or many 100% subsidiaries with at least a few associated firms or joint ventures. Conversely, the only constellation where the equity approach will lead to the lowest reported emissions is when a firm has many subsidiaries in which it holds a low majority share (e.g., 51%) and few associated firms or joint ventures.

3. Previous Literature

In the research field of sustainability, improving sustainability is an important aspect [

44,

45]. Moreover, the development of indicators for measuring sustainability is a key topic [

46]. Accordingly, such indicators have been developed for different purposes [

47]. With respect to sustainability accounting and reporting, the existing literature is very extensive and multifaceted. Looking at the keywords used in corresponding studies shows that the topic of GHG emissions in particular receives strong attention in the sustainability accounting and reporting literature [

48]. The majority of these studies dealing with GHG emissions are theoretically conceptual [

19,

49]. One important aspect that is discussed by such studies is potential effects of carbon disclosure [

21]. Other studies solely review existing literature on carbon disclosure [

16,

17,

19]. However, there are also studies available that examine empirical relationships between firms’ reported GHG emissions and their business performance as well as their value [

24,

25,

26,

27,

28,

50]. In this context, studies found that GHG emissions are negatively priced by investors [

51,

52]. In addition, the influence of stakeholder pressure on firms’ GHG emissions has also been investigated in other studies [

23,

38]. Their results demonstrate that stakeholder pressure is associated with the existence of GHG reporting. Besides stakeholder pressure, other factors that might determine carbon disclosure are also analyzed in existing research [

53,

54,

55]. Furthermore, as with financial reporting [

56,

57], comparability is an issue in GHG reporting that is examined by existing studies as well [

29,

30,

31,

58].

As the GHG Protocol is of major importance in this context, in addition to studies dealing with GHG reporting in general and relating to other standards, there are also studies dealing with the GHG Protocol in particular. However, similar to the studies mentioned above, most studies on the GHG Protocol are primarily theoretical. With regard to the GHG Protocol’s scopes, existing research proposes using blockchain technology to facilitate the measurement of Scope 2 emissions [

59]. Other studies evaluate the effect that different measurement standards, including the GHG Protocol, have on determining products’ carbon footprint [

60]. Similarly, the GHG Protocol is investigated in other practically oriented case studies [

61,

62,

63]. Moreover, existing research examines the regulatory context of the GHG Protocol. For example, these studies outline the regulatory success of the GHG Protocol as a privately developed standard [

7], and show that its application is mainly dependent on overarching policies [

34].

Concerning the practical application of the GHG Protocol, only one study exists that investigates firms’ use of the three consolidation approaches allowed under the GHG Protocol [

33]. This study exclusively refers to European firms’ data from 2019. However, to the best of our knowledge, there is no study that analyzes firms’ GHG reporting practices by using a long-term and global dataset. Given the high relevance of firms’ reported GHG emissions, this lack of empirical research is surprising.

Hence, considering the existing literature highlights the need for an analysis of the actual use of the consolidation approaches allowed under the GHG Protocol.

4. Research Method

This study investigates the consolidation approaches selected by firms to determine their GHG emissions. For this purpose, the answers submitted to the Carbon Disclosure Project’s (CDP) questionnaires from the years 2010 to 2020 are used as provided by the CDP in its database of firm-reported environmental data. Since the CDP database provides reliable and comparable information regarding firms’ reported GHG emissions, it is suitable for conducting empirical analyses [

30,

38].

Since the questionnaires refer to the data of the respective previous year, the data used in this study cover the years 2009 to 2019. A total of 16,604 firm-year observations from 3830 unique firms from 67 countries resulted from these questionnaires. The firms operate in 11 different industry sectors according to the global industry classification standard (GICS), which was applied in the CDP questionnaires until the year 2017. In 2018, the CDP switched to its own activity classification system (CDP-ACS) in its questionnaires, resulting in 13 different industry sectors. Therefore, the CDP’s industry classification scheme was manually converted to the GICS scheme for the years 2018, 2019, and 2020.

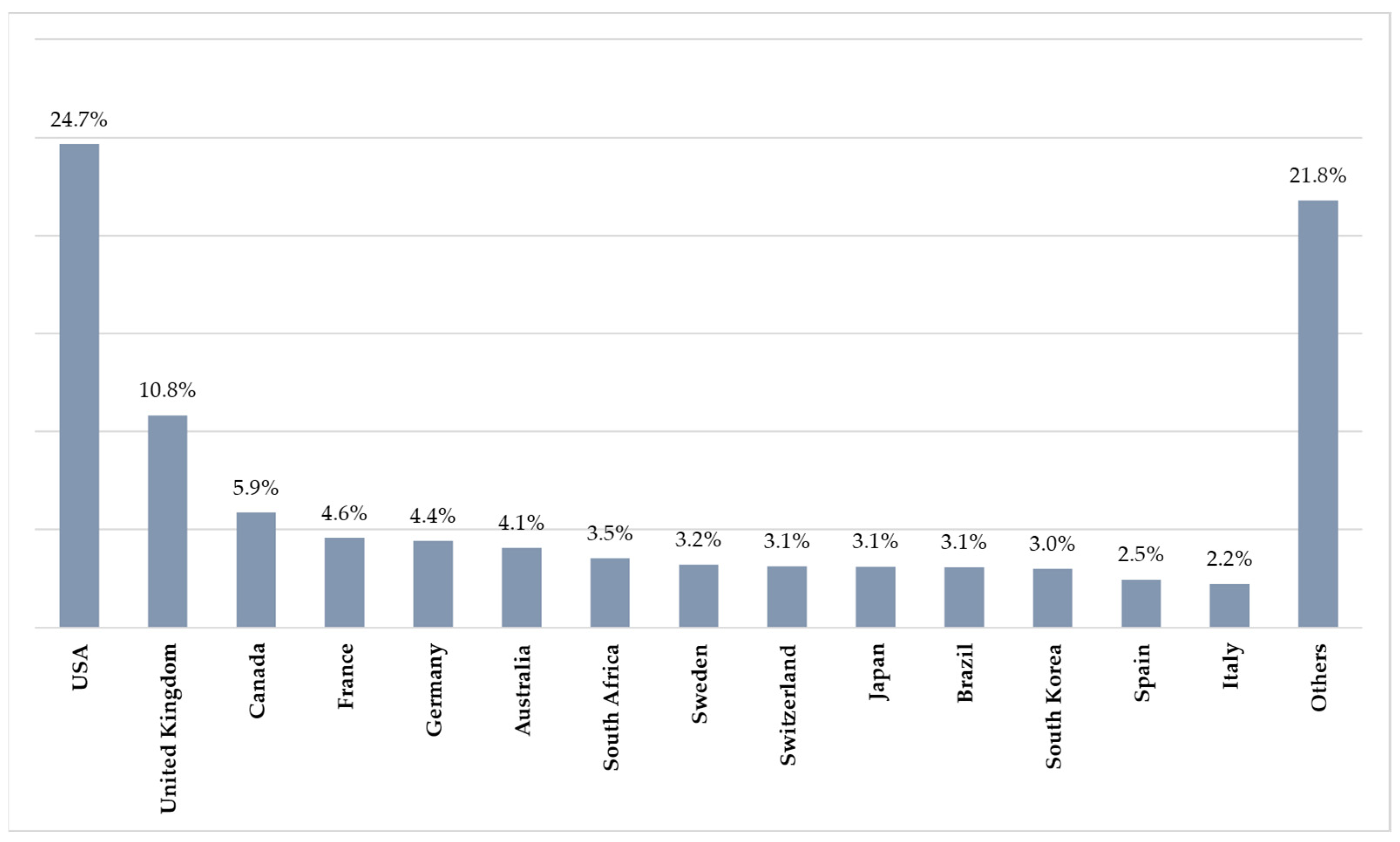

Figure 3 shows the distribution of firm-year observations by country, focusing on the 15 most frequently represented countries in the sample. At the country level, firms from the USA submitted almost a quarter of all CDP questionnaires included in the analysis, followed, by a wide margin, by firms from the UK and Canada. Furthermore, it is notable that the 15 countries listed in

Figure 3 can be characterized as economically developed. In addition to

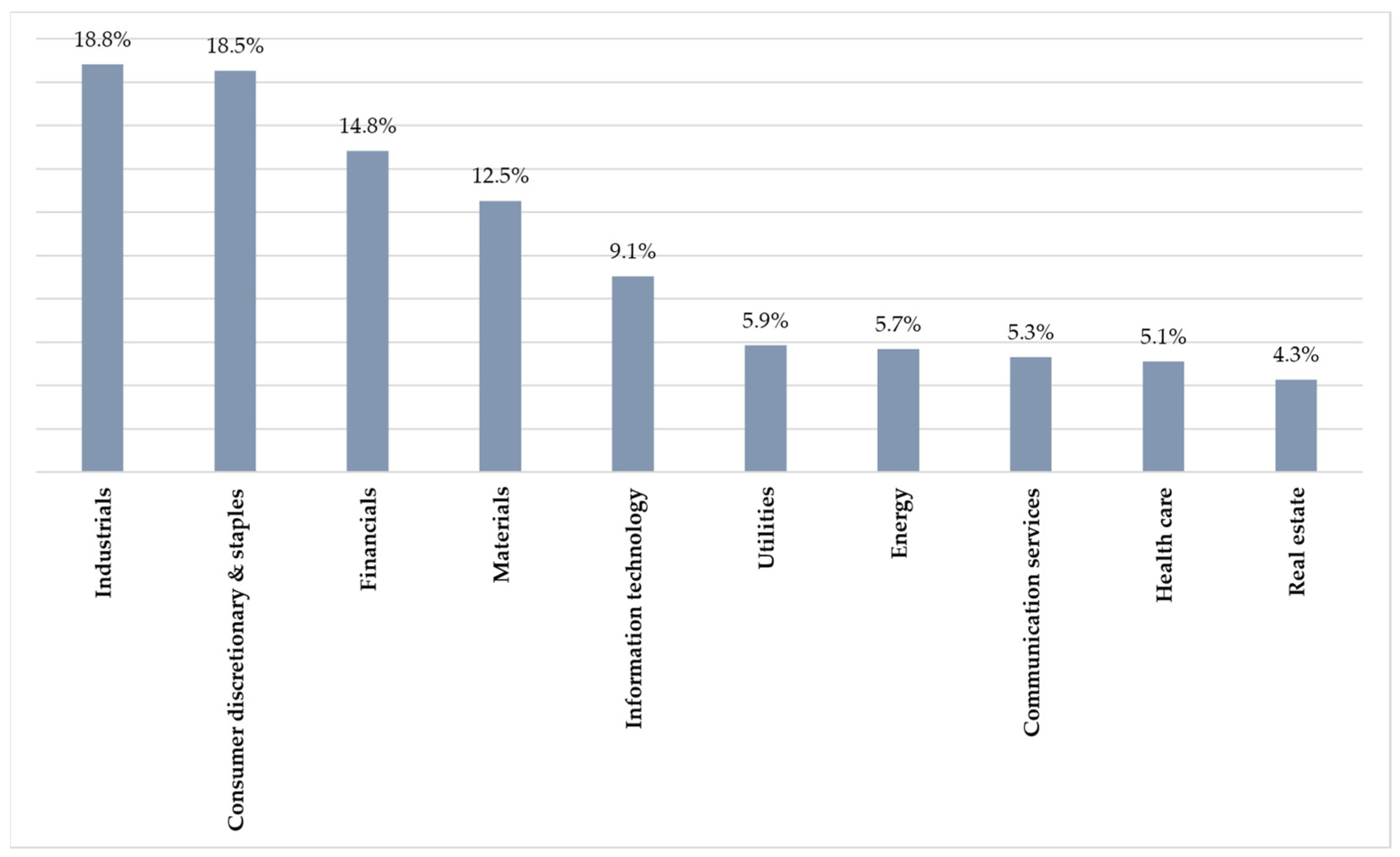

Figure 3, the appendix contains a complete list of the 67 countries included in the analysis. Based on the GICS industry classification,

Figure 4 shows the distribution of firm-year observations by industry. For this illustration, firms with no assignable GICS industry classification (approximately 1.5%) are not displayed. As shown, most of the reporting firms operate in the industrial and consumer goods sector.

5. Results

With regard to the first research question, one purpose of this study is to examine which consolidation approach firms are using and how the choice between the approaches allowed under the GHG Protocol has developed over time. To this end, this section illustrates the results of our analyses regarding the consolidation approach choice in the sample over time, firms’ reported emissions, as well as the choice of approaches depending on industries and countries.

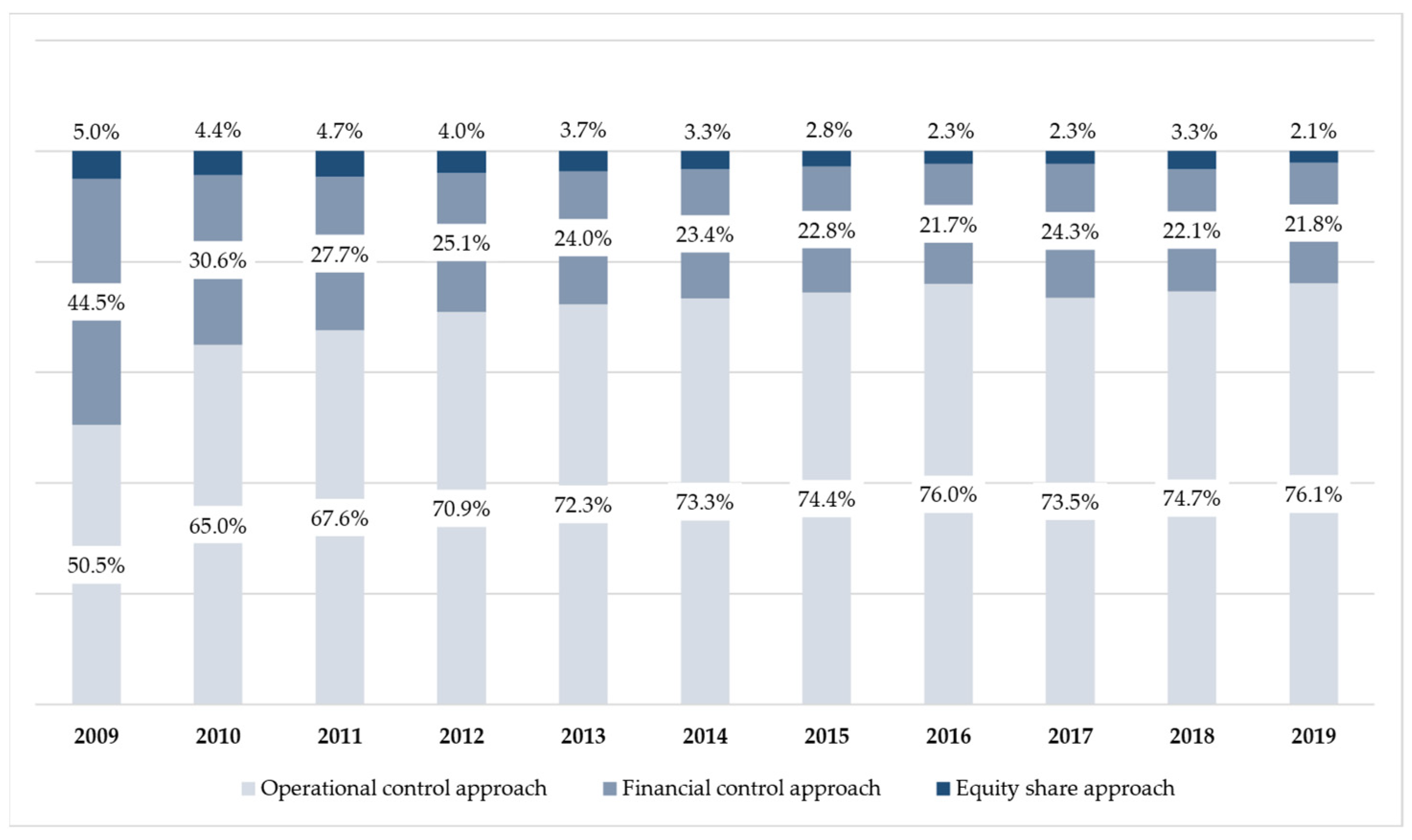

Concerning the question of how the relative distribution of each approach has developed over time,

Figure 5 clearly shows that the operational control approach is the dominating approach. Its share increased by more than 50% over the eleven years covered by the sample, resulting in over three quarters of the sample firms using the operational control approach. Although the financial control approach was of considerable importance in 2009, its share among the firms in the sample has declined by more than half. Similarly, the share of the equity share approach decreased by almost 60%. However, at just 5%, its share was already hardly relevant in 2009.

After evaluation of the use of the different consolidation approaches,

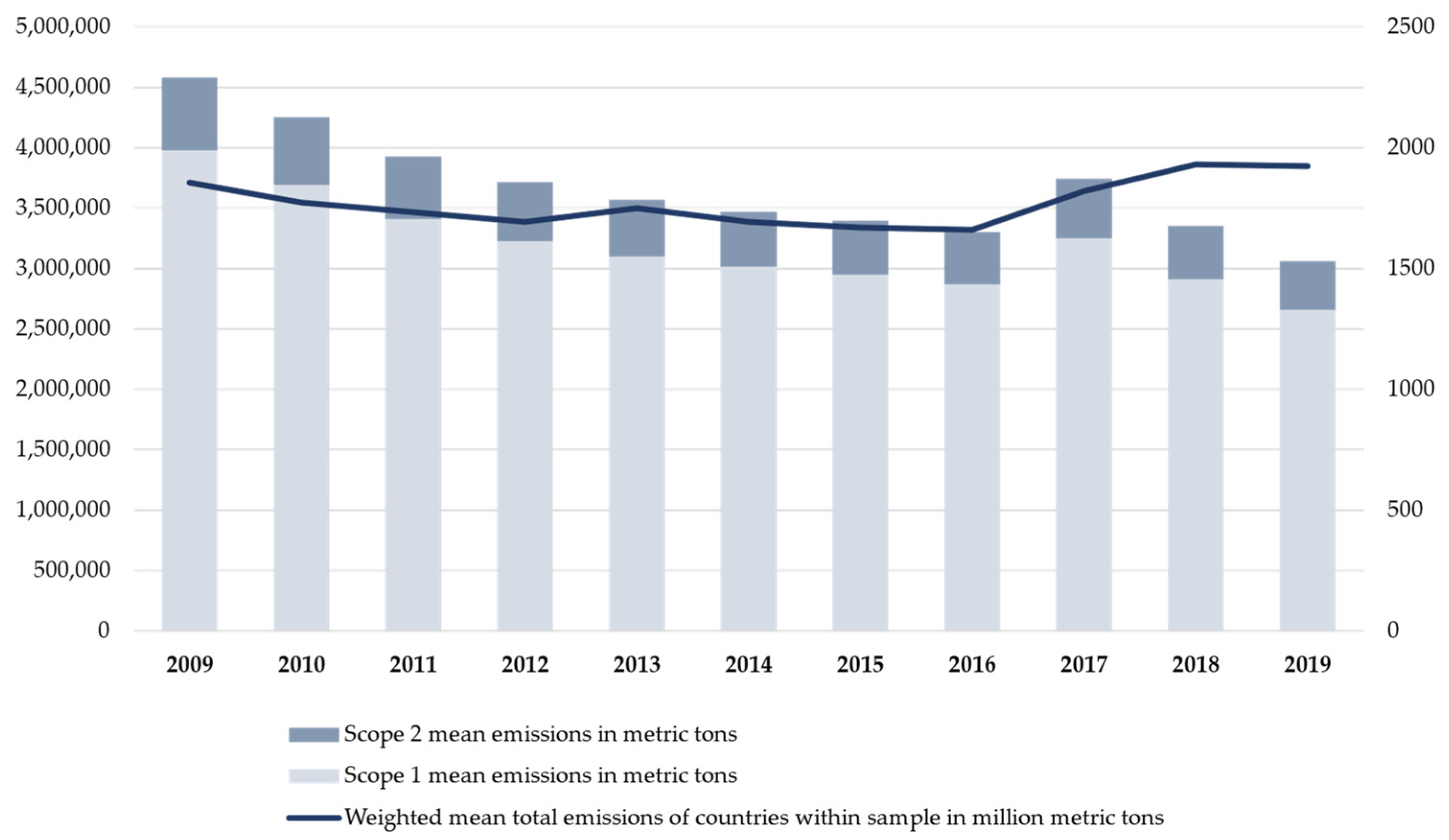

Figure 6 analyzes how the reported Scope 1 and Scope 2 emissions have developed over time. As their reporting is not mandatory [

5], Scope 3 emissions are not reported by every firm and were therefore omitted. In addition, as a benchmark,

Figure 6 shows the average of total emissions of each country in the sample weighted with the respective country’s share in the sample. Through this, the figure provides a comparison of the emissions reported by the sample’s firms and the weighted average emissions of the countries in the sample. This comparison reveals that while the firms’ reported emissions substantially decreased by one third over the period (continuous average growth rate (CAGR) = −3.6%), the weighted country average even increased by 3.7% (CAGR = 0.33%).

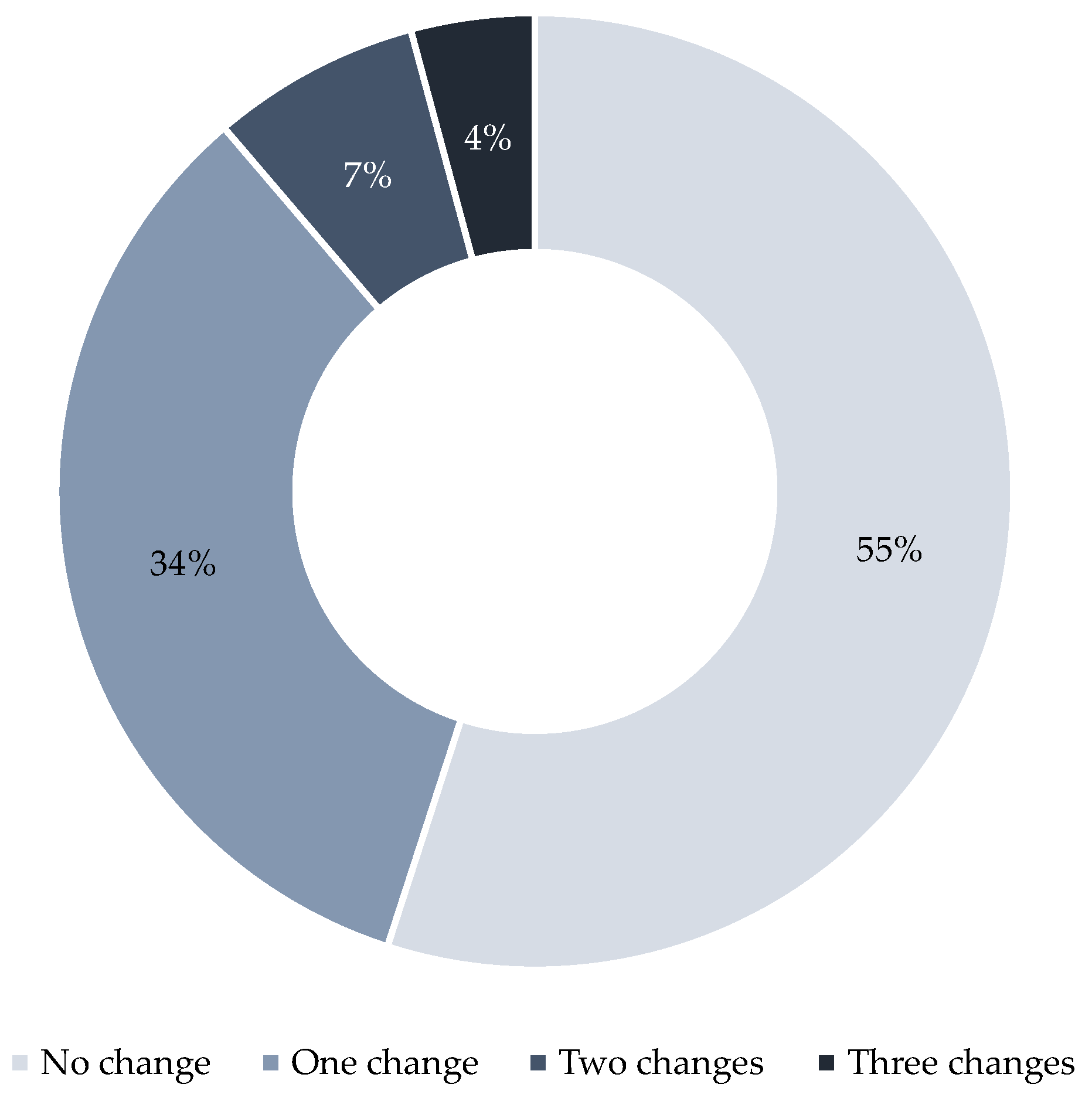

As already indicated by the fact that the shares of the consolidation approaches’ application substantially shifted towards the operational control approach from 2009 to 2019, many firms must have changed their approach during this time. To further investigate firms’ change behavior, we created a subsample solely consisting of firms that answered the CDP questionnaire in each of the eleven years. The development of these 311 firms’ consolidation approach choice is very similar to the full sample, clearly demonstrating the comparability of this subsample with the full sample. In fact, as shown by

Figure 7, 45% of the firms in the subsample changed their approach at least once, and 11% even more than once.

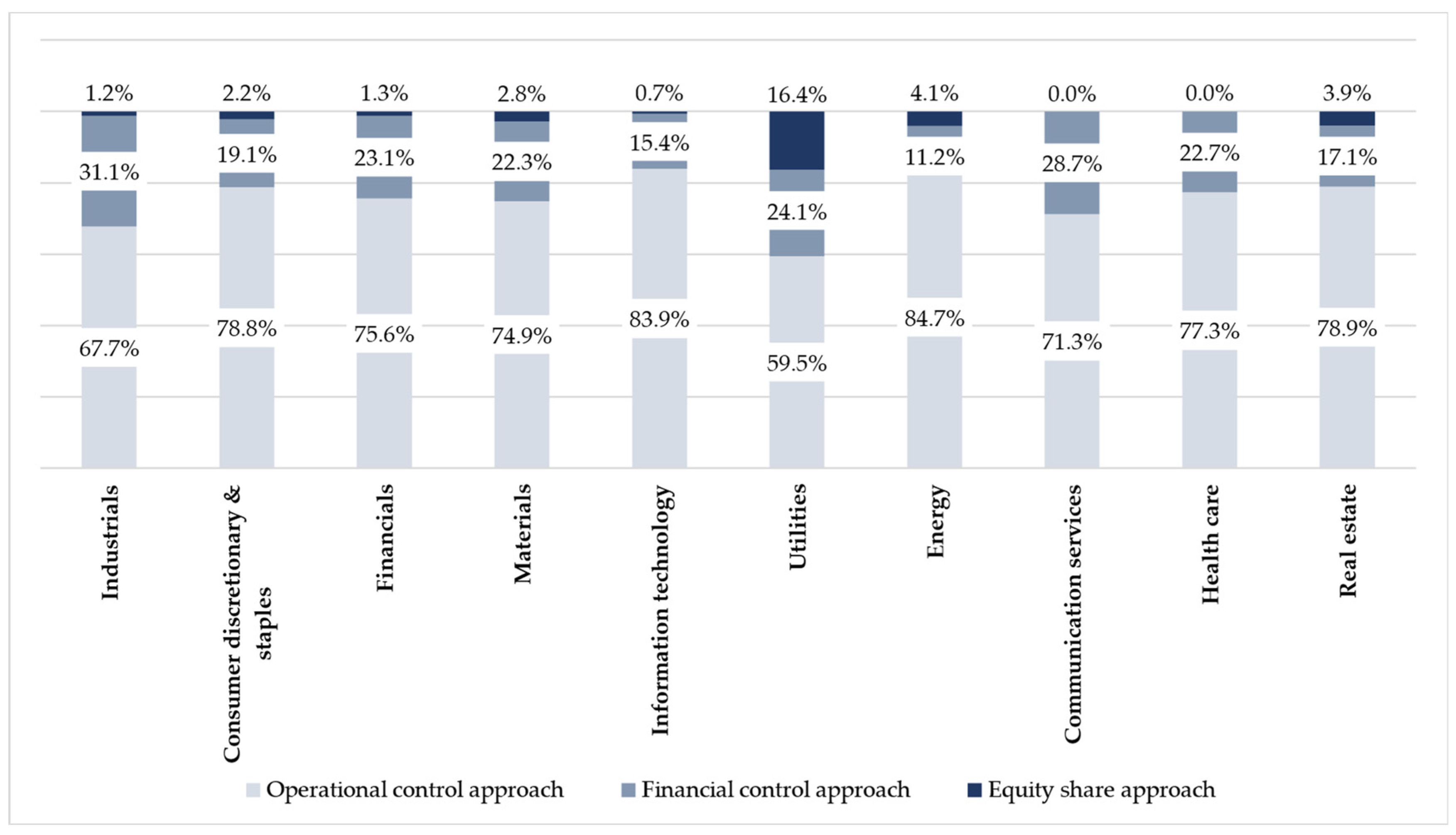

To provide a more detailed picture of the current consolidation approach choices of firms, we lastly investigated the use of the three approaches depending on firms’ industries, according to the GICS classification scheme (see

Section 3) and countries for the last available year of the dataset (2019). For theses analyses, the full sample was used again.

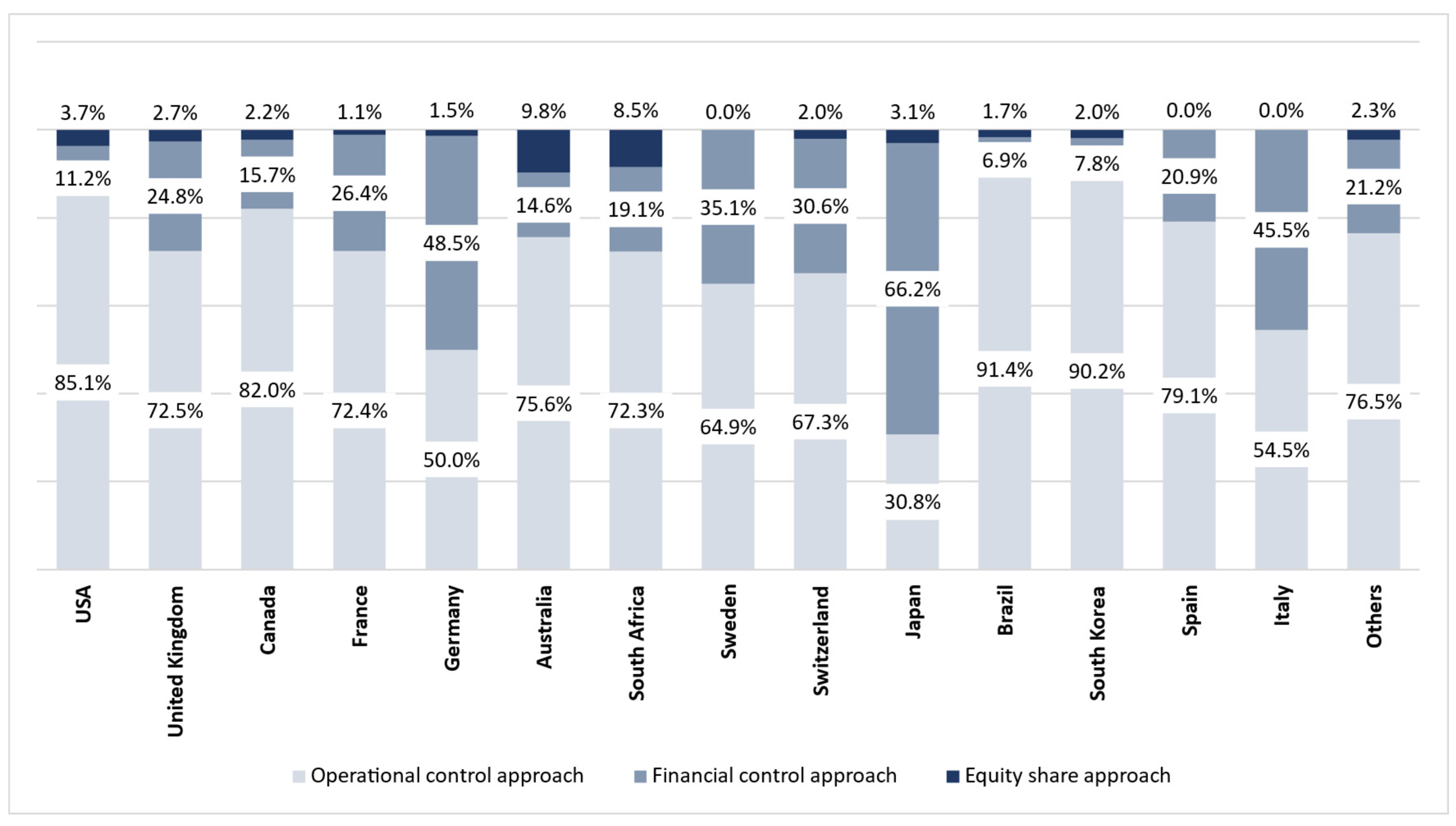

Figure 8 illustrates the distribution of the approaches for each industry. This analysis highlights the dominance of the operational control approach, already demonstrated by

Figure 5. However, it also illustrates some scattering. Considering the utilities sector shows that the operational control approach’s dominance is not on the same level in each industry. Moreover, the equity share approach is not lacking relevance in each industry, as one in six firms from the utilities sector uses this approach. Conversely, the energy sector and the information technology sector show an even stronger dominance of the operational control approach with less than one in six firms not using this approach. Although the industry distribution reveals some scattering, looking at the country level analysis displayed by

Figure 9 shows an even more scattered distribution. In this context, Japan is an especially extreme example, as only 30.8% use the operational control approach and approximately two thirds use the financial control approach in this country. Germany and Italy show similar, although less strong, results. Looking at the other extremum, more than 90% of Brazilian and South Korean firms use the operational control approach, and more than 85% of US firms. Regarding the equity share approach, only Australia and South Africa can be considered as showing any significant relevance of the equity share approach, and in three countries this approach is not used by any firm in the sample.

Summarizing our results, it can be stated that the operational control approach clearly dominates GHG reporting under the GHG Protocol. While the financial control approach was of importance in 2009, its relevance substantially decreased. The equity share approach’s relevance virtually ceased to exist. However, there are some outliers when looking at firms’ approach choices in 2019 at an industry and country level. These show that the financial control approach is highly relevant in some countries and that even the equity approach is used to a significant extent in one industry and two countries. Moreover, a substantial number of firms changed their approach more than once within eleven years. Only 55% of firms consistently applied the same approach during the sample period.

6. Discussion

Based on the results that were presented in the previous section, this section critically discusses the implications for standard setters, policy makers, and users of emissions information.

Figure 5 clearly shows that the share of firms using the operational control approach has increased by approximately 50% within eleven years. In contrast, the shares of both the financial control approach and the equity share approach have decreased by more than half. Comparing the share of these approaches as found in our dataset with the results of the only existing study, we find a very similar distribution [

33]. However, this comparison is only possible for 2019, as the corresponding study exclusively analyzed data from European companies from 2019. Nonetheless, this comparison confirms the predominance of the operational control approach as well as the low relevance of the equity share approach. On the one hand, this rising predominance may indicate that there is a growing consensus regarding the use of the operational control approach. Such a possible consensus would be beneficial to achieving comparability between firms, which is an issue for the decision making processes of users of sustainability information [

15,

22] and for GHG reporting in particular [

29,

30,

31]. However, the possible consensus is only demonstrated by the aggregated development. In contrast,

Figure 8 and

Figure 9 clearly show that this consensus is not valid for every industry and every country. Especially for a comparison of firms from Germany and Japan with the USA, Brazil, and South Korea, there clearly is no consensus. Considering other research’s finding that cultural characteristics affect firms’ emissions disclosure behavior [

54,

64], such an effect might be valid in this case as well. Additionally, this development indicates that more and more firms adopt an approach that in most cases leads to lower reported emissions than the financial control approach. Although only based on speculation, this could partially add to the development of emissions shown by

Figure 6, as firms’ emissions decreased substantially more than countries’ emissions. Moreover, the equity share approach might lead to higher costs, as information must be generated from many different sources [

5]. Thus, users should consider both aspects when interpreting this finding and incorporating it into their decision-making process.

As

Figure 7 shows, among the 311 firms that responded to the CDP questionnaire in each year and used the GHG Protocol in each year, approximately 45% changed their consolidation approach at least once. While a one-time change might make sense in light of a possibly growing consensus, the fact that 11% of the firms changed their approach more than once cannot be explained by adaptation to an emerging consensus. As a result, such changes negatively affect comparability over time, which is an important characteristic for users of information [

65] and found to be an issue in GHG reporting for older periods as well [

42]. Therefore, the considerably high share of firms that changed the approach more than once leads to the question of whether such a behavior is compatible with a methodological consistency over time that is demanded by reporting frameworks (e.g., IFRS and US Generally Accepted Accounting Principles (GAAP)). In fact, the principle of using “consistent methodologies to allow for meaningful comparisons of emissions over time” [

5] (p. 7) is also embedded in the GHG Protocol. For the standard setter, this finding implies that a full retrospective recalculation might be required in order to mitigate the negative effects for comparability. Such a requirement could also lead to fewer changes, as a change would be more costly.

In this context, it is noteworthy that most firms changed from the financial to the operational control approach. The GHG Protocol states that using the financial or operational control criterion is not expected to lead to significant differences. However, as the GHG Protocol itself acknowledges: “A notable exception is the oil and gas industry, which often has complex ownership/operatorship structures. Thus, the choice of control criterion in the oil and gas industry can have substantial consequences for a firm’s GHG inventory” [

5] (p. 17). Since this industry type is by nature a large GHG emitter, this seems to be an important exception. Therefore, again considering the frequent changes in determining organizational boundaries, the standard setter should reevaluate the significance of this exception. Moreover, the operational control approach leads to lower reported emissions in most situations, which should also be noted when evaluating the comparability of both approaches.

The potential effects of the different consolidation approaches and firms’ method changes, as we have illustrated in

Figure 7, should especially be recognized by rating agencies and when interpreting their ESG ratings. Since most ratings consider GHG emissions as a factor [

66], the choice of an approach indirectly influences a firm’s ESG rating. In this context, existing evidence shows that investors consider GHG emissions as a discount to firms’ equity [

27,

28,

51,

52]. To (re)direct capital flows into sustainable usages, ESG ratings need to reflect the climate performance of firms correctly [

67]. Moreover, as reporting moderates the positive (negative) effects of good (bad) sustainability performance on firms’ value [

68], users should consider this moderating effect and thus examine the information value of GHG emissions with special attention.

Furthermore, this study provides implications for policy makers as well. Several policy makers committed themselves to achieving environmental sustainability. This objective, especially with respect to reducing GHG emissions, is embedded, e.g., in the United Nations’ Agenda 2030 [

69] and in the EU’s Green Deal [

70]. In particular, the EU aims “to reorient capital flows towards sustainable investments” [

71] (p. 2), which is addressed through the EU Taxonomy in particular. As GHG reporting is one part of this overarching sustainability objective by being intended to reduce emissions [

72], the picture of a firm that is conveyed by reported GHG emissions should be consistent with this objective. In virtually all cases, as we have shown in

Figure 5, the picture of a firm’s GHG performance is provided using the operational or financial control approach. Only in some industries and countries does the equity share approach have significant relevance (see

Figure 8 and

Figure 9). However, under the control approach, the GHG emissions of (most) minority investments do not affect the investing firms’ GHG reporting. Consequently, the deliberate decision to participate in a business whose activities prevent achieving environmental sustainability, thereby creating a capital flow towards environmentally harmful usages, does not adversely affect firms’ reported contribution to achieving environmental sustainability. Considering the very small share of firms using the equity share approach highlights that this issue is applicable to most firms. Moreover, a recent proposal by the EU Commission shows that firms’ responsibility for environmentally harmful activities could also be extended to their whole value chain [

73]. Considering this, not having a (partial) reporting responsibility for GHG emissions of an investee does not seem to be consistent with the nature of such proposals. Nevertheless, this does not necessarily lead to a theoretical superiority of the equity share approach (see below). As the GHG Protocol is a key component of sustainability-related policy making [

34], policy makers should critically evaluate the extent to which current GHG reporting practices, and particularly the consolidation approaches, are consistent with their own sustainability goals. In this context, our study provides the first long-term overview of these practices.

In this context, policy makers and users of emissions information need to be aware of and assess the information value of (currently) reported GHG emissions, which significantly depend on firms’ selected consolidation approach. In this regard, our findings support policy makers and users in assessing the information value of currently reported GHG emissions, as our findings show the practical relevance of each approach. To assess the information value of current GHG reporting practices, our findings should be contextualized in light of the consolidation approaches’ characteristics. While reported emissions under the control approach provide information on the emissions that are directly caused under a firm’s control, the reported number does not contain any information on a firm’s contribution or harm to sustainability goals by financing and thus supporting other firms, although not controlling them. As shown by our results, this issue applies to the vast majority of the firms in our sample. However, under the equity share approach another information issue arises. Although a firm might fully control another firm’s operations by holding only 51% of its shares, under the equity approach a firm is made responsible for only 51% of the emissions in terms of reporting. Although the firm would be able to actively manage the investee’s emissions in this case, its incentives to aim for an emissions reduction are reduced. This issue, however, only applies to a very small proportion of the firms in our sample. As a result, no approach, and thus current GHG reporting practice, appears to be fully consistent with political and societal goals. No approach allows holistic assessment of a firm’s full contribution or harm to environmental sustainability. Accordingly, additional information concepts might be necessary to fully address sustainability goals, which is a question the standard setter should address in order to remain relevant in the future.

7. Open Research Agenda

While our findings provide clear implications for various actors in the sustainability reporting area, there are also some limitations that should be considered when interpreting our results. First of all, although our sample covers a huge number of international firms, it cannot be excluded that the sample is subject to a selection bias. Moreover, the data themselves are solely based on firms’ answers to the CDP questionnaire, which might include errors or inconsistencies in data formats and units. Therefore, to overcome these limitations and, most importantly, to address crucial questions that are beyond the scope of this study, this section provides exemplary research questions that have not yet been addressed in the research field of GHG reporting. By addressing these research questions, future research can contribute to the strongly needed discussion on GHG reporting’s role in achieving environmental sustainability.

First, considering

Figure 5, it becomes evident that almost half of all firms included in our sample have changed their consolidation approach for reporting GHG emissions. This fact is surprising, since the principle of continuity is an essential condition according to GHG, IFRS, as well as US GAAP. The principle of continuity is of high importance, as it enables the comparison of reported information over time [

74]. However, in the case a firm changes its consolidation method for reporting GHG emissions, comparisons are only achievable if adjustments are made retrospectively. Future research should therefore investigate the effects a change in the consolidation approach causes for the stakeholders. Moreover, empirical capital market reactions and potential changes in ESG ratings should be analyzed in the case a firm changes its consolidation method.

Second, it is of great importance to obtain a better understanding of stakeholders’ and firms’ knowledge regarding accounting policy options for GHG reporting. Provided that stakeholders have the necessary expertise, they can conduct their own analyses to evaluate the sustainability of firms. The same is applicable to rating agencies that issue ESG ratings based on firms’ reported GHG emissions. In this context, it would be highly beneficial to apply classification models to investigate the impact of firms’ chosen consolidation method and the amount of GHG emissions reported on their ESG rating [

75]. To address this, besides logistic regression, the use of machine learning models is a promising approach to identify relationships between firms’ characteristics and the ESG rating. There are already studies that have successfully applied machine learning models on accounting data, therefore, their methodological approach can serve as a foundation for future studies [

76,

77,

78].

Third, the role of accounting standard setters should be critically investigated, as stricter accounting rules might discourage a change in the consolidation method and therefore improve comparability.

The following

Table 1 provides an overview of our open research agenda to shape the future of GHG emissions research. We emphasize that both qualitative and quantitative methods are necessary to close existing research gaps. Especially, surveys, experiments, interviews, empirical analysis, and conceptual studies are promising research methods.

8. Conclusions

The reporting of GHG emissions is of great importance nowadays, as the quantity of emissions has a direct impact on the assessment of firms’ sustainability performance and their market valuation [

27,

28,

51,

52]. However, in order to compare firms’ reported GHG emissions with each other, comparable and consistent consolidation approaches are necessary. The GHG Protocol is currently the most widely used framework for reporting GHG emissions. However, as of today, the evidence on firms’ use of the consolidation approaches under the GHG Protocol is limited.

Therefore, this study investigated the use of the equity share, operational control, and financial control approach by using a sample of 16,604 firm-year observations of the years 2009–2019, resulting from 3830 unique firms from 67 countries. We found that the vast majority of firms use the same consolidation approach, the operational control approach, thus supporting inter-firm comparability. However, this approach leads to lower reported GHG emissions in many cases, especially compared to the financial control approach, whose application decreased by more than half during the sample period. Moreover, almost half of the firms in our sample have changed their consolidation approach at least once between 2009 and 2019. Hence, in contrast to inter-firm comparability, we found a lack of temporal comparability to be an issue in these cases. From a political, or even societal, perspective, we have argued that current GHG reporting practices are not fully consistent with achieving environmental sustainability. Both control approaches, which were used by approximately 98% of the sample firms in 2019, do not measure emissions caused by non-controlled investees. As a result, these firms’ reported emissions remain completely unchanged if they finance a firm with high emissions without controlling it. Consequently, policy makers and users of GHG information should evaluate the information value of currently reported emissions. Our findings inform this evaluation, as we have illustrated the current reporting practices under the GHG Protocol and contextualized these practices in light of the consolidation approaches’ characteristics. Particularly, given the nature of recent policy regulations and proposals that go beyond financial reporting concepts and additionally address non-financial stakeholders, the question arises as to whether GHG reporting should contain the same or similar consolidation approaches as financial reporting. Such similarities are present in the case of the current consolidation approaches allowed under the GHG Protocol and compatibility of financial and GHG reporting is even required by regulators [

79].

Therefore, we would like to encourage future researchers to further investigate how current GHG reporting could be improved. To this end, we developed an open research agenda which serves as a foundation for researchers to close existing research gaps. As already called for by other studies [

80,

81], with this research agenda we would like to encourage other researchers to address environmental issues in their research to support sustainability goals.

As a result, this study contributes to the literature by providing one of the first investigations of firms’ application of the GHG Protocol’s consolidation approaches by using a large dataset. Based on our results, policy makers and standard setters should critically evaluate how and whether current GHG reporting contributes to achieving environmental sustainability. In this regard, our study aims to stimulate a discussion on the sufficiency of current GHG reporting practices for achieving environmental sustainability and thus supporting the mitigation of climate change. Moreover, we provide a basis for other researchers to further contribute to this important discussion by addressing our open research agenda.