1. Introduction

The rapid economic growth experienced by China following the introduction of economic reforms and liberalization has been instrumental in harnessing its population and resource advantages [

1]. However, this extensive economic development has also yielded ecological degradation and multifaceted challenges that intersect with the goal of achieving sustainable development. One prominent challenge resides within China’s prevailing industrial structure, characterized by industries exhibiting low value-added characteristics and high energy consumption patterns, which pose a formidable obstacle to the realization of sustainable economic progress [

2]. It is crucial to emphasize that the predominant developmental paradigm, predominantly fixated on gross domestic product (GDP) growth, has incentivized local governments to rely heavily on inefficient and environmentally detrimental industrial systems [

3]. Consequently, this has caused a misallocation of production factors, diminished industrial innovation capacity, triggered concerns of overcapacity, and incrementally approached the ecological carrying capacity limit. These multifaceted challenges significantly endanger China’s prospects for long-term economic sustainability and, by extension, its overarching well-being, thereby underscoring the imperative of addressing the structural inefficiencies within its industrial landscape in the pursuit of sustainable development objectives [

4].

Consequently, the promotion of green finance has become a key focus in pursuing sustainable development in China [

5]. There is a consensus on leveraging financial mechanisms to channel funds toward industries that promote energy efficiency. Green finance plays a crucial role in facilitating green economic growth and supporting industrial structure upgrading. The introduction of the “five development concepts” at the Fifth Plenary Session of the 18th CPC Central Committee has paved the way for the establishment of a green finance system, marking a new direction in financial reforms. Green finance encompasses a range of financial services aimed at supporting activities that yield environmental benefits, such as improving environmental conditions, addressing climate change, and optimizing resource allocation. Its development is centered around achieving a harmonious balance between environmental advantages and economic gains, ensuring effective financial support for initiatives promoting a green economy [

6].

GF is widely considered a prerequisite for ecological civilization, providing new avenues for financing green projects and extending financial support for technological innovation and talent acquisition [

7]. Secondly, green industries have become a significant impetus for high-quality economic development. GF plays a crucial role in fostering the coordinated growth of the green industry and guiding various stakeholders’ participation in environmental industries. The development of the GF system in China is exemplified by initiatives like green credit, green bonds, and green insurance, and the scale of this development is expanding annually, accompanied by the diversification of GF instruments [

8]. The progression of GF in the country is shifting from decentralized and experimental exploration towards systematization and widespread implementation.

Simultaneously, a new wave of industrial revolution is unfolding in Western countries. Rapid advancements in research, innovation, and the adoption of green and clean technologies, such as solar power generation, chip technology, and green infrastructure, are taking place. International organizations like the G20 and TPP (Trans-Pacific Partnership Agreement) are increasingly focusing on green energy innovation and sustainable industrial transformation [

9]. Therefore, promoting industrial transformation and optimization are key to achieving high-quality economic development, driven by both domestic structural optimization trends and the global green industry’s technological innovation advancements.

Industrial structure optimization and upgrading involve a dynamic process of redistributing production factors. As industries undergo transformation and upgrading, production resources naturally shift from sectors with low input–output rates or sluggish input–output growth to those with higher rates, thereby enhancing resource allocation efficiency and overall societal productivity. This process promotes industrial survival of the fittest and fosters sustainable economic development [

10]. In the current context, with China actively promoting industrial structural transformation, green economy development, achieving industry transformation, and upgrading through green finance hold immense practical significance [

11]. While numerous governments worldwide have committed to or are engaged in providing green financial incentives, academic research on the potential economic consequences remains limited due to endogenous challenges. This study mainly investigates the role of GF in upgrading the IS. By conducting theoretical and empirical analyses, this article presents policy suggestions to facilitate China’s development. Feasible measures to strengthen green finance are proposed, providing valuable insights for policymakers.

This study makes a valuablecontribution to the existing academic literature in several key dimensions. Firstly, it investigates the role of green finance (GF) in driving advancements in industrial structure upgrading across 31 provinces of China. This research delves into the mechanisms underlying this phenomenon, with a particular focus on the influences of technological innovation and foreign direct investment. This scholarly endeavor enriches the literature surrounding the development of GF and its interconnectedness with the factors shaping industrial structure (IS). Secondly, this paper explores the regulatory effects of environmental regulatory intervention (ERI) and the level of government intervention in facilitating the promotion of IS upgrading through GF. Given the unique national conditions in China, government intervention assumes a pivotal role in this context. The findings of this study provide valuable insights into the formulation of policy guidance and the direction of government intervention strategies. Thirdly, taking into account the prevailing disparities in regional development and varying degrees of market orientation within China, this article scrutinizes the heterogeneity of GF’s impact on industrial structure. It offers tailored development recommendations customized to regions characterized by economic underdevelopment and a limited degree of market orientation. The insights derived from this research are instrumental in formulating policy guidance and recommendations aimed at achieving sustainable development.

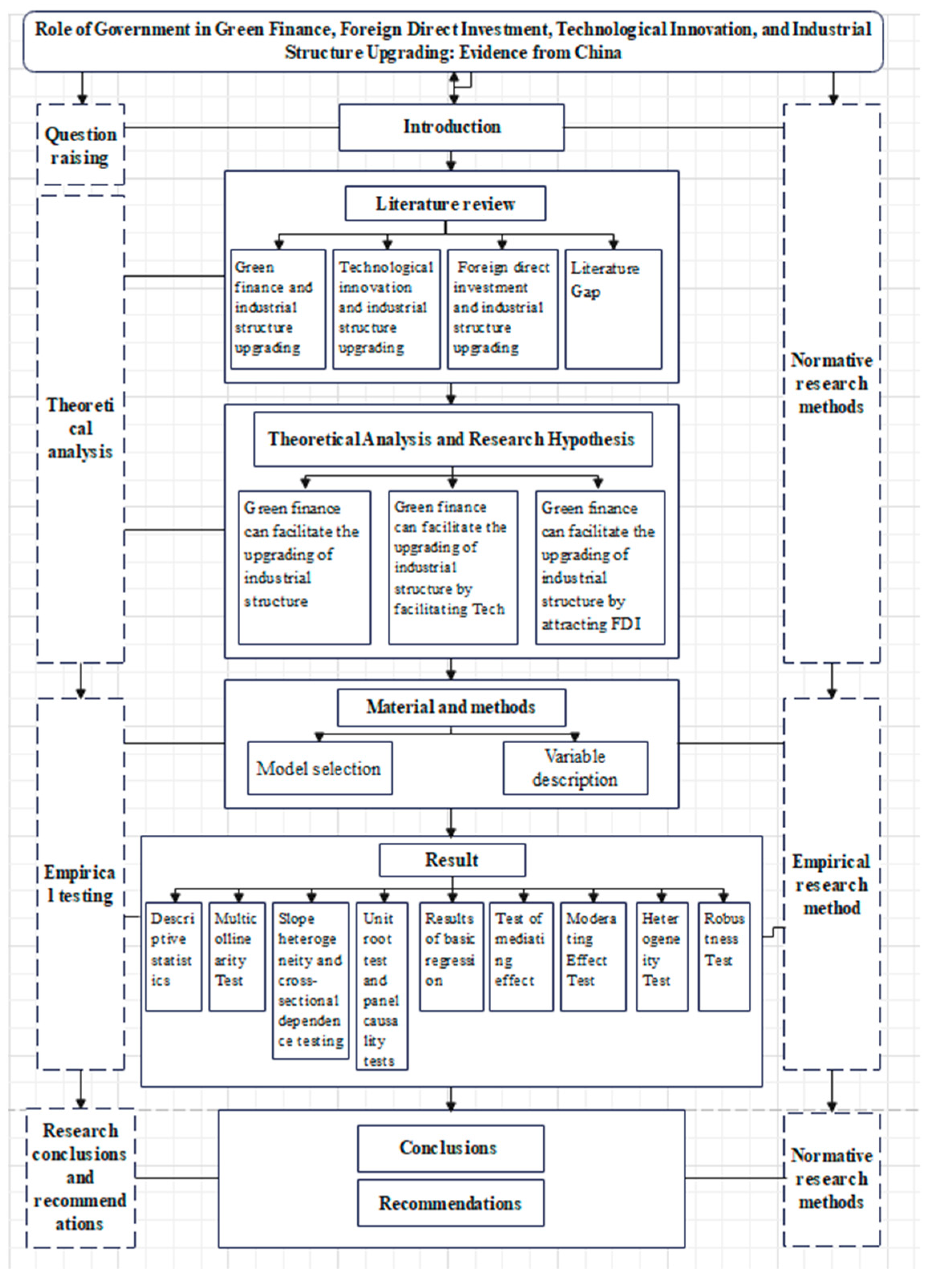

The structure of this article is organized as follows:

Section 2 offers an extensive review of the relevant literature. Subsequently,

Section 3 provides a comprehensive theoretical analysis and outlines the research hypotheses. In

Section 4, the materials and methods employed in the study are described.

Section 5 is dedicated to presenting the research findings and results. Lastly, in

Section 6, the article culminates by drawing conclusions and presenting recommendations. The layout of this manuscript is also presented visually in the

Figure 1.

3. Theoretical Analysis and Research Hypothesis

Some scholars investigated the relationship between GF and the upgrading of IS and found that GF is crucial for optimizing industrial structure [

49]. Firstly, GF is a financial investment activity. Through the Government or financial institutions, GF ushers the transfer of funds from industries with overcapacity to those with low pollution or environmental protection, diminishes the financing cost of environmental industries, and optimizes resources to facilitate IS upgrading [

11]. Moreover, the steady flow of capital into green industries leads to the transfer of intangible assets, such as brands and creativity. This facilitates the integration of industries and fosters a synergistic effect between intangible assets, ultimately contributing to the transformation of IS. Simultaneously, GF contributes to risk reduction by providing insurance for emerging industries or innovative projects characterized by high risks and potentially high yields. Therefore, it realizes the objectives of optimizing the IS and promoting sustainable development. Additionally, financial development endeavors to address environmental degradation and can be employed to adjust economic and industrial structures [

10]. In light of these insights, we propose Hypothesis 1:

Hypothesis 1. Green finance can facilitate the upgrading of industrial structure.

Technological innovation (Tech) serves as a significant catalyst for the upgrading of IS and is a crucial factor in achieving sustainable development [

32]. The implementation of a GF system effectively influences the level of scientific and technological innovation by utilizing its functions of resource allocation, capital provision, and risk diversification. This, in turn, promotes IS upgrading and the modernization of the industrial chain. First, green credit and other financial services encourage banks and insurance companies to offer low-cost and stable financial support for green products. This support extends to upstream and downstream enterprises within the green industry chain, thereby alleviating financing constraints and providing additional financing channels for enterprises. The diversification function of financial institutions helps mitigate technological innovation risks and optimize resource allocation, ultimately fostering technological progress. Furthermore, the advancement of green securities enables the issuance of securities to clean research and development enterprises, thereby increasing environmental premiums and reducing their financing costs. Simultaneously, the issuance of securities for financing by polluting enterprises can be restrained, compelling them to engage in green technology innovation activities. Additionally, green insurance, as an institutional arrangement, provides diversified protection and compensation for business risks faced by insured entities. A well-established insurance product system can effectively safeguard risks associated with Tech and stimulate the innovation vitality of companies.

Tech stimulates enterprise product upgrading, enhances production efficiency, improves production modes, stimulates demand structure, and facilitates technology diffusion, thereby providing an impetus for upgrading industrial structure [

31,

32]. Technological innovation leads to the widespread application of new technologies, equipment, and processes, creating new production environments and prospects. This impacts and eliminates outdated industries characterized by outdated technology, low efficiency, and poor quality, thus promoting industrial structure transformation and upgrading [

30]. Secondly, scientific and technological innovation drives advancements in machinery and equipment, thereby promoting upgrading industrial production technology. This, in turn, enhances allocation efficiency, production efficiency, and product added value. The large-scale production facilitated by Tech also benefits the formation and accumulation of human capital, which aids in upgrading industrial structure [

50]. Thirdly, technological innovation guides the direction of demand development and stimulates changes in demand structure, thereby facilitating IS upgrading. Finally, technological innovation strengthens the technological interconnection between different industries and departments in social production, facilitating the upgrading of IS through the diffusion effect of technology. Based on these insights, we propose the following hypothesis:

Hypothesis 2. Green finance can facilitate the upgrading of industrial structure by facilitating Tech.

GF supports environmental protection and sustainable development projects through capital markets and financial instruments. The development and implementation of GF policies provide financial support and a policy guarantee for green industries, create a good development environment, and attract FDI. The inflow of foreign capital improves economic benefits while realizing environmental protection and IS change [

51]. It is worth noting that FDI can facilitate the upgrading of regional IS through direct and indirect effects. Direct effects refer to the influence of FDI on optimizing regional IS through capital input. FDI directly or indirectly entering the production field can improve the current situation of facing capital and technology constraints, and thus facilitate the upgrading of IS.

Indirect effects means that FDI can facilitate the optimization of regional IS through knowledge and technology spillover. FDI provides the Chinese economy with a number of advanced equipment, beneficial knowledge, advanced management experience, and excellent production technology [

52]. FDI also upgrades the technical knowledge of the host country through training programs or technical assistance [

46]. The technology spillover effect significantly improves the innovation ability of enterprises, improves the efficiency and output of sustainable projects, and then facilitates the upgrading of IS [

45].

Additionally, the new FDI also puts pressure on domestic companies to act at a higher level of technical efficiency, and at the same time, leverages the global perspectives of foreign companies to broaden international channels for green finance and explore overseas markets, thus further promoting sustainable development and the upgrading of regional IS [

43,

53]. According to this, we put forward the following hypothesis:

Hypothesis 3. Green finance can facilitate the upgrading of industrial structure by attracting FDI.

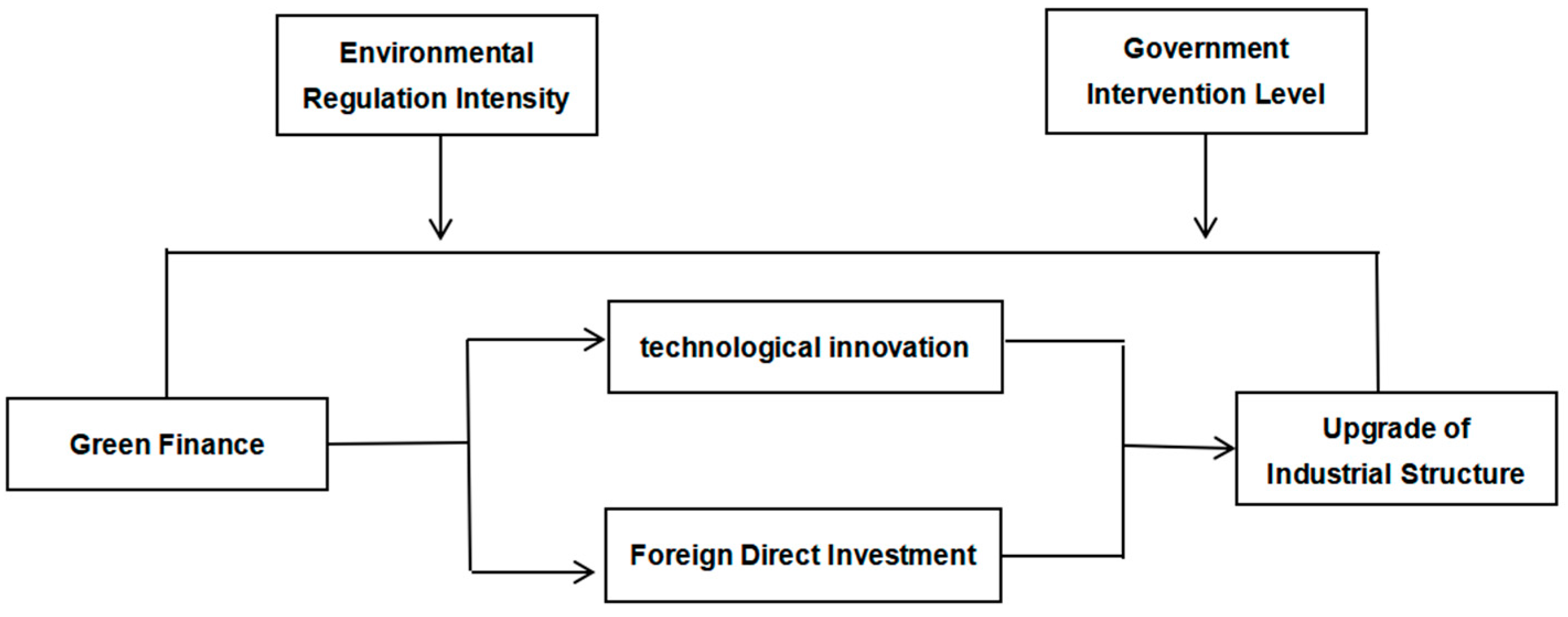

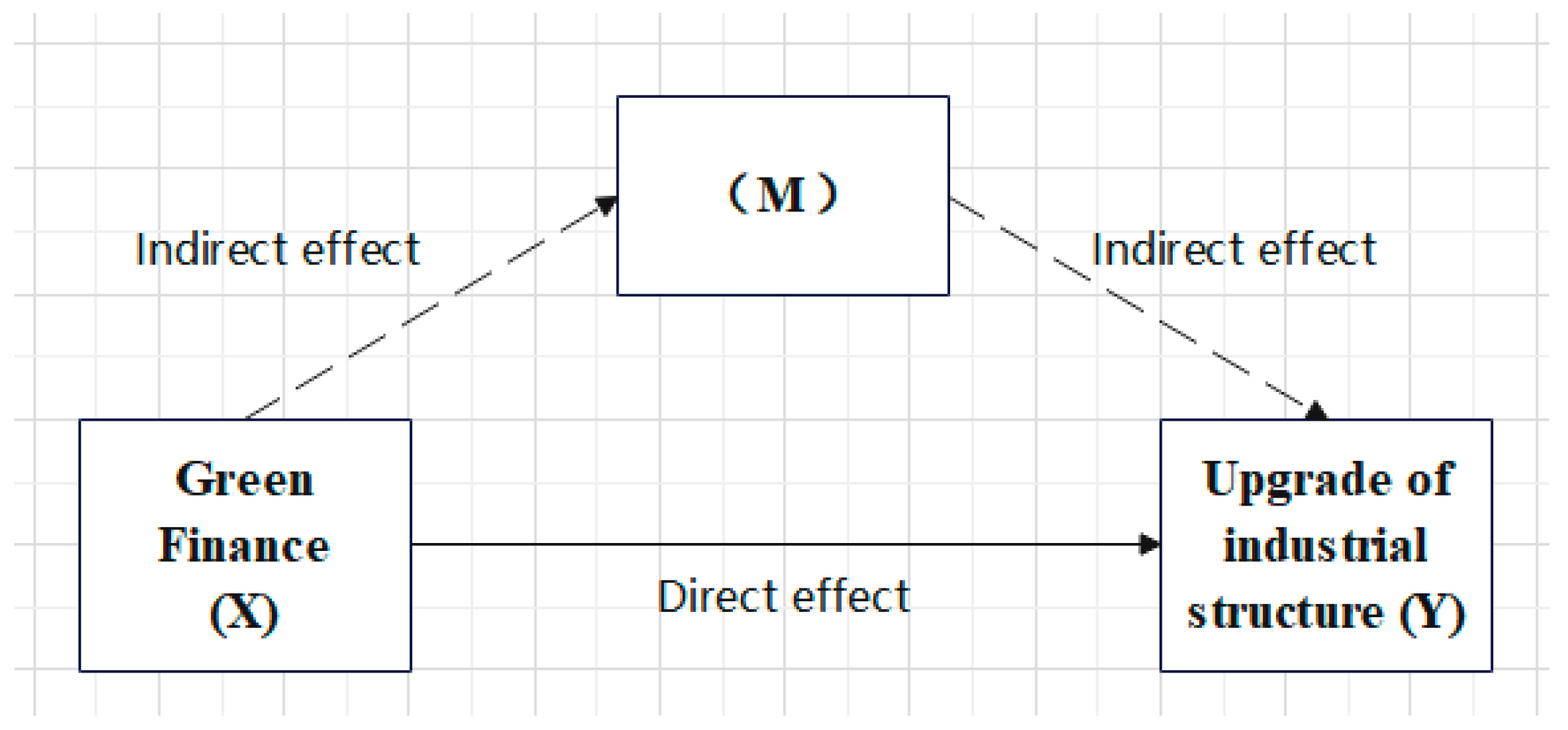

The theoretical model is shown in

Figure 2.

6. Conclusions and Recommendations

6.1. Conclusions

This research uses data from 31 Chinese provinces, spanning the period from 2007 to 2021, to investigate the direct and indirect impacts of GF on IS upgrading through the channel of FDI and technological innovation. Moreover, the study analyzed the moderating role of the intensity of regulations and government intervention in the relationship between GF and IS upgrading.

The study yields the following conclusions: Firstly, the results demonstrate that the development of GF positively influences the upgrading of IS, and these results withstand a series of stability tests. Secondly, green finance facilitates the upgrading of IS by advancing Tech. It serves as a catalyst for innovation, driving the adoption of new technologies, processes, and equipment, and then facilitating the upgrading of IS. Thirdly, green finance attracts FDI and facilitates the transfer of advanced technology and capital. This inflow of FDI and technological advancements further accelerates innovation within industries, consequently promoting the upgrading of IS.

Fourthly, ERI exhibits a forward moderating function on the relationship between GF and the upgrading of IS. Specifically, as the intensity of ERI increases, the promoting effect of GF on industrial structure upgrading strengthens. Fifthly, excessive government intervention impedes the promoting function of GF on the upgrading of IS. With an increase in government intervention, the positive influence of GF on industrial structure upgrading diminishes. Sixthly, the facilitating effect of GF on the upgrading of IS demonstrates regional heterogeneity. In coastal provinces with a high level of economic development, GF plays a pivotal role in facilitating the upgrading of IS, whereas in inland areas, the promoting effect is negligible. Lastly, the promoting function of GF on the upgrading of IS exhibits market heterogeneity. In regions characterized by a higher level of market-oriented, the effect of GF on IS upgrading is prominent. Conversely, in regions with a lower level of market-oriented, the effect is not prominent.

6.2. Suggestions

Based on the above conclusion, this study offers the following suggestions: Firstly, it is essential to facilitate the innovation of GF instruments and enhance the overall GF system. To achieve this, China should increase the innovation of GF instruments, strengthen the capacity of GF to allocate factor resources and support the green industry. Additionally, there should be efforts to raise awareness and facilitate the concept of GF both domestically and internationally. This will help improve the recognition of China’s GF policies, standards, and products within the global community, particularly in the context of favorable industrial green transformation development.

Secondly, there should be strong support for scientific and technological innovation. Green finance can play a crucial role by offering adequate and stable funding, alleviating financing constraints, optimizing resource allocation, and dispersing operational risks. These measures will accelerate technological innovation and enhance resource utilization efficiency.

Thirdly, efforts should be made to intensify opening-up initiatives to attract FDI and fully leverage foreign capital. This can be achieved by improving the preferential policies for green finance, creating a favorable business environment, and attracting foreign investment that brings valuable knowledge, advanced management experience, and excellent production technology. This will significantly contribute to the upgrading of the IS.

Fourthly, it is crucial to strengthen the construction of policy channels for environmental regulation and enhance the efficiency of their implementation. The influence of ERI on the upgrading of IS should be fully utilized, and tailored encouragement and regulation measures should be implemented based on the specific features of different industries. Each province should adopt appropriate environmental regulation measures aligned with its unique industrial structure and resource endowment conditions. By effectively leveraging the influence of ERI on IS optimization, regional industrial transformation and high-quality economic development can be promoted.

Fifthly, there is a need to reduce the level of government intervention and allow the market to play a critical role in resource allocation. Vertical management and law enforcement should be implemented to minimize local interference. Lastly, considering the unbalanced development levels of GF within China, the Government should offer targeted policy support to inland regions and areas with a low degree of market orientation. This support will help improve their industrial structure and contribute to their overall development. By implementing these recommendations, China can facilitate the effective upgrading of IS, foster sustainable economic development, and capitalize on the potential of GF to drive positive change.