Abstract

The Chinese government’s ongoing endeavors to achieve the “low carbon goals” hold immense importance in global emissions reduction. Nonetheless, reducing emissions will inevitably cause economic losses. Therefore, the pursuit of green economic efficiency is regarded as an effective tool to mitigate the economic losses during emission reduction. Synchronously, the realization of green economic efficiency is essential for sustainable development. With the increasing awareness of regional green development, emphasis companies place on environmental, social, and corporate governance (ESG), which contributes to corporate ESG construction, could become a novel advantage in terms of attracting investors. Additionally, it could have a lasting impact on corporate green technological innovation, thereby enhancing the efficiency. Based on the data of A-share listed companies in China from 2009 to 2019, this study analyzes the effect of corporate ESG construction on the efficiency of regional green economy as well as its mechanism. The research findings demonstrate a significant positive impact of corporate ESG construction on the efficiency of regional green economies. Specifically, each unit improvement in corporate ESG construction is associated with an approximate 0.7% increase in the efficiency of the regional green economy. The conclusion can be drawn after robustness testing. Notably, the effect of corporate ESG construction is more pronounced for companies located in the eastern region, state-owned enterprises, and high-polluting industries. In terms of the underlying mechanism, corporate ESG construction facilitates regional green economic efficiency by fostering corporate green technological innovation. Furthermore, it is observed that environmental regulations have a negative moderating influence on corporate ESG construction, which in turn affects regional green economic efficiency. When examining the decomposed variables of regional green economic efficiency, the impact of corporate ESG construction on regional green scale efficiency is found to align with its overall effect on regional green economic efficiency. This study contributes to the existing research on corporate ESG construction and regional green economic efficiency, offering valuable insights to guide companies in enhancing both aspects. Building upon the conclusions drawn, we will provide policy recommendations from the perspectives of the company itself, corporate investors, and the government. These recommendations aim to facilitate improvements in corporate ESG construction and foster the enhancement of regional green economic efficiency.

1. Introduction

The challenges posed by population change, climate change, and resource scarcity have made global sustainable development an urgent concern that has garnered significant attention worldwide. At the same time, guided by the principles of green development, enhancing the efficiency of the green economy serves as the impetus for achieving social sustainable development and attaining high-quality economic growth. The ongoing efforts of the Chinese government to accomplish the “low-carbon goals” align with the prevailing notion of green development and showcase China’s steadfast resolve to actively combat climate change, pursue a path of green and low-carbon development, and foster the collective progress of humanity. Corporate ESG construction is closely aligned with China’s low-carbon goals. Given the growing challenges of resource and environmental constraints, as well as regional economic and social disparities, it becomes imperative for companies to integrate environmental, social, and corporate governance (ESG) factors into their investment, organizational, and production decision-making processes. By incorporating ESG practices, enterprises can explore avenues to improve regional green economic efficiency at the corporate level. This approach holds not only practical value, but also significant theoretical implications.

Enterprises hold a crucial role in the development of regional economies. In China’s new stage of development, enterprises are socially responsible for enhancing the efficiency of regional green economies. As the concept of new development continues to permeate all dimensions of social and economic progress, government entities are also reinforcing requirements for ESG information disclosure by listed companies. In December 2017, the China Securities Regulatory Commission mandated that environmental protection agencies disclose key environmental information [1]. Subsequently, according to the revised guidelines for listed companies’ annual and semi-annual reports in June 2021 [2], emphasizing the disclosure of “environmental and social responsibility”, the objective is to strengthen the fulfillment of corporate social responsibility (CSR) in terms of green development and environmental protection through ESG information disclosure, while also pursuing profit maximization.

Currently, most scholars focus on studying the factors that influence corporate ESG construction and its relationship with corporate operations. Additionally, they explore the interpretation of indicators for regional green economic efficiency and their influencing factors. However, there is limited research on integrating corporate ESG construction with macroeconomic factors. This study aims to fill this research gap by examining the impact of corporate ESG construction on regional green economic efficiency within the same analytical framework. The objective is to investigate whether corporate ESG construction affects regional green economic efficiency and the nature of this effect. By doing so, this study intends to advance the knowledge and understanding of corporate ESG construction and its implications for green economic efficiency.

This article aims to address three key questions. (1) Does corporate ESG construction have an impact on the efficiency of a regional green economy? (2) What are the mechanisms through which corporate ESG construction influences the efficiency of a regional green economy? (3) Does the impact of corporate ESG construction on the efficiency of a regional green economy vary based on corporate characteristics? Drawing from stakeholder theory and signal transmission theory, this article focuses on analyzing the theoretical mechanisms and impact of corporate ESG construction on the efficiency of a regional green economy. To investigate this, we analyze the relationship between enterprise ESG construction and regional green economic efficiency using ESG rating data from the CSI (China Securities Index). Furthermore, we explore the potential mechanisms through which corporate green innovation and environmental regulations may influence this relationship. By addressing these questions, this study aims to enhance the long-term value of companies, promote the alignment of their social and economic values, and ultimately improve regional green economic efficiency.

Compared to the existing literature, this study offers three potential contributions. Firstly, it investigates the impact of enterprise ESG construction on regional green economic efficiency using signaling theory and stakeholder theory. The study acknowledges that the demand for regional green development creates environmental regulatory pressure and stimulates aspirations for green innovation. As a result, companies are motivated to embrace ESG practices and fulfill their corporate social responsibility. This departure from the traditional “three highs, three lows” production model improves the expected output levels, reduces unexpected output levels, and ultimately enhances regional green economic efficiency. The study examines the underlying mechanisms and presents empirical evidence to support this process. Secondly, the study examines the mechanisms through which enterprise ESG affects regional green economic efficiency from the perspectives of corporate green innovation and environmental regulation. This novel approach provides fresh insights into the role of corporate ESG construction in enhancing regional green economic efficiency and expands the research focus within the relevant literature. Furthermore, the study utilizes ESG rating databases from two independent rating agencies, CSI and SynTao Green Finance, to explore the effects of corporate ESG construction on regional green development. This helps reduce uncertainties in research outcomes arising from the variability of enterprise ESG ratings.

The structure of this article is organized as follows: Section 2: Literature Review provides a comprehensive overview of previous research related to the topic, serving as the basis for the current study. Section 3: Theoretical Analysis and Hypotheses presents the analysis process of theory and proposes hypotheses. Section 4: Methodology and Data makes explanation for the data, variables and methods used in this paper. Section 5: Research Results and Discussion presents the statistical analysis findings, showcasing the results obtained from the study. It also includes an in-depth discussion and interpretation of these results. Section 6: Conclusions and Implications concludes the study by summarizing the main findings and implications derived from the research. Furthermore, it offers policy suggestions based on the significance of the conclusions reached in the study.

2. Literature Review

With the increasing emphasis on green and sustainable development, corporate ESG construction has experienced a surge in growth. ESG construction serves as a crucial reflection of a company’s sustainable business capabilities and its commitment to corporate social responsibility (CSR). Many scholars have focused on studying the economic consequences of corporate ESG construction and the factors that influence it. From an economic perspective, the attention is primarily directed towards the impact of corporate ESG construction on various aspects such as corporate financing costs, corporate value, and corporate innovation. Disclosing ESG construction helps reduce the information asymmetry related to CSR, leading to companies with stronger ESG construction experiencing significantly lower financing costs [1,2,3,4]. It can also improve investment efficiency and significantly increase the market value [5,6,7]. Additionally, better ESG construction is linked to enhanced levels of technological innovation [8]. Fulfilling CSR obligations can establish a positive corporate image, garner support from stakeholders, alleviate financing constraints, and enhance resource-acquisition capabilities [9]. Regarding corporate ESG construction, factors such as digital transformation, enterprise financial performance, and company size all demonstrate significant effects on a company’s ESG construction [10,11,12,13]. Furthermore, there is a long-term alignment between corporate ESG construction and corporate green innovation [14,15,16].

Research on regional green economy efficiency primarily focuses on the factors that influence it and the measurement of relevant indicators. In order to assess regional green economic efficiency, undesirable outputs such as industrial waste, emissions, and wastewater are incorporated into analytical frameworks. This approach offers a fresh perspective on traditional total-factor productivity and provides an indicator for measuring high-quality economic development in China. The development of the digital economy plays a significant role in improving regional green economic efficiency [17,18], with high marketization being a crucial condition for achieving such efficiency [19]. Additionally, the upgrading of industrial structures and the rectification of factor distortions serve as important channels through which the digital economy influences green economic efficiency [20]. Environmental regulations also play a substantial role in promoting green economic efficiency [21], although some studies have observed an inverted U-shaped relationship between environmental regulations and green economic efficiency [22]. Technological innovation has been found to have a positive effect on green economic efficiency [23], and carbon trading policies can facilitate the growth of regional green economic efficiency through technological advancements [24]. As for the indicator measurement, several models are commonly used, including the SBM-DEA model (slack-based model-data envelopment analysis) and the DEA (data envelopment analysis) model [25,26].

The aforementioned study provides substantial empirical evidence for examining the relationship between corporate ESG and regional green economic efficiency, offering a valuable theoretical perspective for comprehending the development of corporate ESG and the regional green economy. However, the existing literature predominantly focuses on investigating the impact of macroeconomic policies and environmental factors on micro-level corporate behavior. For instance, it has been observed that environmental policy uncertainty significantly hinders corporate green investments, while green credit policies are beneficial in reducing the fictitiousness of heavily polluting enterprises [27,28]. Nonetheless, there is limited research exploring how micro-level corporate behavior influences macroeconomic policies. This neglects the research perspective that encompasses not only the micro-to-micro or macro-to-micro relationships, but also the micro-to-macro relationships, where the decisions made by micro-level companies possess interrelated attributes rather than being isolated. In the existing studies, the mechanisms and pathways of regional green economic efficiency have been analyzed, along with the exploration of the relationship between corporate ESG construction, corporate behavior, and financial performance. However, there is a gap in the research regarding the effects of corporate ESG construction on promoting regional green economic efficiency. Furthermore, though some of the literature has delved into the impact of corporate ESG construction on innovation 8, there is still a need for further investigation to deepen our understanding of the relationship between corporate ESG construction and green technological innovation within the context of environmental regulations. Additionally, the mechanisms through which corporate ESG construction enhances regional green economic efficiency require more exploration. Therefore, this study aims to address these gaps by conducting theoretical analysis and developing a mathematical model. It seeks to explore whether the behavior of micro-level companies, through ESG construction, has an impact on the development of the regional green economy. The specific research design will be discussed in detail in the subsequent sections.

3. Theoretical Analysis and Hypotheses

3.1. Corporate ESG Construction and Regional Green Economic Efficiency

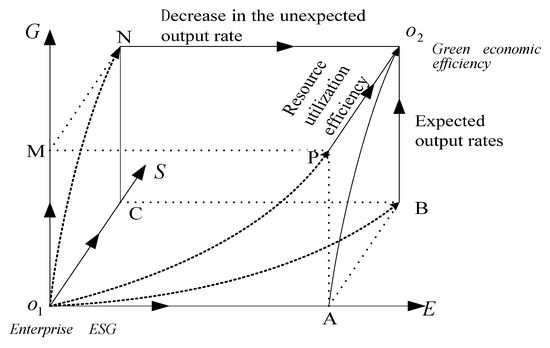

The intrinsic factors of regional green economic efficiency primarily encompass resource utilization efficiency, the reduction of unexpected outputs, and the efficiency of expected outputs. This study aims to investigate the impact of corporate ESG construction on these three factors by examining environmental awareness, governance effectiveness, and CSR conveyed through corporate ESG initiatives. By conducting this analysis, we can gain insights into the underlying mechanism through which enterprise ESG practices influence regional green economic efficiency. To provide a visual representation of this mechanism, we have constructed a diagram (Figure 1) depicting the driving effect of enterprise ESG on regional green economic efficiency, based on the analytical approach proposed by Hu [29]. To facilitate our analysis, we make the following assumptions regarding the characteristics of the model diagram: 1. O1 represents the initial point of the impact of corporate ESG construction, encompassing environmental, social, and governance aspects. This impact is primarily observed in how ESG integrates social and economic value into the strategic development goals of a company. This integration helps establish a social consensus in an uncertain environment. Simultaneously, guided by the core principle of green development, ESG construction communicates the social and economic responsibilities of a firm to market participants. This communication influences the investment and consumption behavior of stakeholders, thereby compelling the company to enhance its governance level, reduce environmental pollution, strengthen corporate social responsibility, and progress towards green and sustainable development. 2. O2 symbolizes the areas where the intrinsic elements of regional green economic efficiency have an impact. It mainly reflects the intrinsic factors of regional green economic efficiency across three dimensions: resource utilization efficiency, efficiency of expected outputs, and reduction in unexpected outputs. 3. The arrows in the diagram signify an increase or decrease in the corresponding variables. By delineating these features in the model diagram, we can better comprehend the relationship between corporate ESG construction and regional green economic efficiency.

Figure 1.

Mechanism model of the effect of firms’ ESG construction on regional green economic efficiency (E: environmental; S: social; and G: governance).

From a stakeholder theory perspective, corporate ESG construction redefines the objective of maximizing the corporate value by incorporating considerations for CSR. This transformation has two main effects. Firstly, in terms of CSR, the philosophy of social responsibility conveyed through ESG initiatives enables companies to accumulate social capital and establish business cooperation networks. This helps alleviate resource constraints in their production processes [30]. Moreover, heightened CSR awareness encourages companies to embrace technological innovation and adopt efficient resource utilization practices to address regional resource limitations. As a result, firms can improve their resource utilization efficiency (as represented by vector PO2 in Figure 1). Secondly, concerning corporate environmental responsibility, an enhanced corporate environmental awareness prompts companies to focus on pollution control in their production processes through the adoption of green technological innovations. This approach emphasizes source control and end-of-pipe pollution treatment. Additionally, heightened corporate environmental awareness drives companies to transition into clean industries, thereby optimizing and upgrading the industrial structure [31]. Consequently, under certain conditions, this transition can lead to a reduction in unexpected outputs. Lastly, in terms of corporate governance effectiveness, strong corporate governance practices aid in reducing transaction costs, mitigating managerial opportunism and uncertainty [32], minimizing opportunity costs and risks, enhancing management and production levels, and improving the expected output rate (as depicted by vector BO2). By considering these effects, the implementation of corporate ESG construction contributes to the maximization of economic value while incorporating CSR principles.

From the perspective of signal transmission theory, the information disclosure of enterprise ESG construction is a process that involves transmitting signals. As the entity responsible for disseminating ESG construction information, the enterprise plays a crucial role in determining the quality of information disclosure. To enable investors to gain a deeper understanding of the true condition of the enterprise and make informed decisions, as well as to help the enterprise secure favorable development opportunities, the enterprise aims to disclose high-quality information. This commitment to quality information disclosure is driven by both internal aspirations for survival and growth, as well as external regulatory pressures. Stakeholders, as the primary recipients and key stakeholders of enterprise signal information, demonstrate a keen interest in both the quantity and quality of information released by the enterprise. They base their investment decisions on their understanding of this information, thereby influencing the level of enterprise ESG construction. Consequently, this interplay has a direct impact on the enterprise’s development momentum and its ESG construction. When stakeholders’ expectations regarding enterprise ESG construction and regional green development increase, the enterprise must correspondingly enhance stakeholders’ perception of its actual social performance. This entails aligning the enterprise’s actions and initiatives with the heightened expectations in order to meet the evolving demands of stakeholders. By doing so, the enterprise can foster trust and confidence among stakeholders and ensure continued support for its ESG construction efforts. This compels the enterprise to enhance its ESG construction level and improve the quality of ESG construction information. By doing so, the enterprise can attract greater attention and investment from stakeholders, as well as facilitate the acquisition of ESG construction funds. These efforts further allow the enterprise to fulfill its environmental and social governance responsibilities. Simultaneously, there is an increasing societal and governmental demand for green development. Enterprises that excel in ESG construction are motivated to influence stakeholders’ perception of their actual social performance by improving their level of information disclosure and emphasizing their advantages in social performance. This strategic approach enables these enterprises to secure favorable development opportunities. Additionally, the exemplary performance of high-level enterprises in ESG construction serves as a demonstration effect on other enterprises with lower levels of ESG construction in the region. This influence promotes an overall improvement in the level of ESG construction among regional enterprises. Consequently, it contributes to the enhancement of environmental, social, and governance effectiveness within the region’s enterprises. Ultimately, this facilitates the advancement of regional green economic development.

Under the combined influence of stakeholder promotion and signal transmission, companies are increasingly recognizing the importance of environmental protection, corporate governance, and strengthening their corporate social responsibility (CSR). The implementation of CSR contracts encourages executives to prioritize stakeholder interest [33]. In the long term, this emphasis is beneficial for enhancing corporate governance and its impact on society and the environment. When good corporate governance practices are combined with the environmental effects of enterprise ESG construction, a synergistic effect is created, resulting in a “1 + 1 > 2” outcome. This synergistic effect enables companies to improve their expected outputs while simultaneously reducing unexpected outputs. In other words, the combined effect of vectors O1A and O1M gives rise to the sum vector O1P. As a result, the vectors NO2 and BO2 are correspondingly extended, indicating a decrease in the rate of unexpected outputs and an increase in the rate of expected outputs.

From the stakeholders’ perspective, exceptional ESG performance contributes to the enhancement of corporate governance [34]. Corporate ESG construction serves as a means to convey positive signals regarding CSR and governance to stakeholders, thereby attracting greater attention to corporate governance and social impact. This increased scrutiny compels companies to improve their governance capabilities and strengthen their CSR awareness, resulting in improved access to financing and resources. Flammer and Luo have found that enhancing CSR initiatives motivates and enhances employees’ workplace behavior [35]. By improving CSR through ESG construction and strengthening governance capabilities, companies can enhance their resource utilization efficiency and increase their expected output rates. In other words, under the combined effect of vectors O1M and O1C, the sum vector O1N is formed. Consequently, the resource utilization rate (vector PO2) and the expected output rate (vector BO2) exhibit an upward trend.

Improved CSR in ESG construction, influenced by environmental factors, leads to a simultaneous increase in resource utilization efficiency and decrease in the rate of unexpected outputs. On one hand, CSR initiatives encourage companies to proactively address regulatory requirements from societal entities, leading to the enhanced disclosure of their environmental protection efforts and fulfillment of CSR obligations. On the other hand, in order to effectively fulfill CSR responsibilities, companies place greater emphasis on environmental protection and energy conservation [36]. In essence, the combined effect of vectors O1A and O1C results in the sum vector O1B. Consequently, vectors PO2 and NO2 are extended, indicating an increase in resource utilization efficiency and reduction in the rate of unexpected outputs.

Based on the above observations, we propose the following hypothesis:

Hypothesis 1.

Effective corporate ESG construction has the potential to enhance regional green economic efficiency.

3.2. Corporate ESG Construction, Green Technology Innovation, and Regional Green Economic Efficiency

In increasingly competitive market environments, innovation plays a crucial role in helping companies maintain a competitive advantage. Green technology innovation, specifically, is focused on promoting environmentally-friendly production practices and energy-efficient resource utilization, leading to positive ecological externalities. However, due to challenges in accurately quantifying and monitoring innovation inputs, uncertainties surrounding the effects and benefits of innovation, and the difficulty in collateralizing innovative assets, companies often encounter financing constraints when it comes to green innovation [37]. Therefore, long-term and stable financial support is essential for enabling companies to carry out green technology innovation [38].

According to signaling theory, fulfilling enterprise ESG responsibilities helps mitigate regulatory risks and risks associated with products and technology [39,40]. This enables companies to establish extensive networks, expand financing channels, and increase opportunities for acquiring external resources. Moreover, effective ESG construction has a positive impact on a company’s value [41], significantly improving its financial performance [42], thereby bringing forth more benefits and providing the necessary resources and environment for innovation. In addition, agency theory suggests that modern enterprises face significant agency problems. Effective corporate governance optimizes the internal management structure through equity balance and incentives, thus mitigating information asymmetry and constraining management from making decisions that contradict the company’s long-term development. This enhances the confidence of external investors and shareholders while stabilizing resource channels. As a result, the firms’ ESG construction can attract the resources required for green technological innovation and provide a favorable resource environment for it.

Green innovation in companies primarily aims to enhance expected output efficiency, improve resource utilization efficiency, and reduce the rate of unexpected outputs, thereby contributing to the advancement of green economic efficiency. Technological progress serves as a critical driver for productivity improvement. In their pursuit of expected productivity levels, companies continuously optimize and upgrade their production technologies. Technological advancements not only enhance factor productivity, but also result in savings of factor inputs [43], consequently improving the efficiency of expected outputs. The transformation towards green practices within companies represents a crucial pathway towards achieving long-term sustainable development. Additionally, high levels of technological innovation can effectively stimulate green development both within companies and across cities [44]. Technological innovation plays a key role in enhancing resource allocation efficiency, energy conservation, and emission reduction by reducing energy consumption per unit of output. This, in turn, improves long-term green economic efficiency [45,46].

Based on these considerations, we propose Hypothesis 2:

Hypothesis 2.

A firm’s ESG construction has the potential to enhance regional green economic efficiency through corporate green innovation.

3.3. Corporate ESG Construction, Environmental Regulations, and Regional Green Economic Efficiency

Environmental regulations have a significant impact on firms’ costs and subsequently influences their innovation behavior. According to cost theory, environmental regulations disrupt the allocation of resources within businesses, diverting resources that would have otherwise been allocated to production and research and development (R&D) towards pollution control measures. This diversion of resources increases costs for businesses, which in turn reduces their motivation for technological upgrades and impedes the improvement of ESG practices [47]. As a result, this inhibits the enhancement of regional green economic efficiency.

When the costs associated with environmental regulations are relatively low, businesses tend to allocate a portion of their funds for green technological innovation towards pollution control measures in order to achieve short-term profits. This allocation inevitably reduces the resources and effort dedicated to green technology research and development (R&D) by companies [48]. As a result, the improvement of regional green economic efficiency is further suppressed.

According to signal transmission theory, a well-established corporate ESG framework helps to build a positive corporate reputation and image [49], which in turn facilitates financing opportunities for the company. However, when environmental regulations are set at excessively high levels and impose additional costs on companies, it can lead to reduced investment enthusiasm and potentially result in divestment or scaled-down investment. This limitation in investment opportunities may hinder domestic companies from learning advanced technologies and management practices from other firms, ultimately impacting green economic efficiency.

Based on the above discussion, we propose Hypothesis 3:

Hypothesis 3.

Environmental regulation negatively moderates the effect of enterprise ESG on regional green economic efficiency.

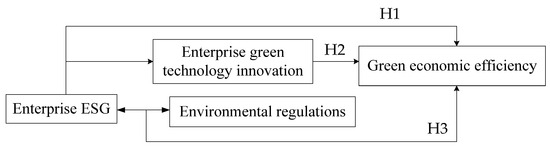

To provide a clearer understanding for readers, we present the hypotheses in Figure 2.

Figure 2.

Hypotheses.

4. Methodology and Data

4.1. Panel Regression Model

The model setting in this paper was based on references from existing literature [23].

4.1.1. Model Setting for ESG’s Effect on Regional Green Economic Efficiency

To empirically test hypothesis H1, which examines the direct effect of firms’ ESG on regional green economic efficiency, we construct the following baseline regression model:

where subscripts i and t represent individual samples and years, respectively. represents regional green economic efficiency, represents firm ESG construction rating score, represents a set of control variables, represents year effects, represents industry effects, and represents the random disturbance term. Unless otherwise specified, the variables in subsequent models have the same meanings as in model (1).

4.1.2. Model Setting for the Effect of ESG and Green Innovation on Regional Green Economic Efficiency

Our theoretical analysis suggests that firms’ green technological innovation plays a mediating role in the effect of firms’ ESG on regional green economic efficiency. Following the three-step method of mediation analysis proposed by Wen [50], model (1) is used as the first step in the mediation analysis, and the following two models are constructed:

In model (2), represents firms’ green technological innovation. This includes three proxy variables: the overall level of green technology innovation (gpat), the “quality” of green technology innovation (ginv1), and the “quantity” of green technology innovation (ginv2). The meanings of the other variables are the same as in model (1).

4.1.3. Model Setting for the Effect of ESG and Environmental Regulations on Regional Green Economic Efficiency

From the previous theoretical analysis, we know that environmental regulations might moderate the effect of firms’ ESG on regional green economic efficiency. To empirically test the moderating effect of regional environmental regulations on the effect of firms’ ESG on regional green economic efficiency, the following model is constructed:

where is the level of regional environmental regulation intensity and is the interaction term between firm ESG construction and environmental regulation intensity, which reflects the moderating effect of environmental regulations on ESG’s effect on regional green economic efficiency. The meanings of the other variables are the same as in model (1).

4.2. Evaluation Methods and Data Sources

4.2.1. Core Explained Variable

Economic efficiency is commonly assessed through various methods, such as stochastic frontier analysis (SFA), the Solow residual method, and data envelopment analysis (DEA). However, SFA and the Solow residual method rely on strong assumptions regarding random error terms, which can potentially result in biased estimates. In contrast, non-parametric DEA estimation does not necessitate such assumptions. The DEA-based slacks-based measure (SBM) model is particularly effective in identifying green economic efficiency. Moreover, by incorporating unexpected outputs into the SBM framework, a super SBM-DEA model can offer a more comprehensive measurement of green economic efficiency [51,52]. Based on these considerations, we have chosen the super SBM-DEA model as a suitable method for measuring regional green economic efficiency. Our analysis includes twenty-nine provinces and regions in China as decision-making units (excluding Hong Kong, Macao, Taiwan, Heilongjiang, and Tibet due to insufficient data). The input factors considered are physical capital, human capital, and resource energy, while the desired output is regional GDP. Undesirable outputs are represented by industrial wastewater, exhaust gas, and solid waste emissions. In our calculations, physical capital input is measured using the perpetual inventory method with a depreciation rate of 5%. The input indicator for fixed assets, required in the calculation, is replaced by the total fixed-asset formation. The data used for this study are sourced from the China Statistical Yearbook. To quantify human capital input, we utilize the number of employees at the end of the year, obtained from the statistical yearbooks of each province and region in China. Energy input is measured by total energy consumption, which is then converted to standard coal units, sourced from the China Energy Statistical Yearbook. Regional GDP is based on the year 2005 and is represented by the real value adjusted by the consumer price index specific to each region. The data for these indicators are sourced from the statistical yearbooks of each province and region. For the undesirable output indicators, we obtain data from the China Environmental Statistical Yearbook. These indicators include quantifications of industrial wastewater, exhaust gas, and solid waste emissions.

4.2.2. Core Explanatory Variables and Mechanism Variables

To measure corporate ESG construction, we utilize ESG rating data provided by CSI (China Securities Index) and assign the CSI’s nine-level ESG rating (AAA~C) to each firm, with values ranging from 9 to 1.

In terms of green technological innovation, we analyze it in three aspects, following the methodology proposed by Li et al. [53]. Firstly, we assess the overall level of firms’ green innovation using the natural logarithm of the sum of green invention patent applications, green utility model patent applications, and 1. Additionally, we decompose this overall level into two components: the “quality” of green innovation, measured by the natural logarithm of the number of green invention patent applications plus 1, and the “quantity” of green innovation, measured by the natural logarithm of the number of green utility model patent applications plus 1.

For measuring environmental regulation, we select the ratio of industrial pollution control investment to industrial added value.

4.2.3. Control Variables

In order to analyze the impact of firms’ ESG on regional green economic efficiency, it is crucial to incorporate and control for other variables that have a significant influence on regional green economic efficiency. Therefore, following the methodology proposed by Wang et al. [54], we include firm-level control variables such as the asset-liability ratio (lev) and asset return rate (roa). Additionally, we also include provincial-level control variables, including the marketization index (mket), GDP index of each province (gdpix), urbanization rate (urb), and government expenditure (fin).

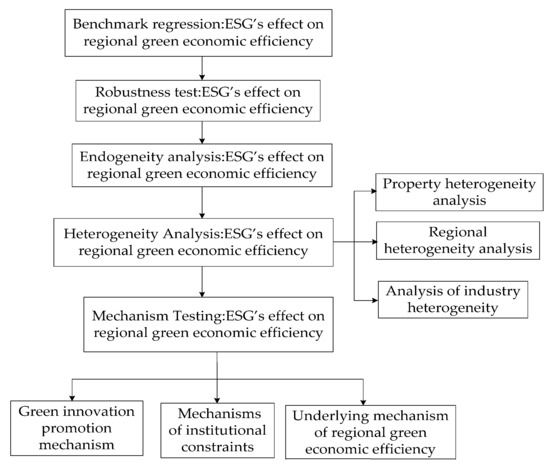

4.3. Empirical Process

To facilitate better understanding of the methods employed in this paper, we utilize a pathway diagram to illustrate the empirical process (Figure 3).

Figure 3.

Empirical Process.

4.4. Data Sources and Descriptive Statistics

Based on the theoretical analysis, we have selected data from 2009 to 2019 for research samples and decision-making units. These samples consist of listed A-share companies located in 29 provinces, cities, and regions. Data related to enterprise ESG are obtained from the Wind database, while green innovation data are sourced from the China Research Data Services Platform and the Wind database. Macroeconomic variables are derived from the statistical yearbooks of various provinces, and other variable data are obtained from the CSMAR database and the RoyalFlush iFinD database.

Table 1 shows the descriptive statistics and definitions of the main variables. The mean value of ESG in the sample is 4.05, the maximum value is 6.75, and the minimum value is 1. This means the average rating of the sample firms is between B and BB, indicating that there is room for improvement in their ESG construction, and there are large differences in ESG construction levels between firms. The mean value of regional green economic efficiency is 0.583, the maximum value is 1.279, and the minimum value is 0.143. This indicates imbalances in green economic development among provinces, showing large differences. In terms of green innovation in firms, each firm applies for an average of e0.220 green invention patents and e0.256 green utility model patents per year.

Table 1.

Descriptive statistics and variables.

5. Empirical Results and Discussion

In order to test the research hypothesis regarding the impact of corporate ESG construction on regional green economic efficiency, this study employs several empirical tests. These tests include a benchmark regression analysis, an endogeneity test, a robustness test, a heterogeneity test, and a mechanism test.

5.1. Benchmark Regression Results

Columns (1) and (2) in Table 2 present the benchmark regression results for the impact of enterprise ESG on regional green economic efficiency. In column (1), the regression is conducted without incorporating other control variables. The coefficient of corporate ESG construction is found to be significantly positive at the 1% level. Moving to Model (2), control variables are added to the regression in column (1). The coefficients of corporate ESG construction remain statistically significant at the 1% level. This suggests that corporate ESG construction has a positive effect on regional green economic efficiency. Moreover, for each improvement in the ESG construction level, there is a 0.7% increase in green technology efficiency. These findings highlight that corporate ESG construction enhances regional green economic efficiency and contributes to the realization of a green economy by improving ESG practices. It is evident that corporate ESG construction not only influences firm performance, but also promotes regional green economic efficiency by elevating the level of corporate ESG construction. This fosters a coordinated development between the regional economy and green practices.

Table 2.

Results of Benchmark regression and robustness test.

Green development is a crucial concept that underpins the overall development of our country. It represents an inevitable choice in achieving sustainable and high-quality development. Enterprises serve as the source of market vitality, and macroeconomic development reflects the collective behavior of these micro-level enterprises. The construction of enterprise ESG reflects the attitude and progress of enterprise green transformation. Currently, our country is dedicated to achieving green development goals by providing financial and policy support. This includes encouraging enterprises to actively engage in green transformation, improve their ESG construction level, and ultimately enhance the efficiency of the regional green economy. These efforts align with Hypothesis 1. Distinguishing itself from prior studies, this research breaks through the existing literature’s perspective by transitioning from the micro-to-macro level. It begins from the standpoint of individual enterprises and endeavors to explore the impact of changes in enterprise behavioral decision-making on macroeconomic development. Through this approach, enterprises are encouraged to fulfill their social responsibilities and contribute to the task of economic development.

5.2. Robustness Test of ESG’s Effect on Regional Green Economic Efficiency

To further ensure the robustness of our benchmark regression results, we conduct three robustness analyses. First, we replace the original data with ESG rating data from SynTao Green Finance to analyze the uncertainty in ESG construction stemming from subjective ESG ratings. This allows us to explore any potential variations in the effects on regional green economic efficiency. Second, we utilize different rating assignment methods for enterprise ESG. Specifically, we assign a value of 1 to companies with ratings of BBB or above, and a value of 0 to those with lower ratings. Third, we apply a standardization technique, specifically Z-scores, to the core explanatory variable. This involves transforming the data by subtracting the mean and dividing it by the sample standard deviation. The result is a new variable with a mean of 0 and a standard deviation of 1. Columns (3)–(5) in Table 2 present the regression results obtained from these robustness tests, allowing us to evaluate the stability and consistency of our findings.

Column (3) illustrates the regression results using the SynTao Green Finance (sdesg) rating index as the core explanatory variable. The coefficient is found to be significantly positive at the 1% level. This suggests that the regression results for corporate ratings obtained from different rating agencies also demonstrate a significant positive effect on regional green economic efficiency. Moving to column (4), we observe the regression results after changing the rating assignment method. Remarkably, the coefficient remains significantly positive, indicating that the positive effect of enterprise ESG on green economic efficiency persists irrespective of the rating assignment approach. Proceeding to column (5), we present the results after standardizing the corporate ESG construction rating score. Encouragingly, the coefficient remains significantly positive. These consistent findings indicate that different measurement approaches do not alter the positive effect of enterprise ESG on regional green economic efficiency. Overall, the robustness test results consistently demonstrate the significant and robust positive effect of ESG on regional green economic efficiency.

5.3. Endogeneity Analysis

To address potential endogeneity in the model, we employ three analyses and treatments.

Firstly, following the approach of Xi et al. [55], we use the earliest ESG construction rating score of each company as an instrumental variable in a two-stage regression. This instrumental variable satisfies the relevance and exclusivity constraints as it impacts the subsequent ESG construction of the firm, but does not directly impact the green economic efficiency of the region. The regression results are presented in columns (1) and (2) of Table 3. Notably, the coefficient remains significant at the 5% level, indicating that the results remain robust even after accounting for endogeneity.

Table 3.

Regression results for the endogeneity analysis.

Secondly, it is worth noting that better corporate ESG construction exhibits a stronger promotion effect on green economic efficiency. However, we also need to consider the possibility that regions with higher levels of green economic development may experience more intense market competition and stricter regulatory supervision of corporate behavior. This, in turn, encourages companies to improve their ESG construction. Such influences can give rise to endogeneity issues due to bidirectional causality. To address this concern, we incorporate lagged explanatory variables in our analysis to alleviate the problem of bidirectional causality. Specifically, we include lagged ESG construction variables (L.esg, L2.esg) as explanatory variables. Columns (3) and (4) in Table 3 present the regression results obtained after incorporating these lagged variables. Notably, the coefficients of both lagged variables are found to be significantly positive at the 1% level, providing support for Hypothesis 1. This indicates that good corporate ESG construction has a positive and long-term impact on green economic efficiency.

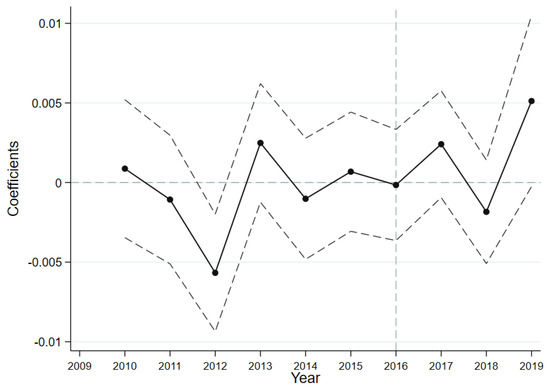

Finally, to address potential endogeneity issues stemming from other factors, we adopt the difference-in-differences method, following the approach outlined by Song et al. [56]. In recent years, China has been making continuous improvements to regulatory policies regarding ESG information disclosure by listed companies. In August 2016, a significant policy development took place when the People’s Bank of China, the China Securities Regulatory Commission, and seven other departments jointly issued the “Guiding Opinions on Building a Green Financial System” [57]. This policy introduced a mandatory environmental information disclosure system for listed companies. We consider this policy as a quasi-natural experiment, with the year 2016 marking its implementation. Given that the majority of listed companies are affected by ESG regulatory policies, it becomes challenging to distinguish clear experimental and control groups. Hence, in line with Nunn et al. [58], we employ a continuous difference-in-differences model for estimation. In this model, we set a policy dummy variable, called “Time,” to 0 when the year <2016 and 1 otherwise.

The regression results, presented in column (5) of Table 3, provide insights into the effect of ESG regulatory policy shocks on regional green economic efficiency. The coefficient of the interaction term, time × egg, reflects this effect. Notably, the coefficient before the interaction term is 0.01 and significantly positive at the 1% level, indicating a positive impact of ESG policy implementation on regional green economic efficiency. These findings align with the baseline regression results. Additionally, the balance trend test, illustrated in Figure 4, confirms that prior to the policy’s implementation in 2016, its effect was not significant. However, from 2017 onwards, the policy’s impact gradually became evident, which is consistent with the conclusion given in column (5) of Table 3. This further strengthens the robustness of the baseline regression results. Overall, these findings indicate that the implementation of ESG regulatory policies has a certain influence on regional green economic efficiency.

Figure 4.

Balance trend test. Notes: The Solid line represent the trend of coefficient changes. The dotted line represent the change interval at the 95% significance level.

5.4. Heterogeneity Analysis

5.4.1. Property Heterogeneity Analysis

To examine potential differences in the impact of ESG on regional green economic efficiency between enterprises with different property rights we divide the sample enterprises into two categories: state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs), based on their ownership. We then conduct a subsample regression analysis. The results, presented in columns (1) and (2) of Table 4, reveal that the coefficient of ESG for the SOE sample is 0.011, which is statistically significant at the 1% level. However, the coefficient of ESG for the non-SOE sample is not found to be statistically significant. From this, we can infer that the positive effect of enterprise ESG on regional green economic efficiency is more prominent among SOEs compared to non-SOEs.

Table 4.

Firm heterogeneity in ESG’s effect on regional green economic efficiency.

This could be attributed to the fact that SOEs carry dual social and economic responsibilities. In comparison to non-SOEs, their strategic management objectives and organizational management are influenced by national policies, and they possess stronger corporate social responsibility (CSR) and political affiliations. Consequently, they are subjected to more stringent government regulations. Fulfilling ESG responsibilities helps improve the internal governance of SOEs, enhances management’s willingness to take risks through innovative incentive mechanisms, promotes innovative decision-making, develops a competitive advantage, and receives more resource support. Furthermore, as significant entities in socio-economic development, SOEs play a crucial role in demonstrating policy compliance and fulfilling political responsibilities in ESG construction. Therefore, when compared to non-SOEs, SOEs exhibit greater motivation to fulfill ESG responsibilities, leading to a more pronounced impact of ESG construction on regional green economic efficiency.

5.4.2. Regional Heterogeneity Analysis

Different levels of economic development can contribute to variations in the impact of ESG initiatives. There are also disparities in the levels of green economic efficiency and firm development across different regions. To examine this, we classify the sample companies into two groups based on their registered locations: the eastern region and the central and western regions. Analyzing the regression results presented in columns (3) and (4) of Table 4, we find that the ESG coefficient for companies in the eastern region is 0.03, which is statistically significant at the 10% level. However, the coefficient for companies in the central and western regions is not statistically significant. This suggests that ESG initiatives have a more pronounced effect on promoting green economic efficiency in the eastern region. This can be attributed to several factors. Firstly, the eastern region benefits from clear resource advantages, higher levels of economic development, and a more comprehensive institutional environment. Secondly, evolving investment philosophies among investors now place greater emphasis on non-financial indicators such as ESG, while government regulations impose stricter requirements on companies. These factors have compelled companies in the eastern region to pay more attention to ESG in order to reduce regulatory and public pressures. Additionally, the eastern region boasts a more developed economy and is able to provide more resources and financial policy support to companies. This enhances firms’ motivation to improve their ESG practices. On the other hand, the relatively lower levels of economic development in the central and western regions result in a lack of motivation and resources for companies to prioritize ESG initiatives. Furthermore, in the central and western regions, governments, societies, and companies primarily emphasize economic benefits to promote economic development, often neglecting CSR considerations. As a result, ESG investment by companies in these regions is relatively lower. In conclusion, for companies located in the eastern region, the effect of ESG initiatives on regional green economic efficiency is more significant due to the region’s clear resource advantages, higher levels of economic development, evolving investment philosophies, stricter government regulations, and greater availability of resources and financial policy support.

5.4.3. Analysis of Industry Heterogeneity

To examine the impact of ESG on regional green economic efficiency among companies with varying degrees of pollution, we classify the sample into two categories: polluting and non-polluting companies. This classification is based on the “Industry Classification Management Directory for Environmental Inspection of Listed Companies” published by the Ministry of Environmental Protection of China [59], and the “Industry Classification Guidelines for Listed Companies” (revised in 2012) published by the China Securities Regulatory Commission [60]. We then conduct a sub-sample regression analysis, and the results are presented in columns (5) and (6) of Table 4. The regression results indicate that the ESG coefficient for polluting companies is significantly positive at the 1% level. However, for non-polluting companies, the ESG coefficient is not statistically significant. This suggests that the positive effect of ESG on regional green economic efficiency is more pronounced among polluting companies. The differential impact can be attributed to the varying levels of environmental regulatory constraints faced by different industries. Polluting companies, in particular, are subjected to stricter environmental regulations and garner more public attention due to their environmental impact. As a result, they are compelled to address pollution issues more actively. Moreover, polluting companies can improve their public image and environmental reputation by implementing pollution control measures. This, in turn, broadens their potential customer base and enhances their ESG performance. Consequently, their efforts contribute to influencing regional green economic efficiency positively. In summary, polluting companies, facing stricter environmental constraints and greater public scrutiny, have a stronger incentive to address pollution issues and improve their ESG practices. This enables them to enhance their influence over regional green economic efficiency.

5.5. Mechanism Testing

5.5.1. Green Innovation Promotion Mechanism

The promotion of green economic transformation has become a globally discussed topic, and China has been actively committed to green development, with a particular focus on the green transformation of enterprises. To further analyze the mechanism through which firms’ ESG practices impact regional green economic efficiency, we introduce green technological innovation as a mediating variable and construct a model to test its mediating effect. The regression results, presented in columns (1)–(6) of Table 5, provide insights into this analysis. In column (1), the positive effect of ESG on the overall level of green technological innovation in enterprises is evident, with a coefficient of 0.152. This coefficient is statistically significant at the 1% level, indicating that enterprises’ ESG practices significantly promote green innovation. Moving forward, in columns (2) and (3), we explore the effect of enterprise ESG practices on the quality and quantity of green technological innovation. The regression coefficients for these variables are 0.128 and 0.092, respectively, both of which are statistically significant at the 1% level. These findings suggest that enterprise ESG construction can improve both the quality and quantity of green technological innovation. Expanding our analysis, columns (4)–(6) present the regression results obtained by incorporating both ESG and green technological innovation into the model. In all three cases, the coefficients of ESG remain statistically significant at the 1% level. This indicates that enterprise ESG practices enhance regional green economic efficiency by promoting firms’ green innovation. To summarize, the findings confirm that enterprise ESG practices have a positive and significant impact on the overall level, quality, and quantity of green technological innovation. Moreover, incorporating ESG into the model further demonstrates its role in enhancing regional green economic efficiency through the promotion of firms’ green innovation.

Table 5.

Regression results for the mediation and moderation mechanisms.

Based on the literature review, one possible explanation is that corporate ESG practices can enhance the level of green technological innovation within the company. This is primarily achieved through increased investment in research and development (R&D) activities. Additionally, such R&D investments can positively impact the company’s green economic efficiency [61], particularly by improving its level of green innovation. The presence of green innovation within the company, by enhancing technological efficiency and promoting technological progress, significantly contributes to green economic efficiency [62]. This improvement is mainly observed in the quality of the company’s green innovation. Furthermore, according to the “Guiding Opinions on Building a Market-oriented Green Technology Innovation System” proposed by The National Development and Reform Commission and the Ministry of Science and Technology [63], the emphasis is placed on strengthening the role of enterprises in green innovation and increasing support for their green technology innovation. This initiative provides Chinese enterprises with a reliable market environment to engage in green technology innovation and promotes the overall green development of the economy. In summary, corporate ESG practices have the potential to enhance regional green economic efficiency by influencing green technological innovation. This hypothesis can be further verified by research studies.

5.5.2. Mechanisms of Institutional Constraints

To examine the influence of the institutional environment on the effect of ESG practices on regional green economic efficiency, we introduce environmental regulations as a moderating variable and construct a moderation effect model. The regression results are presented in columns (7) and (8) of Table 5. In column (7), we present the regression results without including moderating and control variables. Here, the coefficient of ESG is significantly positive, indicating that enterprise ESG practices contribute positively to regional green economic efficiency. Moving to column (8), we present the regression results after incorporating the intensity of environmental regulations and the interaction term between environmental regulations and ESG (ESG × ER). In this case, the coefficient of ESG remains significantly positive. However, both the coefficients of environmental regulations and the interaction term are significantly negative. This suggests that environmental regulations have a notable inhibitory effect on green economic efficiency and weaken the positive impact of enterprise ESG practices. One possible explanation for these findings is the implementation of stringent environmental management policies. These policies have resulted in more stringent environmental regulations. The increased costs associated with compliance to these regulations may have led to reduced investment by companies in improving their green technologies. As a result, the advancement of corporate ESG practices has been hindered, leading to a suppression of improvements in green economic efficiency. This confirms Hypothesis 3, which suggests that environmental regulations have an inhibitory effect on the relationship between ESG practices and regional green economic efficiency.

5.5.3. Underlying Mechanism of Regional Green Economic Efficiency

We utilize the Malmquist index decomposition method to analyze and decompose green economic efficiency into two components: green scale efficiency and green pure technical efficiency. In order to achieve this, we construct the following models:

In Equations (5) and (6), green scale efficiency and green pure technical efficiency are represented by and, respectively, with the same variable meanings as in model (1). Models (1) and (2) in Table 6 display the regression results obtained by examining the relationship between enterprise ESG and pure green technical efficiency, as well as green scale efficiency, respectively. When pure green technical efficiency serves as the dependent variable, the coefficients, after adding control variables, are not statistically significant, indicating that the impact of ESG on pure green technical efficiency is not significant. However, when the dependent variable is green scale efficiency, as demonstrated in models (3) and (4), the regression coefficients are 0.006 and 0.006, respectively, both significantly positive at the 1% level. This suggests that enterprise ESG practices significantly promote green scale efficiency. Comparing the regression results in Table 2 and Table 6, and considering the relationship between green technical efficiency, pure green technical efficiency, and green scale efficiency, it becomes evident that enterprise ESG practices have a substantial impact on green technical efficiency and green scale efficiency, while the effect on pure green technical efficiency is not significant. These findings indicate that the positive influence of enterprise ESG practices on regional green economic efficiency is primarily achieved through its impact on green scale efficiency.

Table 6.

Intrinsic mechanisms of enterprise ESG’s effect on regional green economic efficiency.

6. Conclusions and Limitations

Enhancing the efficiency of the regional green economy is crucial for achieving high-quality economic development in China. Therefore, it is imperative to thoroughly examine whether corporate ESG construction can promote the improvement of regional green economy efficiency in China. To investigate this, the study utilizes unbalanced panel data consisting of 15,192 samples from 1454 Chinese A-share listed companies spanning the period from 2009 to 2019. The findings of this study are as follows: Firstly, the research demonstrates that corporate ESG construction has a significant positive impact on regional green economic efficiency. This suggests that stronger ESG construction leads to a more pronounced promotion of regional green economic efficiency. Secondly, with regards to the mechanism, enterprise ESG influences regional green economic efficiency by facilitating firms’ green technological innovation. Notably, the effect of enterprise ESG on regional green economic efficiency is negatively moderated by environmental regulation. Under the influence of environmental regulation, the positive effect of enterprise ESG on regional green economic efficiency is weakened. This implies that the impact of enterprise ESG on regional green economic efficiency is dampened by environmental regulations. When examining the decomposed variables of regional green economic efficiency, it is found that the significance and direction of enterprise ESG’s effect on both green economic efficiency and green scale efficiency are consistent. This consistency suggests that enterprise ESG has a consistent impact on different aspects of regional green economic efficiency. Moreover, the promoting effect of ESG on regional green economic efficiency is found to be more significant for State-Owned Enterprises (SOEs), enterprises located in economically developed regions, and polluting enterprises. This indicates that these specific types of companies experience a stronger influence from enterprise ESG on regional green economic efficiency. These three conclusions effectively address the three questions posed in the introduction section of this paper: the first question is whether corporate ESG affects the efficiency of the regional green economy; the second question is how corporate ESG influences the efficiency of the regional green economy; the third question is whether the impact of corporate ESG on the efficiency of the regional green economy varies based on company characteristics.

The existing literature on the study of regional green economy efficiency has identified a non-linear relationship between regional green economy efficiency and both the digital economy and environmental regulations. This relationship exhibits an inverted U-shape, as observed from a macro–macro perspective [64,65]. On the other hand, research focused on corporate ESG construction suggests a non-linear relationship between ESG construction and intangible assets of the company, displaying an inverted S-shape [66]. Additionally, companies with better ESG performance tend to have higher stock returns, which can be understood from a micro–micro perspective [67]. The similarity between this study and existing research lies in their exploration of the economic consequences of ESG construction in enterprises or the factors that influence regional green economy efficiency. The research findings of this paper not only contribute to the existing literature on the study of corporate ESG and green economy efficiency, but also offer a fresh perspective by breaking through the traditional research perspectives that focus solely on micro-to-micro or macro-to-macro relationships. Specifically, this paper explores the impact of corporate ESG construction on regional green economy efficiency from the perspective of micro enterprises, providing theoretical and empirical evidence. The study further investigates the mechanisms through which green innovation and environmental regulations mediate this relationship. By examining how changes in enterprises’ behavioral decision making can influence macroeconomic development, this research emphasizes the importance of companies fulfilling their social responsibilities and presents a new direction for promoting regional green development. Based on the empirical conclusions mentioned above, several suggestions are proposed for practical application.

Initially, the green development of enterprises is crucial for regional green economic development. Corporate ESG construction has been identified as a means to improve regional green economic efficiency. According to the “A-Share ESG Rating Analysis Report 2023” [68], the ESG level of A-share-listed companies in China is steadily increasing, indicating the growing importance placed on ESG by these companies. However, there is still room for improvement in terms of the professionalism and completeness of ESG information disclosure. Therefore, it is imperative for enterprises to enhance their ESG system and integrate improved ESG practices into their strategic planning for value enhancement and sustainable development. By doing so, enterprises can contribute to their own healthy green development and, consequently, promote regional green economic efficiency. This is particularly significant for non-State-Owned Enterprises (non-SOEs) and enterprises located in underdeveloped regions. These companies can optimize their ESG practices, enhance their image value, attract more investors, and gain access to additional resources. This, in turn, can elevate their ESG performance and further enhance regional green economic efficiency.

The government can play a significant role in promoting regional green economic efficiency by taking several measures. Firstly, increasing subsidies for pollution reduction by polluting enterprises can incentivize them to undertake green and low-carbon transformations, thereby improving their ESG construction. This, in turn, contributes to regional green economic efficiency. To encourage enterprises to prioritize ESG construction, the government could consider establishing a benchmark to reward and subsidize different levels of ESG construction. The growth rate of ESG construction at enterprises, combined with the growth value of regional green economic efficiency and financial budget expenditure, can be used to determine the methods and standards for rewarding and subsidizing ESG construction in different locations. For instance, if a company demonstrates a one-percentage-point increase in its ESG construction level, its tax revenue could decrease by several percentage points or units as a form of reward. These measures create a favorable environment for enterprises to actively engage in ESG construction, contributing to the enhancement of regional green economic efficiency.

In order to promote the construction of enterprise ESG, the government can consider establishing and improving the system for the accounting verification, audit, and mandatory information disclosure of ESG construction. This would effectively compel enterprises to enhance their level of ESG construction. The research findings also indicate that a higher level of enterprise ESG construction is more conducive to promoting regional green economic efficiency. From the perspective of signal transmission theory, in a market economy, the timely and accurate disclosure of enterprise ESG construction information in a legal and compliant manner can influence the decision-making behavior of stakeholders. This, in turn, establishes a market supervision and forcing mechanism for enterprise ESG construction. Simultaneously, a robust ESG construction information disclosure system can play a crucial role in effectively enhancing regional green economic efficiency through ESG construction. By implementing these measures, the government can encourage enterprises to prioritize ESG construction, promote transparency and accountability, and contribute to the overall improvement of regional green economic efficiency.

Currently, the ESG information disclosure system in China remains incomplete, leading to discrepancies between the domestic system and the international mainstream ESG rating system. Consequently, the evaluation of Chinese companies’ ESG performance becomes less objective, making it challenging for investment institutions to comprehensively analyze the risks and values of companies through ESG ratings. Therefore, it is crucial to further enhance the ESG information disclosure system. Improving the ESG information disclosure system is essential to ensure transparency, authenticity, and effectiveness in the disclosure of information. This will help reduce financing costs, strengthen the construction of national innovation platforms, promote corporate green innovation, and enhance regional green economic efficiency. By addressing these issues, China can bridge the gaps in its ESG information disclosure system, align with international standards, and create an environment conducive to the accurate assessment of companies’ ESG performance. This will not only attract more responsible investment, but also contribute to sustainable development and the advancement of the regional green economy.

The study has three main limitations, pertaining to theoretical analysis, sample selection, and data. Firstly, from a theoretical perspective, the analysis may not be exhaustive due to limited knowledge in the field. Secondly, the study focuses solely on Chinese listed companies and lacks analysis of foreign companies. To address this, future research intends to investigate the effectiveness of corporate ESG construction on regional green economic efficiency in other countries. Additionally, a unified ESG rating system is currently unavailable. This study relies on ESG scores from two representative rating agencies, which may limit the sample’s representativeness. Therefore, future research aims to expand the selection of ESG rating agencies to enhance the validity of the conclusions. Lastly, there are limitations in the research data as they only cover information until 2019, primarily due to the significant impact of the pandemic on the Chinese economy. The next step of this study involves updating the empirical research using more recent data.

Author Contributions

Conceptualization, A.H. and X.Y.; Methodology, A.H. and X.Y.; Data curation, X.Y.; Formal analysis, A.H.; Funding acquisition, A.H.; Project administration, A.H.; Investigation, X.Y.; Software, A.H. and X.Y.; Resources, X.Y.; Supervision, S.W.; Validation, S.F.; Visualization, A.H. and X.Y.; Writing—original draft, A.H. and X.Y.; Writing—review and editing, A.H. All authors have read and agreed to the published version of the manuscript.

Funding

This work was partly supported by the Philosophy and Social Science Planning Project of the Guizhou Province (No. 21GZYB57).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to thank the anonymous referees for their comments and suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Standard No. 2 on the Content and Format of Information Disclosure by Companies Offering Public Securities—Content and Format of Annual Reports. Available online: http://www.csrc.gov.cn/csrc/c100028/c1001392/content.shtml (accessed on 29 December 2017).

- The Revised Guidelines for Listed Companies’ Annual and Smi-annual Reports. Available online: http://www.csrc.gov.cn/csrc/c100028/cb25156c4913f4c9ea6b658cad8011f17/content.shtml (accessed on 28 June 2021).

- Ould Daoud Ellili, N. Environmental, social, and governance disclosure, ownership structure and cost of capital: Evidence from the UAE. Sustainability 2020, 12, 7706. [Google Scholar]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 2019, 79, 102097. [Google Scholar]

- Fan, S.; Huang, H.; Mbanyele, W.; Zhao, X. A step toward inclusive green growth: Can digital finance be the main engine? Environ. Sci. Pollut. Res. 2023, 1–23. [Google Scholar] [CrossRef]

- Borghesi, R.; Houston, J.F.; Naranjo, A. Corporate socially responsible investments: CEO altruism, reputation, and shareholder interests. J. Corp. Financ. 2014, 26, 164–181. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar]

- Broadstock, D.C.; Matousek, R.; Meyer, M.; Tzeremes, N.G. Does corporate social responsibility impact firms’ innovation capacity? The indirect link between environmental & social governance implementation and innovation performance. J. Bus. Res. 2019, 119, 99–110. [Google Scholar]

- Lin, B.; Li, B. The Impact of ESG Responsibility construction on Enterprise R&D Investment—From the Perspective of Resource Acquisition and Resource Allocation. Soft Science, 25 March 2023; pp. 1–12. [Google Scholar]

- Fan, S.; Huang, H.; Mbanyele, W.; Guo, Z.; Zhang, C. Inclusive green growth for sustainable development of cities in China: Spatiotemporal differences and influencing factors. Environ. Sci. Pollut. Res. 2023, 30, 11025–11045. [Google Scholar]

- Zhong, Y.; Zhao, H.; Yin, T. Resource Bundling: How Does Enterprise Digital Transformation Affect Enterprise ESG Development? Sustainability 2023, 15, 1319. [Google Scholar]

- DasGupta, R. Financial performance shortfall, ESG controversies, and ESG performance: Evidence from firms around the world. Financ. Res. Lett. 2022, 46, 102487. [Google Scholar]

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review. J. Bus. Ethics 2019, 167, 333–360. [Google Scholar]

- Zheng, M.; Feng, G.-F.; Jiang, R.-A.; Chang, C.-P. Does environmental, social, and governance performance move together with corporate green innovation in China? Bus. Strategy Environ. 2023, 32, 1670–1679. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar]

- Khanchel, I.; Lassoued, N.; Baccar, I. Sustainability and firm performance: The role of environmental, social and governance disclosure and green innovation. Manag. Decis. 2023, in press.

- Wang, Y. Digital Economy, Technical Innovation and China’s Green Total Factor Productivity Growth. Int. J. Comput. Intell. Syst. 2023, 16, 92. [Google Scholar] [CrossRef]

- Lyu, Y.; Wang, W.; Wu, Y.; Zhang, J. How does digital economy affect green total factor productivity? Evidence from China. Sci. Total Environ. 2023, 857, 159428. [Google Scholar]

- Zhang, M.; Li, B. How to design regional characteristics to improve green economic efficiency: A fuzzy-set qualitative comparative analysis approach. Environ. Sci. Pollut. Res. 2022, 29, 6125–6139. [Google Scholar] [CrossRef] [PubMed]

- Lyu, Y.; Wang, W.; Wu, Y.; Zhang, J. Digital economy development, industrial structure upgrading and green total factor productivity: Empirical evidence from China’s cities. Int. J. Environ. Res. Public Health 2022, 19, 2414. [Google Scholar]

- Tong, L.; Jabbour, C.J.C.; Najam, H.; Abbas, J. Role of environmental regulations, green finance, and investment in green technologies in green total factor productivity: Empirical evidence from Asian region. J. Clean. Prod. 2022, 380, 134930. [Google Scholar] [CrossRef]

- Wang, Z.; Yang, Y.; Wei, Y. Study on relationship between environmental regulation and green total factor productivity from the perspective of FDI—Evidence from China. Sustainability 2022, 14, 11116. [Google Scholar] [CrossRef]

- Jiakui, C.; Abbas, J.; Najam, H.; Liu, J.; Abbas, J. Green technological innovation, green finance, and financial development and their role in green total factor productivity: Empirical insights from China. J. Clean. Prod. 2023, 382, 135131. [Google Scholar] [CrossRef]

- Shao, W.; Yang, K.; Jin, Z. How the carbon emissions trading system affects green total factor productivity? A quasi-natural experiment from 281 Chinese cities. Front. Energy Res. 2023, 10, 895539. [Google Scholar]

- Li, Q. Regional Technological Innovation and Green Economic Efficiency Based on DEA Model and Fuzzy Evaluation. J. Intell. Fuzzy Syst. 2019, 37, 6415–6425. [Google Scholar] [CrossRef]