1. Introduction

In the modern world, in the conditions of rapid development of science, engineering, and technology, new technologies of innovative nature are rapidly emerging, leading to the transformation of the principles of economic activity [

1]. There are already such achievements in the world as knowing about human nature and the way business markets work.

At the same time, new products are being created with great frequency, where created products are improved in order to increase competitive advantages and in connection with the emergence of new market needs. New market needs and the sustainable development of organizations can provide the development and creation of new products.

In our opinion, such products should be innovative products. Innovative products are products that have technical characteristics that surpass those of competitors, and consumer properties and are oriented to meet both current and future needs at a high level [

2].

At the same time, at present, there is no methodological toolkit developed in practice that allows us to determine the characteristics of innovative products and which should be applied in practice when creating these products.

Today’s experience has shown that a stable economy is achieved through highly competitive products that form a new product market or fundamentally change the existing market [

3]. The advanced development organization, which sells the product on the market, turns out to be, for some time, practically a monopolist in this market, and the product itself is dominant. Based on these conditions, the stability of the organization arises. In order to maintain this stability, organizations need to update their products and not wait for the moment when the break-even point is reached.

The break-even point refers to the position of the enterprise in which the enterprise covers only its costs and produces a critical volume of output. The manufacturer does not need to wait for the break-even point to be reached, as the time to create innovative products is practically minimal in specific conditions. In this regard, it is necessary to determine the time lag when the break-even point is reached and by this time to realize the production of innovative products with competitive advantages compared to what was produced earlier.

The production of any product is determined by the level of development of production relations and the productive forces achieved in the organization [

4,

5]. At the same time, almost every organization seeks to improve the competitiveness of its products. Our research shows that the organization that has set this goal should be guided by the law of product competitiveness management.

The author’s interpretation of this law is as follows: the law of competitiveness management is an economic law that reflects the dependence of demand for goods on their competitive advantages created through innovation and supported by continuous implementation, which provides an increase in the life cycle of goods (services) and allows its production as long as the costs of maintaining competitive advantages are recouped, and the income from the sale of goods (services) provides sustainable growth for the main production and financial and economic activities of the organization. The application of this law allows a significant increase in the profit of the organization, as presented in

Figure 1.

The practical application of the model presented in

Figure 1 is to find the break-even point, which determines the range in which the detailed analysis of economic and technological parameters of products is carried out.

This approach is applicable to enterprises that actively develop and introduce innovative products into production in which the structure of costs for the formation of competitive advantages can be separately allocated from the costs of research and development, as well as the cost of implementing innovative technologies. In this case, R&D usually accounts for about one-third of the total costs incurred by the enterprise during the period of active competitiveness management, which can be clearly seen in

Figure 1.

Moreover, the growth of investments in applied scientific research at the initial stage, i.e., when the transition to new innovative products has not yet taken place, causes the break-even point to move to the right. This often discourages investors and often complicates the solution of organizational problems associated with the introduction of new technologies. However, after the introduction, the organization of serial production, including the total costs, is recouped faster due to the satisfaction of accumulated demand for innovative products and sufficiently competitive products. At this stage, the revenue curve takes the form of a downward convex line, and profits begin to accelerate.

Next, it is necessary to calculate the point of reaching such a volume of the output at which profit is maximized and total costs are minimized. After overcoming this point, in the conditions of the continued increase in output, the profitability of activities begins to fall. This is due to market saturation, the emergence of products—the analogs of competitors—hence the need for management decisions to update products or technologies used, change marketing tools, etc. In each case, the decision depends on the current situation, but the main thing is not to lose control, not to allow for a situation when the products become non-competitive and not in demand by the market.

This paper is organized as follows:

Section 1 justifies that, in practice, no methodological toolkit has been developed to identify the characteristics of intonation products.

Section 2 presents the methodology for assessing the technical level of the enterprise products.

Section 3 presents the results of the conducted study.

Section 4 discusses the problems of creating innovative products at the present stage.

Section 5 draws conclusions and proposes a methodological toolkit to effectively manage the creation and production of innovative products and their renewal.

2. Methods

The main problem in creating innovative products is that the production cycle of these products is usually quite long in time; therefore, there is a great risk that by the time these products reach the market, their technical and economic characteristics are largely obsolete [

6,

7]. To solve this problem, it is necessary to use an approach based on the design and creation of future products.

When designing products for the future, it is necessary to focus not only and not so much on existing product requirements and instead on the requirements that will be in the future. Of course, we cannot “look into the future”, but if the product design is focused on the advanced development of the organization, it is possible to predict future needs in the market.

In order to look into the future, we needed to build and define the technical and economic image of the product. It is built on the application of radically new methods and technologies of production, based on the use of the latest materials, in combination with processing methods; based on the application of new approaches in the organization of the production process, allowing them to reduce the cost of the created product, allows us to approach the balance “the price of the product—the possibilities of the buyer”.

According to the research results for innovative products, the main characteristics were:

- -

Technical characteristics that are significantly superior to the competitors’ offers available on the market;

- -

The product is applied for the first time for a more effective solution to certain tasks;

- -

The product is based on new achievements in science and technology;

- -

The compliance of price characteristics with the buyer’s capabilities;

- -

The ability to satisfy the current and future needs of customers while occupying a high market share.

The constructed product image makes it possible to create a digital twin of this product, which can be built on the basis of the following principles: scientific validity, tactical and technical feasibility, and technological feasibility.

Putting new highly competitive products into production starts with the analysis of main consumer expectations on the prospective technical and economic image of the created products as a result of which technical, economic, environmental, ergonomic, and other characteristics underly the creation of such products and are determined, as well as the requirements for the production of such products.

Taking into account that the majority of large manufacturers have diversified production facilities, in our opinion, building digital twins of each of the production facilities and the multilevel digitalization of the business processes of the organization allow us to approach the issue of building digital models and the formation of a digital twin of the entire organization based on a system of complex qualitative and quantitative target indicators required (desired) by all stakeholders, characterizing the production, economic and financial performance of the enterprise.

In order to solve the problem of whether the means of production of an enterprise allows it to produce innovative products, it is necessary to assess the technical level of production.

To assess the highest criterion, namely technological sovereignty (Ts), it is proposed that a sum of products of sub-criteria are used by a weight coefficient for each individual part of the product:

where

Cti is the number of mastered critical technologies out of the total amount required for the production of

i component part;

Mi—the specific amount of available domestic material in the total mass of

i component part;

Ci—the specific amount of available component parts out of the total number of component parts of

i component part;

Wi—weight coefficient of

i component part;

n—number of component parts in the product (product).

The final assessment of the technical and technological level of the enterprise is desirable to be unambiguous, or the decision-making process could drag on for an indefinite period of time while taking into account the above-described need to reduce dependence on imports, where delays are unacceptable. Therefore, this methodology offers certainty to the result of the assessment—obtaining an integral complex indicator, which also models the process of human decision-making in such a problem on the basis of available information and constraints for the possibility of subsequent use in the decision support system. The authors propose to confirm the obtained integral assessment in the following way. This method is often used in practice—in comparison with the obtained calculated data and an expert assessment based on the results of their visit to the enterprise. In the case of the convergence of estimates, we talk about the reliability of the obtained result.

The sequence of calculation for the integral complex indicator of the technical and technological level consists of an ascending and sequential calculation of aggregated indicators for the sub-criteria of the “tree of objectives” starting from the lowest level. For example, the integral indicator “equipment” (the level of the highest criteria) consists of three sub-criteria: “development”, “production”, and “testing” (the first level). In turn, the sub-criterion “production” consists of sub-criteria: “flexibility”, “processes”, “equipment” (second level), etc. For all aggregated level indicators, the rule was normalization in the range from 0 to 1.

The determination of weighting coefficients is carried out expertly at each of the levels, and it is advisable to have groups of specialists who determine the weight using pairwise comparison of sub-criteria.

To obtain an unambiguous assessment, each highest criterion (HC) should be reduced to the following form: 0 < HC ≤ 1.

The final formula for calculating the technical and technological level of the enterprise

(

Cr):

where

Wi represents the weighting coefficients determined by experts and taking into account the importance of each top criterion

The following interpretation of the obtained values of technical and technological level in the range of possible values is proposed:

0 < Cr ≤ 6:

0 < Cr ≤ 1—level indicating that the organization under consideration does not have any significant level or potential. Such an assessment is not typical for the high-tech knowledge-intensive enterprises under consideration, but it is possible if the company has no production facilities and is mainly engaged in intellectual activities.

0 < Cr ≤ 2—low level. Engaging an organization at this level is undesirable. If it is necessary to involve all existing enterprises in the production of import-substituting components, such an organization should give the lowest priority product for development.

1 < Cr ≤ 3—satisfactory level. The involvement of an organization at this level is possible. It should be noted that organizations with a satisfactory level are preferable to give products with a clear production technology that does not require significant resources in development. If it is necessary to involve all existing enterprises in the production of import-substituting components, such an organization should give the least priority product for development.

2 < Cr ≤ 4—medium level. Organizations at this level are capable of performing most tasks, including both product development and product staging. Some existing constraints prevent the most complex products from being transferred.

3 < Cr ≤ 5—high level. The high level allows the transfer of organizations to replenish retired imports for the most complex products that require creation and the development of new and advanced technologies.

4 < Cr ≤ 6—top tier. Organizations with the highest level are unique; they are drivers of growth. The authors suggest using such organizations to create or master critical and breakthrough technologies.

Level 3 and 4, achieved by the enterprise, corresponds to the fact that the enterprise has all the necessary conditions and resources to produce innovative products.

In previous studies, we evaluated the competitiveness of products and their ability to be attributed to innovative products, but we did not consider one of the important parameters of innovative products, namely the parameter of cost, and, in this case, under the parameter of cost we understand the tool that provides the design of products for a given value.

The idea of this approach is based on the concept of competitiveness as a certain ratio of price and quality. This study on the sales market allowed us to estimate the market “selling” price of the product, and by subtracting the desired profit from this price, we obtained the cost price of the product.

Thus, the purpose of designing for a given cost is to create competitiveness with a certain quality of the product, the cost of which is predetermined. This cost, together with specified design characteristics, becomes one of the fixed indicators.

In this classical approach, the finished product is evaluated on the basis of costs according to known cost indicators, and alternatives are similarly evaluated. In contrast to the current practice, in the design for a given value, the product is considered a set of elements for the completed technological chain (independent units or elements). The design of each node includes an assessment of its cost, i.e., economics is taken into account at an early stage of the design, and here both are adjusted, and the consideration of alternatives is allowed [

8].

In essence, designing for a given cost is considered a solution to the optimization problem, which consists of considering the design and technological solutions (CTS) according to the cost criterion and selecting a product variant that provides the minimum value of the production cost while maintaining quality indicators no lower than the specified minimum value. In this methodology, a node (element) is considered an independent product whose CTSs are not related to the entire technological chain.

Labor intensity, material intensity, and CTS complexities in justifying the appearance of the product, the development of the product taking into account the limitations of complexity, material intensity, and labor intensity are consecutively considered. If there is information about analogs (prototypes), it is considered to identify the potential of its modifications and the estimation of cost indicators. In conclusion, alternative variants are considered, and the best one is selected that meets all the requirements.

When estimating economic parameters, the concepts of labor intensity, material intensity, and the degree of complexity for the structural and technological appearance of the product are replaced by purely economic concepts—added value and rate of return.

If the final product is obtained by the consecutive processing of the initial material by n firms [

9], its final price can be represented by the following formula:

C+1—the cost of the product produced by the first enterprise, —the incremental cost of production received by the j-th enterprise when producing its products, αi—profit rate of the i-th enterprise.

If the rate of profit for all enterprises is the same and equal to

α, then the final price is equal to:

For the same technological chain in the case where n enterprises are included in the corporation, the price of the final product is as follows:

Let us determine the difference between

P and

Pk.

This difference is always non-negative in the case of α = 0, it is equal to 0, and in other cases, it is positive, i.e., the price of the final product is lower under corporate management.

Let us define the efficiency of the organization of enterprises into a corporation as the ratio of the reduction in the price of the final product to the price obtained in corporate activity.

Let all businesses bring in the same additional cost of production.

The presented data indicate that integration processes can contribute to an increase in the rate of the profit of enterprises depending on the number of participants who carry out consecutive redistribution by reducing the cost of the final product.

Having determined a given value that ensures its competitiveness in the market, the task of providing this value arises and can be achieved based on two solutions:

The optimization of design and technological parameters of products: reliability, durability, established tempering, fits, used materials, and components. We singled out the costliest of this direction—the acquisition of components (element-component base) at their cost to meet the specified cost of the product.

The determination of resources for their purchase.

We believe that due to the complexity of the set tasks, the diversity of management subjects, and the need to evaluate investments according to several criteria, it is advisable to use all three known groups of algorithms to select investment objects: absolute priority algorithms, direct priority algorithms, and inverse priority algorithms.

Absolute priority algorithms, in this case, are priorities that do not depend on a required (declared) amount of resources and are determined, as a rule, on the basis of available data, in particular, past experience. If the distribution of financing in k directions when forming the investment budget in the past period (

x1,

x2, …,

xk), the priorities of the directions are calculated by the formula:

The resource allocation is determined by the formula:

where

Si—declared amount of financing;

γ—a parameter determined from the equation.

In direct priority algorithms, the priority of the direction of resource use is proportional to the size of the request for the amount of investment. Further, a number of fundamentally indistinguishable sequences of resource allocation according to the principle of proportional allocation (cutbacks) can be used. The allocation of resources is carried out according to the formula

The disadvantage of the whole group in direct prioritization algorithms is the inflated requirements for the volume of investment resources, which are not always justified. The authors [

10] revealed a tendency to increase the declared resources depending on the import substitution project being implemented.

In the algorithms of inverse priorities, the priority form is in inverse proportion to the declared volume of investment resources; that is, there is clear information about the criterion for assessing the public effectiveness of the project, as well as the necessary value of this criterion. This calculation was carried out according to Formula (15).

The allocation of the resource is carried out according to the formula:

where

γ—parameter determined from the equation:

The undoubted advantage of this algorithm is the ability to optimize the amount of allocated resources when achieving the target indicator of economic efficiency.

The reverse priority algorithm, in our opinion, should be used as the main one when forming programs for attracting investment resources. In addition, it allows us to apply the method of prioritizing investment projects, known as “cost-effectiveness”. The essence of this method consists of the ordering of measures by decreasing efficiency and the construction of an aggregated curve of “cost-effectiveness”, which reflects the maximum effect that can be obtained by allocating a certain number of resources [

11].

The constructed cost-effectiveness curve allows a number of problems to be solved. Thus, it can be used to solve the problems of competitiveness, in particular, to suppress competitors. In this case, the target value of the Eo effect was known, which was necessary to drive competitors out of the market, and the graph determines the minimum level of Ro funding with the corresponding set of measures, representing the optimal set of measures formed according to the target indicator “victory over competitors” (see

Figure 3).

In this approach, the key condition is that any investment project or integrated program can be financed from different sources. In particular, when the financial resources of a particular investor are limited. The subject of the investment process can be attracted only at that stage (or set of projects) when the efficiency curve, on the one hand, does not exceed the budget constraints (Ro) and, on the other hand, shows an acceptable level for him. In the future, this project will be financed from other sources, in particular, state budget funds [

12].

This algorithm complies with all the principles of project analysis. This is especially important for us in the visualization of the entire project and consideration of two variants—with and without the project from different positions: investor, society, state, etc. In this case, each aspect of the project is considered from the perspective of the investor, society, state, etc. In this case, each aspect represents a formalized criterion of effectiveness [

13]. This approach can be used in hierarchical management systems when the target criteria changes depending on the level of management: enterprise, subject of the federation, or national economy.

The algorithm of construction for the aggregate curve of “cost-effectiveness” is simple [

14]. The order is as follows: at the first stage, the points of the curve corresponding to the packages of projects obtained by the successive addition of projects in descending order of their efficiency are marked; in

Figure 3, these are points A1, A2, and A3.

For multi-criteria analysis, curves are constructed according to the criterion “cost-effectiveness”, clearly representing the process of maximizing the given indicator criteria of efficiency (

Figure 4). The presented figure demonstrates a linear–proportional relationship between the profit and stability of the organization; the higher the profit, the higher the stability of the organization.

In this figure, the upper curve shows the dependence of profit on resources when maximizing the profit criterion; the lower curve reflects the dependence of profit on resources when maximizing the volume of output, the middle curve—the dependence of profit—when maximizing the criterion of reducing payments for the use of attractive resources. This figure shows the area of scattering of criterion values at optimization, in this case—the maximization—of different criteria. Graphical representation provides an opportunity to view all possible options and choose an acceptable solution [

15].

In this case, one of the most important tools to achieve the economic development of the organization is the development of service business models based on the peculiarities of the organization and application in practice. In the current conditions, there is a scheme of production and its realization, either directly to the consumer or through an intermediary in some cases, which stipulates after-sales service and warranty repair [

16,

17,

18,

19]. When applying the service business model, the manufacturer does not transfer the product into the ownership of the consumer and sets a fee for its operation and all the services that he provides to the consumer during the operation of the product.

The manufacturer receives income not only from the explication of the delivered product by the consumer but also from the supply of consumables, with the repair using its spare parts, the supply of necessary materials for various types of maintenance, and the modernization of the product during its operation, etc. This gives the possibility of a long period of receiving the income part from different sources and the possibility of leveling the income part based on the decrease in income from one activity and the increase in income from another. This will be more for the life cycle of the product, and the more the manufacturer is interested in this, the more he will support the duration of this cycle in every possible way, with more competitive advantages of the delivered product and the greater income he will receive from this product.

Studies of creation and application in the practice of service business models have shown that they are created with the purpose of increasing the economic efficiency of the organization’s activity on the basis of creating its specific advantages in the sales markets, as well as through the provision of a wide range of quality services in all areas of application in the product’s operation [

19,

20,

21]. Using the obtained significant revenues, the product supplier can direct them to the creation of product upgrades with highly competitive advantages in the market, which creates permanent conditions for the supplier’s dominance in the sales market.

These service business models can be created for a specific product, including organizations and groups of companies, which in each case builds its policy on the creation of service business services [

9,

22]. As research has shown, the practical application of service business models by various organizations is an effective way to increase their economic sustainability. The essence of this consists of obtaining an organization of increasing profits depending on the expansion of service services and guaranteeing the provision of uninterrupted and highly efficient work for the entire period of the product life cycle.

Another important point is the possibility of optimizing costs and reducing losses in the event of various factors that are related to the impact that the service business model has on the organization due to the diverse implementation of service services both within the framework of one customer and all others that the organization provides with its product. This mechanism of creating an economic effect, in this case, is explained as follows. Since the financial and economic activity of the organization is subject to various factors, such as external and internal risks, the proposed scheme of the application of service business models with the use of different consumption patterns and the dynamic response of the supplier to the challenges of an external and internal environment can minimize the total losses of the organization for one type of delivered product at the expense of which there is an increase in the revenue part of other types of delivered products, which certainly leads to the economic sustainability of the organization [

22,

23]. At the same time, a reduction in the fixed costs of the organization at the development of service business models is possible due to the transfer and optimization of various functions of management alongside the regulation of relations with suppliers of consumables, components, and spare parts. The regulation of supply prices on the basis of long-term contracts also reduces costs. Another factor that reduces costs is the deep monitoring and forecasting of market needs, setting the terms of renewal and market entry of products with high consumer properties.

All these tasks can be solved with the help of an intelligent management system [

2,

24]. This system should be developed on the basis of artificial intelligence and big data processing methods, which have multifunctional capabilities at different stages of the product life cycle. Such a system should produce multivariate solutions, which decision makers should use can carry out the development of measures to improve the service models of sales in the market and, at the same time, decide on the creation of specific product advantages or the development and production of new products. An important function of such a system is to manage the renewal of supplied products and services taking into account the evolution of needs on the basis of initial data on changes in consumer orientation and obtaining recommendations for improving products, the product life cycle, competitive advantages, and the dominance of products on the basis of service models in the market over a long period of time, which certainly creates conditions for the sustainable and stable development of the organization.

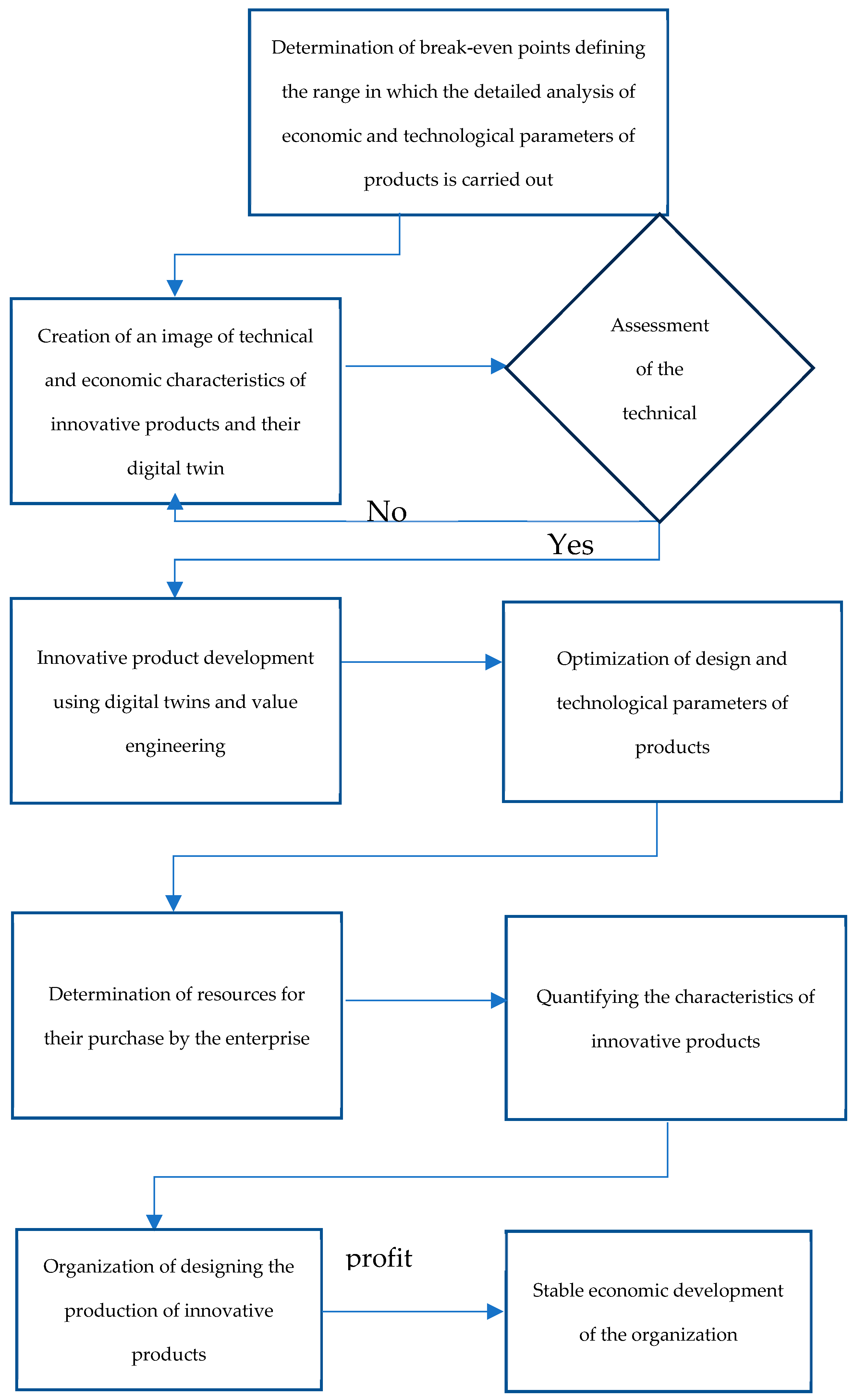

Based on the developed tools, we formed an algorithm for the methodological toolkit to manage the formation of the technical and economic characteristics of such products. This methodological toolkit is formed from the tools presented in

Figure 5.

It should be noted that, as a result of tests of the prototype of innovative products conducted in the virtual environment on its digital twin, a decision could be made to change the technical and economic characteristics of the developed products. In this case, a return to the third stage of the described algorithm could be realized. This cycle can be repeated an unlimited number of times until the business achieves the goal of developing a competitive and radically new product.