The Influence of Environmental Protection Tax Law on Urban Land Green Use Efficiency in China: The Nonlinear Moderating Effect of Tax Rate Increase

Abstract

:1. Introduction

2. Policy Background and Research Hypotheses

2.1. Policy Background

2.2. Theoretical Analysis and Research Hypotheses

2.2.1. Impact of EPTL on Urban LGUE

2.2.2. Impact Mechanism of EPTL on Urban LGUE

2.2.3. Moderating Effects of Tax Rate Increases

3. Research Design

3.1. Measurement Model

3.1.1. Measurement Model of Urban LGUE

3.1.2. Econometrics Model

3.2. Variable Selection

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Control Variables

3.3. Data Description

4. Empirical Results

4.1. Baseline Regression Results

4.2. Robustness Tests

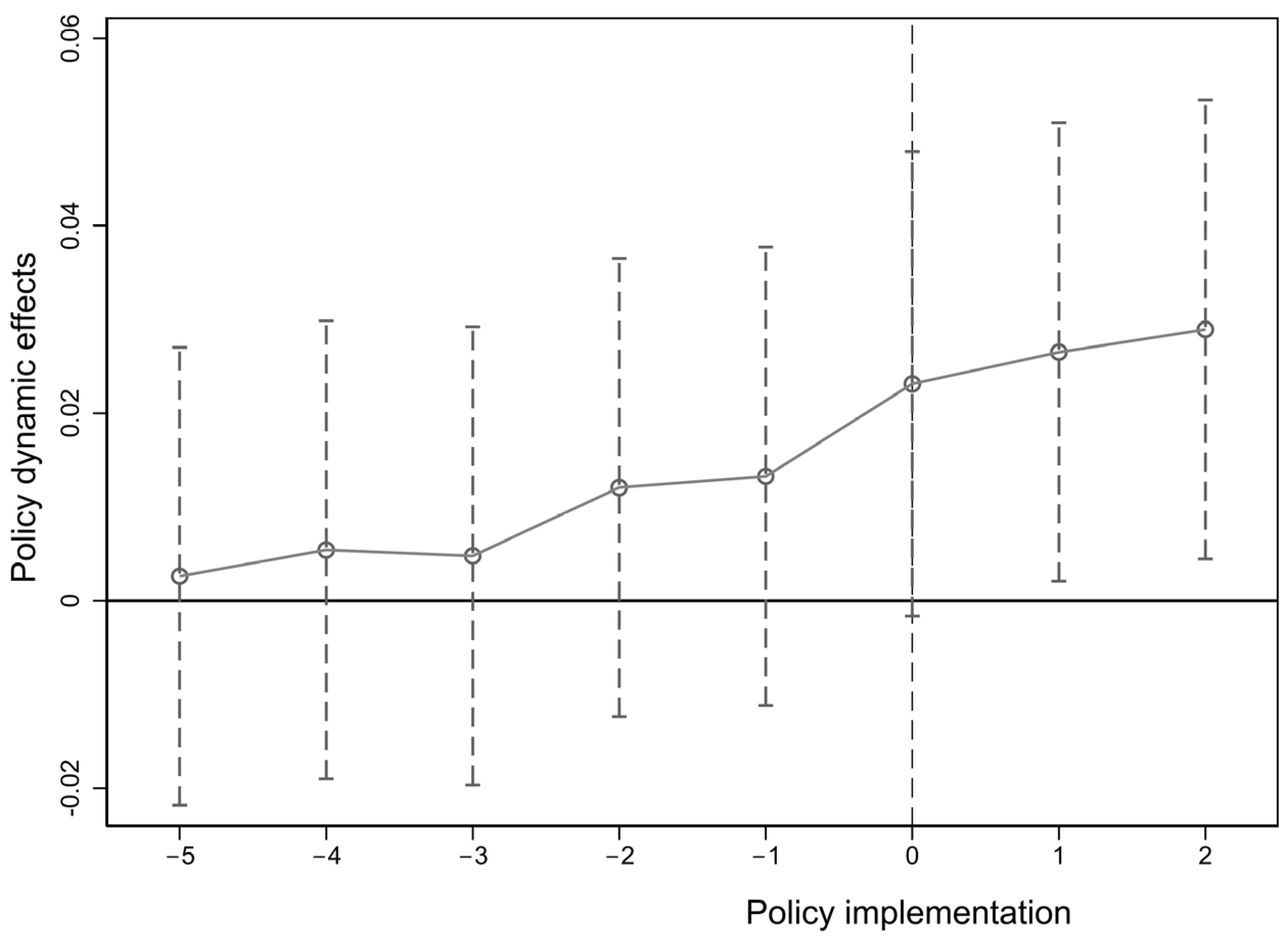

4.2.1. Parallel Trends Test and Dynamic Effects Analysis

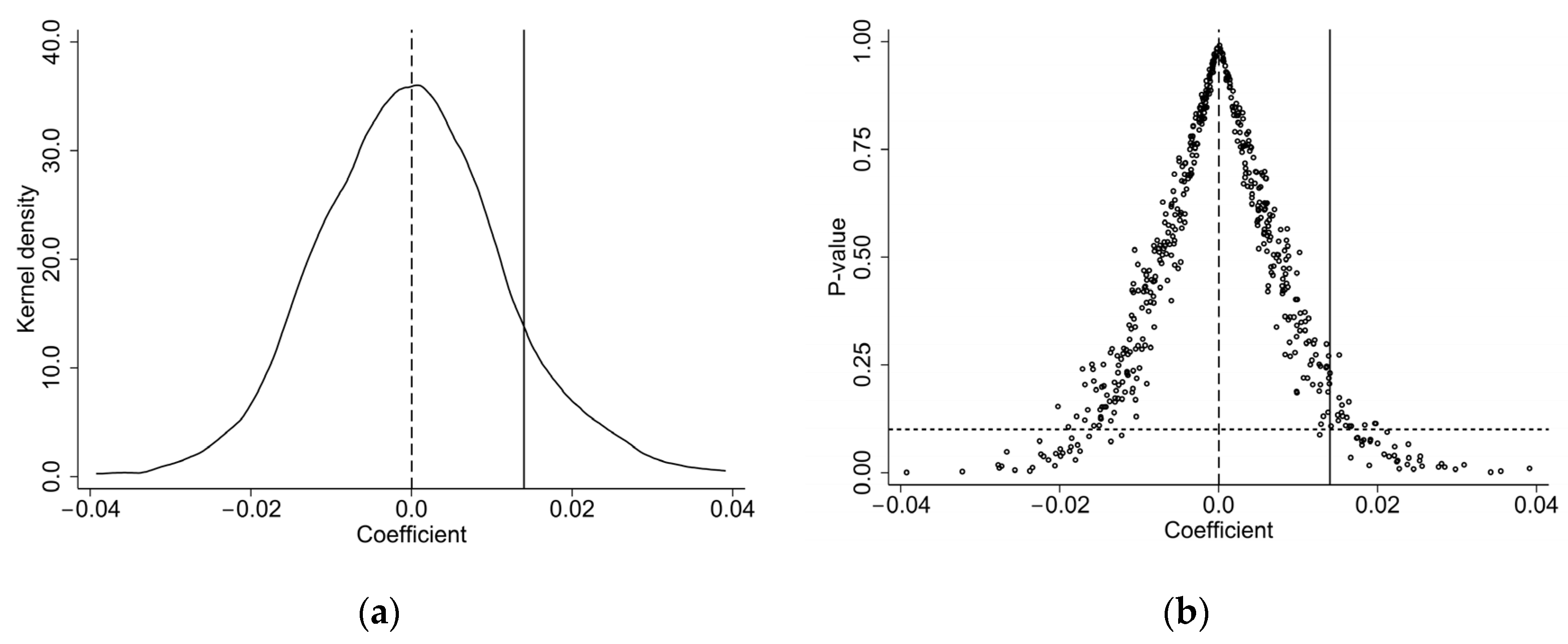

4.2.2. Placebo Tests

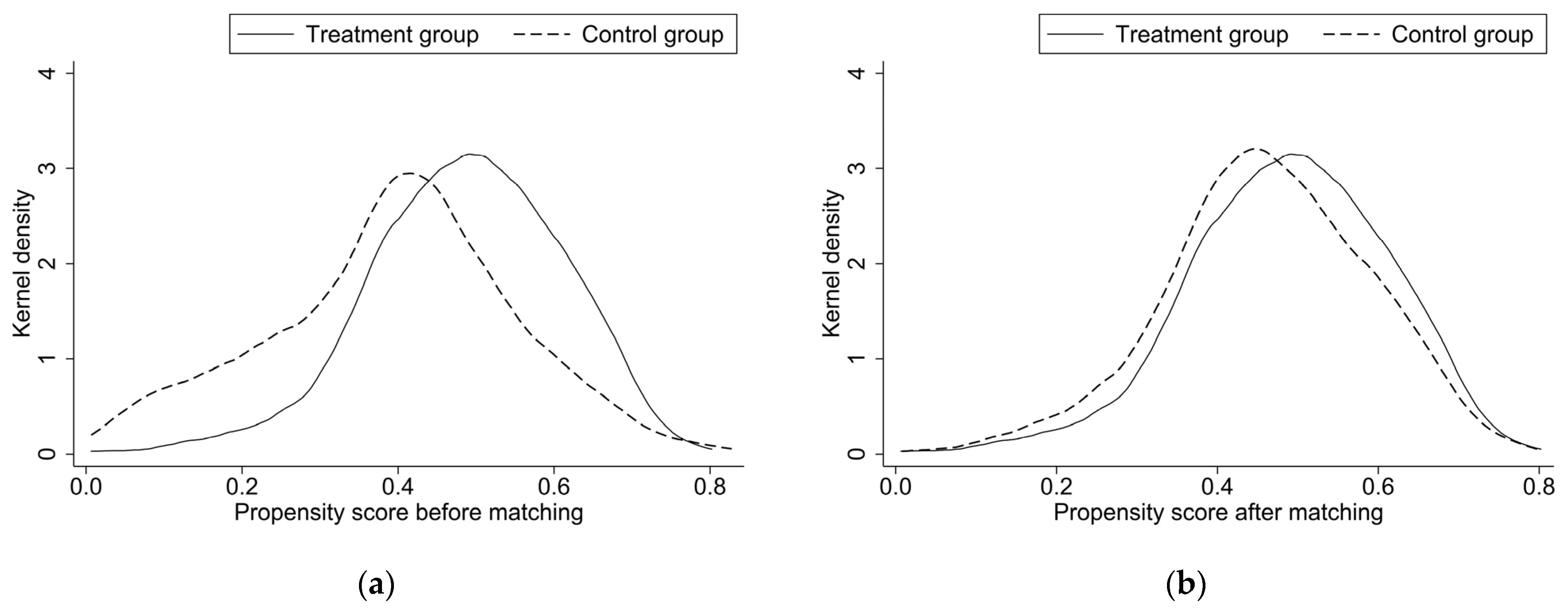

4.2.3. Propensity Score Matching and Difference-in-Differences (PSM-DID)

4.3. Impact Mechanism Analysis

4.4. Moderating Effect of Tax Rate Increase

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wu, H.; Fang, S.; Zhang, C.; Hu, S.; Nan, D.; Yang, Y. Exploring the impact of urban form on urban land use efficiency under low-carbon emission constraints: A case study in China’s Yellow River Basin. J. Environ. Manag. 2022, 311, 114866. [Google Scholar] [CrossRef]

- Liu, J.; Feng, H.; Wang, K. The low-carbon city pilot policy and urban land use efficiency: A policy assessment from China. Land 2022, 11, 604. [Google Scholar] [CrossRef]

- Xu, N.; Zhao, D.; Zhang, W.; Zhang, H.; Chen, W.; Ji, M.; Liu, M. Innovation-driven development and urban land low-carbon use efficiency: A policy assessment from China. Land 2022, 11, 1634. [Google Scholar] [CrossRef]

- Wang, Z.; Fu, H.; Liu, H.; Liao, C. Urban development sustainability, industrial structure adjustment, and land use efficiency in China. Sustain. Cities Soc. 2023, 89, 104338. [Google Scholar] [CrossRef]

- Wang, J.; Wang, K.; Shi, X.; Wei, Y.M. Spatial heterogeneity and driving forces of environmental productivity growth in China: Would it help to switch pollutant discharge fees to environmental taxes? J. Clean. Prod. 2019, 223, 36–44. [Google Scholar] [CrossRef]

- Zhang, Q.; Yu, Z.; Kong, D. The real effect of legal institutions: Environmental courts and firm environmental protection expenditure. J. Environ. Econ. Manag. 2019, 98, 102254. [Google Scholar] [CrossRef]

- Gao, X.; Liu, N.; Hua, Y. Environmental Protection Tax Law on the synergy of pollution reduction and carbon reduction in China: Evidence from a panel data of 107 cities. Sustain. Prod. Consum. 2022, 33, 425–437. [Google Scholar] [CrossRef]

- Wang, J.; Zhang, X. Land-based urbanization in China: Mismatched land development in the post-financial crisis era. Habitat Int. 2022, 125, 102598. [Google Scholar] [CrossRef]

- Zhao, A.; Wang, J.; Sun, Z.; Guan, H. Environmental taxes, technology innovation quality and firm performance in China—A test of effects based on the Porter hypothesis. Econ. Anal. Policy 2022, 74, 309–325. [Google Scholar] [CrossRef]

- Tiba, S.; Omri, A. Literature survey on the relationships between energy, environment and economic growth. Renew. Sustain. Energy Rev. 2017, 69, 1129–1146. [Google Scholar] [CrossRef]

- Pigou, A.C. The Economics of Welfare, 4th ed.; Macmillan and Co.: London, UK, 1932. [Google Scholar]

- Tullock, G. Excess benefit. Water Resour. Res. 1967, 3, 643–644. [Google Scholar] [CrossRef]

- Pearce, D. The role of carbon taxes in adjusting to global warming. Econ. J. 1991, 101, 938–948. [Google Scholar] [CrossRef]

- Baumol, W.J.; Oates, W.E. The use of standards and prices for protection of the environment. In The Economics of Environment, 1st ed.; Bohm, P., Kneese, V.A., Eds.; Palgrave Macmillan: London, UK, 1971; pp. 53–65. [Google Scholar]

- Morley, B. Empirical evidence on the effectiveness of environmental taxes. Appl. Econ. Lett. 2012, 19, 1817–1820. [Google Scholar] [CrossRef]

- Goulder, L.H. Environmental taxation and the double dividend: A reader’s guide. Int. Tax Public Financ. 1995, 2, 157–183. [Google Scholar] [CrossRef]

- Rybak, A.; Joostberens, J.; Manowska, A.; Pielot, J. The impact of environmental taxes on the level of greenhouse gas emissions in Poland and Sweden. Energies 2022, 15, 4465. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B. Environmental policy and ‘double dividend’in a transitional economy. Energy Policy 2019, 134, 110947. [Google Scholar] [CrossRef]

- Bovenberg, A.L.; Goulder, L.H. Costs of environmentally motivated taxes in the presence of other taxes: General equilibrium analyses. Natl. Tax J. 1997, 50, 59–87. [Google Scholar] [CrossRef]

- Bhat, A.A.; Mishra, P.P. Evaluating the performance of carbon tax on green technology: Evidence from India. Environ. Sci. Pollut. Res. 2020, 27, 2226–2237. [Google Scholar] [CrossRef]

- Hu, B.; Dong, H.; Jiang, P.; Zhu, J. Analysis of the applicable rate of environmental tax through different tax rate scenarios in China. Sustainability 2020, 12, 4233. [Google Scholar] [CrossRef]

- Fullerton, D.; Leicester, A.; Smith, S. Environmental Taxes; National Bureau of Economic Research: Cambridge, MA, USA, 2008; Available online: https://www.nber.org/papers/w14197 (accessed on 1 June 2023).

- Lee, S.; Chewpreecha, U.; Pollitt, H.; Kojima, S. An economic assessment of carbon tax reform to meet Japan’s NDC target under different nuclear assumptions using the E3ME model. Environ. Econ. Policy Stud. 2018, 20, 411–429. [Google Scholar] [CrossRef]

- Aydin, C.; Esen, Ö. Reducing CO2 emissions in the EU member states: Do environmental taxes work? J. Environ. Plan. Manag. 2018, 61, 2396–2420. [Google Scholar] [CrossRef]

- Dong, K.; Shahbaz, M.; Zhao, J. How do pollution fees affect environmental quality in China? Energy Policy 2022, 160, 112695. [Google Scholar] [CrossRef]

- Ji, S.; Jiang, F.; Li, J.; Wang, Y.; Zhang, W. Assessment of the performances of pollutant discharge fee in China. Ecol. Indic. 2021, 125, 107468. [Google Scholar] [CrossRef]

- Wang, H.; Mamingi, N.; Laplante, B.; Dasgupta, S. Incomplete enforcement of pollution regulation: Bargaining power of Chinese factories. Environ. Resour. Econ. 2003, 24, 245–262. [Google Scholar] [CrossRef]

- Liu, G.; Sun, W.; Kong, Z.; Dong, X.; Jiang, Q. Did the pollution charge system promote or inhibit innovation? Evidence from Chinese micro-enterprises. Technol. Forecast. Soc. Change 2023, 187, 122207. [Google Scholar] [CrossRef]

- Zhao, X.; Yin, H.; Zhao, Y. Impact of environmental regulations on the efficiency and CO2 emissions of power plants in China. Appl. Energy 2015, 149, 238–247. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. The emissions reduction effect and technical progress effect of environmental regulation policy tools. J. Clean. Prod. 2017, 149, 191–205. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Wang, Z.; Li, J. The heterogeneous relationship between pollution charges and enterprise green technology innovation, based on the data of Chinese industrial enterprises. Energies 2022, 15, 1663. [Google Scholar] [CrossRef]

- Shi, H.; Qiao, Y.; Shao, X.; Wang, P. The effect of pollutant charges on economic and environmental performances: Evidence from Shandong Province in China. J. Clean. Prod. 2019, 232, 250–256. [Google Scholar] [CrossRef]

- Xiao, B.; Niu, D.; Guo, X.; Xu, X. The impacts of environmental tax in China: A dynamic recursive multi-sector CGE model. Energies 2015, 8, 7777–7804. [Google Scholar] [CrossRef]

- Li, P.; Lin, Z.; Du, H.; Feng, T.; Zuo, J. Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J. Environ. Manag. 2021, 295, 113112. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Xia, F.; Zhang, B. Can raising environmental tax reduce industrial water pollution? Firm-level evidence from China. Environ. Impact Assess. Rev. 2023, 101, 107155. [Google Scholar] [CrossRef]

- Guo, B.; Wang, Y.; Zhou, H.; Hu, F. Can environmental tax reform promote carbon abatement of resource-based cities? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. 2022, 1–13. [Google Scholar] [CrossRef] [PubMed]

- Wang, L.; Ma, P.; Song, Y.; Zhang, M. How does environmental tax affect enterprises’ total factor productivity? Evidence from the reform of environmental fee-to-tax in China. J. Clean. Prod. 2023, 413, 137441. [Google Scholar] [CrossRef]

- He, X.; Jing, Q. The influence of environmental tax reform on corporate profit margins—Based on the empirical research of the enterprises in the heavy pollution industries. Environ. Sci. Pollut. Res. 2023, 30, 36337–36349. [Google Scholar] [CrossRef] [PubMed]

- He, L.; Chen, K. Can China’s “tax-for-fee” reform improve water performance–evidence from Hebei province. Sustainability 2021, 13, 13854. [Google Scholar] [CrossRef]

- Su, H.; Yang, S. Spatio-Temporal Urban Land Green Use Efficiency under Carbon Emission Constraints in the Yellow River Basin, China. Int. J. Environ. Res. Public Health 2022, 19, 12700. [Google Scholar] [CrossRef] [PubMed]

- Tang, Y.; Wang, K.; Ji, X.; Xu, H.; Xiao, Y. Assessment and spatial-temporal evolution analysis of urban land use efficiency under green development orientation: Case of the Yangtze River Delta urban agglomerations. Land 2021, 10, 715. [Google Scholar] [CrossRef]

- Tan, S.; Hu, B.; Kuang, B.; Zhou, M. Regional differences and dynamic evolution of urban land green use efficiency within the Yangtze River Delta, China. Land Use Policy 2021, 106, 105449. [Google Scholar] [CrossRef]

- Xie, H.; Chen, Q.; Lu, F.; Wang, W.; Yao, G.; Yu, J. Spatial-temporal disparities and influencing factors of total-factor green use efficiency of industrial land in China. J. Clean. Prod. 2019, 207, 1047–1058. [Google Scholar] [CrossRef]

- Xie, R.; Yao, S.; Han, F.; Zhang, Q. Does misallocation of land resources reduce urban green total factor productivity? An analysis of city-level panel data in China. Land Use Policy 2022, 122, 106353. [Google Scholar] [CrossRef]

- Deng, S. Exploring the relationship between new-type urbanization and sustainable urban land use: Evidence from prefecture-level cities in China. Sustain. Comput. Inform. Syst. 2021, 30, 100446. [Google Scholar] [CrossRef]

- Wang, P.; Shao, Z.; Wang, J.; Wu, Q. The impact of land finance on urban land use efficiency: A panel threshold model for Chinese provinces. Growth Change 2021, 52, 310–331. [Google Scholar] [CrossRef]

- Ge, K.; Zou, S.; Ke, S.; Chen, D. Does urban agglomeration promote urban land green use efficiency? Take the Yangtze River Economic Zone of China as an example. Sustainability 2021, 13, 10527. [Google Scholar] [CrossRef]

- Porter, M.E. America’s green strategy. Sci. Am. 1991, 264, 168. [Google Scholar] [CrossRef]

- Zhang, X.; Lu, X.; Chen, D.; Zhang, C.; Ge, K.; Kuang, B.; Liu, S. Is environmental regulation a blessing or a curse for China’s urban land use efficiency? Evidence from a threshold effect model. Growth Change 2021, 52, 265–282. [Google Scholar] [CrossRef]

- Wu, J.; Tal, A. From pollution charge to environmental protection tax: A comparative analysis of the potential and limitations of China’s new environmental policy initiative. J. Comp. Policy Anal. Res. Pract. 2018, 20, 223–236. [Google Scholar] [CrossRef]

- Shi, X.; Jiang, Z.; Bai, D.; Fahad, S.; Irfan, M. Assessing the impact of green tax reforms on corporate environmental performance and economic growth: Do green reforms promote the environmental performance in heavily polluted enterprises? Environ. Sci. Pollut. Res. 2023, 30, 56054–56072. [Google Scholar] [CrossRef] [PubMed]

- Yu, H.; Liao, L.; Qu, S.; Fang, D.; Luo, L.; Xiong, G. Environmental regulation and corporate tax avoidance: A quasi-natural experiments study based on China’s new environmental protection law. J. Environ. Manag. 2021, 296, 113160. [Google Scholar] [CrossRef]

- Peng, M.; Wei, C.; Jin, Y.; Ran, H. Does the Environmental Tax Reform Positively Impact Corporate Environmental Performance? Sustainability 2023, 15, 8023. [Google Scholar] [CrossRef]

- Tang, P.; Yang, S.; Yang, S. How to design corporate governance structures to enhance corporate social responsibility in China’s mining state-owned enterprises? Resour. Policy 2020, 66, 101619. [Google Scholar] [CrossRef]

- Singhania, M.; Saini, N. Demystifying pollution haven hypothesis: Role of FDI. J. Bus. Res. 2021, 123, 516–528. [Google Scholar] [CrossRef] [PubMed]

- Chen, M.; Wang, Q.; Bai, Z.; Shi, Z.; Meng, P.; Hao, M. Green land use efficiency and influencing factors of resource-based cities in the Yellow River Basin under carbon emission constraints. Buildings 2022, 12, 551. [Google Scholar] [CrossRef]

- You, J.; Ding, G.; Zhang, L. Heterogeneous dynamic correlation research among industrial structure distortion, two-way FDI and carbon emission intensity in China. Sustainability 2022, 14, 8988. [Google Scholar] [CrossRef]

- Liu, Q.; Lu, Y. Firm investment and exporting: Evidence from China’s value-added tax reform. J. Int. Econ. 2015, 97, 392–403. [Google Scholar] [CrossRef]

- Wang, X.; Su, Z.; Mao, J. How does haze pollution affect green technology innovation? A tale of the government economic and environmental target constraints. J. Environ. Manag. 2023, 334, 117473. [Google Scholar] [CrossRef]

- Huang, S.; Lin, H.; Zhou, Y.; Ji, H.; Zhu, N. The influence of the policy of replacing environmental protection fees with taxes on enterprise green innovation—Evidence from China’s heavily polluting industries. Sustainability 2022, 14, 6850. [Google Scholar] [CrossRef]

- Niu, S.; Luo, X.; Yang, T.; Lin, G.; Li, C. Does the Low-Carbon City Pilot Policy Improve the Urban Land Green Use Efficiency? —Investigation Based on Multi-Period Difference-in-Differences Model. Int. J. Environ. Res. Public Health 2023, 20, 2704. [Google Scholar] [CrossRef] [PubMed]

| Layer of Criteria | Layer of Factors | Layer of Indicators | Unit |

|---|---|---|---|

| inputs | labor | number of employees at the end of the year | km2 |

| land | area of built districts | 104 persons | |

| capital | total investment in fixed assets of the whole society | 108 CNY | |

| outputs | economic benefits | GDP | 108 CNY |

| environmental benefits | green coverage rate of built districts | % | |

| unexpected outputs | carbon emissions | ton | |

| industrial so2 emissions | ton | ||

| industrial soot emissions | ton | ||

| industrial waste water | 104 tons |

| Variable | N | Mean | S.D. | Minimum | Maximum |

|---|---|---|---|---|---|

| 2502 | 0.656 | 0.158 | 0.254 | 1.125 | |

| 2502 | 10.745 | 0.556 | 9.007 | 13.056 | |

| 2502 | 0.206 | 0.099 | 0.081 | 0.625 | |

| 2502 | 0.039 | 0.043 | 0.003 | 0.232 | |

| 2502 | 0.035 | 0.017 | 0.013 | 0.111 | |

| 2502 | 0.879 | 0.075 | 0.618 | 0.994 |

| (1) | (2) | |

|---|---|---|

| 0.024 * (0.006) | 0.014 * (0.005) | |

| control variables | no | yes |

| constant term | yes | yes |

| time fixed effect | yes | yes |

| individual fixed effect | yes | yes |

| sample size | 2502 | 2502 |

| (1) | (2) | |

|---|---|---|

| 0.024 * (0.006) | 0.015 * (0.005) | |

| control variables | no | yes |

| constant term | yes | yes |

| time fixed effect | yes | yes |

| individual fixed effect | yes | yes |

| sample size | 2452 | 2452 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| 0.145 * (0.027) | 0.001 (0.001) | −0.012 * (0.003) | 0.011 * (0.002) | |

| control variables | yes | yes | yes | yes |

| constant term | yes | yes | yes | yes |

| time fixed effect | yes | yes | yes | yes |

| individual fixed effect | yes | yes | yes | yes |

| sample size | 2502 | 2502 | 2502 | 2502 |

| (1) | (2) | |

|---|---|---|

| 0.026 * (0.010) | 0.032 * (0.010) | |

| −0.019 * (0.004) | −0.020 * (0.004) | |

| control variables | no | yes |

| constant term | yes | yes |

| time fixed effect | yes | yes |

| individual fixed effect | yes | yes |

| sample size | 2502 | 2502 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peng, C.; Zhao, L.; Liu, L.; Chen, J. The Influence of Environmental Protection Tax Law on Urban Land Green Use Efficiency in China: The Nonlinear Moderating Effect of Tax Rate Increase. Sustainability 2023, 15, 12431. https://doi.org/10.3390/su151612431

Peng C, Zhao L, Liu L, Chen J. The Influence of Environmental Protection Tax Law on Urban Land Green Use Efficiency in China: The Nonlinear Moderating Effect of Tax Rate Increase. Sustainability. 2023; 15(16):12431. https://doi.org/10.3390/su151612431

Chicago/Turabian StylePeng, Cheng, Lu Zhao, Liwen Liu, and Jia Chen. 2023. "The Influence of Environmental Protection Tax Law on Urban Land Green Use Efficiency in China: The Nonlinear Moderating Effect of Tax Rate Increase" Sustainability 15, no. 16: 12431. https://doi.org/10.3390/su151612431

APA StylePeng, C., Zhao, L., Liu, L., & Chen, J. (2023). The Influence of Environmental Protection Tax Law on Urban Land Green Use Efficiency in China: The Nonlinear Moderating Effect of Tax Rate Increase. Sustainability, 15(16), 12431. https://doi.org/10.3390/su151612431