The Impact of Green Organizational Capabilities on Competitive Advantage of Construction Enterprises in Vietnam: The Mediating Role of Green Innovation

Abstract

1. Introduction

2. Literature Review

3. Theoretical Framework and Hypothesis Development

3.1. Green Organizational Capabilities

3.2. Green Innovation

3.3. Competitive Advantage

3.4. Hypothesis Development

3.4.1. The Impact of Green Organizational Capabilities on Competitive Advantage

3.4.2. The Mediating Role of Green Innovation on the Relationship between Green Organizational Capabilities and Competitive Advantage

4. Methodology

4.1. Data Collection

4.2. Variables Measurement

4.3. Analytical Techniques

5. Empirical Results

5.1. Testing the Reliability of the Scale

5.2. Exploratory Factor Analysis (EFA)

5.2.1. First Factor Analysis Results

5.2.2. Second Factor Analysis Results

5.3. Chartered Financial Analysis (CFA)

Second-Order Variable Evaluation

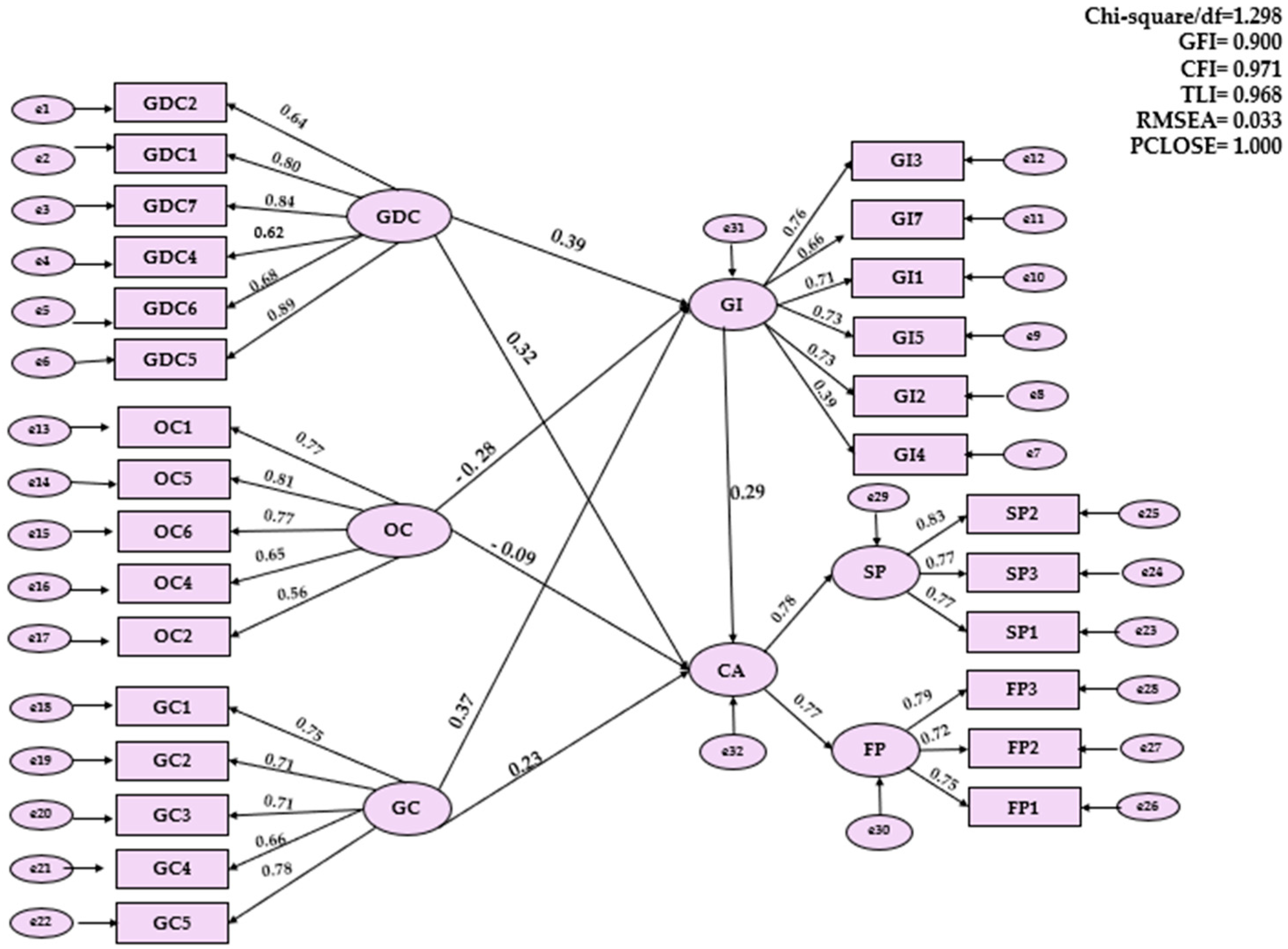

5.4. Structural Equation Model (SEM) Analysis

6. Conclusions

7. Contributions and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Collis, D.J. Research note: How valuable are organizational capabilities? Strateg. Manag. J. 1994, 15, 143–152. [Google Scholar] [CrossRef]

- Chen, Y.S. The driver of green innovation and green image–green core competence. J. Bus. Ethics 2008, 81, 531–543. [Google Scholar] [CrossRef]

- Fei, J.; Wang, Y.; Yang, Y.; Chen, S.; Zhi, Q. Towards Eco-city: The Role of Green Innovation. Energy Procedia 2016, 104, 165–170. [Google Scholar] [CrossRef]

- Chang, C.H. The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Chiou, T.Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Awan, U.; Sroufe, R.; Kraslawski, A. Creativity enables sustainable development: Supplier engagement as a boundary condition for the positive effect on green innovation. J. Clean. Prod. 2019, 226, 172–185. [Google Scholar] [CrossRef]

- Kuo, S.Y.; Lin, P.C.; Lu, C.S. The effects of dynamic capabilities, service capabilities, competitive advantage, and organizational performance in container shipping. Transp. Res. Part A Policy Pract. 2017, 95, 356–371. [Google Scholar] [CrossRef]

- Ministry of Industry and Trade. National State of the Environment Report. Hanoi, Vietnam. 2021. Available online: https://pcd.monre.gov.vn/Data/files/2023/03/20230217_Bao%20cao%20HTMT%20quoc%20gia%20nam%202021.pdf (accessed on 11 June 2023).

- Hang, T.T.T. The relationship between green supply chain management and firm performance: Case of Vietnamese construction enterprises. J. Econ. Dev. 2022, 303, 145–155. [Google Scholar]

- Rossini, M.; Costa, F.; Tortorella, G.L.; Portioli-Staudacher, A. The interrelation between Industry 4.0 and lean production: An empirical study on European manufacturers. Int. J. Adv. Manuf. Technol. 2019, 102, 3963–3976. [Google Scholar] [CrossRef]

- Quintana-García, C.; Benavides-Chicón, C.G.; Marchante-Lara, M. Does a green supply chain improve corporate reputation? Empirical evidence from European manufacturing sectors. Ind. Mark. Manag. 2021, 92, 344–353. [Google Scholar] [CrossRef]

- Gold, A.H.; Malhotra, A.; Segars, A.H. Knowledge management: An organizational capabilities perspective. J. Manag. Inf. Syst. 2001, 18, 185–214. [Google Scholar] [CrossRef]

- Spanos, Y.E.; Prastacos, G. Understanding organizational capabilities: Towards a conceptual framework. J. Knowl. Manag. 2004, 8, 31–43. [Google Scholar] [CrossRef]

- Jacobides, M.G. The architecture and design of organizational capabilities. Ind. Corp. Chang. 2006, 15, 151–171. [Google Scholar] [CrossRef]

- Yu, W.; Ramanathan, R.; Nath, P. The impacts of marketing and operations capabilities on financial performance in the UK retail sector: A resource-based perspective. Ind. Mark. Manag. 2014, 43, 25–31. [Google Scholar] [CrossRef]

- Amoako-Gyampah, K.; Boakye, K.G.; Famiyeh, S.; Adaku, E. Supplier integration, operational capability and firm performance: An investigation in an emerging economy environment. Prod. Plan. Control 2020, 31, 1128–1148. [Google Scholar] [CrossRef]

- Ali, Z.; Zwetsloot, I.M.; Nada, N. An empirical study to explore the interplay of Managerial and Operational capabilities to infuse organizational innovation in SMEs. Procedia Comput. Sci. 2019, 158, 260–269. [Google Scholar] [CrossRef]

- Winter, S.G. Understanding dynamic capabilities. Strateg. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef]

- Lin, Y.H.; Chen, Y.S. Determinants of green competitive advantage: The roles of green knowledge sharing, green dynamic capabilities, and green service innovation. Qual. Quant. 2017, 51, 1663–1685. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lin, Y.H.; Lin, C.Y.; Chang, C.W. Enhancing green absorptive capacity, green dynamic capacities and green service innovation to improve firm performance: An analysis of structural equation modeling (SEM). Sustainability 2015, 7, 15674–15692. [Google Scholar] [CrossRef]

- Qiu, L.; Jie, X.; Wang, Y.; Zhao, M. Green product innovation, green dynamic capability, and competitive advantage: Evidence from Chinese manufacturing enterprises. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 146–165. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chang, T.W.; Lin, C.Y.; Lai, P.Y.; Wang, K.H. The influence of proactive green innovation and reactive green innovation on green product development performance: The mediation role of green creativity. Sustainability 2016, 8, 966. [Google Scholar] [CrossRef]

- Begum, S.; Ashfaq, M.; Xia, E.; Awan, U. Does green transformational leadership lead to green innovation? The role of green thinking and creative process engagement. Bus. Strategy Environ. 2022, 31, 580–597. [Google Scholar] [CrossRef]

- Malik, M.S.; Ali, K.; Kausar, N.; Chaudhry, M.A. Enhancing environmental performance through green hrm and green innovation: Examining the mediating role of green creativity and moderating role of green shared vision. Pak. J. Commer. Soc. Sci. 2021, 15, 265–285. [Google Scholar]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Protogerou, A.; Caloghirou, Y.; Lioukas, S. Dynamic capabilities and their indirect impact on firm performance. Ind. Corp. Chang. 2012, 21, 615–647. [Google Scholar] [CrossRef]

- Ahmed, M.U.; Kristal, M.M.; Pagell, M. Impact of operational and marketing capabilities on firm performance: Evidence from economic growth and downturns. Int. J. Prod. Econ. 2014, 154, 59–71. [Google Scholar] [CrossRef]

- Koufteros, X.A.; Vonderembse, M.A.; Doll, W.J. Integrated product development practices and competitive capabilities: The effects of uncertainty, equivocality, and platform strategy. J. Oper. Manag. 2002, 20, 331–355. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chang, C.H. The determinants of green product development performance: Green dynamic capabilities, green transformational leadership, and green creativity. J. Bus. Ethics 2013, 116, 107–119. [Google Scholar] [CrossRef]

- Amabile, T.M. A model of creativity and innovation in organizations. Res. Organ. Behav. 1988, 10, 123–167. [Google Scholar]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Huang, J.W.; Li, Y.H. Green Innovation and Performance: The View of Organizational Capability and Social Reciprocit. J. Bus. Ethics 2015, 145, 309–324. [Google Scholar] [CrossRef]

- Song, W.; Yu, H. Green Innovation Strategy and Green Innovation: The Roles of Green Creativity and Green Organizational Identity. Corp. Soc. Responsib. Environ. Manag. 2017, 25, 135–150. [Google Scholar] [CrossRef]

- Lai, S.B.; Wen, C.T.; Chen, Y.S. The Exploration of the Relationship between the Environmental Pressure and the Corporate Competitive Advantage. In Proceedings of the CSMOT Academic Conference, National Chiao Tung University, Hsin-Chu, Taiwan, 8–9 December 2003. [Google Scholar]

- Khan, S.J.; Kaur, P.; Jabeen, F.; Dhir, A. Green process innovation: Where we are and where we are going. Bus. Strategy Environ. 2021, 30, 3273–3296. [Google Scholar] [CrossRef]

- Porter, M.E. Industry structure and competitive strategy: Keys to profitability. Financ. Anal. J. 1980, 36, 30–41. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Peteraf, M.A.; Bergen, M.E. Scanning dynamic competitive landscapes: A market-based and resource-based framework. Strateg. Manag. J. 2003, 24, 1027–1041. [Google Scholar] [CrossRef]

- Schilke, O. On the contingent value of dynamic capabilities for competitive advantage: The nonlinear moderating effect of environmental dynamism. Strateg. Manag. J. 2014, 35, 179–203. [Google Scholar] [CrossRef]

- Speed, R.J. Oh Mr Porter! A re-appraisal of competitive strategy. Mark. Intell. Plan. 1989, 7, 8–11. [Google Scholar] [CrossRef]

- Saragih, J.; Tarigan, A.; Pratama, I.; Wardati, J.; Silalahi, E.F. The impact of total quality management, supply chain management practices and operations capability on firm performance. Pol. J. Manag. Stud. 2020, 21, 384–397. [Google Scholar] [CrossRef]

- Zollo, M.; Winter, S.G. Deliberate learning and the evolution of dynamic capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef]

- Drnevich, P.L.; Kriauciunas, A.P. Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance. Strateg. Manag. J. 2011, 32, 254–279. [Google Scholar] [CrossRef]

- Peng, M.W.; York, A.S. Behind intermediary performance in export trade: Transactions, agents, and resources. J. Int. Bus. Stud. 2001, 32, 327–346. [Google Scholar] [CrossRef]

- Wu, L.Y. Applicability of the resource-based and dynamic-capability views under environmental volatility. J. Bus. Res. 2010, 63, 27–31. [Google Scholar] [CrossRef]

- Lai, F.; Li, D.; Wang, Q.; Zhao, X. The Information Technology Capability of Third-Party Logistics Providers: A Resource-Based View and Empirical Evidence from China. J. Supply Chain Manag. 2008, 44, 22–38. [Google Scholar] [CrossRef]

- Mikalef, P.; Krogstie, J.; Pappas, I.O.; Pavlou, P. Exploring the relationship between big data analytics capability and competitive performance: The mediating roles of dynamic and operational capabilities. Inf. Manag. 2020, 57, 103169. [Google Scholar] [CrossRef]

- Lavie, D. The competitive advantage of interconnected firms: An extension of the resource-based view. Acad. Manag. Rev. 2006, 31, 638–658. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Stalk, G. Time—The Next Source of Competitive Advantage. 1988. Available online: https://gente.itam.mx/oromero/OK_Time_The_Next_Source_of_Competitive_Advantage.pdf (accessed on 11 June 2023).

- Im, S.; Montoya, M.M.; Workman, J.P., Jr. Antecedents and consequences of creativity in product innovation teams. J. Prod. Innov. Manag. 2013, 30, 170–185. [Google Scholar] [CrossRef]

- Zameer, H.; Wang, Y.; Yasmeen, H. Reinforcing green competitive advantage through green production, creativity and green brand image: Implications for cleaner production in China. J. Clean. Prod. 2020, 247, 119119. [Google Scholar] [CrossRef]

- Ferreira, J.; Cardim, S.; Branco, F. Dynamic capabilities, marketing and innovation capabilities and their impact on competitive advantage and firm performance. In Proceedings of the 13th Iberian Conference on Information Systems and Technologies (CISTI), Caceres, Spain, 13–16 June 2018; pp. 1–7. [Google Scholar]

- Rosenberg, N. Innovation and Economic Growth; OECD Publishing: Paris, France, 2006. [Google Scholar]

- Yuniarty, Y.; Prabowo, H.; Abdinagoro, S. The role of effectual reasoning in shaping the relationship between managerial-operational capability and innovation performance. Manag. Sci. Lett. 2021, 11, 305–314. [Google Scholar] [CrossRef]

- Sun, Y.; Bi, K.; Yin, S. Measuring and integrating risk management into green innovation practices for green manufacturing under the global value chain. Sustainability 2020, 12, 545. [Google Scholar] [CrossRef]

- Yousaf, Z. Go for green: Green innovation through green dynamic capabilities: Accessing the mediating role of green practices and green value co-creation. Environ. Sci. Pollut. Res. 2021, 28, 54863–54875. [Google Scholar] [CrossRef] [PubMed]

- Singh, S.K.; Del Giudice, M.; Chiappetta Jabbour, C.J.; Latan, H.; Sohal, A.S. Stakeholder pressure, green innovation, and performance in small and medium-sized enterprises: The role of green dynamic capabilities. Bus. Strategy Environ. 2022, 31, 500–514. [Google Scholar] [CrossRef]

- Anderson, N.; Potočnik, K.; Zhou, J. Innovation and creativity in organizations: A state-of-the-science review, prospective commentary, and guiding framework. J. Manag. 2014, 40, 1297–1333. [Google Scholar] [CrossRef]

- Baron, R.A.; Tang, J. The role of entrepreneurs in firm-level innovation: Joint effects of positive affect, creativity, and environmental dynamism. J. Bus. Ventur. 2011, 26, 49–60. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- Orsato, R.J. Competitive environmental strategies: When does it pay to be green? Calif. Manag. Rev. 2006, 48, 127–143. [Google Scholar] [CrossRef]

- Berrone, P. Green keys to unlock competitive advantage. ISIE Insight 2009, 2, 50–57. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Zafar, A.U.; Appolloni, A. Does the interaction between the knowledge management process and sustainable development practices boost corporate green innovation? Bus. Strategy Environ. 2021, 30, 4206–4222. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. An Introduction to Structural Equation Modeling. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook; Springer: Cham, Switzerland, 2021; pp. 1–29. [Google Scholar]

- Reuter, C.; Foerstl, K.A.I.; Hartmann, E.V.I.; Blome, C. Sustainable global suppliermanagement: The role of dynamic capabilities in achieving competitive advantage. J. Supply Chain Manag. 2010, 46, 45–63. [Google Scholar] [CrossRef]

- Nasifoglu Elidemir, S.; Ozturen, A.; Bayighomog, S.W. Innovative behaviors, employee creativity, and sustainable competitive advantage: A moderated mediation. Sustainability 2020, 12, 3295. [Google Scholar] [CrossRef]

- Čolaković, A.; Hadžialić, M. Internet of Things (IoT): A review of enabling technologies, challenges, and open research issues. Comput. Netw. 2018, 144, 17–39. [Google Scholar] [CrossRef]

| Green Organizational Capabilities | |

|---|---|

| Operational Capability (referred from Wu et al. (2010) [47] with adjustments) | |

| OC1 | Has an information system facilitating cooperation across functions. |

| OC2 | Has formal procedures facilitating teamwork across functions. |

| OC3 | Continuously standardizes production and working processes. |

| OC4 | Controls the inputs and outputs of products easily and quickly. |

| OC5 | Continuously reduces waste and variance. |

| OC6 | Always ensures to hand over the work to partners in accordance with agreements. |

| Green Dynamic Capability (referred from Qiu et al. (2020) [21] with adjustments) | |

| GDC1 | Will incorporate the knowledge and competence of suppliers into regulating impacts on the environment. |

| GDC2 | Will receive consultation from environmental experts in evaluating and designing green products. |

| GDC3 | Will engage in restructuring to concentrate on environmental sustainability. |

| GDC4 | Will realign its relationships with suppliers to mitigate the environmental pollution caused by its products. |

| GDC5 | Can timely understand and master the support policies related to green development. |

| GDC6 | Can timely keep abreast of and respond to industry green technology changes. |

| GDC7 | Can timely keep abreast of customers’ green needs to adapt to market changes. |

| Green Creativity (referred from Chen & Chang (2013) [30] with adjustments) | |

| GC1 | Company employees suggest new ways to achieve environmental goals. |

| GC2 | Company employees propose new green ideas to improve environmental performance. |

| GC3 | Company employees promote and champion new green ideas to colleagues. |

| GC4 | Company employees implement green ideas into a comprehensive plan. |

| GC5 | Company employees would find creative solutions to environmental problems. |

| Green Innovation (referred from Chen et al. (2006) [32] with adjustments) | |

| GI1 | Chooses the materials to produce the least amount of pollution for conducting the product development or design. |

| GI2 | Uses the fewest amounts of materials to comprise the product for conducting the product development or design. |

| GI3 | Deliberate whether the product is easy to recycle, reuse, and decompose for conducting the product development or design. |

| GI4 | Has a manufacturing process that effectively reduces the emission of hazardous substances or waste. |

| GI5 | Has an operating process that reduces the consumption of water, electricity, coal, etc. |

| GI6 | Has an operating process that reduces the use of raw materials. |

| GI7 | Has an operating process that uses renewable energy. |

| Competitive Advantage (Schilke, 2014) [41] | |

| Strategic Performance | |

| SP1 | Has a cost advantage over its competitors. |

| SP2 | Provide a better quality of products or services. |

| SP3 | Has a large market share. |

| Financial Performance | |

| FP1 | ROI |

| FP2 | ROS |

| FP3 | EBIT |

| Factors | Number of Items | Cronbach’s Alpha | The Smallest Corrected Item-Total Correlation | |

|---|---|---|---|---|

| Before | After | |||

| OC | 6 | 5 | 0.834 | 0.509 |

| GDC | 7 | 7 | 0.874 | 0.580 |

| GC | 5 | 5 | 0.837 | 0.597 |

| GI | 7 | 6 | 0.865 | 0.596 |

| SP | 3 | 3 | 0.833 | 0.687 |

| FP | 3 | 3 | 0.798 | 0.621 |

| Estimate | S.E. | C.R. | p | |||

|---|---|---|---|---|---|---|

| SP | ← | CA | 1.000 | |||

| FP | ← | CA | 1.016 | 0.138 | 7.348 | 0.000 |

| Hypothesis | Relationship | Estimate | S.E. | p | Results |

|---|---|---|---|---|---|

| H1a | CA ← OC | −0.087 | 0.062 | 0.276 | Rejected |

| H1b | CA ← GDC | 0.318 | 0.095 | 0.003 | Accepted |

| H1c | CA ← GC | 0.226 | 0.084 | 0.030 | Accepted |

| H2a | GI ← OC | −0.283 | 0.039 | 0.000 | Rejected |

| CA ← GI | 0.290 | 0.148 | 0.031 | ||

| H2b | GI ← GDC | 0.386 | 0.060 | 0.000 | Accepted |

| CA ← GI | 0.290 | 0.148 | 0.031 | ||

| H2c | GI ← GC | 0.368 | 0.053 | 0.000 | Accepted |

| CA ← GI | 0.290 | 0.148 | 0.031 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, X.H.; Nguyen, K.L.; Nguyen, T.V.H.; Nguyen, T.T.H.; Ta, V.L. The Impact of Green Organizational Capabilities on Competitive Advantage of Construction Enterprises in Vietnam: The Mediating Role of Green Innovation. Sustainability 2023, 15, 12371. https://doi.org/10.3390/su151612371

Nguyen XH, Nguyen KL, Nguyen TVH, Nguyen TTH, Ta VL. The Impact of Green Organizational Capabilities on Competitive Advantage of Construction Enterprises in Vietnam: The Mediating Role of Green Innovation. Sustainability. 2023; 15(16):12371. https://doi.org/10.3390/su151612371

Chicago/Turabian StyleNguyen, Xuan Hung, Khanh Linh Nguyen, Thi Van Ha Nguyen, Thi Thanh Huyen Nguyen, and Van Loi Ta. 2023. "The Impact of Green Organizational Capabilities on Competitive Advantage of Construction Enterprises in Vietnam: The Mediating Role of Green Innovation" Sustainability 15, no. 16: 12371. https://doi.org/10.3390/su151612371

APA StyleNguyen, X. H., Nguyen, K. L., Nguyen, T. V. H., Nguyen, T. T. H., & Ta, V. L. (2023). The Impact of Green Organizational Capabilities on Competitive Advantage of Construction Enterprises in Vietnam: The Mediating Role of Green Innovation. Sustainability, 15(16), 12371. https://doi.org/10.3390/su151612371