Abstract

Environmental performance is extremely vital for sustainable growth in China, and the impact of a regional integration policy plays an important role in improving environmental performance. However, current studies are weak in causal inference, and firm-level evidence is lacking. As a result, taking the Outline of the Pearl River Delta Reform and Development Plan as a quasi-natural experiment, with propensity score matching and difference-in-differences methods, this paper investigates the effect of regional integration on firms’ environmental performance. Our empirical results show that regional integration can significantly improve corporate environmental performance; specifically, the regional integration will result in an increase in the output value, of 46.7%, 22.3%, and 68.1% per unit emission of sulfur dioxide (SO2), industrial wastewater (WATER), and industrial smoke and dust (SD). Moreover, the impact of regional integration differs across different industries. For SO2, the impact of regional integration is greater for the petroleum processing, coking and nuclear fuel processing industries, and special equipment manufacturing; in terms of WATER, the impact is much higher in the tobacco products industry and printing and the reproduction of recording media industry; for SD, the petroleum processing, coking, and nuclear fuel processing industries are highly impacted. Finally, this impact also differs for core and peripheral cities. For policy implications, first, regional integration policies are highly recommended, and China is implementing regional integration in the Beijing–Tianjin–Hebei area and Yangtze River Delta, and these policies should be enhanced for other areas. Second, to maximize the effect of regional integration, the government needs to combine regional industrial structural characteristics to formulate industrial and environmental policies.

1. Introduction

With continuously substantial growth for the last forty years, China has become the second largest economy in the world. The economic growth in China is mainly driven by high capital input and low labor cost; this growth path is featured by a low resource allocation efficiency, which causes high consumption of resources and energy. As a result, environmental issues emerge along with the economic growth in China, including air pollution and industrial waste pollution. At the early stage of Chinese economic reforms, economic performance was the priority of the Chinese government. Nowadays, to maintain sustainable growth, environmental performance has become extremely vital for the Chinese economy and society.

Regional integration has been proved to have a significant impact on environmental performance in prior studies [1,2,3,4]. Regional integration usually refers to urban agglomerations; it indicates the free flow of factors within a region through all-around cooperation [5,6]. Numerous studies use the price method to measure the degree of regional integration, which is also referred to as market integration. With provincial data, some scholars found that market integration significantly reduced environmental pollution [3], especially for sulfur dioxide (SO2), smoke and dust, and suspended particles (PM2.5), and the same impact was also found for CO2 emission performance [1]. With provincial data, evidence showed that market integration significantly improved ecological efficiency [7], and industrial agglomeration exerted a positive externality on environmental efficiency [8]. From the perspective of urban agglomerations, a positive correlation between market integration and green innovation is found [9]. Some scholars further employed samples with city-level data, e.g., an inverted U-shaped relationship is proved between market integration and the emission intensities of sulfur dioxide, industrial wastewater, and industrial smoke and dust [10], and market integration promoted regional green growth [11]. In addition, some researchers employed the spatial Gini coefficient to present economic agglomeration, and they showed that economic agglomeration had a significant effect on haze pollution, carbon emission intensity, and environmental pollution [12,13,14].

Regarding current studies on regional integration and environmental performance, there may exist several weaknesses. First, the traditional gravity model, econometric models, and price approaches are used to measure regional economic integration, but the regional integration process cannot be well reflected by these methods; thus, the causal inference can hardly be identified with them. Second, prior research usually used provincial or city-level data, and firm-level evidence is lacking. However, as the entity of pollutant emissions, the behavior of firms cannot be ignored. Finally, in terms of corporate environmental performance, current studies generally employ the Environmental, Social, and Governance (ESG) rating and environmental social responsibility index [15,16,17]. These ratings are composed indexes and cannot reveal the real pollutant emission of firms. As a result, in this paper, taking the Outline of the Pearl River Delta Reform and Development Plan (OPRDRDP) as a quasi-natural experiment, with Propensity Score Matching and the Differences-in-Differences method (PSM–DID), this paper attempts to investigate the impact of regional integration on corporate environmental performance.

This paper contributes to the current literature in the following aspects. First, previous literature generally used a composite index to present regional integration [4,8,13,14]; however, these indexes are quite subjective. To better identify the causal inference, we employ the Outline of the Pearl River Delta Reform and Development Plan as a quasi-natural experiment to measure regional integration. The OPRDRDP aims at integrating the market and stimulating the industrial agglomerations, and this policy can be taken as an exogenous shock on environmental performance. Second, most existing studies have estimated the impact of regional integration on environmental performance at the national level, regional level, and city level [1,2,3,4]. However, firm-level environmental performance has rarely been investigated. This paper focus on corporate environmental performance; meanwhile, unlike the ESG rating and environmental social responsibility index, we directly employ pollutant emissions, including industrial sulfur dioxide emissions (SO2), industrial wastewater (WATER), and industrial smoke and dust emissions (SD). Finally, this paper further investigates the heterogeneity of firms, which has been ignored in current literature since regional and city-level data are used. More specifically, industrial and regional heterogeneities are considered, which provides a more comprehensive understanding of the relationship between regional integration and environmental performance.

The remainder of this paper is organized as follows: Section 2 provides a brief review of the relevant literature and hypotheses development. The measures of the variables and model specifications are provided in Section 3. Section 4 analyzes the empirical results. Section 5 verifies the robustness of our model. Section 6 concludes.

2. Literature Review and Theoretical Analysis

2.1. Literature Review

Some scholars show that environmental regulation has a great impact on environmental performance [18]. State-owned enterprises have better environmental performance in China [4]. The new Ambient Air Quality Standard policy also significantly promotes the improvement of corporate environmental performance [19]. Command-based environmental regulations had a positive impact on corporate environmental performance, while the impact of market-based environmental regulations was relatively weak [20].

Most studies regarding the relationship between regional integration and environmental performance are based on regional data. With a provincial dataset, evidence shows that regional integration was positively correlated with energy and CO2 emissions performance because regional integration encourages competition [1], and firms are motivated to invest in more research and development on energy efficiency, and the CO2 marginal abatement cost was shown to be positively correlated with regional economic integration [6]. With data of 48 counties of Wuhan in China, some scholars prove that regional integration reduced carbon emission due to knowledge and technology spillovers in environmental protection and enhanced environmental regulation [11]. Extending to 1967 districts and counties, the impact of the Removing Counties and Establishing Districts reform (RCED) in China has been investigated [21], and the findings are in line with prior studies [11,22,23], and the carbon emissions reduction was higher in the energy-intensive sectors of YREB [24]. MDA8O3 concentrations increased in the Yangtze River Delta (YRD) [10], the ambient PM2.5 concentration generally decreased over the YRD, and PM2.5 concentration was also negatively impacted in the Beijing–Tianjin–Hebei urban agglomeration (BTH), but the PM2.5 reduction efficiency was found to be relatively low in the YREB, and the provincial integration of YREB in China significantly reduced water pollution [12,25]. By examining the Yangtze River urban agglomeration in Jiangsu Province in China, the environmental governance performance generally improved [22], but the gap among cities remained significant [24,26,27]. Large gaps of environmental efficiency also exist in the BTH urban agglomeration [28]. Based on the dynamic spatial panel Durbin model, an inverted U-shaped relationship is found between regional integration and the emission intensities of three pollutants, i.e., sulfur dioxide, industrial wastewater, and industrial smoke and dust, because regional integration allows factor free flow and will then strengthen the emission reduction effect of technological innovation [20]. Moreover, regional integration is conducive to improving the efficiency of energy use, and energy efficiency is conducive to emission reductions. These results were also proved by previous studies [4,29], but this nonlinear relationship did not hold for soot emission. Using the panel data of 285 cities in China from 2004 to 2018, Chen et al. (2022) explored the impact of regional integration on urban environmental performance is explored [11], evidence showed that regional integration had a positive impact on urban environmental performance because of the economies of scale effect, industrial composition effect, and knowledge spillover effects, and this relationship also exists in the YRD [30].

To our knowledge, most studies employ a firm-level composed index of an environmental rating to measure environmental performance, but this kind of index cannot directly reflect the situation of pollutant emission. Some literature regarding the relationship between regional integration and environmental performance applies pollutant-based measures; however, these studies generally use region-level data, including provinces and cities, and they ignore the heterogeneity of firms. This paper attempts to investigate the impact of regional integration on firms’ environmental performance, and we directly use firms’ pollutant emissions to measure corporate environmental performance. Furthermore, the heterogeneity of firms will also be considered.

2.2. Theoretical Analysis

This paper combines industrial agglomeration theory, resource-based theory, and political connection theory to explain the mechanism by which regional integration affects the corporate environmental performance.

First, the essence of regional integration lies in the agglomeration of different industries in different areas based on their comparative advantages. Industrial agglomeration was widely studied [31,32,33], indicating that the scale effect originated from some specific industrial agglomerations. When a specific industry is agglomerated in a specific area, the whole transportation cost will be reduced, and all firms from this industry can share the social network, which will decrease the marginal cost of firms located in this area, and then, the firms’ productivity will be improved. Diversification also accounts for urbanization economics; it indicates that infrastructure will be improved with the industrial diversification in cities, all firms will benefit from these infrastructures, and the production cost will decrease. Meanwhile, firms from different industries can cooperate with each other; then, the resources will be optimally allocated. As a result, the corporate environmental performance will be improved.

Second, the resource-based theory suggests that firms generate a competitive advantage by acquiring a large number of heterogeneous resources [34]. The important feature of regional integration also lies in the heterogeneous resource differences between central and peripheral cities. Firms in the core city have a competitive advantage in the utilization of environmental technologies, while firms in the peripheral cities have a competitive advantage in processing and manufacturing. Both advantages are important drivers of firms’ environmental performance provision. Increased regional integration will further enhance these heterogeneous competitive advantages of firms, thereby improving the environmental performance of firms in the region [35].

Finally, from the perspective of political connection, regional integration reduces the opportunities for firms to gain privileges through political connection [36]. Particularly in government-dominated developing countries such as China, a large number of firms try to gain immunity from pollution control by establishing links with the government [37]. As regional integration deepens, all kinds of factors will flow freely, and the profits from privileges gained through political connections will be gradually compressed, leading to an improvement in the environmental performance of firms in the region.

Based on the above analysis, this paper points out that deeper regional integration enhances firms’ environmental performance through the mechanisms of promoting industrial agglomeration, enhancing heterogeneous comparative advantages, and weakening political connection.

3. Model Specifications and Measurement of Variables

3.1. PSM–DID Method

Difference-in-Differences (DID) is the most used method in policy evaluation [38,39], but sample selection bias can greatly reduce the effectiveness of DID. To overcome the above shortcomings, this paper uses the propensity score matching (PSM) method to match the treated group with a more effective control group, thereby reducing the adverse effect of sample selection bias on the reliability of the estimated results [40,41].

First, this paper uses the PSM method to match control groups for each firm impacted by the regional integration policy. The probability function for firm i to be impacted by the regional integration policy can be specified as follows:

where pi denotes the probability for firm i entering the treatment group, and Zi denotes a series covariates affecting the probability pi. Then, we matched the control group for each treatment group firm by the following equation:

where denotes the propensity score of firm i in treated group, and denotes the propensity score of firm i in the untreated group. If the difference between and is within the matching radius r, then firm i is placed in the control group.

Subsequently, this paper constructs the following PSM–DID model to estimate the impact of the regional integration policy on corporate environmental performance:

where cepi,t denotes the corporate environmental performance of firm i in year t, dui,t denotes the treated group dummy, and dti,t denotes the policy year dummy. dui,t × dti,t sdenotes whether the regional integration policy is implemented, and β3 reflects the net impact of regional integration on corporate environmental performance. Xi,t denotes a set of control variables. and denote time- and industry-fixed effects, and denotes error term.

3.2. Measurement of Variables

The dependent variable is corporate environmental performance (cep), which is measured by the natural logarithm of the industrial output value per unit of a firm’s pollutant emissions. Meanwhile, the impact on the amount of pollutant emissions is also explored. This paper selects three types of common pollutants, i.e., industrial sulfur dioxide emissions (SO2), industrial wastewater (WATER), and industrial smoke and dust emissions (SD). Due to missing values, chemical oxygen demand emissions (COD), ammonia nitrogen emissions (TAN), and nitrogen oxygen emissions (NOx) are excluded from our sample. The treated group dummy is denoted as du, which is equal to 1 if the city where the firm is located is affected by the regional integration policy. The regional integration policy year dummy is denoted as dt; it equals 1 if the year is after 2008 since the regional integration policy was implemented in 2008. Following prior studies [1,2,3,4,42], a number of control variables were selected in this paper, including city-level control variables and firm-level control variables: city size (lncitysize), industrial structure (is), economic development (lnpgdp), innovation capacity (lninn), information communication technology (lnict). We also control some firm-level variables: firm’s size (lnsize), ownership of the enterprise (soe), export behavior (export), and a firm’s development stage (maturity). The detailed definitions of the variables are reported in Table 1.

Table 1.

Detailed definition of variables.

3.3. Data

To obtain firm-level pollution data, we matched the Industrial Enterprise Database with the Enterprise Pollution Database. City-level data were obtained from the China City Statistics Database (CCSD) on the China Research Data Service (CNRDS) platform. In addition, cities with administrative division adjustments were excluded, and interpolation was used to make up the missing values. All variables were winsorized at 1% and 99% levels. Finally, 50,243 observations were obtained from 2003 to 2013. The descriptive statistics are presented in Table 2.

Table 2.

Descriptive statistics of variables.

4. Empirical Results

4.1. Results of PSM

The control variables in this paper include both city-level variables and firm-level variables. City-level variables are identical for different companies in the same city, which will reduce the reliability of the propensity score estimation. Therefore, we also included firm-level variables as covariates to implement PSM, and the results are shown in Table 3.

Table 3.

Descriptive statistics of treatment firms and control firms.

Moreover, following the Outline of the Pearl River Delta Reform and Development Plan, the firms located in the following nine cities were included in treatment group: Guangzhou, Foshan, Zhaoqing, Shenzhen, Dongguan, Huizhou, Zhuhai, Zhongshan, and Jiangmen. Firms located in other cities were included in the control group.

4.2. Baseline Regressions

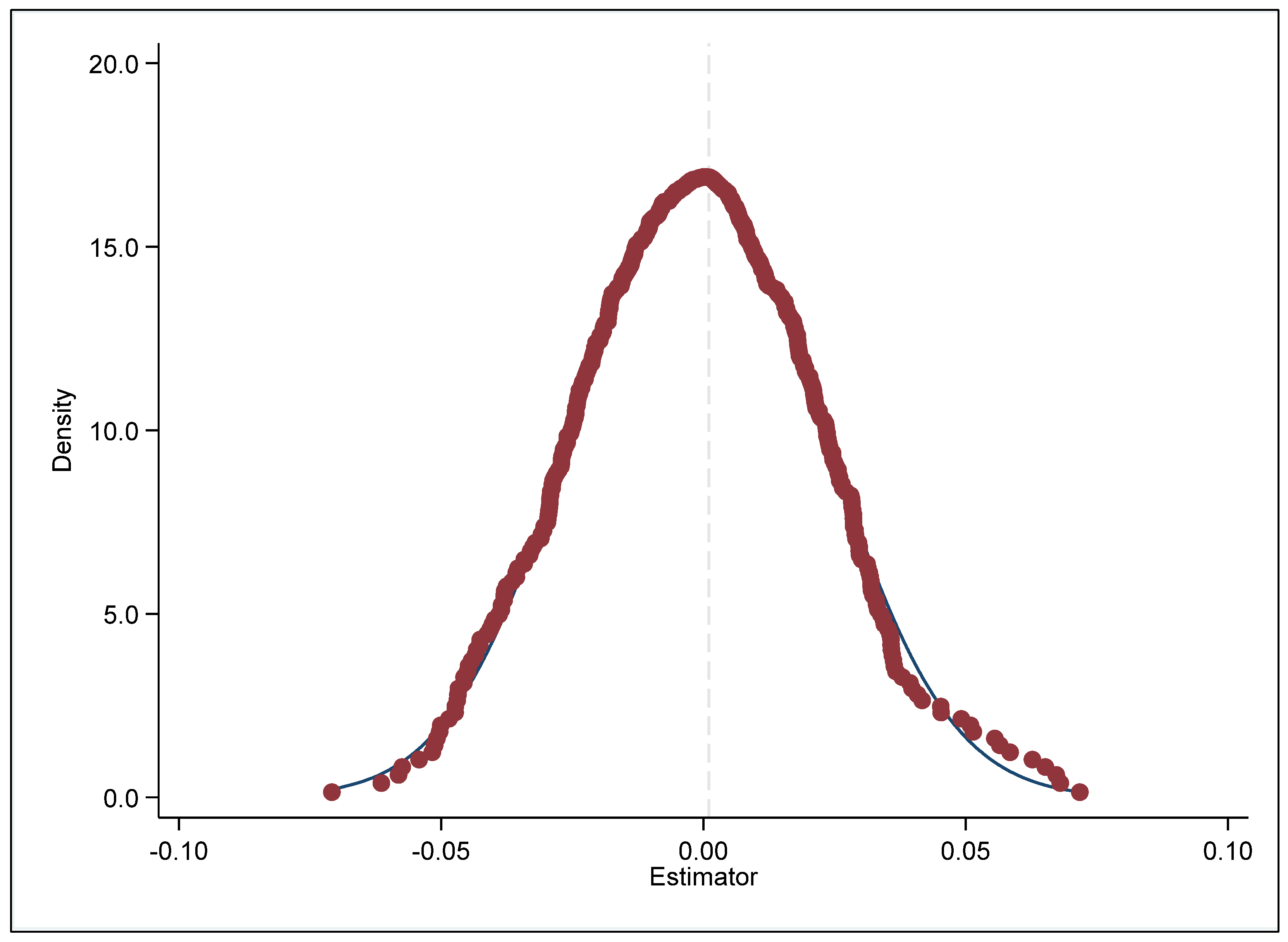

After matching the samples through PSM, we proceed to estimate the impact of the regional integration policy on a firm’s environmental performance through the DID method. The results are shown in Table 4. The results for the output value per unit of pollutant emissions are reported in columns 1 to 3, and columns 4 to 6 present the results for total emissions. Columns 1 and 4 present the results for SO2, columns 2 and 5 show the results for WATER, and the results for SD are reported in columns 3 and 6. Moreover, industry and year fixed effects are included for all specifications. In addition, to be more straightforward, the results are graphically presented in Figure 1.

Table 4.

Impact of regional integration on corporate environmental performance.

Figure 1.

Impact of regional integration on corporate environmental performance.

According to Table 4 and Figure 1, corporate environmental performance increases with regional integration. More specifically, the effect on lncepSO2, lncepWATER, and lncepSD are 0.467, 0.223, and 0.681, respectively. This indicates that the regional integration leads to an increase in the output value, of 46.7%, 22.3%, and 68.1% per unit emission of SO2, WATER, and SD. Meanwhile, we find that the pollutant emissions decrease with regional integration; more specifically, the regional integration leads to a decrease in the emissions of SO2, WATER, and SD by 37.5%, 12.3%, and 58.2%, respectively. Moreover, the impact on the pollutant SD is the highest in both the output value per unit emission and total emission, and the impact on WATER is the lowest. The possible explanation for this difference lies in the industrial composition of the Pearl River Delta region. The emission of WATER is mainly generated by the paper industry and related industries, and the proportion of such industries in this region is relatively low, and the agglomeration effect and selection effect generated by regional integration are not enough to improve the pollution emission performance of such industries. However, SO2 and SD are commonly found in light industries, and the Pearl River Delta is an agglomeration area for such industries. Regional integration breaks down intra-regional market barriers that enhance the circulation of capital and labor, thereby improving corporate environmental performance.

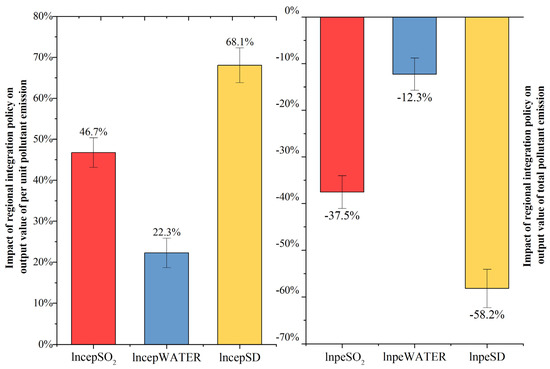

4.3. Parallel Trend Test

To validate the empirical results of baseline regressions, we further implement the parallel trend test. The results are reported in Figure 2; Figure 2a shows the results of the parallel trend test for lncepSO2, the results for lncepWATER are presented in Figure 2b. Figure 2c reports the results for lncepSD. For these three pollutants, the coefficients prior to the implementation of the OPRDRDP are insignificant and negative whereas the coefficients after the implementation of the OPRDRDP are significantly positive, which indicates that the hypothesis of a parallel trend was satisfied.

Figure 2.

(a) Results of the parallel trend test for lncepSO2; (b) Results of the parallel trend test for lncepWATER; (c) Results of the parallel trend test for lncepSD. The X-axis denotes the window period for OPRDRDP implementation. The Y-axis represents the regression coefficient of OPRDRDP implementation.

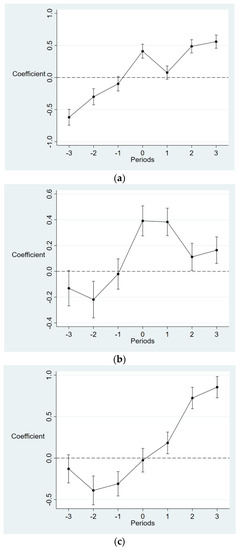

4.4. Industrial Heterogeneity

In this section, we proceed to investigate the industrial heterogeneity. We split the sample into 29 major industries. Industry classification description is presented in Table 5, and empirical results are shown in Figure 3.

Table 5.

Industry classification description.

Figure 3.

Impact of the regional integration policy on corporate environmental performance in different industries. (a) denotes the impact of the regional integration policy on a firm’s output per unit pollutant emissions, (b) denotes the impact of the regional integration policy on a firm’s total pollutant emissions. The bar chart denotes the regression coefficient of dudt in the PSM–DID model, which can reflect the net impact of the regional integration policy. Ind1–ind29 denote 29 major manufacturing industries, and the detailed description of the industries is shown in Table 5.

According to the results of Figure 2a, this paper shows that the impact of regional integration on a firm’s environmental performance differs across different industries. In terms of the environmental performance for SO2, the impact of regional integration is greater for the petroleum processing, coking, and nuclear fuel processing industry (164.4%) and special equipment manufacturing (141.9%). Followed by wood processing and wood, bamboo, palm, and grass products industry (92.0%) and chemical raw materials and chemical products manufacturing industry (94.8%), the impact of regional integration is also relatively high. However, for the tobacco products industry and instrumentation and cultural machinery manufacturing, the effect of regional integration is Insignificant. Further combining the results of Figure 2b, we find that the impact of regional integration on the environmental performance of SO2 in the petroleum processing, coking, and nuclear fuel processing industry is mainly due to the increase in output instead of emission reductions. On the contrary, the improvement in environmental performance in the special equipment manufacturing industry is mainly realized by emission reductions.

In terms of the environmental performance for WATER, the impact of regional integration is much higher in the tobacco products industry (257.9%) and printing and reproduction of recording media industry (213.0%), followed by the agricultural and sideline food processing industry (131.3%) and special equipment manufacturing (113.7%). However, among the above industries, firms’ WATER emissions are reduced only in the tobacco products industry (245.7%) and the printing and reproduction of recording media industry (172.1%). The improvement of firms’ environmental performance for WATER in other industries is mainly due to the improvement of the output rather than the reduction of WATER emissions.

In terms of the environmental performance for SD, regional integration has a significantly positive impact in almost all industries, of which the petroleum processing, coking, and nuclear fuel processing industry (165.9%), general equipment manufacturing (168.8%), and special equipment manufacturing (132.4%) are the highest. Among the above three industries, SD emission is largely reduced in general equipment manufacturing and special equipment manufacturing by 165.2% and 118.3%, respectively, compared with 65.6% for the petroleum processing, coking, and nuclear fuel processing industry. This indicates that the increase in firms’ environmental performance in terms of SD emissions from the petroleum processing, coking, and nuclear fuel processing industry is based on the increase in output rather than pollutant emission reduction.

The above results show that the impact of regional integration on corporate environmental performance varies among different industries. Therefore, the government needs to combine regional industrial structural characteristics to formulate industrial and environmental policies.

4.5. Regional Heterogeneity

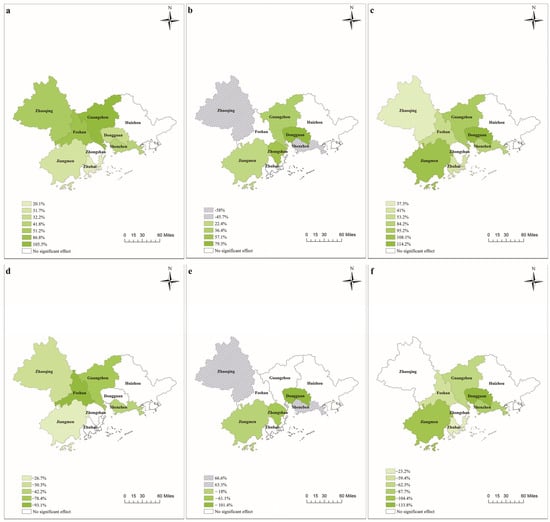

Since there are nine cities in the treated group, we further evaluate the impact of regional integration on the corporate environmental performance in different cities. Empirical results are shown in Figure 4.

Figure 4.

Impact of the regional integration policy on corporate environmental performance in different regions. (a–c) denote the impact of the regional integration policy on the firm-level output value per unit pollutant emissions, (d–f) denote the impact of the regional integration policy on firm-level total pollutant emissions. The color grading of different cities is determined by the absolute value of the regression coefficient of dudt in the PSM–DID model. The darker the color, the stronger the impact of the regional integration policy. The blank area in the figure indicates that the dudt regression coefficient is not significant at the 10% level. The gray area indicates that the regional integration policy has reduced the environmental performance of the enterprise or increased the total amount of pollution emissions of the enterprise.

The results of Figure 4 show that the effect of regional integration on environmental performance of different pollutants differs across different regions. We find that the impact of regional integration is higher for firms located in regional core cities. According to previous studies [43,44], Guangzhou and Shenzhen are the core cities of the Pearl River Delta urban agglomeration, and Foshan, Zhaoqing, Dongguan, Huizhou, Zhuhai, Zhongshan, and Jiangmen are the peripheral cities. For example, the regional integration leads to an increase of 105.5% in terms of environmental performance for SO2 in Guangzhou, which is the core city, whereas the impact of regional integration in Jiangmen and Zhuhai only presents 31.7% and 20.1% (these are peripheral cities). Thus, the difference between core and peripheral cities is significant in terms of the impact of regional integration. However, from the perspective of total pollutant emissions, the emission reduction of sulfur dioxide in Guangzhou only presents 76.4%, which is lower than 93.1% in Foshan. Moreover, the emission reduction in Guangzhou is relatively lower than that of peripheral cities. Regional integration does improve environmental performance by reducing the total amount of a firm’s pollution emissions, but the improvement of a firm’s environmental performance in central cities is mainly driven by the increase in output, while the peripheral cities are mainly driven by the reduction in total emissions. One possible reason for this difference lies in the difference in the industrial structure between the central and peripheral cities. Generally, industries with high pollution are located in the peripheral cities, and these industries are highly impacted by environmental regulation; thus, the pollutant emissions of the peripheral cities are greatly impacted compared to the core cities. Moreover, firms in the tertiary industries are generally located in core cities; thus, they benefit from the regional integration in terms of higher output, and thus, the output of firms located in core cities is more impacted whereas the total emissions are less impacted.

5. Robustness Test

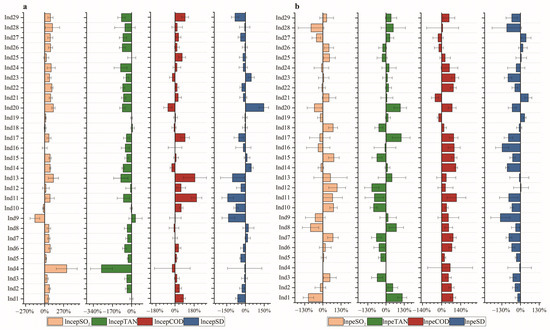

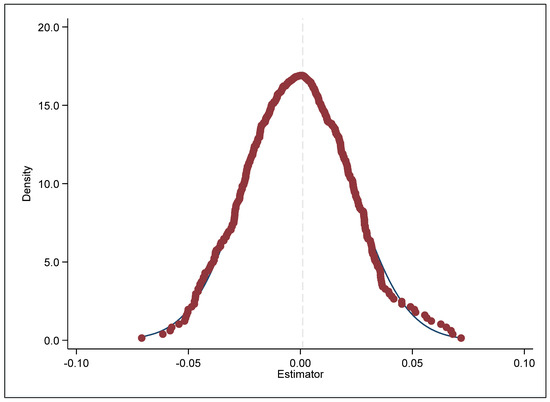

5.1. Placebo Test

The “Outline of the Reform and Development Plan for the Pearl River Delta Region” may also have an impact on firms that are not in the treated group cities, thereby reducing the reliability of the estimated results. Therefore, we randomly select the treatment group by the Monte Carlo method 1000 times to carry out the placebo test to ensure the reliability of the results. Figure 5 reports the distribution of the estimation coefficients of regional integration and the kernel density curve. The coefficients are distributed around zero and obey a normal distribution, which is in line with the expectations of the placebo test. This means that the improvement in environmental performance in the real treatment group is driven by the policy implementation of regional integration.

Figure 5.

The distribution of the estimation coefficients of regional integration and the kernel density curve. The blue line presents the standard normal distribution, and the red dot shows the distribution of estimated coefficients.

5.2. Re-Estimation with Replacement-Matched Samples

To retain more samples to estimate the differences in the impact of the regional integration policy on different industries and regions, the above analysis uses a 1:4 ratio for matching. To ensure the reliability of the results, we match the ratio of 1:1 in this section for re-estimation. The results are shown in Table 6 below.

Table 6.

Estimation results for samples with a 1:1 matching ratio.

6. Conclusions

Environmental performance is extremely vital for sustainable growth in China, and the impact of the regional integration policy plays an important role in improving environmental performance. However, current studies are weak in causal inference, and firm-level evidence is lacking. As a result, taking the Outline of the Pearl River Delta Reform and Development Plan as a quasi-natural experiment, this paper investigates the effect of regional integration on firms’ environmental performance. Our empirical results show that regional integration can significantly improve corporate environmental performance; specifically, the regional integration will result in an increase in the output value, of 46.7%, 22.3%, and 68.1% per unit emission of SO2, WATER, and SD. Moreover, the impact of regional integration differs across different industries. For SO2, the impact of regional integration is greater for the petroleum processing, coking, and nuclear fuel processing industries and special equipment manufacturing; in terms of WATER, the impact is much higher in the tobacco products industry and printing and the reproduction of recording media industry; for SD, the petroleum processing, coking and nuclear fuel processing industries are highly impacted. Finally, this impact also differs for core and peripheral cities.

This paper contributes to current research in the following aspects. First, to identify the causal inference, we take the Outline of the Pearl River Delta Reform and Development Plan as a quasi-natural experiment, whereas most prior studies use the price method or other indexes. Second, unlike regional data and city-level data, this paper employs firm-level data for environmental performance, which helps us understand the emission of specific pollutants. Moreover, with firm-level data, we can investigate the industrial and regional heterogeneities.

For policy implications, first, regional integration policies are highly recommended, China is implementing regional integration in the Beijing–Tianjin–Hebei area and Yangtze River Delta, and these policies should be enhanced for other areas. Second, to maximize the effect of regional integration, the government needs to combine regional industrial structural characteristics to formulate industrial and environmental policies. Third, different environmental protection policies should be implemented by central government. More intense environmental regulations should be enforced for the manufacturing industries in core cities.

This paper is also limited in the following aspects. First, to match two databases, some observations were deleted; thus, more effort will be made for firm identification in the future, and more firms are expected to be matched. Second, through the PSM–DID, parallel trend test, and placebo test, the endogeneity problem has been largely relieved. However, there still exists a possible endogeneity issue; one possibility is that there may also exist some other government policies that impact corporate environmental performance. In future research, one can search related policies and eliminate their impact.

Author Contributions

X.Z.: conceptualization, formal analysis, writing—original draft, X.L.: conceptualization, methodology, Z.Z.: conceptualization, formal analysis, C.Y.: data curation, methodology, R.H.: writing—review & editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research is financially supported by the Science and Technology Research Program of Chongqing Municipal Education Commission (Grant No. KJQN202201162) and GuangDong Basic and Applied Basic Research Foundation (Grant No. 2022A1515110285).

Data Availability Statement

The data is extracted from the website: https://www.epsnet.com.cn/index.html#/Index (accessed on 5 June 2023), it is available after the purchase of permission.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Li, J.; Lin, B. Does energy and CO2 emissions performance of China benefit from regional integration? Energy Policy 2017, 101, 366–378. [Google Scholar] [CrossRef] [PubMed]

- Awad, A. Does economic integration damage or benefit the environment? Africa’s experience. Energy Policy 2019, 132, 991–999. [Google Scholar] [CrossRef]

- Bian, Y.; Song, K.; Bai, J. Market segmentation, resource misallocation and environmental pollution. J. Clean. Prod. 2019, 228, 376–387. [Google Scholar] [CrossRef]

- Wang, Q.; Liu, M.; Zhang, B. Do state-owned enterprises really have better environmental performance in China? Environmental regulation and corporate environmental strategies. Resour. Conserv. Recycl. 2022, 185, 106500. [Google Scholar] [CrossRef]

- Fu, Y.; Zhang, X. Mega urban agglomeration in the transformation era: Evolving theories, research typologies and governance. Cities 2020, 105, 102813. [Google Scholar] [CrossRef]

- He, J.; Li, C.; Yu, Y.; Liu, Y.; Huang, J. Measuring urban spatial interaction in Wuhan Urban Agglomeration, Central China: A spatially explicit approach. Sustain. Cities Soc. 2017, 32, 569–583. [Google Scholar] [CrossRef]

- Sun, X.; Loh, L.; Chen, Z. Effect of market fragmentation on ecological efficiency: Evidence from environmental pollution in China. Environ. Sci. Pollut. Res. 2019, 27, 4944–4957. [Google Scholar] [CrossRef]

- Shen, N.; Peng, H. Can industrial agglomeration achieve the emission-reduction effect? Socio-Econ. Plan. Sci. 2021, 75, 100867. [Google Scholar] [CrossRef]

- Tan, F.; Gong, C.; Niu, Z. How does regional integration development affect green innovation? Evidence from China’s major urban agglomerations. J. Clean. Prod. 2022, 379, 134613. [Google Scholar] [CrossRef]

- Zhang, K.; Shao, S.; Fan, S. Market integration and environmental quality: Evidence from the Yangtze river delta region of China. J. Environ. Manag. 2020, 261, 110208. [Google Scholar] [CrossRef]

- Chen, J.; Hu, X.; Huang, J.; Lin, R. Market integration and green economic growth-recent evidence of China’s city-level data from 2004–2018. Environ. Sci. Pollut. Res. 2022, 29, 44461–44478. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, Q.; Chang, W.-Y. Does economic agglomeration affect haze pollution? Evidence from China’s Yellow River basin. J. Clean. Prod. 2021, 335, 130271. [Google Scholar] [CrossRef]

- Yan, B.; Wang, F.; Dong, M.; Ren, J.; Liu, J.; Shan, J. How do financial spatial structure and economic agglomeration affect carbon emission intensity? Theory extension and evidence from China. Econ. Model. 2022, 108, 105745. [Google Scholar] [CrossRef]

- Yuan, H.; Zhang, T.; Hu, K.; Feng, Y.; Feng, C.; Jia, P. Influences and transmission mechanisms of financial agglomeration on environmental pollution. J. Environ. Manag. 2021, 303, 114136. [Google Scholar] [CrossRef] [PubMed]

- Liang, H.; Renneboog, L. On the Foundations of Corporate Social Responsibility. J. Financ. 2016, 72, 853–910. [Google Scholar] [CrossRef]

- Du, X.; Jian, W.; Zeng, Q.; Chang, Y. Do Auditors Applaud Corporate Environmental Performance? Evidence from China. J. Bus. Ethics 2016, 151, 1049–1080. [Google Scholar] [CrossRef]

- De Villiers, C.; Jia, J.; Li, Z. Are boards’ risk management committees associated with firms’ environmental performance? Br. Account. Rev. 2022, 54, 101066. [Google Scholar] [CrossRef]

- Kagan, R.A.; Gunningham, N.; Thornton, D. Explaining Corporate Environmental Performance: How Does Regulation Matter? Law Soc. Rev. 2003, 37, 51–90. [Google Scholar] [CrossRef]

- Zhang, W.; Luo, Q.; Liu, S. Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Anal. Policy 2022, 74, 105–121. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, R.; Zhang, C. Insight into the driving force of environmental performance improvement: Environmental regulation or media coverage. J. Clean. Prod. 2022, 358, 132024. [Google Scholar] [CrossRef]

- Xiao, R.; Tan, G.; Huang, B.; Li, J.; Luo, Y. Pathways to sustainable development: Regional integration and carbon emissions in China. Energy Rep. 2022, 8, 5137–5145. [Google Scholar] [CrossRef]

- Khan, H.; Weili, L.; Bibi, R.; Sumaira; Khan, I. Innovations, energy consumption and carbon dioxide emissions in the global world countries: An empirical investigation. J. Environ. Sci. Econ. 2022, 1, 12–25. [Google Scholar] [CrossRef]

- Jamil, M.N.; Rasheed, A. Corporate Social Environment and Carbon Dioxide emissions Reduction impact on Organizational Performance; mediator role of Social Capital. J. Environ. Sci. Econ. 2023, 2, 17–24. [Google Scholar] [CrossRef]

- Khan, U.; Liu, W. The Financial availability and Innovation link with Firms & Environmental Performance. J. Environ. Sci. Econ. 2022, 1, 26–35. [Google Scholar] [CrossRef]

- Yu, C.; Long, H.; Zhang, X.; Tan, Y.; Zhou, Y.; Zang, C.; Tu, C. The interaction effect between public environmental concern and air pollution: Evidence from China. J. Clean. Prod. 2023, 391, 136231. [Google Scholar] [CrossRef]

- Asad, M.; Samad, A.; Khan, A.; Khan, A. Green Human Resource Management Perception in the Corporate Sectors of Khyber Pakhtunkhwa, Pakistan. J. Environ. Sci. Econ. 2022, 1, 51–60. [Google Scholar] [CrossRef]

- Muhammad, A.; Idris, M.B.; Ishaq, A.A.; Umar, U.A. Using Laplace series and partial integration in valuing environmental assets and estimating Green GDP. J. Environ. Sci. Econ. 2023, 2, 55–60. [Google Scholar] [CrossRef]

- Feng, D.; Li, J.; Li, X.; Zhang, Z. The Effects of Urban Sprawl and Industrial Agglomeration on Environmental Efficiency: Evidence from the Beijing–Tianjin–Hebei Urban Agglomeration. Sustainability 2019, 11, 3042. [Google Scholar] [CrossRef]

- Yu, C.; Long, H.; Zhang, X.; Tu, C.; Tan, Y.; Zhou, Y.; Zang, C. Regional integration and city-level energy efficiency: Evidence from China. Sustain. Cities Soc. 2023, 88, 125167. [Google Scholar] [CrossRef]

- You, S.; Chen, X. Regional integration degree and its effect on a city’s green growth in the Yangtze River Delta: Research based on a single-city regional integration index. Clean Technol. Environ. Policy 2021, 23, 1837–1849. [Google Scholar] [CrossRef]

- Marshall, I.H. The Acts of the Apostles: An Introduction and Commentary; William B. Eerdmans Publishing: Grand Rapids, MI, USA, 1980; Volume 5. [Google Scholar]

- Arrow, K.J.; Hurwicz, L. Competitive Stability under Weak Gross Substitutability: Nonlinear Price Adjustment and Adaptive Expectations. Int. Econ. Rev. 1962, 3, 233. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Goldman, B.; Klier, T.; Walstrum, T. Evidence on the within-Industry Agglomeration of R&D, Production, and Administrative Occupations; Working Paper. No. WP-2016-20; Federal Reserve Bank of Chicago: Chicago, IL, USA, 2016. [Google Scholar]

- Bliss, M.A.; Gul, F.A. Political connection and cost of debt: Some Malaysian evidence. J. Bank. Financ. 2012, 36, 1520–1527. [Google Scholar] [CrossRef]

- Li, S.; Song, X.; Wu, H. Political Connection, Ownership Structure, and Corporate Philanthropy in China: A Strategic-Political Perspective. J. Bus. Ethics 2014, 129, 399–411. [Google Scholar] [CrossRef]

- Wei, C.; Hu, S.; Chen, F. Do political connection disruptions increase labor costs in a government-dominated market? Evidence from publicly listed companies in China. J. Corp. Financ. 2019, 62, 101554. [Google Scholar] [CrossRef]

- Xiao, G.; Shen, S. To pollute or not to pollute: Political connections and corporate environmental performance. J. Corp. Financ. 2022, 74, 102214. [Google Scholar] [CrossRef]

- Zang, J.; Wan, L.; Li, Z.; Wang, C.; Wang, S. Does emission trading scheme have spillover effect on industrial structure upgrading? Evidence from the EU based on a PSM-DID approach. Environ. Sci. Pollut. Res. 2020, 27, 12345–12357. [Google Scholar] [CrossRef]

- Yu, C.; Kang, J.; Teng, J.; Long, H.; Fu, Y. Does coal-to-gas policy reduce air pollution? Evidence from a quasi-natural experiment in China. Sci. Total Environ. 2021, 773, 144645. [Google Scholar] [CrossRef]

- Yu, C.; Tan, Y.; Zhou, Y.; Zang, C.; Tu, C. Can functional urban specialization improve industrial energy efficiency? Empirical evidence from China. Energy 2022, 261, 125167. [Google Scholar] [CrossRef]

- Kang, J.; Yu, C.; Xue, R.; Yang, D.; Shan, Y. Can regional integration narrow city-level energy efficiency gap in China? Energy Policy 2022, 163, 112820. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, R. Energy efficiency of the mining sector in China, what are the main influence factors? Resour. Conserv. Recycl. 2021, 167, 105321. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).