The Implication of Steel-Intensity-of-Use on Economic Development

Abstract

1. Introduction

2. Literature Review

2.1. Steel Consumption and Economy

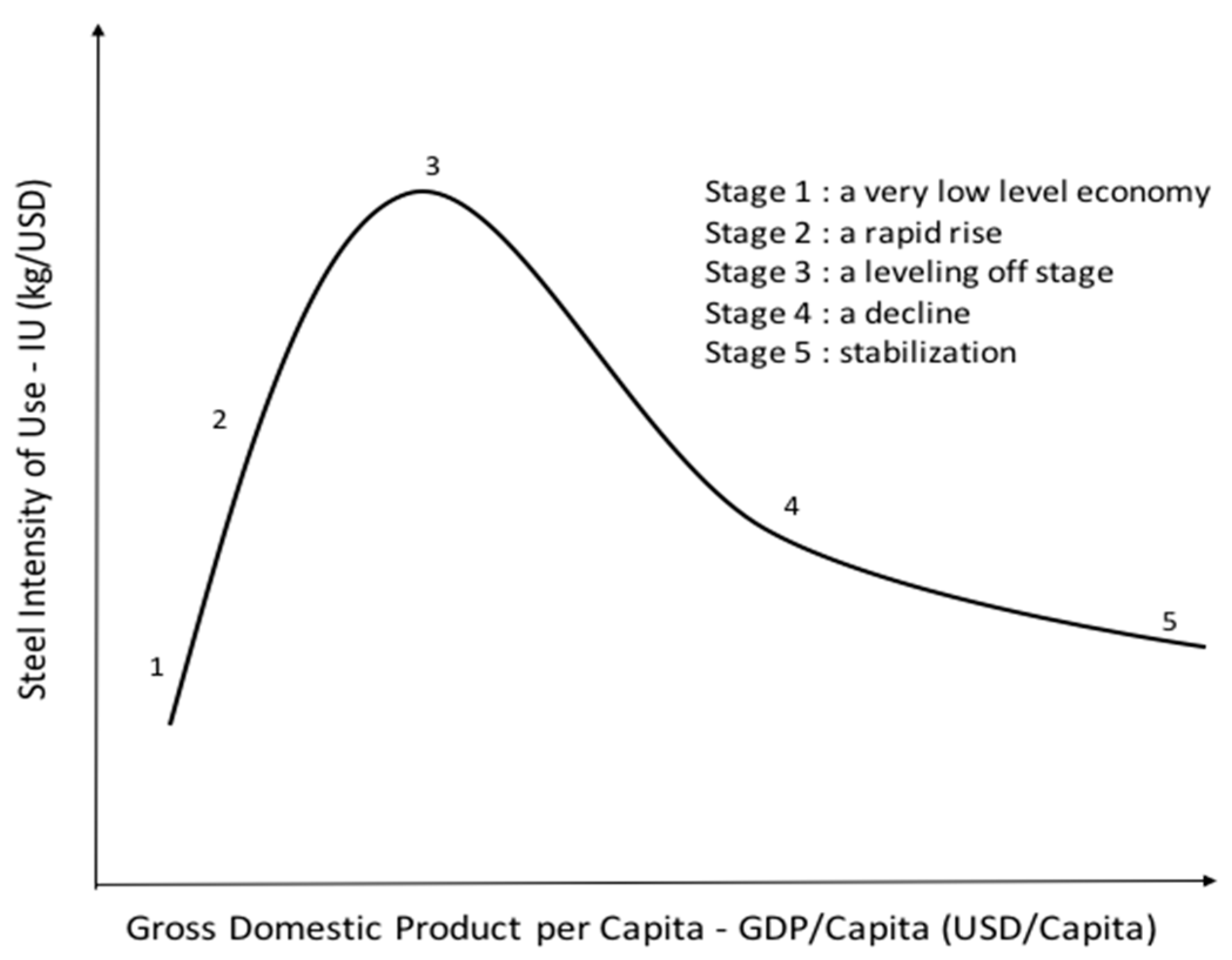

2.2. I-U

2.3. Model Framework for Analysis of Steel Consumption Intensity

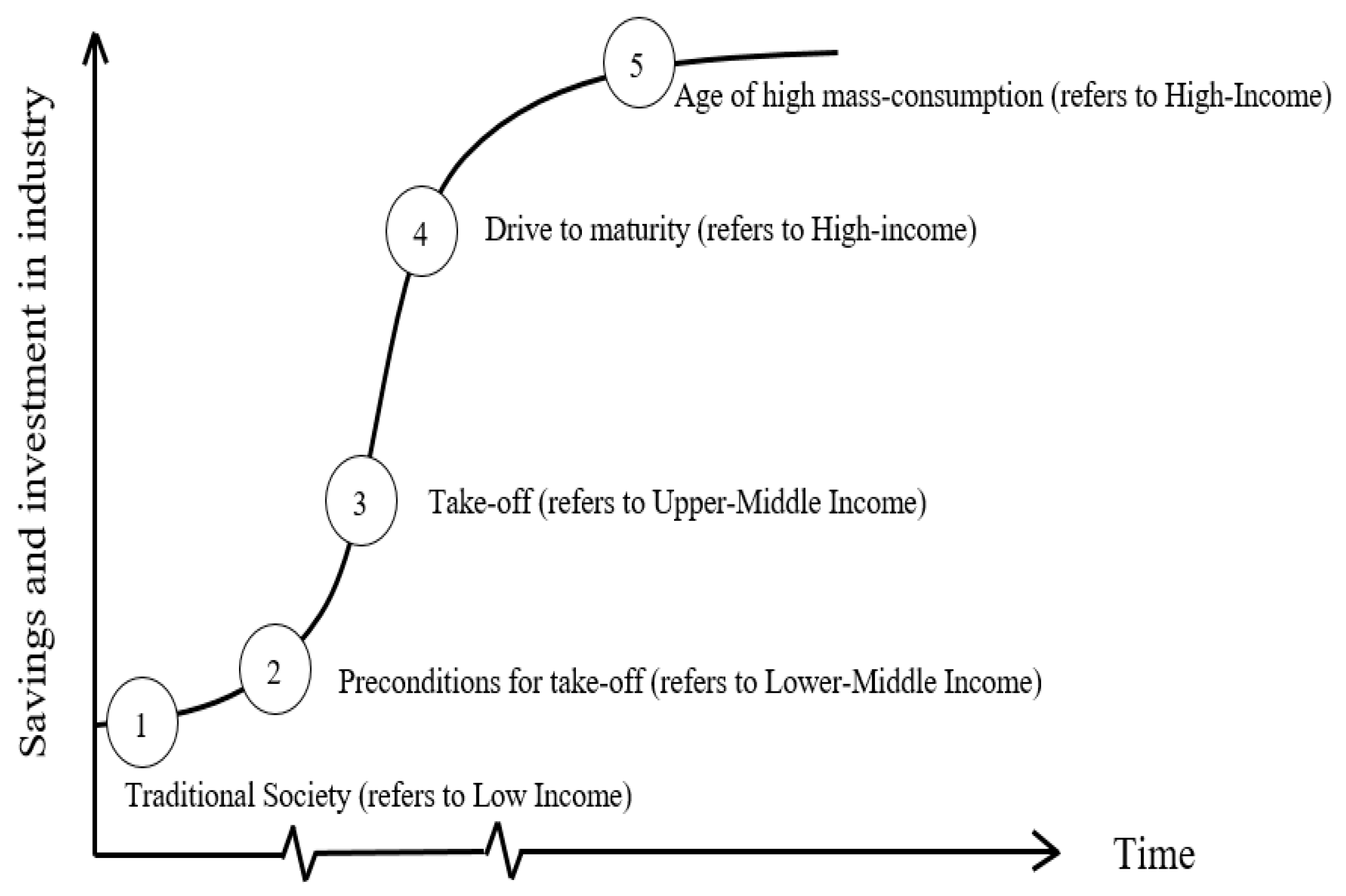

2.4. Country Classification and Economic Stages of Development

2.4.1. Traditional Society

2.4.2. Precondition for Take-Off

2.4.3. Take-Off

2.4.4. Drive to Maturity and Age of High Mass Consumption

3. Materials and Methods

4. Results

4.1. I-U in Developing and Developed Countries

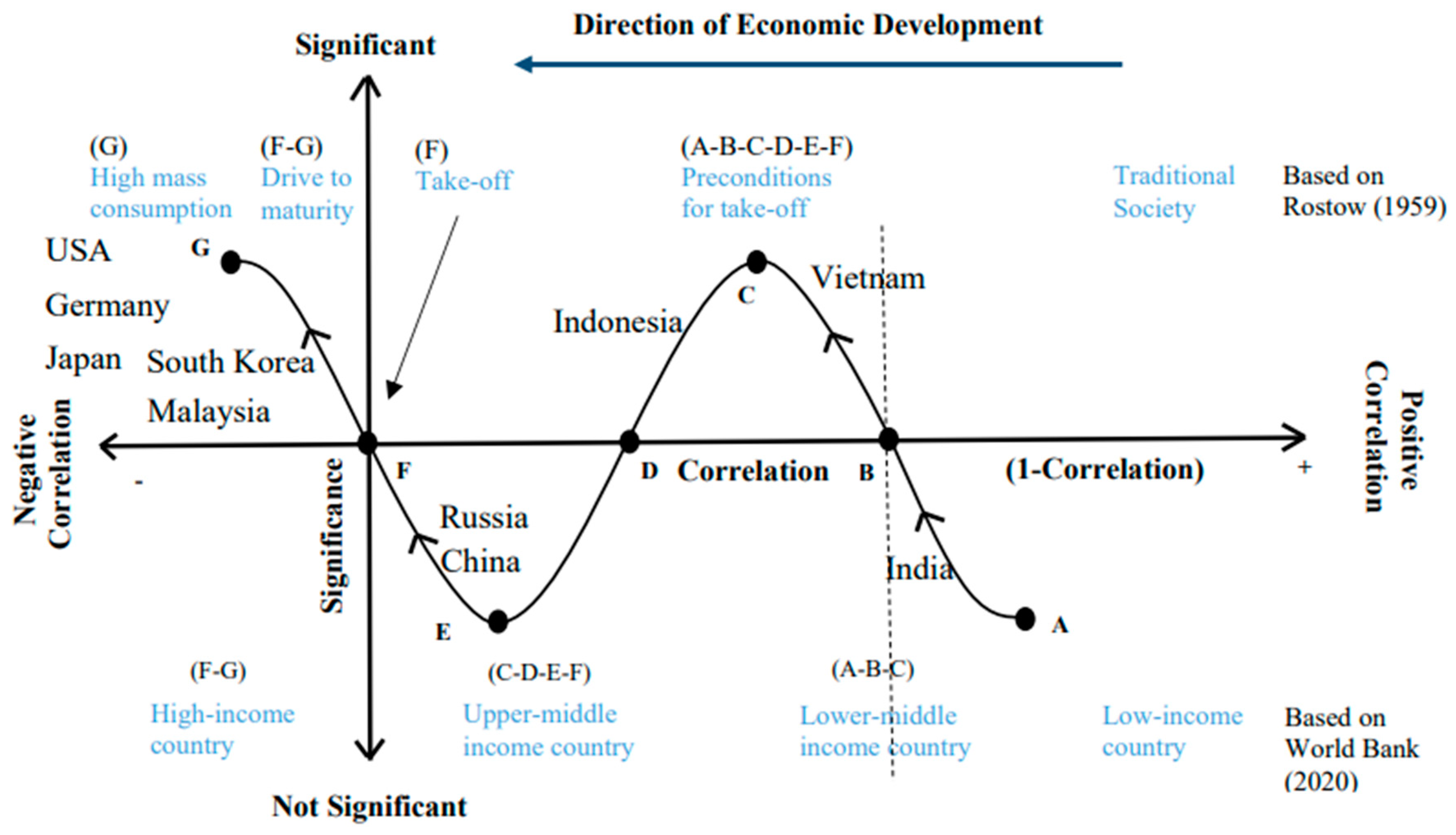

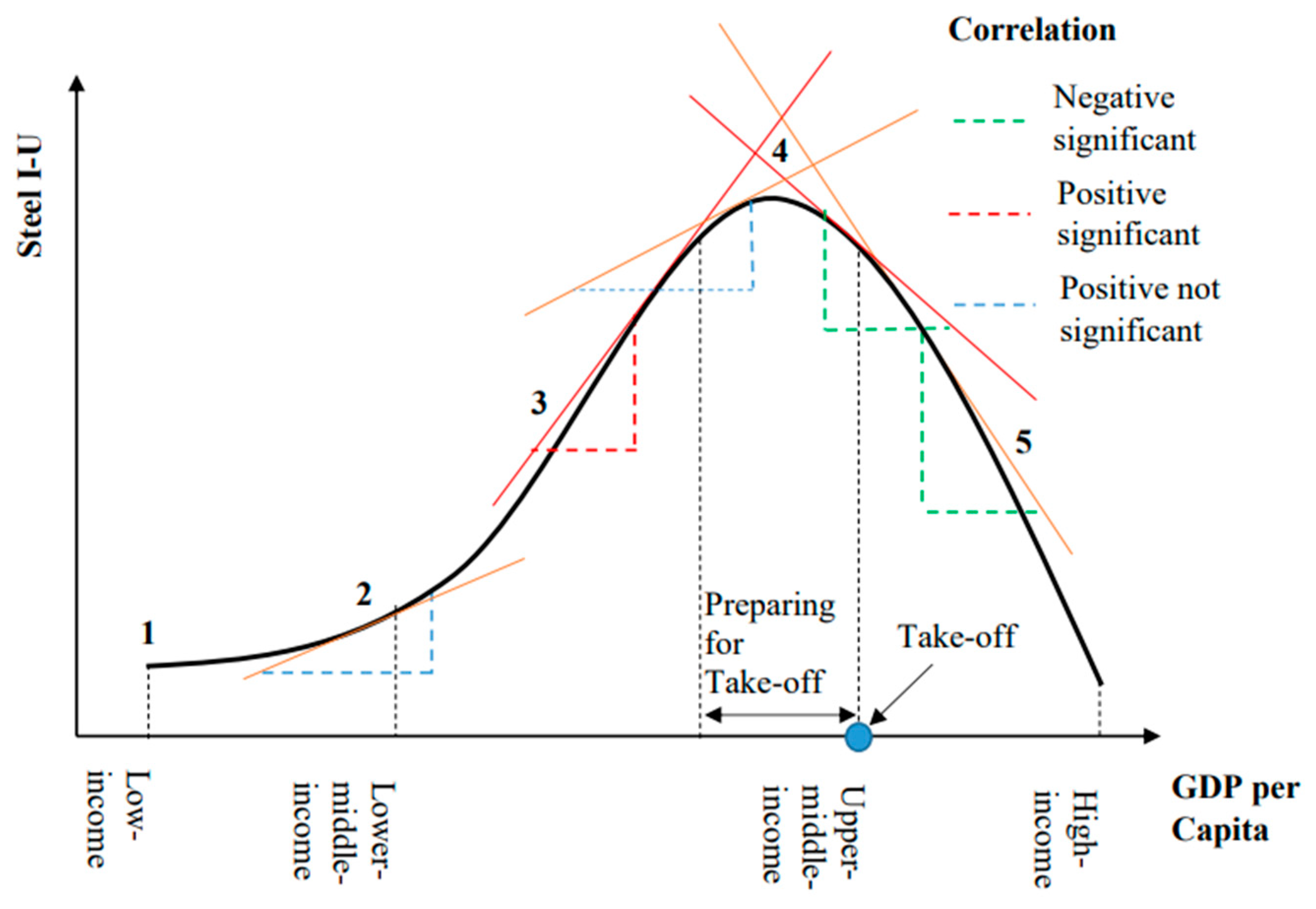

4.2. Correlation between Steel Intensity and Real GDP Per Capita

4.3. Synthesis of the Correlations

5. Linear Regression between I-U and Independent Variables

5.1. Implications

5.1.1. Low-Income

5.1.2. Lower-Middle-Income

5.1.3. Upper-Middle-Income

5.1.4. Transitioning Countries

5.1.5. High-Income

5.2. Lessons Learned from Upper-Middle-Income and High-Income Countries

5.2.1. Preparing for Take-Off and Take-Off

5.2.2. Drive to Maturity

5.2.3. Age of High Mass Consumption

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Dwivedi, A.; Sassanelli, C.; Agrawal, D.; Moktadir, M.A.; D’Adamo, I. Drivers to Mitigate Climate Change in Context of Manufacturing Industry: An Emerging Economy Study. Bus. Strategy Environ. 2023, 1–18. [Google Scholar] [CrossRef]

- Su, D.; Yao, Y. Manufacturing as the key engine of economic growth for middle-income economies. J. Asia Pac. Econ. 2017, 22, 47–70. [Google Scholar] [CrossRef]

- Szirmai, A. Industrialisation as an engine of growth in developing countries, 1950–2005. Struct. Change Econ. Dyn. 2012, 23, 406–420. [Google Scholar] [CrossRef]

- Naudé, W. Why Indonesia Needs a More Innovative Industrial Policy. ASEAN J. Econ. Manag. Account. 2013, 1, 48–65. [Google Scholar]

- De Carvalho, A. Steel Market Developments: Q2 2017; OECD: Paris, France, 2017. [Google Scholar]

- Fernandez, V. Mineral Commodity Consumption and Intensity of Use Re-assessed. Int. Rev. Financ. Anal. 2018, 59, 1–18. [Google Scholar] [CrossRef]

- Malenbaum, W. Material Requirements in the United States and Abroad in the Year 2000: A Research Project Prepared for the National Commission on Materials Policy; University of Pennsylvania: Philadelphia, PA, USA, 1973. [Google Scholar]

- Malenbaum, W. World Demand for Raw Materials in 1985 and 2000; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Wårell, L. Trends and Developments in Long-term Steel Demand—The Intensity-of-Use Hypothesis Revisited. Resour. Policy 2014, 39, 134–143. [Google Scholar] [CrossRef]

- Sharma, V.; Kumar, R.; Singh, H.; Ahmad, W.; Pratap, Y. A Review Study on Uses of Steel in Construction. Int. Res. J. Eng. Technol. 2017, 4, 1140–1142. [Google Scholar]

- Radetzki, M.; Tilton, J. Conceptual and Methodological Issues. In World Metal Demand: Trends and Prospects; Tilton, J., Ed.; Resources for the Future: Washington, DC, USA, 1990. [Google Scholar]

- Guzmán, J.; Nishiyama, T.; Tilton, J. Trends in the intensity of copper use in Japan since 1960. Resour. Policy 2005, 30, 21–27. [Google Scholar] [CrossRef]

- Cheol-Ho, C. The Decoupling of GDP and Steel Demand: Cyclical or Structural? Asian Steel Watch 2018, 5, 72–81. [Google Scholar]

- Roberts, M. Metal Use and the World Economy. Resour. Policy 1996, 22, 183–196. [Google Scholar] [CrossRef]

- Canas, A.; Ferrao, P.; Conceicao, P. A New Environmental Kuznets curve? Relationship between Direct Material Input and Income per Capita: Evidence from Industrialised Countries. Ecol. Econ. 2003, 46, 217–229. [Google Scholar]

- Focacci, A. Empirical Relationship between Total Consumption–GDP Ratio and per Capita Income for Different Metals of a Series of Industrialized Nations. Int. J. Environ. Technol. Manag. 2005, 5, 347–377. [Google Scholar] [CrossRef]

- Focacci, A. Empirical Analysis of the Relationship between Total Consumption–GDP Ratio and per Capita Income for Different Metals: The Cases of Brazil, China and India. Int. J. Soc. Econ. 2007, 34, 612–636. [Google Scholar]

- Warell, L.; Olsson, A. Trends and Developments in the Intensity of Steel Use: An Econometric Analysis. In Proceedings of the Securing the Future and 8th ICARD, Skellefteå, Sweden, 23–26 June 2009; Available online: http://pure.ltu.se/portal/files/3157773/Paper.pdf (accessed on 15 July 2023).

- Jaunky, V. Is there a material Kuznets Curve for Aluminium? Evidence from Rich Countries. Resour. Policy 2012, 37, 296–307. [Google Scholar] [CrossRef]

- WSA (World Steel Association). 2020 World Steels in Figures; World Steel Association: Brussels, Belgium, 2020. [Google Scholar]

- Pheng, L.S.; Hou, L.S. The Economy and the Construction Industry. In Construction Quality and the Economy; Management in the Built Environment; Springer: Singapore, 2019. [Google Scholar]

- PWC (Price Waterhouse Coopers). The World in 2050: Will the Shift in Global Economic Power Continue? Price Waterhouse Coopers: London, UK, 2015. [Google Scholar]

- Liu, Y. Three Essays on the Study of China’s Steel Industry and Industrialization. Ph.D. Thesis, University of Alberta, Edmonton, AB, Canada, 2007. [Google Scholar]

- Crompton, P. Forecasting Steel Demand in South-East Asia; University of Western Australia: Crawley, WA, Australia, 2005. [Google Scholar]

- Bernardini, O.; Galli, R. Dematerialization: Long-term Trends in the Intensity of Use of Materials and Energy. Futures 1993, 25, 431–448. [Google Scholar] [CrossRef]

- Walstedt, B.; Panero, J.D. Forecasting Steel Demand in Developing Countries; International Bank for Reconstruction and Development: Washington, DC, USA, 1968. [Google Scholar]

- Rostow, W.W. The Stages of Economic Growth: A Non-Communist Manifesto, 3rd ed.; Cambridge University Press: Cambridge, UK, 1959. [Google Scholar]

- World Bank. Country Classification. 2020. Available online: https://data.worldbank.org/indicator/NY.GNP.PCAP.CD (accessed on 15 July 2023).

- FAO (Food Agricultural Organization). The Role of Agriculture in the Development of Least-Developed Countries and Their Integration into the World Economy; Commodities and Trade Division; Food and Agriculture Organization of the United Nations: Rome, Italy, 2002. [Google Scholar]

- Brooks, M.; Kulkarni, K.G. Applying Rostow’s Stages of Economic Growth to South Korea. Int. J. Financ. Econ. Econom. 2011, 3, 45–59. [Google Scholar]

- World Bank. GNI Per Capita. 2022. Available online: https://data.worldbank.org/indicator/NY.GNP.PCAP.CD (accessed on 15 July 2023).

- Cheng, D. The Development of the Service Industry in the Modern Economy: Mechanisms and Implications for China. China Financ. Econ. Review 2013, 1, 3. [Google Scholar]

- Okazaki, T. Development State Evolving: Japan’s Graduation from a Middle Income Country. In Developmental State Building: The Politics of Emerging Economies; CIGS Working Paper Series 17-007E; The Canon Institute for Global Studies: Tokyo, Japan, 2017. [Google Scholar]

- Sadler, A. Econometrics for Steel and Raw Material Analysts. Pre-Conference Workshop. The 14th Annual Steel Outlook; IISI: Singapore, 2008. [Google Scholar]

- Robert, J.B. Determinants of Economic Growth: A Cross-Country Empirical Study; NBER Working Papers 5698; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 1996. [Google Scholar]

- World Bank. Population. 2022. Available online: https://data.worldbank.org/indicator/SP.POP.TOTL (accessed on 15 July 2023).

- World Bank. New Country Classifications by Income Level: 2019–2020. 2019. Available online: https://blogs.worldbank.org/opendata/new-country-classifications-income-level-2019-2020 (accessed on 17 July 2023).

- World Bank. Vietnam. 2020. Available online: https://www.worldbank.org/en/country/vietnam/overview (accessed on 17 July 2023).

- World Bank. India: Systematic Country Diagnostic, Realizing the Promise of Prosperity. 2018. Available online: http://documents1.worldbank.org/curated/en/629571528745663168/pdf/Volumes-1-AND-2-India-SCD-Realising-the-promise-of-prosperity-31MAY-06062018.pdf (accessed on 17 July 2023).

- World Bank. India. 2020. Available online: https://www.worldbank.org/en/country/india/overview (accessed on 17 July 2023).

- World Bank. Indonesia. 2020. Available online: https://www.worldbank.org/en/country/indonesia/overview (accessed on 17 July 2023).

- World Bank. China. 2020. Available online: https://www.worldbank.org/en/country/china/overview (accessed on 17 July 2023).

- World Bank. Russia. 2020. Available online: https://www.worldbank.org/en/country/russia/overview (accessed on 17 July 2023).

- World Bank. Malaysia. 2020. Available online: https://www.worldbank.org/en/country/malaysia/overview (accessed on 17 July 2023).

- World Bank. South Korea. 2020. Available online: https://www.worldbank.org/en/country/korea/overview (accessed on 17 July 2023).

- World Bank. Japan. 2020. Available online: https://www.worldbank.org/en/country/japan/overview (accessed on 17 July 2023).

- World Bank. Germany. 2020. Available online: https://www.worldbank.org/en/country/germany/overview (accessed on 17 July 2023).

- World Bank. The United States. 2020. Available online: https://www.worldbank.org/en/country/unitedstates/overview (accessed on 17 July 2023).

- Global Finance. Most Technologically Advanced Countries in the World 2022. 2022. Available online: https://www.gfmag.com/global-data/non-economic-data/best-tech-countries (accessed on 19 July 2023).

- Research and Market. Malaysia Stainless Steel Shaft Market Outlook and Projections, 2019–2027. 2019. Available online: https://www.researchandmarkets.com/reports/4895543/malaysia-stainless-steel-shaft-market-outlook-and (accessed on 19 July 2023).

- Döhrn, R.; Krätschell, K. Long-term Trends in Steel Consumption. Miner. Econ. 2014, 27, 43–49. [Google Scholar] [CrossRef][Green Version]

- Halada, K.; Shimada, M.; Ijima, K. Decoupling Status of Metal Consumption from Economic Growth. Mater. Trans. 2008, 49, 411–418. [Google Scholar] [CrossRef]

- Worrell, E.; Laitner, J.A.; Ruth, M.; Finman, H. Productivity Benefits of Industrial Energy Efficiency Measures. Energy 2003, 28, 1081–1098. [Google Scholar] [CrossRef]

- Popescue, G.H.; Nica, E.; Nicolăescu, E.; Lăzăroiu, G. China’s Steel Industry as A Driving Force for Economic Growth and International Competitiveness. Metalurgija 2015, 55, 123–126. [Google Scholar]

- Feng, P.; Xue, Y.; Shihua, P. Comparative Study on Industrial Concentration Degree of China, Japan, USA, Korea Steel Industry. In Proceedings of the 2020 International Conference on New Energy Technology and Industrial Development (NETID 2020), Dali, China, 18–20 December 2020; Volume 235. [Google Scholar]

- Ocheri, C.; Ajani, O.O.; Daniel, A.; Agbo, N. The Steel Industry: A Stimulus to National Development. J. Powder Metall. Min. 2017, 156, 2. [Google Scholar]

- Lubis, R.F.; Saputra, P.M.A. The Middle-income Trap: Is There a Way out for Asian Countries? J. Indones. Econ. Bus. 2016, 30, 273. [Google Scholar]

- Porter, M.E. The Competitive Advantage of Nations; Free Press: New York, NY, USA, 1990. [Google Scholar]

- Tho, T.V. The Middle-Income Trap: Issues for Association of South East Asian Nation; ADBI Working Paper No. 421; Asian Development Bank Institute: Tokyo, Japan, 2013. [Google Scholar]

- Foxley, A.; Sossdorf, F. Making the Transition from Middle-Income to Advanced Economies; The Carnegie Papers; International Economics: Washington, DC, USA, 2011. [Google Scholar]

- Sun, W.; Cai, J.; Ye, Z. Advances in Energy Conservation of China Steel Industry. Sci. World J. 2013, 2013, 247035. [Google Scholar] [CrossRef]

- Rhee, Y.W.; Ross-Larson, B.; Purcell, G. Korea’s Competitive Edge: Managing the Entry into World Markets; John Hopkins University Press for the World Bank: Baltimore, MD, USA, 1984. [Google Scholar]

- Deloitte. The Services Powerhouse: Increasingly Vital to World Economic Growth. Deloitte Insights 2018, 12, 1–20. Available online: https://www2.deloitte.com/content/dam/Deloitte/my/Documents/risk/my-risk-sdg8-the-services-powerhouse-increasingly-vital-to-world-economic-growth.pdf (accessed on 19 July 2023).

- Kristensson, P. Future Service Technologies and Value Creation. J. Serv. Mark. 2019, 33, 502–506. [Google Scholar] [CrossRef]

- Becker, D.J. Modernization and Development: An Empirical Study of South Korea and Brazil. Honor. Proj. 1991, 4. Available online: https://digitalcommons.iwu.edu/cgi/viewcontent.cgi?article=1022&context=polisci_honproj (accessed on 19 July 2023).

- Maddison, A. The World Economy: A Millennial Perspective, Development Centre Studies; OECD Publishing: Paris, France, 2001. [Google Scholar]

- Basri, F.; Putra, G.A. Escaping the Middle-Income Trap in Indonesia: An Analysis of Risks, Remedies and National Characteristics; Friedrich-Ebert-Stiftung Indonesia Office: Jakarta, Indonesia, 2019. [Google Scholar]

- Vivarelli, M. Structural Change and Innovation as Exit Strategies from the Middle-Income Trap; IZA Discussion Papers, No. 8148; Institute for the Study of Labor (IZA): Bonn, Germany, 2014. [Google Scholar]

- Yeon, J.; Pylia, A.; Kim, T. Structural Shift and Increasing Variety in Korea, 1960–2010: Empirical Evidence of the Economic Development Model by the Creation of New Sectors; Hohenheim Discussion Papers in Business, Economics and Social Sciences No. 13-2016; Universität Hohenheim: Stuttgart, Germany, 2016. [Google Scholar]

- Zhou, S.; Hu, A. China: Surpassing the “Middle Income Trap”; Contemporary China Studies; Springer: Singapore, 2021. [Google Scholar]

- Nelson, R.R.; Winter, S.G. An Evolutionary Theory of Economic Change; Belknap Press of Harvard University Press: Cambridge, MA, USA, 1982. [Google Scholar]

- Mansfield, E. Industrial R&D in Japan and the United States: A Comparative Study. Am. Econ. Rev. 1988, 78, 223–228. [Google Scholar]

- Aghion, P.; Howitt, P. Capital Accumulation and Innovation as Complementary Factors in Long-Run Growth. J. Econ. Growth 1998, 3, 111–130. [Google Scholar]

- Wade, R.H. Industrial Policy in Response to the Middle-Income Trap and the Third Wave of the Digital Revolution. Glob. Policy 2016, 7, 469–480. [Google Scholar] [CrossRef]

| Country | Steel Intensity (Kg/USD) | |||

|---|---|---|---|---|

| Average (2000–2021) | Average (2000–2010) | Average (2011–2021) | Change (%) | |

| Indonesia | 0.014 | 0.013 | 0.015 | 19.1% |

| China | 0.066 | 0.067 | 0.065 | −2.3% |

| Germany | 0.012 | 0.013 | 0.011 | −11.7% |

| India | 0.035 | 0.048 | 0.069 | 45.0% |

| Japan | 0.016 | 0.018 | 0.014 | −19.4% |

| Malaysia | 0.034 | 0.039 | 0.030 | −23.3% |

| South Korea | 0.041 | 0.046 | 0.037 | −20.5% |

| Russia | 0.029 | 0.029 | 0.030 | 5.2% |

| USA | 0.006 | 0.007 | 0.005 | −23.3% |

| Vietnam | 0.059 | 0.048 | 0.069 | 45.0% |

| World | 0.019 | 0.018 | 0.020 | 16.4% |

| India | Vietnam | Indonesia | China | Malaysia | Russia | South Korea | Japan | Germany | USA | |

|---|---|---|---|---|---|---|---|---|---|---|

| Population (000) [36] | 1,366,418 | 96,462 | 270,626 | 1,397,715 | 31,950 | 144,374 | 51,709 | 126,265 | 83,133 | 328,240 |

| GDP per Capita (USD) [31] | 2257 | 3409 | 4333 | 12,556 | 11,109 | 12,195 | 34,998 | 39,313 | 51,204 | 70,249 |

| Steel Production (000 ton) [20] | 111,351 | 17,469 | 7783 | 996,342 | 6820 | 71,897 | 71,412 | 99,284 | 39,627 | 87,761 |

| India | Vietnam | Indonesia | China | Malaysia | Russia | South Korea | Japan | Germany | USA | |

|---|---|---|---|---|---|---|---|---|---|---|

| Pearson Correlation | 0.334 | 0.869 ** | 0.640 ** | −0.019 | −0.833 ** | 0.048 | −0.887 ** | −0.614 ** | −0.572 ** | −0.702 ** |

| Significant level | 0.129 | 0.000 | 0.001 | 0.932 | 0.000 | 0.833 | 0.000 | 0.002 | 0.005 | 0.000 |

| Group | 1 July 2020 (New) | 1 July 2019 (Old) |

|---|---|---|

| Low Income | GNI per capita < 1036 | GNI per capita < 1026 |

| Lower-middle income | 1036 ≤ GNI per capita < 4045 | 1026 ≤ GNI per capita < 3995 |

| Upper-middle income | 4046 ≤ GNI per capita < 12,535 | 3996 ≤ GNI per capita < 12,375 |

| High income | GNI per capita > 12,535 | GNI per capita > 12,375 |

| Country | GNI Per Capita (USD) | Group |

|---|---|---|

| India | 2257 | Lower-middle income |

| Vietnam | 3409 | Lower-middle income |

| Indonesia | 4333 | Upper-middle income |

| China | 12,556 | Upper-middle income |

| Russia | 12,195 | Upper-middle income |

| Malaysia | 11,109 | Upper-middle income |

| South Korea | 34,998 | High income |

| Japan | 39,313 | High income |

| Germany | 51,204 | High income |

| USA | 70,249 | High income |

| Country | Low Income | Lower-Middle Income | Upper-Middle Income | Transition from Upper-Middle Income to High Income | High Income |

|---|---|---|---|---|---|

| India | No country in the classification of low-income develops its steel industry. | Positive | |||

| Not significant | |||||

| Vietnam | Positive | ||||

| Significant | |||||

| Indonesia | Positive | ||||

| Significant | |||||

| China | Negative | ||||

| Not Significant | |||||

| Malaysia | Negative | ||||

| Significant | |||||

| Russia | Positive | ||||

| Not Significant | |||||

| South Korea | Negative | ||||

| Significant | |||||

| Japan | Negative | ||||

| Significant | |||||

| Germany | Negative | ||||

| Significant | |||||

| USA | Negative | ||||

| Significant |

| India | Vietnam | Indonesia | Russia | China | Malaysia | South Korea | Japan | Germany | USA |

|---|---|---|---|---|---|---|---|---|---|

| Final Consumption per Capita | Final Consumption per Capita | Import of goods and services per Capita | Investment per Capita | Negative Final Consumption per Capita | Negative Final Consumption per Capita Investment per Capita | Negative Final Consumption per Capita | Negative Final Consumption per Capita | Negative Final Consumption per Capita | Negative Final Consumption per Capita Investment per Capita |

| Characteristics | Low Income Traditional Society | Lower-Middle Income Precondition for Take-Off | Upper-Middle Income Precondition for Take-Off | Transition from Upper-Middle Income to High Income Take-Off | High Income Drive to Maturity Age of High Mass Consumption |

|---|---|---|---|---|---|

| Economy | GNI per capita < 1036 | 1036 < GNI per capita < 4045 | 4046 < GNI per capita < 12,535 | Precondition for take-off < GNI per capita ≤ 12,535 | GNI per capita > 12,535 |

| Industry | -Dominated by agriculture with traditional cultivating forms -Productivity by man-hour work is lower compared to the subsequent growth stages | -Manufacturing industry has not been developed, and therefore the I-U is still developing -Agriculture sector dominance to GDP surpassed by manufacturing except for the country in the initial level of lower-middle-income -For specific countries, such as Vietnam, the government is so determined to develop manufacturing industries supported by the significant development of the steel industry | Spillover effect occurs in the industry: -Steel-related industries, such as automotive, real estate, machinery, and equipment, significantly supported GDP. -Heavy investment in technology while at the same time the steel intensity use decreases and steel production remained adequate for domestic production. | Investing in technology and orienting to export. | Focus on exporting the products and services contribution of export to the economy is prominent. High-income countries switched the industries from manufacturing to service |

| Steel Industry | -Steel and other related industries are not in existence yet | -Correlation between steel I-U and GDP per capita is positive and can be both significant and insignificant | Two conditions of the steel industry: -Correlation between steel I-U and GDP per capita is positive and significant -Correlation is positive insignificant The decoupling occurs between steel IU and GDP per capita | -Correlation between I-U and GDP per capita is negative significant -The decoupling occurs between steel I-U and GDP per capita -Concerned with the digital transformation of the manufacturing sector and its related services | -Correlation between steel I-U and GDP per capita is negative significant -The decoupling occurs between steel I-U and GDP per capita |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wandebori, H.; Murtyastanto. The Implication of Steel-Intensity-of-Use on Economic Development. Sustainability 2023, 15, 12297. https://doi.org/10.3390/su151612297

Wandebori H, Murtyastanto. The Implication of Steel-Intensity-of-Use on Economic Development. Sustainability. 2023; 15(16):12297. https://doi.org/10.3390/su151612297

Chicago/Turabian StyleWandebori, Harimukti, and Murtyastanto. 2023. "The Implication of Steel-Intensity-of-Use on Economic Development" Sustainability 15, no. 16: 12297. https://doi.org/10.3390/su151612297

APA StyleWandebori, H., & Murtyastanto. (2023). The Implication of Steel-Intensity-of-Use on Economic Development. Sustainability, 15(16), 12297. https://doi.org/10.3390/su151612297