Abstract

The social benefits of charity retail are widely recognized. However, data relating to the potential benefits to the sustainable use of end-of-use consumer goods are scarce. A general survey and an observational study at a typical charity shop aimed to quantify and evaluate reuse via charity retail outlets. We reveal valuable insights to stock data recording, procedures for receiving/dealing with donations (by category), use of standard approaches, quantification of key variables, and accuracy of previous survey data. Methods were successfully developed and trialled to (a) quantify diversion of end-of-use products from residual waste via reuse/recycling, and (b) estimate the cost of unsaleable donations. Future routine use of these methods for charity retail shops is recommended while acknowledging the limitations due to reporting capabilities. We identify four key groups of beneficiaries: (1) the parent charity, (2) charity shop workers (paid and unpaid), (3) donors, and (4) customers. Specific benefits, such as social interactions, are not exclusive to specific beneficiaries. Efforts to improve positive impacts should focus on securing appropriate donations, facilitating information capture, and promoting reuse. An important balance is required between maximising income and reuse, and retaining the social benefits that charities provide to communities.

1. Introduction

The global need for sustainability [1] is driven to an extent by anthropogenic overexploitation of natural resources, including fossil fuels, minerals, water, land, and biota [2]. Often consumer products made using these resources are used only for a short period; their subsequent utility and value depends on their fate after the purchaser no longer wants or needs them. The fate of end-of-use and end-of-life consumer products has implications for sustainability in terms of the environment, economy and society; indeed, future resource management is likely to become more about lifestyle choices and less about managing the wastes we generate [3].

Since 1975, the Waste Hierarchy [3] has provided a basis for sustainable resource management; its principles underpin the Waste Framework Directive [4,5] and thereby guide policy and practice at scale. The Waste Hierarchy sets out priorities to maximise resource conservation and minimise environmental impact. Waste minimisation or prevention is of the highest priority, followed by reuse or preparing for reuse, recycling, recovery (e.g., of energy), and, least preferred, landfill [3]. Consumer products require the extraction of resources, manufacturing, assembly, marketing, delivery, and selling; each of these steps requires natural resources, energy, and labour, increasing the value of the raw materials used [6]. Recycling leads to the recovery of raw materials, requiring energy and labour in the process, whereas product reuse retains the value created during manufacturing. Product reuse offers a way to prolong the usage cycle of devices with enduring reuse value, hence providing a practical option in the transition from a linear to a circular economy [7].

Historically, UK waste management legislation, practice, and infrastructure have only partially aligned with the ideology of the Waste Hierarchy [3]. Instead, waste management has focused much on recycling as a way of mitigating resource depletion and reducing waste production; targets, initiatives and infrastructure developments have been set to encourage the public to recycle their waste [8]. This focus, arguably, stems from the relative ease with which recycling may be quantified, rendering recycling easier to develop, implement, and promote than reuse or waste prevention [9].

Waste management legislation, policy, objectives, and infrastructure may currently encourage recycling over reuse, but donating and selling second-hand items is well established in the UK [10]. During the second World War, ‘make-do-and-mend’ was a necessity at international scale, with repair and reuse extending the life of products in times of global resource scarcity and hardship. Subsequent economic growth, an increase in disposable income and trend-led consumption have resulted in the purchase of second-hand items being generally limited to those with low income [11]. More recently, increasing environmental concern and adverse economic conditions have led to an increased interest in reuse. Buying “pre-loved” (previously owned, second-hand) or “vintage” (not new, but of good quality and/or style) items is increasingly common and popular [11]. Purchasing decisions are crucial in terms of influencing the duration of product use [12].

Options for the preservation of the value of products and components at their end-of-use include direct resale, repair, upgrade, refurbishment, remanufacturing, and repurposing. Reuse via direct resale takes many forms. Car boot sales and flea markets are established and popular in the UK [13,14]. UK high street outlets for second-hand items include charity retail outlets (“Charity shops”), multinational companies (e.g., Cash Converters and CEX), and smaller chains or independent stores. The Internet serves as a marketplace for used items from local to international scale. Recent studies of distinct urban mines, such as universities, have demonstrated the potential for reuse as the preferred end-of-use decision for products with good functionality, resulting in encouraging environmental, economic, and social impacts [15]. These opportunities for reuse extend the lifespan of products, whilst providing usable end-of-use items at reduced prices, and producing income and employment opportunities.

Charity retail is a well-established form of reuse in the UK [9,16]: second-hand items, donated by the public, are sold, and the profits benefit their parent charities. Charity retail originated at the end of the 19th century, starting with the Salvation Army’s second-hand clothing stores for individuals with lower incomes; other charities engaged in retail after 1945 [17]. Post-1985 saw a much more rapid expansion of charities with retail outlets: the number of charity shops increased in the UK as charities realised the potential for income generation [18]. Prior to the COVID-19 pandemic, there were ca. 11,200 charity shops in the UK, and this number has remained stable [19]. These shops raised GBP 278 million for charities in 2016/2017 [17], rising to GBP 363 million in 2021/2022 [20].

Charity shops are a familiar feature of UK high streets and are a crucial source of income for many charities. Most charity shops sell mainly clothing, along with bric-a-brac, books, furniture, music, toys, and, in some cases, electrical and electronic equipment. In addition to selling donated second-hand items, bought-in goods are sold to increase sales and broaden product ranges. A charity shop in the UK must sell ‘wholly or mainly’ donated goods to keep its legal status of serving a charitable purpose [1].

The fashion market illustrates well the positive impacts of charity retail. Textile production to meet consumer demand for clothing [21,22] consumes vast freshwater resources, creates pollution, and contributes more to climate change than international aviation and shipping combined [23]. The UK has the highest clothing consumption rate in Europe: 26.7 kg of new clothing is purchased per capita annually in the UK, compared with 16.7 kg in Germany, 16 kg in Denmark, and 14.5 kg in Italy [24]. Increasing a garment’s lifetime reduces its environmental footprint [23]. Reuse through charity retail provides environmental benefits by avoiding less preferred fates (e.g., landfill, energy recovery or recycling) and prolonging the life of clothing. In the UK in 2018/2019, for example, 339,000 tonnes of textiles were diverted from incineration or landfill through donation to charity shops, saving local councils more than GBP 31 million in waste disposal costs [20]. An increase of 10% in second-hand clothing sales could cut carbon emissions per tonne of clothing by 3% and water use by 4% if it extended garment life by 50% [25]. An estimated 95% of clothes donated to charity shops are reused or recycled [26].

Charity retail also provides extensive economic and social benefits. Prior to the COVID-19 pandemic, charity retail in the UK employed over 26,000 full-time equivalent paid staff and around 200,000 volunteers [20]. Charity customer sales of donated goods and bought-in goods accounted for 0.33% of all UK retail sales (excluding automotive fuel) in 2019. Charity shops typically generate a significant fraction of total income (ca. 20%) for their parent charities [27] as well as promoting the charities and their work [17].

Notably, charity shops in the UK have survived the recent decline of the high street: they occupy vacant shops and generate foot traffic in retail areas against adverse economic conditions and competition with online retail [17]. A high proportion of adults in the UK purchase items from charity shops, and a higher proportion makes donations [26]. The typical current customer transaction value is ca. GBP 4.50 to GBP 5.00 per item for clothing [20]. Since the UK’s recent cost-of-living crisis, use of charity shops has increased markedly [28], with a 15.1% growth in like-for-like store income in January–March 2023 compared with the same period in 2022 [29].

The charity retail sector also provides social benefits in the form of opportunities for individuals to volunteer and thereby gain workplace skills and experience. Volunteers typically value their contribution to charity, social interaction, workplace experience, and the opportunity to develop skills and confidence [26], which can facilitate their transition into paid work. In some cases, volunteering opportunities are specifically provided for disabled individuals to work towards a National Vocational Qualification (NVQ) [30]. Other charities contribute to the rehabilitation of offenders by encouraging and supporting them as volunteers in their stores [30].

Charity retail thus offers positive benefits in environmental, economic, and social terms, and thus aligns with the principles of and requirements for sustainable development [17]. Quantifying these benefits can be challenging [31]. Donations of stock, for example, are not controlled per se but are beholden to donors’ actions. Meaningful data do exist, however, for income (e.g., quarterly reports) and social benefits (e.g., commissioned research). In common with other sectors, quantifying benefits with consistency is a challenge: charity retail operations of different scale have different reporting capabilities and approaches to data collection. Although there are paid employees, charity shops rely on volunteers in appreciable number [20]; a small number of stores are run solely by volunteers. Volunteers have varying levels of experience, skills and ability, which can lead to variations in the way shops operate and maintain records.

Notwithstanding the many benefits of the charity retail sector, particularly in relation to sustainability objectives, there remain challenges, notably in improving efficiency and effectiveness. The Charity Retail Association (CRA) aims to contribute by providing expertise and information to charities; promoting best practice, promoting the social, economic, and environmental benefits of charity retailing; and influencing and monitoring relevant legislation and regulations [32]. The CRA membership currently represents 78% of charity shops in the UK, including 9 of the 10 largest charities [32].

Whilst there are extensive benefits and positive impacts of charity retail, opportunities and means to extend and enhance their activities would be of obvious merit in terms of sustainability goals [33]. This ambition can potentially be realised if policies and procedures are optimised on an evidence-based footing. If higher levels of reuse can be achieved, for example, income and environmental benefits are increased, as are the number and range of items available to customers at modest prices. Processes and practices underpinning actions and decisions from the point of donation to the point of sale are critical in this regard.

The aims of this study were thus to explore and elucidate processes and practices concerning reuse via charity shops as the basis for (1) developing recommendations for standard processes to quantify the benefits of charity retail associated with reuse and recycling and (2) identifying and recommending methods to enhance opportunities for reuse, increase income, and optimize the social benefits of charity retail.

2. Materials and Methods

After considering the aims and context of this study, a mixed methods quantitative and qualitative approach was selected on the basis of prior and insightful application in similar settings [34,35]. Four complementary components (Section 2.1, Section 2.2, Section 2.3 and Section 2.4) aimed to provide insight to the processes and practice at broad- and store-scale, and to determine the levels of reuse and recycling, and costs/benefits of unsaleable donations at store scale. Surveys of Heads of Charity Retail (Section 2.1) were intended to provide insight to the overarching, high-level intentions and understanding of processes and practices. Parallel surveys of charity shop managers (Section 2.1) were undertaken to permit evaluation regarding if and how high-level intentions were implemented at store scale. Store-specific observations and related analyses were intended to illustrate and exemplify processes, practice and associated benefits to hand. We note that Store A is not intended to act as typical or representative of UK charity shops; the observations and analyses reported in this study should be regarded as indicative and do not serve as a basis for generalization. It should also be noted that the term “ragging” herein refers to the practice of selling unsaleable items to a third party (“rag merchants”) who recover financial value via the sale of recyclable and/or reusable items that are not deemed to be of suitable quality or condition for display and sale in a charity shop.

2.1. Survey of Processes and Practices in Charity Shops

Charity Retail Association (CRA) members were surveyed using an online questionnaire circulated to charity shop Store Managers (SMs). Precise information regarding the numbers of CRA member charities and charity shops that received the questionnaire were not recorded at the time the survey was circulated; the CRA has ca. 380 member organisations that collectively operate around 8500 charity shops. Information was requested relating to stock data recording (e.g., number of donations, weight of stock ragged/recycled, etc.) and procedures for receiving and dealing with donations. Head-office staff and SMs were asked questions concerning stock in the Sources of Stock Survey [36], including their use of standard approaches and quantification of key variables. Heads of Charity Retail (HCRs) of CRA members were also surveyed; questions asked of SMs were repeated, and additional questions were asked regarding the frequency and perceived accuracy of stock taking.

2.2. In Situ Observations of Store-Scale Processes and Practices in a Charity Shop

Observations were made and recorded over February, March, and April 2019 at a charity shop for a national UK charity that has over 100 shops in the UK (“Store A”) located on a high street in a relatively low-income area within 1500 m of a university in southern England. Store A is located in close proximity to another seven charity shops and several vacant commercial premises, in an area with a high turnover of businesses. Observations were made by the first author in the role of (1) a volunteer worker (February 2019) on Thursday mornings, and (2) a paid worker (Shop Assistant; February to April 2019) on Sundays, with responsibility for opening and closing the store and overseeing community service workers and volunteers. The actions of donors, customers, and workers were observed and recorded in situ. Types of items donated and their quality, condition, suitability for sale and value were noted, as were procedures for dealing with donations and stock. A stock-take was undertaken every 3 months; notes were made of the numbers and weights of stock on each occasion (Table 1).

Table 1.

Records made during quarterly at each stock-take event at Store A in February, March and April 2019.

2.3. In Situ Observations of Store-Scale Stock and Destinations of Donations to Quantify Reuse and Recycling

A full stock inventory of Store A was undertaken, recording the quantity and weight of donated items. Clothing was separated into three categories (men’s, women’s, and children’s) and weighed in batches. Mixed items were selected randomly for each category; larger items (e.g., coats) were weighed in batches of three items, and other smaller items were weighed in batches of five items. Books, CDs, and DVDs were weighed in batches of 5. Items were categorised, and mean weights estimated by category (Table 2). The weight of items diverted from residual waste through reuse and ragging/recycling was subsequently estimated on the basis of the observed weights.

Table 2.

Categories of stock recorded in a full stock inventory of Store A, April 2019.

2.4. Cost–Benefit Analysis of Unsaleable Donations at Store-Scale

A “Sources of Stock” survey [36] is routinely conducted by charity retail outlets. This survey comprises estimates of data relating to items sold, ragged/recycled and disposed of as waste for clothing, bric-a-brac, books, music/video, furniture, and electrical items. Each CRA member charity has individual procedures for making these estimates.

A cost–benefit analysis of the impact of unsaleable donations on charity shops was undertaken, and a value was estimated for Store A. Input data were drawn from the Sources of Stock Survey [36]; data and information for Store A were collected during the present study. Data reported to the Sources of Stock survey [36] from 2007 to 2017 related to “volumes” sent for ragging/recycling, sent for disposal, and unit sales data. In 2017, further analysis of the data highlighted that the ‘volume’ may have been interpreted inconsistently.

3. Results

3.1. Survey of Processes and Practices in Charity Shops

From the UK charities that agreed to participate in this study, seven individuals completed the ‘Head of Charity Retail’ survey and 90 individuals completed the ‘Shop Manager’ survey (Table 3).

Table 3.

Numbers of survey responses from Store Managers and size of each charity participating in the survey.

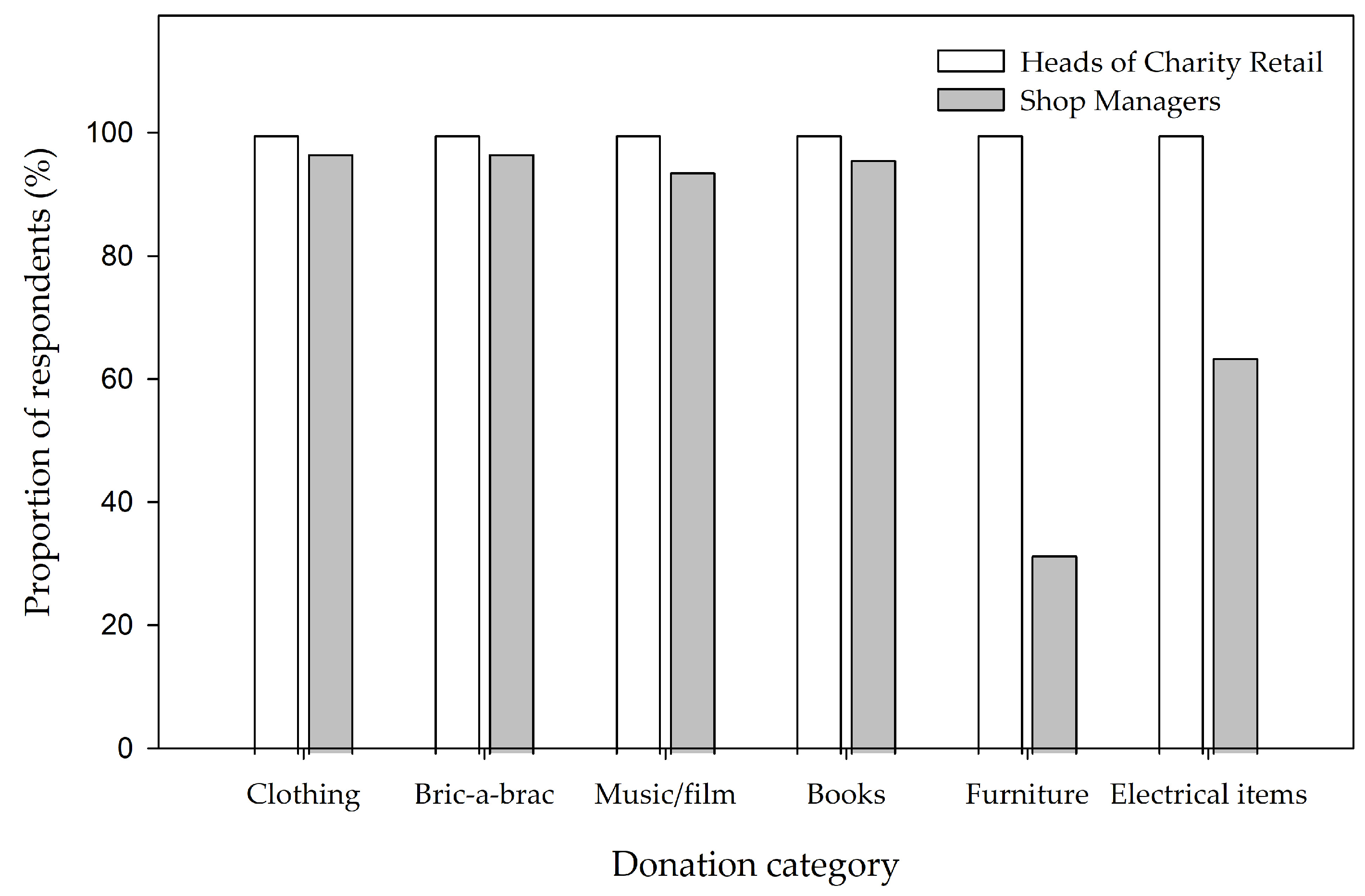

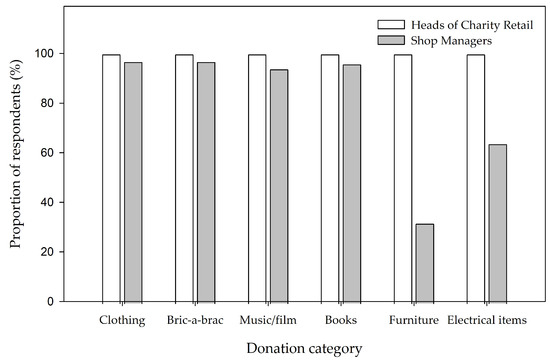

Charity representatives were asked if they have standard procedures for dealing with donations to stores. The Head of Charity Retail (HCR) for each charity answered that there were standard procedures for every category; answers from Store Managers were not always consistent with HCRs for the same charity (Figure 1). Notably, only 32% of SMs stated they had a standard process for dealing with furniture, and 64% for electrical items (Figure 1).

Figure 1.

Proportions of respondents of who for each category answered “yes” to the question “Does your store/charity have a standard process for receiving any of the following items when they arrive at the shop?” N = 7 for Heads of Charity Retail; N = 90 for Shop Managers.

Store Managers were asked to describe their standard process for dealing with donations. Processes for individual shops were reported to differ from the prescribed standard processes in several ways, inferring some inconsistencies and deviation from guidance:

- Unsuitable items that have small defects (e.g., holes, small stains, or missing buttons) were placed in a box and sold at reduced price;

- Clothes were not steamed (cleaned) before being put out onto shop floor;

- Any DVDs, CDs, or books deemed inappropriate for sale (e.g., DVDs restricted for sale only to adults) were sent for ragging;

- A shop run by a charity with a religious ethos will not sell items they believe do not align with their values;

- Items of higher value are sold via internet sales platforms;

- Items are checked for suitability or use in ways other than sale, e.g., donated to homeless shelters;

- Wet stock, broken toys, ceramics, and glass were disposed of with residual waste;

- Pillows, duvets, car seats, and cycle helmets must be disposed of with residual waste as they are not safe or hygienic.

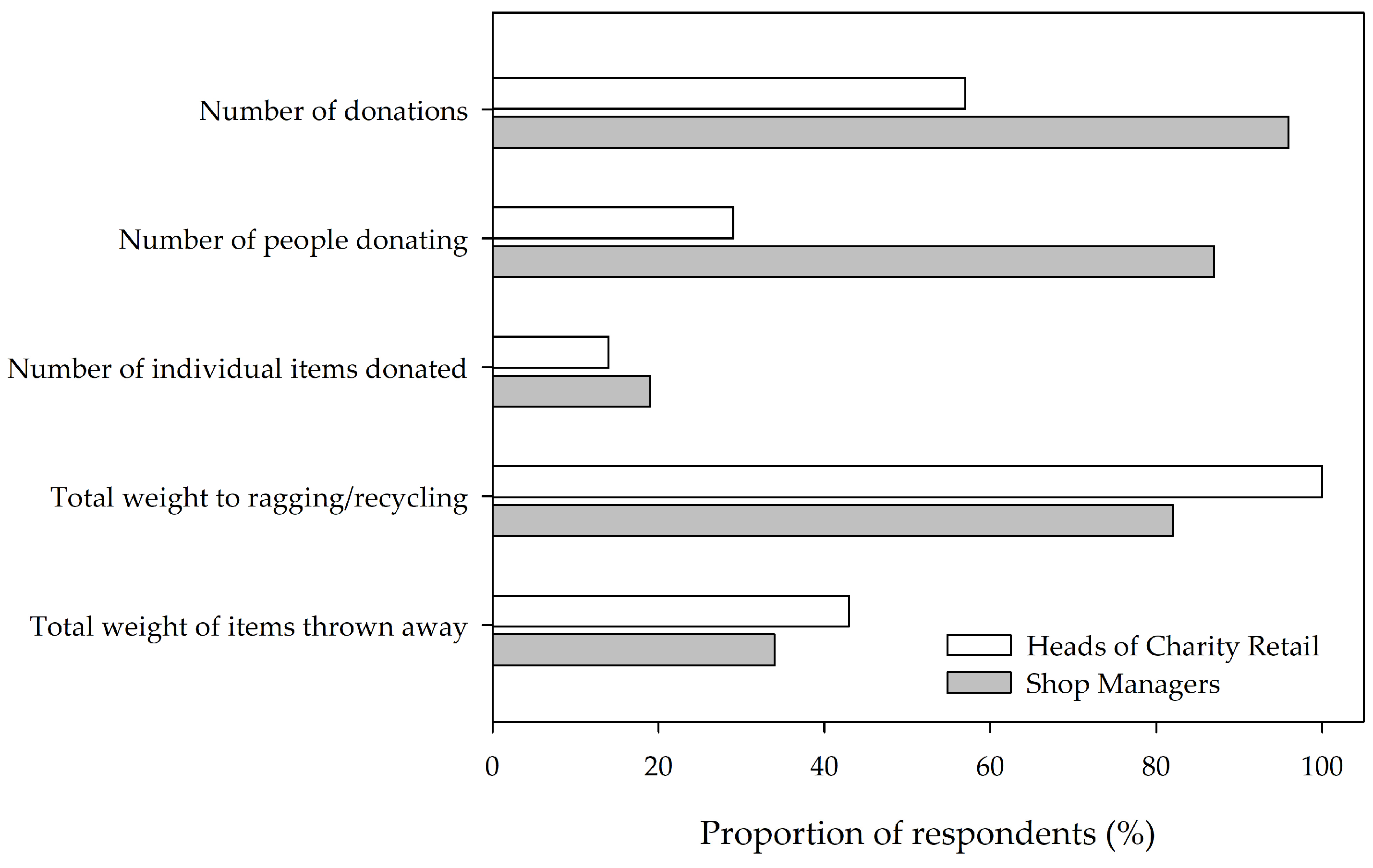

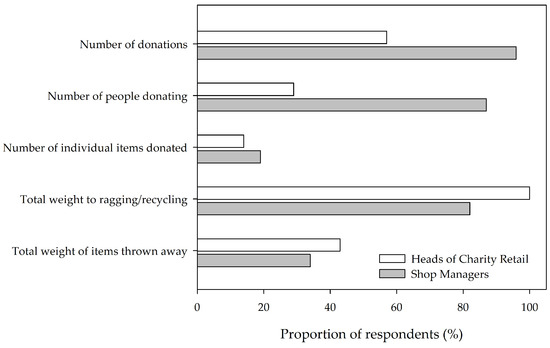

Participants were asked what information is routinely recorded at their stores. Some 96% collect data on the number of donations coming into store. Every one of the HCRs claimed to collect data on the total weight going to ragging/recycling; only 82% of SMs claimed to collect the same data within their own store(s) (Figure 2).

Figure 2.

Average proportions of respondents who for each category answered “yes” to the question “Does your store/charity collect/make note of any of the following information?” N = 7 for Heads of Charity Retail; N = 90 for Shop Managers.

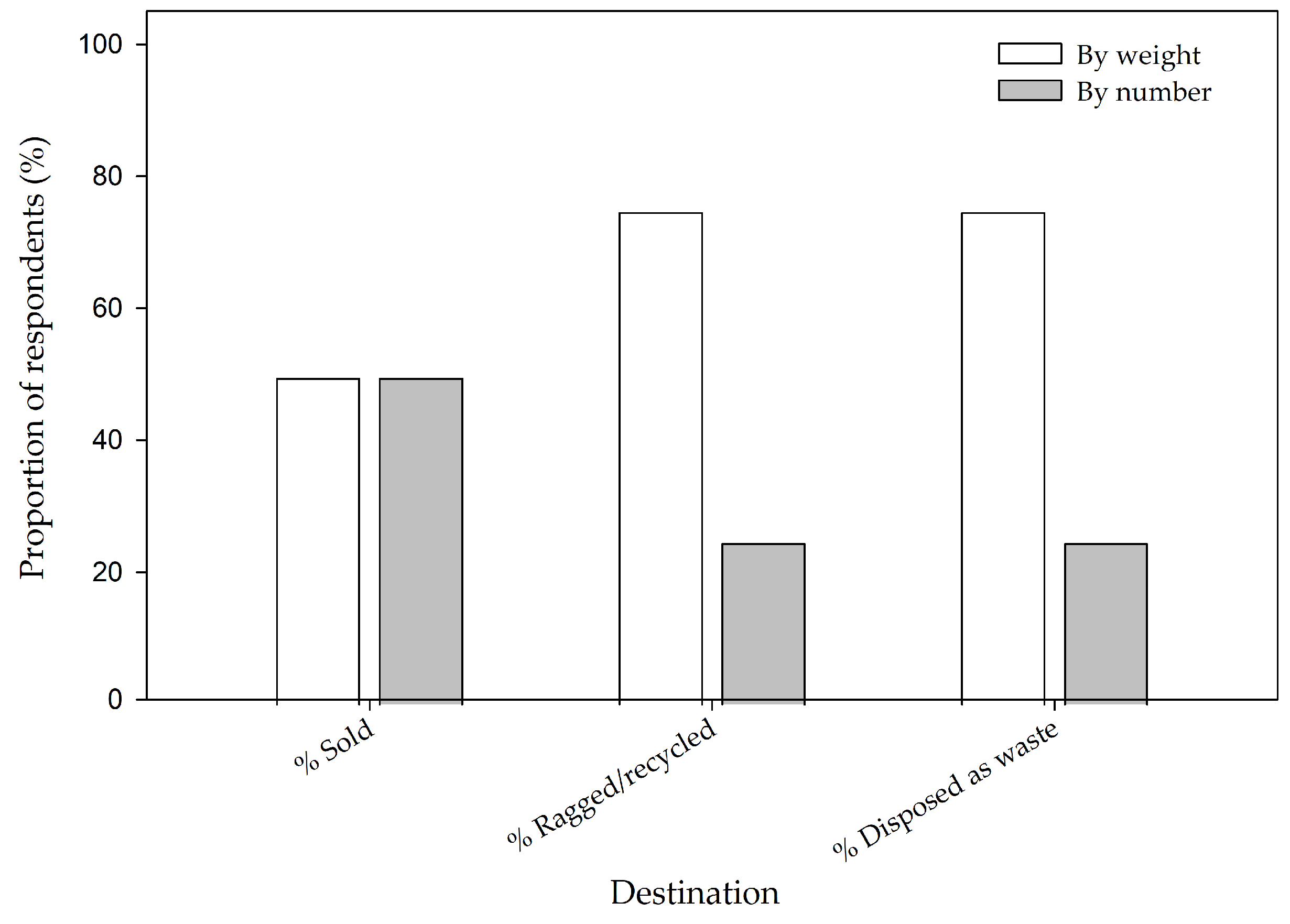

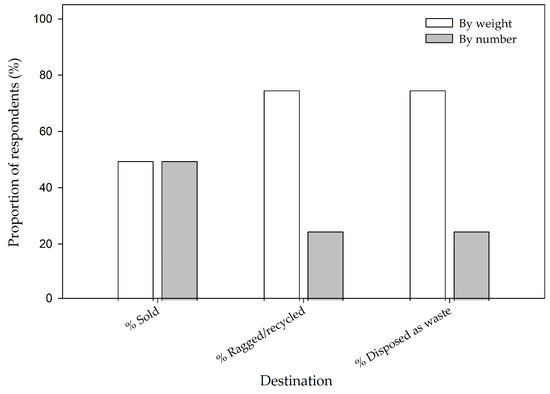

HCRs were asked how they quantify the proportions of donations that were sold, ragged/recycled, and disposed of as residual waste. Responses indicated that approaches differ between categories, e.g., weights of clothing/books/bric-a-brac are recorded; for furniture/electrical items, numbers are recorded. Practice varied between charity and category. Half the respondents stated that they used weight to estimate the percentage sold, and half stated that they used the numbers of items for this purpose (Figure 3). For both ragging/recycling and disposal, 75% of charities stated they used weight as the basis for estimations, and the remaining 25% stated they use numbers of items (Figure 3). Although the processes described by participants were similar for different charities, the basis for the estimation evidently differs.

Figure 3.

Proportions of respondents who selected weight or quantity (number of items) for the question: “How did you estimate the percentages of items sold, ragged/recycled and disposed as of waste?”

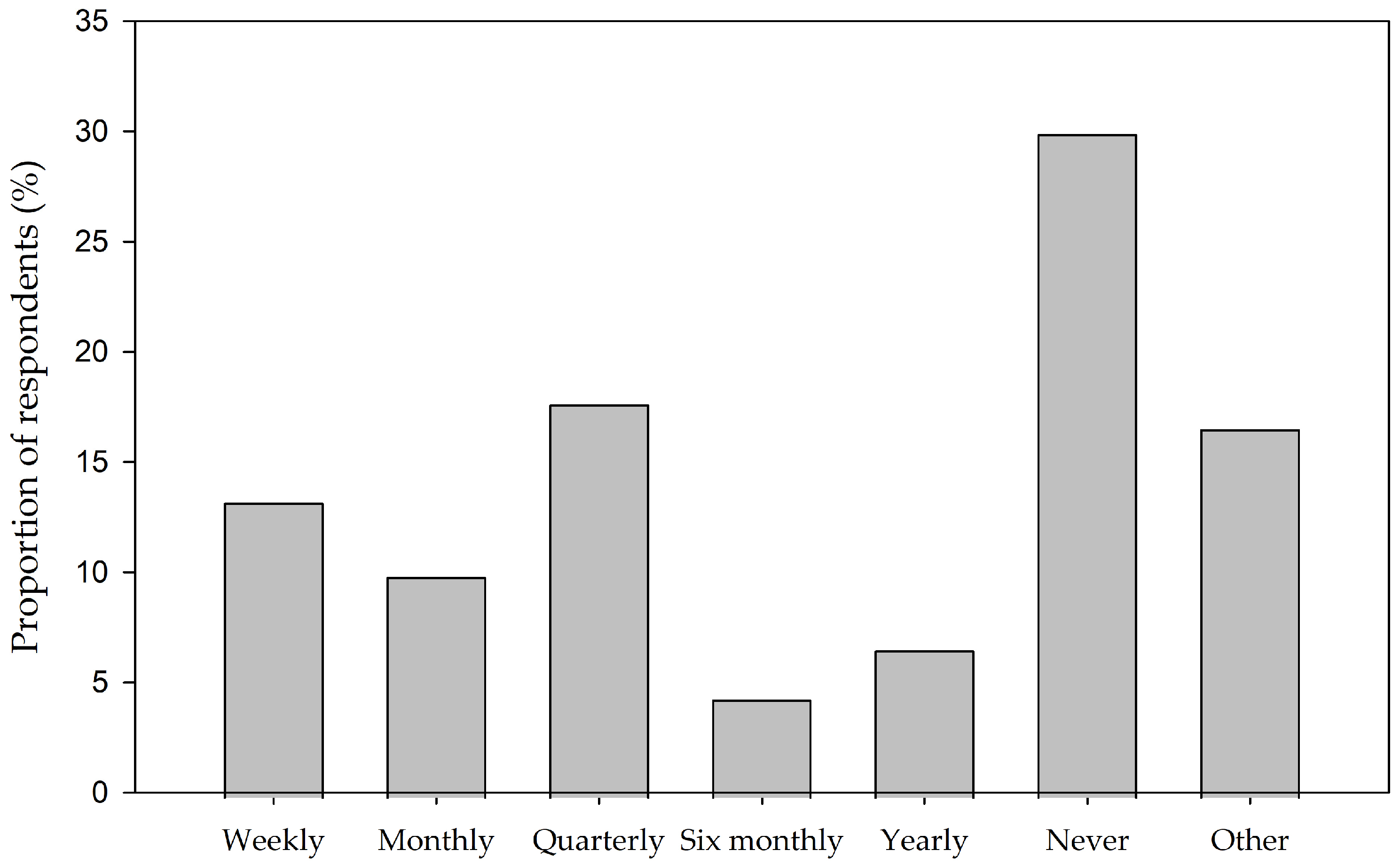

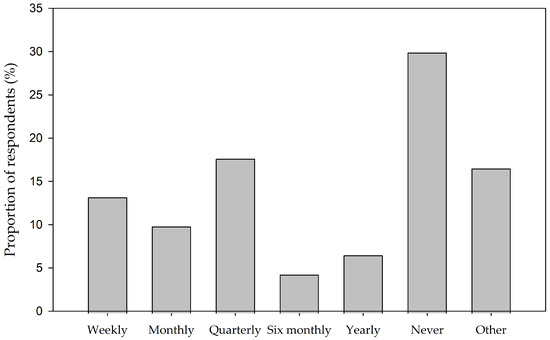

Twelve of the ninety stores surveyed (13%) indicated that stock-takes are undertaken on a weekly basis; 30% reported that stock-takes are not conducted (Figure 4). One SM commented that their store conducts a ‘floor count of stock 3 times per week’. Of those that performed stock-takes, 79% believed them to be accurate.

Figure 4.

Reported frequencies for stock-takes in charity shops. N = 90 for Shop Managers.

3.2. In Situ Observations of Store-Scale Processes and Practices in a Charity Shop

The observed procedures differed for donations of textiles (clothing and linen; Figure S1) and of books, CDs and DVDs, and bric-a-brac, but they followed a similar structure. Small electrical items required portable appliance testing (PAT) prior to sale; larger items and items valued at over GBP10 are sent to another of the same charity’s stores in the region. Due to space limitations, only small items of furniture are usually accepted at Store A. The fate of unsaleable items varied with category: textiles were recycled at a much higher rate than other items. Smaller proportions of donated bric-a-brac, electrical items and children’s toys were unsaleable but still suitable for collection by a third party. Low quality, dirty, or broken items were disposed of with residual waste. Notwithstanding opportunities for reuse or recycling, a sizable amount of residual waste was unavoidably produced at Store A due to the relatively high quantity of dirty or damaged items donated that were of inappropriate quality for resale or recycling.

Within Store A, there were three different staff roles: paid employees (Store Manager, Assistant Manager, and Shop Assistant), volunteers, and workers undertaking compulsory community service. Store A had four paid employees and six volunteers and was otherwise reliant on community service workers (CSWs). Volunteers and community service workers were evidently engaged and enthusiastic. One volunteer had trained in portable appliance testing (PAT); small electrical appliances donated could therefore be tested and sold within the shop if determined to be suitable for sale in terms of electrical safety.

Responsibilities differed between paid employees, volunteers, and CSWs. Volunteers and CSWs are usually given the same level of responsibility and carry out broadly similar tasks. Only paid employees assess if donations are saleable and decide on prices. Pricing textiles (e.g., clothing and linen) is guided by a charity’s national guide, which specifies minimum prices. There was no pricing guide for bric-a-brac, small furniture items, CDs and DVDs, electrical items, books, or toys. The pricing guide did not adjust for brands or account for the quality of items; some high-quality brand items, for example, could be highly worn or slightly damaged and were usually still saleable at a reduced price. Personal judgement was evident in pricing; some items were priced lower than the guide indicated. Valuing items higher than suggested by the pricing guide was rare. Assessment of donated items was evidently influenced by experience as well as the pricing guide. Brand new (unused or unworn) items with price tags still affixed were donated regularly; these were sold in-store for a third of the originally labelled price, according to the pricing guide.

Store A, in common with nearby charity shops, attracted students in higher education, but most customers were not students. Customers were diverse in terms of ethnicity and age; in general, more women entered the store and made purchases than men. Store A also attracted customers who had recently moved to the UK.

Most people who entered Store A purchased and/or donated items. Some individuals entered the store primarily to converse with a member of staff; routines were evident, and visits were highly frequent—more than once per day in some cases. Such visits were typically met with interest and enthusiasm by staff within the shop.

Reasons for purchases differed. Students frequently purchased fashionable or ‘vintage’ items and appeared content when they found a desirable item for lower cost than new. Other individuals sought clothing and shoes for themselves and their families but appeared concerned with prices. It was common for people to ask for discounts, which were usually given. Store A offered promotions and sales: bric-a-brac was offered at reduced price for multiple items, and prices of CDs and DVDs were reduced when store stock of these items was high. A reduction in prices generally resulted in higher volumes of sales.

Donations were occasionally large and thematic. On one occasion, Store A received a large donation of wedding attire and accessories, which were used to create a themed window display. There were three common but not mutually exclusive reasons why donations were made to Store A. Most frequently, individuals donated items because they no longer needed them (“end-of-use”) and thought that a charity shop may benefit from the resultant income. These donations were relatively small but usually comprised higher quality items; occasional donations would consist of one high quality item. Donations were also made of large amounts of unwanted household items; donation enabled the donor to avoid disposal of these items via other means. This was not the most frequent reason for donations, but brought in large quantities of goods, often of variable quality, including a mix of damaged, worn clothing and higher-quality, saleable clothing. Some individuals donated low-quality or worn items, seemingly seeking social interaction; after donating, they remained in the store to converse with a worker. Donations sometimes comprised items that belonged to a recently deceased family member about whom the donor remained in the shop to talk with staff.

Some donations comprised dirty and/or malodorous items. The staff to hand had neither the means nor time to wash clothing, so these items were customarily ragged. However, such clothes were often good quality and, if washed, could potentially be saleable. It became clear that many donors believed charity shops need any donations, of saleable quality and condition or otherwise. Unsaleable items were frequently received, e.g., used underwear, damaged clothing, broken bric-a-brac and some electrical items. Over the observation period, donations were never refused on the basis of their quality or condition. Books were always accepted, despite a sign displayed clearly stating that book donations were not needed. Processing donations took up substantial time for paid employees, particularly when receiving large donations.

The processes for receipt, assessment, preparation for sale, and subsequent fate of items donated to Store A are summarised graphically in Figure S1.

3.3. In Situ Observations of Store-Scale Stock and Destinations of Donations to Quantify Reuse and Recycling

Items in Store A were counted and weighed (Table 4) over one week in April 2019, during which sales were close to the weekly target. The total weight of items sold for ragging for the same week was also recorded. Items diverted from residual waste (the sum of items sold plus those ragged/recycled) for Store A for this week weighed, in total, 673 kg. During this week, the weight of ragged/recycled items was more than three times higher than the weight of those sold. If this week were assumed to be typical, the annual waste diverted from landfill for Store A would be ca. 35 tonnes.

Table 4.

Weight, quantity, and sales data for Store A during April 2019.

The category-specific weight data acquired for Store A (Table 4) provides a basis for estimating the weight of items in terms of (1) reuse (items sold and continued use assumed), (2) ragging (reused by a third party and/or recycled), and (3) diverted from disposal as residual waste (reused/sold plus ragging). Such estimates can be made if numbers of items sold per category and weight of rag sold are known for a specified period. We present a template for how such estimates may be made (Table 5), incorporating category-specific weight data acquired for Store A (Table 4).

Table 5.

Method template for quantification of reuse, ragging, and diversion of materials from the residual waste stream. Mean weights per item, shown in parentheses, are based on direct observations made in Store A. Where mixed items are sent for ragging, total weights may be substituted for weights per category.

The adoption of the proposed approach (Table 5) is subject to location- or organization-specific factors; we note that records of sales and ragging would need to be category-specific and based on suitably comparable categories (see Section 4.1).

3.4. Cost–Benefit Analysis of Unsaleable Donations at Store-Scale

Donations of unsaleable items to charity shops is problematic. Although selling unsaleable donations for ragging generates some income, there are attendant negative impacts. The assessment of unsaleable donations is carried out by paid employees; this activity takes considerable time and diverts their efforts from other tasks. When donations are transferred from other stores (a common practice; see Figure S1), for example, items need to be assessed by a paid employee before they can be set out on the shop floor for sale, while unassessed items often remain in a stock room until staff are available to assess them. At the same time, unsaleable donations incur waste collection costs and utilise valuable storage space in the stock room. The net cost of unsaleable donations to the charity retail sector was thus analysed on a cost–benefit basis (Table 6), considering both the gross cost to Store A and the income brought in from unsaleable donations as an illustration of the net cost and exemplification of how such calculations may be made. Estimates produced for Store A, based on direct observations and secondary data indicated that the net cost of unsaleable donations to Store A was ca. GBP 17,090 per annum (Table 6).

Table 6.

Cost–benefit calculation framework and illustration for unsaleable donations to the charity retail sector. Net cost of unsaleable donations per shop = Gross cost of unsaleable donations − Income from unsaleable donations; Gross cost of unsaleable donations = Paid employee’s time + Waste collection + Waste floor space + Potential income from sales lost; Income from unsaleable donations = Ragging. Factors and values used to calculate the cost and benefits of unsaleable donations for Store A are shown. Costs were calculated for 52 weeks. For the purposes of this illustrative calculation, it was assumed that 40% of items put onto the shop floor were sold. All financial costs and values in GBP Sterling as of April 2019.

4. Discussion

On the basis of the observations and data presented, we consider processes and practices concerning charity shops in the context of their benefits and potential for enhancement. First, the means by which positive impacts are determined (Section 4.1), with specific focus on reuse or recycling of donated and purchased items, are assessed, and suggestions are made for the design and implementation of a harmonised system to aid data capture and underpin initiatives for enhancement. Secondly, opportunities for enhancement of the environmental, economic and social benefits of charity shops benefits are considered, including facets of interactions and dependencies (Section 4.2). Recommendations for change and priorities are set out (Section 4.3), including aspects relating to on-going changes and developments in the charity retail sector. We note that observations and insight obtained via research undertaken at Store A should not be regarded as representative or typical of the UK charity retail sector, but serve to illustrate and exemplify processes and practice within a single charity shop. Although not elucidated explicitly in the present study, the nature of a specific charity shop (e.g., management structure and approach, staff number and characteristics, size, range of items accepted, and pricing policy) and its donors and customers (e.g., economic profile, demographics, nature, number and quality of donations, and purchases) may well influence processes, practice, and performance at store scale. Extrapolations of data relating to Store A should, therefore, be regarded as indicative.

4.1. The Benefits of Charity Shops and Their Assessment

The charity shop sector is considered to be driven by the value of reused items rather than by environmental concerns [37], but the outcome is that products are nonetheless diverted from residual waste through reuse (via sale) and recycling (via ragging), and with associated environmental benefits. Purchasing second-hand items from charity shops rather than new items reduces the resource consumption, freshwater use, chemical and plastic pollution, and greenhouse gas emissions incurred when new products are manufactured [21,22].

Charity shops are effective in diverting items from the residual waste stream through reuse and recycling (Table 4). Assuming the week audited is representative of yearly sales and proportions of items sold, Store A likely diverts around 35 tonnes of materials from residual waste over a year (Table 4). Charity retail in the UK led to the reuse or recycling of ~339,000 tonnes p.a. of textiles in 2018/2019 [20]. Compared with typical household waste generation rates in England (ca. 400 kg per capita, per annum [38]), materials diverted from residual waste by Store A are thus equivalent to around 87 householders. Likewise, diversion of textiles alone due to UK charity retail is equivalent to the total waste generated by around 850,000 householders.

It should be noted, however, that each charity makes its own estimates using different methods; inconsistencies in reporting and accuracy ensue. Charities with appreciable resources and experienced employees are best placed to produce accurate data in this regard; data may otherwise lack rigour. The present study proposes an approach (Table 4) which could improve the accuracy and consistency of reporting. Although the gross contribution of charity retail to reuse and recycling is well established, standardization and harmonization could offer greater insight to best practice across the sector and enable targeting of local- to store-scale initiatives to enhance practice. Improved understanding of category-specific patterns (Table 4), for example, could help identify areas of concern regarding unsaleable donations, and contribute to efforts aiming to better understand the inputs and fates of donated items on a category-specific basis (Table 5). Likewise, standardization of intervals for frequency of currently variable stock-taking (Figure 4) could ensure that audits are undertaken on a necessary and sufficient basis to provide meaningful data to support decisions relating to donations, stock, and sales.

The implementation of standardized, harmonized processes is unlikely to be trivial; there are disparities between responses from Heads of Charity Retail (HCR) and Store Managers (SMs) (Figure 1 and Figure 2) regarding standard procedures for receiving donations. HCRs believed that procedures were in place, but not all SMs did. Levels of seniority, training, and experience can differ between HCRs and SMs; expectations from senior management may not translate in entirety to store scale. The role of SM can be demanding, involving leadership and communication, high levels of physical work, and creative entrepreneurial action [39]. Average yearly salaries for SMs appear relatively low given the level of responsibility associated with this role: the current average salary (June 2023) of ca. GBP 33,600 [40] is very similar to the current UK average income (ca. GBP 33,700 [41]) across all sectors and roles. Charity retailers would not employ an SM without the necessary skills; some charity SMs come from commercial backgrounds and choose to work in charity shops despite the lower salaries. Arguably, the disparity between income and the demands placed upon SMs could impede the recruitment and retention of suitable staff. Volunteers do not necessarily have all the relevant skills; an SM will need to consider skills across a team. Training for paid employees and volunteers has historically been limited and with a low level of financial support [42].

Specific details also need to be considered regarding the standardisation of processes. The level of granularity is critical: recording information by category (Table 4) may provide valuable insight to quantities of donations and their destinations, but more detail imposes a higher workload for charity shop staff or affiliates. We would consider the analysis undertaken for Store A in the present study as a pilot evaluation. Further assessment in this regard should ideally aim to establish an approach that has sufficiently low impact on staff time to be implementable across a wide range of charity shops with varying levels of resource, whilst providing information at a sufficient level of detail to guide practice. The headline figure for materials diverted from the residual waste stream (Table 5), for example, does not necessarily require highly granular data; data for discrete categories may be pooled, with the same outcome still determined. In contrast, the identification of specific donation categories leading to substantial levels of reuse (i.e., sales) or levels of ragging that are high relative to reuse necessitates category-specific quantification. For example, unsaleable bric-a-brac items for Store A are less of a concern than for clothing in terms of the relative weights sold and ragged (Table 4); efforts to increase the proportion of saleable donations would be better focused on clothing than bric-a-brac.

4.2. Income Generation, Environmental Benefits, and the Social Roles of Charity Shops

Emphasis on generating income for parent charities has led to the adoption of commercially orientated practices, which can simultaneously impact on social benefits in communities [43]. Overt focus on retail activities can impact upon their role as community hubs or meeting places (Section 3.2) for customers and volunteers alike: the charity retail sector “at one end of the scale shows unrivalled retail professionalism and at the other a safety net for the socially excluded in society” [18]. There is arguably need for a balance between income generation for a parent charity and maintenance of local-scale community and social benefits.

Enhanced focus on income generation may lead to fewer donations of unsaleable items, with attendant benefits (Section 3.2), but could simultaneously reduce the social value of charity shops. Individuals can benefit from the social interaction of donating to charity shops and their sense of “doing a good thing”. If the charity retail sector strongly promotes their need for donated items with appreciable resale value (i.e., of suitable quality and condition), some donors may be deterred from making donations of lower value items.

Campaigns urging donations but only of saleable items have not been widely adopted by all charities [44]. To reduce donations of unsaleable donations, attempts could be made to promote change amongst donors. Cleanliness of clothing, for example, is critical: shops do not have facility to wash clothes and customers do not want to purchase dirty items. Consequently, usable but dirty clothing is ragged rather than being sold, reducing both income and reuse. Promotion of washing clothes before donating could render hitherto unsaleable donations as saleable, increasing income and reuse. For Store A, quantities of linen and home textiles and clothing sent for ragging, for example, are around three to four times higher than those sold (Table 4); washed and therefore saleable textiles items have potential for generating higher income and align better with the principles of the Waste Hierarchy [3].

Observations made in the present study identified that unsaleable items often form a part of donations of mixed quality comprising both saleable and unsaleable items. In cases of donations comprising or including unsaleable items, the reasons for donating do not appear clear. There is, alas, a possibility that donation to charity shops offers a convenient means for members of the public to discard unwanted and unneeded items, regardless of their potential for sale. With a drive towards the donation of higher quality items, customers with limited financial resources may be adversely affected if there is a resultant bias towards higher prices. Moreover, there is an underpinning concern to hand: donors’ judgement of what is (un)saleable is largely uncertain and impacts markedly on the value of their donation to the charity and the specific fate of donated items.

The donation of unsaleable items has notable impacts on charity shop operations and efficiency. Sorting donations to identify and remove unsaleable items diverts paid employees from other duties. In consequence, items transferred in from other stores, for example, remain in a stock room until there is time to sort and price them; stock replenishment and income are thereby impacted. Unsaleable donations also increase waste collection costs. Ragging generates some, albeit low, income; unsaleable donations cost Store A ca. GBP 17,000 net per year (Table 6). However, space is a significant issue; storerooms are often full, and thus, ragging makes much-needed space available. The profitability of charity shops is clearly adversely impacted by the handling and disposal of donated items as residual waste; all avoidable costs are important for profitability and raising funds to support related charitable causes.

Although we do not have information to hand regarding current practice amongst CRA member charities, it should also be noted that items bought by rag merchants are not always recycled; there is an overseas market for unsaleable, used clothes produced by UK companies [45]. Though exporting textiles from developed to developing nations can extend the life of a garment through reuse, the destination and fate of such items may remain unknown—to the charity and to the donor. The overseas demand for used clothing exports is decreasing [16], which has led to a reduction in rag prices for charity shops but could lead to an increase in quantities of textiles destined for recycling.

A critical factor underpinning reuse potential in charity shops is the question of what is suitable for resale. Regarding clothing, items donated to a charity shop that are well worn or that have slight damage (e.g., lacking a button, a small stain) are typically sent for ragging. Such items may of little worth to all members of the public. In Store A, prices of lower quality garments were reduced considerably if they have not been sold within 2 weeks, but there was no system in place for pricing items with a low resale value at the point of donation. Elsewhere, one Store Manager reported that if items are of low quality or slightly damaged when they come into their store, they are sold in multiples at low cost. Based on observations, the practice of reducing prices in this manner increases sales considerably, as individuals will purchase them with little hesitation. The placement of items of a lower standard in a ‘discount’ area could have a range of positive outcomes: reuse would displace ragging and recycling, income to parent charities would increase, and the needs of customers seeking items at lower prices would be met. Such approaches may, however, undermine attempts to adopt more commercially focused methods.

An alternative to discounted stock areas within stores is to create “outlet” stores in lower income areas, offering lower quality stock sold at very low price, thereby maximising reuse of items that would otherwise have been ragged. There are ‘value’ charity shops, accounting for around 3.4% of charity shops in the UK. Outlet stores can generate increased social benefits and create income opportunities particularly where pricing structure, i.e., low prices, is adapted to the needs of the local community in more deprived areas. Where implemented, this approach can markedly improve stores’ sales [26] and has potential for wider application.

Other approaches to increasing reuse and generating charities’ income have been established. Some charities (e.g., Sue Ryder, South Buckingham Hospice, and Nightingale House) have partnered with waste management companies and local authorities to set up reuse stores at household waste recycling centres (HWRCs) [17,26]. Potentially usable items are salvaged by waste management staff, cleaned, and, if necessary, safety tested before being placed in the shop, which is run by charity staff. These reuse stores have had significant environmental and economic benefits: they provide employment opportunities, increase reuse, and produce another income stream for charities. It is recommended that more charities look to form such partnerships and develop activities in this regard. Some commentators suggest that there is a substantial opportunity for charity shops to have a greater online retail presence [46].

We note that reuse and income generation associated with charity shops and donations thereto do not rely exclusively upon physically present stores. Some survey responses indicated that store managers are selling higher value items online. Estimates indicate that ca. 55% of charities have online stores for this purpose [47]; search engines aid customer choice, and the customer base are not constrained by the need to visit stores in person. The use of the Internet is highly viable as a means to increase the resale of clothing [9,37] and so has high potential for the charity retail sector. Social media also has utility in promoting pro-environmental awareness and actions; some charities have begun to use their online presence to promote the positive impacts of charity retail, including the environmental benefits of reuse through the purchase of donated items.

4.3. Recommendations

If the benefits of charity retail are to be enhanced further in regard to broad issues relating to their purpose and sustainability, we propose that efforts are focused in three key areas.

4.3.1. Securing Appropriate Donations

The need for donations that maximise income and minimise cost is critical for parent charities. Saleable items create the potential for income, as do unsaleable items suitable for ragging; items suitable only for disposal incur a cost (Table 6). Charity retailers and customers alike seek good-quality, affordable items.

Ideally, donations would comprise only items suitable for resale that are clean, undamaged and functioning. Items unsuitable for direct sale should ideally be made available for cleaning and/or repair before reuse. Reuse stores at HWRCs and repair cafes, for example, make available serviceable items for those who wish or need to undertake repair and/or cleaning themselves.

Donation of items without utility and value incurs substantial costs to charity shops (Table 6), and it should be actively discouraged. Use of charity shops as a means of waste disposal is, we contend, unacceptable and inappropriate. Donations, as observed, can comprise a mixture of saleable and unsaleable items. Measures are clearly needed to influence upstream decisions and actions taken by donors such that the balance of costs and benefits associated with unsaleable donations (e.g., Table 6) is favourable to the charity.

4.3.2. Facilitating Information Capture

Resources to capture and analyse market intelligence to guide and underpin sales in the charity retail sector may be limited. For one charity, for example, the Head of Charity Retail reported that computers were available in only half their stores and that the recording and flow of information from stores was often lacking. Means to capture information should recognise and value the specific circumstances in which charity stores operate. At local level, the experience, passion, and knowledge of charity shop staff (paid and/or voluntary) is a critical resource; as the “eyes and ears” of the charity retail sector, their insight has much to offer. Co-ordination of efforts in this regard and capture of store-specific insights should be led, wherever feasible, by (paid) shop managers and, as appropriate, shared through higher-level management structures. A reduction in unsaleable donations (Section 4.3.1; Table 6) would reduce the time needed for sorting donations and could release more time for managers to liaise with unpaid colleagues and capitalise on their experience.

The capture of data needs to be sympathetic to the available resources: simple measures and records (e.g., Table 4) based on counts or weights offer insight at store level and, if aggregated, at much broader scale. Standardised and simple audits, for example (Table 4), readily indicate stock and sales profiles. If repeated at intervals across the sector (acknowledging the limitations due to different charity retailers’ reporting capabilities), such audits would provide insight to longer-term and broad-scale trends. Relatively simple audits (e.g., Table 4) indicate the quantities and fate of donated items on a categorical basis and inform campaigns to enhance sales and reduce costs.

5. Conclusions

Charity retail is well established in the UK and provides a wide range of benefits. The sale of donated items constitutes reuse and thereby aligns wholly with the aims and principles of both the Waste Hierarchy [3] and a circular economy [48]; this sector has arguably predated the contemporary reuse agenda by several decades. This study highlights opportunities for enhancement of charity shops’ benefits. In this regard, we propose that there are two key areas of concern.

First, methods appertaining to stock data recording, procedures for receiving/dealing with donations, use of standard approaches, quantification of key variables, and accuracy of previous survey data are imperative to the effective operation of charity shops and the optimization of their multiple benefits. Methods were successfully developed and trialled to (a) quantify the waste diverted from landfill by the sector via reuse/recycling and (b) estimate the financial cost of unsaleable donations. Future use of these methods as standard procedures for charity retail shops across the UK sector (and potentially internationally) is recommended where possible, acknowledging the limitations due to different charity retailers’ resources and reporting capabilities.

Secondly, the saleability of donated items is critical to the operation and impacts of charity shops. In principle, reducing donations of unsaleable items has clear economic and environmental benefits in terms of increased income generation, reduced processing and storage costs, and achievement of higher rates of reuse. At the same time, the differing characteristics and needs of donors and customers need to be considered, particularly with regard to the social benefits that charity shops provide.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/su151612153/s1, Figure S1: Schematic representation of the processes for receipt, assessment, preparation for sale, and subsequent fate of items donated to Store A.

Author Contributions

Conceptualization, B.R.D., I.D.W. and P.J.S.; methodology, B.R.D. and I.D.W.; formal analysis, B.R.D.; investigation, B.R.D.; resources, I.D.W.; data curation, B.R.D.; writing—original draft preparation, B.R.D.; writing—review and editing, B.R.D., I.D.W. and P.J.S.; visualization, B.R.D. and P.J.S.; supervision, I.D.W. and P.J.S.; project administration, B.R.D. and I.D.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the ethics committee of the Faculty of Environmental and Life Science, University of Southampton, UK (Reference number 47787; approved 8 March 2019).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Acknowledgments

We are grateful to all the workers that completed our survey. We are also very grateful to colleagues at the Charity Retail Association for their helpful comments during the development of this manuscript and for their help in recruiting participants in surveys.

Conflicts of Interest

The authors declare no conflict of interest.

References

- United Nations Department of Economic and Social Affairs: The 17 Goals. Available online: https://sdgs.un.org/goals (accessed on 9 June 2023).

- European Environment Agency: Resource Efficiency and Waste. Available online: https://www.eea.europa.eu/themes/waste/intro (accessed on 26 April 2020).

- Williams, I.D. Forty years of the waste hierarchy. Waste Man. 2015, 40, 1–2. [Google Scholar] [CrossRef] [PubMed]

- European Union (EU). Waste Framework Directive 2008/98/EC. Available online: https://www.eea.europa.eu/policy-documents/waste-framework-directive-2008-98-ec (accessed on 15 June 2023).

- European Union (EU). Directive (EU) 2018/851 of the European Parliament and of the Council of 30 May 2018 Amending Directive 2008/98/EC on Waste. Available online: https://www.eea.europa.eu/policy-documents/directive-eu-2018-851-of (accessed on 15 June 2023).

- Nederland Circulair: The Potential for High-Value Reuse in a Circular Economy. Available online: https://www.circulairondernemen.nl/uploads/27102a5465b3589c6b52f8e43ba9fd72.pdf (accessed on 26 April 2020).

- Shittu, O.S.; Williams, I.D.; Shaw, P.J. The WEEE’ Challenge: Is reuse the “new recycling”? Resourc. Cons. Recycl. 2021, 174, 105817. [Google Scholar] [CrossRef]

- Beasley, J.; Georgeson, R. Reuse in the UK and Ireland; CIWM: Northampton, UK, 2016. [Google Scholar]

- Shaw, P.J.; Williams, I.D. Reuse in practice: The UK’s car and clothing sectors. Detritus 2018, 4, 36–47. [Google Scholar] [CrossRef]

- Gregson, N.; Crewe, L. Second-Hand Cultures; Berg Publishers: Oxford, UK, 2003. [Google Scholar]

- Williams, I.D.; Shaw, P.J. Reuse: Fashion or future? Waste Man. 2017, 60, 1–2. [Google Scholar] [CrossRef] [PubMed]

- Cox, J.; Griffith, S.; Georgi, S.; King, G. Consumer understanding of product lifetimes. Resourc. Cons. Recycl. 2013, 79, 21–29. [Google Scholar] [CrossRef]

- Gregson, N.; Crewe, L. The bargain, the knowledge, and the spectacle: Making sense of consumption in the space of the car-boot sale. Environ. Plan. D Soc. Space 1997, 15, 87–112. [Google Scholar] [CrossRef]

- Gregson, N.; Crang, M.; Laws, J.; Fleetwood, T.; Holmes, H. Moving up the waste hierarchy: Car boot sales, reuse exchange and the challenges of consumer culture to waste prevention. Resourc. Cons. Recycl. 2013, 77, 97–107. [Google Scholar] [CrossRef]

- Shittu, O.S.; Shaw, P.J.; Williams, I.D.; Montiero, N.; Creffield, R. Demonstrating EEE recovery for reuse in a distinct urban mine: A case study. Detritus 2021, 15, 78–93. [Google Scholar] [CrossRef]

- Waste and Resources Action Programme (WRAP). Valuing Our Clothes: The Cost of UK Fashion; WRAP: Banbury, UK, 2017. [Google Scholar]

- Osterley, R.; Williams, I.D. The social, environmental and economic benefits of reuse by charity shops. Detritus 2019, 7, 29–35. [Google Scholar] [CrossRef]

- Horne, S.; Maddrell, A. Charity Shops: Retailing Consumption and Society; Routledge: London, UK, 2002. [Google Scholar]

- Charity Retail Association (CRA). We Map Every Charity Shop in the UK. Available online: https://www.charityretail.org.uk/charity-retail-association-maps-every-charity-shop-in-the-uk/ (accessed on 14 June 2023).

- Charity Retail Association (CRA). Key Statistics. Available online: https://www.charityretail.org.uk/key-statistics/ (accessed on 14 June 2023).

- Bhardwaj, V.; Fairhurst, A. Fast fashion: Response to changes in the fashion industry. Int. Rev. Retail Dist. Cons. Res. 2010, 20, 165–173. [Google Scholar] [CrossRef]

- McNeill, L.; Moore, R. Sustainable fashion consumption and the fast fashion conundrum: Fashionable consumers and attitudes to sustainability in clothing choice. Int. J. Cons. Stud. 2015, 39, 212–222. [Google Scholar] [CrossRef]

- UK Parliament Environmental Audit Committee. Fixing Fashion: Clothing Consumption and Sustainability; UK Parliament: London, UK, 2019. [Google Scholar]

- European Clothing Action Plan (ECAP): Used Textile Collection in European Cities. Available online: http://www.ecap.eu.com (accessed on 15 June 2023).

- Waste and Resources Action Programme (WRAP). Textiles: Market Situation Report; WRAP: Banbury, UK, 2017. [Google Scholar]

- Harrison-Evans, P. Shopping for Good: The Social Benefits of Charity Retail. Available online: https://demos.co.uk/project/shopping-for-good/ (accessed on 15 June 2023).

- Paget, A.; Birdwell, J. Giving Something Back. Available online: https://demos.co.uk/project/giving-something-back/ (accessed on 15 June 2023).

- The Guardian: Resale Therapy: Charities Reinvent Former Topshop to Take on Depop and eBay. Available online: https://www.theguardian.com/society/2023/jan/27/resale-therapy-10-charities-combine-for-pop-up-london-department-store (accessed on 14 June 2023).

- Charity Retail Association (CRA). Charity Shop Sales Continue to Soar as Charities Report Record Sales Quarte. Available online: https://www.charityretail.org.uk/charity-shop-sales-continue-to-soar-as-charities-report-record-sales-quarter/ (accessed on 15 June 2023).

- Scope. Volunteering at Scope. Available online: https://www.scope.org.uk/volunteering (accessed on 15 June 2023).

- Williams, I.D.; Powell, L. Sustainable resource management by students at higher education institutions. Detritus 2019, 6, 11–24. [Google Scholar] [CrossRef]

- Charity Retail Association (CRA). About Us. 2019. Available online: https://www.charityretail.org.uk/about-us/ (accessed on 15 June 2023).

- World Health Organization. Sustainable Development. Available online: https://www.who.int/health-topics/sustainable-development#tab=tab_1 (accessed on 14 June 2023).

- Fink, A. How to Ask Survey Questions; Sage Publications: London, UK, 1995. [Google Scholar]

- Kelley, K.; Clarke, B.; Brown, V.; Sitzia, J. Good practice in the conduct and reporting of survey research. Int. J. Qual. Health Care 2003, 15, 261–266. [Google Scholar] [CrossRef] [PubMed]

- Charity Retail Association (CRA). Sources of Stock 2017; CRA: London, UK, 2017. [Google Scholar]

- Morley, N.J.; Bartlett, C.; McGill, I. Maximising Reuse and Recycling of UK Clothing and Textiles; Oakdene Hollins Ltd.: Aylesbury, UK, 2009. [Google Scholar]

- Statista. Volume of Waste from Households Collected by Local Authorities per Capita in England from 2010 to 2021. Available online: https://www.statista.com/statistics/322535/total-household-waste-volumes-in-england-uk-per-person/ (accessed on 7 June 2023).

- Parsons, E. Charity retail: Past, present and future. Int. J. Retail Dist. Man. 2002, 30, 586–594. [Google Scholar] [CrossRef]

- Glassdoor. Guide Salaries in United Kingdom. Available online: https://www.glassdoor.co.uk/Salaries/charity-shops-salary-SRCH_KO0,13.htm (accessed on 7 June 2023).

- Office for National Statistics (ONS). Average Weekly Earnings in Great Britain: June 2023. Available online: https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/averageweeklyearningsingreatbritain/latest (accessed on 14 June 2023).

- Civil Society. Charity Shop Survey 2019. Available online: https://www.civilsociety.co.uk/news/charity-superstores-surpass-traditional-shops-in-this-year-s-charity-shops-survey.html (accessed on 26 April 2020).

- Broadbridge, A.; Parsons, L. Still serving the community? The professionalisation of the UK charity retail sector. Int. J. Retail Dist. Man. 2003, 31, 418–427. [Google Scholar] [CrossRef]

- Third Sector: Charities Overlooked Mary Portas’ Donate, Don’t Dump Scheme to Pursue Their Own Plans. Available online: https://www.thirdsector.co.uk/charities-overlooked-mary-portas-donate-dont-dump-scheme-pursue-own-plans/fundraising/article/997641 (accessed on 16 June 2023).

- Brooks, A. Riches from rags or persistent poverty? The working lives of second-hand clothing vendors in Maputo, Mozambique. Textile 2012, 10, 222–237. [Google Scholar] [CrossRef]

- Charity Digital. The Online Future of the Charity Shop. Available online: https://charitydigital.org.uk/topics/topics/the-online-future-of-the-charity-shop-7176 (accessed on 14 June 2023).

- Charity Digital. Top 5 Charities Using e-Commerce to Raise Funds. Available online: https://charitydigital.org.uk/topics/topics/top-5-charities-using-e-commerce-to-raise-funds--8079 (accessed on 18 July 2023).

- Stahel, W.R. The circular economy. Nature 2016, 531, 435–438. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).