Optimal Green Input Level for a Capital-Constrained Supply Chain Considering Disruption Risk

Abstract

:1. Introduction

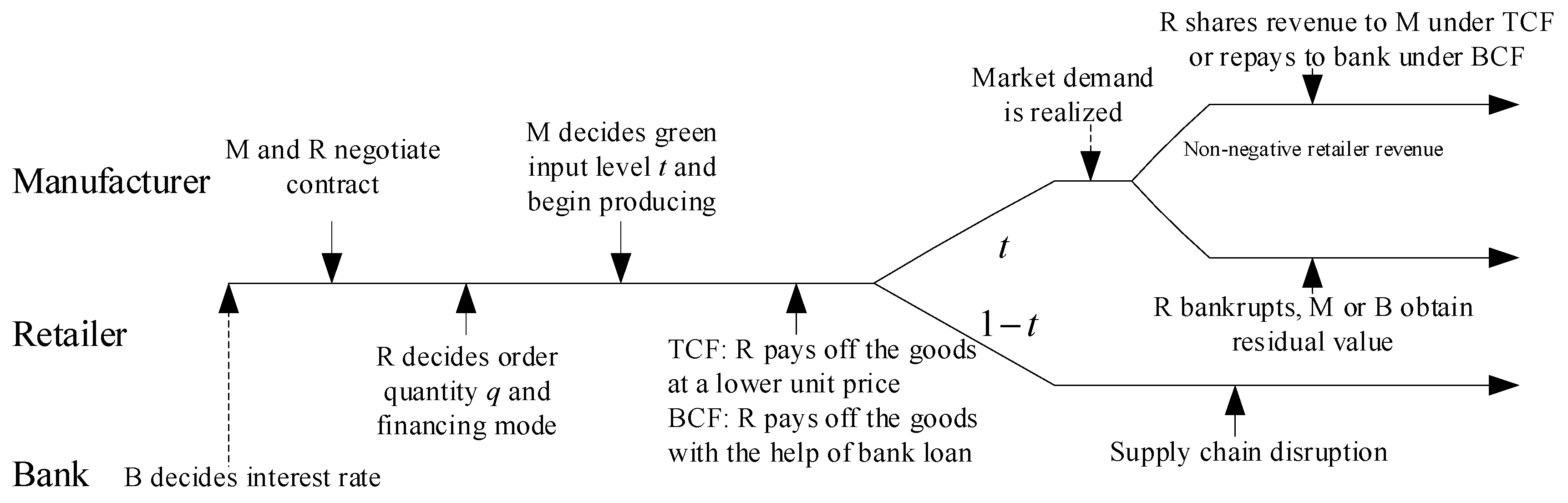

- How different would the game problem of a two-echelon supply chain be when considering the decision of green input level?

- With different financing modes, i.e., BCF and TCF, how does the retailer determine the order quantity to maximize profit?

- How does the manufacturer decide the green input level to achieve the optimal profit with the given order quantity of the retailer?

- How will the retailer select the financing mode? Does the option of financing help reduce the risk of supply disruption compared to no financing?

2. Literature Review

2.1. Green Supply Chain Management

2.2. Supply Chain Finance

2.3. Supply Chain Management Considering Disruption Risk

3. Model Description and Hypothesis

4. Model Analysis

4.1. No Financing: The Benchmark

4.2. Trade Credit Financing

4.3. Bank Credit Financing

4.4. Comparison

5. Numerical Analysis

5.1. Simulation of No-Financing Mode

5.2. Simulation of TCF Mode

5.3. Simulation of BCF Mode

6. Discussion, Conclusions, and Future Work

6.1. Discussion

6.2. Conclusions

6.3. Limitations and Future Research Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sachs, J.D.; Lafortune, G.; Kroll, C.; Fuller, G.; Woelm, F. From Crisis to Sustainable Development: The SDGs as Roadmap to 2030 and Beyond. In Sustainable Development Report 2022; Cambridge University Press: Cambridge, UK, 2022; 36p. [Google Scholar]

- Freyre, A.; Klinke, S.; Patel, M.K. Carbon tax and energy programs for buildings: Rivals or allies? Energy Policy 2020, 139, 111218. [Google Scholar] [CrossRef]

- Lariviere, M.A.; Porteus, E.L. Selling to the Newsvendor: An Analysis of Price-Only Contracts. Manuf. Serv. Oper. Manag. 2001, 3, 293–305. [Google Scholar] [CrossRef]

- Wu, D.D.; Yang, L.; Olson, D.L. Green supply chain management under capital constraint. Int. J. Prod. Econ. 2019, 215, 3–10. [Google Scholar]

- Luo, Y.; Wei, Q.; Ling, Q.; Huo, B. Optimal decision in a green supply chain: Bank financing or supplier financing. J. Clean. Prod. 2020, 271, 122090. [Google Scholar] [CrossRef]

- Christopher, S.T.; Yang, S.A.; Jing, W. Sourcing from Suppliers with Financial Constraints and Performance Risk. Manuf. Serv. Oper. Manag. 2018, 20, 70–84. [Google Scholar]

- Fang, L.; Xu, S. Financing equilibrium in a green supply chain with capital constraint. Comput. Ind. Eng. 2020, 143, 106390. [Google Scholar] [CrossRef]

- Jing, B.; Chen, X.; Cai, G. Equilibrium Financing in a Distribution Channel with Capital Constraint. Prod. Oper. Manag. 2012, 21, 1090–1101. [Google Scholar] [CrossRef]

- Hua, S.; Liu, J.; Cheng, T.C.E.; Zhai, X. Financing and ordering strategies for a supply chain under the option contract. Int. J. Prod. Econ. 2019, 208, 100–121. [Google Scholar] [CrossRef]

- Nureen, N.; Liu, D.; Irfan, M.; Malik, M.; Awan, U. Nexuses among Green Supply Chain Management, Green Human Capital, Managerial Environmental Knowledge, and Firm Performance: Evidence from a Developing Country. Sustainability 2023, 15, 5597. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2012, 10, 99–116. [Google Scholar] [CrossRef]

- Halat, K.; Hafezalkotob, A. Modeling carbon regulation policies in inventory decisions of a multi-stage green supply chain: A game theory approach. Comput. Ind. Eng. 2019, 128, 807–830. [Google Scholar] [CrossRef]

- Turki, S.; Didukh, S.; Sauvey, C.; Rezg, N. Optimization and Analysis of a Manufacturing–Remanufacturing–Transport–Warehousing System within a Closed-Loop Supply Chain. Sustainability 2017, 9, 561. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.J.; Sheu, J.-B. Environmental-regulation pricing strategies for green supply chain management. Transp. Res. Part E Logist. Transp. Rev. 2009, 45, 667–677. [Google Scholar] [CrossRef] [Green Version]

- Rosič, H.; Jammernegg, W. The economic and environmental performance of dual sourcing: A newsvendor approach. Int. J. Prod. Econ. 2013, 143, 109–119. [Google Scholar] [CrossRef] [Green Version]

- Liu, Z.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Chen, Y.; Li, B.; Bai, Q.; Liu, Z. Decision-Making and Environmental Implications under Cap-and-Trade and Take-Back Regulations. Int. J. Environ. Res. Public Health 2018, 15, 678. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Wang, W.; Zhang, Y.; Zhang, W.; Gao, G.; Zhang, H. Incentive mechanisms in a green supply chain under demand uncertainty. J. Clean. Prod. 2021, 279, 123636. [Google Scholar] [CrossRef]

- Yu, W.; Wang, Y.; Feng, W.; Bao, L.; Han, R. Low carbon strategy analysis with two competing supply chain considering carbon taxation. Comput. Ind. Eng. 2022, 169, 108203. [Google Scholar] [CrossRef]

- Bai, S.; Wu, D.; Yan, Z. Operational decisions of green supply chain under financial incentives with emission constraints. J. Clean. Prod. 2023, 389, 136025. [Google Scholar] [CrossRef]

- Du, S.; Zhu, L.; Liang, L.; Ma, F. Emission-dependent supply chain and environment-policy-making in the ‘cap-and-trade’ system. Energy Policy 2013, 57, 61–67. [Google Scholar] [CrossRef]

- Du, S.; Tang, W.; Song, M. Low-carbon production with low-carbon premium in cap-and-trade regulation. J. Clean. Prod. 2016, 134, 652–662. [Google Scholar] [CrossRef]

- Mondal, C.; Giri, B.C. Retailers’ competition and cooperation in a closed-loop green supply chain under governmental intervention and cap-and-trade policy. Oper. Res. 2022, 22, 859–894. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H. Competition and coordination in a dual-channel green supply chain with an eco-label policy. Comput. Ind. Eng. 2021, 153, 107057. [Google Scholar] [CrossRef]

- Jian, J.; Li, B.; Zhang, N.; Su, J. Decision-making and coordination of green closed-loop supply chain with fairness concern. J. Clean. Prod. 2021, 298, 126779. [Google Scholar] [CrossRef]

- Liu, Z.; Lang, L.; Hu, B.; Shi, L.; Huang, B.; Zhao, Y. Emission reduction decision of agricultural supply chain considering carbon tax and investment cooperation. J. Clean. Prod. 2021, 294, 126305. [Google Scholar] [CrossRef]

- Yang, L.; Wang, Y.; Zhang, W.; Tan, Z.; Anwar, S.U. Optimal pricing and sourcing strategies in a symbiotic supply chain under supply uncertainty. J. Clean. Prod. 2023, 408, 137034. [Google Scholar] [CrossRef]

- Huang, J.; Yang, W.; Tu, Y. Financing mode decision in a supply chain with financial constraint. Int. J. Prod. Econ. 2020, 220, 107441. [Google Scholar] [CrossRef]

- Lu, Q.; Gu, J.; Huang, J. Supply chain finance with partial credit guarantee provided by a third-party or a supplier. Comput. Ind. Eng. 2019, 135, 440–455. [Google Scholar] [CrossRef]

- Song, J.; Yan, X. Impact of Government Subsidies, Competition, and Blockchain on Green Supply Chain Decisions. Sustainability 2023, 15, 3633. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Henke, M. Focusing the financial flow of supply chains: An empirical investigation of financial supply chain management. Int. J. Prod. Econ. 2013, 145, 773–789. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Supply Chain Contract Design Under Financial Constraints and Bankruptcy Costs. Manag. Sci. J. Inst. Manag. Sci. 2016, 62, 2341–2357. [Google Scholar] [CrossRef]

- Chen, J.; Zhou, Y.-W.; Zhong, Y. A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. Int. J. Prod. Res. 2017, 55, 5287–5304. [Google Scholar] [CrossRef]

- Shi, J.; Du, Q.; Lin, F.; Lai, K.K.; Cheng, T.C. Optimal financing mode selection for a capital-constrained retailer under an implicit bankruptcy cost. Int. J. Prod. Econ. 2020, 228, 107657. [Google Scholar] [CrossRef]

- Jin, X.; Zhou, H.; Wang, J. Joint finance and order decision for supply chain with capital constraint of retailer considering product defect. Comput. Ind. Eng. 2021, 157, 107293. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, W. Optimal operational and financing portfolio strategies for a capital-constrained closed-loop supply chain with supplier-remanufacturing. Comput. Ind. Eng. 2022, 168, 108133. [Google Scholar] [CrossRef]

- Zou, T.; Zou, Q.; Hu, L. Joint decision of financing and ordering in an emission-dependent supply chain with yield uncertainty. Comput. Ind. Eng. 2021, 152, 106994. [Google Scholar] [CrossRef]

- Sun, H.; Xia, X.; Liu, B. Inventory lot sizing policies for a closed-loop hybrid system over a finite product life cycle. Comput. Ind. Eng. 2020, 142, 106340. [Google Scholar] [CrossRef]

- Shi, J.; Liu, D.; Du, Q.; Cheng, T.C.E. The role of the procurement commitment contract in a low-carbon supply chain with a capital-constrained supplier. Int. J. Prod. Econ. 2023, 255, 108681. [Google Scholar] [CrossRef]

- Kleindorfer, P.R.; Saad, G.H. Managing disruption risks in supply chains. Prod. Oper. Manag. 2005, 14, 53–68. [Google Scholar] [CrossRef]

- Li, J.; Jing, K.; Khimich, M.; Shen, L. Optimization of Green Containerized Grain Supply Chain Transportation Problem in Ukraine Considering Disruption Scenarios. Sustainability 2023, 15, 7620. [Google Scholar] [CrossRef]

- Torabi, S.A.; Baghersad, M.; Mansouri, S.A. Resilient supplier selection and order allocation under operational and disruption risks. Transp. Res. Part E Logist. Transp. Rev. 2015, 79, 22–48. [Google Scholar] [CrossRef]

- Yu, H.; Zeng, A.Z.; Zhao, L. Single or dual sourcing: Decision-making in the presence of supply chain disruption risks. Omega 2009, 37, 788–800. [Google Scholar] [CrossRef]

- Gupta, V.; He, B.; Sethi, S.P. Contingent sourcing under supply disruption and competition. Int. J. Prod. Res. 2015, 53, 3006–3027. [Google Scholar] [CrossRef]

- Hu, H.; Guo, S.; Qin, Y.; Lin, W. Two-stage stochastic programming model and algorithm for mitigating supply disruption risk on aircraft manufacturing supply chain network design. Comput. Ind. Eng. 2023, 175, 108880. [Google Scholar] [CrossRef]

- Qian, X.; Chan, F.T.S.; Zhang, J.; Yin, M.; Zhang, Q. Channel coordination of a two-echelon sustainable supply chain with a fair-minded retailer under cap-and-trade regulation. J. Clean. Prod. 2020, 244, 118715. [Google Scholar] [CrossRef]

- Phan, D.A.; Vo, T.L.H.; Lai, A.N. Supply chain coordination under trade credit and retailer effort. Int. J. Prod. Res. 2019, 57, 2642–2655. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. Trade credit financing and coordination for an emission-dependent supply chain. Comput. Ind. Eng. 2018, 119, 50–62. [Google Scholar] [CrossRef]

- Yavari, M.; Zaker, H. An integrated two-layer network model for designing a resilient green-closed loop supply chain of perishable products under disruption. J. Clean. Prod. 2019, 230, 198–218. [Google Scholar] [CrossRef]

- Babich, V.; Tang, C.S. Managing Opportunistic Supplier Product Adulteration: Deferred Payments, Inspection, and Combined Mechanisms. Manuf. Serv. Oper. Manag. 2012, 14, 301–314. [Google Scholar] [CrossRef] [Green Version]

- Chen, X.; Lu, Q.; Cai, G. Buyer Financing in Pull Supply Chains: Zero-Interest Early Payment or In-House Factoring? Prod. Oper. Manag. 2020, 29, 2307–2325. [Google Scholar] [CrossRef]

- Ji, S.W.; Wang, W.; Dong, Y.T. ILP model research of electronic manufacturing enterprise green supply chain inventory & transportation decision-making. Adv. Mater. Res. 2012, 479, 255–259. [Google Scholar]

| Existing Studies | Findings and Contributions | Capital Constrained | Cleaner Production | Disruption Risk |

|---|---|---|---|---|

| Wu et al. [4] | Optimal operational decisions of supply chain members under the bank and trade financing mode. | √ | √ | |

| Kouvelis and Zhao [32] | Trade credit financing can diversify the supply chain when there is a risk of insolvency and cost of default. | √ | ||

| Phan et al. [47] | They studied the role of trade credit in a capital-constrained supply chain. | √ | ||

| Cao and Yu [48] | They studied the effect of capital on the selection of a centralized supply chain financing mode and willingness to cooperate. | √ | ||

| Zou et al. [37] | They studied the impact of capital on supply chain financing and operations. | √ | √ | |

| Yang et al. [27] | Remanufacturing can be an effective way to increase carbon reduction levels and profit for manufacturers and retailers. | √ | ||

| Liu et al. [26] | The relationship between investment in carbon reduction on market demand and profitability in the agricultural supply chain. | √ | ||

| Fang and Xu [7] | The impact of carbon emission policies on green supply chain emission reduction. | √ | ||

| Yavari and Zaker [49] | The design of a resilient, green, closed-loop supply chain network for perishable products at the risk of power network disruption. | √ | ||

| Li et al. [41] | The paper examined a retailer’s multi-channel sourcing and pricing strategy under supply disruption risk. | √ | ||

| Our paper | The retailer’s financing preference and willingness to order depend on the input level of cleaner production. | √ | √ | √ |

| Symbols | Definition |

|---|---|

| Manufacturer’s unit production cost | |

| Retailer’s order quantity (decision variable) | |

| Optimal order quantity (decision variable) | |

| Unit wholesale price under BCF, with | |

| Unit wholesale price under TCF, with | |

| Retail price, with | |

| Initial capital of the retailer | |

| Stochastic market demand | |

| Manufacturer’s excepted profit (decision variable) | |

| Retailer’s excepted profit (decision variable) | |

| Revenue sharing ratio, with | |

| Input level of cleaner production, with , (decision variable) | |

| The lowest input level of cleaner production, with | |

| The loan interest rate of bank, with |

| 7.50 | 23.44 | 1.88 | 4.92 |

| 10.35 | 32.34 | 2.59 | 7.76 |

| 13.20 | 41.25 | 3.30 | 10.60 |

| 16.05 | 50.16 | 4.01 | 13.44 |

| 18.90 | 59.06 | 4.73 | 16.28 |

| 21.75 | 67.97 | 5.44 | 19.12 |

| 24.60 | 76.88 | 6.15 | 21.96 |

| 27.45 | 85.78 | 6.86 | 24.80 |

| 30.30 | 94.69 | 7.58 | 27.65 |

| 33.15 | 103.59 | 8.29 | 30.49 |

| 36.00 | 112.50 | 9.00 | 33.33 |

| 0.013 | 7.50 | 23.44 | 333.38 | 4.33 | 0.41 | 1.88 | 30.82 | 4.92 | 5.28 | 2.46 |

| 0.016 | 7.92 | 24.73 | 316.59 | 5.08 | 0.42 | 1.98 | 31.43 | 5.33 | 5.95 | 2.36 |

| 0.020 | 8.45 | 26.41 | 299.81 | 6.00 | 0.45 | 2.11 | 32.12 | 5.86 | 6.75 | 2.24 |

| 0.040 | 11.21 | 35.02 | 248.98 | 10.03 | 0.54 | 2.80 | 34.53 | 8.61 | 10.07 | 1.85 |

| 0.061 | 13.96 | 43.63 | 221.23 | 13.41 | 0.62 | 3.49 | 35.90 | 11.36 | 12.61 | 1.62 |

| 0.081 | 16.72 | 52.23 | 202.32 | 16.37 | 0.68 | 4.18 | 36.72 | 14.10 | 14.67 | 1.47 |

| 0.101 | 19.47 | 60.84 | 188.04 | 19.03 | 0.74 | 4.87 | 37.20 | 16.85 | 16.39 | 1.35 |

| 0.122 | 22.23 | 69.45 | 176.61 | 21.46 | 0.79 | 5.56 | 37.44 | 19.60 | 17.85 | 1.26 |

| 0.142 | 24.98 | 78.06 | 167.09 | 23.69 | 0.84 | 6.25 | 37.52 | 22.34 | 19.10 | 1.19 |

| 0.162 | 27.74 | 86.67 | 158.95 | 25.77 | 0.88 | 6.93 | 37.47 | 25.09 | 20.16 | 1.13 |

| 0.182 | 30.49 | 95.28 | 151.84 | 27.70 | 0.93 | 7.62 | 37.33 | 27.83 | 21.07 | 1.08 |

| 0.203 | 33.25 | 103.89 | 145.55 | 29.50 | 0.97 | 8.31 | 37.11 | 30.58 | 21.85 | 1.03 |

| 0.223 | 36.00 | 112.50 | 139.89 | 31.20 | 1.00 | 9.00 | 36.84 | 33.33 | 22.50 | 0.99 |

| 0.143 | 7.50 | 52.45 | 153.87 | 22.00 | 0.67 | 13.48 | 30.31 | 4.89 | 14.75 | 1.64 |

| 0.163 | 10.61 | 65.22 | 147.48 | 23.98 | 0.71 | 15.48 | 30.82 | 7.98 | 15.75 | 1.75 |

| 0.185 | 14.15 | 76.49 | 141.07 | 26.10 | 0.76 | 16.44 | 31.23 | 11.51 | 16.76 | 1.87 |

| 0.203 | 17.00 | 83.74 | 136.45 | 27.70 | 0.79 | 16.50 | 31.45 | 14.36 | 17.46 | 1.96 |

| 0.221 | 19.85 | 89.82 | 132.22 | 29.22 | 0.83 | 16.08 | 31.59 | 17.20 | 18.09 | 2.05 |

| 0.239 | 22.70 | 94.98 | 128.33 | 30.67 | 0.86 | 15.29 | 31.67 | 20.05 | 18.64 | 2.13 |

| 0.257 | 25.55 | 99.42 | 124.71 | 32.05 | 0.89 | 14.22 | 31.69 | 22.89 | 19.13 | 2.21 |

| 0.275 | 28.40 | 103.27 | 121.34 | 33.37 | 0.93 | 12.91 | 31.67 | 25.74 | 19.55 | 2.28 |

| 0.293 | 31.25 | 106.66 | 118.18 | 34.63 | 0.96 | 11.41 | 31.60 | 28.58 | 19.91 | 2.36 |

| 0.311 | 34.10 | 109.65 | 115.21 | 35.83 | 0.98 | 9.76 | 31.50 | 31.43 | 20.21 | 2.43 |

| 0.323 | 36.00 | 111.46 | 113.32 | 36.60 | 1.00 | 8.58 | 31.41 | 33.33 | 20.39 | 2.48 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, J.; Hong, W.; Cheng, J. Optimal Green Input Level for a Capital-Constrained Supply Chain Considering Disruption Risk. Sustainability 2023, 15, 12095. https://doi.org/10.3390/su151512095

Cheng J, Hong W, Cheng J. Optimal Green Input Level for a Capital-Constrained Supply Chain Considering Disruption Risk. Sustainability. 2023; 15(15):12095. https://doi.org/10.3390/su151512095

Chicago/Turabian StyleCheng, Junheng, Weiyi Hong, and Jingya Cheng. 2023. "Optimal Green Input Level for a Capital-Constrained Supply Chain Considering Disruption Risk" Sustainability 15, no. 15: 12095. https://doi.org/10.3390/su151512095

APA StyleCheng, J., Hong, W., & Cheng, J. (2023). Optimal Green Input Level for a Capital-Constrained Supply Chain Considering Disruption Risk. Sustainability, 15(15), 12095. https://doi.org/10.3390/su151512095