Can Global Value Chain Upgrading Promote Regional Economic Growth? Empirical Evidence and Mechanism Analysis Based on City-Level Panel Data in China

Abstract

:1. Introduction

2. Literature Review

2.1. Impact of GVCs on Economic Growth

2.2. Measurement of GVCs

2.3. Literature Evaluation

3. Theoretical Analysis and Research Hypotheses

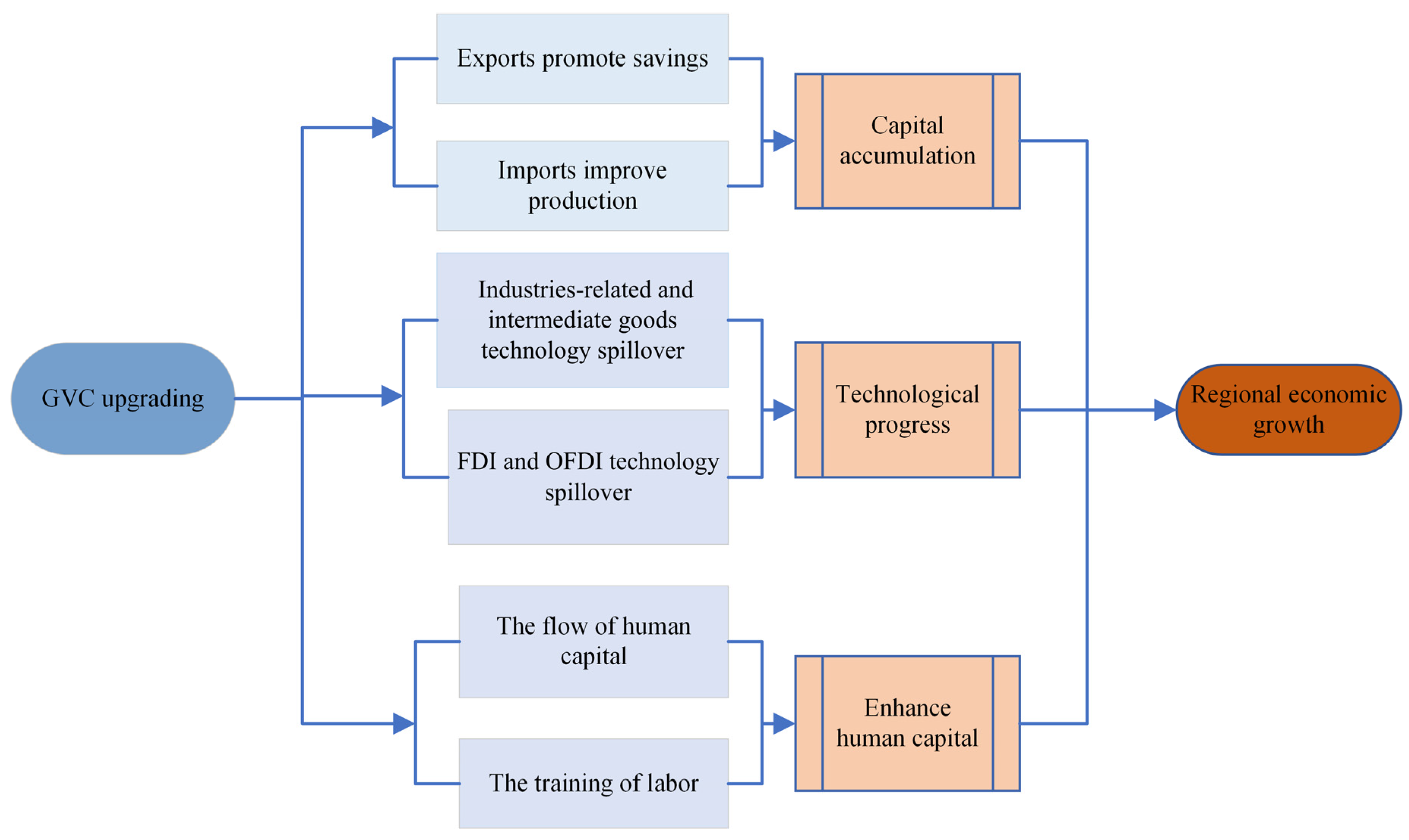

3.1. Theoretical Explanations of the Influence of GVC Upgrading on Regional Economic Growth

3.2. Impact Mechanisms of GVC Upgrading on Regional Economic Growth

3.2.1. Facilitating Capital Accumulation

3.2.2. Promoting Technological Advancement

3.2.3. Enhancing Human Capital

4. Empirical Models and Data Processing

4.1. Empirical Models

4.2. Variable Selection

4.2.1. Core Explanatory Variable: GVC Upgrading Index

4.2.2. Control Variables

- (1)

- Per capita capital stock (PC), which is represented by dividing the city’s physical capital stock by the total population at the end of the year. The physical capital stock is calculated using the perpetual inventory method proposed by Goldsmith (1951) [71], based on the city’s fixed asset investment, fixed asset investment price index, depreciation rate, etc. Its basic formula is as follows:

- (2)

- Other control variables include employment, research and development, openness, infrastructure, government intervention, etc. Employment (EM) is measured by the number of persons employed in various units at year-end. Research and development (RD) is represented by the share of science and technology expenditure in total public finance expenditure. Openness is measured by the share of imports and exports in GDP. Infrastructure (INFRA) is measured by the road area per capita. Government intervention (GOV) is measured by the proportion of government fiscal expenditure in GDP.

4.3. Data Description

5. Empirical Results

5.1. Results of Panel Unit Root and Cointegration Tests

5.2. Baseline Regression Results

5.3. Robustness Test

5.3.1. Replacement of the Core Explanatory Variable: Changing the RCA Threshold

5.3.2. Replacement of the Dependent Variable

5.3.3. Treatment of Endogeneity Issues

5.4. Heterogeneity Analysis

5.5. Test of Mediation Mechanism

5.5.1. Mechanism 1: Promoting Capital Accumulation

5.5.2. Mechanism 2: Promoting Technological Progress

5.5.3. Mechanism 3: Promoting Human Capital Upgrading

6. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, X.; Meng, B.; Wang, Z. Recent patterns of global production and GVC participation. Glob. Value Chain Dev. Rep. 2019, 2019, 9. [Google Scholar]

- Lee, E.; Yi, K.-M. Global value chains and inequality with endogenous labor supply. J. Int. Econ. 2018, 115, 223–241. [Google Scholar] [CrossRef]

- Baldwin, R.; Lopez-Gonzalez, J. Supply-chain trade: A portrait of global patterns and several testable hypotheses. World Econ. 2015, 38, 1682–1721. [Google Scholar] [CrossRef]

- WTO. Global Value Chain Development Report 2019: Technological Innovation, Supply Chain Trade, and Workers in Globalized World; WTO: Geneva, Switzerland, 2019. [Google Scholar]

- Su, D.; Shao, C. Global Value Chain, Regional Economic Growth and Spatial Spillover. J. Int. Trade 2017, 11, 48–59. (In Chinese) [Google Scholar] [CrossRef]

- Gereffi, G. Global value chains in a post-Washington Consensus world. Rev. Int. Polit. Econ. 2014, 21, 9–37. [Google Scholar] [CrossRef]

- Kersan-Škabić, I. The drivers of global value chain (GVC) participation in EU member states. Econ. Res. Ekon. Istraž. 2019, 32, 1204–1218. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report 2013: Global Value Chains: Investment and Trade for Development; UN: Geneva, Switzerland, 2013. [Google Scholar]

- Taglioni, D.; Winkler, D. Making Global Value Chains Work for Development; World Bank Publications: Washington, DC, USA, 2016. [Google Scholar]

- Rodrik, D. New Technologies, Global Value Chains, and Developing Economies; National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar] [CrossRef]

- Shen, C.; Zheng, J. Does global value chains participation really promote skill-biased technological change? Theory and evidence from China. Econ. Model. 2020, 86, 10–18. [Google Scholar] [CrossRef]

- Sposi, M.; Yi, K.-M.; Zhang, J. Trade integration, global value chains, and capital accumulation. IMF Econ. Rev. 2021, 69, 505–539. [Google Scholar] [CrossRef]

- Martínez-Galán, E.; Fontoura, M.P. Global value chains and inward foreign direct investment in the 2000s. World Econ. 2019, 42, 175–196. [Google Scholar] [CrossRef]

- Hollweg, C.H. Global value chains and employment in developing economies. Glob. Value Chain Dev. Rep. 2019, 2019, 63. [Google Scholar]

- Banga, K. Impact of global value chains on employment in India. J. Econ. Integr. 2016, 31, 631–673. [Google Scholar] [CrossRef] [Green Version]

- Hummels, D.; Ishii, J.; Yi, K.-M. The nature and growth of vertical specialization in world trade. J. Int. Econ. 2001, 54, 75–96. [Google Scholar] [CrossRef]

- Gereffi, G.; Fernandez-Stark, K. Global Value Chain Analysis: A Primer, 2nd ed.; Center on Globalization, Governance & Competitiveness (CGGC), Duke University: Durham, NC, USA, 2016. [Google Scholar]

- Jangam, B.P.; Rath, B.N. Do global value chains enhance or slog economic growth? Appl. Econ. 2021, 53, 4148–4165. [Google Scholar] [CrossRef]

- Boffa, M.; Kumritz, V.; Santoni, G.; Taglioni, D.; Winkler, D. Overcoming the Middle-Income Trap: The Role of GVC Integration for Climbing-Up the Income Ladder; University Geneva: Geneva, Switzerland, 2016. [Google Scholar]

- Jithin, P.; Ashraf, S.; Umar, Z. Does global value chain participation induce economic growth? Evidence from panel threshold regression. Appl. Econ. 2023, 55, 2788–2800. [Google Scholar] [CrossRef]

- Pietrobelli, C.; Rabellotti, R. Global Value Chains Meet Innovation Systems: Are There Learning Opportunities for Developing Countries? World Devel. 2011, 39, 1261–1269. [Google Scholar] [CrossRef] [Green Version]

- Yu, Y.; Rong, K.; Su, D.; Zhang, W. The Degree of Global Value Chain Embedment and Total Factor Productivity in Chinese Cities-Empirical Research from 230 Cities. China Soft Sci. 2019, 341, 80–96. (In Chinese) [Google Scholar] [CrossRef]

- Li, S.; He, J.; Liu, Y. Research on Division of Labor of China’s Domestic Value Chain from the Perspective of Global Value Chain. Manag. Rev. 2018, 30, 9–18. [Google Scholar]

- Kan, D.; Lyu, L.; Huang, W.; Yao, W. Digital economy and the upgrading of the global value chain of China’s service industry. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1279–1296. [Google Scholar] [CrossRef]

- Wu, L.; Chen, G.; Peng, S. Human Capital Expansion and Global Value Chain Upgrading: Firm-level Evidence from China. China World Econ. 2021, 29, 28–56. [Google Scholar] [CrossRef]

- Pan, H.; Yang, J.; Zhou, H.; Zheng, X.; Hu, F. Global value chain embeddedness, digital economy and green innovation—Evidence from provincial-level regions in China. Front. Environ. Sci. 2022, 10, 1027130. [Google Scholar] [CrossRef]

- Li, G.; Zhang, X. Does GVC embedding reduce carbon emissions? Empirical evidence from 218 Chinese cities. Struct. Chang. Econ. Dynam. 2023, 66, 253–263. [Google Scholar] [CrossRef]

- Lederman, D.; Maloney, W.F. Natural Resources, Neither Curse Nor Destiny; Stanford University Press: Palo Alto, CA, USA, 2007; pp. 15–39. [Google Scholar]

- Piermartini, R.; Rubínová, S. Knowledge Spillovers through International Supply Chains; The Graduate Institute of International and Development Studies: Geneva, Switzerland, 2014. [Google Scholar]

- De Marchi, V.; Giuliani, E.; Rabellotti, R. Do global value chains offer developing countries learning and innovation opportunities? Eur. J. Dev. Res. 2018, 30, 389–407. [Google Scholar] [CrossRef]

- Lee, K. Schumpeterian Analysis of Economic Catch-Up: Knowledge, Path-Creation, and the Middle-Income Trap; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Antràs, P.; Chor, D. Organizing the global value chain. Econometrica 2013, 81, 2127–2204. [Google Scholar] [CrossRef] [Green Version]

- Gereffi, G.; Lee, J. Why the world suddenly cares about global supply chains. J. Supply Chain. Manag. 2012, 48, 24–32. [Google Scholar] [CrossRef]

- Baldwin, J.R.; Yan, B. Global Value Chains and the Productivity of Canadian Manufacturing Firms; Statistics Canada: Ottawa, Ontario, Canada, 2014.

- Zhang, J.; Zheng, W. The Innovative Effect of Chinese Domestic Firms under the Global Value Chain. Econ. Res. J. 2017, 52, 151–165. (In Chinese) [Google Scholar]

- Raei, M.F.; Ignatenko, A.; Mircheva, M. Global Value Chains: What Are the Benefits and Why Do Countries Participate? International Monetary Fund: Washington, DC, USA, 2019. [Google Scholar]

- Dedrick, J.; Kraemer, K.L.; Linden, G. Who profits from innovation in global value chains? A study of the iPod and notebook PCs. Ind. Corp. Chang. 2010, 19, 81–116. [Google Scholar] [CrossRef] [Green Version]

- Koopman, R.; Powers, W.; Wang, Z.; Wei, S.-J. Give Credit Where Credit Is Due: Tracing Value Added in Global Production Chains; National Bureau of Economic Research: Cambridge, MA, USA, 2010. [Google Scholar] [CrossRef]

- Upward, R.; Wang, Z.; Zheng, J. Weighing China’s export basket: The domestic content and technology intensity of Chinese exports. J. Compare Econ. 2013, 41, 527–543. [Google Scholar] [CrossRef]

- Wang, S.; Chen, H. Could Chinese enterprises real benefit from embedding in global value chains? Environ. Dev. Sustain. 2022, 1–30. [Google Scholar] [CrossRef]

- Chen, H.; Wang, S.; Song, M. Global environmental value chain embeddedness and enterprise production efficiency improvement. Struct. Chang. Econ. Dynam. 2021, 58, 278–290. [Google Scholar] [CrossRef]

- Koopman, R.; Wang, Z.; Wei, S.-J. Tracing value-added and double counting in gross exports. Am. Econ. Rev. 2014, 104, 459–494. [Google Scholar] [CrossRef] [Green Version]

- Wang, Z.; Wei, S.-J.; Yu, X.; Zhu, K. Characterizing Global Value Chains. In Proceedings of the 19th Annual Conference on Global Economic Analysis, Washington DC, USA, 15–17 June 2016; Global Trade Analysis Project (GTAP). Available online: https://www.gtap.agecon.purdue.edu/resources/download/8178.pdf (accessed on 5 March 2023).

- Qu, C.; Shao, J.; Cheng, Z. Can embedding in global value chain drive green growth in China’s manufacturing industry? J. Clean. Prod. 2020, 268, 121962. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, S.-J.; Yu, X.; Zhu, K. Measures of Participation in Global Value Chains and Global Business Cycles; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar] [CrossRef]

- Ge, Y.; Dollar, D.; Yu, X. Institutions and participation in global value chains: Evidence from belt and road initiative. China Econ. Rev. 2020, 61, 101447. [Google Scholar] [CrossRef]

- Xie, R.; Niu, M.; Su, B.; Ge, J. Are global value chains merely global? The case of Chinese Provinces in global value chains. Appl. Econ. 2021, 53, 3778–3794. [Google Scholar] [CrossRef]

- Friedt, F.L.; Zhang, K. The triple effect of Covid-19 on Chinese exports: First evidence of the export supply, import demand and GVC contagion effects. Covid Econ. 2020, 53, 72–109. [Google Scholar]

- Schott, P.K. Across-product versus within-product specialization in international trade. Q. J. Econ. 2004, 119, 647–678. [Google Scholar] [CrossRef] [Green Version]

- Li, F.; Lin, Z.; Huang, L.; Yang, C. Environmental regulation and global value chain division position: Analysis based on global transnational data. Energy Policy 2022, 168, 113101. [Google Scholar] [CrossRef]

- Michaely, M. Trade, Income Levels, and Dependence; North-Holland Amsterdam: Amsterdam, The Netherlands, 1984; Volume 8. [Google Scholar]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Hausmann, R.; Hidalgo, C. Country Diversification, Product Ubiquity, and Economic Divergence; HKS Working Paper No. RWP10-045; Harvard University: Cambridge, MA, USA, 2010. [Google Scholar] [CrossRef] [Green Version]

- Peng, F.; Kang, L.; Liu, T.; Cheng, J.; Ren, L. Trade agreements and global value chains: New evidence from China’s Belt and Road Initiative. Sustainability 2020, 12, 1353. [Google Scholar] [CrossRef] [Green Version]

- Dai, X.; Zheng, L. Impact of Institution Quality on China’s Position in Global Value Chain. J. Int. Trade 2015, 51–63+132. (In Chinese) [Google Scholar] [CrossRef]

- Du, W.; Fang, G.; Gao, T.; Jiang, W. Public credit institutions, export activities, and global value chain participation: Evidence from China’s credit demonstration city construction program. Econ. Model. 2023, 126, 106409. [Google Scholar] [CrossRef]

- Krugman, P.R.; Venables, A. The Seamless World: A Spatial Model of International Specialization; National Bureau of Economic Research Cambridge: Cambridge, MA, USA, 1995. [Google Scholar] [CrossRef] [Green Version]

- Melitz, M.J. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef] [Green Version]

- Bank, W. World Development Report 2020: Trading for Development in the Age of Global Value Chains; The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Unel, B. Human capital formation and international trade. BE J. Econ. Anal. Policy 2015, 15, 1067–1092. [Google Scholar] [CrossRef] [Green Version]

- Davidson, C.; Sly, N. A simple model of globalization, schooling and skill acquisition. Eur. Econ. Rev. 2014, 71, 209–227. [Google Scholar] [CrossRef] [Green Version]

- Acemoglu, D. Patterns of skill premia. Rev. Econ. Stud. 2003, 70, 199–230. [Google Scholar] [CrossRef]

- Hoeriyah, L.; Nuryartono, N.; Pasaribu, S.H. Economic complexity and sustainable growth in developing countries. Econ. Dev. Anal. J. 2022, 11, 23–33. [Google Scholar] [CrossRef]

- Stojkoski, V.; Kocarev, L. The Relationship between Growth and Economic Complexity: Evidence from Southeastern and Central Europe; Munich Personal RePEc Archive, MPRA paper 77837; University Library of Munich: Munich, Germany, 2017; revised. [Google Scholar]

- Zhu, S.; Li, R. Economic complexity, human capital and economic growth: Empirical research based on cross-country panel data. Appl. Econ. 2016, 49, 3815–3828. [Google Scholar] [CrossRef]

- Hausmann, R.; Hidalgo, C.A.; Bustos, S.; Coscia, M.; Simoes, A. The Atlas of Economic Complexity: Mapping Paths to Prosperity; Mit Press: Cambridge, MA, USA, 2014. [Google Scholar] [CrossRef]

- Zhou, D. Influence of Imported Services Intermediate Input on Manufacturing Industry’s Export Sophistication in China. World Econ. Stud. 2015, 27–36+127. (In Chinese) [Google Scholar] [CrossRef]

- Wang, F.; Shi, X. Measurement of High-Quality Development Level of China’s Manufacturing and Its Influencing Factors. China Soft Sci. 2022, 37, 22–31. (In Chinese) [Google Scholar]

- Simoes, A.J.G.; Hidalgo, C.A. The economic complexity observatory: An analytical tool for understanding the dynamics of economic development. In Proceedings of the Workshops at the Twenty-Fifth AAAI Conference on Artificial Intelligence, San Francisco, CA, USA, 7–11 August 2011. [Google Scholar]

- Mankiw, N.G.; Romer, D.; Weil, D.N. A contribution to the empirics of economic growth. Q. J. Econ. 1992, 107, 407–437. [Google Scholar] [CrossRef]

- Goldsmith, R.W. A perpetual inventory of national wealth. In Studies in Income and Wealth; NBER: Cambridge, MA, USA, 1951; Volume 14, pp. 5–73. [Google Scholar]

- Huang, Y.; Ren, R.; Liu, X. Capital Stock Estimates in Chinese Manufacturing by Perpetual Inventory Approach. China Econ. Q. 2002, 1, 377–396. [Google Scholar]

- Zhang, J.; Zhang, Y. Recalculating the Capital of China and a Review of Li and Tang’s Article. Econ. Res. J. 2003, 7, 35–43+90. [Google Scholar]

- Reinsdorf, M.; Cover, M. Measurement of Capital Stocks, Consumption of Fixed Capital, and Capital Services. Report on a Presentation to the Central American Ad Hoc Group on National Accounts, Santo Domingo, Dominican Republic, 2005. Available online: https://www.google.com.hk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwir2oa6gLOAAxUsqVYBHfxODNgQFnoECAkQAQ&url=https%3A%2F%2Funstats.un.org%2Funsd%2Fnationalaccount%2Faeg%2Fpapers%2Fm3Views15.PDF&usg=AOvVaw34jpEU1IVRHHw41aU6P3po&opi=89978449 (accessed on 5 March 2023).

- Ke, S.; Xiang, J. Estimation of the Fixed Capital Stocks in Chinese Cities for 1996–2009. Stat. Res. 2012, 29, 19–24. (In Chinese) [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.-F.; Chu, C.-S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Afjal, M.; Kathiravan, C.; Dana, L.P.; Nagarajan, C.D. The Dynamic Impact of Financial Technology and Energy Consumption on Environmental Sustainability. Sustainability 2023, 15, 9327. [Google Scholar] [CrossRef]

- Pedroni, P. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef] [Green Version]

- Ourens, G. Can the Method of Reflections Help Predict Future Growth? LIDAM Discussion Papers IRES 2013008; Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES): Louvain-la-Neuve, Belgium, 2013. [Google Scholar]

| Variable | Variable Description | Obs. | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| lnY | Log(GDP per capita) | 3824 | 9.83 | 0.83 | 7.73 | 12.67 |

| GVC | Export complexity of a city | 3824 | −0.12 | 0.28 | −1.68 | 1.05 |

| lnPC | Log(per capita capital stock) | 3824 | 10.36 | 1.12 | 7.42 | 13.41 |

| lnEM | Log(employment) | 3824 | 3.61 | 0.75 | 1.70 | 6.89 |

| RD | Research and development | 3824 | 1.48 | 1.21 | 0.07 | 12.15 |

| lnINFRA | Log(infrastructure) | 3824 | 0.86 | 0.94 | −3.87 | 4.29 |

| OPEN | Openness | 3824 | 22.32 | 39.94 | 0.14 | 564.88 |

| GOV | Government intervention | 3824 | 13.36 | 6.07 | 2.79 | 67.50 |

| lnTECH | Log(patents granted per ten thousand people) | 3824 | 6.22 | 1.73 | 0.69 | 11.53 |

| lnHC | Log(students enrolled in general higher education per ten thousand people) | 3824 | 4.36 | 1.37 | −4.61 | 7.18 |

| Variable | LLC | IPS | ||

|---|---|---|---|---|

| Level | First Difference | Level | First Difference | |

| lnY | −26.230 *** | −16.997 *** | 7.494 | −14.545 *** |

| GVC2 | −16.563 *** | −26.830 *** | −18.209 *** | −31.427 *** |

| lnpc | −54.063 *** | −20.385 *** | 15.383 | −3.578 *** |

| lnEM | −6.986 *** | −11.331 *** | −6.756 *** | −26.203 *** |

| rd | −28.255 *** | −26.527 *** | −12.387 *** | −28.567 *** |

| lninfra | −24.047 *** | −31.053 *** | −12.899 *** | −28.523 *** |

| open | −18.092 *** | −28.713 *** | −14.508 *** | −33.184 *** |

| gov | −8.353 *** | −16.731 *** | −8.706 *** | −27.006 *** |

| lntech | −10.871 *** | −23.250 *** | −9.745 *** | −29.148 *** |

| lnhc | −30.371 *** | −29.142 *** | −16.726 *** | −29.002 *** |

| Statistic | p-Value | |

|---|---|---|

| Modified Phillips–Perron t | 23.840 | 0.000 |

| Phillips–Perron t | −9.157 | 0.000 |

| Augmented Dickey–Fuller t | −6.768 | 0.000 |

| Variable | (1) | (2) |

|---|---|---|

| OLS | FE | |

| GVC | 0.0383 ** | 0.159 *** |

| (0.0160) | (0.0249) | |

| lnPC | 0.618 *** | 0.497 *** |

| (0.00616) | (0.0122) | |

| lnEM | 0.0652 *** | 0.129 *** |

| (0.00636) | (0.0217) | |

| RD | −0.0129 *** | 0.0450 *** |

| (0.00360) | (0.00959) | |

| lnINFRA | 0.0864 *** | 0.0536 *** |

| (0.00698) | (0.0158) | |

| OPEN | 0.00207 *** | −0.000135 |

| (0.000113) | (0.000245) | |

| GOV | −0.0223 *** | 0.00218 |

| (0.000720) | (0.00162) | |

| _cons | 3.398 *** | 4.100 *** |

| (0.0562) | (0.103) | |

| N | 3824 | 3824 |

| 0.918 | 0.961 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| lnY | lnY | lnRGDP | |

| GVC | 0.197 *** | ||

| (0.0273) | |||

| GVC1 | 0.161 *** | ||

| (0.0258) | |||

| GVC2 | 0.166 *** | ||

| (0.0247) | |||

| _cons | 4.097 *** | 4.112 *** | 9.568 *** |

| (0.102) | (0.103) | (0.0974) | |

| Control variables | Yes | Yes | Yes |

| N | 3824 | 3824 | 3824 |

| R2 | 0.961 | 0.961 | 0.961 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| First | Second | First | Second | |

| GVC | lnY | GVC | lnY | |

| GVC | 0.232 *** | 0.341 *** | ||

| (5.35) | (4.22) | |||

| L.GVC | 0.532 *** | |||

| (18.25) | ||||

| 0.292 *** | ||||

| L2.GVC | (5.87) | |||

| Control variables | Yes | Yes | Yes | Yes |

| KP-LM | 83.65 *** | 45.13 *** | ||

| Shea partial R-sq | 0.2791 | 0.0828 | ||

| Wald rk F | 333.054 *** | 34.43 *** | ||

| Observations | 3585 | 3585 | 3346 | 3346 |

| R2 | 0.535 | 0.960 | 0.367 | 0.957 |

| Number of cities | 239 | 239 | 239 | 239 |

| Variable | Economic Scale | Employment Scale | Year | ||||

|---|---|---|---|---|---|---|---|

| GDP < 60 Billion Yuan | GDP ≥ 60 Billion Yuan | EM < 300,000 | EM > 300,000 | 2001–2006 | 2007–2009 | 2010–2016 | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| GVC | 0.116 *** | 0.270 *** | 0.123 *** | 0.230 *** | 0.0991 *** | 0.00719 | 0.0273 * |

| (0.0242) | (0.0395) | (0.0266) | (0.0404) | (0.0234) | (0.0136) | (0.0162) | |

| _cons | 4.146 *** | 4.146 *** | 4.104 *** | 4.162 *** | 4.048 *** | 4.092 *** | 4.861 *** |

| (0.178) | (0.111) | (0.184) | (0.150) | (0.160) | (0.118) | (0.0962) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 1707 | 2117 | 1622 | 2201 | 1434 | 717 | 1673 |

| R2 | 0.948 | 0.961 | 0.957 | 0.964 | 0.920 | 0.937 | 0.928 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| lnY | lnY | lnY | lnY | lnY | |

| GVC | 0.475 *** | 0.936 *** | 0.372 *** | 0.117 | 0.0164 |

| (0.161) | (0.211) | (0.0998) | (0.0816) | (0.0438) | |

| _cons | 3.549 *** | 4.849 *** | 5.324 *** | 4.394 *** | 3.166 *** |

| (0.471) | (0.273) | (0.524) | (0.267) | (0.287) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| N | 288 | 144 | 208 | 448 | 192 |

| R2 | 0.986 | 0.956 | 0.976 | 0.973 | 0.985 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| lnY | lnPC | lnY | lnTECH | lnY | lnHC | lnY | |

| GVC | 0.572 *** | 0.831 *** | 0.159 *** | 0.200 ** | 0.151 *** | 0.340 ** | 0.153 *** |

| (0.0669) | (0.113) | (0.0249) | (0.0846) | (0.0235) | (0.158) | (0.0250) | |

| lnPC | 0.497 *** | 0.765 *** | 0.464 *** | 0.461 *** | 0.489 *** | ||

| (0.0122) | (0.0454) | (0.0161) | (0.0769) | (0.0124) | |||

| lnTECH | 0.0425 *** | ||||||

| (0.0110) | |||||||

| lnHC | 0.0179 * | ||||||

| (0.00989) | |||||||

| _cons | 7.317 *** | 6.471 *** | 4.100 *** | −5.441 *** | 4.332 *** | −0.354 | 4.107 *** |

| (0.199) | (0.372) | (0.103) | (0.394) | (0.117) | (0.598) | (0.103) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 3824 | 3824 | 3824 | 3824 | 3824 | 3824 | 3824 |

| R2 | 0.823 | 0.808 | 0.961 | 0.862 | 0.962 | 0.362 | 0.962 |

| Variable | Mediating Effect |

|---|---|

| Capital accumulation | 72.2% |

| Technological progress | 5.3% |

| Human capital upgrading | 3.8% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.; He, Q.; Ji, H. Can Global Value Chain Upgrading Promote Regional Economic Growth? Empirical Evidence and Mechanism Analysis Based on City-Level Panel Data in China. Sustainability 2023, 15, 11732. https://doi.org/10.3390/su151511732

Li C, He Q, Ji H. Can Global Value Chain Upgrading Promote Regional Economic Growth? Empirical Evidence and Mechanism Analysis Based on City-Level Panel Data in China. Sustainability. 2023; 15(15):11732. https://doi.org/10.3390/su151511732

Chicago/Turabian StyleLi, Can, Qi He, and Han Ji. 2023. "Can Global Value Chain Upgrading Promote Regional Economic Growth? Empirical Evidence and Mechanism Analysis Based on City-Level Panel Data in China" Sustainability 15, no. 15: 11732. https://doi.org/10.3390/su151511732

APA StyleLi, C., He, Q., & Ji, H. (2023). Can Global Value Chain Upgrading Promote Regional Economic Growth? Empirical Evidence and Mechanism Analysis Based on City-Level Panel Data in China. Sustainability, 15(15), 11732. https://doi.org/10.3390/su151511732