Financing Options for Green and Affordable Housing (GAH): An Exploratory Study of South Asian Economies

Abstract

1. Introduction

2. Literature Review

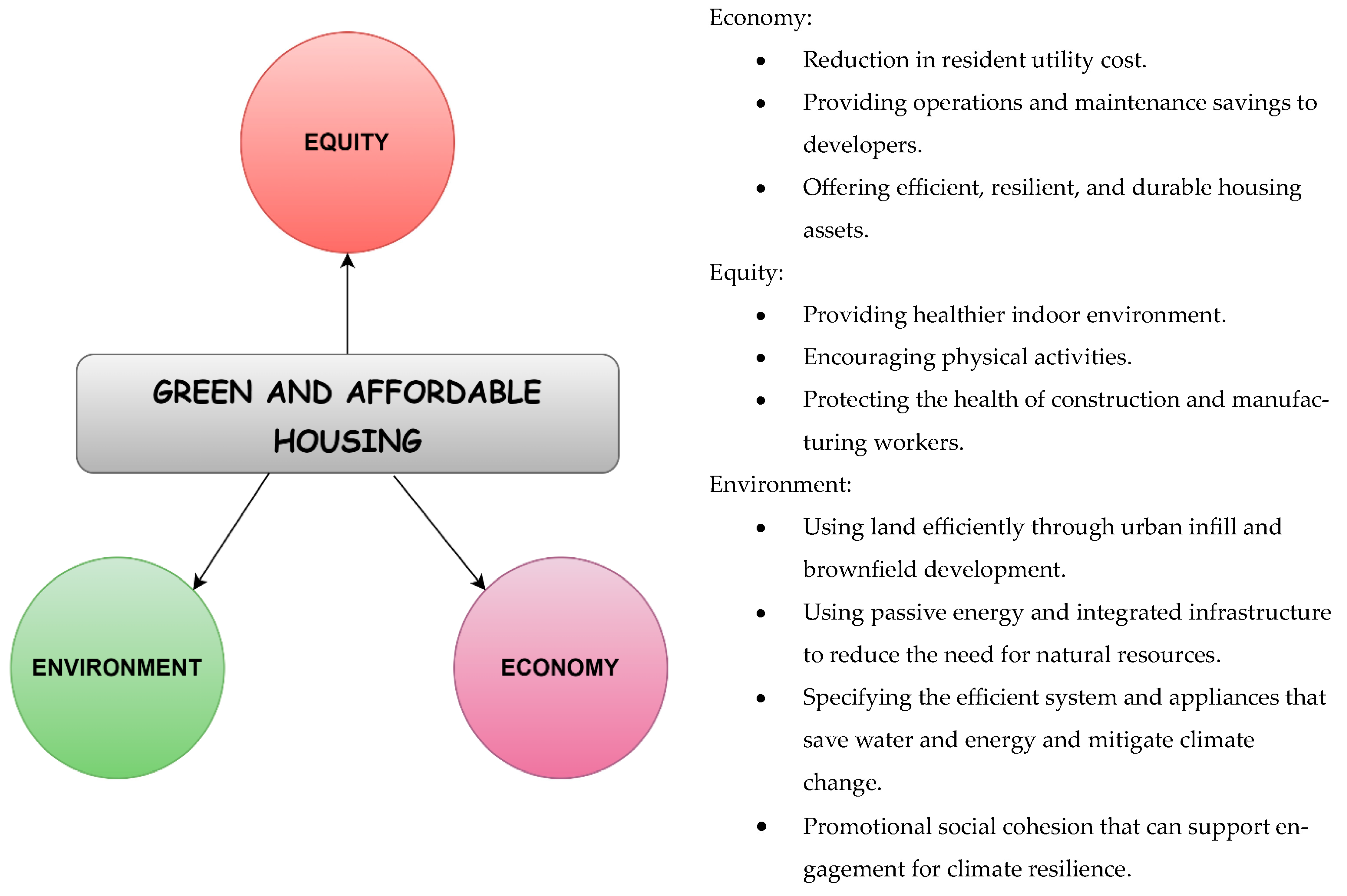

2.1. Evolution of a GAH Finance System

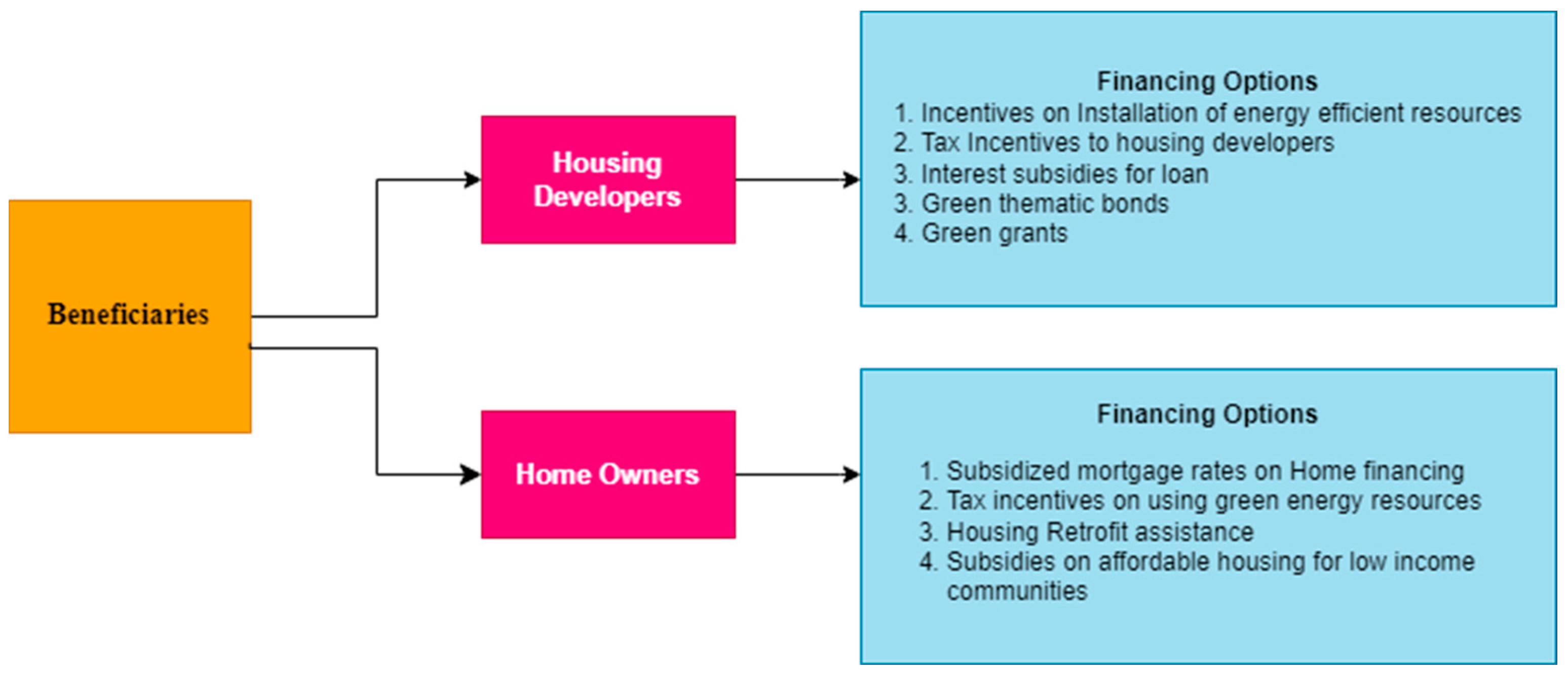

2.2. Identification of Financing Options for GAH

- Note: Lower-income households bear a large financial burden from energy and water bills, which can account for up to 40% of their income, compared to 5% for higher-income households (World Bank 2016) Jørgensen, B. H., and Holttinen, H. (2022). IEA Wind TCP Annual Report 2021. IEA.

- Greater London Authority Report, 2018.

- Australian Housing and Urban research Institute report, Available at: https://apo.org.au/node/598 (accessed on 3 February 2023).

- Ministry of Housing and Urban Affairs (https://pmaymis.gov.in/ (accessed on 3 February 2023)).

- National Housing Bank report-(https://nhb.org.in/ (accessed on 1 January 2023)).

- Government of India (https://mohua.gov.in/ (accessed on 15 January 2023)).

- Ministry of Housing and Urban Affairs, Government of India: (https://pmaymis.gov.in/StaticPages/SRESD.aspx (accessed on 20 January 2023)).

- National Housing Bank, Government of India: (https://nhbonline.org.in/schemes/scheme_details/33 (accessed on 15 January 2023)).

- Ministry of Housing and works (https://mohw.gov.pk/ (accessed on 20 January 2023)).

- Pakistan Housing and Development Authority (PHDA) (https://www.pha.gov.pk/nphp/ (accessed on 28 January 2023)).

- Naya Pakistan Housing Program (https://nphp.nadra.gov.pk/ (accessed on 2 February 2023)).

- State Bank of Pakistan https://www.sbp.org.pk/ (accessed on 12 December 2022)).

3. Materials and Method

3.1. Research Area

3.2. Research Methods

3.3. Cases Profiles

| Case Study I | Pradhan Mantri Awas Yojana (PMAS) | India |

| Case Study II | Naya Pakistan Housing Program | Pakistan |

| Case Study III | Ashrayan Prakalpa: Ashrayan-2 | Bangladesh |

3.3.1. Case Study I: Pradhan Mantri Awas Yojana (PMAS)

GAH in India

Financing Options for Pradhan Mantri Awas Yojana (PMAY) Scheme

- The Credit-Linked Subsidy Scheme (CLSS)-Homeowners: Offers interest subsidies on home loans to eligible beneficiaries who wish to purchase or construct a house. Depending on the income category of the beneficiary and the loan amount, interest subsidies ranging from 2.30% to 6.50% can be obtained. For example, beneficiaries from the LIG and EWS categories can receive interest subsidies of up to 6.50% on loans of up to Rs. 6 lacs, while middle-income group (MIG) beneficiaries can receive interest subsidies of up to 4% on loans of up to Rs. 9 lac or Rs. 12 lacs. As of January 2022, over 2.93 crore beneficiaries have been sanctioned under the PMAY scheme, with more than 1.36 crore of them using the CLSS subsidy [4]. The government has earmarked a total of Rs. 70,000 crores for the CLSS scheme under PMAY, and has disbursed over Rs. 43,000 crores in interest subsidy to beneficiaries. The CLSS scheme has not only made housing more affordable for eligible beneficiaries, but has also facilitated the growth of India’s housing sector [5].

- Affordable Housing in Partnership (AHP)-Housing Developers: The PMAY AHP scheme aims to utilize the current network of public and private sector entities for the effective execution of low-cost housing projects. Eligible entities include central and state government agencies, PSUs, NGOs, cooperative societies, and private builders or developers. The scheme offers a central grant of up to Rs. 1.5 lacs per EWS house and up to Rs. 1.0 lacs per LIG house. Agencies can receive essential assistance of up to Rs. 1.5 lacs per house, while contributing at least 50% of the project cost. The PMAY AHP scheme has successfully provided affordable housing to many beneficiaries, with over 1.5 lacs houses sanctioned and over 1 lac completed and the government has allocated Rs. 8000 crores for the PMAY AHP scheme and has disbursed more than Rs. 4200 crores as central assistance to beneficiaries by January 2022 [1].

- Beneficiary Led Construction (BLC)-Homeowners: Under this scheme, eligible beneficiaries can avail themselves of financial assistance from the government to construct their own houses. The assistance amount varies depending on the income category of the beneficiary. The beneficiary is expected to contribute a minimum of 10% of the project cost, and the remaining amount can be borrowed from banks or financial institutions. The loan amount can be repaid over a period of 15 years. The funding for the BLC component comes from the central government and is a part of the total allocation for PMAY. The government has allocated Rs. 30,000 crores for PMAY in the financial year 2021−2022, out of which a portion is earmarked for the BLC component [6].

- Subsidy for Rehabilitation of Existing Slum Dwellers (SRESD)-Homeowners: Under this scheme, eligible beneficiaries living in slums can avail themselves of financial assistance from the government to upgrade their houses. The assistance amount varies depending on the type of construction and the location of the slum. Under the SRESD scheme, eligible beneficiaries are provided with a subsidy of up to Rs. 1 lac for the building of a new house or the improvement of their existing house. The subsidy amount varies depending on the location of the slum and the cost of construction. In addition, beneficiaries are also provided with a bank loan of up to Rs. 70,000 to meet the remaining cost of construction [8]. To be eligible for the SRESD scheme, the beneficiary must be a slum dweller, as per the definition of the Ministry of Housing and Urban Affairs (MoHUA), and must possess a valid Aadhaar card. The beneficiary must also have been a resident of the same slum for the past 1 year or more, and must not own a pucca house [5]. The funding for the SRESD scheme is shared between the central and state governments. The central government offers a subsidy of up to Rs. 1 lac per house, while the state government provides the remaining funds. The state government is also responsible for identifying eligible beneficiaries, providing land for the rehabilitation project, and ensuring the completion of the project within the stipulated time frame. Figure 3 elaborates the financing framework of PMAY in detail.

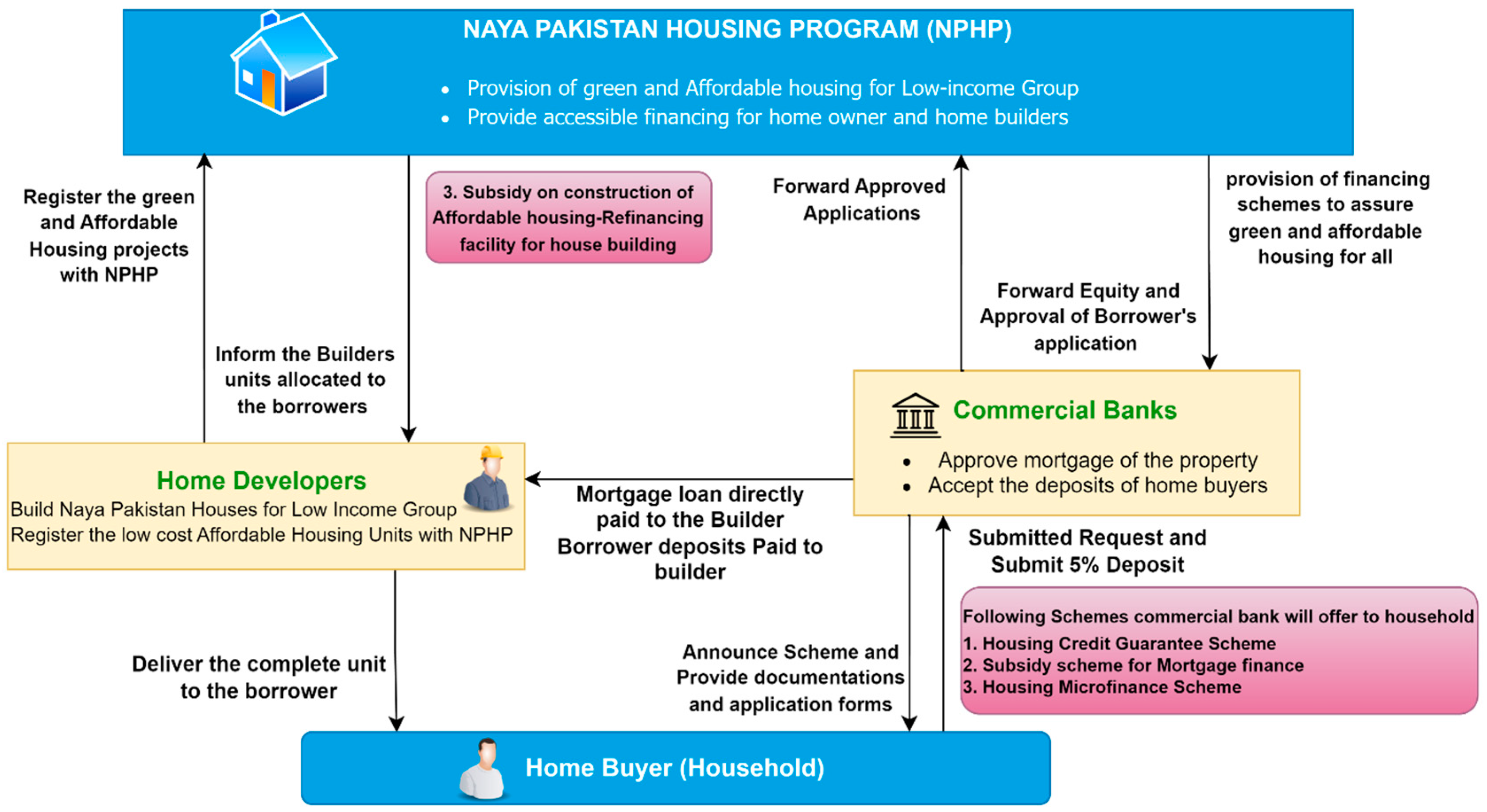

3.3.2. Case Study II: Naya Pakistan Housing Program (NPHP)

GAH in Pakistan

Financing Option for Naya Pakistan Housing Program

- Housing Credit Guarantee Scheme-Lenders: A financing program initiated by the State Bank of Pakistan to support the construction of affordable housing in Pakistan. The program provides credit guarantees to banks and other lending institutions that provide loans for the construction or purchase of homes to eligible borrowers. Under the program, the State Bank of Pakistan provides guarantees of up to 40% of the principal amount of a loan, with a maximum guarantee of PKR 2.5 million per unit. The guarantees are provided on loans for the purchase, construction, or renovation of a home, with a maximum repayment period of 20 years [7]. The program’s aim is to provide credit guarantees to banks and financial institutions for housing finance extended to low and middle-income borrowers.

- Subsidy scheme for Mortgage Finance-Homeowners: A financing initiative under the Naya Pakistan Housing Program, aimed at providing affordable housing options to low-income families in Pakistan. The scheme offers subsidized interest rates on home loans, making it easier for individuals to finance the purchase or construction of a new house. The government provides a subsidy on the markup (interest) rate charged by banks on housing loans. The subsidy amount varies based on the size of the house and the borrower’s income level. The subsidy can cover up to 90% of the markup rate, which can significantly reduce the overall cost of borrowing for the borrower [19].

- The Housing Microfinance Scheme-Homeowners: A financing program initiated by the government of Pakistan to provide affordable housing options to low-income individuals who are unable to access traditional mortgage loans. Under this scheme, microfinance institutions provide loans to individuals or families for the construction, purchase or renovation of homes. The loans provided under this scheme are generally small and short term, with a maximum loan amount of up to USD 3100. The loan repayment period is usually between 3 and 7 years, with a maximum interest rate of 12% per annum. To be eligible for the Housing Microfinance Scheme, applicants must have a steady source of income and a good credit history. The loans are provided without the requirement of collateral, making it easier for low-income individuals to access housing finance.

- Refinance facility for House Building-Housing developers: A financing program introduced by the State Bank of Pakistan to promote affordable housing in the country. Under this program, banks and other financial institutions can obtain long-term funding at a subsidized markup rate from the State Bank of Pakistan and use it to finance low-cost housing projects. The financing is provided to individuals, builders, and developers who are interested in constructing, renovating, or purchasing a home. The highest loan payback length is 20 years, with loan amounts ranging from PKR 500,000 to PKR 5,000,000. The markup rate charged by the State Bank of Pakistan is currently 5% per annum, which is significantly lower than the market rate. The Refinance Facility for House Building is an important component of the Naya Pakistan Housing Program, which aims to offer affordable housing to the people of Pakistan.

3.3.3. Case Study III: Ashrayan Prakalpa: Ashrayan-2 Project

GAH in Bangladesh

Financing Options for Ashrayan Prakalpa: Ashrayan-2 Project

- Subsidized loans for housing-Homeowners: The project offers two types of loan schemes: (1) Soft loan: This loan is provided to ultra-poor families who cannot afford to repay regular loans. The loan amount is up to BDT 50,000, with a repayment period of 3 years and an interest rate of 2%. (2) Regular loan: This loan is provided to low-income households with a loan amount of up to BDT 100,000, with a repayment period of 5 years and an interest rate of 4%. Both loan schemes are available for the construction of new houses, repair and renovation of existing houses, and installation of necessary facilities like sanitation, water supply, and electricity.

- Microfinance Schemes-Homeowners: Microfinance provides small loans, savings, and insurance services to low-income individuals or households who do not have access to traditional banking services to support homeowners to get their houses repaired in a timely fashion. Microfinance interest rates are typically lower than other traditional banking finance and in the small ranges, so it is easier for low-income groups to get benefit from these schemes

- Government subsidy scheme- Ashrayan-2-Homeowners: The government subsidy is available to the beneficiaries of the Ashrayan-2 project who are homeless or landless and do not have the resources to build a house on their own. The government subsidy scheme covers a significant portion of the total cost of each house, typically up to 90% of the cost. The exact amount of the subsidy may vary depending on the location of the house and other factors. This scheme can help to improve the overall living conditions of the beneficiaries and reduce poverty in Bangladesh.

4. Results and Analysis

5. Conclusions and Discussion

6. Policy Recommendations

- According to the Asian Development Bank (2022), by 2050, the population of developing nations is projected to expand by 100%, and their rising markets are predicted to undergo a construction boom. Despite this, housing shortages are being brought on by resource constraints in urban areas, and climate change is increasingly affecting South Asian economies. Several strategies have been put out to meet the goal of green and cheap housing, including:

- Better data collection and analysis can help policymakers understand the extent of the housing crisis and assess the impact of existing policies.

- Easing supply constraints by providing new developable land at low cost and upgrading public transportation systems can help lower housing prices, making it more affordable for low-income groups.

- Promoting the rental market and encouraging the participation of the private sector through financial incentives for the provision of affordable housing to the low-income group.

- Energy Building codes, green building materials certification, and green building rating systems can upscale sustainability practices in the housing sector.

- Community-based savings and loan schemes for upgrading settlements and the development of sustainable housing solutions.

- Regulatory and fiscal incentives, such as subsidies for green construction and retrofits, upgrading to energy-efficient appliances, and reducing taxes and import duties for green building materials to encourage the adoption of sustainable building practices.

- Expanding the availability of green mortgages for low-income, middle income, and female-headed household segments

- Subsidies on the town’s development in rural areas and expansion in microfinancing.

7. Future Research Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- UN Habitat. Population Living in Slums (% of Urban Population). World Bank Data. 2022. Available online: https://data.worldbank.org/indicator/EN.POP.SLUM.UR.ZS (accessed on 3 January 2023).

- Relf, G. How Energy Efficiency Can Boost Resilience. American Council for an Energy-Efficient Economy Report-ACEEE. 2018. Available online: https://www.aceee.org/blog/2018/04/how-energy-efficiency-can-boost (accessed on 3 January 2023).

- Nwadike, A.; Wilkinson, S.; Clifton, C. Improving Disaster Resilience through Effective Building Code Compliance. i-Rec Conference 2019, Reconstruction, Recovery and Resisting Disaster Risk Creation. 2019. Available online: https://www.researchgate.net/profile/AmarachukwuNwadike/publication/339230717_Improving_disaster_resilience_through_effective_building_code_compliance/links/5e452e55299bf1cdb924f6eb/Improving-disaster-resilience-througheffective-building-code-compliance.pdf (accessed on 4 February 2023).

- Nkubito, F. Low-Income Tenants’ Housing Accessibility and Affordable Housing Provision Barriers. Thesis, Technische Universität Dresden, Dresden, Germany, 2022. [Google Scholar]

- Edward, L.G.; Joseph, G. The impact of building restrictions on housing affordability. Econ. Policy Rev. 2003, 6, 21–39. [Google Scholar]

- Lee, H.S.; Singh, A. Adequate and Affordable Housing: Enhancing ADB’s Support to Developing Member Countries; ADB Sustainable Development Working Paper Series 82; ABD Publishing: Jaipur, India, 2022. [Google Scholar]

- Norris, M.; Byrne, M. Asset price Keynesianism, regional imbalances and the Irish and Spanish housing booms and busts. Built Environ. 2015, 41, 227–243. [Google Scholar] [CrossRef]

- Jenkins, P.; Smith, H.; Wang, Y.P. Planning and Housing in the Rapidly Urbanizing World; Housing, Planning and Design Series; Routledge: London, UK, 2006. [Google Scholar]

- Plouin, M.; Adema, W.; Fron, P.; Roth, P.M. A crisis on the horizon: Ensuring affordable, accessible housing for people with disabilities. In OECD Social, Employment and Migration Working Papers 261; OECD Publishing: Paris, France, 2021. [Google Scholar]

- Maeda, B.; Dixon, S.; Kenya, C.B.F.; Reall, K.E.T.F.B. Edge & Affordable Housing. The Edge Buildings Project Studies. 2023. Available online: https://www.fsdkenya.org/wp-content/uploads/2023/01/Review-of-the-EDGE-certification-process-affordable-housing-focus-Case-study-Kwangu-Kwako-Homes.pdf (accessed on 14 January 2023).

- Burke, P.M.; Nelson, G.; Rickerson, W. Boston’s green affordable housing program: Challenges and opportunities. NYUJ Legis. Pub. Pol’y 2007, 11, 1. [Google Scholar]

- Del Pero, A.S.; Adema, W.; Ferraro, V.; Frey, V. Policies to promote access to good-quality affordable housing in OECD countries. In OECD Social, Employment and Migration Working Papers 176; OECD Publishing: Paris, France, 2016; Available online: https://www.oecd.org/els/workingpapers (accessed on 5 December 2022).

- Boehland, J. Greening affordable housing. Race Poverty Environ. 2006, 13, 59–61. [Google Scholar]

- Simbanegavi, P.; Shani, Z.; Watkins, J.; Ramruthan, K. Making rental housing in the gap-market more affordable through green building technology. In The Construction Industry in the Fourth Industrial Revolution: Proceedings of 11th Construction Industry Development Board (CIDB) Postgraduate Research Conference 11 (241–251); Springer International Publishing: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Whitehead, C.; Monk, S.; Clarke, A.; Holmans, A.; Markkanen, S. Measuring Housing Affordability: A Review of Data Sources; Cambridge Centre for Housing and Planning Research: Cambridge, UK, 2009. [Google Scholar]

- Wanyonyi, A.M.; Munala, G.; Alkhizim, A. Adoption of Green Neighborhood Development: A Case of Affordable Housing Projects. East Afr. J. Eng. 2022, 5, 174–180. [Google Scholar] [CrossRef]

- MacAskill, S.; Stewart, R.A.; Roca, E.; Liu, B.; Sahin, O. Green building, split-incentives and affordable rental housing policy. Hous. Stud. 2021, 36, 23–45. [Google Scholar] [CrossRef]

- Otto, E. Gray to Green Communities: A Call to Action on the Housing and Climate Crises; Island Press: Washington, DC, USA, 2021; ISBN 9781642831290. [Google Scholar]

- Buckley, R.; Chiquier, L.; Lea, M. Housing Finance and the Economy. In Housing Finance Policy in Emerging Markets; The World Bank Publishing: Washington, DC, USA, 2009. [Google Scholar] [CrossRef]

- Malpezzi, S.; Vandell, K. Does the low-income housing tax credit increase the supply of housing? J. Hous. Econ. 2002, 11, 360–380. [Google Scholar] [CrossRef]

- Malpezzi, S. Urban Housing and Financial Markets: Some International Comparisons. Urban Stud. 1990, 27, 971–1022. [Google Scholar] [CrossRef]

- Mehta, M.; Dinesh, M. Housing Finance System and Urban Poor. Econ. Political Wkly. 1991, XXVI, 110. [Google Scholar]

- Cruz, P. Transaction Costs and Housing Affordability in Asia. Int. Real Estate Rev. 2008, 11, 128–150. [Google Scholar] [CrossRef]

- Zhuang, J.; Gunatilake, H.; Niimi, Y.; Khan, E.M.; Jiang, Y.; Hassan, R.; Hasan, N.; Khor, A.; Lagman-Martin, P.; Huang, B. Financial Sector Development, Economic Growth, and Poverty Reduction: A Literature Review; ADB Economics Working Paper No 173; Asian Development Bank: Manila, Philippines, 2009. [Google Scholar]

- Sellon, G.H.; VanNahmen, D. The securitization of housing finance. Econ. Rev. 1988, 73, 3–20. [Google Scholar]

- Hedlund, A. A Primer on Housing Finance Reform; Policy paper; The Center for Growth and Opportunity, Utah State University: Logan, UT, USA, 2023. [Google Scholar]

- Mohd, S.; Kaushal, V.K. Green finance: A step towards sustainable development. MUDRA J. Financ. Account. 2018, 5, 59–74. [Google Scholar] [CrossRef]

- Green, R.K.; Wachter, S.M. The housing finance revolution. In The Blackwell Companion to the Economics of Housing: The Housing Wealth of Nations, Property and Real Estate; Wiley Publishing: New York, NY, USA, 2010; pp. 414–445. [Google Scholar]

- Tateno, Y.; Norbu, N.; Meng, C. Financing a Sustainable Recovery from COVID-19 and beyond in Asia-Pacific Least Developed Countries; 2022. Available online: https://repository.unescap.org/handle/20.500.12870/5190 (accessed on 5 December 2022).

- Gibb, K.; Whitehead, C. Towards the more effective use of housing finance and subsidy. Hous. Stud. 2007, 22, 183–200. [Google Scholar] [CrossRef]

- Subramanian, S. Structured Financial Solutions for Green Affordable Housing Projects. Ph.D. Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2005. [Google Scholar]

- Swapan, M.S.H.; Zaman, A.U.; Ahsan, T.; Ahmed, F. Transforming urban dichotomies and challenges of South Asian megacities: Rethinking sustainable growth of Dhaka, Bangladesh. Urban Sci. 2017, 1, 31. [Google Scholar] [CrossRef]

- Hariharan, V.; Nambiar, S.L. Affordable Housing Policies in South Asia: Key Issues and Recommendations. In Accessible Housing for South Asia: Needs, Implementation and Impacts; Springer International Publishing: Cham, Switzerland, 2022; pp. 309–318. [Google Scholar]

- Sengupta, U. Affordable housing development in India: A real deal for low-income people? Int. Dev. Plan. Rev. 2013, 35, 261–282. [Google Scholar] [CrossRef]

- Phang, S.Y.; Phang, S.Y.; Pacey. Policy Innovations for Affordable Housing in Singapore; Springer International Publishing: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Mueller, E.J.; Tighe, J.R. Making the case for affordable housing: Connecting housing with health and education outcomes. J. Plan. Lit. 2007, 21, 371–385. [Google Scholar] [CrossRef]

- Lubell, J.; Crain, R.; Cohen, R. Framing the issues—The positive impacts of affordable housing on health. Cent. Hous. Policy 2007, 34, 1–34. [Google Scholar]

- Gopalan, K.; Venkataraman, M. Affordable housing: Policy and practice in India. IIMB Manag. Rev. 2015, 27, 129–140. [Google Scholar] [CrossRef]

- Vergara, E. Canada: Mortgage Bond Purchase Program. Vergara, Ezekiel (2022) “Canada: Mortgage Bond Purchase Program”. J. Financ. Cris. 2022, 4, 1519–1533. [Google Scholar]

- Bhutta, U.S.; Tariq, A.; Farrukh, M.; Raza, A.; Iqbal, M.K. Green bonds for sustainable development: Review of literature on development and impact of green bonds. Technol. Forecast. Soc. Chang. 2022, 175, 121378. [Google Scholar] [CrossRef]

- Emose, G. Sustainability Bond for the Pacific Feasibility Study. 2021. Available online: https://repository.unescap.org/handle/20.500.12870/3432 (accessed on 5 December 2022).

- Green and Blue Bond Impact Report. 2022. Available online: https://data.adb.org/dataset/green-and-blue-bond-impact-report (accessed on 5 December 2022).

- Olubunmi, O.A.; Xia, P.B.; Skitmore, M. Green building incentives: A review. Renew. Sustain. Energy Rev. 2016, 59, 1611–1621. [Google Scholar] [CrossRef]

- Kundu, A.; Kumar, A. Housing for the urban poor? Changes in credit-linked subsidy. Econ. Political Wkly. 2017, 52, 105–110. [Google Scholar]

- Ahn, Y.H.; Wang, Y.; Lee, K.H.; Jeon, M.H. The greening of affordable housing through public and private partnerships: Development of a model for green affordable housing. J. Green Build. 2014, 9, 93–112. [Google Scholar] [CrossRef]

- Leon, S.; Suttor, G.; Klingbaum, A. Toronto Supportive Housing Growth Plan: Funding Analysis; Wellesley Institute: Toronto, ON, Canada, 2022. [Google Scholar]

- Immigration, R. COW-National Housing Strategy–10 June 2021. 2021. Available online: https://www.canada.ca/en/immigration-refugees-citizenship/corporate/transparency/committees/cow-jun-10-2021/national-housing-strategy.html (accessed on 16 December 2022).

- Saha, D.; d’Almeida, S. Green municipal bonds. Leaders 2017, 5, 886. [Google Scholar]

- Jacobson, D.M.; Randolph, E. SUBJECT: Revisions to the Multifamily Affordable Solar Housing Program Handbook; 2017. Available online: https://www.pge.com/tariffs/assets/pdf/adviceletter/ELEC_5093-E.pdf (accessed on 19 December 2022).

- Bandic, I. Pricing Mortgage-Backed Securities and Collateralized Mortgage Obligations; University of British Colombia Press: Vancouver, Canada, 2004. [Google Scholar]

- Zhang, M.; Lian, Y.; Zhao, H.; Xia-Bauer, C. Unlocking green financing for building energy retrofit: A survey in the western China. Energy Strategy Rev. 2020, 30, 100520. [Google Scholar] [CrossRef]

- Bilal, M.; Meera, A.K.M.; Abdul Razak, D. Issues and challenges in contemporary affordable public housing schemes in Malaysia: Developing an alternative model. Int. J. Hous. Mark. Anal. 2019, 12, 1004–1027. [Google Scholar] [CrossRef]

- Markup Subsidy for Housing Finance. State Bank of Pakistan. 2020. Available online: https://www.sbp.org.pk/smefd/circulars/2020/C11.htm (accessed on 20 January 2023).

- Ghasemi, M.; Ozyan, N. A discussion on affordable housing projects: Case study Mehr Housing, Iran. J. Contemp. Urban Aff. 2018, 2, 137–145. [Google Scholar] [CrossRef]

- Khalil, I. Mortgage Market Design for Low-Cost Housing Units in Pakistan. 2019. Available online: https://www.tabadlab.com (accessed on 20 January 2023).

- Ahmad, S.F. Techniques for Improving Lives by Green Low-Income Housing. In Fourth International Conference on Sustainable Construction Materials and Technologies. 2016. Available online: https://www.claisse.info/Proceedings.Htm (accessed on 5 December 2022).

- Hasan, A.; Ahmed, N.; Raza, M.; Sadiq, A.; Ahmed, S.; Sarwar, M.B. Land Ownership, Control and Contestation in KARACHI and Implications for Low-Income Housing; Human Settlements Group, International Institute for Environment and Development: London, UK, 2013. [Google Scholar]

- Baig, M.S.R.; Nawaz, H.M.U.; Idrees, R.Q. Housing for All: A Case Study of Kachi Abbadis (Slums) in Achieving the Goal of Housing for All in Pakistan. Orient Res. J. Soc. Sci. 2020, 5, 32–44. [Google Scholar]

- Kamal, M.; Ahmed, S. Housing Finance Market in Bangladesh-A Review. IOSR J. Econ. Financ. (IOSR-JEF) 2016, 7, 31–40. [Google Scholar]

- MacAskill, S. Enhancing Affordable Housing Policy and Delivery through Green Building Principles: An Integrated Participatory System Modelling Approach. Ph.D. Thesis, University of Griffith, Nathan, Australia, 2020. [Google Scholar]

| Components | Subcomponents | Authors |

|---|---|---|

| Income Ratios | House price to income ratio Rental cost to income ratio Residual income | [1,10,11,12,13] |

| Loan and Accommodations | Availability of mortgage and interest rate Rental housing availability Low-cost house ownership products Market value home ownership availability | [1,11,13,14,15] |

| Facilities and Services | Availability of employment, public transport services, quality education, health services, shopping facilities, open public green spaces, and social and leisure amenities | [1,3,16] |

| Safety and Comfort | Safety and absence of environmental issues | [3,16] |

| Energy, Resource, and Water Efficient | The lifetime of an environmentally friendly and energy and resource efficient building, from conception to design, construction, operation, maintenance, restoration, and demolition. | [1,3,10,15,17] |

| High Value homes | Lowered bills, lowered default rate and higher resale value | [3,11,18] |

| Financing Programs | Description | Financing Developers | Country | Source | |

|---|---|---|---|---|---|

| Housing Bonds | Australian Affordable Housing Bond based Aggregator (AHBA) loans | Bonds issued to investors to generate funds for housing. Loans and bonds provided to increase supply of housing especially for the low-income community in Australia. | National Housing Finance and Investment Corp. (NHFIC) | Australia | [17] |

| Canada Mortgage Bonds | Institutional investors purchase Canadian mortgage bonds to finance projects related to GAH. | Canada Mortgage and Housing Corporations (CMHC) | Canada | [39] | |

| Green Bonds | These bonds are sold to investors in order to raise funds for initiatives in renewable energy, energy efficiency, sustainable housing, and other environmentally friendly businesses. |

| Germany, Sweden, Africa and other EU countries | [40] | |

| Social Impact Bonds | Social bonds are used to fund eligible projects, and investors receive a fixed return on their investment. | Asian Development Bank | Asia and Pacific | [41] | |

| Sustainability Bonds | These bonds are similar to social bonds but also include projects that reduce greenhouse gas emissions, promote renewable energy, and support climate adaptation and mitigation. These bonds purchased by institutional investors and other retail investors. | Asian Development Bank | Asia and Pacific | [41] | |

| SDG Bonds | These bonds are purchased by investors who are interested in supporting sustainable housing projects in Pacific and Asia. | Asian Development Bank | Asia and Pacific | [29] | |

| Project of Ulaanbaatar GAH and Resilient Urban Renewal Sector | Provide long-lasting and comprehensive solutions to turn Ulaanbaatar City’s subpar, climate-vulnerable, and highly polluting localities into habitable eco-districts that are also inexpensive and low carbon. This will help to leverage investments from the private sector. | Asian Development Bank | Mongolia | [42] | |

| Tax Incentives | Low Income housing Tax credit equity | Tax incentives for housing developers and private investors to build resilient houses for low-income groups. | Tax Reform Act of 1986, which was passed by the United States Congress | United States | [20] |

| Green Building Housing Tax Incentive | Tax incentives for people and companies who develop green in an attempt to offset high capital expenditures. | US Department of Energy, US Environmental Protection Agency | United States | [43] | |

| Interest Subsidies for loans | Credit Link Subsidy Scheme | Interest free mortgages obtained for the purchase or construction of a resilient and sustainable house. | National Housing Bank, India | India | [44] |

| GAH Scheme | Subsidized interest rate on home loans obtained for the purchase or construction of a resilient and sustainable house. | National Housing Bank, India | India | [44] | |

| Affordable Housing Fund | Interest-free mortgage loans obtained to buy or build a sturdy, environmentally friendly home. | National Housing Bank, India | India | [44] | |

| Green Grants | The Weatherization Assistance Program | A federal grant program that provides funding to improve the energy efficiency of homes for low-income households. | U.S. Department of Energy | United States | [31] |

| Community Development Block Grant (CDBG) Programs | The CDBG’s mission is to encourage the growth of livable urban areas by increasing economic possibilities, especially for low- and moderate-income homeowners, and by providing acceptable housing and an appropriate living environment. | The U.S. Department of Housing and Urban Development (HUD) | United States | [45] | |

| The National Housing Co-Investment Fund (NHCF) | Low-cost loans and subsidies to developers to help them construct new affordable housing units, restore existing ones, and make them more resilient. | Canada Mortgage and Housing Corporation (CMHC) | Canada | [46] | |

| The Affordable Housing Innovation Fund (AHIF) | Provide 50% funding for the development of new affordable housing units and repair and renovation of existing units for vulnerable populations. | Canada Mortgage and Housing Corporation (CMHC) | Canada | [47] | |

| The Green Municipal Fund | The GMF offers loans, grants, and technical assistance to municipalities to build green efficient buildings and retrofits. | Federation of Canadian Municipalities (FCM) | Canada | [48] | |

| The Energy Efficient Affordable Housing Program (EEAHP) | Funds for housing developers to support construction of energy efficient affordable housing units. | U.S. Department of Energy | United States of America | [43] | |

| The Multifamily Affordable Solar Housing (MASH) | Incentives for installation of solar energy systems. Provide incentives to install solar energy systems in low-income communities. | California Public Utilities Commission (CPUC) | United States of America | [49] |

| Financing Programs | Description | Financing Developers | Country | References | |

|---|---|---|---|---|---|

| Mortgages | Ginnie Mae Mortgage-Backed Securities (MBS) | Primarily designed to support the government’s housing policy by making mortgage loans more affordable for low and moderate-income borrowers. | Federal Housing Administration (FHA) | United States | [50] |

| HUD’s Energy Efficient Mortgage (EEM) | Mortgages for homeowner to retrofit energy efficient improvements, spend less on energy costs, 100% energy improvement can be financed and allow consumers to buy more homes. | U.S. Department of Housing and Urban Development (HUD) | United States | [31] | |

| Retrofit financing | Building Retrofit Energy Efficiency Financing | Provision of funds to owners of households to retrofit their houses with energy efficient and sustainable features. | U.S. Department of Housing and Urban Development (HUD) | United States | [51] |

| Subsidies on Home Interest Rate | MY housing Scheme | Provide subsidy to reduce cost of financing and make homes more affordable for low-income families; 3.5% interest rate per annum with maximum 35 years repayment. | Malaysian Government Initiative | Malaysia | [52] |

| Markup subsidy on Housing Finance | Markup subsidy for housing finance is a government initiative to provide affordable housing finance to low-income households. The subsidy is in the form of a reduction in the interest rate on home loans, which makes the cost of borrowing lower for eligible borrowers. | State Bank of Pakistan | Pakistan | [53] |

| Dataset | Pakistan | India | Bangladesh |

|---|---|---|---|

| Population | 235,824,862 | 1,420,000,000 | 171,186,372 |

| Urban Population | 88,979,079 | 508,368,361 | 67,979,820 |

| Housing Backlog | 11.4 million | 10 million | 6 million |

| Housing finance as Percentage of GDP | 0.25% | 11.7% | 1.71% |

| Candidates Information | Profile | Experience (Years) |

|---|---|---|

| Interviewee 1 | Housing Market Investor | 27 years |

| Interviewee 2 | Housing Market Investor | 15 Years |

| Interviewee 3 | Financial experts | 10 years |

| Interviewee 4 | Financial Experts | 13 Years |

| Interviewee 5 | Household owner | 10 years |

| Interviewee 6 | Household owner | 15 years |

| Interviewee 7 | Household owner | 12 years |

| Interviewee 8 | Policy Experts | 18 years |

| Interviewee 9 | Policy Experts | 23 years |

| Interviewee 10 | Policy Experts | 27 years |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bashir, S.; Sarker, T.; Talib, M.N.A.; Akram, U. Financing Options for Green and Affordable Housing (GAH): An Exploratory Study of South Asian Economies. Sustainability 2023, 15, 11645. https://doi.org/10.3390/su151511645

Bashir S, Sarker T, Talib MNA, Akram U. Financing Options for Green and Affordable Housing (GAH): An Exploratory Study of South Asian Economies. Sustainability. 2023; 15(15):11645. https://doi.org/10.3390/su151511645

Chicago/Turabian StyleBashir, Sana, Tapan Sarker, Mirza Nouman Ali Talib, and Umair Akram. 2023. "Financing Options for Green and Affordable Housing (GAH): An Exploratory Study of South Asian Economies" Sustainability 15, no. 15: 11645. https://doi.org/10.3390/su151511645

APA StyleBashir, S., Sarker, T., Talib, M. N. A., & Akram, U. (2023). Financing Options for Green and Affordable Housing (GAH): An Exploratory Study of South Asian Economies. Sustainability, 15(15), 11645. https://doi.org/10.3390/su151511645