Urban Flood Loss Assessment and Index Insurance Compensation Estimation by Integrating Remote Sensing and Rainfall Multi-Source Data: A Case Study of the 2021 Henan Rainstorm

Abstract

:1. Introduction

2. Materials and Methods

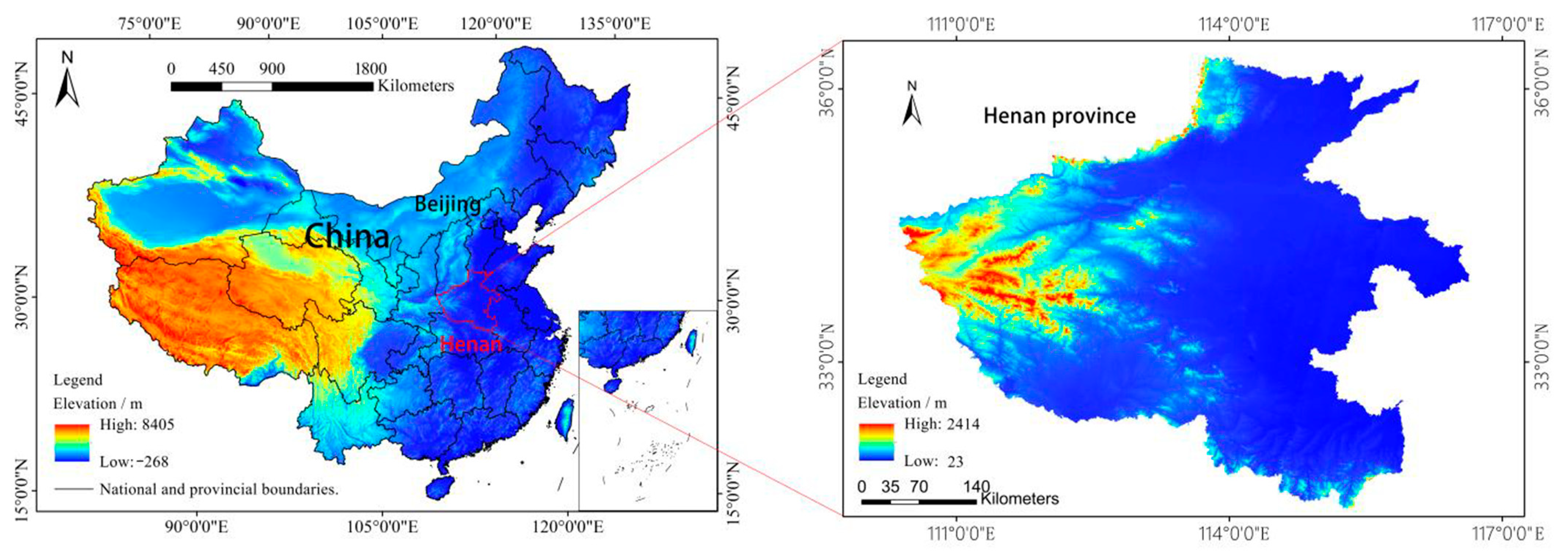

2.1. Study Area

2.2. Data Collection

2.3. Methods

2.3.1. Flood Economic Losses Assessment Model

- (1)

- The Normalized Difference Water Index (NDWI) model

- (2)

- Flood loss model of remote sensing pixels

2.3.2. The UFIITC Model Integrating Remote Sensing and Rainfall Multi-Source Data

- (1)

- Design of compensation structure for flood index insurance

- (2)

- The UFIITC model

2.4. Research Framework

3. Results

3.1. Assessment Results from the Flood Loss Model of Remote Sensing Pixels

3.1.1. Flood Economic Losses Assessment

3.1.2. Accuracy Verification of Loss Assessment Results

- (1)

- Reliability validation of the area of flooded water bodies

- (2)

- Reliability Validation of Flood Losses Assessment Results

3.2. Analysis of Compensation Results from the UFIITC Model

3.3. Accuracy Verification of the UFIITC Model

4. Discussion

- (1)

- The role of flood index insurance in urban flood risk management

- (2)

- The role of remote sensing in the UFIITC model

- (3)

- The role of rainfall multi-source data in the UFIITC model

- (4)

- Future studies

5. Conclusions

- This paper used the flood loss model of remote sensing pixels to invert the flood losses in Henan Province. The flood losses in Henan were CNY 110.20 billion, with an accuracy rate of over 90% when compared with official disaster losses data.

- Based on the meteorological parameter triggering mechanism, a UFIITC model integrating remote sensing and rainfall multi-source data was constructed to realize the tiered compensation estimation. The flood index insurance compensation in Henan was divided into three tiers, and the total amount of compensation payable was CNY 24.137 billion. The accuracy validation effect by analyzing the results showed that the regression of the UFIITC model was better (R2 = 0.98, F = 1379.42, p < 0.05).

- The research results achieved the accurate and efficient estimation of economic losses from large-scale urban flooding and flood insurance compensation. This provides guidance for the accurate implementation of urban flood relief in China and can also provide theoretical and technical support for the high-quality development of urban flood index insurance around the world, particularly in countries with incomplete flood insurance compensation systems.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Su, X.; Shao, W.; Liu, J.; Jiang, Y.; Wang, K. Dynamic assessment of the impact of flood disaster on economy and population under extreme rainstorm events. Remote Sens. 2021, 13, 3924. [Google Scholar] [CrossRef]

- Yu, Q.; Wang, Y.; Li, N. Extreme flood disasters: Comprehensive impact and assessment. Water 2022, 14, 1211. [Google Scholar] [CrossRef]

- Gaagai, A.; Aouissi, H.A.; Krauklis, A.E.; Burlakovs, J.; Athamena, A.; Zekker, I.; Boudoukha, A.; Benaabidate, L.; Chenchouni, H. Modeling and risk analysis of dam-break flooding in a semi-arid montane watershed: A case study of the Yabous dam, Northeastern Algeria. Water 2022, 14, 767. [Google Scholar] [CrossRef]

- Schiermeier, Q. Increased flood risk linked to global warming. Nature 2011, 470, 315–316. [Google Scholar] [CrossRef] [Green Version]

- Gaagai, A.; Boumezbeur, A.; Benaabidate, L. Failure simulation of Babar dam-Algeria and its impact on the valley downstream section. J. Water Land Dev. 2018, 44, 75–89. [Google Scholar] [CrossRef]

- Haraguchi, M.; Lall, U. Flood risks and impacts: A case study of Thailand’s floods in 2011 and research questions for supply chain decision making. Int. J. Disaster Risk Reduct. 2014, 14, 256–272. [Google Scholar] [CrossRef]

- Schroter, K.; Kunz, M.; Elmer, F.; Muhr, B.; Merz, B. What made the June 2013 flood in Germany an exceptional event? A hydro-meteorologica evaluation. Hydrol. Earth Syst. Sci. 2015, 19, 309327. [Google Scholar] [CrossRef] [Green Version]

- Chen, D.; Pan, C.Y.; Qiao, S.B.; Zhi, R.; Tang, S.K.; Yang, J.; Feng, G.L.; Dong, W.J. Evolution and prediction of the extreme rainstorm event in July 2021 in Henan province, China. Atmos. Sci. Lett. 2023, 24, e1156. [Google Scholar] [CrossRef]

- Zheng, X.Z.; Duan, C.F.; Chen, Y.; Li, R.; Wu, Z.X. Disaster loss calculation method of urban flood bimodal data fusion based on remote sensing and text. J. Hydrol. Reg. Stud. 2023, 47, 101410. [Google Scholar] [CrossRef]

- Duan, C.F.; Zheng, X.Z.; Jin, L.H.; Chen, Y.; Li, R.; Yang, Y.L. Study on the remote sensing spectral method for disaster loss inversion in urban flood areas. Water 2022, 14, 2165. [Google Scholar] [CrossRef]

- Nanditha, J.S.; Kushwaha, A.; Singh, R. The pakistan flood of August 2022: Causes and implications. Earths Future 2023, 11, e2022EF003230. [Google Scholar] [CrossRef]

- Landry, C.E.; Turner, D.; Petrolia, D. Flood insurance market penetration and expectations of disaster assistance. Environ. Resour. Econ. 2021, 79, 357–386. [Google Scholar] [CrossRef]

- Porrini, D.; Schwarze, R. Insurance models and European climate change policies: An assessment. Eur. J. Law Econ. 2014, 38, 7–28. [Google Scholar] [CrossRef]

- Tariq, M.A.U.R.; Hoes, O.A.C.; Giesen, N.C.V.D. Development of a risk-based framework to integrate flood insurance. J. Flood Risk Manag. 2014, 7, 291–307. [Google Scholar] [CrossRef]

- Breckner, M.; Englmaier, F.; Stowasser, T.; Sunde, U. Resilience to natural disasters—Insurance penetration, institutions, and disaster types. Econ. Lett. 2016, 148, 106–110. [Google Scholar] [CrossRef]

- Landry, C.E.; Mohammad, R.; Parvar, J. Flood insurance coverage in the coastal zone. J. Risk Insur. 2011, 78, 361–388. [Google Scholar] [CrossRef] [Green Version]

- Kousky, C.; Michel-Kerjan, E.O.; Raschky, P.A. Does federal disaster assistance crowd out flood insurance? J. Environ. Econ. Manag. 2018, 87, 150–164. [Google Scholar] [CrossRef]

- Paresh, S.; Shalika, V.; Pramod, A.; Rao, K.N. Designing weather index insurance of crops for the increased satisfaction of farmers, industry and the government. Clim. Risk Manag. 2019, 25, 100189. [Google Scholar] [CrossRef]

- Robinson, P.; Botzen, W.J.W.; Duijndam, S.; Rao, K.N. Risk communication nudges and flood insurance demand. Clim. Risk Manag. 2021, 34, 100366. [Google Scholar] [CrossRef]

- Kousky, C.; Michel-Kerjan, E. Examining flood insurance claims in the united states: Six key findings. J. Risk Insur. 2017, 84, 819–850. [Google Scholar] [CrossRef]

- Collins, E.L.; Sanchez, G.M.; Terando, A.; Stillwell, C.C.; Mitasova, H.; Sebastian, A.; Meentemeyer, R.K. Predicting flood damage probability across the conterminous United States. Environ. Res. Lett. 2022, 17, 034006. [Google Scholar] [CrossRef]

- Crichton, D. Role of insurance in reducing flood risk. Geneva. Pap. Risk Insur. Issues Pract. 2008, 33, 117–132. [Google Scholar] [CrossRef] [Green Version]

- Dong, J.S.; Shen, W.; Zhang, Y.; Wu, X.S. Development of weather claiming index for rice rainstorm and flood disasters insurance in Suqian city. Sci. Meteor Sin. 2017, 37, 416–424. [Google Scholar] [CrossRef]

- Boudreault, M.; Ojeda, A. Ratemaking territories and adverse selection for flood insurance. Insur. Math. Econ. 2022, 107, 349–360. [Google Scholar] [CrossRef]

- Teh, T.L.; Woolnough, C. A better trigger: Indices for insurance. J. Risk Insur. 2019, 86, 861–885. [Google Scholar] [CrossRef] [Green Version]

- Mulagha, A.M.; Chiwaula, L.S.; Kambewa, P. Parametric and non-parametric estimates of willingness to pay for weather index insurance in Malawi. Int. J. Disaster Risk Reduct. 2021, 62, 102406. [Google Scholar] [CrossRef]

- Barnett, J.B.; Mahul, O. Weather index insurance for agriculture and rural areas in lower-income countries. Amer. J. Agric. Econ. 2007, 89, 1241–1247. [Google Scholar] [CrossRef]

- Linnerooth-Bayer, J.; Mechler, R.; Pflug, G. Refocusing diaster aid. Science 2005, 309, 1044–1046. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Vecere, A.; Martina, M.; Monteiro, R.; Galasso, C. Satellite precipitation–based extreme event detection for flood index insurance. Int. J. Disaster Risk Reduct. 2021, 55, 102108. [Google Scholar] [CrossRef]

- Zhang, X.D. Remote sensing technology and insurance application: Applicability and challenges. Financ. Theory Pract. 2020, 487, 104–109. [Google Scholar] [CrossRef]

- Achtnicht, M.; Osberghaus, D. The demand for index-based flood insurance in a high-income country. Ger. Econ. Rev. 2019, 20, 217–242. [Google Scholar] [CrossRef] [Green Version]

- Cole, S.; Stein, D.; Tobacman, J. Dynamics of demand for index insurance: Evidence from a long-run field experiment. Am. Econ. Rev. 2014, 104, 284–290. [Google Scholar] [CrossRef] [Green Version]

- Akter, S.; Krupnik, T.J.; Rossi, F.; Khanam, F. The influence of gender and product design on farmers’ preferences for weather-indexed crop insurance. Global Environ. Chang. 2016, 38, 217–229. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Yaseen, Q.M.; Akhtar, R.; Khalil, M.K.U.; Jan, O.M.U. Dynamic inoperability input-output modeling for economic losses estimation in industries during flooding. Socio-Econ. Plan. Sci. 2020, 72, 100876. [Google Scholar] [CrossRef]

- Li, W.; Wen, J.; Xu, B.; Li, X.; Du, S. Integrated assessment of economic losses in manufacturing industry in shanghai metropolitan area under an extreme storm flood scenario. Sustainability 2019, 11, 126. [Google Scholar] [CrossRef] [Green Version]

- Jin, X.; Sumaila, U.R.; Yin, K. Direct and indirect loss evaluation of storm surge disaster based on static and dynamic input-output models. Sustainability 2020, 12, 7347. [Google Scholar] [CrossRef]

- Okuyama, Y.; Santos, J.R. Disaster impact and input-out-put analysis. Econ. Syst. Res. 2014, 26, 1–12. [Google Scholar] [CrossRef]

- Huang, C.; Zhang, S.Q.; Dong, L.Y.; Wang, Z.C.; Li, L.Y.; Cui, L.M. Spatial and temporal variabilities of rainstorms over China under climate change. J. Geogr. Sci. 2021, 31, 479–496. [Google Scholar] [CrossRef]

- Song, S.; Cao, Z.; Wu, Z.; Chuai, X. Spatial and temporal dynamics of surface water in china from the 1980s to 2015 based on remote sensing monitoring. Chin. Geogr. Sci. 2022, 32, 174–188. [Google Scholar] [CrossRef]

- Panteras, G.; Cervone, G. Enhancing the temporal resolution of satellite-based flood extent generation using crowd sourced data for disaster monitoring. Int. J. Remote Sens. 2018, 39, 1459–1474. [Google Scholar] [CrossRef]

- Madzimur, F. Applied geographic information system (gis) and remote sensing: Flood hazard risk assessment in the city of Bulawayo. Int. J. Res. Soc. Sci. 2019, 7, 29–47. [Google Scholar] [CrossRef]

- Matheswaran, K.; Alahacoon, N.; Pandey, R.; Amarnath, G. Flood risk assessment in South Asia to prioritize flood index insurance applications in Bihar, India. Geomat. Nat. Hazards Risk 2019, 10, 26–48. [Google Scholar] [CrossRef] [Green Version]

- Giné, X.; Townsend, R.; Vickery, J. Patterns of rainfall insurance participation in rural India. World Bank Econ. Rev. 2008, 22, 539–566. [Google Scholar] [CrossRef] [Green Version]

- Tellman, B.; Lall, U.; Islam, A.K.M.S.; Bhuyan, M.A. Regional index insurance using satellite-based fractional flooded area. Earth’s Future 2022, 10, e2021EF002418. [Google Scholar] [CrossRef]

- Figueiredo, R.; Martina, M.L.V.; Stephenson, D.B.; Youngman, B.D. A probabilistic paradigm for the parametric insurance of natural hazards. Risk Anal. 2018, 38, 2400–2414. [Google Scholar] [CrossRef] [PubMed]

- Xiao, Y.G.; Yao, J. Double trigger agricultural insurance products with weather index and yield index. China Agric. Econ. Rev. 2019, 11, 299–316. [Google Scholar] [CrossRef]

- Liu, H.; Liu, F.; Zheng, L.; Chen, X.L. Research on flood disaster in northern cities combining risk analysis and loss assessment: Taking the heavy rainstorm and flood disaster in Zhengzhou City in July 2021 as an example. J. Cent. China Norm. Univ. (Nat. Sci.) 2023, 57, 59–68. [Google Scholar] [CrossRef]

- Arnaud, P.; Bouvier, C.; Cisneros, L.; Dominguez, R. Influence of rainfall spatial variability on flood prediction. J. Hydrol. 2002, 260, 216–230. [Google Scholar] [CrossRef]

- Smith, M.B.; Koren, V.I.; Zhang, Z.Y.; Reed, S.M.; Pan, J.J.; Moreda, F. Runoff response to spatial variability in precipitation: An analysis of observed data. J. Hydrol. 2004, 298, 267–286. [Google Scholar] [CrossRef]

- Jiang, C.B.; Zhou, Q.; Shen, Y.X.; Liu, G.F.; Zhang, D. Review on hydrological and hydrodynamic coupling models for flood forecasting in mountains watershed. J. Hydraul. Eng. 2021, 52, 1137–1150. [Google Scholar] [CrossRef]

- Zhang, M.; Wang, J. Global flood disaster research graph analysis based on literature mining. Appl. Sci. 2022, 12, 3066. [Google Scholar] [CrossRef]

- Zhang, N.; Su, A. Influence of topography on a severe rainfall process in western Henan province. J. Meteorol. Environ. 2014, 30, 16–24. [Google Scholar] [CrossRef]

- Deng, G.Q.; Chen, H.; Wang, S.Q. Risk assessment and prediction of rainstorm and flood disaster based on Henan province, China. Math. Probl. Eng. 2022, 2022, 5310920. [Google Scholar] [CrossRef]

- Mcfeeters, S.K. The use of the Normalized Difference Water Index (NDWI) in the delineation of open water features. Inter. Remote Sens. 1996, 17, 1425–1432. [Google Scholar] [CrossRef]

- Lep, A.; Envelope, E.; Acpf, C. Analysis of the Taquari Megafan through radiometric indices. J. South Amer. Earth Sci. 2022, 119, 104034. [Google Scholar] [CrossRef]

- Jonkman, S.N.; Bockarjova, M.; Kok, M.; Bernardini, P. Integrated hydrodynamic and economic modelling of flood damage in the Netherlands. Ecol. Econ. 2008, 66, 77–90. [Google Scholar] [CrossRef]

- Sieg, T.; Schinko, T.; Vogel, K.; Mechler, R.; Merz, B.; Kreibich, H. Integrated assessment of short-term direct and indirect economic flood impacts including uncertainty quantification. PLoS ONE 2019, 14, e0212932. [Google Scholar] [CrossRef] [Green Version]

- Shi, R.Q.; Liu, N.; Li, L.; Ye, L.M.; Guo, G.F. Application of rainstorm and flood inundation model in flood disaster. Tor. Rain Disasters 2013, 32, 379–384. [Google Scholar] [CrossRef]

- She, Y.L.; Zhou, Q.; Qu, S. Dynamic loss assessment of flood disaster industrial chain in China. J. Beijing Ins. Tech. (Soc. Sci. Ed.) 2023, 25, 27–42. [Google Scholar] [CrossRef]

- Vedenov, D.V.; Barnett, B.J. Efficiency of weather derivatives as primary crop insurance instruments. Wes. J. Agric. Econ. 2004, 29, 387–403. [Google Scholar] [CrossRef]

- Tesselaar, M.; Botzen, W.J.W.; Robinson, P.J.; Aerts, J.C.; Zhou, F.J. Charity hazard and the flood insurance protection gap: An EU scale assessment under climate change. Ecol. Econ. 2022, 193, 107289. [Google Scholar] [CrossRef]

- Nguyen, N.Q.; Phung, T.P.; Truong, D.T. Willingness to pay for agricultural flood insurance in the Mekong River Delta. Environ. Hazards 2019, 18, 212–227. [Google Scholar] [CrossRef]

- Teja, R.K.; Mrudula, G.; Singh, V.; Srivastava, A.K.; Singh, A.K. Unravelling the causes of 2015 winter monsoon extreme rainfall and floods over Chennai: Influence of atmospheric variability and urbanization on the hydrological cycle. Urban Clim. 2023, 47, 101395. [Google Scholar] [CrossRef]

- Yang, W.Y.; Zhang, J.; Krebs, P. Investigating flood exposure induced socioeconomic risk and mitigation strategy under climate change and urbanization at a city scale. J. Clean. Pro. 2023, 387, 135929. [Google Scholar] [CrossRef]

- Zhang, W.J.; Liao, Q.T.; Yang, S.; Zhang, X.Y.; Zhang, C.L.; Xiang, M.T.; Lei, Z.M. Urban flood risk management based on the Zhengzhou ‘2021.7.20’ flood model deduction. China Flood Dro. Manag. 2021, 31, 1–4. [Google Scholar] [CrossRef]

- Merz, B.; Basso, S.; Fischer, S.; Lun, D.; Blöschl, G.; Merz, R.; Guse, B.; Viglione, A.; Vorogushyn, S.; Macdonald, E.; et al. Understanding heavy tails of flood peak distributions. Water Resour. Res. 2022, 58, e2021WR030506. [Google Scholar] [CrossRef]

- Sun, W.J.; Sun, H. Analyzing the factors effecting catastrophe insurance market equilibrium:Based on evolutionary game model. China Econ. 2016, 295, 99–111. [Google Scholar] [CrossRef]

- Xia, L.; Qin, T. Development dilemma and optimization of operating mechanism of public welfare forest insurance in China. Financ. Theory Pract. 2022, 513, 109–118. [Google Scholar] [CrossRef]

- Masiza, W.; Chirima, J.G.; Hamandawana, H.; Kalumba, A.M.; Magagula, H.B. Linking agricultural index insurance with factors that influence maize yield in rain-fed smallholder farming systems. Sustainability 2021, 13, 5176. [Google Scholar] [CrossRef]

- Furuya, J.; Mar, S.S.; Hirano, A.; Sakurai, T. Optimum insurance contract of flood damage index insurance for rice farmers in Myanmar. Paddy Water Environ. 2021, 19, 319–330. [Google Scholar] [CrossRef]

- Suykens, C.; Priest, J.S.; Doorn-Hoekveld, V.J.W.; Thuillier, T.; Rijswick, M.V. Dealing with flood damages: Will prevention, mitigation, and ex post compensation provide for a resilient triangle? Ecol. Soc. 2016, 21, 401. [Google Scholar] [CrossRef] [Green Version]

- Black, E.; Tarnavsky, E.; Maidment, R.; Greatrex, H.; Mookerjee, A.; Quaife, T.; Brown, M. The use of remotely sensed rainfall for managing drought risk: A case study of weather index insurance in Zambia. Remote Sens. 2016, 8, 342. [Google Scholar] [CrossRef] [Green Version]

- Osgood, D.; Powell, B.; Diro, R.; Farah, C.; Enenkel, M.; Brown, M.E.; Husak, G.; Blakeley, S.L.; Hoffman, L.; McCarty, J.L. Farmer perception, recollection, and remote sensing in weather index insurance: An ethiopia case study. Remote Sens. 2018, 10, 1887. [Google Scholar] [CrossRef] [Green Version]

- Thomas, M.; Tellman, E.; Osgood, D.E. A framework to assess remote sensing algorithms for satellite-based flood index insurance. IEEE J. Sel. Top. Appl. Earth Observ. Remote Sens. 2023, 14, 2589–2604. [Google Scholar] [CrossRef]

- Xu, Z.; Cheng, T.; Hong, S.; Wang, L. Review on applications of remote sensing in urban flood modeling. Chin. Sci. Bull. 2018, 63, 2156–2166. [Google Scholar] [CrossRef]

- Rizwan, M.; Anjum, L.; Mehmood, Q.; Chauhdary, J.N.; Yamin, M.; Awais, M.; Muneer, M.A.; Irfan, M. Daily maximum rainfall estimation by best-fit probability distribution in the source region of Indus River. Theor. Appl. Climatol. 2022, 151, 1171–1183. [Google Scholar] [CrossRef]

- Miller, A.J.; Arias, M.E.; Alvarez, S. Built environment and agricultural value at risk from Hurricane Irma flooding in Florida (USA). Nat. Hazards 2021, 109, 1327–1348. [Google Scholar] [CrossRef]

- Xu, D.; Liu, Y. Research on the effect of rainfall flood regulation and control of wetland park based on SWMM model—A case study of wetland park in Yuanjia village, Qishan county, Shaanxi province. IOP Conf. Ser. Earth Environ. Sci. 2018, 121, 052014. [Google Scholar] [CrossRef]

| Time | Areas with Heavy Rainfall (City) | Maximum Rainfall (mm/24 h) |

|---|---|---|

| 1975/8/5–8/8 | Zhumadian | 1060.3 |

| 1982/7/28–8/5 | Luoyang | 544 |

| 1996/7/28–8/6 | Xinyang | 249 |

| 2010/7/18–7/20 | Nanyang | 432 |

| 2016/7/18–7/20 | Anyang | 607 |

| 2021/7/17–7/23 | Zhengzhou | 624.1 |

| Area | DMSP/OL DN Value | Number of Remote Sensing Pixels Affected | Direct Economic Losses (100 Million CNY) | Indirect Economic Losses (100 Million CNY) | Direct Economic Losses per Unit Area (100 Million CNY/km2) | Inundated Area (km2) |

|---|---|---|---|---|---|---|

| Zhengzhou | 21,420 | 3871 | 431.79 | 86.36 | 0.52 | 829.82 |

| Luoyang | 5355 | 2142 | 111.37 | 22.27 | 0.24 | 459.18 |

| Nanyang | 4335 | 1251 | 81.31 | 16.26 | 0.19 | 437.96 |

| Xuchang | 2805 | 1782 | 70.57 | 14.11 | 0.16 | 432.60 |

| Zhoukou | 2550 | 592 | 59.02 | 11.80 | 0.15 | 382.01 |

| Xinxiang | 4080 | 1562 | 47.74 | 9.55 | 0.14 | 334.84 |

| Shangqiu | 4335 | 1416 | 43.24 | 8.65 | 0.14 | 312.55 |

| Zhumadian | 3570 | 1458 | 41.77 | 8.35 | 0.14 | 308.91 |

| Xinyang | 2040 | 1127 | 40.28 | 8.06 | 0.13 | 303.55 |

| Pingdingshan | 4590 | 1224 | 31.15 | 6.23 | 0.12 | 268.18 |

| Kaifeng | 2550 | 2018 | 29.84 | 5.97 | 0.11 | 266.03 |

| Anyang | 2805 | 1199 | 28.55 | 5.71 | 0.11 | 262.39 |

| Jiaozuo | 2805 | 1441 | 25.81 | 5.16 | 0.10 | 257.03 |

| Puyang | 2295 | 679 | 18.85 | 3.77 | 0.08 | 241.59 |

| Luohe | 1530 | 2043 | 17.23 | 3.45 | 0.07 | 231.52 |

| Sanmenxia | 1785 | 1080 | 12.50 | 2.50 | 0.07 | 182.21 |

| Hebi | 1020 | 1241 | 6.75 | 1.35 | 0.05 | 145.56 |

| Jiyuan | 765 | 850 | 4.23 | 0.85 | 0.05 | 126.91 |

| Economic Losses | Mean | Count | Std.deviation | Median | Min. | Max. | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|---|

| Direct economic losses | 61.22 | 18.00 | 96.46 | 35.72 | 4.23 | 431.79 | 3.70 | 14.69 |

| Direct economic losses per unit of area | 0.14 | 18.00 | 0.11 | 0.13 | 0.05 | 0.52 | 2.89 | 10.08 |

| Area | Assessed Results of Direct Economic Losses (100 Million CNY) | Real Results of Direct Economic Losses (100 Million CNY) | Error (%) |

|---|---|---|---|

| Henan Province | 1102.00 | 1200.6 | 8.21 |

| Zhengzhou | 431.79 | 409 | 5.57 |

| Area | Light Rain p < 10 | Moderate Rain 10 ≤ p < 25 | Heavy Rain 25 ≤ p < 50 | Rainstorm 50 ≤ p < 100 | Heavy Rainstorm 100 ≤ p < 200 | Extraordinary Rainstorm p ≥ 200 |

|---|---|---|---|---|---|---|

| Zhengzhou | 2996 | 559 | 268 | 81 | 13 | 1 |

| Luoyang | 3154 | 582 | 247 | 75 | 7 | 1 |

| Nanyang | 3140 | 574 | 231 | 99 | 21 | 1 |

| Xuchang | 3286 | 595 | 271 | 99 | 22 | 1 |

| Zhoukou | 3296 | 655 | 291 | 99 | 20 | 2 |

| Xinxiang | 2835 | 490 | 193 | 72 | 16 | 2 |

| Shangqiu | 2958 | 594 | 271 | 104 | 19 | 2 |

| Zhumadian | 3615 | 808 | 351 | 147 | 27 | 3 |

| Xinyang | 4238 | 911 | 390 | 163 | 40 | 2 |

| Pingdingshan | 3516 | 672 | 283 | 123 | 27 | 4 |

| Kaifeng | 2862 | 527 | 225 | 91 | 15 | 3 |

| Anyang | 2719 | 504 | 196 | 82 | 11 | 5 |

| Jiaozuo | 2937 | 534 | 213 | 65 | 15 | 1 |

| Puyang | 2637 | 508 | 227 | 71 | 22 | 1 |

| Luohe | 3352 | 671 | 295 | 113 | 20 | 5 |

| Sanmenxia | 3222 | 612 | 221 | 35 | 4 | 1 |

| Hebi | 2091 | 365 | 170 | 63 | 20 | 2 |

| Jiyuan | 2999 | 608 | 235 | 68 | 10 | 1 |

| Area | Light Rain, Moderate Rain, Heavy Rain (Level IV) | Rainstorm (Level III) | Heavy Rainstorm (Level II) | Extraordinary Rainstorm (Level I) | Compensation Payable for Rainstorm in Henan in 2021 |

|---|---|---|---|---|---|

| No Compensation | Tier One | Tier Two | Tier Three | Tier Four | |

| Zhengzhou | 0 | 0.56 | 3.59 | 170.07 | 170.07 |

| Luoyang | 0 | 0.06 | 0.59 | 31.13 | 31.13 |

| Nanyang | 0 | 0.12 | 0.54 | 21.41 | 0 |

| Xuchang | 0 | 0.11 | 0.46 | 19.19 | 0.46 |

| Zhoukou | 0 | 0.10 | 0.49 | 20.68 | 0.10 |

| Xinxiang | 0 | 0.07 | 0.30 | 14.34 | 14.34 |

| Shangqiu | 0 | 0.08 | 0.40 | 14.68 | 0 |

| Zhumadian | 0 | 0.05 | 0.25 | 8.18 | 0.05 |

| Xinyang | 0 | 0.12 | 0.47 | 15.77 | 0.12 |

| Pingdingshan | 0 | 0.04 | 0.18 | 6.53 | 0.04 |

| Kaifeng | 0 | 0.07 | 0.32 | 11.37 | 11.37 |

| Anyang | 0 | 0.04 | 0.27 | 11.11 | 11.11 |

| Jiaozuo | 0 | 0.02 | 0.09 | 4.99 | 0.09 |

| Puyang | 0 | 0.05 | 0.16 | 7.62 | 0 |

| Luohe | 0 | 0.02 | 0.11 | 4.22 | 0.11 |

| Sanmenxia | 0 | 0.01 | 0.04 | 4.57 | 0 |

| Hebi | 0 | 0.02 | 0.06 | 2.36 | 2.36 |

| Jiyuan | 0 | 0.01 | 0.02 | 1.09 | 0.02 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, Z.; Zheng, X.; Chen, Y.; Huang, S.; Hu, W.; Duan, C. Urban Flood Loss Assessment and Index Insurance Compensation Estimation by Integrating Remote Sensing and Rainfall Multi-Source Data: A Case Study of the 2021 Henan Rainstorm. Sustainability 2023, 15, 11639. https://doi.org/10.3390/su151511639

Wu Z, Zheng X, Chen Y, Huang S, Hu W, Duan C. Urban Flood Loss Assessment and Index Insurance Compensation Estimation by Integrating Remote Sensing and Rainfall Multi-Source Data: A Case Study of the 2021 Henan Rainstorm. Sustainability. 2023; 15(15):11639. https://doi.org/10.3390/su151511639

Chicago/Turabian StyleWu, Zhixia, Xiazhong Zheng, Yijun Chen, Shan Huang, Wenli Hu, and Chenfei Duan. 2023. "Urban Flood Loss Assessment and Index Insurance Compensation Estimation by Integrating Remote Sensing and Rainfall Multi-Source Data: A Case Study of the 2021 Henan Rainstorm" Sustainability 15, no. 15: 11639. https://doi.org/10.3390/su151511639

APA StyleWu, Z., Zheng, X., Chen, Y., Huang, S., Hu, W., & Duan, C. (2023). Urban Flood Loss Assessment and Index Insurance Compensation Estimation by Integrating Remote Sensing and Rainfall Multi-Source Data: A Case Study of the 2021 Henan Rainstorm. Sustainability, 15(15), 11639. https://doi.org/10.3390/su151511639