Coordination Mechanism of Revenue Sharing Contracts in Port Supply Chains: A Case Study of China’s Nantong Port

Abstract

1. Introduction

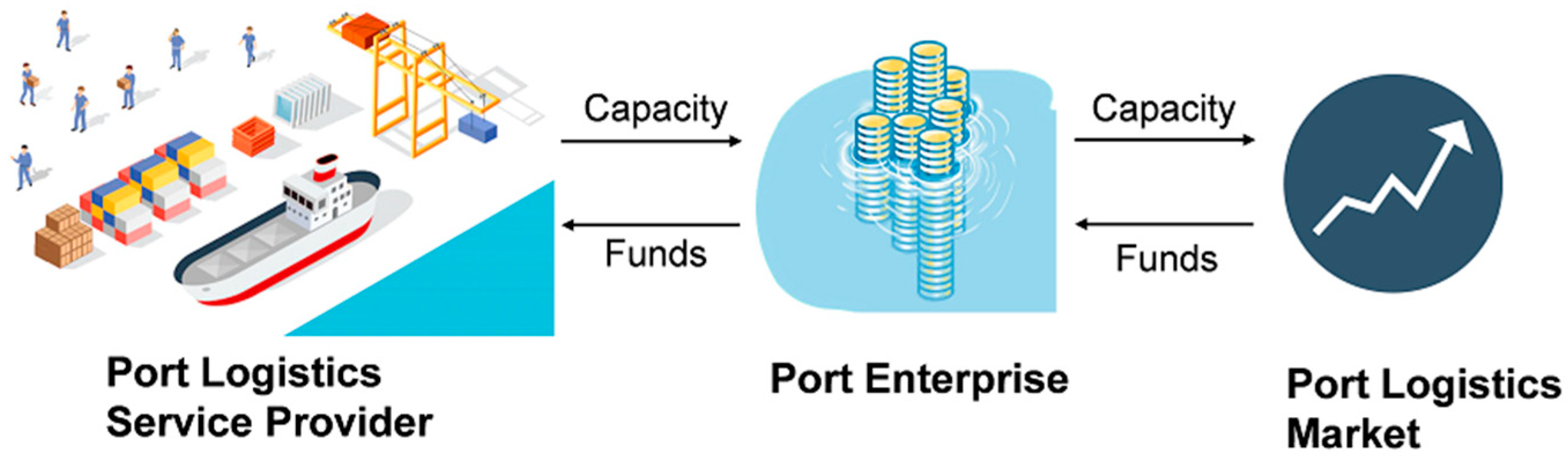

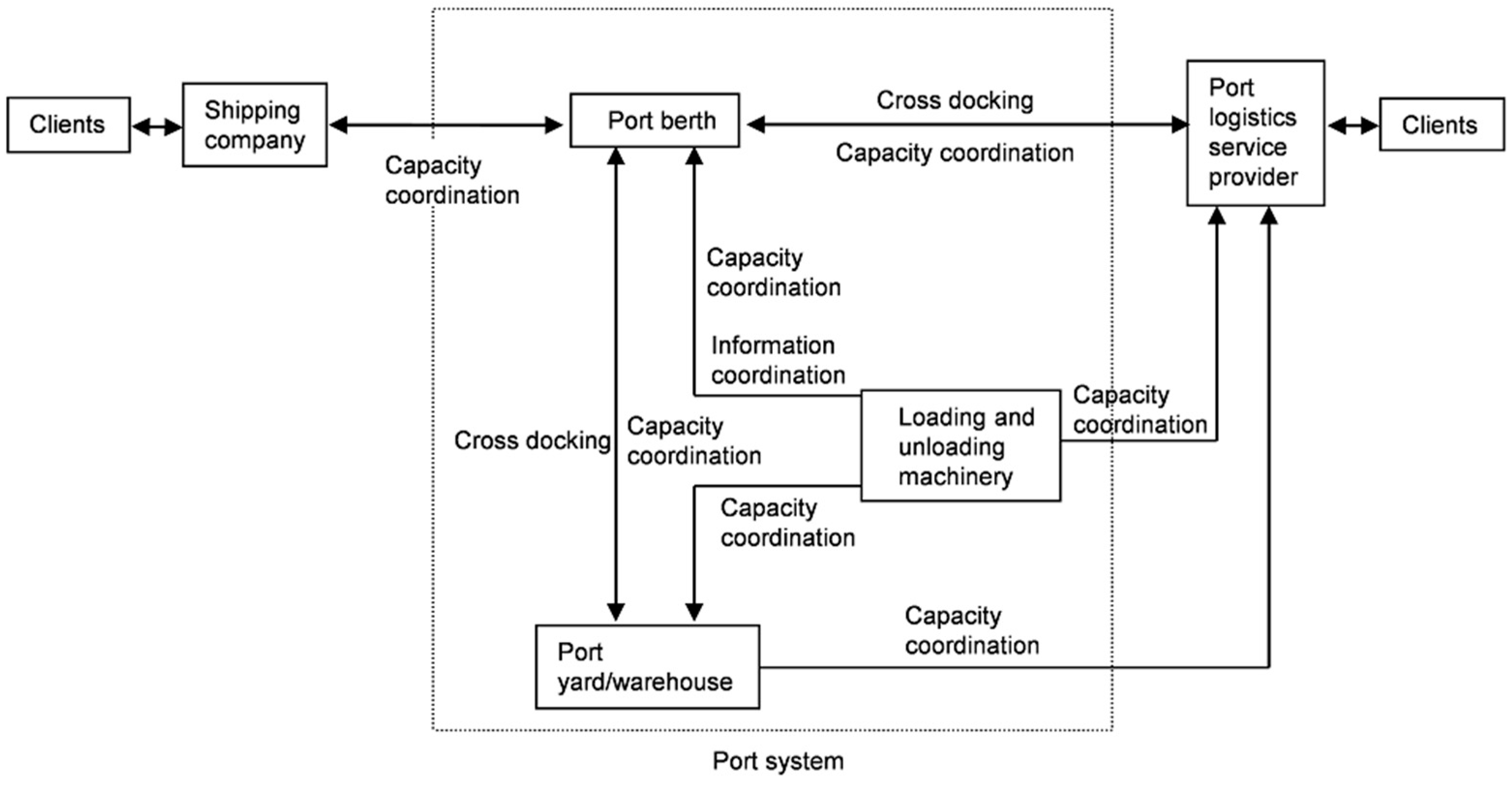

2. Modelling Notations and Hypothesis

- q: logistics capacity of port enterprises;

- S(q): expected logistics capacity of the port:

- L(q): expected loss of logistics capacity of port:

- p: unit logistics service price of port enterprises;

- w: purchase price of port logistics capacity per unit;

- c: operation cost of unit logistics capacity of service providers, where p > w > c > 0;

- : loss caused by lack of capacity of port units;

- : loss caused by lack of unit capacity of port service providers;

- : expected revenue of the port when no RSC is implemented;

- : expected revenue of the service provider when no RSC is implemented;

- π: expected revenue of integrated supply chain system;

- : expected revenue of the port when the RSC is implemented;

- : expected revenue of the service provider when the RSC is implemented;

- : expected revenue of supply chain system when implementing RSC.

- : the maximum logistics capacity of the port.

- : sensitivity coefficient of port logistics capacity order quantity relative to logistics service provider capacity transfer price, .

- : expected revenue of port based on RSC led by ports.

- : expected revenue of port service providers based on RSC led by ports.

- : expected revenue of port supply chain system based on RSC led by ports. The rest of the model symbols are the same as above.

- Both service providers and ports are bounded rationality and risk neutral (that refers to a manner in which an individual neglects risk when making investment decisions), taking the expected revenue maximization as the decision-making objective;

- The logistics demand faced by the port is a non-negative and continuous random variable. The mean value , and F(x) and f(x) are the distribution function and density function, respectively;

- F(x) is a strictly increasing function that is continuously differentiable and invertible, F(0) = 0;

- Insufficient logistics capacity leads to opportunities loss;

- There is no information asymmetry, i.e., price, cost, and demand are public information;

- For a coordination mechanism based on RSC led by port enterprises, there is a negative linear correlation between the actual quantity of port logistics capacity ordering and the transfer price of logistics service providers: .

3. Modelling Formulation and Calculation

3.1. RSC Design

3.1.1. Establishing the Demand Function and Model

3.1.2. Port Enterprise Decision Model and Analysis

3.1.3. Port Service Provider Decision Model and Contract Design

3.2. Coordination Mechanism Based on RSC Led by Port Enterprises

3.2.1. Problem Description and Contract Design

- The port determines the maximum logistics capacity order quantity and retains the λ(0 ≤ λ ≤ 1) part of its revenue; the rest is returned to the service provider. And the port claims that its actual capacity order quantity is sensitive to the capacity transfer price of the logistics service provider.

- The logistics service provider decides its capacity transfer price according to the decision and information of the port.

- In the case that the capacity transfer price of the logistics service provider is specified, the port determines the final logistics capacity order quantity based on the demand information prediction and the maximization of its own profit.

- When the logistics demand arises, the logistics service provider will have to provide the ordered quantity of logistics capacity to the port at the agreed-upon capacity transfer price and perform the required logistics services.

3.2.2. Analysis of Decision Model of Port Service Provider

3.2.3. Port Decision Model and Its Coordination Mechanism

4. Numerical Analysis

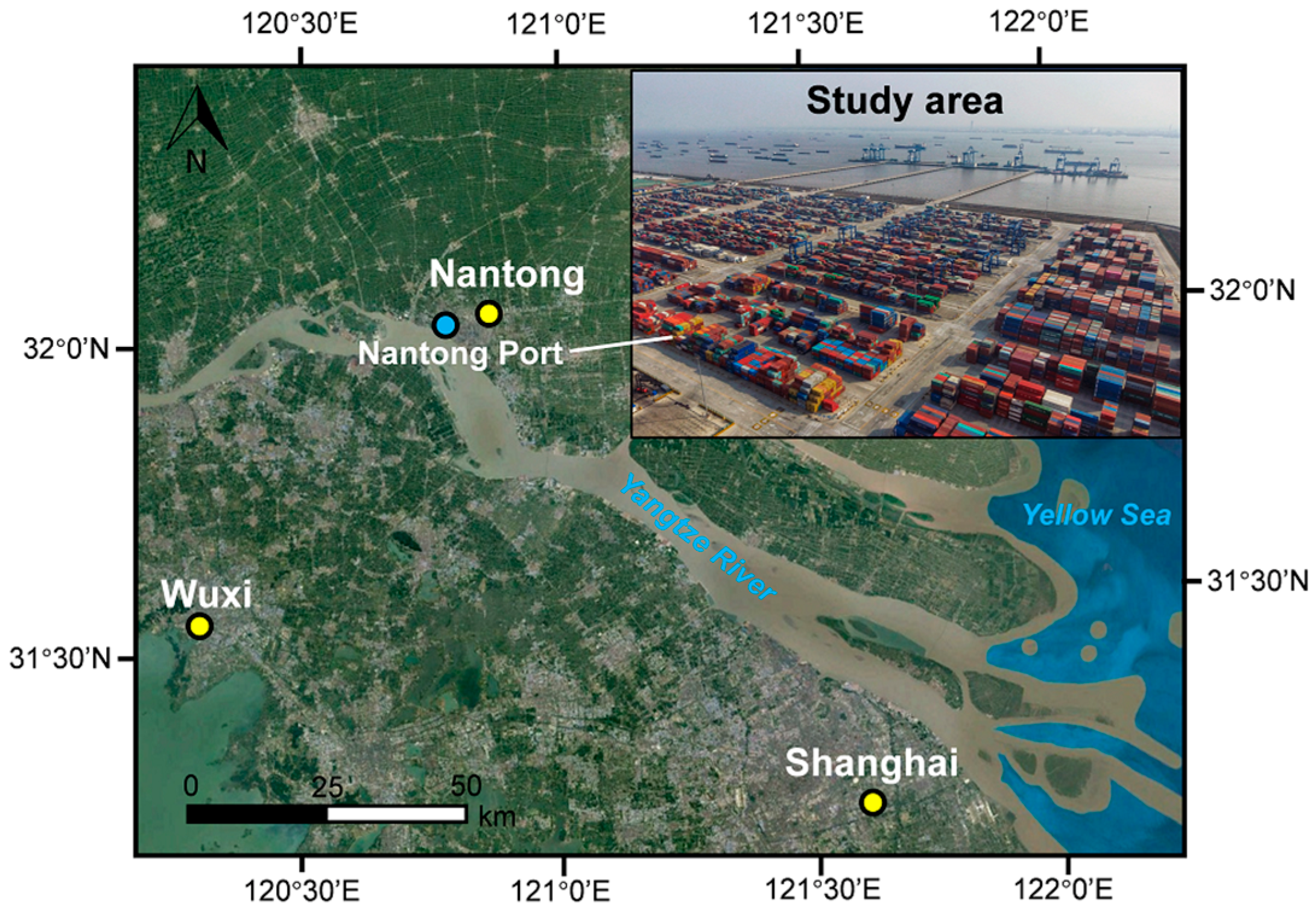

5. Case Study: The Nantong Port

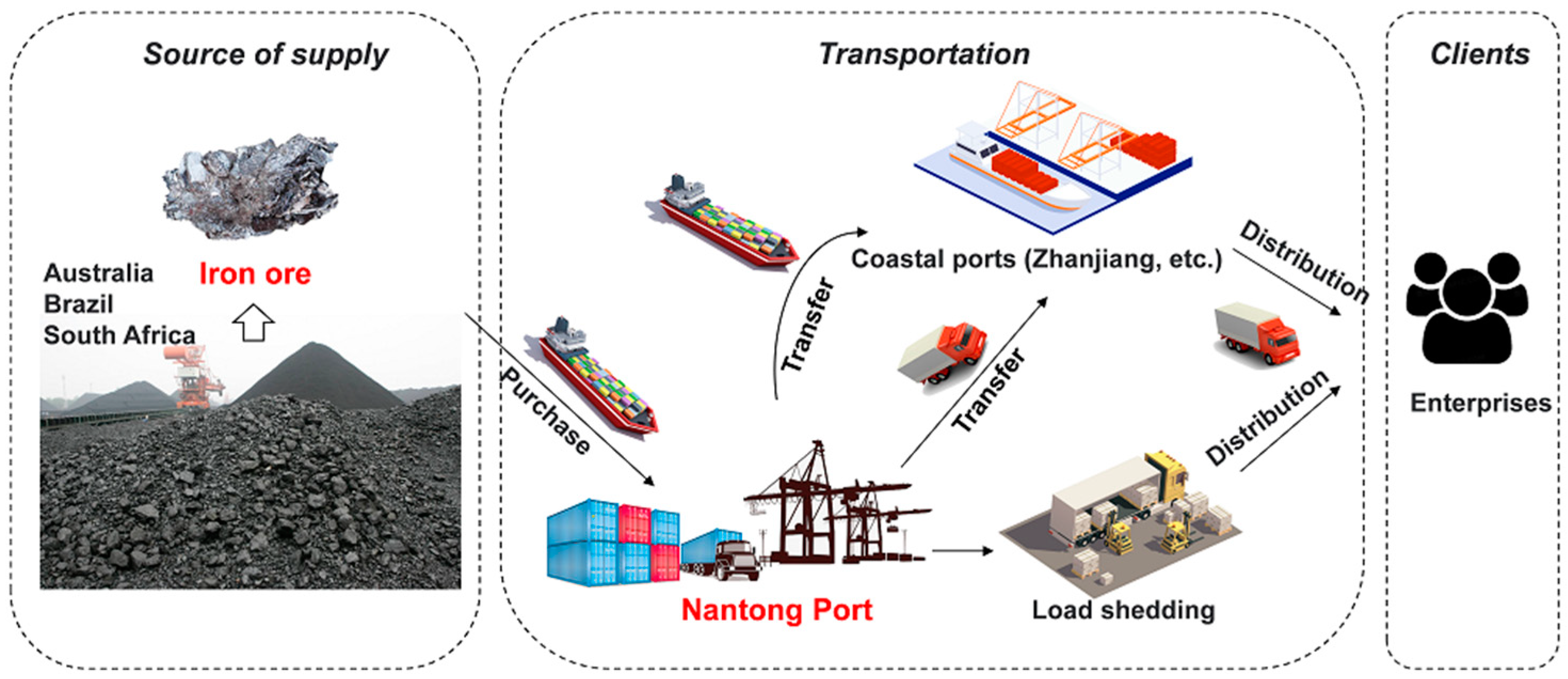

5.1. Iron Ore Supply Chain and Its Revenue Coordination

- direct unloading to land transport to other ports;

- discharge to other ships and then proceed by sea to other ports.

5.2. Implication

- Establish a fair revenue distribution mechanism to ensure that rights and interests of all parties are protected during the cooperation process.

- Strengthen security measures to prevent the disclosure of corporate secrets and personal information.

- Improve port parties’ awareness of policy support and the legal framework by increasing policy publicity and popularizing laws and regulations.

- Conduct regular exchanges and training activities to improve the professional quality of port parties involved in the coordination and game process.

- Establish an effective supervision mechanism to ensure the long-term stability of port logistics and transportation activities based on coordination and game.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Cui, A.P.; Liu, W. LSSC coordination based on competence division and cooperation. J. Shanghai Marit. Univ. 2008, 29, 43–47. [Google Scholar] [CrossRef]

- Bart, N.; Chernonog, T.; Avinadav, T. Revenue sharing contracts in a supply chain: A literature review. IFAC-PapersOnLine 2019, 52, 1578–1583. [Google Scholar] [CrossRef]

- Avinadav, T.; Chernonog, T.; Perlman, Y. The effect of risk sensitivity on a supply chain of mobile applications under a consignment contract with revenue sharing and quality investment. Int. J. Prod. Econ. 2015, 168, 31–40. [Google Scholar] [CrossRef]

- Mortimer, J. The Effects of Revenue-Sharing Contracts on Welfare in Vertically-Separated Markets: Evidence from the Video Rental Industry. SSRN Electron. J. 2002, 28, 336244. [Google Scholar] [CrossRef]

- Gerchak, Y.; Cho, R.K.; Ray, S. Coordination and Dynamic Shelf-Space Management of Video Movie Rentals. Ph.D. Thesis, University of Waterloo, Waterloo, ON, Canada, 2001. [Google Scholar]

- Giannoccaro, I.; Pontrandolfo, P. Supply chain coordination by revenue sharing contracts. Int. J. Prod. Econ. 2004, 89, 131–139. [Google Scholar] [CrossRef]

- Lee, D.P. Port Supply Chains as Social Networks. In Proceedings of the IEEE International Conference on Service Operations and Logistics, and Informatics, Shanghai, China, 21–23 June 2006; pp. 1064–1069. [Google Scholar]

- Song, D.W.; Panayides, P.M. Global supply chain and port/terminal: Integration and competitiveness. Marit. Policy Manag. 2008, 35, 73–87. [Google Scholar] [CrossRef]

- Tian, Y. Logistics Service Quantity Discount–Return Subcontract model. Ind. Eng. Manag. 2006, 11, 40–42. [Google Scholar] [CrossRef]

- Cui, A.P.; Liu, W. Study on Capability Coordination in Logistics Service Supply Chain with Options Contract. Chin. J. Manag. Sci. 2009, 17, 59–65. [Google Scholar] [CrossRef]

- Liu, W.H. Determination Method of the Optimal Revenue-Sharing Coefficient in Three-Echelon Logistics Service Supply Chain. J. Southwest Jiaotong Univ. 2010, 45, 811–816. [Google Scholar] [CrossRef]

- Zhu, W.P.; Liu, W.; Gao, Z.J. Capability coordination in three-echelon logistics service supply chain. J. Shanghai Marit. Univ. 2012, 33, 26–32. [Google Scholar] [CrossRef]

- Meng, L.J.; Huang, Z.Q. Research on the Supply Chain Contract Choice Strategy of Two-stage Logistics Service Supply Chain. J. Chongqing Univ. Soc. Sci. Ed. 2012, 18, 64–72. [Google Scholar]

- Liu, W.H.; Xie, D.; Xu, X.C. Quality supervision and coordination of logistic service supply chain under multi-period conditions. Int. J. Prod. Econ. 2013, 142, 353–361. [Google Scholar] [CrossRef]

- He, C.; Liu, W.; Cui, A.P. Coordination of three·stage logistics service supply chain with effect of logistics service level. J. Shanghai Marit. Univ. 2014, 35, 41–48. [Google Scholar] [CrossRef]

- Wang, J.; Wang, X.J. Model and Algorithm for Port Supply Chain Benefit Allocation in Cloud Environment. Logist. Technol. 2015, 9, 198–201. [Google Scholar] [CrossRef]

- Yang, L. Cooperative Coordination in Logistics Service Supply Chain Based on Principle-Agent Relation. China Bus. Mark. 2015, 11, 58–63. [Google Scholar] [CrossRef]

- Zhang, W.-G.; Fu, J.; Li, H.; Xu, W. Coordination of supply chain with a revenue-sharing contract under demand disruptions when retailers compete. Int. J. Prod. Econ. 2012, 138, 68–75. [Google Scholar] [CrossRef]

- Wang, B.; Ji, F.; Zheng, J.; Xie, K.; Feng, Z. Carbon emission reduction of coal-fired power supply chain enterprises under the revenue sharing contract: Perspective of coordination game. Energy Econ. 2021, 102, 105467. [Google Scholar] [CrossRef]

- Shamsuddoha, M.; Nasir, T.; Hossain, N.U.I. A Sustainable Supply Chain Framework for Dairy Farming Operations: A System Dynamics Approach. Sustainability 2023, 15, 8417. [Google Scholar] [CrossRef]

- Jin, Y.; Gao, C. Hybrid Optimization of Green Supply Chain Network and Scheduling in Distributed 3D Printing Intelligent Factory. Sustainability 2023, 15, 5948. [Google Scholar] [CrossRef]

- Dovbischuk, I. Sustainability in Logistics Service Quality: Evidence from Agri-Food Supply Chain in Ukraine. Sustainability 2023, 15, 3534. [Google Scholar] [CrossRef]

- Shao, W.Q. Research on Coordination Mechanism of Port Service Supply Chain. Ph.D. Thesis, Donghua University, Shanghai, China, 2013. [Google Scholar]

- Petruzzi, C.N.; Dada, M. Pricing and the Newsvendor Problem: A Review with Extensions. Oper. Res. 1999, 47, 183–194. [Google Scholar] [CrossRef]

- Zhang, G.; Liu, Z. A Stackelberg Game of Profit Division in Supply Chains with Dominant Firms. Syst. Eng. 2006, 24, 19–23. [Google Scholar] [CrossRef]

- Wu, L.; Wang, C. Evaluating Shipping Efficiency in Chinese Port Cities: Four-Stage Bootstrap DEA Model. J. Mar. Sci. Eng. 2022, 10, 870. [Google Scholar] [CrossRef]

- Xu, B.; Liu, W.; Li, J. Resilience Regulation Strategy for Container Port Supply Chain under Disruptive Events. J. Mar. Sci. Eng. 2023, 11, 732. [Google Scholar] [CrossRef]

- Pujats, K.; Golias, M.; Konur, D. A Review of Game Theory Applications for Seaport Cooperation and Competition. J. Mar. Sci. Eng. 2020, 8, 100. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, W.; Yu, W.; Shen, D.; Zhang, T. River Chief Information-Sharing System as a River Information Governance Approach in China. Sustainability 2023, 15, 6504. [Google Scholar] [CrossRef]

- Lezhnina, E.A.; Balykina, Y.E. Cooperation between Sea Ports and Carriers in the Logistics Chain. J. Mar. Sci. Eng. 2021, 9, 774. [Google Scholar] [CrossRef]

- Cao, G.; Wang, Y.; Gao, H.; Liu, H.; Liu, H.; Song, Z.; Fan, Y. Coordination Decision-Making for Intelligent Transformation of Logistics Services under Capital Constraint. Sustainability 2023, 15, 5421. [Google Scholar] [CrossRef]

- Beškovnik, B.; Zanne, M.; Golnar, M. Dynamic Changes in Port Logistics Caused by the COVID-19 Pandemic. J. Mar. Sci. Eng. 2022, 10, 1473. [Google Scholar] [CrossRef]

- Heikkilä, M.; Saarni, J.; Saurama, A. Innovation in Smart Ports: Future Directions of Digitalization in Container Ports. J. Mar. Sci. Eng. 2022, 10, 1925. [Google Scholar] [CrossRef]

| ε | θ | η | w | c |

|---|---|---|---|---|

| U(0.4, 2) | 100 | 2 | 4 | 2 |

| Centralized Decision-Making Mechanism | Decentralized Decision-Making Mechanism | Revenue Sharing Contract Mechanism | |||

|---|---|---|---|---|---|

| Optimal service price (Yuan/t) | 4.8 | 9.6 | 4.8 | 4.8 | 4.8 |

| Logistics capability optimal order quantity (104 t) | 5.77 | 1.44 | 5.77 | 5.77 | 5.77 |

| Port expected revenue (104 Yuan) | —— | 5.79 | 5.79 | 6.95 | 8.69 |

| Expected revenue of service provider (104 Yuan) | —— | 2.89 | 5.79 | 4.63 | 2.89 |

| The supply chain system expects revenue (104 Yuan) | 11.58 | 8.68 | 11.58 | 11.58 | 11.58 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, Y.; Tan, Y. Coordination Mechanism of Revenue Sharing Contracts in Port Supply Chains: A Case Study of China’s Nantong Port. Sustainability 2023, 15, 11248. https://doi.org/10.3390/su151411248

Lu Y, Tan Y. Coordination Mechanism of Revenue Sharing Contracts in Port Supply Chains: A Case Study of China’s Nantong Port. Sustainability. 2023; 15(14):11248. https://doi.org/10.3390/su151411248

Chicago/Turabian StyleLu, Yongming, and Yuning Tan. 2023. "Coordination Mechanism of Revenue Sharing Contracts in Port Supply Chains: A Case Study of China’s Nantong Port" Sustainability 15, no. 14: 11248. https://doi.org/10.3390/su151411248

APA StyleLu, Y., & Tan, Y. (2023). Coordination Mechanism of Revenue Sharing Contracts in Port Supply Chains: A Case Study of China’s Nantong Port. Sustainability, 15(14), 11248. https://doi.org/10.3390/su151411248