1. Introduction

Tourism is one of the leading wheels of a country’s economy; several countries rely only on tourism to fuel their economy. Andorra is one of the few countries where tourism is the principal source of state revenue, accounting for 80 percent of the country’s GDP (gross domestic product). Not only do countries such as Andora lack superior resources except in the tourist industry, but tourism has also become a trend of economic development of countries around the world because it has a significant impact on a nation’s life. According to a World Travel and Tourism Council (WTTC) assessment of the global economic effects of traveling and tourism activities, the tourism and travel sector generated 3% of total global GDP in 2015. In 2019, this contribution increased to 10.3 percent of the total global GDP. The absorption of labor is the direct influence of tourism and traveling activities on GDP. In 2015, the number of workers directly absorbed (direct contribution) by the tourism and travel sector was 107.8 million (3.6 percent of the total workforce). In the meantime, the actual contribution (indirect impact) on employment reached 283.6 million (9.5 percent of the entire workforce), while the amount of labor absorbed in 2019 gained 330 million workers, or 10.4 percent of total employment [

1]. During the COVID-19 pandemic, employment from the tour and travel sector increased from 271.3 million in 2020 to 289.5 million in 2021 [

2].

The development of GDP and employment impacts the survival of the tourist and travel business. This GDP generation is due to a rise in the number of investments, with total investment in this industry reaching USD 774.6 billion in 2015, accounting for 4.3 percent of total global investment. It climbed by 4.5 percent in 2016, with a total investment value of USD 1.3 trillion. According to the survey, it is likewise dominated by vacationers (tourism). According to the report, overseas tourists account for 76.6 percent of all visitors. The remaining 23.4 percent, on the other hand, was due to official travel or business matters. Meanwhile, overall investment in 2019 totaled USD 948 billion, accounting for 4.8 percent of total global investment [

1]. Indonesia ranks fourth in terms of the number of international tourists visiting the ASEAN area. The Ministry of Tourism said that 10.87 million foreign tourists visited Indonesia in 2016, exceeding the target of 12 million foreign tourists set for 2016. As a result, Thailand ranked first with 27 million international tourists, followed by Malaysia with 17.6 million. On the other hand, Singapore ranked third, with 12 million foreign visitors in that month. Meanwhile, foreign tourist arrivals in 2019 totaled 16.11 million, a 1.88 percent rise over the previous year [

3].

They perceive the attractive function of tourism in boosting a country’s economy and the competitiveness of Indonesian tourism, which is still inferior to neighboring countries as a foreign tourist destination. As a result, through the Ministry of Tourism and Creative Industries, the Indonesian government conducts numerous efforts to enhance national tourism to expect many foreign tourists to visit. In addition, domestic tourists may also call, boosting the economy of the selected tourist destination. This national tourist development comprises enhancing facilities, increasing the promotion budget, and building infrastructure to host international events. Furthermore, in addition to expanding existing tourism, the government prioritizes halal or sharia tourism. The goal is to attract more tourists from Muslim-majority countries.

Halal tourism has recently received a lot of attention. Halal tourism is defined as tourism that complies with all criteria of Islamic law drawn from the Al-Qur’an and As-Sunah as guidelines [

4]. Halal tourism is a tourist location that has been well-planned and chosen following sharia principles, as the atmosphere in this tourism environment is free of any banned contamination. Meanwhile, a halal tourist destination is a geographical area within one or more administrative regions that contains tourist attractions, religious and public facilities, tourism facilities, accessibility, and communities that are interconnected and complement the realization of a statement by the sharia principle. sharia tourism is separated into numerous components, including Islamic hotels, Islamic travel agents, halal restaurants, and Islamic tourism artifacts. Tourism growth has a substantial influence in terms of increased original local government revenue and investment in regional development. An increase in money from the tourism sector provides locals with more power in their lives since it opens them to more work alternatives. This strategy benefits investors because the government has made it easier to open new business opportunities in the tourism sector [

5].

Halal tourism becomes a distinct trend for a country since the amount of foreign exchange it can bring in for the country is significant. This is attributable to an increase in the number of Muslim tourists worldwide. In 2016, the number of Muslim travelers increased to 121 million and is expected to expand to 156 million in 2020 (assuming no COVID-19 epidemic), with a total expenditure of USD 220 billion and expected to reach USD 300 billion in 2026 [

6]. To capture the hearts of potential visitors and persuade them to visit a place, a systematic and measurable effort is required with the support of all stakeholders. The Indonesian government is working hard to compete worldwide in attracting foreign tourists by developing a sustainable halal-tourism ecosystem.

Increasing global interconnectedness and rapid environmental changes emphasize the importance of competition in attracting foreign tourists. Tourism is now seen as an important engine of economic growth and development in many countries. This condition will justify the allocation of resources to attract more visitors by increasing their competitive position [

7]. The development strategy of the halal-tourist ecosystem in Indonesia employs a Penta helix strategy, with five factors intended to promote the growth and development of halal tourism in Indonesia. In halal tourism, the five elements are the government, media, academics, communities, and commercial actors. The Global Muslim Travel Index (GMTI) recognized Indonesia with the “World Best Halal Travel Destination” award in 2019 for the hard work of all these factors in the growth of halal tourism in Indonesia [

8]. Tourist-object managers, transport or ticketing businesses, hotels, restaurants, gift stores, or goods are essential components of the halal tourism development ecosystem. However, despite its importance in absorbing labor and investment, the tourism industry, a subsector of the creative economy, has gotten less attention from the banking industry, particularly Islamic banking. In 2017, only 6% of tourism-sector actors used financial institutions, while 94% of tourism-sector company actors continued to rely on private finance [

9].

Financial inclusion is very important in creating a country’s economic growth because every individual has the opportunity to access financial institutions [

10]. It is important for MSMEs to increase financial inclusion because MSME development without the support of financial institutions will be difficult to realize [

11]. Scholars have studied the potential of banking financing to boost rural tourism. Due to a drop in agricultural real income, a lack of genuine economic alternatives, and demographic difficulties, small local companies that valorize natural, cultural, and anthropological resources could contribute to rural sustainable development. However, the majority of them require financial assistance from private creditors (banks) [

12]. Islamic banks are alternatives and solutions that can be utilized by business actors for business development because empirically Islamic banks are more resilient to crises and more efficient than conventional banks [

13]. Islamic financial institutions also provide fairer financing for entrepreneurs [

14].

With the engagement of Islamic banking in the tourism industry, halal business is predicted to promote growth in the sector and boost its market share and Islamic banking market share in Indonesia. To date, Islamic banking has only had a 6.1 percent market share. It is hoped that the penetration of this industry will boost the market share of Islamic banking and the incorporation of Islamic financing in the tourism sector. The performance of MSMEs in the tourism sector is arguably still low if the guidelines for their contribution to GDP have only reached 4.80 percent in 2019. However, there is a positive trend, namely an increase from the previous year, although in previous years the contribution was lower than in 2019. In 2015 the contribution of the tourism sector to Indonesia’s GDP reached 4.25 percent; then in 2016, it decreased to 4.13 percent, and in 2017 it decreased again to 4.11 percent. Although in 2018 it increased to 5.25 percent. Then in 2019, the contribution to GDP reached 4.7 percent, and in 2020 decreased to 4.05 percent [

15]. Employment of MSMEs in halal tourism is also low when compared to other sectors. In 2018, the tourism sector was only able to absorb a workforce of 12.7 million workers. The COVID-19 pandemic in 2020 made the tourism sector suffer the biggest losses compared to other sectors in Indonesia. In a difficult situation such as this, the financial sector has a crucial role in helping to restore the tourism sector in Indonesia, including Islamic banking. Therefore, it is important for both individuals and MSMEs to increase financial inclusion.

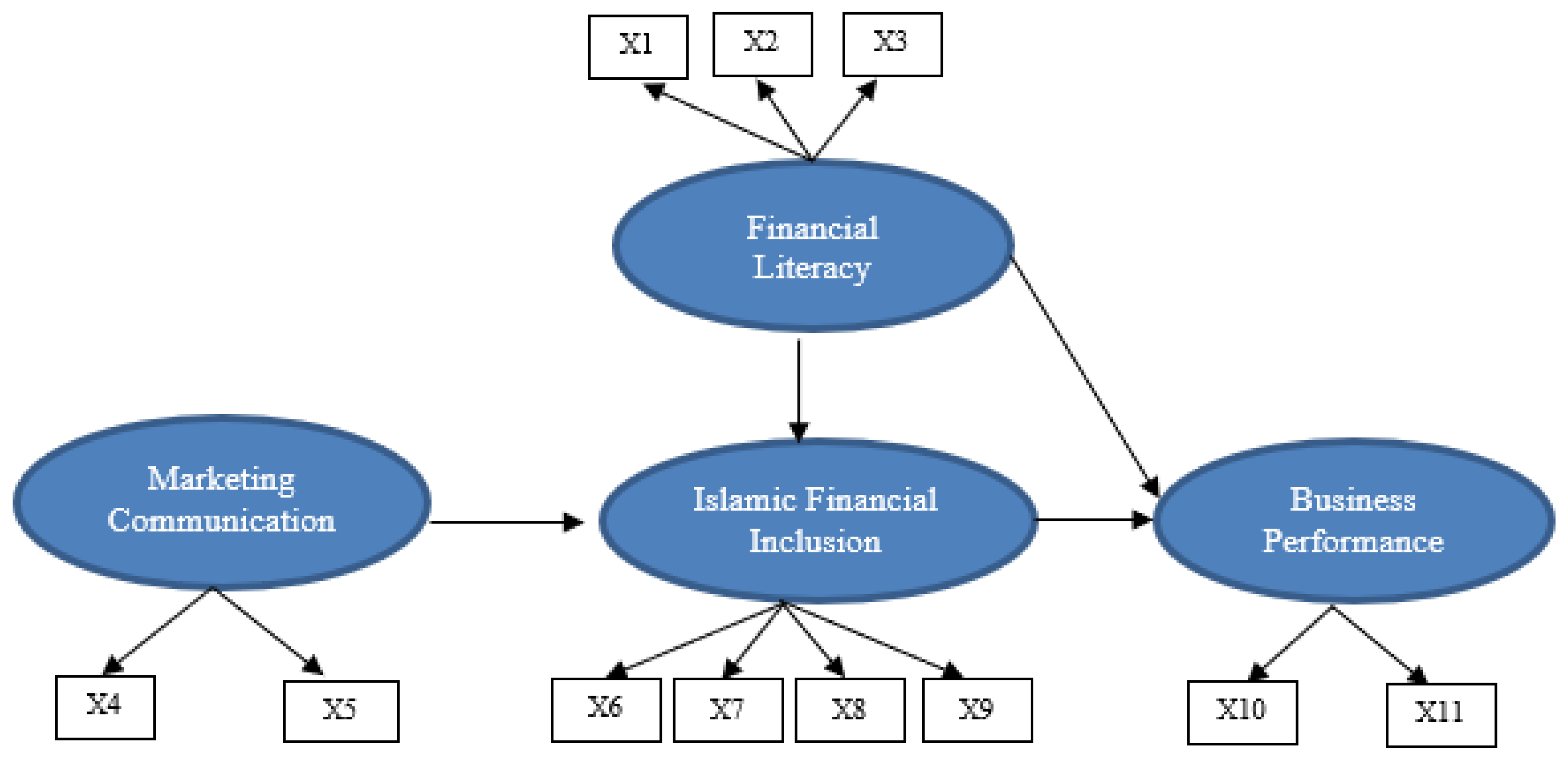

Several studies highlight that the determinants of Islamic financial inclusion are financial literacy [

16,

17,

18]. Apart from financial literacy, marketing communication is also an important element in promoting Islamic financial products to potential customers [

18,

19]. Ignorance of potential customers about the existence of Islamic financial products has resulted in little access to Islamic finance by entrepreneurs in the tourism sector in Indonesia. This study aims to investigate the role of marketing communication and Islamic financial literacy in creating financial inclusion for entrepreneurs in the halal-tourism sector in Indonesia.

In national policy, the government of Indonesia has a strategy on how to develop Islamic financing for the halal-tourism industry sector and small and medium-sized enterprises. Based on the 2019–2024 Indonesian Sharia Economic Masterplan published by the Indonesian National Development Planning Agency, the development of the halal industry in Indonesia cannot be separated from the development of the national halal supply chain. It is stated in the document, that the Islamic financing aspect has an opportunity to serve the halal tourism industry subsector. These opportunities include (1) the growing and varied Sharia financing, (2) collaborative opportunities to obtain financing from banks and the issuance of sukuk, and (3) the development and implementation of Sharia insurance schemes for commercial tourism. However, it is also suspected that there are challenges in financing the halal tourism industry subsector, namely Islamic financial institutions do not yet have specific financing targets for the halal industry, including halal tourism [

20].

This research is an initial effort to explore the development of halal tourism from the supply side. To the author’s knowledge, investigating the role of Islamic financial institutions in developing MSMEs in the tourism sector (supply side) has never been carried out by previous researchers and this is the research gap and novel of this research. The author founds that studies on halal tourism are still dominated by the demand side, such as [

21,

22]. Several additional scholars, such as [

23,

24,

25,

26,

27,

28], also focus on the notion of halal tourism and the key difficulties associated with its development. The findings of this study are likely to contribute to the growth of halal tourism in Indonesia and the development of MSMEs in the Indonesian halal-tourism ecosystem. Furthermore, this research is expected to be able to help achieve the master plan of the Indonesian Islamic economy by examining the factors that influence the acceptance of Islamic banks in halal tourism SMEs.

This paper is organized into five sections. The first part discusses the research background which consists of phenomena and research gaps. In the second part, it discusses the literature review related to the role of Islamic financial literacy and marketing communications in creating Islamic financial inclusion and the performance of SMEs in the halal-tourism sector, as well as previous research. The third section discusses research methodology and the fourth section discusses research results and discussion. The last section discusses the research conclusions and policy recommendations.

5. Discussions

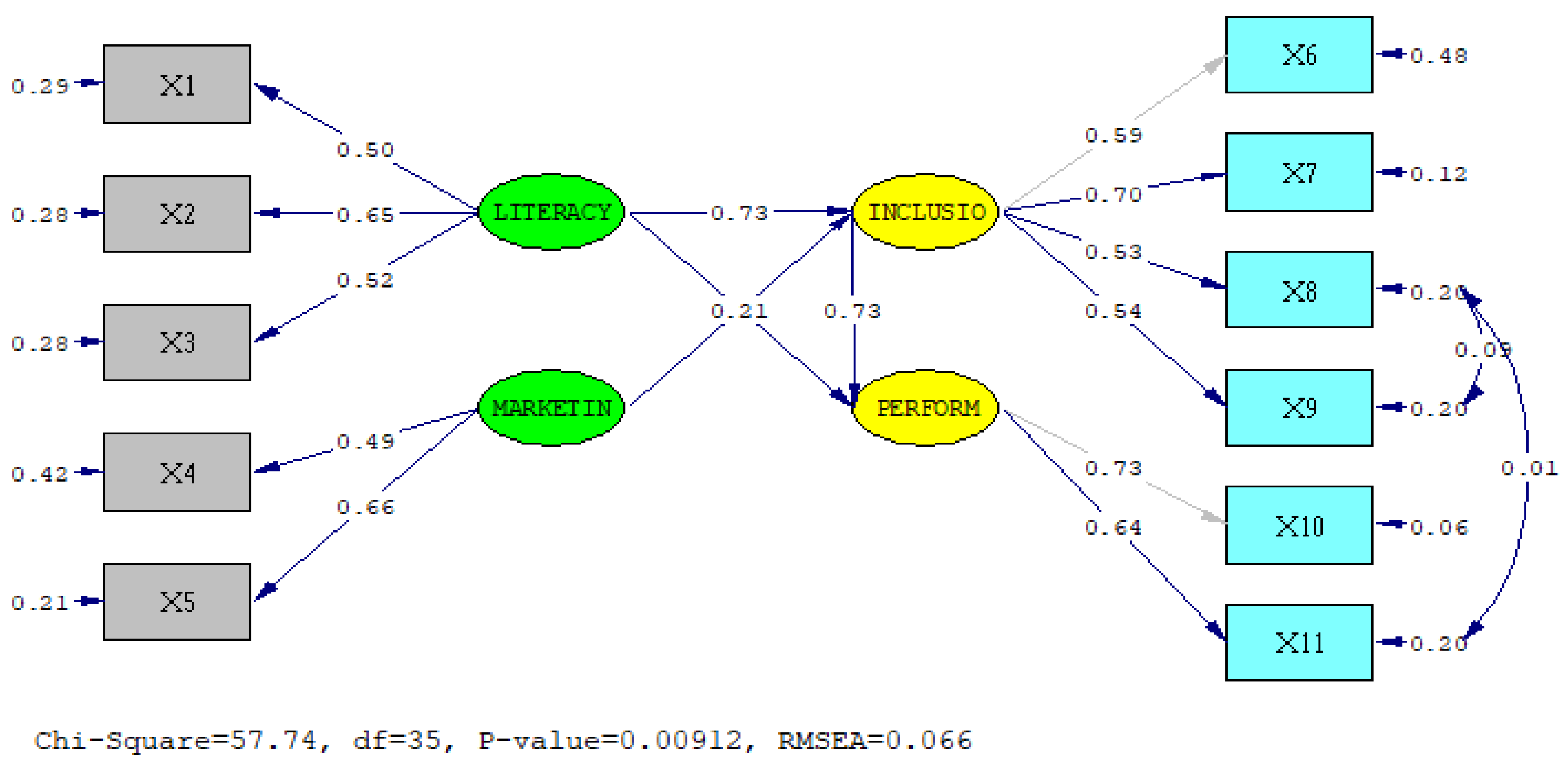

Halal finance is one of the locomotives propelling Islamic finance’s genuine industry. The structural model results reveal that Islamic banking has a positive and significant association with the performance of MSME in the halal-tourism ecosystem. This study’s findings are consistent with [

18,

69,

70]. Scholars also outlined the steps these enterprises must take to obtain financial resources from banks, namely the diversification of income sources, the association and adherence to recognized brands, and the maintenance of a sustainable leverage ratio [

17]. In addition, it was discovered that the size of the bank is unimportant but the kind of bank capital is; private domestic banks are more ready to finance such firms.

This finding shows that MSMEs in Indonesia’s halal-tourism ecosystem require access to Islamic finance institutions to improve and expand their operations. Furthermore, MSMEs must be educated on the importance of company development through financial institutions. On the other side, Islamic banking must expand its operations in halal finance by focusing on the MSME market, particularly MSMEs in the halal-tourist ecosystem. Furthermore, due to the merging of three state banks, Bank Syariah Indonesia must become a locomotive committed to the development of halal tourism in Indonesia. This study also demonstrates a favorable and statistically significant association between financial literacy and financial inclusion. The outcomes of this study support earlier researchers’ conclusions [

16,

42,

43,

44]. As a result, both parties must increase their Islamic financial literacy. sharia banking can work with the entrepreneur community in the halal-tourist ecosystem to teach Islamic financial literacy, increasing the prospects for sharia financial inclusion.

The structural model also discovered a positive but insignificant association between financial literacy and business success. This finding contradicts the findings of [

16,

18,

43,

44,

51,

52]. Although not considerable, this association has had a favorable impact on incorporating Islamic finance and improving MSME business performance in Indonesia’s halal-tourist ecosystem. As a result, initiatives to improve Islamic financial literacy must be pursued indefinitely in order to have a greater impact. Improving Islamic financial literacy can be accomplished by honing Islamic financial skills, such as the notion of syirkah in building their business and enhancing their knowledge of halal financial products to have a stronger impact on the development of MSMEs in the Indonesian halal-tourism ecosystem. The findings of this study are at odds with a previous study [

71], which found that characteristics related to financial literacy significantly and favorably affect the performance of small enterprises in East Kalimantan. The findings of this study also corroborate a previous study [

82] that finds a link between financial literacy, entrepreneurial performance, and an entrepreneurial attitude. A creative venture performs better overall when its members are financially literate. The findings show a positive and significant moderating influence of financial literacy in the relationship between access to credit and the growth of SMEs in emerging economies, which is in accordance with the findings presented in previous studies [

43,

44,

45]. Additionally, the development of SMEs in underdeveloped nations is significantly and favorably impacted by financial literacy and access to capital. The findings of this study concur with those of one previous study [

16]. According to the ANP investigation, supply and demand are the two key factors that affect Indonesia’s level of Islamic financial inclusion.

This study also provides information that there is a positive but not significant relationship between marketing communication and financial inclusion. The results of this study are not in line with [

47,

69,

78]. However, although not significant, the relationship is positive. This means that marketing communications run by Islamic banking as halal finance have attracted interest for MSMEs. For this reason, Islamic banking needs to improve marketing communication to the entrepreneurial community in the halal-tourism ecosystem because marketing communication is a pivotal strategy for banking industries. Customers are not only interested in the products offered but also in how they are offered, which is the most important thing in marketing communication [

83]. Furthermore, ref. [

84] said that banks must carry out integrated marketing communication so that prospective customers can buy the products offered. Scholars such as [

71,

72] said that potential customers are as important as existing customers; thus, an intense approach is needed. In Islamic banking, they must carry out integrated marketing communication through various programs and inform the media channels they have. Meanwhile, Ref. [

85] recommends that marketing communication carried out by banks emphasizes more on adopting personal selling.

Therefore, to improve the performance of SMEs in halal tourism, it is necessary to pay attention to the above variables. The marketing communication variable is a variable that needs attention from Islamic banking. Islamic banking needs to improve its marketing communication through promotion to MSMEs on halal tourism by taking a more intensive approach so that they are interested and decide to use Islamic banking services. The decision of MSMEs to use services in Islamic banking will certainly make it easier for them to conduct business transactions, such as the use of financing, the use of e-banking, mobile banking, and internet banking. MSMEs in halal tourism also need to improve Islamic financial literacy in order to be able to manage finances well. Thus, their business performance can also improve as well. Financial knowledge and financial skills, which are part of financial literacy, seem to need special attention for them. Financial knowledge, such as knowledge about Islamic financial products, will help entrepreneurs in halal tourism to develop their business portfolios. Meanwhile, financial skills, such as the ability to manage debt and the ability to budget, will help them in maintaining the company and in developing their business.

The results of this study provide clear directions to develop halal tourism in Indonesia, especially for business actors in the halal-tourism ecosystem. Business actors need to be equipped with Islamic financial literacy. This study empirically proves that the theory of financial literacy has an impact on financial inclusion and business performance in the halal tourism sector; thus a good understanding of Islamic financial literacy for entrepreneurs needs attention. Entrepreneurs also need to improve access to Islamic financial institutions so that their businesses can develop properly and quickly. On one side, Islamic banking also needs to improve marketing communication with business actors so that it will enhance strong relationships with customers and potential customers.