Abstract

This study investigates how corporate governance affects the financial reporting quality of selected banks in Iraq, focusing on the role of IFRS adoption. The research collected data from 298 questionnaires distributed among diverse private banks, including IS Bank, Vakif Bank, RT Bank, Cihan Bank, Bank of Iraq, and TD Bank. Sobel analysis was used to analyze the mediation between variables. The results demonstrate that IFRS adoption plays a positive mediating role in the relationship between corporate governance and financial reporting quality in private banks. The study highlights the practical benefits of implementing strong corporate governance practices and adopting IFRS, such as improved reporting quality, regulatory compliance, better decision-making, and enhanced reputation. Private banks in Iraq can utilize these findings to enhance their financial performance and reputation by shaping their accounting and governance policies. The research paper provides original insights into the positive impact of corporate governance on financial reporting quality while considering the mediating influence of IFRS adoption, making it a valuable contribution to the research community.

1. Introduction

This study focuses on examining the impact of corporate governance on the financial reporting quality of banks in Iraq, specifically considering the mediating role of IFRS adoption. The adoption of International Financial Reporting Standards (IFRS) is expected to enhance the information content and relevance of financial statements [1]. By establishing universal norms and specialized accounting standards, IFRS represents a globally accepted set of accounting principles. In this study, IFRS is employed as a mediating variable between corporate governance practices and the quality of financial reporting. Corporate governance practices play a crucial role in the business sector by promoting robust auditing standards and enhancing the profitability of corporations. While corporate governance is typically treated as an independent variable and examined as a predictor of financial reporting quality, this study investigates the mediating factors involved [2].

The International Accounting Standards Committee (IASC) was responsible for establishing the International Accounting Standard (IAS) and overseeing its standards. The primary objective of the IASC is to regulate and minimize differences in local accounting standards, ensuring that financial statements can be compared across countries. This comparability enables investors, shareholders, and creditors to make informed decisions [3]. For financial reporting to be considered useful, it must possess certain qualitative characteristics such as relevance, reliability, verifiability, and understandability, among others. Relevance and faithful representation are fundamental characteristics, while the others serve as enhancing characteristics. The gradual adoption of IFRS began with credit institutions [4]. Before the adoption of IFRS, the Statement of Accounting Standard was used; however, it failed to account for agricultural activities, despite agriculture being a crucial sector in the country’s economy. Numerous studies have been conducted on the impact of IFRS on financial reporting quality in various sectors, including insurance and banks. However, there is a scarcity of research specifically focused on the influence of IFRS on financial reporting quality in banks in Iraq. Private banks, including banks, investment firms, and insurance banks, play a vital role in the economy and financial system. They are entrusted with managing clients’ financial assets and are therefore required to operate in a trustworthy, transparent, and accountable manner [1]. As a result, private banks in particular need strong corporate governance practices to fulfill their essential function.

Private banks rely on high-quality financial reporting as it provides precise, comprehensive, and up-to-date information about the institution’s financial performance and position. This information is crucial for stakeholders to make informed decisions, such as whether to invest, lend money, or engage in business with the bank [5]. Furthermore, the quality of financial reporting plays a vital role in building trust and confidence among stakeholders. Accurate and transparent reporting of the bank’s finances indicates effective management and financial stability. This fosters stakeholders’ faith in the institution and enhances their confidence in the future prospects of the bank.

The International Financial Reporting Standards (IFRS) play a crucial role in the financial industry as they provide a standardized framework for reporting financial information. This framework enables stakeholders to compare the financial performance and condition of different institutions, which is particularly significant for private banks operating in a global market with stakeholders from multiple countries [6]. Moreover, the principles-based nature of IFRS is essential for private banks. Unlike prescriptive regulations, IFRS allows businesses to exercise discretion in preparing their financial statements in collaboration with their accountants and auditors. This discretion can result in more meaningful and relevant financial information for stakeholders [7]. Additionally, the adaptability of IFRS to evolving market conditions is vital for private banks. The International Accounting Standards Board (IASB) regularly reviews and updates the IFRS to ensure their continued applicability and usefulness. This ensures that private banks can accurately reflect their current operations and financial condition in their financial reporting [8]. In summary, adhering to IFRS in private banks is of significant importance. It provides a consistent and principle-based structure for financial reporting, which is crucial for fostering trust and confidence among stakeholders [9].

Despite the growing significance of corporate governance and financial reporting quality, there is a notable research gap in the context of Iraq. This research addresses this gap in several important ways. Firstly, there is a scarcity of empirical studies that specifically investigate the relationship between corporate governance and the accuracy of financial reports in Iraq [10]. Furthermore, the existing literature has not adequately considered the unique challenges and characteristics of emerging markets such as Iraq concerning this topic. Therefore, this study contributes by examining this interaction within the Iraqi context, thereby filling this void and expanding our understanding in this area.

In the context of Iraq, there is a notable lack of studies that examine the role of IFRS as a mediator between corporate governance and the quality of financial reporting. Considering Iraq’s efforts to enhance its financial reporting practices and its adoption of IFRS, understanding how IFRS influences this dynamic is crucial. This study addresses this gap by investigating the moderating function of IFRS [11]. Furthermore, there is a scarcity of studies that effectively bridge the gap between theoretical findings and their practical applicability in the real world, particularly within the context of Iraq. Most studies in this field have been conducted in developed countries, leaving regulators, policymakers, and businesses in Iraq unaware of the real-world implications of corporate governance processes and financial reporting quality. This study fills this knowledge gap by providing concrete recommendations on how to enhance corporate governance and financial reporting in the Iraqi context [12].

The primary objective of this research is to investigate the moderating effect of IFRS on the relationship between corporate governance practices and financial reporting quality in Iraq. This study makes several significant contributions to the existing literature. Firstly, it provides empirical research specifically focusing on the link between corporate governance and financial reporting quality within the Iraqi context. By doing so, it addresses a gap in our understanding of corporate governance and financial reporting in developing markets, with a specific focus on Iraq, which has its own distinct economic, political, and cultural norms. Moreover, this research sheds light on how international accounting standards, such as IFRS, influence the connection between corporate governance and financial reporting quality. By examining IFRS’s intermediary function, it provides valuable insights into this relationship and enhances our understanding of the effects of IFRS adoption in various countries. In particular, it offers unique insights into the specific circumstances of Iraq, contributing to the growing body of literature on the impact of IFRS adoption [13].

2. Literature Review and Hypothesis Development

This section presents the relationship between the variables under study. It also provides a review of previous studies that have investigated the relationship between each variable and establishes the basis for formulating research hypotheses.

2.1. The Mediation Role of the Adoption of IFRS between Board Characteristics and Financial Reporting Quality

The relationship between board characteristics and financial reporting quality is mediated by the adoption and use of International Financial Reporting Standards (IFRS). Board characteristics encompass various factors such as the size, independence, experience, diversity, and tenure of a company’s board of directors, among others [14].

The quality of a company’s financial reporting refers to the accuracy, reliability, and relevance of the financial information it presents. It represents the extent to which the financial statements accurately reflect the economic reality of the organization and provide valuable information for stakeholders to make informed decisions [15].

The International Accounting Standards Board (IASB) developed a set of guidelines known as International Financial Reporting Standards (IFRS). Many countries have adopted IFRS as their primary accounting standard or are in the process of transitioning to it. The use of IFRS enhances the comparability, transparency, and overall quality of financial reporting [16].

Multiple prior studies provide evidence supporting the notion that the adoption of IFRS serves as a mediating factor in the relationship between board characteristics and financial reporting quality. In line with these findings, our hypothesis aims to test this assumption [17]. Consequently, the quality of financial reporting is influenced by board characteristics through the adoption of IFRS.

The adoption of IFRS enhances the transparency and comparability of financial statements by promoting consistency in accounting principles and disclosure practices. Consequently, this can lead to improved accuracy in financial reporting [18].

Good corporate governance is commonly associated with board attributes such as independence and experience. The adoption of IFRS can contribute to enhancing the quality of financial reporting by aligning the goals and practices of the board with global accounting standards. By adhering to IFRS, boards can ensure consistency and compliance with internationally recognized reporting guidelines, thereby promoting improved financial reporting quality [15].

Financial reports can now be interpreted with reduced subjectivity due to the standardized structure provided by IFRS. However, it is important to note that the implementation of IFRS still allows for expert discretion in certain situations. The quality of financial reporting can be influenced by the board’s expertise in applying professional judgment [19].

Data on board characteristics, including board size, independence, and experience, as well as financial reporting quality measures such as earnings quality and accrual quality, can be utilized to assess this hypothesis. Statistical methods such as mediation models or structural equation modeling can be employed to evaluate the mediating effect of IFRS adoption on the relationship between board qualities and financial reporting quality [20]. Based on the preceding discussion, the current study formulates the following research hypothesis, emphasizing the role of IFRS adoption as a mediator between board qualities and financial reporting quality.

H1.

The adoption of IFRS has a mediating effect on the relationship between board characteristics and financial reporting quality.

2.2. The Mediation Role of the Adoption of IFRS between CEO Duality and Financial Reporting Quality

The relationship between CEO duality and the quality of financial reporting is influenced by the adoption of International Financial Reporting Standards (IFRS). CEO duality refers to the situation where one individual holds both the positions of CEO and Chairman of the Board of Directors, which grants significant influence over the board’s oversight and strategic decision-making process [14].

Financial reporting quality refers to the accuracy and relevance of a company’s reported financial information. It indicates how well the financial statements reflect the organization’s economic reality and how useful the information is for stakeholders in making decisions. The International Accounting Standards Board (IASB) developed International Financial Reporting Standards (IFRS), a set of guidelines that many countries now use as their primary accounting standard or are in the process of adopting. IFRS enhances comparability, transparency, and the overall quality of financial reporting [15].

Building on these concepts, the hypothesis proposes that the adoption of IFRS moderates the relationship between CEO duality and financial reporting quality. Therefore, the implementation of IFRS influences the quality of financial reporting in the presence of CEO duality. CEO duality can lead to increased concentration of power and reduced accountability within a company. However, the standardized accounting principles and disclosure practices provided by IFRS can promote transparency and accountability, ultimately improving the quality of financial reporting and mitigating the risks associated with having two CEOs [16].

Due to the significant impact of the CEO on board decisions, having a co-CEO structure may compromise the board’s ability to provide independent oversight. By adopting IFRS, companies can ensure that their financial reporting aligns with international standards and facilitates objective auditing by the board and audit committee. This can enhance the accuracy of financial statements. While expertise and judgment are necessary when applying IFRS, accountants are granted some discretion to exercise their professional judgment. IFRS adoption provides a framework for the board and finance personnel to apply professional judgment, reducing biases associated with a co-CEO structure and promoting more reliable financial reporting [17].

To evaluate this theory, researchers analyze the extent of IFRS adoption in a sample of companies, along with data on CEO duality (when the CEO also serves as the Chairman) and financial reporting quality metrics such as earnings quality and accrual quality. Statistical methods such as mediation models or structural equation modeling can be used to assess the mediating effect of IFRS adoption on the relationship between CEO duality and financial reporting quality. Furthermore, the relationship between CEO duality and the quality of financial reporting is influenced by the use of IFRS [18]. Based on the preceding discussion, the following research hypotheses were formulated for the current study.

H2.

The adoption of IFRS has a mediating effect on the relationship between CEO duality and financial reporting quality.

2.3. The Mediation Role of the Adoption of IFRS between Ownership Structure and Financial Reporting Quality

The use of International Financial Reporting Standards (IFRS) acts as a mediating factor in the relationship between ownership structure and financial reporting quality. Ownership structure encompasses elements such as controlling shareholders, institutional ownership, and ownership concentration, which can influence an organization’s decision-making and governance practices [19].

Financial reporting quality refers to the accuracy and relevance of a company’s reported financial information. It reflects how well the financial statements depict the economic reality of the organization and the usefulness of the information for stakeholders in making decisions. International Financial Reporting Standards (IFRS), developed by the International Accounting Standards Board (IASB), are widely adopted as the de facto accounting standard by many countries or are in the process of adoption. IFRS enhances comparability, transparency, and the overall quality of financial reporting [20].

This hypothesis is grounded in the aforementioned concepts, suggesting that the adoption of IFRS mediates the relationship between ownership structure and financial reporting quality. It implies that the impact of ownership structure on financial reporting quality is influenced by the adoption of IFRS [16].

Adopting IFRS promotes openness and comparability in financial statements by fostering uniformity in accounting principles and disclosure practices. This is particularly beneficial in situations involving concentrated ownership structures or controlling shareholders as it reduces the risk of information asymmetry and enhances the credibility of financial statements. Harmonizing reporting practices helps minimize discrepancies in reporting standards or procedures based on the ownership structure of a company. By adopting IFRS, businesses can standardize their financial reporting, making it more consistent and comparable across banks of various sizes and ownership types. This has the potential to improve the accuracy of future financial reports [20].

A well-structured ownership hierarchy contributes to improved corporate accountability and transparency. Through the establishment of a uniform framework for financial reporting, IFRS adoption can enhance governance and accountability. This, in turn, can improve the quality of financial reporting by increasing the likelihood that companies with different ownership structures adhere to the same standards. To test this hypothesis, researchers can collect data from a representative sample of companies, including information on their adoption and degree of IFRS implementation, ownership structures (e.g., ownership concentration, presence of controlling shareholders), and financial reporting quality metrics (e.g., earnings quality, accruals quality). Financial reporting quality and ownership structure are both factors that can be analyzed statistically to evaluate the mediating influence of IFRS adoption [21]. Based on the literature review and previous studies, the following research hypothesis was formulated for the current study.

H3.

The adoption of IFRS has a mediating effect on the relationship between ownership structure and financial reporting quality.

2.4. The Mediation Role of the Adoption of IFRS between Audit Committee Independence and Financial Reporting Quality

The implementation of International Financial Reporting Standards (IFRS) acts as a mediator in the relationship between the independence of audit committees and the quality of financial reporting. Audit committee independence refers to the extent to which committee members are free from conflicts of interest and have the ability to exercise unbiased judgment while overseeing the financial reporting process. Independent audit committees are crucial for effective corporate governance and ensuring the accuracy of financial disclosures [22].

Financial reporting quality relates to the accuracy, clarity, and reliability of a company’s disclosed financial information. It signifies the extent to which financial reports accurately reflect the true economic condition of the organization and provide valuable insights to stakeholders for informed decision-making [2].

The International Accounting Standards Board (IASB) has developed a set of accounting standards known as International Financial Reporting Standards (IFRS). Many countries worldwide have adopted or harmonized with IFRS as their national accounting principles. The primary objective of IFRS implementation is to enhance standardization, clarity, and excellence in financial disclosure [23].

The hypothesis suggests that the implementation of IFRS serves as a mediator in the relationship between the independence of audit committees and the quality of financial reporting. The adoption of IFRS is influenced by the independence of the audit committee, which subsequently impacts the quality of financial reporting [10].

Establishing a standardized framework for oversight is crucial for effective governance and management practices. Such a framework provides a consistent and systematic approach to monitor and evaluate organizational performance, thereby promoting transparency and accountability. Independent audit committees play a critical role in overseeing the financial reporting process and ensuring its integrity. Implementing IFRS provides a uniform structure for presenting financial information, thereby streamlining the audit committee’s supervisory function. By adhering to globally accepted standards, audit committees can more effectively assess and enhance the quality of financial reporting through the adoption of IFRS [24].

Promoting transparency and comparability in financial reporting can be facilitated by ensuring the independence of the audit committee, which has been found to be positively correlated with the implementation of more rigorous financial reporting practices. Adopting IFRS facilitates transparency and comparability by providing consistent accounting policies and disclosure practices. Aligning financial reporting practices with international standards through IFRS adoption enables independent audit committees to more efficiently evaluate financial reporting quality. This harmonization can improve the committee’s ability to fulfill its supervisory role [5].

International Financial Reporting Standards (IFRS) allow for the exercise of professional judgment in certain accounting domains, recognizing the importance of professional expertise. Independent audit committees with diverse expertise can leverage their professional judgment to ensure that financial statements comply with IFRS criteria. This has the potential to enhance the quality of financial reporting and improve its overall caliber [25]. Based on previous studies, the following hypothesis was formulated for the current study.

H4.

The adoption of IFRS has a mediating effect on the relationship between audit committee independence and financial reporting quality.

2.5. The Mediation Role of the Adoption of IFRS between Accountability Structure and Financial Reporting Quality

The term “accountability structure” refers to the internal systems and processes within a company that promote transparency, accountability, and responsibility. This includes reporting structures and methods for evaluating employee performance. An effective accountability structure is crucial for safeguarding the credibility of financial statements and encouraging responsible corporate behavior [26].

The quality of financial reporting can be assessed based on the reliability and accuracy of the company’s financial data. This metric reflects how well the financial statements portray the organization’s economic reality and provide stakeholders with useful information for decision-making [26].

The International Accounting Standards Board (IASB) has developed internationally recognized accounting standards known as International Financial Reporting Standards (IFRS). Adopting IFRS has the potential to enhance the quality, consistency, and transparency of financial reporting worldwide. According to the theory, the adoption of IFRS moderates the relationship between the accountability structure and the quality of financial reporting. Consequently, the accountability structure influences the quality of financial reporting by promoting the use of IFRS [17].

By adopting IFRS, businesses can establish consistent accounting policies and disclosure practices, which contribute to an efficient accountability structure. This facilitates open and comparable financial reporting. Improved internal controls are another benefit of an effective accountability structure. Aligning business procedures with the internationally recognized standards of IFRS strengthens internal control mechanisms, ensuring reliable financial reporting. This alignment enhances the efficiency of internal controls, thereby improving the quality of financial reporting [14].

Adopting IFRS, a globally recognized reporting methodology, can enhance stakeholder confidence in financial statements, thus reinforcing trust and credibility in the organization. The credibility gained from adopting IFRS enhances the integrity of all financial reports [15].

To test this hypothesis, researchers can gather data on the adoption rates of IFRS, financial reporting quality metrics (such as accuracy, transparency, and reliability), and the elements of accountability structures (such as internal control mechanisms, reporting lines, and performance evaluation processes) from a sample of companies. Statistical methods such as mediation models or structural equation modeling can be employed to evaluate the mediating effect of IFRS adoption on the relationship between the accountability structure and the quality of financial reporting. Based on prior studies, this investigation proposes the following hypothesis [16].

H5.

The adoption of IFRS has a mediating effect on the relationship between accountability structure and financial reporting quality.

2.6. The Mediation Role of the Adoption of IFRS between Directors’ Competency and Financial Reporting Quality

The term “competency” in relation to directors refers to the collective knowledge, skills, and expertise possessed by the board members of a company [27]. Competent directors are expected to have a comprehensive understanding of financial reporting principles, regulations, and best practices. Their proficiency is crucial in overseeing the financial reporting process and ensuring the accuracy and reliability of financial statements [15].

Financial reporting quality relates to the level of accuracy, clarity, and reliability of financial information disclosed by a company. It signifies how well financial reports reflect the economic state of the organization and provide valuable insights to stakeholders for informed decision-making [18].

The adoption of International Financial Reporting Standards (IFRS) refers to the incorporation and application of universally recognized accounting standards developed by the International Accounting Standards Board (IASB). The adoption of IFRS aims to enhance the consistency, clarity, and excellence of financial reporting on a global scale [19]. The proposed hypothesis suggests that the implementation of IFRS acts as a mediator in the relationship between the competency of directors and the quality of financial reporting. The adoption of IFRS is influenced by the directors’ competency, which in turn affects the quality of financial reporting [20].

Competent directors possess a thorough understanding of financial reporting principles, including IFRS. Their proficiency enables them to effectively interpret and apply IFRS regulations while overseeing the financial reporting process [28]. The implementation of IFRS provides a standardized framework that aligns with the competency of the board members, leading to an enhanced level of financial reporting excellence [29].

An essential aspect of corporate governance is the ability of competent directors to possess the necessary skills and knowledge to provide effective oversight and guidance in financial reporting matters [30,31,32]. Individual proficiency in IFRS can help detect potential reporting discrepancies, ensure compliance with established guidelines, and maintain the accuracy and reliability of financial records [33]. The implementation of IFRS strengthens directors’ responsibility to advance precise and dependable financial reporting [20].

The ability to make informed decisions based on reliable information is crucial. Directors who possess the necessary competency are better equipped to understand the complexities of financial reporting and assess the accuracy and reliability of financial data [34]. The adoption of IFRS provides directors with access to standardized and comparable financial information, facilitating informed decision-making based on high-quality information. Consequently, this leads to an improvement in the quality of financial reporting [21].

To examine this hypothesis, researchers can gather information on directors’ competency (such as qualifications, expertise, and experience), metrics related to the quality of financial reporting (including accuracy, transparency, and reliability), and the extent of IFRS implementation within a representative sample of companies [22].

Statistical techniques such as mediation models or structural equation modeling can be employed to evaluate the mediating impact of IFRS adoption on the relationship between directors’ competency and financial reporting quality [35]. The present study aims to investigate the potential influence of IFRS adoption on the association between directors’ competency and financial reporting quality. Specifically, the study seeks to determine whether the adoption of IFRS acts as a mediator in this relationship, thereby influencing its significance [2].The following research hypothesis is derived from the preceding analysis:

H6.

The adoption of IFRS has a mediating effect on the relationship between directors’ competency and financial reporting quality.

2.7. Conceptual Framework

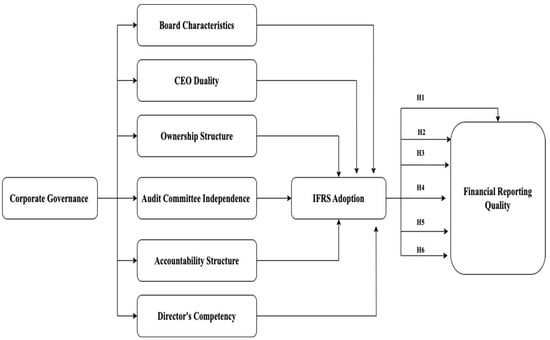

The figure below depicts the research model for the current study, illustrating the relationships among variables (Figure 1):

Figure 1.

Research model by the authors (2023).

The research model represents the theoretical framework guiding the investigation and identifies the variables involved in the study. It visualizes the connections and dependencies among these variables, providing a clear overview of the proposed relationships.

3. Materials and Methods

To investigate the mediating role of IFRS adoption between corporate governance and the quality of financial reporting in private banks located in Erbil, a quantitative study technique would be employed, following several important stages. The first step involves planning the research project, including selecting the research method, determining the sample size, and deciding on the data collection methods. In this case, a quantitative research design would be appropriate, and data could be collected through surveys or reliable sources such as financial reports. The next stage is selecting the sample population, determining which private banks in Erbil, Iraq, will be included in the study. This can be accomplished through random sampling or purposeful sampling if specific criteria need to be met. Once the sample is chosen, data can be collected using questionnaires, financial records, and other relevant sources. It is crucial to gather information on corporate governance processes, IFRS adoptions, and the quality of financial reporting. After data collection, the information can be analyzed using statistical methods such as regression analysis to identify the relationship between good corporate governance, the adoption of IFRS, and the quality of financial reporting. Additionally, mediation analysis can be applied to explore the role of IFRS adoption in moderating conflicts. The subsequent stage involves analyzing the research findings and drawing conclusions regarding the connection between good corporate governance, the adoption of IFRS, and the quality of financial reporting in private banks located in Erbil. These findings can serve as the basis for recommendations aimed at improving the quality of financial reporting within these organizations. By following this systematic approach, the study can effectively investigate the mediating role of IFRS adoption between corporate governance and the quality of financial reporting in private banks in Erbil, Iraq. The outcomes of the research can provide valuable insights and recommendations to enhance financial reporting practices in the private banking sector.

3.1. Sample Size and Sampling Method

For this study, the researchers employed two distinct samples, each intended to capture different aspects of the population and its characteristics. A random sampling method was utilized to gather information from employees of various private banks in Erbil. The term “simple random sample” refers to the selection of data made entirely at random. This approach was used to ensure a representative sample from the total number of banks in Iraq. Only publicly available and archived databases containing non-sensitive information were utilized in this investigation.

The researchers collected a total of 298 questionnaires from selected private banks to conduct their study. The chosen banks included IS Bank, Vakif Bank, RT Bank, Cihan Bank, Bank of Iraq, and TD Bank. These banks were selected to provide a diverse representation of institutions, considering factors such as geographical location and size.

The selection of the above private banks was based on various criteria, including their size, market share, financial performance, and other relevant factors that make them suitable for the study. The decision was also influenced by considerations such as their presence in a specific geographic area, their focus on serving a particular customer segment, or significant events or changes they have experienced, making them interesting subjects for examination. By including a diverse range of private banks in the study, the researcher aimed to obtain a comprehensive understanding of the relationship between corporate governance, IFRS adoption, and the quality of financial reporting in Erbil’s private banking sector.

3.2. Data Collection

As mentioned earlier, a questionnaire was utilized in the study as part of a quantitative approach to analyzing the gathered data. SPSS version 28 was employed for data analysis. A questionnaire is a structured set of questions designed to gather information from employees working at the selected banks. This method is commonly used in research studies. The questionnaire utilized in this study was adapted from previously published research. The questionnaire consisted of two main parts. In the first part, participants were asked to provide basic demographic information such as age, level of education, gender, and marital status. This information helps in understanding the characteristics of the participants and their potential influence on the variables under investigation. The second part of the questionnaire focused on six dimensions of corporate governance, namely board characteristics, CEO duality, ownership structure, audit committee independence, accountability structure, and directors’ competency. Additionally, participants were asked about the adoption of International Financial Reporting Standards (IFRS) and the quality of financial reporting. By including these dimensions in the questionnaire, the study aimed to capture the various aspects of corporate governance and their potential impact on the quality of financial reporting in the selected banks. This comprehensive approach allowed for a thorough examination of the factors under investigation.

4. Results

The table presents the distribution of participants by gender, age, and education level in a sample size of 298 individuals. Out of the total sample, 56.38% are male, while 43.62% are female. Regarding age distribution, the table provides information on the number of participants in different age ranges. In the 20–29 age range, there are 82 participants, representing approximately 27.52% of the sample. The 30–39 age range consists of 53 participants, accounting for 17.79% of the sample. In the 40–49 age range, there are 55 participants, representing 18.46% of the sample. The 50–59 age range includes 65 participants, making up 21.81% of the sample. Lastly, the 60–69 age range comprises 43 participants, accounting for 14.43% of the sample. In terms of education levels, the table provides the number of participants in different categories. There are 22 participants with a diploma, 113 with a bachelor’s degree, 85 with a master’s degree, 65 with a doctoral degree, and 13 with some other type of advanced degree. The percentages represent the distribution of participants across these education categories. Specifically, 7.38% of participants have a high school diploma, 37.92% have a bachelor’s degree, 28.52% have a master’s degree, 21.81% have a doctoral degree, and 4.36% have some other type of advanced degree as seen in Table 1.

Table 1.

Demographic analysis.

Reliability analysis is a statistical method that assesses the consistency and dependability of a set of measurements. Table 2 presents the reliability statistics for various dimensions of corporate governance were obtained using Cronbach’s alpha. For the dimension of board characteristics, the Cronbach alpha value was 0.749, based on eight questions used to measure these characteristics. Similarly, the dimension of CEO duality had a Cronbach alpha value of 0.751, measured using eight questions. The dimension of ownership structure yielded a Cronbach alpha value of 0.769, with eight questions measuring this aspect of corporate governance. The audit committee independence dimension had a Cronbach alpha value of 0.774, based on eight questions. The accountability structure dimension had a Cronbach alpha value of 0.719, with eight questions measuring it. The directors’ competency dimension had a Cronbach alpha value of 0.733, assessed using eight questions. The adoption of IFRS, acting as a mediator, had a Cronbach alpha value of 0.758, measured with eight questions. Finally, the financial reporting quality dimension, considered as an independent variable, yielded a Cronbach alpha value of 0.791, based on eight questions. These reliability results demonstrate the consistency and dependability of all variables and questions employed in this study.

Table 2.

Reliability statistics.

The statistical method known as correlation analysis is employed to evaluate the nature and connection that exists between two or more independent variables. The findings of the correlation analysis revealed significant correlations between various variables and reporting financial quality. Table 3 presents the Pearson correlation coefficient between board characteristics and reporting financial quality was found to be 0.609 **, indicating a strong correlation. Similarly, the Pearson correlation coefficients between CEO duality and reporting financial quality, ownership structure and reporting financial quality, audit committee and reporting financial quality, accountability structure and reporting financial quality, director’s competency and reporting financial quality, and adoption of IFRS and reporting financial quality were 0.623 **, 0.598 **, 0.572 **, 0.633 **, 0.651 **, and 0.593 ** respectively, all of which demonstrated significant correlations. It is noteworthy that the results of the correlation analysis indicated a significant correlation among all variables.

Table 3.

Correlation analysis.

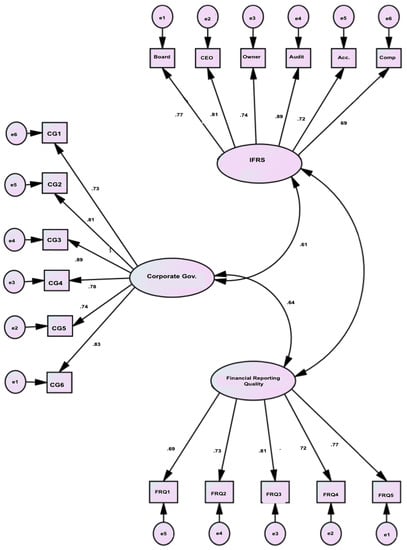

Confirmatory Factor Analysis (CFA)

The CFA model incorporates 17 indicators and 6 elements within its measurement framework, as illustrated in Figure 2.

Figure 2.

Path diagram.

In this study, as indicated in the table above, a value of p < 0.05 (i.e., p < 0.05) signifies statistical significance and enables the rejection of the null hypothesis. Based on the aforementioned information, the estimated model results strongly support the six hypotheses. Table 4 presents the status of four hypotheses in the final structural model:

Table 4.

Estimates of the structural equation model.

The term “direct effect” is employed in structural modeling to describe the relationship between two variables. Table 5 presents the results reveal that all six variables demonstrated a positive and significant impact on financial reporting quality.

Table 5.

Direct effect in structural model.

Researchers inferred that changes to IFRS had a significant indirect effect, suggesting that revisions in IFRS mediate the relationship between corporate governance and financial reporting quality in certain banks as seen in Table 6.

Table 6.

Results of the mediation hypotheses.

Table 7 presents the summary of the hypotheses testing results. Prior research has extensively explored the individual impacts of corporate governance mechanisms and the adoption of International Financial Reporting Standards (IFRS) on financial reporting quality. There is a positive correlation exists between board independence and the quality of financial reporting [36,37,38,39]. According to Ref. [26] have highlighted the favorable influence of effective audit committees on financial reporting quality. Additionally, Ref. [25] have presented evidence supporting the positive impact of robust shareholder rights on financial reporting quality [40,41,42,43,44,45].

Table 7.

Summary of hypotheses testing result.

Furthermore, researchers have investigated the potential mediating role of IFRS in the relationship between corporate governance and financial reporting quality [46,47,48,49,50]. Ref. [23] found that the implementation of IFRS acts as a mediator between board independence and financial reporting quality. Ref. [29] identified IFRS as a significant mediator in the association between audit committee effectiveness and financial reporting quality [24,27,31,32,51,52,53]. These studies collectively provide support for the intermediary function of IFRS in enhancing the quality of financial reporting [52,54,55,56,57].

5. Conclusions

The aim of this research was to examine the mediating role of IFRS in the relationship between corporate governance and financial reporting quality, focusing specifically on the context of Iraq. The research aimed to shed light on the impact of IFRS adoption on enhancing financial reporting quality within the framework of corporate governance practices. The findings contribute to our understanding of the interplay among corporate governance, IFRS adoption, and the quality of financial reports. The results indicate that the adoption of IFRS moderates the link between corporate governance and financial reporting quality, suggesting that implementing IFRS improves the effectiveness of corporate governance practices in ensuring high-quality financial reporting. The study highlights the importance of strong corporate governance practices to promote transparency, accountability, and reliable financial reporting. Independent audit committees, qualified directors, and robust internal control procedures are essential components of efficient corporate governance. By providing a standardized framework for financial reporting, IFRS enhances transparency and facilitates meaningful comparisons.

However, the study has certain limitations that should be acknowledged. The results may not be generalizable to other financial institutions or countries due to the small sample size of private banks in Iraq. Self-reported data may introduce biases due to response tendencies. Further research is necessary to establish causation and control for potential confounding factors. Increasing the sample size by including a wider range of banks or businesses and employing more rigorous research methods are potential avenues for future studies in this field. Longer-term research can provide insights into the effects of IFRS adoption and the evolving nature of corporate governance practices. Comparative studies across countries can offer a better understanding of the global effects of corporate governance and IFRS on financial reporting quality.

Finally, this research addresses a gap in the literature by demonstrating the mediating impact of IFRS adoption on corporate governance and financial reporting quality. It emphasizes the importance of robust corporate governance practices and standardized reporting frameworks in achieving accurate and transparent financial reporting, thereby building trust among investors and facilitating informed business decisions.

5.1. Theoretical Implication

The study’s findings on the mediating role of IFRS adoption between corporate governance and financial reporting quality in private banks have significant theoretical implications. The results support the agency theory, which suggests that agency problems between managers and shareholders can be mitigated through effective corporate governance mechanisms. The adoption of IFRS has the potential to enhance corporate governance processes by promoting transparency, comparability, reducing information asymmetry, and aligning the interests of management and shareholders.

Institutional theory is also relevant as the study focuses on Iraq, a country that has implemented and adhered to International Financial Reporting Standards (IFRS) as an international accounting standard. The adoption of IFRS by private banks in Iraq can be seen as an effort to conform to global accounting standards and comply with regulatory requirements, reflecting the influence of institutional factors.

The study also contributes to stakeholder theory, emphasizing the importance of meeting the needs and expectations of various stakeholders, including investors, customers, employees, and regulators. Financial reporting accuracy is crucial for stakeholders as it provides information about the financial health and operational performance of private banks. The application of IFRS and good corporate governance practices has the potential to improve the quality of financial reporting, thus meeting stakeholders’ requirements.

Overall, this research enhances our understanding of the relationship between corporate governance, IFRS adoption, and financial reporting accuracy in private banks. The findings have implications for theoretical frameworks such as agency theory, institutional theory, and stakeholder theory, and they provide direction for further exploration in these areas.

5.2. Practical Implication

The following is a summary of the practical implications that can be derived from the mediating role of IFRS adoption between corporate governance and the quality of financial reporting in private banks. The study findings suggest that the adoption of International Financial Reporting Standards (IFRS) and the implementation of policies promoting good corporate governance can lead to improvements in the accuracy, transparency, and comparability of financial reporting in private banks. Therefore, it would be advantageous for private banks to adopt IFRS and establish robust corporate governance processes to enhance the quality of their financial reporting.

Compliance with regulatory requirements: International Financial Reporting Standards (IFRS) is an internationally recognized accounting standard mandated by regulatory authorities in many countries, including Iraq. By adopting IFRS, financial institutions can ensure compliance with regulatory standards and avoid penalties or sanctions.

Enhanced reputation and credibility: Private banks that consistently produce high-quality financial reports are likely to enhance their reputation and credibility among stakeholders, including investors, customers, and regulators. The effort and expertise required to produce high-quality financial reports demonstrate the bank’s commitment to transparency and reliability, which can result in increased trust, loyalty, and investment in the organization.

Increased confidence in decision-making: Accurate and transparent financial reporting can instill confidence in decision-making by providing stakeholders with reliable information about the institution’s financial health and performance. This can lead to improved decision-making for managers, informed investment decisions for investors, and well-informed regulatory decisions.

Overall, the study highlights the practical benefits of adopting IFRS and implementing strong corporate governance procedures in private banks in Iraq. Specifically, it emphasizes the advantages within the context of good corporate governance. These benefits include improved financial reporting quality, compliance with regulatory standards, enhanced decision-making, and a bolstered reputation and credibility. Therefore, private banks in Iraq can utilize the study findings to inform their accounting and governance policies, thereby improving their financial performance and reputations.

5.3. Research Limitations

Based on the findings, the researchers acknowledged the following limitations of the study:

Sample size and generalizability: The data for this study were obtained from a specific set of private Iraqi banks, namely IS Bank, Vakif Bank, RT Bank, Cihan Bank, Bank of Iraq, and TD Bank. While these banks provide valuable insights, the findings may not be representative of the entire banking industry in Iraq or applicable to other countries. The small sample size restricts the ability to make broad generalizations based on the study’s results.

Causality and mediation: Establishing causality and understanding the mediation effects requires a comprehensive examination of all relevant factors. While this research focuses on the impact of IFRS adoption on the relationship between corporate governance and financial reporting quality, it is important to consider other factors that may influence this relationship. Unobserved variables or alternative hypotheses can affect the magnitude and direction of the hypothesized mediation effects.

External factors and contextual differences: The study specifically explores the mediating role of IFRS adoption in Iraq. However, it is essential to recognize that different countries may have varying corporate governance practices, financial reporting regulations, and contextual factors. The findings of this study may not directly apply to other regions or countries with distinct governance systems and reporting standards.

These limitations indicate the need for further research with larger and more diverse samples, rigorous study designs, and consideration of contextual factors to enhance the generalizability and depth of understanding in the field of corporate governance, IFRS adoption, and financial reporting quality.

5.4. Future Studies

Future studies in this area could explore the following aspects:

Conduct an analysis to determine the enduring consequences of the adoption of International Financial Reporting Standards (IFRS) on the quality of financial reporting in private banks. Assess if the initial enhancements observed are sustained over a prolonged period of time and identify any possible obstacles or constraints that emerge during the ongoing execution of the project.

Perform a comparative analysis between private banks that have implemented International Financial Reporting Standards (IFRS) and those that have not. Analyze the disparities in the quality of financial reporting and evaluate the specific advantages that the implementation of International Financial Reporting Standards (IFRS) offers to corporate governance procedures.

Explore additional corporate governance mechanisms that can enhance the quality of financial reporting, beyond board size, board independence, and audit committee effectiveness. Examine the potential synergistic effects that may arise from the interplay of these mechanisms and the implementation of International Financial Reporting Standards (IFRS).

Author Contributions

Writing—original draft and methodology, B.G.; writing—review, B.G.; writing—reviewing and editing N.N.A.; revision. M.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data provided on demand.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hasan, M.T.; Rahman, A.A. Conceptual framework for IFRS adoption, audit quality and earnings management: The case of Bangladesh. Int. Bus. Acc. Res. J. 2019, 3, 58–66. [Google Scholar] [CrossRef]

- Khlif, H.; Ahmed, K.; Alam, M. Accounting regulations and IFRS adoption in francophone North African countries: The experience of Algeria, Morocco, and Tunisia. Int. J. Acc. 2020, 55, 2050004. [Google Scholar] [CrossRef]

- Apochi, J.G.; Mustapha, L.O.I. FRS Adoption Financial Reporting Quality in Nigeria: A Conceptual Approach. Eur. J. Acc. Audit. Fin. Res. 2022, 10, 9–18. [Google Scholar]

- Li, B.; Siciliano, G.; Venkatachalam, M.; Naranjo, P.; Verdi, R.S. Economic consequences of IFRS adoption: The role of changes in disclosure quality. Contemp. Acc. Res. 2021, 38, 129–179. [Google Scholar] [CrossRef]

- Mensah, E. The effect of IFRS adoption on financial reporting quality: Evidence from listed manufacturing firms in Ghana. Econ. Res. Ekon. Istr. 2021, 34, 2890–2905. [Google Scholar] [CrossRef]

- Wijayana, S.; Gray, S.J. Institutional factors and earnings management in the Asia-Pacific: Is IFRS adoption making a difference? Manag. Int. Rev. 2019, 59, 307–334. [Google Scholar] [CrossRef]

- De Moura, A.A.F.; Altuwaijri, A.; Gupta, J. Did mandatory IFRS adoption affect the cost of capital in Latin American countries? J. Int. Acc. Audit. Tax. 2020, 38, 100301. [Google Scholar] [CrossRef]

- Mongrut, S.; Winkelried, D. Unintended effects of IFRS adoption on earnings management: The case of Latin America. Emerg. Mark. Rev. 2019, 38, 377–388. [Google Scholar] [CrossRef]

- DeFond, M.; Gao, X.; Li, O.Z.; Xia, L. IFRS adoption in China foreign institutional investments China. J. Acc. Res. 2019, 12, 1–32. [Google Scholar] [CrossRef]

- Krismiaji, K.; Surifah, S. Corporate governance, compliance level of IFRS disclosure and value relevance of accounting information–Indonesian evidence. J. Int. Stud. 2020, 13. [Google Scholar] [CrossRef]

- Boachie, C.; Mensah, E. The effect of earnings management on firm performance: The moderating role of corporate governance quality. Int. Rev. Fin. Anal. 2022, 83, 102270. [Google Scholar] [CrossRef]

- Bagais, O.; Aljaaidi, K. Corporate governance attributes and firm performance in Saudi Arabia. Accounting 2020, 6, 923–930. [Google Scholar] [CrossRef]

- Ogbeide, S.; Ogiugo, H.; Adesuyi, I. Corporate governance mechanisms and financial reporting quality of commercial banks in Nigeria. Insights Reg. Dev. 2021, 3, 136–146. [Google Scholar] [CrossRef]

- Dang, V.C.; Nguyen, Q.K. Internal corporate governance and stock price crash risk: Evidence from Vietnam. J. Sustain. Fin. Invest. 2021, 1–18. [Google Scholar] [CrossRef]

- Nguyen, Q.K.; Dang, V.C. Does the country’s institutional quality enhance the role of risk governance in preventing bank risk? Appl. Econ. Lett. 2022, 30, 850–853. [Google Scholar] [CrossRef]

- Abed, I.A.; Hussin, N.; Haddad, H.; Al-Ramahi, N.M.; Ali, M.A. The moderating effects of corporate social responsibility on the relationship between creative accounting determinants and financial reporting quality. Sustainability 2022, 14, 1195. [Google Scholar] [CrossRef]

- Nguyen, Q.K. Audit committee structure, institutional quality, and bank stability: Evidence from ASEAN countries. Fin. Res. Lett. 2022, 46, 102369. [Google Scholar] [CrossRef]

- Hashed, A.; Almaqtari, F. The impact of corporate governance mechanisms and IFRS on earning management in Saudi Arabia. Accounting 2021, 7, 207–224. [Google Scholar] [CrossRef]

- HRP, A.K.Z.; Siregar, R.A.; Muda, I. Islamic Corporate Governance and Financial Performance in Banks Listed in JII. Int. J. Econ. 2022, 1, 248–256. [Google Scholar]

- Istianingsih Earnings Quality as a link between Corporate Governance Implementation Firm Performance. Int. J. Manag. Sci. Eng. Manag. 2021, 16, 290–301.

- Key, K.G.; Kim, J.Y. IFRS and accounting quality: Additional evidence from Korea. J. Int. Acc. Audit. Tax. 2020, 39, 100306. [Google Scholar] [CrossRef]

- Khamidullina, M.; Makarova, S. The effect of the quality of corporate governance on the dividend policy of banks in the BRICS countries. BRICS J. Econ. 2021, 2, 84–106. [Google Scholar] [CrossRef]

- Kohler, H.; Pochet, C.; Gendron, Y. Networks of interpretation: An ethnography of the quest for IFRS consistency in a global accounting firm. Acc. Organ. Soc. 2021, 95, 101277. [Google Scholar] [CrossRef]

- Soliman WS, M.K. Investigating the effect of corporate governance on audit quality and its impact on investment efficiency. Invest. Manag. Fin. Innov. 2020, 17, 175–188. [Google Scholar]

- Mnif, Y.; Znazen, O. Corporate governance and compliance with IFRS 7: The case of Private banks listed in Canada. Manag. Audit. J. 2020, 35, 448–474. [Google Scholar] [CrossRef]

- Mohsin, M.; Nurunnabi, M.; Zhang, J.; Sun, H.; Iqbal, N.; Iram, R.; Abbas, Q. The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. Int. J. Fin. Econ. 2021, 26, 1793–1807. [Google Scholar] [CrossRef]

- Aburous, D. IFRS and institutional work in the accounting domain. Crit. Perspect. Account. 2019, 62, 1–15. [Google Scholar] [CrossRef]

- Cooray, T.; Gunarathne, A.N.; Senaratne, S. Does corporate governance affect the quality of integrated reporting? Sustainability 2020, 12, 4262. [Google Scholar]

- Jiang, F.; Kim, K.A. Corporate governance in China: A survey. Rev. Financ. 2020, 24, 733–772. [Google Scholar] [CrossRef]

- Hameedi, K.S.; Al-Fatlawi, Q.A.; Ali, M.N.; Almagtome, A.H. Financial performance reporting, IFRS implementation, and accounting information: Evidence from Iraqi banking sector. J. Asian Fin. Econ. Bus. 2021, 8, 1083–1094. [Google Scholar]

- Almuzaiqer, M.A.; Fatima, A.H.; Ahmad, M. Royal Family Members and Corporate Governance Characteristics: The Impact on Earnings Management in UA. Int. J. Bus. Soc. 2022, 23, 689–713. [Google Scholar] [CrossRef]

- Tsalavoutas, I.; Tsoligkas, F.; Evans, L. Compliance with IFRS mandatory disclosure requirements: A structured literature review. J. Int. Acc. Audit. Tax. 2020, 40, 100338. [Google Scholar] [CrossRef]

- Song, X.; Trimble, M. The historical and current status of global IFRS adoption: Obstacles and opportunities for researchers. Int. J. Acc. 2022, 57, 2250001. [Google Scholar] [CrossRef]

- Abdullah, H.; Tursoy, T. Capital structure and firm performance: Evidence of Germany under IFRS adoption. Rev. Manag. Sci. 2021, 15, 379–398. [Google Scholar] [CrossRef]

- Harisa, E.; Mohamad, A.; Meutia, I. Effect of Quality of Good Corporate Governance Disclosure, Leverage and Firm Size on Profitability of Isalmic Commercial Banks. Int. J. Econ. Fin. 2019, 9, 189. [Google Scholar] [CrossRef]

- Semenyshena, N.; Khorunzhak, N.; Zadorozhnyi, Z.M. The institutionalization of accounting: The impact of national standards on the development of economies. Indep. J. Manag. Prod. 2020, 11, 695–711. [Google Scholar] [CrossRef]

- He, X.; Pittman, J.A.; Rui, O.M.; Wu, D. Do social ties between external auditors and audit committee members affect audit quality? Acc. Rev. 2017, 92, 61–87. [Google Scholar] [CrossRef]

- Almaqtari, F.A.; Hashed, A.A.; Shamim, M. Impact of corporate governance mechanism on IFRS adoption: A comparative study of Saudi Arabia, Oman, and the United Arab Emirates. Heliyon 2021, 7, e05848. [Google Scholar] [CrossRef] [PubMed]

- Wahyuni, E.T.; Puspitasari, G.; Puspitasari, E. Has IFRS improved accounting quality in Indonesia? A Systematic Literature Review of 2010–2016. J. Acc. Investig. 2020, 21, 19–44. [Google Scholar] [CrossRef]

- Karaye, A.I.; Zaluki NA, A.; Badru, B.O. Literature Gap on Corporate Governance Mechanisms and Bank Asset Quality. Global Bus. Manag. Rev. 2021, 13, 51–67. [Google Scholar]

- Bouteska, A.; Mili, M. Does corporate governance affect financial analysts’ stock recommendations, target prices accuracy and earnings forecast characteristics? An empirical investigation of US companies. Empir. Econ. 2022, 63, 2125–2171. [Google Scholar] [CrossRef]

- Correa-Garcia, J.A.; Garcia-Benau, M.A.; Garcia-Meca, E. Corporate governance and its implications for sustainability reporting quality in Latin American business groups. J. Clean. Prod. 2020, 260, 121142. [Google Scholar] [CrossRef]

- El-Helaly, M.; Ntim, C.G.; Al-Gazzar, M. Diffusion theory, national corruption and IFRS adoption around the world. J. Int. Acc. Audit. Tax. 2020, 38, 100305. [Google Scholar] [CrossRef]

- Roychowdhury, S.; Shroff, N.; Verdi, R.S. The effects of financial reporting and disclosure on corporate investment: A review. J. Acc. Econ. 2019, 68, 101246. [Google Scholar] [CrossRef]

- Shaker, A.S.; Ezghayer, H.B.; Adam, M.A. Corporate Governance and Quality of Employees Performance: A Conceptual Analysis. Int. J. Psychosoc. Rehabil. 2020, 24, 4957. [Google Scholar]

- Boujelben, S.; Kobbi-Fakhfakh, S. Compliance with IFRS 15 mandatory disclosures: An exploratory study in telecom and construction sectors. J. Fin. Rep. Account. 2020, 18, 707–728. [Google Scholar] [CrossRef]

- Tran, T.; Ha, X.; Le, T.; Nguyen, N. Factors affecting IFRS adoption in listed banks: Evidence from Vietnam. Manag. Sci. Lett. 2019, 9, 2169–2180. [Google Scholar] [CrossRef]

- Wong, F.S.; Ganesan, Y.; Pitchay, A.A.; Haron, H.; Hendayani, R. Corporate governance and business performance: The moderating role of external audit quality. J. Gov. Integr. 2019, 2, 34–44. [Google Scholar] [CrossRef]

- Zahid, R.A.; Simga-Mugan, C. An analysis of IFRS and SME-IFRS adoption determinants: A worldwide study. Emerg. Mark. Fin. Trade 2019, 55, 391–408. [Google Scholar] [CrossRef]

- Ballas, P.; Garefalakis, A.; Lemonakis, C.; Balla, V. Quality of financial reporting under IFRS and corporate governance influence: Evidence from the Greek banking sector during crisis. J. Gov. Regul. 2019, 8. [Google Scholar] [CrossRef]

- Uwuigbe, O.R.; Olorunshe, O.; Uwuigbe, U.; Ozordi, E.; Asiriuwa, O.; Asaolu, T.; Erin, O. Corporate governance and financial statement fraud among listed firms in Nigeria. IOP Conf. Ser. Earth Environ. Sci. 2019, 331, 012055. [Google Scholar] [CrossRef]

- Dang, H.N.; Pham, C.D.; Nguyen, T.X.; Nguyen HT, T. Effects of corporate governance and earning quality on listed Vietnamese firm value. J. Asian Fin. Econ. Bus. 2020, 7, 71–80. [Google Scholar] [CrossRef]

- Arniati, T.; Puspita, D.A.; Amin, A.; Pirzada, K. The implementation of good corporate governance model and auditor independence in earnings’ quality improvement. Entrep. Sustain. Issues 2019, 7, 188. [Google Scholar] [CrossRef] [PubMed]

- Al-Gamrh, B.; Ku Ismail, K.N.I.; Ahsan, T.; Alquhaif, A. Investment opportunities, corporate governance quality, and firm performance in the UAE. J. Acc. Emerg. Econ. 2020, 10, 261–276. [Google Scholar] [CrossRef]

- Almagtome, A.; Khaghaany, M.; Önce, S. Corporate governance quality, stakeholders’ pressure, and sustainable development: An integrated approach. Int. J. Math. Eng. Manag. Sci. 2020, 5, 1077. [Google Scholar] [CrossRef]

- Alsaadi, M.A.; Tijjani, B.; Falgi, K.I. Corporate Governance and Quality of Financial Reporting of Listed Firms: Evidence from Saudi Arabia. Corp. Gov. 2021, 15, 392–410. [Google Scholar]

- Zulfiati, L.; Fadhillah, I.S. Effect of Corporate Governance and Financial Reporting Quality on Asymmetry Information. In Proceedings of the 5th Annual International Conference on Accounting Research (AICAR 2018), Manado, Indonesia, 8–9 August 2018; Atlantis Press: Dordrecht, The Netherlands, 2019; pp. 126–128. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).