A Study of Trends in Low-Energy Development Patterns in China: A Data-Driven Approach

Abstract

1. Background and Introduction

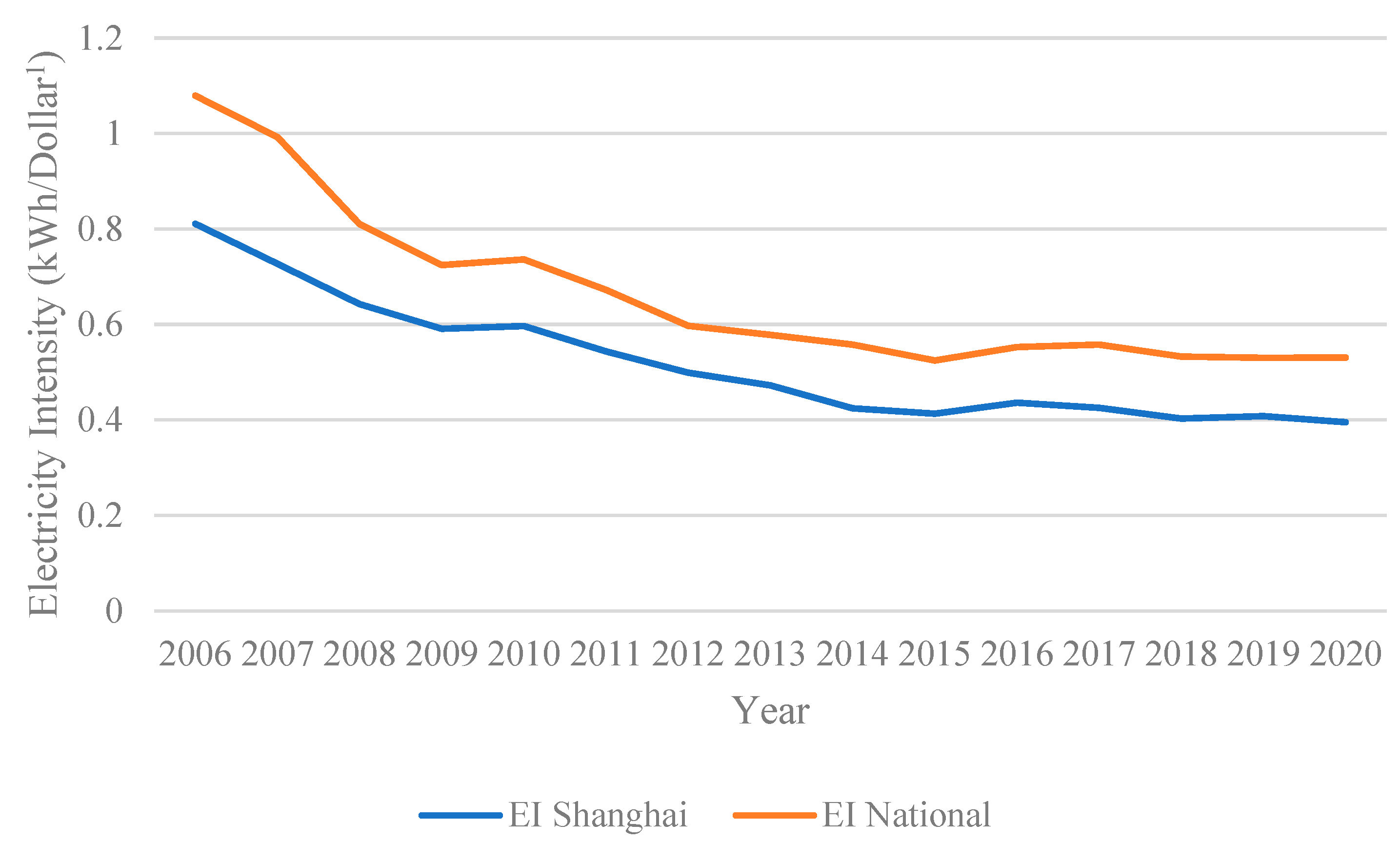

1.1. Overview of China’s Industrial Structure

1.2. Electricity and High-Quality Development

1.3. Current Literature Review on Convergence

2. Methodology and Data

2.1. β-Convergence

2.2. Club Convergence

- Step 1.

- Sort all individuals in the panel data based on the last observation in the panel.

- Step 2.

- Build core groups by selecting the first n highest individuals in the group to form a subgroup with N > n ≥ 2. Run log t regression on the subgroup to calculate its convergence test statistic = t (). Select the core group size according to the following criteria:

- Step 3.

- Select club members. Add individuals to the core subgroup one by one, and run log t regression every time. Set the regression t statistic as . If > c, new individuals will join the subgroup to form the first sub convergence group. C is a manually selected critical value. All members in the group need to meet > −1.65. If not, consider increasing the set value c.

- Step 4.

- In step 3, individuals with form subgroup , and log t test is conducted for this subgroup. If the regression t statistic > −1/65, there are two convergent subgroups in the panel. If this is not the case, overlap steps 1, 2 and 3 to identify if there are smaller panel club convergence members. If there is no n in step 2 to make > −1.65, it means that other individuals in the panel are divergent.

2.3. Variables and Data

3. Empirical Results and Analysis

3.1. Test of β-Convergence

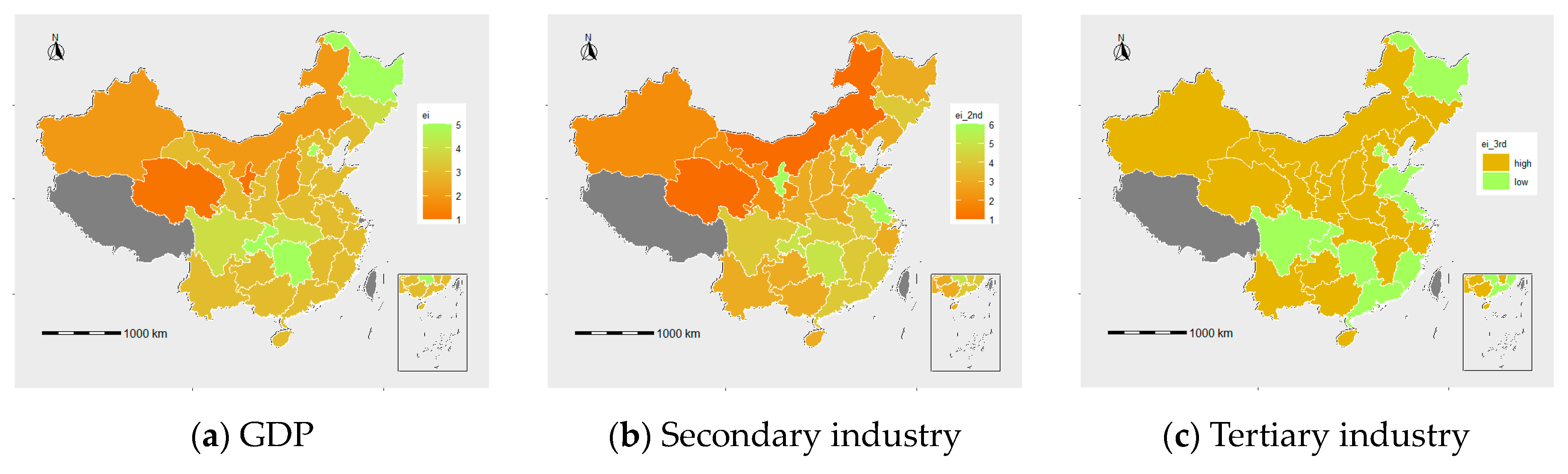

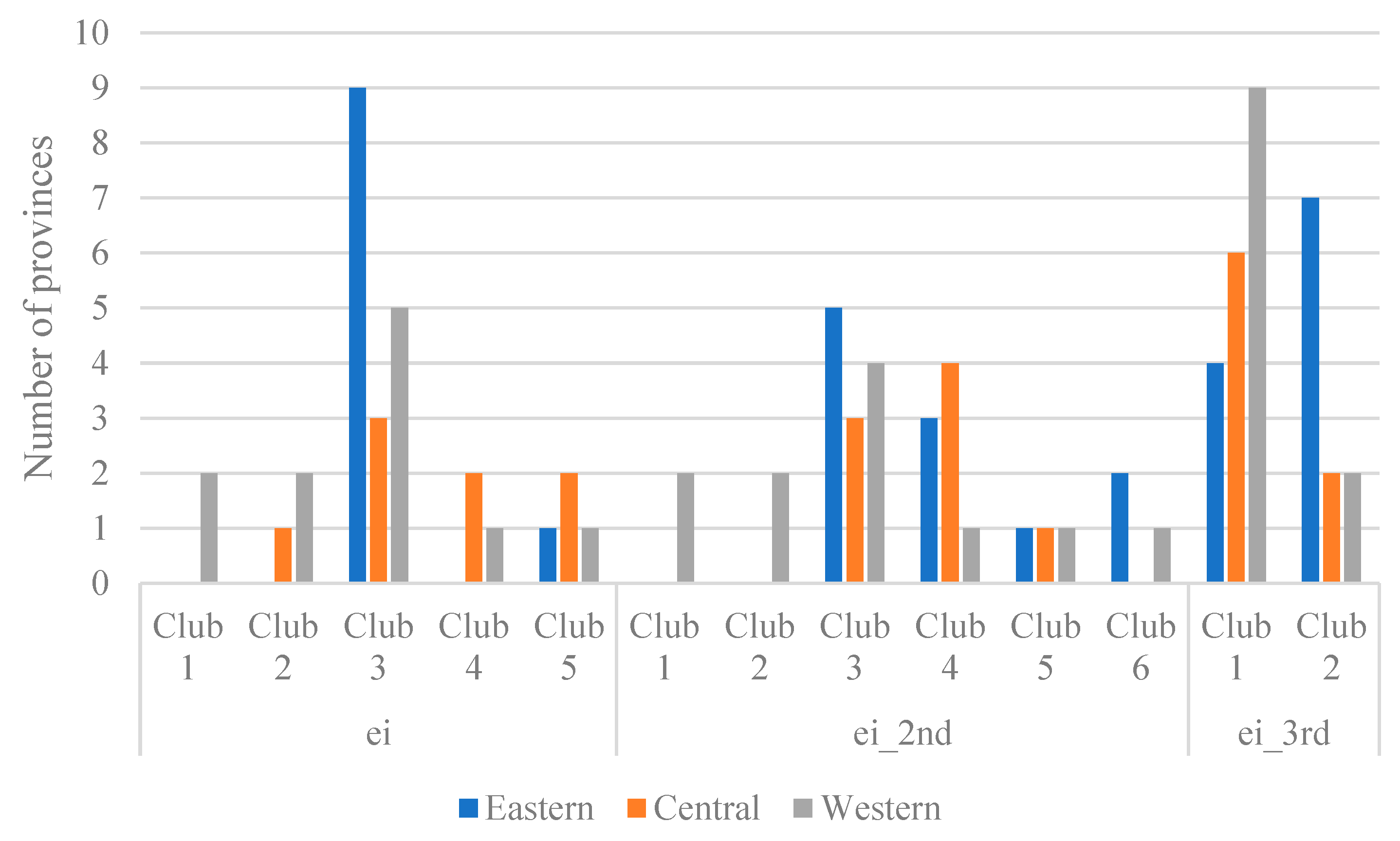

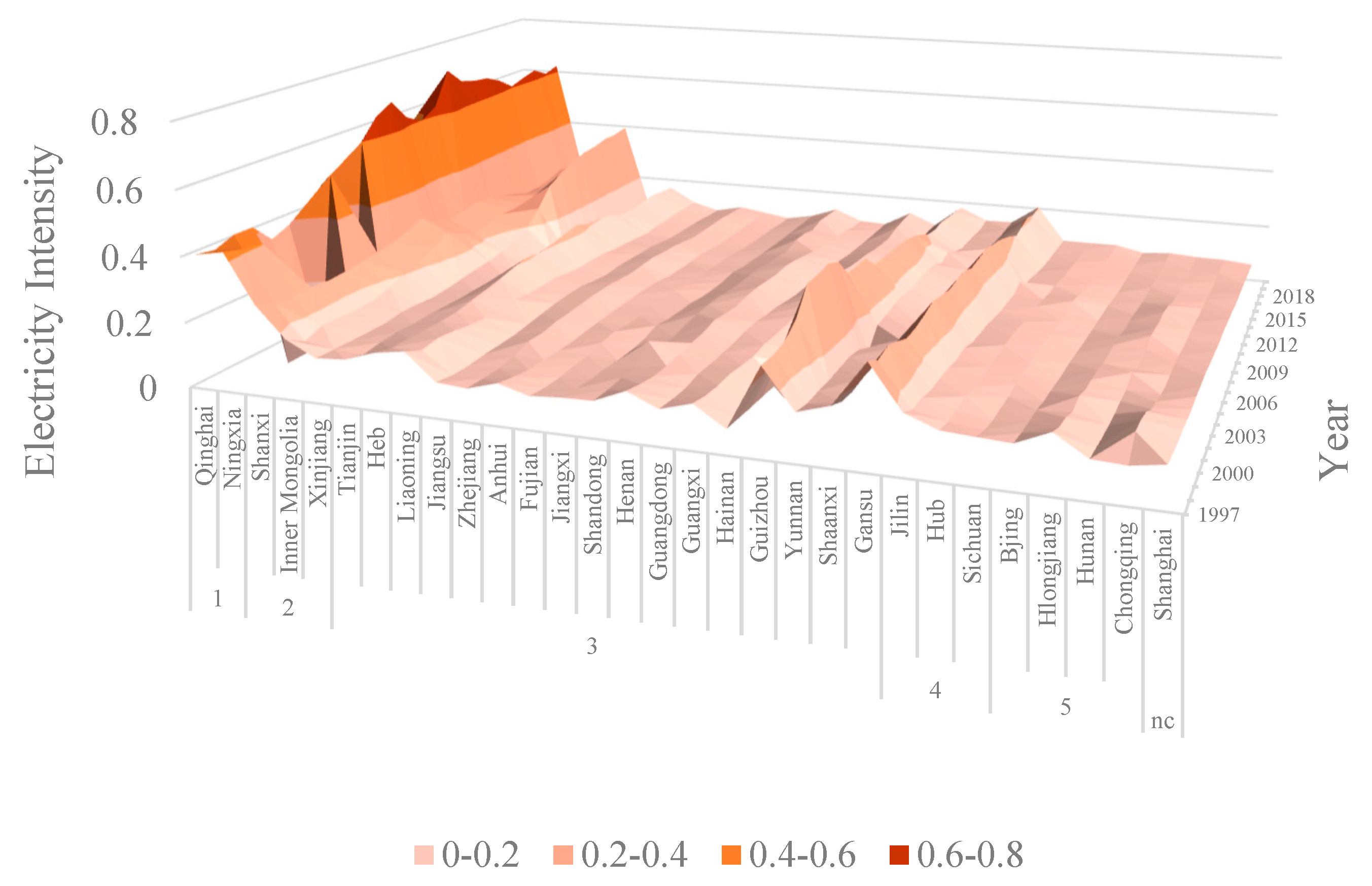

3.2. Club Convergence Analysis

3.3. Discusstion: The Trend and Distribution

4. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tukker, A. Product services for a resource-efficient and circular economy—A review. J. Clean. Prod. 2015, 97, 76–91. [Google Scholar] [CrossRef]

- Pla-Barber, J.; Villar, C.; Narula, R. Governance of global value chains after the COVID-19 pandemic: A new wave of regionalization? BRQ Bus. Res. Q. 2021, 24, 204–213. [Google Scholar] [CrossRef]

- Garcia, R.; dos Santos, U.P.; Suzigan, W. Industrial upgrade, economic catch-up and industrial policy in Brazil: General trends and the specific case of the mining industry. Nova Econ. 2020, 30, 1089–1114. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Lin, B. The effects and reacts of COVID-19 pandemic and international oil price on energy, economy, and environment in China. Appl. Energy 2021, 302, 117612. [Google Scholar] [CrossRef]

- Xu, G.; Yang, H.; Schwarz, P. A strengthened relationship between electricity and economic growth in China: An empirical study with a structural equation model. Energy 2021, 241, 122905. [Google Scholar] [CrossRef]

- Zhang, S.; Guo, Q.; Smyth, R.; Yao, Y. Extreme temperatures and residential electricity consumption: Evidence from Chinese households. Energy Econ. 2022, 107, 105890. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Sun, Z. Current relationship between coal consumption and the economic development and China’s future carbon mitigation policies. Energy Policy 2022, 162, 112812. [Google Scholar] [CrossRef]

- Yu, L.; Wang, Y.; Wei, X.; Zeng, C. Towards low-carbon development: The role of industrial robots in decarbonization in Chinese cities. J. Environ. Manag. 2023, 330, 117216. [Google Scholar] [CrossRef]

- Solarin, S.A.; Shahbaz, M.; Hammoudeh, S. Sustainable economic development in China: Modelling the role of hydroelectricity consumption in a multivariate framework. Energy 2018, 168, 516–531. [Google Scholar] [CrossRef]

- Shiu, A.; Lam, P.-L. Electricity consumption and economic growth in China. Energy Policy 2004, 32, 47–54. [Google Scholar] [CrossRef]

- Xie, P.; Li, H.; Sun, F.; Tian, H. Analysis of the dependence of economic growth on electric power input and its influencing factors in China. Energy Policy 2021, 158, 112528. [Google Scholar] [CrossRef]

- Wang, K.; Niu, D.; Yu, M.; Liang, Y.; Yang, X.; Wu, J.; Xu, X. Analysis and Countermeasures of China’s Green Electric Power Development. Sustainability 2021, 13, 708. [Google Scholar] [CrossRef]

- Wu, W.; Cheng, Y.; Lin, X.; Yao, X. How does the implementation of the Policy of Electricity Substitution influence green economic growth in China? Energy Policy 2019, 131, 251–261. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. CEEEA2.0 model: A dynamic CGE model for energy-environment-economy analysis with available data and code. Energy Econ. 2022, 112, 106117. [Google Scholar] [CrossRef]

- Perera, L.D.H.; Lee, G.H. Have economic growth and institutional quality contributed to poverty and inequality reduction in Asia? J. Asian Econ. 2013, 27, 71–86. [Google Scholar] [CrossRef]

- Liu, G.; Liu, Y.; Zhang, C. Factor allocation, economic growth and unbalanced regional development in China. World Econ. 2017, 41, 2439–2463. [Google Scholar] [CrossRef]

- Huang, K.X.D. Growth and cycles in China’s unbalanced development: Resource misallocation, debt overhang, economic inequality, and the importance of structural reforms. Front. Econ. China 2019, 14, 53–71. [Google Scholar]

- Li, X.; Lu, Z. Quantitative measurement on urbanization development level in urban Agglomerations: A case of JJJ urban agglomeration. Ecol. Indic. 2021, 133, 108375. [Google Scholar] [CrossRef]

- Sadorsky, P. Do urbanization and industrialization affect energy intensity in developing countries? Energy Econ. 2013, 37, 52–59. [Google Scholar] [CrossRef]

- Guo, W.; Zhao, T.; Dai, H. Calculation and decomposition of regional household energy consumption in China: Based on perspectives of urbanization and residents’ consumption. Chin. J. Popul. Resour. Environ. 2017, 15, 132–141. [Google Scholar] [CrossRef]

- Wang, Y.; Lin, B. Can energy poverty be alleviated by targeting the low income? Constructing a multidimensional energy poverty index in China. Appl. Energy 2022, 321, 119374. [Google Scholar] [CrossRef]

- Hao, Y.; Peng, H. On the convergence in China’s provincial per capita energy consumption: New evidence from a spatial econometric analysis. Energy Econ. 2017, 68, 31–43. [Google Scholar] [CrossRef]

- Wang, Y.; Gong, X. Analyzing the difference evolution of provincial energy consumption in China using the functional data analysis method. Energy Econ. 2022, 105, 105753. [Google Scholar] [CrossRef]

- Wang, S.; Sun, S.; Zhao, E.; Wang, S. Urban and rural differences with regional assessment of household energy consumption in China. Energy 2021, 232, 121091. [Google Scholar] [CrossRef]

- Liu, H.; Wang, C.; Tian, M.; Wen, F. Analysis of regional difference decomposition of changes in energy consumption in China during 1995–2015. Energy 2019, 171, 1139–1149. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Liu, Y. China’s urban-rural inequality caused by carbon neutrality: A perspective from carbon footprint and decomposed social welfare. Energy Econ. 2022, 113, 106193. [Google Scholar] [CrossRef]

- Du, K. Econometric convergence test and club clustering using Stata. Stata J. 2017, 17, 882–900. [Google Scholar] [CrossRef]

- Stergiou, E.; Kounetas, K.E. Eco-efficiency convergence and technology spillovers of European industries. J. Environ. Manag. 2021, 283, 111972. [Google Scholar] [CrossRef]

- Bai, C.; Du, K.; Yu, Y.; Feng, C. Understanding the trend of total factor carbon productivity in the world: Insights from convergence analysis. Energy Econ. 2019, 81, 698–708. [Google Scholar] [CrossRef]

- Peng, H.-R.; Tan, X.; Managi, S.; Taghizadeh-Hesary, F. Club convergence in energy efficiency of Belt and Road Initiative countries: The role of China’s outward foreign direct investment. Energy Policy 2022, 168, 113139. [Google Scholar] [CrossRef]

- Zhang, Y.; Jin, W.; Xu, M. Total factor efficiency and convergence analysis of renewable energy in Latin American countries. Renew. Energy 2021, 170, 785–795. [Google Scholar] [CrossRef]

- Morales-Lage, R.; Bengochea-Morancho, A.; Camarero, M.; Martínez-Zarzoso, I. Club convergence of sectoral CO2 emissions in the European Union. Energy Policy 2019, 135, 111019. [Google Scholar] [CrossRef]

- Mulder, P.; de Groot, H.L.F. Structural change and convergence of energy intensity across OECD countries, 1970–2005. Energy Econ. 2012, 34, 1910–1921. [Google Scholar] [CrossRef]

- Herrerias, M.; Liu, G. Electricity intensity across Chinese provinces: New evidence on convergence and threshold effects. Energy Econ. 2013, 36, 268–276. [Google Scholar] [CrossRef]

- Zheng, S.; Yuan, R. Sectoral convergence analysis of China’s emissions intensity and its implications. Energy 2023, 262, 125516. [Google Scholar] [CrossRef]

- Bangjun, W.; Linyu, C.; Feng, J.; Yue, W. Research on club convergence effect and its influencing factors of per capita energy consumption: Evidence from the data of 243 prefecture-level cities in China. Energy 2023, 263, 125657. [Google Scholar] [CrossRef]

- Zhu, J.; Lin, B. Convergence analysis of city-level energy intensity in China. Energy Policy 2020, 139, 111357. [Google Scholar] [CrossRef]

- Cassetta, E.; Nava, C.R.; Zoia, M.G. A three-step procedure to investigate the convergence of electricity and natural gas prices in the European Union. Energy Econ. 2021, 105, 105697. [Google Scholar] [CrossRef]

- Du, Z.; Wang, Y. Does energy-saving and emission reduction policy affects carbon reduction performance? A quasi-experimental evidence in China. Appl. Energy 2022, 324, 119758. [Google Scholar] [CrossRef]

- Lv, C.; Bian, B.; Lee, C.-C.; He, Z. Regional gap and the trend of green finance development in China. Energy Econ. 2021, 102, 105476. [Google Scholar] [CrossRef]

- Wang, M.; Li, X.; Wang, S. Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy 2021, 154, 119758. [Google Scholar] [CrossRef]

- Taştan, H.; Yıldız, H. Club convergence analysis of city-level electricity consumption in Turkey. Energy 2023, 265, 126295. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Sul, D. Economic transition and growth. J. Appl. Econom. 2009, 24, 1153–1185. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Sul, D. Transition Modeling and Econometric Convergence Tests. Econometrica 2007, 75, 1771–1855. [Google Scholar] [CrossRef]

- Lv, T.; Pi, D.; Deng, X.; Hou, X.; Xu, J.; Wang, L. Spatiotemporal Evolution and Influencing Factors of Electricity Consumption in the Yangtze River Delta Region. Energies 2022, 15, 1753. [Google Scholar] [CrossRef]

- Xu, M.; Lin, B. Exploring the “not in my backyard” effect in the construction of waste incineration power plants—Based on a survey in metropolises of China. Environ. Impact Assess. Rev. 2020, 82, 106377. [Google Scholar] [CrossRef]

- Zhang, P.; Wang, X.; Zhang, N.; Wang, Y. China’s energy intensity target allocation needs improvement! Lessons from the convergence analysis of energy intensity across Chinese Provinces. J. Clean. Prod. 2019, 223, 610–619. [Google Scholar] [CrossRef]

- Xin-Gang, Z.; Fan, L. Spatial distribution characteristics and convergence of China’s regional energy intensity: An industrial transfer perspective. J. Clean. Prod. 2019, 233, 903–917. [Google Scholar] [CrossRef]

| Variable | Mean | SD | Max | Min | N |

|---|---|---|---|---|---|

| e_enduse | 124,563.200 | 120,488.400 | 696,509.000 | 498.000 | 715 |

| e_ind | 83,869.980 | 81,089.180 | 535,223.000 | 498.000 | 667 |

| e_const | 1618.005 | 1534.838 | 9722.000 | 35.000 | 713 |

| e_trans | 2671.455 | 2519.784 | 17,975.520 | 54.000 | 714 |

| e_serv | 4646.772 | 5577.146 | 42,806.000 | 29.000 | 712 |

| ADDV2nd | 4397.451 | 5048.128 | 28,923.920 | 61.700 | 720 |

| ADDV3rd | 4725.877 | 5806.745 | 40,305.670 | 91.100 | 720 |

| GDP | 10,057.140 | 11,255.060 | 71,622.420 | 202.800 | 720 |

| ei | 0.165 | 0.124 | 1.448 | 0.011 | 715 |

| ei_2nd | 0.312 | 0.326 | 4.921 | 0.087 | 665 |

| ei_3rd | 0.019 | 0.009 | 0.129 | 0.007 | 712 |

| Beta Coefficient | l_lnei | l_lnei_2nd | l_lnei_3rd |

| −0.346 *** | −0.065 *** | −0.363 *** |

| Variable 2 | Log (t) | ||

|---|---|---|---|

| ei 3 | ei_2nd | ei_3rd | |

| −1.730 | −0.903 | −0.769 | |

| SE | 0.023 | 0.001 | 0.087 |

| −74.176 | −1050.976 | −8.857 | |

| ei | Club 1 | Club 2 | Club 3 | Club 4 | Club 5 | Not Convergent | |

| −1.5 | −0.821 | 0.077 | 1.911 | 0.339 | |||

| −0.399 | −1.033 | 1.639 | 14.389 | 1.512 | |||

| Number of provinces | 2 | 3 | 17 | 3 | 4 | 1 | |

| ei_2nd | |||||||

| Initial Club | Club 1 | Club 2 | Club 3 | Club 4 | Club 5 | Club 6 | Club 7 |

| −0.077 | −3.384 | −0.054 | 3.056 | 0.716 | 0.797 | −2.242 | |

| −0.482 | −0.914 | −1.272 | 7.526 | 1.368 | 2.290 | −54.441 | |

| Number of provinces | 2 | 2 | 12 | 6 | 2 | 3 | 3 |

| Final Club | Club 1 | Club 2 | Club 3 | New Club 4 = Club 4 + 5 | Club 5 | Club 6 | |

| −0.482 | −0.914 | −1.272 | 1.251 | 2.290 | −54.441 | ||

| Number of provinces | 2 | 2 | 12 | 8 | 3 | 3 | |

| ei_3rd | Club 1 | Club 2 | |||||

| 0.009 | 0.229 | ||||||

| 0.225 | 2.382 | ||||||

| Number of provinces | 19 | 11 | |||||

| Log (t) | Club 1 + 2 | Club 2 + 3 | Club 3 + 4 | Club 4 + 5 | Club 5 + 6 | Club 6 + 7 |

|---|---|---|---|---|---|---|

| −1.237 | −1.281 | −0.578 | 1.251 | −0.69 | −1.201 | |

| −7.528 | −15.744 | −32.789 | 8.08 | −3.046 | −86.549 |

| Provinces | |||

|---|---|---|---|

| ei | |||

| Club 1 | Qinghai, Ningxia | ||

| Club 2 | Shanxi, Inner Mongolia, Xinjiang | ||

| Club 3 | Tianjin, Hebei, Liaoning, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong, Henan, Guangdong, Guangxi, Hainan, Guizhou, Yunnan, Shaanxi, Gansu | ||

| Club 4 | Jilin, Hubei, Sichuan | ||

| Club 5 | Beijing, Heilongjiang, Hunan, Chongqing | ||

| Not convergent | Shanghai | ||

| ei_2nd | |||

| Club 1 | Inner Mongolia, Qinghai | ||

| Club 2 | Gansu, Xinjiang | ||

| Club 3 | Hebei, Shanxi, Liaoning, Heilongjiang, Zhejiang, Shandong, Henan, Guangxi, Hainan, Guizhou, Yunnan, Shaanxi | ||

| Club 4 | Jilin, Anhui, Jiangxi, Hubei, Guangdong, Sichuan, Shanghai, Fujian | ||

| Club 5 | Beijing, Hunan, Chongqing | ||

| Club 6 | Tianjin, Jiangsu, Ningxia | ||

| ei_3rd | |||

| Club 1 | Hebei, Shanxi, Inner Mongolia, Liaoning, Jilin, Zhejiang, Anhui, Jiangxi, Henan, Hubei, Guangxi, Hainan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang | ||

| Club 2 | Beijing, Tianjin, Heilongjiang, Shanghai, Jiangsu, Fujian, Shandong, Hunan, Guangdong, Sichuan, Chongqing | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Yang, Q.; Wu, X.; Wang, R.; Gao, T.; Liu, Y. A Study of Trends in Low-Energy Development Patterns in China: A Data-Driven Approach. Sustainability 2023, 15, 10094. https://doi.org/10.3390/su151310094

Wang Y, Yang Q, Wu X, Wang R, Gao T, Liu Y. A Study of Trends in Low-Energy Development Patterns in China: A Data-Driven Approach. Sustainability. 2023; 15(13):10094. https://doi.org/10.3390/su151310094

Chicago/Turabian StyleWang, Yao, Qiang Yang, Xuenan Wu, Ruichen Wang, Tilei Gao, and Yuntong Liu. 2023. "A Study of Trends in Low-Energy Development Patterns in China: A Data-Driven Approach" Sustainability 15, no. 13: 10094. https://doi.org/10.3390/su151310094

APA StyleWang, Y., Yang, Q., Wu, X., Wang, R., Gao, T., & Liu, Y. (2023). A Study of Trends in Low-Energy Development Patterns in China: A Data-Driven Approach. Sustainability, 15(13), 10094. https://doi.org/10.3390/su151310094