1. Introduction

With climate warming becoming a global environmental problem, reducing carbon emissions has become the consensus of many nations. On 22 September 2020, President Xi Jinping put forward the new requirement of striving to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060, which provides a direction for China to respond to environmental climate change and promote the green development of society. A grand blueprint has been drafted in response to the requirement, which has been widely praised and widely accepted by the international community. Due to reforms and opening up, the Chinese economy has grown rapidly. In addition to being an important resource for economic growth, energy is also growing rapidly. Economic growth will continue to increase China’s energy consumption, as well as its carbon dioxide emissions. Increasing carbon emissions will result in an abnormal climate, frequent droughts and floods, a reduction in biodiversity, and other environmental problems [

1]. In addition, this puts China at a disadvantage in the international carbon dioxide negotiations, which will adversely affect China’s economic development in the international environment. Therefore, it is of great significance to reduce energy consumption and carbon emissions under the premise of ensuring a certain economic growth rate as much as possible.

Existing literature believes that energy price is an important factor affecting the intensity of carbon emissions. Liu Chang (2012) believed that energy prices are negatively correlated with carbon emission intensity [

2]. After analyzing the panel data of 30 provinces of China, He Lingyun et al. (2016) found that increasing energy prices moderately can help reduce carbon emission intensity, but regional differences are large [

3]. Wang Fuzhong (2018) discovered the co-integration relationship between energy prices and the carbon intensity of the logistics industry through co-integration analyses, where the rise in energy prices will inhibit the carbon emissions and carbon intensity of the logistics industry [

4]. Wang Libing et al. (2021) used the LMDI decomposition method to study how energy prices inhibit the energy carbon emissions of the Chinese residents’ living sector [

5]. Additionally, some studies also believed that the price of a variety of energies could affect the intensity of carbon emissions. Zheng Yuhua (2016) used the CGE model to emphasize that the decline in coal prices may increase the intensity of carbon emissions by increasing energy demands [

6]. Yan Zheming et al. (2017) conducted empirical research through panel data, and also thought that energy prices can reduce carbon emission intensity significantly [

7]. Zhang Xidong et al. (2016) concluded that increasing the price of natural gas can reduce the intensity of carbon emissions through the optimization of industrial structure and energy consumption structure based on the computable general equilibrium model [

8]. Chen Guanxue et al. (2019) constructed a regression model, found the industrial electricity price is an important factor affecting carbon emissions, and also believed that energy price reform is conducive to carbon emission reduction [

9].

In addition to energy prices, many scholars believed that economic growth is another key factor affecting the intensity of carbon emissions. Wang et al. (2005) and Ang (2009) believed that carbon emissions are positively related with economic growth [

10,

11]. Yuan (2019) conducted an empirical study on the influencing factors of carbon emission intensity of China based on the extended STIRPAT model. Through the co-integration test, a long-term co-integration relationship among per capita GDP and carbon emission intensity has been studied [

12]. Tian Huazheng et al. (2020) used the LMDI method to analyze the contribution of different factors to the change of industrial carbon emission intensity of China, and found the relationship between the output value of different industrial sectors and carbon emissions are different [

13]. Combined with the panel data, Mo Shu et al. (2022) found that financial development will increase the local carbon emission intensity significantly, but also significantly reduce the carbon emission intensity of adjacent areas to a greater extent. Therefore, the overall effect for financial development will inhibit the carbon emission intensity [

14]. Some scholars believe that economic growth and energy consumption structure affect carbon emission intensity at the same time. Shao Yanfei et al. (2015) established a spatial econometric model based on provincial panel data, and believed carbon emission intensity is positively correlated with the proportion of coal consumption and negatively correlated with per capita GDP [

15]. Yan Yanmei et al. (2016) used the Sharpley value decomposition method to compare the carbon emission data of various provinces and cities, and the results showed economic growth was the main driving factor for the decline of carbon emission intensity, as well as that there is a positive correlation between the proportion of coal consumption and carbon emission intensity [

16]. Wang Kai et al. (2021) used the IPAT model with population density, economic development level, technological level, industrial structure, and energy structure as explanatory variables, also using the geographically weighted regression model to analyze the influencing factors of carbon emission intensity (service industries of China), and inferred that the energy structure has positive impacts, while the economic development level has negative impacts [

17]. Wang Mengkai et al. (2022) used the LMDI model to study the impact of industrial structure, energy intensity, and energy structure on the carbon emission intensity of Jiangsu Province, and found the driving effects of energy structure on the carbon emission intensity of Jiangsu Province is the largest [

18]. Zhang Zhuoqun et al. (2022) studied the regional difference of carbon emission intensity in China by using the Dagum–Gini coefficient and decomposition method, concluding that the impact of economic level, industrial structure, and other factors on the change rate of carbon emission intensity has significant heterogeneity [

19].

Compared with many commonly used economic models such as the SDM model, EKT model, STIRPAT model, and CGE model, LMDI model has a simpler structure, but the arithmetic analysis results tend to have better accuracy and stability, and is more suitable for studying the research system of energy consumption impact factors. However, LMDI is often used to analyze the impact of energy price changes on carbon emission intensity from a single factor or two factors, without considering the impact of multiple factors on carbon emission intensity at the same time. In this paper, we try to clarify the impact of energy price changes on carbon emission intensity from the aspects of technological progress, industrial structure, energy consumption structure, and economic growth, which is important for China’s carbon emission reduction and sustainable economic development, as well as to verify the accuracy and stability of LMDI under such application conditions. As a result, based on the LMDI-I multiplicative factor decomposition model, the carbon emission intensity was decomposed into the effect of technological progress and the effect of economic structure change. Additionally, we established an econometric model to analyze the impact of energy price, economic growth, and energy consumption structure on carbon emission intensity. Moreover, we aimed to divide the economic structure into six sectors and three industrial structures, and compare the LMDI decomposition results obtained by the two classifications and the impact of energy prices, economic growth, and energy consumption structure on the decomposition factors.

2. LMDI Multiplicative Decomposition of Carbon Emission Intensity

Many research methods regarding the decomposition of carbon emission intensity in academia exist. In this paper, we used the LMDI-I multiplication decomposition method given by Ang [

20,

21,

22]. The advantage of LMDI method is that it does not produce residual terms and is additive. Two forms of LMDI have been mentioned in this study: LMDI-I and LMDI-II. LMDI-I is more additive than LMDI-II. Ang pointed out that multiplication is more suitable for decomposition intensity index than addition. Therefore, in this paper, LMDI-I multiplication form is used to decompose the carbon emission intensity as follows:

is classified by production department, , which are S1 (agriculture, forestry, animal husbandry, and fishery), S2 (industry), S3 (construction), S4 (transportation, storage, and postal service), S5 (wholesale, retail, accommodation, and catering), S6 (living consumption), S7 (others); means carbon emission intensity; indicates the carbon emission of Sector ; illustrates the output of department ; shows the total output; is the carbon emission intensity of sector ; represents a sectoral economic structure. When classified according to three industries, can be replaced by (the same below), where is the primary, secondary, and tertiary industries, respectively.

Based on LMDI-I multiplication principle, the change of carbon emission intensity in phase relative to that in phase 0 is determined by two factors.

where

refers to the change of carbon emission intensity in the T period relative to the base period 0.

and

refer to the effect of technological progress and the effect of economic structure change, respectively.

According to LMDI-I multiplication decomposition method, the following decomposition results can be obtained:

where

Take logarithms on both sides of Equation (1) to obtain the following:

The ratio logarithm of carbon emission intensity in phase T to carbon emission intensity in phase 0 can be obtained by adding the logarithm of technological progress effect and the logarithm of economic structure change effect. Therefore, the change of carbon emission intensity in period T can be decomposed into the effect of technological progress and the effect of economic structure change. The sensitive and error analysis was performed for the model.

3. Empirical Models and Data

3.1. Model Establishment

Theoretically, energy is both a commodity and a factor of production. As a commodity, energy prices affect energy supply and demand. According to the supply and demand theory, the increase in energy price leads to the decrease in demand and the increase in supply. From the production perspective, when the marginal product ratio of other capital to the marginal product of energy is equal to the price ratio of other capital to the price of energy, the production sector obtains the maximum output. If the energy prices rise, and companies want to continue to obtain maximum output; other capital prices are required to rise at the same time, or increase the marginal product of energy. With the diminishing marginal return, reducing energy input can improve the energy marginal output while other production factors remain stable. Since carbon dioxide emissions are equal to the product of carbon dioxide emission coefficient and energy consumption, energy consumption determines carbon dioxide emissions directly. Therefore, raising energy prices can reduce carbon emissions by reducing energy consumption. Meanwhile, energy prices could adjust carbon intensity through technological progress and economic structure. Firstly, the rise in energy prices has led to a reduction in energy demand and an increase in other capital investment as well as scientific and technological innovation, thereby promoting technological progress and reducing the intensity of carbon emissions. Secondly, the price mechanism, as the most important part of the market mechanism, and rise of energy prices will lead to the reduction in enterprises’ production activities with high energy demands, while the production scale of enterprises with low energy demands will expand, optimizing the economic structure and reducing the intensity of carbon emissions.

Economic growth made high energy consuming enterprises have extra funds for technological improvement, which increased the demand for cost reduction, promoted enterprises to carry out technological improvement, optimized the investment structure of production factors, reduced energy input, and thus reduced carbon emissions. Moreover, economic growth will also adjust the allocation of resources and optimize the economic structure. Low energy industries would receive more investment and reduce carbon emission intensity. The energy consumption structure of China is dominated by coal, due to the proportion of coal consumption being 57.7%, and other energy accounted for 42.3% in 2019. Although the proportion of coal consumption decreased year over year, the important position of coal is unshakable.

As the main fossil energy used in China, coal will increase carbon dioxide emissions due to large-scale consumption, and increase the carbon emission intensity. Therefore, reducing the proportion of coal in energy consumption side and optimizing the energy consumption structure will help reduce carbon emissions per unit of GDP.

Based on the above theoretical analysis, models could be established as follows:

where

means the energy price;

represents economic growth, expressed in per capita GDP;

refers to the structure of energy consumption, indicating the proportion of coal consumption. In order to study the relationship between price and carbon emission intensity, the quadratic term of price has been added to the model.

The following model was established to analyze how energy prices, economic growth, and energy consumption structure affect carbon emission intensity through technological progress and changes in economic structure:

3.2. Statistics

The data used in this paper are from 1980 to 2019. Department i = 1, 2, 3, 4, 5, 6 are agriculture, forestry, animal husbandry and fishery, industry, construction, transportation, storage and postal services, wholesale, retail, accommodation and catering, and consumer goods, respectively. Industry j = 1, 2, 3, which are primary industry (mainly refers to industries producing ingredients and some other biological materials), secondary industry (mainly refers to processing and manufacturing industries), and tertiary industry (refers to industries other than primary and secondary industries). The output value is expressed in GDP, and the real GDP is calculated through the GDP index with 1980 as the constant price. Carbon emission is calculated by , where shows the type of energy, represents the consumption of -type energy, and means the carbon dioxide emission coefficient of -type energy, which is calculated according to IPCC. The energy price was kept constant in 1980, and the purchase price index of fuel and power was adopted. Since there was no purchase price index of fuel and power from 1981 to 1988, the consumption of coal, oil, and natural gas has been calculated as the weight. We used the producer price index of coal mining and preparation industries as well as oil and natural gas mining industries to calculate the replacement price index. The total population at the end of the year (2020) was chosen. The proportion of coal consumption is obtained from the China Energy Statistical Yearbook. The data were from China Statistical Yearbook and China Energy Statistical Yearbook from 1980 to 2020.

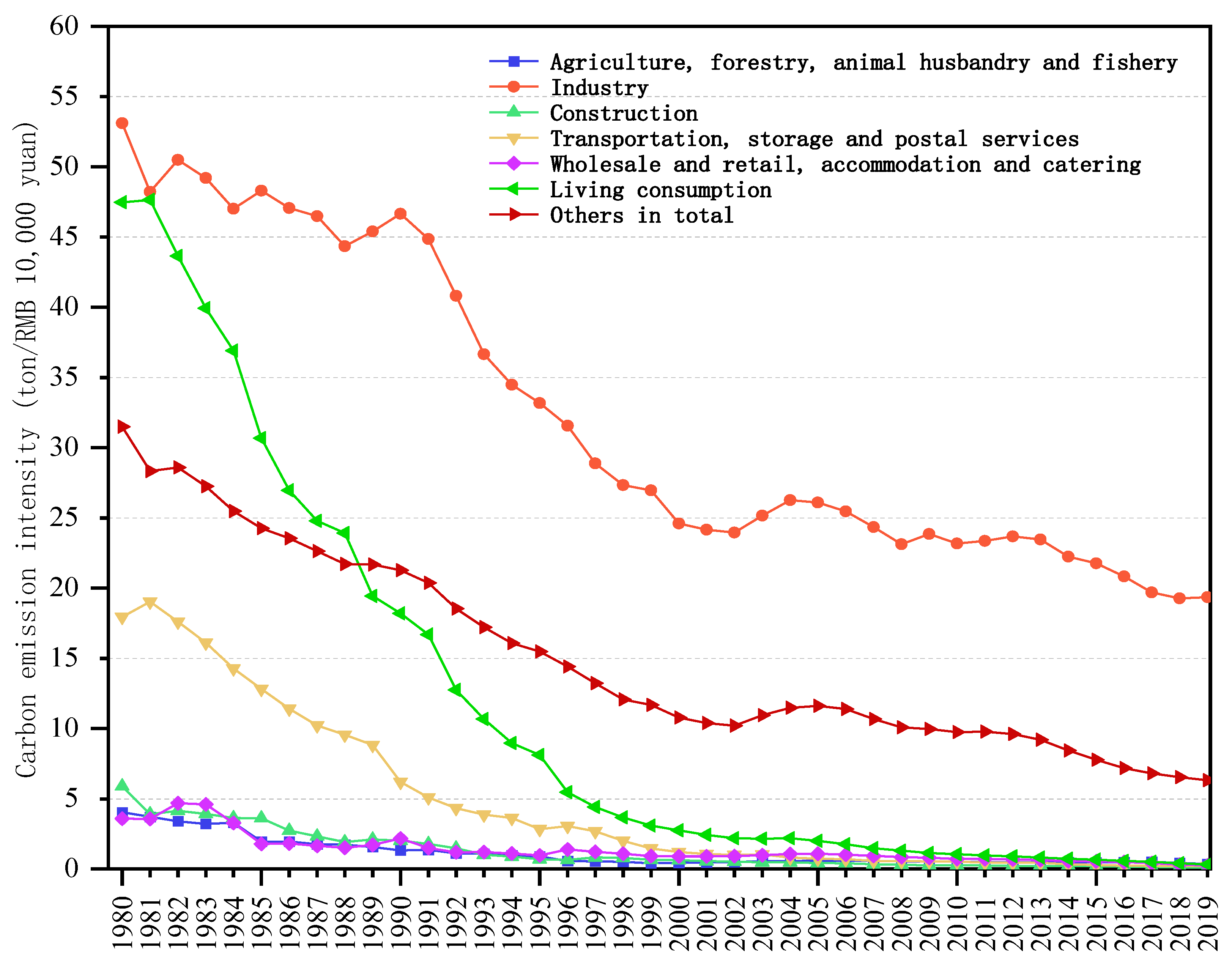

The results for carbon emission intensity of each department are shown in

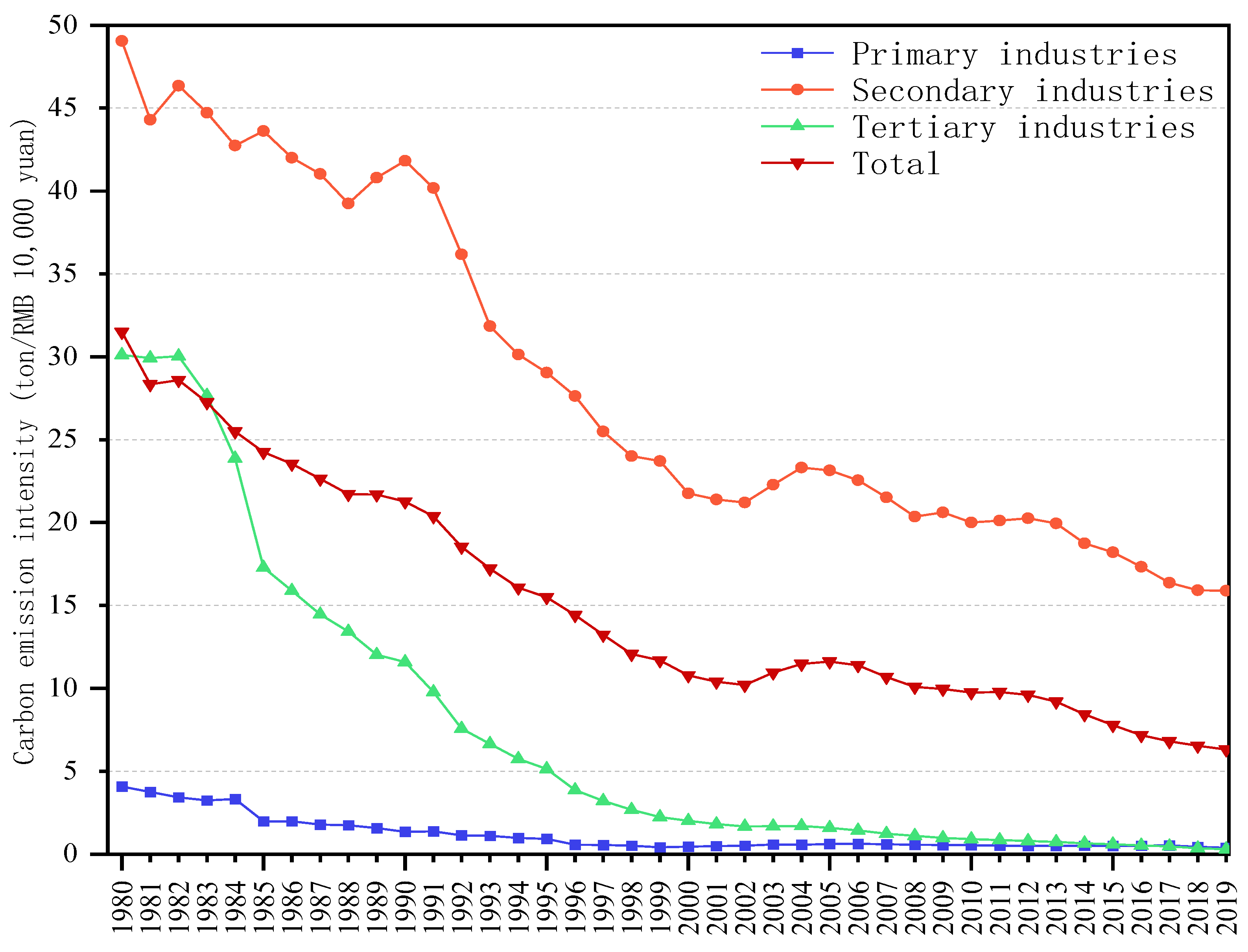

Figure 1, and the results of carbon emission intensity for three industries are shown in

Figure 2. In

Figure 1, carbon emission intensity of China has dropped from 31.50 tons/RMB 10,000 RMB in 1980 to 6.31 tons/RMB 10,000 yuan in 2019, with a significantly reduction in 80%, carbon emission intensity. The overall carbon emission intensity and the carbon emission intensity of the industrial sector showed a common change trend from 1980 to 2019. On the whole, all showed a downward trend year over year. It can be clearly seen from the figure that the overall carbon emission intensity showed a slight increase trend from 2002 to 2005, mainly because after China accessed the WTO, the international import/export trade developed rapidly and entered the early stage of export-led economic growth. At the same time, during this stage, domestic industry developed rapidly, showing a trend of preferential development of heavy industry. The proportion of industrial sector was increasing, and economic development depended on the massive consumption of energy resources. The main export products are resource-intensive products, which usually consume a lot of energy resources, showing a declining trend in energy efficiency and an increase in carbon emission intensity. However, with the implementation of the national 11th 5-Year Plan, all departments started to pay attention to environmental protection while developing the economy, and the intensity of carbon emissions showed a significant decline. The carbon emission intensity of S1, S2, S3, and S4 showed a continuous decline trend year by year. The carbon emission intensity of S5 remained stable from 1980 to 2019. The carbon emission intensity of S6 and S7 decreased rapidly from 1980 to 1998, started to decline slowly from 1999, and no longer fluctuated significantly. As shown in

Figure 2, the carbon emission intensity of secondary industries and the overall carbon emission intensity showed a common developed trend. In terms of the carbon emission intensity of the three industries, although the carbon emission intensity of primary industries has been declining, the rate of decrease is not large, and the decreased value is lower than that of the other two industries. The main reason is because primary industries of China mainly include various aquatic, native, and other agricultural primitive product industries. Such industries do not consume a lot of high-carbon energy resources, and their carbon emissions are small. Therefore, the value of carbon emission intensity is relatively low. The carbon emission intensity of secondary industries is similar to the overall performance. Although the overall trend showed a decrease, individual years often showed an increase. Particularly in 2002–2005, the carbon emissions intensity of secondary industries in China increased since construction is a major component of secondary industries. During this period, industrial development of China showed an inclination trend toward large-scale industries. Domestic carbon dioxide emissions increased rapidly, and carbon emission intensity also increased significantly.

Since 2005, the country has paid attention to the coordinated development of economic development and resource environment, and the carbon emission intensity of secondary industries showed a stable downward trend. The carbon emission intensity of the secondary industry decreased significantly from 1980 to 1998, which is the same as the development trend of the carbon emission intensity of living consumption and other sectors. Tertiary industries of China mainly include service and commerce industries, with a relatively stable downward trend in carbon emissions, and a relatively low dependence on energy resources. Tertiary industries have developed rapidly, and the output value has been continuously increased; thus, the carbon emission intensity has shown a rapid decline and remained stabilized.

4. Empirical Results and Analysis

4.1. Decomposition Results and Analyses of Carbon Emission Intensity

4.1.1. Decomposition Results and Analysis of Carbon Emission Intensity by Sectors

The decomposition of carbon emission intensity used 1980 as the base period.

Table 1 shows the multiplicative decomposition results of LMDI-I by sector. lnCF, lnES, CF, ES, and ln(C

t/C

1980) are the factor decomposition results. The second and third columns are in logarithmic form, while the fourth and fifth columns are in exponential form. Column 6 is the change in carbon emissions in logarithmic forms. From the decomposition results of

and

in logarithmic forms, during 1981–2019, compared with the previous year, only the carbon emission intensity in 1982 and 2003–2005 increased, while the carbon emission intensity in other years decreased. The effect of technological progress has the greatest impact on carbon emission intensity, reducing the overall carbon emission intensity significantly. The impact of the sector structure effect on carbon emission intensity showed a fluctuating trend, which has different effects in different years. On the whole, it inhibits the decline of carbon emission intensity, but the promotion effect of the sector structure effect on the decline of carbon emission intensity is more significant after 2006. During 2003–2005, both the technological progress effect and the sectoral structure effect contributed to the increase in the carbon emission intensity of China. This is related to the rapid development of domestic heavy industry during this period. The frequent use of energy led to a rapid growth in carbon emissions, resulting in a significant increase in the carbon emissions intensity of China.

4.1.2. Decomposition Results and Analyses of Carbon Emission Intensity by Three Industries

Table 2 shows the multiplication decomposition results of LMDI-I classified by three industries. Among them, columns 2–5 are listed as factor decomposition results. The 2nd and 3rd columns are in logarithmic form, and the 4th and 5th columns are in exponential form. Column 6 is the change in carbon emissions in logarithmic form. From the decomposition results, it can be seen that they are similar to the results of the six sector classifications. The effect of technological progress is still the main driving factor to reduce carbon emission intensity, which reduces the overall carbon emission intensity significantly. However, the impact of industrial structure change on the carbon emission intensity change fluctuates, showing different driving effects in different years, but its impact on carbon emission intensity is not large. This is related to the lack of obvious adjustment of the industrial structure in China in the early stage. After 2010, China accelerated the optimization and adjustment of industrial structure. The decomposition results showed that the effect of industrial structure changes after 2010 continued to suppress the growth of carbon emission intensity, and it also showed industrial structure adjustment of China has achieved remarkable results in recent years.

4.2. Co-Integration Tests and Analyses

Before the co-integration test, this paper used the ADF method to test the stability of variables, judge whether each variable has a unit root, and prevent false regression. See

Table 3 for inspection results.

and

are the decomposition result obtained according to the six-sector classification.

and

are the decomposition results obtained according to the three-industry classifications.

It can be seen from

Table 1 that the ADF statistics of the sequences

,

,

,

,

,

, and

are all less than 10% critical values. Therefore, the original assumption is accepted that the variables have unit roots, and the sequence is unstable. After the first-order difference of variables, other than the ADF statistics of

are less than 10% critical value, the ADF statistics of other variables are less than 5% critical value, which shows the sequence is stable after the first-order difference. Therefore, after taking logarithms, all the variables are first-order single integer sequence I (1), and a co-integration test can be carried out.

Table 4 shows the test results by using the Johansen co-integration test. From

Table 4, the significance level of 5% means there is no less than one co-integration equation among the effects of technological progress and energy price, both per capita GDP and regarding the proportion of coal consumption. There is only one co-integration equation among the effects of economic structure change and energy price, per capital GDP as well as the proportion of coal consumption. Therefore, regardless of whether under department or industry classification, there is no less than one co-integration equation among the effects of technological progress and energy price, both for per capita GDP and regarding the proportion of coal consumption. There is a co-integration relationship among the effects of changes in economic structure and energy prices, both per capital GDP and regarding the proportion of coal consumption, indicating that there is a long-term stable relationship among the variables.

5. Estimated Results and Analyses of the Model

In order to eliminate the influence of heteroscedasticity, the regression model was estimated by the weighted least squares method with the reciprocal absolute value of the residuals as the weight. The estimation results of models (3) and (4) are shown in

Table 5. Model (I) was the regression model of each variable on the total carbon emission intensity.

In model (I), the energy price, economic growth, energy consumption structure, and the quadratic coefficient of energy price were −0.168, −0.096, 0.790, and 0.051, respectively, which passed the t-test at the significance level of 1%, so the coefficient was significant. The model as a whole passed the F test at the level of 1%, and R2 was close to 1, indicating that the fitting degree of the model was good. The DW value was 0.953, meaning no first-order auto-correlation among variables. The R2 of models (II)–(V) were all greater than 0.99, and close to 1. The F test also rejected the original hypothesis at the level of 1%, indicating that the coefficients of regression variables are not all equal to 0. Except for a few variables whose coefficients were significant at the 10% level, the coefficients of other variables were significant at the 1% level, and the fitting degree of the model was good. The DW value was close to 2, and it is considered that there is no first-order auto-correlation in the variables of model (II)–(V). Whether the decomposition models (II) and (III) obtained by department classification or the decomposition models (IV) and (V) obtained by three-industry classifications, the estimation coefficients show common characteristics. The results of the error analysis performed indicated that the relationship curve between measuring results and actual results is y = 0.5314x + 94.421, R2 = 0.9905. The empirical results showed a significant correlation among energy prices and carbon emission intensity and the decomposition factors of carbon emission intensity. The energy price coefficient in model (I) was −0.168, which had a significant negative correlation with carbon emission intensity, indicating that increasing energy prices can reduced carbon emission intensity. There was a positive U-shaped relationship, as well as a critical value among energy prices and carbon emission intensity. When the energy price is less than the critical value, increasing the energy price can reduce the carbon emission intensity. When the energy price is greater than the critical value, increasing the energy price cannot reduce the carbon emission intensity. The negative correlation between energy price and carbon emission intensity showed that the current energy price was on the left side of the positive U-shape, so the policy of reducing carbon emission intensity and increasing energy price was still effective. Models (II) and (IV) showed that there was a significant negative correlation among energy prices and the share of the effect of technological progress, while the estimation results of models (III) and (V) represented a significant positive correlation among energy prices and the effect of changes in economic structure. Since the China’s reform and opening up, the increase in energy prices in China has prompted enterprises to find new technologies to transform existing production processes, improve energy efficiency, reduce energy use, or seek other capital to replace the vacancy of energy demand, thus finally reducing carbon emissions. The increase in energy prices has not reduced the intensity of carbon emissions through the adjustment of economic structure, and further in-depth optimization of economic structure is required. The sensitivity analysis indicates energy price, economic growth, and energy consumption are the most influential parameters, which is in consist with the conclusion that these parameters are the three main factors affecting carbon emission intensity.

There is also a significant correlation among economic growth, energy consumption structure, plus carbon emission intensity and its decomposition factors. The per capital GDP coefficients in models (I)–(V) were negative, which indicated a negative correlation among economic growth as well as carbon emission intensity and its decomposition factors. The rapid economic growth of China reduced carbon emission intensity through technological progress and economic structure adjustment. On one hand, economic growth causes excess capital to be used to improve the original production mode, promote technological innovation, and reduce carbon emission intensity. On the other hand, economic growth leads to the further adjustment of resources and optimization of economic structure. Industries with economic benefits in line with low-carbon economy will receive more resources and development opportunities, so as to reduce the intensity of carbon emissions, similar to Canada and Germany [

23,

24]. The proportion coefficient of coal consumption in model (I) was 0.790, indicating that the proportion of coal consumption is positively correlated with carbon emission intensity. The proportion coefficients of coal consumption in models (II)–(V) were 0.557, 0.124, 0.612, and 0.228, respectively, showing a positive correlation among the proportion of coal consumption and the effects of technological progress and changes in economic structure. This shows that the decline in the proportion of coal consumption reduces the intensity of carbon emissions through the effects of technological progress and changes in economic structure. The reduction in the proportion of coal consumption will promote energy innovation in high energy consuming industries and increase investment in new energy. At the same time, the change of energy consumption structure will also promote the optimization and adjustment of economic structure as well as reduce carbon emission intensity.

6. Conclusions and Policy Recommendations

The nationwide reduction in CO2 emissions is an important task for China today, and China has set a social development goal of attaining “peak carbon and carbon neutrality” by 2021. Coal is the main source of energy in China, and the efficient conversion and clean utilization of coal is an important development direction for China. By using the LMDI model to decompose and analyze the factors influencing energy consumption, combined with the statistics of China’s economy and carbon emissions from 1981 to 2019, it is found that the overall carbon emission intensity is on a decreasing trend. The accuracy of the model is relatively high, so the model can be used in the long term to analyze and statistically predict the trend of energy prices and carbon emission intensity. Using the data from 1981 to 2019 and based on the LMDI multiplication model, this paper analyzes the effects of technological progress and economic structural change on carbon emission intensity, and also establishes an econometric model to analyze the changes in China’s energy prices, coal consumption proportion, and economic growth on carbon emission intensity. The main conclusions are as follows:

1. From 1981 to 2019, the carbon emission intensity of seven industry sectors including S1, S2, S3, S4, S5, S6, and S7 showed a downward trend. The carbon emission intensity of the primary, secondary, and tertiary industries also showed a downward trend. Among the decomposition results by sector, the effect of technological progress had the greatest impact on carbon emission intensity, significantly reducing the total carbon emission intensity. The impact of the sectoral structure effect on carbon emission intensity showed a fluctuating trend, with different impacts in different years. As a whole, the decline in carbon emission intensity has been suppressed and increasingly prominent.

2. Energy price, economic growth, and energy consumption structure are the three main factors affecting carbon emission intensity. Since 1980, the impact of energy prices on carbon emission intensity, technological progress, and economic structure has changed. Energy prices mainly affect carbon emission intensity through the effect of technological progress. Therefore, energy price increases have not reduced carbon emissions by affecting economic structure changes. Intensity with higher energy prices cannot significantly optimize the economic structure. Economic growth has significantly reduced carbon emission intensity through the effects of technological progress and economic structure changes. The proportion of coal consumption is positively correlated with the effect of technological progress and the effect of changes in economic structure, and a decrease in the proportion of coal consumption can significantly reduce the intensity of carbon emissions. It should be noted that there are some limitations regarding the model. Prior to 2019, the changes in China’s coal energy prices were basically in line with the changes in international market prices, but after 2019, as China received the impact of the epidemic and international energy prices, some macro-regulatory measures for energy supply protection were taken, especially the domestic price limit mechanism to protect coal for power generation, which imposed mandatory interventions on China’s internal energy prices. The maximum difference between coal supply prices and the maximum gap between coal supply prices and international market prices reaches about 300% (in 2021), and the relevant supply protection policies will probably further cover more industry sectors such as steel and coal chemical industry. Under this mechanism, the accuracy of the forecast and analysis results of the LMDI model as well as the related parameters will be greatly affected. Therefore, the economic data selected in this paper take 2019 as a nodal point, and the relevant analysis results are of a certain reliability and practical value in the developed year interval.

The following recommendations can be made based on the above conclusions:

1. Properly raising energy prices can help reduce carbon intensity. China’s carbon emission intensity is still declining with the increase in energy prices, leaving a certain space for the adjustment of energy price policies, and carbon emission intensity can be reduced by increasing energy prices. Therefore, it is necessary to further promote the reform of the energy market and the marketization of coal prices, establish an integrated, institutionalized, and market-oriented energy price mechanism, give full play to the role of prices in the allocation of market resources, and further expand the adjustment channels of energy prices for carbon emission intensity.

2. Increasing investment in technology is an effective way to reduce carbon emission intensity in the long run. Vigorously developing scientific and technological innovation and improving coal utilization efficiency can effectively reduce China’s demand for coal resources and thus reduce carbon emissions. Firstly, it is necessary to increase capital investment in coal-resources-related technologies, improve the utilization efficiency of coal in mining and processing, promote the clean utilization of coal, and at the same time promote the transformation of coal mining and dressing industry from resource intensive to technology intensive. Secondly, we must increase innovation support for the power industry. Most of China’s coal consumption is used for power generation. The supply capacity and stability of clean power should be improved, and the replacement of traditional coal power by clean energy power generation should be realized as soon as possible. Finally, it is necessary to improve the development and introduction of new energy technologies, and induce foreign investment to favor domestic industries with low energy consumption and high added value such as the new energy automobile industry, so as to ensure the high-quality development of the domestic economic structure.

3. Fossil energy such as coal consuming should be reduced, and new energy should be utilized. Since the reform and opening up, the rapid expansion of China’s economic scale mainly depends on coal consumption. Excessive proportion of coal consumption is not conducive to environmental protection. On the other hand, extensive coal consumption will also reduce China’s energy storage, which will lead to energy shortages in the long run, which in turn will inhibit economic growth. Moreover, we should continue to promote the optimization of the energy structure. In terms of coal, the output of clean coal and coal-bed methane should be increased, and the utilization of wind power, hydro-power, and nuclear power should also be increased in order to reduce the proportion of coal consumption in power production. In other traditional energy sources, the exploitation and use of high calorific value energy such as oil and natural gas should be increased and direct investment in overseas oil and natural gas strengthened to ensure the supply of oil and natural gas. As for non-fossil energy, efforts should be made to develop alternative and renewable energy vigorously as well as increase the proportion of non-fossil energy in the energy structure of China.