1. Introduction

In the conceptual framework of sustainability, the United Nations (UN) launched the so-called seventeen Sustainable Development Goals (SDGs) which projected, in 2015, a horizon until 2030 in order to urge the member states to take actions addressed to reduce poverty, the protection of the planet, and the prosperity of people around the world [

1,

2].

Although certain advances in the fulfillment of those goals (see

Figure 1) have been evidenced, during the first decade, there is still a long way to go, as an urgent need to increase the speed of action to reach this milestone in 2030 is required.

International finance has coined the term “sustainable finance” which, according to the Spanish stock market supervisory, the National Securities Market Commission [

3], aims the economic growth of nations toward more human and balanced development, by satisfying current needs and envisioning a better future for new generations. Therefore, sustainable finance, in addition to strictly financial criteria such as profitability, risk, and liquidity, is mainly based on satisfying environmental, social, and governance needs.

In the same sense, the International Finance Corporation (IFC) [

4] defines green finance as the action of financing investments that offer environmental benefits. This initiative is mainly aimed at financing renewable energy projects which contribute to climate change, the latter being one of the many components that are known as “green philosophy” or “inclusive sustainability” which, in current times, contribute to environmental changes [

5].

In contrast with the aforementioned reference, we can highlight another study on green finance, developed by Yoshino et al. [

6], which analyzes the reduction of global investments in renewable energy and energy efficiency, becoming a threat to the much-desired expansion of investments in green finance which contribute to guaranteeing energy security, allowing compliance with the objectives of climate change and greenhouse gas emissions. These scholars [

6] explain that financial institutions generally pay more attention to fossil fuel projects than green projects, mainly due to risks that prevail among green technologies, in addition to providing a relatively lower rate of return. In summary, the rise of green finance and climate finance are directly and indirectly related to some sustainable developments.

The capital market world, in its eagerness to innovate, has tried to harmonize financial markets and sustainable economic projects. This is how the so-called green bonds were born. Those bonds arose from the need of a group of Swedish pension funds whose desire was to invest in projects aimed at caring for and conserving the climate, thus deciding to contact the World Bank in 2007. Thus, after one year, they issue the first green bond, thus establishing a bridge between climate projects and investor financing [

7].

Green bonds, also called climate bonds or sustainable bonds, are supposed the beginning of the paradigm shift, by including in the financial market the investment in liquid fixed income assets with, moreover, the characteristic of attracting investors with a social awareness, who wish to bet on green projects. Consequently, according to the Climate Bonds Initiative [

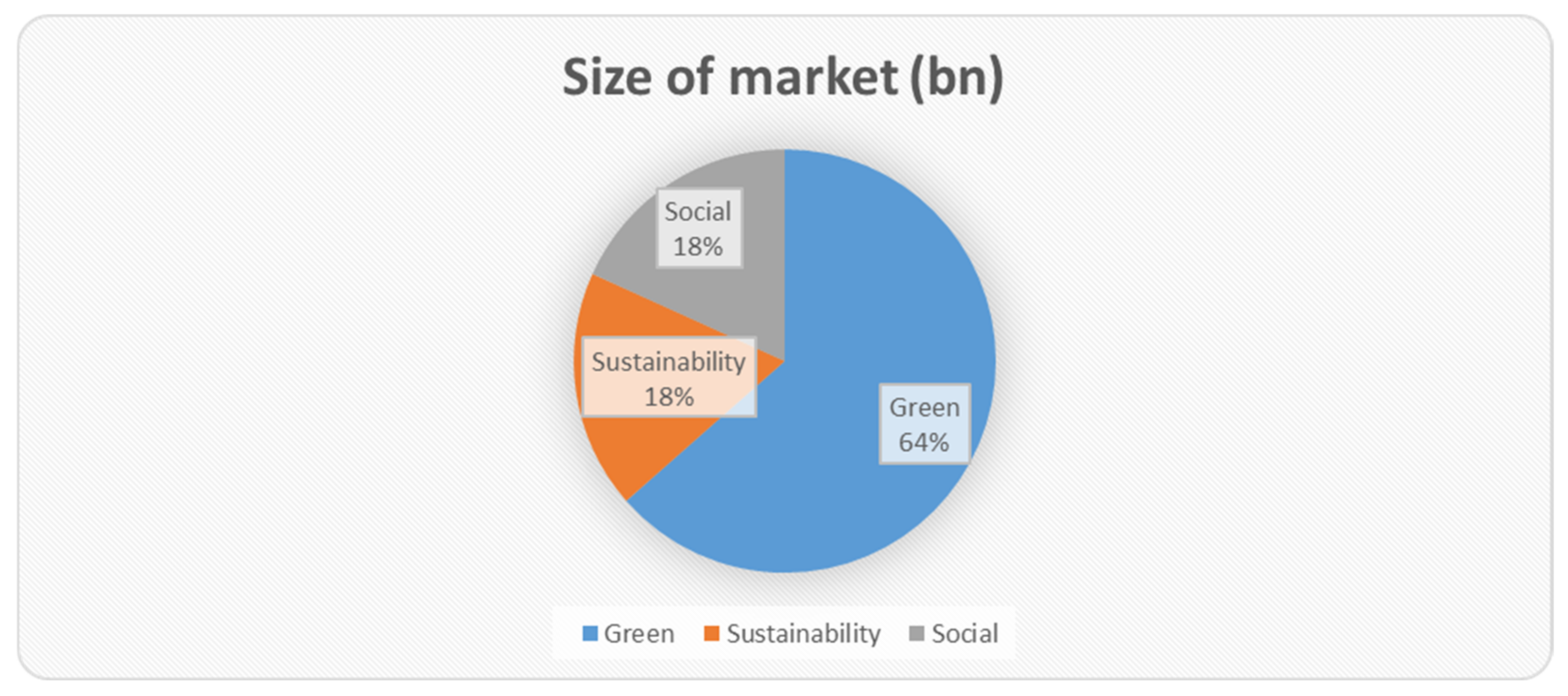

8], whose reports repeatedly show the figures of the behavior of these bonds around the world, these bonds have been classified into three categories: green, social, and sustainability, denoted by the acronym GSS in English.

However, this paper focuses on Latin American and the Caribbean (hereinafter, LAC) countries and it is intended to analyze the participation of the fourteen countries which, until 2020 framed in the program implemented by the UN and with the objectives of sustainability, have decided to participate in the capital market with the issuance of GSS bonds. In this context, the evolution of issuances since their inception and the impact on growth in their economies will be reviewed, as well as the limitations that this region exhibits and the possible differences between sustainable and unsustainable bonds.

This paper is structured as follows: after the Introduction,

Section 2 presents a review of the presence of GSS bonds worldwide and in the LAC region, by conducting, in

Section 3, the literature review of the research on the relation between the issuances of GSS bonds and the economic growth of issuers. On the other hand,

Section 4 sets out the methodology, the data, and the variables which are necessary to analyze this topic from an empirical point of view. As a consequence,

Section 5 presents the results of the multiple linear regression applied in the former section. Finally, the discussion and conclusions are presented in

Section 6 with the proposal of a future research agenda.

6. Discussion and Conclusions

The objective of this paper has been to analyze the influence of the issuances of GSS bonds on the economic growth of countries belonging to the so-called LAC region. To do this, we have used two variables: the ratio “Green Bond Issuance/Total Bond Issuance” and the “Sovereign Green Issuance: Total Planned”. Moreover, in order to enrich the statistical treatment of data (through the techniques of multiple linear regression), we have considered two additional variables related to the status of the involved capital markets (the ratio “Private Credit/GDP” and the “Market Capitalization”) and other three variables concerning the governance of these countries (“Political Risk Rating”, “Regulatory Quality”, and “Rule of Law Index”).

The results of the regression exhibit that three variables (one of each group of the chosen variables) significantly affect the economic growth of the LAC region (measured by the percent variation of the GDP). The first variable (Sovereign Green Issuance: Total Planned) is positively correlated with the explained variable which is logical taking into account that the issuance of GSS bonds shows a greater level of maturity of the corresponding economies. As expected, the second variable (Private Credit/GDP) also is positively correlated with economic growth since it is well known that private credits have a multiplier effect on GDP evolution. Finally, the third significant variable (Rule of Law Index) is negatively correlated with the economic growth as the fulfillment of legal rules increases the equity against the economic efficiency.

Data have been extracted from the Sustainable Banking Network (SBN) and the 2019 report of the International Finance Corporation (IFC) which provides the determinants of the potential growth of GSS bond markets in all countries (specifically in the LAC region) and their corresponding scores. Moreover, we have chosen the year 2019 in order to analyze the economic growth in the period 2018–2019, because the GDP in 2020 was completely anomalous due to the COVID-19 pandemic.

Analogously, Chuch et al. [

49] studied the green bond market in Vietnam which is improving risk-return profiles in order to expand GSS bond policies in emerging nations. Additionally, Tolliver et al. [

30] and Ning et al. [

50] provided a richer econometric analysis of the relationship between sustainable green financing, energy efficiency investment, and economic growth. The presence of an efficient monetary policy and a controlled inflation rate is necessary for sustainable expansion of the GSS market in LAC and LAC’s political stability is the most important political factor. Societal concern for the environment is not an important factor compared with financial and infrastructural criteria to expand the green bond market in LAC. Regarding policy, improving financial issues related to the green bond market is recommended.

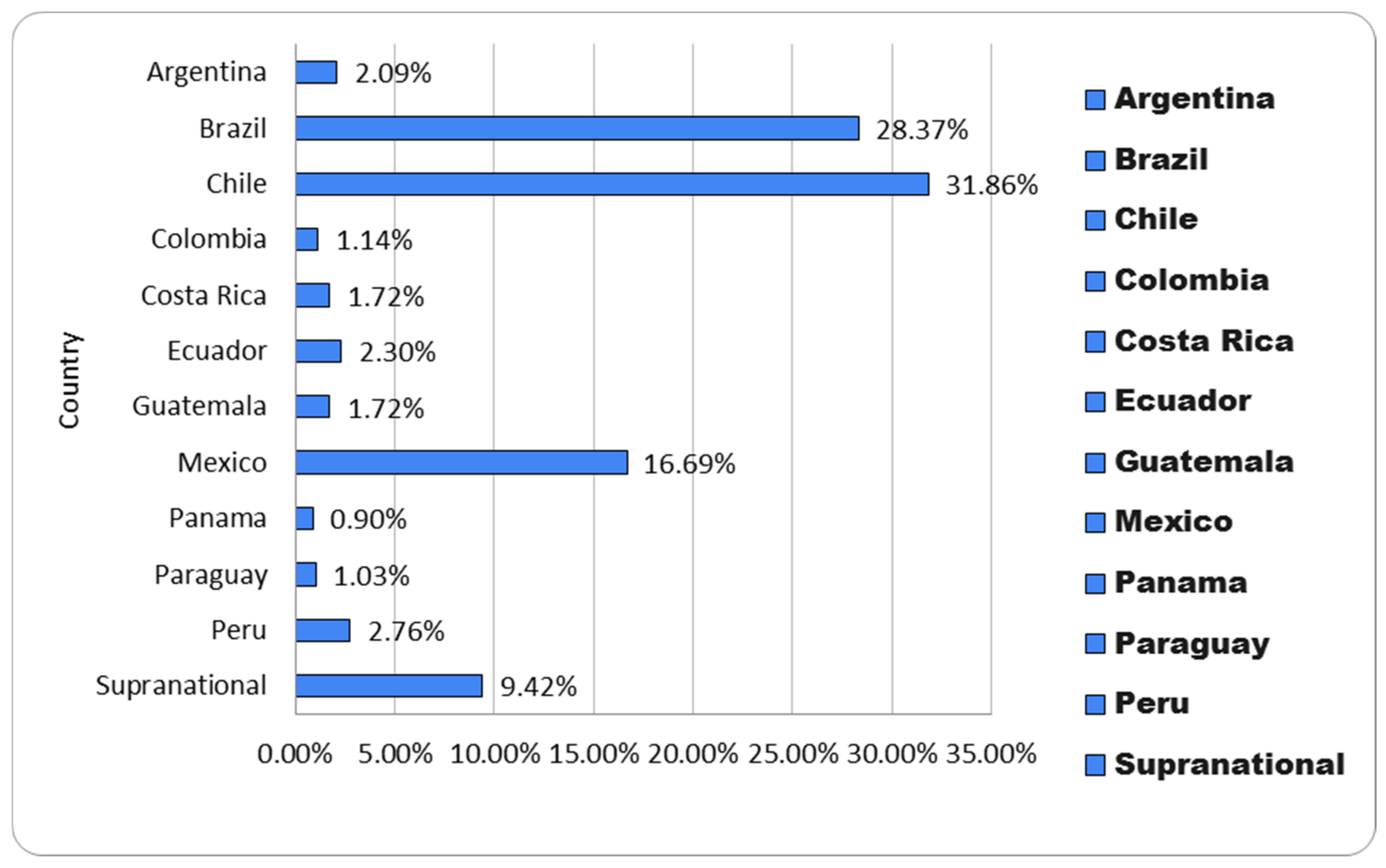

Some scholars have analyzed, until 2020, the factors which determine financing with green bonds in the LAC region and have determined that there is a correspondence between the countries with the highest issuances and the main capital markets of the region. This suggests that the necessary leverage from green bond markets is robust and moderately present in debt markets. However, there is a highly concentrated market and still incipient in the LAC region since almost 80% of accumulated issuances are concentrated in three countries: Brazil, Chile, and Mexico [

13,

51].

Consequently, in the analysis of the green infrastructure investment opportunities, in 2019 Brazil has estimated USD 1.3 tn green investment potential for energy, transport, buildings, waste, and industrial energy efficiency [

52]. This matches our analysis that the economy grows in the countries of the LAC region because the green infrastructure has positive environmental and economic benefits. This can create prosperity by increasing competitiveness, productivity, and employment opportunities; by extending the reach, reliability, and efficiency of the national electricity grid, without creating air pollution; by broadening the economic base; by creating new markets, and by providing inclusion and connectivity across Brazil’s vast landmass [

53].

On the other hand, economic growth is mainly driven by savings and investments but is also determined by population growth, change in the availability of natural resources, and technological change. The study of several countries in the world, including Brazil, shows that there is an enhanced GDP growth in every region but most pronounced in the European Union, followed by India, Japan, and China. Interestingly, the impact is less in the United States and Russia with a GDP only reaching about 1% above BAU (Business as Usual) in 2030, whereas European Union, India, and China raise their GDP by about 2–3% [

50,

54]. On the contrary, Brazil has been included in our study where we have shown that the economic growth of the countries (measured by the variation of the GDP) in the LAC region is related to the volume of issuances of green bonds, based on the Sustainable Banking Network (SBN).

The potential issuance of green bonds varies among emerging market countries and, although each economy has specific factors leading to the development of a green bond market, the factors that indicate the potential of its growth are: (a) promoting the issuance of green bonds, (b) establishing sustainable financing policies and frameworks, (c) capital market development, and (d) political stability and governance.

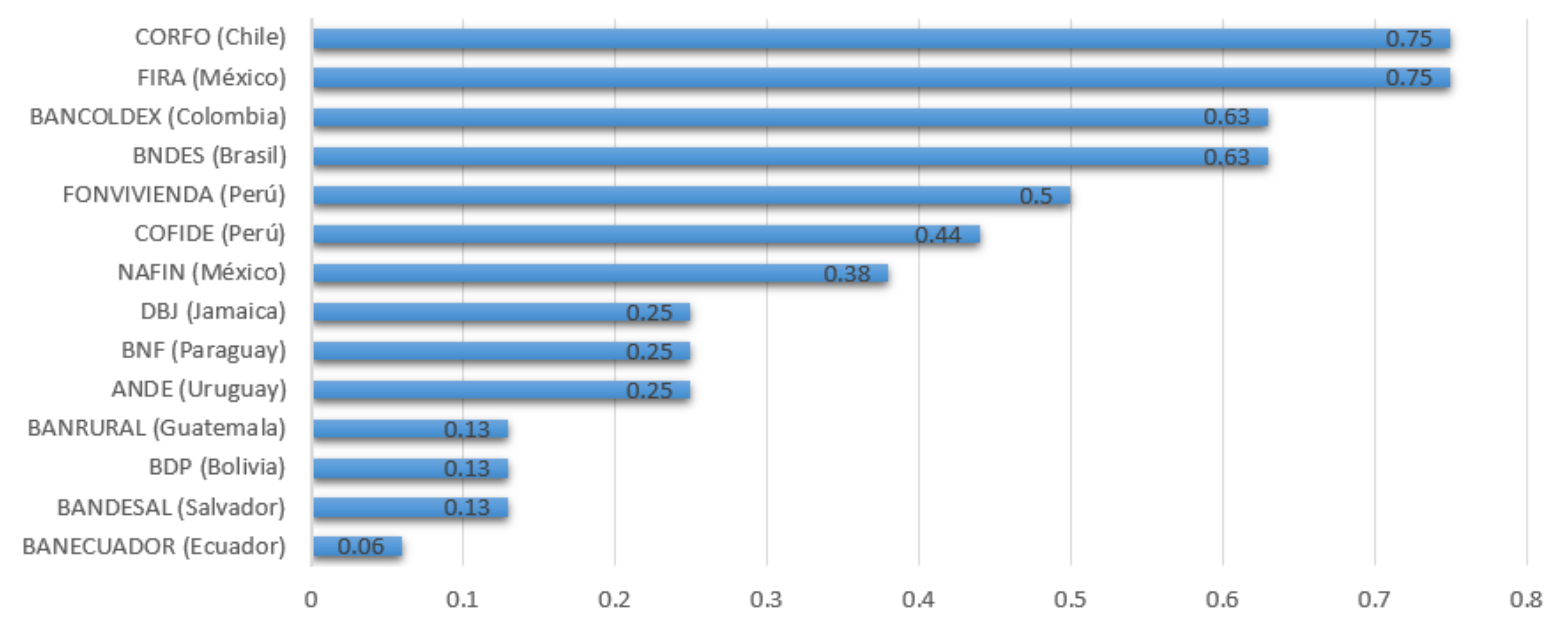

It has been shown that Chile, Brazil, and Mexico are the greatest green and sustainability bond market presences. Additionally, Peru, Argentina, Costa Rica, Colombia, Uruguay, Ecuador, Panama, and Paraguay have lesser extent entered this market. Likewise, development banks have had greater participation in the issuance of GSS bonds in Brazil, Colombia, and México.

It can be concluded that the main drawbacks to the issuance of GSS bonds are the issuance costs, the absence of a diversified portfolio of investment projects, and their low profitability. However, due to the current situation of the COVID-19 pandemic, a development opportunity for the GSS bond market can be presumed. All of this is related to the need for economic recovery which requires large investments linked to the conservation of the environment and greater attention and coordination among national development banks. Another aspect is that a good number of empirical and theoretical studies document that investors voluntarily exchange wealth for social benefits and, therefore, are willing to pay a premium, that is, accept lower yields for bonds related to the conservation of the environment.

The international green bond market has grown exponentially by 2020 and, although the largest number of issues still comes from developed markets, LAC markets have started to take off. This type of issuance, due to its maturity and main features of the structured assets supporting them, makes an attractive operation for portfolio diversification. Furthermore, it is observed that this type of bond does not underperform other structures because it shows similar performance to the rest of the market.

The good news for the Latin American market in 2021 is that issues continue increasing as Colombia planned to launch domestic green bonds at the end of September for at least USD 500,000 million. Likewise, the Brazilian market reaches USD 9 billion in green bonds meaning an advance in its sustainable debt. In addition, México placed the second sustainable bond for 1480 million dollars over 15 years’ maturity at a rate of 2.25% for July 2021.

The growth of sustainable finance in the LAC region shows a top trend. Since the first bond in 2014 and in less than two years, the region’s green bond market has more than quadrupled from USD 15 bn in 2019 to USD 48.60 bn at the end of June 2021. This growth has been driven by the entrance of new issuers from new countries, now amounting to 14, and in particular the continued growth of the sovereign issuance from Chile.

According to the regression analysis carried out, we can determine that the capital market allows to achieve better possibilities in the economic development of nations and that sustainability projects should be taken with greater emphasis in the LAC region accompanied by a dynamic policy that allows awareness to the rulers, society in general and to motivate foreign investors to bet on these idle fund placement alternatives.

A clear limitation of this analysis has been the scarcity of data referred to bond issuances as all GSS bond markets in the LAC region are emerging and so it is necessary to wait for several years to consolidate issuances and then to have longer time series. Finally, future research is desirable and feasible. This work provides the basis to further explore the possible motivations for raising funds available from companies or individuals to invest in sustainability projects in a particular country, in a sample of countries selected for certain characteristics or for all the countries of the region that have or have not issued this type of bonds.