1. Introduction

Microenterprises are considered highly relevant, representing 90% of all companies worldwide and generating 70% of jobs, according to recent figures from the United Nations, and they are constantly growing [

1,

2,

3,

4]. In this context, the study of microenterprises on a global scale is important, as they are part of the economy’s engine and represent monetary growth. Nine out of ten companies belong to this group and autonomously generate two out of three jobs in enterprises, as long as they meet specific characteristics such as annual work units, annual turnover, or annual balance sheets [

5,

6,

7]. However, although microenterprises constitute a large portion of taxpayers, tax collection generated by this group is low (0.1 to 3.9%). Moreover, these microenterprises constantly face economic risks, and there is informality [

8,

9,

10,

11].

In Latin America, tax systems are implemented by analyzing the type of economic activity and the size of the company. Thus, there are four categories of taxpayers: micro, small, medium, and large; the first three categories are considered taxpayers of low fiscal significance, according to [

12,

13]. However, the importance of small- and medium-sized enterprises is not solely based on the collection of taxes but also on the generation of employment, as they represent 99.5% of businesses in the region. Of these companies, 9 out of 10 are classified as microenterprises [

3,

14].

Among the tax systems affecting microenterprises in South American countries, Chile and Peru have specific regimes for economic activity [

15]; Argentina has a simplified regime for small taxpayers, also known as “Fixed Fee”, which replaces three taxes (value-added tax, income tax, and presumed minimum income tax); Colombia has a simplified value-added tax regime, which is voluntary and has formal obligations, such as the issuance of invoices; and finally, Ecuador, which, in 2021, used the general regime (RG) for certain economic activities, the simplified tax regime, and the tax regime for microenterprises (RIM)—the latter was recently added [

12].

Tax collection in Ecuador is considered to impose a tax burden of 19.90% concerning the gross domestic product—a value that is below the average in Latin American countries and the Caribbean, according to the Economic Commission for Latin America and the Caribbean [

16]. Owing to the low tax collection from microentrepreneurs, the tax administration in Ecuador has employed several regimes such as the simplified tax regime (RISE) that replaced the payment of value-added tax and income tax with a monthly or annual fee depending on the economic activity and its category. To belong to this group, total income must not exceed USD 60,000.00, and the company can only have a maximum of 10 employees. This regime is focused on small businesses, has voluntary registration, and avoids making declarations. On the other hand, the RG determines the income tax through a progressive table based on a taxable base (income minus costs and expenses) for natural people and for societies with 25% tax on the profit, with some special cases.

At the end of 2019, the RIM was created with particular characteristics, including the liquidation of income tax and mandatary acceptance [

17]. As a result, the Ecuadorian tax system currently has three regimes, each with peculiarities in the calculation of income tax. The most controversial is the RIM. The responsible entity must publish the registry of microentrepreneurs that belong to the RIM. At the end of 2020, the first list of taxpayers in this group was presented. The new method of calculating income tax for microentrepreneurs begins by obtaining a tax base of income and, based on this, determining 2% income tax. Therefore, by applying this new reform, the tax system aims to help balance fiscal policy with greater simplicity. The payment of income tax for microentrepreneurs under this modality can represent a high fiscal burden, which leads to tax evasion by not invoicing, since sales are the basis of the calculation. Additionally, several taxpayers have decided to eliminate their formal registration and carry out their economic activities clandestinely and informally in order to avoid paying said tax. In addition, this system does not consider losses in the fiscal year, for example, losses during the global economic crisis caused by COVID-19.

According to official numbers, the COVID-19 pandemic exceeded 260 million infected cases worldwide by the end of 2021, with the number of deaths exceeding 5 million. Although the governments took measures, negative effects occurred in all areas. Businesses around the world began to close, services were canceled, and travel was limited [

18,

19,

20,

21,

22]. Ecuador was no exception; this country suffered significant economic losses, and entrepreneurs had to adapt to survive the new working conditions [

23]. Studies carried out in other countries indicated that micro-, small-, and medium-sized companies were more affected than larger companies [

24,

25]. In [

26], the authors found that 85% of these companies could not survive more than three months of the COVID-19 pandemic. Other results found that more than 70% will see worse economic results [

27]. In some countries, taxpayers received state support, making it possible for companies to survive these difficult times, although proposals aimed at a more sustainable economy are lacking [

28,

29,

30].

This research is motivated by the COVID-19 pandemic’s negative effects on the world economy. Moreover, paying taxes significantly influences the survival of microenterprises, even more so in developing countries; thus, this type of analysis is required. Studies like this have an impact on future decisions by reporting the incidence of one or more factors in the accounting results of a vulnerable economic group. The main novelty of this paper is the analysis of an unusual case that arose in Ecuador, where microenterprises faced confinement and a new tax regime.

2. Review of Literature

Regarding works similar to this study, there were few investigations into similar conditions.

Table 1 describes some of the studies found.

The authors of [

31] empirically studied public attitudes about income tax in times of COVID. The results suggested that income is associated with the perception that taxes for the rich are inappropriately high but was not related to perceptions of the adequacy of taxes for the average and poor groups of respondents. Higher satisfaction with state policies was associated with a desire to raise taxes on the wealthy and lower taxes on low-income groups. In addition, preferences for solidarity were associated with higher overall preferred taxation and higher tax progressivity. These findings were projected as an opportunity for improvement through new mechanisms to contribute to sustainable endogenous economic development.

In another study, Ref. [

32] investigated the relationship of a favorable tax environment for small businesses with the aim of analyzing the design of simplified tax schemes for small businesses in Georgia, Ukraine, Russia, and Albania, focusing on the expectations of the microentrepreneur and the tax administration. The rapid growth of the small business segment in the countries analyzed was highlighted; they are considered to be “difficult to tax” taxpayers for the tax administration, with Serbia exemplifying a country that has a simplified regime for small businesses as well as for individual entrepreneurs. They opted for a 2% tax on gross income when businesses have 50 or fewer employees, turnover is less than 8000 average gross monthly salaries, and an average value of assets is less than 6000 gross monthly salaries. Another country that has a similar tax is Azerbaijan, calculating the tax at 2% of the gross turnover only when the turnover is less than 300 times the minimum wage. The author pointed out that the problem of tax systems is that the design is the same for legal entities and natural persons. Finally, there are complaints from small business owners about these systems because only one tax is replaced, and they must continue to deal with a large number of taxes and requirements, therefore qualifying the tax system as complicated and cumbersome.

Similarly, the study conducted by [

33] analyzed the survival of the simplified tax regime in Brazil and the longevity of Brazilian manufacturing companies, focusing on the survival of two groups: those who opted for and against this optional regime. The research was carried out on 3187 manufacturing companies using the econometric tools of propensity score comparison and survival analysis, and the breakdown by level of intensity. In the end, the study concluded that the establishments that adopted the regime showed faster growth compared to those that did not adopt it. In addition, the application of regression allowed us to identify that the establishments that adopted the regimen have a 30% lower probability of mortality than those that did not adopt it, even when the effects of size, average salary, and average duration of the labor relationship are controlled.

The authors of [

13] presented the risk allocation of the tax burden to measure the tax burden outliers. Using a time-varying nonparametric benchmark and path model, this paper measured the fiscal risk allocation of 3552 small and microenterprises in the credit insurance fund from January 2016 to August 2018. The results showed that these outliers have trends of linear drive and nonlinear drive of vibration, and there is some interaction between the two. Along the path of credit and taxation, the excess tax drive mode will change, and it is difficult to wait for the return to normal. In addition, the results provided support for the decision to reduce the tax burden and promote the growth of small and microenterprises.

In this work, the changes in the payment of income tax for 30 Ecuadorian microenterprises in times of COVID-19 are analyzed; to this end, the historical data of the payment of income tax in the last three years from 2018 to 2020 were used, with an emphasis on the last year owing to the implementation of the new payment method established by the RIM. In this context, the objectives of this work are divided into three stages: first, the collection of information from microenterprises; second, the application of instruments to organize the information; and third, the analysis of variation and economic affectation. In addition, we hypothesize that there is a significant difference between the income tax of microentrepreneurs with the RG and that with the RIM during the pandemic. The null and alternative hypotheses are the following:

Hypothesis 1 (H1). There is no difference between the income tax of microentrepreneurs in the comparison of the RG with the RIM applied in times of COVID-19.

Hypothesis 2 (H2). There is a difference between the income tax of microentrepreneurs in the comparison of the RG with the RIM applied in times of COVID-19.

3. Data and Methods

This research took a quantitative approach, which allowed the collection, processing, and construction of a financial information base with data on sales, costs, profit, and income tax for 2020, the year the economic crisis caused by the COVID-19 pandemic appeared. Because the income tax was paid during the following year, information was collected in the year 2021.

The methodology is presented in

Figure 1. The procedures were divided into three stages: collection, instrumentation, and information processing. In the first stage, the data were collected, using the official information of the microenterprises that belonged to the RIM. Then, we collected the financial data of the selected microenterprises, and in cases of not having the complete information, the data collection process was repeated. In the second stage, the designed instruments were applied; for this, a database was built by organizing the microenterprises into three groups. In the third stage, the information was analyzed, obtaining the variation in the income tax generated and the economic impact produced. Finally, a normality test was applied, and a hypothesis was verified.

3.1. Data

The list of microentrepreneurs subject to the new RIM regime was obtained from official government sources. These taxpayers were registered in the last update of the database on 1 December 2020. A convenience sample of 30 microentrepreneurs was obtained, owing to the complexity of the access to information. This group was divided into 3 groups of 10 microentrepreneurs each, classified according to an economic category. Group 1—Natural persons not required to keep accounts (

Table 2); Group 2—Natural persons required to keep accounts (

Table 3); and Group 3—Societies controlled by the Superintendence of Companies, Securities, and Insurance of Ecuador (

Table 4). Sales for the year 2020 in

Table 2,

Table 3 and

Table 4 are in United States dollars (USD). The data were obtained from the income and expense books that each taxpayer maintained in compliance with the tax administration requirements. From here on, the acronyms G1, G2, and G3 represent the microenterprises of Group 1, Group 2, and Group 3, respectively. For example, G1.01 is Microenterprise 1 of Group 1.

3.2. Instruments

The information collected was organized and structured using two instruments. The first instrument is presented in

Table 5; it was a record card of the financial data of the microenterprises in the year 2020. The gross income, costs, expenses, and other deductions were recorded until the tax base and the income tax were obtained with the RIM. A table was completed for each group of microentrepreneurs. As part of the analysis of this information, the income tax was also calculated with the RG; in this way, an estimate of the income tax of microenterprises for the previous regime was known.

The second instrument is presented in

Table 6; it was a record card of the income tax paid by the microenterprises during three periods: in the years 2018 and 2019, when they were under the RG, and in 2020, when the new RIM regime was imposed. This information allowed determining the relative and absolute variation of both schemes with respect to the total value paid for the last three years.

The economic impact of microenterprises was also determined; for this, the economic result of the accounting period 2020 was obtained using the profit or economic loss produced in this period and the income tax paid.

3.3. Hypotheses Testing

The hypotheses test began with a normality test; owing to the number of data, the Shapiro–Wilk method was used as designed for small samples (≤30). A confidence level of α = 0.05 was established. The criteria for determining normality were as follows:

If the p-value is ≥α, it is accepted that the data come from a normal distribution.

If the p-value is <α, it is accepted that the data do NOT come from a normal distribution.

Once the normality of the data was determined, a hypothesis verification technique was applied, either normal distribution or Student’s T, as appropriate. In any case, the rejection zone of the distribution curve was determined for the acceptance or rejection of the null hypothesis H1 and consequently the rejection or acceptance of the alternative hypothesis H2.

To determine the statistical indices of the normality test and the verification of the hypotheses, the SPSS program was used because this software automates all the statistical calculations required.

5. Discussion

This case study analyzed the income tax during the COVID-19 pandemic for microentrepreneurs in Ecuador, a complex case because this tax was affected by two factors, the economic crisis and the regime change, a unique situation. For this, data from primary sources—direct economic figures from the microenterprises—were used. The vast majority of microenterprises analyzed showed a deficit in their tax returns because they were negatively affected by the COVID-19 pandemic, and few microenterprises made profits, consistent with what happened around the world [

18,

34]. On the other hand, the new regime, which was applied for the first time during the pandemic, determined the income tax based on the sales made without considering the expenses. This was unfair to companies that made minimal profits on the sale of their products and required high investment capital. Although this analysis was carried out in Ecuador, the negative effects of the COVID-19 pandemic crisis were witnessed throughout the world, closing companies and producing unemployment [

35,

36]. This particularity generated worse results in this South American country.

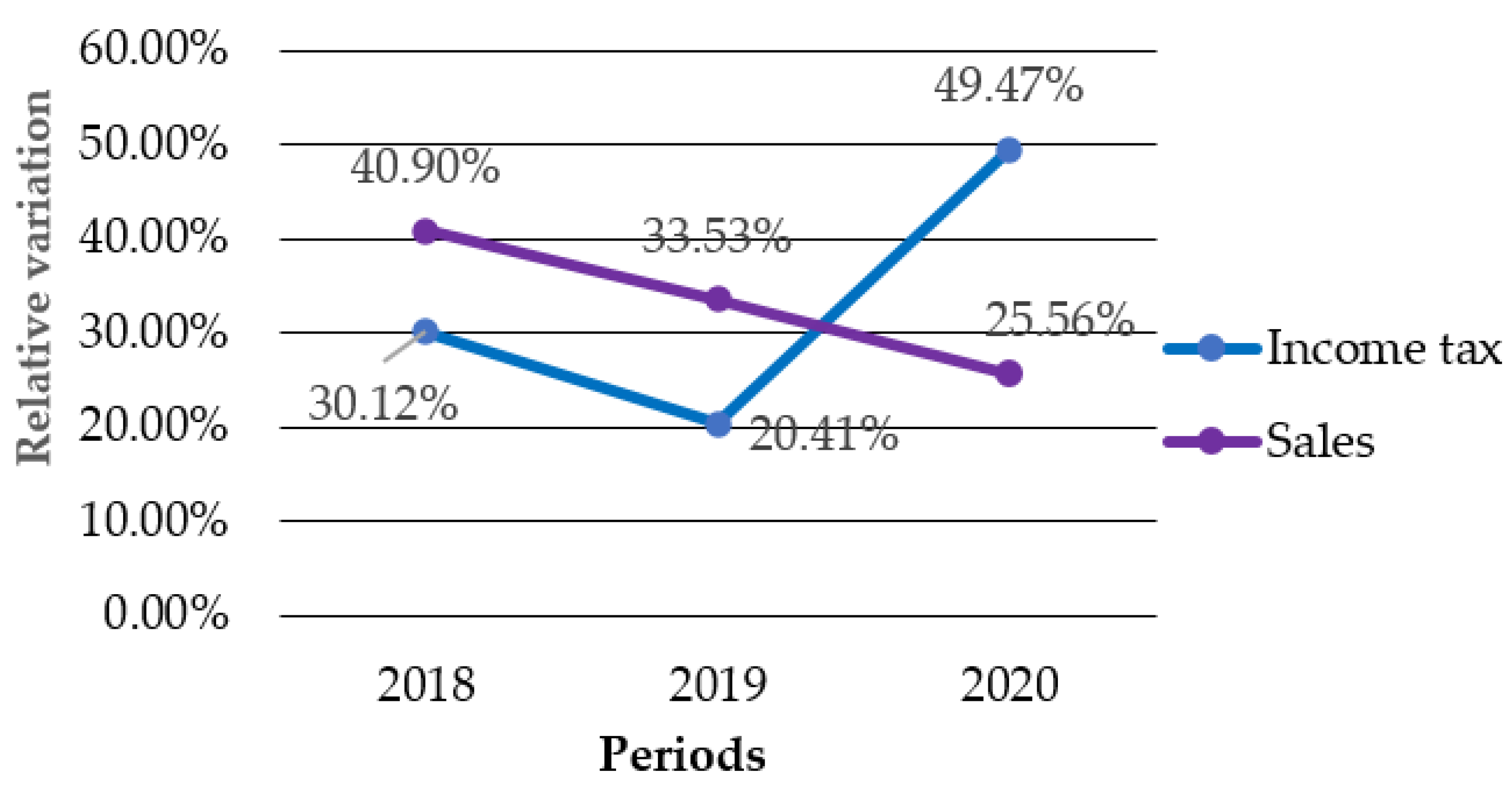

The income tax is paid throughout the world, and it must be fair to improve the working conditions of the owners, especially in times of COVID-19 [

37]. The results of our research showed an increase in this tax when sales decreased in relation to previous years. There is also no microenterprise classification for the payment of income tax under the RIM. As a result, there is a tax inequity that affects owners unequally, generating greater discontent [

38].

Regarding the economic performance of the microenterprises studied in the year 2020, 13 of the 30 microenterprises had economic losses, which implied that their fiscal year ended in debt to banking entities or through agreements with the government when paying their income tax during 2021. The microenterprises also did not receive government support to cover losses or higher taxes during COVID-19. The pandemic continues to affect microentrepreneurs, and the future of these microenterprises is currently doubtful [

39]. Faced with these difficulties, other governments made the decision to support companies to save jobs [

28,

29,

30], but this did not happen for microentrepreneurs in Ecuador. On the contrary, in our results, the damage caused by this regime is evident. Income tax continues to be the main means of collecting taxes, and governments need to cover their expenses, but it is necessary to design more sustainable systems oriented to collective well-being [

13,

31].

The hypothesis test supported the premise that the regime imposed for the year 2020 during COVID-19 was significantly different from the regime applied before the pandemic. Studies have reported a reduction in tax collection as a result of this crisis [

28,

40], but Ecuador continued to collect similar or higher amounts of taxes from microentrepreneurs during COVID-19. The conditions of our study are unique owing to the effect of multiple combined factors: on the one hand, the COVID-19 pandemic that reduced sales, and on the other, the implementation of a simplified tax system that determines the tax from 2% of the gross income. As part of our findings, a decrease in sales was verified in all the microenterprises analyzed, but these same companies had a higher income tax payment compared to the years before the pandemic and before the change of regime. Related research is scarce and limited because of the particularities of this study.

In Ecuador, around one million microenterprises were registered in the year 2020. The objective of this work was not to generalize the results to the entire sector. Although companies with different economic activities and different types of microenterprises were chosen, the number of microentrepreneurs was very limited. This number could not be increased because most microenterprises refused to provide these data, and the tax administration was not authorized to provide this information.

6. Conclusions

The COVID-19 pandemic has had an economic impact around the world. Microenterprises have experienced difficulties in different areas, but Ecuador faced a tax that was not proportional to the profits received. This case study showed several problems in the income tax paid in the first year of the pandemic: decreased sales, increased tax payments, and economic losses. In short, the RIM was not fair for microenterprises in Ecuador, especially for those that had a minimum profit margin on their products or services because they were taxed on the total value of sales. In addition, the pandemic produced considerable economic losses for some microenterprises, yet these paid equal or higher amounts of income tax, compared to previous years.

In practice, this work reported the impact on these microenterprises, showing negative values in some economic results amid the global economic crisis. As a theoretical contribution, we suggested that the lack of equitable regimes supporting the development of microenterprises is indisputable; thus, studies of the parameters to be considered in the liquidation of income tax are required, both in permanent taxes and in temporary taxes, to prevent future crises. In the sociological area, the importance of microenterprises to the microeconomics of a country is indisputable, especially in underdeveloped and developing countries that depend on the jobs generated by this economic sector. This work establishes a precedent for other developing countries that depend largely on microentrepreneurs, to design progressive and equitable regimes for all economic activities to achieve sustainable tax systems.

As a limitation of this study, it was not possible to increase the amount of data by adding more microenterprises because access to their financial information is always limited by the disposition of the owners, and the government is not authorized to provide these economic details. In future works, these microenterprises can be followed up to identify the long-term effects. In addition, more studies are required on the economics of small and microenterprises as affected by the COVID-19 pandemic.