How Strategic Interaction of Innovation Policies between China’s Regional Governments Affects Wind Energy Innovation

Abstract

:1. Introduction

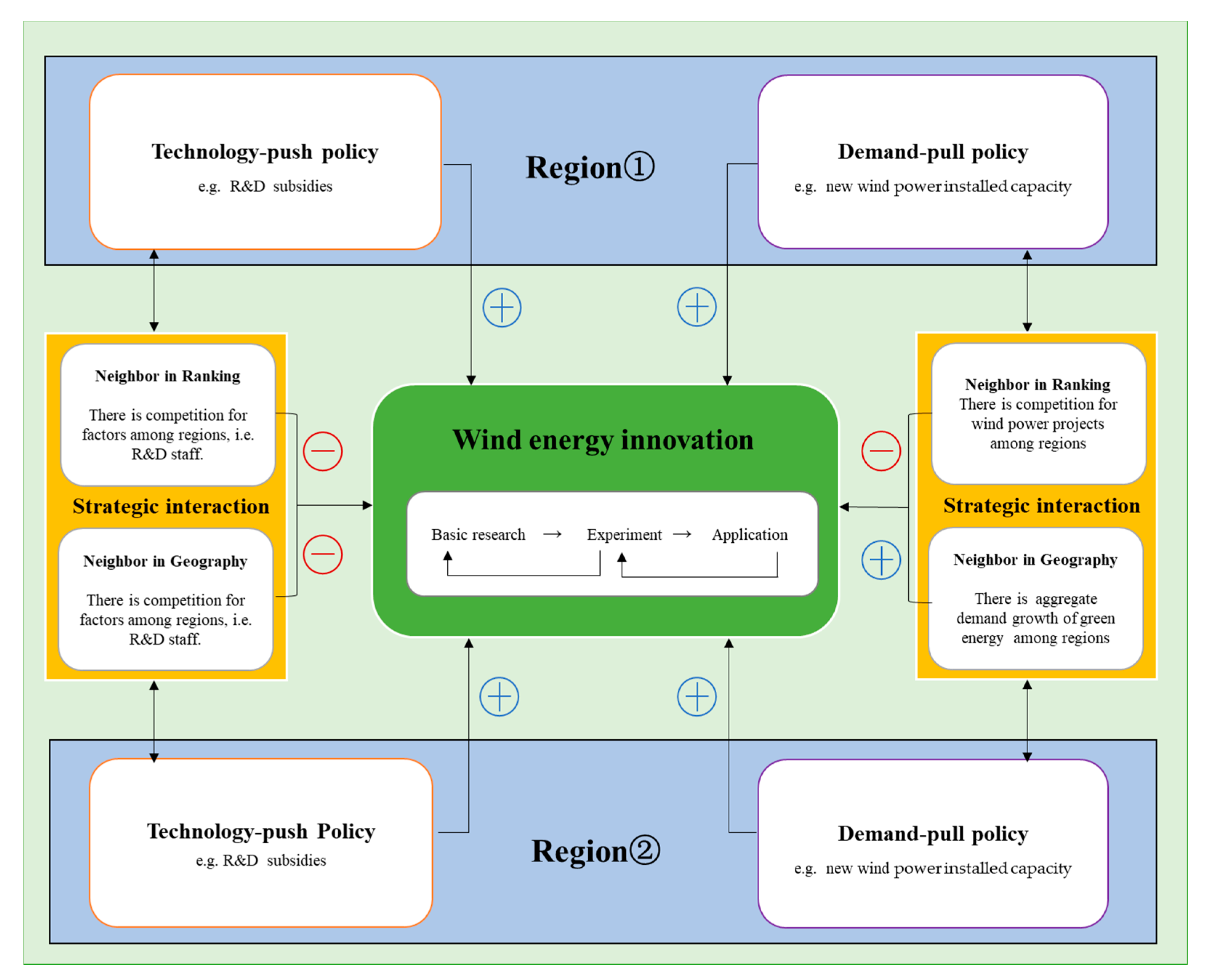

2. Theoretical Analysis and Research Hypotheses

2.1. The Inductive Effect of Innovation Policies

2.1.1. The Inductive Effect of the Technology-Push Policy

2.1.2. The Inductive Effect of the Demand-Pull Policy

2.2. The Strategic Interactions of Innovation Policies between Local Governments and Their Spillover Effects

2.2.1. The Strategic Interactions of the Technology-Push Policy between Local Governments

2.2.2. The Strategic Interactions of Demand-Pull Policy between Local Governments

3. Materials and Methods

3.1. Model Setting

3.2. Variable Selection and Definition

3.2.1. Innovation Variable

3.2.2. Demand-Pull Policy Variable

3.2.3. Technology-Push Policy Variable

3.2.4. Control Variables

3.3. Data Source and Descriptive Statistics

4. Results

4.1. Spatial Correlation Test

4.2. The Results of the Baseline Model

4.3. Robustness Test

5. Further Discussion of the Strategic Interaction Mode between Local Governments

5.1. The Strategic Interaction Mode of the Demand-Pull Policy between Local Governments

5.2. Heterogeneity Analysis

6. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Du, K.; Li, J. Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Shao, X.; Zhong, Y.; Liu, W.; Li, R.Y.M. Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 2021, 296, 113189. [Google Scholar] [CrossRef] [PubMed]

- Franceschini, S.; Faria, L.G.D.; Jurowetzki, R. Unveiling scientific communities about sustainability and innovation. A bibliometric journey around sustainable terms. J. Clean. Prod. 2016, 127, 72–83. [Google Scholar] [CrossRef] [Green Version]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Roh, T.; Lee, K.; Yang, J.Y. How do intellectual property rights and government support drive a firm’s green innovation? The mediating role of open innovation. J. Clean. Prod. 2021, 317, 128422. [Google Scholar] [CrossRef]

- González, P.D.R. The empirical analysis of the determinants for environmental technological change: A research agenda. Ecol. Econ. 2009, 68, 861–878. [Google Scholar] [CrossRef]

- Yu, J.; Zhou, L.-A.; Zhu, G. Strategic interaction in political competition: Evidence from spatial effects across Chinese cities. Reg. Sci. Urban Econ. 2016, 57, 23–37. [Google Scholar] [CrossRef] [Green Version]

- Wang, B.B.; Qi, S.Z. The effect of market-oriented and command-and-control policy tools on emissions reduction innovation: An empirical analysis based on China’s industrial patents data. China Ind. Econ. 2016, 6, 91–108. [Google Scholar] [CrossRef]

- Li, W.; Zheng, M. Is it Substantive Innovation or Strategic Innovation?—Impact of Macroeconomic Policies on Micro-enterprises’ Innovation. Econ. Res. J. 2016, 4, 60–73. [Google Scholar]

- Li, H.; Zhou, L.-A. Political turnover and economic performance: The incentive role of personnel control in China. J. Public Econ. 2004, 89, 1743–1762. [Google Scholar] [CrossRef]

- Besley, T.; Case, A. Incumbent Behavior: Vote Seeking, Tax Setting and Yardstick Competition; National Bureau of Economic Research: Cambridge, MA, USA, 1992. [Google Scholar] [CrossRef]

- Salmon, P. Decentralisation as an incentive scheme. Oxf. Rev. Econ. Policy 1987, 3, 24–43. [Google Scholar] [CrossRef]

- Dosi, G. Technological paradigms and technological trajectories: A suggested interpretation of the determinants and directions of technical change. Res. Policy 1993, 22, 102–103. [Google Scholar] [CrossRef]

- Hoppmann, J.; Wu, G.; Johnson, J. The impact of demand-pull and technology-push policies on firms’ knowledge search. Technol. Forecast. Soc. Chang. 2021, 170, 120863. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C.; Rennings, K. Determinants of eco-innovations by type of environmental impact—The role of regulatory push/pull, technology push and market pull. Ecol. Econ. 2012, 78, 112–122. [Google Scholar] [CrossRef] [Green Version]

- Bush, V. The Endless Frontier, Report to the President on a Program for Postwar Scientific Research; Office of Scientific and Development: Washington, DC, USA, 1945. [Google Scholar]

- Schmookler, J. Invention and Economic Growth; Harvard University Press: Cambridge, MA, USA, 1966. [Google Scholar] [CrossRef]

- Mowery, D.; Rosenberg, N. The influence of market demand upon innovation: A critical review of some recent empirical studies. Res. Policy 1979, 8, 102–153. [Google Scholar] [CrossRef]

- Pavitt, K. Sectoral patterns of technical change: Towards a taxonomy and a theory. Res. Policy 1984, 13, 343–373. [Google Scholar] [CrossRef]

- Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef] [Green Version]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable Energy Policies and Technological Innovation: Evidence Based on Patent Counts. Environ. Resour. Econ. 2009, 45, 133–155. [Google Scholar] [CrossRef]

- Kim, K.; Heo, E.; Kim, Y. Dynamic Policy Impacts on a Technological-Change System of Renewable Energy: An Empirical Analysis. Environ. Resour. Econ. 2015, 66, 205–236. [Google Scholar] [CrossRef]

- Watanabe, C.; Wakabayashi, K.; Miyazawa, T. Industrial dynamism and the creation of a “virtuous cycle” between R&D, market growth and price reduction: The case of photovoltaic power generation (PV) development in Japan. Technovation 2000, 20, 299–312. [Google Scholar] [CrossRef]

- Cleff, T.; Rennings, K. Determinants of environmental product and process innovation. Eur. Environ. 1999, 9, 191–201. [Google Scholar] [CrossRef]

- Fu, W.; Li, C.; Ondrich, J.; Popp, D. Technological Spillover Effects of State Renewable Energy Policy: Evidence from Patent Counts; National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar] [CrossRef]

- Popp, D. Induced Innovation and Energy Prices. Am. Econ. Rev. 2002, 92, 160–180. [Google Scholar] [CrossRef] [Green Version]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of environmental innovation in US manufacturing industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Sarzynski, A.; Larrieu, J.; Shrimali, G. The impact of state financial incentives on market deployment of solar technology. Energy Policy 2012, 46, 550–557. [Google Scholar] [CrossRef]

- Wilson, J.D. Theories of Tax Competition. Natl. Tax J. 1999, 52, 269–304. [Google Scholar] [CrossRef]

- Brueckner, J.K. Welfare Reform and the Race to the Bottom: Theory and Evidence. South. Econ. J. 2000, 66, 505–525. [Google Scholar] [CrossRef]

- Wildasin, D.E. Income Redistribution in a Common Labor Market. Am. Econ. Rev. 1991, 81, 757–774. [Google Scholar]

- Almeida, P.; Kogut, B. Localization of Knowledge and the Mobility of Engineers in Regional Networks. Manag. Sci. 1999, 45, 905–917. [Google Scholar] [CrossRef] [Green Version]

- Los, B.; Verspagen, B. R&D spillovers and productivity: Evidence from U.S. manufacturing microdata. Empir. Econ. 2000, 25, 127–148. [Google Scholar] [CrossRef]

- Ju, J.; Lin, J.Y.; Wang, Y. Endowment structures, industrial dynamics, and economic growth. J. Monet. Econ. 2015, 76, 244–263. [Google Scholar] [CrossRef] [Green Version]

- Chen, H.; Liu, S.; An, R.; Gao, H.; Yu, S. Estimation and allocation of the benefits from electricity market integration in China. Energy Clim. Chang. 2021, 2, 100054. [Google Scholar] [CrossRef]

- Gallaher, A.; Graziano, M.; Fiaschetti, M. Legacy and shockwaves: A spatial analysis of strengthening resilience of the power grid in Connecticut. Energy Policy 2021, 159, 112582. [Google Scholar] [CrossRef]

- Huang, J.; Xiang, S.; Wu, P.; Chen, X. How to control China’s energy consumption through technological progress: A spatial heterogeneous investigation. Energy 2021, 238, 121965. [Google Scholar] [CrossRef]

- Zhao, P.-J.; Zeng, L.-E.; Lu, H.-Y.; Zhou, Y.; Hu, H.-Y.; Wei, X.-Y. Green economic efficiency and its influencing factors in China from 2008 to 2017: Based on the super-SBM model with undesirable outputs and spatial Dubin model. Sci. Total Environ. 2020, 741, 140026. [Google Scholar] [CrossRef] [PubMed]

- Moreno, R.; Paci, R.; Usai, S. Spatial Spillovers and Innovation Activity in European Regions. Environ. Plan. A Econ. Space 2005, 37, 1793–1812. [Google Scholar] [CrossRef]

- Baicker, K. The spillover effects of state spending. J. Public Econ. 2005, 89, 529–544. [Google Scholar] [CrossRef] [Green Version]

- Griliches, Z. Patent Statistics as Economic Indicators: A Survey; National Bureau of Economic Research: Cambridge, MA, USA, 1990. [Google Scholar] [CrossRef]

- Lanjouw, J.O.; Pakes, A.; Putnam, J. How to Count Patents and Value Intellectual Property: The Uses of Patent Renewal and Application Data. J. Ind. Econ. 1998, 46, 405–432. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Glachant, M.; Haščič, I.; Johnstone, N.; Ménière, Y. Invention and Transfer of Climate Change–Mitigation Technologies: A Global Analysis. Rev. Environ. Econ. Policy 2011, 5, 109–130. [Google Scholar] [CrossRef] [Green Version]

- Harhoff, D.; Scherer, F.M.; Vopel, K. Citations, family size, opposition and the value of patent rights. Res. Policy 2003, 32, 1343–1363. [Google Scholar] [CrossRef]

- Klaassen, G.; Miketa, A.; Larsen, K.; Sundqvist, T. The impact of R&D on innovation for wind energy in Denmark, Germany and the United Kingdom. Ecol. Econ. 2005, 54, 227–240. [Google Scholar] [CrossRef]

- Peters, M.; Schneider, M.; Griesshaber, T.; Hoffmann, V.H. The impact of technology-push and demand-pull policies on technical change—Does the locus of policies matter? Res. Policy 2012, 41, 1296–1308. [Google Scholar] [CrossRef]

- Nemet, G.F. Inter-technology knowledge spillovers for energy technologies. Energy Econ. 2012, 34, 1259–1270. [Google Scholar] [CrossRef]

- Anselin, L.; Bera, A.K.; Florax, R.; Yoon, M.J. Simple diagnostic tests for spatial dependence. Reg. Sci. Urban Econ. 1996, 26, 77–104. [Google Scholar] [CrossRef]

- Hausman, J.; Hall, B.; Griliches, Z. Econometric Models for Count Data with an Application to the Patents-R&D Relationship; National Bureau of Economic Research: Cambridge, MA, USA, 1984. [Google Scholar] [CrossRef]

- Jaumotte, F.; Pain, N. From Ideas to Development: The Determinants of R&D and Patenting; OECD Publishing: Paris, France, 2005. [Google Scholar] [CrossRef]

- Hall, B.; Griliches, Z.; Hausman, J. Patents and R&D: Searching for a Lag Structure; National Bureau of Economic Research: Cambridge, MA, USA, 1983. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [Green Version]

- Lahiani, A.; Mefteh-Wali, S.; Shahbaz, M.; Vo, X.V. Does financial development influence renewable energy consumption to achieve carbon neutrality in the USA? Energy Policy 2021, 158, 112524. [Google Scholar] [CrossRef]

- Zhou, S.; Tong, Q.; Pan, X.; Cao, M.; Wang, H.; Gao, J.; Ou, X. Research on low-carbon energy transformation of China necessary to achieve the Paris agreement goals: A global perspective. Energy Econ. 2021, 95, 105137. [Google Scholar] [CrossRef]

| Variable | Variable Name | Variable Symbol | Variable Definition |

|---|---|---|---|

| Innovation output | Patents strength | patentstr | The summation of regional patents strength from Innography patent database |

| Number of patents | patentnum | Regional total number of patents | |

| Innovation policy | Technology-push policy | RD | Regional total research and development investment |

| Demand-pull policy | dAACz | Regional new wind power installed capacity | |

| Control variables | Electricity price | Eprice | Regional average electricity price |

| Thermal power supply rate | Fire_ElecC | Ratio of regional thermal power generation to regional total power consumption | |

| Population growth rate | PopGrow | Regional new population to the regional total population | |

| Regional residents’ consumption level | C | Regional residents’ consumption level | |

| Spatial weight | Adjacent relationship in geography | If the region i and the region j share a common geographical boundary, the spatial weight equals 1, i.e., , otherwise, . | |

| Adjacent relationships in the ranking | If the region i and the region j are next to each other in the ranking, i.e., i precedes or follows j, the spatial weight equals 1, i.e., , otherwise, . |

| Category | Sample Size | Mean | Standard Deviation | Minimum | 25% Quantile | 75% Quantile | Maximum |

|---|---|---|---|---|---|---|---|

| patentstr | 348 | 207.118 | 306.58 | 0 | 40 | 262.8 | 2894 |

| patentnum | 348 | 27.589 | 37.351 | 0 | 5.8 | 37 | 247 |

| L.RD | 348 | 331.422 | 417.813 | 3.341 | 68.424 | 428.54 | 2343.63 |

| Wgeo × L.RD | 348 | 319.865 | 291.661 | 13.647 | 120.625 | 430.672 | 1763.20 |

| Wrank × L.RD | 348 | 325.032 | 356.776 | 11.812 | 81.428 | 415.828 | 1847.14 |

| L.dACCz | 348 | 46.641 | 86.71 | −32 | 0.4 | 57 | 887 |

| Wgeo × L.dACCz | 348 | 54.082 | 58.731 | −9 | 9.447 | 79.107 | 391.913 |

| Wrank’ × L.dACCz | 348 | 44.915 | 50.96 | −4 | 7 | 65 | 332 |

| L.eprice | 348 | 543.526 | 115.269 | 271.62 | 454.335 | 633.445 | 777.33 |

| L.Fire_ElecC | 348 | 77.662 | 30.942 | 15.582 | 57.646 | 93.821 | 169.755 |

| L.C | 348 | 14.001 | 8.727 | 3.499 | 7.784 | 17.046 | 52.732 |

| L.PopGrow | 348 | 5.201 | 2.624 | −0.6 | 3.223 | 6.86 | 11.78 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| 2007 | 0.2703 *** | 0.0285 ** | 0.5269 *** | 0.0059 |

| 2008 | 0.2142 ** | 0.0362 ** | 0.4377 *** | 0.0267 |

| 2009 | 0.0772 | −0.0292 | 0.3498 *** | 0.0558 |

| 2010 | 0.1627 ** | −0.007 | 0.4113 *** | 0.0121 |

| 2011 | 0.1667 ** | −0.0037 | 0.3439 *** | 0.0521 |

| 2012 | 0.1030 * | −0.0272 | 0.1803 ** | 0.0208 |

| 2013 | 0.3679 *** | 0.0472 ** | 0.5665 *** | 0.0013 |

| 2014 | 0.2033 ** | 0.0189 * | 0.4603 *** | 0.0036 |

| 2015 | 0.1182 ** | 0.0052 * | 0.2773 *** | 0.0459 |

| 2016 | 0.1626 *** | 0.0193 ** | 0.2900 *** | 0.056 |

| 2017 | 0.1020 * | −0.0126 | 0.2658 *** | 0.0246 |

| 2018 | 0.1399 * | 0.0307 ** | 0.3161 *** | 0.0805 |

| Variables | Panel Model | GMM: Wgeo | GMM: Wrank | |||

|---|---|---|---|---|---|---|

| RE | FE | RE | FE | RE | FE | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| L.RD | 0.2778 *** (0.0000) | 0.2285 *** (0.0001) | 0.4294 *** (0.0000) | 0.3764 *** (0.0000) | 0.4242 *** (0.0000) | 0.3831 *** (0.0000) |

| Wgeo × L.RD | —— | —— | −0.2869 *** (0.0000) | −0.3035 *** (0.0005) | −0.2989 *** (0.0000) | −0.3185 *** (0.0002) |

| Wrank × L.RD | —— | —— | −0.2880 *** (0.0000) | −0.2617 *** (0.0025) | −0.2804 *** (0.0000) | −0.2398 *** (0.0046) |

| L.dACCz | 0.0819 (0.4803) | 0.0737 (0.5272) | 0.0217 (0.8532) | 0.0405 (0.7174) | 0.0247 (0.8320) | 0.0368 (0.7445) |

| Wgeo × L.dACCz | —— | —— | −0.0715 (0.7169) | −0.0659 (0.7351) | −0.0186 (0.9235) | −0.0263 (0.8918) |

| Wrank′ ×L.dACCz | —— | —— | −0.2651 (0.2695) | −0.3375 (0.1674) | −0.2903 (0.2138) | −0.324 (0.1817) |

| L.eprice | 0.4999 ** (0.0110) | 0.6133 ** (0.0113) | 0.7491 *** (0.0001) | 1.0929 *** (0.0000) | 0.8238 *** (0.0000) | 1.1473 *** (0.0000) |

| L.Fire_ ElecC | 0.6766 (0.2986) | 2.9727 *** (0.0037) | 0.9167 * (0.0936) | 3.3723 *** (0.0003) | 0.9165 * (0.0926) | 3.3681 *** (0.0003) |

| L.C | 9.7577 *** (0.0030) | 8.9664 ** (0.0234) | 20.1703 *** (0.0000) | 19.0568 *** (0.0000) | 19.2103 *** (0.0000) | 16.7013 *** (0.0000) |

| L.PopGrow | −4.9945 (0.5177) | −3.78 (0.7623) | 3.0941 (0.6586) | 5.8591 (0.6357) | 3.4254 (0.6138) | 5.8945 (0.6301) |

| stage1 | 109.7945 *** (0.0000) | 100.1457 *** (0.0014) | 97.0439 *** (0.0008) | 105.1436 *** (0.0007) | 96.4378 *** (0.0002) | 99.5896 *** (0.0004) |

| stage3 | 16.6231 (0.5516) | 45.5057 (0.1321) | 26.5844 (0.3901) | 59.9025 * (0.0539) | 36.704 (0.1857) | 73.579 *** (0.0100) |

| (Intercept) | −373.582 *** (0.0072) | −561.9486 *** (0.0000) | −588.916 *** (0.0000) | |||

| Hausman test | 19.214 ** (0.0138) | 45.359 *** (0.0000) | 25.156 ** (0.0141) | |||

| Variables | 1 Period Lag | 2 Period Lag | 3 Period Lag | 5 Period Lag | ML | ML | Patentnum | Patentnum |

|---|---|---|---|---|---|---|---|---|

| Wrank | Wrank | Wrank | Wrank | Wgeo | Wrank | Wgeo | Wrank | |

| L.RD | 0.3663 *** (0.0000) | 0.3976 *** (0.0000) | 0.3680 *** (0.0001) | 0.6537 *** (0.0000) | 0.3688 *** (0.0000) | 0.3661 *** (0.0000) | 0.0570 *** (0.0000) | 0.057 *** (0.0000) |

| Wgeo × L.RD | −0.3180 *** (0.0001) | −0.3127 *** (0.0022) | −0.2637 ** (0.0267) | −0.2522 (0.1172) | −0.3087 *** (0.0002) | −0.3187 *** (0.0001) | −0.0200 ** (0.0197) | −0.0205 ** (0.0162) |

| Wrank × L.RD | −0.2333 *** (0.0058) | −0.2305 ** (0.0211) | −0.1472 (0.2004) | −0.1477 (0.3540) | −0.2464 *** (0.0030) | −0.2325 *** (0.0051) | −0.0229 *** (0.0065) | −0.0226 *** (0.0071) |

| L.dACCz | −0.0279 (0.7981) | 0.0060 (0.9566) | 0.0183 (0.8727) | 0.0113 (0.9243) | −0.0020 (0.9845) | −0.0296 (0.7822) | 0.0022 (0.8393) | 0.0012 (0.9117) |

| Wtotal × L.dACCz | 1.0884 ** (0.0175) | 1.0330 ** (0.0310) | 1.0491 ** (0.0317) | 0.9510 * (0.0533) | 1.1296 ** (0.0172) | 1.086 ** (0.0155) | 0.0080 (0.8669) | 0.0084 (0.8588) |

| Wrank’ × L.dACCz | −0.4999 ** (0.0409) | −0.4808 * (0.0605) | −0.4431 * (0.0976) | −0.3440 (0.2266) | −0.5737 ** (0.0170) | −0.4951 ** (0.0392) | −0.0370 (0.1281) | −0.0357 (0.1431) |

| L.eprice | 0.9044 *** (0.0006) | 0.9011 *** (0.0017) | 0.8154 *** (0.0074) | 0.7192 ** (0.0280) | 0.9104 *** (0.0006) | 0.904 *** (0.0005) | 0.0785 *** (0.0038) | 0.0774 *** (0.0040) |

| L.Fire_ElecC | 3.2835 *** (0.0005) | 3.1624 *** (0.0021) | 2.8073 ** (0.0131) | 2.6369 * (0.0744) | 3.1967 *** (0.0006) | 3.2871 *** (0.0004) | 0.2275 ** (0.0161) | 0.2277 ** (0.0163) |

| L.C | 16.3731 *** (0.0000) | 14.6677 *** (0.0009) | 11.3742 ** (0.0158) | −0.4517 (0.9354) | 17.3203 *** (0.0000) | 16.3076 *** (0.0000) | 1.7376 *** (0.0000) | 1.7184 *** (0.0000) |

| L.PopGrow | 11.2537 (0.3537) | −0.6143 (0.9627) | −4.5278 (0.7427) | −18.1948 (0.2466) | 10.6928 (0.3762) | 11.2907 (0.3432) | 0.0778 (0.9492) | 0.0629 (0.9587) |

| stage1 | 106.3246 *** (0.0000) | 105.8031 *** (0.0002) | 97.6224 *** (0.0007) | 72.4685 ** (0.0180) | 112.6882 *** (0.0000) | 105.8946 *** (0.0000) | 10.3397 *** (0.0003) | 10.1168 *** (0.0003) |

| stage3 | 54.9627 * (0.0560) | 61.1998 ** (0.0467) | 61.6752 * (0.0543) | 86.2064 ** (0.0117) | 49.7964 * (0.0938) | 55.3112 ** (0.0495) | 6.0229 ** (0.0459) | 6.1305 ** (0.0386) |

| Variables | Demand-Pull Policy | Regional Heterogeneity | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| L.RD | 0.3831 *** (0.0000) | 0.3733 *** (0.0000) | 0.3663 *** (0.0000) | 0.4024 *** (0.0000) | 0.3395 *** (0.0000) | 0.3738 *** (0.0000) |

| Wgeo × L.RD | −0.3185 *** (0.0002) | −0.3310 *** (0.0000) | −0.3180 *** (0.0001) | −0.3617 *** (0.0000) | −0.3807 *** (0.0009) | −0.3999 *** (0.0004) |

| Wrank × L.RD | −0.2398 *** (0.0046) | −0.2239 *** (0.0085) | −0.2333 *** (0.0058) | −0.2511 *** (0.0023) | −0.8237 *** (0.0009) | −0.9271 *** (0.0001) |

| L.dACCz | 0.0368 (0.7445) | −0.0191 (0.8633) | −0.0279 (0.7981) | 0.0135 (0.8988) | −0.0458 (0.6697) | 0.0001 (0.9986) |

| Wgeo × L.dACCz | −0.0263 (0.8918) | |||||

| Wdis × L.dACCz | 0.7245 (0.1714) | |||||

| Wtotal × L.dACCz | 1.0884 ** (0.0175) | 2.7381 *** (0.0000) | 1.0285 ** (0.0192) | 2.7493 *** (0.0000) | ||

| Dr × Wgeo × L.RD | 0.1581 (0.2611) | 0.1241 (0.3643) | ||||

| Dr × Wrank × L.RD | 0.4633 * (0.0552) | 0.5535 ** (0.0189) | ||||

| Dw × Wtotal × L.dACCz | −3.1928 *** (0.0000) | −3.2764 *** (0.0000) | ||||

| Dw × Wrank’ × L.dACCz | 2.5173 *** (0.0000) | 2.6790 *** (0.0000) | ||||

| Wrank’ × L.dACCz | −0.324 (0.1817) | −0.4521 * (0.0841) | −0.4999 ** (0.0409) | −2.4305 *** (0.0000) | −0.4901 ** (0.0431) | −2.5806 *** (0.0000) |

| L.eprice | 1.1473 *** (0.0000) | 1.0466 *** (0.0000) | 0.9044 *** (0.0006) | 1.0275 *** (0.0000) | 1.1278 *** (0.0000) | 1.2657 *** (0.0000) |

| L.Fire_ElecC | 3.3681 *** (0.0003) | 3.4059 *** (0.0003) | 3.2835 *** (0.0005) | 2.9441 *** (0.0015) | 3.1563 *** (0.0008) | 2.8098 *** (0.0022) |

| L.C | 16.7013 *** (0.0000) | 16.1156 *** (0.0000) | 16.3731 *** (0.0000) | 12.9914 *** (0.0014) | 17.0880 *** (0.0000) | 13.759 *** (0.0005) |

| L.PopGrow | 5.8945 (0.6301) | 6.4087 (0.5933) | 11.2537 (0.3537) | 13.1630 (0.2659) | 12.6355 (0.2885) | 13.966 (0.2281) |

| stage1 | 99.5896 *** (0.0004) | 105.4991 *** (0.0001) | 106.3246 *** (0.0000) | 87.7371 *** (0.0015) | 78.1971 *** (0.0034) | 58.312 ** (0.0284) |

| stage3 | 73.579 *** (0.0100) | 68.2274 ** (0.0151) | 54.9627 * (0.0560) | 96.8565 *** (0.0011) | 90.2725 *** (0.0019) | 135.36 *** (0.0000) |

| Demand-Pull Policies | Geography | Ranking | Technology-Push Policy | Geography | Ranking |

|---|---|---|---|---|---|

| Wtotal × L.dACCz | Wrank’ × L.dACCz | Wgeo × L.RD | Wrank × L.RD | ||

| The regions with scarce wind energy resources | 2.7493 *** | −2.5806 *** | The regions with low R&D intensity | −0.3999 *** | −0.9271 *** |

| The regions with abundant wind energy resources | −0.5271 *** | 0.0984 *** | The regions with high R&D intensity | −0.2758 | −0.3736 *** |

| Gaps between groups | −3.2764 *** | 2.679 *** | Gaps between groups | 0.1241 | 0.5535 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.; Shi, H.; Zeng, L.; Dong, X. How Strategic Interaction of Innovation Policies between China’s Regional Governments Affects Wind Energy Innovation. Sustainability 2022, 14, 2543. https://doi.org/10.3390/su14052543

Li C, Shi H, Zeng L, Dong X. How Strategic Interaction of Innovation Policies between China’s Regional Governments Affects Wind Energy Innovation. Sustainability. 2022; 14(5):2543. https://doi.org/10.3390/su14052543

Chicago/Turabian StyleLi, Chengming, Han Shi, Liangen Zeng, and Xiaomeng Dong. 2022. "How Strategic Interaction of Innovation Policies between China’s Regional Governments Affects Wind Energy Innovation" Sustainability 14, no. 5: 2543. https://doi.org/10.3390/su14052543

APA StyleLi, C., Shi, H., Zeng, L., & Dong, X. (2022). How Strategic Interaction of Innovation Policies between China’s Regional Governments Affects Wind Energy Innovation. Sustainability, 14(5), 2543. https://doi.org/10.3390/su14052543