China’s New Silk Road and Central and Eastern Europe—A Systematic Literature Review

Abstract

1. Introduction

2. Literature Review

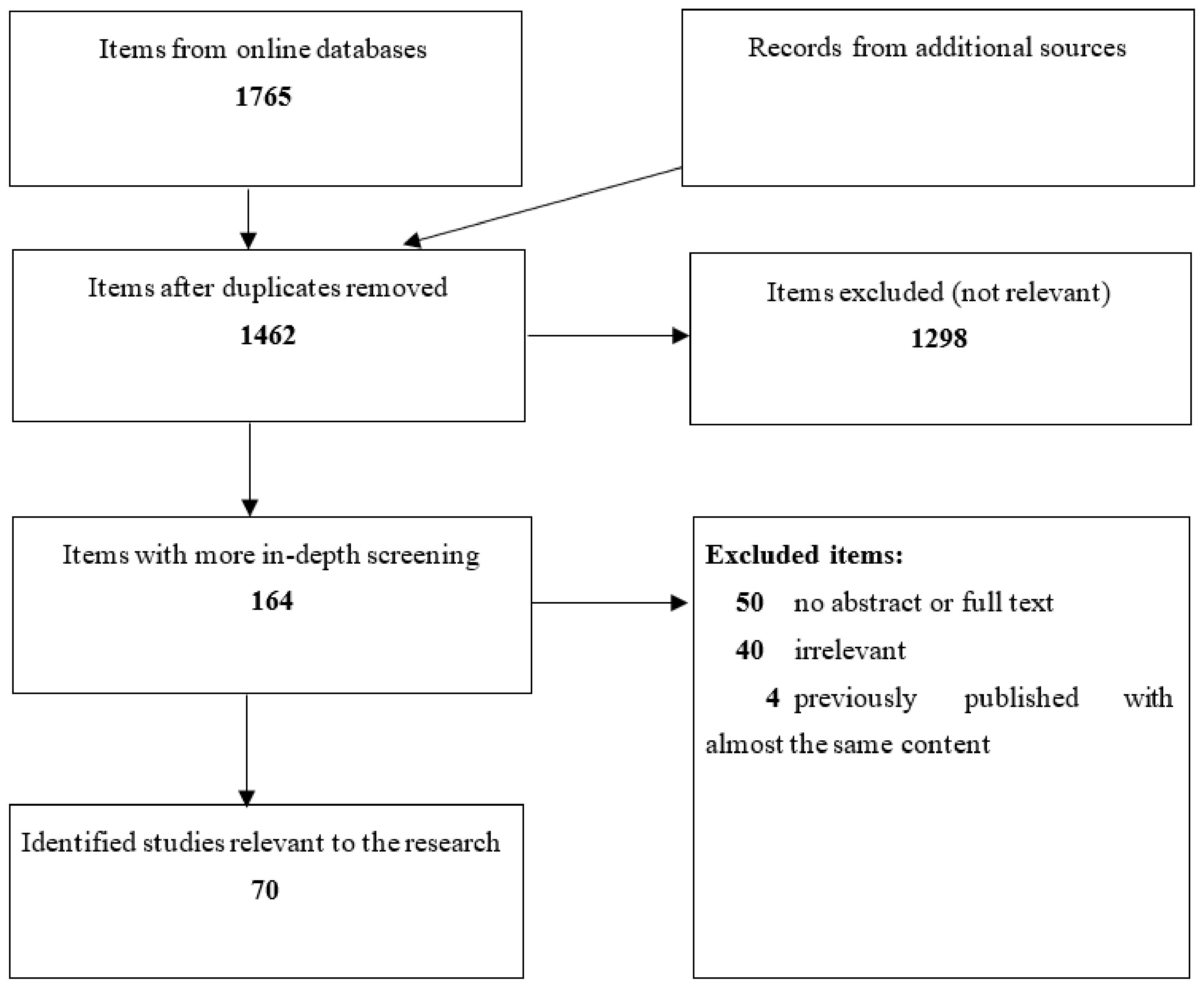

3. Materials and Methods

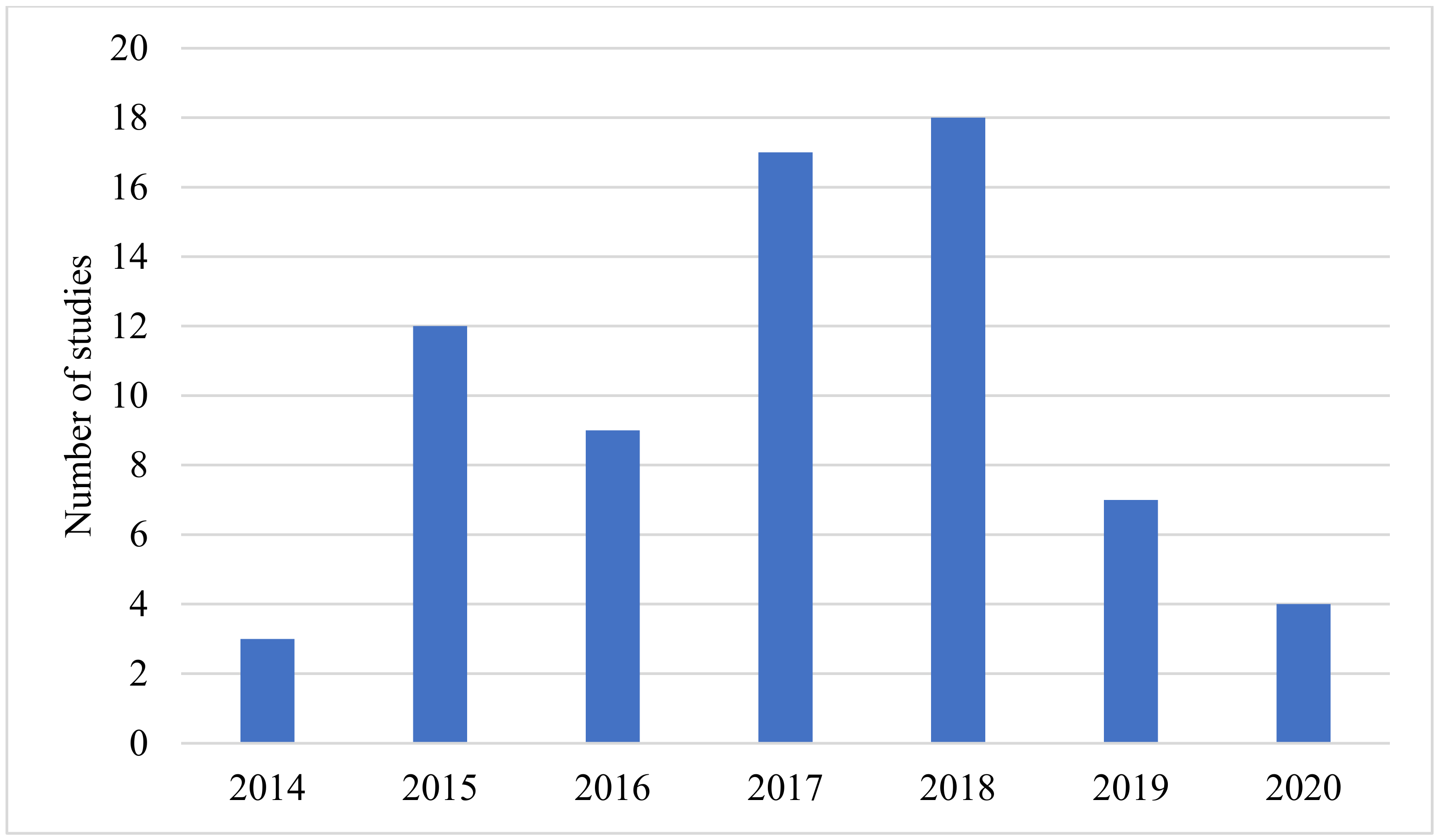

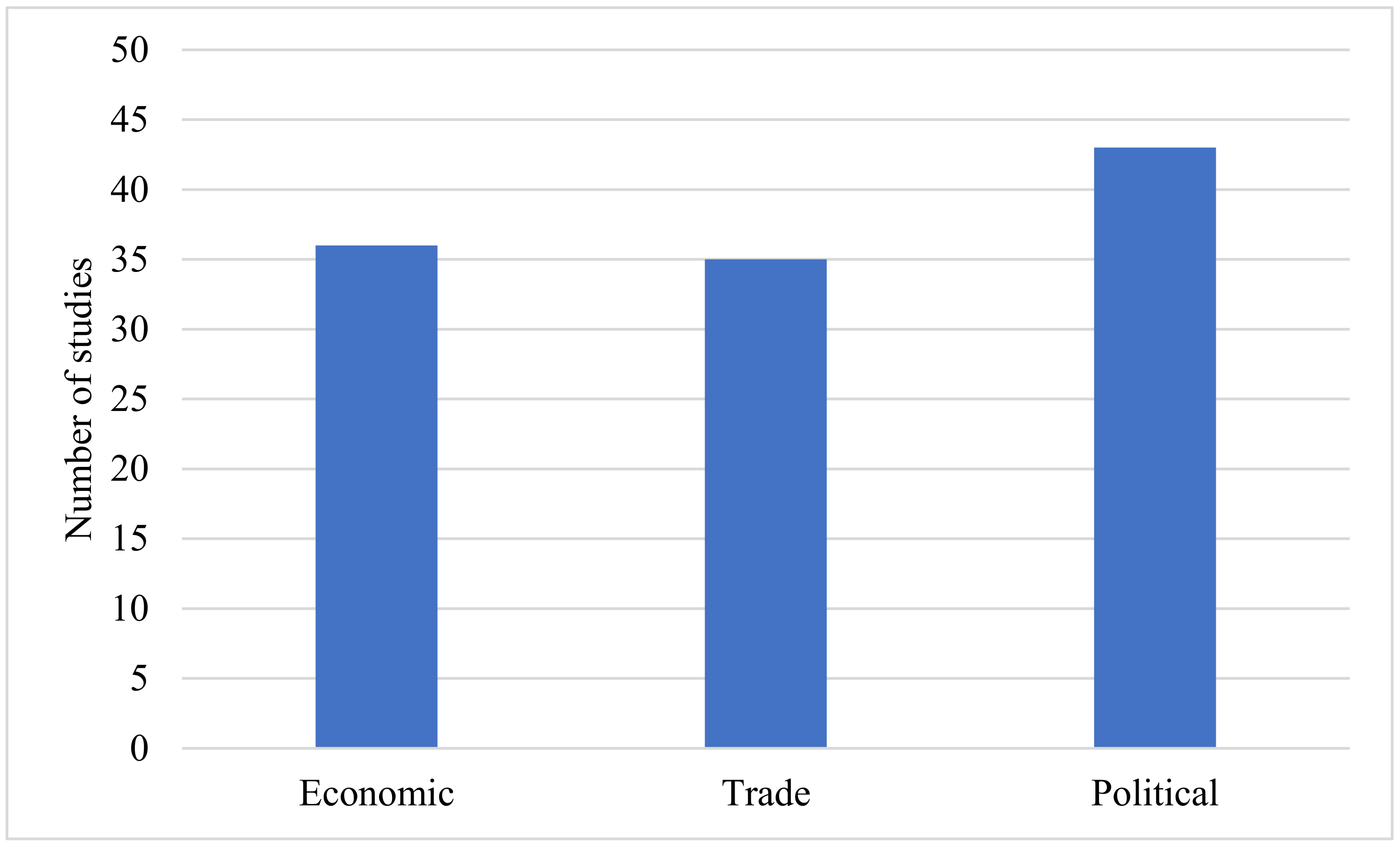

4. Results

4.1. International Trade Corridors

4.2. New Silk Road

4.3. The Goals of the New Silk Road

4.4. Possible Routes

4.5. Financing the Initiative

4.6. Sustainability and Environmental Protection

4.7. Central and Eastern Europe

4.7.1. Poland

4.7.2. Czech Republic

4.7.3. Slovakia

4.7.4. Hungary

4.8. Expected Effects of the New Silk Road

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fallon, T. The new silk road: Xi Jinping’s grand strategy for Eurasia. Am. Foreign Policy Interests 2015, 37, 140–147. [Google Scholar] [CrossRef]

- Wang, H. Textiles as money on the silk road? J. R. Asiat. Soc. 2013, 23, 165–174. [Google Scholar] [CrossRef]

- Li, B. The Termination of the Silk Road: A Study of the History of the Silk Road from a New Perspective. Asian Rev. World Hist. 2020, 8, 7–23. [Google Scholar] [CrossRef]

- Li, P.; Qian, H.; Howard, K.W.; Wu, J. Building a new and sustainable “Silk Road economic belt”. Environ. Earth Sci. 2015, 74, 7267–7270. [Google Scholar] [CrossRef]

- Wan, C.; Yang, Z.; Zhang, D.; Yan, X.; Fan, S. Resilience in transportation systems: A systematic review and future directions. Transp. Rev. 2018, 38, 479–498. [Google Scholar] [CrossRef]

- Keser, H.Y. Importance of Transport Corridors in Regional Development: The Case of TRACECA. Sosyoekonomi 2015, 23, 163–182. [Google Scholar] [CrossRef]

- Li, Y.; Schmerer, H.-J. Trade and the New Silk Road: Opportunities, Challenges, and Solutions. J. Chin. Econ. Bus. Stud. 2017, 15, 205–213. [Google Scholar] [CrossRef]

- Nolan, P. State, Market and Infrastructure: The New Silk Road. Croat. Int. Relat. Rev. 2017, 23, 7–18. [Google Scholar] [CrossRef][Green Version]

- Yu, H. Motivation behind China’s ‘One Belt, One Road’ Initiatives and Establishment of the Asian Infrastructure Investment Bank. J. Contemp. China 2017, 26, 353–368. [Google Scholar] [CrossRef]

- Casarini, N. When All Roads Lead to Beijing. Assessing China’s New Silk Road and its Implications for Europe. Int. Spect. 2016, 51, 95–108. [Google Scholar] [CrossRef]

- Wagener, N.; Aritua, B.; Zhu, T. The New Silk Road: Opportunities for global supply chains and challenges for further development. Log Forum 2020, 16, 193–207. [Google Scholar] [CrossRef]

- Fasslabend, W. The Silk Road: A political marketing concept for world dominance. Eur. View 2015, 14, 293–302. [Google Scholar] [CrossRef]

- Huang, Y. Understanding China’s Belt & Road Initiative: Motivation, framework and assessment. China Econ. Rev. 2016, 40, 314–321. [Google Scholar] [CrossRef]

- Alon, I.; Chen, S.; Mandolfo, M. Supply chain–marketing integration: How do European SMEs go to China via the New Silk Road. Bus. Process Manag. J. 2019, 25, 368–378. [Google Scholar] [CrossRef]

- Toma, S.-G.; Săseanu, A.S.; Teodor, C. A Chinese Business: The Belt and Road Initiative. In Proceedings of the 5th BASIQ International Conference on New Trends in Sustainable Business and Consumption, Bari, Italy, 30 May–1 June 2019; pp. 657–664. [Google Scholar]

- Thürer, M.; Tomašević, I.; Stevenson, M.; Blome, C.; Melnyk, S.; Chan, H.K.; Huang, G.Q. A systematic review of China’s belt and road initiative: Implications for global supply chain management. Int. J. Prod. Res. 2020, 58, 2436–2453. [Google Scholar] [CrossRef]

- Thees, H. Towards local sustainability of mega infrastructure: Reviewing research on the New Silk Road. Sustainability 2020, 12, 10612. [Google Scholar] [CrossRef]

- Khin, A.A.; Chiun, F.Y.; Seong, L.C. Identifying the Factors of the Successful Implementation of Belt and Road Initiative on Small–Medium Enterprises in Malaysia. China Rep. 2019, 55, 345–363. [Google Scholar] [CrossRef]

- Zhang, X. Analysis on the Obstacles for China to Become a Financial Superpower. In Proceedings of the International Conference on Energy Big Data and Low-carbon Development Management, Nanjin, China, 18–20 December 2020. [Google Scholar] [CrossRef]

- Kauf, S.; Laskowska-Rutkowska, S. The location of an international logistics center in Poland as a part of the One Belt One Road initiative. LogForum 2019, 15, 71–83. [Google Scholar] [CrossRef]

- Mulrow, C.D. The Medical Review Article: State of the Science. Ann. Intern. Med. 1987, 106, 485–488. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Snyder, H. Literature review as a research methodology: An overview and guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Paul, J.; Criado, A.R. The art of writing literature review: What do we know and what do we need to know? Int. Bus. Rev. 2020, 29, 101717. [Google Scholar] [CrossRef]

- Paul, J.; Merchant, A.; Dwivedi, Y.K.; Rose, G. Writing an impactful review article: What do we know and what do we need to know? J. Bus. Res. 2021, 133, 337–340. [Google Scholar] [CrossRef]

- Covidence. Better Systematic Review Management. Available online: https://www.covidence.org/ (accessed on 30 January 2022).

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef] [PubMed]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.; Gøtzsche, P.C.; Ioannidis, J.P.; Clarke, M.; Devereaux, P.J.; Kleijnen, J.; Moher, D. The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. J. Clin. Epidemiol. 2009, 62, 1–34. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Moher, D. Updating guidance for reporting systematic reviews: Development of the PRISMA 2020 statement. J. Clin. Epidemiol. 2021, 134, 103–112. [Google Scholar] [CrossRef]

- Bungenberg, M.; Hazarika, A. The European Union’s Trade and Investment Policy in Asia: New Challenges and Opportunities in a Changing Global Environment-Or: Following Individual Roadmaps. Asia Eur. J. 2017, 15, 377–397. [Google Scholar] [CrossRef]

- Erdősi, F. Trans-Eurasian transport links in great and medium-size spaces of power. Tér És Társadalom 2015, 29, 106–126. [Google Scholar] [CrossRef]

- Van der Putten, F.-P.; Meijnders, M. China, Europe and the Maritime Silk Road; Clingendael Institute: Den Haag, The Netherlands, 2015. [Google Scholar]

- Zuokui, L. The role of Central and Eastern Europe in the building of silk road economic belt. Medjunarodni Probl. 2015, 67, 184–195. [Google Scholar] [CrossRef]

- Li, Y.; Bolton, K.; Westphal, T. The effect of the New Silk Road railways on aggregate trade volumes between China and Europe. J. Chin. Econ. Bus. Stud. 2018, 16, 1–18. [Google Scholar] [CrossRef]

- Sarvari, B.; Szeidovitz, A. The Political Economics of the New Silk Road. Balt. J. Eur. Stud. 2016, 6, 3–27. [Google Scholar] [CrossRef]

- Bulis, A.; Skapars, R. Development of “New Silk Road” Northern branch through seaport of Riga in Latvia. Procedia-Soc. Behav. Sci. 2014, 150, 1222–1229. [Google Scholar] [CrossRef][Green Version]

- Fardella, E. Prodi, G. The Belt and Road Initiative Impact on Europe: An Italian Perspective. China World Econ. 2017, 25, 125–138. [Google Scholar] [CrossRef]

- Xinhunet. Hanxinou’Shipped More Than 3,300 Export TEUs After Running for One Year. 2014. Available online: https://www.xinhuanet.com//fortune/2015-04/23/c_1115067478.htm (accessed on 4 August 2021).

- He, L. “Sumanou” Railway Line Breaks the Guinness World Record of Highest Container Freight. 2012. Available online: https://js.people.com.cn/html/2012/11/23/188301.html (accessed on 7 August 2021).

- Zhang, Q. Hunan-Europe Freight Transport Rail to Open Soon. 2014. Available online: http://en.changsha.gov.cn/news/Local/201410/t20141016_646367 (accessed on 9 August 2021).

- Egorova, K. China Launches the World’s Longest Freight Train Route. 2015, RBTH. Available online: http://rbth.com/business/2015/06/16/china_launches_the_worlds_longest_freight_train_route_46921.html (accessed on 14 August 2021).

- Lee, E.; Oduor, P.G.; Farahmand, K.; Tolliver, D. A coupled linear programming model with geospatial dynamic trip assignment for global-scale intermodal transportation. Marit. Econ. Logist. 2014, 16, 33–54. [Google Scholar] [CrossRef]

- Notteboom, T.E. Towards a new intermediate hub region in container shipping? Relay and interlining via the Cape route vs. the Suez route. J. Transp. Geogr. 2012, 22, 164–178. [Google Scholar] [CrossRef]

- Wang, X.; Meng, Q. The impact of landbridge on the market shares of Asian ports. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 190–203. [Google Scholar] [CrossRef]

- Kopytov, E.; Abramov, D. Multiple-criteria analysis and choice of transportation alternatives in multimodal freight transport system. Transp. Telecommun. 2012, 13, 148–158. [Google Scholar] [CrossRef]

- Tavasszy, L.; Minderhoud, M.; Perrin, J.-F.; Notteboom, T. A strategic network choice model for global container flows: Specification, estimation and application. J. Transp. Geogr. 2011, 19, 1163–1172. [Google Scholar] [CrossRef]

- Verny, J.; Grigentin, C. Container shipping on the northern sea route. Int. J. Prod. Econ. 2009, 122, 107–117. [Google Scholar] [CrossRef]

- Zhang, M.; Wu, Z.; Jin, Y. Maritime Routing Problem with Soft Time Windows in the One Belt, One Road Initiative. J. Coast. Res. 2019, 98, 350–355. [Google Scholar] [CrossRef]

- Podberezkin, A.; Podberezkina, O. The Silk Road Renaissance and New Potential of the Russian-Chinese Partnership. China Q. Int. Strateg. Stud. 2015, 1, 305–323. [Google Scholar] [CrossRef]

- Song, W. Logic of the Chinese developmental state and China’s geo-economic engagement with Central and Eastern Europe. Asia Eur. J. 2019, 17, 387–401. [Google Scholar] [CrossRef]

- Huang, J. Silk Road Economic Belt: Can Old BITs Fulfil China’s New Initiative? J. World Trade 2016, 50, 733–754. [Google Scholar]

- Lee, J.Y.; Hyun, K.; Jin, J. China’s New Silk Road: Policies and Implications. J. Int. Logist. Trade 2015, 13, 55–70. [Google Scholar] [CrossRef]

- Nazarko, J.; Kuźmicz, K.A. Introduction to the STEEPVL Analysis of the New Silk Road Initiative. Procedia Eng. 2017, 182, 497–503. [Google Scholar] [CrossRef]

- Chaisse, J.; Matsushita, M. China’s ‘belt and road’ initiative: Mapping the world trade normative and strategic implications. J. World Trade 2018, 52, 163–185. [Google Scholar]

- Fung, K.C.; Aminian, N.; Fu, X.; Kornhohen, I. Internationalization of the use of Chinese currency: Perspectives from the New and the Ancient Silk Roads. J. Chin. Econ. Bus. Stud. 2018, 16, 1–16. [Google Scholar] [CrossRef]

- Tian, W.; Yu, M.; Zhang, F. The exceptional performance of Chinese outward direct investment firms. China Econ. J. 2016, 9, 209–219. [Google Scholar] [CrossRef]

- Nazarko, J.; Kuźmicz, K.A.; Czerewacz-Filipowicz, K. The New Silk Road–Analysis of the potential of new Eurasian transport corridors. Preceedings of the 9 the International Scientific Conference “Business and Management 2016”, Vilnius, Lithuania, 12–13 May 2016. [Google Scholar] [CrossRef][Green Version]

- Pardo, R.P. Europe’s financial security and Chinese economic statecraft: The case of the Belt and Road Initiative. Asia Eur. J. 2018, 16, 237–250. [Google Scholar] [CrossRef]

- Shah, A.R. How Does China–Pakistan Economic Corridor Show the Limitations of China’s ‘One Belt One Road’ Model. Asia Pac. Policy Stud. 2018, 5, 378–385. [Google Scholar] [CrossRef]

- Shambaugh, D. China’s soft-power push: The search for respect. Foreign Aff. 2015, 94, 99–107. [Google Scholar]

- Timofeev, I.; Lissovolik, Y.; Filippova, L. Russia’s Vision of the Belt and Road Initiative: From the Rivalry of the Great Powers to Forging a New Cooperation Model in Eurasia. China World Econ. 2017, 25, 62–77. [Google Scholar] [CrossRef]

- Chin, H.; Lau, F.; He, W.; Cheung, T. The Silk Road Economic Belt and the 21st Century Maritime Silk Road; Fung Business Intelligence Centre: New York, NY, USA, 2015. [Google Scholar]

- European Commission. Investment Plan for Europe Goes Global: China Announces its Contribution to #investEU; Press Release; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Rolland, N. China’s New Silk Road. Natl. Bur. Asian Res. 2015, 12, 1–4. [Google Scholar]

- Meunier, S. A Faustian bargain or just a good bargain? Chinese foreign direct investment and politics in Europe. Asia Eur. J. 2014, 12, 143–158. [Google Scholar] [CrossRef]

- Feng, T.T.; Kang, Q.; Pan, B.B.; Yang, Y.S. Synergies of sustainable development goals between China and countries along the Belt and Road initiative. Curr. Opin. Environ. Sustain. 2019, 39, 167–186. [Google Scholar] [CrossRef]

- Gallo, A.; Accorsi, R.; Baruffaldi, G.; Manzini, R. Designing sustainable cold chains for long-range food distribution: Energy-effective corridors on the Silk Road Belt. Sustainability 2017, 9, 2044. [Google Scholar] [CrossRef]

- Szczudlik, J. Coming out of the shadows: The Polish perspective on China-Central and Eastern Europe relations. Int. Issues Slovak Foreign Policy Aff. 2015, 24, 49–53. [Google Scholar]

- Vangeli, A. Diffusion of ideas in the era of the Belt and Road: Insights from China-CEE think tank cooperation. Asia Eur. J. 2019, 17, 421–436. [Google Scholar] [CrossRef]

- Bartosiewicz, A.; Szterlik, P. Łódź’s benefits from the One Belt One Road initiative. Int. J. Logist. Res. Appl. 2019, 22, 47–63. [Google Scholar] [CrossRef]

- Kowalski, B. China’s foreign policy towards Central and Eastern Europe: The “16+1” format in the South–South cooperation perspective. Cases of the Czech Republic and Hungary. Camb. J. Eurasian Stud. 2017, 1, 1–16. [Google Scholar] [CrossRef]

- Vangeli, A.; Pavlićević, D. Introduction: New perspectives on China–Central and Eastern Europe relations. Asia Eur. J. 2019, 17, 361–368. [Google Scholar] [CrossRef]

- Brînză, A. The “17+ 1” Mechanism: Caught Between China and the United States. China Q. Int. Strateg. Stud. 2019, 5, 213–231. [Google Scholar] [CrossRef]

- Góralczyk, B. China’s interests in Central and Eastern Europe: Enter the dragon. Eur. View 2017, 16, 153–162. [Google Scholar] [CrossRef]

- Kavalski, E. China in Central and Eastern Europe: The unintended effects of identity narratives. Asia Eur. J. 2019, 17, 403–419. [Google Scholar] [CrossRef]

- Matura, T. The belt and road initiative depicted in Hungary and Slovakia. J. Contemp. East Asia Stud. 2018, 7, 174–189. [Google Scholar] [CrossRef]

- Oehler-Şincai, I.M. Central and Eastern Europe: Correlations Between The Eu Dependence-Attitude Matrix And Cooperation Intensity With China. Rev. De Econ. Mond. J. Glob. Econ. 2017, 9, 1–19. [Google Scholar]

- Pendrakowska, P. Poland’s perspective on the Belt and Road Initiative. J. Contemp. East Asia Stud. 2018, 7, 190–206. [Google Scholar] [CrossRef][Green Version]

- Jakubowski, A.; Komornicki, T.; Kowalczyk, K.; Miszczuk, A. Poland as a hub of the Silk Road Economic Belt: Is the narrative of opportunity supported by developments on the ground? Asia Eur. J. 2020, 18, 367–396. [Google Scholar] [CrossRef]

- Nazarko, J.; Czerewacz-Filipowicz, K.; Kuzmicz, K.A. Comparative analysis of the Eastern European countries as participants of the new silk road. J. Bus. Econ. Manag. 2017, 18, 1212–1227. [Google Scholar] [CrossRef]

- Fang, X. The Belt and Road initiative: Connecting China and Central Europe. Int. Issues Slovak Foreign Policy Aff. 2015, 24, 3–14. [Google Scholar]

- Li, J. The 16+1 Mechanism and One Belt One Road Initiative, New Channels of Promoting Sino-Czech Relations. Glob. Econ. Obs. 2017, 5, 159–166. [Google Scholar]

- Fürst, R.; Pleschová, G. Czech and Slovak relations with China: Contenders for China’s favour. Eur. Asia Stud. 2010, 62, 1363–1381. [Google Scholar] [CrossRef]

- Farkas, Z.A.; Pap, N.; Reményi, P. Hungary’s place on Eurasian rail land bridges and the eastern opening. Hung. Geogr. Bull. 2016, 65, 3–14. [Google Scholar] [CrossRef]

- Vangeli, A. China’s New Silk Road and its impact on Sino-European relations. EU-China Obs. 2015, 1, 20–26. [Google Scholar]

- Soukas, J. EU Probe Threatens Landmark China-Hungary Rail Project. GBTIMES, 2017. Available online: https://findchina.info/eu-probe-threatens-landmark-china-hungary-rail-project (accessed on 3 September 2021).

- Dimitrijevic, D. Chinese Investments in Serbia-A Joint Pledge for the Future of the New Silk Road. Balt. J. Eur. Stud. 2017, 7, 64–83. [Google Scholar] [CrossRef]

- Erdősi, F. Global and regional roles of the Russian transport infrastructures. Discuss. Pap. 2008, 69, 5–51. [Google Scholar]

- Beck, A.; Bente, H.; Schilling, M. Railway efficiency: An overview and a look at opportunities for improvement. In Proceedings of the International Transport Forum Discussion Paper. Organisation for Economic Co-operation and Development (OECD), International Transport Forum, Leipzig, Germany, 22–24 May 2013. No.2013-12. [Google Scholar] [CrossRef]

- Bentyn, Z. Poland as a Regional Logistic Hub Serving the Development of Northern Corridor of the New Silk Route. J. Manag. Mark. Logist. 2016, 3, 135–144. [Google Scholar] [CrossRef]

- Lubina, M. From Geopolitical Chance to Security Threat. Pol. Political Sci. Yearb. 2017, 46, 221–238. [Google Scholar] [CrossRef]

- Ondriaš, J. Issues facing China’s soft power in the 16+ 1 Platform. Econ. Ann. Xxi 2018, 172, 22–27. [Google Scholar] [CrossRef]

- Grzywacz, A. Closer to a threat than an opportunity: Polish perception of China’s rise and international engagement. Asia Eur. J. 2020, 18, 177–194. [Google Scholar] [CrossRef]

| Authors | Year | Geographical Area | Key Findings |

|---|---|---|---|

| Alon et al. [14] | 2019 | Europe—China | A need for cooperation between countries and companies. |

| Toma et al. [15] | 2019 | Eurasia | The success of infrastructure developments requires cooperation between countries and the use of a holistic approach. |

| Wan et al. [5] | 2018 | Eurasia | More attention should be paid to the application of resilience. Sustainability must be a priority in the development of the infrastructure. |

| Thürer et al. [16] | 2020 | Eurasia | There are lots of important transport issues related to sustainability. |

| Thees [17] | 2020 | Eurasia | NSR focuses too much on economic growth and in contrast sustainability and environmental protection play little role. The involvement of local people (e.g., scientists) is needed. |

| Khin et al. [18] | 2019 | Malaysia | NSR is a great opportunity for the Malaysian SME sector. There are important factors, such as the development of e-commerce, which could help the companies. |

| Zhang [19] | 2020 | China | Eliminate excessive control of China’s financial sector. Monetary reforms are needed. |

| Kauf and Laskowska-Rutkowska [20] | 2019 | Poland | Stanisławów in Poland may be the most likely location for an international logistics center. Cities such as Łódź, Gdańsk, or Gorzyczki can provide auxiliary regional distribution centers. |

| Name | Route | Distance (km) | Time (Day) | Start of Operation | Frequency | Main Shipment |

|---|---|---|---|---|---|---|

| Yuxinou | Chongqing-Duisburg | 11,179 | 16 | Jul 2011 | 3×/week | IT products |

| Hanxinou | Wuhan- Mělník/Pardubice | 10,863 | 16 | Oct 2012 | 2 to 3×/week | Electronic products, building materials |

| Sumanou | Suzhou-Warsaw | 11,200 | 18 | Nov 2012 | 6–8×/week | IT products, household goods |

| Rongou | Chengdu-Łódź | 9826 | 10.5 | Apr 2013 | 1×/week | IT products, clothes |

| Zhengou | Chengzhou-Hamburg | 10,214 | 19–20 | Jul 2013 | 1×/week | Consumer products (e.g., clothes) |

| Yixinou | Yiwu-Madrid | 13,052 | 21 | Nov 2013 | 3×/months | Mixed goods |

| Hexinou | Hefei-Hamburg | 11,000 | 15 | Jun 2014 | 2×/months | Electronic products |

| Xiangou | Changsha-Duisburg/Moscow/Tashkent | 11,808 | 18 | Oct 2014 | Every 10 days | Tea, porcelain, car parts |

| Haou | Harbin-Moscow/Hamburg | 9820 | 15 | Jun 2015 | 1×/week | Car parts, clothes |

| Export | Import | Trade Balance | |||

|---|---|---|---|---|---|

| Poland | 2,701,584 | 20.79% | 30,414,556 | 32.31% | −27,712,973 |

| Czech Republic | 2,469,651 | 19.00% | 28,337,633 | 30.10% | −25,867,982 |

| Slovak Republic | 1,898,518 | 14.61% | 5,784,117 | 6.14% | −3,885,600 |

| Hungary | 1,666,401 | 12.82% | 7,157,898 | 7.60% | −5,491,497 |

| Greece | 999,093 | 7.69% | 4,546,496 | 4.83% | −3,547,404 |

| Bulgaria | 922,906 | 7.10% | 1,703,270 | 1.81% | −780,364 |

| Romania | 849,940 | 6.54% | 5,094,577 | 5.41% | −4,244,637 |

| Serbia | 329,169 | 2.53% | 2,507,662 | 2.66% | −2,178,493 |

| Lithuania | 309,140 | 2.38% | 1,039,964 | 1.10% | −730,824 |

| Slovenia | 297,361 | 2.29% | 2,335,422 | 2.48% | −2,038,061 |

| Latvia | 179,440 | 1.38% | 570,676 | 0.61% | −391,236 |

| North Macedonia | 166,142 | 1.28% | 544,878 | 0.58% | −378,737 |

| Croatia | 120,454 | 0.93% | 804,121 | 0.85% | −683,667 |

| Albania | 52,735 | 0.41% | 498,572 | 0.53% | −445,837 |

| Bosnia and Herzegovina | 17,149 | 0.13% | 829,555 | 0.88% | −812,406 |

| Montenegro | 16,570 | 0.13% | 302,217 | 0.32% | −285,647 |

| Estonia | 80 | 0.00% | 1,669,652 | 1.77% | −1,669,572 |

| Total Trade | 12,996,332 | 100.00% | 94,141,268 | 100.00% | −81,144,936 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maró, Z.M.; Török, Á. China’s New Silk Road and Central and Eastern Europe—A Systematic Literature Review. Sustainability 2022, 14, 1801. https://doi.org/10.3390/su14031801

Maró ZM, Török Á. China’s New Silk Road and Central and Eastern Europe—A Systematic Literature Review. Sustainability. 2022; 14(3):1801. https://doi.org/10.3390/su14031801

Chicago/Turabian StyleMaró, Zalán Márk, and Áron Török. 2022. "China’s New Silk Road and Central and Eastern Europe—A Systematic Literature Review" Sustainability 14, no. 3: 1801. https://doi.org/10.3390/su14031801

APA StyleMaró, Z. M., & Török, Á. (2022). China’s New Silk Road and Central and Eastern Europe—A Systematic Literature Review. Sustainability, 14(3), 1801. https://doi.org/10.3390/su14031801