Research on the Green Effect of Environmental Policies—From the Perspective of Policy Mix

Abstract

1. Introduction

2. Institutional Background and Research Hypotheses

3. Data Specification and Estimation Strategy

3.1. Data Specification

3.2. Benchmark Model Regression

3.3. Variable Descriptions

3.3.1. Explained Variables

3.3.2. Core Explanatory Variables

3.3.3. Control Variables

4. Empirical Results

4.1. Basic Regression Results

4.2. Robustness Checks

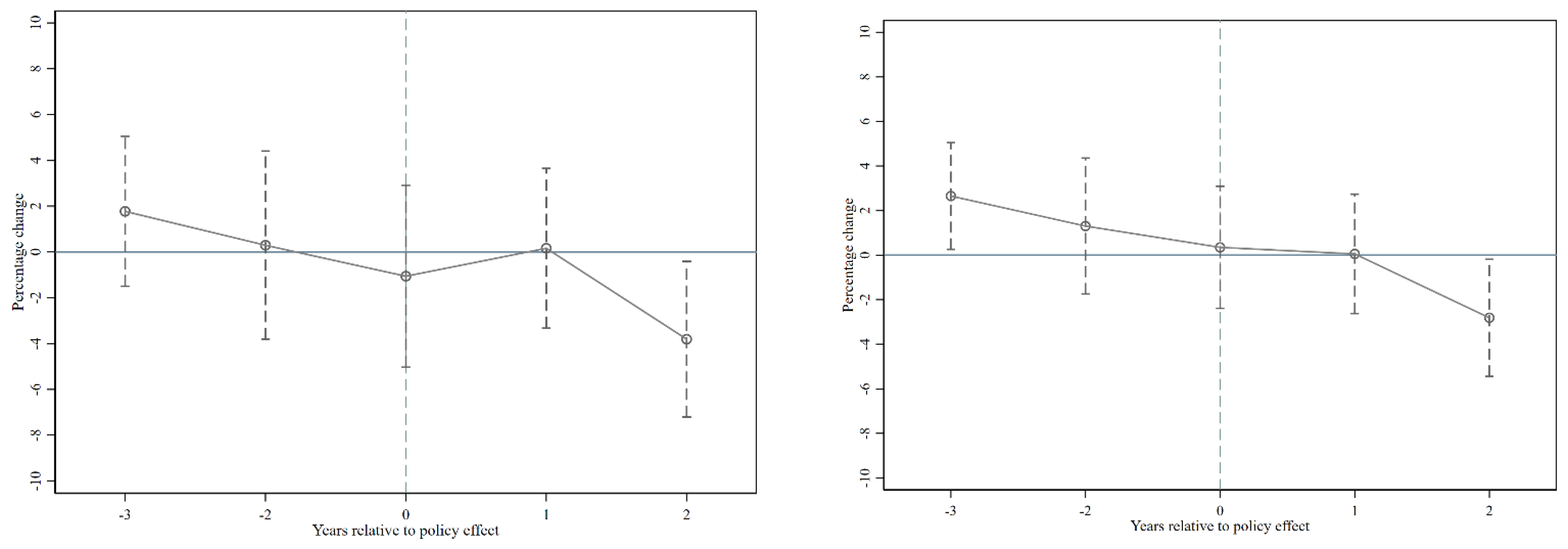

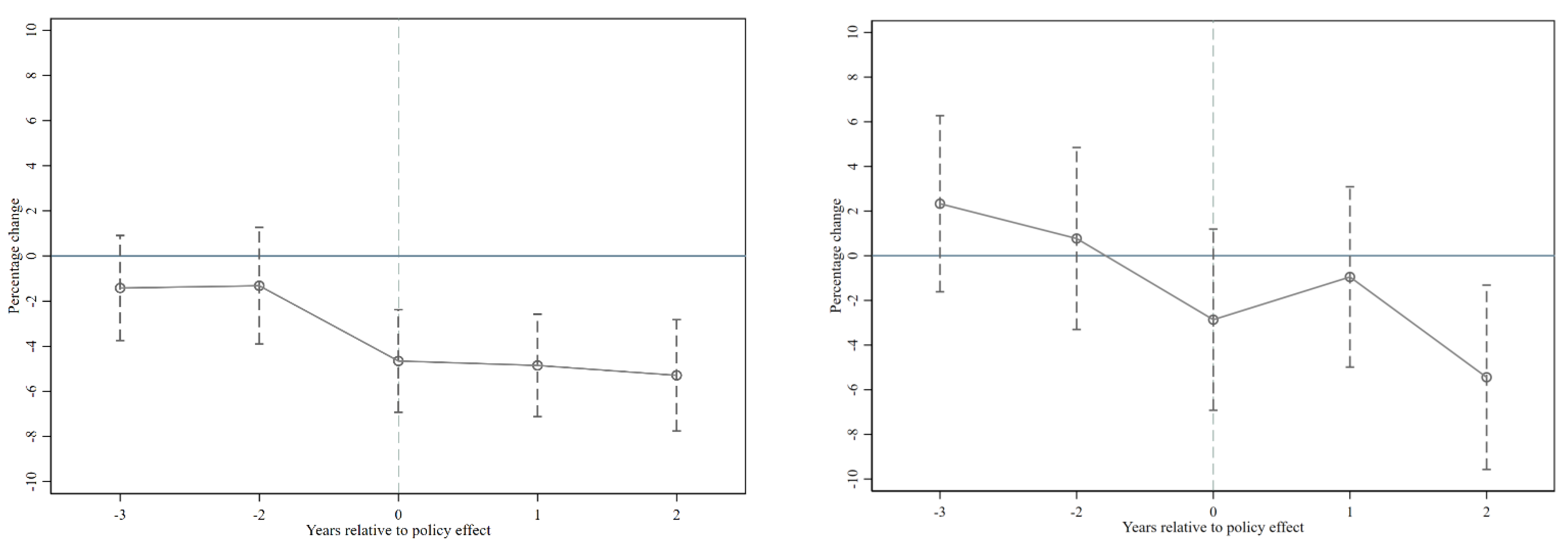

4.2.1. Parallel Trend Test

4.2.2. Substitute Variables

5. Further Discussion

6. Heterogeneity Test

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chen, Z.; Kahn, M.E.; Liu, Y.; Wang, Z. The Consequences of Spatially Differentiated Water Pollution Regulation in China. J. Environ. Econ. Manag. 2018, 88, 468–485. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E.; Sun, W.; Luo, D. Incentivizing China’s Urban Mayors to Mitigate Pollution Externalities: The Role of the Central Government and Public Environmentalism. Reg. Sci. Urban Econ. 2014, 47, 61–71. [Google Scholar] [CrossRef]

- Chang, S.; Lee, C. Ozone Variations through Vehicle Emissions Reductions Based on Air Quality Monitoring Data in Taipei City, Taiwan, from 1994 to 2003. Atmos. Environ. 2006, 40, 3513–3526. [Google Scholar] [CrossRef]

- Han, F.; Li, J. Assessing Impacts and Determinants of China’s Environmental Protection Tax On Improving Air Quality at Provincial Level Based on Bayesian Statistics. J. Environ. Manag. 2020, 271, 111017. [Google Scholar] [CrossRef] [PubMed]

- Bosquet, B. Environmental tax reform: Does it work? A survey of the empirical evidence. Ecol. Econ. 2000, 34, 19–32. [Google Scholar] [CrossRef]

- Wang, R.; Wijen, F.; Heugens, P. Government’s green grip: Multifaceted state influence on corporate environmental actions in China. Strat. Manag. J. 2018, 39, 403–428. [Google Scholar] [CrossRef]

- Karmaker, S.C.; Hosan, S.; Chapman, A.J.; Saha, B.B. The role of environmental taxes on technological innovation. Energy 2021, 232, 121052. [Google Scholar] [CrossRef]

- Wesseh, P.K.; Lin, B. Environmental policy and ‘double dividend’ in a transitional economy. Energy Policy 2019, 134, 110947. [Google Scholar] [CrossRef]

- Lambertini, L.; Pignataro, G.; Tampieri, A. The effects of environmental quality misperception on investments and regulation. Int. J. Prod. Econ. 2020, 225, 107579. [Google Scholar] [CrossRef]

- Mbanyele, W.; Wang, F. Environmental regulation and technological innovation: Evidence from China. Environ. Sci. Pollut. Res. Int. 2022, 29, 12890–12910. [Google Scholar] [CrossRef]

- Calel, R.; Dechezlepretre, A. Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef]

- Erik, H.; Patrick, M. Environmental Policy, Innovation, and Productivity Growth: Controlling the Effects of Regulation and Endogeneity. Environ. Resour. Econ. 2019, 73, 1315–1355. [Google Scholar]

- Jorgenson, D.J.; Wilcoxen, P.J. Environmental Regulation and U.S Economic Growth. Rand J. Econ. 1990, 21, 314–340. [Google Scholar] [CrossRef]

- Pang, A.; Shaw, D. Optimal emission tax with pre-existing distortions. Environ. Econ. Policy Stud. 2011, 13, 79–88. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Aghion, P.; Akcigit, U.; Cagé, J.; Kerr, W.R. Taxation, Corruption, and Growth. Eur. Econ. Rev. 2016, 86, 24–51. [Google Scholar] [CrossRef]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental taxes and the choice of green technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of Environmental Innovation in US Manufacturing Industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Leeuwen, G.; Mohnen, P. Revisiting the Porter hypothesis: An empirical analysis of green innovation for The Netherlands. Econ. Innov. New Technol. 2017, 26, 63–77. [Google Scholar] [CrossRef]

- Hu, B.; Dong, H.; Jiang, P.; Zhu, J. Analysis of the Applicable Rate of Environmental Tax through Different Tax Rate Scenarios in China. Sustainability 2020, 12, 4233. [Google Scholar] [CrossRef]

- Fischer, C.; Springborn, M. Emissions targets and the real business cycle: Intensity targets versus caps or taxes. J. Environ. Econ. Manag. 2011, 62, 352–366. [Google Scholar] [CrossRef]

- Antony, M.; Ollivier, H. Beliefs, Politics, and Environmental Policy. Rev. Environ. Econ. Policy 2016, 10, 183–367. [Google Scholar]

- Blackman, A.; Lyon, T.; Sisto, N. Voluntary Environmental Agreements when Regulatory Capacity is Weak. Comp. Econ. Stud. 2006, 48, 682–702. [Google Scholar] [CrossRef]

- Sugeta, H.; Matsumoto, S. Green Tax Reform in an Oligopolistic Industry. Environ. Resour. Econ. 2005, 31, 253–274. [Google Scholar] [CrossRef]

- Wolff, H. Keep Your Clunker in the Suburb: Low-emission Zones and Adoption of Green Vehicles. Econ. J. 2014, 124, 481–512. [Google Scholar] [CrossRef]

- Markus, G. The effect of low emission zones on air pollution and infant health. J. Environ. Econ. Manag. 2017, 83, 121–144. [Google Scholar]

- Wang, Y.; Sun, X.; Guo, X. Environmental regulation and green productivity growth: Empirical evidence on the Porter Hypothesis from OECD industrial sectors. Energy Policy 2019, 132, 611–619. [Google Scholar] [CrossRef]

- Li, G.; Masui, T. Assessing the Impacts of China’s Environmental Tax Using a Dynamic Computable General Equilibrium Model. J. Clean. Prod. 2019, 208, 316–324. [Google Scholar] [CrossRef]

- Zhang, S.; Mendelsohn, R.; Cai, W.; Cai, B.; Wang, C. Incorporating Health Impacts into A Differentiated Pollution Tax Rate System, A Case Study in the Beijing-Tianjin-Hebei Region in China. J. Environ. Manag. 2019, 250, 109527. [Google Scholar] [CrossRef]

- Helfand, G.E.; Berck, P.; Maull, T. Handbook of Environmental Economics: The Theory of Pollution Policy; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, pp. 249–303. [Google Scholar]

- Slemrod, J. Tax compliance and enforcement. J. Econ. Lit. 2019, 57, 904–954. [Google Scholar] [CrossRef]

- Lori, D.; Nolan, H.N.; Robert, N.S. The effects of environmental regulation on technology diffusion: The case of chlorine manufacturing. Am. Econ. Rev. 2003, 93, 431–435. [Google Scholar]

- Zhao, J.; Jiang, Q.; Dong, X.; Dong, K.; Jiang, H. How does industrial structure adjustment reduce CO2 emissions? Spatial and mediation effects analysis for China. Energy Econ. 2022, 105, 105704. [Google Scholar] [CrossRef]

- Huang, H.; Mbanyele, W.; Fan, S.; Zhao, X. Digital financial inclusion and energy-environment performance: What can learn from China. Structural Change and Economic Dynamics. Struct. Change Econ. Dyn. 2022, 63, 342–366. [Google Scholar] [CrossRef]

- Zhao, H.; Yang, Y.; Li, N.; Liu, D.; Li, H. How Does Digital Finance Affect Carbon Emissions? Evidence from an Emerging Market. Sustainability 2021, 13, 12303. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Liu, Y. China’s urban-rural inequality caused by carbon neutrality: A perspective from carbon footprint and decomposed social welfare. Energy Econ. 2022, 113, 106193. [Google Scholar] [CrossRef]

- Jia, Z. What kind of enterprises and residents bear more responsibilities in carbon trading? A step-by-step analysis based on the CGE model. Environ. Impact Assess. Rev. 2023, 98, 106950. [Google Scholar] [CrossRef]

| Year | Charge Standard | Use of Funds |

|---|---|---|

| 1982 | Implemented over standard charge | Earmarked for its specified purpose only, and used as the environmental protection subsidy |

| 1988 | Kept original rate unchanged | Earmarked for its specified purpose only, and used as the loanable fund for pollution abatement |

| 1993 | Sewage that did not exceed the discharge standard was also charged | Implemented over standard charge |

| 2003 | Enterprises were charged for discharge of all pollutants, and the charges for over-standard sewage discharge were doubled | Earmarked for its specified purpose only, and used as a grant or subsidized loan |

| 2014 | Raised the charges for part of key pollutants | Kept original standard unchanged |

| 2018 | Shifted charge to tax, capped the tax rate and canceled the practice of double tax | Incorporated into the fiscal budget and not earmarked for its specified purpose only |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| AQI | PM2.5 | SO2 | CO | |

| Treat*Post | −2.660 ** | −2.486 *** | −3.854 *** | −0.039 ** |

| (0.922) | (0.817) | (1.089) | (0.018) | |

| second_industry | 0.122 * | 0.0761 | −0.234 *** | −0.003 ** |

| (0.069) | (0.060) | (0.077) | (0.001) | |

| lnpeople | −4.084 *** | −3.384 *** | −0.162 | 0.003 |

| (1.489) | (1.229) | (1.367) | (0.0302) | |

| lnpgdp | 2.091 | 1.927 | 5.370** | 0.053 |

| (1.802) | (1.669) | (2.192) | (0.040) | |

| wat | −0.074 ** | −0.040 | 0.097 *** | 0.002 *** |

| (0.035) | (0.027) | (0.033) | (0.001) | |

| tra | 0.035 | 0.009 | −0.036 | 0.000 |

| (0.038) | (0.031) | (0.037) | (0.001) | |

| gre | 0.142 *** | 0.125 *** | 0.125 ** | 0.002 * |

| (0.054) | 0.044 | (0.051) | (0.001) | |

| lngg | −0.079 | −0.034 | 0.802 | 0.002 |

| (0.461) | 0.470 | (0.654) | (0.009) | |

| deficit | −4.384 | −3.581 | −0.380 | −0.110 |

| (4.317) | (3.511) | (3.176) | (0.134) | |

| City FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| N. Obs | 1389 | 1389 | 1389 | 1389 |

| Adj R-sq | 0.910 | 0.911 | 0.780 | 0.825 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| AQI_num | PM10 | NO2 | O3 | |

| Treat*Post | −0.019 ** | −4.281 *** | −1.883 *** | 2.172 |

| (0.010) | (1.137) | (0.4810) | (1.498) | |

| second_industry | 0.0021 *** | 0.070 | −0.060 | 0.170 * |

| (0.001) | (0.098) | (0.041) | (0.099) | |

| lnpeople | −0.052 *** | −4.955 ** | −1.471 | −1.602 |

| (0.016) | (2.139) | (1.051) | (2.083) | |

| lnpgdp | 0.018 | 4.499 * | 4.643 *** | 6.374 ** |

| (0.022) | (2.486) | (1.312) | (2.815) | |

| wat | −0.002 *** | −0.050 | 0.017 | −0.166 ** |

| (0.001) | (0.051) | (0.033) | (0.067) | |

| tra | 0.001 * | 0.067 | 0.050 ** | 0.057 |

| (0.000) | (0.048) | (0.024) | (0.050) | |

| gre | 0.002 ** | 0.1653 ** | −0.091 * | −0.005 |

| (0.000) | (0.065) | (0.047) | (0.085) | |

| lngg | −0.004 | 0.984 | −0.443 | −1.323 ** |

| (0.005) | (0.685) | (0.298) | (0.599) | |

| deficit | 0.020 | −8.364 | 9.057 *** | −10.647 ** |

| (0.072) | (6.114) | (3.288) | (4.411) | |

| City FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| N. Obs | 1371 | 1371 | 1371 | 1371 |

| Adj R-sq | 0.935 | 0.899 | 0.691 | 0.789 |

| AQI | CO2 | |

|---|---|---|

| (1) | (2) | |

| Treat*Post*Low_carbon | −2.700 ** | −0.0003 ** |

| (0.961) | (0.0001) | |

| Contral Variables | Y | Y |

| City FE | Y | Y |

| Year FE | Y | Y |

| N. Obs | 1389 | 1389 |

| Adj R-sq | 0.692 | 0.646 |

| First Batch | Second Batch | Third Batch | |

|---|---|---|---|

| AQI | |||

| (1) | (2) | (3) | |

| Treat*Post | −7.277 ** | −7.936 ** | −4.510 ** |

| (2.882) | (2.934) | (1.835) | |

| Contral Variables | Y | Y | Y |

| City FE | Y | Y | Y |

| Year FE | Y | Y | Y |

| N. Obs | 37 | 136 | 176 |

| Adj R-sq | 0.878 | 0.669 | 0.653 |

| High Tax | Medium Tax | Low Tax | |

|---|---|---|---|

| CO2 | |||

| (1) | (2) | (3) | |

| Low_carbon | 2.449 *** | −0.062 *** | −0.516 *** |

| (0.010) | (0.003) | (0.049) | |

| Contral Variables | Y | Y | Y |

| City FE | Y | Y | Y |

| Year FE | Y | Y | Y |

| N. Obs | 62 | 649 | 326 |

| High | Low | High | Low | |

|---|---|---|---|---|

| AQI | CO2 | |||

| (1) | (2) | (3) | (4) | |

| Treat*Post*Low_carbon | −4.259 ** | 1.293 | −0.0004 ** | −0.0004 * |

| (1.336) | (1.722) | (0.0002) | (0.0002) | |

| Contral Variables | Y | Y | Y | Y |

| City FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| N. Obs | 609 | 728 | 576 | 677 |

| Adj R-sq | 0.906 | 0.916 | 0.878 | 0.845 |

| EasternRegion | Central Region | WesternRegion | EasternRegion | Central Region | WesternRegion | |

|---|---|---|---|---|---|---|

| AQI | CO2 | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Treat*Post*Low_carbon | −1.671 | 2.178 | −6.575 ** | −0.0003 * | −0.0004 * | −0.0005 * |

| (1.465) | (1.730) | (2.661) | (0.0002) | (0.0002) | (0.0003) | |

| Contral Variables | Y | Y | Y | Y | Y | Y |

| City FE | Y | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y | Y |

| N. Obs | 508 | 474 | 407 | 421 | 386 | 328 |

| Adj R-sq | 0.932 | 0.890 | 0.891 | 0.845 | 0.841 | 0.846 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Z.; Wu, Z.; Zhu, M. Research on the Green Effect of Environmental Policies—From the Perspective of Policy Mix. Sustainability 2022, 14, 15959. https://doi.org/10.3390/su142315959

Liu Z, Wu Z, Zhu M. Research on the Green Effect of Environmental Policies—From the Perspective of Policy Mix. Sustainability. 2022; 14(23):15959. https://doi.org/10.3390/su142315959

Chicago/Turabian StyleLiu, Zixiao, Zengming Wu, and Mengnan Zhu. 2022. "Research on the Green Effect of Environmental Policies—From the Perspective of Policy Mix" Sustainability 14, no. 23: 15959. https://doi.org/10.3390/su142315959

APA StyleLiu, Z., Wu, Z., & Zhu, M. (2022). Research on the Green Effect of Environmental Policies—From the Perspective of Policy Mix. Sustainability, 14(23), 15959. https://doi.org/10.3390/su142315959