How Efficient China’s Tiered Pricing Is for Household Electricity: Evidence from Survey Data

Abstract

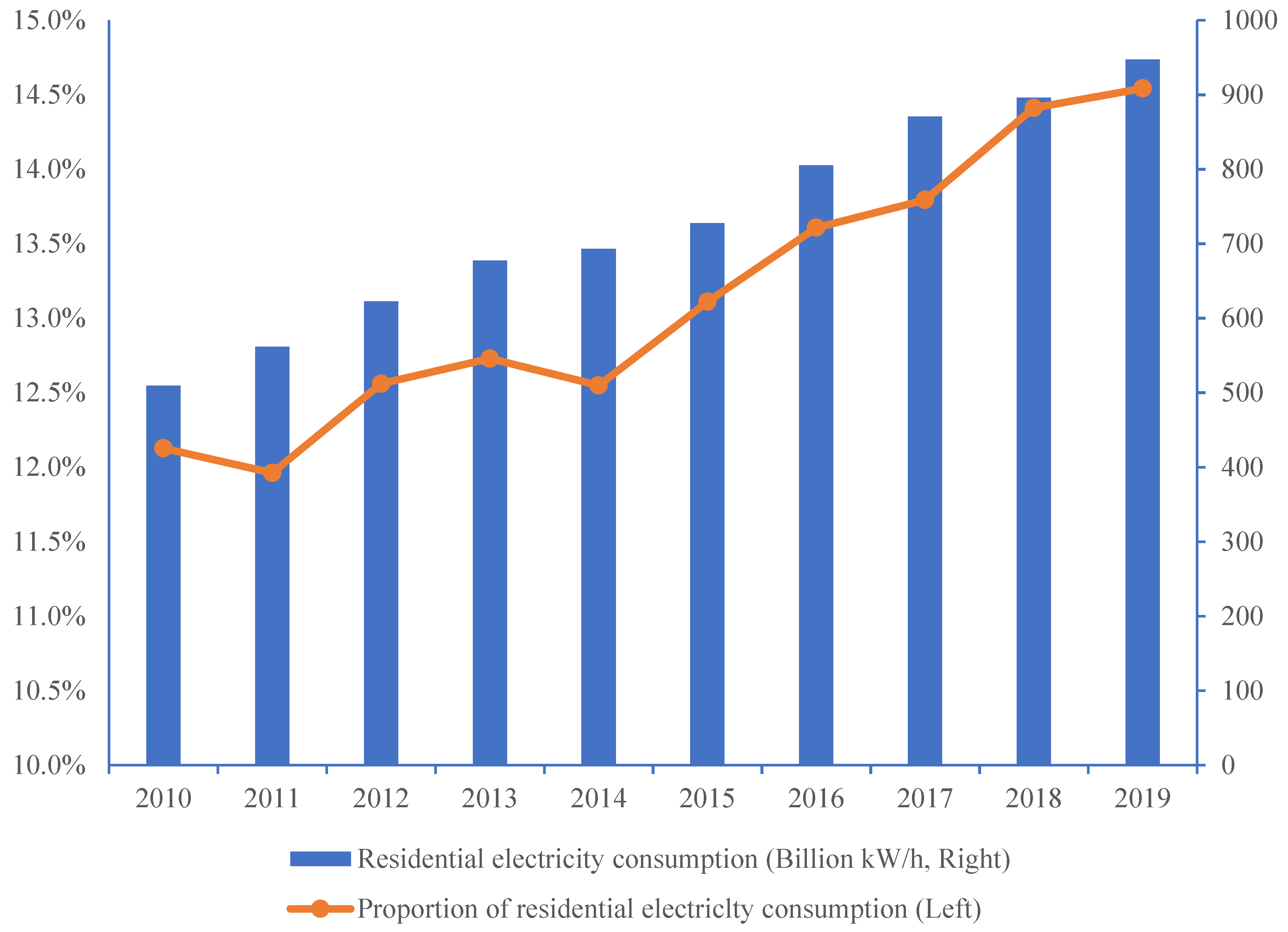

1. Introduction

2. Methodology and Data

2.1. Methodology

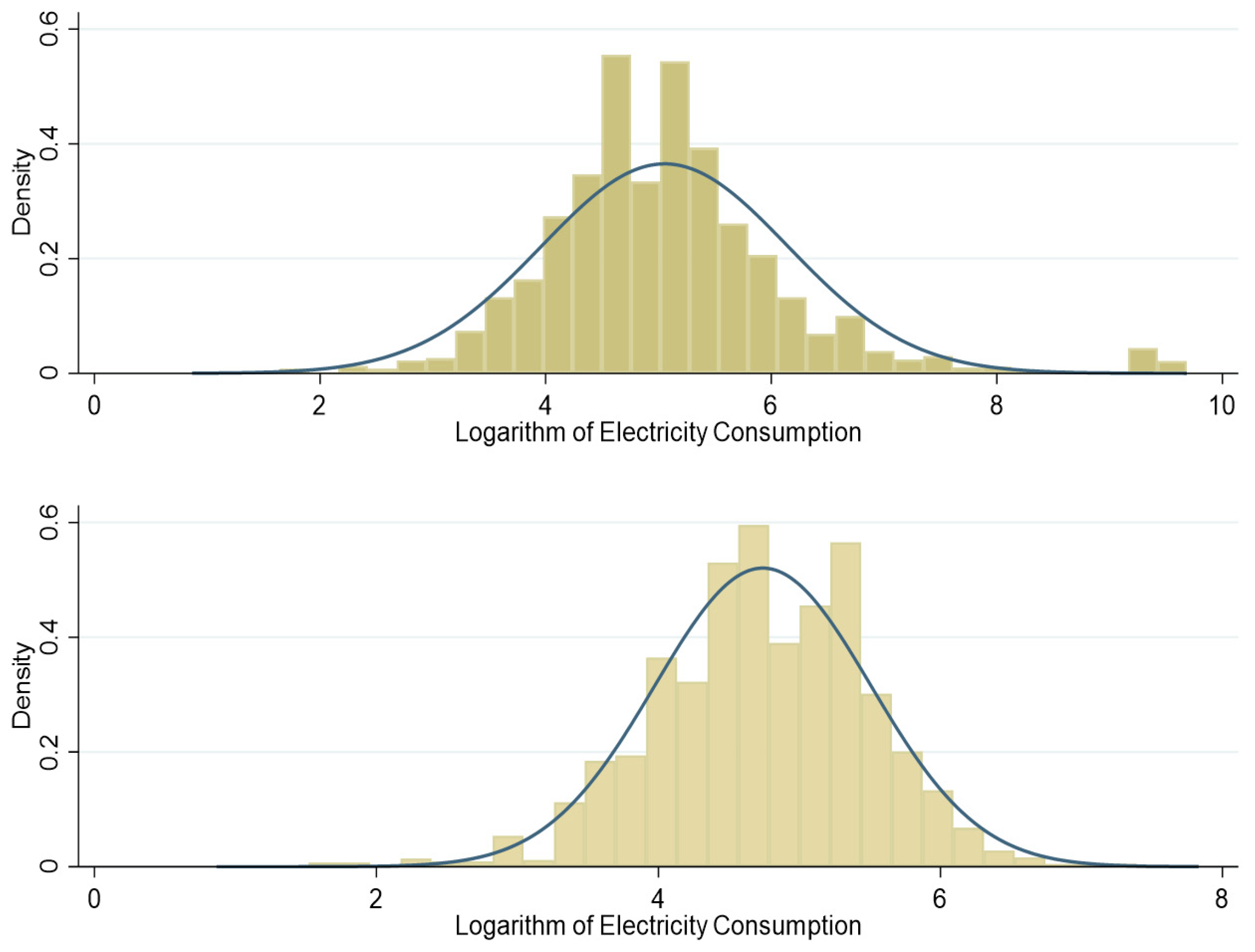

2.2. Data

3. Results

4. Discussion

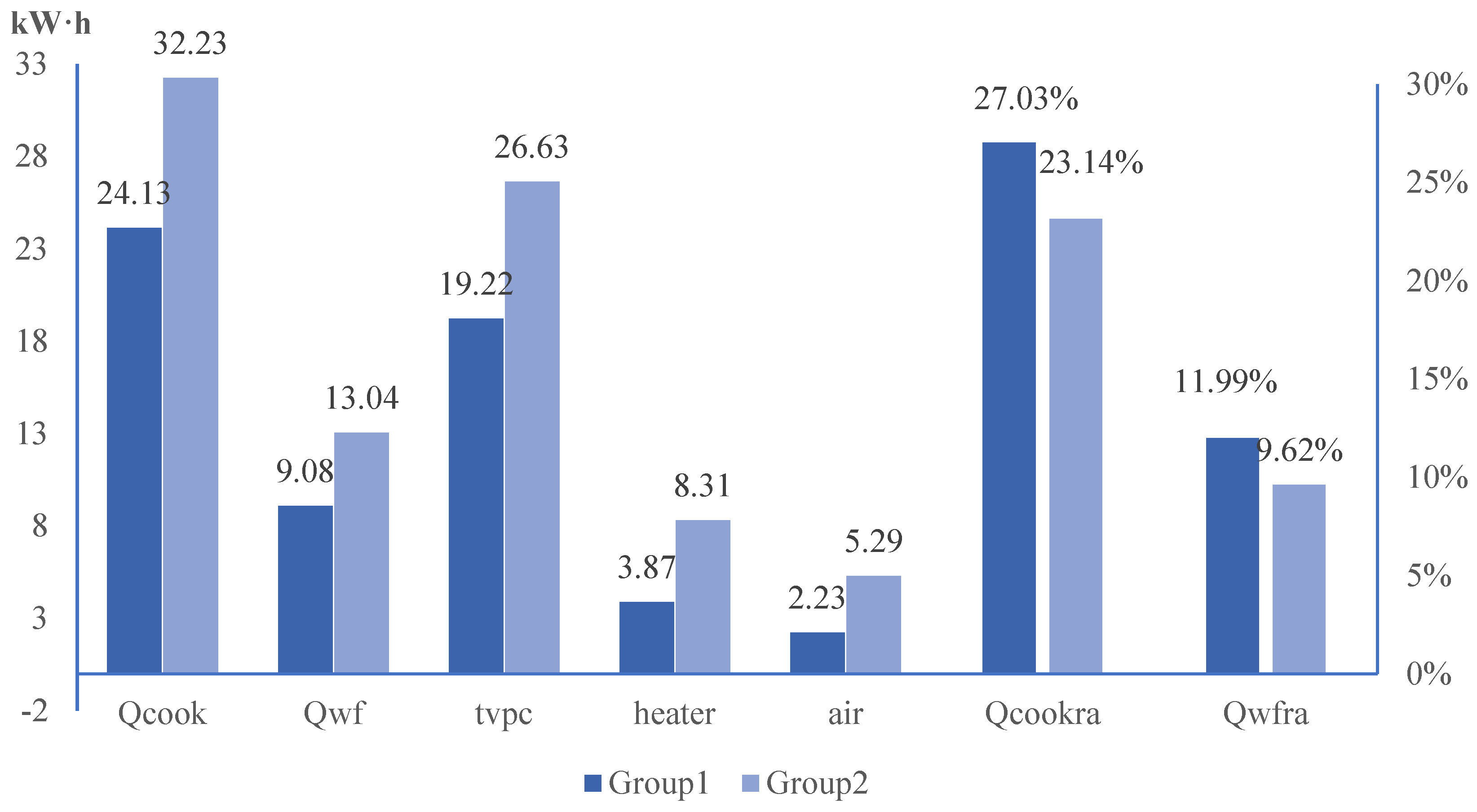

4.1. Examination of Price Elasticity under Income Differences

4.2. Re-Examination of Price Elasticity under Income Differences

5. Conclusions and Policy Implications

- Reduce the coverage of the first-grade electricity of the tiered electricity price. The core of the TPHE is the first level of consumption. Due to historical reasons, China’s residents’ electricity prices have been at a relatively low level for a long time, and the government is too worried about the impact of rising electricity prices on residents’ lives. Therefore, the current first-tier electricity price policy covers a wide range of electricity. As a result, for the vast majority of residential users, electricity prices do not reflect their actual electricity cost, which is not conducive to the use of electricity prices in guiding residents to use electricity reasonably or the efficiency of website resource allocation.

- Raise the difference between the first- and second-tier electricity prices of the tiered electricity price policy. The research results in this paper show that the electricity consumption of the higher-income groups concentrates on the demand generated by improving the quality of life, and therefore has higher price elasticity. However, in the current tiered electricity price policy, the gap between the price of the first-grade electricity and the second-grade electricity is too small, which makes it difficult to raise the policy goal of guiding residents to use electricity reasonably and leads to subsidies for some users who should not be subsidized.

- Further promote the reform of China’s electricity pricing system, improve the role of the market in allocating resources, and use market instruments to improve the efficiency of the electricity market while ensuring the basic needs of low-income groups. In recent years, significant progress has been made in the reform of China’s energy-market mechanism. However, the pricing of the electricity market is still dominated by government administrative pricing, which limits the further improvement of resource allocation efficiency.

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Guo, H.; Davidson, M.R.; Chen, Q.; Zhang, D.; Jiang, N.; Xia, Q.; Kang, C.; Zhang, X. Power market reform in China: Motivations, progress, and recommendations. Energy Policy 2020, 145, 111717. [Google Scholar] [CrossRef]

- Hu, W.; Ho, M.S.; Cao, J. Energy consumption of urban households in China. China Econ. Rev. 2019, 58, 101343. [Google Scholar] [CrossRef]

- Athukorala, W.; Wilson, C.; Managi, S.; Karunarathna, M. Household demand for electricity: The role of market distortions and prices in competition policy. Energy Policy 2019, 134, 110932. [Google Scholar] [CrossRef]

- Du, G.; Lin, W.; Sun, C.; Zhang, D. Residential electricity consumption after the reform of tiered pricing for household electricity in China. Appl. Energy 2015, 157, 276–283. [Google Scholar] [CrossRef]

- Restrepo, J.D.C.; Morales-Pinzón, T. Effects of feedback information on the household consumption of water and electricity: A case study in Colombia. J. Environ. Manag. 2020, 262, 110315. [Google Scholar] [CrossRef]

- Yan, Y.; Zhang, H.; Long, Y.; Zhou, X.; Liao, Q.; Xu, N.; Liang, Y. A factor-based bottom-up approach for the long-term electricity consumption estimation in the Japanese residential sector. J. Environ. Manag. 2020, 270, 110750. [Google Scholar] [CrossRef]

- Shen, B.; Ghatikar, G.; Lei, Z.; Li, J.; Wikler, G.; Martin, P. The role of regulatory reforms, market changes, and technology development to make demand response a viable resource in meeting energy challenges. Appl. Energy 2014, 130, 814–823. [Google Scholar] [CrossRef]

- Zhang, S.; Lin, B. Impact of tiered pricing system on China’s urban residential electricity consumption: Survey evidences from 14 cities in Guangxi Province. J. Clean. Prod. 2018, 170, 1404–1412. [Google Scholar] [CrossRef]

- Wang, X.; Wei, C.; Wang, Y. Does the current tiered electricity pricing structure still restrain electricity consumption in China’s residential sector? Energy Policy 2022, 165, 112995. [Google Scholar] [CrossRef]

- Zheng, X.; Wei, C.; Qin, P.; Guo, J.; Yu, Y.; Song, F.; Chen, Z. Characteristics of residential energy consumption in China: Findings from a household survey. Energy Policy 2014, 75, 126–135. [Google Scholar] [CrossRef]

- Boiteux, M. On the management of public monopolies subject to budgetary constraints. J. Econ. Theory 1971, 3, 219–240. [Google Scholar] [CrossRef]

- Ramsey, F.P. A Contribution to the Theory of Taxation. Econ. J. 1927, 37, 47–61. [Google Scholar] [CrossRef]

- Borenstein, S.; Davis, L.W. The Equity and Efficiency of Two-Part Tariffs in U.S. Natural Gas Markets. J. Law Econ. 2012, 55, 75–128. [Google Scholar] [CrossRef]

- Fang, Y.; Asche, F.; Novan, K. The costs of charging Plug-in Electric Vehicles (PEVs): Within day variation in emissions and electricity prices. Energy Econ. 2018, 69, 196–203. [Google Scholar] [CrossRef]

- Muratori, M.; Kontou, E.; Eichman, J. Electricity rates for electric vehicle direct current fast charging in the United States. Renew. Sustain. Energy Rev. 2019, 113, 109235. [Google Scholar] [CrossRef]

- Bovea, M.D.; Pérez-Belis, V.; Quemades-Beltrán, P. Attitude of the stakeholders involved in the repair and second-hand sale of small household electrical and electronic equipment: Case study in Spain. J. Environ. Manag. 2017, 196, 91–99. [Google Scholar] [CrossRef]

- Kissinger, M.; Damari, Y. Household metabolism: Integrating socio-economic characteristics and lifestyles on individual and national scales as a mean for advancing environmental management. J. Environ. Manag. 2020, 279, 111526. [Google Scholar] [CrossRef]

- Wang, C.; Zhou, K.; Yang, S. A review of residential tiered electricity pricing in China. Renew. Sustain. Energy Rev. 2017, 79, 533–543. [Google Scholar] [CrossRef]

- Lin, B.; Jiang, Z. Designation and influence of household increasing block electricity tariffs in China. Energy Policy 2012, 42, 164–173. [Google Scholar] [CrossRef]

- Belaïd, F.; Joumni, H. Behavioral attitudes towards energy saving: Empirical evidence from France. Energy Policy 2020, 140, 111406. [Google Scholar] [CrossRef]

- Belaïd, F.; Roubaud, D.; Galariotis, E. Features of residential energy consumption: Evidence from France using an innovative multilevel modelling approach. Energy Policy 2019, 125, 277–285. [Google Scholar] [CrossRef]

- Lévy, J.-P.; Belaïd, F. The determinants of domestic energy consumption in France: Energy modes, habitat, households and life cycles. Renew. Sustain. Energy Rev. 2018, 81, 2104–2114. [Google Scholar] [CrossRef]

- Belaïd, F.; Ben Youssef, A.; Lazaric, N. Scrutinizing the direct rebound effect for French households using quantile regression and data from an original survey. Ecol. Econ. 2020, 176, 106755. [Google Scholar] [CrossRef]

- Xie, L.; Yan, H.; Zhang, S.; Wei, C. Does urbanization increase residential energy use? Evidence from the Chinese residential energy consumption survey 2012. China Econ. Rev. 2020, 59, 101374. [Google Scholar] [CrossRef]

- Yu, B.; Yang, X.; Zhao, Q.; Tan, J. Causal Effect of Time-Use Behavior on Residential Energy Consumption in China. Ecol. Econ. 2020, 175, 106706. [Google Scholar] [CrossRef]

- Pu, L.; Wang, X.; Tan, Z.; Wang, H.; Yang, J.; Wu, J. Is China’s electricity price cross-subsidy policy reasonable? Comparative analysis of eastern, central, and western regions. Energy Policy 2020, 138, 111250. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J.M.; López-Otero, X. Estimation of elasticity price of electricity with incomplete information. Energy Econ. 2012, 34, 627–633. [Google Scholar] [CrossRef]

- Flaig, G. Household production and the short- and long-run demand for electricity. Energy Econ. 1990, 12, 116–121. [Google Scholar] [CrossRef]

- Filippini, M.; Hunt, L.C. Energy Demand and Energy Efficiency in the OECD Countries: A Stochastic Demand Frontier Approach. Energy J. 2011, 32, 59–80. [Google Scholar] [CrossRef]

- Niu, G.; Zhao, G. Survey data on political attitudes of China’s urban residents compiled from the Chinese General Social Survey (CGSS). Data Brief 2018, 20, 591–595. [Google Scholar] [CrossRef]

- Hu, S.; He, J.; Yang, C. Evaluating the impacts of the increasing block tariffs on residential electricity consumption in China. Sustain. Prod. Consum. 2022, 29, 180–187. [Google Scholar] [CrossRef]

- Lin, B.; Du, Z. Can urban rail transit curb automobile energy consumption? Energy Policy 2017, 105, 120–127. [Google Scholar] [CrossRef]

- Sun, C. An empirical case study about the reform of tiered pricing for household electricity in China. Appl. Energy 2015, 160, 383–389. [Google Scholar] [CrossRef]

- Pothitou, M.; Hanna, R.F.; Chalvatzis, K.J. Environmental knowledge, pro-environmental behaviour and energy savings in households: An empirical study. Appl. Energy 2016, 184, 1217–1229. [Google Scholar] [CrossRef]

- Druckman, A.; Jackson, T. Household energy consumption in the UK: A highly geographically and socio-economically disaggregated model. Energy Policy 2008, 36, 3177–3192. [Google Scholar] [CrossRef]

- Luo, K.; Qiu, Y.; Xing, B. Commercial consumers pay attention to marginal prices or average prices? Implications for energy conservation policies. J. Clean. Prod. 2022, 377, 134416. [Google Scholar] [CrossRef]

- Ito, K. Do Consumers Respond to Marginal or Average Price? Evidence from Nonlinear Electricity Pricing. Am. Econ. Rev. 2014, 104, 537–563. [Google Scholar] [CrossRef]

- Hausman, J.; McFadden, D. Specification tests for the multinomial logit model. Econ. J. Econ. Soc. 1984, 52, 1219–1240. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Inverse probability weighted M-estimators for sample selection, attrition, and stratification. Port. Econ. J. 2002, 1, 117–139. [Google Scholar] [CrossRef]

- Auffhammer, M.; Mansur, E.T. Measuring climatic impacts on energy consumption: A review of the empirical literature. Energy Econ. 2014, 46, 522–530. [Google Scholar] [CrossRef]

- Hung, M.-F.; Huang, T.-H. Dynamic demand for residential electricity in Taiwan under seasonality and increasing-block pricing. Energy Econ. 2015, 48, 168–177. [Google Scholar] [CrossRef]

- Dubin, J.A.; McFadden, D.L. An Econometric Analysis of Residential Electric Appliance Holdings and Consumption. Econometrica 1984, 52, 345. [Google Scholar] [CrossRef]

- Du, L.; Guo, J.; Wei, C. Impact of information feedback on residential electricity demand in China. Resour. Conserv. Recycl. 2017, 125, 324–334. [Google Scholar] [CrossRef]

- Hargreaves, T.; Nye, M.; Burgess, J. Keeping energy visible? Exploring how householders interact with feedback from smart energy monitors in the longer term. Energy Policy 2013, 52, 126–134. [Google Scholar] [CrossRef]

- Faruqui, A.; Sergici, S.; Sharif, A. The impact of informational feedback on energy consumption—A survey of the experimental evidence. Energy 2010, 35, 1598–1608. [Google Scholar] [CrossRef]

- He, X.; Reiner, D. Electricity demand and basic needs: Empirical evidence from China’s households. Energy Policy 2016, 90, 212–221. [Google Scholar] [CrossRef]

- Liddle, B.; Smyth, R.; Zhang, X. Time-varying income and price elasticities for energy demand: Evidence from a middle-income panel. Energy Econ. 2020, 86, 104681. [Google Scholar] [CrossRef]

- Schulte, I.; Heindl, P. Price and income elasticities of residential energy demand in Germany. Energy Policy 2017, 102, 512–528. [Google Scholar] [CrossRef]

- Cleary, S. The Relationship between Firm Investment and Financial Status. J. Financ. 1999, 54, 673–692. [Google Scholar] [CrossRef]

- Tibshirani, R.J.; Efron, B. An introduction to the bootstrap. Monogr. Stat. Appl. Probab. 1993, 57, 1–436. [Google Scholar]

| Variable | Abbreviation | Obs. | Average | Standard Deviation | Min | Max |

|---|---|---|---|---|---|---|

| Family size | size | 1829 | 2.909 | 1.380 | 1.000 | 14.000 |

| Whether to use smart meters | emet | 1829 | 0.476 | 0.500 | 0.000 | 1.000 |

| Electricity-bill settlement method | bill | 1829 | 0.657 | 0.475 | 0.000 | 1.000 |

| Understand the tiered electricity price | policy | 1829 | 0.388 | 0.487 | 0.000 | 1.000 |

| Electricity price | p1 | 1829 | 0.540 | 0.046 | 0.377 | 0.820 |

| Natural gas prices | p2 | 1829 | 2.549 | 0.710 | 1.480 | 5.930 |

| Electricity consumption | Q | 1829 | 150.253 | 131.717 | 2.377 | 2519.690 |

| Low-temperature days | cdd | 1829 | 25.940 | 27.728 | 0.000 | 112.000 |

| High-temperature days | hdd | 1829 | 171.385 | 46.409 | 54 | 320 |

| Household income | income | 1829 | 6.267 | 15.188 | 0.000 | 400.000 |

| City/Rural | rural | 1829 | 0.353 | 0.478 | 0.000 | 1.000 |

| Frequency of cooking appliances | cooking | 1829 | 32.290 | 45.877 | 0.000 | 671.250 |

| Frequency of electric lamp | lighting | 1829 | 16.864 | 17.324 | 0.000 | 150.500 |

| Frequency of refrigerator usage | fridge | 1829 | 8.741 | 5.093 | 0.000 | 33.000 |

| Frequency of washing machine | washing | 1829 | 22.561 | 12.138 | 0.000 | 161.250 |

| TV frequency | tv | 1829 | 2.866 | 1.265 | 1.000 | 10.000 |

| Computer frequency | pc | 1829 | 2.987 | 1.212 | 0.000 | 17.500 |

| Water-heater use frequency | heater | 1829 | 5.964 | 30.201 | 0.000 | 630.000 |

| Frequency of air conditioning | air | 1829 | 3.675 | 6.061 | 0.250 | 66.125 |

| IV-2SLS | |||

|---|---|---|---|

| (1) | (2) | (3) | |

| lnp1 | −0.882 *** | −1.031 *** | −1.092 *** |

| (−3.055) | (−3.951) | (−4.068) | |

| lnincome | 0.062 *** | 0.025 *** | 0.023 *** |

| (5.867) | (2.917) | (2.889) | |

| lnp2 | 0.328 *** | 0.267 *** | 0.278 *** |

| (4.086) | (3.627) | (3.804) | |

| lnsize | 0.420 *** | 0.310 *** | 0.303 *** |

| (11.178) | (8.889) | (8.737) | |

| rural | 0.358 *** | 0.143 *** | 0.110 *** |

| (10.577) | (4.158) | (3.202) | |

| lncdd | 0.008 ** | 0.003 | 0.003 |

| (1.994) | (0.746) | (0.753) | |

| lnhdd | −0.368 *** | −0.221 *** | −0.195 *** |

| (−5.271) | (−3.222) | (−2.826) | |

| lncooking | 0.007 *** | 0.007 *** | |

| (3.299) | (3.402) | ||

| lnlighting | 0.023 *** | 0.021 *** | |

| (2.782) | (2.588) | ||

| lnfridge | 0.022 *** | 0.022 *** | |

| (7.090) | (7.138) | ||

| lnwashing | −0.048 *** | −0.048 *** | |

| (−2.600) | (−2.585) | ||

| lntv | 0.128 *** | 0.112 *** | |

| (3.207) | (2.800) | ||

| lnpc | 0.044 | 0.050 | |

| (1.080) | (1.306) | ||

| lnheater | 0.014 *** | 0.013 *** | |

| (6.294) | (5.885) | ||

| lnair | 0.191 *** | 0.180 *** | |

| (10.171) | (9.569) | ||

| bill | 0.050 | ||

| (1.550) | |||

| policy | 0.140 *** | ||

| (4.510) | |||

| emet | 0.095 *** | ||

| (3.219) | |||

| _cons | 5.173 *** | 4.566 *** | 4.288 *** |

| (12.836) | (10.831) | (9.759) | |

| Obs | 1829 | 1829 | 1829 |

| Adj-R2 | 0.194 | 0.333 | 0.343 |

| Descriptive Statistics of Instrumental Variables | |

|---|---|

| Average | 0.536 |

| Max | 0.881 |

| Min | 0.377 |

| S.D. | 0.044 |

| Underidentification test | |

| Kleibergen–Paap rk LM statistic | 537.599 |

| p-val | 0.000 |

| Weak identification test | |

| Kleibergen–Paap rk Wald F statistic | 1132.941 |

| Stock–Yogo weak ID test critical values | 16.38 (10%) |

| Tests of endogeneity | |

| Durbin–Wu–Hausman F statistic | 108.933 |

| p-val | 0.000 |

| Electricity Price | Controls | Obs | Adj-R2 | ||

|---|---|---|---|---|---|

| Dichotomous | lnP21 | −0.729 * | Yes | 967 | 0.2968 |

| (−1.91) | |||||

| lnP22 | −1.621 *** | Yes | 862 | 0.1829 | |

| (−4.01) | |||||

| Tertile | lnP31 | −0.469 | Yes | 619 | 0.3248 |

| (−1.02) | |||||

| lnP32 | −1.310 *** | Yes | 679 | 0.2124 | |

| (−3.02) | |||||

| lnP33 | −1.918 *** | Yes | 531 | 0.1616 | |

| (−3.46) | |||||

| Quartile | lnP41 | −0.366 | Yes | 553 | 0.3391 |

| (−0.76) | |||||

| lnP42 | −1.341 ** | Yes | 414 | 0.1901 | |

| (−2.23) | |||||

| lnP43 | −1.508 *** | Yes | 414 | 0.1737 | |

| (−2.98) | |||||

| lnP44 | −1.948 *** | Yes | 448 | 0.1515 | |

| (−3.07) |

| Variables | Coefficient Difference by Fisher’s Permutation Test | p-Value | Coefficient Difference by SUR | p-Value |

|---|---|---|---|---|

| lnp1 | 0.892 | 0.037 | 0.892 | 0.081 |

| lnincome | −0.069 | 0 | −0.069 | 0.085 |

| lnp2 | −0.086 | 0.283 | −0.086 | 0.529 |

| lnsize | −0.023 | 0.354 | −0.023 | 0.737 |

| rural | −0.105 | 0.051 | −0.105 | 0.116 |

| lncdd | 0.004 | 0.296 | 0.004 | 0.587 |

| lnhdd | 0.303 | 0.013 | 0.303 | 0.018 |

| lncooking | 0.005 | 0.138 | 0.005 | 0.248 |

| lnlighting | 0.034 | 0.031 | 0.034 | 0.022 |

| lnfridge | 0.002 | 0.362 | 0.002 | 0.706 |

| lnwashing | −0.124 | 0.007 | −0.124 | 0.027 |

| lntv | 0.19 | 0.008 | 0.19 | 0.012 |

| lnpc | −0.002 | 0.491 | −0.002 | 0.98 |

| lnair | 0.078 | 0.011 | 0.078 | 0.031 |

| lnheater | 0.005 | 0.148 | 0.005 | 0.289 |

| bill | 0.06 | 0.183 | 0.06 | 0.323 |

| policy | 0.036 | 0.278 | 0.036 | 0.544 |

| emet | −0.046 | 0.203 | −0.046 | 0.409 |

| _cons | −0.814 | 0.183 | −0.814 | 0.332 |

| Monthly Electricity Consumption ≤ 115.84 Kwh/Month | Monthly Electricity Consumption > 115.84 kWh/Month | |||||

|---|---|---|---|---|---|---|

| (4) | (5) | (6) | (7) | (8) | (9) | |

| lnp1 | −0.642 ** | −0.459 * | −0.485 * | −0.440 * | −0.678 *** | −0.722 *** |

| (−2.215) | (−1.679) | (−1.728) | (−1.909) | (−2.831) | (−2.929) | |

| lnincome | 0.033 *** | 0.014 | 0.014 | 0.025 *** | 0.013 ** | 0.013 ** |

| (3.516) | (1.574) | (1.548) | (3.195) | (2.015) | (2.118) | |

| lnp2 | 0.260 *** | 0.201 *** | 0.215 *** | 0.087 | 0.087 | 0.090 |

| (3.772) | (2.985) | (3.201) | (1.220) | (1.150) | (1.194) | |

| lnsize | 0.236 *** | 0.143 *** | 0.143 *** | 0.135 *** | 0.131 *** | 0.131 *** |

| (6.238) | (3.969) | (4.024) | (4.116) | (3.958) | (3.970) | |

| rural | 0.180 *** | 0.076 ** | 0.053 | 0.048 * | −0.017 | −0.015 |

| (5.200) | (2.256) | (1.583) | (1.704) | (−0.547) | (−0.471) | |

| lncdd | 0.013 *** | 0.010 *** | 0.009 ** | −0.004 | −0.007 ** | −0.007 * |

| (3.236) | (2.709) | (2.517) | (−1.200) | (−2.118) | (−1.945) | |

| lnhdd | 0.063 | 0.083 | 0.078 | −0.299 *** | −0.254 *** | −0.242 *** |

| (0.868) | (1.187) | (1.090) | (−4.789) | (−3.783) | (−3.524) | |

| lncooking | 0.009 *** | 0.009 *** | 0.000 | 0.000 | ||

| (4.045) | (4.131) | (0.181) | (0.175) | |||

| lnlighting | 0.013 | 0.012 | 0.003 | 0.004 | ||

| (1.396) | (1.313) | (0.425) | (0.485) | |||

| lnfridge | 0.018 *** | 0.018 *** | 0.002 | 0.002 | ||

| (6.690) | (6.622) | (0.421) | (0.411) | |||

| lnwashing | −0.087** | −0.082 ** | −0.019 | −0.020 | ||

| (−2.385) | (−2.251) | (−1.555) | (−1.572) | |||

| lntv | 0.151 *** | 0.145 *** | 0.024 | 0.027 | ||

| (3.596) | (3.394) | (0.665) | (0.743) | |||

| lnpc | −0.012 | −0.008 | 0.031 | 0.032 | ||

| (−0.501) | (−0.365) | (0.919) | (0.931) | |||

| lnheater | 0.005 ** | 0.005 ** | 0.005 ** | 0.005 ** | ||

| (2.181) | (2.031) | (2.406) | (2.530) | |||

| lnair | 0.048 *** | 0.040 ** | 0.095 *** | 0.096 *** | ||

| (2.635) | (2.175) | (5.425) | (5.419) | |||

| bill | 0.010 | 0.039 | ||||

| (0.307) | (1.353) | |||||

| policy | 0.086 *** | −0.007 | ||||

| (2.733) | (−0.260) | |||||

| emet | 0.068 ** | −0.011 | ||||

| (2.202) | (−0.404) | |||||

| _cons | 2.937 *** | 3.327 *** | 3.259 *** | 6.323 *** | 5.939 *** | 5.824 *** |

| (7.074) | (7.521) | (6.986) | (16.625) | (13.676) | (12.980) | |

| Obs | 948.000 | 948.000 | 948.000 | 881.000 | 881.000 | 881.000 |

| r2 | 0.130 | 0.256 | 0.266 | 0.029 | 0.061 | 0.055 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Z.; Li, E.; Zhang, G. How Efficient China’s Tiered Pricing Is for Household Electricity: Evidence from Survey Data. Sustainability 2023, 15, 893. https://doi.org/10.3390/su15020893

Zhang Z, Li E, Zhang G. How Efficient China’s Tiered Pricing Is for Household Electricity: Evidence from Survey Data. Sustainability. 2023; 15(2):893. https://doi.org/10.3390/su15020893

Chicago/Turabian StyleZhang, Zihan, Enping Li, and Guowei Zhang. 2023. "How Efficient China’s Tiered Pricing Is for Household Electricity: Evidence from Survey Data" Sustainability 15, no. 2: 893. https://doi.org/10.3390/su15020893

APA StyleZhang, Z., Li, E., & Zhang, G. (2023). How Efficient China’s Tiered Pricing Is for Household Electricity: Evidence from Survey Data. Sustainability, 15(2), 893. https://doi.org/10.3390/su15020893