To Be or Not to Be? Strategic Analysis of Carbon Tax Guiding Manufacturers to Choose Low-Carbon Technology

Abstract

1. Introduction

2. Literature Review

3. The Basic Model

3.1. Producing Technology and Cost

3.2. Demand Function

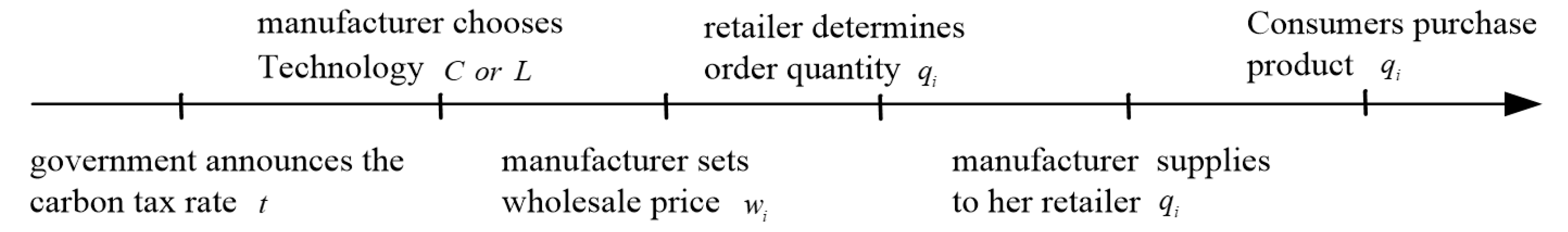

3.3. Event Sequences and Profit Functions

4. Analysis

4.1. Nash Equilibrium

- (i)

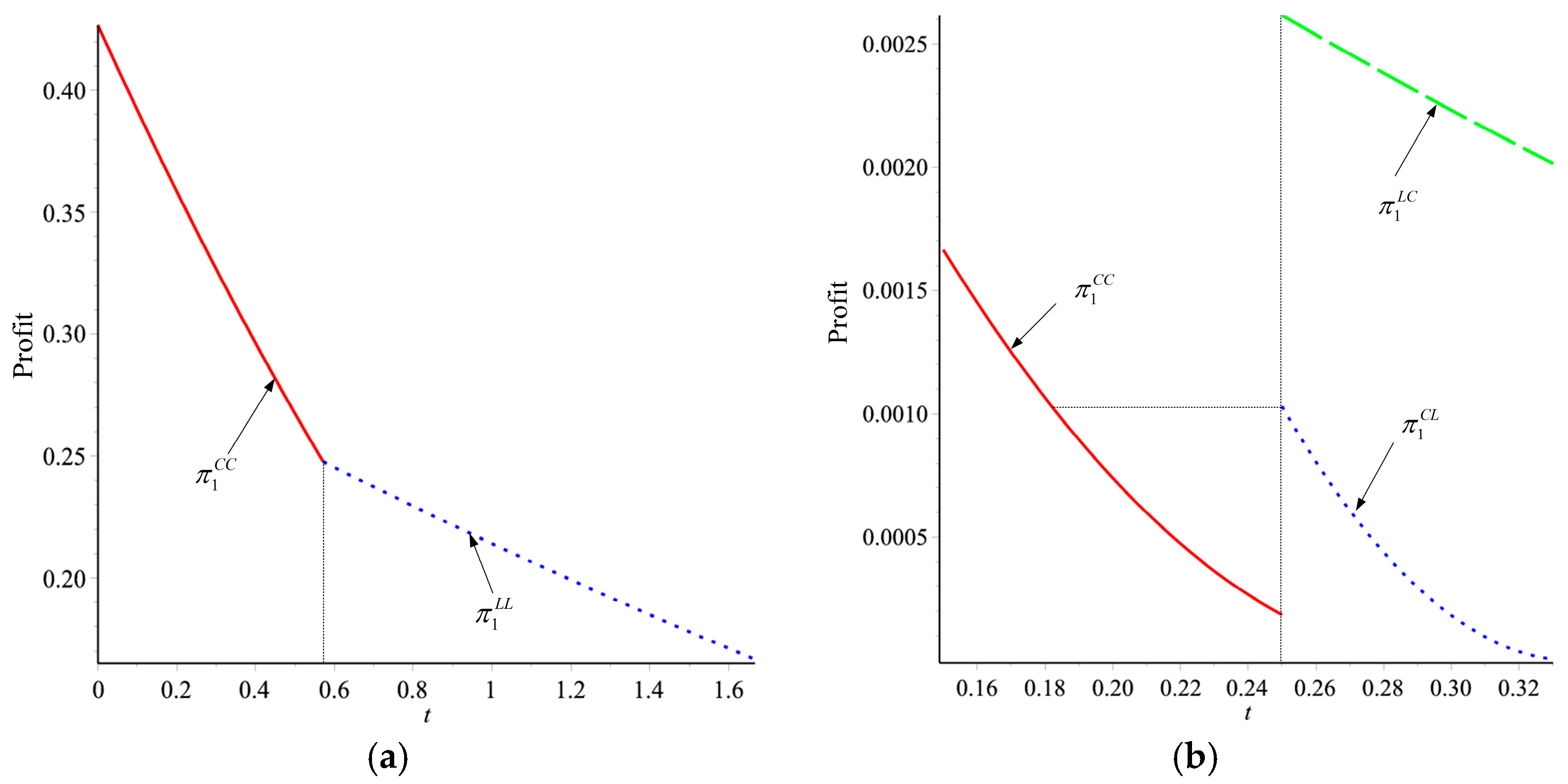

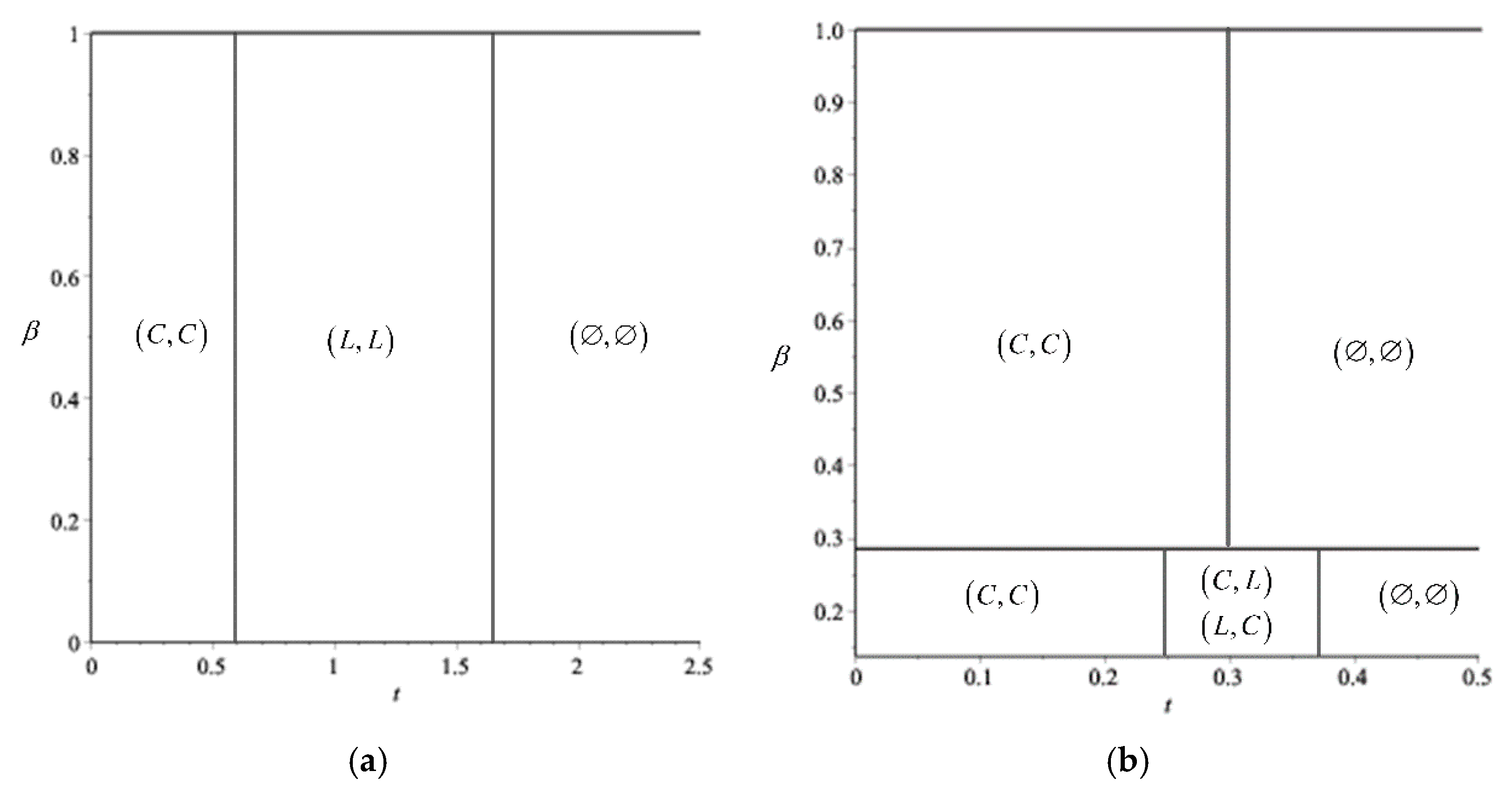

- When the market volume is large (), if the carbon tax , then the equilibrium is ; if the carbon tax , then the equilibrium is ; if the carbon tax , then the equilibrium is .

- (ii)

- When the market volume is small, and the efficiency of the low-carbon technology is high, that is and , if the carbon tax , then the equilibrium is ; if the carbon tax , then the equilibrium are or ; if the carbon tax , then the equilibrium is .

- (iii)

- When the market volume is small, and the efficiency of the low-carbon technology is low, that is and , if the carbon tax , then the equilibrium is ; if the carbon tax , then the equilibrium is .

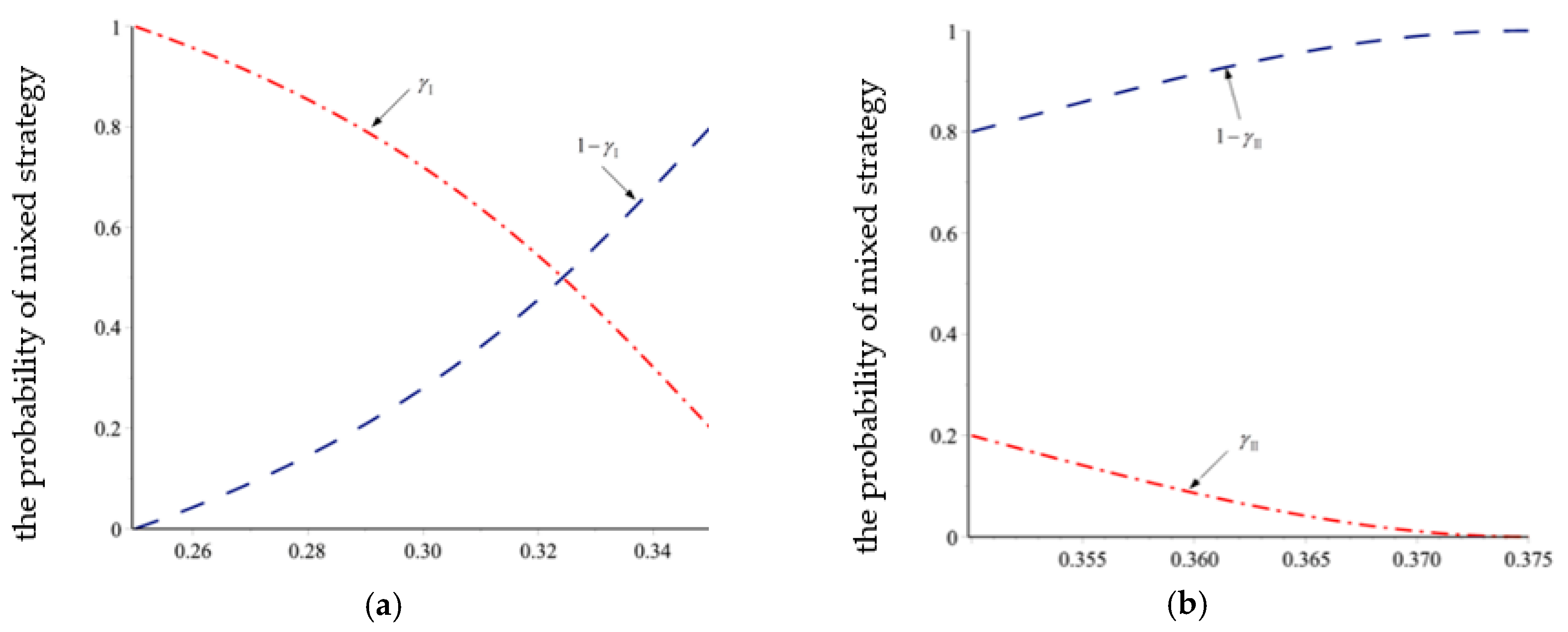

4.2. Mixed Strategy Nash Equilibrium

5. Extensions

5.1. Imperfect Substitute

- (i)

- When the market volume is large (), if the tax , then the equilibrium is ; if the tax , then the equilibrium is ; if the tax , then the equilibrium is .

- (ii)

- When the market volume is small (), and the efficiency of the low-carbon technology is high (), if the tax , then the equilibrium is ; if the tax , then the equilibrium is or ; if the tax , then the equilibrium is .

- (iii)

- When the market volume is small (), and the efficiency of the low-carbon technology is low (), if the tax , then the equilibrium is ; if the tax , then the equilibrium is .

5.2. Price Game

6. Conclusions and Future Research

Supplementary Materials

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 10 November 2022).

- Ruiling, L.; Zhou, L.; Yang, S.; Tijun, F. Evaluating the Impact of Carbon Tax Policy on Manufacturing and Remanufacturing Decisions in a Closed-Loop Supply Chain. Int. J. Prod. Econ. 2022, 245, 108408. [Google Scholar]

- Chen, X.; Wang, X. Effects of Carbon Emission Reduction Policies on Transportation Mode Selections with Stochastic Demand. Transp. Res. Part E Logist. Transp. Rev. 2016, 90, 196–205. [Google Scholar] [CrossRef]

- Govindan, K.; Agarwal, V.; Darbari, J.D.; Jha, P.C. An Integrated Decision-Making Model for the Selection of Sustainable Forward and Reverse Logistic Providers. Ann. Oper. Res. 2019, 273, 607–650. [Google Scholar] [CrossRef]

- Bosung, K.; Sang, W.K.; Kun, S.P. Promoting Supplier’s environmental Innovation via emission taxation. Int. J. Prod. Econ. 2021, 240, 108240. [Google Scholar]

- Ottman, J. The New Rules of Green Marketing: Strategies, Tools, and Inspiration for Sustainable Branding; Routledge: London, UK, 2017. [Google Scholar]

- Cai, Y.J.; Choi, T.M.; Feng, L.; Li, Y. Producer’s choice of design-for-environment under environmental taxation. Eur. J. Oper. Res. 2022, 297, 532–544. [Google Scholar] [CrossRef]

- Bian, G.; Zhang, G.; Zhou, G. Manufacturer vs. Consumer Subsidy with Green Technology Investment and Environmental Concern. Eur. J. Oper. Res. 2020, 287, 832–843. [Google Scholar] [CrossRef]

- Chen, X.; Yang, H.; Wang, X.; Choi, T.M. Optimal Carbon Tax Design for Achieving Low Carbon Supply Chains. Ann. Oper. Res. 2020. [Google Scholar] [CrossRef]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental Taxes and the Choice of Green Technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Alev, I.; Agrawal, V.V.; Atasu, A. Extended Producer Responsibility for Durable Products. Manuf. Serv. Oper. Manag. 2020, 22, 364–382. [Google Scholar] [CrossRef]

- Gopalakrishnan, S.; Granot, D.; Granot, F.; Soi, G.; Cui, H. Incentives and Emission Responsibility Allocation in Supply Chains. Manag. Sci. 2021, 67, 4172–4190. [Google Scholar] [CrossRef]

- He, P.; Zhang, W.; Xu, X.; Bian, Y. Production Lot-sizing and Carbon Emissions under Cap-and-trade and Carbon Tax Regulations. J. Clean. Prod. 2015, 103, 241–248. [Google Scholar] [CrossRef]

- Jin, M.; Shi, X.; Emrouznejad, A.; Yang, F. Determining the Optimal Carbon Tax Rate Based on Data Envelopment Analysis. J. Clean. Prod. 2018, 172, 900–908. [Google Scholar] [CrossRef]

- Haddadsisakht, A.; Ryan, S.M. Closed-loop Supply Chain Network Design with Multiple Transportation Modes under Stochastic Demand and Uncertain Carbon Tax. Int. J. Prod. Econ. 2018, 195, 118–131. [Google Scholar] [CrossRef]

- Yenipazarli, A. Incentives for Environmental Research and Development: Consumer Preferences, Competitive Pressure, and Emissions Taxation. Eur. J. Oper. Res. 2019, 276, 757–769. [Google Scholar] [CrossRef]

- Yenipazarli, A. Managing New and Remanufactured Products to Mitigate Environmental Damage under Emissions Regulation. Eur. J. Oper. Res. 2016, 249, 117–130. [Google Scholar] [CrossRef]

- Cohen, M.C.; Lobel, R.; Perakis, G. The Impact of Demand Uncertainty on Consumer Subsidies for Green Technology Adoption. Manag. Sci. 2016, 62, 1235–1258. [Google Scholar] [CrossRef]

- Zu, Y.; Chen, L.; Fan, Y. Research Low-carbon Strategies in Supply Chain with Environmental Regulations Based on Differential Game. J. Clean. Prod. 2018, 177, 527–546. [Google Scholar] [CrossRef]

- Yu, J.J.; Tang, C.S.; Sodhi, M.; Knuckles, J. Optimal Subsidies for Development Supply Chain. Manuf. Serv. Oper. Manag. 2022, 22, 1131–1147. [Google Scholar] [CrossRef]

- Manikas, A.S.; Kroes, J.R. A Newsvendor Approach to Compliance and Production under Cap and Trade Emissions Regulation. Int. J. Prod. Econ. 2015, 159, 274–284. [Google Scholar] [CrossRef]

- Drake, D.F.; Kleindorfer, P.R.; Van Wassenhove, L.N. Technology Choice and Capacity Portfolios under Emissions Regulation. Prod. Oper. Manag. 2016, 25, 1006–1025. [Google Scholar] [CrossRef]

- Xu, X.; Ping, H.; Hao, X.; Zhang, Q. Supply Chain Coordination with Green Technology under Cap-and-trade Regulation. Int. J. Prod. Econ. 2016, 183, 433–442. [Google Scholar] [CrossRef]

- Chai, Q.; Xiao, Z.; Lai, K.H.; Zhou, G. Can Carbon Cap, and Trade Mechanism be Beneficial for Remanufacturing? Int. J. Prod. Econ. 2018, 203, 311–321. [Google Scholar] [CrossRef]

- Wang, M.; Zhao, L.; Herty, M. Joint Replenishment and Carbon Trading in Fresh Food Supply Chains. Eur. J. Oper. Res. 2019, 277, 561–573. [Google Scholar] [CrossRef]

- Nault, B.R. Equivalence of Taxes and Subsidies in the Control of Production Externalities. Manag. Sci. 2011, 42, 307–320. [Google Scholar] [CrossRef]

- Letmathe, P.; Balakrishnan, N. Environmental Considerations on the Optimal Product Mix. Eur. J. Oper. Res. 2005, 167, 398–412. [Google Scholar] [CrossRef]

- Choi, T.M. Local Sourcing and Fashion Quick Response System: The Impacts of Carbon Footprint Tax. Transp. Res. Part E Logist. Transp. Rev. 2013, 55, 43–54. [Google Scholar] [CrossRef]

- Drake, D.F. Carbon Tariffs: Effects in Settings with Technology Choice and Foreign Production Cost Advantage. Manuf. Serv. Oper. Manag. 2018, 20, 667–686. [Google Scholar] [CrossRef]

- Chan, H.L.; Choi, T.M.; Cai, Y.J.; Shen, B. Environmental Taxes in Newsvendor Supply Chains: A Mean Downside Risk Analysis. IEEE Trans. Syst. Man Cybern. Syst. 2018, 50, 4856–4869. [Google Scholar] [CrossRef]

- Wiesenthal, T.; Leduc, G.; Haegeman, K.; Schwarz, H.G. Bottom-up Estimation of Industrial and Public R&D Investment by Technology in Support of Policy-making: The Case of Selected Low-carbon Energy Technologies. Res. Policy 2012, 41, 116–131. [Google Scholar]

- Subramanian, R.; Gupta, S.; Talbot, B. Product Design and Supply Chain Coordination under Extended Producer Responsibility. Prod. Oper. Manag. 2009, 18, 259–277. [Google Scholar] [CrossRef]

- Yalabik, B.; Fairchild, R.J. Customer, Regulatory, and Competitive Pressure as Drivers of Environmental Innovation. Int. J. Prod. Econ. 2011, 131, 519–527. [Google Scholar] [CrossRef]

- Toptal, A.; Özlü, H.; Konur, D. Joint Decisions on Inventory Replenishment and Emission Reduction Investment under Different Emission Regulations. Int. J. Prod. Res. 2013, 52, 243–269. [Google Scholar] [CrossRef]

- Luo, Z.; Chen, X.; Wang, X. The Role of Co-opetition in Low Carbon Manufacturing. Eur. J. Oper. Res. 2016, 253, 392–403. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Chan, H.K. Manufacturer and Retailer Coordination for Environmental and Economic Competitiveness: A Power Perspective. Transp. Res. Part E Logist. Transp. Rev. 2017, 97, 268–281. [Google Scholar] [CrossRef]

- Hassan, M.; Rousselière, D. Does increasing environmental policy stringency lead to accelerated environmental innovation? A research note. Appl. Econ. 2022, 54, 1989–1998. [Google Scholar] [CrossRef]

- Zhao, J.; Hobbs, B.F.; Pang, J.S. Long-run Equilibrium Modeling of Emissions Allowance Allocation Systems in Electric Power Markets. Oper. Res. 2010, 58, 529–548. [Google Scholar] [CrossRef]

- Krysiak, F.C. Prices vs. Quantities: The Effects on Technology Choice. J. Public Econ. 2008, 92, 1275–1287. [Google Scholar] [CrossRef]

- Storrøsten, H.B. Prices vs. Quantities with Endogenous Cost Structure and Optimal Policy. Resour. Energy Econ. 2015, 41, 143–163. [Google Scholar] [CrossRef]

- Perino, G.; Requate, T. Does more Stringent Environmental Regulation Induce or Reduce Technology Adoption? When the Rate of Technology Adoption is Inverted U-shaped. J. Environ. Econ. Manag. 2012, 64, 456–467. [Google Scholar] [CrossRef]

- Bi, G.; Jin, M.; Ling, L.; Yang, F. Environmental Subsidy and the Choice of Green Technology in the Presence of Green Consumer. Ann. Oper. Res. 2017, 255, 547–568. [Google Scholar] [CrossRef]

- Han, S.; Jiang, Y.; Zhao, L.; Leung SC, H.; Luo, Z. Weight Reduction Technology and Supply Chain Network Design under Carbon Emission Restriction. Ann. Oper. Res. 2020, 290, 567–590. [Google Scholar] [CrossRef]

- Wang, X.; Cho, S.H.; Scheller-Wolf, A. Green Technology Development and Adoption: Competition, Regulation, and Uncertainty—A Global Game Approach. Manag. Sci. 2021, 67, 201–219. [Google Scholar] [CrossRef]

- Feng, F.; Lu, L.X. The Strategic Perils of Low-cost Outsourcing. Manag. Sci. 2012, 58, 1196–1210. [Google Scholar] [CrossRef]

- Li, L.; Zhang, H. Confidentiality and Information Sharing in Supply Chain Coordination. Manag. Sci. 2008, 54, 1467–1481. [Google Scholar] [CrossRef]

| Profit Functions of the Retailers and Manufacturers | Retailer2/Manufacturer2 | ||

|---|---|---|---|

| Low-Carbon Technology L | |||

| Retailer1 /Manufacturer1 | Common technology C | ||

| Low-carbon technology L | |||

| Cases | |||||||||

| Equilibrium | |||||||||

| Cases | |||||||||

| Equilibria | |||||||||

| Cases | |||||||||

| Equilibria | |||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mu, Y.; Niu, F. To Be or Not to Be? Strategic Analysis of Carbon Tax Guiding Manufacturers to Choose Low-Carbon Technology. Sustainability 2022, 14, 15272. https://doi.org/10.3390/su142215272

Mu Y, Niu F. To Be or Not to Be? Strategic Analysis of Carbon Tax Guiding Manufacturers to Choose Low-Carbon Technology. Sustainability. 2022; 14(22):15272. https://doi.org/10.3390/su142215272

Chicago/Turabian StyleMu, Yanfen, and Feng Niu. 2022. "To Be or Not to Be? Strategic Analysis of Carbon Tax Guiding Manufacturers to Choose Low-Carbon Technology" Sustainability 14, no. 22: 15272. https://doi.org/10.3390/su142215272

APA StyleMu, Y., & Niu, F. (2022). To Be or Not to Be? Strategic Analysis of Carbon Tax Guiding Manufacturers to Choose Low-Carbon Technology. Sustainability, 14(22), 15272. https://doi.org/10.3390/su142215272