1. Introduction

Information asymmetry exists among corporate managers, shareholders, and corporate stakeholders [

1]. The information asymmetry does not have a positive influence on corporate value because it gives anxiety and uncertainty to shareholders and corporate stakeholders. According to a stakeholder standpoint approach to the resource-based theory [

2], CEOs can have access to critical resources that many stakeholders can provide. If a manager shares key information about a company with shareholders and stakeholders and reliably presents countermeasures, the value of the firm is likely to be evaluated positively. Based on the stakeholder resource-based theory [

2], in most competitive circumstances, a firm will not be able to attract the kind of resources necessary to generate such profits if the only stakeholder making a claim for the economic benefits of the company is the shareholder. In order to attract the kinds of resources that can generate profits, managers must recognize that stakeholders, besides shareholders, have claims about profits that help their resources generate.

In addition, based on the stakeholder theory [

3,

4], CSR activities of firms have a positive effect on the future corporate value measured by Tobin’s q. Also, the legitimacy theory [

5,

6] explains that the management of a company discloses positive social and environmental information in response to the unfavorable attitude of the media. This is the theory that supports the justification and motivation for disclosing information on activities for the society and environment of a company.

A sound corporate governance structure can improve corporate value. If the CEO transparently discloses management information about the company and acts ethically, the future of the company will naturally be bright. Also, according to the legitimacy theory [

7,

8], corporate social responsibility activities improve the company image and give customers belief and trust in the company, ultimately further strengthening corporate value.

Therefore, managers need to make various efforts to solve information asymmetry about companies. As one of them, the CEO messages on the company’s vision and strategy are disclosed on the corporation’s website. The CEO messages on the corporate website allow shareholders and stakeholders outside the company to know information on the management philosophy of corporate managers and the direction of corporate development.

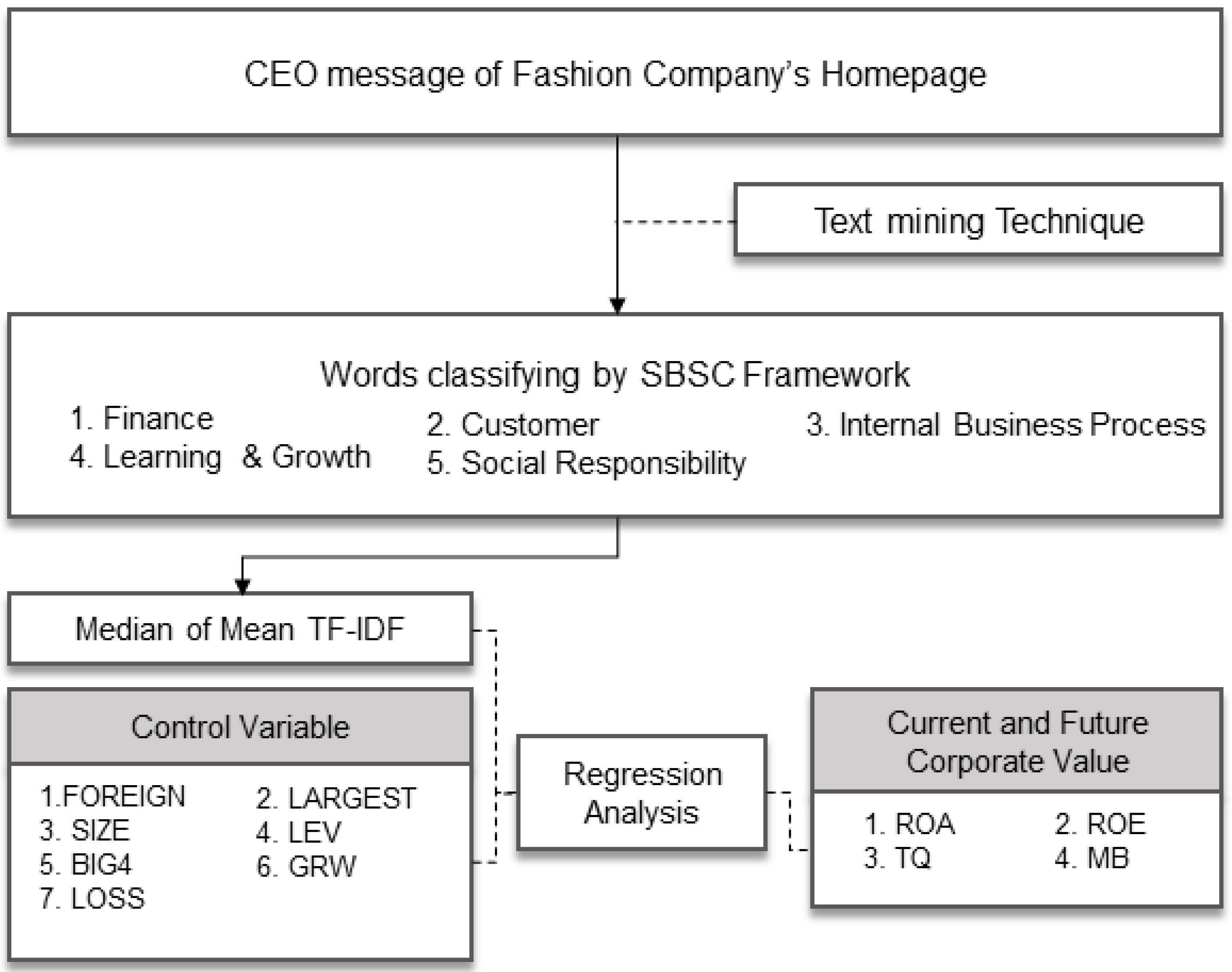

This purpose of this is to examine the association between CEO messages and corporate value on the website of fashion companies. To analyze this, first, through text-mining techniques, keywords that are significantly repeated are extracted from CEO messages on the homepages of companies belonging to the fashion industry. The keywords are then classified through the SBSC (Sustainability Balanced Scorecard) framework. Finally, the more fashion companies emphasize in the CEO message, the higher the corporate value of the present and future.

The corporate homepage contains a variety of information, which delivers many contents to the outside [

9]. Companies present important information directly or indirectly, especially through CEO messages on their homepage [

10]. When a company’s strategy team or marketing team publishes a CEO message on its website, they upload it through careful review [

11]; namely, the CEO messages on the corporate homepage contain important information about the company’s vision, goals, strategy, etc. [

12,

13,

14]. Therefore, this study analyzes the CEO message posted on the company’s website to obtain important information about what the company is aiming for, what it values, and what it practices for it.

One of the representative performance evaluation indicators for companies is the BSC framework [

15,

16,

17]. It is classified into a finance standpoint, a customer standpoint, an internal management process standpoint, and a learning and growth standpoint. In addition to quantitative information such as a financial standpoint, this performance evaluation indicator includes qualitative information such as a customer standpoint, an internal management process standpoint, and a learning and growth standpoint [

18]. Recently, as information on corporate social activities is emphasized, the SBSC framework is often used for performance evaluation or research [

19,

20,

21,

22]. Therefore, in this study, CEO messages are classified using the SBSC framework because it is expected that companies belonging to the fashion industry who have social responsibility and devote themselves to society will have higher corporate value.

The concrete analysis procedure of this paper is as follows. First of all, only companies belonging to the fashion industry among companies listed in Korea’s KOSPI and KOSDAQ are extracted and used as samples. At the same time, financial data on the sample company are downloaded from Kis-value [

23] and converted into variables. Second, CEO messages on the website of the sample company are directly collected by hand-collecting, and words with high TF-IDF [

24,

25] values are selected as keywords through text-mining [

26] techniques. Next, in this study, the CEO messages of the firm are classified using the SBSC framework. In other words, this research classifies the keywords of CEO messages posted on the websites of companies belonging to the fashion industry as being one of finance standpoints, customer standpoints, internal management process standpoints, learning and growth standpoints, and responsibility social standpoints. Finally, we investigate through regression analysis whether firms that emphasize certain factors have changes in their future or current corporate value. Additionally, we check the objectivity and robustness of the results of this study using social network analysis [

27], CONCOR analysis [

28], and 2SLS analysis.

This paper is composed of the following. In

Section 2, our researchers derive the hypotheses from previous studies related to the subject of this study.

Section 3 explains sample selection and research models for demonstrating hypotheses, and

Section 4 shows empirical analysis results and discusses their meanings. In

Section 5, we conclude this paper.

2. Previous Literature and Hypotheses Development

With the “Korean Wave” becoming popular around the world, the Korean fashion industry is also developing. Since the fashion industry is a trend-sensitive industry, consumers’ reactions are very important [

28]. In particular, Korea is a country with developed IT, and in the fashion industry, it more actively conducts marketing activities through various media such as social media and websites to identify consumers’ needs than any other industries [

29]. Korean fashion companies tend to conduct online marketing more actively than companies in other industries. Therefore, this study selects companies belonging to the Korean fashion industry as samples.

Information asymmetry exists between firm insiders (managers) and outsiders (shareholders and corporate stakeholders) [

1]. This information asymmetry does not have a positive influence on company value in the long run as it gives uncertainty to shareholders and corporate stakeholders [

1,

2]. So as to solve the information asymmetry, the CEO of a company delivers information about the company to stakeholders, shareholders, and customers outside the company through various methods. As one of the various means of information transmission, there is a company’s official website.

Hence, CEOs should try to make various efforts to solve information asymmetry about companies. As one of them, the CEO messages on the company’s website supply shareholders, corporate stakeholders, and customers with the company’s vision and strategy. The CEO messages on the corporate website contain critical information on the management philosophy of corporate managers and the plan of corporate development.

Each company has different contents to emphasize through CEO messages through the homepage. In general, the CEO message implies the vision or goal that the company aims for [

9,

11]. Specifically, it may include marketing elements directed at customers or strategies to improve employee satisfaction [

10,

13], and it may include content on corporate social responsibility and activities that have recently been emphasized socially [

12,

13]. This paper examines CEO messages on the websites of Korean fashion companies to investigate which elements of CEO messages will be related to current or future corporate value.

In this research, first, keywords are extracted from CEO messages using the text mining technique [

26]. Then, using the SBSC framework [

20,

22], the keywords are classified into one of the financial standpoints, customer standpoints, internal management process standpoints, learning and growth standpoints, and social responsibility standpoints. Through this process, it is expected that the vision or goal that the company wants to pursue can be inferred to some extent through the CEO messages on the corporate website.

Namely, this study aims to conduct an empirical analysis on whether there is a significant relationship between the points emphasized by the company (financial standpoint, customer standpoint, internal process standpoint, learning and growth standpoint, and corporate social activity) and current or future corporate value. Most of the emphasis in a company’s CEO message is what the company wants to pursue from a long-term standpoint [

9,

10,

12,

14]. Therefore, it is expected that it will be difficult for the emphasis in the CEO messages posted on the company’s website to immediately lead to current corporate performance. Hence, the following hypothesis is derived.

Hypothesis 1. The emphasis on the CEO message’s content (financial standpoint, customer standpoint, internal management process standpoint, learning and growth standpoint, and corporate social activities) on the corporate website belonging to the fashion industry will not have a significant relationship with the current corporate value.

Also, this research conducts an empirical analysis on whether the emphasis (financial standpoint, customer standpoint, internal process standpoint, learning and growth standpoint, and social responsibility) among the CEO messages on the corporate website has a significant relationship with future corporate value.

According to a stakeholder standpoint approach to the resource-based theory [

1], CEOs can have access to significant resources stakeholders can provide. If a manager provides useful and important information about a firm with shareholders and stakeholders, the firm value is likely to be estimated more positively. Based on the stakeholder resource-based theory [

2], if a firm attracts the kind of resources necessary to generate such profits, the manager of the company should recognize that stakeholders as well as shareholders have claims about profits that help their resources generate. And, by the stakeholder theory [

3,

4], CSR activities of firms have a positive impact upon the future firm value [

29,

30]. Also, by the legitimacy theory [

5,

6], if the manager of the company discloses positive social and environmental information in response to the media, it improves the corporate image and brings good results to the company.

If the CEO transparently discloses management information about the company and behaves ethically, corporate governance is sound, and this plays a critical part in the growth of the company. In addition, according to the legitimacy theory [

7,

8], corporate social responsibility activities improve a firm’s image and give customers belief and trust in the company, ultimately further strengthening corporate value.

However, in general, the emphasis on a firm’s CEO message is more time-consuming from a long-term standpoint than easily achievable in the short term [

12,

13]. Even if the emphasis in the CEO message posted on the company’s website does not directly lead to current corporate performance, it may have a significant effect on future corporate value to some extent from a long-term standpoint. In other words, the CEO of the company will continue to pursue what he or she aims for in the CEO message of the website, and these efforts are expected to be realized in the long run to help improve future corporate value. Thus, we derive the following hypothesis.

Hypothesis 2. The emphasis on the CEO message content (financial standpoint, customer standpoint, internal management process standpoint, learning and growth standpoint, and corporate social activities) on the corporate website belonging to the fashion industry will have a significant association with the future firm value.

5. Conclusions

This paper examined the association between CEO messages and current and future firm value on the websites of fashion companies. The research methods of this paper are as follows: First, we extracted the fashion companies’ samples among companies listed in Korea’s KOSPI and KOSDAQ in 2020. Financial data of the sample companies were downloaded from Kis-value [

15] and converted into financial variables. Second, CEO messages’ text data on the homepages of the fashion companies were obtained by hand-collecting. The repeated words with high TF-IDF [

16,

17] values were selected as keywords using text-mining [

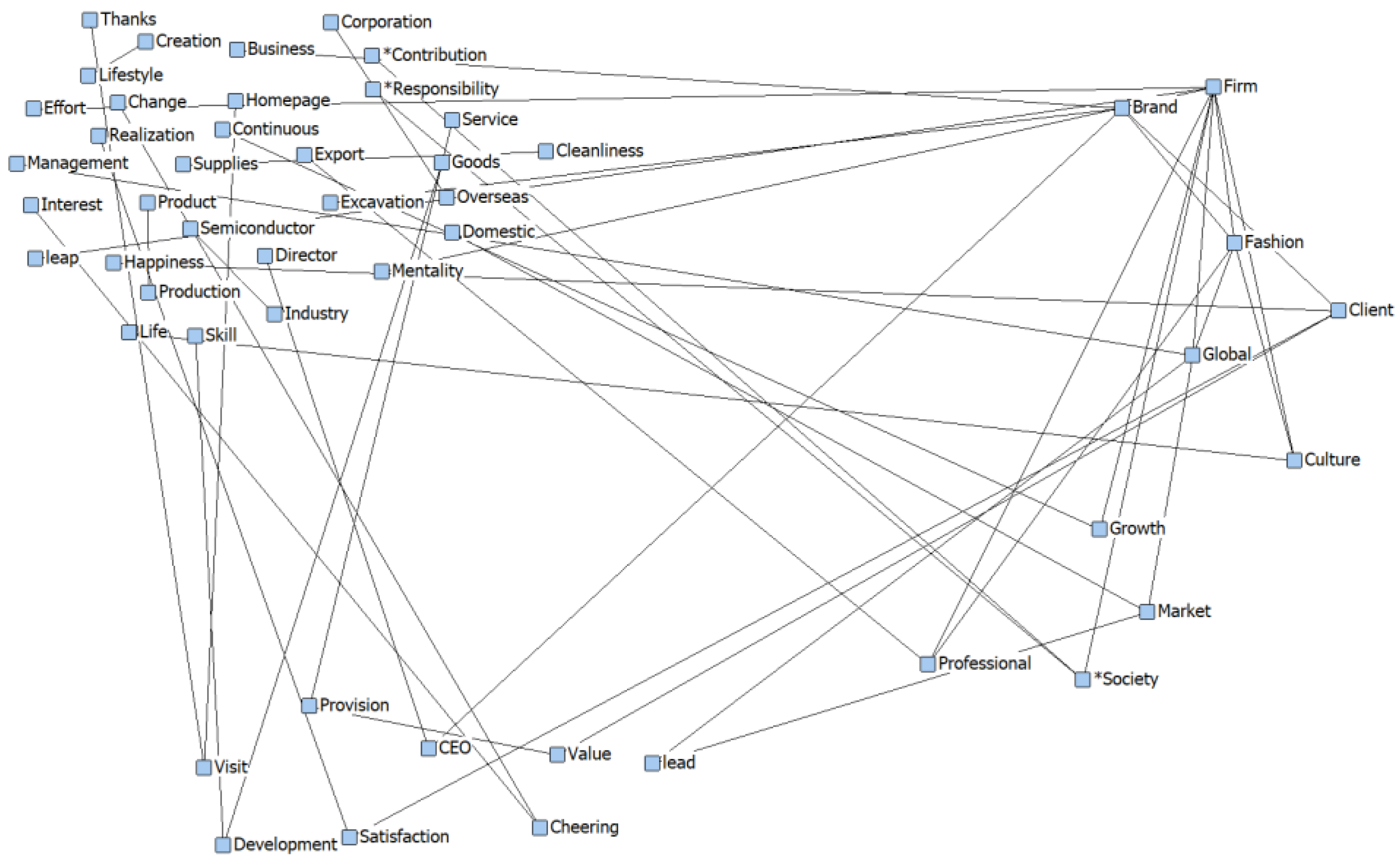

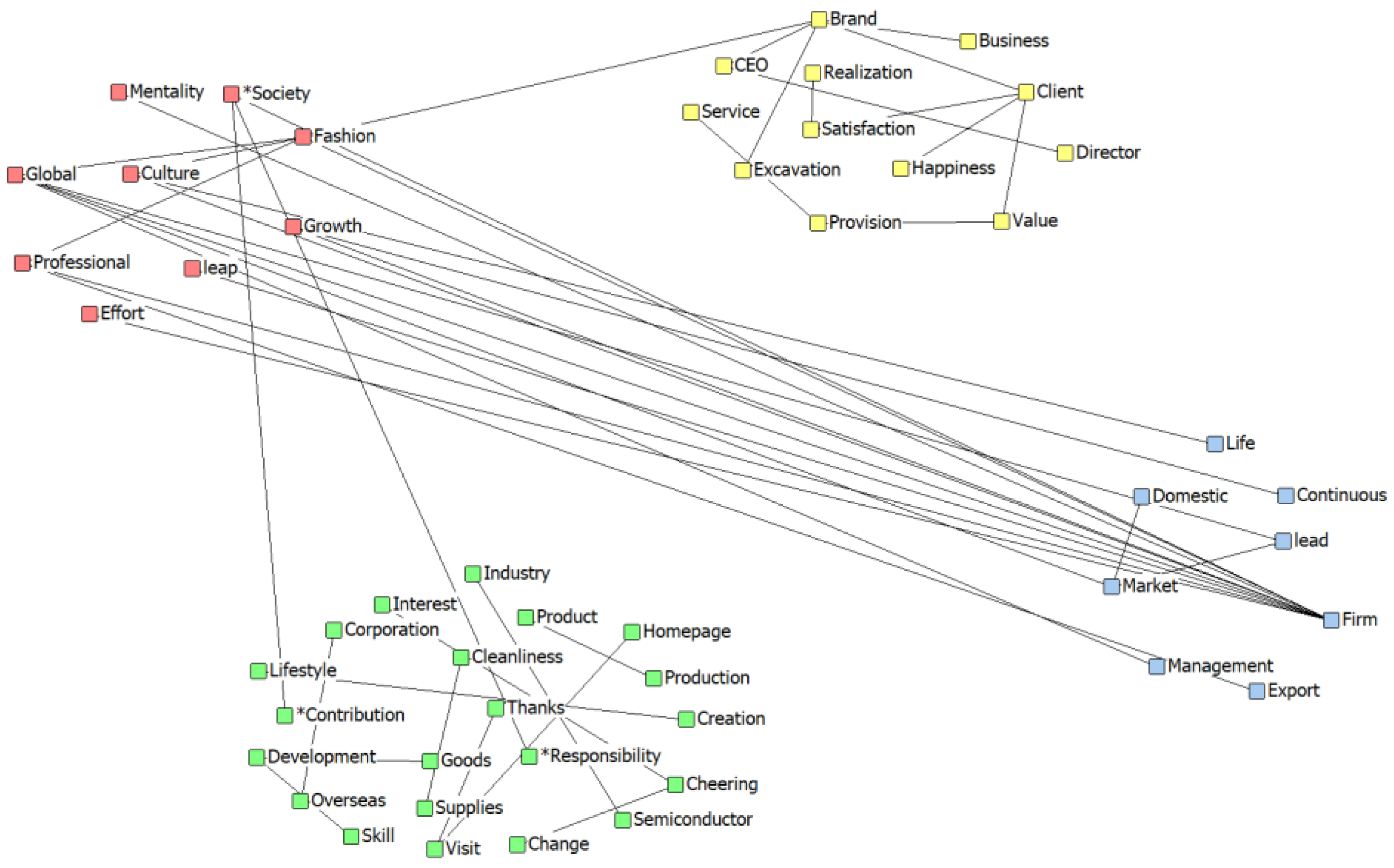

18] techniques. Third, the CEO messages of the fashion firms are classified by the SBSC framework. Namely, keywords of CEO messages posted on the websites of fashion companies were classified as one of financial standpoints, customer standpoints, internal management process standpoints, learning and growth standpoints, and corporate social standpoints. Ultimately, this research investigates through regression analysis whether firms that emphasize certain factors affect their future or current corporate value. As an additional test, to check the objectivity and robustness of the results of this paper, this paper used social network analysis [

19] and CONCOR analysis [

20]. Also, to check endogeneity, this study conducted 2SLS analysis.

The findings of this research are as follows: The first finding presents that all the standpoints of the CEO message of fashion firms had no significant association with current firm value. These results imply that CEO messages posted on the company homepage are generally expressed from a long-term standpoint, and it takes a long time to realize their visions or goals expressed in the CEO message to actually effect corporate value.

The second finding shows that the future firm value can be improved as firms mention more words related to a corporation’s social responsibility among CEO messages of the company homepages disclosed by fashion companies. In recent years, consumers have responded favorably to companies that devote and serve social activities with social responsibility. Especially, owing to the nature of fashion companies, they are relatively more sensitive to consumers’ reactions and consider the image of the firm more importantly than those belonging to other industries. This result implies that if a fashion firm shows its vision and goals related to corporate social responsibility and makes an effort to achieve them, the company’s value will be increased in the future.

Additionally, this study performed social network analysis [

19] and CONCOR analysis [

20] to check the objectivity and robustness of the results of this paper. And, to check endogeneity, this paper also conducted 2SLS analysis. In conclusion, the results of the additional tests support the fact that there is a significant positive association between the mention of social responsibility in the CEO message of the corporate website and future firm value. In other words, this result provides us with important and useful information that fashion companies can grow brand value through social responsibility activities and that the CEO of the firm can play an important part in successful development of the company.

The contributions of this study are as follows. First, this research quantified unstructured text data through text mining for topics in the accounting field and then conducted an empirical analysis using them. The introduction of the new and innovative methodology used in this study is expected to contribute to the development of convergence research.

Second, the empirical analysis results of this study mean that the contents of the company’s CEO message posted on the website contain symbolic and important information about the company. In particular, this study proved through empirical analysis that efforts and performances related to corporate social responsibility help increase corporate value in the long run.

Third, this paper used the SBSC framework to classify keywords of CEO messages posted on the corporate website, clearly identifying what vision and strategy companies emphasize. In particular, this study expanded the scope of empirical research in the future by extracting important information contained in corporate qualitative data and using it for empirical analysis.

Fourth, this study is not the first study to conduct an empirical analysis on the relationship between a company’s CEO message and corporate value. In South Korea, where information flow is fast due to the development of IT technology, consumers are relatively sensitive and can quickly acquire information provided by companies. In addition, the fashion industry is more sensitive than other industries and is greatly influenced by corporate image and brand. Therefore, this paper examined the relationship between the CEO message of a company and corporate value by sampling companies belonging to the Korean fashion industry. As a result of the study, it was reaffirmed that the CEO message disclosed on the company’s website contains meaningful information.

The research scope and limitations of this research are as follows. Our researchers conducted an empirical analysis by sampling only listed companies belonging to the Korean fashion industry. As a result, there is a limitation to the small number of samples. Yet, as a result of the empirical testing of this paper, despite the small number of samples, a significant value was derived for the F-value, which means the validity of the model. In addition, the adjusted R-square value, which means the explanatory power between variables, was also derived as a normal value. In future studies, it is necessary to present more objective research results by securing the number of samples so that there is no problem with the number of samples.