Does Financial Leverage Mediates Corporate Governance and Firm Performance?

Abstract

:1. Introduction

2. Literature Review

2.1. Board Size and Firm Performance

2.2. Board Independence and Firm Performance

2.3. Audit Committee Size and Firm Performance

2.4. Female Directorship and Financial Performance

2.5. CEO Duality and Firm Performance

2.6. Board Size and Capital Structure

2.7. Board Independence and Capital Structure

2.8. Audit Committee Size and Capital Structure

2.9. CEO Duality and Capital Structure

2.10. Female Directorship and Capital Structure

2.11. Financial Leverage and Financial Performance

2.12. Financial Leverage Mediation between Corporate Governance and Financial Performance

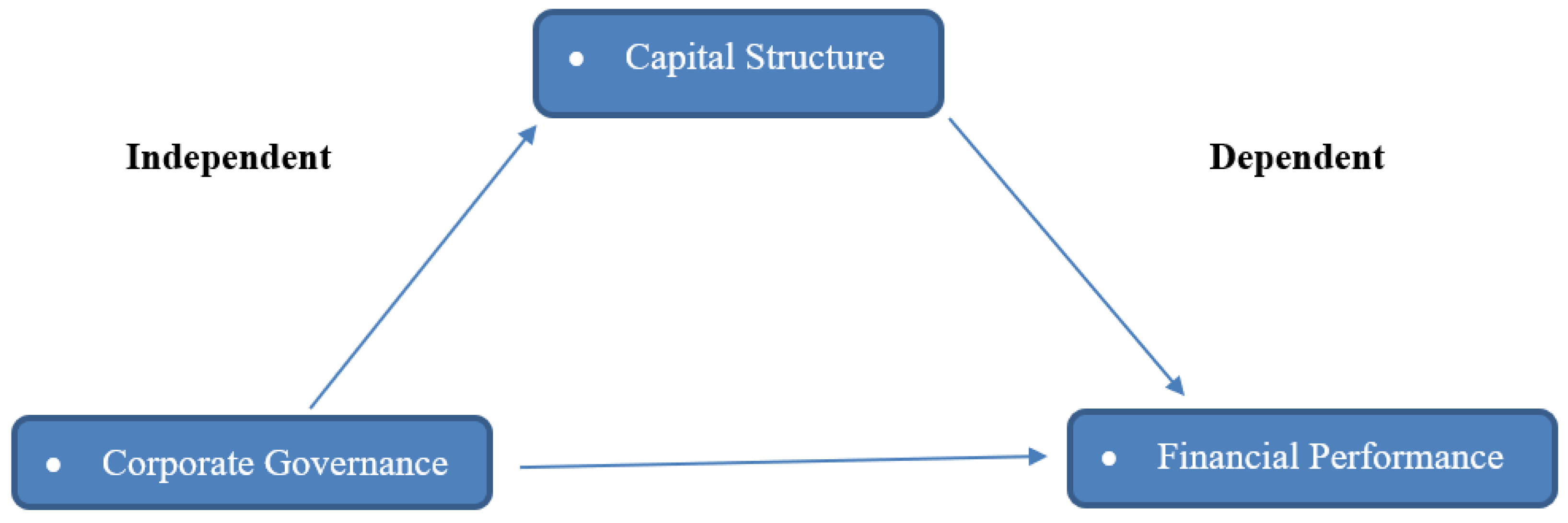

3. Methodology

3.1. Population of Study

3.1.1. Model 1

3.1.2. Model 2

3.1.3. Model 3

3.1.4. Model 4

4. Empirical Results

4.1. Descriptive Statistics

4.2. Regression Results Corporate Governance and Financial Leverage

4.3. Corporate Governance, Financial Leverage Impact on Firm Performance

4.4. Mediation of Financial Leverage between Corporate Governance Firm Performance

4.5. Firm Division in Small and Large on Basis of Firm Size

4.6. Corporate Governance Financial Leverage and Firm Performance Small and Large Firm

5. Conclusions, Recommendation, and Limitation

5.1. Conclusions

5.2. Recommendation and Limitation

5.3. Policy Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable Code | Variable Name | Variable Description |

| Dependent variable firm performance | ||

| ROE | Return on equity | The ratio of earnings before interest and taxes to equity. |

| Independent variable corporate governance | ||

| BS | Board size | A number of board directors, including a chairperson and independent directors. |

| BI | Board independence | The ratio of the number of independent directors to the number of all directors. |

| ACS | Audit committee size | A number of audit committee on the board. |

| WD | Female directorship | The ratio of number of female directors to the total number of directors. |

| CEOD | CEO duality | CEO duality is a dummy variable which take a value of one if the CEO is also the chairperson of the Board of directors, and zero otherwise. |

| Mediating variable | ||

| LEV | Financial leverage | The ratio of total debt to total assets. |

| Control variables | ||

| ROA | Industry return | The first difference of the natural logarithm of the price. |

| F.SIZE | Firm size | The natural logarithm of total assets. |

| F.AGE | Firm age | The natural logarithm of the number of years since the firm was listed. |

| EXPCAP | Capital investment | The ratio of capital expenditure to one-period lagged total assets. |

| C.R | Current ratio | The ratio of current assets to current liabilities. |

| MKT | The market-to-book ratio | The ratio of the market value of common equity to the book value of common equity. |

| NCF | The cash flow to total assets ratio | The ratio of net cash flow from operating to total assets. |

| FXR | The fixed assets ratio | The ratio of net property, plant, and equipment to total assets. |

| ROA | Return on assets | The ratio of earnings before interest and taxes to total assets. |

References

- Pintea, M.O.; Pop, A.M.; Gavriletea, M.D.; Sechel, I.C. Corporate governance and financial performance: Evidence from Romania. J. Econ. Stud. 2020, 48, 1573–1590. [Google Scholar] [CrossRef]

- Khoa, B.T.; Thai, D.T. Capital Structure and Trade-Off Theory: Evidence from Vietnam. J. Asian Financ. Econ. Bus. 2021, 8, 45–52. [Google Scholar] [CrossRef]

- Elok, F.H.; Astari, D. Analysis of Capital Structure on Multinational Corporation: Trade off Theory and Pecking Theory Perspective. Adv. Soc. Sci. Educ. Humanit. Res. 2021, 536, 70–77. Available online: http://repository.unibi.ac.id/38/ (accessed on 15 September 2022).

- Haron, R.; Nomran, N.M.; Othman, A.H.A.; Husin, M.; Sharofiddin, A. The influence of firm, industry and concentrated ownership on dynamic capital structure decision in emerging market. J. Asia Bus. Stud. 2021, 15, 689–709. [Google Scholar] [CrossRef]

- Kyere, M.; Ausloos, M. Corporate governance and firms financial performance in the United Kingdom. Int. J. Financ. Econ. 2021, 26, 1871–1885. [Google Scholar] [CrossRef]

- Iqbal, M.; Javed, F. The moderating role of corporate governance on the relationship between capital structure and financial performance: Evidence from manufacturing sector of Pakistan. Int. J. Res. Bus. Soc. Sci. 2017, 6, 2147–4478. [Google Scholar] [CrossRef] [Green Version]

- Rizwan, M.; Asrar, H.; Siddiqui, N.; Usmani, W. The Impact of Corporate Governance on Financial Performance: An Empirical. Int. J. Manag. Sci. Bus. Res. 2016, 5. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2850312 (accessed on 15 September 2022).

- Iqbal, K. The impact of corporate governance on financial performance of the pharmaceutical industry in Pakistan. Abasyn Univ. J. Soc. Sci. 2016, 9, 166–175. Available online: http://ajss.abasyn.edu.pk/admineditor/papers/V9I1-11.pdf (accessed on 15 September 2022).

- Georgakopoulos, G.; Toudas, K.; Poutos, E.I.; Kounadeas, T.; Tsavalias, S. Capital Structure, Corporate Governance, Equity Ownership and Their Impact on Firms’ Profitability and Effectiveness in the Energy Sector. Energies 2022, 15, 3625. [Google Scholar] [CrossRef]

- Khan, S.; Kamal, Y.; Hussain, S.; Abbas, M. Corporate governance looking back to look forward in Pakistan: A review, synthesis and future research agenda. Future Bus. J. 2022, 8, 24. Available online: https://link.springer.com/article/10.1186/s43093-022-00137-5 (accessed on 15 September 2022). [CrossRef]

- Nguyen, T.; Bai, M.; Hou, Y.; Vu, M.-C. Corporate governance and dynamics capital structure: Evidence from Vietnam. Glob. Financ. J. 2021, 48, 100554. [Google Scholar] [CrossRef]

- Ullah, M.; Afgan, N.; Afridi, S.A. Effects of corporate governance on capital structure and financial performance: Empirical evidence from listed cement corporations in Pakistan. Glob. Soc. Sci. Rev. 2019, 4, 273–283. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Nour, A.-N.I. The impact of corporate governance on firm performance during the COVID-19 pandemic: Evidence from Malaysia. J. Asian Financ. Econ. Bus. 2021, 8, 943–952. [Google Scholar]

- Muhammad, A. Do Pakistani Corporate Governance reforms restore the relationship of trust on banking sector through good governance and disclosure practices. Int. J. Discl. Gov. 2022, 19, 176–203. [Google Scholar] [CrossRef]

- Khan, M. Corporate Governance and Cost of Capital: Evidence from Pakistani Listed Firms. 2016. Available online: https://theses.gla.ac.uk/7722/ (accessed on 15 September 2022).

- Muhammad, R.; Mangawing, M.A.; Salsabilla, S. The influence of intellectual capital and corporate governance on financial performance of Islamic banks. J. Ekon. Dan Keuang. Islam 2021, 7, 77–91. Available online: https://journal.uii.ac.id/JEKI/article/view/15970 (accessed on 15 September 2022). [CrossRef]

- Awan, A.W.; Jamali, J.A. Impact of corporate governance on financial performance: Karachi stock exchange, Pakistan. Bus. Econ. Res. 2016, 6, 401–411. [Google Scholar] [CrossRef] [Green Version]

- Goel, P. Implications of corporate governance on financial performance: An analytical review of governance and social reporting reforms in India. Asian J. Sustain. Soc. Responsib. 2018, 3, 4. [Google Scholar] [CrossRef]

- Patel, M.A. Corporate Governance and Financial Performance in an Emerging Economy Context: Evidence from Pakistan’s Food, Personal Care and Cement Sectors. South Asian J. Manag. 2018, 25, 7–22. Available online: https://search.ebscohost.com/login.aspx?direct=true&profile=ehost&scope=site&authtype=crawler&jrnl=09715428&AN=133083981&h=FLcKYhEDMNf%2BfKW43hrne1UBNCb9gej99WvkfEvMr2zSuoSXzDgSX5LD9mEbvkqD5UVeEUcKfHoH43LdlXq%2FvA%3D%3D&crl=c (accessed on 15 September 2022).

- Bashir, U.; Fatima, U.; Sohail, S.; Rasul, F.; Mehboob, R. Internal corporate governance and financial performance nexus; a case of banks of Pakistan. J. Financ. Account. 2018, 6, 11–17. [Google Scholar] [CrossRef] [Green Version]

- Modigliani, F.; Miller, M.H.A. Corporate income taxes and the cost of capital: A correction. Am. Econ. Rev. 1963, 53, 433–443. Available online: https://www.jstor.org/stable/1809167 (accessed on 15 September 2022).

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. In Corporate Governance; Gower: Hampshire, UK, 2019; pp. 77–132. Available online: https://www.taylorfrancis.com/chapters/edit/10.4324/9781315191157-9/theory-firm-managerial-behavior-agency-costs-ownership-structure-michael-jensen-william-meckling (accessed on 15 September 2022).

- Hastutik, S.; Soetjipto, B.E.; Wadoyo, C.; Winarno, A. Trade-Off and Pecking Order Theory of Capital Structure in Indonesia: Systematic Literature Review. J. Posit. Sch. Psychol. 2022, 2022, 5585–5597. Available online: https://journalppw.com/index.php/jpsp/article/view/7624 (accessed on 15 September 2022).

- Pucheta-Martínez, M.C.; Gallego-Álvarez, I. Do board characteristics drive firm performance? An international perspective. Rev. Manag. Sci. 2020, 14, 1251–1297. [Google Scholar] [CrossRef]

- Puni, A.; Anlesinya, A. Corporate governance mechanisms and firm performance in a developing country. Int. J. Law Manag. 2020, 62, 147–169. [Google Scholar] [CrossRef]

- Goel, A.; Dhiman, R.; Rana, S.; Srivastava, V. Board composition and firm performance: Empirical evidence from Indian companies. Asia-Pac. J. Bus. Adm. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Brahma, S.; Nwafor, C.; Boateng, A. Board gender diversity and firm performance: The UK evidence. Int. J. Financ. Econ. 2021, 26, 5704–5719. [Google Scholar] [CrossRef]

- Fiandrino, S.; Devalle, A.; Cantino, V. Corporate governance and financial performance for engaging socially and environmentally responsible practices. Soc. Responsib. J. 2018, 15, 171–185. [Google Scholar] [CrossRef]

- Abriyani, D.R.; Wiryono, S.K. The effect of good corporate governance and financial performance on the corporate social responsibility disclosure of telecommunication company in Indonesia. Indones. J. Bus. Adm. 2012, 1, 68447. [Google Scholar]

- Amin, A.; Ali, R.; Rehman, R.U.; Naseem, M.A.; Ahmad, M.I. Female presence in corporate governance, firm performance, and the moderating role of family ownership. Econ. Res.-Ekon. Istraživanja 2022, 35, 929–948. [Google Scholar] [CrossRef]

- Al-Saidi, M. Board independence and firm performance: Evidence from Kuwait. Int. J. Law Manag. 2020, 63, 251–262. [Google Scholar] [CrossRef]

- Pillai, R.; Al-Malkawi, H.-A.N.; Bhatti, M.I. Assessing Institutional Dynamics of Governance Compliance in Emerging Markets: The GCC Real Estate Sector. J. Risk Financ. Manag. 2021, 14, 501. [Google Scholar] [CrossRef]

- Handa, R. Role of Board Functions in Bank Performance: Direct and Indirect Effects of Board Independence. Manag. Labour Stud. 2022, 47, 0258042X221078486. [Google Scholar] [CrossRef]

- Kumar, A.; Gupta, J.; Das, N. Revisiting the influence of corporate sustainability practices on corporate financial performance: An evidence from the global energy sector. Bus. Strategy Environ. 2022, in press. [Google Scholar] [CrossRef]

- Nepal, M.; Deb, R. Board characteristics and firm performance: Indian textiles sector panorama. Manag. Labour Stud. 2022, 47, 74–96. [Google Scholar] [CrossRef]

- Dakhlallh, M.M.; Rashid, N.; Abdullah, W.A.W.; Al Shehab, H.J. Audit committee and Tobin’s Q as a measure of firm performance among Jordanian companies. J. Adv. Res. Dyn. Control Syst. 2020, 12, 28–41. [Google Scholar] [CrossRef]

- Ali, A.; Alim, W.; Ahmed, J.; Nisar, S. Yoke of corporate governance and firm performance: A study of listed firms in Pakistan. Indian J. Commer. Manag. Stud. 2022, 13, 8–17. [Google Scholar] [CrossRef]

- Muslih, M. The effect of internal audit and audit committee to firm performance moderated by firm age. South East Asia J. Contemp. Bus. Econ. Law 2021, 25, 233–241. [Google Scholar]

- Marpaung, A.P.; Koto, M.; Shareza Hafiz, M.; Hamdani, R. Female Directors and Firm Performance: Evidence of Family Firm in Indonesia. Asian J. Econ. Bus. Account. 2022, 22, 19–30. [Google Scholar] [CrossRef]

- Loi, R.; Zhang, L.; Lau, V.P.; Ngo, H.-Y. The interaction between leader–member exchange and perceived job security in predicting employee altruism and work performance. J. Occup. Organ. Psychol. 2011, 84, 669–685. [Google Scholar] [CrossRef]

- Margaritis, D.; Psillaki, M. Capital structure, equity ownership and firm performance. J. Bank Financ. 2010, 34, 621–632. [Google Scholar] [CrossRef]

- Javeed, S.; Ong, T.; Latief, R.; Muhamad, H.; Soh, W. Conceptualizing the Moderating Role of CEO Power and Ownership Concentration in the Relationship between Audit Committee and Firm Performance: Empirical Evidence from Pakistan. Sustainability 2021, 13, 6329. [Google Scholar] [CrossRef]

- Gan, D.; Erikson, T. Venture governance: CEO duality and new venture performance. J. Bus. Ventur. Insights 2022, 17, e00304. [Google Scholar] [CrossRef]

- Debnath, P.; Das, P.; Laskar, N.; Khan, S.B.; Dhand, S.; Kaushal, K. CEO duality and firm performance: An empirical study on listed companies from an emerging market. Corp. Gov. Organ. Behav. Rev. 2021, 5, 194–202. [Google Scholar] [CrossRef]

- Feng, Y.; Hassan, A.; Elamer, A.A. Corporate governance, ownership structure and capital structure: Evidence from Chinese real estate listed companies. Int. J. Account. Inf. Manag. 2020, 28, 759–783. [Google Scholar] [CrossRef]

- Gyimah, D.; Kwansa, N.A.; Kyiu, A.K.; Sikochi, A.S. Multinationality and capital structure dynamics: A corporate governance explanation. Int. Rev. Financ. Anal. 2021, 76, 101758. [Google Scholar] [CrossRef]

- Thakolwiroj, C.; Sithipolvanichgul, J. Board characteristics and capital structure: Evidence from Thai listed companies. J. Asian Financ. Econ. Bus. 2021, 8, 861–872. [Google Scholar]

- Ezeani, E.; Kwabi, F.; Salem, R.; Usman, M.; Alqatamin, R.M.H.; Kostov, P. Corporate board and dynamics of capital structure: Evidence from UK, France and Germany. Int. J. Financ. Econ. 2022, in press. [Google Scholar] [CrossRef]

- Khanh, V.; Hung, D.; Van, V.; Huyen, H. A study on the effect of corporate governance and capital structure on firm value in Vietnam. Accounting 2020, 6, 221–230. [Google Scholar] [CrossRef]

- Ofulue, I.; Ezeagba, C.E.; Amahalu, N.N.; Obi, J.C. Financial leverage and financial performance of quoted industrial goods firms in nigeria. Int. J. Manag. Stud. Soc. Sci. Res. 2022, 4, 172–181. [Google Scholar]

- Lidyah, R.; Mismiwat, T.H.; Akbar, D.A.; Africano, F.; Anggreni, M. The effect of audit committee, independent commissioners board and firm size on audit delay through capital structure as an intervening variable in sharia bank. PalArch’s J. Archaeol. Egypt/Egyptol. 2020, 17, 11313–11325. [Google Scholar]

- Thiruvadi, S. Male versus Female Audit Committee Chair Characteristics and Capital Structure Shiyaamsundar Thiruvadi. J. Account. Financ. 2018, 18, 144–153. [Google Scholar]

- Carmo, C.; Alves, S.; Quaresma, B. Women on Boards in Portuguese Listed Companies: Does Gender Diversity Influence Financial Performance? Sustainability 2022, 14, 6186. [Google Scholar] [CrossRef]

- Nawaz, T.; Ohlrogge, O. Clarifying the impact of corporate governance and intellectual capital on financial performance: A longitudinal study of Deutsche Bank (1957–2019). Int. J. Financ. Econ. 2022, in press. [Google Scholar] [CrossRef]

- García, C.J.; Herrero, B. Female directors, capital structure, and financial distress. J. Bus. Res. 2021, 136, 592–601. [Google Scholar] [CrossRef]

- Abd-Elmageed, M.H.; Abdel Megeid, N.S. Impact of CEO Duality, Board Independence, Board Size and Financial Performance on Capital Structure using Corporate Tax Aggressiveness as a Moderator. Account. Thought 2020, 24, 724–759. [Google Scholar] [CrossRef]

- Bawazir, H.; Khayati, A.; AbdulMajeed, F. Corporate governance and the performance of non-financial firms: The case of Oman. Entrep. Sustain. Issues 2021, 8, 595. [Google Scholar] [CrossRef]

- PeiZhi, W.; Ramzan, M. Do corporate governance structure and capital structure matter for the performance of the firms? An empirical testing with the contemplation of outliers. PLoS ONE 2020, 15, e0229157. [Google Scholar] [CrossRef] [Green Version]

- Towo, N.N. Financial Leverage and Financial Performanceof Savings and Credit Co-operative Societiesin Tanzania. Int. J. Rural. Manag. 2022, 12, 09730052221077846. [Google Scholar] [CrossRef]

- Abubakar, A. Financial Leverage and Financial Performance of Oil and Gas Companies in Nigeria. Open J. Manag. Sci. 2020, 1, 28–44. [Google Scholar] [CrossRef]

- Bananuka, J.; Nkundabanyanga, S.K. Audit committee effectiveness, internal audit function, firm-specific attributes and internet financial reporting: A managerial perception-based evidence. J. Financ. Report. Account. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Itan, I.; Chelencia, V. The Mediating Role of Capital Structure in Corporate Governance on Firm Performance of Family Companies. J. Ecodemica J. Ekon. Manaj. Dan Bisnis 2022, 6, 306–318. [Google Scholar] [CrossRef]

- Usman, A.; Usman, H.S. Mediating effect of audit committee on board dynamic and creative accounting in Nigerian firms. Gusau J. Account. Financ. 2022, 3, 29. [Google Scholar]

- Sarwar, A.; Al-Faryan, M.A.S.; Saeed, S. The Impact of Corporate Governance and Financial Leverage on the Performance of Local Thai Banks Using Corporate Social Responsibility as a Mediator. Theor. Econ. Lett. 2022, 12, 19–51. [Google Scholar] [CrossRef]

- Zhou, M.; Li, K.; Chen, Z. Corporate governance quality and financial leverage: Evidence from China. Int. Rev. Financ. Anal. 2021, 73, 101652. [Google Scholar] [CrossRef]

- Varnamkhasti, J.H. Studying the impact of corporate governance on earning management with the mediating role of financial leverage: Case study companies listed on the Tehran stock exchange. Int. J. Health Sci. 2022, 6, 4094–4111. [Google Scholar] [CrossRef]

- Chijoke-Mgbame, A.M.; Mgbame, C.O.; Akintoye, S.; Ohalehi, P. The role of corporate governance on CSR disclosure and firm performance in a voluntary environment. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 294–306. [Google Scholar] [CrossRef]

| Mean | Median | S.D. | Minimum | Maximum | |

|---|---|---|---|---|---|

| F.LEV | 0.24 | 0.33 | 0.12 | 0.00 | 0.65 |

| BS | 9.55 | 9.00 | 3.44 | 6.00 | 14.00 |

| BI | 1.44 | 2.13 | 0.14 | 2.00 | 5.00 |

| ACS | 3.06 | 3.10 | 0.50 | 3.00 | 6.00 |

| WD | 0.99 | 0.82 | 0.15 | 1.00 | 3.00 |

| CE.D | 0.45 | 0.88 | 0.14 | 0.00 | 2.00 |

| ROE | 0.18 | 0.13 | 0.20 | −0.25 | 0.60 |

| ROA | 0.44 | 0.36 | 0.30 | −0.10 | 0.33 |

| INDR | 0.9 | 0.9 | 0.44 | −0.55 | 0.70 |

| F.SIZE | 7.10 | 6.99 | 2.14 | 4.78 | 10.09 |

| F.AGE | 3.40 | 3.60 | 0.85 | 0.10 | 3.33 |

| EXPCAP | 5.44 | 3.86 | 6.10 | 0.10 | 21.99 |

| C.R | 2.27 | 1.61 | 1.88 | 0.05 | 7.30 |

| MKT | 1.71 | 1.31 | 1.12 | 0.30 | 5.10 |

| NCF | 0.19 | 0.18 | 0.05 | −0.24 | 0.36 |

| FXR | 0.12 | 0.24 | 0.17 | 0.04 | 0.90 |

| Variable | Model 1 | Model 2 |

|---|---|---|

| Constant | 0.346 *** (0.11) | 0.392 *** (0.16) |

| INDRt−1 | 0.122 (0.12) | 0.125 (0.12) |

| F.SIZEt−1 | 0.06 *** (0.05) | 0.076 *** (0.06) |

| F.AGEt−1 | 0.033 *** (0.04) | 0.042 *** (0.03) |

| EXPCAPt−1 | 0.022 *** (0.10) | 0.036 *** (0.12) |

| C.Rt−1 | 0.033 *** (0.33) | 0.035 *** (0.36) |

| MKTt−1 | 0.017 ** (0.03) | 0.019 ** (0.04) |

| NCFt−1 | −0.846 *** (0.24) | −0.879 *** (0.25) |

| FXRt−1 | −0.046 (0.29) | −0.056 (0.32) |

| ROAt−1 | −0.237 *** (0.05) | −0.247 *** (0.05) |

| BSt−1 | −0.043 *** (0.04) | |

| BIt−1 | 0.032 *** (0.05) | |

| ACSt−1 | 0.021 *** (0.10) | |

| WDt−1 | 0.044 *** (0.039) | |

| CE.Dt−1 | 0.056 (0.020) | |

| Firms fixed effects | Yes | Yes |

| Year fixed effects | Yes | Yes |

| Adjusted R2 | 0.496 | 0.525 |

| F-statistic | 36.345 *** | 37.264 *** |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Constant | 0.346 *** (0.011) | 0.392 *** (0.016) | 0.494 *** (0.034) | 0.485 *** (0.064) |

| INDRt−1 | 0.122 (0.012) | 0.125 (0.012) | 0.018 ** (0.022) | 0.045 ** (0.018) |

| F.SIZEt−1 | 0.06 *** (0.05) | 0.076 *** (0.06) | 0.044 *** (0.05) | 0.045 *** (0.04) |

| F.AGEt−1 | 0.033 *** (0.04) | 0.042 *** (0.03) | 0.043 ** (0.032) | 0.016 * (0.08) |

| EXPCAPt−1 | 0.02 *** (0.10) | 0.036 *** (0.12) | 0.018 * (0.010) | 0.022 (0.05) |

| C.Rt−1 | 0.033 *** (0.033) | 0.035 *** (0.036) | 0.039 (0.020) | 0.045 (0.030) |

| MKTt−1 | 0.017 ** (0.03) | 0.019 ** (0.04) | 0.045 *** (0.03) | 0.052 *** (0.032) |

| NCFt−1 | −0.846 *** (0.024) | −0.879 *** (0.025) | 0.236 *** (0.042) | 0.245 *** (0.045) |

| FXRt−1 | −0.046 (0.029) | −0.056 (0.032) | 0.056 * (0.029) | −0.066 (0.032) |

| ROAt−1 | −0.237 *** (0.05) | −0.247 *** (0.05) | 0.055 (0.023) | |

| BSt−1 | 0.043 *** (0.04) | 0.044 * (0.05) | ||

| BIt−1 | 0.032 *** (0.05) | 0.076 (0.010) | ||

| ACSt−1 | 0.021 *** (0.010) | 0.412 (0.042) | ||

| WDt−1 | 0.044 *** (0.039) | 0.066 (0.022) | ||

| CE.Dt−1 | 0.056 (0.020) | 0.044 (0.018) | ||

| F.LEVt−1 | 0.256 *** (0.032) | 0.198 *** (0.044) | ||

| Firms fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.390 | 0.483 | 0.459 | 0.402 |

| F-statistic | 7.773 *** | 7.752 *** | 7.959 *** | 7.903 *** |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Small Firms | Small Firms | Large Firm | Large Firm | |

| Constant | 0.356 *** (0.012) | 0.382 *** (0.017) | 0.384 *** (0.044) | 0.365 *** (0.074) |

| INDRt−1 | 0.142 (0.014) | 0.145 (0.016) | 0.028 ** (0.032) | 0.055 ** (0.038) |

| F.SIZEt−1 | 0.006 *** (0.09) | 0.066 *** (0.07) | 0.144 *** (0.25) | 0.145 *** (0.14) |

| F.AGEt−1 | 0.038 *** (0.05) | 0.049 *** (0.09) | 0.053 ** (0.042) | 0.036 * (0.028) |

| EXPCAPt−1 | 0.032 *** (0.15) | 0.046 *** (0.17) | 0.028 * (0.010) | 0.042 * (0.15) |

| C.Rt−1 | 0.043 *** (0.034) | 0.055 *** (0.037) | 0.049 ** (0.030) | 0.055 * (0.040) |

| MKTt−1 | 0.019 ** (0.04) | 0.021 ** (0.05) | 0.065 *** (0.035) | 0.072 *** (0.042) |

| NCFt−1 | −0.946 *** (0.054) | −0.979 *** (0.065) | 0.336 *** (0.092) | 0.545 *** (0.075) |

| FXRt−1 | −0.076 (0.049) | −0.086 (0.052) | 0.076 * (0.019) | −0.096 (0.062) |

| ROAt−1 | −0.257 *** (0.04) | −0.267 *** (0.07) | −0.267 *** (0.07) | 0.055 *** (0.023) |

| BSt−1 | −0.053 *** (0.10) | −0.056 * (0.10) | ||

| BIt−1 | 0.042 *** (0.10) | 0.0184 *** (0.010) | ||

| ACSt−1 | 0.031 *** (0.010) | 0.315 *** (0.018) | ||

| WDt−1 | 0.054 *** (0.059) | 0.096 *** (0.044) | ||

| CE.Dt−1 | 0.067 (0.040) | 0.076 (0.020) | ||

| Firms fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.401 | 0.461 | 0.465 | 0.490 |

| F-statistic | 32.315 | 18.983 | 29.540 | 30.459 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Small Firms | Small Firms | Large Firm | Large Firm | |

| Constant | 0.053 *** (0.10) | 0.545 *** (0.075) | 0.384 *** (0.044) | 0.365 *** (0.074) |

| INDRt−1 | 0.042 *** (0.10) | −0.096 (0.062) | 0.028 ** (0.032) | 0.055 ** (0.038) |

| F.SIZEt−1 | 0.031 *** (0.010) | 0.055 *** (0.023) | 0.144 *** (0.25) | 0.145 *** (0.14) |

| F.AGEt−1 | 0.054 *** (0.059) | 0.056 * (0.10) | 0.055 ** (0.038) | 0.036 * (0.028) |

| EXPCAPt−1 | 0.067 (0.040) | 0.545 *** (0.075) | 0.145 *** (0.14) | 0.042 * (0.15) |

| C.Rt−1 | 0.053 *** (0.10) | −0.096 (0.062) | 0.036 * (0.028) | 0.055 * (0.040) |

| MKTt−1 | 0.042 *** (0.10) | 0.021 ** (0.05) | 0.042 * (0.15) | 0.072 *** (0.042) |

| NCFt−1 | 0.315 *** (0.018) | −0.979 *** (0.065) | 0.055 ** (0.038) | 0.545 *** (0.075) |

| FXRt−1 | 0.096 *** (0.044) | −0.086 (0.052) | 0.076 * (0.019) | 0.053 *** (0.10) |

| ROAt−1 | 0.076 (0.020) | −0.267 *** (0.07) | −0.056 (0.32) | 0.042 * (0.10) |

| BSt−1 | 0.032 *** (0.05) | 0.053 *** (0.10) | −0.247 *** (0.05) | 0.031 (0.010) |

| BIt−1 | 0.315 *** (0.018) | 0.042 *** (0.10) | −0.043 *** (0.04) | 0.054 * (0.059) |

| ACSt−1 | 0.021 *** (0.10) | 0.031 *** (0.010) | 0.042 *** (0.05) | 0.067 (0.040) |

| WDt−1 | 0.044 *** (0.039) | 0.054 *** (0.059) | 0.051 *** (0.10) | 0.053 * (0.10) |

| CE.Dt−1 | 0.056 (0.020) | 0.067 (0.040) | 0.044 *** (0.039) | 0.076 (0.020) |

| F.LEVt−1 | 0.039 *** (0.05) | 0.045 *** (0.18) | ||

| Firms fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.540 | 0.560 | 0.490 | 0.520 |

| F-statistic | 21.315 | 23.120 | 26.402 ** | 31.460 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huynh, Q.L.; Hoque, M.E.; Susanto, P.; Watto, W.A.; Ashraf, M. Does Financial Leverage Mediates Corporate Governance and Firm Performance? Sustainability 2022, 14, 13545. https://doi.org/10.3390/su142013545

Huynh QL, Hoque ME, Susanto P, Watto WA, Ashraf M. Does Financial Leverage Mediates Corporate Governance and Firm Performance? Sustainability. 2022; 14(20):13545. https://doi.org/10.3390/su142013545

Chicago/Turabian StyleHuynh, Quang Linh, Mohammad Enamul Hoque, Perengki Susanto, Waqas Ahmad Watto, and Maryam Ashraf. 2022. "Does Financial Leverage Mediates Corporate Governance and Firm Performance?" Sustainability 14, no. 20: 13545. https://doi.org/10.3390/su142013545

APA StyleHuynh, Q. L., Hoque, M. E., Susanto, P., Watto, W. A., & Ashraf, M. (2022). Does Financial Leverage Mediates Corporate Governance and Firm Performance? Sustainability, 14(20), 13545. https://doi.org/10.3390/su142013545