Abstract

Industrial migration is a hot topic in economic geography. This study traces the migratory process of key high-tech enterprises in Beijing during 2008–2016, revealing the migratory characteristics and patterns of high-tech enterprises within the metropolitan area by using spatial analysis methods and mathematical statistics. The results show that: (1) Migrating enterprises are mainly mixed-ownership and foreign-funded or privately-owned enterprises. Medium-sized enterprises are more likely to relocate than small and large enterprises, especially in lucrative sectors. (2) The migration of high-tech enterprises is mainly based on proximity migration. More than 77.19% of enterprises tend to move to agglomerations or agglomeration expansion areas such as Jiuxianqiao and the Beijing Economic-Technological Development Area (BDA) in Daxing District. In addition, 33 enterprises experience varying degrees of scale expansion after relocation. (3) Most high-tech manufacturing enterprises are in the growth stage of their life cycle. They initially relocate between 7 and 16 years after their establishment, which means that there is roughly a 7-year adaptation or development period for firms within a region after their establishment. During the adaptation period, companies do not tend to relocate; afterwards, as they grow, they need to find other spaces in which to do so. For reasons such as familiarity with the environment, enterprises give priority to finding new locations within the agglomeration and the surrounding area. These results deepen the understanding of the temporal and spatial characteristics of the migration of enterprises within the city from the microscopic perspective and provide a scientific basis for the optimization of industrial space in a metropolis.

1. Introduction

The high-tech industry, which is distinguished by a high knowledge and technology intensity, high added value, and high industrial growth rates, is acknowledged as the driving force behind regional economic growth and high-quality economic development [1]. For metropolitan areas that are about to become global cities or want to occupy a high position in the global production network, the development of high-tech industries plays an important role in promoting the upgrading of the local industrial structure and taking advantage of international economic and technological competition. For instance, New York became an international metropolis during the second industrial revolution, which was symbolized by electricity and steel [2]. Then, Tokyo became the world’s manufacturing capital as a result of the third industrial revolution, which is represented by electronic information [3]. To seize the high ground for future manufacturing, the United States and other nations have enacted the National Strategic Plan for Advanced Manufacturing, making high-tech manufacturing the top priority of the national manufacturing strategy, and emphasizing the back-flow of manufacturing on a consistent basis.

In the process of building a global network or a global metropolis, the accelerated growth of high-tech industries and associated enterprises not only affects the economic structure but also significantly alters the urban industrial space. Therefore, it is necessary to adjust the industrial structure in metropolitan areas. As China’s first mega-city to reduce its development, Beijing has seen a large number of high-tech enterprises continue to migrate to southern cities while relieving Beijing of functions non-essential to its role as China’s capital [4]. Enterprises are the micro-subjects of industrial economic activities, and the locational changes of a large number of enterprises will have an impact on the spatial pattern of urban industries. Therefore, metropolitan areas such as Beijing need to explore the migratory characteristics of high-tech enterprises within the metropolitan area in order to optimize the layout of high-tech industries in the future and to retain high-tech enterprises while achieving high-quality development.

Previous studies on industrial migration or enterprise relocation have mostly been derived by speculating on the changes of industrial spatial patterns. This, however, fundamentally avoids exploring the real situation of industrial migration in cities directly. The movement characteristics of enterprises and the spatial shifts of industries within cities can only be accurately depicted by firm-based studies. Based on the above context, we need to study the developmental evolution of intra-regional enterprise migration at the micro-scale.

This study intends to determine whether high-tech enterprises have a tendency to relocate to agglomerations and to identify the life cycle of migrating enterprises of different sizes. The research was carried out in the following manner. First, we analyzed the evolution of the spatial pattern of high-tech industries using data on Beijing enterprises from 2008 to 2016. Second, we explored the characteristics of different aspects of spatial, temporal, and individual attributes of the migration of high-tech enterprises in Beijing and used them to study the developmental evolution of enterprise migration in the city. Finally, we draw corresponding conclusions based on the research results. This study not only contributes to the enrichment and improvement of the theories of enterprise migration and modern industrial locations but also offers a theoretical foundation for the spatial optimization of industries in Beijing.

2. Literature Review

The existing research focuses on industrial migration at several regional scales, including international, inter-regional, and intercity. On a global level, four international industrial transfers are generally acknowledged to have occurred since World War II [5,6,7]. Additionally, as industrial globalization and the upgrading of the international industrial structure has progressed, several high-tech and high-end manufacturing industries have been relocated to low-cost nations [8,9]. In recent years, the fifth global industrial transfer has begun, showing a two-way transfer of low-end manufacturing industries to Southeast and South Asia and the return of high-end manufacturing industries to developed countries [10,11,12].

In the long term, the inter-regional transfer of industries will have a profound impact on the regional spatial pattern in countries such as Hungary, the United States, and Japan through changes in investment, markets, infrastructure settings, labor, and other factors [13,14,15,16]. In China, the industrial migration has not been evident in the past decades [17,18,19,20]. Numerous empirical studies have demonstrated that the current industrial transfer shows evident “northward” characteristics in China. Many resource-based and low-end companies have moved to the central and western areas due to the growing demand for energy and resources from the east to those regions. Nevertheless, the east still holds most of the world’s high-tech and technologically advanced industries [21,22,23,24]. In addition, the characteristics of industrial transfer vary between regions such as Beijing–Tianjin–Hebei [25,26,27,28], the Yangtze River Delta [28,29,30], and the Pearl River Delta [31,32,33,34].

The evolution of the industrial pattern in cities is one of the external manifestations of urban enterprise migration. In general, the majority of studies concentrate on spatial migration analysis rather than the relocation of enterprises in the city. For instance, Choudhury conducted a study of business relocation in Hamilton, Canada, and concluded that short-distance moves are more typical and tend to occur in smaller firms [35]. Guo et al. discovered that the spatial migration of manufacturing enterprises in Lanzhou City has undergone three stages: centripetal concentration, center–periphery mutual migration, and outward leap [36]; Zhang et al. found that the suburban area of Hangzhou City was the main net migration out of manufacturing enterprises, whereas the migration of enterprises within the central city is relatively inactive [37]. Significant cities such as Beijing, Guangzhou, and Hangzhou have been employed more frequently in studies on cities as research areas to empirically analyze the evolution of the spatial patterns of intra-city enterprises or industries. For instance, Zhang’s study found that although Beijing’s manufacturing industry is still mainly concentrated in the city center, it shows a trend of gradually spreading to the suburbs [38]; Wang et al. concluded that Internet enterprises in Yangzhou have spatially undergone a process of change from agglomeration to random agglomeration, with distribution hotspots gradually spreading from inner-city areas to suburban areas [39]; Cheng et al. suggested that the core software industry agglomeration in Hangzhou continuously radiates outward, forming a cluster distribution pattern of “one-piece and three cores” [40]; according to Sun et al., the creative industry in Xi’an shows the evolutionary characteristics of multi-core diffusion distribution [41]; according to Yu et al., the distribution of high-tech electronic information enterprises in Shenzhen has undergone a process of “agglomeration-dispersion-agglomeration”, and the spatial agglomeration of firms has shifted from a “dual-core resonance” to a “three-legged tripod” pattern [42]; and Broitman et al. have suggested that the spatial decision-making behavior of firms leads to changes in the size of cities [43].

In summary, although previous studies on the cross-regional migration of enterprises or industries have provided valuable information, some deficiencies still exist. Firstly, many studies are based on macro-spatial scales such as countries and provinces, while relatively few research results have been obtained regarding the phenomenon of enterprise migration within urban areas from micro-scales. Secondly, in the research on the evolution of the industrial spatial pattern within the city, it is uncommon to analyze the migratory characteristics of a single enterprise in a particular industry. In addition, most academics have analyzed the characteristics of enterprise migration from a single perspective of geographic space; however, in reality, enterprise migration is not only a simple spatial movement, but is also closely related to the scale change, migration cost, age, and other factors of enterprises. Therefore, this study is aimed at empirically investigating the differences in individual attributes and life cycle characteristics of migrating firms from the microscopic scale.

3. Data and Study Area

3.1. Data Sources

The study was conducted using 2008 and 2016 firm-level data for Beijing, mainly derived from enterprise business registration data and economic census data [44]. In 2008 and 2016, there were 7334 and 3189 manufacturing enterprise data. The location of enterprises, industry codes, employees, operating income, establishment year, and other crucial details were all included in these statistics. We geocoded these data based on the business address using the Gaode Map API interface. By performing this procedure, businesses’ locations can be converted into spatial geographic coordinates that can be used as the underlying spatial data for a business migration study.

The next crucial step is to eliminate enterprises that have moved too short of a distance (less than 100m) or have apparent flaws in their information (some enterprises’ registered addresses may not correspond to where they actually operate, and there are discrepancies between their industry codes and their actual industries of operation). The final sample number for the study was determined to be 114 relocated enterprises in the high-tech manufacturing companies in Beijing (Table 1).

Table 1.

Industrial structure of high-tech manufacturing relocated enterprises.

3.2. Study Area

Beijing was chosen as the study area for this work. Beijing has a crucial strategic position as a national science and technology innovation center. Consequently, Beijing paid high-technology industries a great deal of attention. The construction of a “two-pole and two-system” spatial pattern for high-tech industries was first suggested in the “Eleventh Five-Year Plan for the Development of High-Tech Industries in Beijing” in 2006. This proposal has since become the catalyst for the growth of high-tech industries in Beijing. The “two poles” referred to the central area of the Haidian district and the Beijing Economic-Technological Development Area (BDA), while the “two systems” were the high-tech R&D service development area in the northwest and the high-tech manufacturing development zone in the southeast. The total output value of the high-tech manufacturing industry in Beijing amounted to RMB 356.36 billion, and the main business revenue was RMB 430.85 billion in 2016 [45].

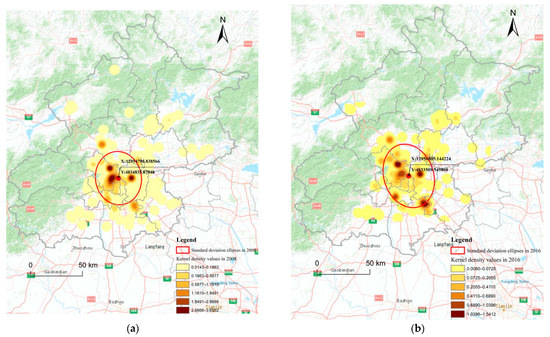

Figure 1 shows the evolution of the spatial pattern of high-tech manufacturing under the reduction in industries in Beijing. In 2008, the spatial distribution of high-tech manufacturing enterprises (925) was multi-core clustered. Approximately 65.72% of the enterprises were distributed in agglomerations [44], including Shangdi in Haidian District (103), Zhongguancun Science City (262), Jiuxianqiao in Chaoyang District (93), Science and Technology Park in Changping District (52), Science City and Industrial Base in Fengtai District (32), and BDA in Daxing District (66). The number of enterprise clusters did not decrease in 2016, even though the absolute number of high-tech manufacturing enterprises in Beijing in that year (441) was less than half of that in 2008. They were mainly concentrated in Shangdi in Haidian District (47), Zhongguancun Science City (54), Jiuxianqiao Electronic City in Chaoyang District (45), Science and Technology Park in Changping District (20), Science and Technology Park in Fengtai District (28), and BDA (82). The agglomerative scope of high-tech manufacturing enterprises in 2016 further spread to the periphery. For example, the Yongfeng Industrial Base, Zhongguancun Environmental Technology Industrial Park, Huilongguan, and other agglomeration expansion regions formed. In addition, the BDA gained prominence as an industrial agglomeration area.

Figure 1.

Spatial patterns of high-tech manufacturing industry from 2008 to 2016: (a) Spatial pattern of high-tech manufacturing industry in 2008; (b) Spatial pattern of high-tech manufacturing industry in 2016.

3.3. Methodology

3.3.1. Standard Deviation Ellipses Analysis

The standard deviation ellipse is an efficient technique in spatial statistics that accurately reveals the general properties of the spatial distribution of geographical elements [46]. It may quantitatively represent the general characteristics of the spatial distribution of geographical elements from numerous angles of the ellipse of spatial distribution, whose fundamental parameters are the long axis, the short axis, and the azimuthal angle. The spatial distribution range of the ellipse represents the central area of the spatial distribution of geographical elements, where the center represents the relative position of geographical elements in two-dimensional space, the azimuth reflects the predominant trend direction of their distribution, and the long axis represents the degree of dispersion of geographical elements along the predominant trend direction.

3.3.2. Kernel Density Estimation

Kernel density estimation is an analytical technique for the nonparametric estimation of point data [47]. It can be used to analyze the degree of agglomeration of enterprises by obtaining a continuous trend of values by smoothing the space or data. Typically, parametric estimation requires obtaining a fixed form of a function, but nonparametric estimation simply requires a certain degree of smoothness, with the value at each point being determined by the data. In the most basic scenario, the value of each point is determined by averaging the values of the surrounding data points. The kernel density estimation is as follows:

In the equation, is the bandwidth, is the number of observations, and is the distance weight between .

4. Attribute Characteristics of High-Tech Manufacturing Migrating Enterprises

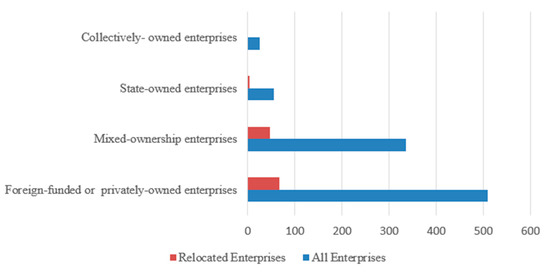

There were 925 high-tech manufacturing enterprises in Beijing in 2008, and 290 survived by 2016. The migration rate of the remaining enterprises was 39.31%. There were 114 enterprises that relocated. According to Figure 2, the majority of migrating firms in the high-tech manufacturing industry are mixed-ownership and foreign-funded or privately-owned (97.43%). This proportion is higher than the percentage of ownership of all firms in the high-technology manufacturing industry (91.35%). This indicates that market forces may have a greater impact on the spatial dynamic evolution of high-tech manufacturing enterprises.

Figure 2.

Ownership structure of all enterprises and relocated enterprises.

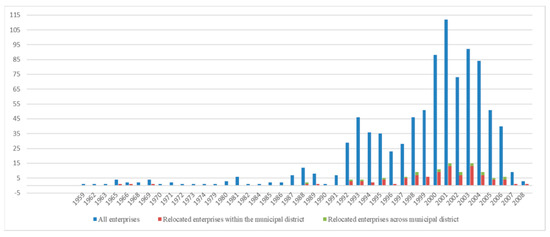

Figure 3 illustrates the opening year of high-tech manufacturing companies. The registration of high-technology enterprises in Beijing spans an extended period. The oldest above-scale enterprise can be traced back to a state-owned enterprise established in 1939. Prior to 1986, the number of high-tech manufacturing companies was relatively small and primarily state-owned. There has been a steady increase in the number of enterprises since 1987, with mixed and collective ownership progressively increasing in prominence. This has been followed by a spurt of growth after 1992 and a peak in 2001 (112). This trend shift can be explained by analyzing the development of China’s high-tech industry. The Party Central Committee approved the “Outline of High-tech Research and Development Program” in 1986, focusing on seven areas of high-tech development. In May 1988, the State Council agreed to establish a pilot zone for the growth of high-tech enterprises in Beijing, centered on Zhongguancun Electronics Street. As a result of the establishment of a market economy, high-tech firms began to shift from government administrative assistance and planning orientation to market-oriented development since 1992, with the emergence of a significant number of high-tech enterprises under multiple ownership (Figure 3).

Figure 3.

Comparison of the years when high-tech enterprises were founded.

On the basis of the preceding information, the opening time of the relocated enterprises was concentrated between 1992 and 2008. The majority of enterprises established in 2001 and 2003 chose to relocate some years later (15 each), and half of them originated from Haidian District. Furthermore, the majority (75%) of enterprises that relocated across the municipal district were founded between 1998 and 2006.

The 2017 statistical classification criteria for large, medium, small, and micro enterprises considered enterprises’ business revenue, number of employees, and total assets. Based on this criterion, enterprises were classified into three categories of size: large (at least 1000 employees and at least $40,000 in business revenue), medium (no less than 300 employees and business revenue of no less than $2000), and small enterprises (others). The individual disparities in the characteristics of migrating enterprises were explored. Medium-sized enterprises made up the vast majority of relocated enterprises in the high-tech manufacturing sector (71 in total), followed by small (43). In terms of the percentage of relocated enterprises in their respective sizes, medium-sized businesses were more likely to relocate (23.74%), whereas no large businesses moved. Twenty-nine small enterprises expanded to become medium-sized, two medium-sized enterprises had shrunk to become small, and two large enterprises had emerged by 2016.

Overall, the average year of establishment for all the enterprises in the high-tech manufacturing industry in 2008 (925 enterprises) was 1998.38. The establishment of medium-sized and small enterprises occurred in a similar year, while the large enterprises (26) were established in 1994. The average opening year for relocated high-tech manufacturing enterprises was 1999, which is consistent with that of the small relocated enterprises. In addition, the average opening year of medium-sized relocated firms was 1998. It seems that the relocation of high-tech manufacturing firms is not firmly related to their start-up time.

The three breakdowns of revenue, employees, and business assets were further compared between all the enterprises and relocated enterprises. The research found that these three indicators for migrating enterprises of different sizes had mean values that were higher than those of all enterprises of that size (Table 2). This may be owing to the highly stringent migration requirements for high-tech companies. Each region requires the enterprises to complete the overall migration with their office, registered office, and place of taxation in addition to a certain standard for annual revenue. Therefore, the more profitable an enterprise is, the more it can afford to migrate. In general, enterprises with a medium size or significant sales are more likely to relocate, but there is a minimal link between the asset size and establishment year.

Table 2.

Differences in individual attributes of high-tech manufacturing relocated enterprises.

5. Spatial Layout Characteristics of Relocated High-Tech Manufacturing Enterprises

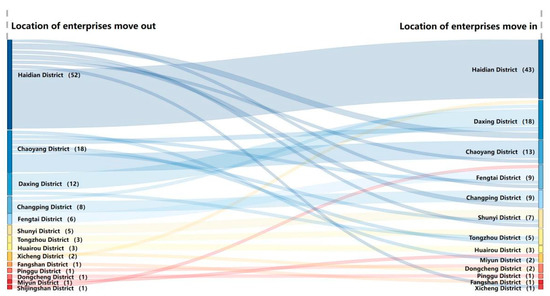

5.1. Immigration and Emigratory charachteristics of High-Tech Manufacturing Enterprises

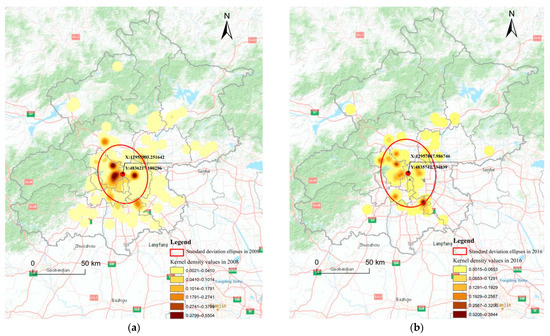

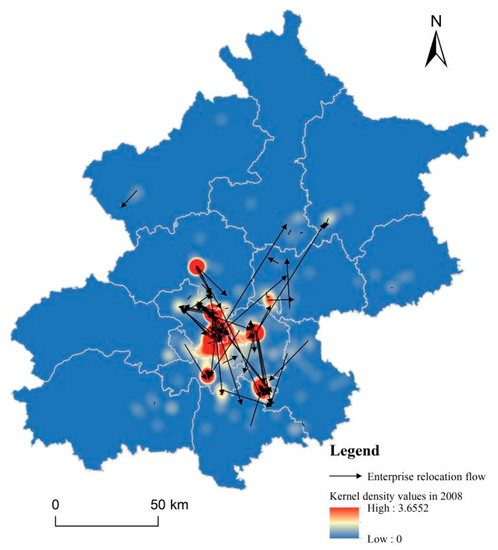

There was a substantial overlap between the locations where high-tech manufacturing enterprises emigrated and the industrial agglomeration areas in 2008. Additionally, firms within the agglomeration are more likely to relocate (15.13%) than those outside of it (7.89%). As shown in Figure 4a, Shangdi, Zhongguancun Science City, and Xueqing Road in Haidian District (52) and Dongzhimen and Jiuxianqiao in Chaoyang District (19) were the main agglomerations in 2008 and the areas where the most high-tech manufacturing enterprises emigrated. In addition, the BDA (12) and the Tianzhu Airport Industrial Zone in Shunyi District (4) also experienced the exodus of a large number of enterprises.

Figure 4.

Kernel density analysis of relocated high-tech manufacturing enterprises in the out-migrating and immigrant areas; (a) Kernel density analysis of relocated high-tech manufacturing enterprises in the out-migrating areas; (b) Kernel density analysis of relocated high-tech manufacturing enterprises in the immigrant areas.

The directional distribution is analyzed using an ellipse of standard deviation comprising point data for 68% of the enterprises. Overall, the spatial distribution of high-tech enterprises both showed a northwest–southeast direction in 2008 and 2016, but the mean center shifted 1.30 km to the southeast. The area of the standard deviation ellipse of relocated enterprises in 2008 (2,077,396,588.68 m2) is significantly smaller than that of relocated enterprises in 2016 (2,654,494,647.21 m2). This suggests that some relocated high-technology enterprises in Beijing chose to leave areas with a high degree of agglomeration and exhibited a tendency to expand outwards, especially in the southeast direction, from their original locations.

This is mirrored to some extent by the nuclear density study performed on the immigrant areas (Figure 4). High-tech manufacturing enterprises formed new agglomeration expansion areas in 2016, such as the Yongfeng Industrial Base and Zhongguancun Environmental Technology Industrial Park in the northwestern part of the Haidian District, and the agglomeration area centered on Jiuxianqiao was expanded further. Most firms relocated to the BDA (22), which fits with the trend of the spatial distribution of high-tech manufacturing enterprises in Beijing shifting southward in 2016. This shows that the high-tech manufacturing industry’s development belt in southern Beijing has exercised its agglomeration impact even further, luring more enterprises to settle within its confines. In addition, some enterprises have relocated to Shangdi (9), the Yongfeng Industrial Base (6), Changchunqiao Road (4) in Haidian District, Jiuxianqiao (5), and the Wangjing Science and Technology Park (5) in Chaoyang District, as well as Huilongguan (4) in Changping District. Overall, Haidian District and Chaoyang District remained agglomerations of high-tech manufacturing companies in 2016, despite the fact that more enterprises left these two districts than entered in.

5.2. Migration Flows Characteristics of High-Tech Manufacturing Enterprises

As shown in Figure 5, the migration of high-tech manufacturing enterprises from 2008 to 2016 was mainly contained within the municipal district. Only 20 of the 114 relocated enterprises chose to move across the urban area, while the remaining 94 moved within the original municipal district. However, this migratory trend alters when agglomerations are considered.

Figure 5.

The urban migration path of high-tech manufacturing enterprises.

Short-distance migration has become the preferred option for high-tech manufacturing companies, which is probably due to the limitation of the original industrial chain. However, traditional industrial agglomeration areas provide a number of obstacles for high-tech enterprises that require steady development, such as high office rents, expansion challenges, and high commuting expenses. Companies tend to relocate to agglomeration expansion areas or other places with advantageous regulations or assistance in order to cut operating costs and seek a broader development platform [48,49].

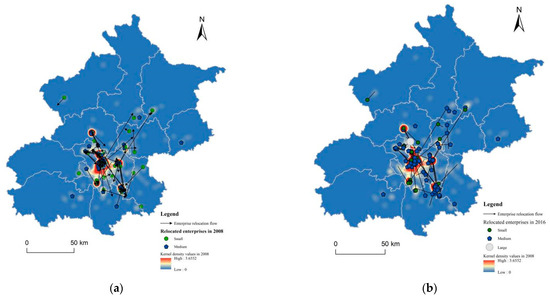

Figure 6 shows the spatial layout of high-tech manufacturing enterprises in 2008 and the relocation paths, revealing which regions are losing ground and which regions have a developing creative manufacturing economy. Shangdi in Haidian District, Zhongguancun Science City, the Jiuxianqiao area in Chaoyang District, the Science and Technology Park in Changping District, the Science City and Industrial Base in Fengtai District, and the BDA held a significant concentration of high-technology manufacturing companies in 2008.

Figure 6.

Migration paths of high-tech manufacturing enterprises.

Fourteen of the seventeen relocated enterprises in the Shangdi agglomeration opted to relocate nearby, with seven abandoning the original agglomeration and relocating to the Yongfeng Industrial Base and Zhongguancun Environmental Technology Industrial Park along the Beiqing Road. Compared with the agglomeration areas, these industrial parks offer more affordable rents than agglomerations and adequate space for sale or lease to suit the vast space requirements of companies, making them attractive to enterprises with various developmental requirements. Among the three companies that relocated across the Haidian District, one company chose to relocate to the Wangjing area in Chaoyang District, while the other two went to Jinye Street and the Industrial Development Zone in Daxing District. This indicates that the majority of enterprises who migrated across the district chose to relocate to non-agglomerations.

In 2008, half of the relocated enterprises in Zhongguancun Science City tended to shift to non-agglomeration areas or agglomeration expansion areas. Half of the 23 firms that migrated within the Haidian District remained in the Science City or went to the Shangdi agglomeration area, and the other 11 companies relocated to non-clustering areas such as Changchunqiao, the Zhongguancun Environmental Technology Industrial Park, and Daliushu Fuhai Centre in the Haidian District. The four enterprises relocated across the Haidian District from Zhongguancun Science City were relocated to Yumin Road in Xicheng District, the Science and Technology Park in Fengtai District, the BDA in Daxing District, and the Juyuan Industrial Zone in Shunyi Distric. This means that two enterprises were relocated to non-agglomeration areas in other districts.

A total of 11 of the 16 relocated companies in the Jiuxianqiao agglomeration were relocated within Chaoyang District. Among these 11 enterprises, only 5 companies remained in the Jiuxianqiao agglomeration, including 4 that relocated to the Wangjing area, not far from Jiuxianqiao, and 1 each that relocated to the East Fourth Ring Road and Chengshousi Road. For example, Beijing Watchdata Co., Ltd., which mainly develops and produces computer hardware and software, moved from Dongzhimen in Chaoyang District to Wangjing Lize Central Park. Among the five enterprises relocated across Chaoyang District, two were relocated to the BDA, while one enterprise each moved to the Jinqiao Technology Industrial Base in Tongzhou District, the Economic Development Zone in Miyun District, and the Tianzhu Airport Industrial Zone in Shunyi District. Additionally, these three regions do not contain any high-tech manufacturing agglomeration areas according to the 2016 industrial space pattern.

The seven relocated companies located in the Science and Technology Park in Changping District primarily relocated to non-agglomeration areas, with only one company remaining in the Science and Technology Park, four that relocated to Huilongguan in Changping District, and one that relocated to the BDA in Daxing District from a long distance.

Notably, none of the eleven enterprises in the BDA have relocated outside of its limits. Additionally, none of the six enterprises in the Science City in Fengtai District relocated outside of its limits, and those that did relocate only moved from one street to another or to nearby office buildings. For example, Beijing Aerospace Jintai Star Measurement Technology Co., Ltd. moved from Hongda North Road in the BDA to Jinxiu Street; BGRIMM Technology Co., Ltd. moved from Building 5, Area 6, No. 188 South 4th Ring Road West to Building 23, Area 18.

In addition, only two of the twenty-one relocated enterprises located in non-agglomeration areas moved from the Xicheng District to the BDA and from Shijingshan District to the Fengtai District Science City. The other enterprises located in non-agglomeration areas still basically relocated within the original district.

In general, the majority of high-tech firms migrated within municipal districts from 2008 to 2016, while a considerable number of enterprises migrating across the district preferred the BDA. Except for enterprises whose registered addresses were located in the BDA and the Science City in Fengtai District in 2008, the relocation of other enterprises located in agglomeration areas showed a trend of migrating from agglomeration areas to non-agglomeration areas. This may be due to the limitations of the space and platform provided by the former agglomeration areas in the growth process of enterprises, as well as the gradual erosion of policy attractiveness. Therefore, enterprises seek to relocate to non-agglomeration locations where there is a more tremendous potential for expansion or where there are legislative incentives and affordable rents. In addition, most of the high-tech enterprises located in non-agglomeration regions in 2008 were not inclined to migrate to newly formed clusters in 2016. This migrant flow also led to a new clustering tendency in the spatial distribution of high-tech manufacturing enterprises in 2016.

6. Life Cycle Characteristics of Migration of High-Tech Manufacturing Enterprises

6.1. Scale-Based Aspects of the Enterprise Life Cycle

At various periods of its life cycle, an enterprise may display regular spatial displacement as well as other traits. These modifications can affect the growth potential and size of enterprises [50,51,52,53]. From the perspective of whether the scale of high-tech enterprises changed before and after their relocation from 2008 to 2016, 33 of the 114 relocated enterprises have changed size, with small enterprises increasing to medium-sized enterprises dominating the trend. It can be inferred that the majority of high-technology companies were in the growth stage during the study period, while only a handful were in the decline stage. As shown in Figure 7 and Table 3, there are distinctions in the specific displacement flow and the segmentation stage of the life cycle of each enterprise.

Figure 7.

Changes in the size of relocated enterprises and industrial agglomeration areas from 2008 to 2016: (a) the sizes of relocated enterprises and industrial agglomeration areas in 2008; (b) the sizes of relocated enterprises and industrial agglomeration areas in 2016.

Table 3.

Comparison of size, location change, probability of relocation, and age of relocation of high-technology manufacturing enterprises.

The 31 firms that grew larger in size generally (77.42 percent) tended to move to the agglomeration or to the expanding region of the agglomeration, and these enterprises were in the growth phase of the enterprise life cycle. Twenty-nine of these enterprises expanded from a small to medium size, and two expanded from medium to large. Among the small enterprises, 72.41% of them that became larger preferred to move within the same agglomeration or to other locations with agglomeration trends. For example, five enterprises relocated within the Jiuxianqiao agglomeration, while two each moved within the BDA, the Shangdi agglomeration in Haidian District, and the Science City in Fengtai District. Six enterprises relocated from the agglomeration to the agglomeration expansion area, such as one that moved from Jiuxianqiao to Wangjing, two that relocated from the Shangdi agglomeration to the Yongfeng Industrial Base, and three that migrated from the Zhongguancun Science City to Beitucheng, Fuhai Centre, and Huilongguan. Such small enterprises are in the adolescent phase of their life cycle, a time when both their workforce size and their sales are proliferating. On the one hand, the growing physical size of the enterprise needs to stretch spatially. On the other hand, the initial agglomeration region may not be able to accommodate a small pilot factory to fulfill the experimental production function of micro and small manufacturing firms. In addition, the benefits of the previous agglomeration area, such as industrial assistance, can result in path dependence and spatially stickiness in the spatial displacement of enterprises. Therefore, micro and small firms that are expanding at this point in their life cycle may consider relocating to other spatially appropriate incubators inside the agglomeration region or leaving the high-density agglomeration area and relocating to an expansion area around the agglomeration.

The two medium-sized enterprises that have expanded to large size have both opted to move from agglomerations to areas of high concentration, one relocating within the Zhongguancun Science City and the other moving from the Changping Science Park to Huilongguan. These enterprises are usually in the adolescence or prime stage of their life cycle. On the one hand, the new employees require additional office space. On the other hand, the company’s image needs to be modernized to reflect its position in the market. If the surrounding industrial base has a suitable climate or advantageous policies, then it is more likely that medium-sized firms with certain strengths would re-select their locations without leaving the agglomeration.

The two downsized companies both shrunk from medium size to small size, moving to Zhongguancun and the non-agglomeration area of Shunyi District, respectively. Such enterprises can be considered to be in the declining or aging stage of their life cycle. As companies’ staff and sales diminish, the competitiveness of enterprises also declines. Due to operational pressure, such an enterprise is compelled to relinquish inefficient capacity, reduce expenses, and return owed money by surrendering its lease and relocating outside the core agglomeration areas.

Most enterprises that have maintained their size have migrated within an agglomeration or from one agglomeration to another or to an agglomeration expansion area. As there are specified criteria for the values of the indicators in the scale division, there are some enterprises that are deemed to be unchanged in scale during the research period, even if there is a slight change in their sales or employee count. It is also feasible to explore their life cycles through variations in these values and location changes. Among the 14 small relocated enterprises that maintain the same scale, more than half (8) have relocated within the original agglomeration area or moved from the agglomeration area to the surrounding area, indicating that they are likely in the growth phase. For instance, the Zhongguancun agglomeration, the Jiuxianqiao agglomeration, and the Science City in Fengtai District all have one enterprise relocated within the same agglomeration. In addition, one company moved from the Zhongguancun to Shangdi, and one company moved from Shangdi to the surrounding Yongfeng industrial base. Among the small firms whose size stayed the same, the number of employees, business income, and assets increased for all but two that relocated from non-clustering to non-clustering locations. Despite the fact that eight years of growth did not allow these enterprises to drastically increase in scale, these micro and small enterprises can be deemed to be in the toddler or adolescent stage of their life cycle. During the early or infant phases of development, they are primarily clustered in incubators. Once a product has earned initial market awareness and a modest revenue flow, they may relocate to other incubators or agglomeration expansion locations in search of permanent office space or more favorable legislative support.

Sixty-seven medium-sized relocated enterprises maintained the same size, with over 70.14% choosing to relocate between agglomeration areas or to agglomeration expansion areas. For instance, seven enterprises relocated within the BDA, four within the Shangdi agglomeration, ten within the Zhongguancun Science City, and seven relocated from the Shangdi and Zhongguancun clusters to the Yongfeng Industrial Base and the Zhongguancun Environmental Technology Industrial Park, respectively. It is worth noting that the employees and operating income of 39 companies have maintained steady progress, but there are also nearly half (28) of the analyzed companies whose values have declined compared with 2008. Twenty of these twenty-eight enterprises have migrated within the agglomeration or the agglomeration’s expanding area. This indicates that the majority of medium-sized enterprises that have maintained their size are in the adolescence, stable, or mature stages of their life cycle. Although they have a particular scale of staff and economic volume, they have not yet reached a level of capital accumulation that allows them to release capital freely, and they cannot guarantee continuous revenue growth; therefore, they still prefer industrial agglomerations when making locational adjustments to achieve scale economy.

6.2. Life Cycle Characteristics of Migrating Enterprises According to Age

The age of a company indicates its longevity within its life cycle. The industrial characteristics of high-tech enterprises lead to rapid renewal iterations and fierce competition within a short period of time. On the one hand, over 600 enterprises ceased to exist from 2008–2016, and on the other hand, the relocated firms we analyzed were all older than eight years, and these companies are relatively long-lived companies in high-tech industries and even in most industries in China. Exploring the locational behavior of such enterprises in the life cycle could help us uncover the secret of sustained development, resilience, and longevity.

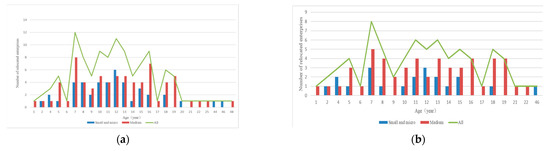

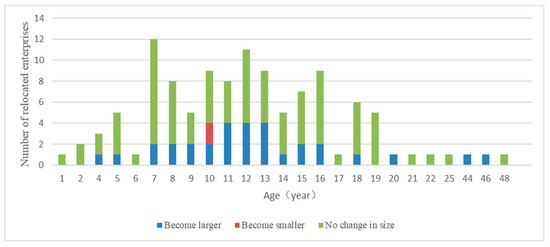

Figure 8 illustrates the correlation between the age and number of relocated firms of different sizes. The age of the enterprise at the time of the move is calculated by deducting the date of the company’s initial migration and its founding year. This study attempts to obtain change records of 114 relocated enterprises to explore the life cycle pattern of high-technology enterprises that have relocated. The number of enterprises in the high-tech manufacturing industry that underwent secondary migration from 2008 to 2016 was significantly higher than that of other high-end manufacturing industries in Beijing, such as the automobile manufacturing industry and pharmaceutical industry. This may be attributed to the fact that high-tech manufacturing enterprises require less physical space and are more flexible with respect to locational adjustment; thus, their migration occurs more frequently. Due to data limitations, 40 companies that did not find the time of change of the specific registered address used their 2013 corporate address for verification. This could cause a total inaccuracy in the calculated findings of 0.35 to 1.40 years. Therefore, the calculation results of all enterprises and enterprises with a specified migration period have been placed in Figure 8 for reference.

Figure 8.

Age and number of high-tech manufacturing enterprises of each size when migration occurs: (a) Age and number of all relocated enterprises when migration occurs; (b) Age and number of enterprises with definite migration time when migration occurs.

In general, the average age of high-tech manufacturing enterprises when they relocated was 12.57 years, and the median age of relocation was 12 years for both all firms and those with a definite time of relocation. Small (12.51 years) and medium-sized firms (12.60 years) had roughly the same average age at the time of relocation. This figure is also similar to those with definite relocation ages (11.89 years, 11.71 years, and 11.96 years for all enterprises, small enterprises, and medium enterprises, respectively). Up to 2016, the age of relocation of high-tech manufacturing enterprises in Beijing was between 1 year and 48 years, of which 72.81% made the decision to relocate when they were established for 7–16 years. This is consistent with the age range of the enterprises with a definite relocation time. It can be assumed that the adaptation period for high-tech manufacturing enterprises is 7–16 years. This means that the probability of relocation decreases sharply after 16 years of establishment, whereas prior to that, enterprises are prone to change location due to various considerations and realities. The largest number of firms relocated at 7 years since establishment, but this value varies by size: 65.11% of small enterprises relocate between 7 and 13 years of age, and 69.01% of medium-sized firms relocate between 7 and 16 years of age; therefore, the adaptation period is likely to be 7–13 years for small enterprises and 7–16 years for medium-sized firms.

6.3. Analysis of the Change in Migration Size and Age

Figure 9 shows the relationship between the age and size changes of migrating firms in the high-tech manufacturing industry. According to Ichak Adizes, firms in their toddler, adolescent, and prime years are more likely to relocate for the purpose of spatial or scale expansion [54]. Therefore, the size change of migrated enterprises can be combined with age to explore the initial growth stages of the life cycle of high-technology enterprises. Among the 114 enterprises, 31 enterprises expanded in scale after their relocation, while 81 remained the same size. Most of the small enterprises (67.44%) have grown into medium-sized enterprises after their migrations. In addition, the distribution of age and the frequency of relocations reveals that small enterprises between the ages of 4 and 20 have one to four migrating enterprises growing in size almost every year. Among them, the largest number of relocated enterprises were 12 years old and 13 years old, with four each developing into medium-sized enterprises. Additionally, there were even small enterprises that moved after 44 and 46 years old and subsequently became medium-sized enterprises. Two medium-sized enterprises became large enterprises at 11 years old, and two became small enterprises at the age of 10. In this way, it is more difficult to explore the precise time of the growth stages of the high-tech manufacturing industry through the change in size and age of migration.

Figure 9.

Age and size change of migrating enterprises in the high-tech manufacturing industry.

Overall, the life cycle characteristics of high-tech manufacturing firms have startling traits in comparison. First, the number of high-tech manufacturing enterprises that exited during the study period was several times higher than that of other industries (635), with enterprises moving in and out frequently and with a rapid pace of renewal and iteration. Second, the majority of the enterprises that expanded in size preferred to move to agglomerations or agglomeration expansion areas, and were in growth stages such as infancy, adolescence, and their prime age. Reduced-scale enterprises are in the decline stage of their life cycle and have a tendency to relocate to non-agglomeration or peripheral areas (Table 4). Third, the mean and median age of the first migration for long-lived firms formed more than eight years ago is close to twelve years. The reasons for this require additional investigation. Meanwhile, the adaptation cycle for high-tech manufacturing firms is 7–16 years; thus, firms at this age are more likely to undertake locational shifts. Fourth, the life cycle of long-lived enterprises in high-tech manufacturing is more individualized. Additionally, each enterprise may not be consistent in its own growth and development years. For instance, some enterprises may relocate when they are 4–16 years old, seeking a broader space to thrive, while other small enterprises are still in their growth phase when they are 44–46 years old and further expand after relocating. By contrast, some medium-sized enterprises may have started the decline phase when they are ten years old, requiring them to return capital by reducing office space and moving out of the agglomeration.

Table 4.

Comparison of size, age of relocation, and life cycle stage of high-technology manufacturing enterprises.

7. Discussion and Conclusions

Research on business migration in international metropolitan areas is inadequate. Existing studies have mainly studied the whole manufacturing or service industry from the regional scale, and there is a lack of research based on the city scale and firm level. This paper explored the characteristics of the locational reselection process of high-tech manufacturing enterprises in the city of Beijing based on micro-enterprise data and using point pattern analysis and other methods. The findings of the study have some reference significance for enriching and improving the theory of enterprise migration and modern industrial locations. This study has demonstrated the following conclusions.

Firstly, we have investigated the relationship between enterprise attributes and enterprise migration, and we find that the ownership of the enterprise, the establishment time of the enterprise, and the size of the enterprise may be related to the enterprise’s migration. Among the 114 companies analyzed, 97.43% are mixed ownership enterprises, foreign-funded enterprises, and privately owned enterprises, indicating that market rules may have a greater impact on enterprise relocation than government policies. The establishment time of the relocation enterprise was concentrated after 1992. For high-tech enterprises, small enterprises are the dominant enterprises in terms of demise, while medium-sized enterprises account for the majority of the surviving and migrating enterprises, and enterprises with medium-sized or high operating incomes are more inclined to migrate.

Secondly, we examined the spatial variation of migrating enterprises. In general, the spatial variations and migratory directions of high-tech enterprises are affected by the original industrial layout. The agglomeration and advantageous locations of high-tech industry development, such as Haidian District, Chaoyang District, and other urban areas, have a significant spatial-locking effect on the migration of enterprises, which focuses the migration of high-tech enterprises mainly in urban areas. However, not all spatial variations in migrating enterprises follow this rule. For example, although the Yongfeng Industrial Base and Zhongguancun Environmental Technology Industrial Park, which are in the northwest of Haidian District, were not the core agglomeration areas of high-tech enterprises before 2008, they still attracted some enterprises by the advantages of their proximity to the clusters, beautiful environment, and relatively low rents. Additionally, the number of enterprises moving to the Daxing District Economic Development Zone in the southeast direction of Beijing was the largest, making the Daxing District Economic Development Zone a new core agglomeration area of high-tech enterprises in 2016. In addition, some enterprises choose to migrate across regions to other agglomeration areas, expansion areas, or non-agglomeration areas.

Thirdly, we have explored the life-cycle characteristics of the relocated enterprises (Table 4). To begin with, most of the relocated enterprises with expanded and unchanged scales are in the growth stage of their life cycle and tend to move to agglomerations or agglomeration expansion areas. The enterprises with a decreasing scale are in the decline stage. Next, the life cycle characteristics of high-tech enterprises do not conform to the industry’s general life cycle pattern. This is not only because high-tech firms are likely to be riskier with respect to growth, with most of them failing before they can enter the next life cycle, but also because these long-lived high-tech manufacturing firms—which are older than eight years of age—have an average relocation age of around 12 years, with an adaptation period of 7–16 years. Finally, the life cycle of high-technology enterprises has been distinctly differentiated and individualized.

Due to limitations regarding the data acquisition, this paper only studies the contemporary data of high-tech enterprises containing attribute characteristics from 2008 and 2016, while high-tech enterprises in Beijing are still in the process of continuous development and evolution. Therefore, it is difficult to identify the precise duration of each detailed stage of the life cycle of high-tech enterprises through a combination of size and age. Future research will focus on the long-term migratory process and life cycle characteristics of high-technology enterprises. In addition, as a pillar industry in Beijing, the drivers of the migration or development of high-technology industries are intertwined with the complex urban elements of Beijing, and our future research intends to further develop a multifaceted quantitative analysis of the impact mechanisms of migration of high-tech enterprises.

Author Contributions

Conceptualization, P.Z. and J.L.; formal analysis, P.Z.; investigation, J.L. and W.Z.; data curation, J.L.; writing—original draft preparation, P.Z.; writing—review and editing, J.L. and W.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (General Program), grant number 42171178.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

We sincerely thank the scholars and experts for their joint efforts to keep improving this paper.

Conflicts of Interest

The authors declare no conflict of interest in this paper.

References

- Wolf, M.; Terrell, D. The high-tech industry, what is it and why it matters to our economic future. Beyond Numbers Employ Unempl. 2016, 5, 1–7. [Google Scholar]

- DiNapoli, T.P.; Bleiwas, K.B. New York City’s Growing High-Tech Industry; Office of the New York State Comptroller: New York, NY, USA; City Public Information Office: Santa Paula, CA, USA, 2014; pp. 1–4. [Google Scholar]

- Honjo, Y. Growth of new start-up firms, evidence from the Japanese manufacturing industry. Appl. Econ. 2004, 36, 343–355. [Google Scholar] [CrossRef]

- Zhao, L. Analysis of the Policy Needs of Beijing-owned Enterprises Migration Under the Background of the Coordinated Development of Beijing, Tianjin and Hebei. Exp. Horiz. 2020, 1, 73–80. [Google Scholar]

- Zhao, J.J.; Ru, L.F.; Duan, X.W.; Miao, C.H. Industrial Transfer Study in Economic Geography, Progress and Prospect. Econ. Geogr. 2014, 34, 1–6. [Google Scholar]

- Lewis, W.A. The Evolution of the International Economic Order; Princeton University Press: Princeton, NJ, USA, 1978. [Google Scholar]

- Hu, J.W. The Basic Rules and Changing Trends of International Industrial Transfer. J. Int. Trade 2004, 5, 56–60. [Google Scholar]

- Pan, Y. The Four Waves of International Industrial Migration and Their Impacts. Contemp. Int. Relat. 2006, 4, 23–27. [Google Scholar]

- Dai, H.W. New Trends of International Industrial Transfer and Implications for China. Intertrade 2007, 2, 45–49. [Google Scholar]

- Si, W.; Chen, L.; Zheng, Y. The Impact of Covid-19 on the Adjustment of Global Industrial Pattern. Int. Stud. Ref. 2020, 11, 1–7. [Google Scholar]

- Yue, S.S. China and Southeast Asian Countries in the Fifth International Industrial Transfer, Comparative Advantages and Policy Options. Southeast Asian Stud. 2021, 4, 124–149+154–155. [Google Scholar]

- Zhao, H.T. Belt and Road Initiative from the Perspective of Transfer of International Industry. Contemp. Int. Relat. 2019, 3, 38–45+64. [Google Scholar]

- Kiss, E. The impacts of relocation on the spatial pattern to Hungarian industry. Geogr. Pol. 2007, 80, 43. [Google Scholar]

- Black, D.; Henderson, V. Spatial evolution of population and industry in the United States. Am. Econ. Rev. 1999, 89, 321–327. [Google Scholar] [CrossRef]

- Tiwari, P.; Syamwil, I.B. Spatial pattern of Japanese manufacturing industry in four ASEAN countries. Pap. Reg. Sci. 2003, 82, 403–415. [Google Scholar] [CrossRef]

- Richetto, J.P.; Moitra, C. The United States’ Manufacturing Sector, Trends in the Spatial Pattern of Inward Foreign Direct Investment. Geogr. Ann. B 1990, 72, 101–116. [Google Scholar] [CrossRef]

- Zhang, G.W. The Study of Industrial Agglomeration Change and the Probability of Industry Transfer In China. Econ. Geogr. 2010, 30, 1670–1674. [Google Scholar]

- Chen, J.J. Industrial Regional Transferring at China Current Stage and Its Power Mechanism. China Ind. Econ. 2002, 8, 37–44. [Google Scholar]

- Fan, X.S.; Li, X.J. Spatial Shift of China’s Industrial Sectors and Development Strategies of the Middle China. Geogr. Geo-Inform. Sci. 2004, 20, 64–68. [Google Scholar]

- Luo, H.C.; Miao, C.H.; Li, G.L. Review on Empirical Research and Related Controversies of Different Regional Scale Industrial Transfer. Hum. Geogr. 2014, 29, 1–8. [Google Scholar]

- Liu, H.G.; Wang, Y.P.; Ji, L. Characteristics, Mechanism and Pattern of Inter-Regional Industry Transfers in China. Econ. Geogr. 2014, 34, 102–107. [Google Scholar]

- Sun, Y.; Xiong, W.; Wang, Z. Research on the Policies of High-Tech Industry Spatial Transferring in China. Sci. Manag. 2010, 31, 163–168. [Google Scholar]

- Gao, B.Y.; Li, J.W.; Liu, H.G. The Quantitative Study on Electronic Information Industry Transfer in China. Econ. Geogr. 2015, 35, 103–109. [Google Scholar]

- Fu, R. Why eastern industries do not move to the west, an explanation based on spatial economic theory. J. World Econ. 2010, 8, 59–71. [Google Scholar]

- Wang, J.J.; Wang, Q.F.; Liu, J.G. Transfer and Cooperation Mechanism of Manufacturing Industry in Beijing, Tianjin and Hebei under the Synergetic Perspective. Econ. Geogr. 2018, 38, 90–99. [Google Scholar]

- Mao, H.Y. Innovation of mechanism and regional policy for promoting coordinated development of the Beijing-Tianjin-Hebei. Prog. Geogr. 2017, 36, 2–14. [Google Scholar]

- Zhang, J.F.; Xi, Q.M.; Sun, T.S.; Li, G.P. Industrial Division and Transfer of Manufacture in Beijing-Tianjin-Hebei Region. Hum. Geogr. 2016, 31, 95–101+160. [Google Scholar]

- Sun, J.W.; Yao, P. Industrial Relocation in Jing-Jin-Ji Region, Regional Specialization and Coordinated Development, An Analysis Based on the Framework of New Economic Geography. Nankai J. 2015, 1, 81–89. [Google Scholar]

- Zhang, M.Z.; Xie, H. Cross-regional Gradient Transfer or Regionally Industrial Agglomeration, An Analysis of Industrial Transfer Based on the Data in China and the Yangtze River Delta Partition from 2003~2013. Collect. Essays Financ. Econ. 2017, 217, 10–17. [Google Scholar]

- Zhao, J.L.; Zhang, L.C. Pan-Yangtze River Delta Manufacturing Industry Transfer Based on “Core-edge” Theory. J. Univ. CAS 2015, 32, 317–324. [Google Scholar]

- Shen, J.H.; Meng, D.Y.; Lu, Y.Q. The Analysis of Spatial Difference of Wanjiang Demonstration Zone Undertaking the Yangtze River Delta’s Industry Transfer. Econ. Geogr. 2012, 32, 43–49. [Google Scholar]

- Xu, H.Y.; Chen, X.J.; Xiong, Y. The Synergy Development between the Industrial Transfer and the Urban Space. Econ. Geogr. 2014, 34, 62–68. [Google Scholar]

- Ye, J.G. The trend of industrial transfer in the Pearl River Delta and the response to it. Macroecon. Manag. 2013, 1, 54–56. [Google Scholar]

- Zhu, B. The Trajectory and Prospects of Industrial Transfer in the Pearl River Delta Region. J. Dev. Reform. 2012, 2, 40–43. [Google Scholar]

- Choudhury, P. Return migration and geography of innovation in MNEs, a natural experiment of knowledge production by local workers reporting to return migrants. J. Econ. Geogr. 2016, 16, 585–610. [Google Scholar] [CrossRef]

- Guo, J.; Yang, Y.C.; Leng, B.R. Characteristics, models and mechanisms of manufacturing enterprises migrations of large cities in western China since 1949, Taking Lanzhou as an example. Geogr. Res-Aust. 2012, 31, 1872–1886. [Google Scholar]

- Zhang, X.J.; Xu, W.X.; Huang, M.J. Migration Characteristics, Mechanisms and Performance of Manufacturing Enterprises, A Case of Hangzhou. Econ. Geogr. 2019, 39, 136–146. [Google Scholar]

- Zhang, X.P.; Sun, L. Manufacture Restructuring and Main Determinants in Beijing Metropolitan Area. Acta Geogr. Sin. 2012, 67, 1308–1316. [Google Scholar]

- Wang, D.; Fang, B.; Chen, Z.F. Spatial Pattern and Evolution of Internet Enterprises Based on Community Scale—An Example of Yangzhou Urban Area. Econ. Geogr. 2018, 38, 133–141. [Google Scholar]

- Liu, C.J.; Wang, Z.Y.; Li, X.S.; Zhou, J.P.; Jiang, J.H.; Hou, H.H. Spatial Pattern Evolution and Location Choice of Internet Startups, A Case Study of Hangzhou. Econ. Geogr. 2021, 41, 107–115+146. [Google Scholar]

- Sun, T.; Li, T.S.; An, C.Y.; Wang, W.T. Evolution and Influence Factors of Spatial-temporal Pattern of Creative Industry in Xi’an. Econ. Geogr. 2021, 41, 125–135. [Google Scholar]

- Yu, Y.; Liu, Q.; Li, G.C. The spatial evolution of Shenzhen high-tech electronic information technology agglomeration pattern and locational determinants. World Reg. Stud. 2020, 29, 557–567. [Google Scholar]

- Broitman, D.; Benenson, I.; Czamanski, D. The impact of migration and innovations on the life cycles and size distribution of cities. Int. Reg. Sci. Rev. 2020, 43, 531–549. [Google Scholar] [CrossRef]

- Li, J.M. Urban Spatial Analysis and Location Policy, Examples of Beijing and Hangzhou, 1st ed.; Social Sciences Academic Press: Beijing, China, 2018; pp. 55–105. [Google Scholar]

- Wei, H. China released the “Eleventh Five-Year Plan for the Development of High-Tech Industries”. Shh. Met. 2008, 5, 58. [Google Scholar]

- Yuill, R.S. The standard deviational ellipse; an updated tool for spatial description. Geogr. Ann. B 1971, 53, 28–39. [Google Scholar] [CrossRef]

- Heidenreich, N.B.; Schindler, A.; Sperlich, S. Bandwidth selection for kernel density estimation, a review of fully automatic selectors. AStA Adv. Stat. Anal. 2013, 97, 403–433. [Google Scholar] [CrossRef]

- Watts, H.D. The Large Industrial Enterprise, Some Spatial Perspectives; Croom Helm: London, UK, 1980. [Google Scholar]

- Morrill, R. Waves of spatial diffusion. J. Reg. Sci. 1968, 8, 1–18. [Google Scholar] [CrossRef]

- Chen, Y.Y.; Tian, G.F.; Wang, L. Industry Life-cycle Evolution and Firm Size Distribution, An Empirical Research Based on China’s Manufacturing Industry. Rev. Ind. Econ. 2013, 12, 100–116. [Google Scholar]

- Tang, Y.J.; Song, Y.Y. The Impacts of Size and Age of Chinese Companies on Firm Growth—Panel Data of Manufacturing Listed Companies. Ind. Econ. Res. 2008, 6, 28–35. [Google Scholar]

- Booth, A. Private sector training and graduate earnings. Rev. Econ. Stat. 1993, 75, 164–170. [Google Scholar] [CrossRef]

- Pischke, J.S. Continuous training in Germany. J. Popul. Econ. 2001, 14, 523–548. [Google Scholar] [CrossRef]

- Adizes, I.; Adiz’es, Y. Corporate Lifecycles: How and Why Corporations Grow and Die and What to Do about It; Business & Professional Division: Columbus, OH, USA, 1988. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).