Project Attribute Information and Initiator’s Commitment in Crowdfunding Message Strategy: An Empirical Investigation of Financing Performance in Agri-Food Crowdfunding

Abstract

1. Introduction

2. Literature Review

2.1. Style of Project Description

2.2. Content of Project Description

3. Theoretical Background and Hypothesis Development

3.1. Theoretical Background

3.2. Conceptual Model and Hypothesis Development

3.2.1. Project Characteristic Attributes in the Central Path and Financing Performance

3.2.2. Project Competitive Attributes in the Edge Path and Financing Performance

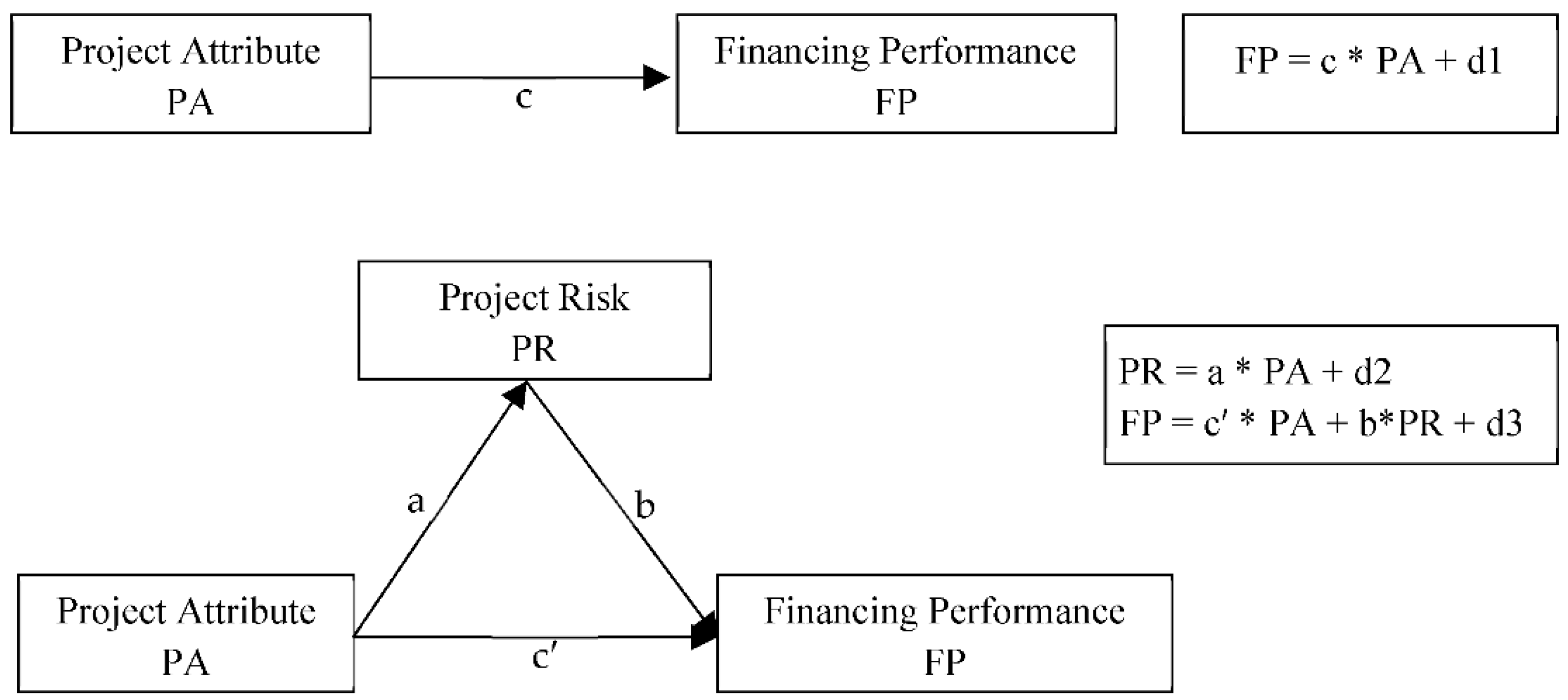

3.2.3. Mediating Role of Project Risk

4. Data and Variables

4.1. Data Collection

4.2. Definition of Variables

4.3. Empirical Model

5. Results

5.1. Descriptive Statistics

5.2. Empirical Analysis

5.2.1. Correlation between Variables

5.2.2. Regression Analysis

5.3. Robustness Assessment

6. Discussion and Implications

6.1. Conclusions

6.2. Implications for Practice

6.3. Limitations

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, Z.; Li, H.; Law, R. Determinants of tourism crowdfunding performance: An empirical study. Tour. Anal. 2017, 22, 323–336. [Google Scholar] [CrossRef]

- Tian, J.; Yin, L.; Jin, J. Impact of Quality Signal, Investor Participation and Project Economy on the Achievement Rate of Crowdfunding of Agricultural Products. Theory Pract. Financ. Econ. 2020, 41, 17–25. (In Chinese) [Google Scholar]

- Mollick, E. The dynamics of crowdfunding: An exploratory study. J. Bus. Ventur. 2014, 29, 1–16. [Google Scholar] [CrossRef]

- Bi, S.; Liu, Z.; Usman, K. The influence of online information on investing decisions of reward-based crowdfunding. J. Bus. Res. 2017, 71, 10–18. [Google Scholar] [CrossRef]

- Courtney, C.; Dutta, S.; Li, Y. Resolving information asymmetry: Signaling, endorsement, and crowdfunding success. Entrep. Theory Pract. 2017, 41, 265–290. [Google Scholar] [CrossRef]

- Bento, N.; Gianfrate, G.; Groppo, S.V. Do crowdfunding returns reward risk? Evidences from clean-tech projects. Technol. Forecast. Soc. Chang. 2019, 141, 107–116. [Google Scholar] [CrossRef]

- Laplane, A.; Mazzucato, M. Socializing the risks and rewards of public investments: Economic, policy, and legal issues. Res. Policy 2020, 49, 100008. [Google Scholar] [CrossRef]

- De Crescenzo, V.; Ribeiro-Soriano, D.E.; Covin, J.G. Exploring the viability of equity crowdfunding as a fundraising instrument: A configurational analysis of contingency factors that lead to crowdfunding success and failure. J. Bus. Res. 2020, 115, 348–356. [Google Scholar] [CrossRef]

- Cappa, F.; Franco, S.; Ferrucci, E.; Maiolini, R. The impact of product and reward types in reward-based crowdfunding. IEEE Trans. Eng. Manag. 2021, 99, 1–12. [Google Scholar] [CrossRef]

- Coakley, J.; Lazos, A. New developments in equity crowdfunding: A review. Rev. Corp. Financ. 2021, 1, 341–405. [Google Scholar] [CrossRef]

- Salido-Andres, N.; Rey-Garcia, M.; Alvarez-Gonzalez, L.I.; Vazquez-Casielles, R. Mapping the field of donation-based crowdfunding for charitable causes: Systematic review and conceptual framework. VOLUNTAS Int. J. Volunt. Nonprofit. Organ. 2021, 32, 288–302. [Google Scholar] [CrossRef]

- Sun, F.; Liu, C. An Exploratory Pledging Framework of Crowdfunding for Utilities Tunnel Engineering Project. Math. Probl. Eng. 2022, 2022, 4658454. [Google Scholar] [CrossRef]

- Yacoub, G.; Mitra, P.; Ratinho, T.; Fatalot, F. Sustainable entrepreneurs: What drives them to engage in different crowdfunding types? Int. J. Entrep. Behav. Res. 2022, 28, 980–1000. [Google Scholar] [CrossRef]

- Li, Y.; Du, J. What drives the rapid achievement of a funding target in crowdfunding? Evidence from China. Agric. Econ. 2020, 66, 269–277. [Google Scholar] [CrossRef]

- Zhang, D.; Li, Y.; Wu, J.; Long, D. Online or not? What factors affect equity crowdfunding platforms to launch projects online in the pre-investment stage? Entrep. Res. J. 2019, 9, 1515. [Google Scholar] [CrossRef]

- Wehnert, P.; Baccarella, C.V.; Beckmann, M. In crowdfunding we trust? Investigating crowdfunding success as a signal for enhancing trust in sustainable product features. Technol. Forecast. Soc. Chang. 2019, 141, 128–137. [Google Scholar] [CrossRef]

- Li, L.; Yang, L.; Zhao, M.; Liao, M.; Cao, Y. Exploring the success determinants of crowdfunding for cultural and creative projects: An empirical study based on signal theory. Technol. Soc. 2022, 70, 102036. [Google Scholar] [CrossRef]

- Ahlers, G.K.; Cumming, D.; Günther, C.; Schweizer, D. Signaling in equity crowdfunding. Entrep. Theory Pract. 2015, 39, 955–980. [Google Scholar] [CrossRef]

- Huang, S.; Pickernell, D.; Battisti, M.; Nguyen, T. Signalling entrepreneurs’ credibility and project quality for crowdfunding success: Cases from the Kickstarter and Indiegogo environments. Small Bus. Econ. 2022, 58, 1801–1821. [Google Scholar] [CrossRef]

- Raab, M.; Schlauderer, S.; Overhage, S.; Friedrich, T. More than a feeling: Investigating the contagious effect of facial emotional expressions on investment decisions in reward-based crowdfunding. Decis. Support Syst. 2020, 135, 113326. [Google Scholar] [CrossRef]

- Yang, J.; Li, Y.; Calic, G.; Shevchenko, A. How multimedia shape crowdfunding outcomes: The overshadowing effect of images and videos on text in campaign information. J. Bus. Res. 2020, 117, 6–18. [Google Scholar] [CrossRef]

- Wang, N.; Li, Q.; Liang, H.; Ye, T.; Ge, S. Understanding the importance of interaction between creators and backers in crowdfunding success. Electron. Commer. Res. Appl. 2018, 27, 106–117. [Google Scholar] [CrossRef]

- Allison, T.H.; Davis, B.C.; Webb, J.W.; Short, J.C. Persuasion in crowdfunding: An elaboration likelihood model of crowdfunding performance. J. Bus. Ventur. 2017, 32, 707–725. [Google Scholar] [CrossRef]

- Yeh, T.L.; Chen, T.Y.; Lee, C.C. Investigating the funding success factors affecting reward-based crowdfunding projects. Innovation 2019, 21, 466–486. [Google Scholar] [CrossRef]

- Zhang, H.; Chen, W. Crowdfunding technological innovations: Interaction between consumer benefits and rewards. Technovation 2019, 84, 11–20. [Google Scholar] [CrossRef]

- Wati, C.R.; Winarno, A. The performance of crowdfunding model as an alternative funding source for micro, small, and medium-scale businesses in various countries. KnE Soc. Sci. 2018, 3, 16–33. [Google Scholar] [CrossRef]

- Fortezza, F.; Pagano, A.; Bocconcelli, R. Serial crowdfunding in start-up development: A business network view. J. Bus. Ind. Mark. 2021, 36, 250–262. [Google Scholar] [CrossRef]

- Liu, Z.; Peng, B.; Ma, C. Can description information in reward-based crowdfunding affect financing performance? Foreign Econ. Manag. 2018, 40, 84–95. (In Chinese) [Google Scholar]

- Wang, Z.; Yang, X. Understanding backers’ funding intention in reward crowdfunding: An elaboration likelihood perspective. Technol. Soc. 2019, 58, 101149. [Google Scholar] [CrossRef]

- Li, Y.; Du, J.; Fu, W. Thirty days are enough: What determines the crowd’s cash time in agri-food crowdfunding? China Agric. Econ. Rev. 2020, 12, 553–575. [Google Scholar] [CrossRef]

- Ma, G.; Ma, J.; Li, H.; Wang, Y.; Wang, Z.; Zhang, B. Customer behavior in purchasing energy-saving products: Big data analytics from online reviews of e-commerce. Energy Policy 2022, 165, 112960. [Google Scholar] [CrossRef]

- Efrat, K.; Gilboa, S. Relationship approach to crowdfunding: How creators and supporters’ interaction enhances projects’ success. Electron. Mark. 2020, 30, 899–911. [Google Scholar] [CrossRef]

- Cumming, D.J.; Leboeuf, G.; Schwienbacher, A. Crowdfunding models: Keep-it-all vs. all-or-nothing. Financ. Manag. 2020, 49, 331–360. [Google Scholar] [CrossRef]

- Ghafari, M. Effective factors in social media on young consumers’ purchase intention and purchasing from these media (case study young consumers in isfahan). QUID Investig. Cienc. Tecnol. 2017, 1, 2208–2213. [Google Scholar]

- MacMillan, K.; Money, K.; Money, A.; Downing, S. Relationship marketing in the not-for-profit sector: An extension and application of the commitment–trust theory. J. Bus. Res. 2005, 58, 806–818. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Burgoon, M.; Denning, V.P.; Roberts, L. Language expectancy theory. In The Persuasion Handbook: Developments in Theory and Practice; Sage Publications: Thousand Oaks, CA, USA, 2002; pp. 117–136. [Google Scholar]

- Pitschner, S.; Pitschner-Finn, S. Non-profit differentials in crowd-based financing: Evidence from 50,000 campaigns. Econ. Lett. 2014, 123, 391–394. [Google Scholar] [CrossRef]

| Variables Type | Variable Name | Description | |

|---|---|---|---|

| Dependent Variable | Financing performance | Financing completion rate (FCR) | The actual financing amount for a single project is divided by the target financing amount. (%) |

| Independent Variables | Project characteristic attributes | Crowdfunding reason (CR) | The value is one if the project gives a crowdfunding reason, and zero otherwise. |

| Capital uses (CU) | The value is one if the project includes planning for the use of funds, and zero otherwise. | ||

| Funding goal (FG) | The amount of money that the project initiator seeks to raise (in CNY). | ||

| Product certification (PC) | Dummy variable indicating whether the project has qualification certificates issued by authoritative organizations. The value is one if the project has qualification certificates, and zero otherwise. | ||

| Project competitive attributes | Type of reward (TR) | The number of different rewards offered in return for the contribution of potential backers in the campaign. | |

| Reward delivery time (RDT) | The delivery time of the reward promised by project initiator (in days). | ||

| Gift (GT) | The value is one if the project provides gifts to backers, and zero otherwise. | ||

| Investment threshold (IT) | The minimum amount of investment a backer will provide in the project (in CNY). | ||

| Mediating Variable | Project risk | Commitment (CT) | The value is one if the project provides a sincere promise about product quality and reward, etc., and zero otherwise. |

| Control Variable | Backer aspect | Number of backers (NB) | The total number of backers in a project. |

| Number of likers (NL) | The total number of people who like a project. | ||

| Initiator aspect | Gold seller certification (GSC) | Length (in days) of campaign from launch to planned completion of the fundraising target. | |

| Security fund (SF) | The amount of earnest money actually paid by the initiator (in CNY). | ||

| Initiator introduction (II) | The value is one if the project includes a detailed description of the initiator, and zero otherwise. | ||

| Rural per capita net income (RPCI) | The per capita net income of farmers in the region where the initiator is located (in CNY). | ||

| Variable | Minimum | Maximum | Mean | Variance | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| FCR | 100.00 | 12,301.00 | 357.4202 | 838.71673 | 8.264 | 90.879 |

| CR | 0.00 | 1.00 | 0.7590 | 0.42787 | −1.213 | −0.530 |

| CU | 0.00 | 1.00 | 0.4923 | 0.50015 | 0.031 | −2.002 |

| FG | 1000.00 | 500,000.00 | 42,453.3731 | 29,062.86817 | 5.227 | 67.849 |

| PC | 0.00 | 1.00 | 0.4202 | 0.49381 | 0.324 | −1.899 |

| TR | 1.00 | 17.00 | 4.8405 | 1.65691 | 1.401 | 4.710 |

| RDT | 0.00 | 210.00 | 10.4374 | 11.30646 | 6.610 | 90.092 |

| GT | 0.00 | 1.00 | 0.2659 | 0.44198 | 1.061 | −0.875 |

| IT | 0.50 | 398.00 | 45.5206 | 39.64963 | 2.739 | 13.517 |

| CT | 0.00 | 1.00 | 0.2847 | 0.45148 | 0.955 | −1.089 |

| NB | 24.00 | 182,803.00 | 3030.2813 | 12,577.22043 | 8.638 | 86.701 |

| NL | 1.00 | 8871.00 | 856.0420 | 933.18593 | 3.302 | 18.617 |

| GSC | 0.00 | 1.00 | 0.0635 | 0.24390 | 3.586 | 10.876 |

| SF | 0.00 | 61,000.00 | 2192.8838 | 6281.96038 | 6.562 | 46.652 |

| II | 0.00 | 1.00 | 0.5369 | 0.49885 | −0.148 | −1.981 |

| RPCI | 6936.20 | 23,205.20 | 12,581.3829 | 3825.44251 | 1.230 | 0.907 |

| Variable | Category | Number of Campaigns | Proportion (%) |

|---|---|---|---|

| CR | Yes | 884 | 75.81 |

| No | 282 | 24.19 | |

| CU | Yes | 572 | 49.06 |

| No | 594 | 50.94 | |

| FG | 1000–9999 | 259 | 22.21 |

| 10,000–49,999 | 846 | 72.56 | |

| ≥50,000 | 61 | 5.23 | |

| PC | Yes | 490 | 42.02 |

| No | 676 | 57.98 | |

| TR | 1–4 | 566 | 48.54 |

| ≥5 | 600 | 51.46 | |

| RDT | <10 | 666 | 57.12 |

| ≥10 | 500 | 42.88 | |

| GT | Yes | 310 | 26.59 |

| No | 856 | 73.41 | |

| IT | <50 | 797 | 68.35 |

| ≥50 | 369 | 31.65 | |

| CT | Yes | 331 | 28.39 |

| No | 835 | 71.61 |

| Variable | Tolerance | VIF |

|---|---|---|

| CR | 0.960 | 1.041 |

| CU | 0.846 | 1.182 |

| FG | 0.938 | 1.067 |

| PC | 0.946 | 1.057 |

| TR | 0.907 | 1.102 |

| RDT | 0.955 | 1.047 |

| GT | 0.859 | 1.164 |

| IT | 0.831 | 1.204 |

| CT | 0.793 | 1.260 |

| NB | 0.939 | 1.065 |

| NL | 0.888 | 1.126 |

| GSC | 0.969 | 1.032 |

| SF | 0.969 | 1.032 |

| II | 0.920 | 1.087 |

| RPCI | 0.944 | 1.060 |

| Variables | FCR | CT | ||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| NB | 7.957 × 10−6 *** (0.000) | 1.014 × 10−5 *** (0.000) | 1.003 × 10−5 *** (0.000) | 7.744 × 10−7 (0.285) |

| NL | 0.109 *** (0.000) | 0.269 *** (0.000) | 0.271 *** (0.000) | 0.014 (0.138) |

| GSC | 0.983 *** (0.000) | 0.686 *** (0.000) | 0.677 *** (0.000) | 0.065 (0.236) |

| SF | 0.026 *** (0.000) | 0.006 (0.435) | 0.006 (0.436) | 0.000 * (0.096) |

| II | 0.109 (0.126) | 0.128 ** (0.025) | 0.115 ** (0.044) | 0.097 *** (0.000) |

| RPCI | 0.379 *** (0.000) | 0.160 ** (0.020) | 0.155 *** (0.025) | 0.039 (0.229) |

| CR | 0.147 ** (0.031) | 0.133 * (0.053) | 0.111 *** (0.001) | |

| CU | 0.142 ** (0.017) | 0.135 ** (0.023) | 0.051 * (0.072) | |

| FG | −0.610 *** (0.000) | −0.603 *** (0.002) | −0.024 ** (0.033) | |

| PC | 0.155 *** (0.007) | 0.157 *** (0.006) | 0.018 (0.516) | |

| TR | 0.145 ** (0.016) | 0.138 ** (0.021) | 0.050 * (0.081) | |

| RDT | −0.057 ** (0.023) | −0.055 ** (0.029) | 0.017 (0.157) | |

| GT | 0.062 (0.316) | 0.074 (0.238) | 0.085 *** (0.004) | |

| IT | −0.107 *** (0.000) | −0.112 *** (0.000) | −0.005 (0.606) | |

| CT | 0.131 ** (0.034) | |||

| F | 19.031 *** (0.000) | 70.660 *** (0.000) | 66.450 *** (0.000) | 4.902 *** (0.000) |

| R2 | 0.224 | 0.462 | 0.464 | 0.156 |

| Adjusted R2 | 0.221 | 0.456 | 0.457 | 0.145 |

| Variables | FCR | CT | ||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| NB | 7.957 × 10−3 *** (0.002) | 1.014 × 10−2 *** (0.003) | 1.003 × 10−3 *** (0.005) | 7.744 × 10−3 (0.281) |

| NL | 0.106 *** (0.001) | 0.265 *** (0.002) | 0.269 *** (0.003) | 0.011 (0.135) |

| GSC | 0.979 *** (0.002) | 0.684 *** (0.001) | 0.675 *** (0.003) | 0.067 (0.234) |

| SF | 0.023 *** (0.003) | 0.009 (0.431) | 0.003 (0.432) | 0.001 * (0.085) |

| II | 0.112 (0.124) | 0.125 ** (0.022) | 0.113 ** (0.041) | 0.086 *** (0.005) |

| RPCI | 0.375 *** (0.001) | 0.164 ** (0.025) | 0.151 *** (0.021) | 0.042 (0.226) |

| CR | 0.149 ** (0.033) | 0.135 * (0.055) | 0.113 *** (0.003) | |

| CU | 0.140 ** (0.015) | 0.133 ** (0.021) | 0.049 * (0.069) | |

| FG | −0.608 *** (0.002) | −0.601 *** (0.004) | −0.022 ** (0.036) | |

| PC | 0.159 *** (0.009) | 0.161 *** (0.007) | 0.022 (0.511) | |

| TR | 0.142 ** (0.013) | 0.135 ** (0.018) | 0.047 * (0.078) | |

| RDT | −0.059 ** (0.025) | −0.057 ** (0.027) | 0.014 (0.155) | |

| GT | 0.060 (0.314) | 0.072 (0.236) | 0.087 *** (0.005) | |

| IT | −0.105 *** (0.001) | −0.109 *** (0.002) | −0.007 (0.605) | |

| CT | 0.129 ** (0.031) | |||

| F | 19.046 *** (0.000) | 70.696 *** (0.000) | 66.467 *** (0.000) | 4.915 *** (0.000) |

| R2 | 0.226 | 0.465 | 0.466 | 0.159 |

| Adjusted R2 | 0.223 | 0.459 | 0.459 | 0.147 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, J. Project Attribute Information and Initiator’s Commitment in Crowdfunding Message Strategy: An Empirical Investigation of Financing Performance in Agri-Food Crowdfunding. Sustainability 2022, 14, 12702. https://doi.org/10.3390/su141912702

Du J. Project Attribute Information and Initiator’s Commitment in Crowdfunding Message Strategy: An Empirical Investigation of Financing Performance in Agri-Food Crowdfunding. Sustainability. 2022; 14(19):12702. https://doi.org/10.3390/su141912702

Chicago/Turabian StyleDu, Junjuan. 2022. "Project Attribute Information and Initiator’s Commitment in Crowdfunding Message Strategy: An Empirical Investigation of Financing Performance in Agri-Food Crowdfunding" Sustainability 14, no. 19: 12702. https://doi.org/10.3390/su141912702

APA StyleDu, J. (2022). Project Attribute Information and Initiator’s Commitment in Crowdfunding Message Strategy: An Empirical Investigation of Financing Performance in Agri-Food Crowdfunding. Sustainability, 14(19), 12702. https://doi.org/10.3390/su141912702