Effects of Chinese Firms’ Innovation on New Energy Vehicles Purchases

Abstract

1. Introduction

2. Conceptualization and Research Hypotheses

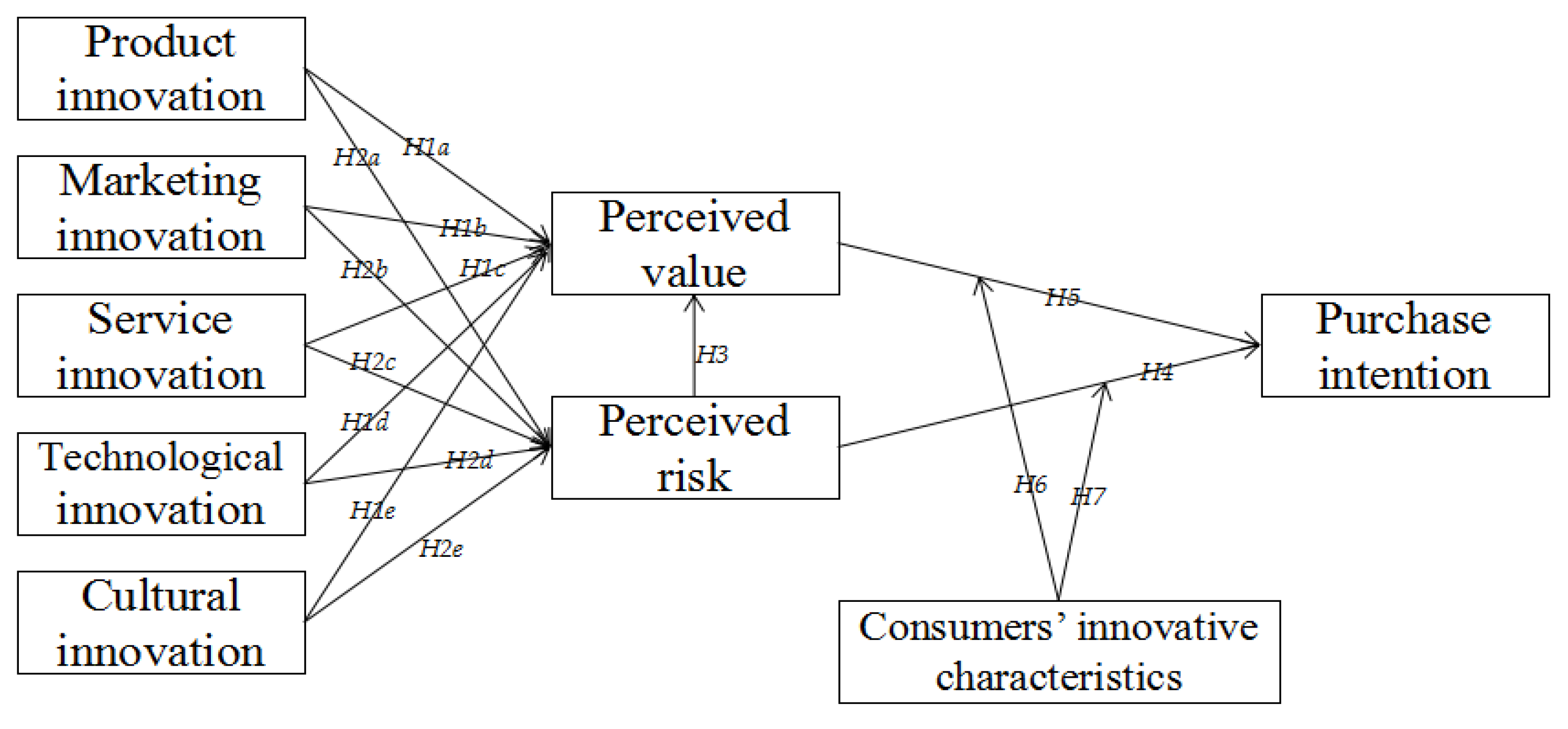

2.1. Overview of the Theoretical Framework

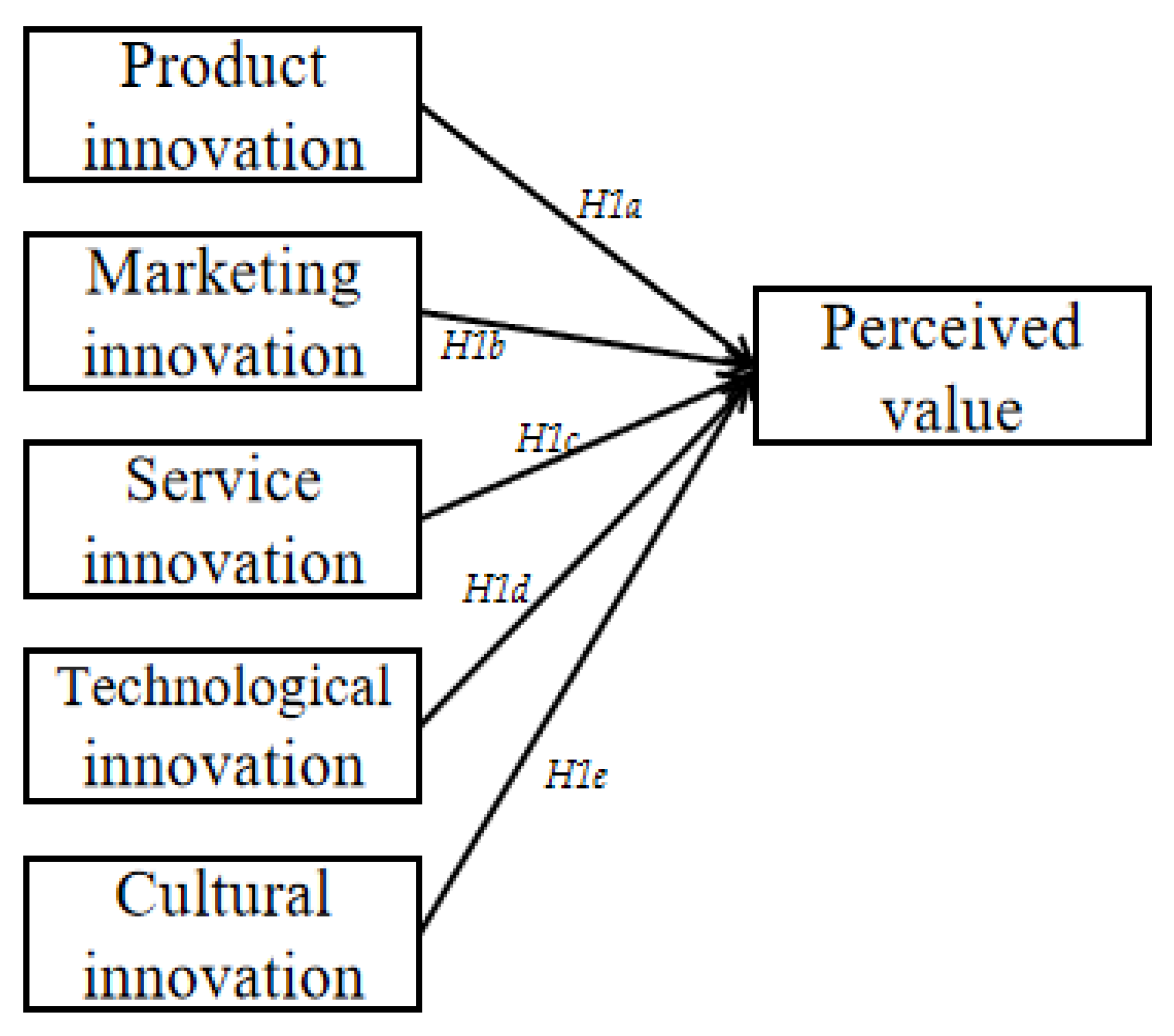

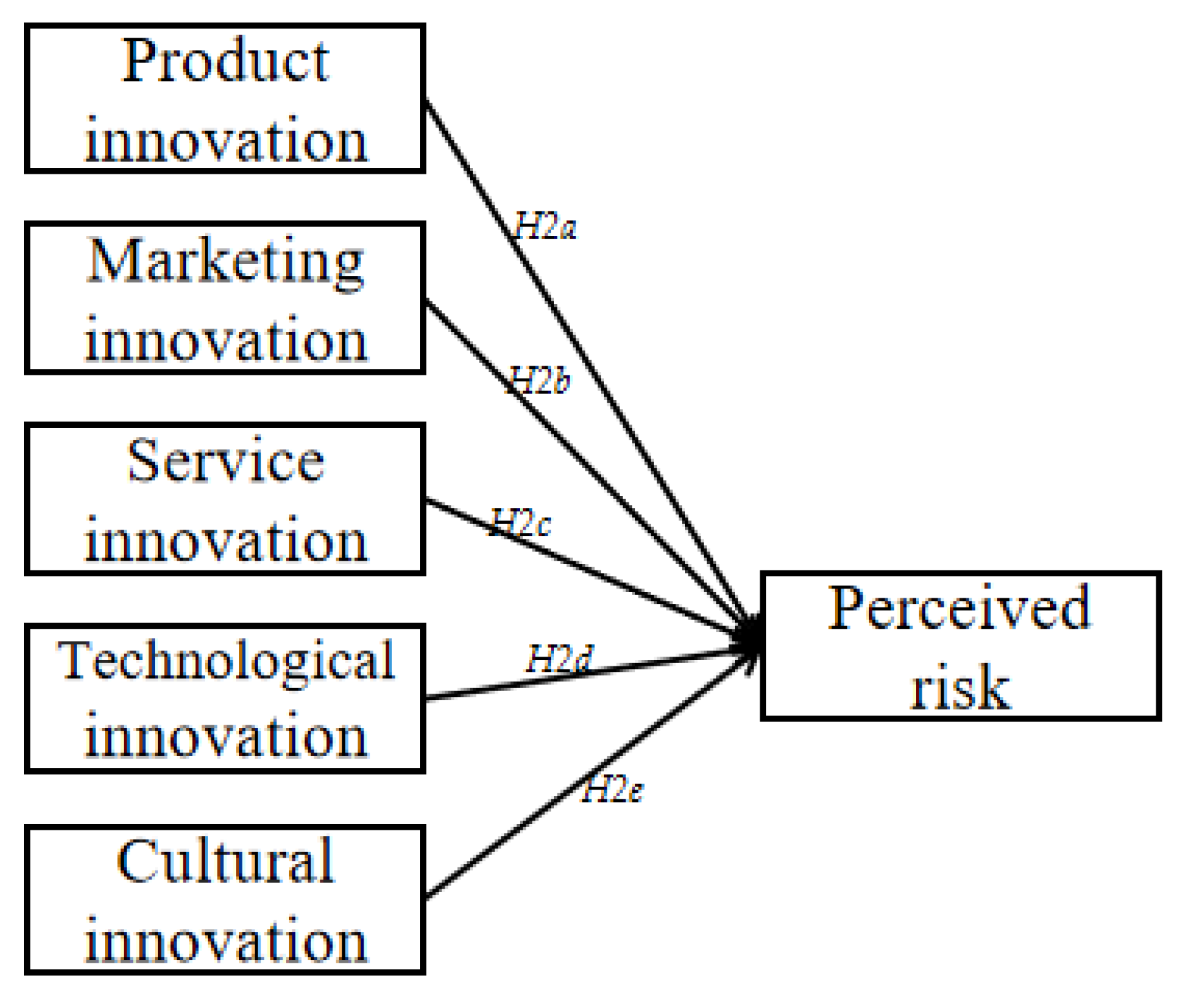

2.2. Firms Innovative Behavior and Consumers’ Perceived Value

2.3. Firms Innovative Behavior and Consumers’ Perceived Risk

2.4. Perceived Risk and Perceived Value

2.5. Perceived Risk, Perceived Value and Purchase Intention

2.6. Consumers’ Innovative Characteristics and Perceived Value, Perceived Risk

3. Methodology

3.1. Data Collection

3.2. Data Measures

4. Results

4.1. Basic Statistics

4.2. Modulation Analysis

5. Discussion and Conclusions

5.1. Discussion and Conclusions

5.2. Research Limitations and Further Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Tushman, M.L.; Anderson, P. Technological Discontinuities and Organizational Environments. Adm. Sci. Q. 1986, 31, 439–465. [Google Scholar] [CrossRef]

- Damanpour, F. Organizational Innovation: A Meta-Analysis of Effects of Determinants and Moderators. Acad. Manag. J. 1991, 34, 555–590. [Google Scholar]

- Higgins, J.M. Innovation: The Core Competence. Strategy Leadersh. 1995, 23, 32–36. [Google Scholar] [CrossRef]

- Cao, Z.; Chen, H. Analysis and Prediction of the Threshold Effect of Urbanization and Energy Consumption. China Popul. ·Resour. Environ. 2015, 11, 59–68. [Google Scholar]

- Du, H.; Liu, D.; Southworth, F.; Ma, S.; Qiu, F. Pathways for Nnergy Conservation and Emissions Mitigation in Road Transport up to 2030: A Case Study of the Jing-Jin-Ji Area, China. J. Clean. Prod. 2017, 162, 882–893. [Google Scholar] [CrossRef]

- Langbroek, J.; Franklin, J.P.; Susilo, Y.O. The Effect of Policy Incentives on Electric Vehicle Adoption. Energy Policy 2016, 94, 94–103. [Google Scholar] [CrossRef]

- Wang, Y.F.; Li, K.P.; Xu, X.M.; Zhang, Y.R. Transport Energy Consumption and Saving in China. Renew. Sustain. Energy Rev. 2014, 29, 641–655. [Google Scholar] [CrossRef]

- Maciejewski, G.; Lesznik, D. Consumers Towards the Goals of Sustainable Development: Attitudes and Typology. Sustainability 2022, 14, 10558. [Google Scholar] [CrossRef]

- Stock, R.M.; Zacharias, N.A. Two Sides of the Same Coin: How do Different Dimensions of Product Program Innovativeness Affect Customer Loyalty? J. Prod. Innov. Manag. 2013, 3, 516–532. [Google Scholar] [CrossRef]

- Sweeney, J.C.; Soutar, G.N. Consumer Perceived Value: The Development of a Multiple Item Scale. J. Retail. 2001, 2, 203–220. [Google Scholar] [CrossRef]

- Jacoby, J.; Kaplan, L.B. The Components of Perceived Risk. Adv. Consum. Res. 1972, 3, 380–389. [Google Scholar]

- Shi, G. Research on the Influence of Smartphone Enterprise Innovation Behavior on Consumers’ Purchase Intention Based on the Structural Equation Model; Shenzhen University: Shenzhen, China, 2017. [Google Scholar]

- Goldsmith, R.E.; Hofacker, C.E. Measuring Consumer Innovativeness. J. Acad. Mark. Sci. 1991, 19, 209–221. [Google Scholar] [CrossRef]

- Maciejewski, G. Consumers Towards Sustainable Food Consumption, Perceived risk in purchasing decisions of the polish consumers: Model-based approach. J. Econ. Manag. 2012, 8, 37–52. [Google Scholar]

- Hao, J. Research on the Influence of Enterprise Innovation Behavior on Customers’ Perceived Value and Purchase Behavior; Tianjin University: Tianjin, China, 2012. [Google Scholar]

- Chen, Y.C.; Shang, R.A.; Kao, C.Y. The Effects of Information Overload on Consumer’s Subjective State Towards Buying Decision in the Internet Shopping Environment. Electron. Commer. Res. Appl. 2009, 8, 48–58. [Google Scholar] [CrossRef]

- Liang, T.P.; Li, Y.W. What Drives Social Commerce: The Role of Social Support and Relationship Quality. Int. J. Electron. Commer. 2011, 16, 69–90. [Google Scholar] [CrossRef]

- Jin, L. The Influence of Service Assurance on Customer Satisfaction Expectations and Behavioral Inclinations: The Media Effect of Risk Perception and Value Perception. Manag. World 2007, 8, 104–110. [Google Scholar]

- Chen, J.; Kim, S. A Comparison of Chinese Consumers’ Intention to Purchase Luxury Fashion Brand for Self-use and Gifts. J. Int. Consum. Mark. 2013, 25, 29–44. [Google Scholar] [CrossRef]

- Zeithaml, V.A. Consumer Perceptions of Price, Quality and Value: A Means-end Model and Synthesis of Evidence. J. Mark. 1988, 7, 2–22. [Google Scholar] [CrossRef]

- Chen, Z.; Dubinsky, A.J. A Conceptual Model of Perceived Customer Value in E-commence: A Preliminary Investigation. Psychol. Mark. 2003, 20, 323–347. [Google Scholar] [CrossRef]

- Ueland, Ø.; Gunnlaugsdottir, H.; Holm, F.; Kalogeras, N.; Leino, O.; Luteijn, J.M.; Magnússon, S.H.; Odekerken, G.; Pohjola, M.V.; Tijhuis, M.J.; et al. State of the Art in Benefit-risk Analysis: Consumer Perception. Food Chem. Toxicol. 2012, 50, 67–76. [Google Scholar] [CrossRef]

- Chen, J.; Liu, K.; Song, Y. The Influence of Reference Group on Consumers’ Perceived Value and Purchase Intention. Shanghai Manag. Sci. 2006, 3, 26–30. [Google Scholar]

- Zhao, D.; Ji, S. An Empirical Study on the Influence of Trust and Perceived Risk on Consumers’ Online Purchasing Intentions. Math. Stat. Manag. 2010, 2, 305–314. [Google Scholar]

- Jiang, R.; Xu, D.; Yan, F. The Influence of Perceived Risk on Trust and Purchase Intention in Online Group Buying. Mod. Financ. 2013, 1, 87–93. [Google Scholar]

- Zhang, Y.; Zhang, M.; Wang, Q.; Ren, Y.; Ma, Y.; Ma, S.; Shao, W.; Yin, S.; Shi, Z. Research on Fresh Agricultural Products Purchase Intention under O2O Model Based on Perceived Benefit-Perceived Risk Framework. China Soft Sci. 2015, 6, 128–138. [Google Scholar]

- Lee, H.Y.; Qu, H.; Kim, Y.S. A Study of the Impact of Personal Innovativeness on Online Travel Shopping Behavior—A Case Study of Korean Travelers. Tour. Manag. 2007, 28, 886–897. [Google Scholar] [CrossRef]

- Noble, S.M.; Griffith, D.A.; Weinberger, M.G. Utilitarian Value in the Internet. J. Travel Tour. Mark. 2005, 17, 63–77. [Google Scholar]

- Ruvio, A.; Shoham, A.; Brencic, M.M. Consumers’ Need for Uniqueness: Short-form Scale Development and Cross-cultural Validation. Int. Mark. Rev. 2008, 25, 33–53. [Google Scholar] [CrossRef]

- Barton, D.L.; Deschamps, I. Management Impacts in the Implementation of New Technologies. Manag. Sci. 1988, 34, 1252–1265. [Google Scholar]

- Cass, A.O.; Fenech, T. Web Retailing Adoption: Exploring the Nature of Internet Users Web Behavior. J. Retail. Consum. Serv. 2003, 10, 81–94. [Google Scholar]

- Chen, W. The Relationship Between Lifestyle, Consumer Innovation and New Product Purchase Behavior; Chongqing University: Chongqing, China, 2014. [Google Scholar]

- Chang, Y.; Zhu, D. Research on the Influencing Factors of Online Shopping Intention Based on the Perspective of Consumer Innovation. J. Manag. 2007, 6, 820–823. [Google Scholar]

- Ho, C.H.; Wu, W. Role of Innovativeness of Consumer in Relationship Between Perceived Attributes of New Products and Intention to Adopt. Int. J. Electron. Bus. Manag. 2011, 9, 258–266. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 24, 337–346. [Google Scholar] [CrossRef]

- Zhang, J.; Liu, L.; Li, J. Research on the Innovation of New Energy Vehicle Business Mode from the Perspective of Ecological Consumption. Ecol. Econ. 2020, 36, 72–77. [Google Scholar]

- Hu, L.; Tang, Y.; Mao, Y. Influencing Factors of the Acceptance of Small Electric Car Based on TAM. Sci. Technol. Manag. Res. 2015, 35, 122–125. [Google Scholar]

- Chen, K.; Gu, R.; Hu, J. Research on Consumer Purchase Intention of New Energy Vehicles under the Benefit-risk Assessment framework. J. Nanjing Tech Univ. 2019, 18, 61–70. [Google Scholar]

- Wang, Y. Managerial Overconfidence, Market Competition Degree and Corporate Innovation Behavior; JiLin University: Changchun, China, 2020. [Google Scholar]

- Jiang, S. Study on the Development of Electric Vehicles Market Based on Customer’s Perceived Value; Huazhong University of Science and Technology: Wuhan, China, 2018. [Google Scholar]

- Liu, R.; Jin, Y. The Influence of the Reference Price of Cultural Innovation Products on Purchase Intention: A Study Based on the Perspective of Pricing Strategy. Res. Financ. Econ. Issues 2019, 7, 121–129. [Google Scholar]

- Chen, S. Research on the Effect and Mechanism of Perceived Product Innovation: The Dual Perspectives of Consumer Behavior and Brand; Northwest University: Xi’an, China, 2015. [Google Scholar]

- Xiao, Y.; Xue, H.; Tao, G. Impact of Consumer Innovativeness of Leading Customers on Willingness to Adopt New Energy Vehicles. J. Technol. Econ. 2016, 35, 50–58. [Google Scholar]

| Variables | Level | Number | Purchase Intention | t/F | p |

|---|---|---|---|---|---|

| gender | male | 203 | 3.153 ± 0.858 | 1.619 | 0.160 |

| female | 276 | 3.286 ± 0.917 | |||

| age | 1 | 168 | 3.232 ± 0.822 | 1.850 | 0.137 |

| 2 | 191 | 3.166 ± 0.931 | |||

| 3 | 78 | 3.221 ± 0.928 | |||

| 4 | 42 | 3.524 ± 0.907 | |||

| education level | 1 | 22 | 3.716 ± 0.78 | 2.665 | 0.047 * |

| 2 | 51 | 3.279 ± 0.905 | |||

| 3 | 271 | 3.223 ± 0.838 | |||

| 4 | 135 | 3.144 ± 0.993 | |||

| monthly income | 1 | 148 | 3.323 ± 0.866 | 1.397 | 0.243 |

| 2 | 152 | 3.26 ± 0.878 | |||

| 3 | 104 | 3.139 ± 0.903 | |||

| 4 | 75 | 3.11 ± 0.957 |

| Variables | Loadings |

|---|---|

| Product innovation | |

| NEV firms are launching new products quickly and there are more new cars on the market | 0.807 |

| NEV firms are producing vehicles with innovative and refined exteriors and interiors | 0.794 |

| NEV firms offer substantial innovation in automotive software, with capability for easy upgrades | 0.768 |

| NEV are becoming more intelligent | 0.798 |

| Composite reliability (CR) | 0.871 |

| Average variance extracted (AVE) | 0.627 |

| Marketing innovation | |

| NEV firms marketing model is very innovative, can be online car booking | 0.817 |

| NEV firms have diversified and innovative ideas geared toward promoting new products | 0.822 |

| NEV firms display innovation in sales activities, e.g., second-hand car replacement | 0.787 |

| Composite reliability (CR) | 0.850 |

| Average variance extracted (AVE) | 0.654 |

| Service innovation | |

| NEV firms offer more innovation in extending range (km) or battery life | 0.817 |

| NEV firms offer innovative service features like life-long free car wash service | 0.805 |

| NEV firms are innovative in offering free battery replacement | 0.798 |

| NEV firms are innovative in offering free software upgrades | 0.827 |

| Composite reliability (CR) | 0.885 |

| Average variance extracted (AVE) | 0.659 |

| Technological innovation | |

| NEV firms invest substantial resources in technology development and innovation | 0.801 |

| NEV firms possess a significant number of technology patents | 0.813 |

| NEV firms are leading the development in key technological areas, such as batteries and battery life extension | 0.779 |

| General charging pile technology for NEV firms is relatively innovative | 0.817 |

| Composite reliability (CR) | 0.879 |

| Average variance extracted (AVE) | 0.644 |

| Cultural innovation | |

| NEV firms have a strong culture of innovation | 0.836 |

| NEV firms are attentive to innovative culture and foster growth of the same | 0.772 |

| NEV firms actively promote the innovative culture of firms | 0.821 |

| Composite reliability (CR) | 0.851 |

| Average variance extracted (AVE) | 0.656 |

| Perceived Value | |

| People around the consumer are beginning to accept NEV | 0.770 |

| NEV are “high technology” products and offer an experience of interesting new technologies | 0.814 |

| NEV reduce fuel costs | 0.794 |

| NEV can contribute to environmental protection | 0.710 |

| Composite reliability (CR) | 0.856 |

| Average variance extracted (AVE) | 0.598 |

| Perceived Risk | |

| I am worried about the low value of NEV | 0.746 |

| I am worried NEV performance is not guaranteed | 0.726 |

| I am worried NEV batteries may be harmful to health | 0.773 |

| I am worried NEV models will be phased out too fast | 0.865 |

| I am afraid even if I buy NEV will not reduce carbon emissions | 0.722 |

| Composite reliability (CR) | 0.878 |

| Average variance extracted (AVE) | 0.590 |

| Purchase intention | |

| When buying a car, I will consider NEV | 0.821 |

| I recommend friends and family to buy a NEV | 0.823 |

| If the price of NEV rises, I will still consider buying | 0.791 |

| If someone recommends a non-NEV option, I will still consider buying a NEV | 0.800 |

| Composite reliability (CR) | 0.883 |

| Average variance extracted (AVE) | 0.654 |

| Consumers’ innovative characteristics | |

| I am a more unconventional person with a strong inclination to accept new things like NEV | 0.754 |

| I am a creative person who like NEV | 0.787 |

| I do not reject NEV, even very optimistic about the future prospects of NEV | 0.775 |

| Among friends, I late or last to know about NEV | 0.761 |

| Among friends, I desire to be the first one to purchase an NEV | 0.806 |

| I am familiar with the brands of NEV before my friends know about them | 0.720 |

| When an NEV becomes available, I will take the initiative to buy it | 0.790 |

| When I want to buy a NEV, the opinions of the people around me will not influence me | 0.850 |

| Without more information about the product, I would also buy a NEV | 0.843 |

| Composite reliability (CR) | 0.936 |

| Average variance extracted (AVE) | 0.621 |

| Dimensions | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| Purchase intention | 0.809 | ||||||||

| Product innovation | 0.223 | 0.792 | |||||||

| Marketing innovation | 0.348 | 0.515 | 0.809 | ||||||

| Service innovation | 0.361 | 0.579 | 0.610 | 0.812 | |||||

| Technological innovation | 0.396 | 0.525 | 0.486 | 0.648 | 0.803 | ||||

| Cultural innovation | 0.303 | 0.405 | 0.555 | 0.584 | 0.540 | 0.810 | |||

| Perceived value | 0.558 | 0.586 | 0.625 | 0.693 | 0.659 | 0.609 | 0.773 | ||

| Perceived risk | −0.507 | −0.086 | −0.188 | −0.120 | −0.191 | −0.145 | −0.339 | 0.768 | |

| Consumers’ innovative characteristics | 0.638 | 0.369 | 0.451 | 0.484 | 0.498 | 0.444 | 0.692 | −0.296 | 0.788 |

| Type of Indicator | Absolute Fitting Index | Value-Added Fitting Index | Parsimony Fitting Index | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Indicators | CMIN/DF | GFI | RMR | RMSAE | NFI | TLI | CFI | PGFI | PNFI |

| Standards | <3 | >0.9 | <0.08 | <0.08 | >0.9 | >0.9 | >0.9 | >0.5 | >0.5 |

| Fitting results | 1.611 | 0.919 | 0.032 | 0.036 | 0.928 | 0.967 | 0.971 | 0.762 | 0.82 |

| Fitting evaluation | excellent | excellent | Good | Good | excellent | excellent | excellent | excellent | excellent |

| Hypothesis | Estimated | Standard Error | t Value | p Value | Results |

|---|---|---|---|---|---|

| H1a | 0.128 | 0.039 | 3.242 | 0.001 | Supported |

| H1b | 0.126 | 0.042 | 3.018 | 0.003 | Supported |

| H1c | 0.18 | 0.045 | 3.969 | *** | Supported |

| H1d | 0.16 | 0.041 | 3.909 | *** | Supported |

| H1e | 0.127 | 0.04 | 3.165 | 0.002 | Supported |

| H2a | 0.051 | 0.054 | 0.934 | 0.35 | Not supported |

| H2b | −0.124 | 0.058 | −2.161 | 0.031 | Supported |

| H2c | 0.053 | 0.062 | 0.847 | 0.397 | No supported |

| H2d | −0.131 | 0.056 | −2.356 | 0.018 | Supported |

| H2e | −0.018 | 0.055 | −0.317 | 0.751 | No supported |

| H3 | −0.206 | 0.039 | −5.252 | *** | Supported |

| H4 | −0.521 | 0.071 | −7.385 | *** | Supported |

| H5 | 0.609 | 0.07 | 8.736 | *** | Supported |

| Type of Indicator | Absolute Fitting Index | Value-Added Fitting Index | Parsimony Fitting Index | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Indicators | CMIN/DF | GFI | RMR | RMSAE | NFI | TLI | CFI | PGFI | PNFI |

| Standards | <3 | >0.9 | <0.08 | <0.08 | >0.9 | >0.9 | >0.9 | >0.5 | >0.5 |

| Fitting results | 1.605 | 0.919 | 0.033 | 0.036 | 0.927 | 0.968 | 0.971 | 0.767 | 0.826 |

| Fitting evaluation | excellent | excellent | Good | Good | excellent | excellent | excellent | excellent | excellent |

| Hypothesis | Estimated | Standard Error | t Value | p Value | Results |

|---|---|---|---|---|---|

| H1a | 0.127 | 0.039 | 3.228 | 0.001 | Support |

| H1b | 0.127 | 0.042 | 3.056 | 0.002 | Support |

| H1c | 0.179 | 0.045 | 3.959 | *** | Support |

| H1d | 0.16 | 0.041 | 3.957 | *** | Support |

| H1e | 0.127 | 0.04 | 3.173 | 0.002 | Support |

| H2b | −0.09 | 0.046 | −1.955 | 0.050 | Support |

| H2d | −0.093 | 0.044 | −2.126 | 0.033 | Support |

| H3 | −0.206 | 0.039 | −5.28 | *** | Support |

| H4 | −0.52 | 0.071 | −7.339 | *** | Support |

| H5 | 0.608 | 0.07 | 8.706 | *** | Support |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B | t | VIF | B | t | VIF | B | t | VIF | B | t | VIF | |

| Constant term | 3.284 | 13.479 *** | 3.354 | 15.43 *** | 3.248 *** | 16.387 | 3.234 | 16.268 *** | ||||

| Gender | 0.126 | 1.476 | 1.088 | 0.027 | 0.357 | 1.103 | 0.024 | 0.344 | 1.103 | 0.026 | 0.374 | 1.104 |

| Age | 0.139 | 2.716 ** | 1.389 | 0.029 | 0.618 | 1.455 | 0.014 | 0.337 | 1.457 | 0.007 | 0.161 | 1.499 |

| Education | −0.096 | −1.695 | 1.116 | −0.049 | −0.962 | 1.124 | −0.01 | −0.223 | 1.132 | −0.008 | −0.163 | 1.135 |

| Monthly income | −0.104 | −2.176 * | 1.561 | −0.034 | −0.778 | 1.596 | −0.024 | −0.609 | 1.597 | −0.023 | −0.594 | 1.597 |

| PV | 0.656 | 11.091 *** | 1.08 | 0.283 *** | 4.304 | 1.607 | 0.295 | 4.417 *** | 1.663 | |||

| CIC | 0.484 *** | 9.913 | 1.567 | 0.475 | 9.564 *** | 1.621 | ||||||

| CIC * PV | 0.052 | 1.014 | 1.086 | |||||||||

| F | 4.154 | 28.779 *** | 45.291 *** | 38.97 *** | ||||||||

| R2 | 0.034 | 0.233 | 0.365 | 0.367 | ||||||||

| ΔR2 | 0.034 | 0.199 | 0.132 | 0.002 | ||||||||

| AIC | 1244.124 | 1135.403 | 1046.815 | 1047.773 | ||||||||

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B | t | VIF | B | t | VIF | B | t | VIF | B | t | VIF | |

| Constant term | 3.284 | 13.479 *** | 3.242 | 14.736 *** | 3.182 | 16.984 *** | 3.156 | 16.962 *** | ||||

| Gender | 0.126 | 1.476 | 1.088 | 0.094 | 1.226 | 1.09 | 0.039 | 0.588 | 1.094 | 0.053 | 0.813 | 1.1 |

| Age | 0.139 | 2.716 ** | 1.389 | 0.063 | 1.349 | 1.424 | 0.001 | −0.001 | 1.443 | 0.009 | 0.221 | 1.452 |

| Education | −0.096 | −1.695 | 1.116 | −0.066 | −1.285 | 1.119 | −0.003 | −0.073 | 1.132 | −0.003 | −0.067 | 1.132 |

| Monthly income | −0.104 | −2.176 * | 1.561 | −0.037 | −0.856 | 1.596 | −0.001 | −0.039 | 1.604 | 0 | 0.005 | 1.604 |

| PR | −0.541 | −10.412 *** | 1.045 | −0.396 | −8.689 *** | 1.107 | −0.427 | −9.202 *** | 1.165 | |||

| CIC | 0.524 | 13.435 *** | 1.116 | 0.518 | 13.394 *** | 1.118 | ||||||

| CIC * PR | 0.114 | 2.964 ** | 1.07 | |||||||||

| F | 4.154 | 25.757 *** | 59.69 *** | 53.262 *** | ||||||||

| R2 | 0.034 | 0.214 | 0.431 | 0.442 | ||||||||

| ΔR2 | 0.034 | 0.180 | 0.217 | 0.010 | ||||||||

| AIC | 1244.124 | 1147.284 | 994.1776 | 987.3194 | ||||||||

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B | t | VIF | B | t | VIF | B | t | VIF | B | t | VIF | |

| Constant term | 3.284 | 13.479 *** | 3.308 | 16.361 *** | 3.218 | 17.34 *** | 3.174 | 17.183 *** | ||||

| Gender | 0.126 | 1.476 | 1.088 | 0.021 | 0.292 | 1.103 | 0.019 | 0.285 | 1.103 | 0.036 | 0.561 | 1.111 |

| Age | 0.139 | 2.716 ** | 1.389 | −0.011 | −0.243 | 1.471 | −0.019 | −0.472 | 1.472 | −0.017 | −0.424 | 1.513 |

| Education | −0.096 | −1.695 | 1.116 | −0.034 | −0.715 | 1.125 | −0.001 | −0.017 | 1.132 | 0.002 | 0.058 | 1.136 |

| Monthly income | −0.104 | −2.176 * | 1.561 | 0.006 | 0.148 | 1.617 | 0.01 | 0.266 | 1.617 | 0.012 | 0.331 | 1.617 |

| PV | 0.535 | 9.418 *** | 1.15 | 0.212 | 3.406 ** | 1.639 | 0.23 | 3.658 *** | 1.707 | |||

| PR | −0.427 | −8.658 *** | 1.112 | −0.374 | −8.225 *** | 1.129 | −0.404 | −8.741 *** | 1.187 | |||

| CIC | 0.438 | 9.518 *** | 1.59 | 0.421 | 9.066 *** | 1.651 | ||||||

| CIC * PV | 0.056 | 1.142 | 1.135 | |||||||||

| CIC * PR | 0.126 | 3.237 ** | 1.113 | |||||||||

| F | 4.154 | 40.228 *** | 53.969 *** | 43.949 *** | ||||||||

| R2 | 0.034 | 0.338 | 0.445 | 0.458 | ||||||||

| ΔR2 | 0.034 | 0.304 | 0.107 | 0.012 | ||||||||

| AIC | 1244.124 | 1066.793 | 984.5217 | 977.6647 | ||||||||

| Hypotheses | Hypotheses Contents | Results |

|---|---|---|

| H6 | Consumers’ innovative characteristics have a positive impact on the process of the perception of value to consumers’ purchase intention. | No supported |

| H7 | Consumers’ innovative characteristics have a positive impact on the process of the perception of risk to consumers’ purchase intention. | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deng, J.; Nam, E.-Y. Effects of Chinese Firms’ Innovation on New Energy Vehicles Purchases. Sustainability 2022, 14, 12426. https://doi.org/10.3390/su141912426

Deng J, Nam E-Y. Effects of Chinese Firms’ Innovation on New Energy Vehicles Purchases. Sustainability. 2022; 14(19):12426. https://doi.org/10.3390/su141912426

Chicago/Turabian StyleDeng, Jun, and Eun-Young Nam. 2022. "Effects of Chinese Firms’ Innovation on New Energy Vehicles Purchases" Sustainability 14, no. 19: 12426. https://doi.org/10.3390/su141912426

APA StyleDeng, J., & Nam, E.-Y. (2022). Effects of Chinese Firms’ Innovation on New Energy Vehicles Purchases. Sustainability, 14(19), 12426. https://doi.org/10.3390/su141912426