In the Context of Digital Finance, Can Knowledge Enable Manufacturing Companies to Be More Courageous and Move towards Sustainable Innovation?

Abstract

1. Introduction

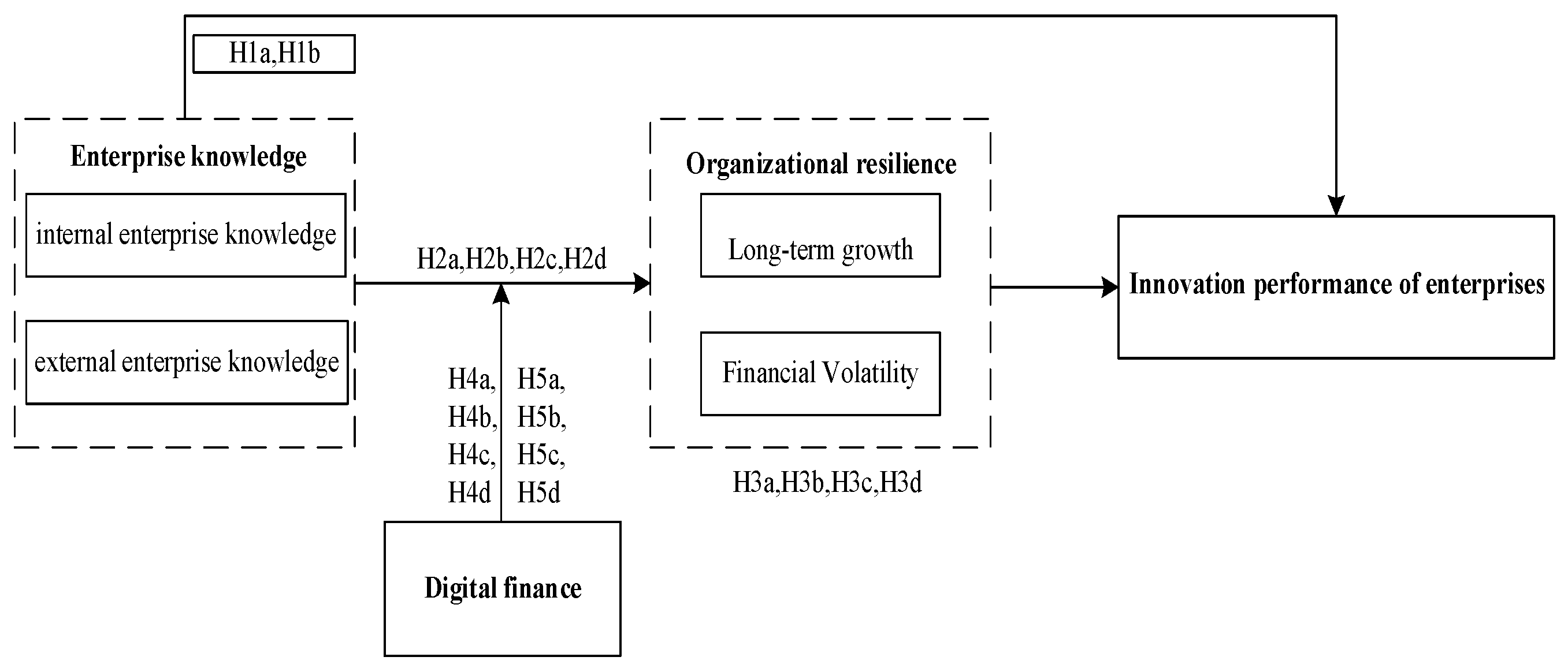

2. Theoretical Background and Literature Review

2.1. Enterprises Knowledge and Innovation Performance

2.2. Enterprise Knowledge and Organizational Resilience

2.3. The Mediating Role of Organizational Resilience

2.4. Moderating Effect of Digital Finance

2.5. Mediating Role with Moderation

3. Materials and Methods

3.1. Sample Selection and Processing

3.2. Variable Design and Metrics

3.2.1. Dependent Variables

3.2.2. Independent Variables

3.2.3. Mediating Variables

3.2.4. Moderating Variables

3.2.5. Control Variables

3.3. Research Model

4. Results

4.1. Descriptive and Correlation Analysis

4.2. Hypothesis Testing

4.2.1. The Role of Enterprise Knowledge on Innovation Performance

4.2.2. The Mediating Role of Organizational Resilience

4.2.3. The Mediating Role of Organizational Resilience

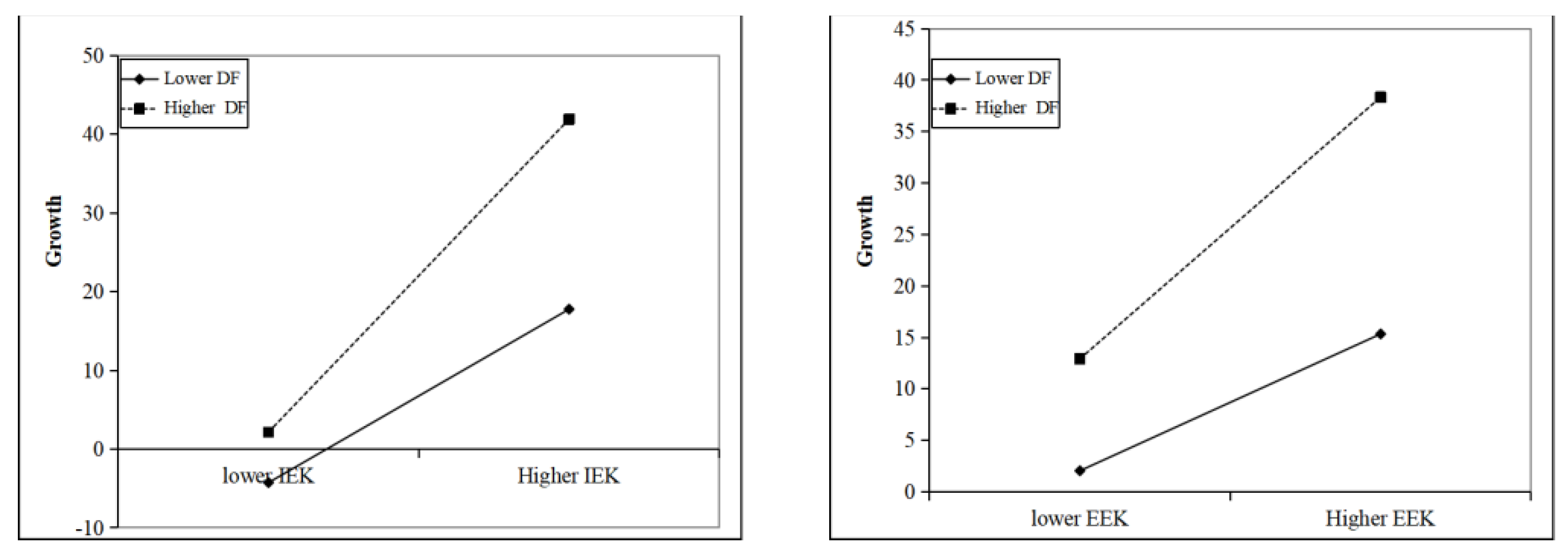

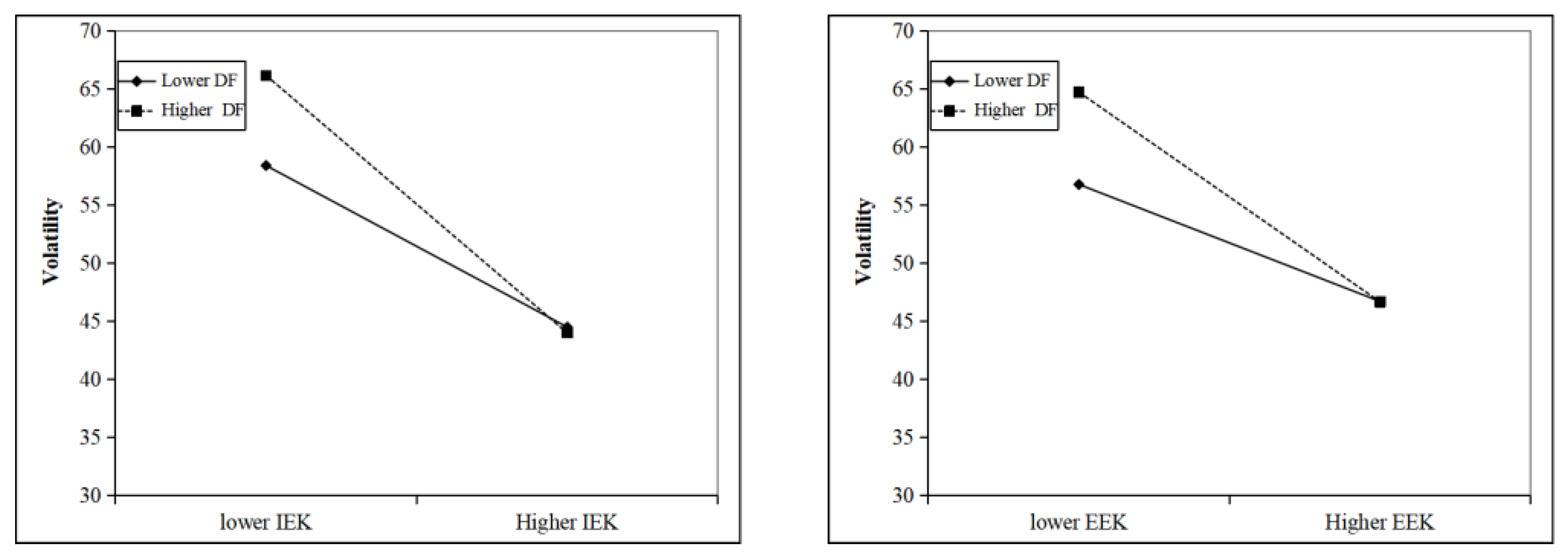

4.2.4. Test for Mediating Effects with Moderation

4.3. Robustness Tests

4.4. Further Research

5. Conclusions and Discussion

5.1. Conclusions

5.2. Theoretical Implications

5.3. Practical Implications

5.4. Research Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Smith, A.; Stirling, A. Innovation, sustainability and democracy: An analysis of grassroots contributions. J. Self-Gover. Manag. Econ. 2018, 6, 64–97. [Google Scholar]

- Sun, Y.; Liu, J.; Ding, Y. Analysis of the relationship between open innovation, knowledge management capability and dual innovation. Technol. Anal. Strat. Manag. 2019, 32, 15–28. [Google Scholar] [CrossRef]

- Lo, J.; Kam, C. Innovation of Organizations in the Construction Industry: Progress and Performance Attributes. J. Manag. Eng. 2022, 38, 6. [Google Scholar] [CrossRef]

- Heredia, J.; Rubiños, C.; Vega, W.; Heredia, W.; Flores, A. New Strategies to Explain Organizational Resilience on the Firms: A Cross-Countries Configurations Approach. Sustainability 2022, 14, 1612. [Google Scholar] [CrossRef]

- Cruz-González, J.; López-Sáez, P.; Emilio Navas-López, J.; Delgado-Verde, M. Directions of external knowledge search: Investigating their different impact on firm performance in high-technology industries. J. Knowl. Manag. 2014, 18, 847–866. [Google Scholar] [CrossRef]

- Duodu, B.; Rowlinson, S. Opening Up the Innovation Process in Construction Firms: External Knowledge Sources and Dual Innovation. J. Constr. Eng. 2022, 147, 04021086. [Google Scholar] [CrossRef]

- Ratten, V.; Ferreira, J.; Carvalho Santos, G.; Marques, C. The impact of knowledge creation and acquisition on innovation, coopetition and international opportunity development. Eur. J. Int. Manag. 2021, 16, 450. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strategic. Manag. J. 2005, 27, 131–150. [Google Scholar] [CrossRef]

- Wang, T.; Yu, X.; Cui, N. The substitute effect of internal R&D and external knowledge acquisition in emerging markets. Eur. J. Mark. 2020, 54, 1117–1146. [Google Scholar]

- Chen, C.; Lin, B.; Lin, J.; Hsiao, Y. Learning-from-parents: Exploitative knowledge acquisition and the innovation performance of joint venture. J. Technol. Transf. 2018, 45, 228–258. [Google Scholar] [CrossRef]

- Luthans, F.; Avolio, B.; Avey, J.; Norman, S. Positive psychological capital: Measurement and relationship with performance and satisfaction. Pers. Psychol. 2007, 60, 541–572. [Google Scholar] [CrossRef]

- Oktari, R.; Munadi, K.; Idroes, R.; Sofyan, H. Knowledge Creation for Community Resilience (KCCR): A Conceptual Model. J. Disaster Res. 2021, 16, 1097–1106. [Google Scholar] [CrossRef]

- Yumagulova, L.; Vertinsky, I. Moving beyond engineering supremacy: Knowledge systems for urban resilience in Canada’s Metro Vancouver region. Environ. Sci. Policy 2019, 100, 66–73. [Google Scholar] [CrossRef]

- Audretsch, D.; Belitski, M. Knowledge complexity and firm performance: Evidence from the European SMEs. J. Knowl. Manag. 2021, 25, 693–713. [Google Scholar] [CrossRef]

- Robb, D. Building resilient organizations resilient organizations actively build and integrate performance and adaptive skills. OD Pract. 2000, 32, 27–32. [Google Scholar]

- Do, H.; Budhwar, P.; Shipton, H.; Nguyen, H.; Nguyen, B. Building organizational resilience, innovation through resource-based management initiatives, organizational learning and environmental dynamism. J. Bus. Res. 2022, 141, 808–821. [Google Scholar] [CrossRef]

- Soetanto, D.; Jack, S. Slack resources, exploratory and exploitative innovation and the performance of small technology-based firms at incubators. J. Technol. Transf. 2016, 43, 1213–1231. [Google Scholar] [CrossRef]

- Dayson, C.; Bimpson, E.; Ellis-Paine, A.; Gilbertson, J.; Kara, H. The ‘resilience’ of community organisations during the COVID-19 pandemic: Absorptive, adaptive and transformational capacity during a crisis response. Volunt. Sect. Rev. 2021, 12, 295–304. [Google Scholar] [CrossRef]

- Weiss, A.; Chambon, V.; Lee, J.; Drugowitsch, J.; Wyart, V. Interacting with volatile environments stabilizes hidden-state inference and its brain signatures. Nat. Commun. 2021, 12, 2228. [Google Scholar] [CrossRef]

- Al-Busaidi, K.; Al-Muharrami, S. Beyond profitability: ICT investments and financial institutions performance measures in developing economies. J. Enterp. Inf. Manag. 2020, 34, 900–921. [Google Scholar] [CrossRef]

- Xia, Y.; Qiao, Z.; Xie, G. Corporate resilience to the COVID-19 pandemic: The role of digital finance. Pac.–Basin Financ. J. 2022, 74, 101791. [Google Scholar] [CrossRef]

- Luo, S. Digital Finance Development and the Digital Transformation of Enterprises: Based on the Perspective of Financing Constraint and Innovation Drive. J. Math. 2022, 2022, 1607020. [Google Scholar] [CrossRef]

- Kapoor, A. Financial inclusion and the future of the Indian economy. Futures 2014, 56, 35–42. [Google Scholar] [CrossRef]

- Fleming, L. Recombinant uncertainty in technological search. Manag. Sci. 2001, 47, 117–132. [Google Scholar] [CrossRef]

- Prokop, V.; Gerstlberger, W.; Zapletal, D.; Striteska, M. The double-edged role of firm environmental behaviour in the creation of product innovation in Central and Eastern European countries. J. Clean Prod. 2022, 331, 129989. [Google Scholar] [CrossRef]

- Chattopadhyay, S.; Bercovitz, J. When one door closes, another door opens for some: Evidence from the post-TRIPS Indian pharmaceutical industry. Strateg. Manag. J. 2020, 41, 988–1022. [Google Scholar] [CrossRef]

- Paruchuri, S.; Awate, S. Organizational knowledge networks and local search: The role of intra-organizational inventor networks. Strateg. Manag. J. 2016, 38, 657–675. [Google Scholar] [CrossRef]

- Cheng, C.C.J.; Shiu, E.C. Establishing a typology of open innovation strategies and their differential impacts on innovation success in an Asia-Pacific developed economy. Asia Pac. J. Manag. 2021, 38, 65–89. [Google Scholar] [CrossRef]

- Li, L.; Xie, J.; Wang, R.; Su, J.; Sindakis, S. The Partner Selection Modes for Knowledge-Based Innovation Networks: A Multiagent Simulation. IEEE Access 2019, 7, 140969–140979. [Google Scholar] [CrossRef]

- Kondo, M. R&D dynamics of creating patents in the Japanese industry. Res. Policy 1999, 28, 587–600. [Google Scholar]

- O’Mahony, M.; Vecchi, M. R&D, knowledge spillovers and company productivity performance. Res. Policy. 2009, 38, 35–44. [Google Scholar]

- Grimes, S.; Du, D. Foreign and indigenous innovation in China: Some evidence from Shanghai. Eur. Plan. Stud. 2013, 21, 1357–1373. [Google Scholar] [CrossRef]

- Wu, F.; Sinkovics, R.; Cavusgil, S.; Roath, A. Overcoming export manufacturers’ dilemma in international expansion. J. Int. Bus. Stud. 2007, 38, 283–302. [Google Scholar] [CrossRef]

- Cohen, W.; Levinthal, D. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128. [Google Scholar] [CrossRef]

- Miller, D.; Fern, M.; Cardinal, L. The Use of Knowledge for Technological Innovation Within Diversified Firms. Acad. Manag. J. 2007, 50, 307–325. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something Old, Something New: A Longitudinal Study of Search Behavior and New Product Introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Khraishi, A.; Paulraj, A.; Huq, F.; Seepana, C. Knowledge management in offshoring innovation by SMEs: Role of internal knowledge creation capability, absorptive capacity and formal knowledge-sharing routines. Supply Chain Manag. J. 2022. [Google Scholar] [CrossRef]

- Xie, X.; Zou, H.; Qi, G. Knowledge absorptive capacity and innovation performance in high-tech companies: A multi-mediating analysis. J. Bus. Res. 2018, 88, 289–297. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, L.; Wang, M.; Zhang, X. The Mediating Role of Environmental Innovation on Knowledge Acquisition and Corporate Performance Relationship—A Study of SMEs in China. Sustainability 2019, 11, 2315. [Google Scholar] [CrossRef]

- Chen, K.; Altinay, L.; Chen, P.; Dai, Y. Market knowledge impacts on product and process innovation: Evidence from travel agencies. Tour. Rev. 2021, 77, 271–286. [Google Scholar] [CrossRef]

- Wang, F.; Chen, J.; Wang, Y.; Lutao, N.; Vanhaverbeke, W. The effect of R&D novelty and openness decision on firms’ catch-up performance: Empirical evidence from China. Technovation 2014, 34, 21–30. [Google Scholar]

- Walker, B.; Holling, C.; Carpenter, S.; Kinzig, A. Resilience, Adaptability and Transformability in Social-ecological Systems. Ecol. Soc. 2004, 9, 5. [Google Scholar] [CrossRef]

- Godwin, I.; Amah, E. Knowledge management and organizational resilience in Nigerian manufacturing organizations. Dev. Ctry. Stud. 2013, 3, 104–120. [Google Scholar]

- Koronis, E.; Ponis, S. Better than before: The resilient organization in crisis mode. J. Bus. Strateg. 2018, 39, 32–42. [Google Scholar] [CrossRef]

- Duchek, S.; Raetze, S.; Scheuch, I. The role of diversity in organizational resilience: A theoretical framework. Bus. Res. 2019, 13, 387–423. [Google Scholar] [CrossRef]

- Quendler, E. Organisational resilience: Building business value in a changing world. J. Int. Bus. Entrep. Dev. 2017, 10, 101. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Bansal, P. The long-term benefits of organizational resilience through sustainable business practices. Strateg. Manag. J. 2015, 37, 1615–1631. [Google Scholar] [CrossRef]

- Yuan, J.; Jiang, Q.; Pan, Y. The Influence Mechanism of Knowledge Network Allocation Mechanism on Knowledge Distillation of High-Tech Enterprises. Comput. Intel. Neurosc. 2022, 2022, 8246234. [Google Scholar] [CrossRef] [PubMed]

- Tognazzo, A.; Gubitta, P.; Favaron, S. Does slack always affect resilience? A study of quasi-medium-sized Italian firms. Entrep. Region. Dev. 2016, 28, 768–790. [Google Scholar] [CrossRef]

- Nonaka, I. A Dynamic Theory of Organizational Knowledge Creation. Organ. Sci. 1994, 5, 14–37. [Google Scholar] [CrossRef]

- Durana, P.; Zauskova, A.; Vagner, L.; Zadnanova, S. Earnings Drivers of Slovak Manufacturers: Efficiency Assessment of Innovation Management. Appl. Sci. 2020, 10, 4251. [Google Scholar] [CrossRef]

- Acquaah, M.; Amoako-Gyampah, K.; Jayaram, J. Resilience in family and nonfamily firms: An examination of the relationships between manufacturing strategy, competitive strategy and firm performance. Int. J. Prod. Res. 2011, 49, 5527–5544. [Google Scholar] [CrossRef]

- Goodman, P.; Ramanujam, R.; Carroll, J.; Edmondson, A.; Hofmann, D.; Sutcliffe, K. Organizational errors: Directions for future research. Res. Organ. Behav. 2011, 31, 151–176. [Google Scholar] [CrossRef]

- Cameron, K.; Bright, D.; Caza, A. Exploring the Relationships between Organizational Virtuousness and Performance. Am. Behav. Sci. 2004, 47, 766–790. [Google Scholar] [CrossRef]

- Ham, J.; Choi, B.; Lee, J. Open and closed knowledge sourcing: Their effect on innovation performance in small and medium enterprises. Ind. Manag. Data Syst. 2017, 117, 1166–1184. [Google Scholar] [CrossRef]

- Lee, P.; Chen, S.; Lin, Y.; Su, H. Toward a Better Understanding on Technological Resilience for Sustaining Industrial Development. IEEE Eng. Manag. 2019, 66, 398–411. [Google Scholar] [CrossRef]

- Morales, L.; Gray, G.; Rajmil, D. Emerging Risks in the FinTech Industry—Insights from Data Science and Financial Econometrics Analysis. Econ. Manag. Financ. Mark. 2022, 17, 9–36. [Google Scholar]

- Stankovic, J.J.; Marjanovic, I.; Drezgic, S.; Popovic, Z. The Digital Competitiveness of European Countries: A Multiple-Criteria Approach. J. Compet. 2020, 13, 117–134. [Google Scholar] [CrossRef]

- Ionescu, L. Digital Data Aggregation, Analysis, and Infrastructures in FinTech Operations. Rev. Contemp. Philos. 2020, 19, 92–98. [Google Scholar]

- Hojnik, J.; Prokop, V.; Stejskal, J. R&D as bridge to sustainable development? Case of Czech Republic and Slovenia. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 146–160. [Google Scholar]

- Marcon, É.; Soliman, M.; Gerstlberger, W.; Frank, A.G. Sociotechnical factors and Industry 4.0: An integrative perspective for the adoption of smart manufacturing technologies. J. Manuf. Technol. Manag. 2021, 33, 259–286. [Google Scholar] [CrossRef]

- Doms, M.; Bartelsman, E. Understanding Productivity: Lessons from Longitudinal Microdata. J. Econ. Lit. 2000, 38, 569–594. [Google Scholar]

- Boeing, P.; Müller, E.; Sandner, P. What Makes Chinese Firms Productive?—Learning from Indigenous and Foreign Sources of Knowledge. SSRN Electron. J. 2012, 196. Available online: http://hdl.handle.net/10419/64613 (accessed on 25 August 2022). [CrossRef][Green Version]

- Lv, W.; Wei, Y.; Li, X.; Lin, L. What Dimension of CSR Matters to Organizational Resilience? Evidence from China. Sustainability 2019, 11, 1561. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C. Circular economy innovations, growth and employment at the firm level: Empirical evidence from Germany. J. Ind. Ecol. 2019, 24, 615–625. [Google Scholar] [CrossRef]

- Schwert, G. Stock market volatility. Financ. Anal. J. 1990, 46, 23–34. [Google Scholar] [CrossRef]

- Chang, K.; Cheng, X.; Wang, Y.; Liu, Q.; Hu, J. The impacts of ESG performance and digital finance on corporate financing efficiency in China. Appl. Econ. Lett. 2021, 1–8. [Google Scholar] [CrossRef]

- Borah, D.; Massini, S.; Piscitello, L. R&D employee tenure in MNC subsidiaries: The role of institutional distance and experience. R&D Manag. 2022. [Google Scholar] [CrossRef]

- Xin, K.; Chen, X.; Zhang, R.; Sun, Y. R&D intensity, free cash flow, and technological innovation: Evidence from high-tech manufacturing firms in China. Asian J. Technol. Innov. 2019, 27, 214–238. [Google Scholar]

- Kogut, B.; Zander, U. Knowledge of the firm, combinative capabilities, and the replication of technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Nguyen, D. How firms accumulate knowledge to innovate—An empirical study of Vietnamese firms. Manag. Decis. 2021, 60, 1413–1437. [Google Scholar]

- Del Vecchio, P.; Mele, G.; Ndou, V.; Secundo, G. Open Innovation and Social Big Data for Sustainability: Evidence from the Tourism Industry. Sustainability 2018, 10, 3215. [Google Scholar] [CrossRef]

- Camelo-Ordaz, C.; García-Cruz, J.; Sousa-Ginel, E.; Valle-Cabrera, R. The influence of human resource management on knowledge sharing and innovation in Spain: The mediating role of affective commitment. Int. J. Hum. Resour. Manag. 2011, 22, 1442–1463. [Google Scholar] [CrossRef]

- Xin, D.; Yi, Y.; Du, J. Does digital finance promote corporate social responsibility of pollution-intensive industry? Evidence from Chinese listed companies. Environ. Sci. Pollut. Res. 2022, 1–17. [Google Scholar] [CrossRef] [PubMed]

- Du, W.; Li, M. Government support and innovation for new energy firms in China. Appl. Econ. 2018, 51, 2754–2763. [Google Scholar]

- Ngoc Thang, N.; Anh Tuan, P. Knowledge acquisition, knowledge management strategy and innovation: An empirical study of Vietnamese firms. Cogent Bus. Manag. 2020, 7, 1786314. [Google Scholar] [CrossRef]

- Qiao, S.; Wang, Q.; Guo, Z.; Guo, J. Collaborative Innovation Activities and BIM Application on Innovation Capability in Construction Supply Chain: Mediating Role of Explicit and Tacit Knowledge Sharing. J. Constr. Eng. 2021, 147, 04021168. [Google Scholar] [CrossRef]

- Wang, M.; Wang, H. Knowledge search and innovation performance: The mediating role of absorptive capacity. Oper. Manag. Res. 2022, 1–11. [Google Scholar] [CrossRef]

- Zan, A.; Yao, Y.; Chen, H. Knowledge search and firm innovation: The roles of knowledge inertia and knowledge integration capability. Technol. Anal. Strateg. 2022, 1–16. [Google Scholar] [CrossRef]

- Li, J.; Li, B. Digital inclusive finance and urban innovation: Evidence from China. Rev. Dev. Econ. 2022, 26, 1010–1034. [Google Scholar]

- Zhao, J.; He, G. Research on the Impact of Digital Finance on the Green Development of Chinese Cities. Discret. Dyn. Nat. Soc. 2022, 2022, 3813474. [Google Scholar] [CrossRef]

- Lu, Z.; Wu, J.; Li, H.; Nguyen, D. Local Bank, Digital Financial Inclusion and SME Financing Constraints: Empirical Evidence from China. Emerg. Mark. Financ. Trade 2021, 58, 1712–1725. [Google Scholar] [CrossRef]

- Sapeciay, Z.; Wilkinson, S.; Costello, S. Building organisational resilience for the construction industry. Int. J. Disaster Resil. 2017, 8, 98–108. [Google Scholar] [CrossRef]

- Turulja, L.; Bajgorić, N. Knowledge Acquisition, Knowledge Application, and Innovation Towards the Ability to Adapt to Change. Int. J. Knowl. Manag. 2018, 14, 1–15. [Google Scholar]

- Ružić, E.; Benazić, D. The Impact of Internal Knowledge Sharing on Sales Department’s Innovativeness and New Product Commercialization. Organizacija 2021, 54, 147–160. [Google Scholar]

- Kang, T.; Baek, C.; Lee, J. The persistency and volatility of the firm R&D investment: Revisited from the perspective of technological capability. Res. Policy 2017, 46, 1570–1579. [Google Scholar]

- Plimmer, G.; Berman, E.; Malinen, S.; Franken, E.; Naswall, K.; Kuntz, J.; Löfgren, K. Resilience in Public Sector Managers. Rev. Public Pers. Adm. 2021, 42, 338–367. [Google Scholar]

- Ozili, P. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Tian, M.; Wang, L.; Yan, S.; Tian, X.; Liu, Z.; Rodrigues, J. Research on Financial Technology Innovation and Application Based on 5G Network. IEEE Access 2019, 7, 138614–138623. [Google Scholar] [CrossRef]

| Variable Type | Name | Abbreviation | Measurement | |

|---|---|---|---|---|

| Dependent | Innovation performance of enterprises | IPE | Total enterprise net profit (billion yuan) | |

| Independent | EK | Internal enterprise knowledge | IEK | Number of patents filed independently in year t − 1 |

| External enterprise knowledge | EEK | Number of patents filed jointly in year t − 1 | ||

| Mediating | OR | Long-term growth | Growth | Cumulative sales growth over three years |

| Financial volatility | Volatility | Weekly average stock price return volatility per year | ||

| Moderating | Digital finance | DF | Provincial Digital Inclusive Finance Index | |

| Control | Corporate maturity | Cage | Year t minus the listed year plus 1 is taken as the natural logarithm | |

| Number of R&D employees | Employee | The number of R&D employees is added by 1 and taken as the natural logarithm | ||

| R&D investment | Research | R&D investment as a percentage of operating revenue | ||

| Enterprise | Code | Enterprise dummy variables | ||

| Year | Year | Year dummy variable | ||

| Average | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. IPE | 2.95 | 7.48 | 1 | ||||||||

| 2. IEKt−1 | 10.15 | 29.97 | 0.38 *** | 1 | |||||||

| 3. EEKt−1 | 1.79 | 6.93 | 0.28 *** | 0.27 *** | 1 | ||||||

| 4. Growth | 6.22 | 22.12 | 0.52 *** | 0.25 *** | 0.20 *** | 1 | |||||

| 5. Volatility | 41.04 | 32.13 | −0.03 *** | −0.01 | −0.01 | −0.01 | 1 | ||||

| 6. DF | 273.24 | 78.18 | 0.09 *** | 0.07 *** | 0.08 *** | 0.17 *** | 0.17 *** | 1 | |||

| 7. Cage | 1.54 | 1.08 | 0.22 *** | 0.21 *** | 0.20 *** | 0.18 *** | 0.18 *** | 0.22 *** | 1 | ||

| 8. Employee | 3.71 | 2.78 | 0.22 *** | 0.25 *** | 0.18 *** | 0.26 *** | 0.39 *** | 0.60 *** | 0.47 *** | 1 | |

| 9. Research | 3.85 | 3.74 | −0.03 *** | 0.14 *** | 0.067 *** | −0.03 *** | 0.36 *** | 0.25 *** | 0.21 *** | 0.39 *** | 1 |

| Variables | Dependent Variable: IPE | |||

|---|---|---|---|---|

| Model 1-1 | Model 1-2 | Model 1-3 | Model 1-4 | |

| IEKt−1 | 0.02 *** (8.67) | 0.02 *** (8.52) | ||

| EEKt−1 | 0.03 *** (3.23) | 0.03 *** (2.80) | ||

| Cage | −1.45 *** (−11.10) | −1.49 *** (−10.17) | −1.37 *** (−9.40) | −1.49 *** (−10.19) |

| Employee | 0.33 *** (12.43) | 0.30 *** (10.12) | 0.32 *** (10.64) | 0.30 *** (10.09) |

| Research | −0.17 *** (−11.31) | −0.20 *** (−11.55) | −0.19 *** (−11.03) | −0.20 *** (−11.55) |

| Constant | 3.83 *** (23.36) | 4.09 *** (21.47) | 4.05 *** (21.16) | 4.01 *** (21.32) |

| Code | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| R-squared | 0.075 | 0.073 | 0.068 | 0.073 |

| F-test | 111.35 | 92.55 | 85.61 | 84.89 |

| Variable | Dependent Variable: Growth | Dependent Variable: Volatility | Dependent Variable: IPE | |||||

|---|---|---|---|---|---|---|---|---|

| Model 2-1 | Model 2-2 | Model 2-3 | Model 2-4 | Model 3-1 | Model 3-2 | Model 3-3 | Model 3-4 | |

| IEKt−1 | 0.11 *** (8.38) | −0.12 *** (−6.62) | 0.02 *** (5.96) | 0.02 *** (8.50) | ||||

| EEKt−1 | 0.18 *** (4.23) | −0.27 *** (−4.28) | 0.01 * (1.72) | 0.03 *** (3.11) | ||||

| Growth | 0.09 *** (48.26) | 0.09 *** (48.66) | ||||||

| Volatility | −0.00 *** (−2.65) | −0.00 *** (−3.03) | ||||||

| Cage | −8.53 *** (−12.20) | −8.01 *** (−11.48) | −34.47 *** (−34.71) | −35.04 *** (−35.41) | −0.76 *** (−5.68) | −1.61 *** (−10.50) | −0.68 *** (−5.11) | −1.51 *** (−9.88) |

| Employee | 1.36 *** (9.52) | 1.44 (10.03) | 7.91 *** (38.88) | 7.83 *** (38.54) | 0.19 *** (6.82) | 0.33 *** (10.42) | 0.20 *** (7.16) | 0.35 *** (11.05) |

| Research | −1.01 *** (−12.90) | −1.03 (−12.41) | 4.54 *** (38.68) | 4.50 *** (38.33) | −0.11 *** (−6.86) | −0.18 *** (10.00) | −0.10 (−6.48) | −0.17 (−9.40) |

| Constant | 13.52 *** (14.81) | 13.28 (14.50) | 55.58 *** (42.85) | 55.91 *** (43.01) | 2.94 *** (16.73) | 4.29 *** (20.94) | 2.91 *** (16.52) | 4.28 *** (20.79) |

| Code | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.11 | 0.11 | 0.36 | 0.36 | 0.23 | 0.07 | 0.22 | 0.07 |

| F-test | 149.36 | 143.49 | 657.22 | 653.27 | 312.52 | 84.82 | 308.71 | 78.71 |

| Variable | Dependent Variable: IPE | Dependent Variable: Growth | Dependent Variable: Volatility | |||

|---|---|---|---|---|---|---|

| Model 4-1 | Model 4-2 | Model 5-1 | Model 5-2 | Model 5-3 | Model 5-4 | |

| IEKt−1 | 0.01 *** (4.85) | −0.01 (−0.41) | −0.05 ** (−2.57) | |||

| EEKt−1 | 0.00 (0.21) | −0.15 *** (−3.10) | 0.01 (0.16) | |||

| DF | −0.01 (−1.28) | −0.01 (−1.39) | −0.05 *** (−2.68) | −0.06 *** (−3.09) | 0.11 *** (3.99) | 0.11 (4.27) |

| IEKt−1 ∗ DF | 0.00 *** (7.18) | 0.00 *** (19.13) | −0.00 *** (−8.20) | |||

| EEKt−1 ∗ DF | 0.00 *** (5.35) | 0.01 *** (13.77) | −0.01 *** (−7.89) | |||

| Cage | −1.32 *** (−8.91) | −1.26 *** (−8.53) | −6.40 *** (−9.16) | −6.62 *** (−9.46) | −35.99 *** (−35.85) | −36.36 *** (−36.43) |

| Employee | 0.29 *** (9.83) | 0.31 *** (10.37) | 1.25 *** (8.82) | 1.34 *** (9.38) | 7.97 *** (39.26) | 7.90 *** (38.94) |

| Research | −0.19 *** (−11.06) | −0.19 *** (−10.70) | −0.96 *** (−11.76) | −0.96 *** (−11.67) | 4.47 *** (38.09) | 4.44 *** (37.84) |

| Constant | 4.88 *** (6.24) | 4.99 *** (6.36) | 20.79 *** (5.63) | 23.01 *** (6.17) | 36.48 *** (6.87) | 35.04 *** (6.59) |

| Code | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.077 | 0.070 | 0.140 | 0.123 | 0.363 | 0.361 |

| F-test | 81.86 | 73.98 | 159.26 | 137.68 | 558.18 | 554.14 |

| Variable | Dependent Variable: IPE | |||

|---|---|---|---|---|

| Model 6-1 | Model 6-2 | Model 6-3 | Model 6-4 | |

| IEKt−1 | 0.01 *** (5.67) | 0.02 *** (8.50) | ||

| EEKt−1 | 0.01 (1.60) | 0.03 *** (3.11) | ||

| Growth | 0.08 *** (35.62) | 0.08 *** (35.70) | ||

| Volatility | −0.004 *** (−2.62) | −0.004 *** (−3.01) | ||

| DF | −0.00 (−0.95) | −0.00 (−1.03) | −0.00 (−0.89) | −0.00 (−0.89) |

| Growth ∗ DF | 0.00 *** (5.36) | 0.00 *** (5.64) | ||

| Volatility ∗ DF | 0.00 (−0.52) | 0.00 (−0.74) | ||

| Cage | −0.73 *** (−5.39) | −1.60 *** (−10.38) | −0.65 *** (−4.85) | −1.50 *** (−9.77) |

| Employee | 0.18 *** (6.65) | 0.33 *** (10.43) | 0.19 *** (6.96) | 0.35 *** (11.05) |

| Research | −0.11 *** (−6.78) | −0.18 *** (−10.00) | −0.10 *** (−6.41) | −0.17 *** (−9.41) |

| Constant | 3.54 *** (4.92) | 5.08 *** (6.48) | 3.47 *** (4.82) | 4.97 *** (6.32) |

| Code | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| R-squared | 0.23 | 0.07 | 0.23 | 0.07 |

| F-test | 267.26 | 71.87 | 264.33 | 66.71 |

| Variable | Dependent Variable: IPE | |

|---|---|---|

| Model 1-a | Model 1-b | |

| IEKt−1 | 0.01 *** (8.00) | |

| EEKt−1 | 0.03 *** (8.00) | |

| Cage | −1.48 *** (−11.34) | −1.46 *** (−11.15) |

| Employee | 0.31 *** (11.51) | 0.33 *** (12.23) |

| Research | −0.18 *** (−12.16) | −0.17 *** (−11.40) |

| Code | Yes | Yes |

| Year | Yes | Yes |

| Constant | 3.75 *** (22.93) | 3.78 *** (3.751) |

| R-squared | 0.08 | 0.08 |

| F-test | 107.50 | 104.52 |

| Variable | Dependent Variable: IPE | |||

|---|---|---|---|---|

| Model 3-a | Model 3-b | Model 3-c | Model 3-d | |

| IEKt−1 | 0.16 *** (5.51) | 0.03 *** (8.06) | ||

| EEKt−1 | 0.03 *** (2.84) | 0.05 *** (4.65) | ||

| Growth | 0.78 *** (39.83) | 0.08 *** (40.16) | ||

| Volatility | −0.00 ** (−1.84) | −0.00 (−2.10) | ||

| Controls | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Code | Yes | Yes | Yes | Yes |

| Constant | 5.50 *** (3.65) | 8.09 *** (4.94) | 5.09 *** (3.37) | 7.54 *** (4.60) |

| Observations | 9632 | 9632 | 9632 | 9632 |

| Adj-R | 0.80 | 0.76 | 0.80 | 0.76 |

| Sobel Z | 4.49 *** | -4.12 *** | 2.50 ** | -2.68 *** |

| Sobel Z-p | (0.000) | (0.000) | 0.013) | (0.007) |

| Goodman-1 Z | 4.46 *** | -4.09 *** | 2.46 ** | -2.64 *** |

| Goodman-1 Z-p | (0.000) | (0.000) | (0.014) | (0.008) |

| Goodman-2 Z | 4.51 *** | -4.14 *** | 2.53 *** | -2.724 |

| Goodman-2 Z-p | (0.000) | (0.000) | (0.011) | (0.006) |

| Intermediary effect as a percentage | 0.01 | 0.19 | 0.00 | 0.07 |

| Variable | Dependent Variable: Growth | Dependent Variable: Volatility | Dependent Variable: IPE | |||||

|---|---|---|---|---|---|---|---|---|

| Model 5-a | Model 5-b | Model 5-c | Model 5-d | Model 6-a | Model 6-b | Model 6-c | Model 6-d | |

| IEKt−1 | 0.00 (0.07) | −0.03 (−1.38) | 0.02 *** (5.34) | 0.03 *** (8.04) | ||||

| EEKt−1 | 0.07 (1.02) | 0.01 (0.06) | 0.03 *** (2.88) | 0.05 *** (4.63) | ||||

| DF | −0.03 ** (−2.21) | −0.02 (−1.04) | −0.01 (−0.60) | −0.02 (−0.84) | 0.00 (0.70) | 0.00 (0.88) | 0.00 (0.73) | 0.00 (1.03) |

| IEKt−1 ∗ DF | 0.00 *** (15.02) | −0.00 (−6.19) | ||||||

| EEKt−1 ∗ DF | 0.00 *** (6.03) | −0.00 *** (−4.98) | ||||||

| Growth | 0.08 *** (35.20) | 0.08 *** (35.26) | ||||||

| Volatility | −0.00 (−1.83) | −0.00 ** (−2.08) | ||||||

| Growth ∗ DF | 0.00 ** (2.36) | 0.00 *** (2.70) | ||||||

| Volatility ∗ DF | 0.00 (0.02) | 0.00 (−0.08) | ||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Code | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 18.01 *** (7.54) | 16.58 *** (6.85) | 56.00 *** (17.98) | 56.48 *** (18.10) | 2.69 *** (6.11) | 3.97 *** (8.24) | 2.63 *** (5.98) | 3.87 *** (8.01) |

| R-squared | 0.14 | 0.20 | 0.37 | 0.36 | 0.23 | 0.08 | 0.23 | 0.07 |

| F-test | 113.42 | 92.48 | 396.17 | 392.85 | 186.06 | 53.45 | 184.05 | 49.88 |

| Hypothesis | Specific Content | Confirmed/Rejected |

|---|---|---|

| H1a | There is a positive correlation between internal enterprise knowledge and innovation performance. | Confirmed |

| H1b | There is a positive correlation between external enterprise knowledge and innovation performance. | Confirmed |

| H2a | There is a positive correlation between internal enterprise knowledge and long-term growth. | Confirmed |

| H2b | There is a positive correlation between external enterprise knowledge and long-term growth. | Confirmed |

| H2c | There is a negative correlation between internal enterprise knowledge and financial volatility. | Confirmed |

| H2d | There is a negative correlation between external enterprise knowledge and financial volatility. | Confirmed |

| H3a | Long-term growth plays a mediating role in the effect of internal enterprise knowledge and innovation performance. | Confirmed |

| H3b | Long-term growth plays a mediating role in the effect of external enterprise knowledge and innovation performance. | Confirmed |

| H3c | Financial volatility plays a mediating role in the effect of internal enterprise knowledge and innovation performance. | Confirmed |

| H3d | Financial volatility plays a mediating role in the effect of external enterprise knowledge and innovation performance | Confirmed |

| H4a | Digital finance strengthens the positive relationship between internal enterprise knowledge and long-term growth. | Confirmed |

| H4b | Digital finance strengthens the positive relationship between external enterprise knowledge and long-term growth. | Confirmed |

| H4c | Digital finance strengthens the negative relationship between internal enterprise knowledge and financial volatility. | Confirmed |

| H4d | Digital finance strengthens the negative relationship between external enterprise knowledge and financial volatility. | Confirmed |

| H5a | Digital finance can positively moderate the mediating effect of long-term growth in internal enterprise knowledge and innovation performance. That is, the mediating effect is more significant at higher levels of digital finance. | Confirmed |

| H5b | Digital finance can positively moderate the mediating effect of financial volatility in internal enterprise knowledge and innovation performance. That is, the mediating effect is more significant at higher levels of digital finance. | Confirmed |

| H5c | Digital finance is able to positively moderate the mediating effect of long-term growth in external enterprise knowledge and innovation performance. That is, the mediating effect is more significant at higher levels of digital finance. | Confirmed |

| H5d | Digital finance is able to positively moderate the mediating effect of financial volatility in the external enterprise knowledge and innovation performance of the firm. That is, the mediating effect is more significant at higher levels of digital finance. | Confirmed |

| Variable | Dependent Variable: IPE | |||

|---|---|---|---|---|

| PSM | PSM-DID | PSM | PSM-DID | |

| Model 7-a | Model 7-b | Model 7-c | Model 7-d | |

| DF_Afterit | 0.48 *** (3.73) | 0.27 *** (2.06) | 0.39 *** (3.10) | 0.23 * (1.89) |

| Controls | No | No | Yes | Yes |

| Code | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Constant | 1.89 *** (21.51) | 1.80 *** (21.28) | 4.73 *** (20.39) | 4.27 *** (19.33) |

| N | 15,712 | 13,031 | 15,712 | 13,031 |

| R-squared | 0.01 | 0.01 | 0.00 | 0.00 |

| F-test | 22.10 | 20.76 | 16.23 | 15.53 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, Y.; Hong, J. In the Context of Digital Finance, Can Knowledge Enable Manufacturing Companies to Be More Courageous and Move towards Sustainable Innovation? Sustainability 2022, 14, 10634. https://doi.org/10.3390/su141710634

Tian Y, Hong J. In the Context of Digital Finance, Can Knowledge Enable Manufacturing Companies to Be More Courageous and Move towards Sustainable Innovation? Sustainability. 2022; 14(17):10634. https://doi.org/10.3390/su141710634

Chicago/Turabian StyleTian, Ying, and Jiayi Hong. 2022. "In the Context of Digital Finance, Can Knowledge Enable Manufacturing Companies to Be More Courageous and Move towards Sustainable Innovation?" Sustainability 14, no. 17: 10634. https://doi.org/10.3390/su141710634

APA StyleTian, Y., & Hong, J. (2022). In the Context of Digital Finance, Can Knowledge Enable Manufacturing Companies to Be More Courageous and Move towards Sustainable Innovation? Sustainability, 14(17), 10634. https://doi.org/10.3390/su141710634