Application of Machine Learning Algorithms for Sustainable Business Management Based on Macro-Economic Data: Supervised Learning Techniques Approach

Abstract

:1. Introduction

- How to determine the best ML technique (KNN, PR, ANN, and SVM) to forecast the macroeconomic indicators (exchange rate and inflation rate)?

- What is the best ML technique (KNN, PR, ANN, and SVM) with the minimum error for predicting the macroeconomic indicators (exchange rate and inflation rate)?

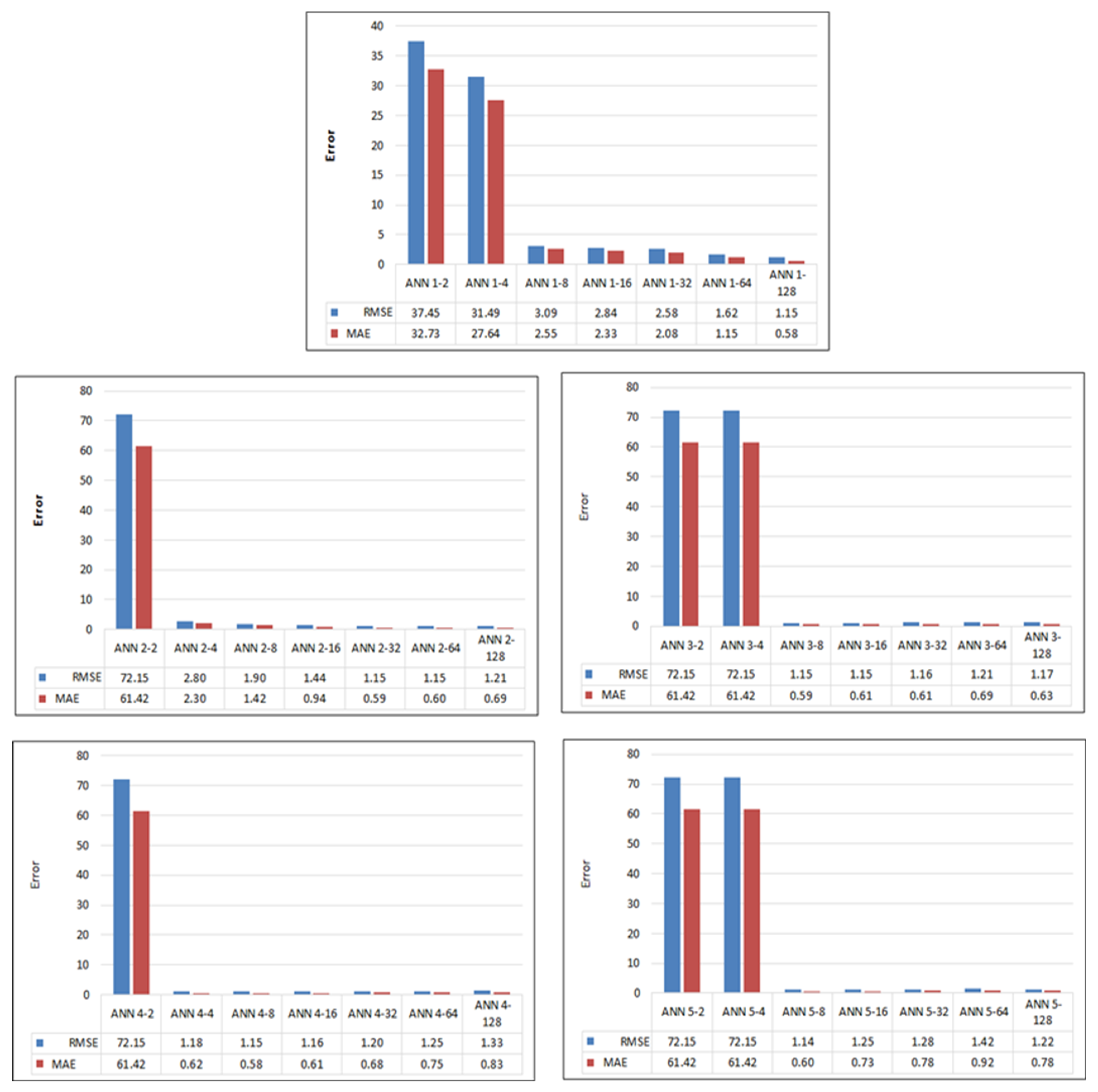

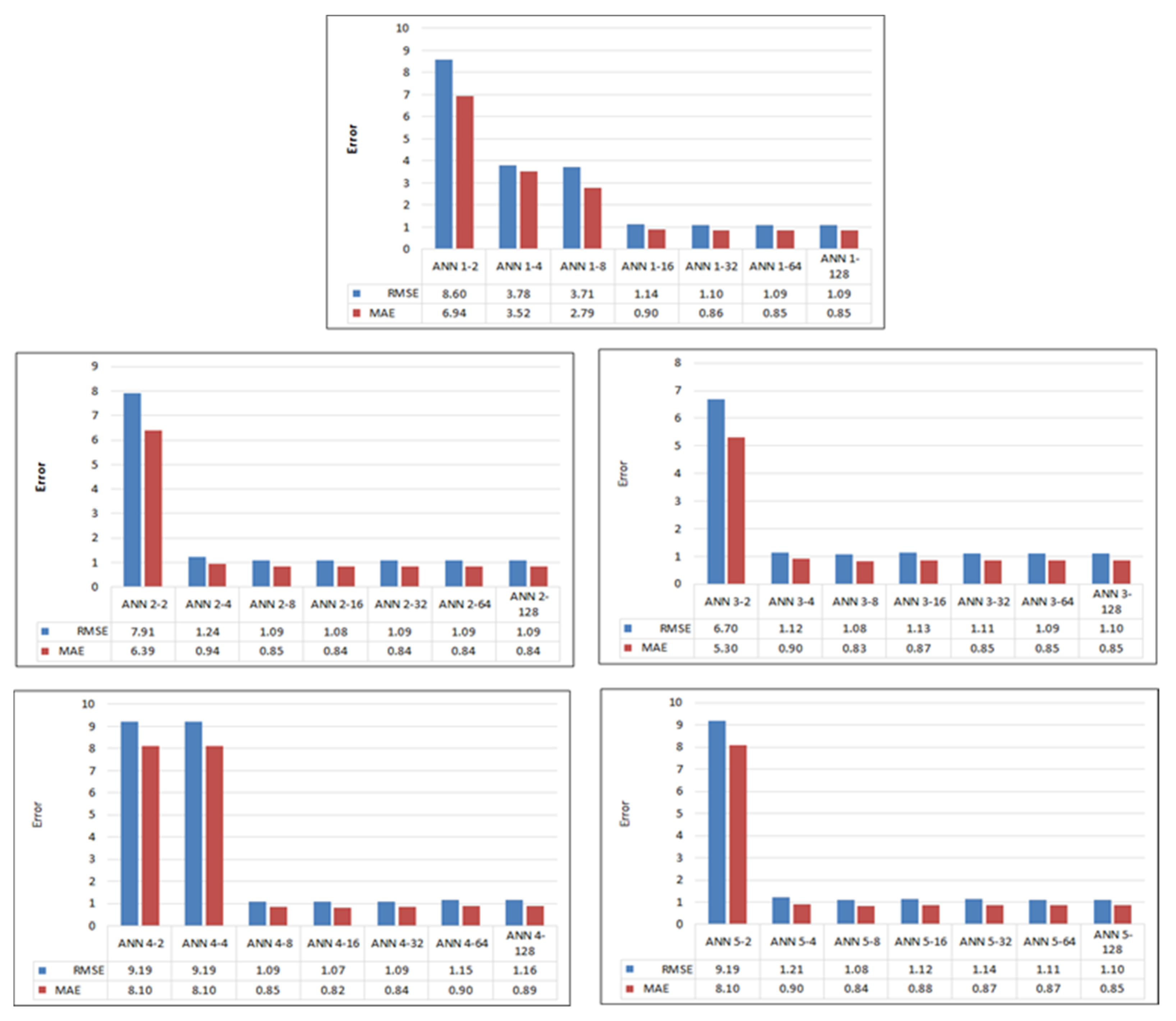

- What are the impacts of the hidden layers and the number of neurons per layer of the ANN technique on the errorless prediction of exchange rates?

- Do the hidden layers and the number of neurons per layer of the ANN technique have any impact on the error-less prediction of inflation rates?

- To examine the best ML technique (KNN, PR, ANN, and SVM) to forecast the macroeconomic indicators (exchange rate and inflation rate);

- To determine the best ML technique (KNN, PR, ANN, and SVM) with the minimum error for predicting the macroeconomic indicators (exchange rate and inflation rate);

- To find out the impacts of the hidden layers and the number of neurons per layer of the ANN technique on errorless prediction of exchange rates;

- Observing the hidden layers and the number of neurons per layer of the ANN technique have any impact on error-less prediction of inflation rates.

2. Literature Review

Theoretical Support of the Research

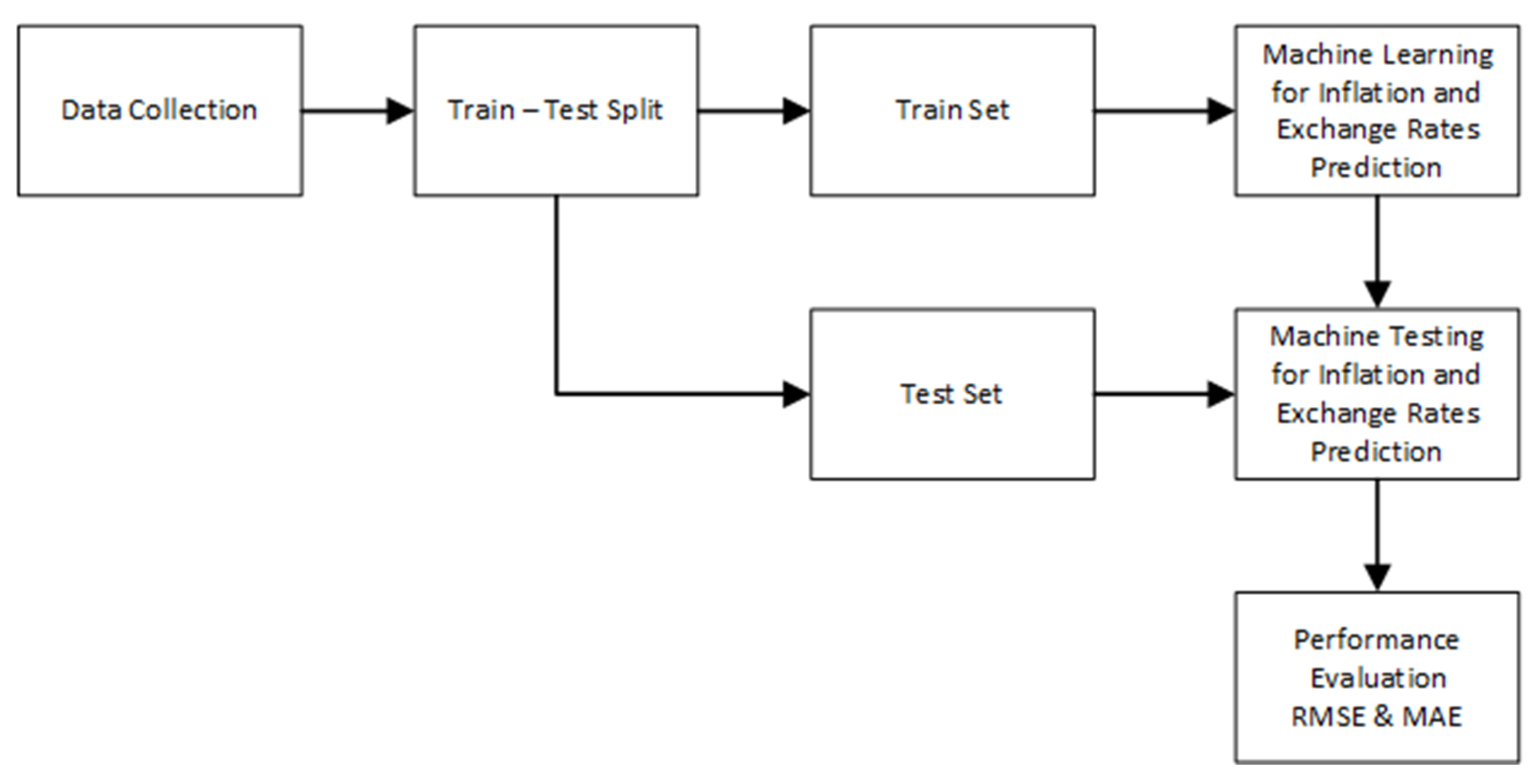

3. Methodology

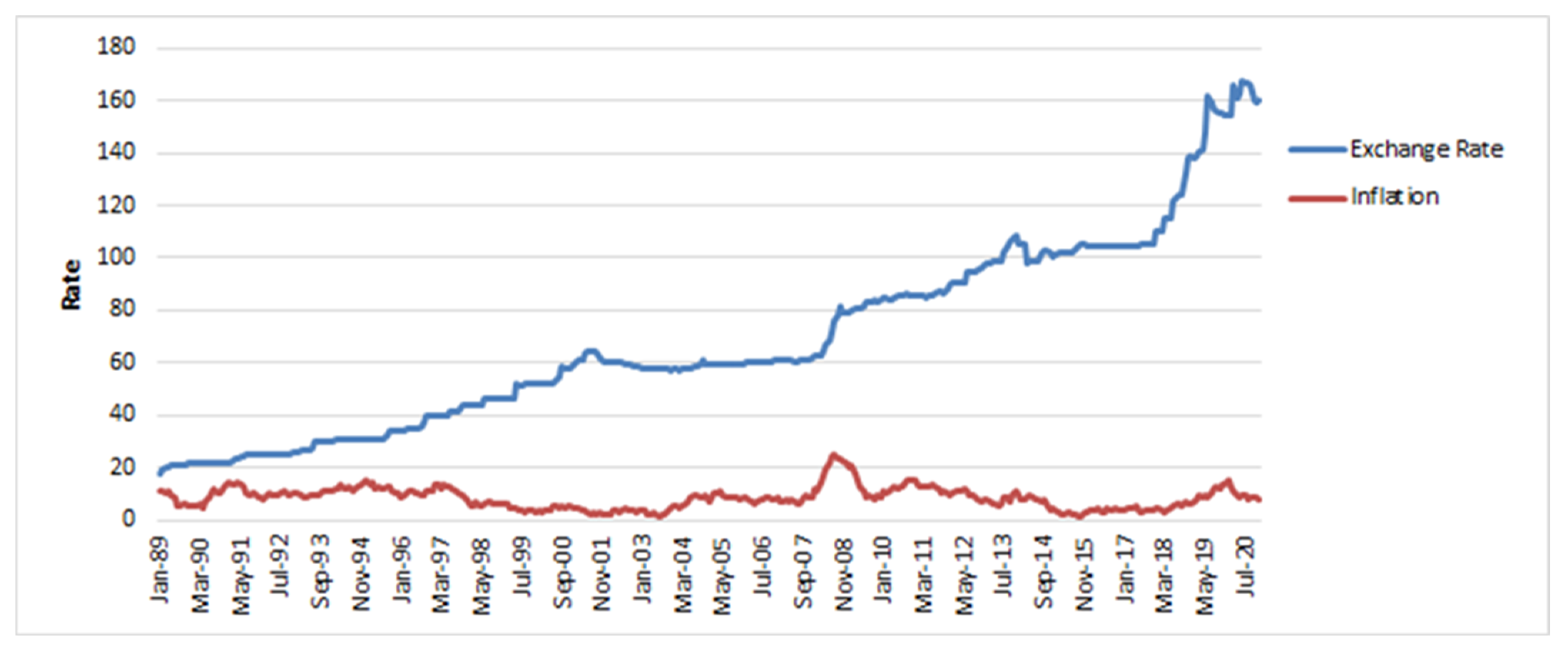

3.1. Data Collection

3.2. Machine Learning Algorithms

3.3. K-Nearest Neighbor (KNN)

3.4. Polynomial Regression

3.5. Support Vector Machine (SVM)

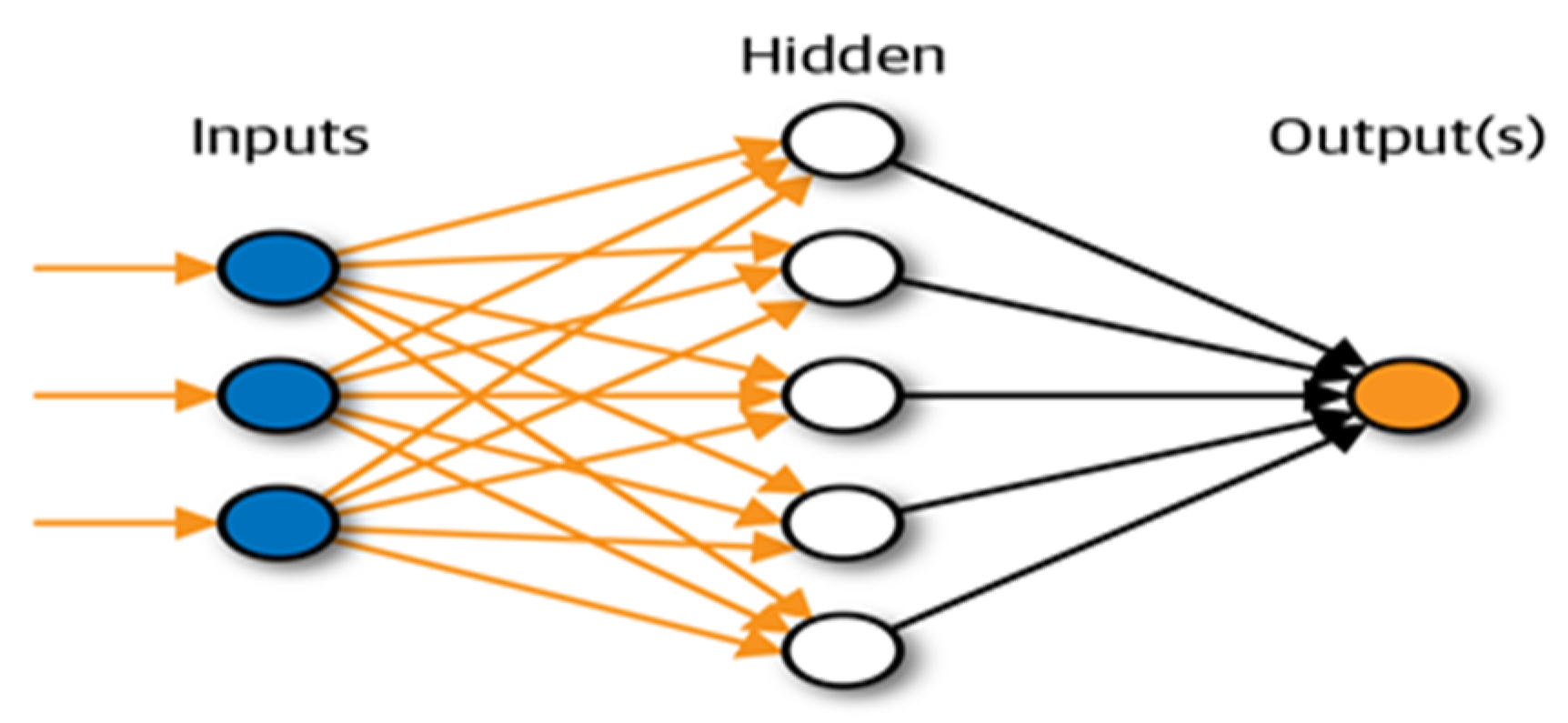

3.6. Artificial Neural Network (ANN)

3.7. Performance Evaluation

3.8. Root Mean Square Error

3.9. Mean Absolute Error

3.10. Experimental Results and Discussion

3.11. Forecasting of Exchange Rates

3.12. Overall Results for Exchange Rate Prediction

3.13. Forecasting of Inflation Rates

3.14. Overall Results for Inflation Rate Forecasting

4. Conclusions

5. Contribution of This Study

6. Future Direction

Author Contributions

Funding

Conflicts of Interest

References

- Richardson, A.; Mulder, T. Nowcasting New Zealand GDP using machine learning algorithms. In Proceedings of the Use of Big Data Analytics and Artificial Intelligence in Central Banking, Bali, Indonesia, 23–26 July 2018. [Google Scholar]

- Goudarzi, S.; Hickok, E.; Sinha, A. AI in Banking and Finance. The Center for Internet and Society. 2018. Available online: https://journals.sagepub.com/doi/10.1177/09722629221087371 (accessed on 13 June 2022).

- Awan, T. (Producer). How Artificial Intelligence Helps Pakistan to Fight Its Battle. Technology Times. Available online: https://www.technologytimes.pk/2020/08/04/how-artificial-intelligence-helps-pakistan-to-fight-its-battle (accessed on 4 August 2020).

- Liu, L.; Wang, W. Exchange rates forecasting with least squares support vector machine. In Proceedings of the the 2008 International Conference on Computer Science and Software Engineering, Washington, DC, USA, 12–14 December 2008. [Google Scholar]

- Collinson, S.; Rugman, A.M. The regional character of Asian multinational enterprises. Asia Pac. J. Manag. 2007, 24, 429–446. [Google Scholar] [CrossRef]

- Ramakrishnan, S.; Butt, S.; Chohan, M.A.; Ahmad, H. Forecasting Malaysian exchange rate using machine learning techniques based on commodities prices. In Proceedings of the 2017 International Conference on Research and Innovation in Information Systems (ICRIIS), Langkawi, Malaysia, 16–17 July 2017. [Google Scholar]

- Jena, P.R.; Majhi, R.; Majhi, B. Development and performance evaluation of a novel knowledge guided artificial neural network (KGANN) model for exchange rate prediction. J. King Saud Univ. Comput. Inf. Sci. 2015, 27, 450–457. [Google Scholar] [CrossRef]

- Shah, D.; Campbell, W.; Zulkernine, F.H. A comparative study of LSTM and DNN for stock market forecasting. In Proceedings of the 2018 IEEE International Conference on Big Data (big data), Seattle, WA, USA, 10–13 December 2018. [Google Scholar]

- Raj, D.A. Spotlight on the Remarkable Potential of AI in KYC. Available online: https://medium.com/all-technology-feeds/spotlight-on-the-remarkable-potential-of-ai-in-kyc-7441bf7eec38 (accessed on 3 April 2018).

- Navyasri, S.; Hafsa, N.; Nayana, S.; Bilimale, N. Predicting the GDP of India using Machine Learning. Int. J. Progress. Res. Sci. Eng. 2020, 1, 78–81. [Google Scholar]

- Yoon, J. Forecasting of real GDP growth using machine learning models: Gradient boosting and random forest approach. Comput. Econ. 2021, 57, 247–265. [Google Scholar] [CrossRef]

- Maehashi, K.; Shintani, M. Macroeconomic forecasting using factor models and machine learning: An application to Japan. J. Jpn. Int. Econ. 2020, 58, 101104. [Google Scholar] [CrossRef]

- Ülke, V.; Sahin, A.; Subasi, A. A comparison of time series and machine learning models for inflation forecasting: Empirical evidence from the USA. Neural Comput. Appl. 2018, 30, 1519–1527. [Google Scholar] [CrossRef]

- Syed, A.A.S.; Lee, K.H. Macroeconomic forecasting for Pakistan in a data-rich environment. Appl. Econ. 2021, 53, 1077–1091. [Google Scholar] [CrossRef]

- Coulombe, P.G.; Leroux, M.; Stevanovic, D.; Surprenant, S. How is machine learning useful for macroeconomic forecasting? arXiv 2020, arXiv:2008.12477. [Google Scholar] [CrossRef]

- Gogas, P.; Papadimitriou, T.; Takli, E. Comparison of simple sum and Divisia monetary aggregates in GDP forecasting: A support vector machines approach. Econ. Bull. 2013, 33, 1101–1115. [Google Scholar]

- Aziz, S.; Dowling, M. Machine learning and AI for risk management. In Disrupting Finance; Lynn, T., Mooney, J.G., Rosati, P., Cummins, M., Eds.; Palgrave Pivot Cham: New York, NY, USA, 2019; pp. 30–50. [Google Scholar]

- Medeiros, M.C.; Vasconcelos, G.F.; Veiga, Á.; Zilberman, E. Forecasting inflation in a data-rich environment: The benefits of machine learning methods. J. Bus. Econ. Stat. 2021, 39, 98–119. [Google Scholar] [CrossRef]

- Kou, G.; Chao, X.; Peng, Y.; Alsaadi, F.E.; Herrera-Viedma, E. Machine Learning Methods for Systemic Risk Analysis in Financial Sectors. Technol. Econ. Dev. Econ. 2019, 25, 716–742. [Google Scholar] [CrossRef]

- Huang, Y.; Kou, G.; Peng, Y. Nonlinear manifold learning for early warnings in financial markets. Eur. J. Oper. Res. 2017, 2, 692–702. [Google Scholar] [CrossRef]

- Chao, X.; Peng, Y. A cost-sensitive multi-criteria quadratic programming model for imbalanced data. J. Oper. Res. Soc. 2017, 69, 500–516. [Google Scholar] [CrossRef]

- Gensler, G.; Bailey, L. Deep Learning and Financial Stability. 2020. Available online: https://www.semanticscholar.org/paper/Deep-Learning-and-Financial-Stability-Gensler-Bailey/daeb93c0419ee9af5d6c785ebe1e75c9fb3ea73f (accessed on 13 June 2022).

- Danielsson, J.; Macrae, R.; Uthemann, A. Artificial intelligence and systemic risk. J. Bank. Financ. Forthcom. 2021, 140, 106290. [Google Scholar] [CrossRef]

- Boukherouaa, E.B.; Shabsigh, G.; AlAjmi, K.; Deodoro, J.; Farias, A.; Iskender, E.S.; Mirestean, A.T.; Ravikumar, R. Powering the Digital Economy: Opportunities and Risks of Artificial Intelligence in Finance; International Monetary Fund: Washington, DC, USA, 2021. [Google Scholar]

- Cicceri, G.; de Vita, F.; Bruneo, D.; Merlino, G.; Puliafito, A. A deep learning approach for pressure ulcer prevention using wearable computing. Hum.-Cent. Comput. Inf. Sci. 2020, 10, 5. [Google Scholar] [CrossRef]

- AlShorman, O.; Alkahatni, F.; Masadeh, M.; Irfan, M.; Glowacz, A.; Althobiani, F.; Kozik, J.; Glowacz, W. Sounds and acoustic emission-based early fault diagnosis of induction motor: A review study. Adv. Mech. Eng. 2021, 13, 1–19. [Google Scholar] [CrossRef]

- Ahmed, E.; Hamdan, A. The impact of corporate governance on firm performance: Evidence from Bahrain Bourse. Marietta 2015, 11, 21–37. [Google Scholar]

| Methods | RMSE | MAE |

|---|---|---|

| KNN (K = 1) | 1.627 | 0.793 |

| SVM linear function | 1.131 | 0.589 |

| SVM RBF | 0.972 | 0.543 |

| Methods | RMSE | MAE |

|---|---|---|

| Polynomial (degree 1) | 1.265 | 0.718 |

| Polynomial (degree 2) | 1.322 | 0.738 |

| Polynomial (degree 3) | 1.273 | 0.741 |

| Polynomial (degree 4) | 1.233 | 0.779 |

| Polynomial (degree 5) | 1.182 | 0.699 |

| Methods | RMSE | MAE |

|---|---|---|

| KNN (K = 1) | 1.627 | 0.793 |

| SVM RBF | 0.972 | 0.543 |

| Polynomial (degree 5) | 1.182 | 0.699 |

| ANN 5-8 | 1.143 | 0.598 |

| Methods | RMSE | MAE |

|---|---|---|

| KNN | 1.592 | 1.178 |

| SVM linear function | 1.095 | 0.838 |

| SVM RBF | 1.219 | 0.892 |

| Method | RMSE | MAE |

|---|---|---|

| Polynomial (degree 1) | 1.087 | 0.831 |

| Polynomial (degree 2) | 1.102 | 0.831 |

| Polynomial (degree 3) | 1.111 | 0.836 |

| Polynomial (degree 4) | 1.133 | 0.845 |

| Polynomial (degree 5) | 1.128 | 0.851 |

| Method | RMSE | MAE |

|---|---|---|

| KNN | 1.592 | 1.178 |

| SVM linear function | 1.095 | 0.838 |

| Polynomial (degree 1) | 1.087 | 0.831 |

| ANN 4-16 | 1.070 | 0.820 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, M.A.; Abbas, K.; Su’ud, M.M.; Salameh, A.A.; Alam, M.M.; Aman, N.; Mehreen, M.; Jan, A.; Hashim, N.A.A.B.N.; Aziz, R.C. Application of Machine Learning Algorithms for Sustainable Business Management Based on Macro-Economic Data: Supervised Learning Techniques Approach. Sustainability 2022, 14, 9964. https://doi.org/10.3390/su14169964

Khan MA, Abbas K, Su’ud MM, Salameh AA, Alam MM, Aman N, Mehreen M, Jan A, Hashim NAABN, Aziz RC. Application of Machine Learning Algorithms for Sustainable Business Management Based on Macro-Economic Data: Supervised Learning Techniques Approach. Sustainability. 2022; 14(16):9964. https://doi.org/10.3390/su14169964

Chicago/Turabian StyleKhan, Muhammad Anees, Kumail Abbas, Mazliham Mohd Su’ud, Anas A. Salameh, Muhammad Mansoor Alam, Nida Aman, Mehreen Mehreen, Amin Jan, Nik Alif Amri Bin Nik Hashim, and Roslizawati Che Aziz. 2022. "Application of Machine Learning Algorithms for Sustainable Business Management Based on Macro-Economic Data: Supervised Learning Techniques Approach" Sustainability 14, no. 16: 9964. https://doi.org/10.3390/su14169964

APA StyleKhan, M. A., Abbas, K., Su’ud, M. M., Salameh, A. A., Alam, M. M., Aman, N., Mehreen, M., Jan, A., Hashim, N. A. A. B. N., & Aziz, R. C. (2022). Application of Machine Learning Algorithms for Sustainable Business Management Based on Macro-Economic Data: Supervised Learning Techniques Approach. Sustainability, 14(16), 9964. https://doi.org/10.3390/su14169964