Eco-Innovation and Firm Performance: Evidence from South America

Abstract

:1. Introduction

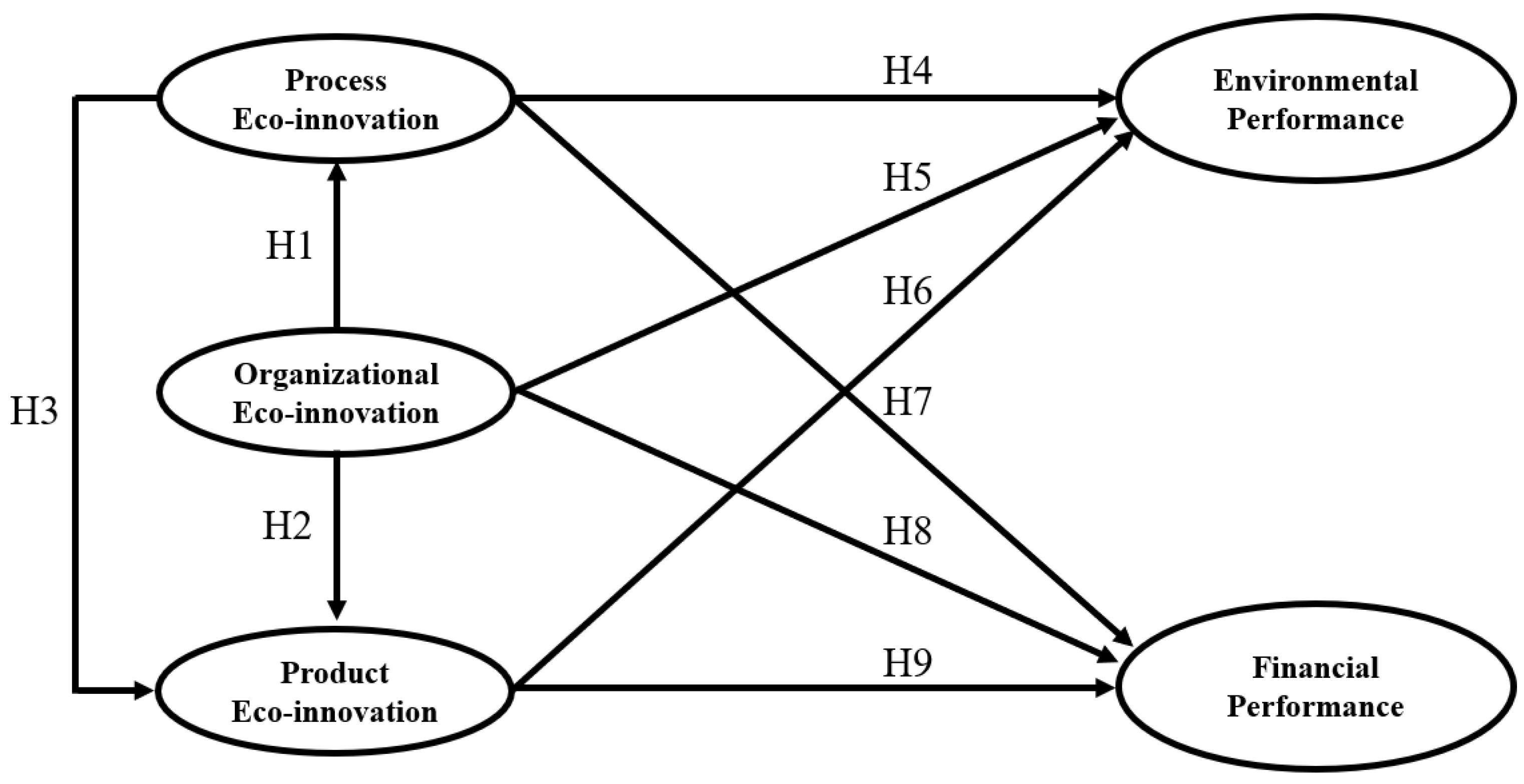

2. Theoretical Framework and Hypotheses Development

3. Material and Methods

3.1. Data Collection

3.2. Characteristics of the Sample

3.3. Measurement of the Variables

3.4. Evaluation of Common Method and Non-Response Bias

3.5. Analysis of Validity and Reliability

4. Data Analysis and Results

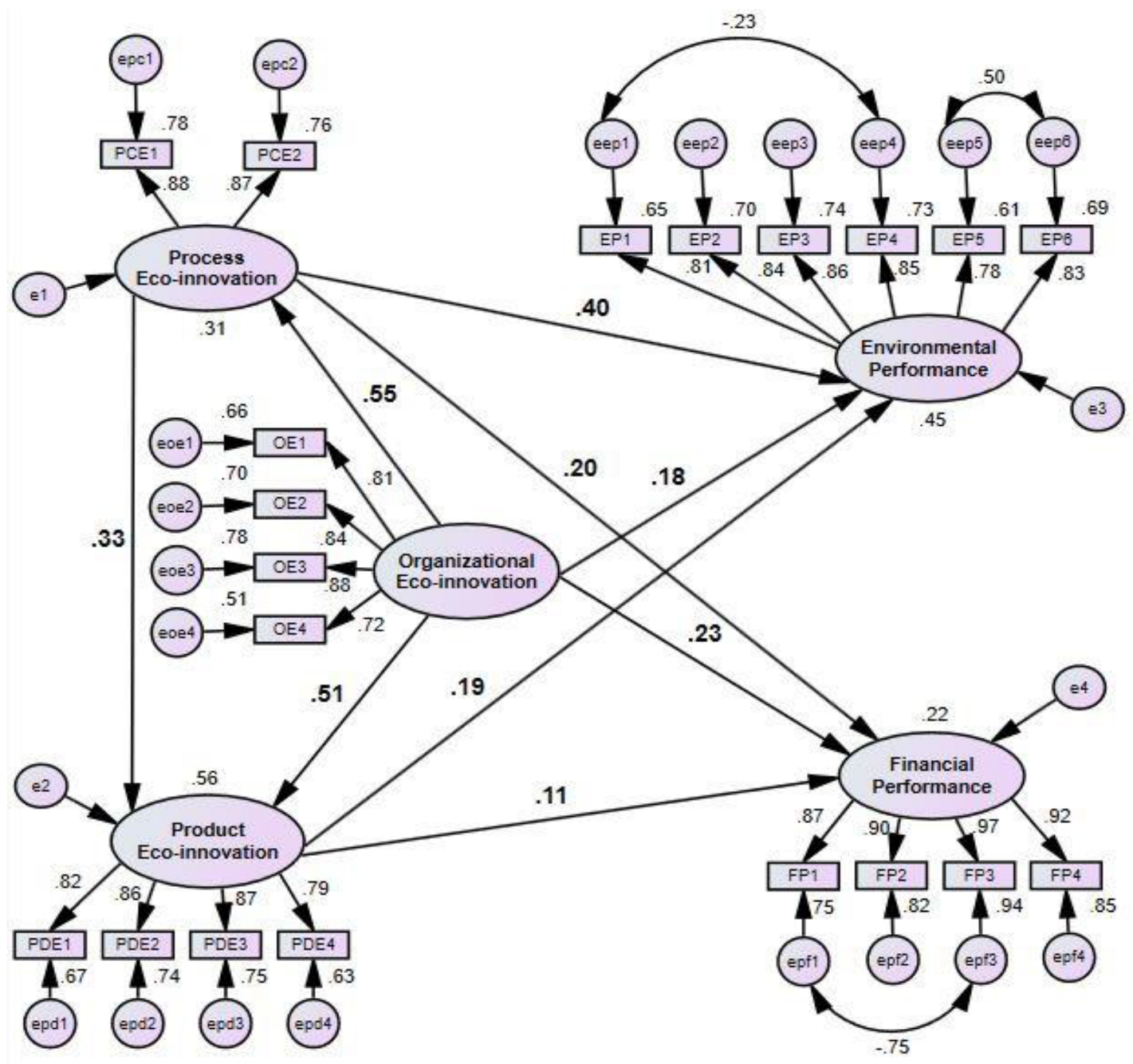

4.1. SEM Analysis and Test of Hypotheses

4.2. Direct, Indirect, and Total Effects

5. Discussion

6. Conclusions

6.1. Limitations, Strengths, and Future Research

6.2. Implications for Theory and Practice

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 2018, 176, 110–118. [Google Scholar] [CrossRef]

- Hojnik, J.; Ruzzier, M. What drives eco-innovation? A review of an emerging literature. Environ. Innov. Soc. Transit. 2015, 19, 31–41. [Google Scholar] [CrossRef]

- Kemp, R.; Pearson, P.P. Final Report MEI Project about Measuring Eco-Innovation; UM Merit: Maastricht, The Netherlands, 2007; Volume 10. [Google Scholar]

- Chan, H.K.; Yee, R.W.Y.; Dai, J.; Lim, M.K. The moderating effect of environmental dynamism on green product innovation and performance. Int. J. Prod. Econ. 2016, 181, 384–391. [Google Scholar] [CrossRef]

- Li, Y. Environmental innovation practices and performance: Moderating effect of resource commitment. J. Clean. Prod. 2014, 66, 450–458. [Google Scholar] [CrossRef]

- Bag, S.; Dhamija, P.; Bryde, D.J.; Singh, R.K. Effect of eco-innovation on green supply chain management, circular economy capability, and performance of small and medium enterprises. J. Bus. Res. 2022, 141, 60–72. [Google Scholar] [CrossRef]

- Cai, W.; Zhou, X. On the drivers of eco-innovation: Empirical evidence from China. J. Clean. Prod. 2014, 79, 239–248. [Google Scholar] [CrossRef]

- Weng, H.-H.; Chen, J.-S.; Chen, P.-C. Effects of Green Innovation on Environmental and Corporate Performance: A Stakeholder Perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef] [Green Version]

- Larbi-Siaw, O.; Xuhua, H.; Owusu, E.; Owusu-Agyeman, A.; Fulgence, B.E.; Frimpong, S.A. Eco-innovation, sustainable business performance and market turbulence moderation in emerging economies. Technol. Soc. 2022, 68, 101899. [Google Scholar] [CrossRef]

- Doran, J.; Ryan, G. The Importance of the Diverse Drivers and Types of Environmental Innovation for Firm Performance: Eco-Innovation Drivers and Firm Performance. Bus. Strategy Environ. 2016, 25, 102–119. [Google Scholar] [CrossRef]

- Lin, R.-J.; Tan, K.-H.; Geng, Y. Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 2013, 40, 101–107. [Google Scholar] [CrossRef]

- Johl, S.K.; Toha, M.A. The Nexus between Proactive Eco-Innovation and Firm Financial Performance: A Circular Economy Perspective. Sustainability 2021, 13, 6253. [Google Scholar] [CrossRef]

- Bossle, M.B.; Dutra de Barcellos, M.; Vieira, L.M.; Sauvée, L. The drivers for adoption of eco-innovation. J. Clean. Prod. 2016, 113, 861–872. [Google Scholar] [CrossRef]

- OECD. Oslo Manual: Guidelines for Collecting and Interpreting Technological Innovation Data; Organisation for Economic Co-operation and Development: Paris, France; Statistical Office of the European Communities: Paris, France, 2005; ISBN 978-92-64-01310-0. [Google Scholar]

- OECD (Ed.). Eco-Innovation in Industry: Enabling Green Growth; OECD Innovation Strategy; OECD: Paris, France, 2009; ISBN 978-92-64-07722-5. [Google Scholar]

- Bocken, N.M.P.; Farracho, M.; Bosworth, R.; Kemp, R. The front-end of eco-innovation for eco-innovative small and medium sized companies. J. Eng. Technol. Manag. 2014, 31, 43–57. [Google Scholar] [CrossRef] [Green Version]

- Lin, H.; Zeng, S.X.; Ma, H.Y.; Qi, G.Y.; Tam, V.W.Y. Can political capital drive corporate green innovation? Lessons from China. J. Clean. Prod. 2014, 64, 63–72. [Google Scholar] [CrossRef]

- Ar, I.M. The Impact of Green Product Innovation on Firm Performance and Competitive Capability: The Moderating Role of Managerial Environmental Concern. Procedia—Soc. Behav. Sci. 2012, 62, 854–864. [Google Scholar] [CrossRef] [Green Version]

- Cheng, C.C.; Yang, C.; Sheu, C. The link between eco-innovation and business performance: A Taiwanese industry context. J. Clean. Prod. 2014, 64, 81–90. [Google Scholar] [CrossRef] [Green Version]

- de Oliveira Brasil, M.V.; Sá de Abreu, M.C.; da Silva Filho, J.C.L.; Leocádio, A.L. Relationship between eco-innovations and the impact on business performance: An empirical survey research on the Brazilian textile industry. Rev. Adm. 2016, 51, 276–287. [Google Scholar] [CrossRef] [Green Version]

- Ryszko, A. Proactive Environmental Strategy, Technological Eco-Innovation and Firm Performance—Case of Poland. Sustainability 2016, 8, 156. [Google Scholar] [CrossRef] [Green Version]

- Küçükoğlu, M.T.; Pinar, R.İ. Positive Influences of Green Innovation on Company Performance. Procedia—Soc. Behav. Sci. 2015, 195, 1232–1237. [Google Scholar] [CrossRef] [Green Version]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Diaz-García, C.; Gonzalez-Moreno, A.; Saenz-Martinez, F.J. Eco-innovation: Insights from a literature review. Innov. Manag. Policy Pract. 2015, 17, 6–23. [Google Scholar] [CrossRef]

- Kemp, R.; Oltra, V. Research Insights and Challenges on Eco-Innovation Dynamics. Ind. Innov. 2011, 18, 249–253. [Google Scholar] [CrossRef]

- Hart, S. A Natural-Resource-Based View of the Firm. Acad. Manage. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef] [Green Version]

- Wernerfelt, B. A Resource-Based View of the Firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [CrossRef]

- Teece, D.; Pisano, G.; Amy, S. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Makadok, R. Toward a synthesis of the resource-based and dynamic-capability views of rent creation. Strateg. Manag. J. 2001, 22, 387–401. [Google Scholar] [CrossRef]

- Cainelli, G.; De Marchi, V.; Grandinetti, R. Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. J. Clean. Prod. 2015, 94, 211–220. [Google Scholar] [CrossRef]

- Barney, J.B.; Ketchen, D.J.; Wright, M. The Future of Resource-Based Theory: Revitalization or Decline? J. Manag. 2011, 37, 1299–1315. [Google Scholar] [CrossRef]

- Hart, S.L.; Dowell, G. Invited Editorial: A Natural-Resource-Based View of the Firm: Fifteen Years After. J. Manag. 2011, 37, 1464–1479. [Google Scholar] [CrossRef]

- Damanpour, F.; Szabat, K.A.; Evan, W.M. The relationship between types of innovation and organizational performance. J. Manag. Stud. 1989, 26, 587–602. [Google Scholar] [CrossRef]

- Damanpour, F.; Walker, R.M.; Avellaneda, C.N. Combinative Effects of Innovation Types and Organizational Performance: A Longitudinal Study of Service Organizations. J. Manag. Stud. 2009, 46, 650–675. [Google Scholar] [CrossRef]

- Gunday, G.; Ulusoy, G.; Kilic, K.; Alpkan, L. Effects of innovation types on firm performance. Int. J. Prod. Econ. 2011, 133, 662–676. [Google Scholar] [CrossRef] [Green Version]

- Raymond, L.; St-Pierre, J. R&D as a determinant of innovation in manufacturing SMEs: An attempt at empirical clarification. Technovation 2010, 30, 48–56. [Google Scholar] [CrossRef]

- Peng, X.; Liu, Y. Behind eco-innovation: Managerial environmental awareness and external resource acquisition. J. Clean. Prod. 2016, 139, 347–360. [Google Scholar] [CrossRef]

- Hojnik, J.; Ruzzier, M. The driving forces of process eco-innovation and its impact on performance: Insights from Slovenia. J. Clean. Prod. 2016, 133, 812–825. [Google Scholar] [CrossRef]

- Cheng, C.C.; Shiu, E.C. Validation of a proposed instrument for measuring eco-innovation: An implementation perspective. Technovation 2012, 32, 329–344. [Google Scholar] [CrossRef]

- CEPAL. Bases de Datos y Publicaciones Estadísticas; CEPAL: Santiago, Chile, 2020. [Google Scholar]

- Zhu, Q.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar] [CrossRef]

- Im, S.; Workman, J.P. Market Orientation, Creativity, and New Product Performance in High-Technology Firms. J. Mark. 2004, 68, 114–132. [Google Scholar] [CrossRef] [Green Version]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Podsakoff, P.M.; Organ, D.W. Self-Reports in Organizational Research: Problems and Prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Todor, W.D.; Grover, R.A.; Huber, V.L. Situational moderators of leader reward and punishment behaviors: Fact or fiction? Organ. Behav. Hum. Perform. 1984, 34, 21–63. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating Nonresponse Bias in Mail Surveys. J. Mark. Res. 1977, 14, 396. [Google Scholar] [CrossRef] [Green Version]

- Jöreskog, K.G.; Sörbom, D. LISREL 8: Structural Equation Modeling with the SIMPLIS Command Language; 4. Print. (With Foreword and Computer Exercises); Erlbaum: Hillsdale, NJ, USA, 1998; ISBN 978-0-89498-033-6. [Google Scholar]

- Fornell, C.; Larcker, D.F. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. J. Mark. Res. 1981, 18, 382. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 8th ed.; Cengage: Andover, UK, 2019; ISBN 978-1-4737-5654-0. [Google Scholar]

- Bartholomew, D.J. Analysis of Multivariate Social Science Data; CRC Press: Boca Raton, FL, USA, 2011; ISBN 978-1-58488-961-8. [Google Scholar]

- Byrne, B.M. Structural Equation Modeling with AMOS: Basic Concepts, Applications, and Programming, 2nd ed.; Multivariate Applications Series; Routledge: New York, NY, USA, 2010; ISBN 978-0-8058-6372-7. [Google Scholar]

- Hair, J.F. (Ed.) Multivariate Data Analysis, 7th ed.; Pearson Custom Library; Pearson New International Edition; Pearson: Harlow, UK, 2014; ISBN 978-1-292-02190-4. [Google Scholar]

- Chion, S.J.; Vincent, C. Analítica de Datos para la Modelación Estructural; Pearson: Lima, Peru, 2016; ISBN 978-612-4149-39-9. [Google Scholar]

- Amores-Salvadó, J.; Martín-de Castro, G.; Navas-López, J.E. The importance of the complementarity between environmental management systems and environmental innovation capabilities: A firm level approach to environmental and business performance benefits. Technol. Forecast. Soc. Chang. 2015, 96, 288–297. [Google Scholar] [CrossRef]

- Przychodzen, J.; Przychodzen, W. Relationships between eco-innovation and financial performance—Evidence from publicly traded companies in Poland and Hungary. J. Clean. Prod. 2015, 90, 253–263. [Google Scholar] [CrossRef]

- Maçaneiro, M.B.; da Cunha, S.K.; Balbinot, Z. Drivers of the Adoption of Eco-Innovations in the Pulp, Paper, and Paper Products Industry in Brazil. Lat. Am. Bus. Rev. 2013, 14, 179–208. [Google Scholar] [CrossRef]

- del Brío, J.Á.; Junquera, B. A review of the literature on environmental innovation management in SMEs: Implications for public policies. Technovation 2003, 23, 939–948. [Google Scholar] [CrossRef]

| Characteristics | Number of Firms | Percentage of Firms | |

|---|---|---|---|

| Size | Medium | 118 | 55.1% |

| Large | 96 | 44.9% | |

| Country | Colombia | 82 | 38.3% |

| Ecuador | 74 | 34.6% | |

| Peru | 58 | 27.1% | |

| Firm age | Less than 5 years | 2 | 1% |

| Between 5 and 10 years | 8 | 4% | |

| Over 10 years | 204 | 95% | |

| Certification | ISO 14001 | 59 | 27.6% |

| ISO 9001 | 18 | 8.4% | |

| Other | 28 | 13.1% | |

| None | 109 | 50.9% | |

| Industry | Food and beverage | 54 | 25.2% |

| Chemical and chemical products | 31 | 14.5% | |

| Metals and metal products | 25 | 11.7% | |

| Textiles, leather, and apparel | 23 | 10.7% | |

| Pharmaceutical products | 15 | 7% | |

| Paper and paper products | 15 | 7% | |

| Electrical equipment and machinery | 15 | 7% | |

| Wood and wood products | 10 | 4.7% | |

| Motor vehicles and transport equipment | 2 | 0.9% | |

| Coke and refined petroleum products | 2 | 0.9% | |

| Computer, electronic, and optical products | 1 | 0.5% | |

| Other | 21 | 9.8% |

| Measurement Items | FL | CR | AVE | |

|---|---|---|---|---|

| Organizational Eco-Innovation (OE) | 0.887 | 0.664 | ||

| OE1 | Our firm often innovatively uses novel systems to manage eco-innovation. | 0.81 | ||

| OE2 | Our firm often innovatively collects and shares information on eco-innovation trends. | 0.84 | ||

| OE3 | Our firm often actively engages in eco-innovation activities. | 0.88 | ||

| OE4 | Our firm often invests a high ratio of R&D in eco-innovation. | 0.72 | ||

| Process eco-innovation (PCE) | 0.870 | 0.769 | ||

| PCE1 | Our firm often innovatively updates manufacturing processes to protect against contamination. | 0.88 | ||

| PCE2 | Our firm often innovatively updates manufacturing processes to meet standards of environmental law. | 0.87 | ||

| Product eco-innovation (PDE) | 0.903 | 0.699 | ||

| PDE1 | Our firm often places emphasis on developing new eco-products through new technologies to simplify their construction and packaging. | 0.82 | ||

| PDE2 | Our firm often places emphasis on developing new eco-products through new technologies to easily recycle their components. | 0.86 | ||

| PDE3 | Our firm often places emphasis on developing new eco-products through new technologies to easily decompose their materials. | 0.87 | ||

| PDE4 | Our firm often places emphasis on developing new eco-products through new technologies to use as little energy as possible. | 0.79 | ||

| Financial performance (FP) | 0.954 | 0.839 | ||

| FP1 | Market share. | 0.87 | ||

| FP2 | Return on investment. | 0.90 | ||

| FP3 | Profits. | 0.97 | ||

| FP4 | Sales. | 0.92 | ||

| Environmental performance (EP) | 0.930 | 0.688 | ||

| EP1 | Reduction of air emission. | 0.81 | ||

| EP2 | Reduction of waste water. | 0.84 | ||

| EP3 | Reduction of solid wastes. | 0.86 | ||

| EP4 | Decrease of consumption for hazardous/harmful/toxic materials. | 0.85 | ||

| EP5 | Decrease of frequency of environmental accidents. | 0.78 | ||

| EP6 | Improvement in enterprise’s environmental situation. | 0.83 | ||

| Constructs | AVE | Correlations | ||||

|---|---|---|---|---|---|---|

| PDE | PCE | OE | FP | EP | ||

| 1. Product eco-innovation (PDE) | 0.699 | 0.836 | ||||

| 2. Process eco-innovation (PCE) | 0.769 | 0.614 | 0.877 | |||

| 3. Organizational eco-innovation (OE) | 0.664 | 0.692 | 0.554 | 0.815 | ||

| 4. Financial Performance (FP) | 0.839 | 0.395 | 0.392 | 0.420 | 0.916 | |

| 5. Environmental Performance (EP) | 0.688 | 0.563 | 0.618 | 0.535 | 0.369 | 0.830 |

| Relation | Standardized Value | p-Value | Hypothesis |

|---|---|---|---|

| Organizational eco-innovation→Process eco-innovation | 0.554 | *** | H1 supported |

| Organizational eco-innovation→Product eco-innovation | 0.507 | *** | H2 supported |

| Process eco-innovation→Product eco-innovation | 0.333 | *** | H3 supported |

| Process eco-innovation→Environmental performance | 0.402 | *** | H4 supported |

| Organizational eco-innovation→Environmental performance | 0.183 | 0.046 ** | H5 supported |

| Product eco-innovation→Environmental performance | 0.190 | 0.052 * | H6 not supported |

| Process eco-innovation→Financial performance | 0.199 | 0.031 ** | H7 supported |

| Organizational eco-innovation→Financial performance | 0.232 | 0.022 ** | H8 supported |

| Product eco-innovation→Financial performance | 0.114 | 0.289 | H9 not supported |

| Direct Effect | Indirect Effect | Total Effect | |||||||

|---|---|---|---|---|---|---|---|---|---|

| OE | PCE | PDE | OE | PCE | PDE | OE | PCE | PDE | |

| PCE | 0.482 ** | - | - | - | - | - | 0.482 ** | - | - |

| PDE | 0.458 ** | 0.346 ** | - | 0.167 ** | - | - | 0.625 ** | 0.346 ** | - |

| EP | 0.168 ** | 0.424 ** | 0.194 | 0.326 ** | 0.067 * | - | 0.494 ** | 0.491 * | 0.194 |

| FP | 0.212 ** | 0.209 ** | 0.115 | 0.173 ** | 0.040 | - | 0.385 ** | 0.249 | 0.115 |

| Region/Country | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Reference Relations | (1) Thailand | Status | (2) Brazil | Status | (3) Ghana | Status | (4) C, E, and P | Status | Common Findings with 4 |

| OE→PCE | 0.59 | HS | 0.75 | HS | - | - | 0.55 | HS | 1, 2 |

| OE→PDE | 0.46 | HS | 0.46 | HS | - | - | 0.51 | HS | 1, 2 |

| PCE→PDE | 0.41 | HS | 0.40 | HS | - | - | 0.33 | HS | 1, 2 |

| PCE→FP | 0.42 | HS | 0.15 | HNS | 0.22 | HNS | 0.20 | HS | 1 |

| OE→FP | 0.51 | HS | 0.42 | HS | 0.04 | HNS | 0.23 | HS | 1, 2 |

| PDE→FP | 0.36 | HS | 0.46 | HS | 0.24 | HNS | 0.11 | HNS | 3 |

| PCE→EP | - | - | 0.04 | HS | 0.40 | HS | 3 | ||

| OE→EP | - | - | 0.22 | HS | 0.18 | HS | 3 | ||

| PDE→EP | - | - | 0.31 | HS | 0.19 | HNS | - | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barriga Medina, H.R.; Guevara, R.; Campoverde, R.E.; Paredes-Aguirre, M.I. Eco-Innovation and Firm Performance: Evidence from South America. Sustainability 2022, 14, 9579. https://doi.org/10.3390/su14159579

Barriga Medina HR, Guevara R, Campoverde RE, Paredes-Aguirre MI. Eco-Innovation and Firm Performance: Evidence from South America. Sustainability. 2022; 14(15):9579. https://doi.org/10.3390/su14159579

Chicago/Turabian StyleBarriga Medina, Holger Raúl, Ruben Guevara, Ronald Enrique Campoverde, and Milton Ismael Paredes-Aguirre. 2022. "Eco-Innovation and Firm Performance: Evidence from South America" Sustainability 14, no. 15: 9579. https://doi.org/10.3390/su14159579

APA StyleBarriga Medina, H. R., Guevara, R., Campoverde, R. E., & Paredes-Aguirre, M. I. (2022). Eco-Innovation and Firm Performance: Evidence from South America. Sustainability, 14(15), 9579. https://doi.org/10.3390/su14159579