1. Introduction

The Hu line is a straight line with an inclination of 45 degrees from Heihe City, Heilongjiang Province to Tengchong City, Yunnan Province in China. It is a geo-demographic demarcation that spans from northern to southern China. The Seventh National Population Census of the People’s Republic of China showed that the northwest side of the Hu line contained 6.5% of the total population. In contrast, the southeast side contained 93.5% of the total population. The imbalance in the spatial distribution of China’s population is the product of climate change. The annual precipitation on the northwest side of the Hu line is less than 400 mm, and the land is developing towards desertification. The southeast is abundant in precipitation, where it is more suitable for human survival. From the perspective of consumption, the total consumption of the northwest side of the Hu line accounts for less than 10%, whereas the household consumption of the southeast side reaches more than 90%. The Hu line is a spatial divider not only for China’s household consumption scale but also for household consumption levels. The household consumption level reflects the extent of residents’ consumption of material goods and services to meet their survival, as well as their developmental and entertainment needs. Compared with the spatially unbalanced consumption scale, the spatially unbalanced distribution of consumption levels reflects the imbalanced economic development among Chinese residents. Climate, natural resources, and other factors have important impacts on the spatial distribution of residents’ consumption level, especially resource endowment, which has greater impact on the stage of development. However, in practice the consumption level of residents on both sides of the Hu line is not completely equal to their natural resource endowment, but tends to be influenced by factors such as the degree of marketization, socialization, and governance. This is more conducive to the consumption level of residents in southeast coastal provinces and cities, and such spatial patterns of regional residents’ consumption level influenced by both natural and human factors is difficult to change. If a reversal in the household consumption balance can be achieved, it will raise the overall household consumption level on the national scale. However, in reality, the household consumption gap between the two sides of the Hu line is widening yearly and exhibiting a strong siphoning effect [

1]. Currently, China is characterized by network and digital developments, which can hugely impact household consumption patterns. If this effectively narrows the gap between household consumption levels on both sides of the Hu line, the spatial siphoning pattern of the bifurcated Hu line among China’s household consumption levels may also change.

Theoretically, the impact of digital finance on household consumption levels is not divorced from the traditional theory of financial deepening, which argues that liquidity constraints limit household consumption. Additionally, finance can achieve intertemporal smoothing by alleviating liquidity constraints so that the potential demand for household consumption can be released [

2,

3]. In particular, this applies to the large-scale use of credit cards, which empowers households to overdraw their future income; this contributes greatly to the leapfrogging growth of household consumption [

4,

5]. However, traditional finance has spatial limitations when alleviating liquidity constraints on household consumption, which stems from the profit-seeking nature of finance, adverse selection, moral hazard, and other factors [

6]. Moreover, traditional finance does not effectively alleviate the liquidity constraints of household consumption. Traditional finance considers the cost–benefit allocation of funds, which leads to the exclusion of traditional finance from residential financial services in areas with low marginal return on capital, especially for rural residents in less developed areas. This spatial exclusion is a serious problem that makes it difficult for rural residents in less developed areas to access financial services [

7]. Although digital finance is not separated from the profit-seeking nature of traditional finance, it can overcome the problem of adverse selection and the moral hazard of traditional finance on household consumption using digital technologies. This can consequently broaden the spatial scope of traditional financial services, and even expand its reach to rural household consumption in remote areas [

8].

In 2004, China’s Alipay, a prototype application of digital finance in China [

9,

10], helped secure residents’ online shopping funds. With it, payments for household consumption became more convenient, thereby greatly contributing to the increase in household consumption. This theory of how Alipay increases household consumption levels is encapsulated by mental accounting theory, which holds that consumers’ consumption decisions are constrained by the amount of cash they carry. Under a cashless consumption environment, consumers will intuitively feel fewer cash restraints and increased psychological costs in the short term, thereby enticing consumers to consume more [

11,

12]. Furthermore, e-wallets reduce consumers’ perception of cash loss and lowers the restraint on the amount of cash they carry. As a result, the frequency of mobile payments positively impacts consumption and eliminates residents’ hesitation toward spending. In addition, cashless payments affect household consumption in two ways: by reducing the cost of shopping [

13] and by increasing the money circulation rate [

14].

Led by financial institutions, mobile payments have gradually evolved into digital financial services. Institution-led digital finance has not been separated from the resource allocation function of traditional finance. It influences household consumption levels through two mechanisms that reduce the liquidity constraint of household consumption and increase property income [

15]. The first is that digital finance improves the payment environment and risk management of household consumption [

16]. The second is that the inclusiveness of digital financial services is stronger than traditional services, which reduces residents’ uncertainty toward the future and is more helpful in terms of adjusting consumption across time and promoting the distribution of household consumption [

17]. In addition, from the perspective of household consumption types, digital finance has a greater driving force toward survival-based consumption. In contrast, the intensity of its effect on development- and entertainment-based consumption is not obvious [

18], which also indicates that digital finance can play a positive role in promoting daily household consumption. However, the promotion effect of digital finance on household consumption is affected by other factors such as the level of economic development and marketization degree [

19], which also leads to the spatial and urban–rural heterogeneity of the impact of digital finance on household consumption. In China, the promotion effect is more obvious in the eastern region [

20], which is also affected by the heterogeneous impact of digital finance on urban and rural household consumption, especially in less developed regions. For example, online shopping growth rates are greater among rural residents than those among urban residents [

21], which may be the result of China’s long-term urban–rural dual economy structure [

22,

23].

Most work has focused on the influencing mechanisms of digital finance on the change in residents’ consumption levels, as well as the consumption structure; nevertheless, the impacts of spatial difference on digital finance and residents’ consumption level remain largely unstudied. The Hu line divides China into two regions: southeast and northwest, based on the provincial household consumption scale. This spatial division of the consumption scale is closely related to China’s population distribution, albeit not all the time. In the early days of reform and opening up, the provinces of Guangxi, Guizhou, Ningxia, and Yunnan on the northwest side of the Hu line had a low marketization degree, large urban–rural income gap, and low urbanization levels. However, the household consumption scale in these provinces was among the highest in China. The reason behind this phenomenon was poverty. Residents in these provinces spent most of their income on food and clothing, which formed a spatial pattern that was characterized by poverty and high consumption on the northwest side of the Hu line. China’s overall consumption increased with the rise in domestic marketization, reduction of the income gap between urban and rural areas, and increase in urbanization. However, rural and urban economic development on the southeast side of the Hu line progressed faster than that on the northwest side, leading to the coexistence of investment-oriented and opulent consumption. This also gave rise to differences in the consumption scale and levels among residents on either side. Simultaneously, the gap between the household consumption scale and levels on both sides of the line also widened. The southeast side demonstrated an obvious siphoning effect on the northwest, which begged the question of whether digital finance could narrow the household consumption gap between the two sides of the Hu line. This paper seeks to explore this question. This paper innovatively includes space in the influencing factors of digital finance on the change of residents’ consumption levels, explores the different effects of digital finance on the change in residents’ consumption levels on both sides of Hu line, and puts forward corresponding policy applications to narrow the gap between consumption levels on both sides.

2. Model Construction

2.1. Spatial Association Measurement Model and Selection of Spatial Weight

Tobler (1970) stated that in the first law of geography, everything is correlated with something else. However, things nearer to each other are more correlated than things that are farther away, thereby influencing the degree of interdependence between data at one location and data at other locations.

Moran’s I has a value between [−1, 1], whereby −1 indicates a strong negative correlation, 1 indicates a strong positive correlation, and 0 indicates no correlation;

and

denote the spatial region labels;

denotes the spatial connectivity matrix, which takes a value of 1 if

and

are adjacent and 0 otherwise; and

and

are the instrument values at the

-th point and the mean value of the entire study region, respectively. The significance of

Moran’s I is tested using the standard normal distribution of the z-value:

This paper adopts the geospatial weight setting method based on the adjacency relationship to choose the spatial weight matrix of Moran’s I. The reasons are as follows: first, the adjacent provinces have similar social and economic environment, and they may be similar at the digital finance development level and residents’ consumption level; second, neighboring provinces are more likely to have spatial spillover effects of digital finance and residents’ consumption level, respectively; and third, digital finance and residents’ consumption level in neighboring provinces are more likely to have mutual spatial causality.

2.2. Impact Factor Measurement Model: Geographic Detectors

A geographic detector is a new statistical method to detect spatial heterogeneity and reveal the driving factors behind it. This method has no linear assumption but clear spatial meaning. The basic idea is, assuming that the study area is divided into several sub regions, that if the sum of the sub-regional variances is less than that of the total area, there is spatial differentiation; if the spatial distribution of the two variables tends to be consistent, there is a statistical correlation between them. The q statistic in the geographical detector can be used to detect the spatial stratification heterogeneity of the dependent variable Y, and to detect the extent to which the explanatory variable X explains the spatial differentiation of the dependent variable Y, as well as the explanatory degree of the independent variable X to the dependent variable.

is the stratification of variable Y or X; and N denote the number of units in stratum h and the whole region, respectively; and are the variances of variable Y in h and the whole region, respectively; and denote the sum of variances within the stratum and the total variance of the whole region, respectively; and q has a value in the range of [0, 1], such that the larger the value, the more significant the spatial differentiation of y. If independent variable X generates stratification, a larger q-value will indicate that the spatial distribution of X and Y is more consistent, with the independent variable having a stronger explanatory power on instrument Y. However, when the opposite is true, its explanatory power is weaker. In extreme cases, a q-value of 1 indicates that within the stratification of X, the variance of Y is 0 (i.e., X completely controls the spatial distribution of Y). A q-value of 0 indicates that the variance of Y after stratification by X is equal to the variance of Y without stratification. As such, Y is not stratified by X (i.e., X has no relationship with Y).

When calculating the q statistic, the study area includes two coverages of the dependent variable Y and the independent variable X. The explanatory variable X is the categorical variable, and the dependent variable Y is the numeric variable. First, calculate the mean value ()and variance () of the dependent variable Y. Then, the coverages of independent variable X and dependent variable Y are superimposed to calculate the mean value () and variance () of the dependent variable Y in each coverage, and these mean values and variances are brought into Formula (3) so as to obtain the q-value of geographical detector. The q-value demonstrates that the independent variable X explains of Y.

A geographical detector has strict requirements for data: The dependent variable has to be a numeric variable and the independent variable has to be a categorical variable. If the independent variable is a numeric variable, it needs to be stratified to reduce the variance within classes and maximize the variance between classes. In this study, we used the Natural Breaks Classification to divide the independent variable into five classes. The basic idea of the Natural Breaks Classification is that there are some natural (not artificial) turning points and break points in any set of values that are statistically significant. These break points can divide the data into a few classes with similar characteristics. Therefore, natural break points are optimal boundaries for classification that minimize the within-class sum of squared differences and maximize the between-class sum of squared differences.

There is not only one factor that affects the dependent variable

Y; different explanatory variables

X can be represented by

. Assuming that there are only two independent variables,

and

, these two variables may interact with the dependent variable

Y. Here, we identified the interactions between the different explanatory variables

X and assessed whether factors

and

increase or decrease the explanatory power to the dependent variable Y when acting together, or whether the effects of these factors on

Y are independent of each other. This assessment was done by first calculating the

q-values of the two factors

and

on

, namely,

and, respectively. The values of

and

represent the explanatory degrees of the independent variables

and

to the dependent variable

Y, respectively. Following this, we calculated the

q-value of

on

Y, namely,

. this indicates the explanatory degree of the interaction between independent variables to the dependent variable. Finally, we compared the values of

,

, and

to assess their interactions (See

Table 1).

3. Variable Selection and Data Sources

This paper selected several independent variables that affect residents’ consumption level (Y), including the development level of digital finance (), the degree of marketization (), the urban–rural income gap (), and the level of urbanization ().

(1) Household consumption (Y) indicator selection: Household consumption level (yuan/person) = total household consumption in GDP for the reporting period/average annual population for the reporting period. Data on GDP and total household consumption for each province were obtained from the official website of the National Bureau of Statistics of China. The average population data for the reporting period were obtained from the “China Population Statistics Yearbook” from previous years.

(2) Digital financial developmental level (

) indicator selection: The Peking University Digital Financial Inclusion Index [

24] was chosen as a substitute index. It covers digital financial coverage, digital financial usage depth, and inclusive finance digitalization, including payment, credit, insurance, creditworthiness, investments, monetary funds, and other digital financial services. The sample includes 337 cities above the prefecture level and 2800 counties in 31 provinces across mainland China.

(3) Marketization degree indicator (

) selection: Currently, digital finance can help liquidity-constrained consumers. The theory of liquidity-constrained consumers states that the “permanent income–life cycle hypothesis” is inconsistent with reality. In the hypothesis, there is a constant interest rate; residents can choose between consumption and savings at the same interest rates, and there are no liquidity-constrained consumers. In reality, consumers do not have ready access to funds from financial markets to compensate for the consumption constraints caused by their lack of liquidity at any given point. As such, they can only reduce their consumption in the current period. Even if liquidity constraints do not occur in the current period, the fact that they will occur in the future will also reduce consumption. Therefore, there is a clear relationship between the marketization degree and the sensitivity of consumption to immediate income [

25]. Digital finance expands the marketization degree and reduces the impact of liquidity constraints on household consumption levels. In this paper, the marketization index from the “Marketization Index of China’s Provinces: NERI Report 2020” was used as a proxy indicator to measure the marketization degree in each province, which comprehensively measures the degree of marketization in five dimensions: the relationship between the government and the market, the development of the non-state economy, the development of product markets, the development of factor markets, the development of market intermediary organizations, and the state of the legal environment.

(4) Urban–rural income gap indicator (

) selection: Integrating digital finance with the urban–rural income gap will affect household consumption levels. Digital finance lowers the cost and threshold of financial services for household consumption. It extends the accessibility of financial services to low-income groups, which affects the consumption structure by reducing the urban–rural income gap [

26]. The underlying mechanism is that digital finance lowers the cost and threshold of rural financial services, alleviates information asymmetry, and breaks the geographical and class restrictions of financial services. This makes the “long tail” of rural residents, who are excluded from traditional financial services, the target of inclusive digital financial services [

27]. Data on the urban–rural income disparity were calculated on the basis of the statistical bulletin of each province in China.

(5) Urbanization level indicator (

) selection: The convergence of digital finance with urbanization changes household consumption levels. The development of digital finance accelerates its penetration into urban and rural consumer markets. Digital finance also improves the liquidity constraints of rural household consumption and reduces their worries about future uncertainty. On the other hand, urbanization provides rural residents with jobs and increases their sources of income, thereby increasing the money they have available for consumption in any given period [

28]. In addition, towns and cities are the hubs of modern logistics and information flows, and they are the gathering places of consumer goods and consumer information. Urban residents have a demonstration and traction effect on rural residents, who begin to imitate urban lifestyles and converge their consumption psychology and habits with those of urban residents [

29]. Data on urbanization levels were obtained from the statistical bulletin of each province in China.

In data processing, the independent variables were stratified by using Natural Breaks Classification. The independent variables with numeric values were transformed into five-point scale categorical variables to meet the requirements of the geographical detector for data. The Natural Breaks Classification was applied to divide the independent variables into five classes, which is based on the internal statistical distributions of the values of independent variables. The variance within classes was the smallest and the variance between classes was the largest. In the process of transforming independent variables into categorical variables, variables such as the development level of digital finance, the degree of marketization, the income gap between urban and rural areas, and the level of urbanization cannot be divided into five classes equally. For example, a three-class classification was the most optimal range found in the data measuring urbanization level. However, considering the requirements of the geographical detector for the same classes of all independent variables, this study uniformly divided the data of all independent variables into five classes through Natural Breaks Classification, which did not affect the accuracy of the empirical results.

5. Conclusions and Insights

Spatial exclusion is a practical problem in the theory of sustainable finance, which is not only reflected in the spatial inequality in finance, but also in the spatial imbalance of residents’ consumption levels. Areas with rapid economic growth can overcome the liquidity constraints of residents’ consumption to a greater extent; residents can release their consumption potential through intertemporal smoothing. In contrast, for regions lagging in financial development, finance restrains residents’ consumption levels instead. Digital finance reduces the liquidity constraints of traditional finance on residents’ consumption. Theoretically, digital finance can solve the problem of spatial exclusion in the sustainable development of finance, but influenced by the degree of marketization, urban–rural income gap, urbanization rate, and other factors, digital finance in reality is not able to completely address the issues associated with liquidity constraints and spatial exclusion in improving residents’ consumption levels. Exploring the impact of the unbalanced spatial development of digital finance on residents’ consumption levels, this study has expanded the scope of traditional research in sustainable finance and provided a new perspective to better understand residents’ consumption levels.

In China, the spatial difference in household consumption levels has become a constraint that hinders balanced economic development. In theory, digital finance extends the geographical accessibility of financial services, especially for residents in remote areas who originally had restricted access to financial services, and promotes increased consumption. However, in reality, the spatial imbalance of household consumption levels has not been alleviated with digital financial developments, which were uneven. The unbalanced spatial layout of digital finance and residents’ consumption levels is not conducive to the social and economic sustainable development, which is manifested in the following three aspects: First, it inhibits the fairness of residents’ consumption of resources, as residents southeast of Hu line consume more resources than those in the northwest, which is not consistent with the philosophy of social equity. Second, it restrains the efficiency of financial allocation of resources. The efficiency of digital finance in stimulating the potential of resource consumption on the southeast side of the Hu line is higher than that on the northwest side, which is unfavorable for sustainable development of the economy. Third, it inhibits the coordinated development between digital finance and residents’ consumption levels. The mutual promotion between these two are more significant on the southeast side of Hu line than that on the northwest side, which is not conducive to high-quality economic development.

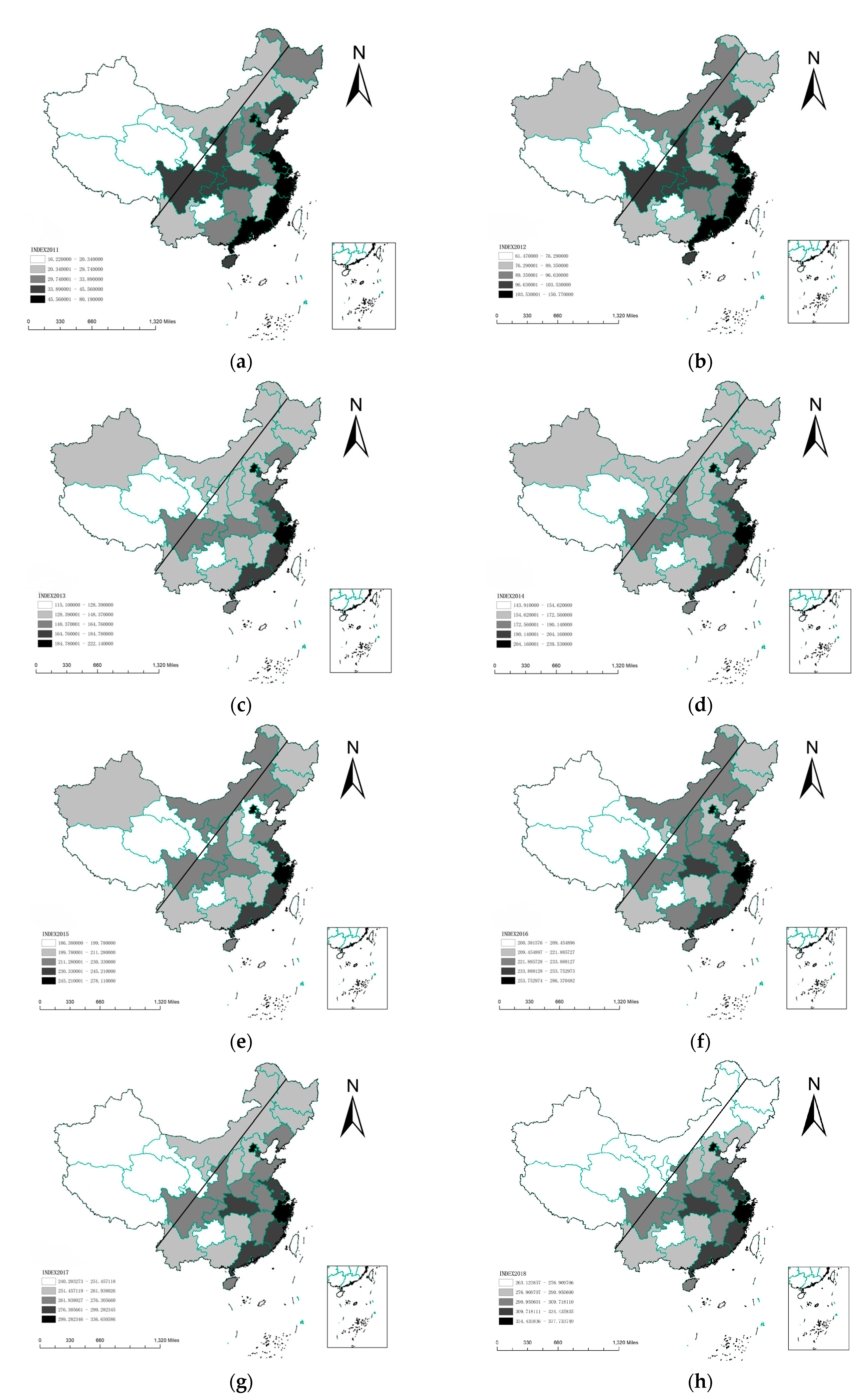

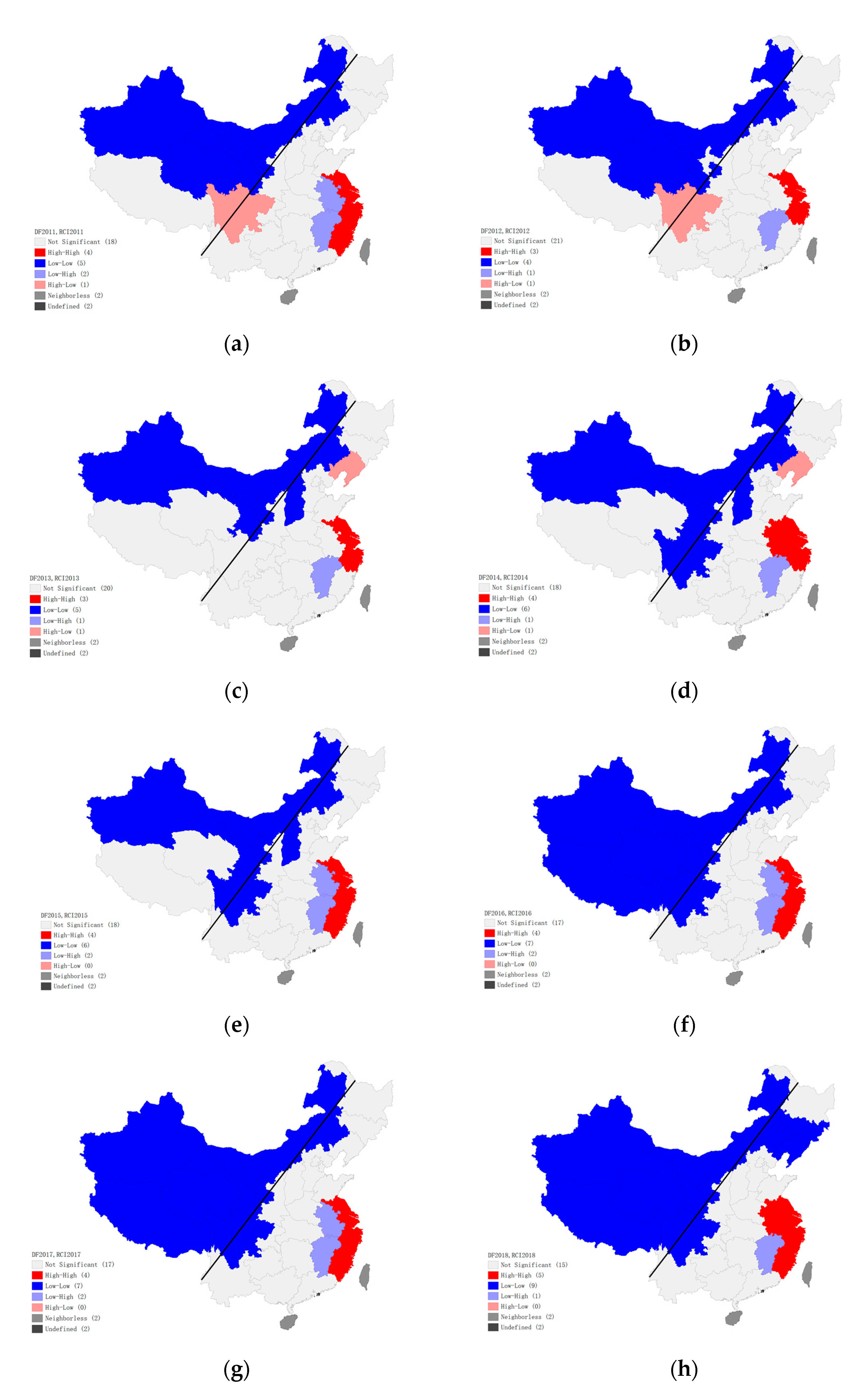

Accordingly, given that digital finance and household consumption levels are imbalanced, this study has explored whether accelerating digital financial developments in less-developed regions can increase household consumption levels to create a spatial balance to achieve social and economic sustainability. After conducting a series of empirical analyses, we have drawn the following conclusions. First, digital finance and household consumption levels possess a spatially imbalanced pattern that is bounded by the Hu line. Digital finance and household consumption levels are found to be greater on the southeast side of the Hu line than those on the northwest side; the closer the province is to the southeast coast, the higher the levels of digital finance and household consumption. Furthermore, this spatial gap is expanding yearly, and digital finance and household consumption levels show a strong spatial siphoning effect. Second, digital finance is an important influencing factor for household consumption changes. Digital finance plays a role in raising household consumption on both sides of the Hu line. However, this raising effect is spatially asymmetric, as the increase in household consumption levels on the southeast side of the Hu line is greater than that on the northwest side. The joint effects of digital finance with the marketization degree, urban–rural income gap, urbanization level, and other factors together intensify the spatial division of household consumption levels along the Hu line. Third, both digital finance and household consumption levels have strong spatial links. However, the spatial effect of digital finance on household consumption levels shows obvious spatial heterogeneity, with the High–High spatial enhancement effect being concentrated in the coastal areas of the Hu line’s southeast side. In contrast, the Low–Low spatial pull-down effect is concentrated on the Hu line’s northwest side. In summary, digital finance has a positive promotion and mutual spatial link effect on household consumption. This means that digital finance can narrow the household consumption-level gap on both sides of the Hu line by accelerating digital financial development on the west side of the Hu line (since a spatial link effect exists for digital finance on household consumption levels).

From the above empirical results, we know that narrowing the household consumption gap on both sides of the Hu line is feasible through a differentiated development of digital finance. However, policies in line with these efforts are needed. First, better digital financial infrastructures should be constructed on the northwest side of the Hu line. Second, the marketization process within provinces on the northwest side of the Hu Line should be accelerated. Finally, a broadened expansion of digital finance on the northwest side of the Hu line is needed for increased accessibility among rural residents in remote areas. From these insights, this paper proposes the following policy recommendations: first, strengthening the cooperation between the southeast coastal and northwest provinces in digital financial infrastructure construction, including cooperation in artificial intelligence, blockchain, and cloud computing, which will effectively narrow the digital financial infrastructure gap between the north and south sides of the Hu line; second, reforming governments’ functions within the northwest provinces and accelerating government-assisted, market-oriented reforms in cities with decentralized systems, such that digital finance can be fully integrated with factor mobility; and last, encouraging financial institutions to expand digital financial products into rural areas and innovate targeted digital financial products, which will address the existing liquidity constraints and broaden digital finance accessibility for rural residents.